RedT Energy - 500 Beiträge pro Seite

eröffnet am 19.03.19 21:13:23 von

neuester Beitrag 31.05.21 23:27:42 von

neuester Beitrag 31.05.21 23:27:42 von

Beiträge: 11

ID: 1.300.320

ID: 1.300.320

Aufrufe heute: 0

Gesamt: 801

Gesamt: 801

Aktive User: 0

ISIN: JE00BLR94N79 · WKN: A2P2R3 · Symbol: J4Q5

0,2760

EUR

-7,38 %

-0,0220 EUR

Letzter Kurs 25.04.24 Frankfurt

Werte aus der Branche Dienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 79,80 | +871,99 | |

| 0,7000 | +75,00 | |

| 41,00 | +32,26 | |

| 1.149,00 | +11,25 | |

| 44,75 | +9,95 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 29,52 | -10,63 | |

| 5,4800 | -12,32 | |

| 35,00 | -14,63 | |

| 2,4000 | -20,53 | |

| 0,6300 | -30,00 |

heute erst gesehen, dass inzwischen börsennotiert;

scheint kurz vor knapp zu sein:

https://www.energy-storage.news/news/redt-in-very-accelerate…

"The future of vanadium flow machine company redT has been plunged into doubt after it launched a strategic review of its ongoing business.

The review, launched alongside an emergency fundraising drive, has resulted in the redundancy of nearly 25% of redT’s workforce and a frank admission that it could cease to trade if it fails to raise enough cash.

There have also been changes at board level, with chairman Jeff Kenna standing down and Scott McGregor also withdrawing, but remaining at the company to handle day-to-day operations.

In a statement to the market yesterday afternoon, London Stock Exchange-listed redT confirmed that it had raised £940,000 (US$1.24 million) via a placing of 47 million ordinary shares with VSA Capital to fund them during the review period. It has also launched an Open Offer for qualifying shareholders to acquire new shares at 2p per share, aiming to raise up to £2.26 million."

scheint kurz vor knapp zu sein:

https://www.energy-storage.news/news/redt-in-very-accelerate…

"The future of vanadium flow machine company redT has been plunged into doubt after it launched a strategic review of its ongoing business.

The review, launched alongside an emergency fundraising drive, has resulted in the redundancy of nearly 25% of redT’s workforce and a frank admission that it could cease to trade if it fails to raise enough cash.

There have also been changes at board level, with chairman Jeff Kenna standing down and Scott McGregor also withdrawing, but remaining at the company to handle day-to-day operations.

In a statement to the market yesterday afternoon, London Stock Exchange-listed redT confirmed that it had raised £940,000 (US$1.24 million) via a placing of 47 million ordinary shares with VSA Capital to fund them during the review period. It has also launched an Open Offer for qualifying shareholders to acquire new shares at 2p per share, aiming to raise up to £2.26 million."

Antwort auf Beitrag Nr.: 60.144.579 von R-BgO am 19.03.19 21:13:23RedT picked by Statkraft for C&I solar-plus-storage in the UK

https://www.pv-tech.org/news/redt-picked-by-statkraft-for-ci…

By Liam Stoker Mar 25, 2019

Norwegian utility Statkraft has partnered with flow machine specialist redT on a fully-financed solar-plus-storage offering for the UK’s thriving C&I renewables market.

The solution will offer companies in the UK savings on their energy bills of up to 20% over a 25 year power purchase agreement (PPA) through the installation of solar arrays and redT flow machines at their premises.

Statkraft is to also bring customers into its virtual power plant, which the state-owned company intends to double in capacity to 2GW before the summer, to enable them to access flexibility optimisation services.

It’s intended that the initial phase of the agreement will see the deployment of some 10MW of solar PV and 6MWh of flow machine capacity. But it’s the companies’ aim to ramp this up significantly over the next three years, with the target set of installing 100MW of solar PV and 60MWh of storage in that time.

Andy Cooper, head of UK downstream at Statkraft, said the fully-financed offering stood to enable its customers to take advantage of renewable energy.

“Statkraft is committed to being the leading partner for clients seeking to better utilise renewable energy and maximise the value of flexibility. The partnership with redT enables Statkraft and Bryt Energy to offer additional options that will benefit customers, incorporating storage, renewable energy solutions, advanced asset optimisation and trading within a VPP,” he said.

Earlier this month, Solar Media's sister publications Solar Power Portal and Energy-Storage.news reported on the extent of redT’s financial woes, issues which have prompted the firm to launch a strategic review of the business moving forward.

The company is seeking to raise around £1.5 million (US$1.98 million) from a placing and open share offer to see it through the next four to six months, and teased the imminent announcement of a solar-plus-storage offering with a major European utility.

Upon confirming that company to be Statkraft, executive chairman Neil O’Brien said the duo were “breaking new ground in the energy industry”.

“With this roll out of low cost solar coupled with heavy cycling, flow machine technology, we hope to accelerate the deployment of energy storage providing low risk energy savings to commercial energy users, and creating an effective, hedge against rising energy prices,” he said.

https://www.pv-tech.org/news/redt-picked-by-statkraft-for-ci…

By Liam Stoker Mar 25, 2019

Norwegian utility Statkraft has partnered with flow machine specialist redT on a fully-financed solar-plus-storage offering for the UK’s thriving C&I renewables market.

The solution will offer companies in the UK savings on their energy bills of up to 20% over a 25 year power purchase agreement (PPA) through the installation of solar arrays and redT flow machines at their premises.

Statkraft is to also bring customers into its virtual power plant, which the state-owned company intends to double in capacity to 2GW before the summer, to enable them to access flexibility optimisation services.

It’s intended that the initial phase of the agreement will see the deployment of some 10MW of solar PV and 6MWh of flow machine capacity. But it’s the companies’ aim to ramp this up significantly over the next three years, with the target set of installing 100MW of solar PV and 60MWh of storage in that time.

Andy Cooper, head of UK downstream at Statkraft, said the fully-financed offering stood to enable its customers to take advantage of renewable energy.

“Statkraft is committed to being the leading partner for clients seeking to better utilise renewable energy and maximise the value of flexibility. The partnership with redT enables Statkraft and Bryt Energy to offer additional options that will benefit customers, incorporating storage, renewable energy solutions, advanced asset optimisation and trading within a VPP,” he said.

Earlier this month, Solar Media's sister publications Solar Power Portal and Energy-Storage.news reported on the extent of redT’s financial woes, issues which have prompted the firm to launch a strategic review of the business moving forward.

The company is seeking to raise around £1.5 million (US$1.98 million) from a placing and open share offer to see it through the next four to six months, and teased the imminent announcement of a solar-plus-storage offering with a major European utility.

Upon confirming that company to be Statkraft, executive chairman Neil O’Brien said the duo were “breaking new ground in the energy industry”.

“With this roll out of low cost solar coupled with heavy cycling, flow machine technology, we hope to accelerate the deployment of energy storage providing low risk energy savings to commercial energy users, and creating an effective, hedge against rising energy prices,” he said.

Antwort auf Beitrag Nr.: 60.144.579 von R-BgO am 19.03.19 21:13:23

redT energy plc ("redT" or "the Company")

redT energy plc, the energy storage company, is pleased to announce that it has received valid acceptances from shareholders and assurances from institutional shareholders that applications will be made in aggregate for sufficient Open Offer Shares to ensure that the total funds raised by the Placing and Open Offer announced on 14 March 2019 will exceed the minimum amount required for the Fundraising and the strategic review process to proceed.

VSA Capital, the Company's financial adviser and broker, have received assurances that certain institutional shareholders will take up their Open Offer Entitlements and apply for additional Open Offer Shares under the Excess Application facility amounting to at least 28,000,000 Open Offer Shares raising at least £560,000 before expenses.

These proceeds together with the £940,000 raised by means of the conditional Placing also announced on 14 March 2019 mean that the Fundraising will, in aggregate, raise at least £1.5 million before expenses and therefore exceed the minimum proceeds required for the Fundraising to proceed as set out in the announcement and the circular posted to Shareholders on 19 March 2019.

The Company is therefore pleased to announce that the minimum proceeds condition will be met and that subject to Shareholders' approval at the General Meeting to be held on 9 April 2019 and subject to certain other conditions relating to the Placing Agreement, Admission of the New Ordinary Shares to trading and dealings on AIM are expected to commence on 10 April 2019.

The Company confirms that, with funding secured for the next few months, the strategic review process is continuing as planned and the Company continues to engage in promising discussions with potential strategic partners regarding the support and finance of the Company's continued growth.

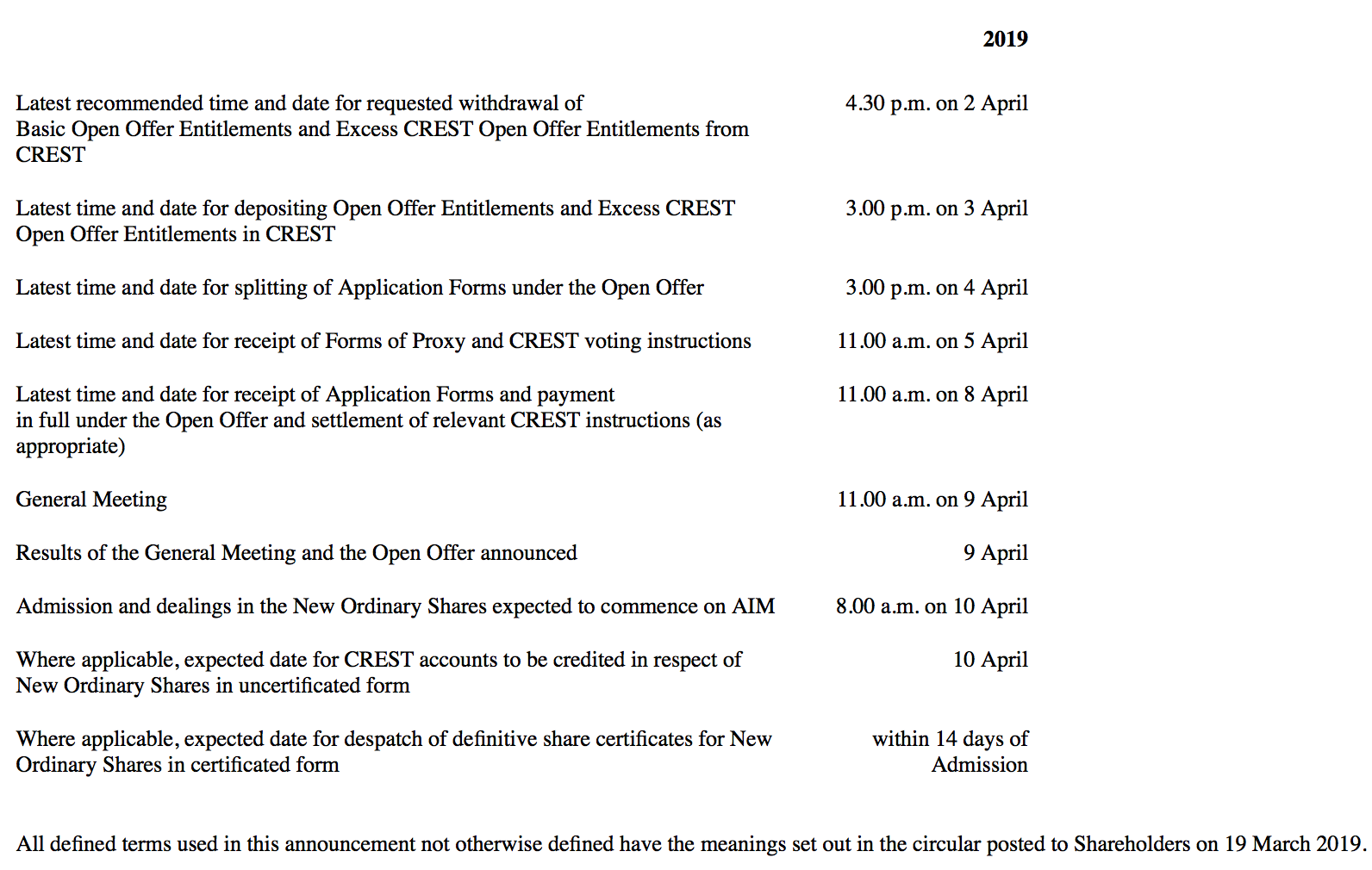

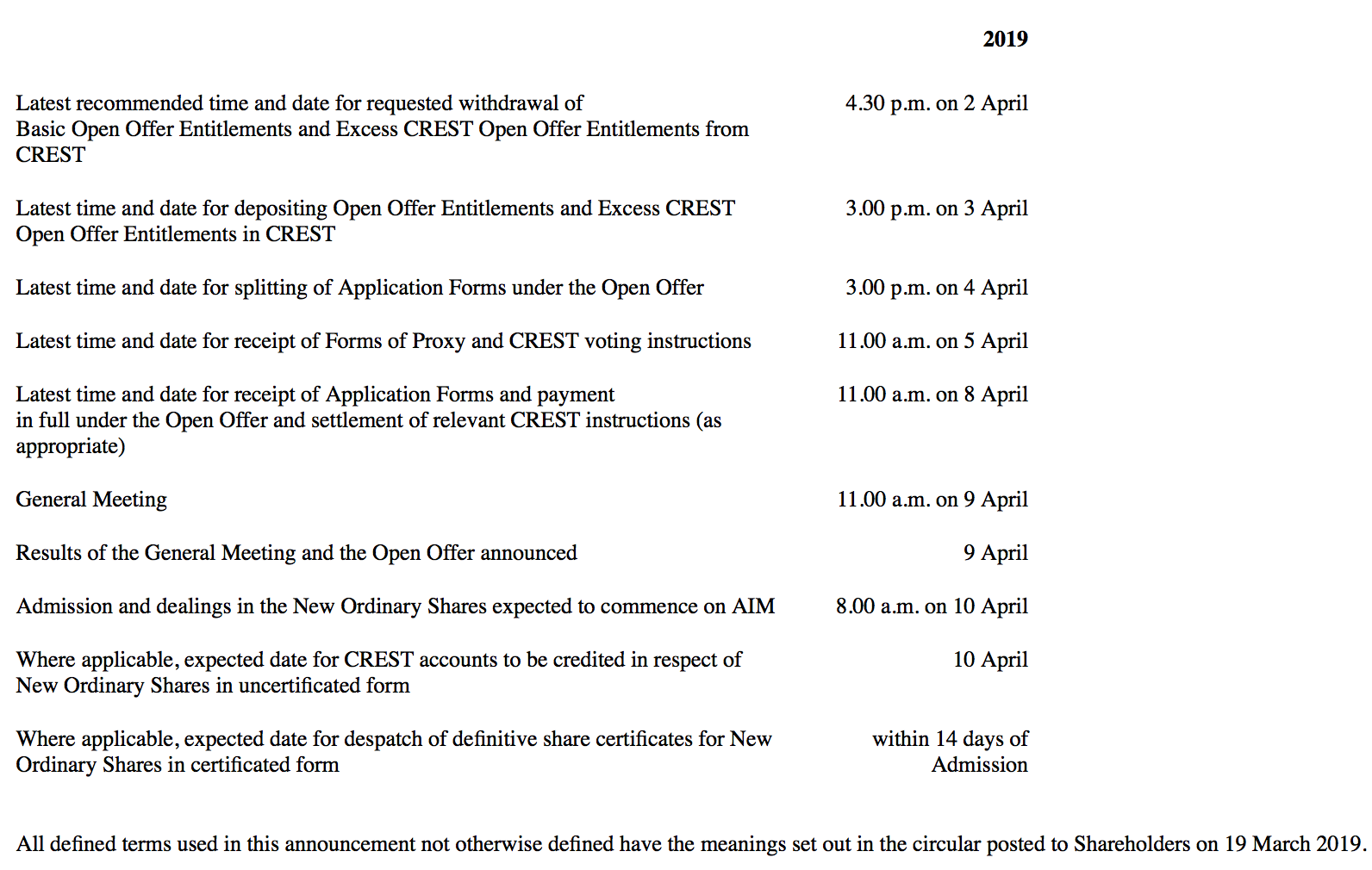

The timetable of remaining principal events regarding the Fundraising is set out below:

Open Offer proceeds exceed minimum requirement

1 April 2019redT energy plc ("redT" or "the Company")

redT energy plc, the energy storage company, is pleased to announce that it has received valid acceptances from shareholders and assurances from institutional shareholders that applications will be made in aggregate for sufficient Open Offer Shares to ensure that the total funds raised by the Placing and Open Offer announced on 14 March 2019 will exceed the minimum amount required for the Fundraising and the strategic review process to proceed.

VSA Capital, the Company's financial adviser and broker, have received assurances that certain institutional shareholders will take up their Open Offer Entitlements and apply for additional Open Offer Shares under the Excess Application facility amounting to at least 28,000,000 Open Offer Shares raising at least £560,000 before expenses.

These proceeds together with the £940,000 raised by means of the conditional Placing also announced on 14 March 2019 mean that the Fundraising will, in aggregate, raise at least £1.5 million before expenses and therefore exceed the minimum proceeds required for the Fundraising to proceed as set out in the announcement and the circular posted to Shareholders on 19 March 2019.

The Company is therefore pleased to announce that the minimum proceeds condition will be met and that subject to Shareholders' approval at the General Meeting to be held on 9 April 2019 and subject to certain other conditions relating to the Placing Agreement, Admission of the New Ordinary Shares to trading and dealings on AIM are expected to commence on 10 April 2019.

The Company confirms that, with funding secured for the next few months, the strategic review process is continuing as planned and the Company continues to engage in promising discussions with potential strategic partners regarding the support and finance of the Company's continued growth.

The timetable of remaining principal events regarding the Fundraising is set out below:

Antwort auf Beitrag Nr.: 60.144.579 von R-BgO am 19.03.19 21:13:23RedT bids to create ‘leading player’ in energy storage with Avalon merger

Published: 25 Jul 2019

By: Liam Stoker

https://www.solarpowerportal.co.uk/news/redt_bids_to_create_…

RedT has confirmed it has agreed outline terms for a reverse takeover of fellow vanadium redox flow battery firm Avalon, a move which the firm said would create a “leading player” in the energy storage market.

RedT, whose future has been uncertain owing to financial difficulties, confirmed this morning that outline terms for the proposed merger had been agreed, and the duo have plans for the injection of “significant new funding” to propel the combined business forward.

The merger itself will take the form of a reverse takeover in which a share-for-share acquisition of Avalon has been sealed, using redT shares valued at 1.65p per share.

That deal values Delaware, US-based Avalon at around US$37.5 million.

The combined company will seek re-admission to trade on the AIM market of the London Stock Exchange, and it intends to raise at least £24 million of new funds in order to power the company forward.

RedT, Avalon and the former’s financial adviser VSA Capital have received preliminary support for that fundraising from what’s been described as a “strong new strategic investor” that intends to make a cornerstone investment, on top of interest from existing institutional investors in redT, and existing and new investors in Avalon.

That interest has allowed redT’s board to today state with confidence that the merged business will start in a “robust” financial position, able to pursue an “exciting development and growth strategy”.

RedT said the combined entity would have operations in North America, Europe and Asia alongside a global sales footprint, and be in a position to capitalise on “significant opportunities” in the energy storage market.

Trading in redT shares has this morning been suspended pending advanced discussions and an agreement between the two firms. The duo have attached no specific timeframe to those discussions concluding but stressed a desire to publish admission documents as soon as possible.

Neil O’Brien, executive chairman at redT, said getting to this stage in its search for strategic partners was a “major step forward” for the business.

“The combination of our two companies will create a major force in the rapidly growing energy storage sector. We will have global reach, world-leading technology and an enhanced ability to drive down production costs and attract new capital,” he said.

RedT’s future had appeared uncertain for a number of months despite the formation of a major C&I solar-plus-storage offering with European utility Statkraft. It secured a further £3.2 million of funding in April this year, but last month reported a widening loss and admitted that failure to land additional investment could result in the firm ceasing to trade by the end of November.

Published: 25 Jul 2019

By: Liam Stoker

https://www.solarpowerportal.co.uk/news/redt_bids_to_create_…

RedT has confirmed it has agreed outline terms for a reverse takeover of fellow vanadium redox flow battery firm Avalon, a move which the firm said would create a “leading player” in the energy storage market.

RedT, whose future has been uncertain owing to financial difficulties, confirmed this morning that outline terms for the proposed merger had been agreed, and the duo have plans for the injection of “significant new funding” to propel the combined business forward.

The merger itself will take the form of a reverse takeover in which a share-for-share acquisition of Avalon has been sealed, using redT shares valued at 1.65p per share.

That deal values Delaware, US-based Avalon at around US$37.5 million.

The combined company will seek re-admission to trade on the AIM market of the London Stock Exchange, and it intends to raise at least £24 million of new funds in order to power the company forward.

RedT, Avalon and the former’s financial adviser VSA Capital have received preliminary support for that fundraising from what’s been described as a “strong new strategic investor” that intends to make a cornerstone investment, on top of interest from existing institutional investors in redT, and existing and new investors in Avalon.

That interest has allowed redT’s board to today state with confidence that the merged business will start in a “robust” financial position, able to pursue an “exciting development and growth strategy”.

RedT said the combined entity would have operations in North America, Europe and Asia alongside a global sales footprint, and be in a position to capitalise on “significant opportunities” in the energy storage market.

Trading in redT shares has this morning been suspended pending advanced discussions and an agreement between the two firms. The duo have attached no specific timeframe to those discussions concluding but stressed a desire to publish admission documents as soon as possible.

Neil O’Brien, executive chairman at redT, said getting to this stage in its search for strategic partners was a “major step forward” for the business.

“The combination of our two companies will create a major force in the rapidly growing energy storage sector. We will have global reach, world-leading technology and an enhanced ability to drive down production costs and attract new capital,” he said.

RedT’s future had appeared uncertain for a number of months despite the formation of a major C&I solar-plus-storage offering with European utility Statkraft. It secured a further £3.2 million of funding in April this year, but last month reported a widening loss and admitted that failure to land additional investment could result in the firm ceasing to trade by the end of November.

Antwort auf Beitrag Nr.: 61.109.494 von R-BgO am 26.07.19 09:26:00

A flow battery ‘competitive with the LG Chems and Samsungs of this world’

Published: 1 Aug 2019, 15:23

By: Andy Colthorpe

Seeking to create a “global player” in the emerging flow battery industry, Avalon Battery and redT have been in talks about forming a combined company. Energy-storage.news has been speaking with the CEOs of both, and with Alex Au, CTO of NEXTracker. Designing power plants based around its solar trackers – and the clever algorithms that drive them – NEXTracker has been using Avalon Battery products in its NX Flow range for a couple of years.

Here’s some choice words from conversations with Scott McGregor, CEO at redT, Avalon Battery CEO Matt Harper and NEXTracker’s chief technology officer, Alex Au.

E-S.n: It’s been described as a ‘reverse takeover’ (RTO), but I understand it’s being considered a merger in practical terms?

Matt Harper, Avalon Battery: An RTO is a mechanism that’s usually used for a sort of shortcut for an operating company to back into an inoperative one that has been publicly listed in the past. [The London Stock Exchange] took a look at this and decided that based on the status of the two companies and based on what we’re trying to do together, that it would be deemed to be an RTO. But practically speaking, both companies are totally operational, both companies have great product in the field and a terrific pipeline of business, so to all intents and purposes, it really is a merger.

What are some of the market signs and tipping points towards long-duration energy storage becoming more commonplace?

Alex Au, NEXTracker: There’s a really powerful trend coming from the market saying: we’re looking for a four-hour firm power plant. That’s kind of like that ‘baseload’ conversation.

PV is very straightforward: I’m going to produce electrons when the sun is shining and make money.

Then when you go and add a battery component to it, if you don’t care how often you cycle it or beat up the battery, you’re going to deliver additional power to the grid at times when it’s most valuable or when there’s frequency events, those types of things. To be able to use this application in an aggressive manner – now you can not only make money when the sun shines but also make money based on what the market requires.

That has really unlocked a lot of opportunities.

The flow battery is an actual product that can really just get beat up and handle those cycles. If I come to you and say, “hey, I just ran this test, I’ve had a really aggressive 0-100% to 50% to 0 to 25% to 0 and so on and I cannot show any degradation on the electrolyte and it’s been 20 years," I’d have just told you that I have a battery that has a better degradation profile than a solar panel.

What brought the two companies together?

MH: We were both out looking for investment at the same time and we had the happy accident of speaking with some of the same people about investing in the company.

What some of those investors came back with in feedback is that they said: “we really like this space, we see massive opportunity in what both of your companies do and in vanadium flow in general. But we feel that there is a scale that is needed to make this business work that no one in the business has yet achieved. Is there a way that we can [put] the two companies together and then with a significant capital injection get you guys up and off to the races together?” That was the initial thinking behind it.

Scott McGregor, redT: Both companies have very different geographical footprints, so Avalon is very strong in the US and China and we are strong in Europe, Australia, South East Asia and Africa.

So we don’t necessarily compete with each other which is quite nice. It’s more complementary than anything and we’ve got a good global footprint to cover everywhere.

We’ve got two different technical solutions which when combined will provide value for our customers. You combine that with US$30 million of funding, it’s very good for the industry, it’ll push flow forwards faster and in more applications across the world.

People like to remind me that most of the already-installed base of energy storage worldwide is pumped hydro, with the last few years seeing a rise in lithium-ion. Yet big companies like Lockheed Martin are working on flow batteries. What does that say for the market going forward?

AA: It’s taking the discussion away from the procurement guys and putting it back in the hands of the developer. The developer does not look at [cut sheets] the developer looks at their spreadsheets.

When a spreadsheet says, here’s a very low upfront cost for this lithium-ion battery. Then there’s another line item of the cost for augmentation, replacement and management of those lithium cells as they degrade over time. Not only does it degrade over time but the efficiency changes.

Just as module mismatch, when you have mismatch on a string, your pipe gets smaller and your function is off that weakest module. The same thing happens with a bank of lithium-ion batteries. The older cells need to be managed differently than the augmented cells and the replaced battery cells so that line item when you look at it from a developer and not knowing what lithium prices are in the future, not knowing the format, not knowing the voltage range creates a tremendous amount of risk.

You then need to do a capacity maintenance plan for that.

Now, you go to a developer and say I have this asset – and this asset, it doesn’t change, you don’t have to worry about the augmentation. All those lines of risk are removed from that spreadsheet and it’s a lot easier to focus on what the product actually does.

SM: It is good [as a sign of interest in the market]. Support from the big companies in lithium and saying hang on, we need flow as well. It supports a debate you and I often have that flow is completely different technology, it’s opposite to lithium.

Lithium is a very cheap power technology which is good for certain applications but the future of energy storage will be heavy cycling energy storage. So, heavy-duty, infrastructure energy storage which is what flow is.

That market hasn’t come online yet because of the business models and the technology availability, so as flow gets out and proves itself as a solution, you can open up many more energy storage applications that require much harder working assets that lithium can’t do.

I actually say lithium and flow are complementary technologies, doing different things.

There are already a few competitors in the space and if what you say is true, a much bigger market for flow will mean a lot more competition. What’s needed to have a competitive edge?

SM: [The merger] creates a strong player globally. Every player so far is a little bit narrow in their reach because they don’t want to be spread around the world. There’s nothing wrong with that, but this merger does create a global player: which does create scale in terms of funding, we can then get behind all of the project finance work that you need to do with insurance on the products and create the ability to deal with international companies.

MH: The thing that Avalon has done fundamentally differently than every other flow battery manufacturer is that we’ve taken a highly integrated platform-centric approach where we’ve built a lot of very good quality things at very low cost and have used that as a way of being ready to really build tremendous market adoption with this type of technology.

AA: We believe through all the testing and modelling we’ve done, supply chain and value add or cost reduction through volume that this is a much better product in the large-scale stationary storage application.

I applaud this, I think it’s a great thing for the industry to identify that this player is coming out and saying, we’re making the right decision to compete against the Samsungs and the LGs of this world through this avenue.

Selbstbewußt scheinen sie zu sein:

https://www.energy-storage.news/blogs/a-flow-battery-competi…A flow battery ‘competitive with the LG Chems and Samsungs of this world’

Published: 1 Aug 2019, 15:23

By: Andy Colthorpe

Seeking to create a “global player” in the emerging flow battery industry, Avalon Battery and redT have been in talks about forming a combined company. Energy-storage.news has been speaking with the CEOs of both, and with Alex Au, CTO of NEXTracker. Designing power plants based around its solar trackers – and the clever algorithms that drive them – NEXTracker has been using Avalon Battery products in its NX Flow range for a couple of years.

Here’s some choice words from conversations with Scott McGregor, CEO at redT, Avalon Battery CEO Matt Harper and NEXTracker’s chief technology officer, Alex Au.

E-S.n: It’s been described as a ‘reverse takeover’ (RTO), but I understand it’s being considered a merger in practical terms?

Matt Harper, Avalon Battery: An RTO is a mechanism that’s usually used for a sort of shortcut for an operating company to back into an inoperative one that has been publicly listed in the past. [The London Stock Exchange] took a look at this and decided that based on the status of the two companies and based on what we’re trying to do together, that it would be deemed to be an RTO. But practically speaking, both companies are totally operational, both companies have great product in the field and a terrific pipeline of business, so to all intents and purposes, it really is a merger.

What are some of the market signs and tipping points towards long-duration energy storage becoming more commonplace?

Alex Au, NEXTracker: There’s a really powerful trend coming from the market saying: we’re looking for a four-hour firm power plant. That’s kind of like that ‘baseload’ conversation.

PV is very straightforward: I’m going to produce electrons when the sun is shining and make money.

Then when you go and add a battery component to it, if you don’t care how often you cycle it or beat up the battery, you’re going to deliver additional power to the grid at times when it’s most valuable or when there’s frequency events, those types of things. To be able to use this application in an aggressive manner – now you can not only make money when the sun shines but also make money based on what the market requires.

That has really unlocked a lot of opportunities.

The flow battery is an actual product that can really just get beat up and handle those cycles. If I come to you and say, “hey, I just ran this test, I’ve had a really aggressive 0-100% to 50% to 0 to 25% to 0 and so on and I cannot show any degradation on the electrolyte and it’s been 20 years," I’d have just told you that I have a battery that has a better degradation profile than a solar panel.

What brought the two companies together?

MH: We were both out looking for investment at the same time and we had the happy accident of speaking with some of the same people about investing in the company.

What some of those investors came back with in feedback is that they said: “we really like this space, we see massive opportunity in what both of your companies do and in vanadium flow in general. But we feel that there is a scale that is needed to make this business work that no one in the business has yet achieved. Is there a way that we can [put] the two companies together and then with a significant capital injection get you guys up and off to the races together?” That was the initial thinking behind it.

Scott McGregor, redT: Both companies have very different geographical footprints, so Avalon is very strong in the US and China and we are strong in Europe, Australia, South East Asia and Africa.

So we don’t necessarily compete with each other which is quite nice. It’s more complementary than anything and we’ve got a good global footprint to cover everywhere.

We’ve got two different technical solutions which when combined will provide value for our customers. You combine that with US$30 million of funding, it’s very good for the industry, it’ll push flow forwards faster and in more applications across the world.

People like to remind me that most of the already-installed base of energy storage worldwide is pumped hydro, with the last few years seeing a rise in lithium-ion. Yet big companies like Lockheed Martin are working on flow batteries. What does that say for the market going forward?

AA: It’s taking the discussion away from the procurement guys and putting it back in the hands of the developer. The developer does not look at [cut sheets] the developer looks at their spreadsheets.

When a spreadsheet says, here’s a very low upfront cost for this lithium-ion battery. Then there’s another line item of the cost for augmentation, replacement and management of those lithium cells as they degrade over time. Not only does it degrade over time but the efficiency changes.

Just as module mismatch, when you have mismatch on a string, your pipe gets smaller and your function is off that weakest module. The same thing happens with a bank of lithium-ion batteries. The older cells need to be managed differently than the augmented cells and the replaced battery cells so that line item when you look at it from a developer and not knowing what lithium prices are in the future, not knowing the format, not knowing the voltage range creates a tremendous amount of risk.

You then need to do a capacity maintenance plan for that.

Now, you go to a developer and say I have this asset – and this asset, it doesn’t change, you don’t have to worry about the augmentation. All those lines of risk are removed from that spreadsheet and it’s a lot easier to focus on what the product actually does.

SM: It is good [as a sign of interest in the market]. Support from the big companies in lithium and saying hang on, we need flow as well. It supports a debate you and I often have that flow is completely different technology, it’s opposite to lithium.

Lithium is a very cheap power technology which is good for certain applications but the future of energy storage will be heavy cycling energy storage. So, heavy-duty, infrastructure energy storage which is what flow is.

That market hasn’t come online yet because of the business models and the technology availability, so as flow gets out and proves itself as a solution, you can open up many more energy storage applications that require much harder working assets that lithium can’t do.

I actually say lithium and flow are complementary technologies, doing different things.

There are already a few competitors in the space and if what you say is true, a much bigger market for flow will mean a lot more competition. What’s needed to have a competitive edge?

SM: [The merger] creates a strong player globally. Every player so far is a little bit narrow in their reach because they don’t want to be spread around the world. There’s nothing wrong with that, but this merger does create a global player: which does create scale in terms of funding, we can then get behind all of the project finance work that you need to do with insurance on the products and create the ability to deal with international companies.

MH: The thing that Avalon has done fundamentally differently than every other flow battery manufacturer is that we’ve taken a highly integrated platform-centric approach where we’ve built a lot of very good quality things at very low cost and have used that as a way of being ready to really build tremendous market adoption with this type of technology.

AA: We believe through all the testing and modelling we’ve done, supply chain and value add or cost reduction through volume that this is a much better product in the large-scale stationary storage application.

I applaud this, I think it’s a great thing for the industry to identify that this player is coming out and saying, we’re making the right decision to compete against the Samsungs and the LGs of this world through this avenue.

Hier geht nun endlich etwas los, Vanadium Batterien können die Energiespeicherung revolutionieren

Q&A with Larry Zulch, CEO

https://vimeo.com/524842644

https://vimeo.com/524842644

Vanadium Redox Battery (VRB) Market Is Booming Worldwide 2021-2028

https://manometcurrent.com/vanadium-redox-battery-vrb-market…

https://manometcurrent.com/vanadium-redox-battery-vrb-market…

VSA Capital Market Movers - Invinity Energy Systemshttps://www.proactiveinvestors.co.uk/companies/news/949646/v…

US solar-storage projects that decarbonise, save energy costs from Ameresco, ENGIE and Invinity

https://www.energy-storage.news/blogs/us-solar-storage-projects-that-decarbonise-save-energy-costs-from-ameresco

https://www.energy-storage.news/blogs/us-solar-storage-projects-that-decarbonise-save-energy-costs-from-ameresco

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +3,06 | |

| -3,42 | |

| +0,58 | |

| +2,08 | |

| +1,28 | |

| -0,73 | |

| +0,09 | |

| +0,83 | |

| 0,00 | |

| -0,30 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 240 | ||

| 107 | ||

| 82 | ||

| 78 | ||

| 75 | ||

| 53 | ||

| 41 | ||

| 38 | ||

| 36 | ||

| 34 |

RedT Energy