Key Energy Services (KEG) -- Permian Basin service provider - 500 Beiträge pro Seite

eröffnet am 01.04.19 00:17:17 von

neuester Beitrag 10.03.20 20:13:04 von

neuester Beitrag 10.03.20 20:13:04 von

Beiträge: 9

ID: 1.301.079

ID: 1.301.079

Aufrufe heute: 0

Gesamt: 273

Gesamt: 273

Aktive User: 0

ISIN: US49309J2024 · WKN: A2P1JY · Symbol: KEGX

0,0166

USD

0,00 %

0,0000 USD

Letzter Kurs 18.04.24 Nasdaq OTC

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +53,15 | |

| 6,0800 | +43,06 | |

| 1,2100 | +34,44 | |

| 1,4399 | +33,32 | |

| 0,5070 | +31,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,8100 | -6,33 | |

| 6,4500 | -6,58 | |

| 6,7000 | -6,94 | |

| 1.050,01 | -14,28 | |

| 15,500 | -29,51 |

weiter von hier: https://www.wallstreet-online.de/diskussion/1289240-1-10/key…

Antwort auf Beitrag Nr.: 60.241.878 von faultcode am 01.04.19 00:17:17

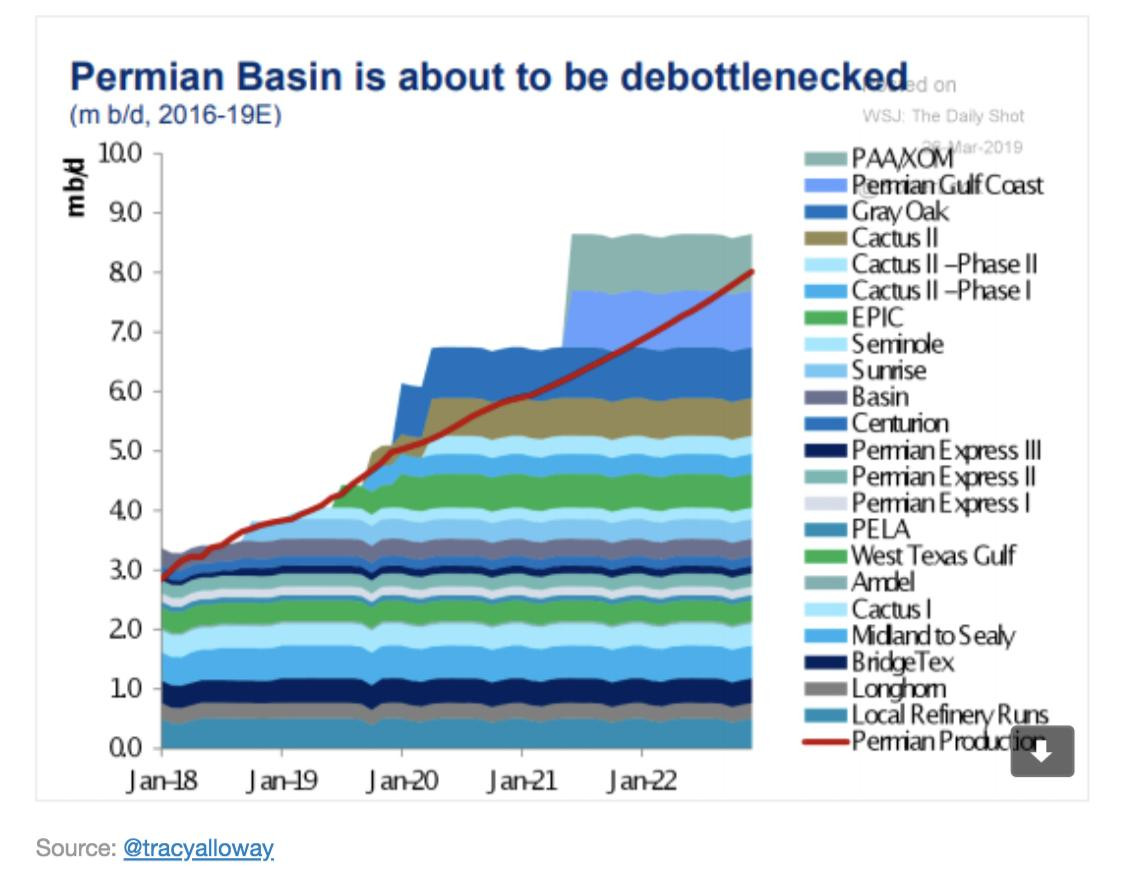

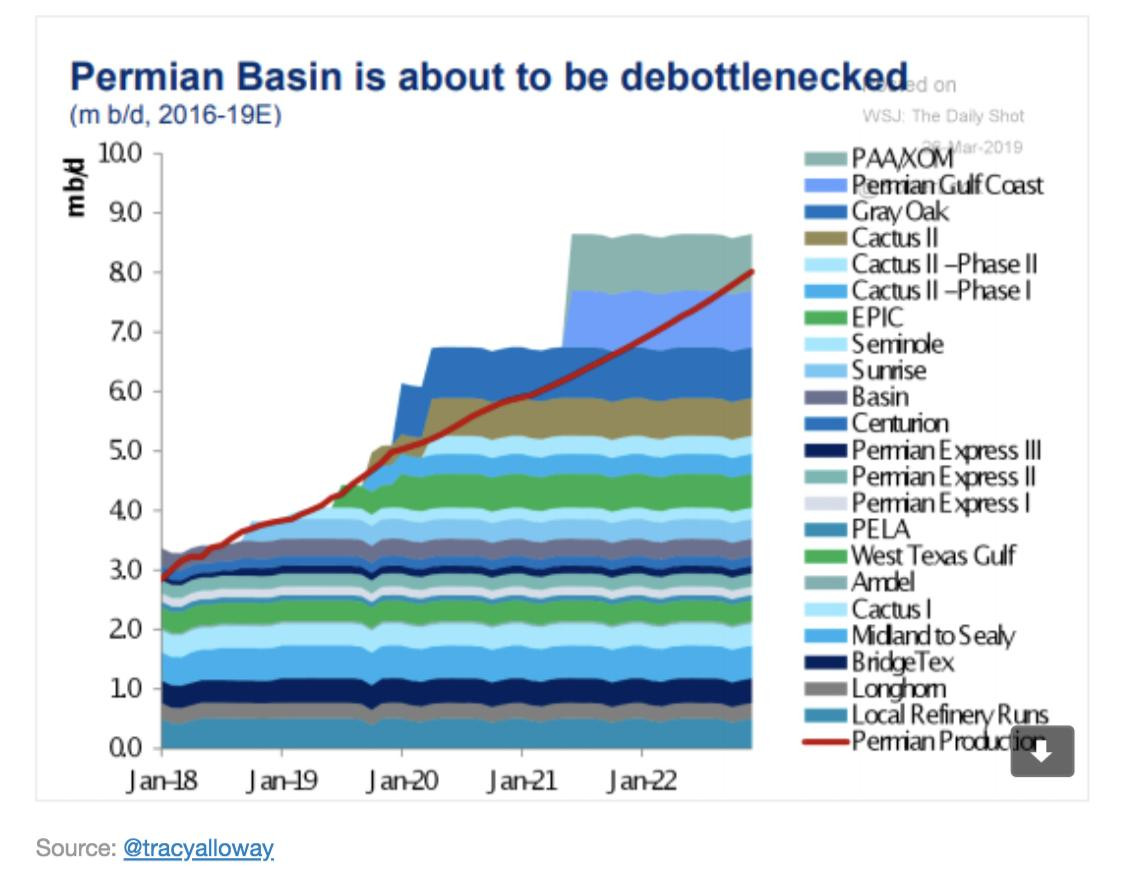

aus: WSJ, The daily shot

=> es werden bereits in den nächsten Monaten eine Reihe von neuen Pipeline-Kapazitäten hinzukommen

De-bottlenecking

.

aus: WSJ, The daily shot

=> es werden bereits in den nächsten Monaten eine Reihe von neuen Pipeline-Kapazitäten hinzukommen

Key Energy Services Receives Notice From NYSE Regarding Continued Listing Requirements

28.6.http://www.globenewswire.com/news-release/2019/06/28/1876262…

=>

...Key Energy Services, Inc. (“Key”) (NYSE: KEG) today announced that it had received a letter from the New York Stock Exchange (the “NYSE”) notifying it that Key was not in compliance with the NYSE’s continued listing standards because, over a period of 30 consecutive trading days, the average market capitalization of Key’s common shares was below $50 million and Key’s stockholders’ equity was less than $50 million as of March 31, 2019. This notice does not have an immediate effect on the listing of Key’s common shares.

In accordance with NYSE rules, Key intends to timely notify the NYSE that Key intends to cure the deficiency. Under the NYSE rules, Key has 45 days from the receipt of the notification to submit a plan advising the NYSE of definitive action Key has taken, or is taking, that would bring Key into conformity with the continued listed standards within 18 months of receipt of the notification. Key intends to develop and submit a business plan to bring it into compliance with the listing standards within the required timeframe.

Within 45 days of receipt of the plan, the NYSE will make a determination as to whether Key has made a reasonable demonstration of an ability to come into conformity in the 18-month period. If the NYSE accepts the plan, Key’s common shares will continue to be listed and traded on the NYSE during the 18-month cure period, subject to Key’s compliance with other continued listing standards, and Key will be subject to quarterly monitoring by the NYSE for compliance with the plan...

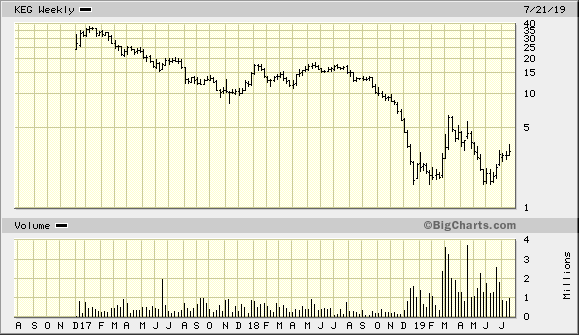

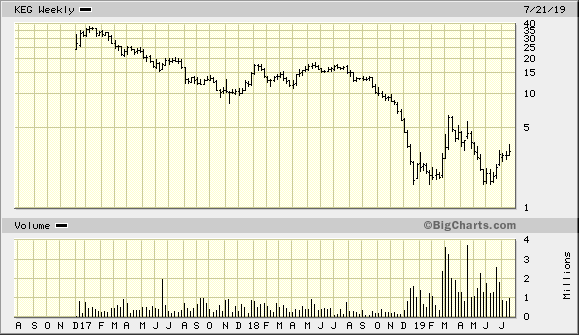

Antwort auf Beitrag Nr.: 60.919.647 von faultcode am 29.06.19 14:13:16Doppeltief??

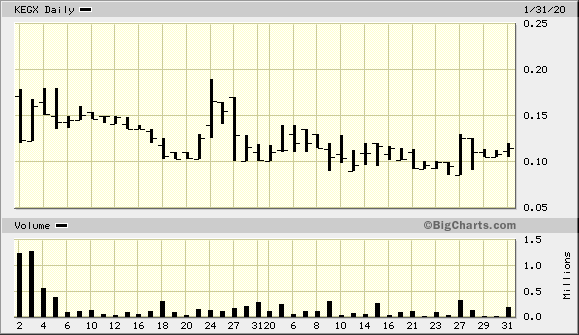

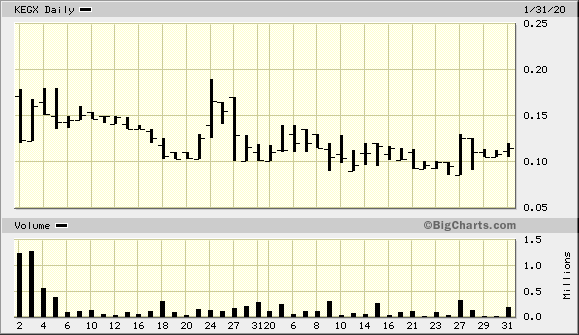

<kompletter Chart nach Chapter 11>

<kompletter Chart nach Chapter 11>

Antwort auf Beitrag Nr.: 61.113.577 von faultcode am 26.07.19 17:09:37

Key Energy Services Announces Strategic Review of Capital Structure; Enters Into Forbearance Agreements with Term Loan and ABL Lenders

https://www.marketwatch.com/press-release/key-energy-service…

=>

HOUSTON, Oct 31, 2019 (GLOBE NEWSWIRE via COMTEX) -- HOUSTON, Oct. 31, 2019 (GLOBE NEWSWIRE) -- Key Energy Services, Inc. ("Key" or the "Company") KEG, -47.96% announced today that it has engaged Moelis & Company LLC as its financial advisor and Sullivan & Cromwell LLP as its legal advisor to assist the Company in analyzing various strategic alternatives to address its capital structure and to position the Company for future success.

In connection with this strategic review, the Company elected not to make a scheduled interest payment due October 18, 2019 under the Term Loan and Security Agreement, dated as of December 15, 2016 (the "Term Loan Agreement"), by and among Key, Cortland Products Corp., as agent, and the lenders party thereto (the "Term Loan Lenders") relating to the Company's senior secured term loan. The Company's failure to make the October interest payment resulted in a default under the Term Loan Agreement and a cross default under the Loan and Security Agreement, dated as of April 5, 2019 (as further amended, restated, supplemented or otherwise modified from time to time, the "ABL Credit Agreement") by and among Key, as borrower, the Lenders party thereto (the "ABL Lenders" and, collectively with the Term Loan Lenders, the "Lenders") and Bank of America, N.A. as Administrative Agent and Sole Collateral Agent (such defaults, the "Specified Defaults").

On October 29, 2019, the Company entered into forbearance agreements with Term Loan Lenders collectively holding over 99.5% of the principal amount of the outstanding term loans (the "Term Loan Forbearance Agreement") and all of the ABL Lenders (the "ABL Forbearance Agreement" and, collectively, the "Forbearance Agreements"). Pursuant to the Forbearance Agreements, the Lenders party thereto have agreed that, until the earlier of December 6, 2019 or the occurrence of certain specified early termination events, such Lenders will forbear from exercising any default-related rights and remedies with respect to the Specified Defaults. The Forbearance Agreements contain certain representations and warranties of the Company and covenants with which the Company must comply during the forbearance period, including a requirement to maintain aggregate bank and book cash balances of at least $10,000,000 as measured on a weekly basis. The failure to comply with such covenants, among other things, would result in the early termination of the forbearance period.

The Company is in active discussions with the Lenders regarding the Company's capital structure and the potential to reduce its debt level in light of challenging market conditions.

As part of its strategic review, the Company has determined to focus its operations on the Company's core areas of operations and exit certain low margin markets. The Company believes that this will allow reductions in its cost structure and improvements in its operating cash flow, in addition to generating future capital expenditure savings. The Company otherwise intends to continue to operate in the ordinary course of business in respect of its core markets while discussions with its Lenders take place, providing the same high level of quality service and responsiveness that its customers, vendors and business partners have come to expect. The Company expects that the conclusion of its negotiations with the Lenders will not result in an impairment of amounts owed to its trade vendors or a change of its ordinary course operations in its core markets, including with its employees in those markets.

Rob Saltiel, President and Chief Executive Officer, stated, "Addressing our capital structure is a top priority for Key, and our management and Board are working constructively with our Lenders to reach a good outcome for our Company. As we explore various strategic alternatives, we remain focused on providing our customers with the same high level of safety and service quality to which they are accustomed. While the outlook for North American oilfield services remains challenging, we believe that the conclusion of this process will position Key for future success."

...

--> -50%

"Chapter 11", die 2.

Zitat von faultcode: ...<kompletter Chart nach Chapter 11>

Key Energy Services Announces Strategic Review of Capital Structure; Enters Into Forbearance Agreements with Term Loan and ABL Lenders

https://www.marketwatch.com/press-release/key-energy-service…

=>

HOUSTON, Oct 31, 2019 (GLOBE NEWSWIRE via COMTEX) -- HOUSTON, Oct. 31, 2019 (GLOBE NEWSWIRE) -- Key Energy Services, Inc. ("Key" or the "Company") KEG, -47.96% announced today that it has engaged Moelis & Company LLC as its financial advisor and Sullivan & Cromwell LLP as its legal advisor to assist the Company in analyzing various strategic alternatives to address its capital structure and to position the Company for future success.

In connection with this strategic review, the Company elected not to make a scheduled interest payment due October 18, 2019 under the Term Loan and Security Agreement, dated as of December 15, 2016 (the "Term Loan Agreement"), by and among Key, Cortland Products Corp., as agent, and the lenders party thereto (the "Term Loan Lenders") relating to the Company's senior secured term loan. The Company's failure to make the October interest payment resulted in a default under the Term Loan Agreement and a cross default under the Loan and Security Agreement, dated as of April 5, 2019 (as further amended, restated, supplemented or otherwise modified from time to time, the "ABL Credit Agreement") by and among Key, as borrower, the Lenders party thereto (the "ABL Lenders" and, collectively with the Term Loan Lenders, the "Lenders") and Bank of America, N.A. as Administrative Agent and Sole Collateral Agent (such defaults, the "Specified Defaults").

On October 29, 2019, the Company entered into forbearance agreements with Term Loan Lenders collectively holding over 99.5% of the principal amount of the outstanding term loans (the "Term Loan Forbearance Agreement") and all of the ABL Lenders (the "ABL Forbearance Agreement" and, collectively, the "Forbearance Agreements"). Pursuant to the Forbearance Agreements, the Lenders party thereto have agreed that, until the earlier of December 6, 2019 or the occurrence of certain specified early termination events, such Lenders will forbear from exercising any default-related rights and remedies with respect to the Specified Defaults. The Forbearance Agreements contain certain representations and warranties of the Company and covenants with which the Company must comply during the forbearance period, including a requirement to maintain aggregate bank and book cash balances of at least $10,000,000 as measured on a weekly basis. The failure to comply with such covenants, among other things, would result in the early termination of the forbearance period.

The Company is in active discussions with the Lenders regarding the Company's capital structure and the potential to reduce its debt level in light of challenging market conditions.

As part of its strategic review, the Company has determined to focus its operations on the Company's core areas of operations and exit certain low margin markets. The Company believes that this will allow reductions in its cost structure and improvements in its operating cash flow, in addition to generating future capital expenditure savings. The Company otherwise intends to continue to operate in the ordinary course of business in respect of its core markets while discussions with its Lenders take place, providing the same high level of quality service and responsiveness that its customers, vendors and business partners have come to expect. The Company expects that the conclusion of its negotiations with the Lenders will not result in an impairment of amounts owed to its trade vendors or a change of its ordinary course operations in its core markets, including with its employees in those markets.

Rob Saltiel, President and Chief Executive Officer, stated, "Addressing our capital structure is a top priority for Key, and our management and Board are working constructively with our Lenders to reach a good outcome for our Company. As we explore various strategic alternatives, we remain focused on providing our customers with the same high level of safety and service quality to which they are accustomed. While the outlook for North American oilfield services remains challenging, we believe that the conclusion of this process will position Key for future success."

...

--> -50%

Antwort auf Beitrag Nr.: 61.817.629 von faultcode am 01.11.19 18:53:4227.1.

Key Energy Services Announces Restructuring Support Agreement

http://www.globenewswire.com/news-release/2020/01/27/1975297…

...

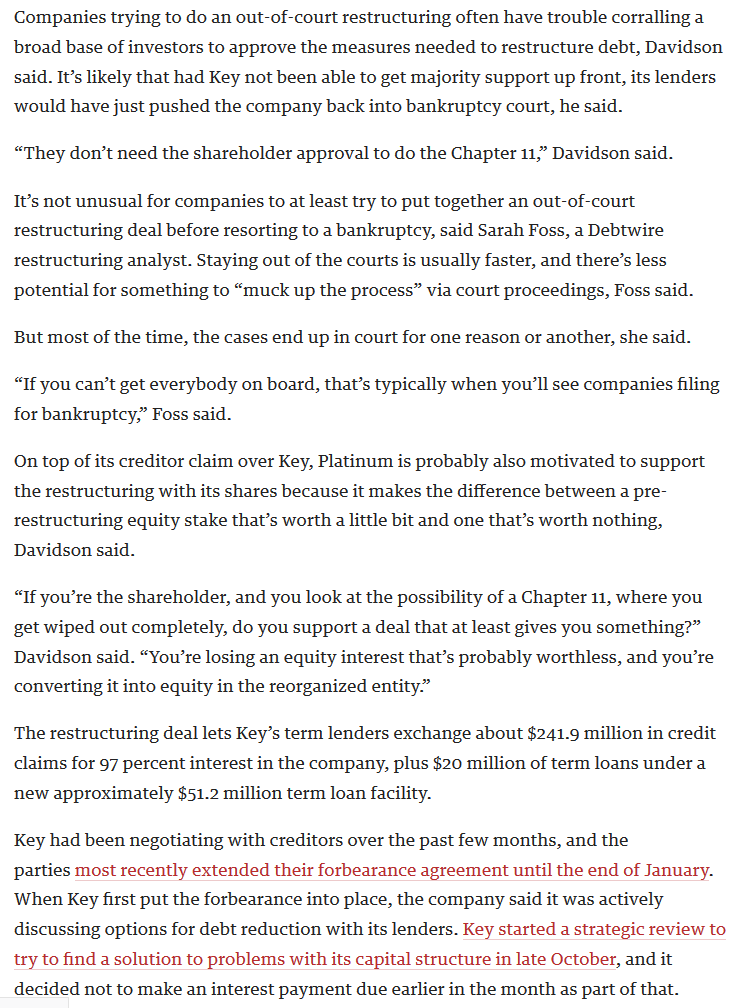

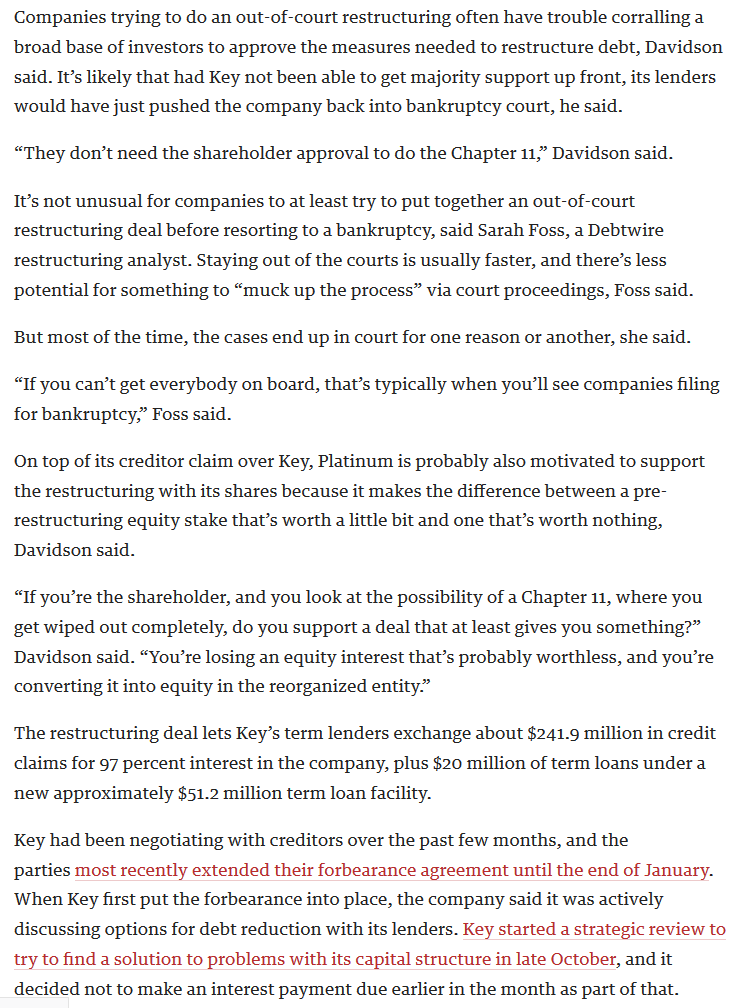

Key Energy Services, Inc. (“Key” or the “Company”) announced today that it has entered into a Restructuring Support Agreement (including the exhibit thereto, the “RSA”) with lenders under its term loan facility collectively holding over 99.5% (the “Supporting Term Lenders”) of the principal amount of the Company’s outstanding term loans. The RSA contemplates a series of out-of-court transactions that will effectuate a financial restructuring of the Company’s capital structure and indebtedness and related facilities, including the conversion of approximately $241.9 million aggregate outstanding principal of the Company’s term loans (together with accrued interest thereon) into (i) newly issued shares of the common stock of the Company and (ii) $20 million of term loans under a new approximately $51.2 million term loan facility (the “Restructuring”).

The Restructuring is expected to reduce the Company’s long term debt by approximately 80%.

Upon completion of the Restructuring, Supporting Term Lenders are expected to own 97% of the common stock of the Company and holders of existing equity interests are expected to hold 3% of the common stock of the Company, in each case subject to potential dilution as a result of certain new warrants (the “New Warrants”) and a new management incentive plan (the “MIP”), each as described further below.

Under the RSA, the parties have agreed to support and cooperate with each other in good faith, to coordinate and to use their respective commercially reasonable best efforts to consummate the Restructuring as soon as reasonably practicable on the terms set forth in the RSA. The Company currently expects to complete the restructuring by the end of February 2020.

Marshall Dodson, Key’s Interim Chief Executive Officer stated, “This agreement marks an important milestone in our process of addressing Key’s capital structure, reducing our debt and improving the company’s liquidity. I would like to thank Key’s dedicated employees, who through this period of uncertainty, have continued to provide safe and excellent service to our customers. While the market conditions we face in 2020 are expected to remain challenging, I believe that with the improved capital structure this transaction affords Key, our great employees will be able to take advantage of the opportunities present in today’s market and continue on our path to improved financial performance.”

...

Key Energy Services Announces Restructuring Support Agreement

http://www.globenewswire.com/news-release/2020/01/27/1975297…

...

Key Energy Services, Inc. (“Key” or the “Company”) announced today that it has entered into a Restructuring Support Agreement (including the exhibit thereto, the “RSA”) with lenders under its term loan facility collectively holding over 99.5% (the “Supporting Term Lenders”) of the principal amount of the Company’s outstanding term loans. The RSA contemplates a series of out-of-court transactions that will effectuate a financial restructuring of the Company’s capital structure and indebtedness and related facilities, including the conversion of approximately $241.9 million aggregate outstanding principal of the Company’s term loans (together with accrued interest thereon) into (i) newly issued shares of the common stock of the Company and (ii) $20 million of term loans under a new approximately $51.2 million term loan facility (the “Restructuring”).

The Restructuring is expected to reduce the Company’s long term debt by approximately 80%.

Upon completion of the Restructuring, Supporting Term Lenders are expected to own 97% of the common stock of the Company and holders of existing equity interests are expected to hold 3% of the common stock of the Company, in each case subject to potential dilution as a result of certain new warrants (the “New Warrants”) and a new management incentive plan (the “MIP”), each as described further below.

Under the RSA, the parties have agreed to support and cooperate with each other in good faith, to coordinate and to use their respective commercially reasonable best efforts to consummate the Restructuring as soon as reasonably practicable on the terms set forth in the RSA. The Company currently expects to complete the restructuring by the end of February 2020.

Marshall Dodson, Key’s Interim Chief Executive Officer stated, “This agreement marks an important milestone in our process of addressing Key’s capital structure, reducing our debt and improving the company’s liquidity. I would like to thank Key’s dedicated employees, who through this period of uncertainty, have continued to provide safe and excellent service to our customers. While the market conditions we face in 2020 are expected to remain challenging, I believe that with the improved capital structure this transaction affords Key, our great employees will be able to take advantage of the opportunities present in today’s market and continue on our path to improved financial performance.”

...

Antwort auf Beitrag Nr.: 62.560.105 von faultcode am 02.02.20 21:09:09Enterprise Value (EV): ~USD228m|30.9.19

--> wenn man annimmt, daß das Restructuring Support Agreement daran nichts ändert, blieben den Bestandsaktionären noch mMn maximal 3% x (USD242m - USD51m new term loan facility) = ~USD5.7m

<Working cap war zum 30.9. positiv mit ~+USD23m, was aber nur pro forma gilt wegen Schuldendienstaufschub und Zinsaufschub>

--> 20.443m outstanding shares zu derzeit USD0.115 bedeuten ~USD2.4 an Market Cap

hmm --> das erklärt wohl auch, warum die Aktie am Montag, 27.1., stieg:

--> ich sehe eben diese Differenz von ~USD5.7m und ~USD2.4m (nur als Größenordnung) als Risikoabschlag, daß bei den auch derzeit niedrigen Ölpreisen der Deal nicht durchkommt und Key Energy Services endgültig liquidiert werden muss

--> am Fr kam noch diese Mitteilung:

31.1.

Item 1.01 Entry into a Material Definitive Agreement.

As previously announced, on October 29, 2019, Key Energy Services, Inc. (the “Company” or “Key”) entered into a forbearance agreement (as amended on December 6, 2019, December 20, 2019 and January 10, 2020 the “ABL Forbearance Agreement”) with Bank of America, N.A., as administrative agent (the “Administrative Agent”), and all of the lenders party thereto (the “Lenders”) regarding a cross-default under the Loan and Security Agreement, dated as of April 5, 2019, by and among Key, the Administrative Agent and the Lenders (such defaults, the “Specified Defaults”).

On January 31, 2020, the Company and the Lenders party thereto amended the ABL Forbearance Agreement (the “Forbearance Agreement Amendment”).

Pursuant to the Forbearance Agreement Amendment, the Lenders party thereto have agreed to extend the forbearance period until the earliest of (i) February 28, 2020, (ii) the occurrence of certain specified early termination events and (iii) the date on which the previously announced Restructuring Support Agreement between the Company and certain lenders under the Company’s term loan facility (the “RSA”) is terminated in accordance with its terms.

In addition, the Lenders have agreed that the Forbearance Agreement shall also apply to any cross-default under the Loan and Security Agreement that may arise from certain specified defaults under the term loan facility set forth in the RSA.

The foregoing description of the Forbearance Agreement Amendment is qualified in its entirety by reference to the complete text of the Amendment to the ABL Forbearance Agreement, attached as Exhibit 10.1 hereto and incorporated herein by reference.

...

https://fintel.io/doc/sec-keg-8k-key-energy-services-2020-ja…

--> wenn man annimmt, daß das Restructuring Support Agreement daran nichts ändert, blieben den Bestandsaktionären noch mMn maximal 3% x (USD242m - USD51m new term loan facility) = ~USD5.7m

<Working cap war zum 30.9. positiv mit ~+USD23m, was aber nur pro forma gilt wegen Schuldendienstaufschub und Zinsaufschub>

--> 20.443m outstanding shares zu derzeit USD0.115 bedeuten ~USD2.4 an Market Cap

hmm --> das erklärt wohl auch, warum die Aktie am Montag, 27.1., stieg:

--> ich sehe eben diese Differenz von ~USD5.7m und ~USD2.4m (nur als Größenordnung) als Risikoabschlag, daß bei den auch derzeit niedrigen Ölpreisen der Deal nicht durchkommt und Key Energy Services endgültig liquidiert werden muss

--> am Fr kam noch diese Mitteilung:

31.1.

Item 1.01 Entry into a Material Definitive Agreement.

As previously announced, on October 29, 2019, Key Energy Services, Inc. (the “Company” or “Key”) entered into a forbearance agreement (as amended on December 6, 2019, December 20, 2019 and January 10, 2020 the “ABL Forbearance Agreement”) with Bank of America, N.A., as administrative agent (the “Administrative Agent”), and all of the lenders party thereto (the “Lenders”) regarding a cross-default under the Loan and Security Agreement, dated as of April 5, 2019, by and among Key, the Administrative Agent and the Lenders (such defaults, the “Specified Defaults”).

On January 31, 2020, the Company and the Lenders party thereto amended the ABL Forbearance Agreement (the “Forbearance Agreement Amendment”).

Pursuant to the Forbearance Agreement Amendment, the Lenders party thereto have agreed to extend the forbearance period until the earliest of (i) February 28, 2020, (ii) the occurrence of certain specified early termination events and (iii) the date on which the previously announced Restructuring Support Agreement between the Company and certain lenders under the Company’s term loan facility (the “RSA”) is terminated in accordance with its terms.

In addition, the Lenders have agreed that the Forbearance Agreement shall also apply to any cross-default under the Loan and Security Agreement that may arise from certain specified defaults under the term loan facility set forth in the RSA.

The foregoing description of the Forbearance Agreement Amendment is qualified in its entirety by reference to the complete text of the Amendment to the ABL Forbearance Agreement, attached as Exhibit 10.1 hereto and incorporated herein by reference.

...

https://fintel.io/doc/sec-keg-8k-key-energy-services-2020-ja…

Antwort auf Beitrag Nr.: 62.560.366 von faultcode am 02.02.20 21:53:3428.1.

Behind the deal: Energy services co.'s restructuring nabbed major shareholder approval

https://www.bizjournals.com/houston/news/2020/01/28/behind-t…

...

...

Behind the deal: Energy services co.'s restructuring nabbed major shareholder approval

https://www.bizjournals.com/houston/news/2020/01/28/behind-t…

...

...

Antwort auf Beitrag Nr.: 62.560.465 von faultcode am 02.02.20 22:05:009.3.

Key Energy Services Announces Completion of Restructuring

http://www.globenewswire.com/news-release/2020/03/09/1997011…

...

Key Energy Services, Inc. (“Key” or the “Company”) announced today that on March 6, 2020, the Company completed the transactions described in its previously announced Restructuring Support Agreement (the “RSA”). Pursuant to the RSA and related agreements, lenders collectively holding over 99.5% of the Company’s term loans exchanged approximately $241.9 million aggregate outstanding principal of such term loans (together with accrued interest) into

(1) approximately 13.3 million newly issued shares of common stock of the Company an

(2) $20 million of term loans under a new approximately $51.2 million term loan facility.

The 13.3 million shares issued to the lenders represent 97% of the outstanding shares of common stock following such exchange and give effect to the 50-for-1 reverse stock split also implemented by the Company on March 6, 2020. As part of the new term loan facility, the lenders also provided $30 million of new term loan funding.

As contemplated by the RSA, on March 6, 2020, the Board of Directors of the Company also declared a dividend of two series of warrants to each stockholder of record as of the close of business on February 18, 2020, pursuant to which stockholders will receive their pro rata share of the warrants based on their ownership of common stock as of the record date.

The first series of warrants will entitle the holders to purchase in the aggregate 1,669,730 shares of the Company’s Common Stock, at an exercise price of $19.23 per share of common stock and subject to adjustment as set forth in the warrant agreement. The second series of warrants will entitle the holders to purchase in the aggregate 1,252,297 shares of the Company’s common stock, at an exercise price of $28.85 per share of common stock and subject to adjustment as set forth in the warrant agreement. Each series of warrants will have a four-year exercise period.

In connection with the Restructuring, Key entered into a third amendment to its existing ABL facility (the “New ABL Facility”). The New ABL Facility, among other things,

(i) reduces the lenders’ aggregate commitments to make revolving loans to $70 million and

(ii) increases the applicable interest rate margin by 75 basis points to 275–375 basis points for LIBOR borrowing and 175–225 basis points for base rate borrowing, in each case depending on the fixed charge coverage ratio at the time of determination.

The New ABL Facility contains affirmative and negative covenants that are substantially similar to those under the Company’s prior term loan facility.

On March 6, 2020, in connection with the Restructuring, Bryan Kelln, Mary Ann Sigler, Paul T. Bader, Philip Norment, and Steven H. Pruett resigned as members of the Board. As contemplated by the RSA and pursuant to a stockholders agreement entered into on March 6, 2020, J. Marshall Dodson, current Interim Chief Executive Officer of the Company, Harry Quarls, Alan Menkes and Marcus Rowland were appointed to the Board on March 6, 2020. Harry Quarls was appointed Chairman of the Board of Directors.

...

Key Energy Services Announces Completion of Restructuring

http://www.globenewswire.com/news-release/2020/03/09/1997011…

...

Key Energy Services, Inc. (“Key” or the “Company”) announced today that on March 6, 2020, the Company completed the transactions described in its previously announced Restructuring Support Agreement (the “RSA”). Pursuant to the RSA and related agreements, lenders collectively holding over 99.5% of the Company’s term loans exchanged approximately $241.9 million aggregate outstanding principal of such term loans (together with accrued interest) into

(1) approximately 13.3 million newly issued shares of common stock of the Company an

(2) $20 million of term loans under a new approximately $51.2 million term loan facility.

The 13.3 million shares issued to the lenders represent 97% of the outstanding shares of common stock following such exchange and give effect to the 50-for-1 reverse stock split also implemented by the Company on March 6, 2020. As part of the new term loan facility, the lenders also provided $30 million of new term loan funding.

As contemplated by the RSA, on March 6, 2020, the Board of Directors of the Company also declared a dividend of two series of warrants to each stockholder of record as of the close of business on February 18, 2020, pursuant to which stockholders will receive their pro rata share of the warrants based on their ownership of common stock as of the record date.

The first series of warrants will entitle the holders to purchase in the aggregate 1,669,730 shares of the Company’s Common Stock, at an exercise price of $19.23 per share of common stock and subject to adjustment as set forth in the warrant agreement. The second series of warrants will entitle the holders to purchase in the aggregate 1,252,297 shares of the Company’s common stock, at an exercise price of $28.85 per share of common stock and subject to adjustment as set forth in the warrant agreement. Each series of warrants will have a four-year exercise period.

In connection with the Restructuring, Key entered into a third amendment to its existing ABL facility (the “New ABL Facility”). The New ABL Facility, among other things,

(i) reduces the lenders’ aggregate commitments to make revolving loans to $70 million and

(ii) increases the applicable interest rate margin by 75 basis points to 275–375 basis points for LIBOR borrowing and 175–225 basis points for base rate borrowing, in each case depending on the fixed charge coverage ratio at the time of determination.

The New ABL Facility contains affirmative and negative covenants that are substantially similar to those under the Company’s prior term loan facility.

On March 6, 2020, in connection with the Restructuring, Bryan Kelln, Mary Ann Sigler, Paul T. Bader, Philip Norment, and Steven H. Pruett resigned as members of the Board. As contemplated by the RSA and pursuant to a stockholders agreement entered into on March 6, 2020, J. Marshall Dodson, current Interim Chief Executive Officer of the Company, Harry Quarls, Alan Menkes and Marcus Rowland were appointed to the Board on March 6, 2020. Harry Quarls was appointed Chairman of the Board of Directors.

...

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,02 | |

| +0,64 | |

| +1,54 | |

| -0,50 | |

| -0,51 | |

| +0,78 | |

| +2,79 | |

| -3,40 | |

| +1,26 | |

| +1,11 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 191 | ||

| 93 | ||

| 66 | ||

| 50 | ||

| 46 | ||

| 42 | ||

| 40 | ||

| 37 | ||

| 35 | ||

| 27 |