Carl Icahn: Kasse gemacht: Star-Investor stiegt vor Lyft-Börsengang aus (Seite 5) | Diskussion im Forum

eröffnet am 04.04.19 10:50:59 von

neuester Beitrag 14.02.24 15:57:49 von

neuester Beitrag 14.02.24 15:57:49 von

Beiträge: 86

ID: 1.301.322

ID: 1.301.322

Aufrufe heute: 0

Gesamt: 4.093

Gesamt: 4.093

Aktive User: 0

ISIN: US55087P1049 · WKN: A2PE38 · Symbol: LYFT

16,150

USD

-3,35 %

-0,560 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

18.04.24 · Business Wire (engl.) |

18.03.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

11.03.24 · Business Wire (engl.) |

07.03.24 · Business Wire (engl.) |

Werte aus der Branche Informationstechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 70,50 | +188,93 | |

| 0,6120 | +32,75 | |

| 3,2000 | +23,08 | |

| 1,1500 | +21,69 | |

| 4,1000 | +20,59 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,8000 | -37,78 | |

| 0,7500 | -40,00 | |

| 12,300 | -47,21 | |

| 7,0000 | -62,10 | |

| 82,75 | -68,36 |

Beitrag zu dieser Diskussion schreiben

die Konsolidierung läuft:

18.11.

Gett shuts down Juno ride-hailing service, hops in with Lyft

https://www.bizjournals.com/newyork/news/2019/11/18/gett-shu…

=>

...Juno, an app launched three years ago by entrepreneur Talmon Marco to compete with ride-hailing giant Uber Technologies Inc., is no more.

Parent company Gett confirmed Monday that it was closing Juno's operations in New York and partnering with Uber rival Lyft Inc.

Marco created Juno after making $900 million off the sale of messaging app Viber to Japanese online retailer Rakuten Inc.

At the time, Juno had been known for paying taxi drivers across New York City to download the app with the idea that it would upend other ride-hailing competitors, whether it be Uber, Lyft, Via or Gett

Marco's plan didn't quite work, and he sold the company to Gett in 2017 for roughly $250 million.

Gett, known for its "surge pricing sucks" campaign, is backed by Volkswagen Group. The Israel-based company is part of GetTaxi Inc.

...

The company blamed the “enactment of misguided regulations in New York City earlier this year" for the closure.

...

18.11.

Gett shuts down Juno ride-hailing service, hops in with Lyft

https://www.bizjournals.com/newyork/news/2019/11/18/gett-shu…

=>

...Juno, an app launched three years ago by entrepreneur Talmon Marco to compete with ride-hailing giant Uber Technologies Inc., is no more.

Parent company Gett confirmed Monday that it was closing Juno's operations in New York and partnering with Uber rival Lyft Inc.

Marco created Juno after making $900 million off the sale of messaging app Viber to Japanese online retailer Rakuten Inc.

At the time, Juno had been known for paying taxi drivers across New York City to download the app with the idea that it would upend other ride-hailing competitors, whether it be Uber, Lyft, Via or Gett

Marco's plan didn't quite work, and he sold the company to Gett in 2017 for roughly $250 million.

Gett, known for its "surge pricing sucks" campaign, is backed by Volkswagen Group. The Israel-based company is part of GetTaxi Inc.

...

The company blamed the “enactment of misguided regulations in New York City earlier this year" for the closure.

...

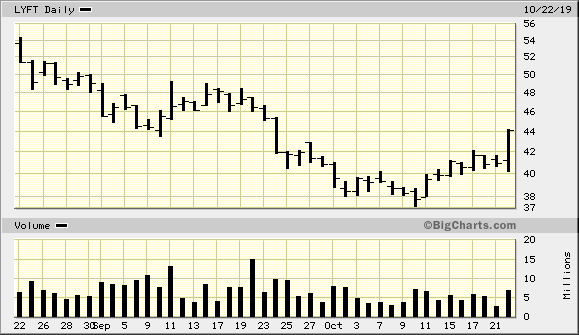

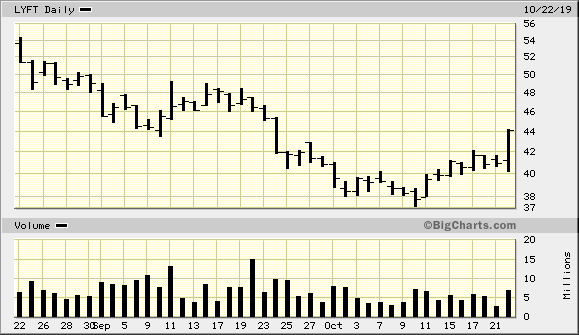

Antwort auf Beitrag Nr.: 61.685.170 von faultcode am 14.10.19 00:18:21Ich räume meine Position derweil und vorerst --> auf Beobachtung:

Lyft stock jumps 5% after co-founders tell WSJ they see profitability a year earlier than expected

https://www.cnbc.com/2019/10/22/lyft-stock-jumps-after-repor…

=>

Key Points

• Lyft co-founders Logan Green and John Zimmer told the Wall Street Journal that the company could be profitable on an adjusted EBITDA basis as soon as next year.

• That’s one year earlier than the company previously projected.

...

Lyft stock jumps 5% after co-founders tell WSJ they see profitability a year earlier than expected

https://www.cnbc.com/2019/10/22/lyft-stock-jumps-after-repor…

=>

Key Points

• Lyft co-founders Logan Green and John Zimmer told the Wall Street Journal that the company could be profitable on an adjusted EBITDA basis as soon as next year.

• That’s one year earlier than the company previously projected.

...

bei Lyft sind nur die nur Class A stocks im Handel

Another factor weighing on companies that have recently gone public is changes to the membership requirements in benchmark stock indexes.Updated rules state that companies with multiple share classes can’t be added to indexes maintained by the S&P Dow Jones Indices LLC. Companies with multiple share classes also face restrictions at the FTSE Russell. The trickle-down of this is that many of the largest companies to IPO in 2019 (including Chewy, Lyft and Pinterest) are being ignored by US mutual funds and ETFs.

Goldman Sachs wrote: “Multi-class voting to insulate management from its own shareholders comes at a significant long-term cost.” Companies with multiple share classes are facing this fact, as their share prices are not being levitated through the inclusion in many popular and widely owned benchmark indexes.

https://www.zerohedge.com/markets/cream-cash-burning-crop

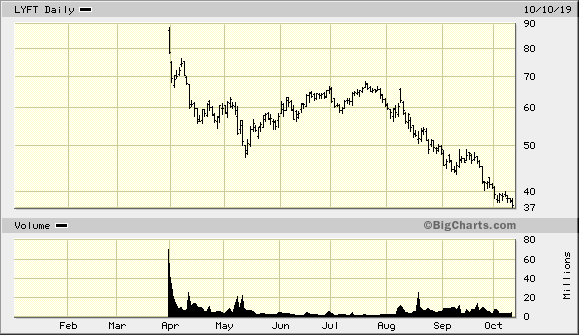

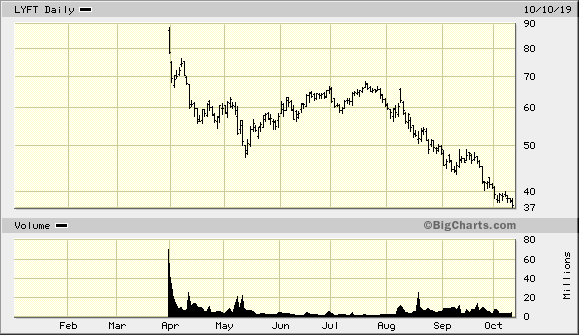

Antwort auf Beitrag Nr.: 61.417.571 von faultcode am 05.09.19 12:54:22beim Rennen nach unten führt LYFT (6m-Basis) - heute mit Alltime Low. Entgegen dem Markt

--> UBER auch heute rot - aber nicht so deutlich wie LYFT:

--> IPO-Kurs war USD72 lt. https://www.nasdaq.com/market-activity/ipos/overview?dealId=…

--> UBER auch heute rot - aber nicht so deutlich wie LYFT:

--> IPO-Kurs war USD72 lt. https://www.nasdaq.com/market-activity/ipos/overview?dealId=…

wg direkt anschreiben - im stark hierachisch tickenden deutschland werde ich dafür oft belächelt

in usa, skandinavien, auch holland - selbst in der uk bekomme ich oft von vermeintlich großen tieren eine antwort ...

sc

in usa, skandinavien, auch holland - selbst in der uk bekomme ich oft von vermeintlich großen tieren eine antwort ...

sc

Antwort auf Beitrag Nr.: 61.495.766 von SmartCap am 16.09.19 18:44:18ich habe den pivot podcast zur uber story gehört, besonders informativ fand ich's nicht, ist mehr talk geplänkel

Scott Galloway find ich ganz orginell - deswegen lese/höre ich öfter was er so im sinn hat

(er ist übrigens im board of directors von S. Schambachs neuer us firma, zumindest als ich das checkte vor ca 1 jahr)

Scott prophezeit 80% kursverlust nä 2 jahre für uber ...

sc

Scott Galloway find ich ganz orginell - deswegen lese/höre ich öfter was er so im sinn hat

(er ist übrigens im board of directors von S. Schambachs neuer us firma, zumindest als ich das checkte vor ca 1 jahr)

Scott prophezeit 80% kursverlust nä 2 jahre für uber ...

sc

Antwort auf Beitrag Nr.: 61.493.486 von faultcode am 16.09.19 14:25:38ich würde ihn direkt fragen per email evtl. in verb. mit frage ob er auch in europa investieren will ...

falls du den pivot pocast mit scott galloway/ kara s. kennst - da wird das buch vom autor nochmals vorgestellt- ich wollte es mir in nä tagen anören

sc

falls du den pivot pocast mit scott galloway/ kara s. kennst - da wird das buch vom autor nochmals vorgestellt- ich wollte es mir in nä tagen anören

sc

Antwort auf Beitrag Nr.: 61.421.894 von SmartCap am 05.09.19 19:51:033.9.

The Meteoric Rise And Fall Of Uber's Founder

--> interessanter Artikel. Vielleicht werde ich mir mal das Buch dazu kaufen; sowas landet ja immer nach einiger Zeit bei der Ramschware; v.a. wenn Uber-Longies bei weiterem Kursverfall nichts mehr davon wissen wollen

nebenbei: was macht eigentlich Serial entrepreneur Travis Kalanick heutzutage?

--> er betreibt nun seinen low-profile globalen Venture fund 10100: http://10100fund.com/

The Meteoric Rise And Fall Of Uber's Founder

--> interessanter Artikel. Vielleicht werde ich mir mal das Buch dazu kaufen; sowas landet ja immer nach einiger Zeit bei der Ramschware; v.a. wenn Uber-Longies bei weiterem Kursverfall nichts mehr davon wissen wollen

nebenbei: was macht eigentlich Serial entrepreneur Travis Kalanick heutzutage?

--> er betreibt nun seinen low-profile globalen Venture fund 10100: http://10100fund.com/

Zitat von faultcode: 11.9.

Gig Workers Win in California

https://gizmodo.com/gig-workers-win-1837883577

=>

After the better part of year, California’s Senate today passed AB5, legislation that is expected to unravel the contractor business model of companies like Uber, Lyft, and Doordash.

In a historic victory, workers for those companies and others like them are now likely to be considered employees, entitled to the benefits and protections that status conveys.

...

...keine Panik. Z.Z. laufen - wie auch bei TSLA, UBER etc. - Shorteindeckungen

ich tippe auf uber - da u.a vermutlich mehr kriminelle energie als bei lyft ...

https://www.wbur.org/hereandnow/2019/09/03/uber-super-pumped…

https://www.wbur.org/hereandnow/2019/09/03/uber-super-pumped…