PagerDuty -- noch ein 2019-IPO: IT-supervision (Seite 2)

eröffnet am 14.04.19 23:54:08 von

neuester Beitrag 10.01.24 20:40:26 von

neuester Beitrag 10.01.24 20:40:26 von

Beiträge: 13

ID: 1.301.974

ID: 1.301.974

Aufrufe heute: 0

Gesamt: 1.519

Gesamt: 1.519

Aktive User: 0

ISIN: US69553P1003 · WKN: A2PF9K · Symbol: 2TY

19,555

EUR

-1,68 %

-0,335 EUR

Letzter Kurs 18.04.24 Tradegate

Neuigkeiten

27.03.24 · Business Wire (engl.) |

19.03.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

13.03.24 · Business Wire (engl.) |

13.02.24 · Business Wire (engl.) |

Werte aus der Branche Informationstechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6120 | +32,75 | |

| 1,1500 | +21,69 | |

| 1,7000 | +18,88 | |

| 33,42 | +18,46 | |

| 0,6950 | +15,83 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2577 | -28,13 | |

| 1,1100 | -34,71 | |

| 2,8000 | -37,78 | |

| 12,300 | -47,21 | |

| 7,0000 | -62,10 |

Beitrag zu dieser Diskussion schreiben

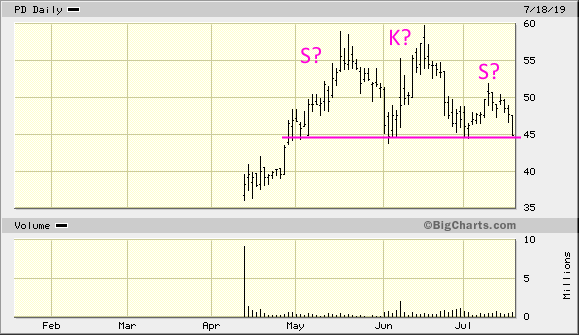

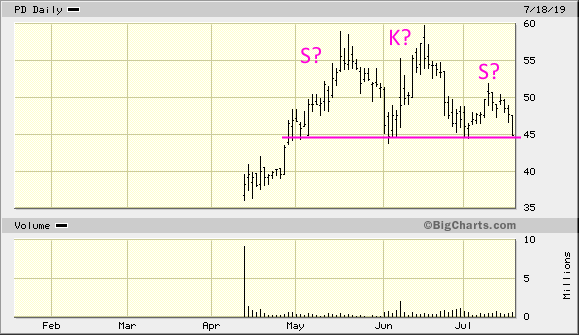

Antwort auf Beitrag Nr.: 60.354.262 von faultcode am 15.04.19 00:00:01obwohl - das sieht auch nicht mehr so gesund aus:

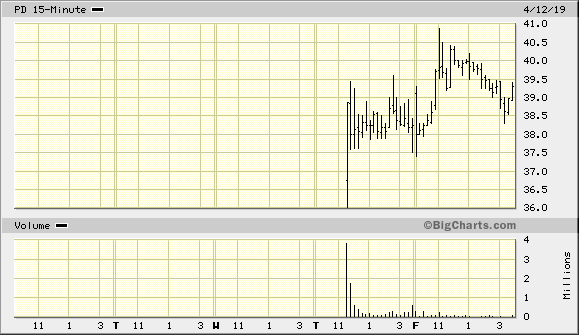

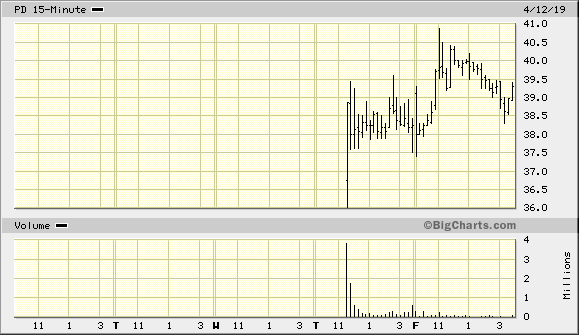

Antwort auf Beitrag Nr.: 60.354.244 von faultcode am 14.04.19 23:54:08hier ist der IPO geglückt soweit:

=> aber ne MC von USD2.9b bei Revenues von sagenhaften USD117.8m|2018 , wenn auch mit +48% YoY

, wenn auch mit +48% YoY

=> aber ne MC von USD2.9b bei Revenues von sagenhaften USD117.8m|2018

, wenn auch mit +48% YoY

, wenn auch mit +48% YoY

https://www.pagerduty.com/

Symbol: PD

Run by a female CEO, San Francisco software company raises $218 million in IPO

https://www.bizjournals.com/sanfrancisco/news/2019/04/10/pag…

=>

...PagerDuty raised $218 million in its IPO Wednesday, coming in above the high end of its recently increased pricing range – a signal of hot demand for the enterprise software company.

The San Francisco-based enterprise software company expects to begin trading Thursday on the New York Stock Exchange under the ticker PD. And while its public markets debut comes a week after Lyft’s closely watched and rocky IPO, it’s unlikely to face a similar fate as Lyft.

PagerDuty priced its IPO at $24 per share today, higher than the pricing range of $21 to $23 per share that it indicated on Tuesday.

Lyft also priced its IPO at the high end of its pricing range, settling on $72 per share. But Wednesday, it closed at $60.12, down nearly 11 percent. The similarities between these two tech unicorn IPOs roughly ends there.

PagerDuty is an enterprise software company. Enterprise software startups have plenty of other publicly traded enterprise software companies that institutional investors can compare them to before investing in their IPOs, a major institutional investor said in a previous interview. Lyft had no direct comparisons that investors could use before it went public.

PagerDuty runs a cloud platform where it collects signals from software-enabled systems and devices, then correlates and analyzes the signals in real-time and notifies customers if something is amiss...

Symbol: PD

Run by a female CEO, San Francisco software company raises $218 million in IPO

https://www.bizjournals.com/sanfrancisco/news/2019/04/10/pag…

=>

...PagerDuty raised $218 million in its IPO Wednesday, coming in above the high end of its recently increased pricing range – a signal of hot demand for the enterprise software company.

The San Francisco-based enterprise software company expects to begin trading Thursday on the New York Stock Exchange under the ticker PD. And while its public markets debut comes a week after Lyft’s closely watched and rocky IPO, it’s unlikely to face a similar fate as Lyft.

PagerDuty priced its IPO at $24 per share today, higher than the pricing range of $21 to $23 per share that it indicated on Tuesday.

Lyft also priced its IPO at the high end of its pricing range, settling on $72 per share. But Wednesday, it closed at $60.12, down nearly 11 percent. The similarities between these two tech unicorn IPOs roughly ends there.

PagerDuty is an enterprise software company. Enterprise software startups have plenty of other publicly traded enterprise software companies that institutional investors can compare them to before investing in their IPOs, a major institutional investor said in a previous interview. Lyft had no direct comparisons that investors could use before it went public.

PagerDuty runs a cloud platform where it collects signals from software-enabled systems and devices, then correlates and analyzes the signals in real-time and notifies customers if something is amiss...

PagerDuty -- noch ein 2019-IPO: IT-supervision