Marathon Petroleum (Seite 2)

eröffnet am 08.05.19 21:35:55 von

neuester Beitrag 14.12.23 16:49:24 von

neuester Beitrag 14.12.23 16:49:24 von

Beiträge: 41

ID: 1.303.626

ID: 1.303.626

Aufrufe heute: 0

Gesamt: 4.360

Gesamt: 4.360

Aktive User: 0

ISIN: US56585A1025 · WKN: A1JEXK · Symbol: MPC

198,92

USD

+0,34 %

+0,67 USD

Letzter Kurs 19:25:19 NYSE

Neuigkeiten

22.04.24 · Accesswire |

18.04.24 · Accesswire |

15.04.24 · Accesswire |

28.03.24 · Accesswire |

27.03.24 · Accesswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +53,15 | |

| 6,0800 | +43,06 | |

| 0,8200 | +41,38 | |

| 0,5070 | +31,52 | |

| 16,030 | +18,65 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,2150 | -9,02 | |

| 6,8500 | -9,27 | |

| 1,2000 | -14,29 | |

| 11,720 | -17,11 | |

| 20,000 | -33,33 |

Beitrag zu dieser Diskussion schreiben

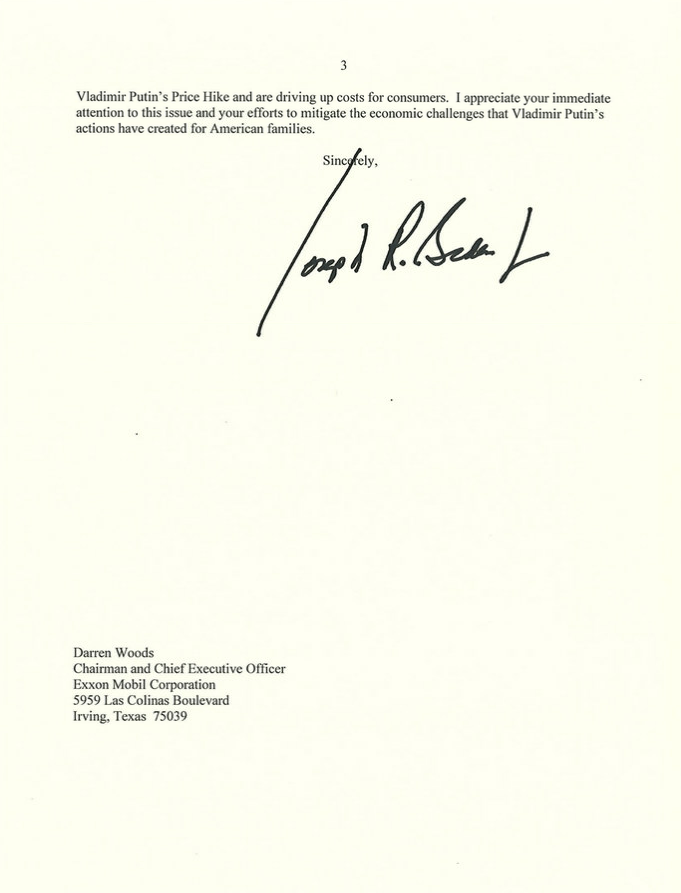

Antwort auf Beitrag Nr.: 71.792.207 von faultcode am 15.06.22 22:27:28die Antwort der Industrie: https://de.scribd.com/document/578446086/Letter-to-President…

=>

...

...

=>

...

...

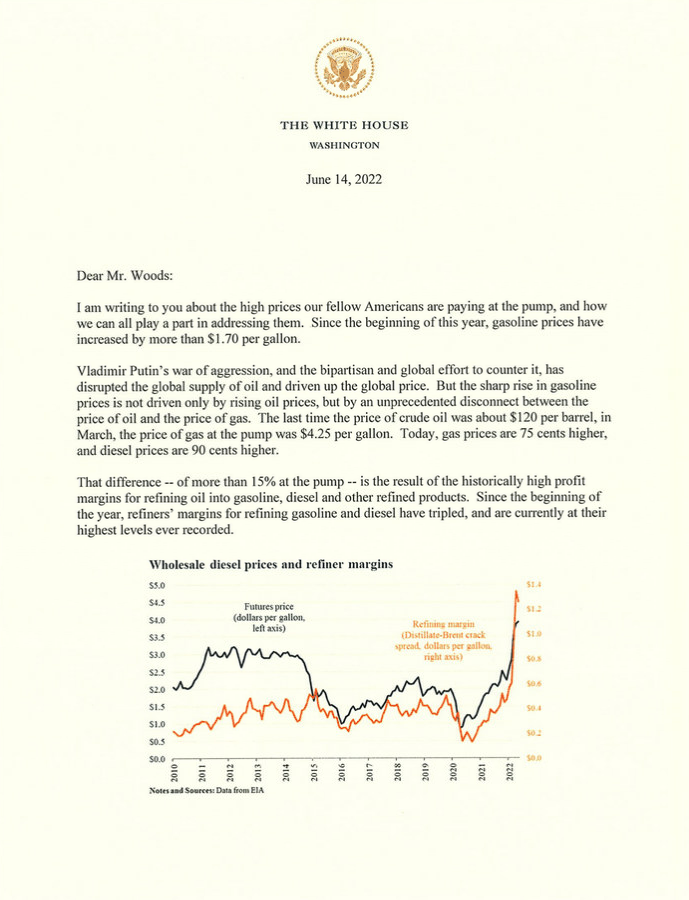

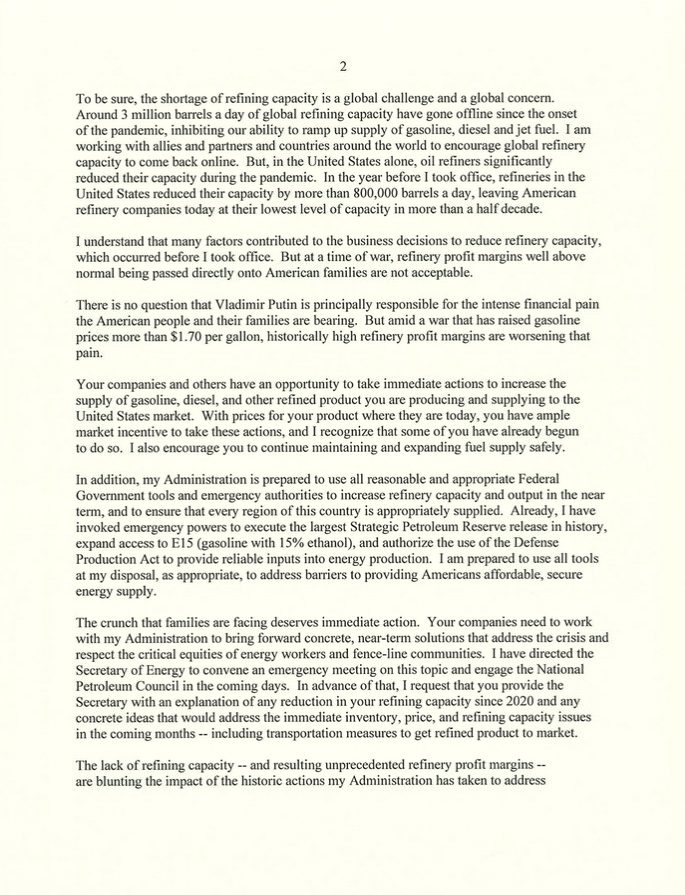

hier eine Kopie des Biden-Briefes an die U.S.-Ölindustrie (hier CEO Woods von Exxon): https://twitter.com/JavierBlas/status/1537014456839983106

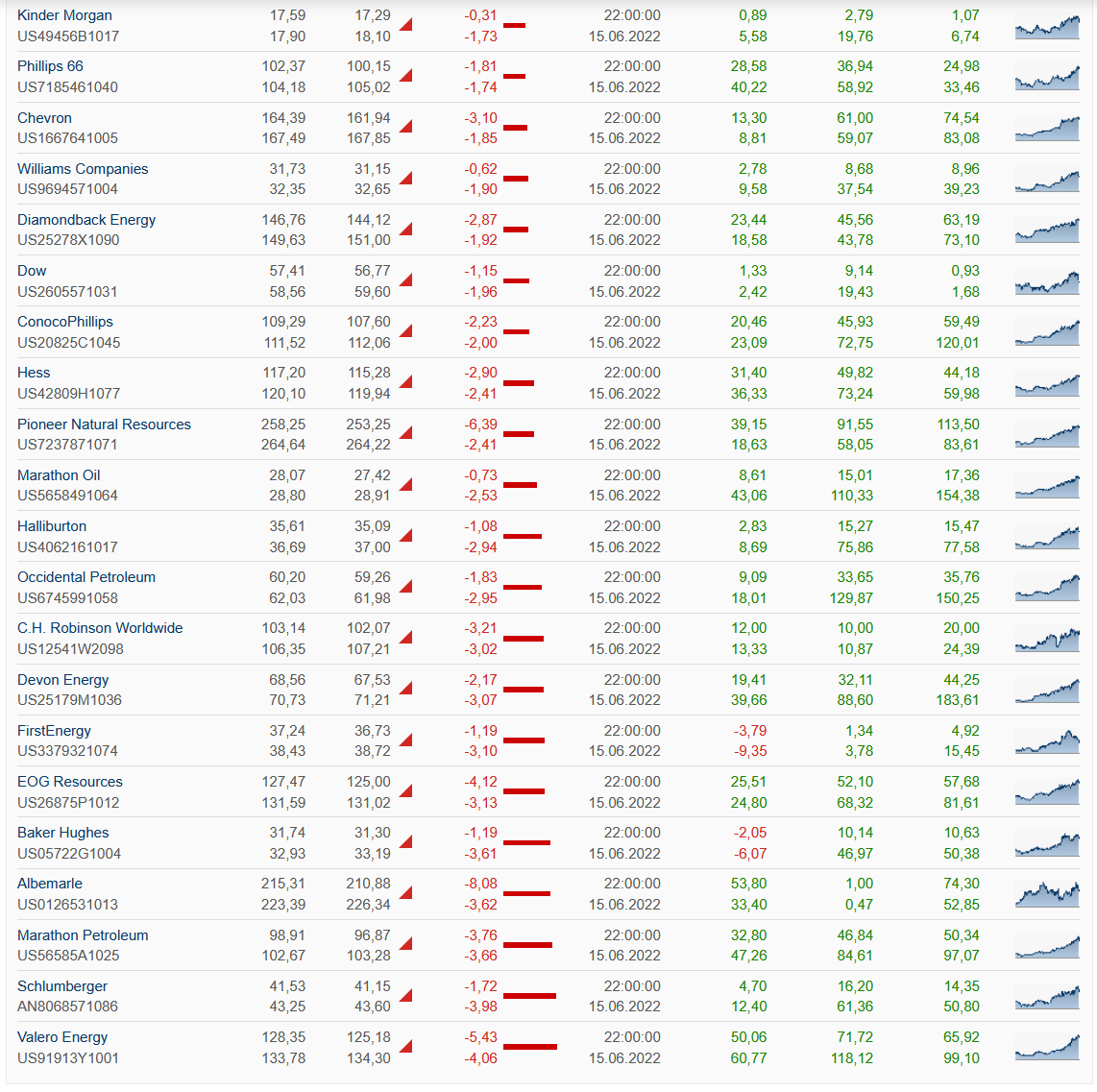

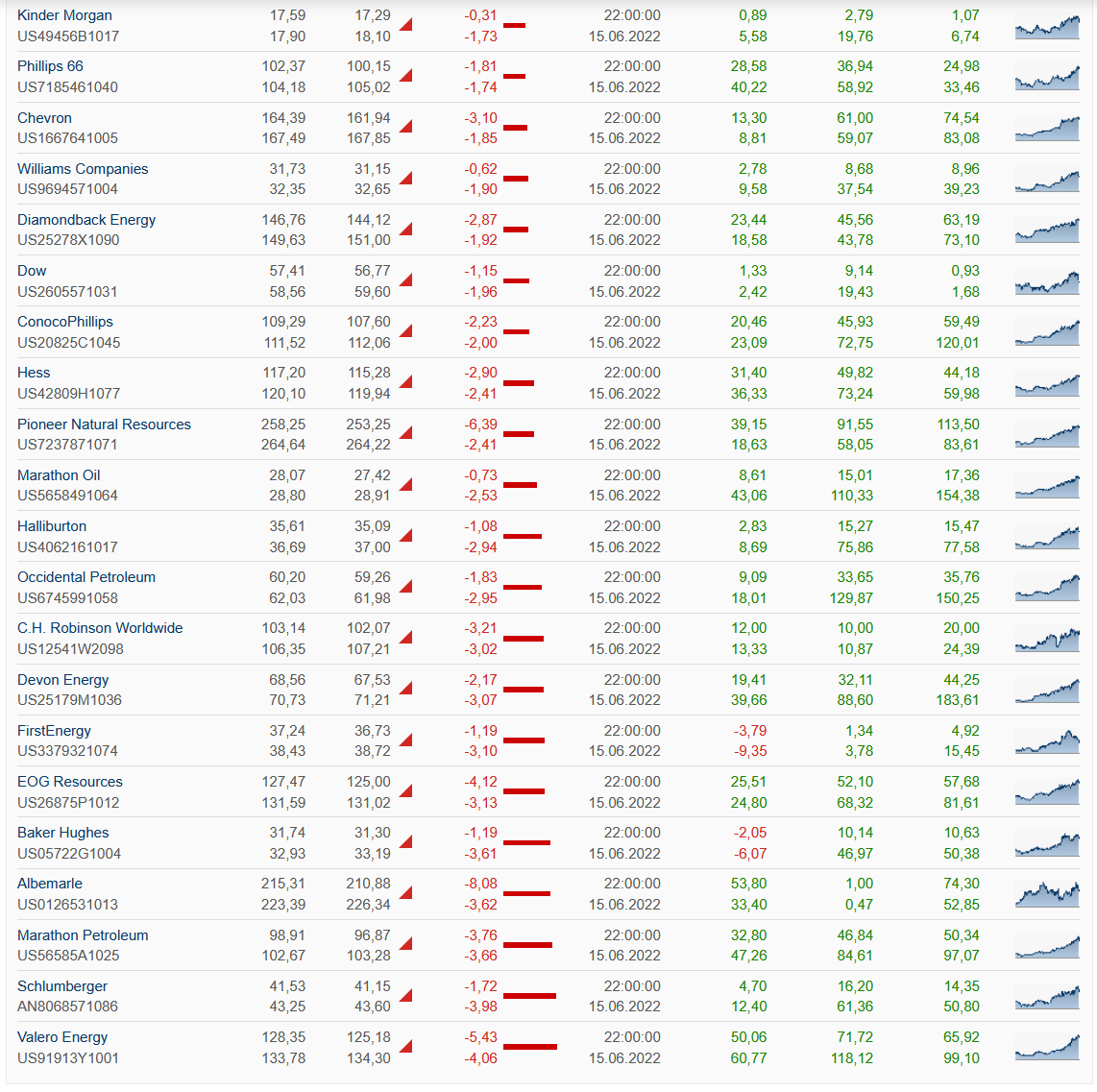

=> die meisten Verlierer heute im SP500 sind Ölfirmen:

https://www.finanzen.net/index/s&p_500/topflop

Witzigerweise sind auch Ausrüster dabei zu finden, die bei einer Kapazitätsausweitung mehr Geschäft hätten => das Ganze macht so gesehen hinten und vorne keinen Sinn

Joe's eigene Behörde (U.S. Energy Information Administration, EIA) schrieb am 8.7.2021 dazu:

In 2020, the pandemic contributed to a substantial decrease in demand for motor fuels and refined petroleum products, which put downward pressure on refinery margins and made market conditions more challenging for refinery operators. In addition to challenging market conditions, increasing market interest in renewable diesel production and pre-existing plans to scale down or reconfigure petroleum refineries all contributed to the closing of a handful of refineries in 2020.

https://www.eia.gov/todayinenergy/detail.php?id=48636

=> wollte Joe Biden nicht sowieso die "erneuerbaren Energien" fördern?

=> die meisten Verlierer heute im SP500 sind Ölfirmen:

https://www.finanzen.net/index/s&p_500/topflop

Witzigerweise sind auch Ausrüster dabei zu finden, die bei einer Kapazitätsausweitung mehr Geschäft hätten => das Ganze macht so gesehen hinten und vorne keinen Sinn

Joe's eigene Behörde (U.S. Energy Information Administration, EIA) schrieb am 8.7.2021 dazu:

In 2020, the pandemic contributed to a substantial decrease in demand for motor fuels and refined petroleum products, which put downward pressure on refinery margins and made market conditions more challenging for refinery operators. In addition to challenging market conditions, increasing market interest in renewable diesel production and pre-existing plans to scale down or reconfigure petroleum refineries all contributed to the closing of a handful of refineries in 2020.

https://www.eia.gov/todayinenergy/detail.php?id=48636

=> wollte Joe Biden nicht sowieso die "erneuerbaren Energien" fördern?

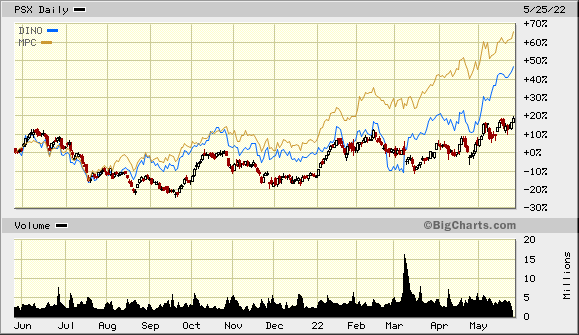

PSX, DINO und MPC heute mit neuem Jahreshoch:

13.5.

The US Can't Make Enough Fuel and There's No Fix in Sight

https://www.bnnbloomberg.ca/the-us-can-t-make-enough-fuel-an…

...

As for selling those assets to someone who could ramp up production, no one’s buying — even as industry players are sitting on massive piles of cash. “We feel we’ve got higher returns, better uses for the capital to employ than buying a refinery that’s on the market at this point in time,” Valero Chief Executive Officer Joe Gorder said in a conference call with analysts in late April.

To be sure, there could be some small-scale relief ahead. US refiners ran at 90% last week, and that percentage will increase as seasonal maintenance wraps up this month. Some units can then even run 10% or 20% beyond their nameplate capacity to maximize production in the short term. But that’s a rate that can’t be sustained without risking damage. A few refineries are also focusing on debottlenecking or even adding new units inside existing facilities to boost capacity, though it’s a drop in the bucket volumewise compared to the total already lost — and it won’t come until 2023 or 2024.

In short, “too much refining capacity was closed during the pandemic,” Bloomberg Intelligence’s Valle said. “Diesel shortages and the price surge are likely here to stay.”

The US Can't Make Enough Fuel and There's No Fix in Sight

https://www.bnnbloomberg.ca/the-us-can-t-make-enough-fuel-an…

...

As for selling those assets to someone who could ramp up production, no one’s buying — even as industry players are sitting on massive piles of cash. “We feel we’ve got higher returns, better uses for the capital to employ than buying a refinery that’s on the market at this point in time,” Valero Chief Executive Officer Joe Gorder said in a conference call with analysts in late April.

To be sure, there could be some small-scale relief ahead. US refiners ran at 90% last week, and that percentage will increase as seasonal maintenance wraps up this month. Some units can then even run 10% or 20% beyond their nameplate capacity to maximize production in the short term. But that’s a rate that can’t be sustained without risking damage. A few refineries are also focusing on debottlenecking or even adding new units inside existing facilities to boost capacity, though it’s a drop in the bucket volumewise compared to the total already lost — and it won’t come until 2023 or 2024.

In short, “too much refining capacity was closed during the pandemic,” Bloomberg Intelligence’s Valle said. “Diesel shortages and the price surge are likely here to stay.”

21.2.

Marathon’s Huge Louisiana Refinery Rocked by Explosion, Fire

https://finance.yahoo.com/news/marathon-huge-louisiana-oil-r…

...

Marathon Petroleum Corp.’s oil refinery near New Orleans exploded into flames on Monday, threatening to crimp fuel supplies and raise pump prices at a time of already rampant inflation.

The company’s Garyville, Louisiana, plant is one of the nation’s largest and a key supplier of gasoline, diesel and other fuels. Marathon said five people were injured. The blaze that started around 9:30 a.m. local time was declared extinguished about 4 1/2 hours later.

The fire occurred in a hydrocracker, according to a person familiar with the operation, a crucial price of equipment that breaks heavy petroleum molecules down into lighter products such as diesel.

If any damages are significant enough to halt production at the Garyville complex, regional fuel supplies may be stretched.

...

Marathon’s Huge Louisiana Refinery Rocked by Explosion, Fire

https://finance.yahoo.com/news/marathon-huge-louisiana-oil-r…

...

Marathon Petroleum Corp.’s oil refinery near New Orleans exploded into flames on Monday, threatening to crimp fuel supplies and raise pump prices at a time of already rampant inflation.

The company’s Garyville, Louisiana, plant is one of the nation’s largest and a key supplier of gasoline, diesel and other fuels. Marathon said five people were injured. The blaze that started around 9:30 a.m. local time was declared extinguished about 4 1/2 hours later.

The fire occurred in a hydrocracker, according to a person familiar with the operation, a crucial price of equipment that breaks heavy petroleum molecules down into lighter products such as diesel.

If any damages are significant enough to halt production at the Garyville complex, regional fuel supplies may be stretched.

...

Antwort auf Beitrag Nr.: 69.791.625 von faultcode am 03.11.21 14:28:25

in den USA ist NatGas mittlerweile ein gutes Stück wieder zurückgekommen.

=> und durch:

Zitat von faultcode: ...Die Preise für NatGas belasten auch hier....

in den USA ist NatGas mittlerweile ein gutes Stück wieder zurückgekommen.

=> und durch:

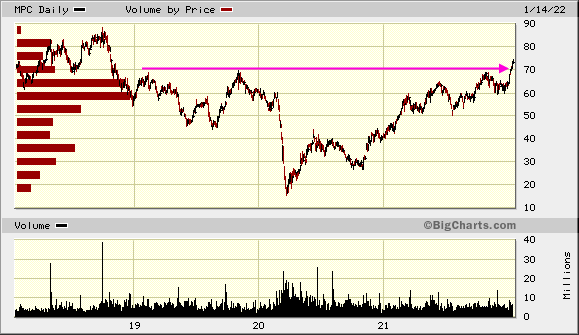

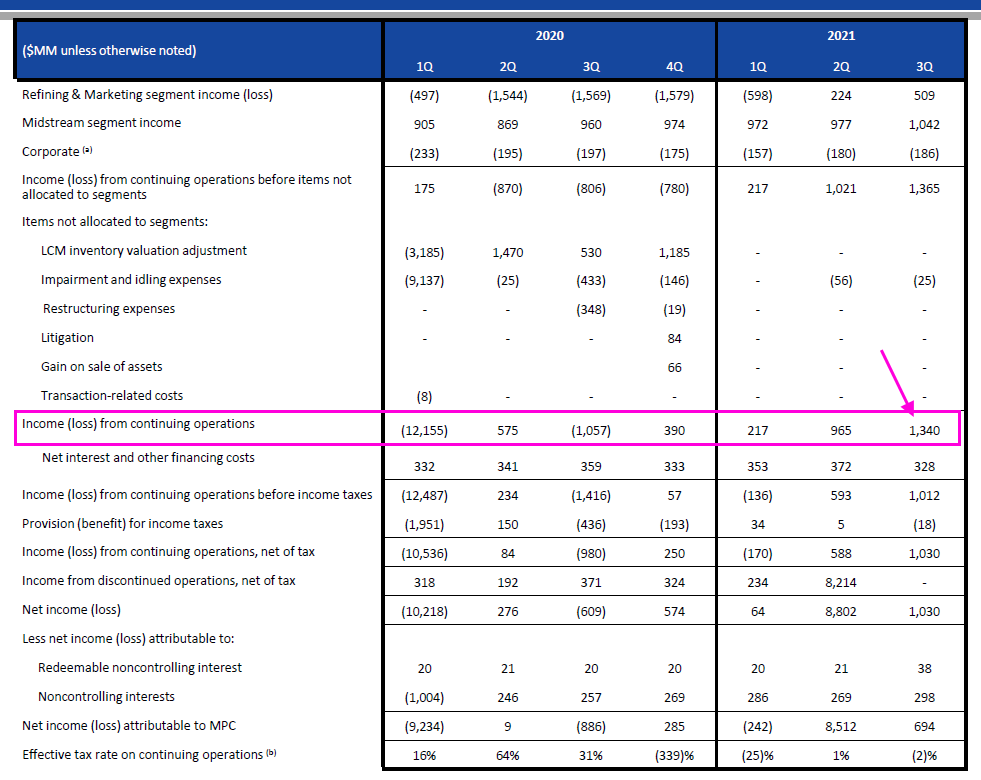

MPC mit mMn gefälligem Q3-Ergebnis. Post-Krise mit höchstem oper. Ergebnis aus fortgeführten Geschäften:

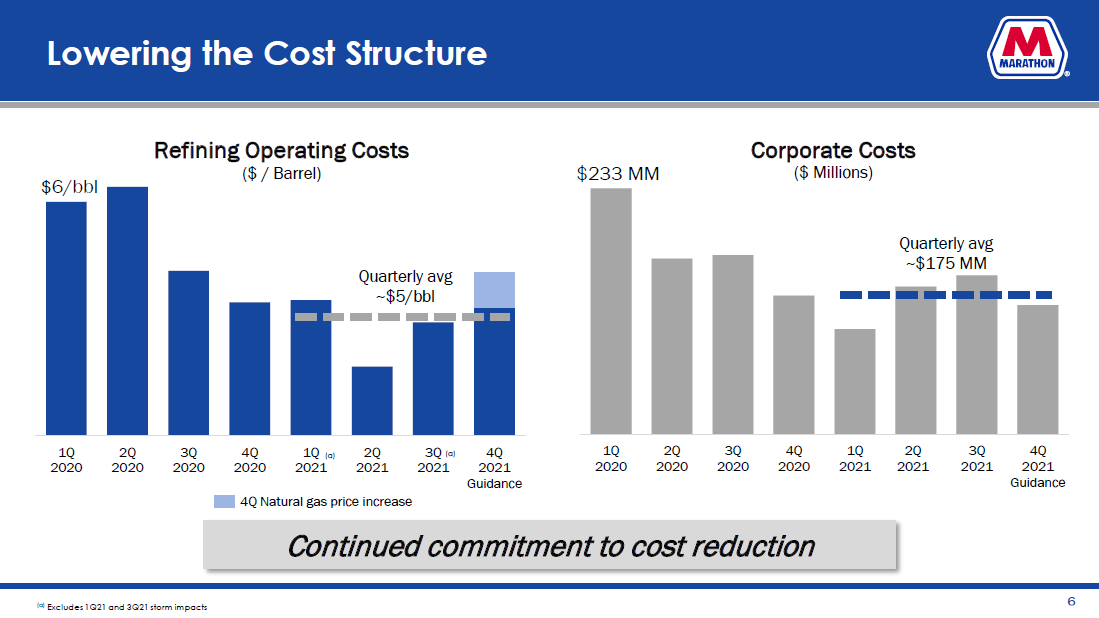

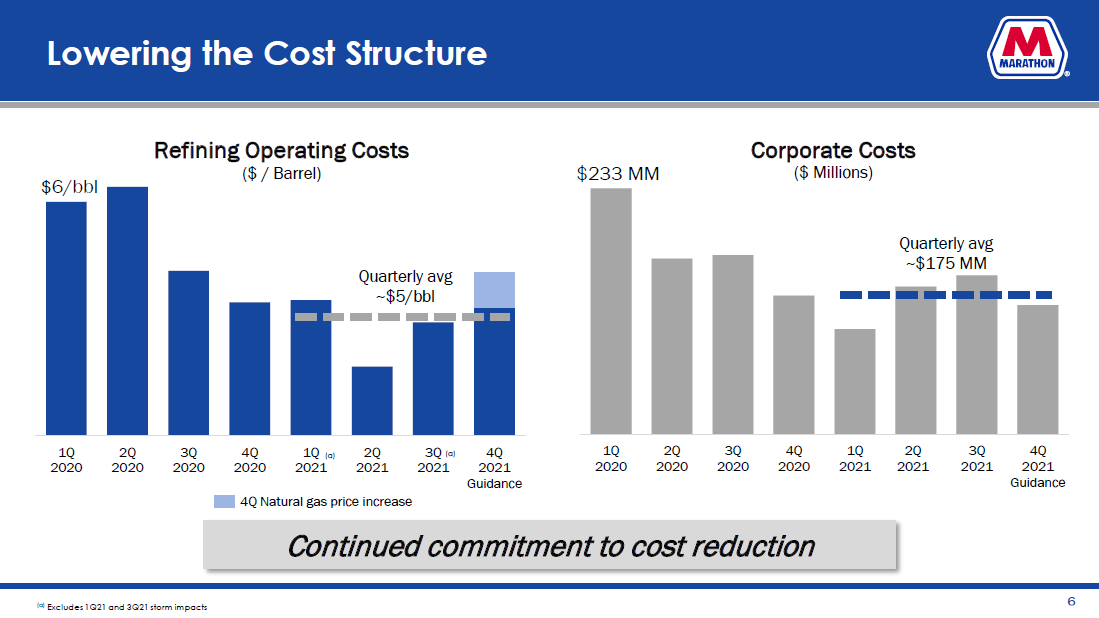

Die Preise für NatGas belasten auch hier.

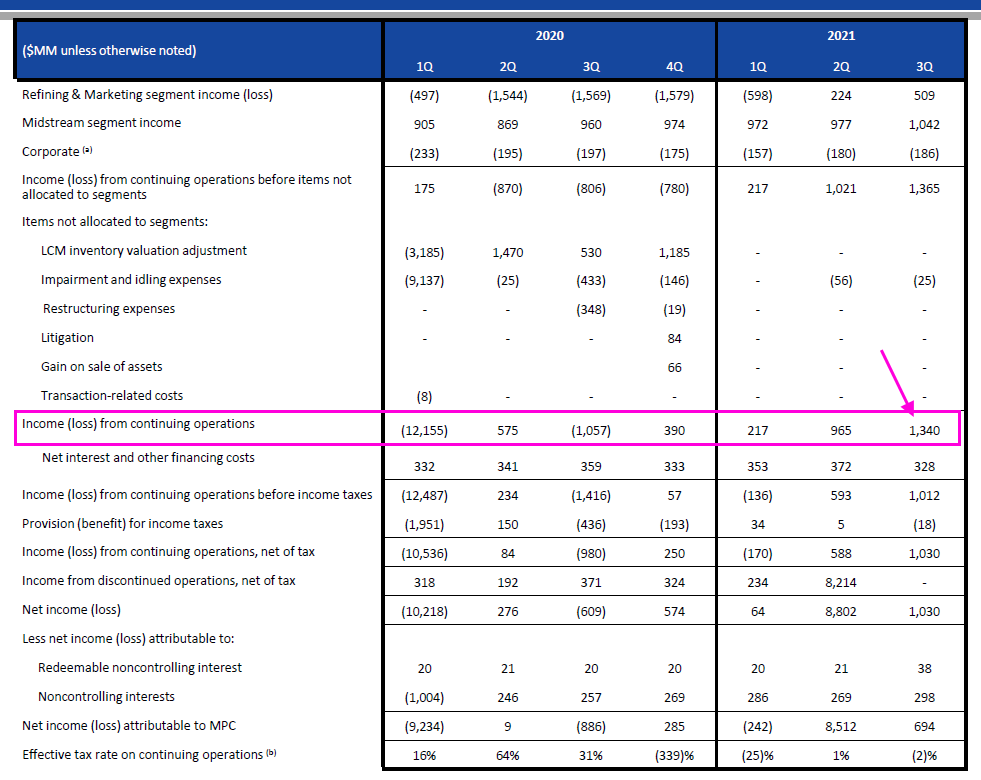

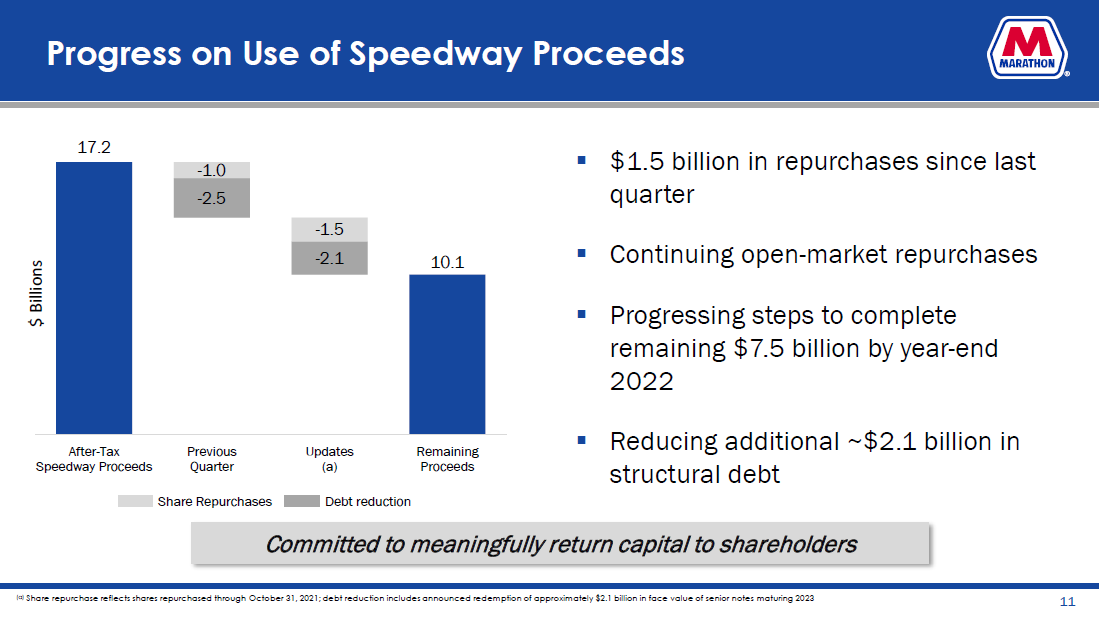

Daß es beim Speedway-Verkauf noch zu rechtlichen Komplikationen mit der US-Regierung kommen könnte (Beitrag Nr. 20), scheint kein Thema in der Q3-Präsentation zu sein (ich habe das CC-Transkript aber nicht gelesen):

ansonsten:

Die Preise für NatGas belasten auch hier.

Daß es beim Speedway-Verkauf noch zu rechtlichen Komplikationen mit der US-Regierung kommen könnte (Beitrag Nr. 20), scheint kein Thema in der Q3-Präsentation zu sein (ich habe das CC-Transkript aber nicht gelesen):

ansonsten:

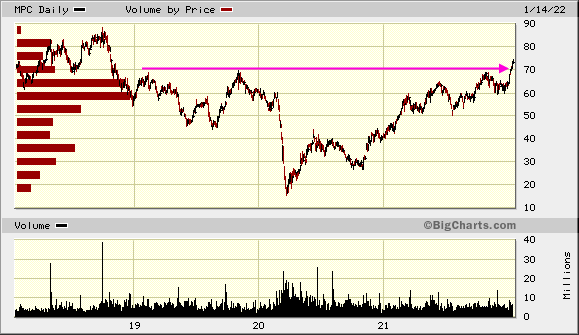

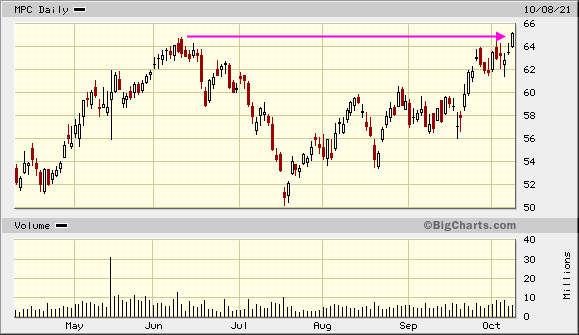

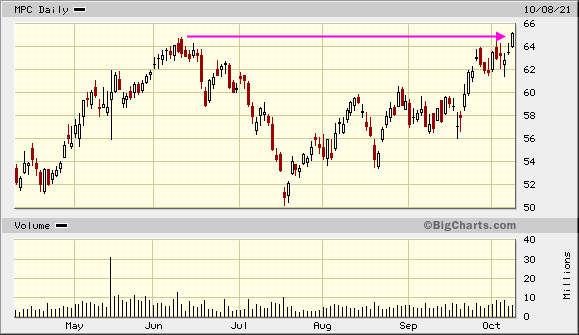

MPC vor dem Durchbruch?

die Biden-Administration hat einen Schuldigen für zu hohe Inflation gefunden:

https://twitter.com/business/status/1432346393432166407

...

FTC Chair Lina Khan is directing staff to identify new legal theories to challenge retail fuel station mergers and investigate possible collusion by national chains to push up prices, she said in an Aug. 25 letter to White House economic adviser Brian Deese obtained by Bloomberg.

...

https://twitter.com/business/status/1432346393432166407

...

FTC Chair Lina Khan is directing staff to identify new legal theories to challenge retail fuel station mergers and investigate possible collusion by national chains to push up prices, she said in an Aug. 25 letter to White House economic adviser Brian Deese obtained by Bloomberg.

...

4.8.

Marathon Petroleum Corporation Q2 adjusted earnings Beat Estimates

https://markets.businessinsider.com/news/stocks/marathon-pet…

...

• Earnings: $965 million in Q2 vs. $575 million in the same period last year.

• EPS: $0.46 in Q2 vs. -$0.28 in the same period last year.

• Excluding items, Marathon Petroleum Corporation reported adjusted earnings of $437 million or $0.67 per share for the period.

• Analysts projected $0.53 per share

• Revenue: $29.83 billion in Q2 vs. $12.3 billion in the same period last year.

Marathon Petroleum Corporation Q2 adjusted earnings Beat Estimates

https://markets.businessinsider.com/news/stocks/marathon-pet…

...

• Earnings: $965 million in Q2 vs. $575 million in the same period last year.

• EPS: $0.46 in Q2 vs. -$0.28 in the same period last year.

• Excluding items, Marathon Petroleum Corporation reported adjusted earnings of $437 million or $0.67 per share for the period.

• Analysts projected $0.53 per share

• Revenue: $29.83 billion in Q2 vs. $12.3 billion in the same period last year.