PBF Energy (Seite 3)

eröffnet am 27.06.19 00:16:24 von

neuester Beitrag 08.09.23 17:43:29 von

neuester Beitrag 08.09.23 17:43:29 von

Beiträge: 44

ID: 1.306.296

ID: 1.306.296

Aufrufe heute: 0

Gesamt: 2.645

Gesamt: 2.645

Aktive User: 0

ISIN: US69318G1067 · WKN: A1J9SG · Symbol: PEN

52,20

EUR

+0,12 %

+0,06 EUR

Letzter Kurs 08:01:13 Tradegate

Neuigkeiten

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 21,990 | +90,22 | |

| 6,0800 | +43,06 | |

| 0,5070 | +31,52 | |

| 0,6100 | +15,09 | |

| 0,6180 | +14,87 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 437,25 | -5,48 | |

| 4,5200 | -5,64 | |

| 15,570 | -7,32 | |

| 1,3250 | -7,67 | |

| 1.050,01 | -14,28 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 68.153.716 von faultcode am 11.05.21 21:47:56

https://twitter.com/AndyGrewal/status/1391957832317210627

https://twitter.com/AndyGrewal/status/1391957832317210627

Antwort auf Beitrag Nr.: 68.153.716 von faultcode am 11.05.21 21:47:56

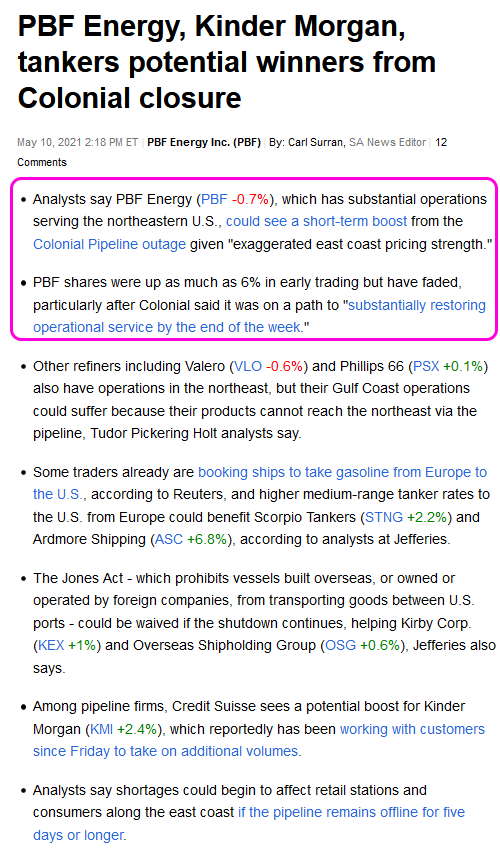

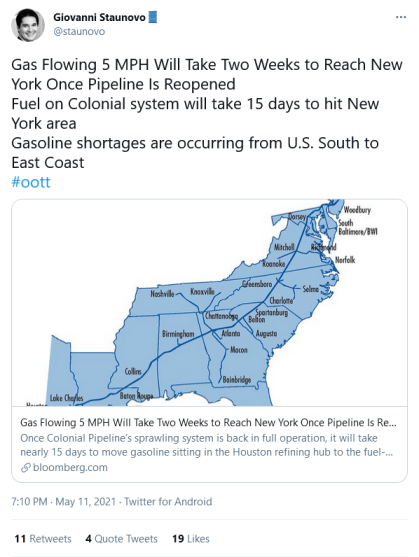

gestern war das Sentiment noch entsprechend:

...

https://seekingalpha.com/news/3694067-pbf-energy-kinder-morg…

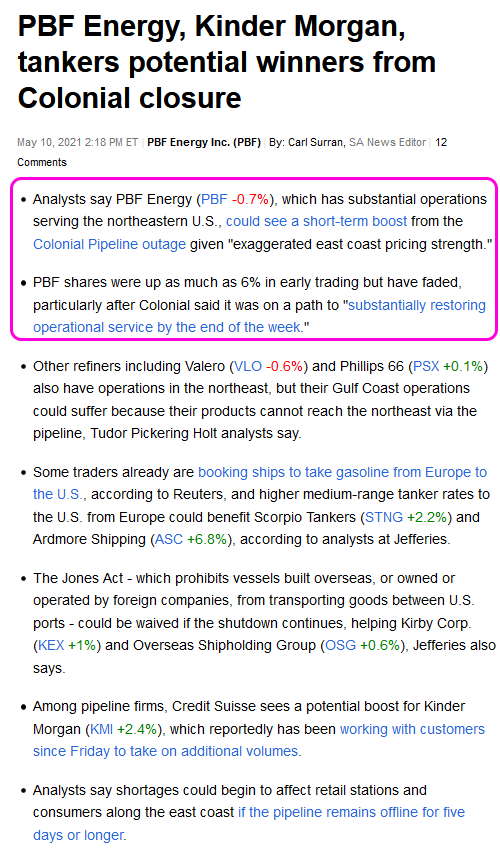

Zitat von faultcode: interessant, daß PBF (oder auch PBFX) heute nicht anspringen:

...

gestern war das Sentiment noch entsprechend:

...

https://seekingalpha.com/news/3694067-pbf-energy-kinder-morg…

Antwort auf Beitrag Nr.: 67.144.767 von faultcode am 22.02.21 20:59:55interessant, daß PBF (oder auch PBFX) heute nicht anspringen:

https://twitter.com/staunovo/status/1392165136127959042

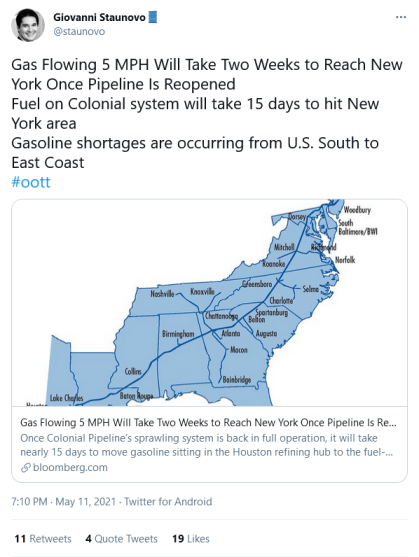

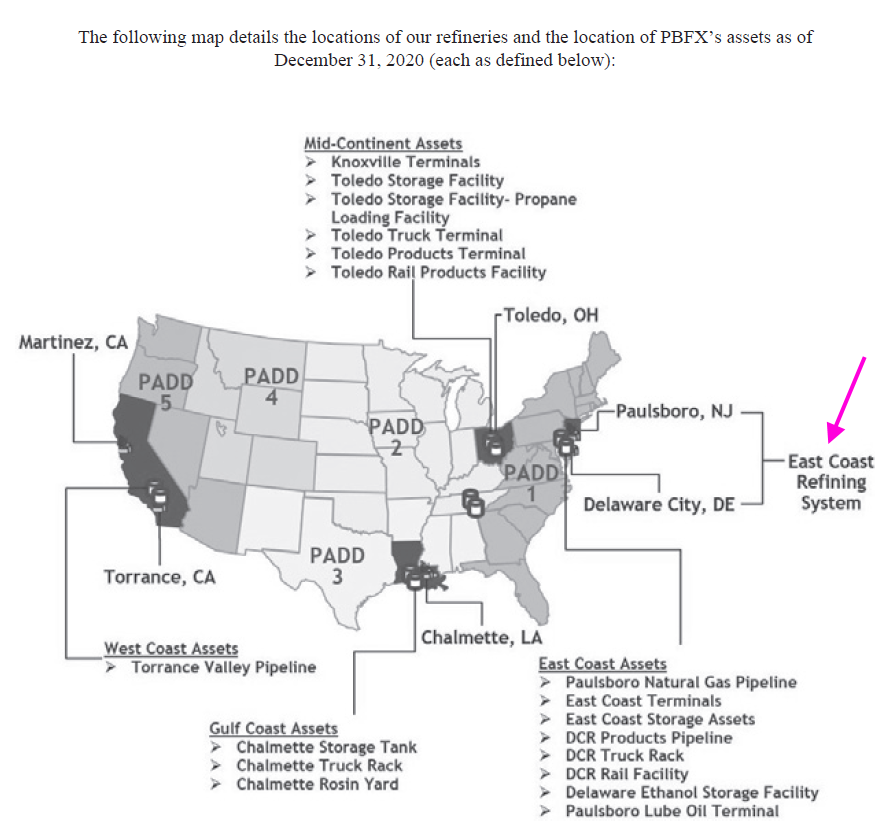

siehe (AR2020):

Die Raffinerie in Delaware City (Throughput Capacity, barrels per day: 180k) kann auch mit dem Zug beliefert werden; Paulsboro (105k) nur zu Wasser.

https://twitter.com/staunovo/status/1392165136127959042

siehe (AR2020):

Die Raffinerie in Delaware City (Throughput Capacity, barrels per day: 180k) kann auch mit dem Zug beliefert werden; Paulsboro (105k) nur zu Wasser.

Antwort auf Beitrag Nr.: 67.108.944 von faultcode am 19.02.21 18:23:2422.2.

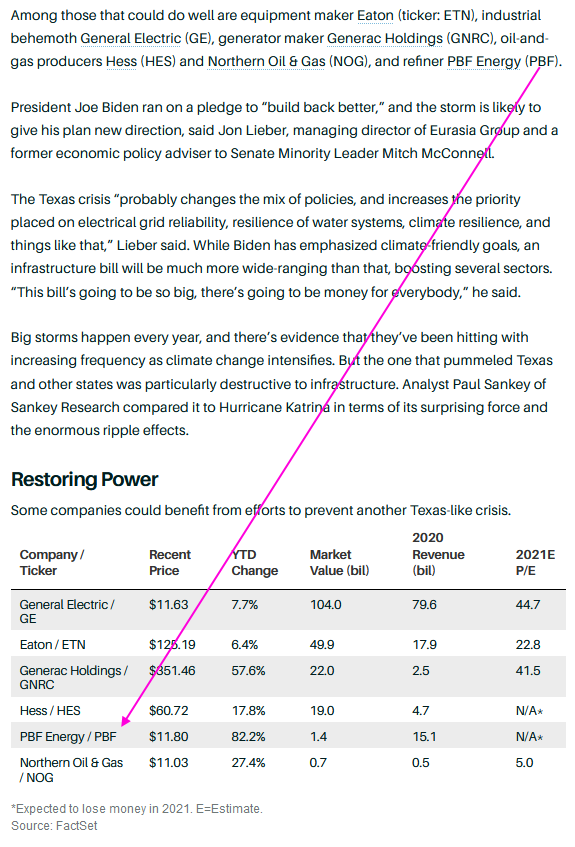

Texas Looks to Rebuild. Here Are 6 Stocks That Could Benefit.

https://www.barrons.com/articles/texas-looks-to-rebuild-here…

...

...

Texas Looks to Rebuild. Here Are 6 Stocks That Could Benefit.

https://www.barrons.com/articles/texas-looks-to-rebuild-here…

...

...

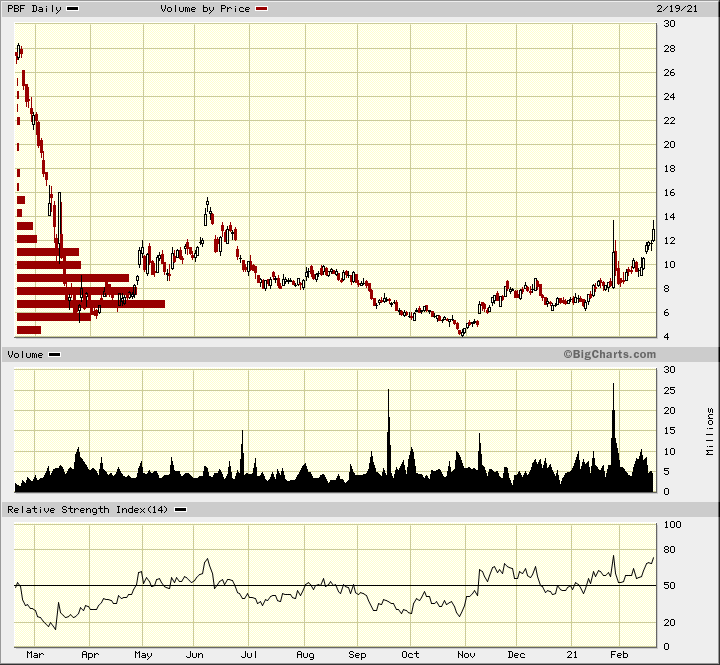

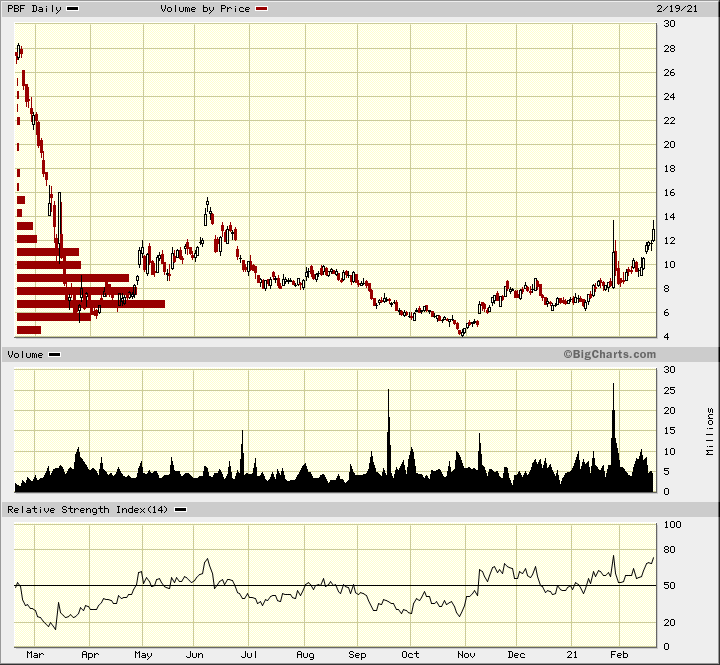

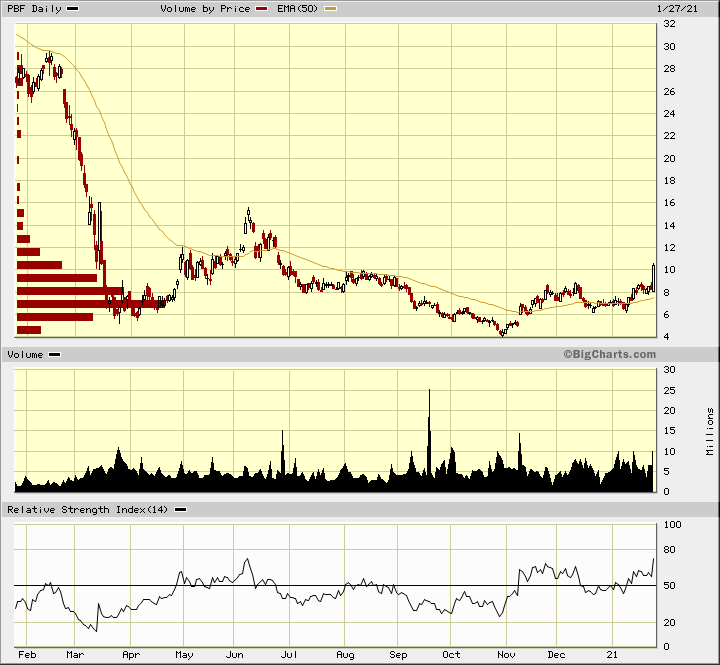

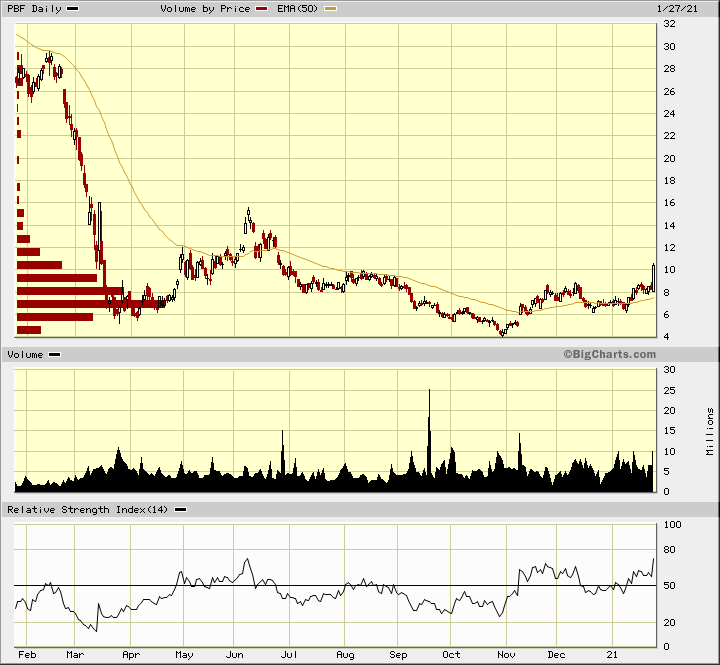

Antwort auf Beitrag Nr.: 66.648.386 von faultcode am 27.01.21 20:29:04nächster Anlauf:

Laut Morningstar haben die Shorties im Januar ~1.38M Aktien zurückgekauft.

Laut Morningstar haben die Shorties im Januar ~1.38M Aktien zurückgekauft.

Antwort auf Beitrag Nr.: 66.649.868 von faultcode am 27.01.21 21:21:5911.2.

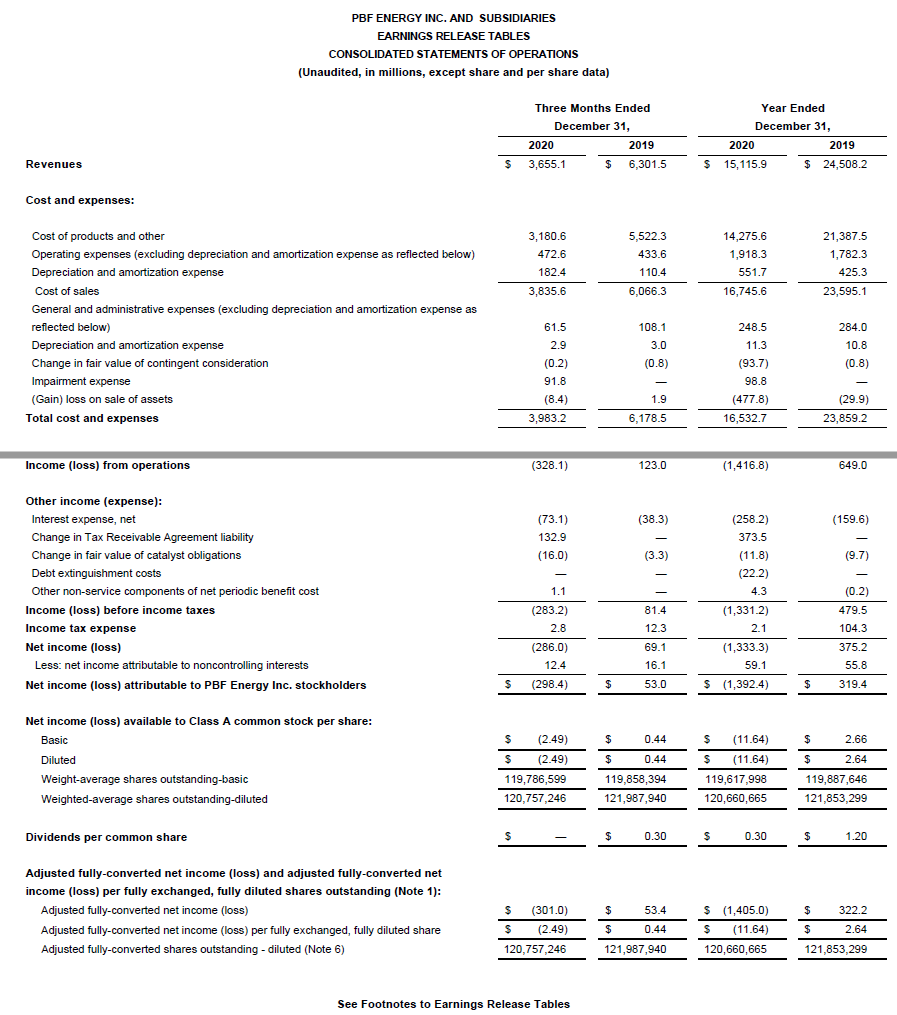

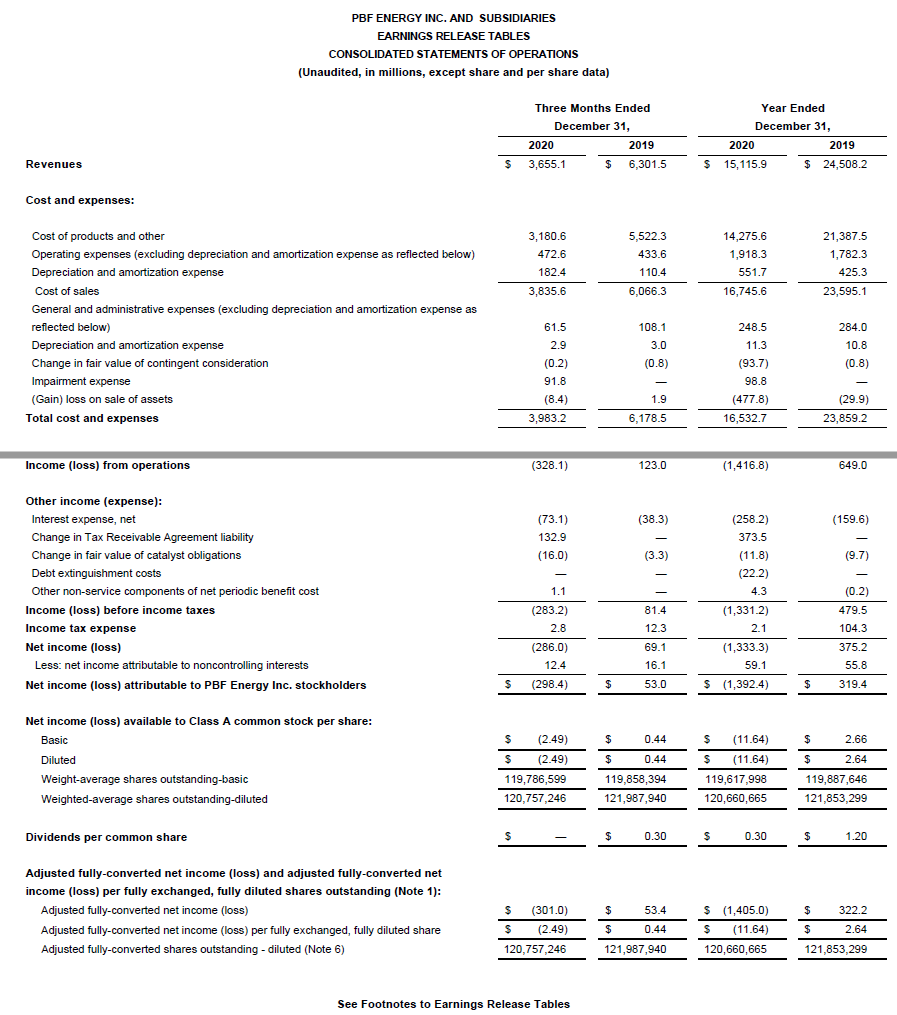

die Horror-Zahlen zu 2020:

https://investors.pbfenergy.com/news/2021/02-11-2021-1130475…

...

und 2021e soll wieder ganz opportunistisch werden, so wie eben 2020:

...

Mr. Nimbley continued, ...

...

During 2020, we aggressively managed our capital expenditures, with total refining capital expenditures of approximately $370 million, an almost 50% reduction to our planned 2020 expenditures. Going forward, we expect refining capital expenditures to be approximately $150 million for the first six months of 2021 and we will remain flexible for the balance of the year depending on the progress of the refining environment.

Our refineries operated at reduced rates during the fourth quarter and, based on current market conditions, we anticipate operating our refineries at lower utilization until such time that sustained product demand justifies higher production. We expect near-term throughput to be in the 675,000 to 725,000 barrel per day range for our refining system.

...

die Horror-Zahlen zu 2020:

https://investors.pbfenergy.com/news/2021/02-11-2021-1130475…

...

und 2021e soll wieder ganz opportunistisch werden, so wie eben 2020:

...

Mr. Nimbley continued, ...

...

During 2020, we aggressively managed our capital expenditures, with total refining capital expenditures of approximately $370 million, an almost 50% reduction to our planned 2020 expenditures. Going forward, we expect refining capital expenditures to be approximately $150 million for the first six months of 2021 and we will remain flexible for the balance of the year depending on the progress of the refining environment.

Our refineries operated at reduced rates during the fourth quarter and, based on current market conditions, we anticipate operating our refineries at lower utilization until such time that sustained product demand justifies higher production. We expect near-term throughput to be in the 675,000 to 725,000 barrel per day range for our refining system.

...

Antwort auf Beitrag Nr.: 66.648.386 von faultcode am 27.01.21 20:29:04..damit fing es heute an und wurde auch noch das (alte) Carlos Slim-Gerücht aufgewärmt:

11.1.

Slim Boosts Oil Industry Investments in Post-Pandemic Bet

https://finance.yahoo.com/news/carlos-slim-boosts-oil-indust…

...

Carlos Slim and his family have accumulated stakes worth $230 million in oil refiner PBF Energy Inc. and pipeline operator PBF Logistics LP, continuing to snap up stock even as the shares have slumped.

The family investment vehicle, Control Empresarial de Capitales, is now PBF Energy’s largest shareholder and the second-biggest in PBF Logistics.

...

11.1.

Slim Boosts Oil Industry Investments in Post-Pandemic Bet

https://finance.yahoo.com/news/carlos-slim-boosts-oil-indust…

...

Carlos Slim and his family have accumulated stakes worth $230 million in oil refiner PBF Energy Inc. and pipeline operator PBF Logistics LP, continuing to snap up stock even as the shares have slumped.

The family investment vehicle, Control Empresarial de Capitales, is now PBF Energy’s largest shareholder and the second-biggest in PBF Logistics.

...

Antwort auf Beitrag Nr.: 66.399.050 von faultcode am 12.01.21 13:58:00als reine Vorsichtsmaßnahme schließen die Shorties weiter Positionen. News gibt's keine:

+25%

Short % of Float (Dec 30, 2020): 16.82% (Morningstar); die Quote fiel auch schon im Dezember

+25%

Short % of Float (Dec 30, 2020): 16.82% (Morningstar); die Quote fiel auch schon im Dezember

PBF könnte in den kommenden Quartalen (Post-Covid) interessant werden.

=> Watchlist

=> Watchlist

Erdöl-Produkte werden offenbar weltweit, Ex-China, noch einige Zeit knapp sein:

11.1.

Almost Half of South Africa’s Oil Refining Seen Shut Until 2022

https://www.msn.com/en-us/money/markets/almost-half-of-south…

...

South African plants owned by Glencore Plc and Petroliam Nasional Bhd that make up 43% of the nation’s oil-refining capacity are expected to stay shut until at least 2022, according to energy consultant Citac.

Astron Energy Ltd., a unit of Glencore, has yet to restart the 100,000 barrel-a-day Cape Town refinery after a deadly explosion and fire in July. Petronas unit Engen Holdings Ltd.’s Durban plant also stopped production in December after a fire.

The closures will force South Africa to rely heavily on fuel imports. All four of South Africa’s oil refineries -- with a total capacity of more than 500,000 barrels a day -- have had accidents or are under review, with the industry already hit hard by the Covid pandemic. A pending national clean-fuels policy is also likely to increase costs to upgrade machinery.

Engen said options are being considered for its 120,000 barrel-a-day plant after a local news website reported it’s expected to shut in 2023 and may be converted into a fuel-storage terminal. If the plan is to close in two years, “it would not make economic sense to invest into bringing it back up,” said Elitsa Georgieva, an analyst at Citac.

Astron and Engen didn’t immediately reply to emailed requests for comment.

The Sapref refinery, a joint venture of Royal Dutch Shell Plc and BP Plc, also faces uncertainty as Shell reviews its shareholding in the business. Sasol Ltd. has also been deciding on plans for its Natref refinery since conducting a review of the plant.

=> das sollte auch Produkt-Tankern zugutekommen

11.1.

Almost Half of South Africa’s Oil Refining Seen Shut Until 2022

https://www.msn.com/en-us/money/markets/almost-half-of-south…

...

South African plants owned by Glencore Plc and Petroliam Nasional Bhd that make up 43% of the nation’s oil-refining capacity are expected to stay shut until at least 2022, according to energy consultant Citac.

Astron Energy Ltd., a unit of Glencore, has yet to restart the 100,000 barrel-a-day Cape Town refinery after a deadly explosion and fire in July. Petronas unit Engen Holdings Ltd.’s Durban plant also stopped production in December after a fire.

The closures will force South Africa to rely heavily on fuel imports. All four of South Africa’s oil refineries -- with a total capacity of more than 500,000 barrels a day -- have had accidents or are under review, with the industry already hit hard by the Covid pandemic. A pending national clean-fuels policy is also likely to increase costs to upgrade machinery.

Engen said options are being considered for its 120,000 barrel-a-day plant after a local news website reported it’s expected to shut in 2023 and may be converted into a fuel-storage terminal. If the plan is to close in two years, “it would not make economic sense to invest into bringing it back up,” said Elitsa Georgieva, an analyst at Citac.

Astron and Engen didn’t immediately reply to emailed requests for comment.

The Sapref refinery, a joint venture of Royal Dutch Shell Plc and BP Plc, also faces uncertainty as Shell reviews its shareholding in the business. Sasol Ltd. has also been deciding on plans for its Natref refinery since conducting a review of the plant.

=> das sollte auch Produkt-Tankern zugutekommen