PBF Energy (Seite 4)

eröffnet am 27.06.19 00:16:24 von

neuester Beitrag 08.09.23 17:43:29 von

neuester Beitrag 08.09.23 17:43:29 von

Beiträge: 44

ID: 1.306.296

ID: 1.306.296

Aufrufe heute: 0

Gesamt: 2.645

Gesamt: 2.645

Aktive User: 0

ISIN: US69318G1067 · WKN: A1J9SG · Symbol: PBF

55,71

USD

+0,40 %

+0,22 USD

Letzter Kurs 15:44:53 NYSE

Neuigkeiten

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 21,990 | +90,22 | |

| 6,0800 | +43,06 | |

| 1,2100 | +34,44 | |

| 0,5070 | +31,52 | |

| 4,8200 | +18,14 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14,190 | -5,40 | |

| 437,25 | -5,48 | |

| 15,570 | -7,32 | |

| 11,500 | -7,93 | |

| 1.050,01 | -14,28 |

Beitrag zu dieser Diskussion schreiben

8.12.

Midwest refining 'firehose' jets more fuel to East Coast, pressuring plants

https://finance.yahoo.com/news/midwest-refining-firehose-jet…

...

U.S. Midwest refiners are gearing up to send more gasoline and diesel to East Coast buyers, hoping to fill a void created by refinery closures and cutbacks, but likely to add pressure to regional fuel producers.

Midwest refiners, such as BP and Husky Energy , that process inexpensive Canadian crude are betting on East Coast markets to boost sales and margins. But the move could make it more difficult for PBF Energy to restore production of gasoline, diesel and jet fuel at its Paulsboro, N.J., plant. "The midwest refining complex is a firehose to the East Coast, which is already drowning in imports," said Zachary Rogers, senior oil analyst at consultancy Rapidan Energy Group.

Shippers are geared up to transport up to 25,000 barrels per barrels (bpd) of refined products on the Mariner 1 pipeline from the Midwest as soon as this week, two traders familiar with the matter, said. If demand permits, refiners could double that amount, they said. "We do expect that this service will help to lower overall fuel costs for Pennsylvania residents and business," said a spokeswoman at Energy Transfer , which operates Mariner 1. Volumes of between 20,000 bpd and 25,000 bpd will begin this month, she said.

East Coast refineries produce only part of the fuel consumed in the region, with pipeline and seaborne imports furnishing most. Three refineries, owned by Delta Airlines , PBF Energy and Phillips 66 , produce 700,000 bpd combined out of the 5.2 million bpd of gasoline, diesel, and jet fuel consumed last year, Energy Information Administration data shows.

The largest refiner, Philadelphia Energy Solutions, halted operations following a 2019 explosion, Canada's Come-by-Chance, which sold fuel into the East Coast, was idled in May, and PBF Energy said in October it would shut fuel-producing units at its 180,000 bpd Paulsboro refinery.

Midwest refiners a year ago began targeting the region with 120,000 bpd through a partial reversal of the Laurel Pipeline, which opened western Pennsylvania markets. Laurel operator Buckeye Partners likely will push for the pipeline to fully reverse direction and to reach Philadelphia, said Sandy Fielden, downstream energy analyst at Morningstar. Buckeye Enterprises, which operates the Laurel Pipeline, did not respond to requests for comment. "The argument not to fully reverse the line now gets weaker and weaker as the East Coast refining sector shrinks," Fielden said

...

--> die PBF-Aktie ist davon vorerst nicht beeindruckt:

Midwest refining 'firehose' jets more fuel to East Coast, pressuring plants

https://finance.yahoo.com/news/midwest-refining-firehose-jet…

...

U.S. Midwest refiners are gearing up to send more gasoline and diesel to East Coast buyers, hoping to fill a void created by refinery closures and cutbacks, but likely to add pressure to regional fuel producers.

Midwest refiners, such as BP and Husky Energy , that process inexpensive Canadian crude are betting on East Coast markets to boost sales and margins. But the move could make it more difficult for PBF Energy to restore production of gasoline, diesel and jet fuel at its Paulsboro, N.J., plant. "The midwest refining complex is a firehose to the East Coast, which is already drowning in imports," said Zachary Rogers, senior oil analyst at consultancy Rapidan Energy Group.

Shippers are geared up to transport up to 25,000 barrels per barrels (bpd) of refined products on the Mariner 1 pipeline from the Midwest as soon as this week, two traders familiar with the matter, said. If demand permits, refiners could double that amount, they said. "We do expect that this service will help to lower overall fuel costs for Pennsylvania residents and business," said a spokeswoman at Energy Transfer , which operates Mariner 1. Volumes of between 20,000 bpd and 25,000 bpd will begin this month, she said.

East Coast refineries produce only part of the fuel consumed in the region, with pipeline and seaborne imports furnishing most. Three refineries, owned by Delta Airlines , PBF Energy and Phillips 66 , produce 700,000 bpd combined out of the 5.2 million bpd of gasoline, diesel, and jet fuel consumed last year, Energy Information Administration data shows.

The largest refiner, Philadelphia Energy Solutions, halted operations following a 2019 explosion, Canada's Come-by-Chance, which sold fuel into the East Coast, was idled in May, and PBF Energy said in October it would shut fuel-producing units at its 180,000 bpd Paulsboro refinery.

Midwest refiners a year ago began targeting the region with 120,000 bpd through a partial reversal of the Laurel Pipeline, which opened western Pennsylvania markets. Laurel operator Buckeye Partners likely will push for the pipeline to fully reverse direction and to reach Philadelphia, said Sandy Fielden, downstream energy analyst at Morningstar. Buckeye Enterprises, which operates the Laurel Pipeline, did not respond to requests for comment. "The argument not to fully reverse the line now gets weaker and weaker as the East Coast refining sector shrinks," Fielden said

...

--> die PBF-Aktie ist davon vorerst nicht beeindruckt:

Antwort auf Beitrag Nr.: 65.536.303 von faultcode am 29.10.20 13:50:54

https://twitter.com/FordWealth/status/1322323258700636172

<meine Verschönerung>

$SUN ist Sunoco L.P. an der NYSE

https://twitter.com/FordWealth/status/1322323258700636172

<meine Verschönerung>

$SUN ist Sunoco L.P. an der NYSE

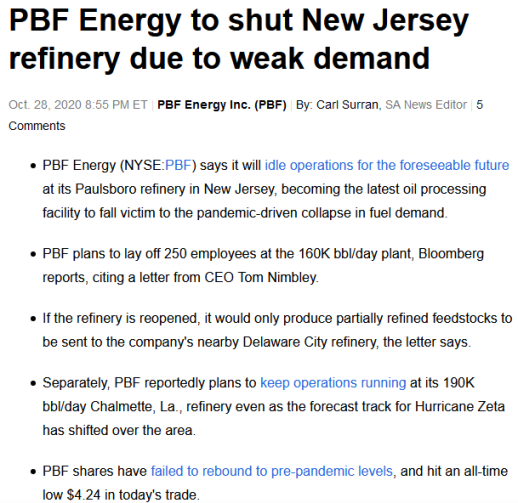

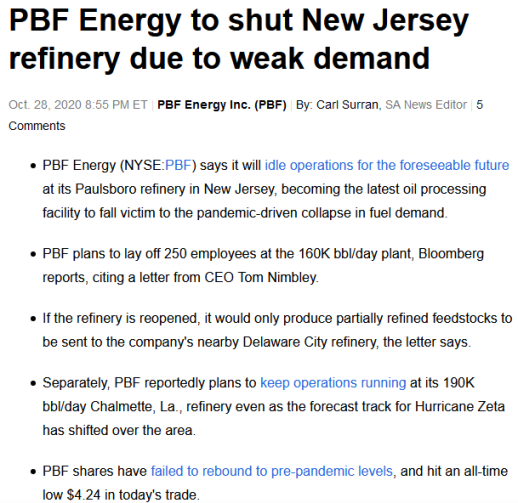

Antwort auf Beitrag Nr.: 65.515.720 von faultcode am 28.10.20 01:35:31

...

https://seekingalpha.com/news/3627900-pbf-energy-to-shut-new…

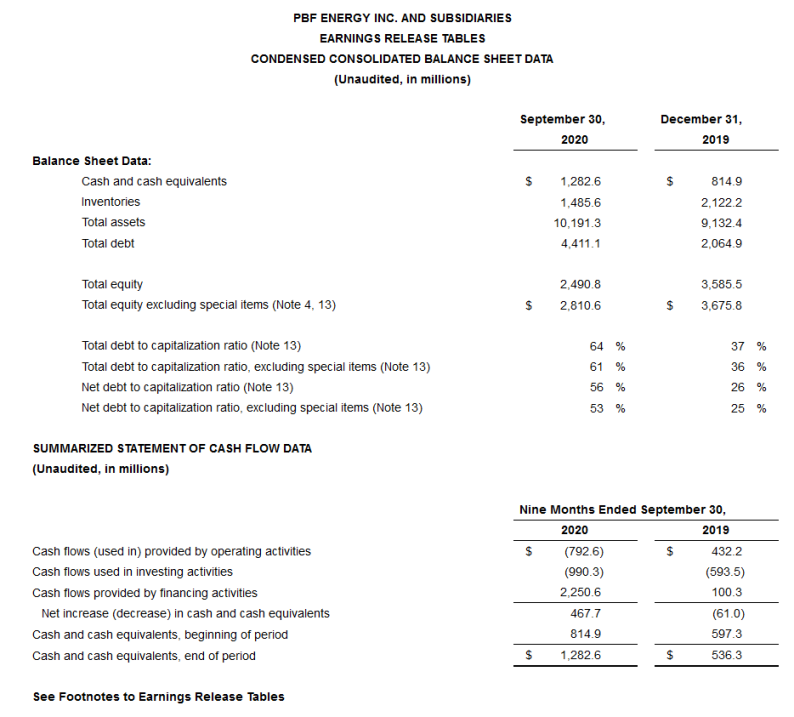

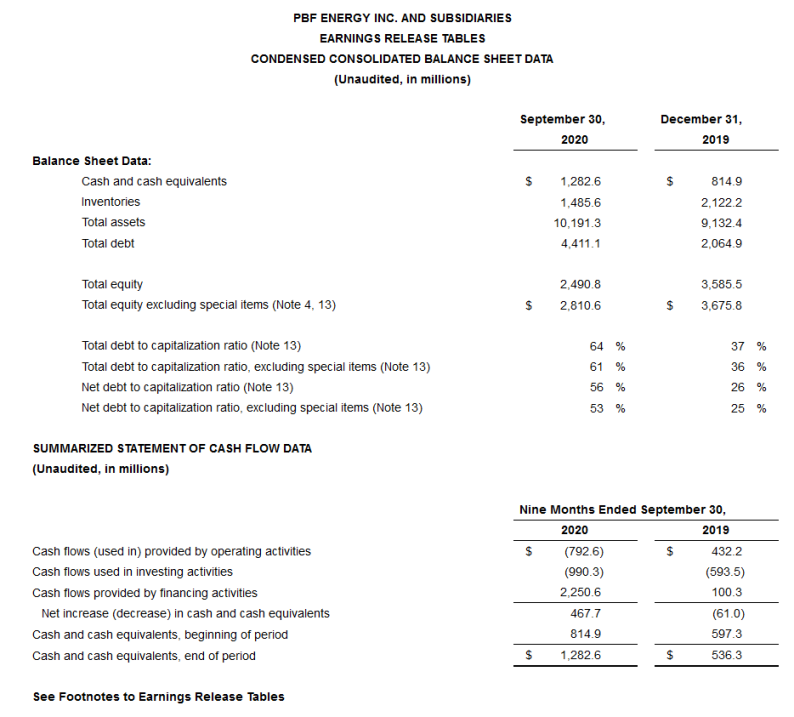

ansonsten die Zahlen zu 2020Q3 mit u.a.:

https://investors.pbfenergy.com/news/2020/10-29-2020-1031420…

...

https://seekingalpha.com/news/3627900-pbf-energy-to-shut-new…

ansonsten die Zahlen zu 2020Q3 mit u.a.:

https://investors.pbfenergy.com/news/2020/10-29-2020-1031420…

Antwort auf Beitrag Nr.: 64.318.064 von faultcode am 07.07.20 11:11:222020Q3-Zahlen kommen am Do vor Handelsbeginn: https://investors.pbfenergy.com/news/2020/09-22-2020-2130557…

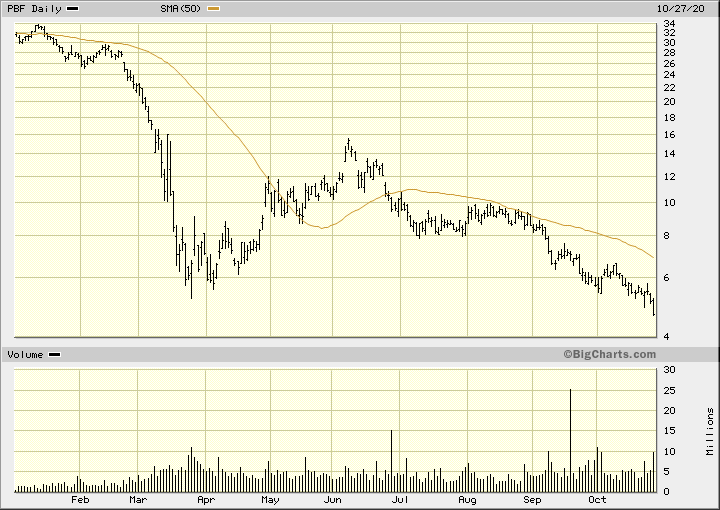

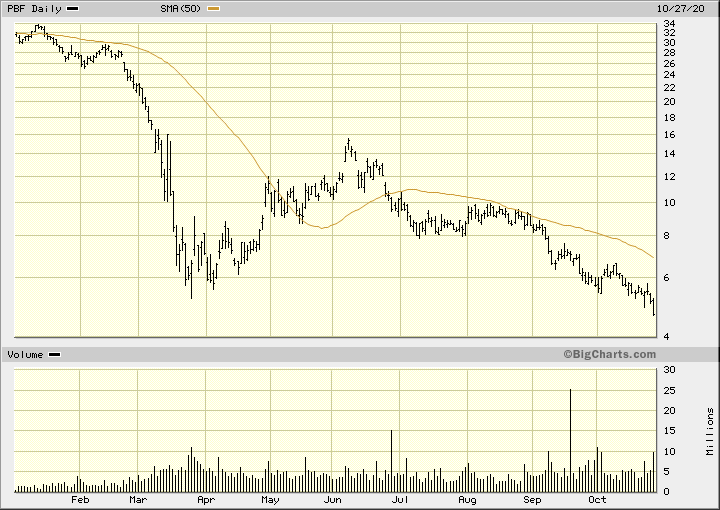

Man könnte meinen, bei PBF würden die Lichter ausgehen. OK, bei solche Zyklikern ist nun oft Lockdown-Panik im Gange:

zum 30.6. galt:

• Cash & Short Term Investments: USD1.23b

• ST Debt & Current Portion LT Debt: USD161m

• Working capital > USD1b

https://www.marketwatch.com/investing/stock/pbf/financials/b…

Der Verkauf von Steam methane reformer (SMR) hydrogen production plants an Air Products im April brachte >USD500m ein: https://www.prnewswire.com/news-releases/pbf-energy-complete…

Durch den Wegfall der Dividende in 2020Q2 verkaufen auch automatisch Dividenden-ETF's etc.

Noch aus dem letzten 10Q:

4. CURRENT EXPECTED CREDIT LOSSES

Credit Losses

...

The Company performs a quarterly allowance for doubtful accounts analysis to assess whether an allowance needs to be recorded for any outstanding trade receivables. In estimating credit losses, management reviews accounts that are past due, have known disputes or have experienced any negative credit events that may result in future collectability issues. There was no allowance for doubtful accounts recorded as of June 30, 2020 and December 31, 2019.

Liquidity

...

Our refining capital spending program is on track to meet our revised guidance of approximately $360.0 million for 2020, with the bulk of the spending having occurred in the first and second quarters. For the remainder of 2020, we expect to incur approximately $90.0 million to $100.0 million in refining capital expenditures.

We have no expected debt maturities due in 2020.

Man könnte meinen, bei PBF würden die Lichter ausgehen. OK, bei solche Zyklikern ist nun oft Lockdown-Panik im Gange:

zum 30.6. galt:

• Cash & Short Term Investments: USD1.23b

• ST Debt & Current Portion LT Debt: USD161m

• Working capital > USD1b

https://www.marketwatch.com/investing/stock/pbf/financials/b…

Der Verkauf von Steam methane reformer (SMR) hydrogen production plants an Air Products im April brachte >USD500m ein: https://www.prnewswire.com/news-releases/pbf-energy-complete…

Durch den Wegfall der Dividende in 2020Q2 verkaufen auch automatisch Dividenden-ETF's etc.

Noch aus dem letzten 10Q:

4. CURRENT EXPECTED CREDIT LOSSES

Credit Losses

...

The Company performs a quarterly allowance for doubtful accounts analysis to assess whether an allowance needs to be recorded for any outstanding trade receivables. In estimating credit losses, management reviews accounts that are past due, have known disputes or have experienced any negative credit events that may result in future collectability issues. There was no allowance for doubtful accounts recorded as of June 30, 2020 and December 31, 2019.

Liquidity

...

Our refining capital spending program is on track to meet our revised guidance of approximately $360.0 million for 2020, with the bulk of the spending having occurred in the first and second quarters. For the remainder of 2020, we expect to incur approximately $90.0 million to $100.0 million in refining capital expenditures.

We have no expected debt maturities due in 2020.

Antwort auf Beitrag Nr.: 63.031.513 von faultcode am 17.03.20 00:48:31PBF Energy könnte sehr wahrscheinlich von der Schließung der Dakota Access-Pipeline proftieren, weil deren Rohöl sowieso meist/oft mit dem Zug angekarrt werden muss.

Auch wenn die Aktie bislang null darauf reagierte (*).

Dakota Access bleibt in jedem Fall bis Mitte 2021 außer Betrieb, solange das neue Umwelt-Gutachten erstellt wird.

Der Rechtsstreit dort wird wohl noch lange andauern, und unter einem möglichen Pres. Biden wird sich eine Wiederöffnung wohl mindestens verzögern, wenn überhaupt.

7.7.

U.S. Midwest products prices due to rise from Dakota Access pipeline shutdown

https://www.reuters.com/article/us-usa-pipeline-energy-trans…

...

Companies that have access to crude supplied by rail are likely to benefit, such as Par Pacific Holdings (PARR.N) and PBF Energy (PBF.N), TPH’s Blair said.

...

(*)

Auch wenn die Aktie bislang null darauf reagierte (*).

Dakota Access bleibt in jedem Fall bis Mitte 2021 außer Betrieb, solange das neue Umwelt-Gutachten erstellt wird.

Der Rechtsstreit dort wird wohl noch lange andauern, und unter einem möglichen Pres. Biden wird sich eine Wiederöffnung wohl mindestens verzögern, wenn überhaupt.

7.7.

U.S. Midwest products prices due to rise from Dakota Access pipeline shutdown

https://www.reuters.com/article/us-usa-pipeline-energy-trans…

...

Companies that have access to crude supplied by rail are likely to benefit, such as Par Pacific Holdings (PARR.N) and PBF Energy (PBF.N), TPH’s Blair said.

...

(*)

15 -- 10 -- 15 -- 10 -- ...

6.2.

...Ten U.S. refineries emitted excessive cancer-causing benzene in 2019 -report

https://finance.yahoo.com/news/ten-u-refineries-emitted-exce…

...

Ten U.S. oil refineries, including six in Texas, released the cancer-causing chemical benzene in concentrations that exceeded federal limits last year, according to government data published by the green group Environmental Integrity Project on Thursday.

The study is based on the first full year of data reported by U.S. refineries since a U.S. Environmental Protection Agency rule was implemented in 2018. The rule requires continuous monitoring of air pollutants around plants to protect nearby communities, many of which are disproportionately poor, black and Hispanic.

"These results highlight refineries that need to do a better job of installing pollution controls and implementing safer workplace practices," EIP Executive Director Eric Schaeffer said in a statement. "Now, EPA needs to enforce these rules."

EPA officials did not immediately respond to requests for comment.

Long-term exposure to benzene can cause blood disorders and leukemia, according to the agency.

Monitoring for benzene is meant to be a tool that allows for "early detection of potential problems," said Ericka Perryman, a spokeswoman for the American Fuel & Petrochemical Manufacturers trade group, in a statement.

But the EPA's data "is not intended as a measure of community exposure or health risk and could inadvertently provide misleading results to the public," she added.

According to the report, benzene levels consistently exceeded the EPA standard of 9 micrograms per cubic meter of air at the fencelines of 10 of the more than 100 refineries examined by EIP. The EPA requires facilities that exceed that threshold to take corrective action, the report said.

Philadelphia Energy Solutions' refinery in Philadelphia recorded the highest benzene concentrations, at nearly five times the EPA standard, the data show. HollyFrontier Corp's Navajo Artesia plant in New Mexico followed, with more than three times the federal standard.

Philadelphia Energy shut that refinery and filed for bankruptcy in July after a fire destroyed part of the plant.

Texas was the hardest-hit state, with six refineries exceeding the federal benzene standard, the report said. These are Total SA's Port Arthur refinery, Chevron Corp's Pasadena Refinery, Flint Hills Resources' Corpus Christi East refinery, Valero Energy Corp's Corpus Christi East, Royal Dutch Shell Plc's Deer Park and Marathon Petroleum Corp's Galveston Bay Texas refinery.

Two other refineries listed are Chevron's Pascagoula in Mississippi and PBF Energy Inc's Chalmette Refining in Louisiana.

In a statement, Chevron said it had taken steps to improve performance and added that its Pascacoula and Pasadena refineries were in compliance with EPA requirements.

Marathon spokesman Jamal Kheiry said in an emailed statement that a relief valve at its refinery's dock was the source of a benzene release in March 2019. The company took steps to fix the problem, he said.

"We are committed to comply with EPA rules," Total spokeswoman Marie Maitre said in an email. "Our refinery employees live and have families in this community and the Total Port Arthur Refinery works hard at being a good neighbor."

Flint Hills spokesman Andy Saenz said the EPA's fenceline monitoring program "is not an accurate measurement of ambient air conditions in a community." He said benzene levels in Corpus Christi were "much lower than this report would suggest and well within public health standards."

Owners of the other refineries did not immediately comment on the report.

...

...Ten U.S. refineries emitted excessive cancer-causing benzene in 2019 -report

https://finance.yahoo.com/news/ten-u-refineries-emitted-exce…

...

Ten U.S. oil refineries, including six in Texas, released the cancer-causing chemical benzene in concentrations that exceeded federal limits last year, according to government data published by the green group Environmental Integrity Project on Thursday.

The study is based on the first full year of data reported by U.S. refineries since a U.S. Environmental Protection Agency rule was implemented in 2018. The rule requires continuous monitoring of air pollutants around plants to protect nearby communities, many of which are disproportionately poor, black and Hispanic.

"These results highlight refineries that need to do a better job of installing pollution controls and implementing safer workplace practices," EIP Executive Director Eric Schaeffer said in a statement. "Now, EPA needs to enforce these rules."

EPA officials did not immediately respond to requests for comment.

Long-term exposure to benzene can cause blood disorders and leukemia, according to the agency.

Monitoring for benzene is meant to be a tool that allows for "early detection of potential problems," said Ericka Perryman, a spokeswoman for the American Fuel & Petrochemical Manufacturers trade group, in a statement.

But the EPA's data "is not intended as a measure of community exposure or health risk and could inadvertently provide misleading results to the public," she added.

According to the report, benzene levels consistently exceeded the EPA standard of 9 micrograms per cubic meter of air at the fencelines of 10 of the more than 100 refineries examined by EIP. The EPA requires facilities that exceed that threshold to take corrective action, the report said.

Philadelphia Energy Solutions' refinery in Philadelphia recorded the highest benzene concentrations, at nearly five times the EPA standard, the data show. HollyFrontier Corp's Navajo Artesia plant in New Mexico followed, with more than three times the federal standard.

Philadelphia Energy shut that refinery and filed for bankruptcy in July after a fire destroyed part of the plant.

Texas was the hardest-hit state, with six refineries exceeding the federal benzene standard, the report said. These are Total SA's Port Arthur refinery, Chevron Corp's Pasadena Refinery, Flint Hills Resources' Corpus Christi East refinery, Valero Energy Corp's Corpus Christi East, Royal Dutch Shell Plc's Deer Park and Marathon Petroleum Corp's Galveston Bay Texas refinery.

Two other refineries listed are Chevron's Pascagoula in Mississippi and PBF Energy Inc's Chalmette Refining in Louisiana.

In a statement, Chevron said it had taken steps to improve performance and added that its Pascacoula and Pasadena refineries were in compliance with EPA requirements.

Marathon spokesman Jamal Kheiry said in an emailed statement that a relief valve at its refinery's dock was the source of a benzene release in March 2019. The company took steps to fix the problem, he said.

"We are committed to comply with EPA rules," Total spokeswoman Marie Maitre said in an email. "Our refinery employees live and have families in this community and the Total Port Arthur Refinery works hard at being a good neighbor."

Flint Hills spokesman Andy Saenz said the EPA's fenceline monitoring program "is not an accurate measurement of ambient air conditions in a community." He said benzene levels in Corpus Christi were "much lower than this report would suggest and well within public health standards."

Owners of the other refineries did not immediately comment on the report.

...

Antwort auf Beitrag Nr.: 61.769.600 von faultcode am 25.10.19 21:46:443.2.

...Shell verkauft US-Raffinerie an PBF Energy...

https://www.finanzen.net/nachricht/aktien/konzernstrategie-m…

Der Energiekonzern Shell hat seine Raffinerie im kalifornischen Martinez für 1,2 Milliarden US-Dollar an PBF Energy verkauft.

Teil der Transaktion ist die fortgesetzte Lieferung von Ölprodukten der Raffinerie an das Markenkraftstoffgeschäft von Shell, das der Konzern behalten hat, wie Royal Dutch Shell plc mitteilte.

Der Verkauf erfolgt im Zuge der Konzernstrategie, etwa die Hälfte seiner Raffinerien weltweit zu verkaufen. In den vergangenen Jahren haben neue Raffinerien in Ländern wie Indien und China zu einem Überangebot an weltweiten Raffineriekapazitäten geführt, was die Gewinne belastete.

...

...Shell verkauft US-Raffinerie an PBF Energy...

https://www.finanzen.net/nachricht/aktien/konzernstrategie-m…

Der Energiekonzern Shell hat seine Raffinerie im kalifornischen Martinez für 1,2 Milliarden US-Dollar an PBF Energy verkauft.

Teil der Transaktion ist die fortgesetzte Lieferung von Ölprodukten der Raffinerie an das Markenkraftstoffgeschäft von Shell, das der Konzern behalten hat, wie Royal Dutch Shell plc mitteilte.

Der Verkauf erfolgt im Zuge der Konzernstrategie, etwa die Hälfte seiner Raffinerien weltweit zu verkaufen. In den vergangenen Jahren haben neue Raffinerien in Ländern wie Indien und China zu einem Überangebot an weltweiten Raffineriekapazitäten geführt, was die Gewinne belastete.

...

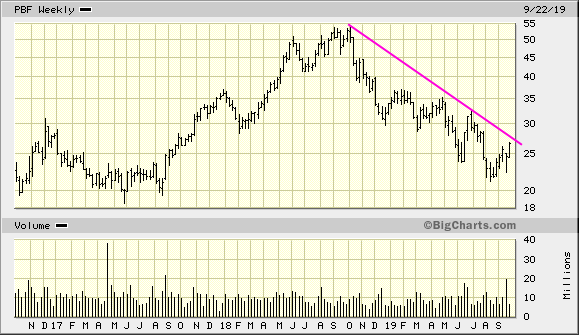

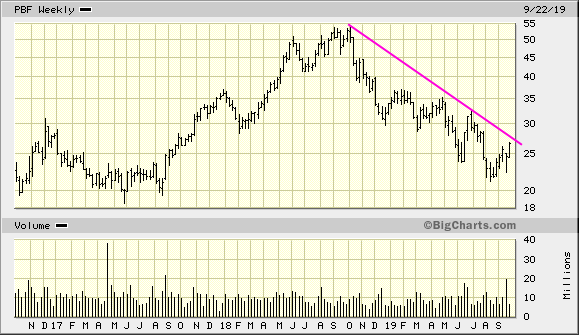

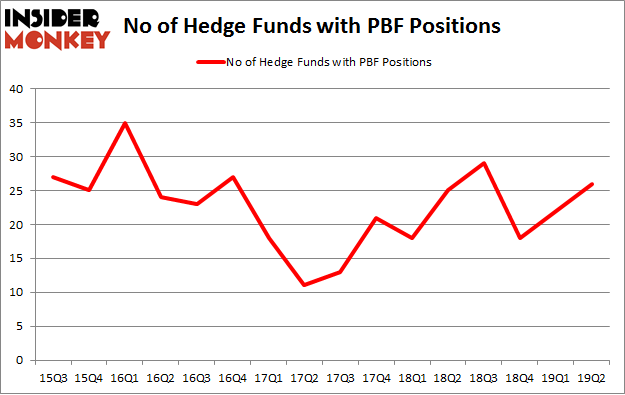

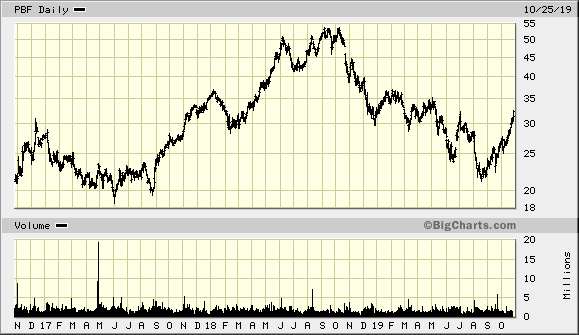

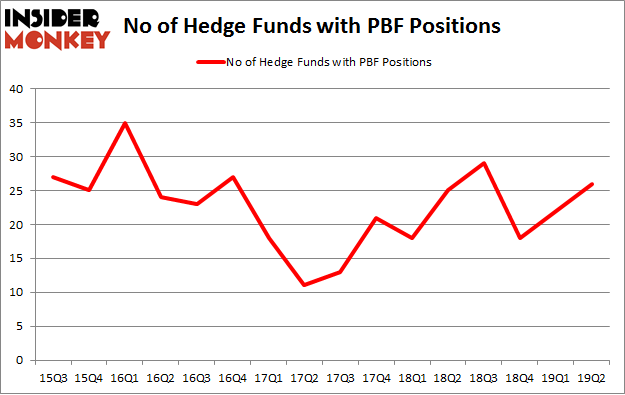

Antwort auf Beitrag Nr.: 61.586.388 von faultcode am 27.09.19 19:22:38--> so ist es:

--> da sind die Hedgies nun erhöht rein (long):

25.10.

Hedge Funds Are Snapping Up

https://finance.yahoo.com/news/pbf-energy-inc-pbf-hedge-1530…

...

--> da sind die Hedgies nun erhöht rein (long):

25.10.

Hedge Funds Are Snapping Up

https://finance.yahoo.com/news/pbf-energy-inc-pbf-hedge-1530…

...

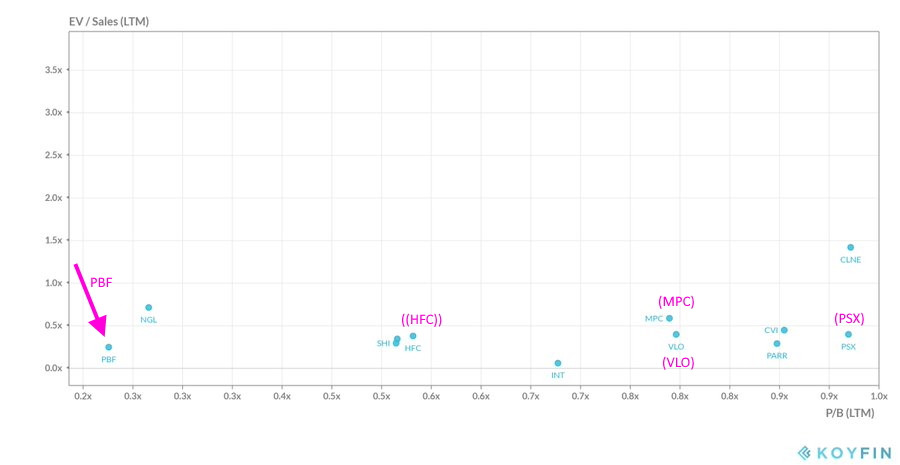

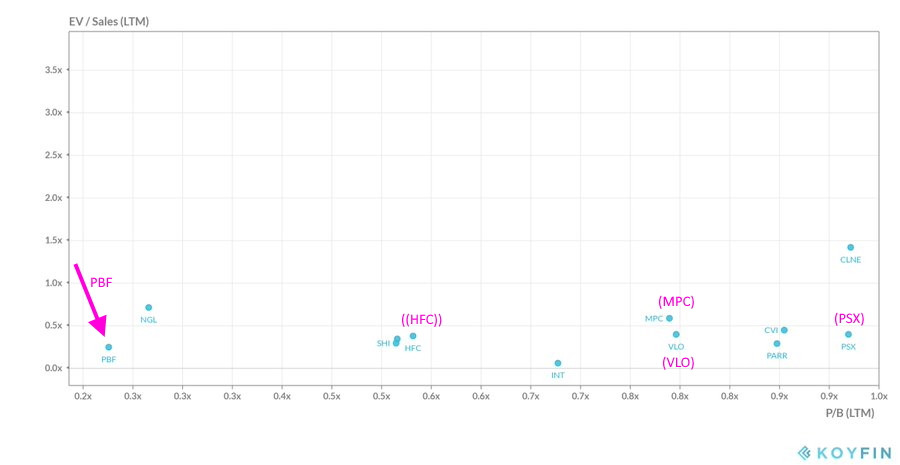

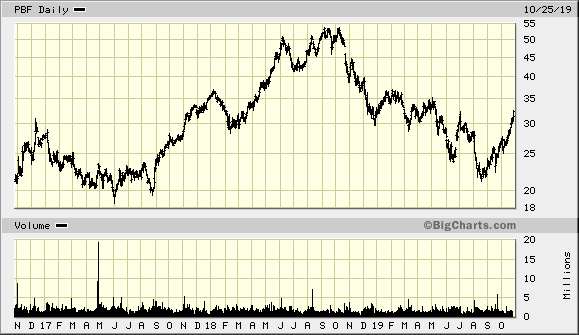

Antwort auf Beitrag Nr.: 60.900.072 von faultcode am 27.06.19 00:22:29wahrscheinlich befinden sich die US-Refiner nun an einem Sweet spot: Nachfrage noch gut, Rohstoffpreise günstig: