Northern Graphite: Aktueller Börsenwert: 4 Mio US$. Marge von ü45 Mio p.a. bei Produktion!

eröffnet am 02.12.19 14:04:49 von

neuester Beitrag 12.04.24 23:39:53 von

neuester Beitrag 12.04.24 23:39:53 von

Beiträge: 419

ID: 1.316.291

ID: 1.316.291

Aufrufe heute: 0

Gesamt: 18.790

Gesamt: 18.790

Aktive User: 0

ISIN: CA66516A1057 · WKN: A1H95Z · Symbol: 0NG

0,1010

EUR

-9,01 %

-0,0100 EUR

Letzter Kurs 08:08:27 Tradegate

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 11.04.24 |

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 11.04.24 |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7850 | +34,19 | |

| 1,5650 | +14,23 | |

| 45,20 | +14,14 | |

| 2,4600 | +11,82 | |

| 2,4000 | +9,89 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2000 | -10,45 | |

| 3,7000 | -10,52 | |

| 0,6360 | -10,67 | |

| 1,0500 | -12,50 | |

| 28,53 | -14,71 |

Beitrag zu dieser Diskussion schreiben

.... bin gespannt wann die Firma meldet das das Vorhaben den Betrieb auf Volllast & 7 Tagewoche zu fördern umgesetzt wurde

China’s export ban on graphite boosts opportunities for non-Chinese graphite producers

In October last year, China announced new export permit requirements for certain graphite products, citing national security concerns and aiming to bolster its control over critical mineral supply amid challenges to its manufacturing dominance.China is utilising its dominant position in the global critical minerals and raw materials supply chain to address the expanded economic security policies in Western nations. This threatens foreign manufacturers, especially in the US, which relies heavily on imported anode materials.

As the leading graphite producer and exporter worldwide, China refines over 90 percent of the global graphite supply.

This dominance holds significant influence in the manufacturing of electric vehicle (EV) batteries, where graphite serves as a crucial component for anodes, the negatively charged part of the battery.

As a result, in December, natural graphite and synthetic graphite shipments from China slumped 91% and 28% respectively.

...

https://www.sharecafe.com.au/2024/02/16/chinas-export-ban-on…

Durch diese Meldung von Nouveau Monde Graphite hat Graphite wieder stärkere Aufmerksamkeit bekommen, wäre passend wenn auch Northern Graphite demnächst etwas in der Art publizieren könnte, aktuell reagiert hier der Kurs wohl so negativ, weil diese Meldung des Mitbewerbers vom Markt sehr positive aufgenommen wurde. 🤔

GM to Invest $150 Million in Canadian Miner, Agrees Supply Deal

https://www.wallstreet-online.de/diskussion/1348760-1-10/nou…

GM to Invest $150 Million in Canadian Miner, Agrees Supply Deal

https://www.wallstreet-online.de/diskussion/1348760-1-10/nou…

Der Grund für den heutigen NGC Kursanstieg ....rückt Graphite damit (wieder) etwas in das Blickfeld der Anleger? Andere News?

Syrah commences AAM production at Vidalia, USA

https://www.wallstreet-online.de/diskussion/1258524-1-10/syr…

Syrah commences AAM production at Vidalia, USA

https://www.wallstreet-online.de/diskussion/1258524-1-10/syr…

Antwort auf Beitrag Nr.: 75.006.431 von Oginvest am 22.12.23 13:35:50

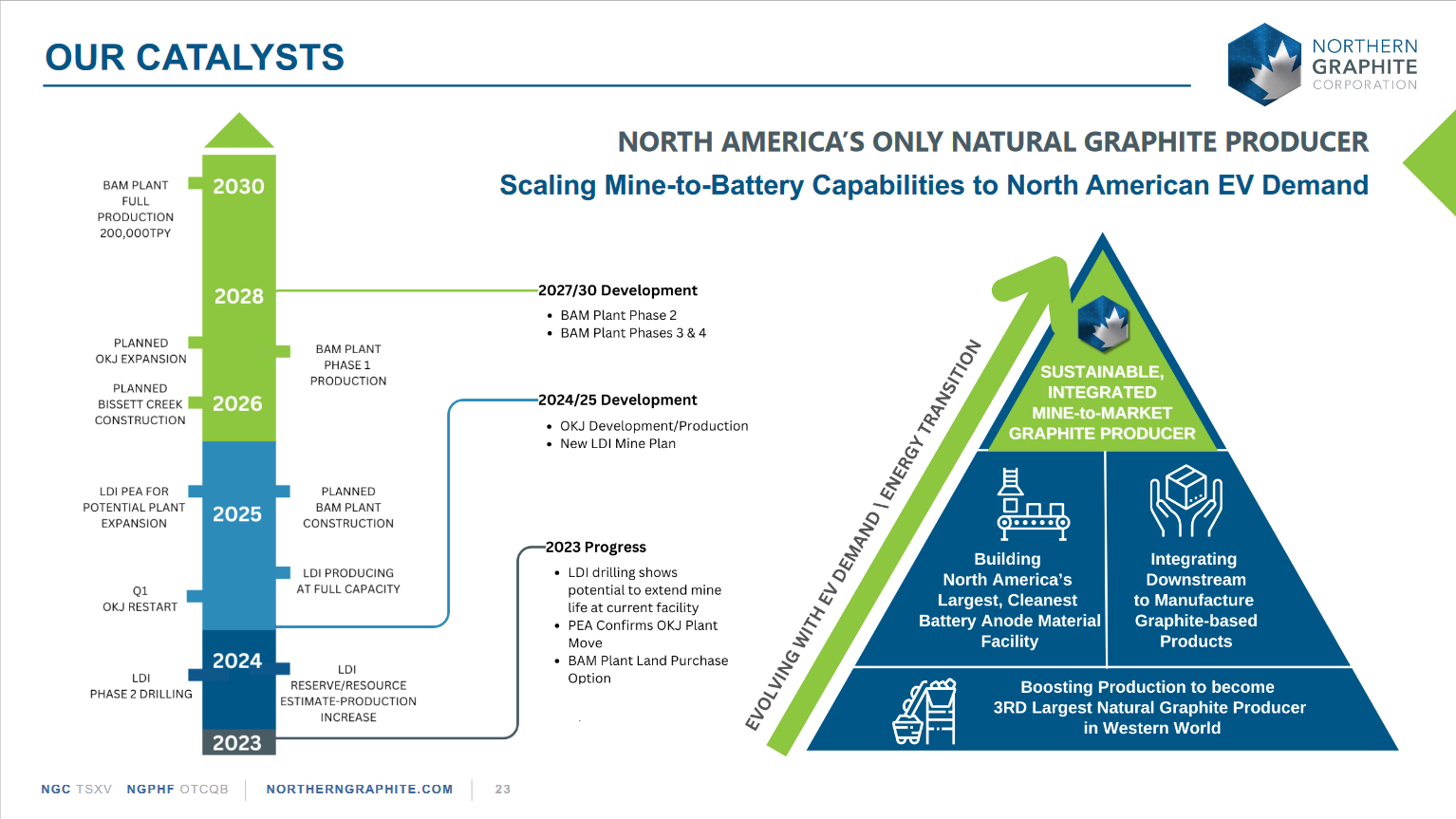

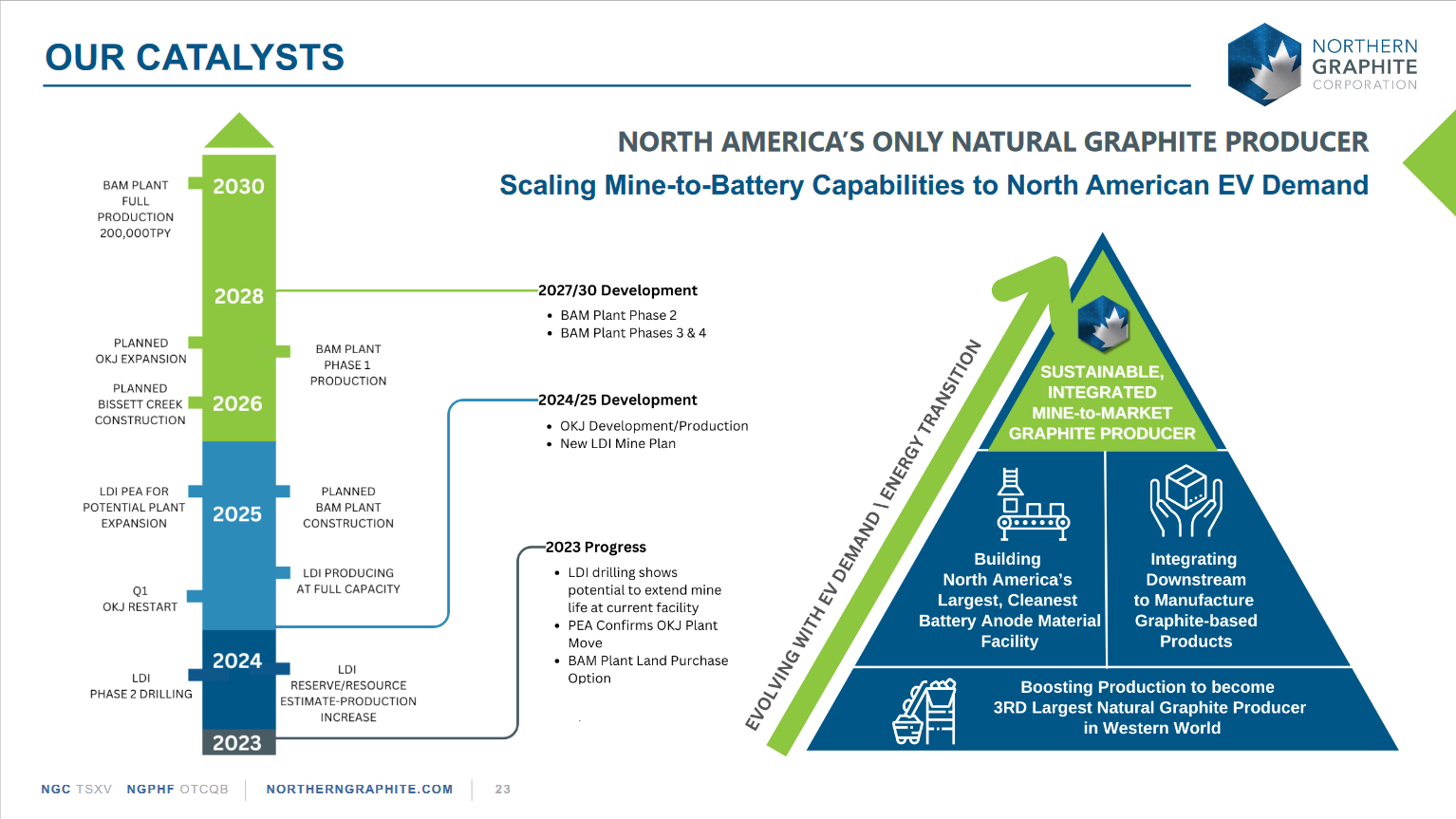

Northern Graphite Investor Event - January 18, 2024

Watch Northern Graphite's investor event of January 18, 2024 with a graphite market overview presented by EIU Global Economist and Lead Commodities Editor, Matt Sherwood, as well as a corporate overviews from Northern CEO Hugues Jacquemin, COO Kirsty Liddicoat and CFO Guillaume Jacq. The event also features a Q&A with all participants.

Antwort auf Beitrag Nr.: 75.197.756 von Fuenfvorzwoelf am 01.02.24 00:03:40👍 Auszug aus: Northern Graphite Launches Battery Materials Group to Spearhead Mine-to-Battery Strategy

- Acquires state-of-the-art laboratory and expertise in carbon materials, electrochemistry and Lithium-Ion batteries

- Licenses proprietary, patented technology for use in both solid-state and Li-Ion batteries

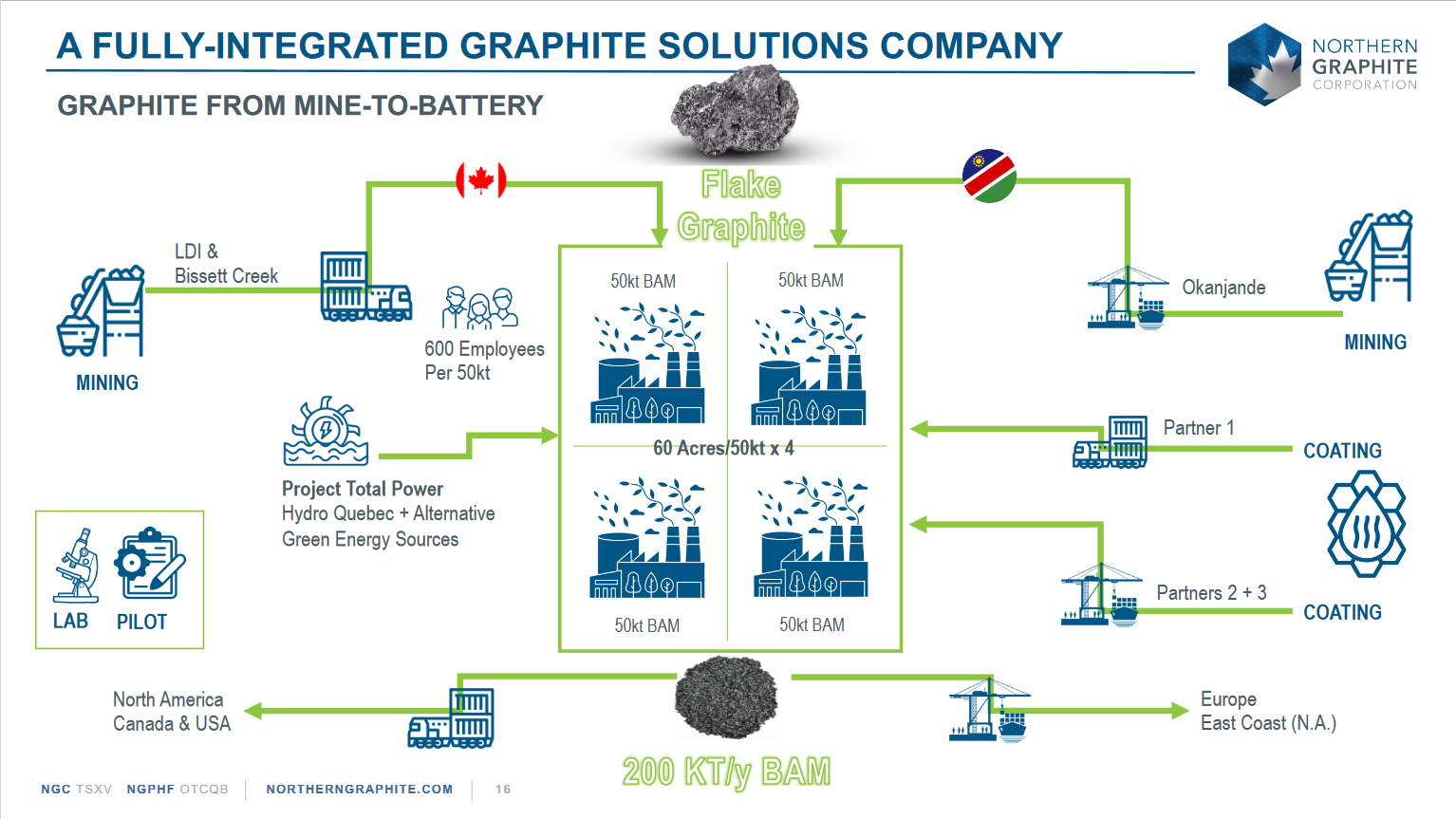

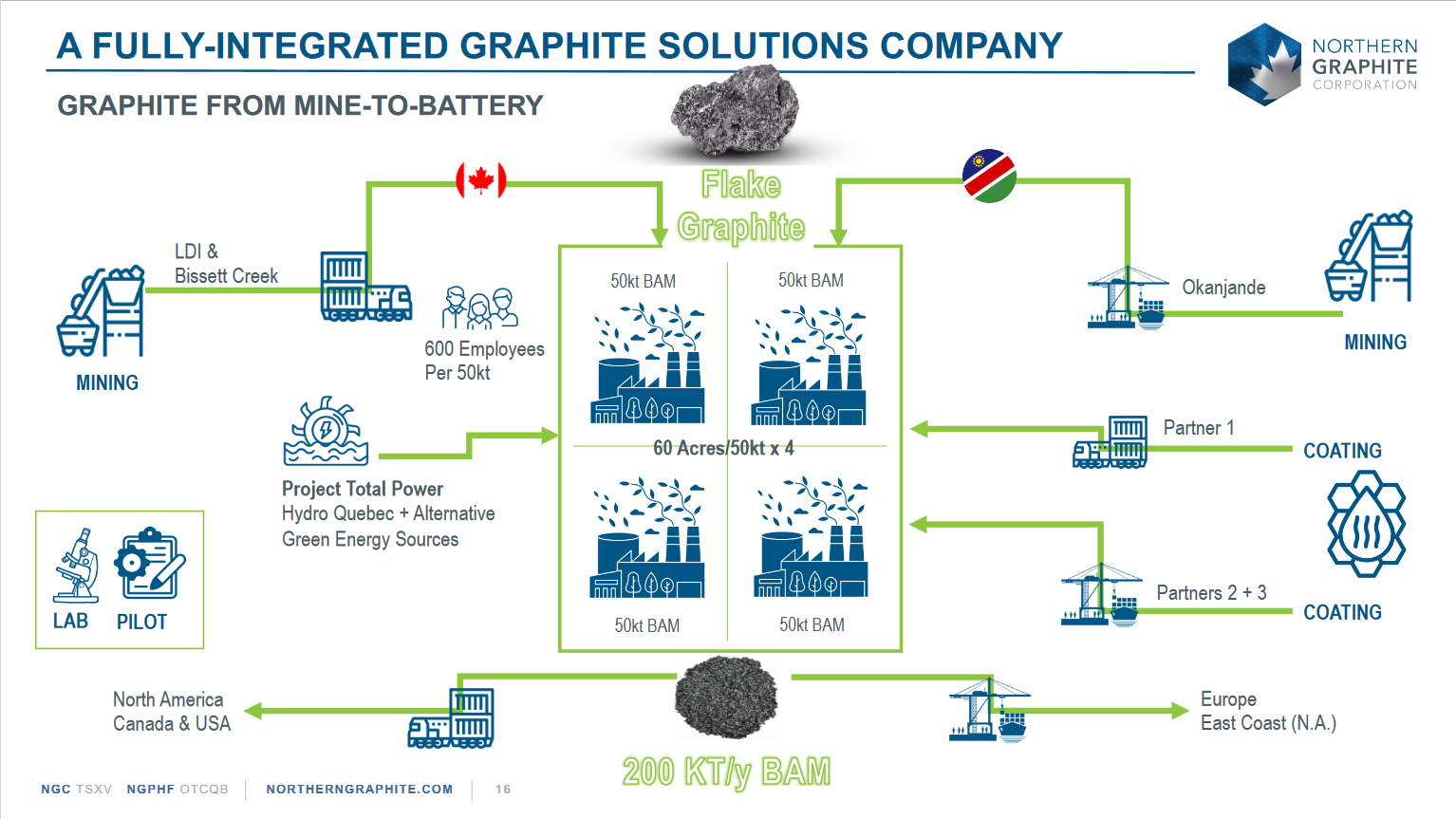

January 31, 2024: Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTCQB, FRA:0NG, XSTU:0NG) (the “Company” or “Northern”) is pleased to announce the launch of the NGC Battery Materials Group to spearhead its mine-to-battery strategy, which would make Northern one of the sole integrated developers, producers, and processors of natural graphite outside of China.

NGC Battery Materials Group was formed through the acquisition of the assets and R&D team of the battery division of Germany’s Heraeus Group, and includes a fully operational, state-of-the-art laboratory in Frankfurt. Northern has also licensed IP from Heraeus to develop, produce, and sell Porocarb®, a high-performance porous hard carbon material developed over the last 10 years and patented by Heraeus to enhance the efficiency and speed of energy storage mechanisms. NGC Battery Materials Group will be operated by Northern and financed by selling excess production capacity to partners and other material developers. Northern will pay Heraeus a 2 percent royalty on sales of all Porocarb® products.

...

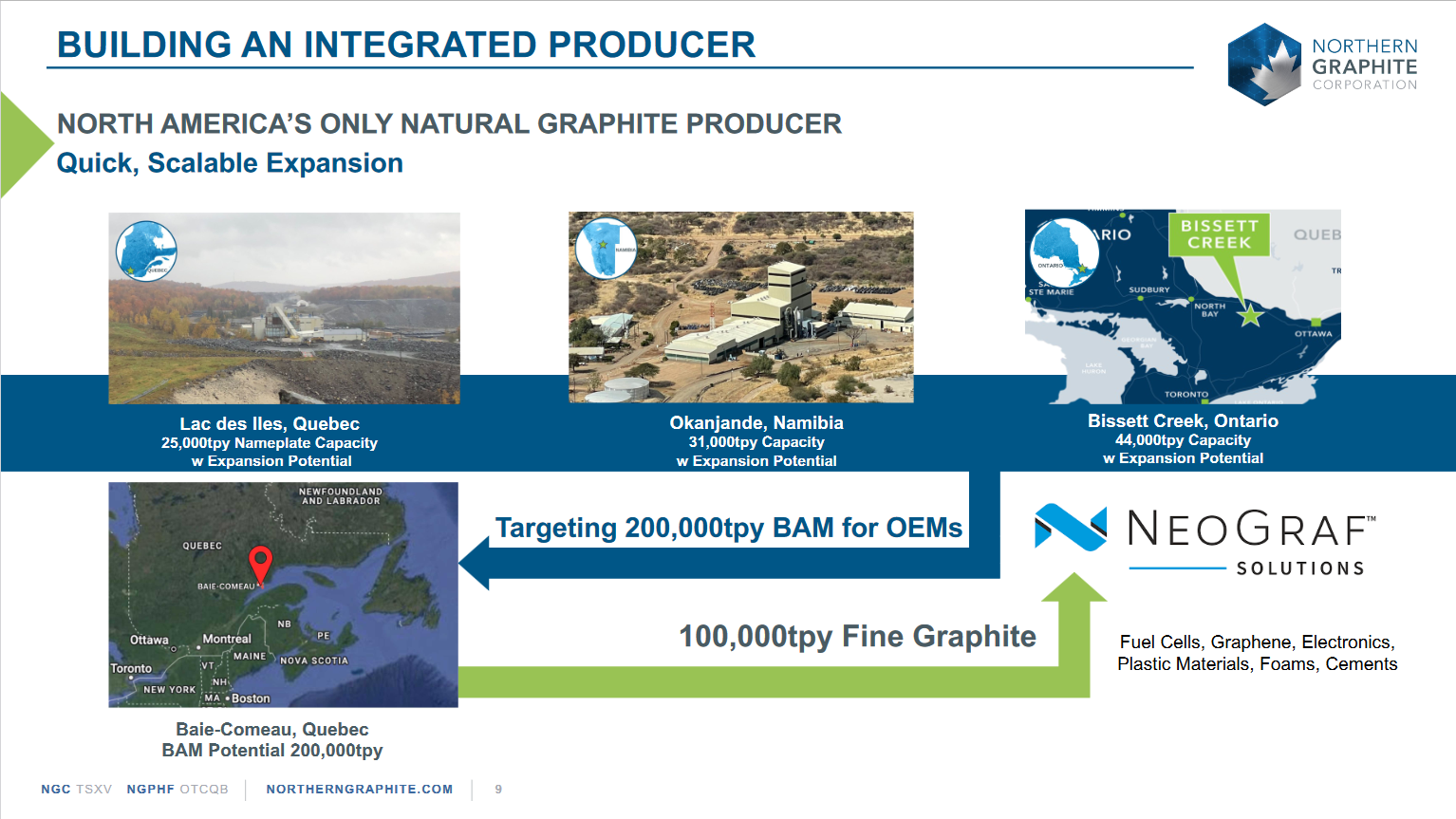

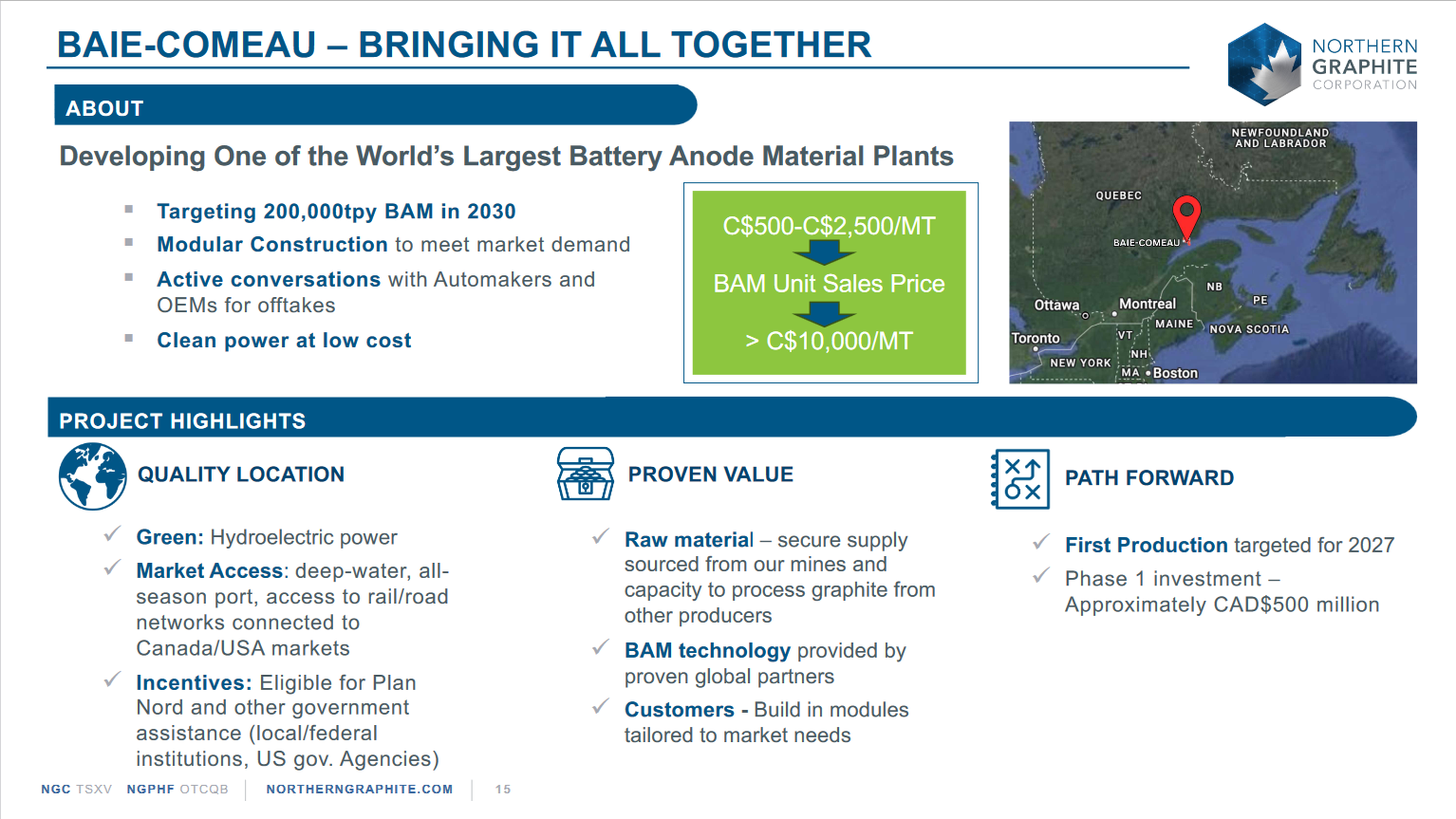

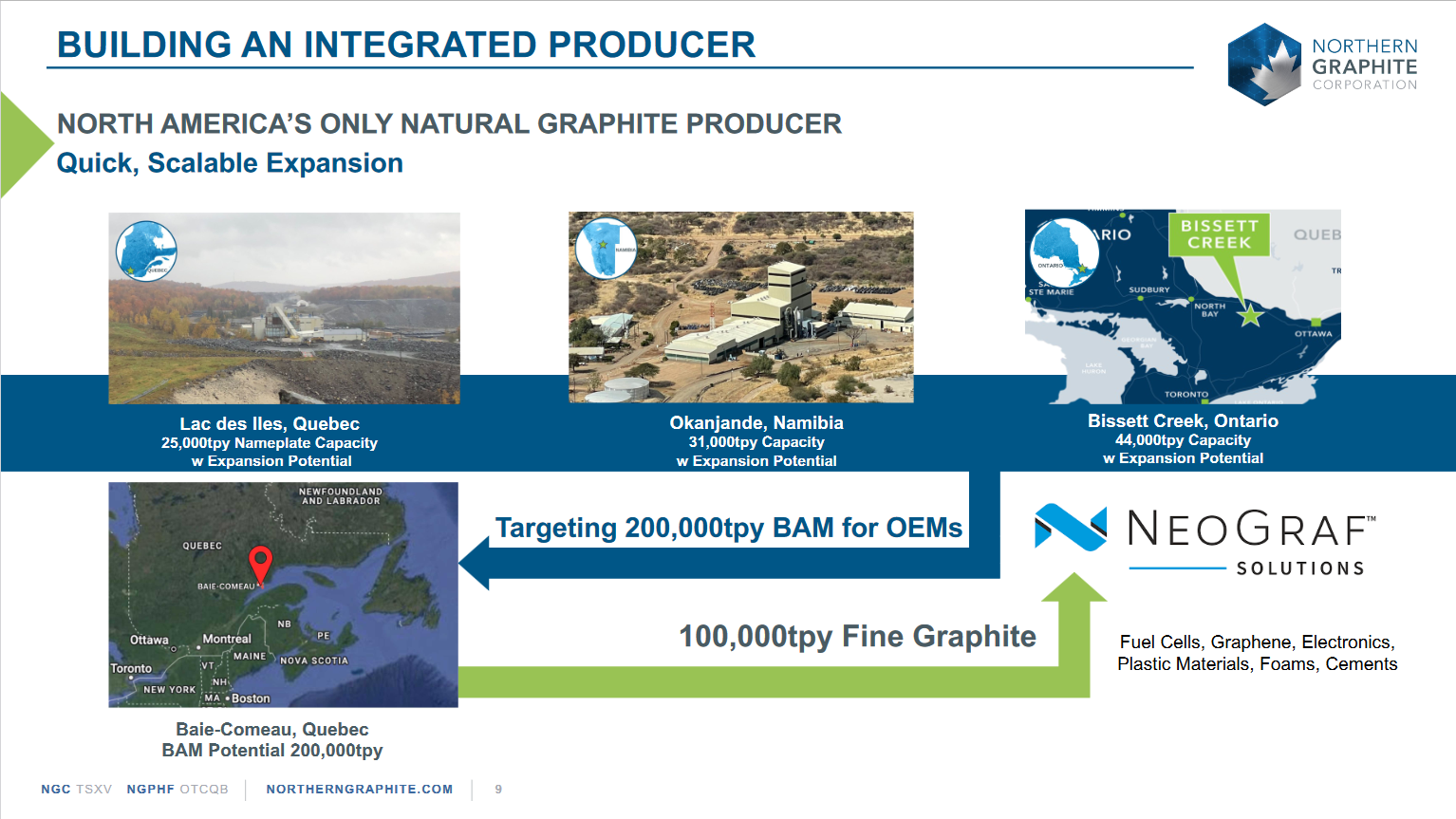

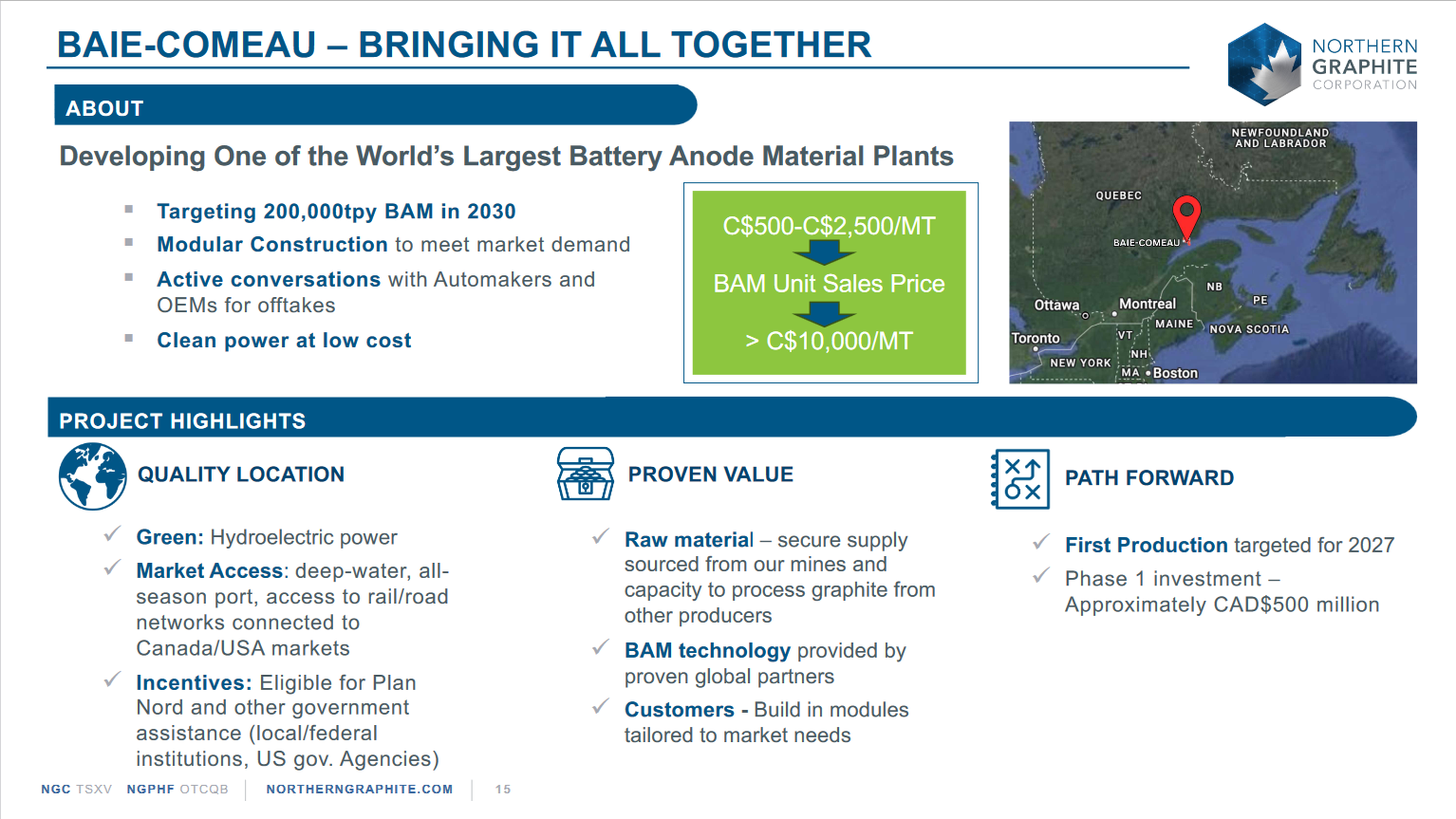

NGC Battery Materials Group will lead the development of Northern’s planned 200,000 tpy Baie-Comeau Battery Anode Material facility, with construction anticipated to commence in 2026, subject to financing. Northern plans to build Baie-Comeau in modules tailored to the specific needs of OEMs and EV battery makers, including proper milling, shaping, and classification of graphite flakes, followed by purification and coating.

...

Porocarb® Solid State and Li Ion Batteries Capabilities

Porocarb® can be used as a performance additive in Lithium-Ion batteries or utilized as protective carbon coating for solid state battery anodes. Its well-defined network of interconnected macropores serve as reservoirs and transport pathways that lend unique functionality and performance-enhancing capabilities for next-generation battery systems, including lithium-Ion and solid-state batteries. It is already being evaluated by a number of solid state and Lithium-Ion battery makers globally.

“This is a high-value, breakthrough carbon product for solid state batteries and with this transaction, Northern now has the exclusive license from Heraeus to make and sell it for use in anodes and cathodes in exchange for a two percent royalty on sales,” said Mr. Jacquemin, noting that Porocarb® is currently priced on the market at around $100/kg on average, depending on product grade. “We also have access to a demonstration plant that can produce 100 tonnes of Porocarb® per year, and that’s just to start.”

https://www.northerngraphite.com/media/news-releases/display…

- Acquires state-of-the-art laboratory and expertise in carbon materials, electrochemistry and Lithium-Ion batteries

- Licenses proprietary, patented technology for use in both solid-state and Li-Ion batteries

January 31, 2024: Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTCQB, FRA:0NG, XSTU:0NG) (the “Company” or “Northern”) is pleased to announce the launch of the NGC Battery Materials Group to spearhead its mine-to-battery strategy, which would make Northern one of the sole integrated developers, producers, and processors of natural graphite outside of China.

NGC Battery Materials Group was formed through the acquisition of the assets and R&D team of the battery division of Germany’s Heraeus Group, and includes a fully operational, state-of-the-art laboratory in Frankfurt. Northern has also licensed IP from Heraeus to develop, produce, and sell Porocarb®, a high-performance porous hard carbon material developed over the last 10 years and patented by Heraeus to enhance the efficiency and speed of energy storage mechanisms. NGC Battery Materials Group will be operated by Northern and financed by selling excess production capacity to partners and other material developers. Northern will pay Heraeus a 2 percent royalty on sales of all Porocarb® products.

...

NGC Battery Materials Group will lead the development of Northern’s planned 200,000 tpy Baie-Comeau Battery Anode Material facility, with construction anticipated to commence in 2026, subject to financing. Northern plans to build Baie-Comeau in modules tailored to the specific needs of OEMs and EV battery makers, including proper milling, shaping, and classification of graphite flakes, followed by purification and coating.

...

Porocarb® Solid State and Li Ion Batteries Capabilities

Porocarb® can be used as a performance additive in Lithium-Ion batteries or utilized as protective carbon coating for solid state battery anodes. Its well-defined network of interconnected macropores serve as reservoirs and transport pathways that lend unique functionality and performance-enhancing capabilities for next-generation battery systems, including lithium-Ion and solid-state batteries. It is already being evaluated by a number of solid state and Lithium-Ion battery makers globally.

“This is a high-value, breakthrough carbon product for solid state batteries and with this transaction, Northern now has the exclusive license from Heraeus to make and sell it for use in anodes and cathodes in exchange for a two percent royalty on sales,” said Mr. Jacquemin, noting that Porocarb® is currently priced on the market at around $100/kg on average, depending on product grade. “We also have access to a demonstration plant that can produce 100 tonnes of Porocarb® per year, and that’s just to start.”

https://www.northerngraphite.com/media/news-releases/display…

China’s Export Controls Might Trigger a U.S. Graphite Boom

Jan 09, 2024 - In the name of “national security”, Beijing has imposed new exports controls on graphite, restricting one of the most critical battery metals to Western markets as China attempts to dominate the global EV market. It’s both a threat and an opportunity. It’s an opportunity if you are a rare graphite processing company with operations in both the U.S. and China. One of the biggest news pieces on the graphite scene since Beijing’s export restrictions was a proposed SPAC deal in December 2023 that could see Graphex Group (NYSE American: GRFX), with a market cap of $40 million, sell its USA processing business for between $100 million and $200 million. The USA processing business would be spun off as a separate Nasdaq listing.

Graphex isn’t a cash-guzzling mining operation with years-long exploration processes to get through: The USA spinoff will be processing graphite—a first in the country—and that’s where some 85% of the graphite profit is. The company is now moving forward quickly with design and equipment selection for its flagship Detroit graphite processing plant and the hunt is on for additional locations, with major JV and offtake deals apparently underway.

...

And back on the home front in North America, Graphex believes it has multiple raw graphite supply deals lined up to feed its Detroit processing plant—along with other proposed new plants as they come online--in accordance with the IRA sourcing requirements for North American supply that doesn’t come from China.

Late last year, Graphex entered into an LOI with Northern Graphite Corporation (TSXV:NGC) for raw material supply, and signed an MOU with Reforme Group Pty Ltd. And in January this year, they joined forces with Northern Graphite to build a large-scale graphite processing facility in Quebec’s Baie-Comeau region. The partners are now evaluating sites to house a facility that could produce up to 200,000 tons of graphite annually. They also have an LOI with Canada-based Gratomic for raw graphite to evaluate building.

...

https://oilprice.com/Energy/Energy-General/Chinas-Export-Con…

Antwort auf Beitrag Nr.: 75.126.753 von Oginvest am 18.01.24 19:00:24Auszug NGC Präsentation JANUARY 2024:

https://www.northerngraphite.com/_resources/presentations/co…

https://www.northerngraphite.com/_resources/presentations/co…