Exklusivinterview mit Omar Abu Rashed : Union Investment-Aktienexperte: Ölpreis und König könnten Sa (Seite 2) | Diskussion im Forum

eröffnet am 04.12.19 19:37:28 von

neuester Beitrag 27.03.23 12:40:58 von

neuester Beitrag 27.03.23 12:40:58 von

Beiträge: 59

ID: 1.316.459

ID: 1.316.459

Aufrufe heute: 3

Gesamt: 5.123

Gesamt: 5.123

Aktive User: 0

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 65.563.907 von teecee1 am 01.11.20 17:20:23November 3, 20207:54 AMUpdated an hour ago

Saudi Aramco third-quarter profit slumps 44.6% as pandemic chokes demand

By Hadeel Al Sayegh, Rania El Gamal | 3 Min Read

DUBAI (Reuters) - Saudi Arabian state oil giant Aramco 2222.SE on Tuesday reported a 44.6% drop in third-quarter net profit as the coronavirus crisis continued to choke demand and weigh on crude prices. ...

https://www.reuters.com/article/saudi-aramco-results/update-…

........................................................................................................................................................

The $110 Trillion Trend That Bezos, Buffet And Musk Are Betting On

By Sasha Kay - Nov 02, 2020, 7:02 PM CST

Over 3,000 investors with over $110 trillion in assets under management can’t be wrong …

That $110 trillion supports “responsible investment”, or ESG investing for a more sustainable future.

Some of that $110 trillion dollars is now squarely focused on the electric vehicle (EV) industry.

And Tesla (NASDAQ:TSLA) is predicted to be the next trillion-dollar company, with stocks soaring more than 300% this year thanks to record demand, record deliveries and even record-breaking revenues and profits. ...

https://oilprice.com/Energy/Energy-General/The-110-Trillion-…

........................................................................................................................................................

Libya Oil Output Hits 800,000 Bpd

By Irina Slav - Nov 02, 2020, 11:00 AM CST

Libya’s crude oil production has reached 800,000 bpd, Reuters has reported, citing sources in the know. This is a 100,000-bpd increase in just a few days, the report added.

Libya started ramping up oil production in late September when the Libyan national Army agreed to a ceasefire with the Government of National Accord and lifted its blockade from oil facilities.

During the more than eight months of the blockade, Libya’s oil output slumped from over 1 million bpd to less than 100,000 bpd. Since the lifting of the blockade, ...

https://oilprice.com/Energy/Crude-Oil/Libya-Oil-Output-Hits-…

Saudi Aramco third-quarter profit slumps 44.6% as pandemic chokes demand

By Hadeel Al Sayegh, Rania El Gamal | 3 Min Read

DUBAI (Reuters) - Saudi Arabian state oil giant Aramco 2222.SE on Tuesday reported a 44.6% drop in third-quarter net profit as the coronavirus crisis continued to choke demand and weigh on crude prices. ...

https://www.reuters.com/article/saudi-aramco-results/update-…

........................................................................................................................................................

The $110 Trillion Trend That Bezos, Buffet And Musk Are Betting On

By Sasha Kay - Nov 02, 2020, 7:02 PM CST

Over 3,000 investors with over $110 trillion in assets under management can’t be wrong …

That $110 trillion supports “responsible investment”, or ESG investing for a more sustainable future.

Some of that $110 trillion dollars is now squarely focused on the electric vehicle (EV) industry.

And Tesla (NASDAQ:TSLA) is predicted to be the next trillion-dollar company, with stocks soaring more than 300% this year thanks to record demand, record deliveries and even record-breaking revenues and profits. ...

https://oilprice.com/Energy/Energy-General/The-110-Trillion-…

........................................................................................................................................................

Libya Oil Output Hits 800,000 Bpd

By Irina Slav - Nov 02, 2020, 11:00 AM CST

Libya’s crude oil production has reached 800,000 bpd, Reuters has reported, citing sources in the know. This is a 100,000-bpd increase in just a few days, the report added.

Libya started ramping up oil production in late September when the Libyan national Army agreed to a ceasefire with the Government of National Accord and lifted its blockade from oil facilities.

During the more than eight months of the blockade, Libya’s oil output slumped from over 1 million bpd to less than 100,000 bpd. Since the lifting of the blockade, ...

https://oilprice.com/Energy/Crude-Oil/Libya-Oil-Output-Hits-…

Antwort auf Beitrag Nr.: 65.493.679 von teecee1 am 26.10.20 09:28:55Donald Trump Signs Order to Protect Fracking Industry

by Joshua Caplan 31 Oct 2020

President Donald Trump on Saturday announced the signing of an executive order to protect both the fracking and oil and gas industries following former Vice President Joe Biden’s pledge to “transition from the oil industry.”

https://twitter.com/EricTrump/status/1322554089297842176

https://oilprice.com/Energy/Crude-Oil/How-The-Oil-Industry-F…

“Just signed an order to protect fracking and the oil and gas industry,” the president wrote on Twitter. “This means JOBS, low energy bills, and continued AMERICAN ENERGY INDEPENDENCE! Sleepy Joe would BAN fracking and destroy American energy jobs! He has NO clue!!” ...

https://www.breitbart.com/politics/2020/10/31/donald-trump-s…

..........................................................................................................................................................

... 🧠 ... alles tantzt nach unseren Nasen ... 🐷 ... 💵💴💶💷 ... 💰 ...

Blackrock, Bezos And Musk Charging Ahead in this $30 Trillion Mega-Trend

By Nick Freeman - Oct 28, 2020, 4:01 PM CDT

A massive $250 billion has poured into ESG index funds since August, making ESG an investing megatrend that’s soared over 733% in just two years and has had over $30 trillion invested globally.

This is Big Capital’s new safe haven and some of the largest names in finance and tech from Goldman Sachs, to Elon Musk and Jeff Bezos are investing heavily.

ESG is considered a less risky and increasingly lucrative corner of Wall Street.

The multi-trillion-dollar reality is that tech and ESG are now inextricably linked.

And they are massively outperforming the market.

The holy grail of this new trend, therefore, should be a solid ESG platform combined with an impressive tech ecosystem.

And now, ..

https://oilprice.com/Energy/Energy-General/Blackrock-Bezos-A…

https://www.italo-cinema.de/sonstiges/cinema-mondiale/item/a…

..........................................................................................................................................................

Kurdistan Halts All Oil Exports After Attack

By Charles Kennedy - Oct 30, 2020, 4:30 PM CDT

The Kurdistan Region Government in Iraq declared a halt to all oil exports on Friday after experiencing an attack on a crude oil pipeline earlier in the week.

The pipeline suffered an attack on Wednesday, disrupting the flow of crude.

The KRG-controlled area of Iraq manages oil exports through the pipeline to the Ceyhan port in Turkey.

The market is carefully watching Iraq’s crude oil production and exports, as the most non-compliant member of the OPEC+ production cut agreement for nearly the entire duration of that agreement. Rumors surfaced earlier this week that Iraq may not be on board with extending the current production quotas beyond January 2021, after Saudi Arabia and Russia hinted that the oil market may not support the scheduled relaxing of cuts then as planned.

Iraq quickly dispelled the notion, however, that it would not be behind

extending the cuts, stressing that the nation would stand behind whatever OPEC+ unanimously agreed upon.

Iraq has been in a difficult place with its quota under the OPEC+ agreement, ...

https://oilprice.com/Latest-Energy-News/World-News/Kurdistan…

..........................................................................................................................................................

Oil Plunges To $35 As Lockdowns Return

By Tsvetana Paraskova - Oct 29, 2020, 9:50 AM CDT

Oil prices extended their 5-percent slump from Wednesday into Thursday morning, plunging by another 5 percent, with WTI Crude sliding to $35 a barrel, as major economies in Europe renewed lockdowns to fight the second wave of the coronavirus.

As of 10:07 a.m. EDT on Thursday, WTI Crude was plunging by 5.27 percent at $35.11, and Brent Crude was plummeting by 4.98 percent at $36.89. The U.S. benchmark slid to its lowest level since June, while the international crude benchmark Brent dropped below $37 a barrel to its lowest price since May this year.

The sell-off in oil intensified this week with market sentiment souring by the day since the American Petroleum Institute (API) reported on Tuesday ...

Oil market participants are concerned that the return of lockdowns in Europe will significantly weigh on economic recovery and fuel demand. Two of the largest economies in Europe, Germany, and France, ...

Adding to this an ongoing production surge from Libya, the market is likely to trade defensively ahead of Tuesday’s major risk event,” John Hardy, Head of FX Strategy at Saxo Bank, said early ...

https://oilprice.com/Energy/Energy-General/Oil-Plunges-To-35…

by Joshua Caplan 31 Oct 2020

President Donald Trump on Saturday announced the signing of an executive order to protect both the fracking and oil and gas industries following former Vice President Joe Biden’s pledge to “transition from the oil industry.”

https://twitter.com/EricTrump/status/1322554089297842176

https://oilprice.com/Energy/Crude-Oil/How-The-Oil-Industry-F…

“Just signed an order to protect fracking and the oil and gas industry,” the president wrote on Twitter. “This means JOBS, low energy bills, and continued AMERICAN ENERGY INDEPENDENCE! Sleepy Joe would BAN fracking and destroy American energy jobs! He has NO clue!!” ...

https://www.breitbart.com/politics/2020/10/31/donald-trump-s…

..........................................................................................................................................................

... 🧠 ... alles tantzt nach unseren Nasen ... 🐷 ... 💵💴💶💷 ... 💰 ...

Blackrock, Bezos And Musk Charging Ahead in this $30 Trillion Mega-Trend

By Nick Freeman - Oct 28, 2020, 4:01 PM CDT

A massive $250 billion has poured into ESG index funds since August, making ESG an investing megatrend that’s soared over 733% in just two years and has had over $30 trillion invested globally.

This is Big Capital’s new safe haven and some of the largest names in finance and tech from Goldman Sachs, to Elon Musk and Jeff Bezos are investing heavily.

ESG is considered a less risky and increasingly lucrative corner of Wall Street.

The multi-trillion-dollar reality is that tech and ESG are now inextricably linked.

And they are massively outperforming the market.

The holy grail of this new trend, therefore, should be a solid ESG platform combined with an impressive tech ecosystem.

And now, ..

https://oilprice.com/Energy/Energy-General/Blackrock-Bezos-A…

https://www.italo-cinema.de/sonstiges/cinema-mondiale/item/a…

..........................................................................................................................................................

Kurdistan Halts All Oil Exports After Attack

By Charles Kennedy - Oct 30, 2020, 4:30 PM CDT

The Kurdistan Region Government in Iraq declared a halt to all oil exports on Friday after experiencing an attack on a crude oil pipeline earlier in the week.

The pipeline suffered an attack on Wednesday, disrupting the flow of crude.

The KRG-controlled area of Iraq manages oil exports through the pipeline to the Ceyhan port in Turkey.

The market is carefully watching Iraq’s crude oil production and exports, as the most non-compliant member of the OPEC+ production cut agreement for nearly the entire duration of that agreement. Rumors surfaced earlier this week that Iraq may not be on board with extending the current production quotas beyond January 2021, after Saudi Arabia and Russia hinted that the oil market may not support the scheduled relaxing of cuts then as planned.

Iraq quickly dispelled the notion, however, that it would not be behind

extending the cuts, stressing that the nation would stand behind whatever OPEC+ unanimously agreed upon.

Iraq has been in a difficult place with its quota under the OPEC+ agreement, ...

https://oilprice.com/Latest-Energy-News/World-News/Kurdistan…

..........................................................................................................................................................

Oil Plunges To $35 As Lockdowns Return

By Tsvetana Paraskova - Oct 29, 2020, 9:50 AM CDT

Oil prices extended their 5-percent slump from Wednesday into Thursday morning, plunging by another 5 percent, with WTI Crude sliding to $35 a barrel, as major economies in Europe renewed lockdowns to fight the second wave of the coronavirus.

As of 10:07 a.m. EDT on Thursday, WTI Crude was plunging by 5.27 percent at $35.11, and Brent Crude was plummeting by 4.98 percent at $36.89. The U.S. benchmark slid to its lowest level since June, while the international crude benchmark Brent dropped below $37 a barrel to its lowest price since May this year.

The sell-off in oil intensified this week with market sentiment souring by the day since the American Petroleum Institute (API) reported on Tuesday ...

Oil market participants are concerned that the return of lockdowns in Europe will significantly weigh on economic recovery and fuel demand. Two of the largest economies in Europe, Germany, and France, ...

Adding to this an ongoing production surge from Libya, the market is likely to trade defensively ahead of Tuesday’s major risk event,” John Hardy, Head of FX Strategy at Saxo Bank, said early ...

https://oilprice.com/Energy/Energy-General/Oil-Plunges-To-35…

Antwort auf Beitrag Nr.: 65.476.392 von teecee1 am 23.10.20 13:10:22Market As Factions Sign Ceasefire

By Tsvetana Paraskova - Oct 23, 2020, 4:30 PM CDT

Warring factions in Libya signed a countrywide ceasefire on Friday brokered by the United Nations. The ceasefire is poised to lead to more Libyan oil supply to the market at a time when demand is weak, and OPEC+ prepares to ease production cuts as of January.

The UN-led mediation by the 5+5 Joint Military Commission, representing the UN-recognized Government in Tripoli and the self-styled Libyan National Army (LNA) of General Khalifa Haftar, agreed to a ceasefire, which UN Acting Special Representative, Stephanie Williams, said could help secure “a better, safer, and more peaceful future for all the Libyan people.” ...

https://oilprice.com/Latest-Energy-News/World-News/More-Liby…

..........................................................................................................................................................

Saudi Arabia Is Suffering The Consequences Of Its Failed Oil Price War

by Tyler Durden

Fri, 10/23/2020 - 19:20

Authored by Simon Watkins via OilPrice.com,

Nine months on from Saudi Arabia’s second major oil price war in the last five years, more negative consequences are manifesting themselves. Aside from the irrevocably damaged core relationship with the U.S., the permanent distrust of international investors, and the further alienation of many of its fellow OPEC members, Saudi Arabia is now beginning to discover the true depth and breadth of damage that it has done to its own economy, which will endure for many years to come.

Figures released at the end of September show that Saudi Arabia’s economy contracted 7 per cent year-on-year (y-o-y) in the second quarter of 2020, with the Kingdom’s private sector showing a negative growth rate of 10.1 per cent, while the public sector recorded negative growth of 3.5 per cent. Saudi’s oil revenue in the first half of the year was 35 per cent lower than a year earlier, while non-oil revenue fell by 37 per cent. Moreover, in the second quarter of 2020 alone, the Kingdom’s petroleum refining activities recorded a 14 per cent y-o-y drop. All of this resulted in a current account deficit of SAR67.4 billion (US$18 billion), or 12 per cent of GDP, in Q220 compared with a surplus of SAR42.9 billion, or 5.8 per cent of GDP, a year earlier, according to Saudi Arabia’s General Authority for ...

https://www.zerohedge.com/geopolitical/saudi-arabia-sufferin…

..........................................................................................................................................................

The U.S. Has A Major EV Problem

By Tsvetana Paraskova - Oct 24, 2020, 4:00 PM CDT

Even a battery with a million-mile lifespan can’t overcome one of the key hurdles to mass adoption of electric vehicles (EVs) in the United States and elsewhere—the insufficient public charging infrastructure. The EV revolution is not only about car performance, choice availability, or price parity with internal combustion engine (ICE) vehicles. It also hinges on easy access to charging infrastructure to allay customer fears that they could be left stranded without battery power and without a charging point nearby.

EV infrastructure in the United States is expanding, but it needs a lot more expansion and investments to be ready for EVs to increase their market share.

Even California, the leader in EV sales and Tesla’s largest U.S. market, has recognized that it needs to fill the gap in charging infrastructure if it is to meet California Governor Gavin Newsom’s target of phasing out the sale of new gasoline-fueled passenger vehicles by 2035.

Earlier this month, the California Energy Commission (CEC) approved a US$384 million plan to accelerate zero-emission transportation, including by allocating US$132.9 million for light-duty EV charging infrastructure and another US$129.8 million for medium- and heavy-duty EVs and infrastructure.

In August, California state officials gave Southern California Edison the green light for a US$436-million EV charging infrastructure program that will add about 38,000 new chargers throughout the utility’s 50,000-square-mile service area, which will be the nation’s largest EV charging program run by an investor-owned utility.

Who Should Operate Charging Points?

California is the leader when it comes to plans to authorize utilities to invest in EV charging infrastructure. More than half of the total US$2.6 billion approved by regulators in 24 states came from California as of September, The Wall Street Journal reported, ...

https://oilprice.com/Energy/Energy-General/The-US-Has-A-Majo…

... ... jeder macht was er will ... mit öffentlichen Geldern ... ähhh, vom Steuerzahler ... Ladestation auf dem Mars von E. Musk ...

... jeder macht was er will ... mit öffentlichen Geldern ... ähhh, vom Steuerzahler ... Ladestation auf dem Mars von E. Musk ...

..........................................................................................................................................................

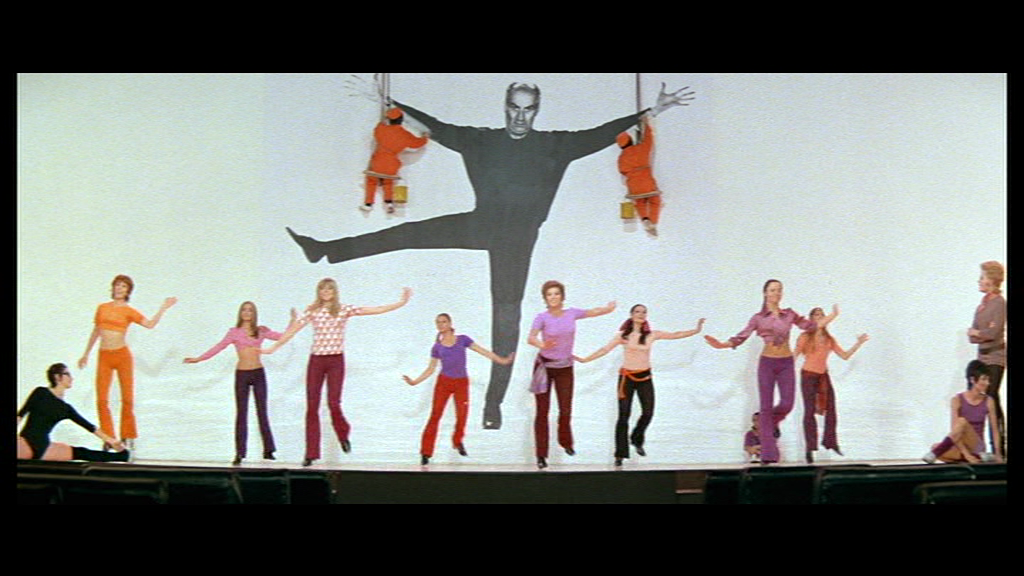

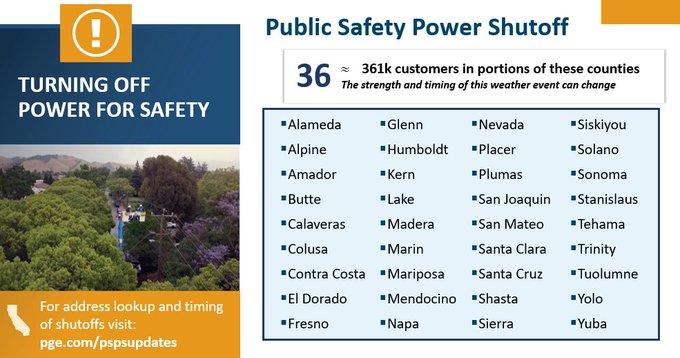

Oct 23, 2020

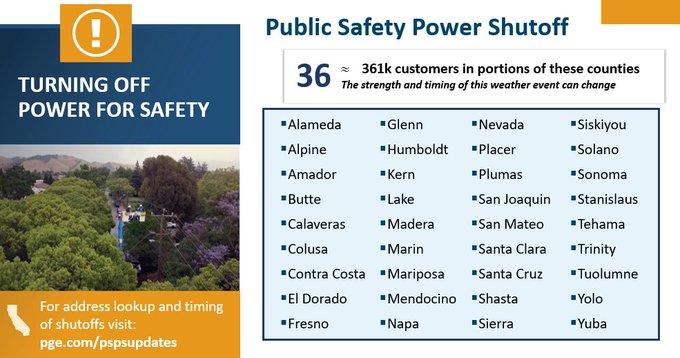

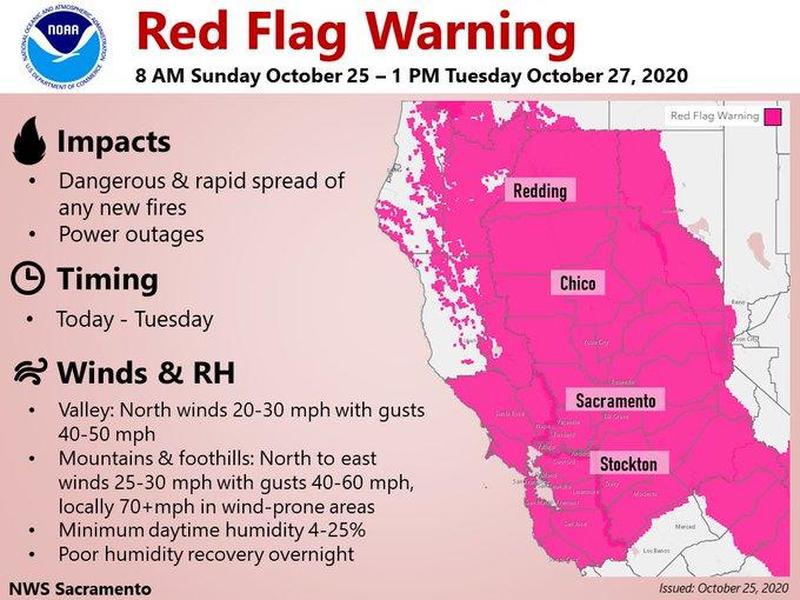

PG&E Warns of Power Cuts to 466,000 Customers To Prevent Fires

Mark Chediak and Brian K. Sullivan, Bloomberg News

(Bloomberg) -- California’s largest utility, PG&E Corp., is warning it may cut power to 466,000 homes and businesses to prevent falling wires from igniting dry brush as the most powerful gusts of the 2020 fire season buffet the state. ...

https://www.bnnbloomberg.ca/pg-e-warns-of-power-cuts-to-466-…

https://www.zerohedge.com/commodities/pge-may-cut-power-near…

---

https://www.zerohedge.com/commodities/california-begins-cutt…

-----

... ... False Flag ... vor der US Wahl ... Wahlbeeinflussung: Briefwahl ... Notversorgung mit Lebensmittel etc. ...

... False Flag ... vor der US Wahl ... Wahlbeeinflussung: Briefwahl ... Notversorgung mit Lebensmittel etc. ...

By Tsvetana Paraskova - Oct 23, 2020, 4:30 PM CDT

Warring factions in Libya signed a countrywide ceasefire on Friday brokered by the United Nations. The ceasefire is poised to lead to more Libyan oil supply to the market at a time when demand is weak, and OPEC+ prepares to ease production cuts as of January.

The UN-led mediation by the 5+5 Joint Military Commission, representing the UN-recognized Government in Tripoli and the self-styled Libyan National Army (LNA) of General Khalifa Haftar, agreed to a ceasefire, which UN Acting Special Representative, Stephanie Williams, said could help secure “a better, safer, and more peaceful future for all the Libyan people.” ...

https://oilprice.com/Latest-Energy-News/World-News/More-Liby…

..........................................................................................................................................................

Saudi Arabia Is Suffering The Consequences Of Its Failed Oil Price War

by Tyler Durden

Fri, 10/23/2020 - 19:20

Authored by Simon Watkins via OilPrice.com,

Nine months on from Saudi Arabia’s second major oil price war in the last five years, more negative consequences are manifesting themselves. Aside from the irrevocably damaged core relationship with the U.S., the permanent distrust of international investors, and the further alienation of many of its fellow OPEC members, Saudi Arabia is now beginning to discover the true depth and breadth of damage that it has done to its own economy, which will endure for many years to come.

Figures released at the end of September show that Saudi Arabia’s economy contracted 7 per cent year-on-year (y-o-y) in the second quarter of 2020, with the Kingdom’s private sector showing a negative growth rate of 10.1 per cent, while the public sector recorded negative growth of 3.5 per cent. Saudi’s oil revenue in the first half of the year was 35 per cent lower than a year earlier, while non-oil revenue fell by 37 per cent. Moreover, in the second quarter of 2020 alone, the Kingdom’s petroleum refining activities recorded a 14 per cent y-o-y drop. All of this resulted in a current account deficit of SAR67.4 billion (US$18 billion), or 12 per cent of GDP, in Q220 compared with a surplus of SAR42.9 billion, or 5.8 per cent of GDP, a year earlier, according to Saudi Arabia’s General Authority for ...

https://www.zerohedge.com/geopolitical/saudi-arabia-sufferin…

..........................................................................................................................................................

The U.S. Has A Major EV Problem

By Tsvetana Paraskova - Oct 24, 2020, 4:00 PM CDT

Even a battery with a million-mile lifespan can’t overcome one of the key hurdles to mass adoption of electric vehicles (EVs) in the United States and elsewhere—the insufficient public charging infrastructure. The EV revolution is not only about car performance, choice availability, or price parity with internal combustion engine (ICE) vehicles. It also hinges on easy access to charging infrastructure to allay customer fears that they could be left stranded without battery power and without a charging point nearby.

EV infrastructure in the United States is expanding, but it needs a lot more expansion and investments to be ready for EVs to increase their market share.

Even California, the leader in EV sales and Tesla’s largest U.S. market, has recognized that it needs to fill the gap in charging infrastructure if it is to meet California Governor Gavin Newsom’s target of phasing out the sale of new gasoline-fueled passenger vehicles by 2035.

Earlier this month, the California Energy Commission (CEC) approved a US$384 million plan to accelerate zero-emission transportation, including by allocating US$132.9 million for light-duty EV charging infrastructure and another US$129.8 million for medium- and heavy-duty EVs and infrastructure.

In August, California state officials gave Southern California Edison the green light for a US$436-million EV charging infrastructure program that will add about 38,000 new chargers throughout the utility’s 50,000-square-mile service area, which will be the nation’s largest EV charging program run by an investor-owned utility.

Who Should Operate Charging Points?

California is the leader when it comes to plans to authorize utilities to invest in EV charging infrastructure. More than half of the total US$2.6 billion approved by regulators in 24 states came from California as of September, The Wall Street Journal reported, ...

https://oilprice.com/Energy/Energy-General/The-US-Has-A-Majo…

...

... jeder macht was er will ... mit öffentlichen Geldern ... ähhh, vom Steuerzahler ... Ladestation auf dem Mars von E. Musk ...

... jeder macht was er will ... mit öffentlichen Geldern ... ähhh, vom Steuerzahler ... Ladestation auf dem Mars von E. Musk .............................................................................................................................................................

Oct 23, 2020

PG&E Warns of Power Cuts to 466,000 Customers To Prevent Fires

Mark Chediak and Brian K. Sullivan, Bloomberg News

(Bloomberg) -- California’s largest utility, PG&E Corp., is warning it may cut power to 466,000 homes and businesses to prevent falling wires from igniting dry brush as the most powerful gusts of the 2020 fire season buffet the state. ...

https://www.bnnbloomberg.ca/pg-e-warns-of-power-cuts-to-466-…

https://www.zerohedge.com/commodities/pge-may-cut-power-near…

---

https://www.zerohedge.com/commodities/california-begins-cutt…

-----

...

... False Flag ... vor der US Wahl ... Wahlbeeinflussung: Briefwahl ... Notversorgung mit Lebensmittel etc. ...

... False Flag ... vor der US Wahl ... Wahlbeeinflussung: Briefwahl ... Notversorgung mit Lebensmittel etc. ...

Antwort auf Beitrag Nr.: 65.439.165 von teecee1 am 20.10.20 11:44:10Why Crude-Tanker Collapse Could Be Long And Painful

by Tyler Durden

Thu, 10/22/2020 - 20:20

By Greg Miller of FreightWaves

Chinese water torture is defined as “a painful process in which cold water is slowly dripped onto the scalp, forehead or face for a prolonged period of time, allegedly making the restrained victim insane.” Crude-tanker owners and investors may face their own version of this ancient torment. Today’s agonizingly low rates could be just the beginning.

The massive floating storage volumes that built up earlier this year are unloading. But very, very slowly. In aggregate, they’re dripping out. Meanwhile, oil demand is growing, but again, very slowly. Incremental oil demand is a trickle, not a flood.

First the party, now the hangover

Crude tankers filled up with storage cargoes in April-June after Saudi Arabia opened its spigots despite COVID-weakened demand. Tanker rates hit historic highs of over $250,000 per day but did so by pulling forward demand via storage deals and borrowing from the future.

The best hope for tanker markets was that storage would unwind quickly as global consumption rebounded. This was the so-called “short hangover” or “rip off the Band-Aid” scenario. It would depress rates in the near term as storage tankers unloaded and swiftly reentered the spot-market scrum. But it would hasten a return to normalcy.

Alas, new data provided to FreightWaves by intelligence company Kpler confirms that the Band-Aid is not being ripped off. It also implies that barring a major geopolitical event to supercharge spot rates, ...

https://www.zerohedge.com/economics/why-crude-tanker-collaps…

..........................................................................................................................................................

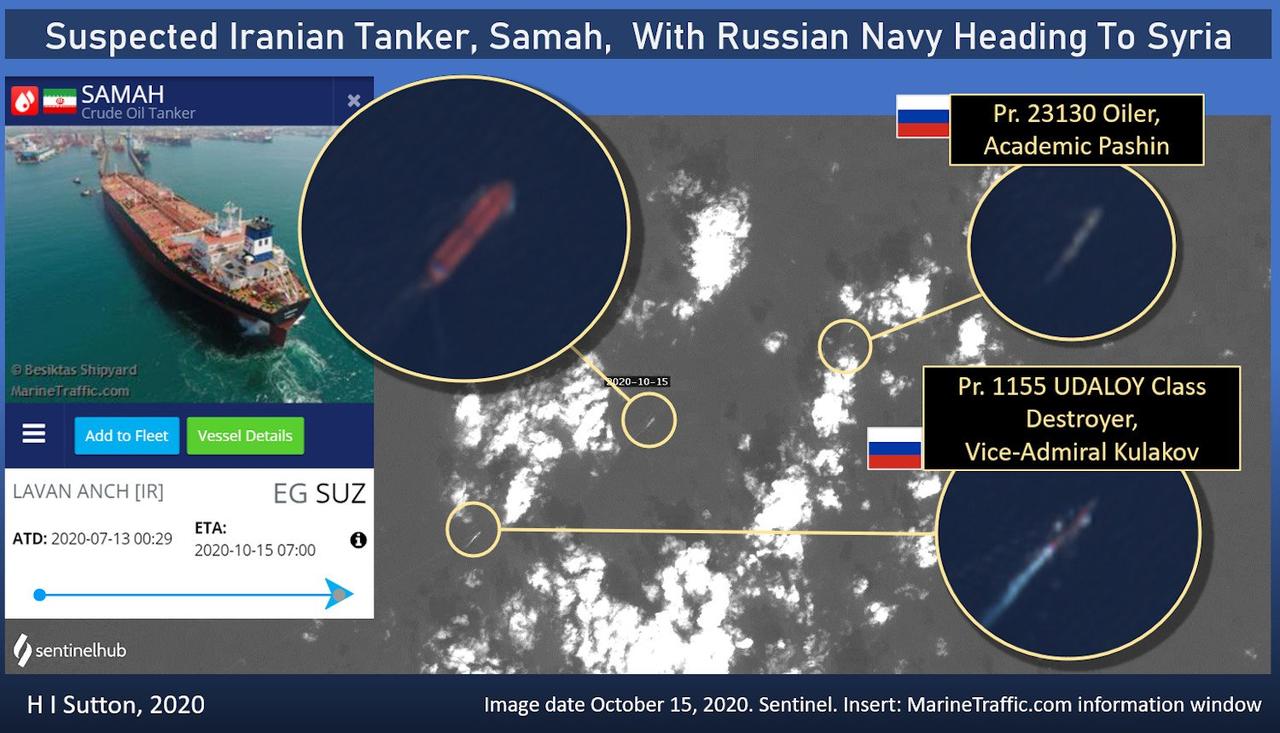

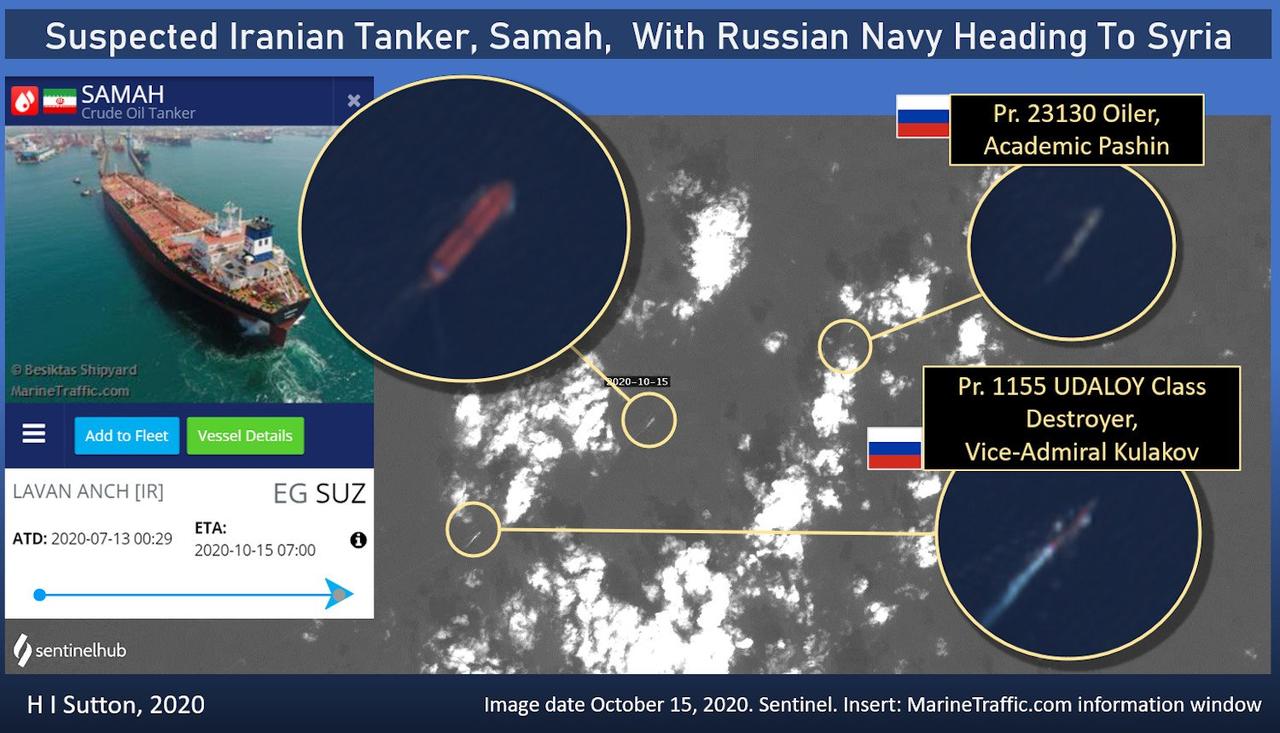

Russian Destroyers Are Escorting Iranian Tankers In Mediterranean Amid US-UK Threats

by Tyler Durden

Fri, 10/23/2020 - 04:15

The United States Naval Institute has highlighted in a new report that Iranian fuel tankers are being escorted by Russia's military in the Mediterranean in order to prevent a high seas intercept or detention by American or allied vessels, as happened in 2019 with the Grace-1 off Gibraltar which involved seizure by elite British forces.

Citing satellite imagery, the US Naval Institute's official news page details that "Last week, the Iranian-flagged oil tanker Samah entered the Mediterranean Sea via the Suez Canal." The imagery shows that:

"After a few miles, the 900-foot-long ship stopped reporting its position and destination. Evidence suggests the ship sailed to Syria, escorted by two Russian Navy ships, including a destroyer."

https://www.zerohedge.com/geopolitical/russias-military-esco…

..........................................................................................................................................................

Oil Production Cuts Could Be Extended: Putin

by Tyler Durden

Fri, 10/23/2020 - 03:30

Submitted by OilPrice.com

Russia does not rule out the possibility that OPEC+ could extend its current 7.7 million barrels per day of production cuts into next year, according to Russian President Vladimir Putin.

The comments could be merely jawboning to a market that is desperately seeking reassurances that oil production will not ramp up too quickly beyond demand. But Russia has in the past been reluctant to keep up its end of the oil production cuts, so any mention that it is even thinking about a slower tapering of the cuts is noteworthy.

In fact, Russia had failed to bring its own oil production down to the level it agreed to for most of the period of cuts in 2019 and early 2020.

Russia also was the spark that ignited the oil price war between it and Saudi Arabia-and by default the United States, when it refused to agree to additional cuts using the argument that as OPEC decreases its production, it opens the door for U.S. producers to increase theirs.

Vladimir Putin has had several discussions with Saudi Arabia and the United States on the state of the oil markets. “We believe there is no need to change anything in our agreements,” Putin said. “We will watch how the market is recovery. The consumption is on the rise.”

Putin added, ...

https://www.zerohedge.com/markets/oil-production-cuts-could-…

..........................................................................................................................................................

Iraq’s Kurdistan Region Says It Is Committed To OPEC+ Cuts

By Charles Kennedy - Oct 22, 2020, 12:30 PM CDT

The semi-autonomous Kurdistan region in Iraq has agreed to reduce the region’s crude oil production as part of the ongoing OPEC+ agreement, the Kurdistan Regional Government (KRG) said on Thursday.

The statement came after Iraq’s Oil Minister Ihsan Abdul Jabbar said earlier this week at an online petroleum conference that “the Kurdistan Region has not been contributing to OPEC+ cuts.”

Iraq, the least compliant member of the OPEC+ production cut pact, has promised for months to reduce its oil production and fall in line with its quota—something it hasn’t done since 2017.

In recent months, ...

https://oilprice.com/Latest-Energy-News/World-News/Iraqs-Kur…

by Tyler Durden

Thu, 10/22/2020 - 20:20

By Greg Miller of FreightWaves

Chinese water torture is defined as “a painful process in which cold water is slowly dripped onto the scalp, forehead or face for a prolonged period of time, allegedly making the restrained victim insane.” Crude-tanker owners and investors may face their own version of this ancient torment. Today’s agonizingly low rates could be just the beginning.

The massive floating storage volumes that built up earlier this year are unloading. But very, very slowly. In aggregate, they’re dripping out. Meanwhile, oil demand is growing, but again, very slowly. Incremental oil demand is a trickle, not a flood.

First the party, now the hangover

Crude tankers filled up with storage cargoes in April-June after Saudi Arabia opened its spigots despite COVID-weakened demand. Tanker rates hit historic highs of over $250,000 per day but did so by pulling forward demand via storage deals and borrowing from the future.

The best hope for tanker markets was that storage would unwind quickly as global consumption rebounded. This was the so-called “short hangover” or “rip off the Band-Aid” scenario. It would depress rates in the near term as storage tankers unloaded and swiftly reentered the spot-market scrum. But it would hasten a return to normalcy.

Alas, new data provided to FreightWaves by intelligence company Kpler confirms that the Band-Aid is not being ripped off. It also implies that barring a major geopolitical event to supercharge spot rates, ...

https://www.zerohedge.com/economics/why-crude-tanker-collaps…

..........................................................................................................................................................

Russian Destroyers Are Escorting Iranian Tankers In Mediterranean Amid US-UK Threats

by Tyler Durden

Fri, 10/23/2020 - 04:15

The United States Naval Institute has highlighted in a new report that Iranian fuel tankers are being escorted by Russia's military in the Mediterranean in order to prevent a high seas intercept or detention by American or allied vessels, as happened in 2019 with the Grace-1 off Gibraltar which involved seizure by elite British forces.

Citing satellite imagery, the US Naval Institute's official news page details that "Last week, the Iranian-flagged oil tanker Samah entered the Mediterranean Sea via the Suez Canal." The imagery shows that:

"After a few miles, the 900-foot-long ship stopped reporting its position and destination. Evidence suggests the ship sailed to Syria, escorted by two Russian Navy ships, including a destroyer."

https://www.zerohedge.com/geopolitical/russias-military-esco…

..........................................................................................................................................................

Oil Production Cuts Could Be Extended: Putin

by Tyler Durden

Fri, 10/23/2020 - 03:30

Submitted by OilPrice.com

Russia does not rule out the possibility that OPEC+ could extend its current 7.7 million barrels per day of production cuts into next year, according to Russian President Vladimir Putin.

The comments could be merely jawboning to a market that is desperately seeking reassurances that oil production will not ramp up too quickly beyond demand. But Russia has in the past been reluctant to keep up its end of the oil production cuts, so any mention that it is even thinking about a slower tapering of the cuts is noteworthy.

In fact, Russia had failed to bring its own oil production down to the level it agreed to for most of the period of cuts in 2019 and early 2020.

Russia also was the spark that ignited the oil price war between it and Saudi Arabia-and by default the United States, when it refused to agree to additional cuts using the argument that as OPEC decreases its production, it opens the door for U.S. producers to increase theirs.

Vladimir Putin has had several discussions with Saudi Arabia and the United States on the state of the oil markets. “We believe there is no need to change anything in our agreements,” Putin said. “We will watch how the market is recovery. The consumption is on the rise.”

Putin added, ...

https://www.zerohedge.com/markets/oil-production-cuts-could-…

..........................................................................................................................................................

Iraq’s Kurdistan Region Says It Is Committed To OPEC+ Cuts

By Charles Kennedy - Oct 22, 2020, 12:30 PM CDT

The semi-autonomous Kurdistan region in Iraq has agreed to reduce the region’s crude oil production as part of the ongoing OPEC+ agreement, the Kurdistan Regional Government (KRG) said on Thursday.

The statement came after Iraq’s Oil Minister Ihsan Abdul Jabbar said earlier this week at an online petroleum conference that “the Kurdistan Region has not been contributing to OPEC+ cuts.”

Iraq, the least compliant member of the OPEC+ production cut pact, has promised for months to reduce its oil production and fall in line with its quota—something it hasn’t done since 2017.

In recent months, ...

https://oilprice.com/Latest-Energy-News/World-News/Iraqs-Kur…

Oil Prices Fall As Concerns About Second Wave Weigh On Markets ... RED WAVE is coming ... 🌊🌪🌩💥 ...

By Tsvetana Paraskova - Oct 16, 2020, 10:00 AM CDT

Oil prices slid early on Friday and were on track for a flat weekly performance, as new coronavirus cases in Europe and the United States continued to spike, alarming the market that the oil demand recovery will be derailed.

As of 10:25 a.m. EDT on Friday, WTI Crude prices were trading down 1.10 percent on the day, at $40.49. Brent Crude was down 1.14 percent at $42.66. A stronger U.S. dollar, which makes buying oil more expensive for holders of other currencies, also weighed on oil prices on Friday.

This week, ...

https://oilprice.com/Energy/Energy-General/Oil-Prices-Fall-A…

.........................................................................................................................................................

... 💣 ... spielen wir blinde 🐄 ... oder verstecken ... Hauptsache es gibt Kohle ...💵💴💶💷 .... ähhh, einen höheren Ölpreis ... 📈 ... MIC ...

ISIS Calls On Followers To Attack Westerners & Oil Pipelines Inside Saudi Arabia

by Tyler Durden

Mon, 10/19/2020 - 19:20

Though the so-called Islamic State Caliphate was at its height in 2014 and 2015, the terror group has been driven underground since it lost 95% of its territory in Iraq and Syria by December 2017. And in October 2019 the US military said it killed ISIS leader Abu Bakr al-Baghdadi on the outskirts of Idlib province in Syria.

Effectively defeated, it's believed that ISIS has since organized itself into a network of terror cells in Iraq and Syria. This has been used as a prime justification for the Pentagon keeping some 500 to possibly 2,000 American troops in Syria, alongside Trump's 'secure the oil' campaign in Deir Ezzor.

But now Reuters reports ISIS has issued a rare new message urging supporters to attack westerners and oil pipelines inside Saudi Arabia. ...

https://www.zerohedge.com/geopolitical/isis-calls-followers-…

https://oilprice.com/Energy/Energy-General/ISIS-Calls-For-At…

.........................................................................................................................................................

Iran To Import North Korean missiles In 25-Year Military Deal With China

By Simon Watkins - Oct 19, 2020, 5:00 PM CDT

Following the end on the 18th of October of the 13-year United Nations’ embargo on Iran buying or selling weapons, the roll-out of the military component of the 25-year deal between China and Iran will begin in November, as exclusively revealed by Oil Price.com. After a series of meetings in China on the 9th and 10th of October between Iran’s Foreign Minister, Mohammad Zarif, and his China counterpart, Wang Yi, this military component may now also feature the deployment in Iran of North Korean weaponry and technology, in exchange for oil, according to sources very close to the Iranian government spoken to by OilPrice.com last week. Most notably this would include Hwasong-12 mobile ballistic missiles, with a range of 4,500 kilometres, and the development of liquid propellant rocket engines suitable for intercontinental ballistic missiles (ICBMs) or satellite launch vehicles (SLVs). This will all be part of a broader triangular relationship co-ordinated by Beijing and further facilitated by the imminent launch of a new digitised currency system by China.

This sort of co-ordination – ...

https://oilprice.com/Energy/Energy-General/Iran-To-Import-No…

.........................................................................................................................................................

OPEC+ Is On The Brink Of A Crisis

By Cyril Widdershoven - Oct 19, 2020, 7:00 PM CDT

The OPEC+ member countries are on the brink of a financial crisis if the latest assessments of the International Monetary Fund (IMF) are accurate. The IMF has presented a very bleak outlook for an economic recovery in the Middle East and Central Asia, predicting a 4.1% contraction for the region. The main driving factor behind this bearish outlook is the IMF’s forecast that oil prices will remain in the $40 to $50 range in 2021. An extension of the current low oil price environment for another year would badly hurt oil and gas exporting countries, which includes all of the OPEC+ members. In its statement, the IMF predicted an economic contraction of 2.8% in April for the Middle East and Central Asia. IMF director Jihad Azour highlighted a large disparity in the projected economic loss of oil-importing and exporting countries, forecasting a negative 6.6% growth for oil-exporting countries, compared to a contraction of 1.3% for oil-importing countries. With many of the OPEC+ members being rentier-states, the need for higher oil prices cannot be overstated. A vast part of the government budgets of OPEC member states depends on oil and gas-related revenues. As such, all OPEC countries are looking at significant budget deficits this year, especially Saudi Arabia, the UAE, Bahrain, Iraq, Iran, and Kuwait. Former OPEC member Qatar is in a similar situation, even as it tries to mitigate the damage by increasing its LNG exports. As both oil and gas demand has seen significant demand destruction this year, prices for both have plunged. At present, Brent oil prices are still 40% below their pre-COVID levels. There is little hope of a significant rise in prices any time soon as global oil and gas storage volumes are still at historically high levels, and demand looks set to dip again due to new COVID-related lockdowns and a further economic recession. The frequently cited breakeven price for the Saudi government budget is $80 per barrel, although Saudi government budget discussions seem to revolve around an oil price of $50. Iraq has also stated that it expects price levels of $50 per barrel for 2021. These optimistic predictions seem to be based solely on Chinese post-Covid economic figures, ...

https://oilprice.com/Energy/Energy-General/OPEC-Is-On-The-Br…

... IMF - MAFIA ...

IMF Sees Oil Prices At $40-50 Next Year

By Tsvetana Paraskova - Oct 19, 2020, 11:00 AM CDT

Oil prices are not expected to rise much next year, and will stay in the $40-50 a barrel range, putting additional pressure on the oil exporters in the Middle East, the International Monetary Fund (IMF) said on Monday in its update on the Regional Economic Outlook for the Middle East and Central Asia.

Gross domestic product in the region is set to drop by 4.1 percent this year, a downward revision of 1.3 percentage points compared with IMF’s forecast in April 2020. The economies in the oil exporters in the Middle East and North Africa are expected to suffer more and shrink by 6.6 percent this year, according to the IMF. ...

https://oilprice.com/Energy/Crude-Oil/IMF-Sees-Oil-Prices-At…

.........................................................................................................................................................

OPEC Meeting Ends Without Firm Decision On Output Cuts ... ☎ ... 📞... Calls ... 💣 ...

By Julianne Geiger - Oct 19, 2020, 5:00 PM CDT

OPEC said on Monday that it would not shirk its responsibilities to the market as fears about the next Covid-19 wave push down prices.

Oil prices sank on Monday over disappointing economic data out of China, fears of this resurgence of coronavirus cases, additional lockdown measures in Europe, and the looming threat that OPEC could turn on the taps in January as originally planned.

But sources inside member countries, according to Reuters, said that this planned output increase could be reversed should the need arise.

To assuage the fears present in the market, ...

https://oilprice.com/Latest-Energy-News/World-News/OPEC-Meet…

By Tsvetana Paraskova - Oct 16, 2020, 10:00 AM CDT

Oil prices slid early on Friday and were on track for a flat weekly performance, as new coronavirus cases in Europe and the United States continued to spike, alarming the market that the oil demand recovery will be derailed.

As of 10:25 a.m. EDT on Friday, WTI Crude prices were trading down 1.10 percent on the day, at $40.49. Brent Crude was down 1.14 percent at $42.66. A stronger U.S. dollar, which makes buying oil more expensive for holders of other currencies, also weighed on oil prices on Friday.

This week, ...

https://oilprice.com/Energy/Energy-General/Oil-Prices-Fall-A…

.........................................................................................................................................................

... 💣 ... spielen wir blinde 🐄 ... oder verstecken ... Hauptsache es gibt Kohle ...💵💴💶💷 .... ähhh, einen höheren Ölpreis ... 📈 ... MIC ...

ISIS Calls On Followers To Attack Westerners & Oil Pipelines Inside Saudi Arabia

by Tyler Durden

Mon, 10/19/2020 - 19:20

Though the so-called Islamic State Caliphate was at its height in 2014 and 2015, the terror group has been driven underground since it lost 95% of its territory in Iraq and Syria by December 2017. And in October 2019 the US military said it killed ISIS leader Abu Bakr al-Baghdadi on the outskirts of Idlib province in Syria.

Effectively defeated, it's believed that ISIS has since organized itself into a network of terror cells in Iraq and Syria. This has been used as a prime justification for the Pentagon keeping some 500 to possibly 2,000 American troops in Syria, alongside Trump's 'secure the oil' campaign in Deir Ezzor.

But now Reuters reports ISIS has issued a rare new message urging supporters to attack westerners and oil pipelines inside Saudi Arabia. ...

https://www.zerohedge.com/geopolitical/isis-calls-followers-…

https://oilprice.com/Energy/Energy-General/ISIS-Calls-For-At…

.........................................................................................................................................................

Iran To Import North Korean missiles In 25-Year Military Deal With China

By Simon Watkins - Oct 19, 2020, 5:00 PM CDT

Following the end on the 18th of October of the 13-year United Nations’ embargo on Iran buying or selling weapons, the roll-out of the military component of the 25-year deal between China and Iran will begin in November, as exclusively revealed by Oil Price.com. After a series of meetings in China on the 9th and 10th of October between Iran’s Foreign Minister, Mohammad Zarif, and his China counterpart, Wang Yi, this military component may now also feature the deployment in Iran of North Korean weaponry and technology, in exchange for oil, according to sources very close to the Iranian government spoken to by OilPrice.com last week. Most notably this would include Hwasong-12 mobile ballistic missiles, with a range of 4,500 kilometres, and the development of liquid propellant rocket engines suitable for intercontinental ballistic missiles (ICBMs) or satellite launch vehicles (SLVs). This will all be part of a broader triangular relationship co-ordinated by Beijing and further facilitated by the imminent launch of a new digitised currency system by China.

This sort of co-ordination – ...

https://oilprice.com/Energy/Energy-General/Iran-To-Import-No…

.........................................................................................................................................................

OPEC+ Is On The Brink Of A Crisis

By Cyril Widdershoven - Oct 19, 2020, 7:00 PM CDT

The OPEC+ member countries are on the brink of a financial crisis if the latest assessments of the International Monetary Fund (IMF) are accurate. The IMF has presented a very bleak outlook for an economic recovery in the Middle East and Central Asia, predicting a 4.1% contraction for the region. The main driving factor behind this bearish outlook is the IMF’s forecast that oil prices will remain in the $40 to $50 range in 2021. An extension of the current low oil price environment for another year would badly hurt oil and gas exporting countries, which includes all of the OPEC+ members. In its statement, the IMF predicted an economic contraction of 2.8% in April for the Middle East and Central Asia. IMF director Jihad Azour highlighted a large disparity in the projected economic loss of oil-importing and exporting countries, forecasting a negative 6.6% growth for oil-exporting countries, compared to a contraction of 1.3% for oil-importing countries. With many of the OPEC+ members being rentier-states, the need for higher oil prices cannot be overstated. A vast part of the government budgets of OPEC member states depends on oil and gas-related revenues. As such, all OPEC countries are looking at significant budget deficits this year, especially Saudi Arabia, the UAE, Bahrain, Iraq, Iran, and Kuwait. Former OPEC member Qatar is in a similar situation, even as it tries to mitigate the damage by increasing its LNG exports. As both oil and gas demand has seen significant demand destruction this year, prices for both have plunged. At present, Brent oil prices are still 40% below their pre-COVID levels. There is little hope of a significant rise in prices any time soon as global oil and gas storage volumes are still at historically high levels, and demand looks set to dip again due to new COVID-related lockdowns and a further economic recession. The frequently cited breakeven price for the Saudi government budget is $80 per barrel, although Saudi government budget discussions seem to revolve around an oil price of $50. Iraq has also stated that it expects price levels of $50 per barrel for 2021. These optimistic predictions seem to be based solely on Chinese post-Covid economic figures, ...

https://oilprice.com/Energy/Energy-General/OPEC-Is-On-The-Br…

... IMF - MAFIA ...

IMF Sees Oil Prices At $40-50 Next Year

By Tsvetana Paraskova - Oct 19, 2020, 11:00 AM CDT

Oil prices are not expected to rise much next year, and will stay in the $40-50 a barrel range, putting additional pressure on the oil exporters in the Middle East, the International Monetary Fund (IMF) said on Monday in its update on the Regional Economic Outlook for the Middle East and Central Asia.

Gross domestic product in the region is set to drop by 4.1 percent this year, a downward revision of 1.3 percentage points compared with IMF’s forecast in April 2020. The economies in the oil exporters in the Middle East and North Africa are expected to suffer more and shrink by 6.6 percent this year, according to the IMF. ...

https://oilprice.com/Energy/Crude-Oil/IMF-Sees-Oil-Prices-At…

.........................................................................................................................................................

OPEC Meeting Ends Without Firm Decision On Output Cuts ... ☎ ... 📞... Calls ... 💣 ...

By Julianne Geiger - Oct 19, 2020, 5:00 PM CDT

OPEC said on Monday that it would not shirk its responsibilities to the market as fears about the next Covid-19 wave push down prices.

Oil prices sank on Monday over disappointing economic data out of China, fears of this resurgence of coronavirus cases, additional lockdown measures in Europe, and the looming threat that OPEC could turn on the taps in January as originally planned.

But sources inside member countries, according to Reuters, said that this planned output increase could be reversed should the need arise.

To assuage the fears present in the market, ...

https://oilprice.com/Latest-Energy-News/World-News/OPEC-Meet…

Antwort auf Beitrag Nr.: 65.134.609 von teecee1 am 20.09.20 13:16:25 ... 🦅🦅🦅 ...

- Big Pharma Kartell ... COVID 19

- Big Oil Kartell ... 💵 ...

- Big Bank Bang Kartell ... 💰 ...

„Aufregung gerechtfertigt“

Bank of America befeuert Kursfantasien der Wasserstoff-Aktien-Fans

Autor: wallstreet:online Zentralredaktion | 01.10.2020, 13:33 |

Die Bank of America (BofA) hat der grünen Wasserstoff-Branche in einer Studie glänzende Aussichten bescheinigt. Bis 2050 könnten weltweit jährlich vier Billionen US-Dollar durch die grüne Wasserstoff-Industrie und verwandte Wirtschaftszweige umgesetzt werden. Möglich werde dies durch staatlich verordneten Klimaschutz, sinkende Preise bei erneuerbaren Energien sowie technische Errungenschaften bei Brennstoffzellen und Elektrolyseuren.

Haim Israel, Head of Thematic Investing Strategy bei BofA Global Research und Leiter der Studie, glaubt, ...

- Vollständiger Artikel unter: https://www.wallstreet-online.de/nachricht/12987160-aufregun…

.....................................................................................................................................................

https://operationdisclosure1.blogspot.com/2020/10/benjamin-f…

Eine weitere ist, dass die lang erwartete Wasserstoff-Revolution anscheinend endlich beginnt. Wasserstoffbetriebene Autos sind eine viel bessere Technologie als benzinbetriebene, denn das einzige Abgas, das sie ausstoßen, ist Wasserdampf. Ebenso können sie, anders als elektrische Autos, schnell betankt werden und haben eine weit größere Reichweite mit einer Tankfüllung. ...

---

Saudi Arabia Sends Blue Ammonia to Japan in World-First Shipment

Verity Ratcliffe

Sun, September 27, 2020, 1:11 PM GMT+2

(Bloomberg) -- The world’s first shipment of blue ammonia is on its way from Saudi Arabia to Japan, where it will be used in power stations to produce electricity without carbon emissions.

Saudi Aramco, which made the announcement Sunday, ...

https://finance.yahoo.com/news/saudi-arabia-sends-blue-ammon…

..........................................................................

Aramco, Sabic hit blue ammonia milestone for zero carbon project in Japan

September 30/2020

MOSCOW (MRC) -- Saudi Aramco has completed its purchase of a 70 per cent stake in petrochemicals company Saudi Basic Industries for USD69.1 billion and extended the payment period by three years to 2028, providing a cushion against weak oil prices, said Chemweek.

The deal values Saudi Basic Industries Corp (SABIC) at 123.39 riyals (USD32.90) per share, 27.5 per cent above the company's share price of 89.40 riyals, as the coronavirus outbreak has hurt demand for petrochemicals products and dented SABIC's shares.

"It is a significant leap forward, which accelerates Aramco's downstream strategy and transforms our company into one of the major global petrochemicals players," Aramco CEO Amin Nasser said in a statement. SABIC is the world's fourth-biggest petrochemicals company.

Aramco and the Saudi state Public Investment Fund (PIF) amended the payment structure for deal, Aramco said in a bourse filing on Wednesday. Following a seller loan provided by the PIF, Aramco will pay instalments and loan charges until 2028, extending a previous 2025 deadline.

The first USD7 billion payment is due on or before Aug. 2, 2020, with the last instalment, a loan charge of USD1 billion, on or before April 7, 2028. The transaction was funded through promissory notes issued to the PIF at the deal's close on Tuesday, Aramco said. ...

http://www.mrcplast.com/news-news_open-377042.html

.....................................................................................................................................................

Blue Ammonia: Another Major Breakthrough For Hydrogen Power

By Haley Zaremba - Oct 01, 2020, 3:00 PM CDT

Hydrogen burns completely cleanly, leaving behind nothing but water vapor, making it extremely attractive as an emissions-free fossil fuel alternative. While hydrogen receives a lot of lip service as a potential clean energy fuel solution for the global energy transition, the true picture is a bit more complicated. ...

Hydrogen is only as clean as the fuel that was used to create it. In reality, there is not just hydrogen, but green hydrogen, blue hydrogen, and gray hydrogen, the distinguishing feature of each being the kind of energy production that was used to produce it. By another categorization, one could say that there is green hydrogen, and then there is greenwashed hydrogen. Green hydrogen is the cleanest form of hydrogen, and therefore the most promising for a more climate-friendly energy future. It’s made through the exclusive use of renewable and emissions-free energies. Gray hydrogen, the most common form of hydrogen currently used in industrial applications, is made with fossil fuels, ...

https://oilprice.com/Energy/Energy-General/Blue-Ammonia-Anot…

.....................................................................................................................................................

Trump’s Offshore Oil Ban Will Hit Wind Farms Hard

By Alex Kimani - Oct 01, 2020, 6:00 PM CDT

Last month, President Trump shocked the entire oil industry after extending the existing moratorium on oil drilling along Florida’s, Georgia’s and South Carolina’s coasts. The announcement marked a complete 180 from White House’s previous stance that sought to open up those areas to oil drilling and caught many industry officials, congressional aides, and lobbyists, who have been working on the same issue, completely off-guard. It also went contrary to the sentiment of voters in those regions--including the majority of Democrats-- who say they are ‘‘more likely to vote for a candidate who supports access to oil and gas produced in the U.S.’’

Under normal circumstances, Trump’s stance would have been a big win by the clean energy camp and environmentalists who have been opposed to drilling activity in threatened areas. Unfortunately, it turns out that the renewables energy sector will be just as severely impacted by the moratorium.

Trump’s decision to rule out energy development along the East Coast will bar not only offshore oil and gas drilling but coastal wind farm development in equal measure.

The Interior Department agency has confirmed the broad reach of Trump’s latest orders and is likely to significantly impact U.S. wind development, a sector that has lately been recording the fastest growth amidst the Covid-19 pandemic. ...

https://oilprice.com/Energy/Energy-General/Trumps-Offshore-O…

... 💣 ... wann kommt die TESLA ... 💣 ... https://www.anl.gov/article/argonne-and-tae-technologies-he… ...

- Big Pharma Kartell ... COVID 19

- Big Oil Kartell ... 💵 ...

- Big Bank Bang Kartell ... 💰 ...

„Aufregung gerechtfertigt“

Bank of America befeuert Kursfantasien der Wasserstoff-Aktien-Fans

Autor: wallstreet:online Zentralredaktion | 01.10.2020, 13:33 |

Die Bank of America (BofA) hat der grünen Wasserstoff-Branche in einer Studie glänzende Aussichten bescheinigt. Bis 2050 könnten weltweit jährlich vier Billionen US-Dollar durch die grüne Wasserstoff-Industrie und verwandte Wirtschaftszweige umgesetzt werden. Möglich werde dies durch staatlich verordneten Klimaschutz, sinkende Preise bei erneuerbaren Energien sowie technische Errungenschaften bei Brennstoffzellen und Elektrolyseuren.

Haim Israel, Head of Thematic Investing Strategy bei BofA Global Research und Leiter der Studie, glaubt, ...

- Vollständiger Artikel unter: https://www.wallstreet-online.de/nachricht/12987160-aufregun…

.....................................................................................................................................................

https://operationdisclosure1.blogspot.com/2020/10/benjamin-f…

Eine weitere ist, dass die lang erwartete Wasserstoff-Revolution anscheinend endlich beginnt. Wasserstoffbetriebene Autos sind eine viel bessere Technologie als benzinbetriebene, denn das einzige Abgas, das sie ausstoßen, ist Wasserdampf. Ebenso können sie, anders als elektrische Autos, schnell betankt werden und haben eine weit größere Reichweite mit einer Tankfüllung. ...

---

Saudi Arabia Sends Blue Ammonia to Japan in World-First Shipment

Verity Ratcliffe

Sun, September 27, 2020, 1:11 PM GMT+2

(Bloomberg) -- The world’s first shipment of blue ammonia is on its way from Saudi Arabia to Japan, where it will be used in power stations to produce electricity without carbon emissions.

Saudi Aramco, which made the announcement Sunday, ...

https://finance.yahoo.com/news/saudi-arabia-sends-blue-ammon…

..........................................................................

Aramco, Sabic hit blue ammonia milestone for zero carbon project in Japan

September 30/2020

MOSCOW (MRC) -- Saudi Aramco has completed its purchase of a 70 per cent stake in petrochemicals company Saudi Basic Industries for USD69.1 billion and extended the payment period by three years to 2028, providing a cushion against weak oil prices, said Chemweek.

The deal values Saudi Basic Industries Corp (SABIC) at 123.39 riyals (USD32.90) per share, 27.5 per cent above the company's share price of 89.40 riyals, as the coronavirus outbreak has hurt demand for petrochemicals products and dented SABIC's shares.

"It is a significant leap forward, which accelerates Aramco's downstream strategy and transforms our company into one of the major global petrochemicals players," Aramco CEO Amin Nasser said in a statement. SABIC is the world's fourth-biggest petrochemicals company.

Aramco and the Saudi state Public Investment Fund (PIF) amended the payment structure for deal, Aramco said in a bourse filing on Wednesday. Following a seller loan provided by the PIF, Aramco will pay instalments and loan charges until 2028, extending a previous 2025 deadline.

The first USD7 billion payment is due on or before Aug. 2, 2020, with the last instalment, a loan charge of USD1 billion, on or before April 7, 2028. The transaction was funded through promissory notes issued to the PIF at the deal's close on Tuesday, Aramco said. ...

http://www.mrcplast.com/news-news_open-377042.html

.....................................................................................................................................................

Blue Ammonia: Another Major Breakthrough For Hydrogen Power

By Haley Zaremba - Oct 01, 2020, 3:00 PM CDT

Hydrogen burns completely cleanly, leaving behind nothing but water vapor, making it extremely attractive as an emissions-free fossil fuel alternative. While hydrogen receives a lot of lip service as a potential clean energy fuel solution for the global energy transition, the true picture is a bit more complicated. ...

Hydrogen is only as clean as the fuel that was used to create it. In reality, there is not just hydrogen, but green hydrogen, blue hydrogen, and gray hydrogen, the distinguishing feature of each being the kind of energy production that was used to produce it. By another categorization, one could say that there is green hydrogen, and then there is greenwashed hydrogen. Green hydrogen is the cleanest form of hydrogen, and therefore the most promising for a more climate-friendly energy future. It’s made through the exclusive use of renewable and emissions-free energies. Gray hydrogen, the most common form of hydrogen currently used in industrial applications, is made with fossil fuels, ...

https://oilprice.com/Energy/Energy-General/Blue-Ammonia-Anot…

.....................................................................................................................................................

Trump’s Offshore Oil Ban Will Hit Wind Farms Hard

By Alex Kimani - Oct 01, 2020, 6:00 PM CDT

Last month, President Trump shocked the entire oil industry after extending the existing moratorium on oil drilling along Florida’s, Georgia’s and South Carolina’s coasts. The announcement marked a complete 180 from White House’s previous stance that sought to open up those areas to oil drilling and caught many industry officials, congressional aides, and lobbyists, who have been working on the same issue, completely off-guard. It also went contrary to the sentiment of voters in those regions--including the majority of Democrats-- who say they are ‘‘more likely to vote for a candidate who supports access to oil and gas produced in the U.S.’’

Under normal circumstances, Trump’s stance would have been a big win by the clean energy camp and environmentalists who have been opposed to drilling activity in threatened areas. Unfortunately, it turns out that the renewables energy sector will be just as severely impacted by the moratorium.

Trump’s decision to rule out energy development along the East Coast will bar not only offshore oil and gas drilling but coastal wind farm development in equal measure.

The Interior Department agency has confirmed the broad reach of Trump’s latest orders and is likely to significantly impact U.S. wind development, a sector that has lately been recording the fastest growth amidst the Covid-19 pandemic. ...

https://oilprice.com/Energy/Energy-General/Trumps-Offshore-O…

... 💣 ... wann kommt die TESLA ... 💣 ... https://www.anl.gov/article/argonne-and-tae-technologies-he… ...

...  ... solange die Wall-Street existiert gibt es ... ??? ... und es wird immer so bleiben ...

... solange die Wall-Street existiert gibt es ... ??? ... und es wird immer so bleiben ...

Saudi Prince Abdulaziz Warns Oil Short Sellers: "We Will Never Leave This Market Unattended"

by Tyler Durden

Fri, 09/18/2020 - 09:15

As the price of oil begins to falter, Saudi Arabia has stepped up its rhetoric, even going as far as to warn short sellers not to bet against the price of the commodity.

Saudi Energy Minister Prince Abdulaziz bin Salman gave "clear hints" on Thursday that there could be a change of direction in production policy forthcoming as the price of oil continues its slide, according to Bloomberg.

He said Thursday: “We will never leave this market unattended. I want the guys in the trading floors to be as jumpy as possible. I’m going to make sure whoever gambles on this market will be ouching like hell.” ...

https://www.zerohedge.com/energy/saudi-prince-abdulaziz-warn…

....................................................................................................................................................

18.09.2020 07:25:34

Saudi-Arabien mahnt Förderdisziplin bei OPEC+-Treffen an

Saudi-Arabien dringt auf die Einhaltung des vom Ölkartell OPEC und seinen Partnern (OPEC+) beschlossenen Förderlimits.

Bei einem Online-Treffen warnte der saudische Energieminister Abdulasis bin Salman am Donnerstag davor, mehr Öl als erlaubt zu fördern. "Versuche, den Markt zu überlisten, werden nicht erfolgreich sein", sagte er zu den anderen zugeschalteten Ministern. Gerade angesichts der Folgen der Corona-Krise auf den Ölmarkt sei Disziplin geboten. Länder, die gegenüber den OPEC+ falsche Versprechungen über ihre Ölförderung machten, würden das Ziel der Allianz, den Markt zu stabilisieren und zu steuern, verfehlen.

Die Vereinigten Arabischen Emirate sicherten zu, die Über-Produktion vom August mit niedrigeren Fördermengen im Oktober und November ...

https://www.finanzen.ch/nachrichten/rohstoffe/saudi-arabien-…

....................................................................................................................................................

China’s Crude Oil Imports Are Slowing Down

By Charles Kennedy - Sep 18, 2020, 5:00 PM CDT

China’s imports of crude oil have been trending much lower in September than in the past four months, while the rest of Asia is also significantly slowing imports this month with demand still under pressure, IHS Markit said on Friday.

Crude oil discharged at Chinese ports in the last two weeks were below 8 million barrels per day (bpd), at levels similar to what China imported in March and April, Fotios Katsoulas, Liquid Bulk Principal Analyst, Maritime & Trade, at IHS Markit, said in an analysis.

So far in the third quarter, China’s crude oil imports have stayed strong, with high congestion at many major crude ports.

“But activity so far in September suggests that the world’s biggest ...

https://oilprice.com/Energy/Crude-Oil/Chinas-Crude-Oil-Impor…

... solange die Wall-Street existiert gibt es ... ??? ... und es wird immer so bleiben ...

... solange die Wall-Street existiert gibt es ... ??? ... und es wird immer so bleiben ...Saudi Prince Abdulaziz Warns Oil Short Sellers: "We Will Never Leave This Market Unattended"

by Tyler Durden

Fri, 09/18/2020 - 09:15

As the price of oil begins to falter, Saudi Arabia has stepped up its rhetoric, even going as far as to warn short sellers not to bet against the price of the commodity.

Saudi Energy Minister Prince Abdulaziz bin Salman gave "clear hints" on Thursday that there could be a change of direction in production policy forthcoming as the price of oil continues its slide, according to Bloomberg.

He said Thursday: “We will never leave this market unattended. I want the guys in the trading floors to be as jumpy as possible. I’m going to make sure whoever gambles on this market will be ouching like hell.” ...

https://www.zerohedge.com/energy/saudi-prince-abdulaziz-warn…

....................................................................................................................................................

18.09.2020 07:25:34

Saudi-Arabien mahnt Förderdisziplin bei OPEC+-Treffen an

Saudi-Arabien dringt auf die Einhaltung des vom Ölkartell OPEC und seinen Partnern (OPEC+) beschlossenen Förderlimits.

Bei einem Online-Treffen warnte der saudische Energieminister Abdulasis bin Salman am Donnerstag davor, mehr Öl als erlaubt zu fördern. "Versuche, den Markt zu überlisten, werden nicht erfolgreich sein", sagte er zu den anderen zugeschalteten Ministern. Gerade angesichts der Folgen der Corona-Krise auf den Ölmarkt sei Disziplin geboten. Länder, die gegenüber den OPEC+ falsche Versprechungen über ihre Ölförderung machten, würden das Ziel der Allianz, den Markt zu stabilisieren und zu steuern, verfehlen.

Die Vereinigten Arabischen Emirate sicherten zu, die Über-Produktion vom August mit niedrigeren Fördermengen im Oktober und November ...

https://www.finanzen.ch/nachrichten/rohstoffe/saudi-arabien-…

....................................................................................................................................................

China’s Crude Oil Imports Are Slowing Down

By Charles Kennedy - Sep 18, 2020, 5:00 PM CDT

China’s imports of crude oil have been trending much lower in September than in the past four months, while the rest of Asia is also significantly slowing imports this month with demand still under pressure, IHS Markit said on Friday.

Crude oil discharged at Chinese ports in the last two weeks were below 8 million barrels per day (bpd), at levels similar to what China imported in March and April, Fotios Katsoulas, Liquid Bulk Principal Analyst, Maritime & Trade, at IHS Markit, said in an analysis.

So far in the third quarter, China’s crude oil imports have stayed strong, with high congestion at many major crude ports.

“But activity so far in September suggests that the world’s biggest ...

https://oilprice.com/Energy/Crude-Oil/Chinas-Crude-Oil-Impor…

Antwort auf Beitrag Nr.: 65.021.748 von teecee1 am 08.09.20 17:14:54 Saudi Aramco is now suffering the consequences of failed oil price war

12 Sep, 2020 14:01 / Updated 3 hours ago

It was evident to anyone with even half a brain that the last Saudi-instigated oil price war would end in abject failure for the Saudis, just as the previous 2014-2016 effort did and for the very same reasons.

For Crown Prince Mohammed bin Salman (MbS), one of the masterminds behind the oil war – the economic and political problems that his country now face appear to come a very distant second to preserving whatever he thinks is left of his own reputation, with the most obvious public manifestation of this being the aftermath of the internationally-shunned omni-shambolic initial public offering (IPO) for hydrocarbons giant, Saudi Aramco (Aramco). Consequently, in order to stand by one of the inducements required to inveigle anyone to buy the shares – in the triple-locked guaranteed dividend payout – swingeing cuts to key projects for Saudi Arabia are now being announced. ...

https://www.rt.com/business/500469-saudi-suffering-oil-price…

.....................................................................................

Ölpreis-Krieg und Pandemie: Saudi Aramco hat sich völlig verkalkuliert

12.09.2020 12:08

Der saudische Öl-Riese Saudi Aramco hatte einen Ölpreis-Krieg gegen Russland angezettelt, den er verloren hat. Die Pandemie hat die Ölpreise drastisch zurückgehen lassen. Doch der Konzern muss dieses Jahr Dividenden in Milliardenhöhe ausschütten. Das wird aber nicht möglich sein.

• Wie hoch die Dividenden-Verpflichtungen von Saudi Aramco ist

• Wie die Saudis den Ölpreis-Krieg gegen Russland verloren haben

• Wie sich der Netto-Gewinn von Saudi Aramco entwickelt hat

https://deutsche-wirtschafts-nachrichten.de/506289/OElpreis-…

.........................................................................................................................................................

Russian Energy Minister Arrested On Embezzlement Allegations

By Editorial Dept - Sep 11, 2020, 12:00 PM CDT

Politics, Geopolitics & Conflict

Jordan is expecting to resume oil imports from Iraq this month to the tune of 10,000 bpd, after it had to suspend imports completely in August due to the pandemic. Jordan gets as much as 7% of its oil imports from Iraq, through a deal they forged last February. The current import deal is set to expire in November.

As another part of the saga that never ends, Nigeria is asking a Milan court for an immediate advanced payment from Eni and Shell - a payment that would exceed $1 billion - in the corruption trial over the infamous OPL 245 oilfield. Nigeria, the largest oil producer in Africa, gets 86% of all export revenue from its oil and gas industry, yet the country is riddled with energy insecurity and corruption. Nigeria’s budget office warned that the country could fall into a recession in the third quarter on the back of low oil prices and the pandemic. ...

https://oilprice.com/Energy/Energy-General/Russian-Energy-Mi…

.........................................................................................................................................................

Trump Announces ‘Historic Peace Deal’ Between Bahrain And Israel

By Tom Kool - Sep 11, 2020, 4:08 PM CDT

In a three-way phone call on Friday with Israeli Prime Minister Benjamin Netanyahu and King Hamad bin Isa Al Khalifa of Bahrain, U.S. President Trump announced that Bahrain became the next Arab Gulf State to join the historic peace deal that Israel closed with the UAE on August 13th.

Addressing reporters on Thursday, U.S. President Donald Trump already hinted at the participation of another nation in the peace deal. While some analysts expected Saudi Arabia to be the next Arab nation to normalize relations with Jerusalem, there were already some signals that Bahrain would be the next nation to establish relations after the country opened its airspace to Israeli flights.

Shortly after the phone call, U.S. President Trump announced the ‘’Historic Breakthrough’’, saying that it is ‘’the second Arab country to make peace with Israel in 30 days!’’

Trump also tweeted the joint statement in which the two nations agree to work together to increase stability, security and prosperity in the region.

Joint Statement of the United States, the Kingdom of Bahrain, and the State of Israel ...

https://oilprice.com/Latest-Energy-News/World-News/Trump-Ann…

... ... "Bibi ... so ein Mist, keine Kriege mehr ... was machen wir jetzt mit dem ganzen Öl ... ??? ... "

... "Bibi ... so ein Mist, keine Kriege mehr ... was machen wir jetzt mit dem ganzen Öl ... ??? ... "

.........................................................................................................................................................

DoD Confirms $10-$20 Billion COVID Bailout For Contractors After Trump Blasted Military-Industrial Complex

by Tyler Durden

Fri, 09/11/2020 - 09:45

This is surely the last thing the American people want to hear, but it does confirm President Trump's recent statements saying that top Pentagon brass essentially seeks out constant wars to keep defense contractors "happy": the Department of Defense plans to cut major military contractors a $10 billion to $20 billion COVID bailout check.

Defense One reports: "With lawmakers and the White House unable to come to an agreement on a new coronavirus stimulus package, it’s unlikely that money requested to reimburse defense contractors for pandemic-related expenses will reach these companies until at least the second quarter of 2021, according to the Pentagon’s top weapons buyer."

Defense undersecretary for acquisition and sustainment, Ellen Lord, in recent statements has indicated the private defense firm stimulus would cover the period from March 15 to Sept. 15 and is estimated at “between $10 and $20 billion.” ...

https://www.zerohedge.com/political/after-trump-lambasted-en…

12 Sep, 2020 14:01 / Updated 3 hours ago