Exklusivinterview mit Omar Abu Rashed : Union Investment-Aktienexperte: Ölpreis und König könnten Sa (Seite 4) | Diskussion im Forum

eröffnet am 04.12.19 19:37:28 von

neuester Beitrag 27.03.23 12:40:58 von

neuester Beitrag 27.03.23 12:40:58 von

Beiträge: 59

ID: 1.316.459

ID: 1.316.459

Aufrufe heute: 2

Gesamt: 5.118

Gesamt: 5.118

Aktive User: 0

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 63.391.298 von teecee1 am 20.04.20 21:00:47CFTC Warns Traders Oil Prices Can Turn Negative Again

by Tyler Durden

Wed, 05/13/2020 - 13:30

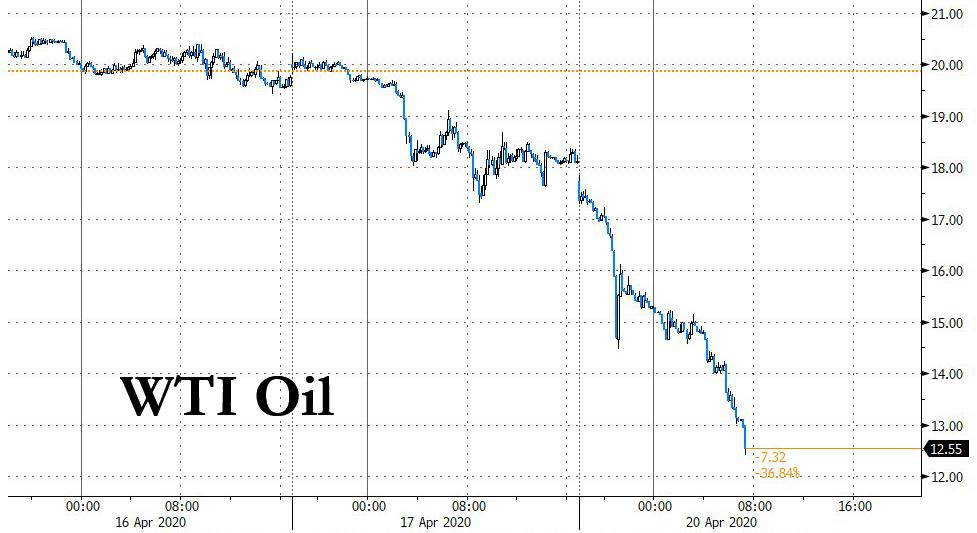

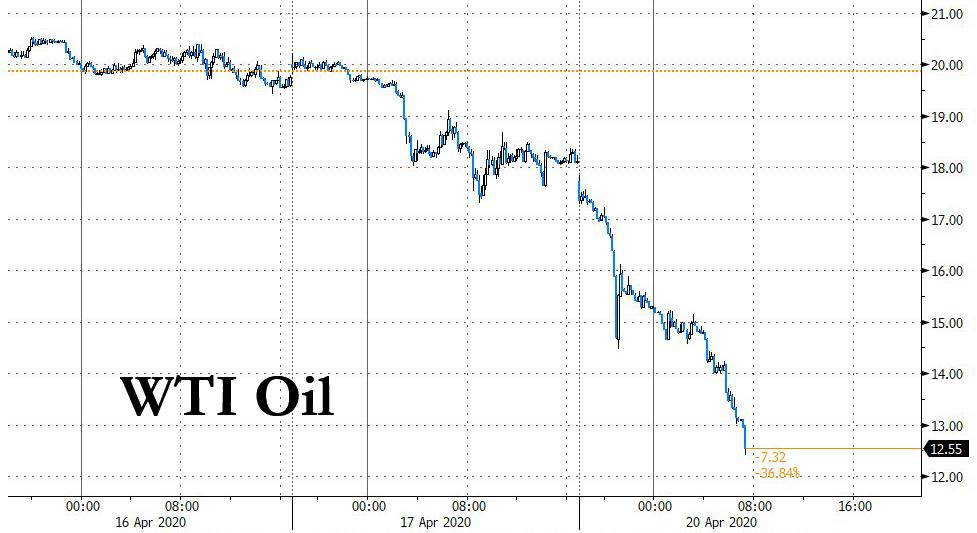

With just one week left until the expiration of the June WTI contract, whose open interest is still a whopping 270K contracts equivalent to 270 million barrels that may soon require a physical delivery spot...

... and some traders getting flashbacks to the catastrophic oil price crash on April 20, today the CFTC poured gasoline on the smouldering fire when it warned that oil futures contracts could again trade with negative prices during the coronavirus pandemic.

As Bloomberg and Dnyuz reports, the Commodity Futures Trading Commission will advise exchanges to monitor their markets and remind them to "maintain rules to provide for the exercise of emergency authority”, including the power to “suspend or curtail trading in any contract” if markets become disorderly, according to an advisory notice to be released on Wednesday.

“We are issuing this advisory in the wake of unusually high volatility and negative pricing experienced in the May 2020 West Texas Intermediate (WTI), Light Sweet Crude Oil Futures contract on April 20,” says the eight-page advisory signed by the CFTC’s heads of market oversight, ...

https://www.zerohedge.com/markets/cftc-warns-traders-oil-pri…

....................................................................................................................................................

SocGen Reportedly Ends Commodity-Financing Biz After $240 Million Loss In Asian Oil-Trading Giant Bankruptcy

by Tyler Durden

Tue, 05/12/2020 - 13:06

After pointing out the perplexing lack of high-profile blow-ups in the current commodity crush (as a reminder back in 2016 when oil dropped less than it has now, the Glencores and Trafiguras of the world were this close to collapse), we reported less than a month ago that one of Singapore's biggest and most iconic - and extremely secretive - oil traders, Hin Leong Trading, whose website reports revenue surpassed $14 billion all the way back in 2012, filed for bankruptcy protection after, according to a Bloomberg report, the son of the "legendary" founder of Hin Leong said the Singapore oil trader hid about $800 million in losses racked up in futures trading.

At the time we warned that potentially means huge losses for the banks which provided the merchant with billions in loans as the collateral they thought they have as a guarantee isn’t there. Altogether, Hin Leong is said to owe almost $4 billion to more than 20 banks including HSBC (which said it booked a substantial loan loss provisions from an exposure to oil traders), who will now scramble to figure out just how massive their loan losses are. ...

https://www.zerohedge.com/commodities/socgen-reportedly-ends…

by Tyler Durden

Wed, 05/13/2020 - 13:30

With just one week left until the expiration of the June WTI contract, whose open interest is still a whopping 270K contracts equivalent to 270 million barrels that may soon require a physical delivery spot...

... and some traders getting flashbacks to the catastrophic oil price crash on April 20, today the CFTC poured gasoline on the smouldering fire when it warned that oil futures contracts could again trade with negative prices during the coronavirus pandemic.

As Bloomberg and Dnyuz reports, the Commodity Futures Trading Commission will advise exchanges to monitor their markets and remind them to "maintain rules to provide for the exercise of emergency authority”, including the power to “suspend or curtail trading in any contract” if markets become disorderly, according to an advisory notice to be released on Wednesday.

“We are issuing this advisory in the wake of unusually high volatility and negative pricing experienced in the May 2020 West Texas Intermediate (WTI), Light Sweet Crude Oil Futures contract on April 20,” says the eight-page advisory signed by the CFTC’s heads of market oversight, ...

https://www.zerohedge.com/markets/cftc-warns-traders-oil-pri…

....................................................................................................................................................

SocGen Reportedly Ends Commodity-Financing Biz After $240 Million Loss In Asian Oil-Trading Giant Bankruptcy

by Tyler Durden

Tue, 05/12/2020 - 13:06

After pointing out the perplexing lack of high-profile blow-ups in the current commodity crush (as a reminder back in 2016 when oil dropped less than it has now, the Glencores and Trafiguras of the world were this close to collapse), we reported less than a month ago that one of Singapore's biggest and most iconic - and extremely secretive - oil traders, Hin Leong Trading, whose website reports revenue surpassed $14 billion all the way back in 2012, filed for bankruptcy protection after, according to a Bloomberg report, the son of the "legendary" founder of Hin Leong said the Singapore oil trader hid about $800 million in losses racked up in futures trading.

At the time we warned that potentially means huge losses for the banks which provided the merchant with billions in loans as the collateral they thought they have as a guarantee isn’t there. Altogether, Hin Leong is said to owe almost $4 billion to more than 20 banks including HSBC (which said it booked a substantial loan loss provisions from an exposure to oil traders), who will now scramble to figure out just how massive their loan losses are. ...

https://www.zerohedge.com/commodities/socgen-reportedly-ends…

Antwort auf Beitrag Nr.: 63.392.921 von teecee1 am 20.04.20 23:07:45Aramco Plans $75 Billion Dividend as Profit Drops 25%

Matthew Martin and Anthony Di Paola, Bloomberg • May 12, 2020

(Bloomberg) -- Saudi Arabia’s state-controlled oil giant retained its massive dividend despite a 25% plunge in profit, and signaled it would keep spending in check as it braces for deeper damage from the oil crisis.

Saudi Aramco, the world’s most valuable company, will pay a dividend of $18.75 billion for the first three months of 2020. That would leave it on track to meet its full-year goal of $75 billion, though the company didn’t specify if it was still committed to that number.

The dividend is crucial for the kingdom, which holds about 98% of Aramco and is facing its worst financial turmoil in decades. On Monday, ...

https://finance.yahoo.com/news/saudi-aramco-profit-drops-25-…

...................................................................

... ... Wie soll man es den Leuten erklären ... das wir den Gürtel enger schnallen müssen ... in jedem Land ... 209 Staaten ...

... Wie soll man es den Leuten erklären ... das wir den Gürtel enger schnallen müssen ... in jedem Land ... 209 Staaten ...

Saudi Arabia Running Out Of Money: Riyadh To Slash Spending By $27 Billion, Suspend Cost Of Living Allowance

by Tyler Durden

Sun, 05/10/2020 - 23:36

Last weekend we quoted Finance Minister Mohammed Al-Jadaan, who warned that the world's biggest oil exporter hasn’t witnessed "a crisis of this severity" in decades, adding that government spending will have to be cut "very deeply", something we touched on previously.

We didn't have long to wait, because early on Monday, the Saudi government - which appears to be running out of money fast - ordered government spending cuts including suspending the cost of living allowance amid broad austerity measures for about $26.6 billion and a tripling of the value-added tax as part of measures aimed to shore up state finances, which have been battered by low oil prices and the coronavirus.

"Cost of living allowance will be suspended as of June first, and the value added tax will be increased to 15% from 5% as of July first," said the Saudi finance minister according to the state news agency, suggesting Saudi Arabia is on the verge of a full-blown fiscal crisis.

Other measures includes canceling or delaying some operational and capital expenditures for a number of government agencies and reducing the credits planned for a number of state initiatives, including ...

https://www.zerohedge.com/markets/saudi-arabia-running-out-m…

...................................................................

Kaum Nachfrage nach Öl: Saudi-Arabien verkündet weitere Einschnitte bei Öl-Fördermenge

Epoch Times11. Mai 2020 Aktualisiert: 11. Mai 2020 17:57

Das Geschäft mit Öl gerät wegen der zusammengebrochenen Weltwirtschaft immer weiter unter Druck. Die bisher vereinbarten Reduzierungen der Fördermengen reichen immer noch nicht aus um den Preis auf einem stabilen Niveau zu halten.

Saudi-Arabien will zur Stützung des weltweiten Ölpreises die tägliche Fördermenge nochmals deutlich senken. Die Regierung habe den saudiarabischen Ölriesen Aramco aufgefordert, pro Tag eine Million Barrel Erdöl weniger als bislang zu fördern, erklärte das Ölministerium des Landes am Montag nach Angaben der amtlichen Nachrichtenagentur SPA. So sollen demnach künftig nur noch 7,5 Millionen Barrel täglich produziert werden. Ein Barrel entspricht 159 Litern.

Auch Saudi-Arabiens Nachbarstaat Kuwait verkündete eine ...

https://www.epochtimes.de/wirtschaft/unternehmen/kaum-nachfr…

...................................................................

... ... wer den Hals nicht voll genug bekommt ...

... wer den Hals nicht voll genug bekommt ...

Aramco May Delay Payments For $69 Billion Sabic Acquisition

By Irina Slav - May 11, 2020, 11:30 AM CDT

Aramco is considering staggering payments for the 70 percent in chemicals conglomerate Sabic that it said it would acquire last year.

Bloomberg reports that the options the oil major was mulling over involved delaying payments for the majority stake in Sabic as well as reducing the initial installment to the seller, Saudi Arabia’s sovereign wealth fund.

Aramco signed the deal to buy 70 percent in Sabic from the Public Investment Fund of Saudi Arabia in March 2019, for the equivalent of US$69.1 billion in Saudi riyals at the time. The acquisition was part of Aramco’s preparation for going public, which happened, after much anticipation, at the end of last year.

Meanwhile, an exclusive Reuters report said that Aramco was also looking to review the price of the Sabic acquisition. The chemicals major’s market value, according to the report, which cited unnamed sources, had fallen by 40 percent since the start of the latest oil price rout, with the price Aramco paid for the 40-percent stake high above the current trading price of Sabic.

The Reuters report also notes ...

https://oilprice.com/Latest-Energy-News/World-News/Aramco-Ma…

...................................................................

UAE Making Even Bigger Cuts To Oil Production Next Month

By Julianne Geiger - May 11, 2020, 5:30 PM CDT

...

But the move to cut additional barrels by Kuwait, Saudi Arabia, and the UAE was seen not as a positive move, but as an out-of-options move as Middle East producers find themselves without buyers. Today’s announcement of additional cuts could, therefore, spark fear instead of confidence as the market views it as a reflection of the true state of the market.

https://oilprice.com/Latest-Energy-News/World-News/UAE-Makin…

Matthew Martin and Anthony Di Paola, Bloomberg • May 12, 2020

(Bloomberg) -- Saudi Arabia’s state-controlled oil giant retained its massive dividend despite a 25% plunge in profit, and signaled it would keep spending in check as it braces for deeper damage from the oil crisis.

Saudi Aramco, the world’s most valuable company, will pay a dividend of $18.75 billion for the first three months of 2020. That would leave it on track to meet its full-year goal of $75 billion, though the company didn’t specify if it was still committed to that number.

The dividend is crucial for the kingdom, which holds about 98% of Aramco and is facing its worst financial turmoil in decades. On Monday, ...

https://finance.yahoo.com/news/saudi-aramco-profit-drops-25-…

...................................................................

...

... Wie soll man es den Leuten erklären ... das wir den Gürtel enger schnallen müssen ... in jedem Land ... 209 Staaten ...

... Wie soll man es den Leuten erklären ... das wir den Gürtel enger schnallen müssen ... in jedem Land ... 209 Staaten ...Saudi Arabia Running Out Of Money: Riyadh To Slash Spending By $27 Billion, Suspend Cost Of Living Allowance

by Tyler Durden

Sun, 05/10/2020 - 23:36

Last weekend we quoted Finance Minister Mohammed Al-Jadaan, who warned that the world's biggest oil exporter hasn’t witnessed "a crisis of this severity" in decades, adding that government spending will have to be cut "very deeply", something we touched on previously.

We didn't have long to wait, because early on Monday, the Saudi government - which appears to be running out of money fast - ordered government spending cuts including suspending the cost of living allowance amid broad austerity measures for about $26.6 billion and a tripling of the value-added tax as part of measures aimed to shore up state finances, which have been battered by low oil prices and the coronavirus.

"Cost of living allowance will be suspended as of June first, and the value added tax will be increased to 15% from 5% as of July first," said the Saudi finance minister according to the state news agency, suggesting Saudi Arabia is on the verge of a full-blown fiscal crisis.

Other measures includes canceling or delaying some operational and capital expenditures for a number of government agencies and reducing the credits planned for a number of state initiatives, including ...

https://www.zerohedge.com/markets/saudi-arabia-running-out-m…

...................................................................

Kaum Nachfrage nach Öl: Saudi-Arabien verkündet weitere Einschnitte bei Öl-Fördermenge

Epoch Times11. Mai 2020 Aktualisiert: 11. Mai 2020 17:57

Das Geschäft mit Öl gerät wegen der zusammengebrochenen Weltwirtschaft immer weiter unter Druck. Die bisher vereinbarten Reduzierungen der Fördermengen reichen immer noch nicht aus um den Preis auf einem stabilen Niveau zu halten.

Saudi-Arabien will zur Stützung des weltweiten Ölpreises die tägliche Fördermenge nochmals deutlich senken. Die Regierung habe den saudiarabischen Ölriesen Aramco aufgefordert, pro Tag eine Million Barrel Erdöl weniger als bislang zu fördern, erklärte das Ölministerium des Landes am Montag nach Angaben der amtlichen Nachrichtenagentur SPA. So sollen demnach künftig nur noch 7,5 Millionen Barrel täglich produziert werden. Ein Barrel entspricht 159 Litern.

Auch Saudi-Arabiens Nachbarstaat Kuwait verkündete eine ...

https://www.epochtimes.de/wirtschaft/unternehmen/kaum-nachfr…

...................................................................

...

... wer den Hals nicht voll genug bekommt ...

... wer den Hals nicht voll genug bekommt ...Aramco May Delay Payments For $69 Billion Sabic Acquisition

By Irina Slav - May 11, 2020, 11:30 AM CDT

Aramco is considering staggering payments for the 70 percent in chemicals conglomerate Sabic that it said it would acquire last year.

Bloomberg reports that the options the oil major was mulling over involved delaying payments for the majority stake in Sabic as well as reducing the initial installment to the seller, Saudi Arabia’s sovereign wealth fund.

Aramco signed the deal to buy 70 percent in Sabic from the Public Investment Fund of Saudi Arabia in March 2019, for the equivalent of US$69.1 billion in Saudi riyals at the time. The acquisition was part of Aramco’s preparation for going public, which happened, after much anticipation, at the end of last year.

Meanwhile, an exclusive Reuters report said that Aramco was also looking to review the price of the Sabic acquisition. The chemicals major’s market value, according to the report, which cited unnamed sources, had fallen by 40 percent since the start of the latest oil price rout, with the price Aramco paid for the 40-percent stake high above the current trading price of Sabic.

The Reuters report also notes ...

https://oilprice.com/Latest-Energy-News/World-News/Aramco-Ma…

...................................................................

UAE Making Even Bigger Cuts To Oil Production Next Month

By Julianne Geiger - May 11, 2020, 5:30 PM CDT

...

But the move to cut additional barrels by Kuwait, Saudi Arabia, and the UAE was seen not as a positive move, but as an out-of-options move as Middle East producers find themselves without buyers. Today’s announcement of additional cuts could, therefore, spark fear instead of confidence as the market views it as a reflection of the true state of the market.

https://oilprice.com/Latest-Energy-News/World-News/UAE-Makin…

...  ... 4 / 10 / 20 ... Rockefeller's Death ... ... DJT ...

... 4 / 10 / 20 ... Rockefeller's Death ... ... DJT ...

Crude Oil May 20 (CL=F)

NY Mercantile - NY Mercantile Delayed Price. Currency in USD

Add to watchlist

-35.2000-53.4700 (-299.23%)

https://finance.yahoo.com/quote/CL=F?p=CL=F

.....................................................................................................................................................

History In The Making: Oil Settles At Negative $37.63 Per Barrel

by Tyler Durden

Mon, 04/20/2020 - 12:56

Update (1425ET): And there it is... May WTI just traded below zero for the first time ever (trading below NEGATIVE $40 per barrel)... There was a small bid right into the settlement at 1430ET leaving the May contract to settle at negative $37.63. ...

https://www.zerohedge.com/markets/historic-oil-crash-sends-c…

.....................................................................................................................................................

Oil Prices Crash as Storage Shortage Looms

by John Carney20 Apr 2020

The joke among oil traders Monday morning is that gas stations will soon be paying customers to fill up their tanks as the search for storage options intensifies.

Oil prices plunged on Monday to multi-decade lows. ...

Soon to be expiring contracts are typically traded in lower volumes. Some traders may be selling the expiring May contract for fear that storing oil will become more expensive as high production numbers clash with low demand around the globe.

The June WTI contract for West Texas Intermediate futures, fell by more than 11.5 percent. Brent crude oil, considered the global benchmark, fell by around 6 percent.

Analysts are concerned that the capacity for storing oil may run out soon. The storage facility in Cushing, Oklahoma has become a ...

When prices for futures contracts expiring further out are higher than contracts expiring sooner, traders describe the market as being in “contango.” The opposite, where near-term contracts are cheaper than long-term, is called “backwardation.” The current market, with a steep discount for oil available for near-term delivery, is known as “super-contang0.” The definitions of those terms may not matter to most consumers but they are fun to say.

“Uncontained contango,” is a new phrase being thrown around to describe super-contango driven by lack of storage capacity. ...

https://www.breitbart.com/health/2020/04/20/oil-price-crash/

... 4 / 10 / 20 ... Rockefeller's Death ... ... DJT ...

... 4 / 10 / 20 ... Rockefeller's Death ... ... DJT ...Crude Oil May 20 (CL=F)

NY Mercantile - NY Mercantile Delayed Price. Currency in USD

Add to watchlist

-35.2000-53.4700 (-299.23%)

https://finance.yahoo.com/quote/CL=F?p=CL=F

.....................................................................................................................................................

History In The Making: Oil Settles At Negative $37.63 Per Barrel

by Tyler Durden

Mon, 04/20/2020 - 12:56

Update (1425ET): And there it is... May WTI just traded below zero for the first time ever (trading below NEGATIVE $40 per barrel)... There was a small bid right into the settlement at 1430ET leaving the May contract to settle at negative $37.63. ...

https://www.zerohedge.com/markets/historic-oil-crash-sends-c…

.....................................................................................................................................................

Oil Prices Crash as Storage Shortage Looms

by John Carney20 Apr 2020

The joke among oil traders Monday morning is that gas stations will soon be paying customers to fill up their tanks as the search for storage options intensifies.

Oil prices plunged on Monday to multi-decade lows. ...

Soon to be expiring contracts are typically traded in lower volumes. Some traders may be selling the expiring May contract for fear that storing oil will become more expensive as high production numbers clash with low demand around the globe.

The June WTI contract for West Texas Intermediate futures, fell by more than 11.5 percent. Brent crude oil, considered the global benchmark, fell by around 6 percent.

Analysts are concerned that the capacity for storing oil may run out soon. The storage facility in Cushing, Oklahoma has become a ...

When prices for futures contracts expiring further out are higher than contracts expiring sooner, traders describe the market as being in “contango.” The opposite, where near-term contracts are cheaper than long-term, is called “backwardation.” The current market, with a steep discount for oil available for near-term delivery, is known as “super-contang0.” The definitions of those terms may not matter to most consumers but they are fun to say.

“Uncontained contango,” is a new phrase being thrown around to describe super-contango driven by lack of storage capacity. ...

https://www.breitbart.com/health/2020/04/20/oil-price-crash/

...  ...

...

....................................................................................................................................................

Asian Oil Trading Legend Files For Bankruptcy After Hiding $800 Million In Losses, Secretly Selling Loan Collateral

by Tyler Durden

Sun, 04/19/2020 - 17:55

Last weekend we reported that one of Singapore's biggest and most iconic - and extremely secretive - oil traders, Hin Leong Trading, whose website reports revenue surpassed $14 billion all the way back in 2012, was on the verge of collapse as the company's banks had frozen letters of credit for the firm - a death sentence for any commodity merchant - over its ability to repay debt; as a result, the firm appointed advisers to help negotiate with banks for more time to resolve its finances.

After pointing out the perplexing lack of high-profile blow-ups in the current commodity crush (as a reminder back in 2016 when oil dropped less than it has now, the Glencores and Trafiguras of the world were this close to collapse), we explained the critical nature of L/Cs...

Letters of credit are a critical financial backstop for commodity traders, used as way of financing critical short-term trade. A bank issues the so-called L/C on behalf of the buyer as a guarantee of payment to the seller. Once the goods have exchanged hands, the buyer repays the lender.

... and said that Hin Leong had "suddenly found itself without providers of L/Cs - for reasons still not exactly known - without which it is effectively paralyzed as it needs to front cash for any transactions, something no modern commodity merchant can afford to do." ...

One unexpected consequence of the company's sudden bankruptcy, is that with a record 160MM barrels of oil loaded up on tankers to ease the global commodity glut, Singapore may suddenly lose its place as the world's tanker "parking lot." While traditionally Singapore has had massive spare oil storage capacity which explains photos such as shits one...

...

Hin Leong's Universal Terminal with storage capacity of 2.33 million cubic meters is the largest independent petroleum storage terminal in Singapore and one of the biggest independent storage facilities worldwide. Source: Hin Leong

https://www.zerohedge.com/commodities/singapore-oil-trading-…

....................................................................................................................................................

Futures Plunge As WTI Crashes By Most On Record, Tumbling To $11 Per Barrel

by Tyler Durden

Mon, 04/20/2020 - 08:13

Oil prices crashed the most on record with the May WTI futures contract hitting its lowest level since 1999, plunging as low as $11 or down 38%, as nobody wants to take actual physical storage amid widespread fears crude storage will soon be full; meanwhile companies prepare to report the worst quarterly earnings since the financial crisis, while tens of thousands of people continue to get sick every day with the coronavirus.

While Brent was only down $1.12, or 4%, at $26.96 a barrel on Monday morning, the carnage took place in the landlocked WTI, whose May contract fell $5.70 to its lowest since March 1998 though the sell-off was exaggerated by the contract’s Tuesday expiry because no one wants to be left long to take delivery as there is nowhere to put the physical product. In any case, the 37% drop was the biggest one-day drop on record! ...

https://www.zerohedge.com/markets/futures-plunge-wti-crashes…

....................................................................................................................................................

Rio Tinto

https://www.portoflosangeles.org/business/terminals/liquid-b…

Port of Rotterdam

PORT TERMINAL VLADIVOSTOK

https://oookim.ru/vladivostok-port-terminal/

https://www.oiltanking.com/de/kontakt/standorte-weltweit.htm…

....................................................................................................................................................

Saudi Aramco May Cause A Bloodbath In Cushing

Apr. 17, 2020 7:08 PM ET|

Robert Boslego

Summary

https://seekingalpha.com/article/4338308-saudi-aramco-may-ca…

...

...

....................................................................................................................................................

Asian Oil Trading Legend Files For Bankruptcy After Hiding $800 Million In Losses, Secretly Selling Loan Collateral

by Tyler Durden

Sun, 04/19/2020 - 17:55

Last weekend we reported that one of Singapore's biggest and most iconic - and extremely secretive - oil traders, Hin Leong Trading, whose website reports revenue surpassed $14 billion all the way back in 2012, was on the verge of collapse as the company's banks had frozen letters of credit for the firm - a death sentence for any commodity merchant - over its ability to repay debt; as a result, the firm appointed advisers to help negotiate with banks for more time to resolve its finances.

After pointing out the perplexing lack of high-profile blow-ups in the current commodity crush (as a reminder back in 2016 when oil dropped less than it has now, the Glencores and Trafiguras of the world were this close to collapse), we explained the critical nature of L/Cs...

Letters of credit are a critical financial backstop for commodity traders, used as way of financing critical short-term trade. A bank issues the so-called L/C on behalf of the buyer as a guarantee of payment to the seller. Once the goods have exchanged hands, the buyer repays the lender.

... and said that Hin Leong had "suddenly found itself without providers of L/Cs - for reasons still not exactly known - without which it is effectively paralyzed as it needs to front cash for any transactions, something no modern commodity merchant can afford to do." ...

One unexpected consequence of the company's sudden bankruptcy, is that with a record 160MM barrels of oil loaded up on tankers to ease the global commodity glut, Singapore may suddenly lose its place as the world's tanker "parking lot." While traditionally Singapore has had massive spare oil storage capacity which explains photos such as shits one...

...

Hin Leong's Universal Terminal with storage capacity of 2.33 million cubic meters is the largest independent petroleum storage terminal in Singapore and one of the biggest independent storage facilities worldwide. Source: Hin Leong

https://www.zerohedge.com/commodities/singapore-oil-trading-…

....................................................................................................................................................

Futures Plunge As WTI Crashes By Most On Record, Tumbling To $11 Per Barrel

by Tyler Durden

Mon, 04/20/2020 - 08:13

Oil prices crashed the most on record with the May WTI futures contract hitting its lowest level since 1999, plunging as low as $11 or down 38%, as nobody wants to take actual physical storage amid widespread fears crude storage will soon be full; meanwhile companies prepare to report the worst quarterly earnings since the financial crisis, while tens of thousands of people continue to get sick every day with the coronavirus.

While Brent was only down $1.12, or 4%, at $26.96 a barrel on Monday morning, the carnage took place in the landlocked WTI, whose May contract fell $5.70 to its lowest since March 1998 though the sell-off was exaggerated by the contract’s Tuesday expiry because no one wants to be left long to take delivery as there is nowhere to put the physical product. In any case, the 37% drop was the biggest one-day drop on record! ...

https://www.zerohedge.com/markets/futures-plunge-wti-crashes…

....................................................................................................................................................

Rio Tinto

https://www.portoflosangeles.org/business/terminals/liquid-b…

Port of Rotterdam

PORT TERMINAL VLADIVOSTOK

https://oookim.ru/vladivostok-port-terminal/

https://www.oiltanking.com/de/kontakt/standorte-weltweit.htm…

....................................................................................................................................................

Saudi Aramco May Cause A Bloodbath In Cushing

Apr. 17, 2020 7:08 PM ET|

Robert Boslego

Summary

https://seekingalpha.com/article/4338308-saudi-aramco-may-ca…

Antwort auf Beitrag Nr.: 62.930.231 von teecee1 am 09.03.20 09:35:07Gemengelage am 16. März 2020

Von N8waechter - 16. Mrz. 2020

+ + +

Neue Arrestwelle in Saudi-Arabien. 298 Staatsbeamte, darunter hochrangige Militärangehörige, wurden wegen Erpressung und Amtsmissbrauch einkassiert:

https://www.n8waechter.net/2020/03/16/gemengelage-am-16-maer…

March 15, 2020 / 7:03 PM / a day ago

Saudi Arabia detains 298 public officials in new corruption probes

......

... ...wenn der Kurs auf 0,1 Rial fällt kaufe ich Aramco zurück ...

...wenn der Kurs auf 0,1 Rial fällt kaufe ich Aramco zurück ...  ... Simsala-BiM ... *X* ... Arab-Karamba ... Abrakadabra ...

... Simsala-BiM ... *X* ... Arab-Karamba ... Abrakadabra ...

https://www.tadawul.com.sa/wps/portal/tadawul/market-partici…

... ... für 26 Mrd. Fake Dollar habe ich 5% verkauft ... ähhh ... + 3 Mrd. ...

... für 26 Mrd. Fake Dollar habe ich 5% verkauft ... ähhh ... + 3 Mrd. ...

Alles läuft nach der Sanduhr …

Der Sandmann

***

Von N8waechter - 16. Mrz. 2020

+ + +

Neue Arrestwelle in Saudi-Arabien. 298 Staatsbeamte, darunter hochrangige Militärangehörige, wurden wegen Erpressung und Amtsmissbrauch einkassiert:

https://www.n8waechter.net/2020/03/16/gemengelage-am-16-maer…

March 15, 2020 / 7:03 PM / a day ago

Saudi Arabia detains 298 public officials in new corruption probes

......

...

...wenn der Kurs auf 0,1 Rial fällt kaufe ich Aramco zurück ...

...wenn der Kurs auf 0,1 Rial fällt kaufe ich Aramco zurück ...  ... Simsala-BiM ... *X* ... Arab-Karamba ... Abrakadabra ...

... Simsala-BiM ... *X* ... Arab-Karamba ... Abrakadabra ...https://www.tadawul.com.sa/wps/portal/tadawul/market-partici…

...

... für 26 Mrd. Fake Dollar habe ich 5% verkauft ... ähhh ... + 3 Mrd. ...

... für 26 Mrd. Fake Dollar habe ich 5% verkauft ... ähhh ... + 3 Mrd. ...Alles läuft nach der Sanduhr …

Der Sandmann

***

Antwort auf Beitrag Nr.: 62.922.194 von teecee1 am 08.03.20 13:29:2309 MAR 11:04 AM

2222

Saudi Arabian Oil Co.

Trading name: SAUDI ARAMCO

Price: 27.00

Change: -3.00 ( -10.00% )

....................................................................

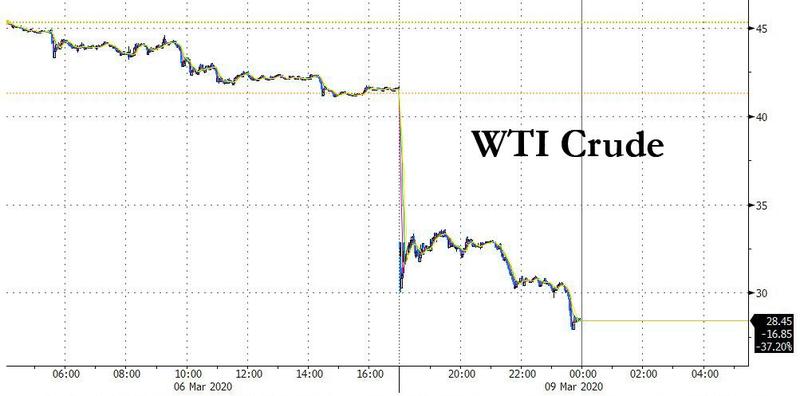

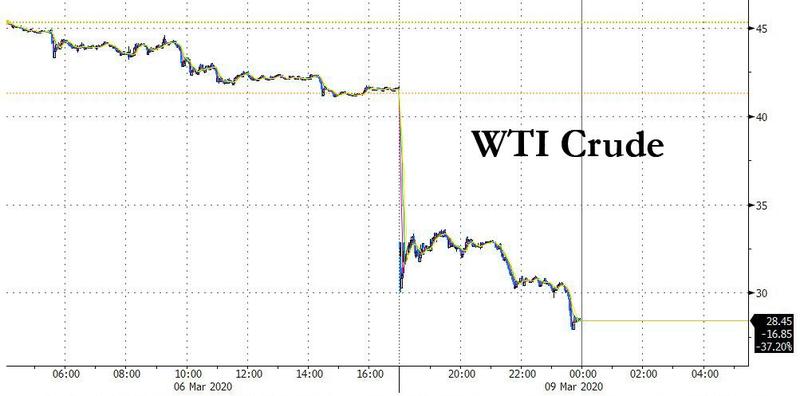

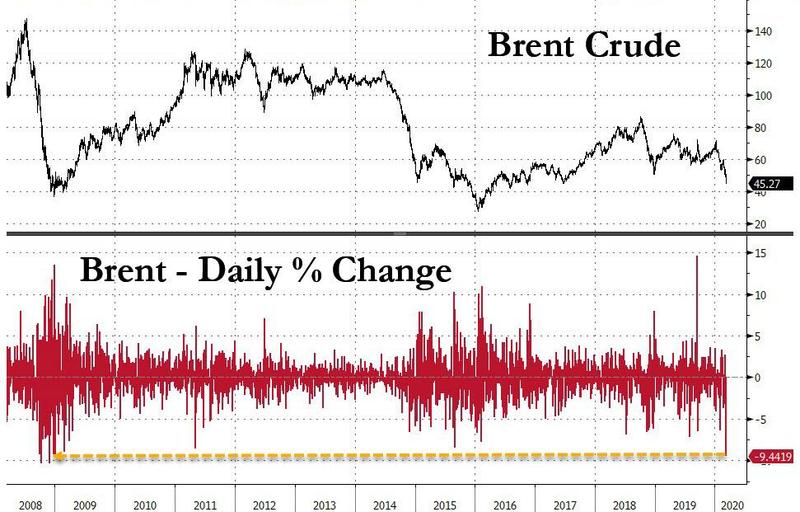

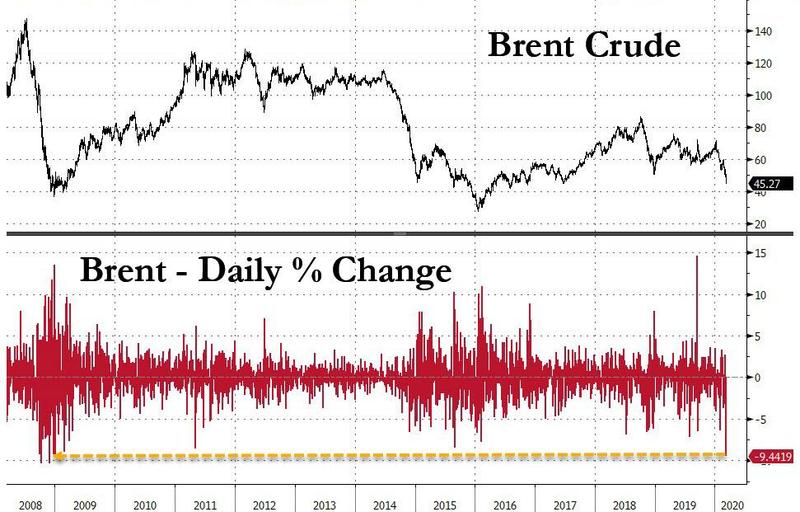

Panic Purgatory: Oil Crashes To $27; S&P Futures Locked Limit Down, Treasuries Soar Limit Up Amid Historic Liquidation

by Tyler Durden

Mon, 03/09/2020 - 00:43

The Sunday futures fiasco started off on the back foot, with virtually every risk asset that is not nailed down puking with a force unseen since the financial crisis. It has only gotten worse since.

....

https://www.zerohedge.com/markets/panic-purgatory-oil-crashe…

...................................................................................................................................

Market Bloodbath: Middle East Stocks Crater; Kuwait Halted; Aramco Below IPO; Dow Indicated Down 500

by Tyler Durden

Sun, 03/08/2020 - 11:01

In case a global viral pandemic wasn't enough of a concern, on Saturday Saudi Arabia launched a global oil price war, ...

... ... gestern waren noch ein paar Twitter Beiträge ... Oil auf 30 Dollar ... sind aber verschwunden ... S&P, DOW -5% ...

... gestern waren noch ein paar Twitter Beiträge ... Oil auf 30 Dollar ... sind aber verschwunden ... S&P, DOW -5% ...

https://www.zerohedge.com/markets/market-bloodbath-middle-ea…

.................................................................................................................

Russland: Putin erklärt dem US-Fracking-Öl den Krieg

8. März 2020 aikos2309

Nachdem Washington in einem Wirtschaftskrieg Nord Stream 2 sabotiert, schlägt Moskau zurück – und erklärt der US-Fracking-Industrie den Krieg. Russland wehrt sich.

Die OPEC+ ist nicht mehr, nach 24 Stunden, in denen Russland das Kräfteverhältnis in der Ölwelt auf den Kopf gestellt hat und die Mitglieder der OPEC+ benommen und verwirrt zurückgelassen haben. Es schockiert Saudi-Arabien, das jetzt mit sozialen Unruhen konfrontiert ist und dessen Ölpreis weit unter Riads Budgetbedarf liegt.

Und jetzt hat Bloomberg die beeindruckende Hintergrundgeschichte hinter der Ankündigung vom Freitag, ...

https://www.pravda-tv.com/2020/03/russland-putin-erklaert-de…

... ... ähhh, die Russen ... ähhh neee, die Saudis ... ähhh, ja wer denn nuuuu ... Trump ... Maduro ... Merkel ... G Sachs ...

... ähhh, die Russen ... ähhh neee, die Saudis ... ähhh, ja wer denn nuuuu ... Trump ... Maduro ... Merkel ... G Sachs ...

.........................................................................................

Sachs warns $20 oil is possible

Brian Sozzi

Editor-at-Large

Yahoo FinanceMarch 8, 2020

Filling up that new gas-guzzling SUV is about to get a heck of a lot cheaper this spring.

Brent crude oil futures tanked as much as 31% to $31 a barrel on Sunday evening as Saudi Arabia ratcheted up pressure on Russia by slashing its list prices by the most in some 20 years. Saudi Arabia’s shock decision as talks on production cuts between OPEC and its allies ended unceremoniously on Friday. ...

https://finance.yahoo.com/news/saudi-arabia-triggers-an-oil-…

2222

Saudi Arabian Oil Co.

Trading name: SAUDI ARAMCO

Price: 27.00

Change: -3.00 ( -10.00% )

....................................................................

Panic Purgatory: Oil Crashes To $27; S&P Futures Locked Limit Down, Treasuries Soar Limit Up Amid Historic Liquidation

by Tyler Durden

Mon, 03/09/2020 - 00:43

The Sunday futures fiasco started off on the back foot, with virtually every risk asset that is not nailed down puking with a force unseen since the financial crisis. It has only gotten worse since.

....

https://www.zerohedge.com/markets/panic-purgatory-oil-crashe…

...................................................................................................................................

Market Bloodbath: Middle East Stocks Crater; Kuwait Halted; Aramco Below IPO; Dow Indicated Down 500

by Tyler Durden

Sun, 03/08/2020 - 11:01

In case a global viral pandemic wasn't enough of a concern, on Saturday Saudi Arabia launched a global oil price war, ...

...

... gestern waren noch ein paar Twitter Beiträge ... Oil auf 30 Dollar ... sind aber verschwunden ... S&P, DOW -5% ...

... gestern waren noch ein paar Twitter Beiträge ... Oil auf 30 Dollar ... sind aber verschwunden ... S&P, DOW -5% ...

https://www.zerohedge.com/markets/market-bloodbath-middle-ea…

.................................................................................................................

Russland: Putin erklärt dem US-Fracking-Öl den Krieg

8. März 2020 aikos2309

Nachdem Washington in einem Wirtschaftskrieg Nord Stream 2 sabotiert, schlägt Moskau zurück – und erklärt der US-Fracking-Industrie den Krieg. Russland wehrt sich.

Die OPEC+ ist nicht mehr, nach 24 Stunden, in denen Russland das Kräfteverhältnis in der Ölwelt auf den Kopf gestellt hat und die Mitglieder der OPEC+ benommen und verwirrt zurückgelassen haben. Es schockiert Saudi-Arabien, das jetzt mit sozialen Unruhen konfrontiert ist und dessen Ölpreis weit unter Riads Budgetbedarf liegt.

Und jetzt hat Bloomberg die beeindruckende Hintergrundgeschichte hinter der Ankündigung vom Freitag, ...

https://www.pravda-tv.com/2020/03/russland-putin-erklaert-de…

...

... ähhh, die Russen ... ähhh neee, die Saudis ... ähhh, ja wer denn nuuuu ... Trump ... Maduro ... Merkel ... G Sachs ...

... ähhh, die Russen ... ähhh neee, die Saudis ... ähhh, ja wer denn nuuuu ... Trump ... Maduro ... Merkel ... G Sachs ............................................................................................

Sachs warns $20 oil is possible

Brian Sozzi

Editor-at-Large

Yahoo FinanceMarch 8, 2020

Filling up that new gas-guzzling SUV is about to get a heck of a lot cheaper this spring.

Brent crude oil futures tanked as much as 31% to $31 a barrel on Sunday evening as Saudi Arabia ratcheted up pressure on Russia by slashing its list prices by the most in some 20 years. Saudi Arabia’s shock decision as talks on production cuts between OPEC and its allies ended unceremoniously on Friday. ...

https://finance.yahoo.com/news/saudi-arabia-triggers-an-oil-…

Antwort auf Beitrag Nr.: 62.920.848 von teecee1 am 08.03.20 10:25:12Freitagabend: ... die ÖLlampe brennt ...

... der Motor stottert ... und mein Arsc. schwitzt ... 3-

Macron-cap finalisiert krassen Migranatendeal!

weiterlesen >> ... brennen .. fliegen die alten OILlappen ...

....................................................

2222

Saudi Arabian Oil Co.

Trading name: SAUDI ARAMCO

Price: 30.00

Change: -3.00 ( -9.09% )

https://www.tadawul.com.sa/wps/portal/tadawul/market-partici…

............................................................................................................................................

Nach Scheitern von OPEC-Sitzung: Saudi-Arabien will Ölproduktion steigern – Bloomberg

11:13 08.03.2020(aktualisiert 11:21 08.03.2020) https://sptnkne.ws/BBvX

Saudi-Arabien plant eine Steigerung der Erdölförderung, da sich Russland und die Opec-Staaten bei den Gesprächen am Freitag in Wien nicht auf die Produktionsstrategie ab April einigen konnten. Dies berichtet die Agentur Bloomberg unter Verweis auf eigene Quellen am Sonntag.

Saudi-Arabien könnte im April die eigene Ölproduktion deutlich steigern und sogar einen Rekord von 12 Millionen Barrel pro Tag erreichen, sagten Quellen, die anonym bleiben wollten, gegenüber Bloomberg. Dabei fördere das Land in diesem Monat etwa 9,7 Millionen Barrel pro Tag, hieß es.

Eine solche Steigerung der Ölförderung könnte den Markt „ins Chaos stürzen“, da die Ölnachfrage ohnehin durch den Corona-Ausbruch rapide gesunken sei, schrieben die Bloomberg-Autoren.

Die saudische „Schock-Strategie“ könnte darauf abzielen, Russland und andere Förderstaaten auf diese Weise schnellstmöglich maximale Verluste erleiden zu lassen, um sie wieder an den Verhandlungstisch zu bringen.

Saudi-Arabien habe sich veranlasst gefühlt, die Ölförderung drastisch zu steigern, nachdem der russische Energieminister Alexander Nowak am Freitag in Wien beim „Opec+“-Treffen ein Ultimatum abgelehnt hatte, das eine Teilnahme an der gemeinsamen Produktionskürzung vorgesehen habe, hieß es bei Bloomberg.

Ölpreis auf Talfahrt

Am späten Freitagnachmittag ... ... 💣 ... "Ordo Ab Chao" - Ordnung aus dem Chaos ...

https://de.sputniknews.com/politik/20200308326563264-opec-si…

............................................

Saudi Arabia Starts All-Out Oil War: MbS Destroys OPEC By Flooding Market, Slashing Oil Prices

by Tyler Durden

Sat, 03/07/2020 - 19:45

With the commodity world still smarting from the Nov 2014 Saudi decision to (temporarily) break apart OPEC, and flood the market with oil in (failed) hopes of crushing US shale producers (who survived thanks to generous banks extending loan terms and even more generous buyers of junk bonds), which nonetheless resulted in a painful manufacturing recession as the price of Brent cratered as low as the mid-$20's in late 2015/early 2016, on Saturday, Saudi Arabia launched its second scorched earth, or rather scorched oil campaign in 6 years. And this time there will be blood.

Following Friday's shocking collapse of OPEC+, when Russia and Riyadh were unable to reach an agreement during the OPEC+ summit in Vienna which was seeking up to 1.5 million b/d in further oil production cuts, on Saturday Saudi Arabia kick started what Bloomberg called an all-out oil war, slashing official pricing for its crude and making the deepest cuts in at least 20 years on its main grades, in an effort to push as many barrels into the market as possible.

In the first major marketing decision since the meeting, the Saudi state producer Aramco, which successfully IPOed just before the price of oil cratered...

... ... wer sitzt in Wien ... Rothschild ... ??? ...

... wer sitzt in Wien ... Rothschild ... ??? ...

https://www.zerohedge.com/commodities/saudi-arabia-starts-al…

.......................................................................................................................................

Venezuela: Weitere Festnahmen in Öl- und Gaskorporation PDVSA

10:19 08.03.2020(aktualisiert 10:38 08.03.2020) https://sptnkne.ws/BBvz

Venezuelas Innenminister Néstor Reverol hat am Samstag über neue Festnahmen von Angestellten und führenden Mitarbeitern der staatlichen Öl- und Gaskorporation PDVSA berichtet. Unter den 38 Festgenommenen befinden sich die Crewmitglieder des Tankers „Negra Hipólita“, der Präsident des Unternehmens PDV Marina und sein Berater sowie sechs Manager.

„Im Rahmen einer interinstitutionellen Untersuchung unter Leitung der Generalstaatsanwaltschaft sind neben den 30 Mitgliedern der Tanker-Besatzung weitere acht Personen festgenommen worden“, sagte Reverol dem TV-Sender „Iguana“.

Dem Minister zufolge haben Mitarbeiter der Hauptverwaltung für den militärischen Abschirmdienst die Entwendung von Brennstoffen aus der Ölraffinerie Paraguana im Bundesstaat Falcón aufgeklärt. Es handelt sich um 40.000 Barrel Benzin, 36.000 Barrel Dieseltreibstoff und 50.000 Barrel Flugkerosin, die der Tanker „Negra Hipólita“ an die Seegrenze zwischen Venezuela und den Niederländischen Antillen gebracht hatte und die dann auf den unter kolumbianischer Flagge fahrenden Tanker „Panamanian Glory“ verladen wurden.

Die venezolanischen Seestreitkräfte brachten die „Negra Hipólita“ auf und eskortierten den Tanker zum Marinestützpunkt Agustín Armario in Puerto-Cabello. Dort wurde das Schiff durchsucht und seine Crew verhaftet.

Vor dem Hintergrund einer ...

https://de.sputniknews.com/panorama/20200308326563241-venezu…

....................................................................................................................................................

... ... Wann ... wird Gerhard Schröder von seiner Vergangheit eingeholt ... Kanzler ... NordBeam3 ... ??? ...

... Wann ... wird Gerhard Schröder von seiner Vergangheit eingeholt ... Kanzler ... NordBeam3 ... ??? ...

...................................................................................................................................................

MbS Widens Purge: Dozens Of Royals And Army Officers Swept Up After Powerful Princes Arrested

by Tyler Durden

Sat, 03/07/2020 - 16:40

Yesterday we predicted a return to MbS' infamous Ritz-Carlton Riyadh shakedown of 2017 after a dramatic Friday morning raid on the homes of King Salman's brother, Prince Ahmed bin Abdulaziz al Saud, and Prince Mohammed bin Nayef bin Abdulaziz al Saud.

All eyes are on the spread of the deadly coronavirus, so what better time to initiate a broader crackdown (or at least dramatically restart the 2017-2018 purge), than when world leaders are distracted by making sure their societies survive a potential apocalyptic pandemic?

The pair, which happen to be the kingdom's top most powerful royals aside from MbS, having both in the past been in charge of Saudi armed forces and intelligence in the post of Interior Minister, were arrested for allegedly plotting a coup to unseat the king and crown prince. Of course any level of evidence was not forthcoming. Treason could bring the death penalty.

It appears the resumption of MbS' purge of any power rivals or centers of influence is back on after a year-long lull following the Oct. 2018 murder and dismemberment of journalist Jamal Khashoggi is officially back on.

The WSJ reports: "Saudi Arabian Crown Prince Mohammed bin Salman has embarked on a broad security crackdown by rounding up royal rivals, government officials and military officers in an effort to quash potential challenges to his power, Saudi royals and advisers familiar with the matter said Saturday."

This includes "dozens of Interior Ministry officials, senior army officers and others suspected of supporting a coup attempt...".

With Gov. Cuomo declaring New York in a 'state of emergency' Saturday after a new spike in Covid-19 cases, the crackdown in the Saudi kingdom has barely made a dent in terms of competing with the dozens of coronavirus headlines this weekend.

And yet hundreds of princes and high Saudi officials are now experiencing chills of a very different sort: ...

... 💩 ... An Gela Mehr-Geld Zittern ...

https://www.zerohedge.com/geopolitical/mbs-widens-purge-doze…

... der Motor stottert ... und mein Arsc. schwitzt ... 3-

Macron-cap finalisiert krassen Migranatendeal!

weiterlesen >> ... brennen .. fliegen die alten OILlappen ...

....................................................

2222

Saudi Arabian Oil Co.

Trading name: SAUDI ARAMCO

Price: 30.00

Change: -3.00 ( -9.09% )

https://www.tadawul.com.sa/wps/portal/tadawul/market-partici…

............................................................................................................................................

Nach Scheitern von OPEC-Sitzung: Saudi-Arabien will Ölproduktion steigern – Bloomberg

11:13 08.03.2020(aktualisiert 11:21 08.03.2020) https://sptnkne.ws/BBvX

Saudi-Arabien plant eine Steigerung der Erdölförderung, da sich Russland und die Opec-Staaten bei den Gesprächen am Freitag in Wien nicht auf die Produktionsstrategie ab April einigen konnten. Dies berichtet die Agentur Bloomberg unter Verweis auf eigene Quellen am Sonntag.

Saudi-Arabien könnte im April die eigene Ölproduktion deutlich steigern und sogar einen Rekord von 12 Millionen Barrel pro Tag erreichen, sagten Quellen, die anonym bleiben wollten, gegenüber Bloomberg. Dabei fördere das Land in diesem Monat etwa 9,7 Millionen Barrel pro Tag, hieß es.

Eine solche Steigerung der Ölförderung könnte den Markt „ins Chaos stürzen“, da die Ölnachfrage ohnehin durch den Corona-Ausbruch rapide gesunken sei, schrieben die Bloomberg-Autoren.

Die saudische „Schock-Strategie“ könnte darauf abzielen, Russland und andere Förderstaaten auf diese Weise schnellstmöglich maximale Verluste erleiden zu lassen, um sie wieder an den Verhandlungstisch zu bringen.

Saudi-Arabien habe sich veranlasst gefühlt, die Ölförderung drastisch zu steigern, nachdem der russische Energieminister Alexander Nowak am Freitag in Wien beim „Opec+“-Treffen ein Ultimatum abgelehnt hatte, das eine Teilnahme an der gemeinsamen Produktionskürzung vorgesehen habe, hieß es bei Bloomberg.

Ölpreis auf Talfahrt

Am späten Freitagnachmittag ... ... 💣 ... "Ordo Ab Chao" - Ordnung aus dem Chaos ...

https://de.sputniknews.com/politik/20200308326563264-opec-si…

............................................

Saudi Arabia Starts All-Out Oil War: MbS Destroys OPEC By Flooding Market, Slashing Oil Prices

by Tyler Durden

Sat, 03/07/2020 - 19:45

With the commodity world still smarting from the Nov 2014 Saudi decision to (temporarily) break apart OPEC, and flood the market with oil in (failed) hopes of crushing US shale producers (who survived thanks to generous banks extending loan terms and even more generous buyers of junk bonds), which nonetheless resulted in a painful manufacturing recession as the price of Brent cratered as low as the mid-$20's in late 2015/early 2016, on Saturday, Saudi Arabia launched its second scorched earth, or rather scorched oil campaign in 6 years. And this time there will be blood.

Following Friday's shocking collapse of OPEC+, when Russia and Riyadh were unable to reach an agreement during the OPEC+ summit in Vienna which was seeking up to 1.5 million b/d in further oil production cuts, on Saturday Saudi Arabia kick started what Bloomberg called an all-out oil war, slashing official pricing for its crude and making the deepest cuts in at least 20 years on its main grades, in an effort to push as many barrels into the market as possible.

In the first major marketing decision since the meeting, the Saudi state producer Aramco, which successfully IPOed just before the price of oil cratered...

...

... wer sitzt in Wien ... Rothschild ... ??? ...

... wer sitzt in Wien ... Rothschild ... ??? ...https://www.zerohedge.com/commodities/saudi-arabia-starts-al…

.......................................................................................................................................

Venezuela: Weitere Festnahmen in Öl- und Gaskorporation PDVSA

10:19 08.03.2020(aktualisiert 10:38 08.03.2020) https://sptnkne.ws/BBvz

Venezuelas Innenminister Néstor Reverol hat am Samstag über neue Festnahmen von Angestellten und führenden Mitarbeitern der staatlichen Öl- und Gaskorporation PDVSA berichtet. Unter den 38 Festgenommenen befinden sich die Crewmitglieder des Tankers „Negra Hipólita“, der Präsident des Unternehmens PDV Marina und sein Berater sowie sechs Manager.

„Im Rahmen einer interinstitutionellen Untersuchung unter Leitung der Generalstaatsanwaltschaft sind neben den 30 Mitgliedern der Tanker-Besatzung weitere acht Personen festgenommen worden“, sagte Reverol dem TV-Sender „Iguana“.

Dem Minister zufolge haben Mitarbeiter der Hauptverwaltung für den militärischen Abschirmdienst die Entwendung von Brennstoffen aus der Ölraffinerie Paraguana im Bundesstaat Falcón aufgeklärt. Es handelt sich um 40.000 Barrel Benzin, 36.000 Barrel Dieseltreibstoff und 50.000 Barrel Flugkerosin, die der Tanker „Negra Hipólita“ an die Seegrenze zwischen Venezuela und den Niederländischen Antillen gebracht hatte und die dann auf den unter kolumbianischer Flagge fahrenden Tanker „Panamanian Glory“ verladen wurden.

Die venezolanischen Seestreitkräfte brachten die „Negra Hipólita“ auf und eskortierten den Tanker zum Marinestützpunkt Agustín Armario in Puerto-Cabello. Dort wurde das Schiff durchsucht und seine Crew verhaftet.

Vor dem Hintergrund einer ...

https://de.sputniknews.com/panorama/20200308326563241-venezu…

....................................................................................................................................................

...

... Wann ... wird Gerhard Schröder von seiner Vergangheit eingeholt ... Kanzler ... NordBeam3 ... ??? ...

... Wann ... wird Gerhard Schröder von seiner Vergangheit eingeholt ... Kanzler ... NordBeam3 ... ??? ......................................................................................................................................................

MbS Widens Purge: Dozens Of Royals And Army Officers Swept Up After Powerful Princes Arrested

by Tyler Durden

Sat, 03/07/2020 - 16:40

Yesterday we predicted a return to MbS' infamous Ritz-Carlton Riyadh shakedown of 2017 after a dramatic Friday morning raid on the homes of King Salman's brother, Prince Ahmed bin Abdulaziz al Saud, and Prince Mohammed bin Nayef bin Abdulaziz al Saud.

All eyes are on the spread of the deadly coronavirus, so what better time to initiate a broader crackdown (or at least dramatically restart the 2017-2018 purge), than when world leaders are distracted by making sure their societies survive a potential apocalyptic pandemic?

The pair, which happen to be the kingdom's top most powerful royals aside from MbS, having both in the past been in charge of Saudi armed forces and intelligence in the post of Interior Minister, were arrested for allegedly plotting a coup to unseat the king and crown prince. Of course any level of evidence was not forthcoming. Treason could bring the death penalty.

It appears the resumption of MbS' purge of any power rivals or centers of influence is back on after a year-long lull following the Oct. 2018 murder and dismemberment of journalist Jamal Khashoggi is officially back on.

The WSJ reports: "Saudi Arabian Crown Prince Mohammed bin Salman has embarked on a broad security crackdown by rounding up royal rivals, government officials and military officers in an effort to quash potential challenges to his power, Saudi royals and advisers familiar with the matter said Saturday."

This includes "dozens of Interior Ministry officials, senior army officers and others suspected of supporting a coup attempt...".

With Gov. Cuomo declaring New York in a 'state of emergency' Saturday after a new spike in Covid-19 cases, the crackdown in the Saudi kingdom has barely made a dent in terms of competing with the dozens of coronavirus headlines this weekend.

And yet hundreds of princes and high Saudi officials are now experiencing chills of a very different sort: ...

... 💩 ... An Gela Mehr-Geld Zittern ...

https://www.zerohedge.com/geopolitical/mbs-widens-purge-doze…

Antwort auf Beitrag Nr.: 62.626.078 von teecee1 am 09.02.20 11:39:14 ...  ... zu viele Köche verderben den Brei ... Oil ...

... zu viele Köche verderben den Brei ... Oil ...

... ... zu viele Prinzen verd-erben den Stamm ...

... zu viele Prinzen verd-erben den Stamm ...

..................................................................................................................................................

Prinzen in Saudi-Arabien wegen Putsch-Plänen festgenommen

Epoch Times7. März 2020 Aktualisiert: 7. März 2020 6:47

König Salman Bruder Prinz Ahmed bin Abdulasis al-Saud und seinem Neffen Prinz Mohammed bin Najef wird Verrat zur Last gelegt. ...

https://www.epochtimes.de/politik/welt/medien-mehrere-prinze…

..................................................................................................................................................

March 7, 2020

United States Unleashes Military Coup In Saudi Arabia After Russia Ignites Oil Price Armageddon

By: Sorcha Faal, and as reported to her Western Subscribers

An astounding new Security Council (SC) report circulating in the Kremlin today adding a new and fearful chapter to The New Great Game reality of our world, makes it no wonder why top American energy security expert Samantha Gross has just stated with alarm “I'm a little shocked frankly because the Russians are really playing with fire”—a response Gross made to a series of pivotal moves occurring in this “New Great Game” yesterday that began with the United States blocking the United Nations from supporting a Russian-Turkish ceasefire in Syria—that Russia quickly countered by igniting a global “Oil Price Armageddon”—a term describing how Russia made a dramatic turn away from the Saudi-led OPEC+ and refused to cut production to hold up the price of oil—which cratered the price of oil to its present price of $41.57 a barrel—a catastrophic price for US oil producers who need a barrel of oil to cost as much as $65 to break even—and are the same US oil producers who were warned late last year that “2020 Will Be The Year Of Oil Bankruptcies”—a warning that swiftly became true yesterday as evidenced by what happened with the CBOE Volatility Index (VIX), otherwise known as the “Fear Gauge” or “Fear Index”—a creation of the Chicago Board Options Exchange (CBOE) that is a real-time market index that represents the market's expectation of 30-day forward-looking volatility—and that yesterday caught a large American financial entity disastrously betting everything they had on global oil prices being stabilized—the reaction to which saw shocked US market traders saying such things as “Someone Big Was Utterly Blown The Fuck Out”—“Someone Big Literally Doesn't Exist Anymore”—and “The Fed Must Now Step In Or A Catastrophic Crash Is Inevitable”—but to prevent such a catastrophic crash from happening, saw Saudi Arabia having paid $500 million to the US to move thousands of American military troops into their oil rich nation—American troops who yesterday, and joined by thousands of US troops stationed in neighboring countries, rapidly moved into combat readiness to protect vital Saudi government facilities and oil production centers—immediately after which, Crown Prince Mohammed bin Salman placed in detention his main rivals for power Prince Ahmed bin Abdulaziz, the younger brother of Saudi King Salman bin Abdulaziz al-Saud, royal cousin Prince Nawaf bin Nayef and former interior minister Mohammed bin Nayef—who were then accused in court of attempting a coup and are now under threat of lifetime imprisonment or execution—but whose real crime was their opposing the lost revenues caused by Saudi oil production cuts—production cuts whose main beneficiary are American oil producers needing a higher price per barrel—and due to Russia now having blown up the OPEC+ cartel, are Saudi oil production cuts sure to accelerate before an “inevitable crash” occurs.

http://www.whatdoesitmean.com/index3149.htm

..................................................................................................................

March 8, 2020 / 8:37 AM / Updated an hour ago

Saudi Aramco trades below IPO price for first time

DUBAI (Reuters) - Shares of Saudi Aramco (2222.SE) fell below their initial public offering (IPO) price on Sunday for the first time since they began trading in December after the OPEC oil supply cut pact with Russia fell apart on Friday.

Aramco shares were trading at 31.50 riyals ($8.40) at 0705 GMT, down 4.85%, compared to the IPO price of 32 riyals....

https://www.reuters.com/article/us-saudi-aramco-stocks/saudi…

.................................................................................................................................

Saudi-Arabien senkt nach Scheitern der Förderbremse Öl-Preise

(reu) Saudiarabien hat nach dem Scheitern der Gespräche zwischen der Opec und Russland über eine gemeinsame Förderbremse seine Ölpreise für April gesenkt. Der staatliche Öl-Konzern Saudi Aramco gab am Samstagabend bekannt, den offiziellen Verkaufspreis (OSP) für alle Sorten und alle Abnehmer zusammenzustreichen.

So werde der OSP für Lieferungen nach Nordwest-Europa um acht Dollar je Barrel gesenkt, hiess es. ...

https://www.nzz.ch/wirtschaft/saudearabien-senkt-nach-scheit…

.................................................................................................................................

Saudi Aramco: EU gibt grünes Licht für Sabic-Übernahme

06.03.2020

Sabic-Hauptquartier in Riyadh / Saudi-Arabien (Foto: Sabic)Sabic-Hauptquartier in Riyadh / Saudi-Arabien (Foto: Sabic)

Ende Februar erteilte die Europäische Kommission ihre vorbehaltlose Genehmigung für die Übernahme des Chemiekonzerns Sabic (Riyadh / Saudi-Arabien) durch den mit Abstand größten Ölförderer der Welt Saudi Aramco (Dhahran / Saudi-Arabien). Laut EU-Kartellbehörde werfe die Transaktion angesichts der „moderaten gemeinsamen Marktanteile“ der von beiden produzierten Petrochemikalien und Produkte keine Wettbewerbsbedenken auf. Die indische Wettbewerbsbehörde CCI hatte die Übernahme bereits im September 2019 genehmigt.

Saudi Aramco hatte im März 2019 angekündigt, ...

https://www.kunststoffweb.de/branchen-news/saudi_aramco_eu_g…

........

Saudi Aramco secures EC approval for $69bn stake acquisition in SABIC

Oil & GasDownstreamPetrochemicals

By NS Energy Staff Writer 02 Mar 2020

Announced about a year ago, Saudi Aramco's proposed acquisition of the majority stake in SABIC now has unconditional approvals across all jurisdictions in which pre-notification antitrust filings are needed ...

Saudi Aramco has secured an unconditional approval from the European Commission (EC) for its proposed 70% stake acquisition in Saudi Basic Industries Corporation (SABIC) for SAR259.12bn ($69.07bn).

The majority stake in the Saudi Arabian petrochemical company is being acquired by the oil and gas company from the Public Investment Fund of Saudi Arabia (PIF). ...

https://www.nsenergybusiness.com/news/saudi-aramco-sabic-dea…

... ... der ganze Jahresgewinn für 2020 ...

... der ganze Jahresgewinn für 2020 ...

..............................................................................................................

Thu 27 Feb 2020 12:32 PM

Saudi IPO nets $2.3bn for one of world's richest doctors

The IPO is the first in Saudi Arabia since state-owned oil company Saudi Aramco raised almost $30 billion in December

Dr Sulaiman Al Habib Medical Group is one of the biggest providers of healthcare in Saudi Arabia, operating hospitals, outpatient clinics, pharmacies and medical labs throughout the kingdom, as well as in Dubai (pictured) and Bahrain.

... ... China Konkurrenz für Organtransplantationen ... mit was macht man am meisten Gewinn ... un-Gesundheit ... Schöheits OP - Gehirn raus ... KI-Chip rein ...

... China Konkurrenz für Organtransplantationen ... mit was macht man am meisten Gewinn ... un-Gesundheit ... Schöheits OP - Gehirn raus ... KI-Chip rein ...

A Saudi paediatrician has become one of the world’s wealthiest doctors after the medical-services group he founded priced its initial public offering at the top of a marketed range.

https://www.tadawul.com.sa/wps/portal/tadawul/markets/listin…

Sulaiman Abdulaziz Al-Habib’s 49% stake in his eponymous company is worth 8.5 billion riyals ($2.3 billion), according to the Bloomberg Billionaires Index, based on the announced selling price of 50 riyals a share. He plans to sell 17.4 million shares in the IPO, according to the prospectus. The company didn’t respond to a request for comment.

Dr Sulaiman Al Habib Medical Group is one of the biggest providers of healthcare in Saudi Arabia, operating hospitals, outpatient clinics, pharmacies and medical labs throughout the kingdom, as well as in Dubai and Bahrain.

The IPO is the first in Saudi Arabia since state-owned oil company Saudi Aramco raised almost $30 billion in December.

Private sector health

The firm is seeking to capitalise on the government’s plans to ramp up private-sector participation in healthcare and the country’s demographic trends. Saudi Arabia’s population is disproportionately young and relatively unhealthy. More than a third of adults are obese and 18.5% suffer from diabetes, according to World Health Organization statistics.

Al-Habib, 68, established the business in 1993 after serving as chief medical officer and ...

https://www.arabianbusiness.com/healthcare/441413-saudi-ipo-…

https://thearabweekly.com/saudi-companies-look-build-momentu…

... zu viele Köche verderben den Brei ... Oil ...

... zu viele Köche verderben den Brei ... Oil ......

... zu viele Prinzen verd-erben den Stamm ...

... zu viele Prinzen verd-erben den Stamm .....................................................................................................................................................

Prinzen in Saudi-Arabien wegen Putsch-Plänen festgenommen

Epoch Times7. März 2020 Aktualisiert: 7. März 2020 6:47

König Salman Bruder Prinz Ahmed bin Abdulasis al-Saud und seinem Neffen Prinz Mohammed bin Najef wird Verrat zur Last gelegt. ...

https://www.epochtimes.de/politik/welt/medien-mehrere-prinze…

..................................................................................................................................................

March 7, 2020

United States Unleashes Military Coup In Saudi Arabia After Russia Ignites Oil Price Armageddon

By: Sorcha Faal, and as reported to her Western Subscribers

An astounding new Security Council (SC) report circulating in the Kremlin today adding a new and fearful chapter to The New Great Game reality of our world, makes it no wonder why top American energy security expert Samantha Gross has just stated with alarm “I'm a little shocked frankly because the Russians are really playing with fire”—a response Gross made to a series of pivotal moves occurring in this “New Great Game” yesterday that began with the United States blocking the United Nations from supporting a Russian-Turkish ceasefire in Syria—that Russia quickly countered by igniting a global “Oil Price Armageddon”—a term describing how Russia made a dramatic turn away from the Saudi-led OPEC+ and refused to cut production to hold up the price of oil—which cratered the price of oil to its present price of $41.57 a barrel—a catastrophic price for US oil producers who need a barrel of oil to cost as much as $65 to break even—and are the same US oil producers who were warned late last year that “2020 Will Be The Year Of Oil Bankruptcies”—a warning that swiftly became true yesterday as evidenced by what happened with the CBOE Volatility Index (VIX), otherwise known as the “Fear Gauge” or “Fear Index”—a creation of the Chicago Board Options Exchange (CBOE) that is a real-time market index that represents the market's expectation of 30-day forward-looking volatility—and that yesterday caught a large American financial entity disastrously betting everything they had on global oil prices being stabilized—the reaction to which saw shocked US market traders saying such things as “Someone Big Was Utterly Blown The Fuck Out”—“Someone Big Literally Doesn't Exist Anymore”—and “The Fed Must Now Step In Or A Catastrophic Crash Is Inevitable”—but to prevent such a catastrophic crash from happening, saw Saudi Arabia having paid $500 million to the US to move thousands of American military troops into their oil rich nation—American troops who yesterday, and joined by thousands of US troops stationed in neighboring countries, rapidly moved into combat readiness to protect vital Saudi government facilities and oil production centers—immediately after which, Crown Prince Mohammed bin Salman placed in detention his main rivals for power Prince Ahmed bin Abdulaziz, the younger brother of Saudi King Salman bin Abdulaziz al-Saud, royal cousin Prince Nawaf bin Nayef and former interior minister Mohammed bin Nayef—who were then accused in court of attempting a coup and are now under threat of lifetime imprisonment or execution—but whose real crime was their opposing the lost revenues caused by Saudi oil production cuts—production cuts whose main beneficiary are American oil producers needing a higher price per barrel—and due to Russia now having blown up the OPEC+ cartel, are Saudi oil production cuts sure to accelerate before an “inevitable crash” occurs.

http://www.whatdoesitmean.com/index3149.htm

..................................................................................................................

March 8, 2020 / 8:37 AM / Updated an hour ago

Saudi Aramco trades below IPO price for first time

DUBAI (Reuters) - Shares of Saudi Aramco (2222.SE) fell below their initial public offering (IPO) price on Sunday for the first time since they began trading in December after the OPEC oil supply cut pact with Russia fell apart on Friday.

Aramco shares were trading at 31.50 riyals ($8.40) at 0705 GMT, down 4.85%, compared to the IPO price of 32 riyals....

https://www.reuters.com/article/us-saudi-aramco-stocks/saudi…

.................................................................................................................................

Saudi-Arabien senkt nach Scheitern der Förderbremse Öl-Preise

(reu) Saudiarabien hat nach dem Scheitern der Gespräche zwischen der Opec und Russland über eine gemeinsame Förderbremse seine Ölpreise für April gesenkt. Der staatliche Öl-Konzern Saudi Aramco gab am Samstagabend bekannt, den offiziellen Verkaufspreis (OSP) für alle Sorten und alle Abnehmer zusammenzustreichen.

So werde der OSP für Lieferungen nach Nordwest-Europa um acht Dollar je Barrel gesenkt, hiess es. ...

https://www.nzz.ch/wirtschaft/saudearabien-senkt-nach-scheit…

.................................................................................................................................

Saudi Aramco: EU gibt grünes Licht für Sabic-Übernahme

06.03.2020

Sabic-Hauptquartier in Riyadh / Saudi-Arabien (Foto: Sabic)Sabic-Hauptquartier in Riyadh / Saudi-Arabien (Foto: Sabic)

Ende Februar erteilte die Europäische Kommission ihre vorbehaltlose Genehmigung für die Übernahme des Chemiekonzerns Sabic (Riyadh / Saudi-Arabien) durch den mit Abstand größten Ölförderer der Welt Saudi Aramco (Dhahran / Saudi-Arabien). Laut EU-Kartellbehörde werfe die Transaktion angesichts der „moderaten gemeinsamen Marktanteile“ der von beiden produzierten Petrochemikalien und Produkte keine Wettbewerbsbedenken auf. Die indische Wettbewerbsbehörde CCI hatte die Übernahme bereits im September 2019 genehmigt.

Saudi Aramco hatte im März 2019 angekündigt, ...

https://www.kunststoffweb.de/branchen-news/saudi_aramco_eu_g…

........

Saudi Aramco secures EC approval for $69bn stake acquisition in SABIC

Oil & GasDownstreamPetrochemicals

By NS Energy Staff Writer 02 Mar 2020

Announced about a year ago, Saudi Aramco's proposed acquisition of the majority stake in SABIC now has unconditional approvals across all jurisdictions in which pre-notification antitrust filings are needed ...

Saudi Aramco has secured an unconditional approval from the European Commission (EC) for its proposed 70% stake acquisition in Saudi Basic Industries Corporation (SABIC) for SAR259.12bn ($69.07bn).

The majority stake in the Saudi Arabian petrochemical company is being acquired by the oil and gas company from the Public Investment Fund of Saudi Arabia (PIF). ...

https://www.nsenergybusiness.com/news/saudi-aramco-sabic-dea…

...

... der ganze Jahresgewinn für 2020 ...

... der ganze Jahresgewinn für 2020 .................................................................................................................

Thu 27 Feb 2020 12:32 PM

Saudi IPO nets $2.3bn for one of world's richest doctors

The IPO is the first in Saudi Arabia since state-owned oil company Saudi Aramco raised almost $30 billion in December

Dr Sulaiman Al Habib Medical Group is one of the biggest providers of healthcare in Saudi Arabia, operating hospitals, outpatient clinics, pharmacies and medical labs throughout the kingdom, as well as in Dubai (pictured) and Bahrain.

...

... China Konkurrenz für Organtransplantationen ... mit was macht man am meisten Gewinn ... un-Gesundheit ... Schöheits OP - Gehirn raus ... KI-Chip rein ...

... China Konkurrenz für Organtransplantationen ... mit was macht man am meisten Gewinn ... un-Gesundheit ... Schöheits OP - Gehirn raus ... KI-Chip rein ...A Saudi paediatrician has become one of the world’s wealthiest doctors after the medical-services group he founded priced its initial public offering at the top of a marketed range.

https://www.tadawul.com.sa/wps/portal/tadawul/markets/listin…

Sulaiman Abdulaziz Al-Habib’s 49% stake in his eponymous company is worth 8.5 billion riyals ($2.3 billion), according to the Bloomberg Billionaires Index, based on the announced selling price of 50 riyals a share. He plans to sell 17.4 million shares in the IPO, according to the prospectus. The company didn’t respond to a request for comment.

Dr Sulaiman Al Habib Medical Group is one of the biggest providers of healthcare in Saudi Arabia, operating hospitals, outpatient clinics, pharmacies and medical labs throughout the kingdom, as well as in Dubai and Bahrain.

The IPO is the first in Saudi Arabia since state-owned oil company Saudi Aramco raised almost $30 billion in December.

Private sector health

The firm is seeking to capitalise on the government’s plans to ramp up private-sector participation in healthcare and the country’s demographic trends. Saudi Arabia’s population is disproportionately young and relatively unhealthy. More than a third of adults are obese and 18.5% suffer from diabetes, according to World Health Organization statistics.

Al-Habib, 68, established the business in 1993 after serving as chief medical officer and ...

https://www.arabianbusiness.com/healthcare/441413-saudi-ipo-…

https://thearabweekly.com/saudi-companies-look-build-momentu…

Antwort auf Beitrag Nr.: 62.909.700 von teecee1 am 06.03.20 17:16:55Freitagabend: ... im STAU ...

Microcap finalisiert krassen Millionendeal!

weiterlesen >>

.......................................................................................................................................................

Ölpreis auf Talfahrt – Opec-Förderlimits fallen trotz Corona-Krise zum 1. April

Epoch Times6. März 2020 Aktualisiert: 6. März 2020 20:23

Das Ölkartell Opec will die Produktion kürzen, doch sein Partner Russland wehrt sich. Letztlich enden die Gespräche ohne Deal. Die Opec+ steht mitten in der Corona-Krise vor einer Belastungsprobe.

...

Saudi-Arabiens Staatshaushalt in Gefahr

Vor allem für das Opec-Schwergewicht Saudi-Arabien stellt ein so niedriger Ölpreis auch mit Blick auf den Staatshaushalt ein Problem dar. Daher hatte sich der Wüstenstaat zuletzt immer wieder bereit erklärt, für den Großteil der Kürzungen aufzukommen oder gar zusätzliche, freiwillige Einschränkungen vorzunehmen. Russland dagegen zeigte zuletzt wenig Interesse, den Ölpreis durch eine geringere Produktion in die Höhe zu treiben.

Zuletzt hatte die „Opec+“ im Dezember 2019 den Ölhahn weiter zugedreht und eine tägliche Produktionskürzung um insgesamt 2,1 Millionen Barrel im Vergleich zu Oktober 2018 beschlossen. Seit Dezember 2016 reagierte der Verbund immer wieder mit solchen Förderlimits auf die Entwicklungen am Ölmarkt – und riskierte damit zunehmend Marktanteile. Derzeit entfallen auf die Opec etwas weniger als 30 Prozent der weltweiten Ölproduktion, vor einigen Jahren war der Anteil noch deutlich höher. Die größere Runde der „Opec+“ steht derzeit für etwa 45 Prozent der globalen Rohölproduktion.

Unterbietungswettbewerb nicht unwahrscheinlich

Spannend wird nun sein, ...

https://www.epochtimes.de/wirtschaft/oelpreis-auf-talfahrt-o…

... ... was erreicht man damit ... was ist das Ziel ... ??? ... Shell, Total, OMV, etc. ... Nordbeam3 ... Spekulanten etc. ... stabile Preise - stabile Wirtschaft ...

... was erreicht man damit ... was ist das Ziel ... ??? ... Shell, Total, OMV, etc. ... Nordbeam3 ... Spekulanten etc. ... stabile Preise - stabile Wirtschaft ...

... ... Bei einem schwankenden Ölpreis(Markt etc.) lässt sich nicht langfristig planen ... Haushalt etc. ... die einzigen die davon profitieren sind ... ??? ... denen das egal ist ...

... Bei einem schwankenden Ölpreis(Markt etc.) lässt sich nicht langfristig planen ... Haushalt etc. ... die einzigen die davon profitieren sind ... ??? ... denen das egal ist ...

...................................................................................................................................................

"Today Will Be A Regretful Day" - Oil Prices Have Collapsed After OPEC+ Talks End Without A Deal

by Tyler Durden

Fri, 03/06/2020 - 11:18

Update (1115ET): Oil prices are utterly collapsing after the OPEC+ talks have ended with no agreement on current or further production cuts and very terse communique.

Saudi Oil Minister Prince Abdulaziz bin Salman is quoted by delegates as having said inside the OPEC+ meeting that “today will be a regretful day.”

WTI is down 9%, trading with a $41 handle!

https://www.zerohedge.com/markets/oil-plunges-4-after-russia…

... ... wann fallen die $40 ... 💩 ... Lektion 1, 2,u, 3 ...