Wirecard-Aktie: Neuer Softbank-Deal, neue Milliarden an Transaktionsvolumen? - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 20.12.19 16:10:58 von

neuester Beitrag 05.12.20 11:46:59 von

neuester Beitrag 05.12.20 11:46:59 von

Beiträge: 28

ID: 1.317.357

ID: 1.317.357

Aufrufe heute: 0

Gesamt: 4.593

Gesamt: 4.593

Aktive User: 0

ISIN: DE0007472060 · WKN: 747206 · Symbol: WDI

0,0518

EUR

-32,90 %

-0,0254 EUR

Letzter Kurs 15.11.21 Frankfurt

Neuigkeiten

05.01.24 · BörsenNEWS.de |

09.12.23 · BörsenNEWS.de |

08.12.23 · BörsenNEWS.de |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +500,00 | |

| 0,6800 | +312,12 | |

| 9,0000 | +17,65 | |

| 1,6800 | +15,87 | |

| 2,1400 | +12,93 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,0700 | -12,45 | |

| 446,00 | -13,43 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 | |

| 0,5338 | -31,13 |

Es handelt sich um einen automatisiert angelegten Thread zur Nachricht "Wirecard-Aktie: Neuer Softbank-Deal, neue Milliarden an Transaktionsvolumen?" vom Autor The Motley Fool

Die Aktie von Wirecard (WKN: 747206) befindet sich derzeit noch immer im Zwiespalt zwischen der Financial Times und den Vorwürfen der bilanziellen Unregelmäßigkeiten sowie der spannenden Wachstumsgeschichte, die hinter diesem …

Lesen Sie den ganzen Artikel: Wirecard-Aktie: Neuer Softbank-Deal, neue Milliarden an Transaktionsvolumen?

Die Aktie von Wirecard (WKN: 747206) befindet sich derzeit noch immer im Zwiespalt zwischen der Financial Times und den Vorwürfen der bilanziellen Unregelmäßigkeiten sowie der spannenden Wachstumsgeschichte, die hinter diesem …

Lesen Sie den ganzen Artikel: Wirecard-Aktie: Neuer Softbank-Deal, neue Milliarden an Transaktionsvolumen?

NEW COVER: Masayoshi Son's SoftBank Vision Fund has bigger problems than WeWork.

The visionary venture capital firm is famous for making outsize bets on tech startups. It has also been described as an environment of sycophancy and harassment https://bloom.bg/38OHJyh

https://www.youtube.com/watch?v=0DBO00x1EuY

The visionary venture capital firm is famous for making outsize bets on tech startups. It has also been described as an environment of sycophancy and harassment https://bloom.bg/38OHJyh

https://www.youtube.com/watch?v=0DBO00x1EuY

Antwort auf Beitrag Nr.: 62.207.544 von teecee1 am 20.12.19 16:10:58Das ist ja billig.

Ein Video mit Geldverbrennung.

Hoffentlich schauen sich das die LV an, die wollen, das das Geld der Aktionäre brennt.

Es könnte aber auch ihres sein.

In diesem Sinn frohe Weihnachten.

Ein Video mit Geldverbrennung.

Hoffentlich schauen sich das die LV an, die wollen, das das Geld der Aktionäre brennt.

Es könnte aber auch ihres sein.

In diesem Sinn frohe Weihnachten.

Antwort auf Beitrag Nr.: 62.207.544 von teecee1 am 20.12.19 16:10:58

... 😴 ... 27/4 ... digitales 💸 Geld schläft nicht ... 24/7 ...😴 ...

........................................................................................................................................................

... 🎅 ... Tesla ... 🎅 ...

Masayoshi Son, Tech Visionary or Robber Baron?

Shuli Ren

Bloomberg December 23, 2019

...

So how did the world fall out of love with Masa Son?

Over the past three years, Son has deployed his giant war chest aggressively, threatening to back a startup’s rival if founders refuse his money, or investing in competitors and forcing them to merge. These unsavory tactics only became more bothersome when much-hyped SoftBank-backed IPOs started failing. Now we’re coming to realize that Son is less a technology guru than a die-hard capitalist, reinventing the 19th-century business model by squeezing workers for a bit of extra profit.

Take a look at the Vision Fund’s portfolio. Rather than investing in hard tech such as AI or chip design, a whopping 40% has been funneled into transportation and logistics companies such as Uber and its ride-hailing clones around the world. You can be sure that drivers on the streets of Shanghai and Jakarta don’t get insurance or pension benefits; they’re only paid per ride. This contract culture seeps well beyond delivery, too: India’s lodging chain Oyo Hotels and Homes, for instance, is asking mom-and-pop business owners to absorb big fixed costs upfront, a New York Times investigation found.

But we are living in the 21st century, when human capital ought be worth something and worker protests have erupted around the world. In China alone, three SoftBank-backed unicorns faced 32 strikes last year. So it’s just a matter of time before governments start to step in, demanding better labor protection. If you buy into Karl Marx’s view that a business’s profit pie is a zero-sum divide between workers and capitalists, Son’s portion will inevitably shrink. Put another way, the path to profitability for many of his unicorns will be long and winding — or may even lead to a dead end.

For now, SoftBank is running like a well-oiled machine. But with the Vision Fund fully deployed, and the second iteration likely a lot smaller, Son may have trouble offloading his startup stakes. To make matters worse, he has folded WeWork under the SoftBank umbrella. Beyond footing the bill for a bailout, ...

https://finance.yahoo.com/news/masayoshi-son-tech-visionary-…

......................................................................................................................................................

SoftBank $3B Bailout Bid For WeWork Stuck As Banks Considering 'Credit Risk'

Amit Nag ,Benzinga • December 23, 2019

SoftBank Group Corp’s (OTC: SFTBY) talks with Japan’s top three banks to secure $3 billion to help fund its support of a real estate startup WeWork have stalled, according to Reuters.

What Happened

Japan’s three biggest banks are considering the credit risks involved with a $3 billion loan that SoftBank is seeking from the banks to help ...

https://finance.yahoo.com/news/softbank-3b-bailout-bid-wewor…

.........................

... In his latest comment on the repo market, Curvature's Scott Skyrm noted that "once the term RP operations switch to being undersubscribed, it either means most of the Street's year-end funding need is fulfilled, or banks are close to their balance sheet limits." His full comment below:

https://www.zerohedge.com/markets/repo-crisis-fades-away-sec…

......................

https://www.zerohedge.com/technology/tesla-slides-deeper-poc…

.......................................................................................................................................................

... 💣 ... wenn Softbank implodiert ... 🦃 ... hängt alles an einer Strippe-nzieher ... wenn Ihr mich fallen lasst ... 💩 ... FED ...

... 😴 ... 27/4 ... digitales 💸 Geld schläft nicht ... 24/7 ...😴 ...

........................................................................................................................................................

... 🎅 ... Tesla ... 🎅 ...

Masayoshi Son, Tech Visionary or Robber Baron?

Shuli Ren

Bloomberg December 23, 2019

...

So how did the world fall out of love with Masa Son?

Over the past three years, Son has deployed his giant war chest aggressively, threatening to back a startup’s rival if founders refuse his money, or investing in competitors and forcing them to merge. These unsavory tactics only became more bothersome when much-hyped SoftBank-backed IPOs started failing. Now we’re coming to realize that Son is less a technology guru than a die-hard capitalist, reinventing the 19th-century business model by squeezing workers for a bit of extra profit.

Take a look at the Vision Fund’s portfolio. Rather than investing in hard tech such as AI or chip design, a whopping 40% has been funneled into transportation and logistics companies such as Uber and its ride-hailing clones around the world. You can be sure that drivers on the streets of Shanghai and Jakarta don’t get insurance or pension benefits; they’re only paid per ride. This contract culture seeps well beyond delivery, too: India’s lodging chain Oyo Hotels and Homes, for instance, is asking mom-and-pop business owners to absorb big fixed costs upfront, a New York Times investigation found.

But we are living in the 21st century, when human capital ought be worth something and worker protests have erupted around the world. In China alone, three SoftBank-backed unicorns faced 32 strikes last year. So it’s just a matter of time before governments start to step in, demanding better labor protection. If you buy into Karl Marx’s view that a business’s profit pie is a zero-sum divide between workers and capitalists, Son’s portion will inevitably shrink. Put another way, the path to profitability for many of his unicorns will be long and winding — or may even lead to a dead end.

For now, SoftBank is running like a well-oiled machine. But with the Vision Fund fully deployed, and the second iteration likely a lot smaller, Son may have trouble offloading his startup stakes. To make matters worse, he has folded WeWork under the SoftBank umbrella. Beyond footing the bill for a bailout, ...

https://finance.yahoo.com/news/masayoshi-son-tech-visionary-…

......................................................................................................................................................

SoftBank $3B Bailout Bid For WeWork Stuck As Banks Considering 'Credit Risk'

Amit Nag ,Benzinga • December 23, 2019

SoftBank Group Corp’s (OTC: SFTBY) talks with Japan’s top three banks to secure $3 billion to help fund its support of a real estate startup WeWork have stalled, according to Reuters.

What Happened

Japan’s three biggest banks are considering the credit risks involved with a $3 billion loan that SoftBank is seeking from the banks to help ...

https://finance.yahoo.com/news/softbank-3b-bailout-bid-wewor…

.........................

... In his latest comment on the repo market, Curvature's Scott Skyrm noted that "once the term RP operations switch to being undersubscribed, it either means most of the Street's year-end funding need is fulfilled, or banks are close to their balance sheet limits." His full comment below:

https://www.zerohedge.com/markets/repo-crisis-fades-away-sec…

......................

https://www.zerohedge.com/technology/tesla-slides-deeper-poc…

.......................................................................................................................................................

... 💣 ... wenn Softbank implodiert ... 🦃 ... hängt alles an einer Strippe-nzieher ... wenn Ihr mich fallen lasst ... 💩 ... FED ...

Antwort auf Beitrag Nr.: 62.221.946 von teecee1 am 23.12.19 16:31:48Rettung durch das Fed: Was ist bloss am amerikanischen Geldmarkt los?

Die US-Notenbank hat seit der Finanzkrise viel Geld in den Markt gepumpt. Die Banken haben sich bequem eingerichtet. Das rächt sich: Beim Versuch, Liquidität abzuschöpfen, kommt es zu Verwerfungen. Sogleich springt das Fed wieder ein. Ratlosigkeit macht sich breit.

https://apps.newyorkfed.org/markets/autorates/tomo-results-d…

Martin Lanz, Washington

24.12.2019, 06.00 Uhr

Am amerikanischen Geldmarkt rumort es. Mitte September stiegen die Zinssätze plötzlich stark an, scheinbar aus heiterem Himmel. Die US-Notenbank musste die Situation mit Liquiditätsspritzen beruhigen. Könnte das ein Vorbote einer neuen Finanzkrise sein? Jedenfalls weckt dies ungute Erinnerungen. Vor gut einem Jahrzehnt vertrauten sich die Banken untereinander nicht mehr, was zum Einfrieren des Geldmarktes führte. Was steckt dieses Mal dahinter? Die Ursachenforschung führt unter anderem nach Washington, zu den steigenden Haushaltsdefiziten.

Wenn 150 Milliarden Dollar den Besitzer wechseln

Wie kam es im September zu den Ausschlägen im Finanzsystem? Das US-Finanzministerium zog am 16. September von Grossfirmen planmässig Steuerzahlungen ein und wickelte gleichentags eine umfangreiche Auktion von Schatzanweisungen (Treasury Bills) ab. Innert eines Tages flossen deshalb riesige Beträge von den Girokonten, die Geschäftsbanken bei der Notenbank haben, auf das Girokonto des Finanzministeriums beim Fed.

Wie gross sollen die Sichtguthaben der Banken beim Fed sein?

https://www.nzz.ch/wirtschaft/erst-schlaefert-das-fed-den-ge…

.........................................................................................................................................................

Below is the transcript of the interview:

--- Beginning of transcript ---

Hoshino: Hello everyone. Today is December 20th, 2019. My name is Hoshino. Next year is going to be very exciting as we enter the Age of Aquarius. We are going to have a mass meditation on the Age of Aquarius Activation in January with the aim to bring the financial reset to the reality. And I'm really happy to have two very special guests, Cobra and Benjamin Fulford to have an interview with me about this meditation and the current situation of the financial system.

So welcome, Cobra.

Cobra: Thank you for your invitation.

Hoshino: And welcome Ben.

Benjamin Fulford: Yeah thanks for having me on.

Hoshino: We have received many questions from our readers, and so without further ado, let’s start talking about the current situation of the financial system. So, Ben, based on your observation, how would you describe the current situation of the real economy? How bad is it?

Ben: Well, that’s kind of a loaded question. It depends what you're talking about, but essentially what's happened is that the United States has de-industrialized and now they are having trouble paying for their Imports. But they still control the dollar printing press and their reserve currency. What they're doing is they're creating trillions of dollars and pumping it into the stock market, which they control so they're using the stock market to launder their funny money to keep their system afloat but they don't have the physical production to back up their funny money, that's the situation. So, it's just a matter of time before the whole system collapses and that's why they're desperately trying to get China to buy more stuff. That's why we have Trump saying that China is going to buy 200 billion dollars of stuff every year from them, because if they don't get, that they're doomed. But I've been arguing that we need to bankrupt them because they've been at war for most of the past 240 years and they have a dysfunctional society and a dysfunctional system that needs to be rebooted and the American people need to be liberated.

Hoshino: Right, thank you for that. Cobra, do you have anything to add on this?

Cobra: Yes, basically what is happening is that this debt-based financial system was ongoing for quite some time, and it was quite successful for the Cabal because it was their way of controlling the surface population but what is happening now is that there are more and more structural inconsistencies in the system and more and more people are aware of them. And this awareness is what is actually starting to accelerate the collapse of the old system and this is what we are experiencing right now. It is not yet the common knowledge; an average person in the United States, still thinks that the stock market is doing great everything is just perfect and they are not really aware of what is happening at the core of the system and this is what we will be talking about a little bit today.

Hoshino: Thank you. So, Ben, based on your experience as a journalist in the financial industry, do you have any suggestions on finding indexes of the real economic situation instead of looking at indexes such as Dow Jones Index or being brainwashed by the mainstream media?

Ben: Well, the things you need to look at are actual industrial production, you need to look at goods and services, imports and exports and trade balances. In other words, any index that's based on stuff that actually exists as opposed to, virtual things such as derivatives which are maybe 1,000 times more in number than the actual underlying real thing that it's supposed to be based on. So, you look at the Baltic Dry Index to look at what's happening with ships, you look at what's happening to the physical trade and then you look at for how well the people are doing you need to look at something called median GNP per capita which means it's the level where half the people are above and half the people are below. So, for example in Canada, it is about $80,000 and in the US it's more like $15,000. But if you look at per capita GDP which say per fare, it looks like the Americans are richer. So you have to at the end of the day see how you yourself and your family are doing compared to before and that's the best way to look at it.

Hoshino: Right. Cobra, do you agree with that? Do you have anything to add?

Cobra: Yes. Actually this is the core of the situation. The current financial system is not based on real trade it's not actually a capitalist system. it is based on the theoretical value which is created with sophisticated computer programs. All these derivatives, all the stock market, all… even the treasuries, all those financial instruments are just an idea that exists inside of a computer, and the state of economy does not reflect anymore the real production. And this is the core of the issue. What will happen in the coming collapse is that the planetary financial system will have to revert back to the real basics in a new way. It will have to revert to real production, real productivity and real creativity of people and not this funny money situation which existed for the last two centuries and after World War II especially. This is going to change.

Ben: I would say to be honest I think the real problem started in 1971, ...

https://www.welovemassmeditation.com/2019/12/interview-with-…

.....................................................................................................................................................

Einführung von Quantum Financial System (QFS) und Global Currency Reset

QFS-System ohne Äquivalente weiterentwickelt

Politiker und Bankiers wurden in Echtzeit auf frischer Tat ertappt.

Tiefe Staatsschlacht ist verloren; unser Sieg ist nahe.

Jedes Land muss GESARA-konform sein, um am QFS teilnehmen zu können.

QFS beendet korruptes Zentralbankensystem der Kabale

Das QFS-System wird das neue globale Netzwerk für den Transfer von Gold oder Asset-Backed-Geld abdecken, das von Russland und China initiiert wurde, um das US-zentral gesteuerte Swift-System zu ersetzen.

Dieses neue Quantum Financial System – QFS läuft auf einem Quantencomputer, der auf einem umlaufenden Satelliten basiert, und wird durch Secret Space Programme geschützt, um sicherzustellen, ...

http://finalwakeupcall.info/de/2019/03/13/qfs-auserweltliche…

............................

Trump ruft "Space Force" als neue US-Teilstreitkraft ins Leben

Aktualisiert am 21. Dezember 2019, 19:48 Uhr

Erfolg für den US-Präsidenten: Donald Trump hat die Bildung einer "Space Force" angeregt, nun wird das Projekt Wirklichkeit. Der Republikaner will damit "die amerikanische Überlegenheit im Weltraum" sichern.

Mit einer neu geschaffenen "Space Force" wappnet sich das US-Militär für Konflikte im Weltraum. Nach der Verabschiedung durch den Kongress unterzeichnete Präsident Donald Trump am Freitagabend (Ortszeit) ein Gesetzespaket zum Verteidigungshaushalt (NDAA), ...

https://www.gmx.net/magazine/politik/trump-ruft-space-force-…

...........................

Die US-Notenbank hat seit der Finanzkrise viel Geld in den Markt gepumpt. Die Banken haben sich bequem eingerichtet. Das rächt sich: Beim Versuch, Liquidität abzuschöpfen, kommt es zu Verwerfungen. Sogleich springt das Fed wieder ein. Ratlosigkeit macht sich breit.

https://apps.newyorkfed.org/markets/autorates/tomo-results-d…

Martin Lanz, Washington

24.12.2019, 06.00 Uhr

Am amerikanischen Geldmarkt rumort es. Mitte September stiegen die Zinssätze plötzlich stark an, scheinbar aus heiterem Himmel. Die US-Notenbank musste die Situation mit Liquiditätsspritzen beruhigen. Könnte das ein Vorbote einer neuen Finanzkrise sein? Jedenfalls weckt dies ungute Erinnerungen. Vor gut einem Jahrzehnt vertrauten sich die Banken untereinander nicht mehr, was zum Einfrieren des Geldmarktes führte. Was steckt dieses Mal dahinter? Die Ursachenforschung führt unter anderem nach Washington, zu den steigenden Haushaltsdefiziten.

Wenn 150 Milliarden Dollar den Besitzer wechseln

Wie kam es im September zu den Ausschlägen im Finanzsystem? Das US-Finanzministerium zog am 16. September von Grossfirmen planmässig Steuerzahlungen ein und wickelte gleichentags eine umfangreiche Auktion von Schatzanweisungen (Treasury Bills) ab. Innert eines Tages flossen deshalb riesige Beträge von den Girokonten, die Geschäftsbanken bei der Notenbank haben, auf das Girokonto des Finanzministeriums beim Fed.

Wie gross sollen die Sichtguthaben der Banken beim Fed sein?

https://www.nzz.ch/wirtschaft/erst-schlaefert-das-fed-den-ge…

.........................................................................................................................................................

Below is the transcript of the interview:

--- Beginning of transcript ---

Hoshino: Hello everyone. Today is December 20th, 2019. My name is Hoshino. Next year is going to be very exciting as we enter the Age of Aquarius. We are going to have a mass meditation on the Age of Aquarius Activation in January with the aim to bring the financial reset to the reality. And I'm really happy to have two very special guests, Cobra and Benjamin Fulford to have an interview with me about this meditation and the current situation of the financial system.

So welcome, Cobra.

Cobra: Thank you for your invitation.

Hoshino: And welcome Ben.

Benjamin Fulford: Yeah thanks for having me on.

Hoshino: We have received many questions from our readers, and so without further ado, let’s start talking about the current situation of the financial system. So, Ben, based on your observation, how would you describe the current situation of the real economy? How bad is it?

Ben: Well, that’s kind of a loaded question. It depends what you're talking about, but essentially what's happened is that the United States has de-industrialized and now they are having trouble paying for their Imports. But they still control the dollar printing press and their reserve currency. What they're doing is they're creating trillions of dollars and pumping it into the stock market, which they control so they're using the stock market to launder their funny money to keep their system afloat but they don't have the physical production to back up their funny money, that's the situation. So, it's just a matter of time before the whole system collapses and that's why they're desperately trying to get China to buy more stuff. That's why we have Trump saying that China is going to buy 200 billion dollars of stuff every year from them, because if they don't get, that they're doomed. But I've been arguing that we need to bankrupt them because they've been at war for most of the past 240 years and they have a dysfunctional society and a dysfunctional system that needs to be rebooted and the American people need to be liberated.

Hoshino: Right, thank you for that. Cobra, do you have anything to add on this?

Cobra: Yes, basically what is happening is that this debt-based financial system was ongoing for quite some time, and it was quite successful for the Cabal because it was their way of controlling the surface population but what is happening now is that there are more and more structural inconsistencies in the system and more and more people are aware of them. And this awareness is what is actually starting to accelerate the collapse of the old system and this is what we are experiencing right now. It is not yet the common knowledge; an average person in the United States, still thinks that the stock market is doing great everything is just perfect and they are not really aware of what is happening at the core of the system and this is what we will be talking about a little bit today.

Hoshino: Thank you. So, Ben, based on your experience as a journalist in the financial industry, do you have any suggestions on finding indexes of the real economic situation instead of looking at indexes such as Dow Jones Index or being brainwashed by the mainstream media?

Ben: Well, the things you need to look at are actual industrial production, you need to look at goods and services, imports and exports and trade balances. In other words, any index that's based on stuff that actually exists as opposed to, virtual things such as derivatives which are maybe 1,000 times more in number than the actual underlying real thing that it's supposed to be based on. So, you look at the Baltic Dry Index to look at what's happening with ships, you look at what's happening to the physical trade and then you look at for how well the people are doing you need to look at something called median GNP per capita which means it's the level where half the people are above and half the people are below. So, for example in Canada, it is about $80,000 and in the US it's more like $15,000. But if you look at per capita GDP which say per fare, it looks like the Americans are richer. So you have to at the end of the day see how you yourself and your family are doing compared to before and that's the best way to look at it.

Hoshino: Right. Cobra, do you agree with that? Do you have anything to add?

Cobra: Yes. Actually this is the core of the situation. The current financial system is not based on real trade it's not actually a capitalist system. it is based on the theoretical value which is created with sophisticated computer programs. All these derivatives, all the stock market, all… even the treasuries, all those financial instruments are just an idea that exists inside of a computer, and the state of economy does not reflect anymore the real production. And this is the core of the issue. What will happen in the coming collapse is that the planetary financial system will have to revert back to the real basics in a new way. It will have to revert to real production, real productivity and real creativity of people and not this funny money situation which existed for the last two centuries and after World War II especially. This is going to change.

Ben: I would say to be honest I think the real problem started in 1971, ...

https://www.welovemassmeditation.com/2019/12/interview-with-…

.....................................................................................................................................................

Einführung von Quantum Financial System (QFS) und Global Currency Reset

QFS-System ohne Äquivalente weiterentwickelt

Politiker und Bankiers wurden in Echtzeit auf frischer Tat ertappt.

Tiefe Staatsschlacht ist verloren; unser Sieg ist nahe.

Jedes Land muss GESARA-konform sein, um am QFS teilnehmen zu können.

QFS beendet korruptes Zentralbankensystem der Kabale

Das QFS-System wird das neue globale Netzwerk für den Transfer von Gold oder Asset-Backed-Geld abdecken, das von Russland und China initiiert wurde, um das US-zentral gesteuerte Swift-System zu ersetzen.

Dieses neue Quantum Financial System – QFS läuft auf einem Quantencomputer, der auf einem umlaufenden Satelliten basiert, und wird durch Secret Space Programme geschützt, um sicherzustellen, ...

http://finalwakeupcall.info/de/2019/03/13/qfs-auserweltliche…

............................

Trump ruft "Space Force" als neue US-Teilstreitkraft ins Leben

Aktualisiert am 21. Dezember 2019, 19:48 Uhr

Erfolg für den US-Präsidenten: Donald Trump hat die Bildung einer "Space Force" angeregt, nun wird das Projekt Wirklichkeit. Der Republikaner will damit "die amerikanische Überlegenheit im Weltraum" sichern.

Mit einer neu geschaffenen "Space Force" wappnet sich das US-Militär für Konflikte im Weltraum. Nach der Verabschiedung durch den Kongress unterzeichnete Präsident Donald Trump am Freitagabend (Ortszeit) ein Gesetzespaket zum Verteidigungshaushalt (NDAA), ...

https://www.gmx.net/magazine/politik/trump-ruft-space-force-…

...........................

!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de

Antwort auf Beitrag Nr.: 62.248.436 von teecee1 am 30.12.19 12:38:19But the Deep State is much broader than just the government. It includes the heads of major corporations, all of whom are heavily involved in selling to the State and enabling it. That absolutely includes Silicon Valley, although those guys at least have a sense of humor, evidenced by their “Don’t Be Evil” motto.

It also includes all the top people in the Fed, and the heads of all the major banks, brokers, and insurers. Add the presidents and many professors at top universities, which act as Deep State recruiting centers… all the top media figures, of course… and many regulars at things like Bohemian Grove and the Council on Foreign Relations. They epitomize the status quo, held together by power, money, and propaganda. ...

https://www.zerohedge.com/political/doug-casey-deep-state-re…

https://www.zerohedge.com/geopolitical/understanding-deep-st…

... 😴 ... Gier frist Hirn ... Corona Test vs Corruption ... 💰 ...

But we don’t have time to go all the way down the rabbit hole, ... 🎅 ... test a Rabbit, a Goat, a Wolf, many "SleepSheeps", ... a Papaya ... 🎁 ...

It also includes all the top people in the Fed, and the heads of all the major banks, brokers, and insurers. Add the presidents and many professors at top universities, which act as Deep State recruiting centers… all the top media figures, of course… and many regulars at things like Bohemian Grove and the Council on Foreign Relations. They epitomize the status quo, held together by power, money, and propaganda. ...

https://www.zerohedge.com/political/doug-casey-deep-state-re…

https://www.zerohedge.com/geopolitical/understanding-deep-st…

... 😴 ... Gier frist Hirn ... Corona Test vs Corruption ... 💰 ...

But we don’t have time to go all the way down the rabbit hole, ... 🎅 ... test a Rabbit, a Goat, a Wolf, many "SleepSheeps", ... a Papaya ... 🎁 ...

Antwort auf Beitrag Nr.: 64.192.138 von teecee1 am 26.06.20 12:11:02

................................

Börse

20 Jahre Neuer Markt: Was von den Trümmern übrig blieb

https://www.focus.de/finanzen/experten/boerse-20-jahre-neuer…

...........................................................................................................................................................

Gerichtsurteil straft T-Aktionäre ab - zu Recht

Veröffentlicht am 16.05.2012 | Lesedauer: 2 Minuten

Von Karsten Seibel

Kein Verzicht auf Privatanleger

Das Oberlandesgericht stellt mit dem Entscheid zum Musterverfahren indirekt nichts anderes fest, als dass allzu blauäugige Anleger die Finger von einem Börsengang lassen sollten. So drückte es die Vorsitzende Richterin natürlich nicht aus. Sie wies darauf hin, ...

https://www.welt.de/debatte/kommentare/article106325290/Geri…

...........................................................................................................................................................

.. Buuub ... 💥 ...

... Wirecard Assets ...

- Gold: ...

- Silber: ...

- Platinmetalle: ...

- Beton, Ytong, Gipskartooon ...

- 💩-Papier ...

- Schmutzfänger-Masken ...

- Corona Impfampullen ...

... wie gut brennt Papiergeld ... ??? ... Bargeld kommt weg ... !!! ... „Mindestreserve“ ...

🔥🔥🔥🔥🔥

................................

Börse

20 Jahre Neuer Markt: Was von den Trümmern übrig blieb

https://www.focus.de/finanzen/experten/boerse-20-jahre-neuer…

...........................................................................................................................................................

Gerichtsurteil straft T-Aktionäre ab - zu Recht

Veröffentlicht am 16.05.2012 | Lesedauer: 2 Minuten

Von Karsten Seibel

Kein Verzicht auf Privatanleger

Das Oberlandesgericht stellt mit dem Entscheid zum Musterverfahren indirekt nichts anderes fest, als dass allzu blauäugige Anleger die Finger von einem Börsengang lassen sollten. So drückte es die Vorsitzende Richterin natürlich nicht aus. Sie wies darauf hin, ...

https://www.welt.de/debatte/kommentare/article106325290/Geri…

...........................................................................................................................................................

.. Buuub ... 💥 ...

... Wirecard Assets ...

- Gold: ...

- Silber: ...

- Platinmetalle: ...

- Beton, Ytong, Gipskartooon ...

- 💩-Papier ...

- Schmutzfänger-Masken ...

- Corona Impfampullen ...

... wie gut brennt Papiergeld ... ??? ... Bargeld kommt weg ... !!! ... „Mindestreserve“ ...

🔥🔥🔥🔥🔥

Antwort auf Beitrag Nr.: 64.213.042 von teecee1 am 28.06.20 18:55:40 ... 💶 ... ein Anruf bei der EZB und das ...-Geld wird gedruckt ... 💶💶💶 ... Mrd. ... 💥 ...

https://de.wikipedia.org/wiki/Europ%C3%A4ische_Zentralbank

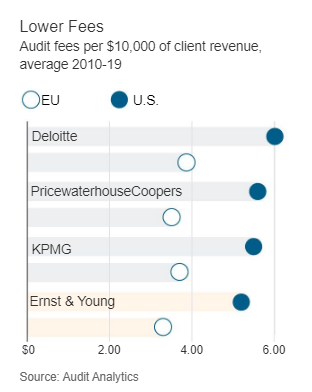

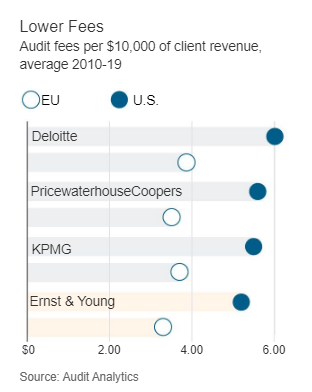

Wirecard: Anwälte geschädigter Anleger wollen jetzt Ernst & Young und den Staat verklagen ... 🤣 ...

Von Reinhard Werner 7. Juli 2020 Aktualisiert: 7. Juli 2020 18:55

Der Zahlungsdienst Wirecard ist nach dem Auffliegen eines Betrugsskandals insolvent. Nun wollen Gläubiger von Ernst & Young als Wirtschaftsprüfer und notfalls auch vom Staat Schadensersatz fordern. Anwälte bereiten zurzeit Sammelklagen für bis zu 10.000 Geschädigte vor.

Auf die Wirtschaftsprüfer von Ernst & Young (EY) könnte infolge der Wirecard-Insolvenz schon bald eine Sammelklage zurollen. Wie der „Focus“ berichtet, wollen die Anwälte Wolfgang Schirp und Marc Liebscher eine Sammelklage von 7.000 bis 10.000 Mandanten anstrengen, die durch das Geschäftsgebaren von Wirecard Schäden in einer Gesamthöhe von 1,5 Milliarden Euro erlitten hätten.

Das „kleine Einmaleins des Wirtschaftsprüfer-Geschäfts“ missachtet?

Von Wirecard selbst ist nichts mehr zu holen. Nachdem im April erste Nachrichten über falsche Konzernabschlüsse, ...

https://www.epochtimes.de/wirtschaft/unternehmen/wirecard-an…

https://de.wikipedia.org/wiki/Europ%C3%A4ische_Zentralbank

Wirecard: Anwälte geschädigter Anleger wollen jetzt Ernst & Young und den Staat verklagen ... 🤣 ...

Von Reinhard Werner 7. Juli 2020 Aktualisiert: 7. Juli 2020 18:55

Der Zahlungsdienst Wirecard ist nach dem Auffliegen eines Betrugsskandals insolvent. Nun wollen Gläubiger von Ernst & Young als Wirtschaftsprüfer und notfalls auch vom Staat Schadensersatz fordern. Anwälte bereiten zurzeit Sammelklagen für bis zu 10.000 Geschädigte vor.

Auf die Wirtschaftsprüfer von Ernst & Young (EY) könnte infolge der Wirecard-Insolvenz schon bald eine Sammelklage zurollen. Wie der „Focus“ berichtet, wollen die Anwälte Wolfgang Schirp und Marc Liebscher eine Sammelklage von 7.000 bis 10.000 Mandanten anstrengen, die durch das Geschäftsgebaren von Wirecard Schäden in einer Gesamthöhe von 1,5 Milliarden Euro erlitten hätten.

Das „kleine Einmaleins des Wirtschaftsprüfer-Geschäfts“ missachtet?

Von Wirecard selbst ist nichts mehr zu holen. Nachdem im April erste Nachrichten über falsche Konzernabschlüsse, ...

https://www.epochtimes.de/wirtschaft/unternehmen/wirecard-an…

Antwort auf Beitrag Nr.: 64.325.690 von teecee1 am 07.07.20 20:35:23Wirecard-Skandal nimmt skurrile Züge an ... Schach ... ☕ ...

Von Petra Henning

Aktualisiert am 18. Juli 2020, 17:32 Uhr

Der Bilanzskandal wird immer skurriler. Während CEO Markus Braun und Manager Oliver Bellenhaus mit der Staatsanwaltschaft kooperieren, ist Ex-Vorstand Jan Marsalek weiter auf der Flucht. Doch der Skandal zieht zunehmend auch politische Kreise: Finanzminister Olaf Scholz wusste bereits seit Februar 2019 von den Vorwürfen. Im Herbst 2019 unterstützte das Kanzleramt Wirecards geplante Expansion nach China.

Der Bilanzskandal bei Wirecard führte dazu, dass das DAX-Unternehmen Ende Juni Insolvenz anmelden musste. Es war bekannt geworden, dass in der Bilanz 1,9 Milliarden Euro fehlten. Die Staatsanwaltschaft vermutet, ...

https://www.gmx.net/magazine/wirtschaft/wirecard-skandal-sku…

...........................................................................................................................................................

Das Ende der BRD Verwaltungs GmbH ... 2020 ... der ZUG ist abgefahren ... 💣 ...

https://www.pravda-tv.com/2020/07/planen-trump-und-putin-die…

Die Regierungskriminalität und das Ende des BRD Rechtsystems

8,943 views • Jan 19, 2011

💕__/____/____/__________

Von Petra Henning

Aktualisiert am 18. Juli 2020, 17:32 Uhr

Der Bilanzskandal wird immer skurriler. Während CEO Markus Braun und Manager Oliver Bellenhaus mit der Staatsanwaltschaft kooperieren, ist Ex-Vorstand Jan Marsalek weiter auf der Flucht. Doch der Skandal zieht zunehmend auch politische Kreise: Finanzminister Olaf Scholz wusste bereits seit Februar 2019 von den Vorwürfen. Im Herbst 2019 unterstützte das Kanzleramt Wirecards geplante Expansion nach China.

Der Bilanzskandal bei Wirecard führte dazu, dass das DAX-Unternehmen Ende Juni Insolvenz anmelden musste. Es war bekannt geworden, dass in der Bilanz 1,9 Milliarden Euro fehlten. Die Staatsanwaltschaft vermutet, ...

https://www.gmx.net/magazine/wirtschaft/wirecard-skandal-sku…

...........................................................................................................................................................

Das Ende der BRD Verwaltungs GmbH ... 2020 ... der ZUG ist abgefahren ... 💣 ...

https://www.pravda-tv.com/2020/07/planen-trump-und-putin-die…

Die Regierungskriminalität und das Ende des BRD Rechtsystems

8,943 views • Jan 19, 2011

💕__/____/____/__________

... 📢 ... 💵 ... Wirecard 2.00 ... 💶 ...

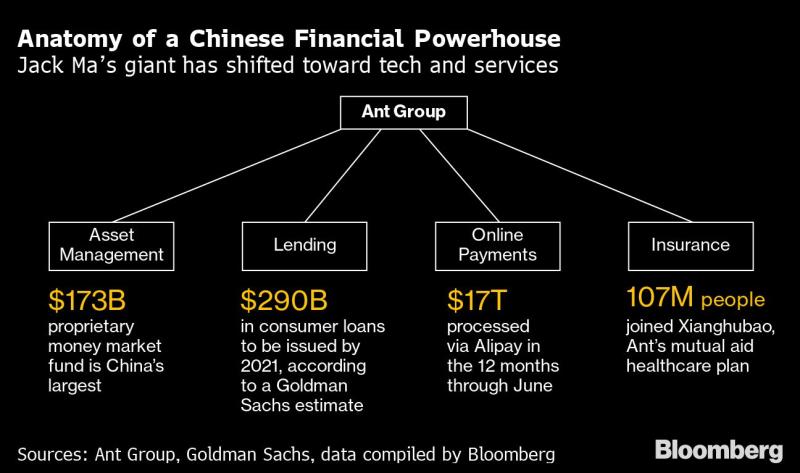

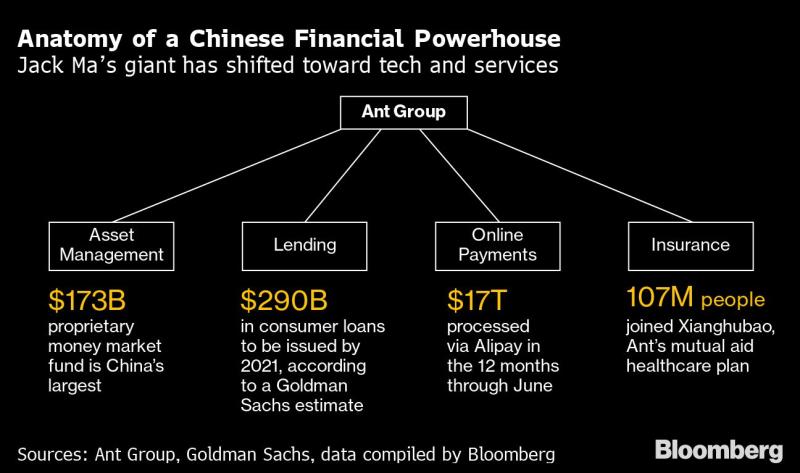

Jack Ma's Ant Group, valued at US$200 billion, to kick start concurrent IPOs in Shanghai and Hong Kong, bypassing New York

Alison Tudor-Ackroyd alison.t-a@scmp.com, South China Morning Post • July 20, 2020

https://finance.yahoo.com/news/ant-group-said-pick-banks-105…

---

(Bloomberg) -- Ant Group, the parent of China’s largest mobile payment company, has picked China International Capital Corp., Citigroup Inc., JPMorgan Chase & Co. and Morgan Stanley for its Hong Kong initial public offering, according to people familiar with the matter.

The banks are working with billionaire Jack Ma’s Ant on the share sale in Hong Kong, which could raise about $10 billion, the people said. More advisers could be added to the offering at a later stage, said the people, who asked not to be identified as the information is private.

Ant Group, formerly known as Ant Financial, ...

... Ant generated $2 billion in profit in the fourth quarter, based on Bloomberg calculations made from Alibaba’s filing. ...

... 🤥 ... hier sind die fehlenden 1,9 Mrd. €uroh-nen ...

https://finance.yahoo.com/news/ant-group-kick-start-concurre…

... Anti Financial Soup ...

... "Ali Zisch & Wesch" ... ist der Zaster ... "Mit einem Wisch ist alles Wech Tech!" ... unterm Tisch ...

https://www.finanznachrichten.de/suche/uebersicht.htm?suche=… ANT GROUP

https://www.finanznachrichten.de/nachrichten-aktien/ant-fina…

... doa spielt di Musi ...

🎵🎵🎵🎵🎵

Jack Ma's Ant Group, valued at US$200 billion, to kick start concurrent IPOs in Shanghai and Hong Kong, bypassing New York

Alison Tudor-Ackroyd alison.t-a@scmp.com, South China Morning Post • July 20, 2020

https://finance.yahoo.com/news/ant-group-said-pick-banks-105…

---

(Bloomberg) -- Ant Group, the parent of China’s largest mobile payment company, has picked China International Capital Corp., Citigroup Inc., JPMorgan Chase & Co. and Morgan Stanley for its Hong Kong initial public offering, according to people familiar with the matter.

The banks are working with billionaire Jack Ma’s Ant on the share sale in Hong Kong, which could raise about $10 billion, the people said. More advisers could be added to the offering at a later stage, said the people, who asked not to be identified as the information is private.

Ant Group, formerly known as Ant Financial, ...

... Ant generated $2 billion in profit in the fourth quarter, based on Bloomberg calculations made from Alibaba’s filing. ...

... 🤥 ... hier sind die fehlenden 1,9 Mrd. €uroh-nen ...

https://finance.yahoo.com/news/ant-group-kick-start-concurre…

... Anti Financial Soup ...

... "Ali Zisch & Wesch" ... ist der Zaster ... "Mit einem Wisch ist alles Wech Tech!" ... unterm Tisch ...

https://www.finanznachrichten.de/suche/uebersicht.htm?suche=… ANT GROUP

https://www.finanznachrichten.de/nachrichten-aktien/ant-fina…

... doa spielt di Musi ...

🎵🎵🎵🎵🎵

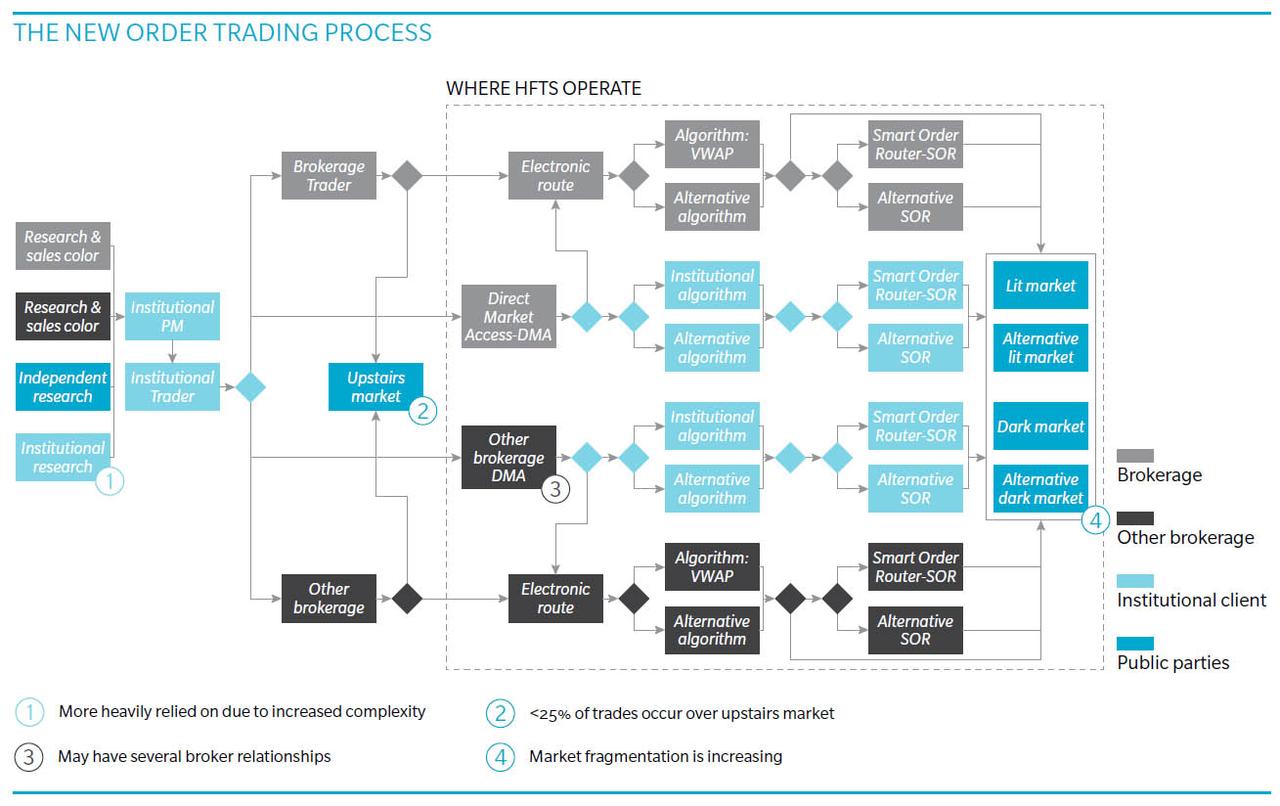

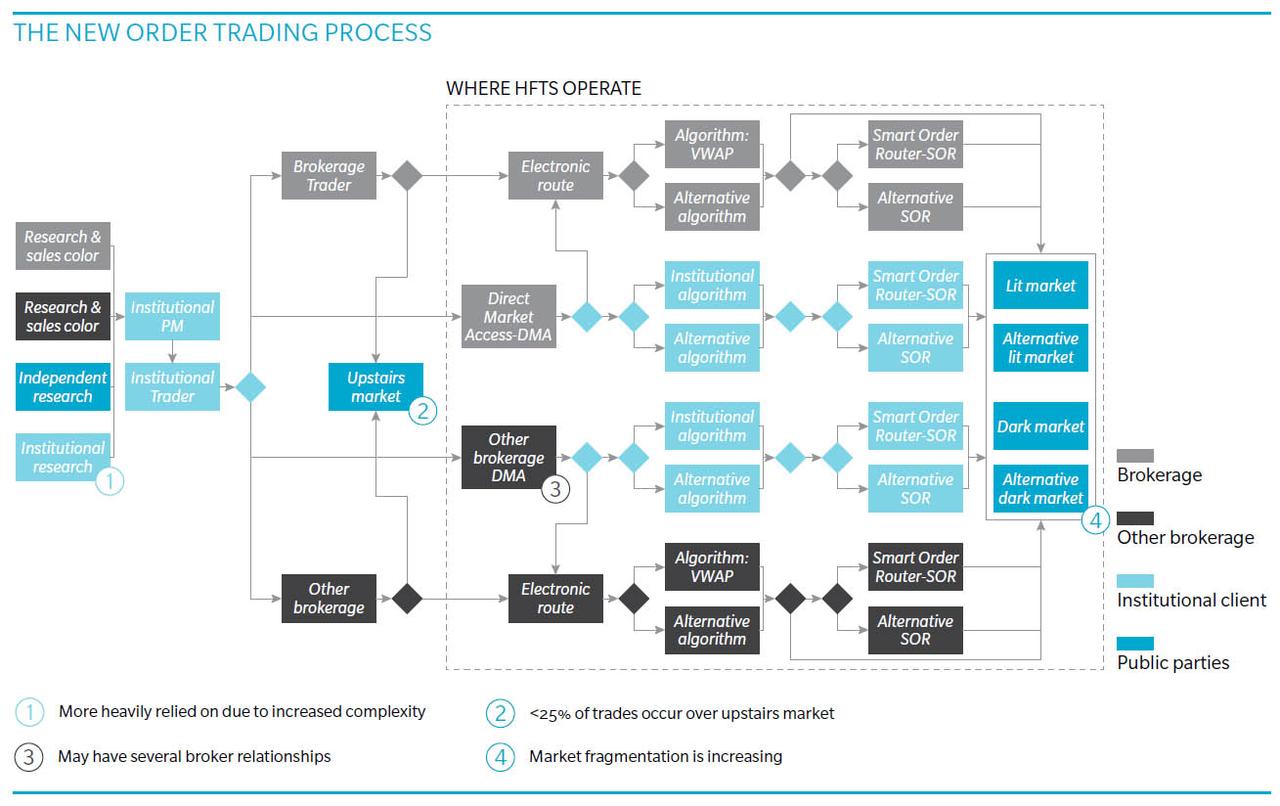

Antwort auf Beitrag Nr.: 64.476.555 von teecee1 am 20.07.20 17:54:03Joe Saluzzi Breaks Down How The High Frequency Wall Street Casino Steals Your Money

by Tyler Durden

Mon, 07/27/2020 - 11:30

Ever wonder exactly how the high frequency algorithmic, Fed fueled Wall Street machine really works? ...

Algos Are One Step Ahead and There's Nothing Regulators Can Do ... 💶 ... BaFin ... https://de.wikipedia.org/wiki/Bundesanstalt_f%C3%BCr_Finanzd… ... Hauptsache Wir bekommen unser monatl. Gehalt ... 💶 ... von wem auch immer ... !!! ...

Algos can "sense when the order book is about to change", Saluzzi says. They then built their own book based off of seeing market quotes faster than the average person. When Saluzzi is asked about whether or not algos can be used to manipulate the market, he reveals that regulators don't have visibility on how one market can be used to move another - including the S&P futures market and the S&P cash market.

"You can post bids on one exchange - say BATS - and then you're on another exchange, or a dark pool, looking to sell. It makes it more difficult for one exchange to see you're a spoofer." ...

How The Wall Street Casino Is Stealing Your Money (Market Update 7.17.20)

27,954 views • Premiered Jul 18, 2020

Peak Prosperity

370K subscribers

https://www.zerohedge.com/markets/joe-saluzzi-breaks-down-ho…

by Tyler Durden

Mon, 07/27/2020 - 11:30

Ever wonder exactly how the high frequency algorithmic, Fed fueled Wall Street machine really works? ...

Algos Are One Step Ahead and There's Nothing Regulators Can Do ... 💶 ... BaFin ... https://de.wikipedia.org/wiki/Bundesanstalt_f%C3%BCr_Finanzd… ... Hauptsache Wir bekommen unser monatl. Gehalt ... 💶 ... von wem auch immer ... !!! ...

Algos can "sense when the order book is about to change", Saluzzi says. They then built their own book based off of seeing market quotes faster than the average person. When Saluzzi is asked about whether or not algos can be used to manipulate the market, he reveals that regulators don't have visibility on how one market can be used to move another - including the S&P futures market and the S&P cash market.

"You can post bids on one exchange - say BATS - and then you're on another exchange, or a dark pool, looking to sell. It makes it more difficult for one exchange to see you're a spoofer." ...

How The Wall Street Casino Is Stealing Your Money (Market Update 7.17.20)

27,954 views • Premiered Jul 18, 2020

Peak Prosperity

370K subscribers

https://www.zerohedge.com/markets/joe-saluzzi-breaks-down-ho…

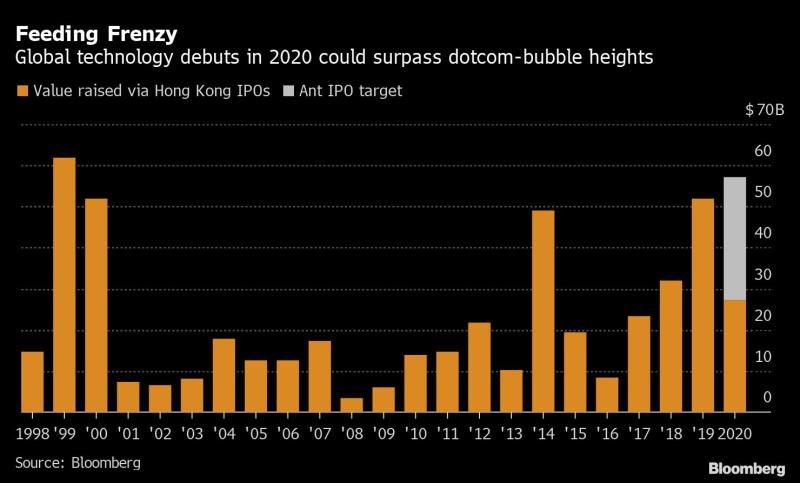

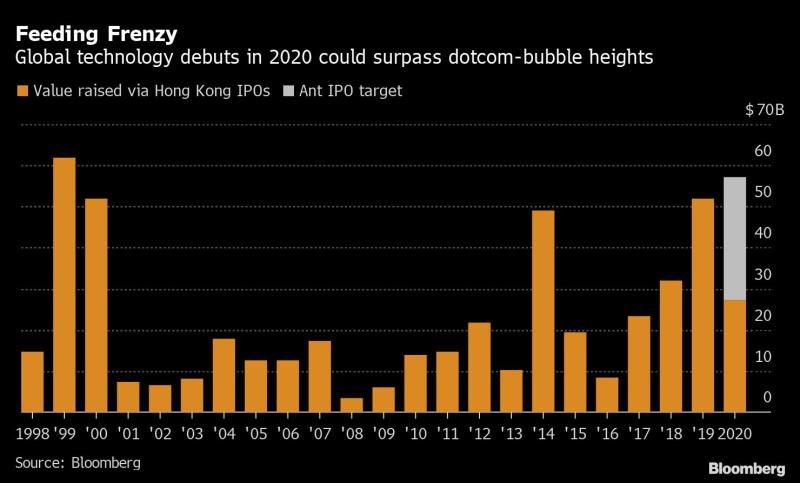

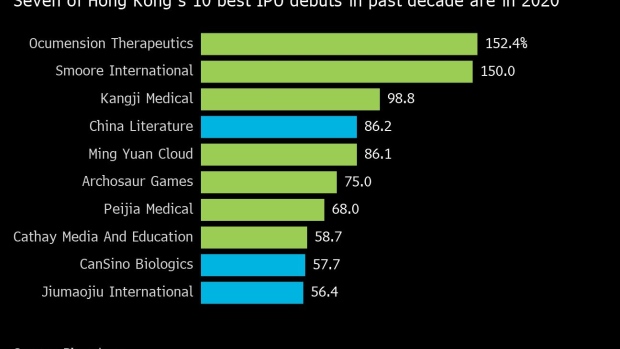

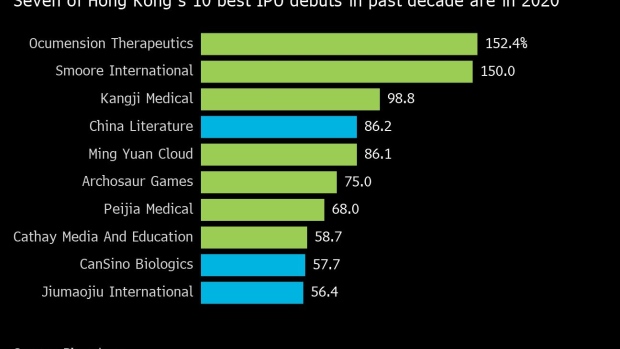

Antwort auf Beitrag Nr.: 64.476.555 von teecee1 am 20.07.20 17:54:03Jack Ma’s Ant Fuels Tech IPO Frenzy Not Seen Since Dotcom Bubble

Edwin Chan, Manuel Baigorri and Crystal Tse, Bloomberg • August 30, 2020

Jack Ma’s Ant Fuels Tech IPO Frenzy Not Seen Since Dotcom Bubble

(Bloomberg) -- Ant Group’s potentially record-sized initial public offering could propel technology capital-raising in 2020 past the dizzying heights of the dotcom bubble, an extraordinary showing in a pandemic-stricken year fraught with geopolitical uncertainty.

Jack Ma’s Chinese financial titan aims to raise at least $30 billion in Hong Kong and Shanghai in October, ...

https://finance.yahoo.com/news/ipo-looms-know-jack-ma-000000…

.....................................................................

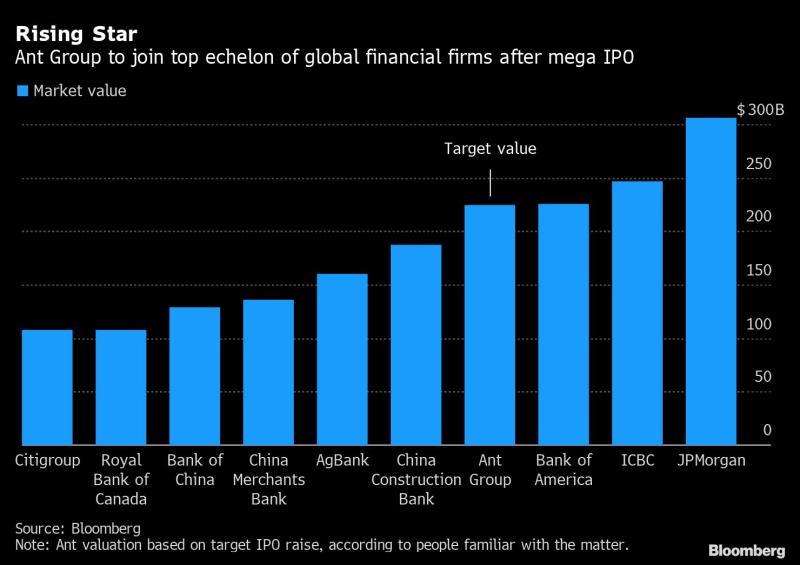

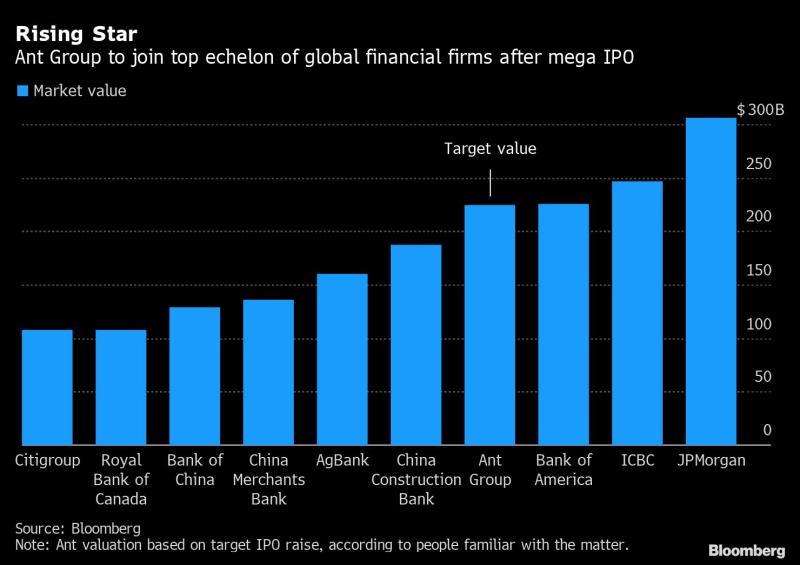

As IPO Looms, All You Need to Know About Jack Ma’s Ant Group

Lulu Yilun Chen, Bloomberg • August 30, 2020

As IPO Looms, All You Need to Know About Jack Ma’s Ant Group

(Bloomberg) -- Billionaire Jack Ma’s Ant Group is poised to pull off what could be the biggest initial public offering ever by simultaneously listing in Hong Kong and Shanghai. It’s said to be gunning for a valuation of $225 billion, making it the world’s fourth-largest financial company.

A 2011 offshoot of Chinese giant Alibaba Group Holding Ltd., ...

https://finance.yahoo.com/news/ipo-looms-know-jack-ma-000000…

.......................................................................................................................................................

By Mon. midnight 31 Aug. the Deep State SWIFT system would be completely disconnected.

On Tues. 1 Sept. gold/ asset-backed currency (including the US Note) Quantum Financial System would be the sole financial system platform online for all 209 countries, plus behind the scenes, all 16 NESARA / GESARA measures would be implemented. ...

... 🌞 ... der nächste Winter kommt bestimmt ... ⛄ ...

😭⛄⛄⛄😭

Edwin Chan, Manuel Baigorri and Crystal Tse, Bloomberg • August 30, 2020

Jack Ma’s Ant Fuels Tech IPO Frenzy Not Seen Since Dotcom Bubble

(Bloomberg) -- Ant Group’s potentially record-sized initial public offering could propel technology capital-raising in 2020 past the dizzying heights of the dotcom bubble, an extraordinary showing in a pandemic-stricken year fraught with geopolitical uncertainty.

Jack Ma’s Chinese financial titan aims to raise at least $30 billion in Hong Kong and Shanghai in October, ...

https://finance.yahoo.com/news/ipo-looms-know-jack-ma-000000…

.....................................................................

As IPO Looms, All You Need to Know About Jack Ma’s Ant Group

Lulu Yilun Chen, Bloomberg • August 30, 2020

As IPO Looms, All You Need to Know About Jack Ma’s Ant Group

(Bloomberg) -- Billionaire Jack Ma’s Ant Group is poised to pull off what could be the biggest initial public offering ever by simultaneously listing in Hong Kong and Shanghai. It’s said to be gunning for a valuation of $225 billion, making it the world’s fourth-largest financial company.

A 2011 offshoot of Chinese giant Alibaba Group Holding Ltd., ...

https://finance.yahoo.com/news/ipo-looms-know-jack-ma-000000…

.......................................................................................................................................................

By Mon. midnight 31 Aug. the Deep State SWIFT system would be completely disconnected.

On Tues. 1 Sept. gold/ asset-backed currency (including the US Note) Quantum Financial System would be the sole financial system platform online for all 209 countries, plus behind the scenes, all 16 NESARA / GESARA measures would be implemented. ...

... 🌞 ... der nächste Winter kommt bestimmt ... ⛄ ...

😭⛄⛄⛄😭

Antwort auf Beitrag Nr.: 64.938.030 von teecee1 am 31.08.20 15:13:51 ... 😴 ... Marsalek hat sich nach Kaner-mehr-da abgesetzt ... 😴 ... Provinz: British Corona ... 😤 ...

Payment Tech Firm Nuvei Files to Go Public in Canada

Paula Sambo and Doug Alexander

Bloomberg September 1, 2020

(Bloomberg) -- Nuvei Corp., which supplies payment technology to the sports betting industry as well as other vendors, has filed for an initial public offering in Canada.

The Montreal-based company and selling shareholders didn’t disclose how much they’re planning to raise or the IPO price in Tuesday’s regulatory filing. It will use the IPO proceeds to pay down debt.

The company was valued at $2 billion in December, ...

https://finance.yahoo.com/news/payment-tech-firm-nuvei-files…

... 🎵 ... Ringlein, Ringlein du mußt wandern ... Taler, Taler ... von deir einen korrupten Hand(... Sau ...) zur ander'n. ... Oh wie herrlich, o wie schön. Niemand wird die Korruption seh'n. ... Hallo BaFin ... !!! ... 🎵 ... Wann zwitchert(... singt ...) ein dummer Vogel ... ??? ... 🎵 ... Schmiergeld, Schmiergeld ...

https://de.wikipedia.org/wiki/Taler,_Taler,_du_musst_wandern

................................................................................................................

Ant’s Mega IPO Sets Up Jack Ma to Escalate War With Tencent

Zheping Huang and Lulu Yilun Chen, Bloomberg News

https://www.finanznachrichten.de/nachrichten-aktien/ant-grou…

Ant Group’s late-summer IPO filing drove home why the business -- backed by 711 million active users that spent $17 trillion through its platform -- is headed for potentially the world’s largest stock debut. Yet investors may do well to focus on the long-term threat to its core businesses from arch rival Tencent Holdings Ltd.

... ... 17.000.000.000.000.- HKD ... Billionen : 711.000.000,- = 23.910,- HKD ...

... 17.000.000.000.000.- HKD ... Billionen : 711.000.000,- = 23.910,- HKD ...

Ant is set to join the top echelon of global finance alongside Bank of America Corp., as it seeks to raise about $30 billion with a valuation of about $225 billion in Hong Kong and Shanghai, people familiar have said. Once the dust settles, the crown jewel of Jack Ma’s Alibaba Group Holding Ltd. empire has to contend with a renewed challenge from old nemesis Tencent that’s ...

https://www.bnnbloomberg.ca/ant-s-mega-ipo-sets-up-jack-ma-t…

https://finance.yahoo.com/news/ant-mega-ipo-sets-jack-200000…

... ... womit verdienten Banken, Versicherungen und Immo... Ihr FalschGeld und womit FinTech's 🌞 Sch.einbankensystem ... ??? ... eierlegende Wollmilchschweine ... oder alles nur Salat ...

... womit verdienten Banken, Versicherungen und Immo... Ihr FalschGeld und womit FinTech's 🌞 Sch.einbankensystem ... ??? ... eierlegende Wollmilchschweine ... oder alles nur Salat ...

................................................................................................................

China's Offshore Konten ...

Name: Tencent Holdings Ltd

Straße 29/F., Three Pacific Place, No. 1 Queen’s Road East

Stadt George Town

Land: Kaimaninseln

Branche: Software und Internet

Referenzwährung: HKD

Aktienanzahl: 9,58 Mrd.

Marktkapitalisierung: 535,06 Mrd.EUR

https://www.wallstreet-online.de/aktien/tencent-holdings-akt…

https://www.finanznachrichten.de/nachrichten-aktien/tencent-…

📈📉📈📉📈📉

Payment Tech Firm Nuvei Files to Go Public in Canada

Paula Sambo and Doug Alexander

Bloomberg September 1, 2020

(Bloomberg) -- Nuvei Corp., which supplies payment technology to the sports betting industry as well as other vendors, has filed for an initial public offering in Canada.

The Montreal-based company and selling shareholders didn’t disclose how much they’re planning to raise or the IPO price in Tuesday’s regulatory filing. It will use the IPO proceeds to pay down debt.

The company was valued at $2 billion in December, ...

https://finance.yahoo.com/news/payment-tech-firm-nuvei-files…

... 🎵 ... Ringlein, Ringlein du mußt wandern ... Taler, Taler ... von deir einen korrupten Hand(... Sau ...) zur ander'n. ... Oh wie herrlich, o wie schön. Niemand wird die Korruption seh'n. ... Hallo BaFin ... !!! ... 🎵 ... Wann zwitchert(... singt ...) ein dummer Vogel ... ??? ... 🎵 ... Schmiergeld, Schmiergeld ...

https://de.wikipedia.org/wiki/Taler,_Taler,_du_musst_wandern

................................................................................................................

Ant’s Mega IPO Sets Up Jack Ma to Escalate War With Tencent

Zheping Huang and Lulu Yilun Chen, Bloomberg News

https://www.finanznachrichten.de/nachrichten-aktien/ant-grou…

Ant Group’s late-summer IPO filing drove home why the business -- backed by 711 million active users that spent $17 trillion through its platform -- is headed for potentially the world’s largest stock debut. Yet investors may do well to focus on the long-term threat to its core businesses from arch rival Tencent Holdings Ltd.

...

... 17.000.000.000.000.- HKD ... Billionen : 711.000.000,- = 23.910,- HKD ...

... 17.000.000.000.000.- HKD ... Billionen : 711.000.000,- = 23.910,- HKD ... Ant is set to join the top echelon of global finance alongside Bank of America Corp., as it seeks to raise about $30 billion with a valuation of about $225 billion in Hong Kong and Shanghai, people familiar have said. Once the dust settles, the crown jewel of Jack Ma’s Alibaba Group Holding Ltd. empire has to contend with a renewed challenge from old nemesis Tencent that’s ...

https://www.bnnbloomberg.ca/ant-s-mega-ipo-sets-up-jack-ma-t…

https://finance.yahoo.com/news/ant-mega-ipo-sets-jack-200000…

...

... womit verdienten Banken, Versicherungen und Immo... Ihr FalschGeld und womit FinTech's 🌞 Sch.einbankensystem ... ??? ... eierlegende Wollmilchschweine ... oder alles nur Salat ...

... womit verdienten Banken, Versicherungen und Immo... Ihr FalschGeld und womit FinTech's 🌞 Sch.einbankensystem ... ??? ... eierlegende Wollmilchschweine ... oder alles nur Salat ...................................................................................................................

China's Offshore Konten ...

Name: Tencent Holdings Ltd

Straße 29/F., Three Pacific Place, No. 1 Queen’s Road East

Stadt George Town

Land: Kaimaninseln

Branche: Software und Internet

Referenzwährung: HKD

Aktienanzahl: 9,58 Mrd.

Marktkapitalisierung: 535,06 Mrd.EUR

https://www.wallstreet-online.de/aktien/tencent-holdings-akt…

https://www.finanznachrichten.de/nachrichten-aktien/tencent-…

📈📉📈📉📈📉

Antwort auf Beitrag Nr.: 64.997.619 von teecee1 am 05.09.20 11:13:48 ... 💰 ... 50 . Ten-Cent übernimmt das Luftballongeschäft von Wire-Fraud ...

China's Tencent to open Southeast Asia regional hub in Singapore

Reuters Staff Reuters Hong Kong / Tue, September 15, 2020 / 01:30 pm

Chinese gaming and social media group Tencent said on Tuesday it would open a new office in Singapore that will be its regional hub for Southeast Asia. The move,

This article was published in thejakartapost.com with the title "China's Tencent to open Southeast Asia regional hub in Singapore". Click to read: https://www.thejakartapost.com/news/2020/09/15/chinas-tencen…

................................................................................................................

How Will China’s DCEP Affect WeChat Pay and Alipay?

By Evan Ezquer - September 5, 2020 265

...

The testing involved four different cities in China namely: Shenzhen, Xiong’an, Chengdu, and Suzhou. While trials were ongoing, the Agricultural Bank of China also launched an e-wallet to serve as storage for the digital yuan.

How Will the DCEP Affect WeChat Pay and Alipay?

The China digital currency space is completely saturated by Alibaba’s Alipay and Tencent Holdings’ WeChat Pay. Amounting to a whopping $49 trillion market, over 500 times bigger than electronic payments in the US. The Duo (Alipay and WeChat Pay) have single-handedly transformed China into a nearly-cashless economy.

The proposed launch of China’s digital yuan could, however, could spell doom for the two fintech giants. Despite increased pressure on launching the DCEP, China’s PBOC Governor Yi Gang insists that testing is expected to continue until 2022. However, there is no finality to this timeline as the country is yet to officially confirm any detail of the DCEP launch. ...

https://www.asiacryptotoday.com/how-will-chinas-dcep-affect-…

https://www.asiacryptotoday.com/category/news/

................................................................................................................

BrownCryptoKid Answers Question about Blockchain and QFS 9-13-20

...

We won’t be going to a cashless society…. I feel that’s true… What do you think, Charlie?

37:13 Charlie Ward: When I asked that question it was made very clear to me that the poorest people in the world… whether it’s in India, Pakistan, China, Russia, Africa… depend on cash… this is their life… it’s very easily when you live in the bubble of the UK / USA…. Oh 99% of the people use credit cards (in your bubble)… but when you get outside that bubble you find that 99% of the people in India, Pakistan and Africa have never even heard of a credit card…

37:51 I watched the transition of China where they tried to introduce digital currency… and they started doing the “WeChat” and the WeChat pay so they used what we call “what’s up”… they made WeChat so you could put money onto it and use it… they use it in McDonald’s WeChat Pay it’s funny to watch… they’ve been very very clever, as the Chinese are…

📢 . . . . . . 📢

China's Tencent to open Southeast Asia regional hub in Singapore

Reuters Staff Reuters Hong Kong / Tue, September 15, 2020 / 01:30 pm

Chinese gaming and social media group Tencent said on Tuesday it would open a new office in Singapore that will be its regional hub for Southeast Asia. The move,

This article was published in thejakartapost.com with the title "China's Tencent to open Southeast Asia regional hub in Singapore". Click to read: https://www.thejakartapost.com/news/2020/09/15/chinas-tencen…

................................................................................................................

How Will China’s DCEP Affect WeChat Pay and Alipay?

By Evan Ezquer - September 5, 2020 265

...

The testing involved four different cities in China namely: Shenzhen, Xiong’an, Chengdu, and Suzhou. While trials were ongoing, the Agricultural Bank of China also launched an e-wallet to serve as storage for the digital yuan.

How Will the DCEP Affect WeChat Pay and Alipay?

The China digital currency space is completely saturated by Alibaba’s Alipay and Tencent Holdings’ WeChat Pay. Amounting to a whopping $49 trillion market, over 500 times bigger than electronic payments in the US. The Duo (Alipay and WeChat Pay) have single-handedly transformed China into a nearly-cashless economy.

The proposed launch of China’s digital yuan could, however, could spell doom for the two fintech giants. Despite increased pressure on launching the DCEP, China’s PBOC Governor Yi Gang insists that testing is expected to continue until 2022. However, there is no finality to this timeline as the country is yet to officially confirm any detail of the DCEP launch. ...

https://www.asiacryptotoday.com/how-will-chinas-dcep-affect-…

https://www.asiacryptotoday.com/category/news/

................................................................................................................

BrownCryptoKid Answers Question about Blockchain and QFS 9-13-20

...

We won’t be going to a cashless society…. I feel that’s true… What do you think, Charlie?

37:13 Charlie Ward: When I asked that question it was made very clear to me that the poorest people in the world… whether it’s in India, Pakistan, China, Russia, Africa… depend on cash… this is their life… it’s very easily when you live in the bubble of the UK / USA…. Oh 99% of the people use credit cards (in your bubble)… but when you get outside that bubble you find that 99% of the people in India, Pakistan and Africa have never even heard of a credit card…

37:51 I watched the transition of China where they tried to introduce digital currency… and they started doing the “WeChat” and the WeChat pay so they used what we call “what’s up”… they made WeChat so you could put money onto it and use it… they use it in McDonald’s WeChat Pay it’s funny to watch… they’ve been very very clever, as the Chinese are…

📢 . . . . . . 📢

Antwort auf Beitrag Nr.: 64.476.555 von teecee1 am 20.07.20 17:54:03 ... 🌲 ... ich würde bis 🤶 warten und €50 Billionen ... 🎁 ... Wire-Fraud 3.50 ... 🎄 ...

Jack Ma’s Ant to Lift IPO Funding Target to $35 Billion

Lulu Yilun Chen,Bloomberg • September 21, 2020

Jack Ma’s Ant to Lift IPO Funding Target to $35 Billion

(Bloomberg) -- Jack Ma’s Ant Group is seeking to raise at least $35 billion in its initial public offering after assessing early investor interest, people familiar with the matter said, putting the Chinese fintech giant on track for a record debut sale.

Ant lifted its IPO target based on an increased valuation of about $250 billion, up from previous estimates of $225 billion, said the people, who asked not to be identified discussing private matters. It was earlier expecting to raise at least $30 billion, people familiar have said.

Ant’s simultaneous listing in Hong Kong and Shanghai may mark the biggest IPO ever, topping Saudi Aramco’s record $29 billion sale. Ant could exceed Bank of America Corp.’s market capitalization, and be more than twice the size of Citigroup Inc. Among U.S. banks, only JPMorgan Chase & Co. is bigger at $300 billion. ...

https://finance.yahoo.com/news/jack-ma-ant-said-lift-0334163…

https://www.finanznachrichten.de/nachrichten-aktien/ant-grou…

.......................................................................................................................................................

17.09.2020 22:08

Ant Financial-IPO: Diese chinesischen Fintechs könnten ebenfalls einen Blick wert sein

https://www.finanzen.net/nachricht/aktien/auf-dem-weg-nach-o…

🎅🤶🎅🤶🎅

Jack Ma’s Ant to Lift IPO Funding Target to $35 Billion

Lulu Yilun Chen,Bloomberg • September 21, 2020

Jack Ma’s Ant to Lift IPO Funding Target to $35 Billion

(Bloomberg) -- Jack Ma’s Ant Group is seeking to raise at least $35 billion in its initial public offering after assessing early investor interest, people familiar with the matter said, putting the Chinese fintech giant on track for a record debut sale.

Ant lifted its IPO target based on an increased valuation of about $250 billion, up from previous estimates of $225 billion, said the people, who asked not to be identified discussing private matters. It was earlier expecting to raise at least $30 billion, people familiar have said.

Ant’s simultaneous listing in Hong Kong and Shanghai may mark the biggest IPO ever, topping Saudi Aramco’s record $29 billion sale. Ant could exceed Bank of America Corp.’s market capitalization, and be more than twice the size of Citigroup Inc. Among U.S. banks, only JPMorgan Chase & Co. is bigger at $300 billion. ...

https://finance.yahoo.com/news/jack-ma-ant-said-lift-0334163…

https://www.finanznachrichten.de/nachrichten-aktien/ant-grou…

.......................................................................................................................................................

17.09.2020 22:08

Ant Financial-IPO: Diese chinesischen Fintechs könnten ebenfalls einen Blick wert sein

https://www.finanzen.net/nachricht/aktien/auf-dem-weg-nach-o…

🎅🤶🎅🤶🎅

Antwort auf Beitrag Nr.: 64.938.030 von teecee1 am 31.08.20 15:13:51Charlie Ward just posted this revised 12 minute video of The Quantum Financial System.

It now has an added spoken track and animations.

QFS Updated Special Thanks to David Jackman 9-22-20

ab min. 1:50

.............................................................................................................................................

marc friedrich•@marcfriedrich7 · Sep 22

1. Deutsche Bank: $1.3 TRILLION

2. JP Morgan: $514 BILLION

Every big Bank is involved in the money laundering scandal.

How could this go on for so long? Why did no CEO step back yet?

Did governments cover up the criminal actions?

We need a new banking system!

https://twitter.com/marcfriedrich7/status/130825030809987481…

.............................................................................................................................................

Massive money laundering | Top banks accused of playing part in movement of $2 trillion

It now has an added spoken track and animations.

QFS Updated Special Thanks to David Jackman 9-22-20

ab min. 1:50

.............................................................................................................................................

marc friedrich•@marcfriedrich7 · Sep 22

1. Deutsche Bank: $1.3 TRILLION

2. JP Morgan: $514 BILLION

Every big Bank is involved in the money laundering scandal.

How could this go on for so long? Why did no CEO step back yet?

Did governments cover up the criminal actions?

We need a new banking system!

https://twitter.com/marcfriedrich7/status/130825030809987481…

.............................................................................................................................................

Massive money laundering | Top banks accused of playing part in movement of $2 trillion

Antwort auf Beitrag Nr.: 65.167.885 von teecee1 am 23.09.20 13:19:21Wirtschaftliche Korona Krise

Die Essenz des größten Bankbetrugs aller Zeiten

Das Geheimnis der Geldschöpfung liegt darin, “es nicht zu buchen”

Falsches Geld erzeugt falschen Reichtum

Diejenigen, die die Wahrheit kennen und nicht zögern, sie zu verbreiten, werden durch das Abschalten der Internetverbindung zum Schweigen gebracht. Dies geschah auch mit dieser Website. Jetzt gerade wiederhergestellt, ist FWC wieder online.

Peter B. Meyer

September 23, 2020

Phantomgeld treibt die Märkte an und schafft Schuldsklaverei

Das Geheimnis, wie Geld geschaffen wird, muss der Öffentlichkeit vollständig offenbart werden. Die Macht der Geldschöpfung hat die Bankster mächtiger gemacht als jede Nation auf der Erde. In der Tat sind dies internationale Banker wie die Weltbank, der IWF, die BIZ und alle Zentralbanken, einschließlich der Federal Reserve. Dies ist die Schattenregierung, die fast alle Nationalstaaten auf der ganzen Welt kontrolliert. Ihre betrügerische Buchhaltungskriminalität wird in diesem Artikel erläutert. Das Beste, was ein Leser tun kann, ist, dieses Wissen mit allen Kontakten zu teilen. Wenn viel mehr Menschen von diesem Betrug erfahren, wird dieser Betrug eher gestoppt. ...

http://finalwakeupcall.info/de/2020/09/23/wirtschaftliche-ko…

.......................................................................................................................................................

... ... mehr Phantom Assets ... 💴💵💶💷 ...

... mehr Phantom Assets ... 💴💵💶💷 ...

JPMorgan to Move $230 Billion Assets to Germany Under Brexit

Steven Arons and Nicholas Comfort, Bloomberg • September 23, 2020

... ... Wirecard steht an letzter Stelle ... der Platz reicht nicht aus ... 10 von 1000 ...

... Wirecard steht an letzter Stelle ... der Platz reicht nicht aus ... 10 von 1000 ...

JPMorgan to Move $230 Billion Assets to Germany Under Brexit

(Bloomberg) -- JPMorgan Chase & Co. is moving about 200 billion euros ($230 billion) from the U.K. to Frankfurt as a result of Britain’s exit from the European Union, a shift that will make it one of the largest banks in Germany.

The U.S. bank plans to finish the migration of the assets to its Frankfurt-based subsidiary by the end of the year, people familiar with the matter said. The change could boost its balance sheet enough to become the country’s sixth-largest bank, ...

https://finance.yahoo.com/news/jpmorgan-move-230-billion-ass…

... 🎵 ... Pinke, Pinke, ... Taler, Taler, du musst wandern von denen die noch was haben zu den anderen. ... 🎵 ...

🏧🏧🏧🏧🏧

Die Essenz des größten Bankbetrugs aller Zeiten

Das Geheimnis der Geldschöpfung liegt darin, “es nicht zu buchen”

Falsches Geld erzeugt falschen Reichtum

Diejenigen, die die Wahrheit kennen und nicht zögern, sie zu verbreiten, werden durch das Abschalten der Internetverbindung zum Schweigen gebracht. Dies geschah auch mit dieser Website. Jetzt gerade wiederhergestellt, ist FWC wieder online.

Peter B. Meyer

September 23, 2020

Phantomgeld treibt die Märkte an und schafft Schuldsklaverei

Das Geheimnis, wie Geld geschaffen wird, muss der Öffentlichkeit vollständig offenbart werden. Die Macht der Geldschöpfung hat die Bankster mächtiger gemacht als jede Nation auf der Erde. In der Tat sind dies internationale Banker wie die Weltbank, der IWF, die BIZ und alle Zentralbanken, einschließlich der Federal Reserve. Dies ist die Schattenregierung, die fast alle Nationalstaaten auf der ganzen Welt kontrolliert. Ihre betrügerische Buchhaltungskriminalität wird in diesem Artikel erläutert. Das Beste, was ein Leser tun kann, ist, dieses Wissen mit allen Kontakten zu teilen. Wenn viel mehr Menschen von diesem Betrug erfahren, wird dieser Betrug eher gestoppt. ...

http://finalwakeupcall.info/de/2020/09/23/wirtschaftliche-ko…

.......................................................................................................................................................

...

... mehr Phantom Assets ... 💴💵💶💷 ...

... mehr Phantom Assets ... 💴💵💶💷 ...JPMorgan to Move $230 Billion Assets to Germany Under Brexit

Steven Arons and Nicholas Comfort, Bloomberg • September 23, 2020

...

... Wirecard steht an letzter Stelle ... der Platz reicht nicht aus ... 10 von 1000 ...

... Wirecard steht an letzter Stelle ... der Platz reicht nicht aus ... 10 von 1000 ...

JPMorgan to Move $230 Billion Assets to Germany Under Brexit

(Bloomberg) -- JPMorgan Chase & Co. is moving about 200 billion euros ($230 billion) from the U.K. to Frankfurt as a result of Britain’s exit from the European Union, a shift that will make it one of the largest banks in Germany.

The U.S. bank plans to finish the migration of the assets to its Frankfurt-based subsidiary by the end of the year, people familiar with the matter said. The change could boost its balance sheet enough to become the country’s sixth-largest bank, ...

https://finance.yahoo.com/news/jpmorgan-move-230-billion-ass…

... 🎵 ... Pinke, Pinke, ... Taler, Taler, du musst wandern von denen die noch was haben zu den anderen. ... 🎵 ...

🏧🏧🏧🏧🏧

Antwort auf Beitrag Nr.: 65.170.588 von teecee1 am 23.09.20 16:50:15WIrecard's Business 'Almost Entirely Fraudulent', Auditors Uncover $1BN Loss, Report Finds

by Tyler Durden

Thu, 09/24/2020 - 07:15

Carmine Di Sibio, the international chairman of EY, said in a letter to clients published earlier thsi month that while he "regrets" the firm's staggering lapse in supervising Wirecard (something the firm has continued to blame entirely on Wirecard's deceptions, along with the invisible hand of Russian intelligence), the incident was a lesson learned, though he insisted that EY was ultimately "successful" in detecting the fraud.

While that's technically true, it's also true that dozens of red flags surfaced over the years that seemed to openly hint at the ongoing massive fraud operating just below the surface. And as auditors, regulators and prosecutors sift through the wreckage, they're uncovering more stunning details prompting them to ask themselves: How did Wirecard's shell game continue for so long without anybody speaking up? ...

The €1.9 billion in fraudulent profits Wirecard reported between the beginning of 2015 and Q1 2020 was actually a €740 million ($860) loss. Even if the fraud hadn't been uncovered when it did - even if the FT had never printed a word - the company would have eventually dissolved, as the burn rate far outstripped any reasonable expectation of income or capital raised.

Furthermore, bankruptcy court has determined that the real value of Wirecard’s assets is just €428 million, an amount dwarfed by the €3.2 billion in debt Wirecard carried when it collapsed. ...

Wirecard's "totally opaque" structure and "small business mentality" meant that its 55 subsidiaries were all effectively siloed off from one another. The main office in Munich had no idea what was going on elsewhere. in retrospect, it's a setup seemingly designed to enable an ongoing fraud. ...

https://www.zerohedge.com/technology/wirecards-business-almo…

..........................................................................................................................

Bundesrepublik Deutschland ... 💣 ... Wirecard 5.0 ... 💣 ...

80 Mio. Schlafschafe die

90% Steuern zahlen - Eiinahmen (Schurwolle)

2 Billionen Schulden

... Germany "totally opaque" structure and "small business mentality" meant that its 99 subsidiaries were all effectively siloed off from one another. The main office in Berlin had no idea what was going on elsewhere. in retrospect, it's a setup seemingly designed to enable an ongoing fraud. ...

🦃🦃🦃🦃🦃

by Tyler Durden

Thu, 09/24/2020 - 07:15

Carmine Di Sibio, the international chairman of EY, said in a letter to clients published earlier thsi month that while he "regrets" the firm's staggering lapse in supervising Wirecard (something the firm has continued to blame entirely on Wirecard's deceptions, along with the invisible hand of Russian intelligence), the incident was a lesson learned, though he insisted that EY was ultimately "successful" in detecting the fraud.

While that's technically true, it's also true that dozens of red flags surfaced over the years that seemed to openly hint at the ongoing massive fraud operating just below the surface. And as auditors, regulators and prosecutors sift through the wreckage, they're uncovering more stunning details prompting them to ask themselves: How did Wirecard's shell game continue for so long without anybody speaking up? ...

The €1.9 billion in fraudulent profits Wirecard reported between the beginning of 2015 and Q1 2020 was actually a €740 million ($860) loss. Even if the fraud hadn't been uncovered when it did - even if the FT had never printed a word - the company would have eventually dissolved, as the burn rate far outstripped any reasonable expectation of income or capital raised.

Furthermore, bankruptcy court has determined that the real value of Wirecard’s assets is just €428 million, an amount dwarfed by the €3.2 billion in debt Wirecard carried when it collapsed. ...

Wirecard's "totally opaque" structure and "small business mentality" meant that its 55 subsidiaries were all effectively siloed off from one another. The main office in Munich had no idea what was going on elsewhere. in retrospect, it's a setup seemingly designed to enable an ongoing fraud. ...

https://www.zerohedge.com/technology/wirecards-business-almo…

..........................................................................................................................

Bundesrepublik Deutschland ... 💣 ... Wirecard 5.0 ... 💣 ...

80 Mio. Schlafschafe die

90% Steuern zahlen - Eiinahmen (Schurwolle)

2 Billionen Schulden

... Germany "totally opaque" structure and "small business mentality" meant that its 99 subsidiaries were all effectively siloed off from one another. The main office in Berlin had no idea what was going on elsewhere. in retrospect, it's a setup seemingly designed to enable an ongoing fraud. ...

🦃🦃🦃🦃🦃

Kryppel-Zahlungsdienstleistungen ... 💣 ... Wirecard 8.0 ... 💣 ...

Felipe Erazo 05 Sep 2020

Experten: Kryptowährungen könnten vom Wettbewerb nach Wirecard profitieren

Blockchain und Krypto könnten vom Sturz des deutschen Zahlungsdienstleisters profitieren.

Nachdem der deutsche Zahlungsdienstleister in einen Betrugsskandal verwickelt ist, der zur Insolvenz des Unternehmens geführt hat, schicken sich die anderen großen Zahlungsdienstleister VISA, PayPal und Mastercard an, diese Lücke zu schließen. Im Zuge des Wettstreits um digitale Zahlungen könnten nun auch Krypto-Zahlungsdienstleistungen vermehrt in den Fokus rücken, wie Branchenexperten meinen.

Jerry Chan, der CEO des Blockchain-Dienstleisters TAAL, und Rod Hsu, der Präsident der Krypto-Handelsplattform Coincurve, geben sich im Interview mit Cointelegraph zuversichtlich, dass dieser neu aufkommende Wettbewerb dafür sorgen könnte, dass sich Digitalwährungen als Zahlungsmethode etablieren.

Chan geht sogar noch einen Schritt weiter, ...

https://de.cointelegraph.com/news/industry-leaders-say-block…

... ... was produzieren bzw. was stellen wir eigentlich her ... ??? ...

... was produzieren bzw. was stellen wir eigentlich her ... ??? ...

... ... öhhh, ... Niiiiichtsss... ! ...

... öhhh, ... Niiiiichtsss... ! ...

... ... was können wir den idioten noch anbieten bzw, verkaufen ... ??? ...

... was können wir den idioten noch anbieten bzw, verkaufen ... ??? ...

... ... ähhh, ... Niiiiichtsss ... ! ...

... ähhh, ... Niiiiichtsss ... ! ...

... ... wie finanzieren wir uns ... ??? ...

... wie finanzieren wir uns ... ??? ...

... ... uhhh, ... hoffentlich merkt das niemand ... ! ...

... uhhh, ... hoffentlich merkt das niemand ... ! ...

.........................................................................................................................................................

Federal Reserve stellt neue Pläne für digitalen Dollar (CBDC) vor

von Christian Stede

Am 25. September 2020 · Lesezeit: 2 Minuten

Die Entwicklung einer CBDC (Central Bank Digital Currency) ist auch für die US-Notenbank Fed ein großes Thema, nicht erst seit COVID-19. Nun gibt es ein neues Grundsatzpapier aus Cleveland.