The Big 4 (Seite 4)

eröffnet am 14.01.20 22:21:12 von

neuester Beitrag 02.02.24 13:19:17 von

neuester Beitrag 02.02.24 13:19:17 von

Beiträge: 51

ID: 1.318.601

ID: 1.318.601

Aufrufe heute: 1

Gesamt: 3.147

Gesamt: 3.147

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 1248 | |

| vor 23 Minuten | 1008 | |

| vor 1 Stunde | 998 | |

| vor 48 Minuten | 897 | |

| vor 1 Stunde | 811 | |

| gestern 19:37 | 780 | |

| vor 15 Minuten | 677 | |

| vor 1 Stunde | 591 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.737,36 | -0,56 | 198 | |||

| 2. | 2. | 138,02 | -1,93 | 95 | |||

| 3. | 7. | 6,6320 | -1,43 | 70 | |||

| 4. | 5. | 0,1810 | -1,90 | 51 | |||

| 5. | Neu! | 670,40 | -23,15 | 46 | |||

| 6. | 8. | 3,7700 | +0,80 | 45 | |||

| 7. | 17. | 7,2900 | -0,21 | 43 | |||

| 8. | 4. | 2.390,60 | 0,00 | 41 |

Beitrag zu dieser Diskussion schreiben

EY als Prüfer hat sich hier mehr Zeit zum Prüfen erbeten (*).

Doch dann das!

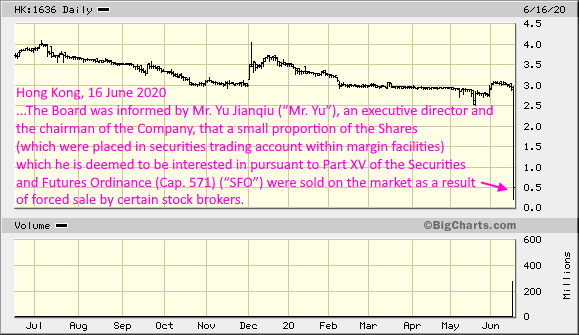

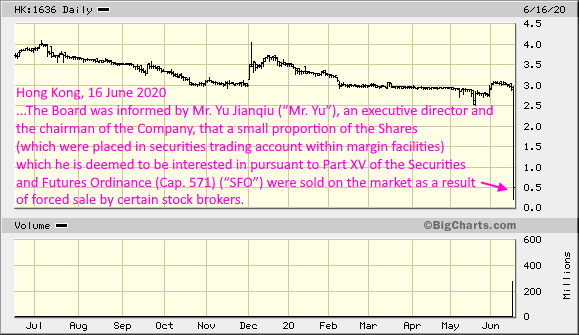

Margin Call 📢📢📢

China Metal Resources Utilization Ltd.

HK:1636

http://www.cmru.com.cn/en/index.aspx

https://hindenburgresearch.com/cmru/ (~)

https://finance.yahoo.com/news/china-metal-resources-utiliza…

(*) Hong Kong, 5 June 2020

...

As mentioned in the Previous Announcements, the main reasons for audit works have not completed are due to (1) primarily a recent event concerning the Company in respect of which additional audit works are required to be carried out by the auditor of the Company (the ‘‘Auditor’’); and (2) also the delay of the audit field works in the Group’s various operating units in the People’s Republic of China (‘‘PRC’’) as result of the COVID-19 outbreak in the PRC.

It is currently expected that the 2019 Annual Results will be published by 19 June 2020 and the 2019 Annual Report will be despatched to shareholders by 26 June 2020.

...

Mit "a recent event" ist der Short-Report von Hindenburg Research gemeint (~).

Merke: auch nur "wenige" verpfändete Aktien im Eigentum der Unternehmensleitung können bei Margin Call ein kleines Erdbeben auslösen.

Doch dann das!

Margin Call 📢📢📢

China Metal Resources Utilization Ltd.

HK:1636

http://www.cmru.com.cn/en/index.aspx

https://hindenburgresearch.com/cmru/ (~)

https://finance.yahoo.com/news/china-metal-resources-utiliza…

(*) Hong Kong, 5 June 2020

...

As mentioned in the Previous Announcements, the main reasons for audit works have not completed are due to (1) primarily a recent event concerning the Company in respect of which additional audit works are required to be carried out by the auditor of the Company (the ‘‘Auditor’’); and (2) also the delay of the audit field works in the Group’s various operating units in the People’s Republic of China (‘‘PRC’’) as result of the COVID-19 outbreak in the PRC.

It is currently expected that the 2019 Annual Results will be published by 19 June 2020 and the 2019 Annual Report will be despatched to shareholders by 26 June 2020.

...

Mit "a recent event" ist der Short-Report von Hindenburg Research gemeint (~).

Merke: auch nur "wenige" verpfändete Aktien im Eigentum der Unternehmensleitung können bei Margin Call ein kleines Erdbeben auslösen.

Antwort auf Beitrag Nr.: 63.787.892 von faultcode am 24.05.20 23:14:328.6.2020

EY fights fires on three audit cases that threaten its global reputation

https://www.ft.com/content/576e4c7f-93e5-4e8a-b5ba-5e1161533…

...

EY told the FT that it understands “our vital role in serving the public interest and fostering trust and confidence in capital markets.

“Audit quality is critical to this and we continuously seek to be globally consistent in delivering high quality audits through investing in technology, training for our people and improving our processes.”

The firm launched a programme in 2015 to improve management and communication for its audit

teams. “There is still more to do, and EY is ready to accept that challenge,” said Felice Persico,

global chair for assurance, in the firm’s latest report into audit quality.

So far the fallout for the firm has been negligible, despite publicity around Mr Rihan’s case,

including a BBC Panorama investigation into “gold, drug money and a major auditor’s ‘cover-up’”.

EY audits 30 per cent of Fortune 500 companies and around 25 per cent of the FTSE 100. It

continues to advise governments, with its mandates only growing as the public sector rapidly

outsources logistical support to combat the pandemic.

“I don’t think EY has lost a single dollar of business from this,” said an observer.

One former EY partner added: “In terms of the potential damage, the reality is that they will keep going, life for the big accountants just moves on. The financial impact on companies of this scale is only ever petty cash. Their ego may take a hit, but only regulatory change will have any tangible impact.”

__

BBC Panorama investigation:

28.10.2019

EY: Gold, drug money and a major auditor's 'cover-up'

https://www.bbc.co.uk/news/uk-50194681

...

EY fights fires on three audit cases that threaten its global reputation

https://www.ft.com/content/576e4c7f-93e5-4e8a-b5ba-5e1161533…

...

EY told the FT that it understands “our vital role in serving the public interest and fostering trust and confidence in capital markets.

“Audit quality is critical to this and we continuously seek to be globally consistent in delivering high quality audits through investing in technology, training for our people and improving our processes.”

The firm launched a programme in 2015 to improve management and communication for its audit

teams. “There is still more to do, and EY is ready to accept that challenge,” said Felice Persico,

global chair for assurance, in the firm’s latest report into audit quality.

So far the fallout for the firm has been negligible, despite publicity around Mr Rihan’s case,

including a BBC Panorama investigation into “gold, drug money and a major auditor’s ‘cover-up’”.

EY audits 30 per cent of Fortune 500 companies and around 25 per cent of the FTSE 100. It

continues to advise governments, with its mandates only growing as the public sector rapidly

outsources logistical support to combat the pandemic.

“I don’t think EY has lost a single dollar of business from this,” said an observer.

One former EY partner added: “In terms of the potential damage, the reality is that they will keep going, life for the big accountants just moves on. The financial impact on companies of this scale is only ever petty cash. Their ego may take a hit, but only regulatory change will have any tangible impact.”

__

BBC Panorama investigation:

28.10.2019

EY: Gold, drug money and a major auditor's 'cover-up'

https://www.bbc.co.uk/news/uk-50194681

...

"Bilanzprobleme"

Top 10 Accounting Scandals in the Past Decadeshttps://corporatefinanceinstitute.com/resources/knowledge/ot…

...

=> Liste daraus:

• Waste Management Scandal (1998)

• Enron Scandal (2001)

• WorldCom Scandal (2002)

• Tyco Scandal (2002)

• HealthSouth Scandal (2003)

• Freddie Mac Scandal (2003)

• American International Group (AIG) Scandal (2005)

• Lehman Brothers Scandal (2008)

• Bernie Madoff Scandal (2008)

• Satyam Scandal (2009)

Ich darf noch den Parmalat-Skandal von Ende 2003 hinzufügen, bei dem - noch ganz klassisch - Schulden in Mrd.-Höhe versteckt wurden: https://de.wikipedia.org/wiki/Parmalat#Finanzbetrug

=> daß das erst 2 Jahre nach Enron aufflog, zeigt mMn, wie langsam hier die Mühlen mahlen.

Das ist verständlich, nicht zuletzt deshalb, weil bei einem Bilanzskandal zunächst viele/die meisten Stakeholder davon profitieren. Und das oft über mehrere Jahre hinweg:

Fraud creates alpha

@TESLAcharts

Daher spricht die Finanzfolklore-Presse auch im Nachhinein oft nur von "Bilanzproblemen" als schärfste Form der Bewertung.

Im Englischen oft mit ""accounting irregularities" verharmlost.

Vordergründig, um sich bei laufenden Verfahren nicht in juristische Verwicklungen zu begeben.

Hintergründig aber, weil (heutzutage) die Presse im Internet-Zeitalter auch noch am letzten Einnahme-Strom aus der Werbung festhalten muss/will, und Kunden nicht zu sehr verschrecken will.

Nicht jedes Problem ist auch ein Skandal.

Aber einen Betrugs-Skandal, der für das Unternehmen und oft viele Stakeholder existenziellen Charakter hat bzw. hatte, ein "Problem" zu nennen, ist eigentlich bereits selber ein Skandal.

Und nicht zuletzt den Steinhoff-Skandal von 2017, bei dem über viele Jahre hinweg (1998-2016) - und natürlich mit testierten Jahresabschlüssen - mit Hilfe von "Family & Friends"-Geschäften Vermögenswerte von zuletzt ~EUR10Mrd. vorgetäuscht wurden:

https://www.wallstreet-online.de/diskussion/1285031-81-90/st…

1.11.2018

Steinhoff’s secret history and the dirty world of Markus Jooste

https://www.wallstreet-online.de/diskussion/1285031-11-20/st…

Antwort auf Beitrag Nr.: 63.743.128 von faultcode am 19.05.20 22:22:12Every industry has its problem areas.

Natürlich, so auch EY:

• 2019: Klient Thomas Cook muss in die Insolvenz, nachdem sich plötzlich ein GBP 200 million-Loch in der Firmen-Kasse aufgetan hatte; keine 12 Monate nachdem EY noch alles als paletti beschied

• 2020: Klient NMC Health geht in die Insolvenz, nachdem sie mit dem Segen von EY allzu sehr Schulden kleingerechnet haben

• 2020: beim Klienten Wirecard stösst deren Auffassung von kreativer Bilanzierung und luftiger Dokumentation auf vielfache Verwunderung. EY scheint sich daran jahrelang nicht gestört zu haben

Natürlich, so auch EY:

• 2019: Klient Thomas Cook muss in die Insolvenz, nachdem sich plötzlich ein GBP 200 million-Loch in der Firmen-Kasse aufgetan hatte; keine 12 Monate nachdem EY noch alles als paletti beschied

• 2020: Klient NMC Health geht in die Insolvenz, nachdem sie mit dem Segen von EY allzu sehr Schulden kleingerechnet haben

• 2020: beim Klienten Wirecard stösst deren Auffassung von kreativer Bilanzierung und luftiger Dokumentation auf vielfache Verwunderung. EY scheint sich daran jahrelang nicht gestört zu haben

18.5.

EY overhauls UK leadership and splits audit governance

Changes come as incoming head of UK firm faces pressure to improve audit quality

https://www.ft.com/content/e3871d8a-dac8-4675-a379-137123652…

EY has overhauled its UK leadership and split the governance of its audit practice as part of measures to improve quality following sustained criticism of the accounting industry from regulators and politicians.

The Big Four firm announced new heads of its audit, assurance, consulting and tax practices on Monday, prompted by the appointment of Hywel Ball as chairman and managing partner of the firm in the UK and Ireland. Mr Ball, who was head of audit and assurance, will take over from Steve Varley, who has run the firm for nine years, at the start of July.

EY said it would split the roles governing its audit and assurance practice in “recognition of the societal importance of these functions” and to “ensure that audit quality continues to receive dedicated focus”.

...

The move to split the audit and assurance roles comes in response to claims of conflicts of interest and poor working practices in the profession. Auditors have been accused of failing to review their clients’ books with sufficient scepticism after a series of accounting scandals at high-profile UK companies including Carillion, BHS, Tesco, BT and Patisserie Valerie.

EY is under investigation by regulators over its audit work for failed travel operator Thomas Cook and NMC Health, a former FTSE 100 company that was engulfed in a scandal over hidden debts and put into administration in April.

...

EY overhauls UK leadership and splits audit governance

Changes come as incoming head of UK firm faces pressure to improve audit quality

https://www.ft.com/content/e3871d8a-dac8-4675-a379-137123652…

EY has overhauled its UK leadership and split the governance of its audit practice as part of measures to improve quality following sustained criticism of the accounting industry from regulators and politicians.

The Big Four firm announced new heads of its audit, assurance, consulting and tax practices on Monday, prompted by the appointment of Hywel Ball as chairman and managing partner of the firm in the UK and Ireland. Mr Ball, who was head of audit and assurance, will take over from Steve Varley, who has run the firm for nine years, at the start of July.

EY said it would split the roles governing its audit and assurance practice in “recognition of the societal importance of these functions” and to “ensure that audit quality continues to receive dedicated focus”.

...

The move to split the audit and assurance roles comes in response to claims of conflicts of interest and poor working practices in the profession. Auditors have been accused of failing to review their clients’ books with sufficient scepticism after a series of accounting scandals at high-profile UK companies including Carillion, BHS, Tesco, BT and Patisserie Valerie.

EY is under investigation by regulators over its audit work for failed travel operator Thomas Cook and NMC Health, a former FTSE 100 company that was engulfed in a scandal over hidden debts and put into administration in April.

...

<nur für's Protokoll>

2016: https://www.wsj.com/articles/pricewaterhousecoopers-settles-…

2018: https://www.marketwatch.com/story/federal-judge-awards-fdic-…

2019:

- https://www.fdic.gov/news/news/press/2019/pr19019.html

- https://www.housingwire.com/articles/48456-pwc-reaches-335-m…

https://en.wikipedia.org/wiki/Taylor,_Bean_%26_Whitaker

https://en.wikipedia.org/wiki/Colonial_Bank_(United_States)

Tags:

• Colonial Bank

• Taylor, Bean & Whitaker

• Federal Deposit Insurance Corporation (FDIC)

• PwC

2016: https://www.wsj.com/articles/pricewaterhousecoopers-settles-…

2018: https://www.marketwatch.com/story/federal-judge-awards-fdic-…

2019:

- https://www.fdic.gov/news/news/press/2019/pr19019.html

- https://www.housingwire.com/articles/48456-pwc-reaches-335-m…

https://en.wikipedia.org/wiki/Taylor,_Bean_%26_Whitaker

https://en.wikipedia.org/wiki/Colonial_Bank_(United_States)

Tags:

• Colonial Bank

• Taylor, Bean & Whitaker

• Federal Deposit Insurance Corporation (FDIC)

• PwC

Antwort auf Beitrag Nr.: 63.548.907 von faultcode am 04.05.20 01:26:014 May 2020

UK's Financial Reporting Council to investigate Ernst & Young's auditing of NMC Health

Regular to concentrate on 2018 financial statements of troubled UAE-based healthcare provider

https://www.arabianbusiness.com/banking-finance/446116-uks-f…

...

Ernst & Young and the other three large accounting firms have been criticized by UK regulators for sloppy audit work and perceived conflicts of interest, which have prompted parliamentary calls for them to split up their consulting and auditing arms.

...

UK's Financial Reporting Council to investigate Ernst & Young's auditing of NMC Health

Regular to concentrate on 2018 financial statements of troubled UAE-based healthcare provider

https://www.arabianbusiness.com/banking-finance/446116-uks-f…

...

Ernst & Young and the other three large accounting firms have been criticized by UK regulators for sloppy audit work and perceived conflicts of interest, which have prompted parliamentary calls for them to split up their consulting and auditing arms.

...

Antwort auf Beitrag Nr.: 62.969.210 von faultcode am 11.03.20 22:09:15bei NMC ist das "Steinhoff-Phänomen" wieder sichtbar geworden: Gründer und Chairman verklagt das Management:

30.4.

BR Shetty admits serious fraud in companies, blames 'group of executives' for it

The Udupi-born businessman is facing criminal charges in Abu Dhabi allegedly for fraud and forgery.

https://www.thenewsminute.com/article/br-shetty-admits-serio…

BR Shetty, the founder of troubled healthcare operater NMC Health on Wednesday claimed that a probe conducted by his own advisors had found alleged fraud at NMC and payment services group Finablr.

The statement put out by the billionaire based out of Abu Dhabi admits serious frauds in the company, but pins the blame on a 'small group of executives' and completely absolves Shetty who currently faces charges in Abu Dhabi.

In a statement released to the media, BR Shetty said, "The preliminary findings provided by my advisors from my own investigations indicate that serious fraud and wrongdoing appears to have taken place at NMC, Finablr PLC (‘Finablr’), as well as within some of my private companies, and against me personally. This fraud also appears to have been undertaken by a small group of current and former executives at these companies."

BR Shetty's flagship company NMC Health is the largest private healthcare provider in the United Arab Emirates and was founded by him in the 1970s. It was placed under the United Kingdom court's supervision earlier this month over allegations of accounting frauds. The company was accused of understating its debt by 4.5 billion dollars.

In his statement, BR Shetty stated that bank accounts were operated in his name to engineer fradulent money transfers that he did not know about. He also stated that companies were set up in his name without his knowledge. Similarly, he stated, loans, cheques, personal guarantees and bank transfers were created in his name using a forged signature.

In addition, he cited misleading financial statements, information regarding the performance of his companies and the payment of expenses using personal bank accounts.

"My advisors and I have therefore shared information and evidence from our findings with all relevant boards, as well as with relevant law enforcement and regulatory authorities. We will Continue to proactively share this information as this work continues and in order to assist these Parties with their own investigations and inquiries," he stated.

On April 15, the Abu Dhabi Commercial Bank, which has around 3 billion dirham exposure in NMC Healthcare, filed a criminal complaint against Shetty, former CEO Prasanth Manghat and others alleging serious fraud. The bank wanted the accounts of all the accused to be seized.

Though the controversy has been going on for months, Shetty has maintained a studious silence. In his statement he says that this 'restraint in speaking out has come at great personal cost to hin both by reputation and materially'.

He, however, claimed that this was the right time to speak up as his own legal and forensic investigations were showing inital findings.

He also expressed regret over the hardships faced by his employees, "My greatest regret is for the thousands of hardworking employees in the companies we established who are now enduring extreme uncertainty and hardship, especially during the current public health crisis. It also pains me to see the damage caused to my business partners, shareholders and other stakeholders who we have worked with for so long," he said.

Who is BR Shetty?

Bavaguthu Raghuram Shetty, who hails from Udupi in coastal Karnataka, grew up in a family of farmers along with three brothers and three sisters. He belongs to the Tuluva Bunt community and for residents in coastal Karnataka, his was the ultimate success story - the story of a man who left Udupi with very less money in pocket to work as a medical representative in UAE and then went on to create a business empire that saw him take possession of two floors on the Burj Khalifa building. His wealth was estimated by Forbes to be $4.2 billion in 2018.

Things began to unravel for BR Shetty when California based firm Muddy Waters questioned the financial reporting of NMC Health in 2019. The firm revealed that NMC Health which deals with several banks in UAE, has understated its debt by at least $4.5 million. In addition, BR Shetty's financial services Finablr discovered that $100 million worth of cheques were issued without consent or knowledge of the company's board.

Top executives at both these firms have either resigned or been removed. The London Stock Exchange also suspended trading in the stock of both companies in February. BR Shetty, who has stepped down from his executive roles in NMC Health now faces criminal charges in Abu Dhabi allegedly for fraud and forgery.

BR Shetty, however, said that he intended to clear his name and ensure that the missing funds are returned to the rightful owners."I intend to work tirelessly to clear my name and assist any authorities in getting to the truth and help them ensure that misappropriated or missing funds are returned by the perpetrators to their rightful owners," stated BR Shetty in his statement.

30.4.

BR Shetty admits serious fraud in companies, blames 'group of executives' for it

The Udupi-born businessman is facing criminal charges in Abu Dhabi allegedly for fraud and forgery.

https://www.thenewsminute.com/article/br-shetty-admits-serio…

BR Shetty, the founder of troubled healthcare operater NMC Health on Wednesday claimed that a probe conducted by his own advisors had found alleged fraud at NMC and payment services group Finablr.

The statement put out by the billionaire based out of Abu Dhabi admits serious frauds in the company, but pins the blame on a 'small group of executives' and completely absolves Shetty who currently faces charges in Abu Dhabi.

In a statement released to the media, BR Shetty said, "The preliminary findings provided by my advisors from my own investigations indicate that serious fraud and wrongdoing appears to have taken place at NMC, Finablr PLC (‘Finablr’), as well as within some of my private companies, and against me personally. This fraud also appears to have been undertaken by a small group of current and former executives at these companies."

BR Shetty's flagship company NMC Health is the largest private healthcare provider in the United Arab Emirates and was founded by him in the 1970s. It was placed under the United Kingdom court's supervision earlier this month over allegations of accounting frauds. The company was accused of understating its debt by 4.5 billion dollars.

In his statement, BR Shetty stated that bank accounts were operated in his name to engineer fradulent money transfers that he did not know about. He also stated that companies were set up in his name without his knowledge. Similarly, he stated, loans, cheques, personal guarantees and bank transfers were created in his name using a forged signature.

In addition, he cited misleading financial statements, information regarding the performance of his companies and the payment of expenses using personal bank accounts.

"My advisors and I have therefore shared information and evidence from our findings with all relevant boards, as well as with relevant law enforcement and regulatory authorities. We will Continue to proactively share this information as this work continues and in order to assist these Parties with their own investigations and inquiries," he stated.

On April 15, the Abu Dhabi Commercial Bank, which has around 3 billion dirham exposure in NMC Healthcare, filed a criminal complaint against Shetty, former CEO Prasanth Manghat and others alleging serious fraud. The bank wanted the accounts of all the accused to be seized.

Though the controversy has been going on for months, Shetty has maintained a studious silence. In his statement he says that this 'restraint in speaking out has come at great personal cost to hin both by reputation and materially'.

He, however, claimed that this was the right time to speak up as his own legal and forensic investigations were showing inital findings.

He also expressed regret over the hardships faced by his employees, "My greatest regret is for the thousands of hardworking employees in the companies we established who are now enduring extreme uncertainty and hardship, especially during the current public health crisis. It also pains me to see the damage caused to my business partners, shareholders and other stakeholders who we have worked with for so long," he said.

Who is BR Shetty?

Bavaguthu Raghuram Shetty, who hails from Udupi in coastal Karnataka, grew up in a family of farmers along with three brothers and three sisters. He belongs to the Tuluva Bunt community and for residents in coastal Karnataka, his was the ultimate success story - the story of a man who left Udupi with very less money in pocket to work as a medical representative in UAE and then went on to create a business empire that saw him take possession of two floors on the Burj Khalifa building. His wealth was estimated by Forbes to be $4.2 billion in 2018.

Things began to unravel for BR Shetty when California based firm Muddy Waters questioned the financial reporting of NMC Health in 2019. The firm revealed that NMC Health which deals with several banks in UAE, has understated its debt by at least $4.5 million. In addition, BR Shetty's financial services Finablr discovered that $100 million worth of cheques were issued without consent or knowledge of the company's board.

Top executives at both these firms have either resigned or been removed. The London Stock Exchange also suspended trading in the stock of both companies in February. BR Shetty, who has stepped down from his executive roles in NMC Health now faces criminal charges in Abu Dhabi allegedly for fraud and forgery.

BR Shetty, however, said that he intended to clear his name and ensure that the missing funds are returned to the rightful owners."I intend to work tirelessly to clear my name and assist any authorities in getting to the truth and help them ensure that misappropriated or missing funds are returned by the perpetrators to their rightful owners," stated BR Shetty in his statement.

Wenn Wirtschaftsprüfer anfangen auf Twitter Witzchen zu machen..

<Tweets mittlerweile gelöscht>

..dann sollte man erst recht vorsichtig mit deren "Bestätigungsvermerken des unabhängigen Abschlussprüfers" etc. sein

https://twitter.com/AhmadEjazBDO

https://www.bdo.co.uk/en-gb/our-people/kieran-storan

Tag:

• BDO

<Tweets mittlerweile gelöscht>

..dann sollte man erst recht vorsichtig mit deren "Bestätigungsvermerken des unabhängigen Abschlussprüfers" etc. sein

https://twitter.com/AhmadEjazBDO

https://www.bdo.co.uk/en-gb/our-people/kieran-storan

Tag:

• BDO