Owens & Minor - U.S.-Pharmagroßhandel (healthcare logistics services) (Seite 2)

eröffnet am 16.02.20 23:41:47 von

neuester Beitrag 24.09.22 14:36:08 von

neuester Beitrag 24.09.22 14:36:08 von

Beiträge: 17

ID: 1.320.373

ID: 1.320.373

Aufrufe heute: 0

Gesamt: 976

Gesamt: 976

Aktive User: 0

ISIN: US6907321029 · WKN: 904611 · Symbol: 6OM

23,200

EUR

-3,33 %

-0,800 EUR

Letzter Kurs 24.04.24 Tradegate

Neuigkeiten

22.04.24 · Business Wire (engl.) |

20.02.24 · Business Wire (engl.) |

08.02.24 · Business Wire (engl.) |

07.12.23 · Business Wire (engl.) |

06.12.23 · Business Wire (engl.) |

Werte aus der Branche Gesundheitswesen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,8800 | +51,58 | |

| 0,5340 | +26,09 | |

| 373,83 | +18,26 | |

| 1,3900 | +10,32 | |

| 7,5500 | +10,22 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4240 | -12,37 | |

| 0,5925 | -15,36 | |

| 1,5500 | -30,49 | |

| 2,1500 | -36,79 | |

| 73,27 | -49,61 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 62.698.105 von faultcode am 17.02.20 00:37:14so, und nun noch zur Implikation

das Coronavirus und Owens & Minor --> Jim Cramer hat die Lösung

27.1.

Jim Cramer: 6 Stocks to Buy on Coronavirus Fears

These companies all could be strong -- even if the 2019 nCoV fear spreads.

https://realmoney.thestreet.com/jim-cramer/jim-cramer-6-stoc…

...

Three years ago, a little company called Owens & Minor (OMI) bought the single-best infectious disease pureplay, Halyard, which had been an underperforming company ever since it was spun off by Kimberly-Clark (KMB) . The acquisition cost Owens & Minor $710 million and for that the company got the premier franchise in hospital gowns and hospital masks. This stock, having falling 84% in the last five years, is not for the squeamish. It has more than $1.6 billion in debt and is firesaling certain properties to raise cash to meet those obligations.

That said, it has historically been an investment in a heavy flu season so it does synch up with the coronavirus.

...

das Coronavirus und Owens & Minor --> Jim Cramer hat die Lösung

27.1.

Jim Cramer: 6 Stocks to Buy on Coronavirus Fears

These companies all could be strong -- even if the 2019 nCoV fear spreads.

https://realmoney.thestreet.com/jim-cramer/jim-cramer-6-stoc…

...

Three years ago, a little company called Owens & Minor (OMI) bought the single-best infectious disease pureplay, Halyard, which had been an underperforming company ever since it was spun off by Kimberly-Clark (KMB) . The acquisition cost Owens & Minor $710 million and for that the company got the premier franchise in hospital gowns and hospital masks. This stock, having falling 84% in the last five years, is not for the squeamish. It has more than $1.6 billion in debt and is firesaling certain properties to raise cash to meet those obligations.

That said, it has historically been an investment in a heavy flu season so it does synch up with the coronavirus.

...

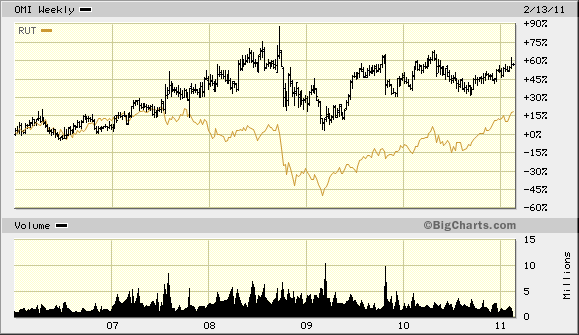

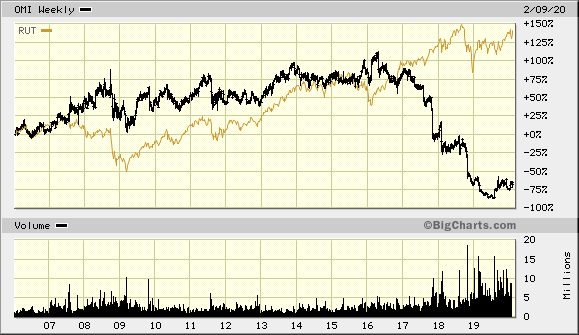

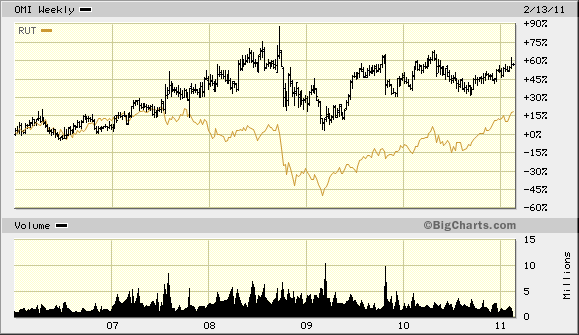

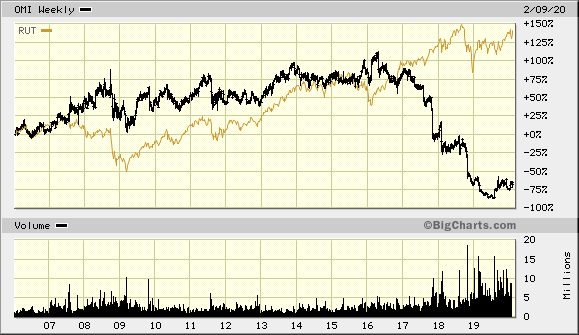

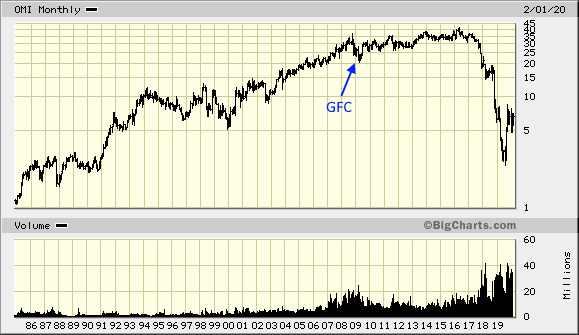

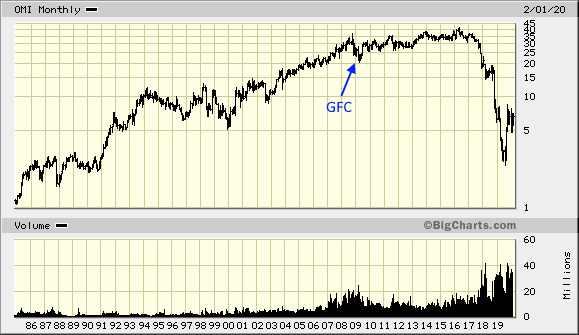

Antwort auf Beitrag Nr.: 62.698.066 von faultcode am 17.02.20 00:21:18ich habe oben die GFC eingezeichnet, und nachdem sie im S&P Small Cap 600 Index (SML) enthalten sind, hier der Benchmark während dieser Krise:

--> nein, geht nicht, wegen fehlender Daten hier; also stattdessen den schwächeren RUSSELL 2000 (RUT):

--> während der GFC zeigte OMI sehr gute, relative Stärke:

..die danach, also so 2010 bis 2014, aber verloren ging (wenn auch kein Total return hier):

der RUT ist ein Kursindex

--> nein, geht nicht, wegen fehlender Daten hier; also stattdessen den schwächeren RUSSELL 2000 (RUT):

--> während der GFC zeigte OMI sehr gute, relative Stärke:

..die danach, also so 2010 bis 2014, aber verloren ging (wenn auch kein Total return hier):

der RUT ist ein Kursindex

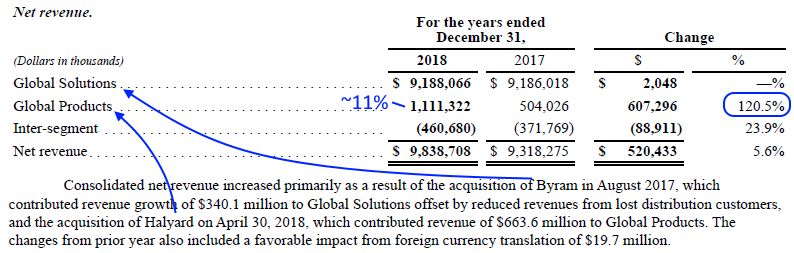

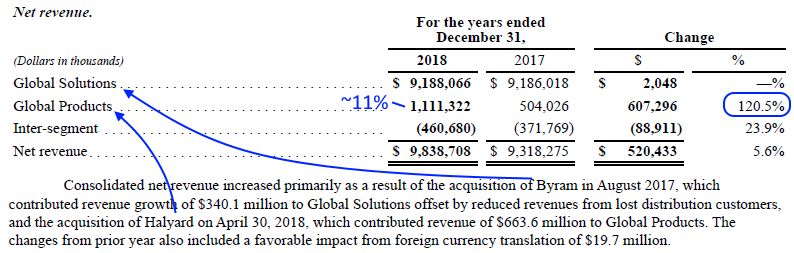

Antwort auf Beitrag Nr.: 62.698.030 von faultcode am 16.02.20 23:50:59Man hat auch Eigen-Produkte, die man auch stärken will (+), aber der große Hauptteil ist Distribution (#):

• für 2009 bis 2016, also bevor die Schwierigkeiten anfingen, betrug die Gross Margin im Schnitt: 11.22% bei Standardabweichung 1.12%

• für 2009 bis 2016 betrug die EBT Margin im Schnitt: 1.97% bei Standardabweichung 0.31%

Zahlen aus: https://stockrow.com/OMI

=> natürgemäß ist so ein Distributions-Geschäft halt margenschwach, was heißt, daß man keine allzu großen Fehler machen darf, was aber ab 2017 passiert ist.

Eigen-Produkte nennen sich hier Global Products, die mit der Übernahme des Halyard S&IP-Geschäftes deutlich ausgebaut wurden (auch diese Übernahme leitete wohl dann den Niedergang ein (~) ). Die hießen zuletzt Avanos Medical, falls man suchen will.

S&IP = surgical and infection prevention

Mit der Byram Healthcare-Übernahme betrat man den home health market.

(#)

(~)

• für 2009 bis 2016, also bevor die Schwierigkeiten anfingen, betrug die Gross Margin im Schnitt: 11.22% bei Standardabweichung 1.12%

• für 2009 bis 2016 betrug die EBT Margin im Schnitt: 1.97% bei Standardabweichung 0.31%

Zahlen aus: https://stockrow.com/OMI

=> natürgemäß ist so ein Distributions-Geschäft halt margenschwach, was heißt, daß man keine allzu großen Fehler machen darf, was aber ab 2017 passiert ist.

Eigen-Produkte nennen sich hier Global Products, die mit der Übernahme des Halyard S&IP-Geschäftes deutlich ausgebaut wurden (auch diese Übernahme leitete wohl dann den Niedergang ein (~) ). Die hießen zuletzt Avanos Medical, falls man suchen will.

S&IP = surgical and infection prevention

Mit der Byram Healthcare-Übernahme betrat man den home health market.

(#)

(~)

Antwort auf Beitrag Nr.: 62.698.021 von faultcode am 16.02.20 23:44:24Die Shortquote ist immer noch hoch mMn: Short % of Shares Outstanding, Jan 30, 2020: 18.72% laut Morningstar

Sowas kann mMn auch mit der Angst vor Amazon zu tun haben, die ja auch immer mehr in den Gesundheits-Bereich vordringen/vordringen wollen; zumindest in den USA.

Im AR2018 sagen sie zum Thema Wettbewerb u.a.:

We may experience competition from third-party online commerce sites.

Traditional distribution relationships are being challenged by online commerce solutions. Such competition will require us to cost-effectively adapt to changing technology, to continue to provide enhanced service offerings and to continue to differentiate our business (including with additional value-added services) to address demands of consumers and customers on a timely basis. The emergence of such competition and our inability to anticipate and effectively respond to changes on a timely basis could have a material adverse effect on our business

...

Competition

The industries in which we operate are highly competitive. Global Solutions competitors include two major nationwide manufacturers who also provide distribution services, Cardinal Health, Inc. and privately-held Medline Industries, Inc.

In addition, we compete with a number of regional and local distributors, companies that distribute products to patient's homes and customer self-distribution models.

Major logistics competitors serving healthcare manufacturers in the United States and in Europe include United Parcel Service, FedEx Corporation, Deutsche Post DHL and Alloga, as well as local competitors in specific countries.

The major competitors of our Global Products business include Cardinal Health, Inc., Medline Industries, Inc., Hogy Medical, Multigate Medical Products, Mölnlycke Health Care and HARTMANN Group.

In the United States, several of our distribution partners and GPOs are also competitors or are increasingly seeking to compete with us by direct sourcing their own products.

In developing and emerging markets, we compete against reusable products, or low usage of infection prevention products, due in large part to limited awareness and education on infection prevention practices and products.

...

GPO '= Group Purchasing Organizations

..weiter unten heißt es u.a.:

We face competition and accelerating pricing pressure.

The medical/surgical supply distribution industry in the United States is highly competitive and characterized by pricing pressure which accelerated in 2017 and continued into 2018 and put further margin pressure on our business. We expect this margin pressure to continue.

...

In addition, in recent years, the healthcare industry in the United States has experienced and continues to experience significant consolidation in response to cost containment legislation and general market pressures to reduce costs. This consolidation of our customers and suppliers generally gives them greater bargaining power to reduce the pricing available to them, which may adversely impact our results of operations and financial condition. The healthcare third-party logistics business in both the United States and Europe also is characterized by intense competition from a number of international, regional and local companies, including large conventional logistics companies and internet based non-traditional competitors that are moving into the healthcare and pharmaceutical distribution business. This competitive market places

continuous pricing pressure on us from customers and manufacturers that could adversely affect our results of operations and financial condition if we are unable to continue to retain and/or grow our revenues and to offset margin reductions caused by pricing pressures through cost control measures.

We have significant concentration in and dependence on certain healthcare provider customers and Group Purchasing Organizations.

In 2018, our top ten customers in the United States represented approximately 23% of our consolidated net revenue. In addition, in 2018, approximately 72% of our consolidated net revenue was from sales to member hospitals under contract with our largest group purchasing organizations (GPO): Vizient, Premier and HPG.

We could lose a significant healthcare provider customer or GPO relationship if an existing contract expires without being replaced or is terminated by the customer or GPO prior to its expiration. Although the termination of our relationship with a given GPO would not necessarily result in the loss of all of the member hospitals as customers, any such termination of a GPO relationship, or a significant individual healthcare provider customer relationship, could have a material adverse effect on our results of operations and financial condition.

Our operating income is dependent on certain significant domestic suppliers. In the United States, we distribute products from nearly 1,400 suppliers and are dependent on these suppliers for the continuing supply of products. In 2018, sales of products of our ten largest domestic suppliers accounted for approximately 47% of consolidated net revenue.

In the Global Solutions segment, sales of products supplied by Medtronic, Johnson & Johnson and Becton Dickinson accounted for approximately 10%, 7% and 7% of our consolidated net revenue for 2018, respectively.

In addition, combined sales of products supplied by Medline Industries and Cardinal Health, both of which are also our competitors, accounted for approximately 11% of our consolidated net revenue for 2018.

...

=> wer kann da noch einen Grund finden, diese Aktie zu kaufen?

Sowas kann mMn auch mit der Angst vor Amazon zu tun haben, die ja auch immer mehr in den Gesundheits-Bereich vordringen/vordringen wollen; zumindest in den USA.

Im AR2018 sagen sie zum Thema Wettbewerb u.a.:

We may experience competition from third-party online commerce sites.

Traditional distribution relationships are being challenged by online commerce solutions. Such competition will require us to cost-effectively adapt to changing technology, to continue to provide enhanced service offerings and to continue to differentiate our business (including with additional value-added services) to address demands of consumers and customers on a timely basis. The emergence of such competition and our inability to anticipate and effectively respond to changes on a timely basis could have a material adverse effect on our business

...

Competition

The industries in which we operate are highly competitive. Global Solutions competitors include two major nationwide manufacturers who also provide distribution services, Cardinal Health, Inc. and privately-held Medline Industries, Inc.

In addition, we compete with a number of regional and local distributors, companies that distribute products to patient's homes and customer self-distribution models.

Major logistics competitors serving healthcare manufacturers in the United States and in Europe include United Parcel Service, FedEx Corporation, Deutsche Post DHL and Alloga, as well as local competitors in specific countries.

The major competitors of our Global Products business include Cardinal Health, Inc., Medline Industries, Inc., Hogy Medical, Multigate Medical Products, Mölnlycke Health Care and HARTMANN Group.

In the United States, several of our distribution partners and GPOs are also competitors or are increasingly seeking to compete with us by direct sourcing their own products.

In developing and emerging markets, we compete against reusable products, or low usage of infection prevention products, due in large part to limited awareness and education on infection prevention practices and products.

...

GPO '= Group Purchasing Organizations

..weiter unten heißt es u.a.:

We face competition and accelerating pricing pressure.

The medical/surgical supply distribution industry in the United States is highly competitive and characterized by pricing pressure which accelerated in 2017 and continued into 2018 and put further margin pressure on our business. We expect this margin pressure to continue.

...

In addition, in recent years, the healthcare industry in the United States has experienced and continues to experience significant consolidation in response to cost containment legislation and general market pressures to reduce costs. This consolidation of our customers and suppliers generally gives them greater bargaining power to reduce the pricing available to them, which may adversely impact our results of operations and financial condition. The healthcare third-party logistics business in both the United States and Europe also is characterized by intense competition from a number of international, regional and local companies, including large conventional logistics companies and internet based non-traditional competitors that are moving into the healthcare and pharmaceutical distribution business. This competitive market places

continuous pricing pressure on us from customers and manufacturers that could adversely affect our results of operations and financial condition if we are unable to continue to retain and/or grow our revenues and to offset margin reductions caused by pricing pressures through cost control measures.

We have significant concentration in and dependence on certain healthcare provider customers and Group Purchasing Organizations.

In 2018, our top ten customers in the United States represented approximately 23% of our consolidated net revenue. In addition, in 2018, approximately 72% of our consolidated net revenue was from sales to member hospitals under contract with our largest group purchasing organizations (GPO): Vizient, Premier and HPG.

We could lose a significant healthcare provider customer or GPO relationship if an existing contract expires without being replaced or is terminated by the customer or GPO prior to its expiration. Although the termination of our relationship with a given GPO would not necessarily result in the loss of all of the member hospitals as customers, any such termination of a GPO relationship, or a significant individual healthcare provider customer relationship, could have a material adverse effect on our results of operations and financial condition.

Our operating income is dependent on certain significant domestic suppliers. In the United States, we distribute products from nearly 1,400 suppliers and are dependent on these suppliers for the continuing supply of products. In 2018, sales of products of our ten largest domestic suppliers accounted for approximately 47% of consolidated net revenue.

In the Global Solutions segment, sales of products supplied by Medtronic, Johnson & Johnson and Becton Dickinson accounted for approximately 10%, 7% and 7% of our consolidated net revenue for 2018, respectively.

In addition, combined sales of products supplied by Medline Industries and Cardinal Health, both of which are also our competitors, accounted for approximately 11% of our consolidated net revenue for 2018.

...

=> wer kann da noch einen Grund finden, diese Aktie zu kaufen?

Antwort auf Beitrag Nr.: 62.698.012 von faultcode am 16.02.20 23:41:47ich habe nun ein bischen weitergelesen und muss sagen, so ganz schlau bin ich derzeit immer noch nicht aus dem Unternehmen geworden.

Vielleicht kann man hier mal anfangen: https://en.wikipedia.org/wiki/Owens_%26_Minor

--> die sind 1882 aus einer Apotheke in Richmond, Virginia, hervorgegangen

Hier eine für mich eher nichtssagende Präsentation zur "38th Annual J.P. Morgan Healthcare Conference" vom 16.1.2020:

(+) http://investors.owens-minor.com/static-files/14e5ac50-6bda-…

Der neue CEO ist seit März 2019 im Amt.

OMI ist kein SP500-Unternehmen; mit einer MK von <USD500mio viel zu klein dafür.

Das Europa-Geschäft verkauft man nun, um die Schulden zu reduzieren (noch kein Vollzug):

16.1.

Owens & Minor Intends to Sell Movianto Business

http://investors.owens-minor.com/news-releases/news-release-…

Vielleicht kann man hier mal anfangen: https://en.wikipedia.org/wiki/Owens_%26_Minor

--> die sind 1882 aus einer Apotheke in Richmond, Virginia, hervorgegangen

Hier eine für mich eher nichtssagende Präsentation zur "38th Annual J.P. Morgan Healthcare Conference" vom 16.1.2020:

(+) http://investors.owens-minor.com/static-files/14e5ac50-6bda-…

Der neue CEO ist seit März 2019 im Amt.

OMI ist kein SP500-Unternehmen; mit einer MK von <USD500mio viel zu klein dafür.

Das Europa-Geschäft verkauft man nun, um die Schulden zu reduzieren (noch kein Vollzug):

16.1.

Owens & Minor Intends to Sell Movianto Business

http://investors.owens-minor.com/news-releases/news-release-…

weiter von hier: https://www.wallstreet-online.de/diskussion/1319677-11-20/gi…