Keine Angst vom "schwarzen Schwan": Corona-Börsen: Ruhig bleiben und zukaufen, statt dem h (Seite 2) | Diskussion im Forum

eröffnet am 26.02.20 20:01:23 von

neuester Beitrag 24.01.24 12:29:12 von

neuester Beitrag 24.01.24 12:29:12 von

Beiträge: 71

ID: 1.320.917

ID: 1.320.917

Aufrufe heute: 0

Gesamt: 6.375

Gesamt: 6.375

Aktive User: 0

ISIN: DE0008469008 · WKN: 846900

17.888,00

PKT

-0,70 %

-127,00 PKT

Letzter Kurs 17:57:17 Lang & Schwarz

Neuigkeiten

09:30 Uhr · wallstreetONLINE Redaktion |

16:03 Uhr · dpa-AFX |

15:38 Uhr · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

21.11.

Blackstone to End Legacy Strategy That Gave Money to Hedge Funds

https://finance.yahoo.com/news/blackstone-end-legacy-strateg…

...

Blackstone Inc. is winding down a strategy that allocated capital to hedge funds ranging from Two Sigma Investments to Magnetar Capital.

The Blackstone Diversified Multi-Strategy fund will shutter by the end of the year. The fund operates under the European Union’s UCITS Directive and provides investors daily access to their capital, a structure that has come under pressure.

It manages about $200 million in assets, down from its peak $2.3 billion in 2018.

“We are in talks with clients to move their capital to newer strategies that offer greater flexibility than the current structure allows,” a spokesman for the investment firm said in a statement confirming plans to close the fund.

The Blackstone unit that runs the fund manages about $89 billion in assets, the spokesman added.

...

Blackstone to End Legacy Strategy That Gave Money to Hedge Funds

https://finance.yahoo.com/news/blackstone-end-legacy-strateg…

...

Blackstone Inc. is winding down a strategy that allocated capital to hedge funds ranging from Two Sigma Investments to Magnetar Capital.

The Blackstone Diversified Multi-Strategy fund will shutter by the end of the year. The fund operates under the European Union’s UCITS Directive and provides investors daily access to their capital, a structure that has come under pressure.

It manages about $200 million in assets, down from its peak $2.3 billion in 2018.

“We are in talks with clients to move their capital to newer strategies that offer greater flexibility than the current structure allows,” a spokesman for the investment firm said in a statement confirming plans to close the fund.

The Blackstone unit that runs the fund manages about $89 billion in assets, the spokesman added.

...

Antwort auf Beitrag Nr.: 74.015.589 von faultcode am 16.06.23 13:18:0531.10.

FT: Odey Asset Management to close after sexual assault allegations against founder

https://www.ft.com/content/432dbfef-71fd-471e-9e05-a81b1a46f…

...

Both Odey and the firm face a lawsuit from two of his alleged victims for personal injury and psychological harm. Odey and the firm are yet to formally respond to the claim, which has been filed in London’s High Court.

...

FT: Odey Asset Management to close after sexual assault allegations against founder

https://www.ft.com/content/432dbfef-71fd-471e-9e05-a81b1a46f…

...

Both Odey and the firm face a lawsuit from two of his alleged victims for personal injury and psychological harm. Odey and the firm are yet to formally respond to the claim, which has been filed in London’s High Court.

...

30.8.

Hedge funds are shorting stocks that Biden's IRA was meant to help

Betting climate stimulus will tip debt-reliant green companies over the edge

https://financialpost.com/investing/hedge-funds-shorting-sto…

...

Renaud Saleur, chief executive at Geneva-based Anaconda Invest SA, expects the vast sums of cash being pumped into the United States economy by the Inflation Reduction Act (IRA) to make life harder in the near term for many of the companies it was supposed to help.

“People have forgotten” that a lot of green businesses are still “project financing and therefore extremely sensitive to interest rates, extremely sensitive to the discounted future cash flows,” he said. “And extremely sensitive to the cost of commodities that are going to be used to build the turbines or to build the offshore wind farms.”

...

Hedge funds are shorting stocks that Biden's IRA was meant to help

Betting climate stimulus will tip debt-reliant green companies over the edge

https://financialpost.com/investing/hedge-funds-shorting-sto…

...

Renaud Saleur, chief executive at Geneva-based Anaconda Invest SA, expects the vast sums of cash being pumped into the United States economy by the Inflation Reduction Act (IRA) to make life harder in the near term for many of the companies it was supposed to help.

“People have forgotten” that a lot of green businesses are still “project financing and therefore extremely sensitive to interest rates, extremely sensitive to the discounted future cash flows,” he said. “And extremely sensitive to the cost of commodities that are going to be used to build the turbines or to build the offshore wind farms.”

...

Oceanwood macht dicht

Oceanwood Capital Management (Norske Skog et al --> https://www.wallstreet-online.de/diskussion/1264109-11-20/no…):18.8.

Oceanwood’s Deputy CIO to Start Own Firm as Hedge Fund Shutters

https://www.bnnbloomberg.ca/oceanwood-s-deputy-cio-to-start-…

...

Oceanwood Capital Management’s deputy chief investment officer Julian Garcia Woods is striking out on his own and the hedge fund he co-managed with founder Christopher Gate is shutting down.

Woods, who has been at Oceanwood since 2007, is taking a team from the firm and plans to launch CoreLane Capital Management early next year, according to Andrew Baker, head of business development at the London-based company. Oceanwood will return capital to investors while Gate, 59, is retiring, he said.

Oceanwood’s Opportunities Fund, which managed more than $2 billion in peak assets, currently runs about $500 million. Some of the capital will be transfered to Woods’ new firm, with Gate also investing in the startup, according to Baker, who will become CEO of CoreLane. Gate didn’t respond to emails seeking comment.

The new fund will run a concentrated portfolio of equity and credit bets, focusing on European special situations investment opportunities. CoreLane will build its portfolio around corporate actions such as spinoffs, mergers and acquisitions, reorganizations, bankruptcies and recapitalizations.

...

More than 2,500 hedge funds have shuttered over the last five years, exceeding launches during the period, according to data compiled by Hedge Fund Research Inc.

Founded in 2006 by Gate and an investment team from Tudor Investment Corp., Oceanwood has been one of the largest event-driven hedge funds in London.

Sizable bets since its inception have included NH Hotel Group SA, Spanish lender Unicaja Banco SA, Norske Skog ASA and a short wager on scandal-plagued payments processor Wirecard AG. At times, it has turned an activist investor in companies ranging from NH Hotel, Merlin Properties Socimi SA to Just Eat Takeaway.com NV.

...

Ende eines Tech-Shorty-ETF's: "the anti-ARKK"

10.8.

Hedge Fund Alum George Noble Shutters New ETF After 59% Plunge

https://finance.yahoo.com/news/hedge-fund-alum-george-noble-…

...

Hedge-fund veteran George Noble’s foray into the exchange-traded fund industry has come to a quick, and painful, end.

The Noble Absolute Return ETF (ticker NOPE), which took long and short equity positions and which has dropped 59% since its September debut, is set to liquidate, according to a Wednesday announcement. Its plunge has happened even as the S&P 500 rose 23% over that stretch and the Nasdaq 100 jumped some 36%.

NOPE held positions against a number of tech stocks that have posted staggering advances in 2023. The tech sector overall has made an impressive comeback following 2022’s drubbing, partly fueled by hype over prospects for artificial intelligence, as well as optimism that the Federal Reserve is likely done raising interest rates.

The largest bearish position in the ETF is a short bet against the Invesco QQQ Trust Series 1 fund (QQQ), which tracks the tech-heavy Nasdaq 100, data compiled by Bloomberg show. It also holds wagers against electric-vehicle-maker Tesla Inc. and Nvidia Corp., the chipmaker whose shares have surged about 190% this year. Other short positions include Coinbase Global Inc. and Apple Inc., which have also rallied.

“NOPE was like the anti-ARKK — a negation of high growth stocks that never found the long-term bear market it thought would happen,” Bloomberg Intelligence senior ETF analyst Eric Balchunas said. “In the end, for hot-sauce-type ETFs, you need good performance to make it and NOPE never delivered.”

...

=> merke: U.S.-Tech erst (richtig) shorten, wenn die meisten Bären weg vom Fenster sind

https://www.noble-funds.com/ -->

Sculptor Capital Management ($SCU, NYSE), früher Och-Ziff Capital Management Group: das Ende als (einzig) öffentlich gelisteter Hedge fund:

24.7.

Rithm Capital to acquire hedge fund Sculptor for $639 million

https://www.msn.com/en-us/money/savingandinvesting/rithm-cap…

...

Asset manager Rithm Capital has agreed to acquire hedge fund firm Sculptor Capital Management for $639 million, the companies said in a statement on Monday.

Rithm will pay $11.15 per class A share of Sculptor, which represents a premium of 18% over Sculptor's closing price on Friday.

Sculptor, once known as Och-Ziff Capital Management, had been exploring a sale since last year, amid a legal battle with its founder, Daniel Och.

Och accused his former firm in a lawsuit of letting Chief Executive James Levin wield power over the board to extract "ever-escalating" pay despite subpar performance. Sculptor in August 2022 called Och's filing "misleading and full of falsehoods."

Rithm's chairman and chief executive officer, Michael Nierenberg, said the deal is "transformational." The transaction will allow the company to expand beyond real estate and financial services and roughly double its assets under management to over $60 billion. Rithm also has $7 billion of capital.

Sculptor, which manages credit, private real estate equity and multi-strategy funds, will become a subsidiary of Rithm and continue to be led by Levin as chief investment officer.

In a note to clients, BTIG said the deal broadens Rithm's "investment stance with the flexibility to put assets either on its own balance sheet as a direct investor, or leverage its asset management capabilities with third-party capital."

24.7.

Rithm Capital to acquire hedge fund Sculptor for $639 million

https://www.msn.com/en-us/money/savingandinvesting/rithm-cap…

...

Asset manager Rithm Capital has agreed to acquire hedge fund firm Sculptor Capital Management for $639 million, the companies said in a statement on Monday.

Rithm will pay $11.15 per class A share of Sculptor, which represents a premium of 18% over Sculptor's closing price on Friday.

Sculptor, once known as Och-Ziff Capital Management, had been exploring a sale since last year, amid a legal battle with its founder, Daniel Och.

Och accused his former firm in a lawsuit of letting Chief Executive James Levin wield power over the board to extract "ever-escalating" pay despite subpar performance. Sculptor in August 2022 called Och's filing "misleading and full of falsehoods."

Rithm's chairman and chief executive officer, Michael Nierenberg, said the deal is "transformational." The transaction will allow the company to expand beyond real estate and financial services and roughly double its assets under management to over $60 billion. Rithm also has $7 billion of capital.

Sculptor, which manages credit, private real estate equity and multi-strategy funds, will become a subsidiary of Rithm and continue to be led by Levin as chief investment officer.

In a note to clients, BTIG said the deal broadens Rithm's "investment stance with the flexibility to put assets either on its own balance sheet as a direct investor, or leverage its asset management capabilities with third-party capital."

11.7.

UK Looks to End Public Hedge Fund Disclosures of Short-Selling

https://news.bloomberglaw.com/securities-law/uk-looks-to-end…

...

The UK no longer wants hedge funds to publicly reveal their large short positions in company stocks, which the government says risks copycat trades and short squeezes.

The public register of short positions worth 0.5% or more of any London-listed firm will be replaced by an aggregated list, according to plans set out in a paper Tuesday. It comes after asset managers said in a government survey the current rules “negatively impact the price discovery process.”

...

UK Looks to End Public Hedge Fund Disclosures of Short-Selling

https://news.bloomberglaw.com/securities-law/uk-looks-to-end…

...

The UK no longer wants hedge funds to publicly reveal their large short positions in company stocks, which the government says risks copycat trades and short squeezes.

The public register of short positions worth 0.5% or more of any London-listed firm will be replaced by an aggregated list, according to plans set out in a paper Tuesday. It comes after asset managers said in a government survey the current rules “negatively impact the price discovery process.”

...

Antwort auf Beitrag Nr.: 73.021.826 von faultcode am 04.01.23 14:04:3304.01.2023

16.6.

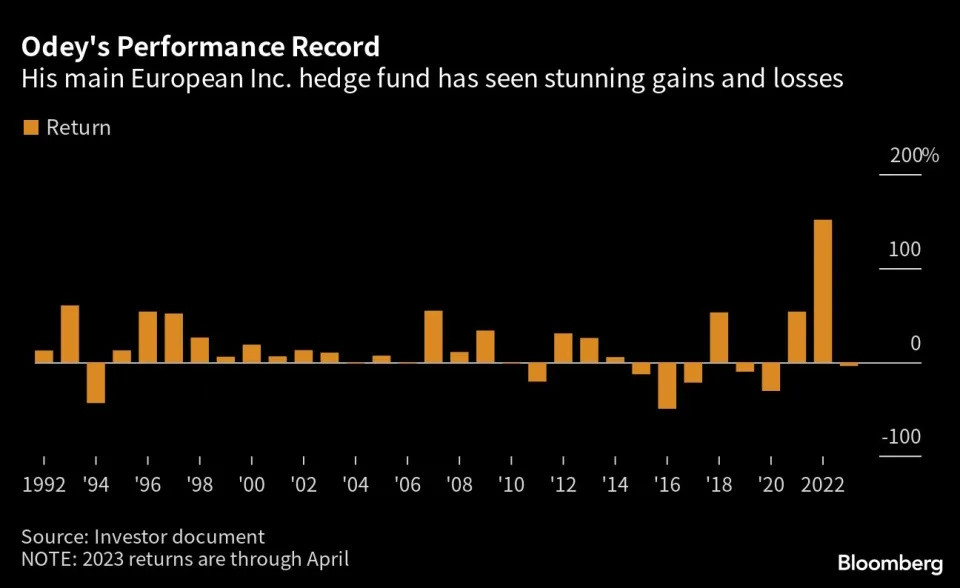

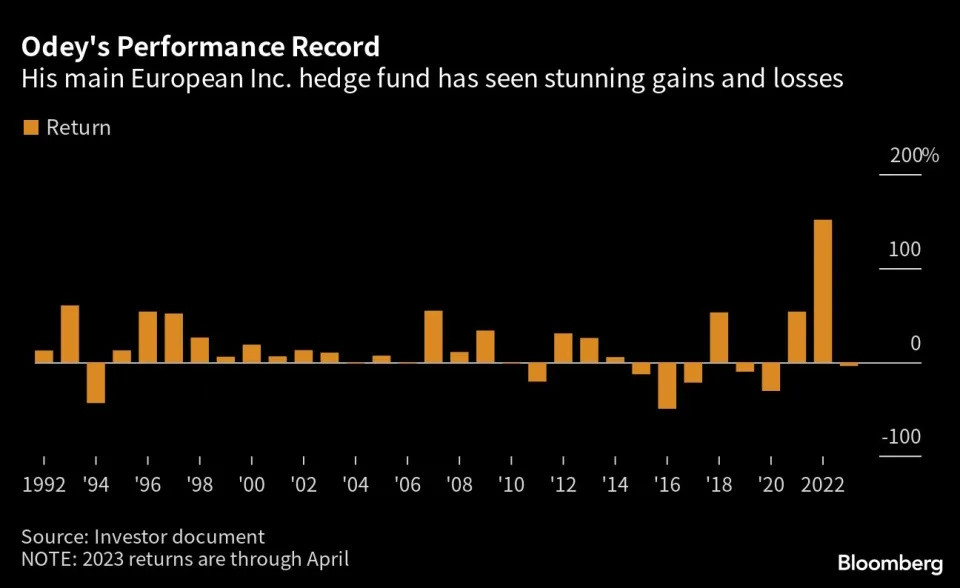

Crispin Odey’s One-Week Downfall Was Decades in the Making

https://finance.yahoo.com/news/crispin-odeys-one-week-downfa…

...

“I have the ability to remain in an uncomfortable place for an uncomfortable amount of time,” Crispin Odey told Bloomberg last year.

It was a reference to his investing style and stunning comeback from years of successive losses. With the company that bears his name imploding, days after he was ousted amid allegations of sexual harassment and assault, that sentiment is about to be tested.

Odey’s three-decade run as one of London’s most famed and controversial hedge fund managers has come to a screeching halt. Within the space of a week he has gone from celebrating his best ever year of performance to having to watch from the sidelines as the firm he founded is broken up.

The dramatic fall from grace caps a career punctuated by extreme performance highs and lows. A notoriously contrarian investor, Odey, 64, made a name for himself as an extreme risk taker, who produced spectacular gains but also outsized losses.

Odey Asset Management LLP, the firm, which he created in 1991, at one point ran as much as $13 billion of assets. That had fallen to about $4.3 billion before the recent allegations prompted investors to pull their funds as service providers, including Morgan Stanley and Goldman Sachs Group Inc, severed ties.

...

“The implosion of Odey Asset Management has been a stark reminder for investors how much attention should be paid to key-man risk,” said Berlin-based Harald Berlinicke, the chief investment officer of Max-Berlinicke-Erben family office. “It is often conveniently ignored. Most of the time, the bill never arrives but when it does, investors are usually scratching their heads over how much they have to pay.”

...

Zitat von faultcode: ...

Odey’s Hedge Fund Soars 152% in Best Ever Year on Inflation Bet

https://finance.yahoo.com/news/odey-hedge-fund-soars-152-102…

...

16.6.

Crispin Odey’s One-Week Downfall Was Decades in the Making

https://finance.yahoo.com/news/crispin-odeys-one-week-downfa…

...

“I have the ability to remain in an uncomfortable place for an uncomfortable amount of time,” Crispin Odey told Bloomberg last year.

It was a reference to his investing style and stunning comeback from years of successive losses. With the company that bears his name imploding, days after he was ousted amid allegations of sexual harassment and assault, that sentiment is about to be tested.

Odey’s three-decade run as one of London’s most famed and controversial hedge fund managers has come to a screeching halt. Within the space of a week he has gone from celebrating his best ever year of performance to having to watch from the sidelines as the firm he founded is broken up.

The dramatic fall from grace caps a career punctuated by extreme performance highs and lows. A notoriously contrarian investor, Odey, 64, made a name for himself as an extreme risk taker, who produced spectacular gains but also outsized losses.

Odey Asset Management LLP, the firm, which he created in 1991, at one point ran as much as $13 billion of assets. That had fallen to about $4.3 billion before the recent allegations prompted investors to pull their funds as service providers, including Morgan Stanley and Goldman Sachs Group Inc, severed ties.

...

“The implosion of Odey Asset Management has been a stark reminder for investors how much attention should be paid to key-man risk,” said Berlin-based Harald Berlinicke, the chief investment officer of Max-Berlinicke-Erben family office. “It is often conveniently ignored. Most of the time, the bill never arrives but when it does, investors are usually scratching their heads over how much they have to pay.”

...

https://www.wallstreet-online.de/etf/a2dwav-goldman-sachs-he…

2.6.

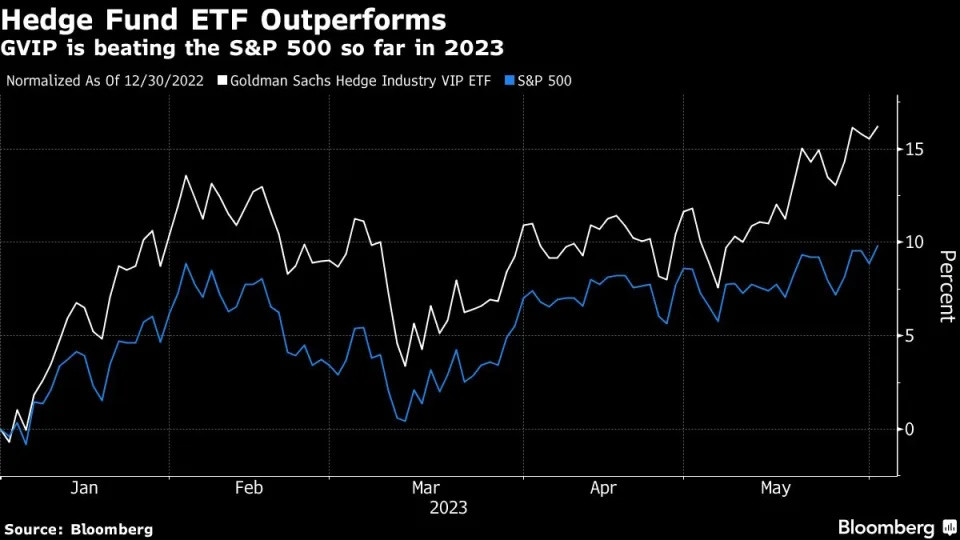

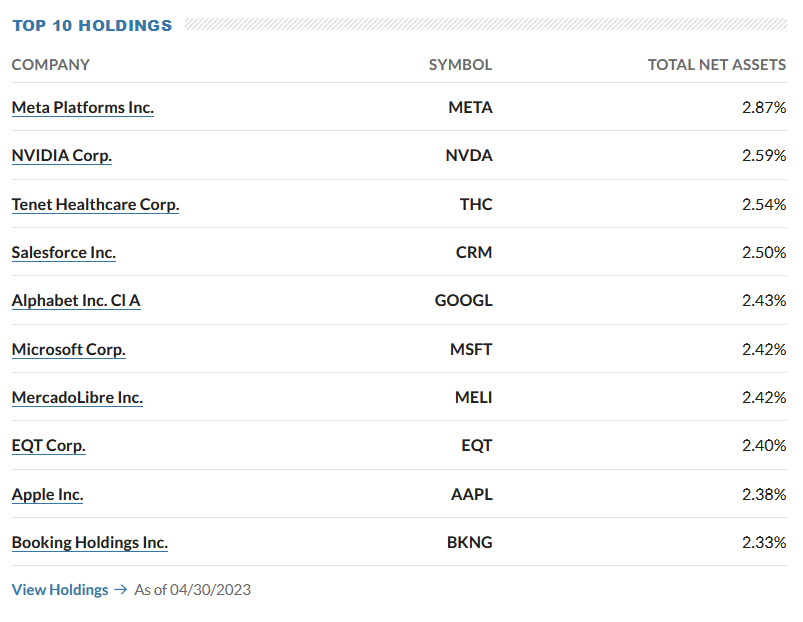

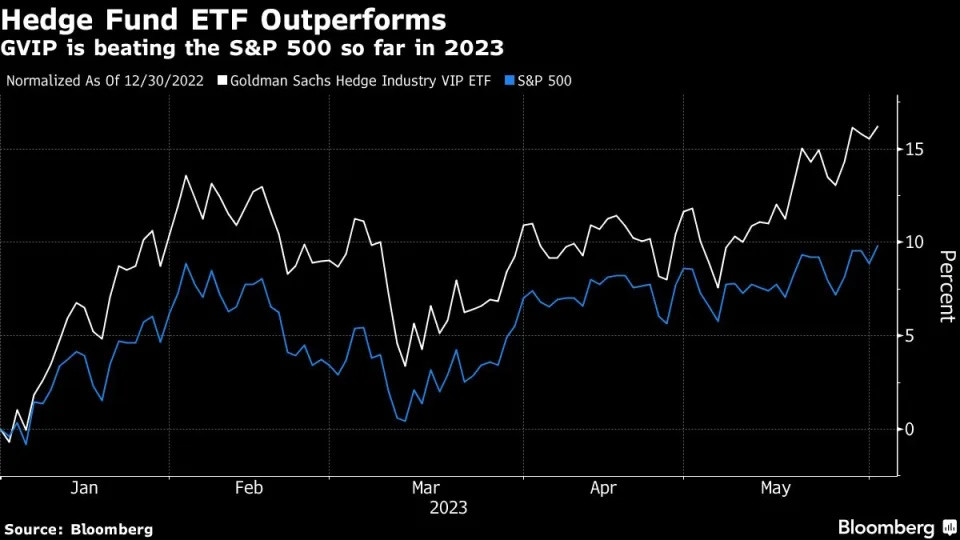

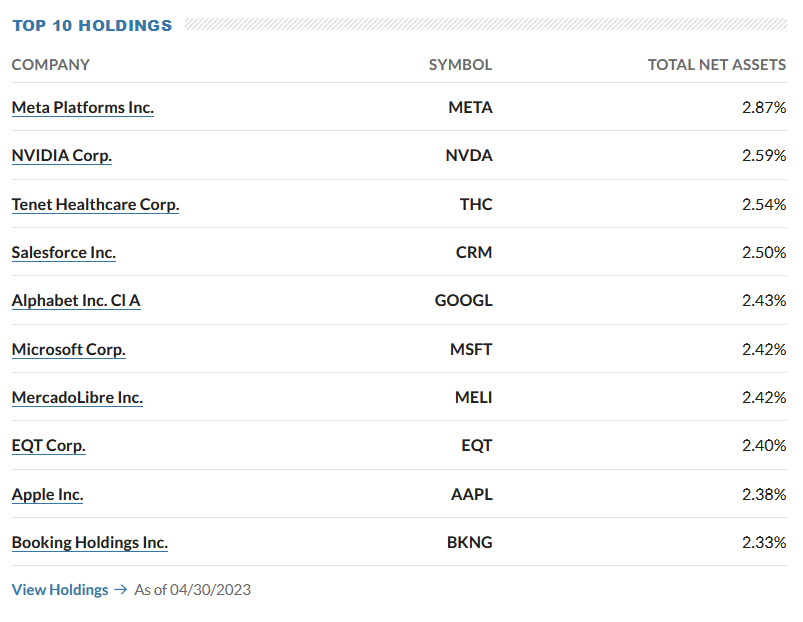

Goldman’s Hedge Fund ETF Is Crushing the S&P 500 With AI Bets

https://finance.yahoo.com/news/goldman-hedge-fund-etf-crushi…

...

The $127 million Goldman Sachs Hedge Industry VIP exchange-traded fund (ticker GVIP), which scans 13F filings to build a portfolio of popular hedge fund picks, has rallied more than 16% so far in 2023, Bloomberg data shows. That compares to a nearly 10% climb for the S&P 500.

GVIP’s 2023 outperformance is largely thanks to its three largest holdings: AI-darlings Nvidia Corp., Broadcom Inc. and Advanced Micro Devices Inc.

Paced by Nvidia, the chipmakers have surged over the past month as hype builds around the technology, which was a hot topic in the latest round of corporate earnings. While GVIP has lagged the S&P 500 since its inception in late 2016, the ETF’s returns suggest that hedge funds were able to get ahead of the AI craze.

“GVIP and the underlying fundamentally-driven hedge fund managers being tracked deserve some credit for properly positioning ahead of the recent AI mania,” said Nate Geraci, president of The ETF Store, an advisory firm. “That said, every dog has its day.”

GVIP is rebalanced quarterly and consists of the 50 stocks that appear most frequently among the top ten holdings of US hedge funds. Its holdings are equally weighted at each reshuffle.

Typically, the ETF tends to do well during periods that see tech and growth stocks outperform, and trail when risk appetite sours, according to Geraci. As such, GVIP underperformed in 2022 with a 32% plunge, compared to the S&P 500’s 19% fall.

...

=>

https://www.marketwatch.com/investing/fund/gvip?mod=search_s…

2.6.

Goldman’s Hedge Fund ETF Is Crushing the S&P 500 With AI Bets

https://finance.yahoo.com/news/goldman-hedge-fund-etf-crushi…

...

The $127 million Goldman Sachs Hedge Industry VIP exchange-traded fund (ticker GVIP), which scans 13F filings to build a portfolio of popular hedge fund picks, has rallied more than 16% so far in 2023, Bloomberg data shows. That compares to a nearly 10% climb for the S&P 500.

GVIP’s 2023 outperformance is largely thanks to its three largest holdings: AI-darlings Nvidia Corp., Broadcom Inc. and Advanced Micro Devices Inc.

Paced by Nvidia, the chipmakers have surged over the past month as hype builds around the technology, which was a hot topic in the latest round of corporate earnings. While GVIP has lagged the S&P 500 since its inception in late 2016, the ETF’s returns suggest that hedge funds were able to get ahead of the AI craze.

“GVIP and the underlying fundamentally-driven hedge fund managers being tracked deserve some credit for properly positioning ahead of the recent AI mania,” said Nate Geraci, president of The ETF Store, an advisory firm. “That said, every dog has its day.”

GVIP is rebalanced quarterly and consists of the 50 stocks that appear most frequently among the top ten holdings of US hedge funds. Its holdings are equally weighted at each reshuffle.

Typically, the ETF tends to do well during periods that see tech and growth stocks outperform, and trail when risk appetite sours, according to Geraci. As such, GVIP underperformed in 2022 with a 32% plunge, compared to the S&P 500’s 19% fall.

...

=>

https://www.marketwatch.com/investing/fund/gvip?mod=search_s…

14.4.

Crypto Investment Firm BlockTower Winds Down Its Market-Neutral Fund

Miami-based digital-asset investment firm BlockTower Capital wound down a “market-neutral” crypto fund that at one point oversaw more than $100 million with the goal of generating returns no matter which direction prices took.

https://financialpost.com/pmn/business-pmn/crypto-investment…

...

The opportunity for a market-neutral strategy “shrunk dramatically in the aftermath of 2022,” Blocktower Chief Information Officer Ari Paul said in a statement, adding that higher interest rates and increasing compliance challenges related to decentralized finance investment strategies also contributed to the decision to close the fund.

...

=> es ist jedesmal dasselbe: immer dann, wenn man eine "market-neutral strategy" bräuchte, funktioniert sie nicht

Jede Generation muss das wohl auf's Neue erst lernen.

Crypto Investment Firm BlockTower Winds Down Its Market-Neutral Fund

Miami-based digital-asset investment firm BlockTower Capital wound down a “market-neutral” crypto fund that at one point oversaw more than $100 million with the goal of generating returns no matter which direction prices took.

https://financialpost.com/pmn/business-pmn/crypto-investment…

...

The opportunity for a market-neutral strategy “shrunk dramatically in the aftermath of 2022,” Blocktower Chief Information Officer Ari Paul said in a statement, adding that higher interest rates and increasing compliance challenges related to decentralized finance investment strategies also contributed to the decision to close the fund.

...

=> es ist jedesmal dasselbe: immer dann, wenn man eine "market-neutral strategy" bräuchte, funktioniert sie nicht

Jede Generation muss das wohl auf's Neue erst lernen.

17:55 Uhr · onemarkets Blog · DAXAnzeige |

16:03 Uhr · dpa-AFX · BMW |

15:38 Uhr · dpa-AFX · Deutsche Bank |

15:20 Uhr · dpa-AFX · BASF |

14:57 Uhr · dpa-AFX · BASF |

14:34 Uhr · dpa-AFX · BASF |

13:27 Uhr · BörsenNEWS.de · DHL Group |

12:59 Uhr · dpa-AFX · BMW |

12:48 Uhr · dpa-AFX · Merck |

12:13 Uhr · dpa-AFX · BMW |

| Zeit | Titel |

|---|---|

| 17:27 Uhr | |

| 16:31 Uhr | |

| 16:04 Uhr | |

| 15:30 Uhr | |

| 12:53 Uhr | |

| 10:19 Uhr | |

| 08:43 Uhr | |

| 07:09 Uhr | |

| 24.04.24 | |

| 23.04.24 |