Die Rote Waldameise ... KPCh ... - 500 Beiträge pro Seite

eröffnet am 02.11.20 09:34:59 von

neuester Beitrag 12.12.20 10:59:16 von

neuester Beitrag 12.12.20 10:59:16 von

Beiträge: 10

ID: 1.333.367

ID: 1.333.367

Aufrufe heute: 0

Gesamt: 806

Gesamt: 806

Aktive User: 0

ISIN: CNE1000044N1 · WKN: A2QGCN

EUR

0,00 %

0,00 EUR

Letzter Kurs Lang & Schwarz

Neuigkeiten

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +500,00 | |

| 1,9500 | +56,00 | |

| 1,2900 | +36,33 | |

| 3,8600 | +15,57 | |

| 9,8000 | +7,69 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,690 | -11,51 | |

| 5,0800 | -11,83 | |

| 9,8500 | -17,92 | |

| 3,20 | -17,95 | |

| 0,7500 | -25,00 |

🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜

HKEX: To Offer Investors More Options on ANT GROUP (06688.HK)'s Mkt Debut

2020/11/02 12:23

HKEX (00388.HK) +4.200 (+1.135%) Short selling $149.89M; Ratio 21.259% announced that it will offer investors more options on ANT GROUP (06688.HK) shares on the debut date (5 November 2020), including Ant futures, options and derivative warrants.

Ant shares will also be included in HKEX’s designated securities eligible for short selling on 5 November 2020, ...

http://www.aastocks.com/en/stocks/news/aafn-con/NOW.1053082/…

...........................................................................................................................................................

Alibaba Group Holding Ltd., which was co-founded by Ma and currently owns about a third of Ant, has agreed to subscribe for 730 million of the company’s Shanghai shares, which will be listed under the ticker “0688688,”...

https://finance.yahoo.com/news/ant-ipo-investors-commit-days…

...........................................................................................................................................................

Highlight

Khazanah stands to earn handsome windfall from Ant IPO — report

Surin Murugiah / theedgemarkets.com

November 02, 2020 09:34 am +08

KUALA LUMPUR (Nov 2): Sovereign wealth fund Khazanah Nasional Bhd is among an elite group of foreign investors who stand to earn a handsome windfall from Ant Group Co Ltd’s market debut.

In 2018, the fast-growing financial-technology giant raised US$10.3 billion from investors outside mainland China, including wealthy individuals and private funds as well as larger institutions.

It was Ant’s third private capital raising and the company’s only sale of stock to foreign investors before its initial public offering (IPO).

The Wall Street Journal (WSJ) on Oct 29 reported that Khazanah, along with the sovereign-wealth fund of Singapore (Temasek Holdings Private Ltd), the Canada Pension Plan Investment Board and private-equity firms Silver Lake, Warburg Pincus, Carlyle Group and General Atlantic, was among the biggest foreign buyers — investing at least US$500 million each in 2018, citing Ant’s listing prospectus.

The WSJ said mutual-fund managers T Rowe Price Group Inc, BlackRock Inc and Fidelity Investments were in for US$200 million to US$500 million.

The report said Khazanah had invested some US$650 million and Temasek US$500 million via funds or entities they controlled or managed.

It said other well-connected buyers in 2018, ...

https://www.theedgemarkets.com/article/khazanah-stands-earn-…

...........................................................................................................................................................

November 2, 20207:59 AMUpdated an hour ago

Explainer: How mom-and-pop investors stumped up a record $3 trillion for Ant shares

By Samuel Shen, Scott Murdoch, Julie Zhu 4 Min Read

HONG KONG (Reuters) - Retail investors bid for a record $3 trillion worth of shares in Ant Group Co Ltd’s dual listing, in an unprecedented show of interest from mom-and-pop savers betting on demand for its financial technology services in China. ...

Each mainland retail investor was allowed to bid for one unit, or 500 Ant shares, for every 5,000 yuan worth of other Chinese shares already owned, up to 317,000 Ant shares. No cash was needed to bid, and investors allotted shares following a lottery-like draw must have enough money to cover their bid. ...

HOW DO RETAIL INVESTORS USE MARGIN FINANCING AND HOW DOES IT WORK FOR LENDERS?

Retail investors in Hong Kong borrow heavily as larger bids boost the chance of share allocation, pinning their hopes of benefiting from a debut trading day pop. They pay back the loan soon after listing and pocket the gains. ...

https://www.reuters.com/article/ant-group-ipo/explainer-how-…

...........................................................................................................................................................

Der chinesische Fintech-Konzern Ant Group setzt mit seinem dualen Börsengang neue Massstäbe

Das chinesische Fintech-Unternehmen Ant Group geht Anfang November gleich an zwei Börsen. Nutzniesser ist jedoch nicht der amerikanische Kapitalmarkt. Vielmehr setzt die Ant Group im amerikanisch-chinesischen Konflikt ein Zeichen und hat sich für die Börsen in Hongkong und Schanghai entschieden.

Matthias Müller, Pekin

02.11.2020, 05.30 Uhr

https://www.nzz.ch/wirtschaft/ant-group-fintech-konzern-aus-…

...........................................................................................................................................................

https://www.scmp.com/business/banking-finance/article/310775…

🐜🐜🐜🐜🐜🐜

HKEX: To Offer Investors More Options on ANT GROUP (06688.HK)'s Mkt Debut

2020/11/02 12:23

HKEX (00388.HK) +4.200 (+1.135%) Short selling $149.89M; Ratio 21.259% announced that it will offer investors more options on ANT GROUP (06688.HK) shares on the debut date (5 November 2020), including Ant futures, options and derivative warrants.

Ant shares will also be included in HKEX’s designated securities eligible for short selling on 5 November 2020, ...

http://www.aastocks.com/en/stocks/news/aafn-con/NOW.1053082/…

...........................................................................................................................................................

Alibaba Group Holding Ltd., which was co-founded by Ma and currently owns about a third of Ant, has agreed to subscribe for 730 million of the company’s Shanghai shares, which will be listed under the ticker “0688688,”...

https://finance.yahoo.com/news/ant-ipo-investors-commit-days…

...........................................................................................................................................................

Highlight

Khazanah stands to earn handsome windfall from Ant IPO — report

Surin Murugiah / theedgemarkets.com

November 02, 2020 09:34 am +08

KUALA LUMPUR (Nov 2): Sovereign wealth fund Khazanah Nasional Bhd is among an elite group of foreign investors who stand to earn a handsome windfall from Ant Group Co Ltd’s market debut.

In 2018, the fast-growing financial-technology giant raised US$10.3 billion from investors outside mainland China, including wealthy individuals and private funds as well as larger institutions.

It was Ant’s third private capital raising and the company’s only sale of stock to foreign investors before its initial public offering (IPO).

The Wall Street Journal (WSJ) on Oct 29 reported that Khazanah, along with the sovereign-wealth fund of Singapore (Temasek Holdings Private Ltd), the Canada Pension Plan Investment Board and private-equity firms Silver Lake, Warburg Pincus, Carlyle Group and General Atlantic, was among the biggest foreign buyers — investing at least US$500 million each in 2018, citing Ant’s listing prospectus.

The WSJ said mutual-fund managers T Rowe Price Group Inc, BlackRock Inc and Fidelity Investments were in for US$200 million to US$500 million.

The report said Khazanah had invested some US$650 million and Temasek US$500 million via funds or entities they controlled or managed.

It said other well-connected buyers in 2018, ...

https://www.theedgemarkets.com/article/khazanah-stands-earn-…

...........................................................................................................................................................

November 2, 20207:59 AMUpdated an hour ago

Explainer: How mom-and-pop investors stumped up a record $3 trillion for Ant shares

By Samuel Shen, Scott Murdoch, Julie Zhu 4 Min Read

HONG KONG (Reuters) - Retail investors bid for a record $3 trillion worth of shares in Ant Group Co Ltd’s dual listing, in an unprecedented show of interest from mom-and-pop savers betting on demand for its financial technology services in China. ...

Each mainland retail investor was allowed to bid for one unit, or 500 Ant shares, for every 5,000 yuan worth of other Chinese shares already owned, up to 317,000 Ant shares. No cash was needed to bid, and investors allotted shares following a lottery-like draw must have enough money to cover their bid. ...

HOW DO RETAIL INVESTORS USE MARGIN FINANCING AND HOW DOES IT WORK FOR LENDERS?

Retail investors in Hong Kong borrow heavily as larger bids boost the chance of share allocation, pinning their hopes of benefiting from a debut trading day pop. They pay back the loan soon after listing and pocket the gains. ...

https://www.reuters.com/article/ant-group-ipo/explainer-how-…

...........................................................................................................................................................

Der chinesische Fintech-Konzern Ant Group setzt mit seinem dualen Börsengang neue Massstäbe

Das chinesische Fintech-Unternehmen Ant Group geht Anfang November gleich an zwei Börsen. Nutzniesser ist jedoch nicht der amerikanische Kapitalmarkt. Vielmehr setzt die Ant Group im amerikanisch-chinesischen Konflikt ein Zeichen und hat sich für die Börsen in Hongkong und Schanghai entschieden.

Matthias Müller, Pekin

02.11.2020, 05.30 Uhr

https://www.nzz.ch/wirtschaft/ant-group-fintech-konzern-aus-…

...........................................................................................................................................................

https://www.scmp.com/business/banking-finance/article/310775…

🐜🐜🐜🐜🐜🐜

Antwort auf Beitrag Nr.: 65.567.105 von teecee1 am 02.11.20 09:34:59NTD: Vorgehen chinesischer Milliardäre bedroht Millionen | Mann für Benutzung von Wikipedia verhaftet

Epoch Times2. November 2020 Aktualisiert: 2. November 2020 19:31

Laut China sei eine vollständige Abkopplung der USA unrealistisch. Die USA haben ihre Abkoppelung von China in diesem Jahr beschleunigt.

Chinas Ant Group soll diese Woche in Shanghai und Hongkong gelistet werden. Das Online-Zahlungsunternehmen soll mit mehr als 34 Milliarden Dollar das weltweit größte Börsendebüt erleben.

Die Polizei verhaftete einen chinesischen Internetnutzer, ...

https://www.epochtimes.de/china/ntd-vorgehen-chinesischer-mi…

🐜........................................................................................................................................................🐜

Mega-IPO der Ant Group – Chinas Variante der Volksaktie ... ... Aramco ...

... Aramco ...

13:03 02.11.20

Staatlich verordneter Run auf die Aktien

Um zu den schwindelerregenden Zahlen zu gelangen, überhäufen lokale Banken potenzielle Anleger mit Krediten, nur um sicherzustellen, dass die Aktien nach der Eröffnung des Handels in die Höhe schnellen. Hongkongs Banken und Makler bieten interessierten Anlegern Margenkredite von fast 300 Milliarden Hongkong-Dollar (umgerechnet rund 39 Milliarden US-Dollar) an, mit denen sie sich in den Börsengang einkaufen können. Es droht eine gefährliche Blase. Man erinnert sich hierzulande nur ungern an den Börsengang der Volksaktie Deutsche Telekom zur Jahrtausendwende. ...

– dieser Börsengang nichts anderes ist als ein von der Regierung beauftragter Volks-IPO. ...

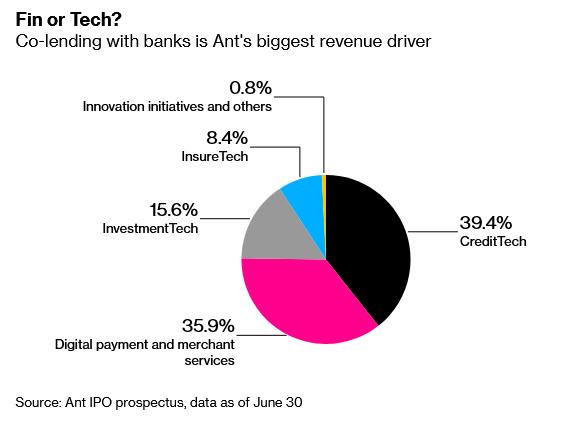

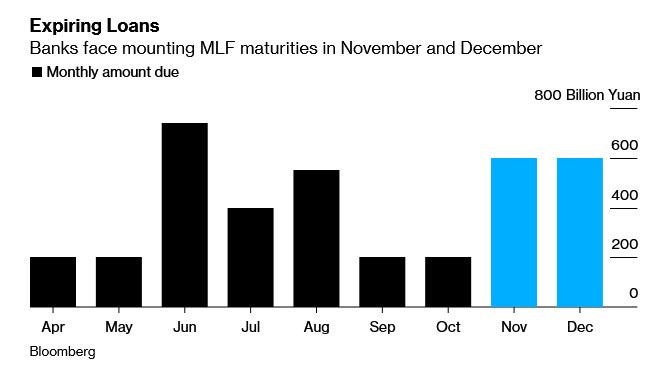

Mehr als nur ein Zahlungsabwickler

Neben diesem „staatlich verordneten“ Run auf die Aktien kann aber auch durchaus das Geschäftsmodell der Ant Group, deren Großaktionär kein geringerer als der Multimilliardär und Alibaba-Gründer Jack Ma ist, durchaus als Begründung für das starke Interesse der Investoren an den Unternehmensanteilen herhalten. Denn die Ant Group ist mehr als nur ein Unternehmen mit dem eher margenschwachen Geschäft für Zahlungsabwicklungen. Kunden können mit der App auch Kredite beantragen, in Fonds investieren und Versicherungen abschließen. Hier wird also nicht nur mit den Transaktionen, sondern auch mit den gesammelten Daten sehr viel schnelles Geld verdient. Mit Alipay hat man das heißeste Unternehmen unter seinen Fittichen. Und das IPO so kurz nach der Präsidentschaftswahl in den USA hat auch einen besonderen politischen Reiz: Er soll Chinas Überlegenheit gegenüber den USA symbolisieren.

Nebenbei bemerkt wird Ant in Shanghai unter dem Ticker-Symbol 688688 und in Hongkong unter 6688 gehandelt, ganz im Sinne von Jack Ma's Vorliebe für die Zahl Acht, ...

http://www.stock-world.de/analysen/nc12109221

🐜........................................................................................................................................................🐜

Helen Partz vor 23 Stunden

Chinesische Zentralbank: Pilotprojekte für digitalen Yuan verarbeiten 300 Mio. US-Dollar

Chinas Pilotprojekt für den digitalen Yuan gewinnt immer mehr an Fahrt.

Der Gouverneur der chinesischen Zentralbank hat weitere Details über das laufende Pilotprojektfür die digitale Währung des Landes verraten.

Yi Gang, der Gouverneur der Volksbank von China, sagte, dass in den Pilotprojekten für den digitalen Yuan bis heute mehr als vier Millionen Transaktionen im Wert von insgesamt mehr als 299 Mio. US-Dollar verarbeitet worden seien. Diese Zahlen gab er auf der Konferenz der Hongkonger Fintech Week am 2. November bekannt, wie Bloomberg berichtete.

Laut Yi seien die Pilotprojekte bisher reibungslos verlaufen, nachdem sie für großangelegte Tests auf vier Städte ausgeweitet wurden.

Die wachsende Nachfrage nach ...

Er erklärte, dass Fintech-Unternehmen gegenüber Geschäftsbanken einige entscheidende Vorteile in Bezug auf den Aufbau eines Kundenstamms und das Risikomanagement hätten. ...

https://de.cointelegraph.com/news/china-s-digital-yuan-pilot…

🐜........................................................................................................................................................🐜

Jack Martin vor 10 Stunden

Kaimaninseln: Regulierung für virtuelle Vermögenswertdienstleister

Die bekannte Steueroase bemüht sich offenbar tatsächlich um eine Besserung ihres Images.

Das Ministerium für Finanzdienstleistungen auf den Kaimaninseln gab bekannt, dass es einen Regulierungsrahmen für Anbieter virtueller Vermögenswerte (VASPs) erarbeiten wolle.

In einer Pressemitteilung vom 31. Oktober behauptete das Ministerium, ...

https://de.cointelegraph.com/news/cayman-islands-introduce-r…

🐜..................................................................................................................................🐜

Adresse und Kontaktdaten

Name Tencent Holdings Ltd

Straße 29/F., Three Pacific Place, No. 1 Queen’s Road East

Stadt George Town

Land 🇰🇾Kaimaninseln

🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜

Epoch Times2. November 2020 Aktualisiert: 2. November 2020 19:31

Laut China sei eine vollständige Abkopplung der USA unrealistisch. Die USA haben ihre Abkoppelung von China in diesem Jahr beschleunigt.

Chinas Ant Group soll diese Woche in Shanghai und Hongkong gelistet werden. Das Online-Zahlungsunternehmen soll mit mehr als 34 Milliarden Dollar das weltweit größte Börsendebüt erleben.

Die Polizei verhaftete einen chinesischen Internetnutzer, ...

https://www.epochtimes.de/china/ntd-vorgehen-chinesischer-mi…

🐜........................................................................................................................................................🐜

Mega-IPO der Ant Group – Chinas Variante der Volksaktie ...

... Aramco ...

... Aramco ...13:03 02.11.20

Staatlich verordneter Run auf die Aktien

Um zu den schwindelerregenden Zahlen zu gelangen, überhäufen lokale Banken potenzielle Anleger mit Krediten, nur um sicherzustellen, dass die Aktien nach der Eröffnung des Handels in die Höhe schnellen. Hongkongs Banken und Makler bieten interessierten Anlegern Margenkredite von fast 300 Milliarden Hongkong-Dollar (umgerechnet rund 39 Milliarden US-Dollar) an, mit denen sie sich in den Börsengang einkaufen können. Es droht eine gefährliche Blase. Man erinnert sich hierzulande nur ungern an den Börsengang der Volksaktie Deutsche Telekom zur Jahrtausendwende. ...

– dieser Börsengang nichts anderes ist als ein von der Regierung beauftragter Volks-IPO. ...

Mehr als nur ein Zahlungsabwickler

Neben diesem „staatlich verordneten“ Run auf die Aktien kann aber auch durchaus das Geschäftsmodell der Ant Group, deren Großaktionär kein geringerer als der Multimilliardär und Alibaba-Gründer Jack Ma ist, durchaus als Begründung für das starke Interesse der Investoren an den Unternehmensanteilen herhalten. Denn die Ant Group ist mehr als nur ein Unternehmen mit dem eher margenschwachen Geschäft für Zahlungsabwicklungen. Kunden können mit der App auch Kredite beantragen, in Fonds investieren und Versicherungen abschließen. Hier wird also nicht nur mit den Transaktionen, sondern auch mit den gesammelten Daten sehr viel schnelles Geld verdient. Mit Alipay hat man das heißeste Unternehmen unter seinen Fittichen. Und das IPO so kurz nach der Präsidentschaftswahl in den USA hat auch einen besonderen politischen Reiz: Er soll Chinas Überlegenheit gegenüber den USA symbolisieren.

Nebenbei bemerkt wird Ant in Shanghai unter dem Ticker-Symbol 688688 und in Hongkong unter 6688 gehandelt, ganz im Sinne von Jack Ma's Vorliebe für die Zahl Acht, ...

http://www.stock-world.de/analysen/nc12109221

🐜........................................................................................................................................................🐜

Helen Partz vor 23 Stunden

Chinesische Zentralbank: Pilotprojekte für digitalen Yuan verarbeiten 300 Mio. US-Dollar

Chinas Pilotprojekt für den digitalen Yuan gewinnt immer mehr an Fahrt.

Der Gouverneur der chinesischen Zentralbank hat weitere Details über das laufende Pilotprojektfür die digitale Währung des Landes verraten.

Yi Gang, der Gouverneur der Volksbank von China, sagte, dass in den Pilotprojekten für den digitalen Yuan bis heute mehr als vier Millionen Transaktionen im Wert von insgesamt mehr als 299 Mio. US-Dollar verarbeitet worden seien. Diese Zahlen gab er auf der Konferenz der Hongkonger Fintech Week am 2. November bekannt, wie Bloomberg berichtete.

Laut Yi seien die Pilotprojekte bisher reibungslos verlaufen, nachdem sie für großangelegte Tests auf vier Städte ausgeweitet wurden.

Die wachsende Nachfrage nach ...

Er erklärte, dass Fintech-Unternehmen gegenüber Geschäftsbanken einige entscheidende Vorteile in Bezug auf den Aufbau eines Kundenstamms und das Risikomanagement hätten. ...

https://de.cointelegraph.com/news/china-s-digital-yuan-pilot…

🐜........................................................................................................................................................🐜

Jack Martin vor 10 Stunden

Kaimaninseln: Regulierung für virtuelle Vermögenswertdienstleister

Die bekannte Steueroase bemüht sich offenbar tatsächlich um eine Besserung ihres Images.

Das Ministerium für Finanzdienstleistungen auf den Kaimaninseln gab bekannt, dass es einen Regulierungsrahmen für Anbieter virtueller Vermögenswerte (VASPs) erarbeiten wolle.

In einer Pressemitteilung vom 31. Oktober behauptete das Ministerium, ...

https://de.cointelegraph.com/news/cayman-islands-introduce-r…

🐜..................................................................................................................................🐜

Adresse und Kontaktdaten

Name Tencent Holdings Ltd

Straße 29/F., Three Pacific Place, No. 1 Queen’s Road East

Stadt George Town

Land 🇰🇾Kaimaninseln

🐜🐜🐜🐜🐜🐜🐜🐜🐜🐜

Antwort auf Beitrag Nr.: 65.577.839 von teecee1 am 03.11.20 09:52:39

🐜..................................................................................................................................🐜

Is The Suspension Of The World's Biggest IPO Chinese Retaliation Against BABA's Ma?

by Tyler Durden

Tue, 11/03/2020 - 08:48

Update (0845ET): Following SSE's suspension, Ant Group has confirmed that it is also suspending its IPO (dual listing) in Hong Kong.

This legged BABA shares down further (now down 9%)...

* * *

The world's largest IPO - Ant Group's $35 billion dual-offering - is in peril as the Shanghai Stock Exchange has suspended the listing amid questions about regulatory compliance.

As a reminder, Ant is the parent of Alipay, a payments service spun out of Alibaba.

This decision follows reports that four Chinese regulators including the central bank and banking watchdog called billionaire Jack Ma and Ant Group Co.’s top executives to a rare joint supervisory interview on Monday, underscoring rising government scrutiny of the company before its stock-market debut.

“Ant Group will implement the meeting opinions in depth,” the company said in a statement. It will follow guidelines including stable innovation, an embrace of supervision and service to the real economy, it said.

The FT reports that the meeting came after Mr Ma criticised China’s state-owned banks at a financial summit in Shanghai at the end of October. ...

https://www.zerohedge.com/markets/shanghai-stock-exchange-po…

🐜..................................................................................................................................🐜

November 3, 20209:30 AMUpdated 3 hours ago

China's Ant expected to double on debut amid pent-up retail demand: fund managers

By Samuel Shen, Julie Zhu | 4 Min Read

SHANGHAI/HONG KONG (Reuters) - China’s Ant Group is expected to double its market value on debut, as unmet demand from mom-and-pop investors and an impending inclusion in major global indexes could offset worries about tighter regulations, fund managers said. ...

https://www.reuters.com/article/ant-group-ipo-valuation/chin…

🐜..................................................................................................................................🐜

Jack Ma Gets a Warning From China on Ant’s Rapid Expansion

Bloomberg News

November 2, 2020, 3:32 PM GMT+1 Updated on November 3, 2020, 4:33 AM GMT+1

https://www.bloomberg.com/news/articles/2020-11-02/jack-ma-s…

🐜..................................................................................................................................🐜

Ant Group IPO: Watchdogs summon Jack Ma

Nov. 03, 2020 2:17 AM ETAlibaba Group Holding Limited (BABA)By: Mamta Mayani, SA News

• Ant Group (NYSE:BABA) founder Jack Ma and two other senior executives were summoned by Chinese regulators, just days ahead of the world's biggest IPO of $34.5B.

• In a statement issued on Monday, the People’s Bank of China, the China Banking and Insurance Regulatory Commission, the Securities Regulatory Commission and the State Administration of Foreign Exchange said they had conducted “regulatory interviews” with Ma, Ant Group's chairman Eric Jing and its president Hu Xiaoming.

• No further details about the meetings were disclosed, although such a move is typically seen as a warning or dressing down of sorts.

• Ant Group's shares are due to begin trade in Hong Kong and Shanghai on November 5. The first dual listing of its kind on the two exchanges attracted more than $3T from retail investors.

• The company has come under increased scrutiny and tighter regulation as it has expanded the range of financial technology services it offers.

• Previously: Ant Group prices world's largest IPO at $34.5B with $313B market cap (Oct. 26)

• Previously: Ant Group's Shanghai retail book 872x oversubscribed (Oct. 29)

https://seekingalpha.com/news/3630149-ant-group-ipo-watchdog…

🐜..................................................................................................................................🐜

Ant Group Mgmt Summoned by CSRC & Other Bodies, Pledges to Enhance Inclusive Service

2020/11/03 07:46

Jack Ma, Eric Jing and Simon Hu, respectively ANT GROUP (06688.HK) (688688.SH)'s actual controller, chairman and CEO, had been summoned by PBoC, CBIRC, CSRC and SAFE for regulatory interviews.

In response, ...

http://www.aastocks.com/en/stocks/news/aafn-con/NOW.1053222/…

🐜..................................................................................................................................🐜

Is The Suspension Of The World's Biggest IPO Chinese Retaliation Against BABA's Ma?

by Tyler Durden

Tue, 11/03/2020 - 08:48

Update (0845ET): Following SSE's suspension, Ant Group has confirmed that it is also suspending its IPO (dual listing) in Hong Kong.

This legged BABA shares down further (now down 9%)...

* * *

The world's largest IPO - Ant Group's $35 billion dual-offering - is in peril as the Shanghai Stock Exchange has suspended the listing amid questions about regulatory compliance.

As a reminder, Ant is the parent of Alipay, a payments service spun out of Alibaba.

This decision follows reports that four Chinese regulators including the central bank and banking watchdog called billionaire Jack Ma and Ant Group Co.’s top executives to a rare joint supervisory interview on Monday, underscoring rising government scrutiny of the company before its stock-market debut.

“Ant Group will implement the meeting opinions in depth,” the company said in a statement. It will follow guidelines including stable innovation, an embrace of supervision and service to the real economy, it said.

The FT reports that the meeting came after Mr Ma criticised China’s state-owned banks at a financial summit in Shanghai at the end of October. ...

https://www.zerohedge.com/markets/shanghai-stock-exchange-po…

🐜..................................................................................................................................🐜

November 3, 20209:30 AMUpdated 3 hours ago

China's Ant expected to double on debut amid pent-up retail demand: fund managers

By Samuel Shen, Julie Zhu | 4 Min Read

SHANGHAI/HONG KONG (Reuters) - China’s Ant Group is expected to double its market value on debut, as unmet demand from mom-and-pop investors and an impending inclusion in major global indexes could offset worries about tighter regulations, fund managers said. ...

https://www.reuters.com/article/ant-group-ipo-valuation/chin…

🐜..................................................................................................................................🐜

Jack Ma Gets a Warning From China on Ant’s Rapid Expansion

Bloomberg News

November 2, 2020, 3:32 PM GMT+1 Updated on November 3, 2020, 4:33 AM GMT+1

https://www.bloomberg.com/news/articles/2020-11-02/jack-ma-s…

🐜..................................................................................................................................🐜

Ant Group IPO: Watchdogs summon Jack Ma

Nov. 03, 2020 2:17 AM ETAlibaba Group Holding Limited (BABA)By: Mamta Mayani, SA News

• Ant Group (NYSE:BABA) founder Jack Ma and two other senior executives were summoned by Chinese regulators, just days ahead of the world's biggest IPO of $34.5B.

• In a statement issued on Monday, the People’s Bank of China, the China Banking and Insurance Regulatory Commission, the Securities Regulatory Commission and the State Administration of Foreign Exchange said they had conducted “regulatory interviews” with Ma, Ant Group's chairman Eric Jing and its president Hu Xiaoming.

• No further details about the meetings were disclosed, although such a move is typically seen as a warning or dressing down of sorts.

• Ant Group's shares are due to begin trade in Hong Kong and Shanghai on November 5. The first dual listing of its kind on the two exchanges attracted more than $3T from retail investors.

• The company has come under increased scrutiny and tighter regulation as it has expanded the range of financial technology services it offers.

• Previously: Ant Group prices world's largest IPO at $34.5B with $313B market cap (Oct. 26)

• Previously: Ant Group's Shanghai retail book 872x oversubscribed (Oct. 29)

https://seekingalpha.com/news/3630149-ant-group-ipo-watchdog…

🐜..................................................................................................................................🐜

Ant Group Mgmt Summoned by CSRC & Other Bodies, Pledges to Enhance Inclusive Service

2020/11/03 07:46

Jack Ma, Eric Jing and Simon Hu, respectively ANT GROUP (06688.HK) (688688.SH)'s actual controller, chairman and CEO, had been summoned by PBoC, CBIRC, CSRC and SAFE for regulatory interviews.

In response, ...

http://www.aastocks.com/en/stocks/news/aafn-con/NOW.1053222/…

Antwort auf Beitrag Nr.: 65.582.888 von teecee1 am 03.11.20 16:39:05Adresse und Kontaktdaten

Name: Alibaba Group Holding Ltd

Straße: 699 Wang Shang Road, Binjiang District

PLZ: 310052

Stadt: George Town

Land: 🇰🇾 Kaimaninseln

........................................................................................................................................................

Weltgrößter Börsengang von Alibaba-Tochter liegt auf Eis

13 Std

Der weltgrößte Börsengang ist geplatzt: Zwei Tage vor dem geplanten Debüt an den Börsen in Shanghai und Hongkong machten die chinesischen Aufseher dem Zahlungsabwickler Ant am Dienstag einen Strich durch die Rechnung.

Der Konzern erfüllt die Voraussetzungen für die 37 Milliarden Dollar schwere Emission nicht, wie der Betreiber des Zahlungsdienstleisters Alipay eingestehen musste. Am Aktienmarkt fielen die Papiere des chinesischen Amazon-Rivalen Alibaba zeitweise um fast zehn Prozent und steuerten auf den größten Tagesverlust der Firmengeschichte zu. Den bis 2057 laufenden Dollar-Anleihen des Online-Händlers drohte der größte Tagesverlust seit dem Börsencrash vom März.

Die chinesische Finanzaufsicht hatte nach Aussage von Insidern am Montag Alibaba-Gründer Jack Ma, der das Fintech-Unternehmen Ant Financial ins Leben gerufen hatte, ...

https://express.deutsche-wirtschafts-nachrichten.de/507342/W…

........................................................................................................................................................

15h ago

China Tells Ant It Must Meet New Capital Requirements Before IPO

Bloomberg News,

(Bloomberg) -- Chinese regulators have told Ant Group Co. it can’t proceed with an initial public offering until after it complies with new capital requirements and other restrictions imposed on the country’s financial conglomerates at the start of this month.

Ant will have to make changes that include capital increases at its lucrative micro-lending units, people familiar with the matter said. Ant must also reapply for licenses for the units to operate nationwide, the people added, asking not to be identified discussing a private matter.

It’s unclear how extensively Ant will have to overhaul its business to meet all of China’s new regulations, which took effect on Nov. 1 and were designed to rein in systemic risks posed by companies that straddle at least two financial business lines. Representatives for Ant and ...

https://www.bnnbloomberg.ca/china-tells-ant-it-must-meet-new…

........................................................................................................................................................

Kyle Bass

@Jkylebass

It's rumored that the US sanctions against Ant Group, Alibaba, and TenCent were derailed by a single phone call from Mike Evans (Alibaba president and Goldman Sachs alum) to a senior US Govt official. Ant Group could have agreed to share transaction data and account details 1/4

with US intelligence. Maybe xi decided to go with China's own digital currency? It's possible xi wanted to stop Jack Ma's bombastic public comments about the Chinese banks? Could this be a Bo Xilai moment for Mr. Ma? It wasn't long ago when Dalian Wanda, HNA, and Anbang 2/4 ...

https://twitter.com/Jkylebass/status/1323678076958576642

........................................................................................................................................................

... ... Schwarze Liste vs Grauer Markt ... Schwarzliste - Graumarkt ... Wirefraud ...

... Schwarze Liste vs Grauer Markt ... Schwarzliste - Graumarkt ... Wirefraud ...

November 3, 20209:42 PMUpdated 12 hours ago

Exclusive: Trump administration shelves bid to blacklist China's Ant Group - sources

By Humeyra Pamuk, Alexandra Alper, Karen Freifeld | 4 Min Read

WASHINGTON (Reuters) - The Trump administration has put on hold an effort to blacklist Ant Group Co Ltd 6688.HK 688688.SS, the Chinese financial technology company affiliated with e-commerce giant Alibaba, following a phone call between a company executive and a top U.S. government official, four people familiar with the matter said.

Reuters reported last month that the U.S. State Department had submitted a proposal to add Ant Group to a trade blacklist in order to deter U.S. investors from taking part in its initial public offering, ...

But the Commerce Department, which oversees the blacklist, shelved the proposal after Alibaba Group Holding Inc 9988.HK President Michael Evans urged Commerce Secretary Wilbur Ross to reject the bid in a phone call, the people said, declining to be named because they were not authorized to speak on the matter.

Three of the people said fears of antagonizing Wall Street ahead of Tuesday’s presidential elections and the possibility of a lawsuit helped convince Ross to set the plan aside.

... 💩 ... Drei Chinesen mit 'nem Tütchen Gras saßen in der Wohnung und rauchten etwas.

Da kam die Polizei: Ja, was ist denn das? ...

“It could spur legal action or cause a chill in markets,” one of the sources said.

In contrast, ...

https://www.reuters.com/article/us-usa-china-ant-exclusive/e…

........................................................................................................................................................

Alexander Bueso

03 Nov, 2020 19:48 04 Nov, 2020 01:30

Beijing forces Ant Group to shelve Shanghai IPO

Jack Ma, the world's richest man, own Ant Group, and some market commentary described regulators' decision as a public slap down of the billionaire. ...

One month before, Ma had publicly criticised China's regulatory framework arguing that it was outdated and not fit for purpose for financial technology firms. ...

Commenting on the news, Jeffrey Halley, senior market analyst at Oanda, told clients: "It would appear that Jack (Icarus) Ma did just that with the Chinese Government and banking regulators last night, as Ant Financials' IPO was pulled in Shanghai and Hong Kong.

"China's government appears to disagree with Mr Ma's assertion the Ant Financial is a tech company and not a financial one.

"His comments on the Basle capital regulations clearly didn't resonate in the halls of power in Beijing, and today Mr Ma is less wealthy after Ali Baba stock was pummelled overnight. There's only one big boss in China, and it's not Jack Ma." ...

https://www.sharecast.com/news/international-companies/beiji…

........................................................................................................................................................

Tencent Joining Lawsuit Against US Govt's WeChat Ban

2020/11/03 10:23

TENCENT (00700.HK) -3.500 (-0.582%) Short selling $991.66M; Ratio 9.744% announced that it is joining the lawsuit filed by WeChat users that seeks suspension of the U.S. executive ban, emphasizing that it did so only to ensure its business information is kept confidential, ...

http://www.aastocks.com/en/stocks/news/aafn-con/NOW.1053348/…

........................................................................................................................................................

Nov 2, 2020

WeChat parent Tencent seeks to protect data in Trump ban lawsuit

Peter Blumberg, Bloomberg News

WeChat’s parent company, Tencent Holdings Ltd., told a judge it will ask to have confidential business information protected in a lawsuit by users challenging the Trump administration’s ban on the Chinese-owned mobile messaging app.

Tencent also said in a filing Monday in San Francisco federal court ...

A group called the U.S. WeChat Users Alliance persuaded a judge to temporarily block President Donald Trump’s restrictions on the app ...

https://www.bnnbloomberg.ca/wechat-parent-tencent-seeks-to-p…

........................................................................................................................................................

Helen Partz vor 15 Stunden

Chinas digitaler Yuan: "Weit entfernt" von Sieg über US-Dollar

Die chinesische CBDC wird den US-Dollar wohl erst einmal nicht so schnell als globale Reservewährung ablösen.

David Roche, der Präsident und globale Stratege bei Independent Strategy, glaubt, dass Chinas digitaler Yuan "noch einen langen Weg" vor sich habe, bevor er dem US-Dollar die Position als Reservewährung streitig machen kann, wie CNDC am 2. November berichtete.

Laut Roche könnte die chinesische digitale Zentralbankwährung (CBDC) hypothetisch den US-Dollar als Reservewährung schlagen, ...

https://de.cointelegraph.com/news/china-s-digital-yuan-is-a-…

🐼🐼🐼🐼🐼

🐼🐼🐼🐼🐼

Name: Alibaba Group Holding Ltd

Straße: 699 Wang Shang Road, Binjiang District

PLZ: 310052

Stadt: George Town

Land: 🇰🇾 Kaimaninseln

........................................................................................................................................................

Weltgrößter Börsengang von Alibaba-Tochter liegt auf Eis

13 Std

Der weltgrößte Börsengang ist geplatzt: Zwei Tage vor dem geplanten Debüt an den Börsen in Shanghai und Hongkong machten die chinesischen Aufseher dem Zahlungsabwickler Ant am Dienstag einen Strich durch die Rechnung.

Der Konzern erfüllt die Voraussetzungen für die 37 Milliarden Dollar schwere Emission nicht, wie der Betreiber des Zahlungsdienstleisters Alipay eingestehen musste. Am Aktienmarkt fielen die Papiere des chinesischen Amazon-Rivalen Alibaba zeitweise um fast zehn Prozent und steuerten auf den größten Tagesverlust der Firmengeschichte zu. Den bis 2057 laufenden Dollar-Anleihen des Online-Händlers drohte der größte Tagesverlust seit dem Börsencrash vom März.

Die chinesische Finanzaufsicht hatte nach Aussage von Insidern am Montag Alibaba-Gründer Jack Ma, der das Fintech-Unternehmen Ant Financial ins Leben gerufen hatte, ...

https://express.deutsche-wirtschafts-nachrichten.de/507342/W…

........................................................................................................................................................

15h ago

China Tells Ant It Must Meet New Capital Requirements Before IPO

Bloomberg News,

(Bloomberg) -- Chinese regulators have told Ant Group Co. it can’t proceed with an initial public offering until after it complies with new capital requirements and other restrictions imposed on the country’s financial conglomerates at the start of this month.

Ant will have to make changes that include capital increases at its lucrative micro-lending units, people familiar with the matter said. Ant must also reapply for licenses for the units to operate nationwide, the people added, asking not to be identified discussing a private matter.

It’s unclear how extensively Ant will have to overhaul its business to meet all of China’s new regulations, which took effect on Nov. 1 and were designed to rein in systemic risks posed by companies that straddle at least two financial business lines. Representatives for Ant and ...

https://www.bnnbloomberg.ca/china-tells-ant-it-must-meet-new…

........................................................................................................................................................

Kyle Bass

@Jkylebass

It's rumored that the US sanctions against Ant Group, Alibaba, and TenCent were derailed by a single phone call from Mike Evans (Alibaba president and Goldman Sachs alum) to a senior US Govt official. Ant Group could have agreed to share transaction data and account details 1/4

with US intelligence. Maybe xi decided to go with China's own digital currency? It's possible xi wanted to stop Jack Ma's bombastic public comments about the Chinese banks? Could this be a Bo Xilai moment for Mr. Ma? It wasn't long ago when Dalian Wanda, HNA, and Anbang 2/4 ...

https://twitter.com/Jkylebass/status/1323678076958576642

........................................................................................................................................................

...

... Schwarze Liste vs Grauer Markt ... Schwarzliste - Graumarkt ... Wirefraud ...

... Schwarze Liste vs Grauer Markt ... Schwarzliste - Graumarkt ... Wirefraud ...November 3, 20209:42 PMUpdated 12 hours ago

Exclusive: Trump administration shelves bid to blacklist China's Ant Group - sources

By Humeyra Pamuk, Alexandra Alper, Karen Freifeld | 4 Min Read

WASHINGTON (Reuters) - The Trump administration has put on hold an effort to blacklist Ant Group Co Ltd 6688.HK 688688.SS, the Chinese financial technology company affiliated with e-commerce giant Alibaba, following a phone call between a company executive and a top U.S. government official, four people familiar with the matter said.

Reuters reported last month that the U.S. State Department had submitted a proposal to add Ant Group to a trade blacklist in order to deter U.S. investors from taking part in its initial public offering, ...

But the Commerce Department, which oversees the blacklist, shelved the proposal after Alibaba Group Holding Inc 9988.HK President Michael Evans urged Commerce Secretary Wilbur Ross to reject the bid in a phone call, the people said, declining to be named because they were not authorized to speak on the matter.

Three of the people said fears of antagonizing Wall Street ahead of Tuesday’s presidential elections and the possibility of a lawsuit helped convince Ross to set the plan aside.

... 💩 ... Drei Chinesen mit 'nem Tütchen Gras saßen in der Wohnung und rauchten etwas.

Da kam die Polizei: Ja, was ist denn das? ...

“It could spur legal action or cause a chill in markets,” one of the sources said.

In contrast, ...

https://www.reuters.com/article/us-usa-china-ant-exclusive/e…

........................................................................................................................................................

Alexander Bueso

03 Nov, 2020 19:48 04 Nov, 2020 01:30

Beijing forces Ant Group to shelve Shanghai IPO

Jack Ma, the world's richest man, own Ant Group, and some market commentary described regulators' decision as a public slap down of the billionaire. ...

One month before, Ma had publicly criticised China's regulatory framework arguing that it was outdated and not fit for purpose for financial technology firms. ...

Commenting on the news, Jeffrey Halley, senior market analyst at Oanda, told clients: "It would appear that Jack (Icarus) Ma did just that with the Chinese Government and banking regulators last night, as Ant Financials' IPO was pulled in Shanghai and Hong Kong.

"China's government appears to disagree with Mr Ma's assertion the Ant Financial is a tech company and not a financial one.

"His comments on the Basle capital regulations clearly didn't resonate in the halls of power in Beijing, and today Mr Ma is less wealthy after Ali Baba stock was pummelled overnight. There's only one big boss in China, and it's not Jack Ma." ...

https://www.sharecast.com/news/international-companies/beiji…

........................................................................................................................................................

Tencent Joining Lawsuit Against US Govt's WeChat Ban

2020/11/03 10:23

TENCENT (00700.HK) -3.500 (-0.582%) Short selling $991.66M; Ratio 9.744% announced that it is joining the lawsuit filed by WeChat users that seeks suspension of the U.S. executive ban, emphasizing that it did so only to ensure its business information is kept confidential, ...

http://www.aastocks.com/en/stocks/news/aafn-con/NOW.1053348/…

........................................................................................................................................................

Nov 2, 2020

WeChat parent Tencent seeks to protect data in Trump ban lawsuit

Peter Blumberg, Bloomberg News

WeChat’s parent company, Tencent Holdings Ltd., told a judge it will ask to have confidential business information protected in a lawsuit by users challenging the Trump administration’s ban on the Chinese-owned mobile messaging app.

Tencent also said in a filing Monday in San Francisco federal court ...

A group called the U.S. WeChat Users Alliance persuaded a judge to temporarily block President Donald Trump’s restrictions on the app ...

https://www.bnnbloomberg.ca/wechat-parent-tencent-seeks-to-p…

........................................................................................................................................................

Helen Partz vor 15 Stunden

Chinas digitaler Yuan: "Weit entfernt" von Sieg über US-Dollar

Die chinesische CBDC wird den US-Dollar wohl erst einmal nicht so schnell als globale Reservewährung ablösen.

David Roche, der Präsident und globale Stratege bei Independent Strategy, glaubt, dass Chinas digitaler Yuan "noch einen langen Weg" vor sich habe, bevor er dem US-Dollar die Position als Reservewährung streitig machen kann, wie CNDC am 2. November berichtete.

Laut Roche könnte die chinesische digitale Zentralbankwährung (CBDC) hypothetisch den US-Dollar als Reservewährung schlagen, ...

https://de.cointelegraph.com/news/china-s-digital-yuan-is-a-…

🐼🐼🐼🐼🐼

🐼🐼🐼🐼🐼

Antwort auf Beitrag Nr.: 65.590.061 von teecee1 am 04.11.20 10:40:05 ...  ... Wer hat das Recht Geld 💶 auszugeben ... etc. ... "in welcher Form auch immer" ... Haftungsfrage ... ??? ... ein souveräner Staat ... Kaisrerreich, Königreich ... ??? ...

... Wer hat das Recht Geld 💶 auszugeben ... etc. ... "in welcher Form auch immer" ... Haftungsfrage ... ??? ... ein souveräner Staat ... Kaisrerreich, Königreich ... ??? ...

Digital money

Ant Group and fintech come of age

A blockbuster listing shows how fintech is revolutionising finance

Oct 8th 2020

IN 1300 OR so Marco Polo, a Venetian merchant, introduced Europeans to a monetary marvel witnessed in China. The emperor, he wrote, “causes the bark of trees, made into something like paper, to pass for money all over his country”. Eventually the West also adopted paper money, some six centuries after China invented it. More recent foreign travellers to China have come back agog at the next big step for money: the total disappearance of paper, replaced by pixels on phone screens.

China’s pre-eminence in digital money is likely to be on display in the next few weeks with the monster listing of Ant Group, its largest fintech firm, in Hong Kong and Shanghai. Measured by cash raised, ...

https://www.economist.com/leaders/2020/10/08/ant-group-and-f…

👁 ........................................................................................................................................................ 👁

👁 ........................................................................................................................................................ 👁

China

NTD: Kramp-Karrenbauer appelliert an Zusammenarbeit mit USA | Chinas Finanzmodell mit Betrug assoziiert

Epoch Times4. November 2020 Aktualisiert: 4. November 2020 18:33

Chinas Vizepräsident warnte davor, dass das chinesische Finanzwesen spekulative Glücksspiele und Schneeballsysteme vermeiden sollte. Experten behaupten, dass es dafür bereits zu spät sein könnte. ...

3:00 - 5:40

https://www.epochtimes.de/china/ntd-kramp-karrenbauer-appell…

👁 ........................................................................................................................................................ 👁

Monmonkey compensate Ant investor with Xiaomi shares

Business | 5 Nov 2020 2:39 pm

Monmonkey Group Securities launched a plan of "Lost Ant, Gain Xiaomi" yesterday to offer shares of Xiaomi (1810) for investors who subscribed to Ant Group's initial public offerings.

Customers who have previously subscribed to Ant by applying for margin financing through the company will be given shares of Xiaomi in proportion, ...

https://www.thestandard.com.hk/breaking-news/section/1/15862…

👁 ........................................................................................................................................................ 👁

'It's a joke': retail investors shocked as China halts Ant Group's IPO

By Yoyo Chow, Clare Jim | 4 Min Read

HONG KONG (Reuters) - Mom-and-pop investors who put in bids worth a record $3 trillion in China’s Ant group - equivalent to Britain’s annual economic output - were stunned after regulators abruptly suspended what would have been the world’s largest stock market debut. ...

“I’d probably invest again just because of the sheer size of the market share Ant Financial has,” said a 21-year-old student investor in Beijing who goes by the name Clementine. ...

https://www.reuters.com/article/ant-group-ipo-suspension-rea…

👁 ........................................................................................................................................................ 👁

Ant's IPO Suspension Shows It's Too Big To Fail Now

by Tyler Durden

Tue, 11/03/2020 - 19:45

By Ye Xie, Bloomberg macro commentator and analyst

The first shock on Election Day didn’t come from the U.S. Rather, it was the news that China suspended Ant Group’s $35 billion initial public offering. ...

https://www.zerohedge.com/markets/ants-ipo-suspension-shows-…

-----

With Ant Crackdown, Beijing Puts China's Richest Man Squarely In Its Sights

by Tyler Durden

Wed, 11/04/2020 - 14:45

For years, entrepreneur Jack Ma's spectacular rise to multi-billion wealth and global fame was cited as a sterling example of how China's transformation to a capitalist society (with Chinese characteristics) could actually work: after all, if a simple teacher could launch the Alibaba empire and accumulate $64 billion in wealth, making him China's richest man (and #17 in Forbes global listing of billionaires) anyone could do it. All that was torpedoed over the past 48 hours when the snarling communist tiger hiding just behind the scenes, emerged demonstrating vividly that in China, winners and losers come and go with a simple thumbs up - or down - by the Politburo. ...

https://www.zerohedge.com/markets/ant-crackdown-beijing-puts…

👁👁👁👁👁👁👁👁👁👁👁

... Wer hat das Recht Geld 💶 auszugeben ... etc. ... "in welcher Form auch immer" ... Haftungsfrage ... ??? ... ein souveräner Staat ... Kaisrerreich, Königreich ... ??? ...

... Wer hat das Recht Geld 💶 auszugeben ... etc. ... "in welcher Form auch immer" ... Haftungsfrage ... ??? ... ein souveräner Staat ... Kaisrerreich, Königreich ... ??? ... Digital money

Ant Group and fintech come of age

A blockbuster listing shows how fintech is revolutionising finance

Oct 8th 2020

IN 1300 OR so Marco Polo, a Venetian merchant, introduced Europeans to a monetary marvel witnessed in China. The emperor, he wrote, “causes the bark of trees, made into something like paper, to pass for money all over his country”. Eventually the West also adopted paper money, some six centuries after China invented it. More recent foreign travellers to China have come back agog at the next big step for money: the total disappearance of paper, replaced by pixels on phone screens.

China’s pre-eminence in digital money is likely to be on display in the next few weeks with the monster listing of Ant Group, its largest fintech firm, in Hong Kong and Shanghai. Measured by cash raised, ...

https://www.economist.com/leaders/2020/10/08/ant-group-and-f…

👁 ........................................................................................................................................................ 👁

👁 ........................................................................................................................................................ 👁

China

NTD: Kramp-Karrenbauer appelliert an Zusammenarbeit mit USA | Chinas Finanzmodell mit Betrug assoziiert

Epoch Times4. November 2020 Aktualisiert: 4. November 2020 18:33

Chinas Vizepräsident warnte davor, dass das chinesische Finanzwesen spekulative Glücksspiele und Schneeballsysteme vermeiden sollte. Experten behaupten, dass es dafür bereits zu spät sein könnte. ...

3:00 - 5:40

https://www.epochtimes.de/china/ntd-kramp-karrenbauer-appell…

👁 ........................................................................................................................................................ 👁

Monmonkey compensate Ant investor with Xiaomi shares

Business | 5 Nov 2020 2:39 pm

Monmonkey Group Securities launched a plan of "Lost Ant, Gain Xiaomi" yesterday to offer shares of Xiaomi (1810) for investors who subscribed to Ant Group's initial public offerings.

Customers who have previously subscribed to Ant by applying for margin financing through the company will be given shares of Xiaomi in proportion, ...

https://www.thestandard.com.hk/breaking-news/section/1/15862…

👁 ........................................................................................................................................................ 👁

'It's a joke': retail investors shocked as China halts Ant Group's IPO

By Yoyo Chow, Clare Jim | 4 Min Read

HONG KONG (Reuters) - Mom-and-pop investors who put in bids worth a record $3 trillion in China’s Ant group - equivalent to Britain’s annual economic output - were stunned after regulators abruptly suspended what would have been the world’s largest stock market debut. ...

“I’d probably invest again just because of the sheer size of the market share Ant Financial has,” said a 21-year-old student investor in Beijing who goes by the name Clementine. ...

https://www.reuters.com/article/ant-group-ipo-suspension-rea…

👁 ........................................................................................................................................................ 👁

Ant's IPO Suspension Shows It's Too Big To Fail Now

by Tyler Durden

Tue, 11/03/2020 - 19:45

By Ye Xie, Bloomberg macro commentator and analyst

The first shock on Election Day didn’t come from the U.S. Rather, it was the news that China suspended Ant Group’s $35 billion initial public offering. ...

https://www.zerohedge.com/markets/ants-ipo-suspension-shows-…

-----

With Ant Crackdown, Beijing Puts China's Richest Man Squarely In Its Sights

by Tyler Durden

Wed, 11/04/2020 - 14:45

For years, entrepreneur Jack Ma's spectacular rise to multi-billion wealth and global fame was cited as a sterling example of how China's transformation to a capitalist society (with Chinese characteristics) could actually work: after all, if a simple teacher could launch the Alibaba empire and accumulate $64 billion in wealth, making him China's richest man (and #17 in Forbes global listing of billionaires) anyone could do it. All that was torpedoed over the past 48 hours when the snarling communist tiger hiding just behind the scenes, emerged demonstrating vividly that in China, winners and losers come and go with a simple thumbs up - or down - by the Politburo. ...

https://www.zerohedge.com/markets/ant-crackdown-beijing-puts…

👁👁👁👁👁👁👁👁👁👁👁

Antwort auf Beitrag Nr.: 65.603.222 von teecee1 am 05.11.20 11:21:19November 12, 20209:06 PMUpdated 6 minutes ago

Chinese President Xi Jinping decided to halt Ant's IPO: WSJ

By Reuters Staff | 2 Min Read

China’s President Xi Jinping personally decided to pull the plug on Ant Group’s $37-billion initial public offering, the Wall Street Journal reported on Thursday, citing Chinese officials with the knowledge of the matter.

The decision to stop what would have been the world’s largest ever IPO, came days after the fintech giant’s billionaire founder Jack Ma launched a public attack on the country’s financial watchdogs and banks.

President Xi ordered Chinese regulators to investigate and effectively shut down Ant's stock market flotation, the report said here.

Ant Group did not immediately respond to Reuters request for comment. The Information Office of the State Council, China’s cabinet, ...

https://www.reuters.com/article/antgroup-ipo/chinese-preside…

👂........................................................................................................................................................👂

How Ant’s Suspended IPO Is Related to China’s Digital Yuan

Nov 12, 2020 at 4:05 p.m.

David Pan

Ant Group’s suspended initial public offering (IPO) has shed further light on a possible motivation behind China’s digital yuan. The Chinese government appears to view the payments giant as a destabilizing force to China’s economy, and the digital yuan is a way to keep companies like this in check.

Industry watchers say the People’s Bank of China (PBoC) might use the digital yuan as part of a broader effort ...

Deposits leak

China’s payment giants pose other threats as well. Commercial banks in China have been losing cash deposits to non-banking payment platforms. The Chinese mobile banking market saw about $8 trillion worth of transactions in the last three months of 2019, with Alipay taking 55% of the market and WeChat Pay having 39%.

Alipay has one of the world’s largest money market funds called Yu’e Bao, which essentially is a mutual fund that usually invests in safe asset classes such as treasury bonds to earn interest that is higher than many of the saving accounts in commercial banks. Its users tend to put their in-app cash into the fund. With other similar funds on its distribution platform, Alipay had nearly $600 billion in total assets as of June.

“Loan-to-deposit ratio determines how much money a commercial bank can lend,” Aurora Wong, vice president of crypto firm ZB Group, said. “More cash deposits enable the banks to lend more, which is one of the most lucrative businesses by earning interest.”

China’s commercial banks need to maintain or raise their deposit base to keep up with lending, especially when the economic slowdown deepens.

Some of the commercial banks in China hope retail depositors will use the digital yuan in their payment transactions. When the users convert the virtual currency back to fiat, the cash will remain in the bank accounts instead of on mobile payment apps.

The latest attempt to encourage mass adoption of the digital yuan was a $1.5 million giveaway by PBOC in October for Shenzhen citizens, Wong said.

Each of the 50,000 participants, who downloaded the digital wallet, would be selected in a lottery to receive about $30 during the week-long campaign. Stores in Shenzhen posted the QR code for the wallet users to scan and pay for their purchases.

The digital yuan’s benefits for China’s commercial banks go beyond increasing cash deposits. With a larger user base, the banks will have more transaction data to profile consumers, analyze their online behavior and experiment with different ways to monetize the data.

“Commercial banks in China are becoming more similar to fintech companies,” Wong said. “I think this won’t be the last virtual currency giveaway and there will be even more programs to incentivize consumers to use the wallets from commercial banks.” ...

Mass adoption

One technical feature that sets the digital yuan apart from Alipay in terms of payment is that users do not need a bank account to be linked to a mobile app in order to do cash transactions.

China has more than 225 million people without a bank account, which is one of the largest unbanked populations in the world, according to a 2017 report from Global Findex.

The digital yuan account has a sliding scale of Know-Your-Customer (KYC) requirements corresponding to the amount of digital yuan you want to own and use, said Chuanwei Zou, chief economist of blockchain infrastructure firm PlatOn, said.

“The more identity information you register with the digital yuan wallet, the more digital yuan you can have in the wallet,” Zou said. ...

https://www.coindesk.com/how-ants-suspended-ipo-is-related-t…

👂........................................................................................................................................................👂

... ... China macht den Anfang ... NWO ...

... China macht den Anfang ... NWO ...

13.11.2020 07:52

Kritischer als US-Wahl: Das bedeutet das verschobene Ant Financial-IPO für Asien

Die überraschende Absage des geplanten Rekord-Börsengangs der Alibaba-Tochter Ant Financial traf Investoren wie ein Schlag ins Gesicht und dürfte ein Indiz dafür sein, dass sich das Umfeld für Fintechs in Asien nun grundlegend ändert - mit kritischeren Auswirkungen für China als der Ausgang der US-Wahl.

• Börsengang von Ant Financial zwei Tage vor dem IPO-Termin geplatzt

• Neue Regulierungen bedrohen gesamte chinesische Tech-Branche

• Börsenstandorte Shanghai und Hongkong geschwächt ...

https://www.finanzen.net/nachricht/aktien/strengere-regulier…

👂👂👂👂👂👂👂👂👂👂

Chinese President Xi Jinping decided to halt Ant's IPO: WSJ

By Reuters Staff | 2 Min Read

China’s President Xi Jinping personally decided to pull the plug on Ant Group’s $37-billion initial public offering, the Wall Street Journal reported on Thursday, citing Chinese officials with the knowledge of the matter.

The decision to stop what would have been the world’s largest ever IPO, came days after the fintech giant’s billionaire founder Jack Ma launched a public attack on the country’s financial watchdogs and banks.

President Xi ordered Chinese regulators to investigate and effectively shut down Ant's stock market flotation, the report said here.

Ant Group did not immediately respond to Reuters request for comment. The Information Office of the State Council, China’s cabinet, ...

https://www.reuters.com/article/antgroup-ipo/chinese-preside…

👂........................................................................................................................................................👂

How Ant’s Suspended IPO Is Related to China’s Digital Yuan

Nov 12, 2020 at 4:05 p.m.

David Pan

Ant Group’s suspended initial public offering (IPO) has shed further light on a possible motivation behind China’s digital yuan. The Chinese government appears to view the payments giant as a destabilizing force to China’s economy, and the digital yuan is a way to keep companies like this in check.

Industry watchers say the People’s Bank of China (PBoC) might use the digital yuan as part of a broader effort ...

Deposits leak

China’s payment giants pose other threats as well. Commercial banks in China have been losing cash deposits to non-banking payment platforms. The Chinese mobile banking market saw about $8 trillion worth of transactions in the last three months of 2019, with Alipay taking 55% of the market and WeChat Pay having 39%.

Alipay has one of the world’s largest money market funds called Yu’e Bao, which essentially is a mutual fund that usually invests in safe asset classes such as treasury bonds to earn interest that is higher than many of the saving accounts in commercial banks. Its users tend to put their in-app cash into the fund. With other similar funds on its distribution platform, Alipay had nearly $600 billion in total assets as of June.

“Loan-to-deposit ratio determines how much money a commercial bank can lend,” Aurora Wong, vice president of crypto firm ZB Group, said. “More cash deposits enable the banks to lend more, which is one of the most lucrative businesses by earning interest.”

China’s commercial banks need to maintain or raise their deposit base to keep up with lending, especially when the economic slowdown deepens.

Some of the commercial banks in China hope retail depositors will use the digital yuan in their payment transactions. When the users convert the virtual currency back to fiat, the cash will remain in the bank accounts instead of on mobile payment apps.

The latest attempt to encourage mass adoption of the digital yuan was a $1.5 million giveaway by PBOC in October for Shenzhen citizens, Wong said.

Each of the 50,000 participants, who downloaded the digital wallet, would be selected in a lottery to receive about $30 during the week-long campaign. Stores in Shenzhen posted the QR code for the wallet users to scan and pay for their purchases.

The digital yuan’s benefits for China’s commercial banks go beyond increasing cash deposits. With a larger user base, the banks will have more transaction data to profile consumers, analyze their online behavior and experiment with different ways to monetize the data.

“Commercial banks in China are becoming more similar to fintech companies,” Wong said. “I think this won’t be the last virtual currency giveaway and there will be even more programs to incentivize consumers to use the wallets from commercial banks.” ...

Mass adoption

One technical feature that sets the digital yuan apart from Alipay in terms of payment is that users do not need a bank account to be linked to a mobile app in order to do cash transactions.

China has more than 225 million people without a bank account, which is one of the largest unbanked populations in the world, according to a 2017 report from Global Findex.

The digital yuan account has a sliding scale of Know-Your-Customer (KYC) requirements corresponding to the amount of digital yuan you want to own and use, said Chuanwei Zou, chief economist of blockchain infrastructure firm PlatOn, said.

“The more identity information you register with the digital yuan wallet, the more digital yuan you can have in the wallet,” Zou said. ...

https://www.coindesk.com/how-ants-suspended-ipo-is-related-t…

👂........................................................................................................................................................👂

...

... China macht den Anfang ... NWO ...

... China macht den Anfang ... NWO ...13.11.2020 07:52

Kritischer als US-Wahl: Das bedeutet das verschobene Ant Financial-IPO für Asien

Die überraschende Absage des geplanten Rekord-Börsengangs der Alibaba-Tochter Ant Financial traf Investoren wie ein Schlag ins Gesicht und dürfte ein Indiz dafür sein, dass sich das Umfeld für Fintechs in Asien nun grundlegend ändert - mit kritischeren Auswirkungen für China als der Ausgang der US-Wahl.

• Börsengang von Ant Financial zwei Tage vor dem IPO-Termin geplatzt

• Neue Regulierungen bedrohen gesamte chinesische Tech-Branche

• Börsenstandorte Shanghai und Hongkong geschwächt ...

https://www.finanzen.net/nachricht/aktien/strengere-regulier…

👂👂👂👂👂👂👂👂👂👂

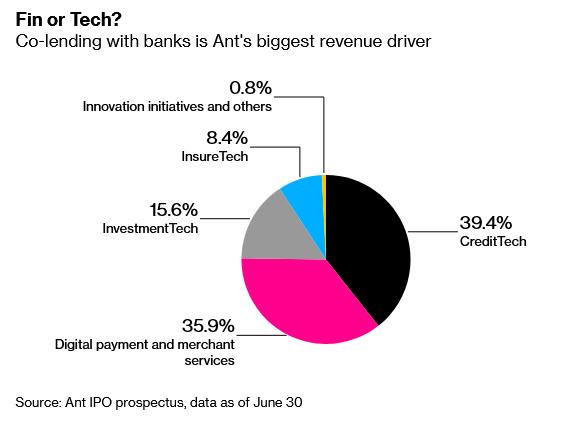

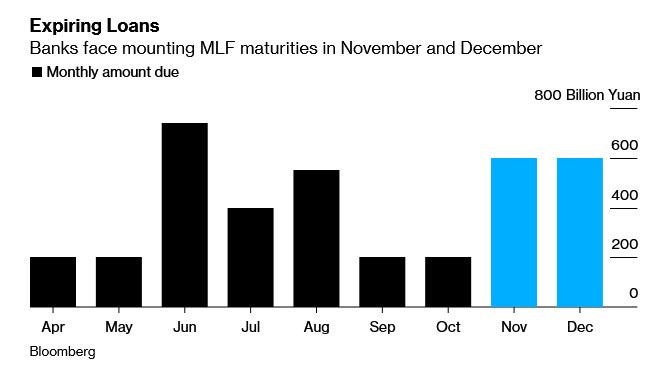

Antwort auf Beitrag Nr.: 65.694.339 von teecee1 am 13.11.20 09:03:20Traders On Edge As China Faces $900 Billion Liquidity Shortage

by Tyler Durden

Sun, 11/15/2020 - 20:13

Update: facing a potentially calamitous liquidity shortage, China buckled and despite hawkish commentary from its central bankers, moments ago the PBOC announced that it would offer a whopping 800 billion in MLF, which was not only vastly greater than the CNY 200BN whisper number, but was 200 billion more than the currently maturing MLF amount of 600 billion, indicating that what PBOC Deputy Governor Liu Guoqiang said recently when he warned that exiting easing measures was "a matter of time" and "necessary," was just a jawboning placeholder, and with China finding itself in a funding scramble, the PBOC not only delivered but left quite a bit of liquidity on top. ...

https://www.zerohedge.com/markets/traders-edge-china-faces-9…

........................................................................................................................................................

The Law Offices of Frank R. Cruz Continues Its Investigation of Alibaba Group Holding Limited (BABA) on Behalf of Investors

Nachrichtenquelle: Business Wire (engl.) | 05.11.2020, 19:00 | 125 | 0 | 0

The Law Offices of Frank R. Cruz continues its investigation of Alibaba Group Holding Limited (“Alibaba” or the “Company”) (NYSE: BABA) on behalf of investors concerning the Company’s possible violations of federal securities laws.

If you are a shareholder who suffered a loss, click here to participate.

Alibaba owns a 33% equity interest in Ant Small and Micro Financial Services Group Co., Ltd. (“Ant Group”), an online microlending company that operates Alipay, ...

https://www.wallstreet-online.de/nachricht/13122623-the-law-…

........................................................................................................................................................

BABA CLASS ACTION NOTICE

Glancy Prongay & Murray LLP Files Securities Fraud Lawsuit Against Alibaba Group Holding Limited

Nachrichtenquelle: Business Wire (engl.) | 13.11.2020, 22:00

https://www.wallstreet-online.de/nachricht/13159968-baba-cla…

........................................................................................................................................................

Alibaba & Ant Financial: Das Politik-Problem könnte größer sein als gedacht

Nachrichtenquelle: The Motley Fool | 16.11.2020, 10:34

https://www.wallstreet-online.de/nachricht/13163415-alibaba-…

🦷🦷🦷🦷🦷🦷🦷🦷🦷🦷

by Tyler Durden

Sun, 11/15/2020 - 20:13

Update: facing a potentially calamitous liquidity shortage, China buckled and despite hawkish commentary from its central bankers, moments ago the PBOC announced that it would offer a whopping 800 billion in MLF, which was not only vastly greater than the CNY 200BN whisper number, but was 200 billion more than the currently maturing MLF amount of 600 billion, indicating that what PBOC Deputy Governor Liu Guoqiang said recently when he warned that exiting easing measures was "a matter of time" and "necessary," was just a jawboning placeholder, and with China finding itself in a funding scramble, the PBOC not only delivered but left quite a bit of liquidity on top. ...

https://www.zerohedge.com/markets/traders-edge-china-faces-9…

........................................................................................................................................................

The Law Offices of Frank R. Cruz Continues Its Investigation of Alibaba Group Holding Limited (BABA) on Behalf of Investors

Nachrichtenquelle: Business Wire (engl.) | 05.11.2020, 19:00 | 125 | 0 | 0

The Law Offices of Frank R. Cruz continues its investigation of Alibaba Group Holding Limited (“Alibaba” or the “Company”) (NYSE: BABA) on behalf of investors concerning the Company’s possible violations of federal securities laws.

If you are a shareholder who suffered a loss, click here to participate.

Alibaba owns a 33% equity interest in Ant Small and Micro Financial Services Group Co., Ltd. (“Ant Group”), an online microlending company that operates Alipay, ...

https://www.wallstreet-online.de/nachricht/13122623-the-law-…

........................................................................................................................................................

BABA CLASS ACTION NOTICE

Glancy Prongay & Murray LLP Files Securities Fraud Lawsuit Against Alibaba Group Holding Limited

Nachrichtenquelle: Business Wire (engl.) | 13.11.2020, 22:00

https://www.wallstreet-online.de/nachricht/13159968-baba-cla…

........................................................................................................................................................

Alibaba & Ant Financial: Das Politik-Problem könnte größer sein als gedacht

Nachrichtenquelle: The Motley Fool | 16.11.2020, 10:34

https://www.wallstreet-online.de/nachricht/13163415-alibaba-…

🦷🦷🦷🦷🦷🦷🦷🦷🦷🦷

Systemkritischer Finanzgigant. Ant kann China aus den Angeln heben.

Sorry war nicht vollständig

Systemkritischer Finanzgigant. Ant kann China aus den Angeln heben.

https://www.n-tv.de/wirtschaft/Ant-kann-China-aus-den-Angeln…

Systemkritischer Finanzgigant. Ant kann China aus den Angeln heben.

https://www.n-tv.de/wirtschaft/Ant-kann-China-aus-den-Angeln…

Antwort auf Beitrag Nr.: 65.719.956 von teecee1 am 16.11.20 12:24:39

Why Ant Group IPO is Suspended? | Alibaba | Jack Ma | Stock | Economy | China State-Owned

59.235 Aufrufe • Premiere am 10.11.2020

........................................................................................................................................................

December 2, 202011:08 AMUpdated 10 days ago

Exclusive: China's Ant considers Paytm stake sale amid tensions with India - sources

By Sumeet Chatterjee, Aditi Shah, Anirban Sen | 4 Min Read

HONG KONG/NEW DELHI (Reuters) - Chinese fintech giant Ant Group is considering selling its 30% stake in Indian digital payment processor Paytm amid tensions between the two Asian neighbours and a toughening competitive landscape, people with direct knowledge of the matter said. ...

https://www.reuters.com/article/us-ant-group-paytm-exclusive…

........................................................................................................................................................

Nov 29, 2020

Ant IPO Is Said to Face Slim Chances of Getting Done Next Year

(Bloomberg) -- The chances that Jack Ma’s Ant Group Co. will be able to revive its massive stock listing next year are looking increasingly slim as China overhauls rules governing the fintech industry, according to regulatory officials familiar with the matter.

Ant is still in the early stages of reviewing changes needed to appease regulators, who demand that its business comply with a slate of new and proposed guidelines in areas including lending to consumers, the officials said. With so much work needed and some rules not yet spelled out, the officials said the initial public offering may not get done before 2022.

An additional delay of a year or more would be another setback for billionaire Ma, as well as the early-stage investors including Warburg Pincus LLC that were counting on a windfall from what was poised to be a record $35 billion IPO. It would also deal a potential blow to Alibaba Group Holding Ltd., ...

https://www.bnnbloomberg.ca/ant-ipo-is-said-to-face-slim-cha…

........................................................................................................................................................

UPDATE 3-Ant, Grab's venture and Sea to usher in Singapore digital banking

By Anshuman Daga | 5 Min Read

* Singapore awards first digital banking licences

* Asia turns to tech startups to shake up financial sectors

* Incumbent banks seen well placed to tackle challenges

* Singapore winners set to branch out to Southeast Asia (Recasts with details on winners, adds comments)

SINGAPORE, Dec 4 (Reuters) - Southeast Asian ride-hailing firm Grab’s venture with Singtel and internet platform company Sea Ltd have each won licences to run Singapore’s first digital banks, in the city-state’s biggest banking shakeup in two decades.

Singapore’s move to herald newer players including Alibaba Group affiliate Ant Group and a consortium comprising China’s Greenland Financial Holding Group comes as Asian regulators tap tech firms to shake up their often staid markets. ...

The Monetary Authority of Singapore (MAS) expects the digital banks to start operating from early 2022 after meeting the necessary pre-conditions of Singapore, one of the world’s top financial centres, and Southeast’s main hub. ...

“We expect them to thrive alongside the incumbent banks and raise the industry’s bar in delivering quality financial services, particularly for currently underserved businesses and individuals,” said Ravi Menon, managing director of the Monetary Authority of Singapore (MAS).

https://www.reuters.com/article/singapore-banks/update-3-ant…

........................................................................................................................................................

Dec 4, 2020

Ant, Grab Win Singapore Digital Bank Licenses Along With Sea

Chanyaporn Chanjaroen and Yoolim Lee, Bloomberg News

(Bloomberg) -- Ant Group Co. and a venture led by Grab Holdings Ltd. won licenses to run digital banks in Singapore, paving the way for the technology giants to expand their financial services in the Southeast Asian hub.