Die 10 beliebtesten Aktien auf Robinhood - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 03.01.21 21:17:34 von

neuester Beitrag 05.02.21 21:31:18 von

neuester Beitrag 05.02.21 21:31:18 von

Beiträge: 43

ID: 1.337.516

ID: 1.337.516

Aufrufe heute: 0

Gesamt: 2.497

Gesamt: 2.497

Aktive User: 0

ISIN: US5949181045 · WKN: 870747 · Symbol: MSFT

404,27

USD

-1,84 %

-7,57 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

| Microsoft Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

18.04.24 · BNP Paribas Anzeige |

18.04.24 · dpa-AFX |

18.04.24 · dpa-AFX |

Werte aus der Branche Informationstechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5400 | +191,89 | |

| 1,8525 | +20,49 | |

| 1,7000 | +18,88 | |

| 33,42 | +18,46 | |

| 0,6950 | +15,83 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2577 | -28,13 | |

| 82,60 | -28,79 | |

| 1,1100 | -34,71 | |

| 2,8000 | -37,78 | |

| 7,0000 | -62,10 |

Es handelt sich um einen automatisiert angelegten Thread zur Nachricht "Die 10 beliebtesten Aktien auf Robinhood" vom Autor The Motley Fool

Millennials haben dieses Jahr zum ersten Mal so richtig erlebt, was Volatilität bedeutet. Und sie haben auch die Gelegenheit beim Schopfe gepackt, sich in gute Aktien einzukaufen. Das lässt sich schön über die Online-Investing-App Robinhood …

Lesen Sie den ganzen Artikel: Die 10 beliebtesten Aktien auf Robinhood

Millennials haben dieses Jahr zum ersten Mal so richtig erlebt, was Volatilität bedeutet. Und sie haben auch die Gelegenheit beim Schopfe gepackt, sich in gute Aktien einzukaufen. Das lässt sich schön über die Online-Investing-App Robinhood …

Lesen Sie den ganzen Artikel: Die 10 beliebtesten Aktien auf Robinhood

ob das noch lange gut geht mit Robinhood und seinen Usern?

Auf jeden Fall bis zum IPO noch in diesem Jahr mMn.

Auf jeden Fall bis zum IPO noch in diesem Jahr mMn.

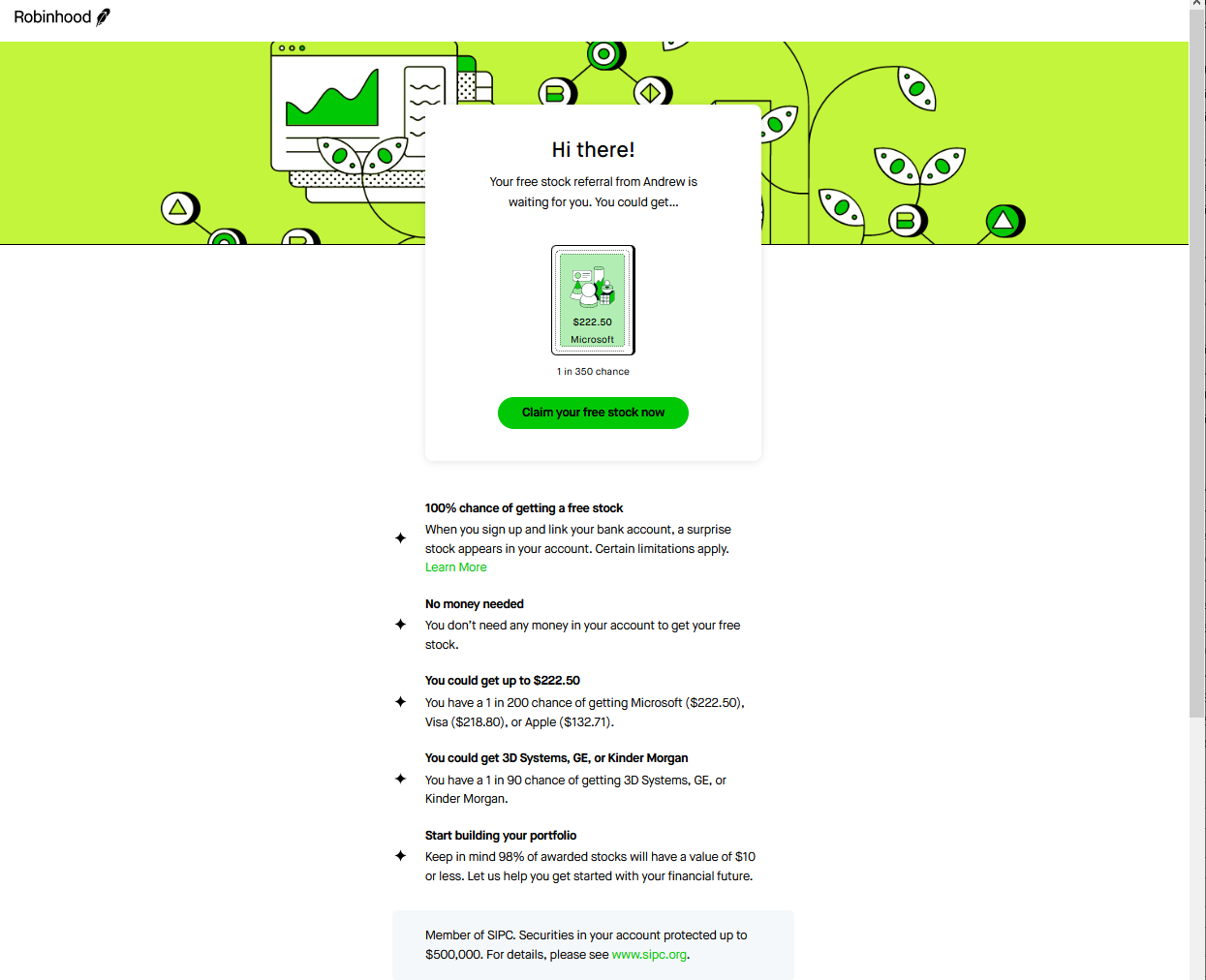

Antwort auf Beitrag Nr.: 66.269.918 von faultcode am 03.01.21 21:17:34OPK soll es u.a. dort derzeit bei solchen Aktionen geben

https://join.robinhood.com/andrewy29

...

https://join.robinhood.com/andrewy29

...

Antwort auf Beitrag Nr.: 66.269.930 von faultcode am 03.01.21 21:19:46siehe: https://twitter.com/petershk/status/1344286443959627781

For fun I made a Robinhood account. It took me 5 minutes to sign up, get approved and transfer funds for trading...

Here's some details... Read on.

...

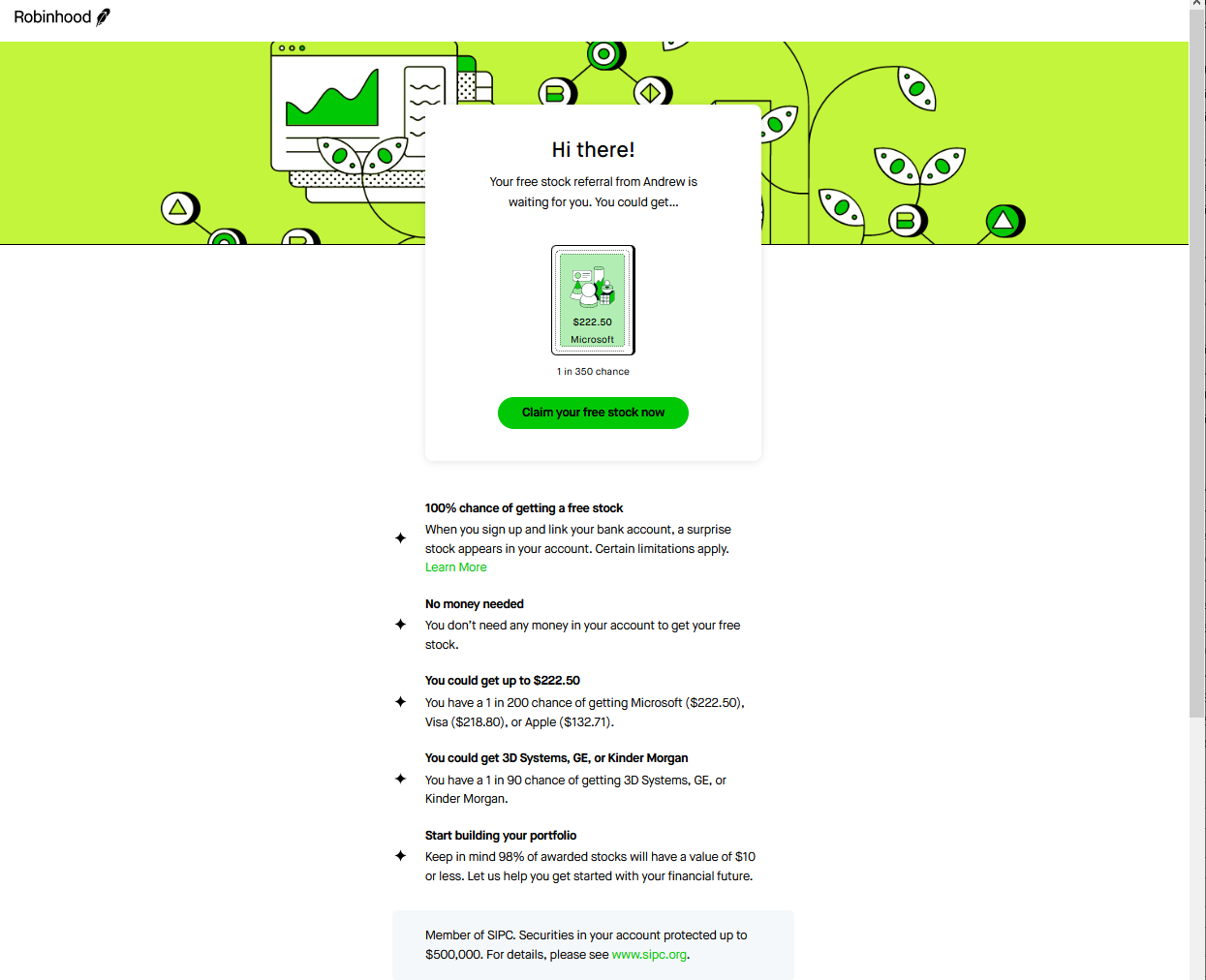

Margin, Bitcoin, fractional shares,... und Optionen

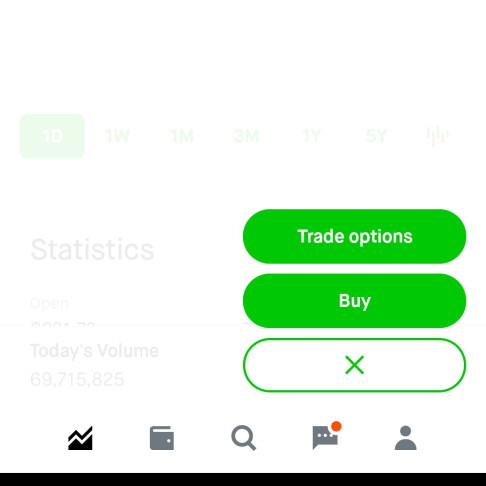

Clicking a stock opens a "trade" button that looks like this.

Notice options is first, buy second.

Options took me to an approval process (which took about a minute) and now away I go trading Baba options.

...

This is probably the best UI/UX of any investing app I've seen and also the most dangerous.

Fascinating.

...

For fun I made a Robinhood account. It took me 5 minutes to sign up, get approved and transfer funds for trading...

Here's some details... Read on.

...

Margin, Bitcoin, fractional shares,... und Optionen

Clicking a stock opens a "trade" button that looks like this.

Notice options is first, buy second.

Options took me to an approval process (which took about a minute) and now away I go trading Baba options.

...

This is probably the best UI/UX of any investing app I've seen and also the most dangerous.

Fascinating.

...

Antwort auf Beitrag Nr.: 66.269.966 von faultcode am 03.01.21 21:25:59Schönes insight herzlichen Dank

Faszinierend und gefährlich triffts ganz gut finde ich

Faszinierend und gefährlich triffts ganz gut finde ich

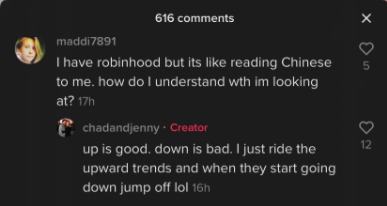

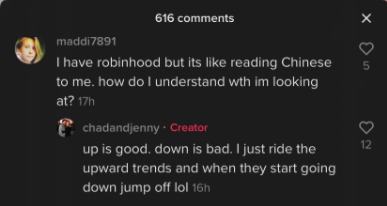

"Up is good, down is bad"

(aus Kommentar unter Link unten)

ein Beitrag zur derzeitigen Stimmung bei manchen Kleinanlegern: https://twitter.com/RampCapitalLLC/status/135087587448102503…

..und dabei stehen die USD2,000-Schecks in den USA, bzw. das Upgrade um +USD1,400, noch gar nicht an

(aus Kommentar unter Link unten)

ein Beitrag zur derzeitigen Stimmung bei manchen Kleinanlegern: https://twitter.com/RampCapitalLLC/status/135087587448102503…

..und dabei stehen die USD2,000-Schecks in den USA, bzw. das Upgrade um +USD1,400, noch gar nicht an

Microsoft steigt bei General Motors ein

Antwort auf Beitrag Nr.: 66.508.562 von MrCromme am 19.01.21 17:22:01Bekomme den link nicht kopiert, hier der Text:

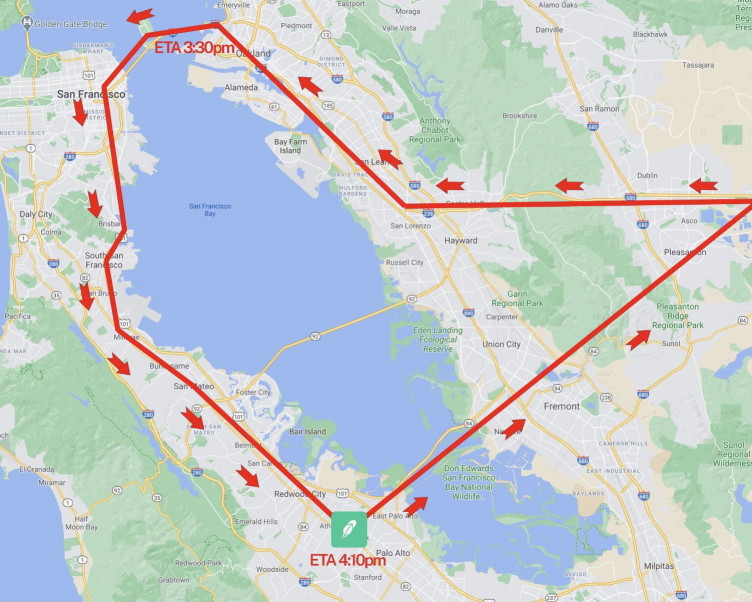

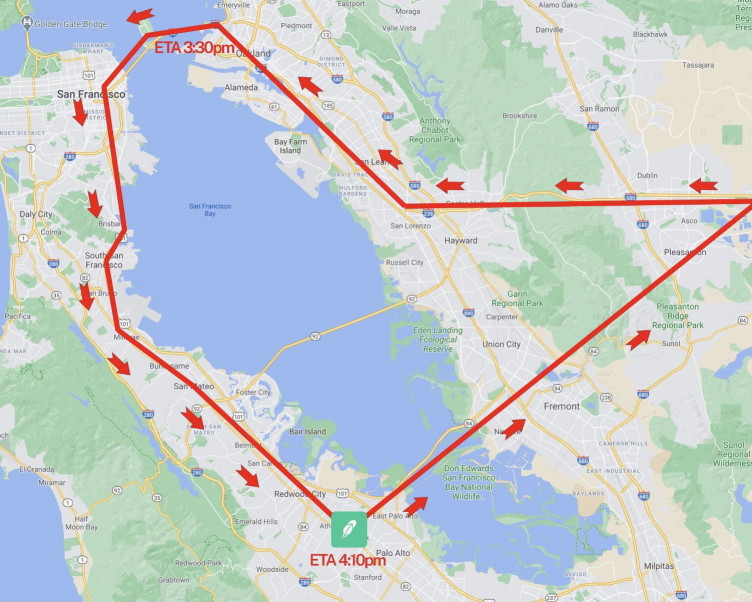

Microsoft will als nächster Technologiekonzern im Geschäft mit selbstfahrenden Autos mitmischen. Der Windows-Riese beteiligt sich an einer zwei Milliarden Dollar schweren Finanzierungsrunde der Robotaxi-Firma Cruise des Autokonzerns General Motors , wie die Unternehmen am Dienstag mitteilten. Cruise wurde dabei insgesamt mit 30 Milliarden Dollar bewertet. Die Firma testet ihre Fahrzeuge seit Jahren in San Francisco und stellte bereits den Prototypen eines autonomen Taxis ohne Platz für einen Fahrer vor.

Microsoft will in die Partnerschaft unter anderem Dienste seiner Cloud-Plattform Azure einbringen - auf die Cruise künftig hauptsächlich zurückgreifen wird. An der Finanzierungsrunde beteiligt sich neben dem Mutterkonzern GM auch der japanische Autobauer Honda .

Die anderen großen Tech-Konzerne sind bereits sehr aktiv in dem Bereich: Die Google -Schwesterfirma Waymo gilt als ein führender Entwickler von Robotaxi-Technik, Apple arbeitet ebenfalls an Systemen zum autonomen Fahren, Amazon kaufte den Roboterwagen-Entwickler Zoox und ordnete ihn in seine Gerätesparte ein.

Cruise bekam im vergangenen Jahr die Genehmigung, Autos ohne Sicherheitsfahrer am Steuer auf die Straßen von San Francisco zu schicken. Zuvor hatten Waymo und Zoox ebenfalls die Erlaubnis erhalten, ohne Menschen am Steuer auf öffentlichen Straßen zu fahren.

Cruise hatte ursprünglich den Start eines Robotaxi-Angebots noch für 2019 angekündigt, den Termin dann aber auf unbestimmte Zeit verschoben.

Microsoft will als nächster Technologiekonzern im Geschäft mit selbstfahrenden Autos mitmischen. Der Windows-Riese beteiligt sich an einer zwei Milliarden Dollar schweren Finanzierungsrunde der Robotaxi-Firma Cruise des Autokonzerns General Motors , wie die Unternehmen am Dienstag mitteilten. Cruise wurde dabei insgesamt mit 30 Milliarden Dollar bewertet. Die Firma testet ihre Fahrzeuge seit Jahren in San Francisco und stellte bereits den Prototypen eines autonomen Taxis ohne Platz für einen Fahrer vor.

Microsoft will in die Partnerschaft unter anderem Dienste seiner Cloud-Plattform Azure einbringen - auf die Cruise künftig hauptsächlich zurückgreifen wird. An der Finanzierungsrunde beteiligt sich neben dem Mutterkonzern GM auch der japanische Autobauer Honda .

Die anderen großen Tech-Konzerne sind bereits sehr aktiv in dem Bereich: Die Google -Schwesterfirma Waymo gilt als ein führender Entwickler von Robotaxi-Technik, Apple arbeitet ebenfalls an Systemen zum autonomen Fahren, Amazon kaufte den Roboterwagen-Entwickler Zoox und ordnete ihn in seine Gerätesparte ein.

Cruise bekam im vergangenen Jahr die Genehmigung, Autos ohne Sicherheitsfahrer am Steuer auf die Straßen von San Francisco zu schicken. Zuvor hatten Waymo und Zoox ebenfalls die Erlaubnis erhalten, ohne Menschen am Steuer auf öffentlichen Straßen zu fahren.

Cruise hatte ursprünglich den Start eines Robotaxi-Angebots noch für 2019 angekündigt, den Termin dann aber auf unbestimmte Zeit verschoben.

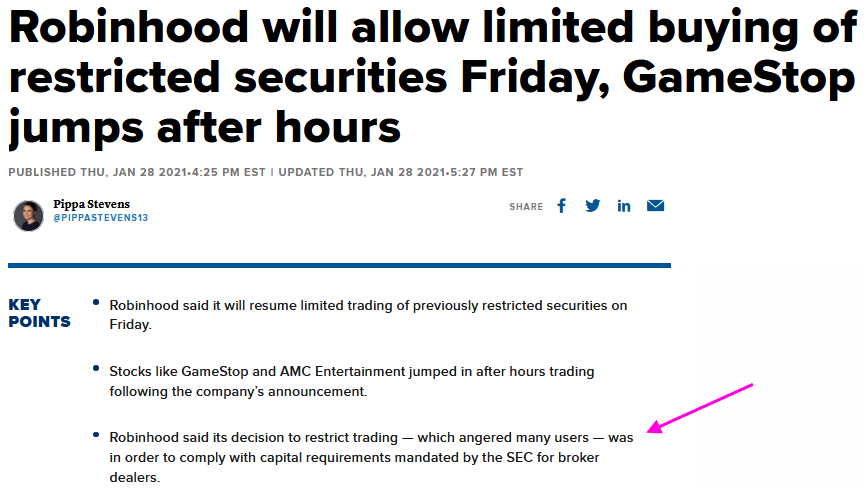

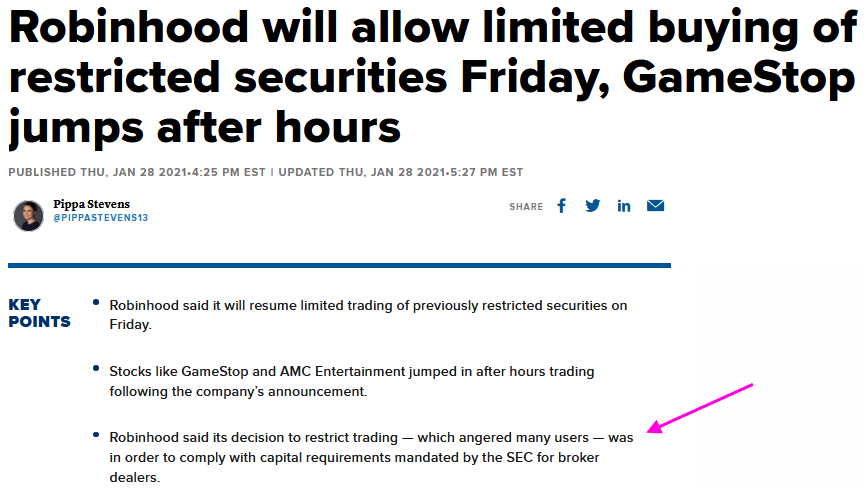

Antwort auf Beitrag Nr.: 66.496.736 von faultcode am 19.01.21 01:33:46https://www.cnbc.com/2021/01/28/robinhood-will-allow-limited…

...

=>

...

=>

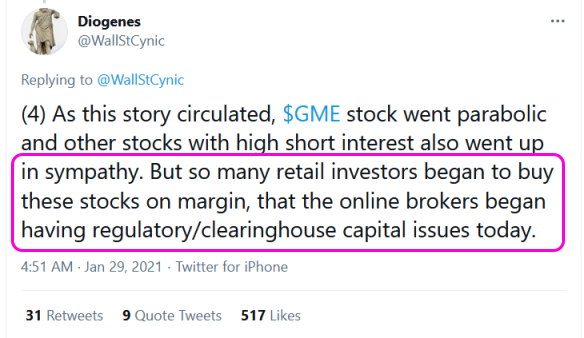

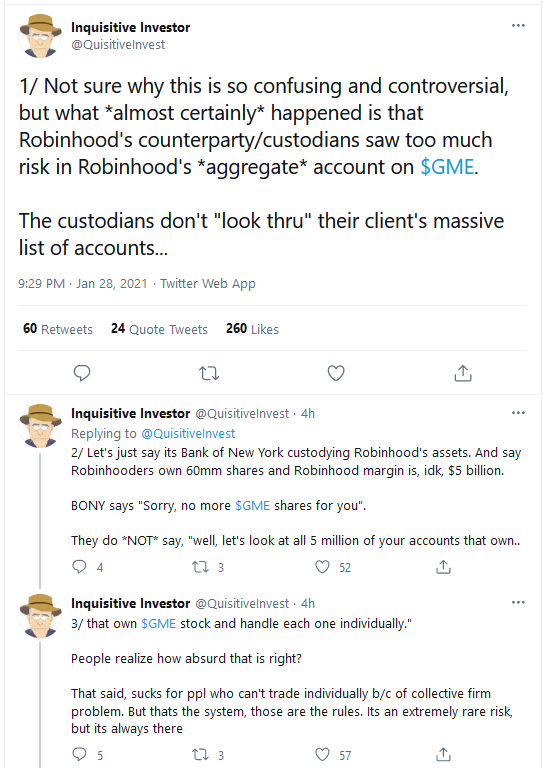

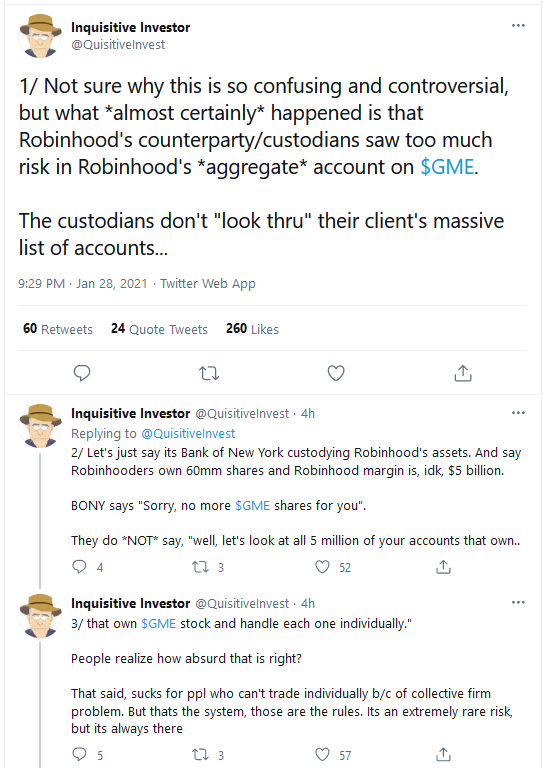

Antwort auf Beitrag Nr.: 66.682.358 von faultcode am 28.01.21 23:39:10Einerseits.

Andererseits:

ROBINHOOD LIKELY TO RAISE MARGIN REQUIREMENTS, SYSTEM IS UNDER STRESS - CNBC

https://twitter.com/Fxhedgers/status/1354916348124491781

Andererseits:

ROBINHOOD LIKELY TO RAISE MARGIN REQUIREMENTS, SYSTEM IS UNDER STRESS - CNBC

https://twitter.com/Fxhedgers/status/1354916348124491781

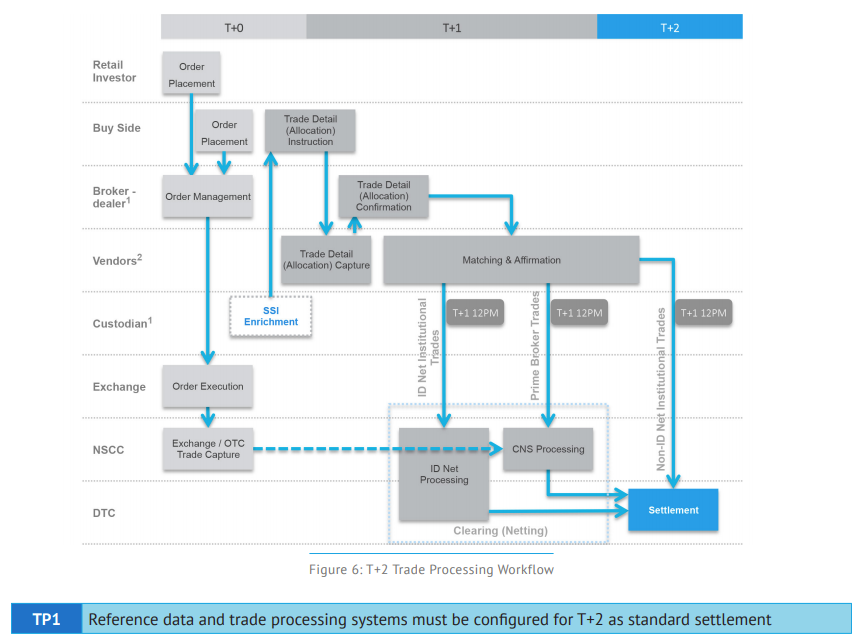

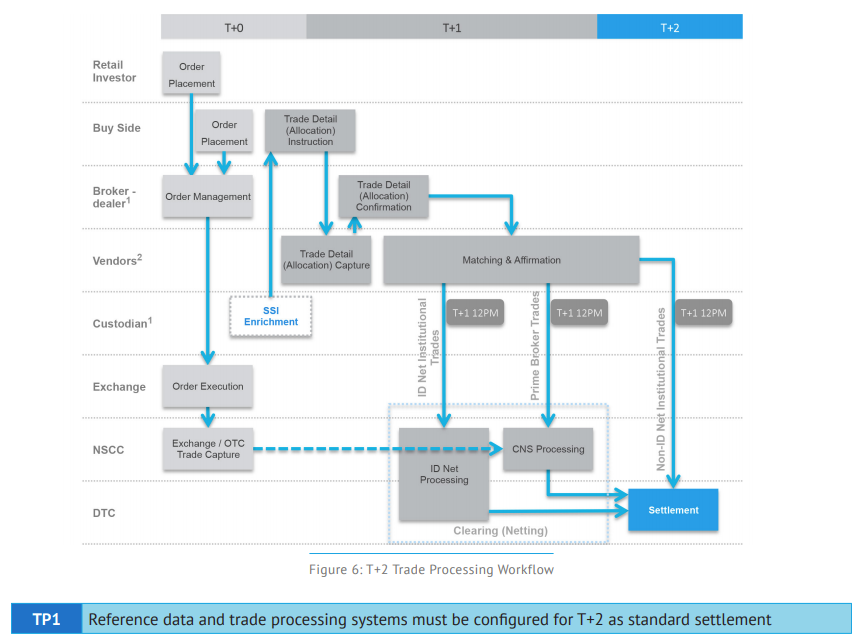

Antwort auf Beitrag Nr.: 66.682.385 von faultcode am 28.01.21 23:41:03Thread: https://twitter.com/bennpeifert/status/1354918506186166274

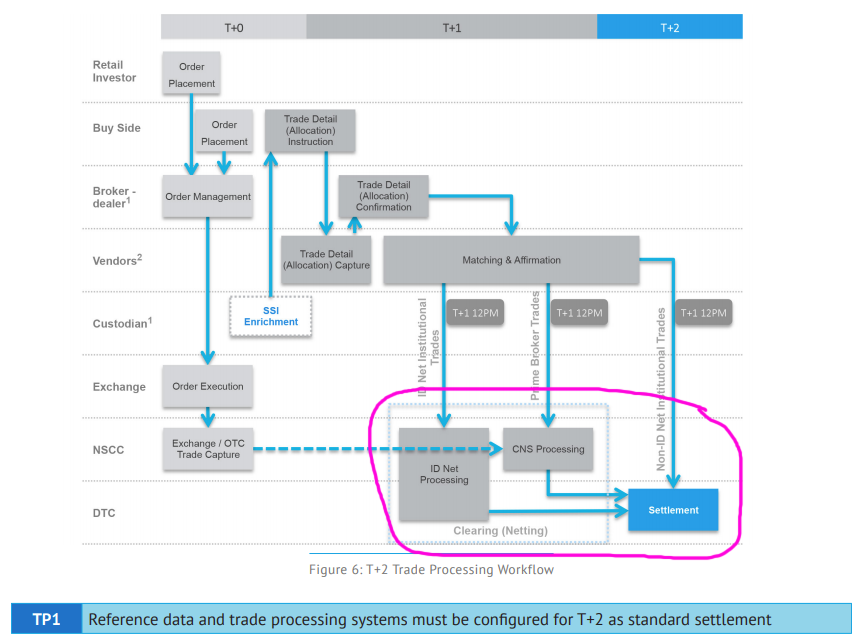

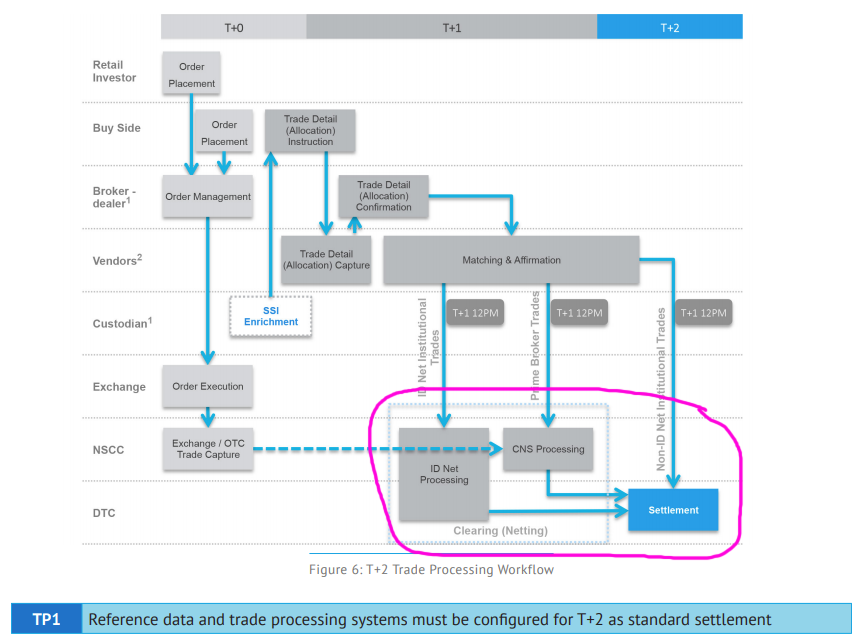

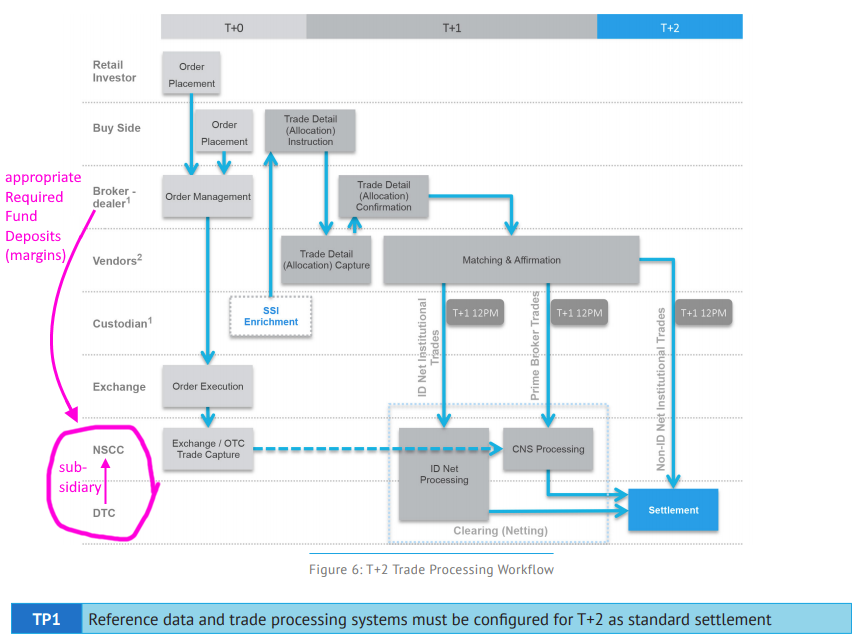

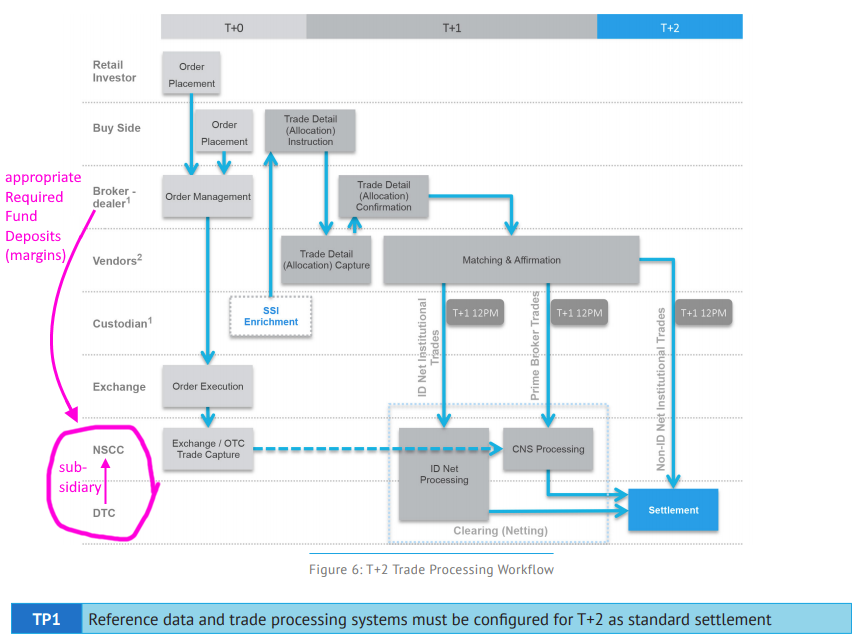

Trade processing workflow:

Einerseits.

Andererseits hat Robinhood seit Ende 2018 sein eigenes Clearing-System:

10.10.2018

Robinhood launches its own trade-clearing system as customer growth surges

https://www.cnbc.com/2018/10/10/robinhood-launches-its-own-t…

• Robinhood spent two years quietly building its own clearing system so it wouldn’t have to rely on an external firm to clear and settle transactions or take custody of assets.

• The move positions the online brokerage to be able to scale faster and expand into more areas of financial services, its CEO says.

• The Menlo Park-based start-up also announces it has 6 million customers, up from 5 million in August, and 4 million in May.

...

Trade processing workflow:

Einerseits.

Andererseits hat Robinhood seit Ende 2018 sein eigenes Clearing-System:

10.10.2018

Robinhood launches its own trade-clearing system as customer growth surges

https://www.cnbc.com/2018/10/10/robinhood-launches-its-own-t…

• Robinhood spent two years quietly building its own clearing system so it wouldn’t have to rely on an external firm to clear and settle transactions or take custody of assets.

• The move positions the online brokerage to be able to scale faster and expand into more areas of financial services, its CEO says.

• The Menlo Park-based start-up also announces it has 6 million customers, up from 5 million in August, and 4 million in May.

...

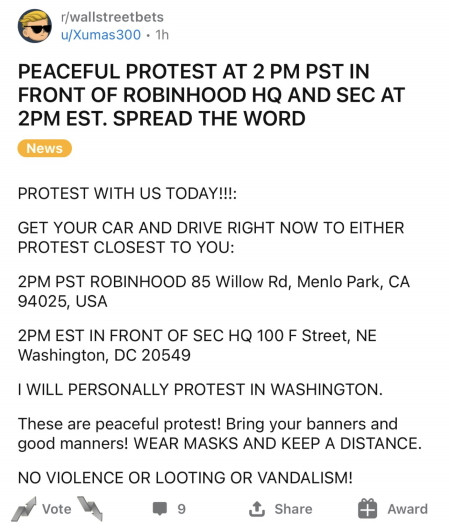

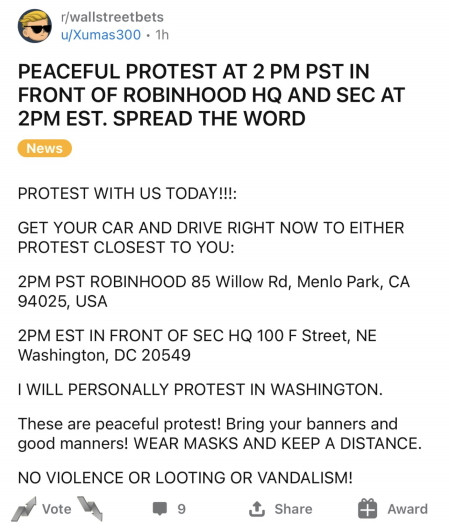

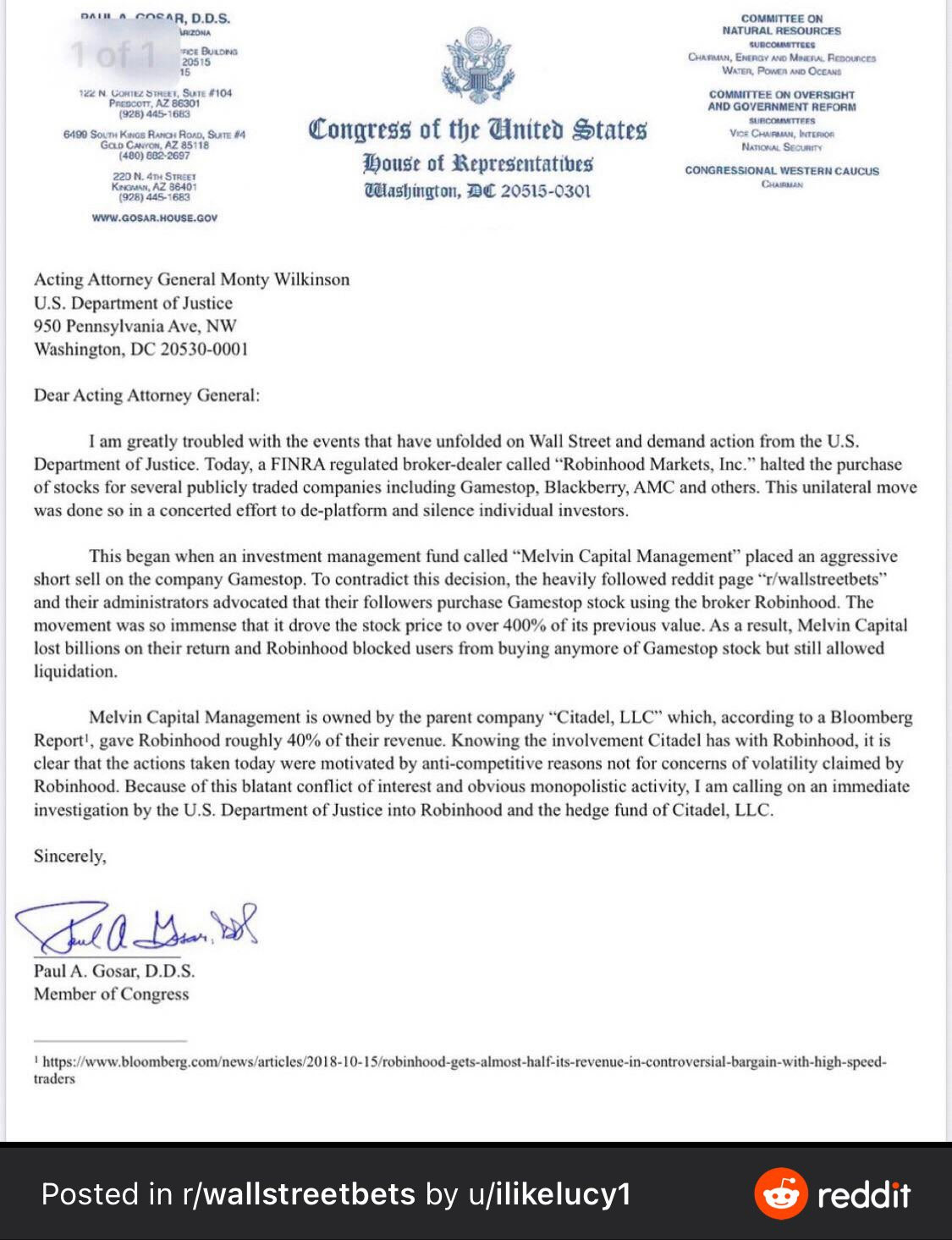

Antwort auf Beitrag Nr.: 66.682.460 von faultcode am 28.01.21 23:47:4628.1.

https://twitter.com/AGeminiStallion/status/13548518060487516…

--> https://twitter.com/ScooterCasterNY/status/13549259015580098…

___

###############################################

#

# ich meine auch: die Rolle von Citadel (und Co.) in diesem ganzen Komplex muss untersucht werden

#

###############################################

Denn man kann im Leben nun mal nicht Diener zweier Herren sein:

a/ die Robinhood "User" einerseits (das sind in Wahrheit keine mündigen Kunden, sondern für dumm gehaltene User); Stichwort: Verkauf der Order flows

b/ und andererseits die alten Bekannten und Ziehsöhne und Töchter an der Wall Street, die oft gegen die Positionen dieser User wetten, auch weil sie die Daten dazu von Robinhood mutmaßlich nach wie vor bekommen. Stichwort: Abschaltung der RobinTrack-API (ich sagte ja mehrfach, daß die Gold wert war)

siehe auch:

13.8.2020

Point72 "Urgently" Asking Brokerages For User Data After Robinhood Kills Off RobinTrack

https://www.zerohedge.com/markets/point72-urgently-asking-br…

man kann sagen: ab Punkt X hat die Wall Street mitgeholfen das für sich im Schnitt profitable Monster Robinhood zu schaffen

https://twitter.com/AGeminiStallion/status/13548518060487516…

--> https://twitter.com/ScooterCasterNY/status/13549259015580098…

___

###############################################

#

# ich meine auch: die Rolle von Citadel (und Co.) in diesem ganzen Komplex muss untersucht werden

#

###############################################

Denn man kann im Leben nun mal nicht Diener zweier Herren sein:

a/ die Robinhood "User" einerseits (das sind in Wahrheit keine mündigen Kunden, sondern für dumm gehaltene User); Stichwort: Verkauf der Order flows

b/ und andererseits die alten Bekannten und Ziehsöhne und Töchter an der Wall Street, die oft gegen die Positionen dieser User wetten, auch weil sie die Daten dazu von Robinhood mutmaßlich nach wie vor bekommen. Stichwort: Abschaltung der RobinTrack-API (ich sagte ja mehrfach, daß die Gold wert war)

siehe auch:

13.8.2020

Point72 "Urgently" Asking Brokerages For User Data After Robinhood Kills Off RobinTrack

https://www.zerohedge.com/markets/point72-urgently-asking-br…

man kann sagen: ab Punkt X hat die Wall Street mitgeholfen das für sich im Schnitt profitable Monster Robinhood zu schaffen

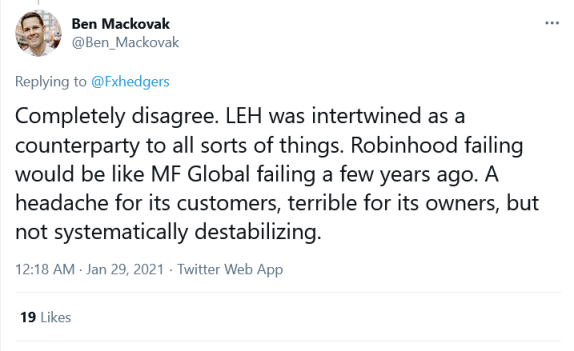

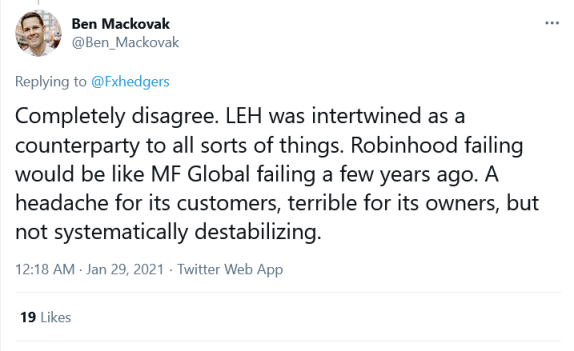

Antwort auf Beitrag Nr.: 66.682.964 von faultcode am 29.01.21 00:49:59IF ROBINHOOD WENT UNDER, THERE WOULD BE CATASTROPHIC RAMIFICATIONS, SIMILAR TO LEHMAN BROS : PIPER SANDLER

https://twitter.com/Fxhedgers/status/1354918564780601349 (*)

siehe auch:

https://twitter.com/Fxhedgers/status/1354918564780601349

(*) andererseits:

https://twitter.com/Ben_Mackovak/status/1354931836015828992

MF Global: https://en.wikipedia.org/wiki/MF_Global#The_looming_crisis,_…

https://twitter.com/Fxhedgers/status/1354918564780601349 (*)

siehe auch:

https://twitter.com/Fxhedgers/status/1354918564780601349

(*) andererseits:

https://twitter.com/Ben_Mackovak/status/1354931836015828992

MF Global: https://en.wikipedia.org/wiki/MF_Global#The_looming_crisis,_…

Antwort auf Beitrag Nr.: 66.694.640 von faultcode am 29.01.21 13:40:4029.1.

'Highly-Shorted' Stocks Slammed As WallStreetBets Reddit Site Goes Down For Some

https://www.zerohedge.com/markets/highly-shorted-stocks-slam…

'Highly-Shorted' Stocks Slammed As WallStreetBets Reddit Site Goes Down For Some

https://www.zerohedge.com/markets/highly-shorted-stocks-slam…

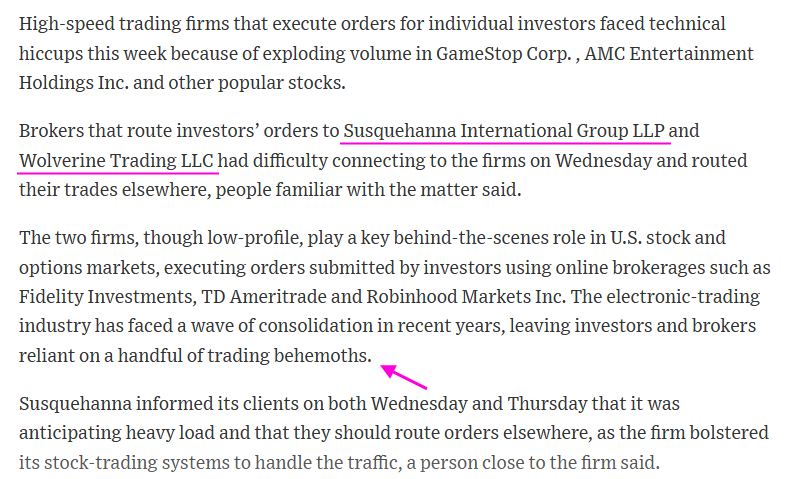

Antwort auf Beitrag Nr.: 66.702.890 von faultcode am 29.01.21 17:50:19GameStop Frenzy Causes Glitches for High-Speed Traders

Brokers were unable to route investors’ orders to Susquehanna and Wolverine

https://www.wsj.com/articles/gamestop-frenzy-causes-glitches…

...

Brokers were unable to route investors’ orders to Susquehanna and Wolverine

https://www.wsj.com/articles/gamestop-frenzy-causes-glitches…

...

Antwort auf Beitrag Nr.: 66.703.280 von faultcode am 29.01.21 18:03:31Over 8,000 next week $800 calls in $GME have traded today.

This is over $60mm in premium.

Which hedge fund keeps trying to gamma squeeze the stock?

This is not reddit vs. the hedge funds. This is one set of hedge funds against another.

https://twitter.com/JCOviedo6/status/1355198116568444930

This is over $60mm in premium.

Which hedge fund keeps trying to gamma squeeze the stock?

This is not reddit vs. the hedge funds. This is one set of hedge funds against another.

https://twitter.com/JCOviedo6/status/1355198116568444930

ein MF Global-Moment?

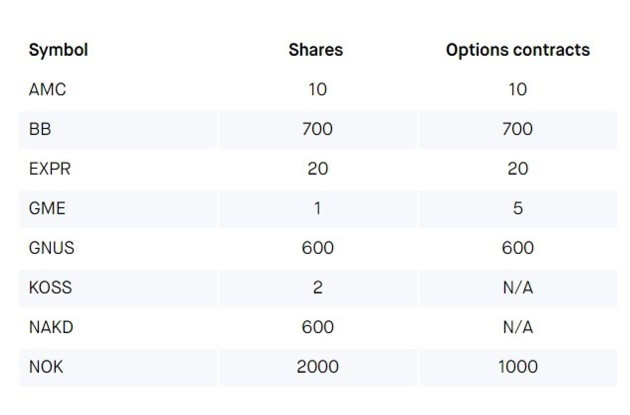

Friday, Jan 29, 2021 - 16:59Robinhood Caps Maximum Holdings In 36 Stocks To Just One Share

https://www.zerohedge.com/markets/robinhood-caps-maximum-hol…

...

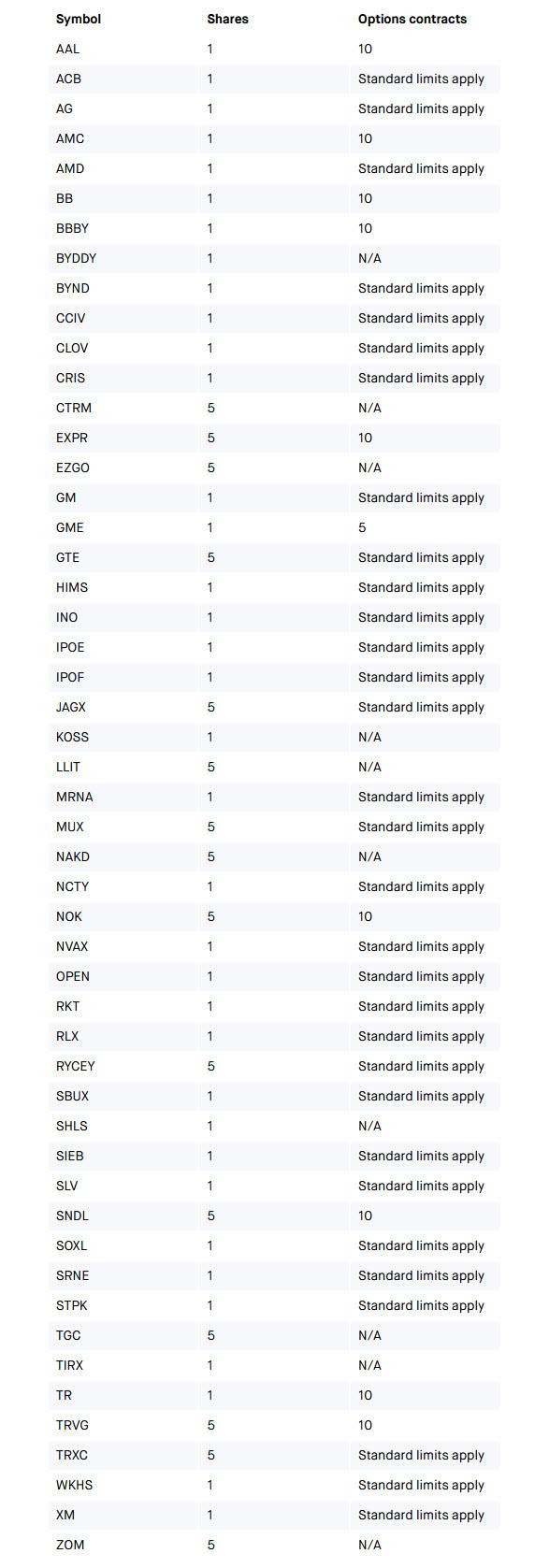

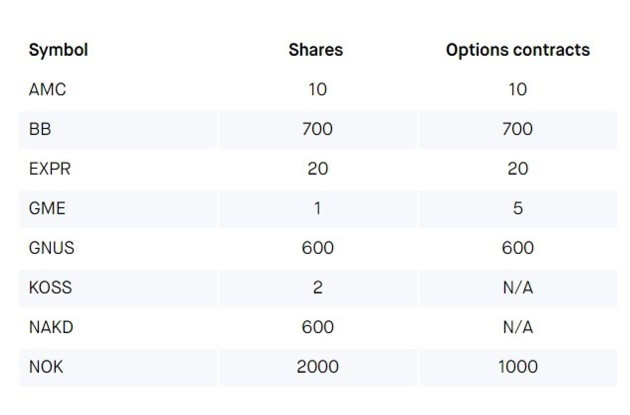

"The table below shows the maximum number of shares and options contracts to which you can increase your positions. Please note that these are aggregate limits for each security and not per-order limits, and include shares and options contracts that you already hold. These limits may be subject to change throughout the day."

<Liste unten>

...

Why is this happening? The most likely reason is that between DTC, clearinghouses and other regulatory entities, Robinhood was found to be in another capital deficiency position - even with the billions raised overnight - and it is being forced to delever.

This likely means that Robinhood is as of this moment, scrambling to obtain even more capital, although we somehow doubt it will be just as easy to "take from the rich" as it was late last night especially since the client exodus is surely accelerating.

It also means that we may have to have another "Lehman Weekend" situation on our hands, only this time it will be a "Robinhood Weekend", and an urgent acquisition from a strategic buyer may be required to prevent the worst case outcome.

We only hope that the billions in funds held in custody for clients is segregated should the company collapse (pinging Jon Corzine here).

In any case, expect a lot of Robinhood related news over the weekend.

Antwort auf Beitrag Nr.: 66.710.651 von faultcode am 29.01.21 23:13:34selbst Standardwerte wie AMD, General Motors oder Starbucks stehen auf dieser Blacklist:

Short % of Float (Jan 14, 2021) -- Morningstar:

AMD -- 5.96%

General Motors -- 1.31%

Starbucks -- 0.94%

da ist mMn in der Tat was im Busch

Short % of Float (Jan 14, 2021) -- Morningstar:

AMD -- 5.96%

General Motors -- 1.31%

Starbucks -- 0.94%

da ist mMn in der Tat was im Busch

Antwort auf Beitrag Nr.: 66.710.834 von faultcode am 29.01.21 23:28:29Stake, in Robinhood-Clone aus Australien (*), hat auch Probleme:

29.1.

To our Stake community,

The Stake experience over the past few days has not been up to scratch for you, nor up to the standards we hold ourselves to. We sincerely apologise for the inconvenience and frustration this has caused.

Stake was founded with the intention to open up access to global markets, no matter who you are or where you live. Over this week, that access was not to the quality it should have been.

...

https://hellostake.com/featured-post/platform-update/

(*)

Stakeshop Pty Ltd, trading as Stake, ACN 610105505, is an authorised representative (Authorised Representative No. 1241398) of Sanlam Private Wealth Pty Ltd (Australian Financial Services Licence No. 337927).

Stake is the trading name of Hellostake Limited (no. 11676409), authorised and regulated by the UK Financial Conduct Authority (FRN: 830771).

...

29.1.

To our Stake community,

The Stake experience over the past few days has not been up to scratch for you, nor up to the standards we hold ourselves to. We sincerely apologise for the inconvenience and frustration this has caused.

Stake was founded with the intention to open up access to global markets, no matter who you are or where you live. Over this week, that access was not to the quality it should have been.

...

https://hellostake.com/featured-post/platform-update/

(*)

Stakeshop Pty Ltd, trading as Stake, ACN 610105505, is an authorised representative (Authorised Representative No. 1241398) of Sanlam Private Wealth Pty Ltd (Australian Financial Services Licence No. 337927).

Stake is the trading name of Hellostake Limited (no. 11676409), authorised and regulated by the UK Financial Conduct Authority (FRN: 830771).

...

Antwort auf Beitrag Nr.: 66.710.834 von faultcode am 29.01.21 23:28:29

DTC = Depository Trust Company: https://www.investopedia.com/terms/d/dtc.asp

..die in den USA ein Quasi-Monopol hat.

Und das in Zusammenarbeit mit den Clearing-Stellen und deren Trade-Finanzierung über <=2 Handelstage hinweg (bei Verkauf von GameStop-Aktien durch den Broker-Kunden z.B.) + Collateral (Sicherheit)-Zahlung (1...3%) an die DTC:

(siehe oben)

Die DTC hätte nun bei GameStop und Co. die Collateral auf 100% erhöht wegen sehr hoher Vola.

Der CEO von Webull meinte dazu, daß die Clearing-Stellen das derzeit finanziell nicht verkraften können, auch weil (zunächst) die Clearing-Stellen an Stelle der bankrotten Melvin Capital deren Collateral bezahlt hätten

Hier die ersten 5 Minuten zur Erklärung, wobei man natürlich im Hinterkopf behalten muss, daß der CEO von Webull halt auch seine Sicht der Dinge hat, die mir aber soweit plausibel erscheint:

28.1.

Anthony Denier, CEO of Webull | ZingerNation

25:52

Anthony Denier kommt auch auf Citadel und die mit ihnen verbundenen Hedgies zu sprechen.

Tag:

• Counterparty Risk

Counterparty Risk

also das Problem scheint größer zu sein und im Zentrum sitzt auch die:DTC = Depository Trust Company: https://www.investopedia.com/terms/d/dtc.asp

..die in den USA ein Quasi-Monopol hat.

Und das in Zusammenarbeit mit den Clearing-Stellen und deren Trade-Finanzierung über <=2 Handelstage hinweg (bei Verkauf von GameStop-Aktien durch den Broker-Kunden z.B.) + Collateral (Sicherheit)-Zahlung (1...3%) an die DTC:

(siehe oben)

Die DTC hätte nun bei GameStop und Co. die Collateral auf 100% erhöht wegen sehr hoher Vola.

Der CEO von Webull meinte dazu, daß die Clearing-Stellen das derzeit finanziell nicht verkraften können, auch weil (zunächst) die Clearing-Stellen an Stelle der bankrotten Melvin Capital deren Collateral bezahlt hätten

Hier die ersten 5 Minuten zur Erklärung, wobei man natürlich im Hinterkopf behalten muss, daß der CEO von Webull halt auch seine Sicht der Dinge hat, die mir aber soweit plausibel erscheint:

28.1.

Anthony Denier, CEO of Webull | ZingerNation

25:52

Anthony Denier kommt auch auf Citadel und die mit ihnen verbundenen Hedgies zu sprechen.

Tag:

• Counterparty Risk

Antwort auf Beitrag Nr.: 66.711.410 von faultcode am 30.01.21 00:45:0429.1.

Texas AG Issues CIDs To Robinhood, Citadel, Others Over "Shocking Coordination" Between Hedge Funds, Trading Platforms To Halt Trading

https://www.zerohedge.com/markets/texas-ag-issues-cids-robin…

...

Texas Attorney General Ken Paxton sent out a Civil Investigative Demand to 13 entities, including Robinhood and Citadel, regarding the "suspension of stock trading and investing" requiring higher margin reserves for trading certain companies and suspending chat platform activity.

Other names which were also issued CIDs include:

• Discord

• Robinhood Markets

• Robinhood Securities

• Interactive Brokers

• TD Ameritrade

• TD Bank

• E-Trade

• WeBull Financia

• Public Holdings

• M1 Holdings

• Citadel Financial

• Apex Clearing.

...

(FC: FormaT)

AG = Attorney General = Bundesanwalt/Staatsanwalt

CID = Civil Investigative Demand

Texas AG Issues CIDs To Robinhood, Citadel, Others Over "Shocking Coordination" Between Hedge Funds, Trading Platforms To Halt Trading

https://www.zerohedge.com/markets/texas-ag-issues-cids-robin…

...

Texas Attorney General Ken Paxton sent out a Civil Investigative Demand to 13 entities, including Robinhood and Citadel, regarding the "suspension of stock trading and investing" requiring higher margin reserves for trading certain companies and suspending chat platform activity.

Other names which were also issued CIDs include:

• Discord

• Robinhood Markets

• Robinhood Securities

• Interactive Brokers

• TD Ameritrade

• TD Bank

• E-Trade

• WeBull Financia

• Public Holdings

• M1 Holdings

• Citadel Financial

• Apex Clearing.

...

(FC: FormaT)

AG = Attorney General = Bundesanwalt/Staatsanwalt

CID = Civil Investigative Demand

Antwort auf Beitrag Nr.: 66.711.410 von faultcode am 30.01.21 00:45:04DTCC THE MAIN U.S CLEARINGHOUSE FOR U.S STOCK TRADES RAISED THE CAPITAL REQUIREMENTS INDUSTRYWIDE TO $33.5B FROM $26B THURS, A 30% INCREASE : DJ

https://twitter.com/Fxhedgers/status/1355343072129761281

--> bearish

https://twitter.com/Fxhedgers/status/1355343072129761281

--> bearish

https://twitter.com/compound248/status/1355274739351248898

..

What’s happening with RobinHood?

A quick primer.

This is a “plumbing” issue. It is esoteric, even for those on Wall Street.

A very long thread on how the toilet is clogged.

...

Most RH clients (& all HFs) use “margin” accounts, not “cash” accounts. RH's sign up process nudges new customers into margin accounts by default.

...

Practically speaking, in margin accounts, the client does NOT own *any* securities. Rather, margin account holders "own" a promise from their broker.

...

For equity options contracts (puts and calls), the primary clearing entity is OCC (Options Clearing Corp). I'm going to refer to "DTCC" below, but know that the same story can be told for options with OTC.

...

Clearing for US equities is generally a “T+2” process: settlement takes no more than 2 days from the trade. But the Buyer’s & Seller’s brokerage accounts generally reflect the transaction immediately - behind the scenes, there is lending. Lending means "counterparty credit risk."

...

DTCC provides its balance sheet to guarantee settlement. But its balance sheet isn't that big, so it has to tightly manage counterparty risk to guarantee accurate settlement.

In this way, DTCC is both a central repository for Title, and also the guarantor of Title.

...

DTCC clients are the brokers, and so the title is held in "Street name" (the broker's name), not your name.

...

RH’s *real* customers are buyers of “order flow”, the largest of whom is Citadel (the same Citadel that bailed out Melvin Capital with Point72 on Monday)

...

So now you own $GME stock in the margin account.

Actually, you don’t - RH owns the stock and simply passes through many of the rights of ownership to you, crediting you with quasi-ownership.

This is important because if RH failed, you would not “own” your stocks, per se. You would be a creditor with a claim against RH. This is a key risk of margin accounts.

See Lehman Brothers.

...

While many brokers share the proceeds of stock lending w/ clients, RobinHood does not. RobinHood keeps it all.

This is a critical way RH gets paid. This payment can be VERY large on hard to borrow names.

...

..

What’s happening with RobinHood?

A quick primer.

This is a “plumbing” issue. It is esoteric, even for those on Wall Street.

A very long thread on how the toilet is clogged.

...

Most RH clients (& all HFs) use “margin” accounts, not “cash” accounts. RH's sign up process nudges new customers into margin accounts by default.

...

Practically speaking, in margin accounts, the client does NOT own *any* securities. Rather, margin account holders "own" a promise from their broker.

...

For equity options contracts (puts and calls), the primary clearing entity is OCC (Options Clearing Corp). I'm going to refer to "DTCC" below, but know that the same story can be told for options with OTC.

...

Clearing for US equities is generally a “T+2” process: settlement takes no more than 2 days from the trade. But the Buyer’s & Seller’s brokerage accounts generally reflect the transaction immediately - behind the scenes, there is lending. Lending means "counterparty credit risk."

...

DTCC provides its balance sheet to guarantee settlement. But its balance sheet isn't that big, so it has to tightly manage counterparty risk to guarantee accurate settlement.

In this way, DTCC is both a central repository for Title, and also the guarantor of Title.

...

DTCC clients are the brokers, and so the title is held in "Street name" (the broker's name), not your name.

...

RH’s *real* customers are buyers of “order flow”, the largest of whom is Citadel (the same Citadel that bailed out Melvin Capital with Point72 on Monday)

...

So now you own $GME stock in the margin account.

Actually, you don’t - RH owns the stock and simply passes through many of the rights of ownership to you, crediting you with quasi-ownership.

This is important because if RH failed, you would not “own” your stocks, per se. You would be a creditor with a claim against RH. This is a key risk of margin accounts.

See Lehman Brothers.

...

While many brokers share the proceeds of stock lending w/ clients, RobinHood does not. RobinHood keeps it all.

This is a critical way RH gets paid. This payment can be VERY large on hard to borrow names.

...

Antwort auf Beitrag Nr.: 66.722.675 von faultcode am 31.01.21 01:37:15

(Wie hoch ist eigentlich der Anteil der Cash accounts bei RH?)

Und damit ist in Summe ihr Counterparty Risk aus Sicht von Dritten stark gestiegen.

Daher hat RH derzeit jedes Interesse daran, daß die User GameStop und ähnliche Aktien verkaufen (und keine neuen kaufen), um dieses Risiko abzubauen.

Und dasselbe scheint auch für Interactive Brokers zu gelten mit 100% Margin-Anforderung für GameStop-Long-Positionen: https://twitter.com/IBKR/status/1354792600004386818

=> möglicherweise entspricht diese IB-Aussage nicht der Wahrheit:

Interactive Brokers has put AMC, BB, EXPR, GME, and KOSS option trading into liquidation only due to the extraordinary volatility in the markets....

Ich nehme an, Ähnliches gilt für Optionen/Derivate, gleich welcher Art, und auch Shortpositionen von RH-Usern bei GameStop und Co.

Und solange die Kurse bei GameStop so hoch sind, bleibt halt auch das Counterparty Risk bei RH hoch.

Sie sollen ja noch Bankkredit von X * USD100M letzte Woche bekommen haben (zusätzlich zur KE); immerhin: https://www.bloomberg.com/news/articles/2021-01-28/robinhood…

...

Robinhood’s lenders include JPMorgan Chase & Co. and Goldman Sachs Group Inc., according to data compiled by Bloomberg.

=> folglich kommt Robinhood wohl erst wieder aus der Krise, wenn die Kurse bei GameStop und Co. deutlich fallen, wodurch auch immer.

Der Witz an der Sache ist aber - und der CEO von RH und das BoD wissen das auch alle - daß das Geschäftsmodell von RH ohne Shortseller, also von Hedgies (nicht den eigenen Usern), nicht funktionieren würde, weil sie ja auch von deren Leihgebühren leben. Siehe oben:

While many brokers share the proceeds of stock lending w/ clients, RobinHood does not. RobinHood keeps it all. This is a critical way RH gets paid. This payment can be VERY large on hard to borrow names.

Das ist ein komplizierte Situation zur Zeit.

___

Was ist mit deutschen Brokern, wie z.B. Trade Republic, die auch "Probleme" bei GameStop haben?

30.1.

Technische Probleme waren aber nicht allein der Grund, weshalb Trade Republic zeitweise den Handel mit einzelnen dieser Aktien stoppte. Das gab der Trade-Republic-Gründer Christian Hecker selbst gegenüber dem Portal Finance Forward zu: „Aufgrund des Hypes dieser US-Nebenwerte und der außerordentlichen Volatilität sind wir zu dem Schluss gekommen, dass eine vorübergehende Anpassung des Angebots notwendig ist.“

https://www.businessinsider.de/gruenderszene/fintech/trade-r…

Wenn ich hier schaue, gehören dem Kunden die Wertpapiere und nicht Trade Republic:

Die Wertpapiere in Deinem Depot fallen nicht unter die Einlagensicherung, sondern stehen in Deinem Eigentum. Sie werden durch unsere Depotbank HSBC Deutschland in den entsprechenden Lagerstellen im In- und Ausland gelagert. Daher gehören die Wertpapiere in jedem Fall Dir.

https://www.traderepublic.com/de-de

(FC: Format)

der Robinhood-User als Gläubiger von Robinhood

So gesehen, sitzt Robinhood/RH seit Neuestem also auf sehr vielen Aktien, die fundamental gesehen astronomisch hoch bewertet sind. Und die rechtlich ihnen gehören und nicht den Usern.(Wie hoch ist eigentlich der Anteil der Cash accounts bei RH?)

Und damit ist in Summe ihr Counterparty Risk aus Sicht von Dritten stark gestiegen.

Daher hat RH derzeit jedes Interesse daran, daß die User GameStop und ähnliche Aktien verkaufen (und keine neuen kaufen), um dieses Risiko abzubauen.

Und dasselbe scheint auch für Interactive Brokers zu gelten mit 100% Margin-Anforderung für GameStop-Long-Positionen: https://twitter.com/IBKR/status/1354792600004386818

=> möglicherweise entspricht diese IB-Aussage nicht der Wahrheit:

Interactive Brokers has put AMC, BB, EXPR, GME, and KOSS option trading into liquidation only due to the extraordinary volatility in the markets....

Ich nehme an, Ähnliches gilt für Optionen/Derivate, gleich welcher Art, und auch Shortpositionen von RH-Usern bei GameStop und Co.

Und solange die Kurse bei GameStop so hoch sind, bleibt halt auch das Counterparty Risk bei RH hoch.

Sie sollen ja noch Bankkredit von X * USD100M letzte Woche bekommen haben (zusätzlich zur KE); immerhin: https://www.bloomberg.com/news/articles/2021-01-28/robinhood…

...

Robinhood’s lenders include JPMorgan Chase & Co. and Goldman Sachs Group Inc., according to data compiled by Bloomberg.

=> folglich kommt Robinhood wohl erst wieder aus der Krise, wenn die Kurse bei GameStop und Co. deutlich fallen, wodurch auch immer.

Der Witz an der Sache ist aber - und der CEO von RH und das BoD wissen das auch alle - daß das Geschäftsmodell von RH ohne Shortseller, also von Hedgies (nicht den eigenen Usern), nicht funktionieren würde, weil sie ja auch von deren Leihgebühren leben. Siehe oben:

While many brokers share the proceeds of stock lending w/ clients, RobinHood does not. RobinHood keeps it all. This is a critical way RH gets paid. This payment can be VERY large on hard to borrow names.

Das ist ein komplizierte Situation zur Zeit.

___

Was ist mit deutschen Brokern, wie z.B. Trade Republic, die auch "Probleme" bei GameStop haben?

30.1.

Technische Probleme waren aber nicht allein der Grund, weshalb Trade Republic zeitweise den Handel mit einzelnen dieser Aktien stoppte. Das gab der Trade-Republic-Gründer Christian Hecker selbst gegenüber dem Portal Finance Forward zu: „Aufgrund des Hypes dieser US-Nebenwerte und der außerordentlichen Volatilität sind wir zu dem Schluss gekommen, dass eine vorübergehende Anpassung des Angebots notwendig ist.“

https://www.businessinsider.de/gruenderszene/fintech/trade-r…

Wenn ich hier schaue, gehören dem Kunden die Wertpapiere und nicht Trade Republic:

Die Wertpapiere in Deinem Depot fallen nicht unter die Einlagensicherung, sondern stehen in Deinem Eigentum. Sie werden durch unsere Depotbank HSBC Deutschland in den entsprechenden Lagerstellen im In- und Ausland gelagert. Daher gehören die Wertpapiere in jedem Fall Dir.

https://www.traderepublic.com/de-de

(FC: Format)

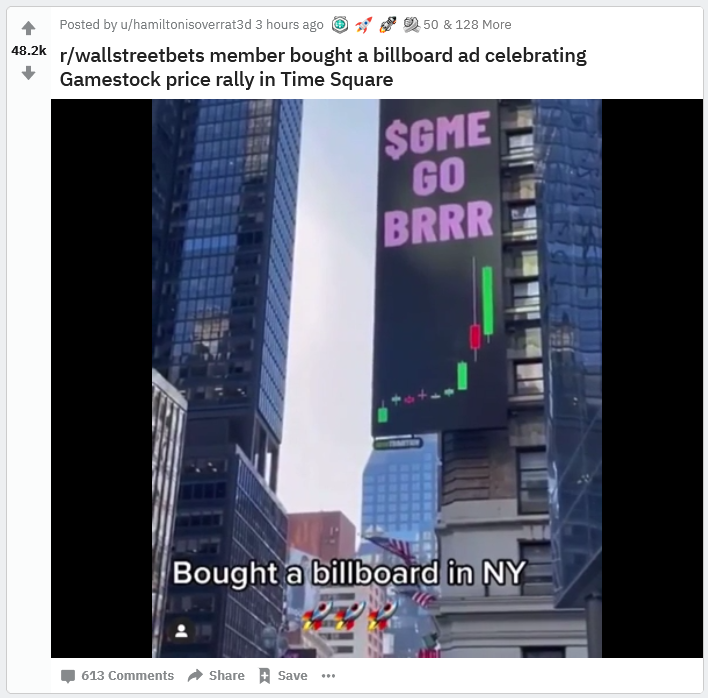

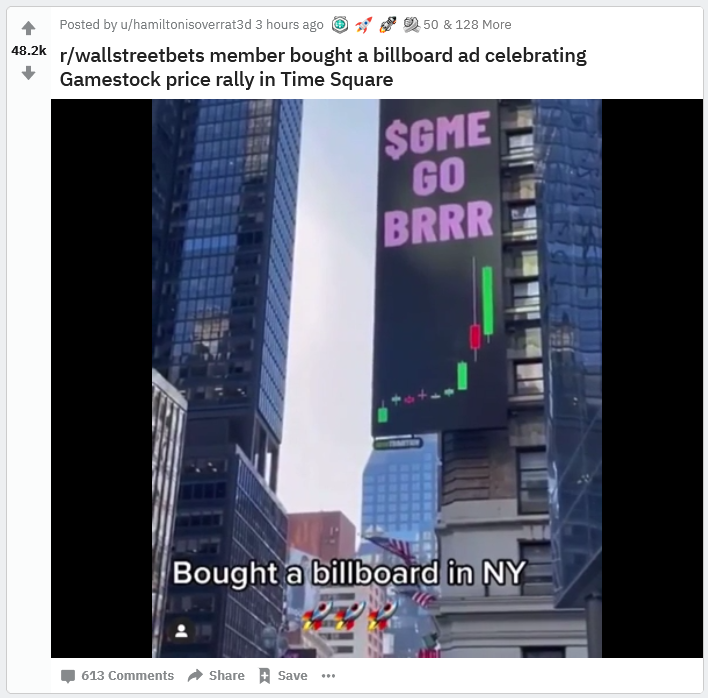

Antwort auf Beitrag Nr.: 66.722.822 von faultcode am 31.01.21 02:48:16https://www.reddit.com/r/nextfuckinglevel/comments/l8xb41/rw…

Antwort auf Beitrag Nr.: 66.722.825 von faultcode am 31.01.21 02:56:37https://twitter.com/pistol_pete_1_/status/135583470862250394…

https://twitter.com/KasparCMS/status/1355246224207609856

https://twitter.com/KasparCMS/status/1355246224207609856

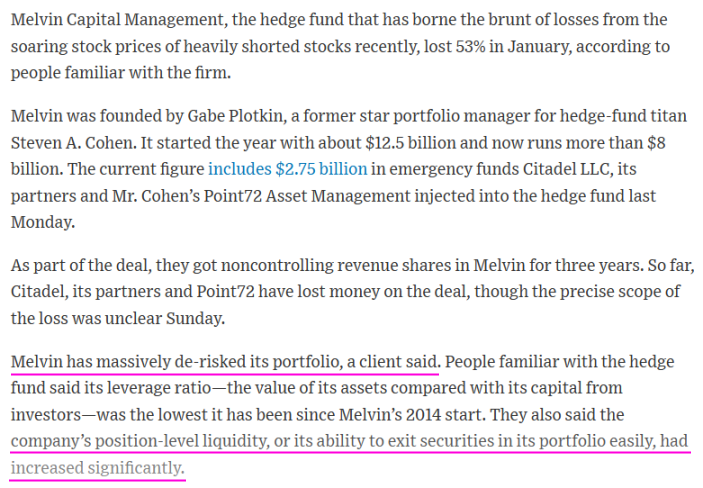

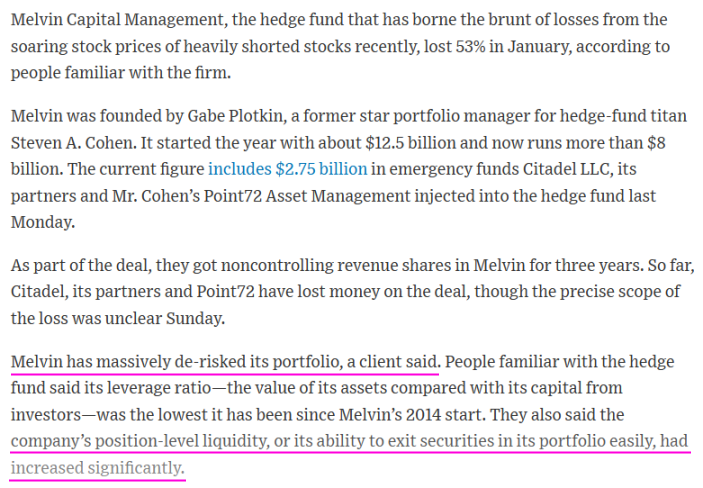

Updated Jan. 31, 2021 10:14 am ET

Melvin Capital Lost 53% in January, Hurt by GameStop and Other Bets

Citadel, its partners and Point72 took losses from their investment in the hedge fund

https://www.wsj.com/articles/melvin-capital-lost-53-in-janua…

...

Melvin Capital Lost 53% in January, Hurt by GameStop and Other Bets

Citadel, its partners and Point72 took losses from their investment in the hedge fund

https://www.wsj.com/articles/melvin-capital-lost-53-in-janua…

...

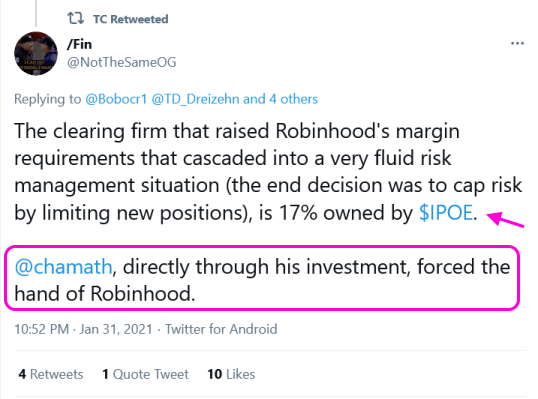

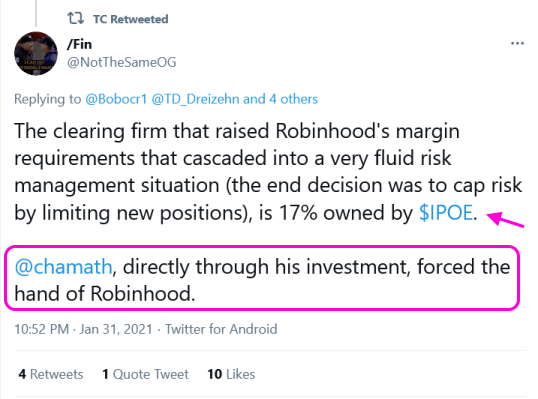

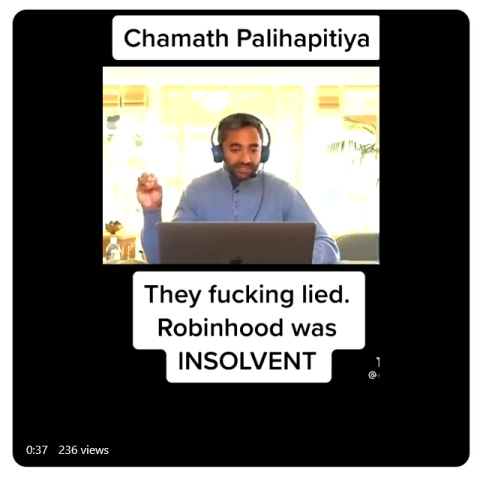

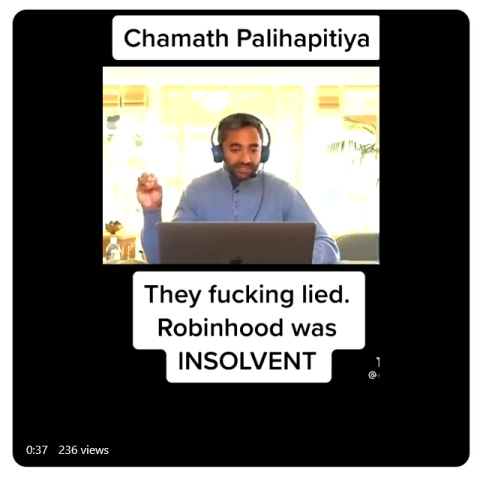

Antwort auf Beitrag Nr.: 66.728.995 von faultcode am 31.01.21 17:13:46Chamath Palihapitiya mittendrin statt nur dabei:

https://twitter.com/NotTheSameOG/status/1355997490940698628

IPOE ist eine SPAC-Bude von Chamath:

Der Hindergrund ist mMn klar:

• IPOE soll auch mit SOFI fusionieren, um einen Wettbewerber von Robinhood, die ja noch privat sind und nun möglicherweise regulatorische Probleme haben, zu schaffen

7.1.

IPOE Stock: 9 Things to Know Ahead of the SoFi SPAC Merger

https://investorplace.com/2021/01/ipoe-stock-9-things-to-kno…

Chamath Palihapitiya just announced that Social Capital Hedosophia will bring SoFi public

By Sarah Smith, InvestorPlace Web Content Producer Jan 7, 2021, 1:15 pm EST

Chamath Palihapitiya is at it again. On Thursday, he announced that Social Capital Hedosophia Holdings V (NYSE:IPOE), yet another of his blank-check companies, would take SoFi public. As IPOE stock races ahead, here is what you need to know about the upcoming SoFi SPAC merger.

To start, investors should get a sense of the basic story. Importantly, Palihapitiya is the man behind several recent, high-profile special purpose acquisition companies. You can thank him for Opendoor (NASDAQ:OPEN) and Clover Health (NASDAQ:CLOV), which will begin trading on the Nasdaq Exchange tomorrow. In fact, Palihapitiya is behind Virgin Galactic (NYSE:SPCE), one of the first SPAC mergers in recent history.

Now, he is making a big bet on SoFi, a player in the fintech space.

...

Essentially, SoFi is an online fintech startup that specializes in all things personal finance. It helps customers with student loan refinancing, mortgages, personal loans, credit cards, investing and banking. Additionally, SoFi offers these students through desktop services and a mobile app.

...

https://twitter.com/NotTheSameOG/status/1355997490940698628

IPOE ist eine SPAC-Bude von Chamath:

Der Hindergrund ist mMn klar:

• IPOE soll auch mit SOFI fusionieren, um einen Wettbewerber von Robinhood, die ja noch privat sind und nun möglicherweise regulatorische Probleme haben, zu schaffen

7.1.

IPOE Stock: 9 Things to Know Ahead of the SoFi SPAC Merger

https://investorplace.com/2021/01/ipoe-stock-9-things-to-kno…

Chamath Palihapitiya just announced that Social Capital Hedosophia will bring SoFi public

By Sarah Smith, InvestorPlace Web Content Producer Jan 7, 2021, 1:15 pm EST

Chamath Palihapitiya is at it again. On Thursday, he announced that Social Capital Hedosophia Holdings V (NYSE:IPOE), yet another of his blank-check companies, would take SoFi public. As IPOE stock races ahead, here is what you need to know about the upcoming SoFi SPAC merger.

To start, investors should get a sense of the basic story. Importantly, Palihapitiya is the man behind several recent, high-profile special purpose acquisition companies. You can thank him for Opendoor (NASDAQ:OPEN) and Clover Health (NASDAQ:CLOV), which will begin trading on the Nasdaq Exchange tomorrow. In fact, Palihapitiya is behind Virgin Galactic (NYSE:SPCE), one of the first SPAC mergers in recent history.

Now, he is making a big bet on SoFi, a player in the fintech space.

...

Essentially, SoFi is an online fintech startup that specializes in all things personal finance. It helps customers with student loan refinancing, mortgages, personal loans, credit cards, investing and banking. Additionally, SoFi offers these students through desktop services and a mobile app.

...

B Book?

30.1.Is Robinhood on the brink of collapse?

https://www.zerohedge.com/news/2021-01-30/robinhood-brink-co…

...

Which looks like the FXCM trick; Robinhood is not operating a b-book. They clear through Citadel Securities, a market maker, who b-books the trades (goes short basically) by not clearing them. In addition to that, Citadel is heavily invested in Melvin Capital, the hedge fund with a massive short position in $GME.

NOTE: It is not possible to short private equity stock. Robinhood is currently a private company, available on private markets. They claim to have plans for an IPO but so did Refco. If Robinhood's book is as toxic as it seems, there is no way out for the firm other than to drive the prices of these stocks back down, or to simply reverse the positions which never really existed in the first place.

They might want to call b-book mastermind Dror "Drew" Niv who was able to mask his b-booking operation by creating an offshore entity who was the sole counterparty of transactions below a certain size. He's currently chumming it up with his bros in Greenwich, CT since his firm FXCM has been permanently banned by the NFA.

We aren't saying that Robinhood is a fraud, we are saying that all the signs are there. For equity brokers who clear their orders properly, there is no reason to limit $GME purchases to one. There is no reason to limit withdrawals, or need 'liquidity' for net cap requirements.

Running a broker-dealer is not so complicated like an OTC desk, orders match up and it's all exchange traded. Broker dealers don't take any risk, at least any meaningful risk. Market makers do. This is the question that we should be asking Vladimir - are you acting as an agent or a principal?

...

https://www.crediblock.com/

https://crediblock.com/secondsight/

http://www.forex-central.net/A-book-B-book.php

The B Book - used by Market Maker brokers

Forex brokers that use a B Book keep their clients' orders internally. They take the other side of their clients' trades, which means that the brokers' profits are often equal to their clients' losses. Brokerage firms are able to manage the risks associated with the holding of a B Book by using certain risk management strategies: internal hedging through the matching of opposite orders submitted by other clients, spread variations, etc. As the majority of retail traders lose money, the use of a B Book is very profitable for brokers.

It is obvious that this model generates conflicts of interest between brokers and their clients. Profitable traders can cause these brokers to lose money. Traders are often worried about being subject to the underhanded tactics of some brokers who seek to always be profitable. That's why the larger market maker forex brokers use a hybrid model that involves placing trades in an A Book or in a B Book based on traders' profiles.

___

Zu:

If Robinhood's book is as toxic as it seems, there is no way out for the firm other than to drive the prices of these stocks back down...

--->

Zitat von faultcode: So gesehen, sitzt Robinhood/RH seit Neuestem also auf sehr vielen Aktien, die fundamental gesehen astronomisch hoch bewertet sind. Und die rechtlich ihnen gehören und nicht den Usern.

...

Und damit ist in Summe ihr Counterparty Risk aus Sicht von Dritten stark gestiegen.

Daher hat RH derzeit jedes Interesse daran, daß die User GameStop und ähnliche Aktien verkaufen (und keine neuen kaufen), um dieses Risiko abzubauen...

https://www.marketwatch.com/story/robinhood-slims-restricted…

...

Per the limits, Robinhood users can only buy one share of GameStop (and up to five options contracts), and up to 10 of AMC (and 10 options contracts).

“Please note that these are aggregate limits for each security and not per-order limits, and include shares and options contracts that you already hold,” Robinhood said. “These limits may be subject to change throughout the day.”

...

...

Per the limits, Robinhood users can only buy one share of GameStop (and up to five options contracts), and up to 10 of AMC (and 10 options contracts).

“Please note that these are aggregate limits for each security and not per-order limits, and include shares and options contracts that you already hold,” Robinhood said. “These limits may be subject to change throughout the day.”

...

Hier eine andere und deutlich günstigere Deutung der Ereignisse um Robinhood/RH..

• NSCC = National Securities Clearing Corporation: https://www.investopedia.com/terms/n/nscc.asp

..die im Wesentlich darauf abzielt, daß RH vorschriftmäßig ihren "appropriate Required Fund Deposit (i.e., margin)"-Anforderungen nachkam letzte Woche. Hier gibt es unzählige Einträge dazu:

https://www.federalregister.gov/documents/search?conditions%…

..und zwar nicht nur durch die DTCC (siehe am Ende), sondern auch durch die NSCC, einer Tochter der DTCC:

Stichwörter:

• Dodd-Frank

• VaR

• Gap Risk Measure

• Deposit Floor Calc

• Mark-to-Market

Also: 29.1. -- https://twitter.com/KralcTrebor/status/1354952686165225478

Ok - here's my best explanation of why @RobinhoodApp restricted trading in the short-squeeze stocks.

Spoiler: the story isn't the Ken Griffen called Janet Yellen who instructed DTCC to raise margin on Robinhood to force them to shut down the speculative buying.

Here goes ...

...

NSCC is the entity that takes that credit risk. It matches up the net buyers and sellers, post-trade, and handles the exchange of cash for security. To mitigate the credit risk that one of the clearing brokers fails, they demand the brokers post a clearing deposit with them.

...

These deposits are held in the Clearing Fund at the NSCC.

...

They had 10.5bn in the Clearing Fund as of Sep 30, 2020.

This is the regime post-Dodd-Frank. NSCC updated it's rules in 2018 to improve the VaR calc and to add the Gap Risk Measure.

How did this impact Robinhood?

...

Now 99% 2d VaR is much higher. It should be 20x higher for their net portfolio, but the formula will smooth it out some. Maybe it's ~4x bigger. So just on VaR, they have to post 120m now. That they should have.

The Gap Risk Measure is what kills them.

If GME is over 30% of their net unsettled portfolio, then they are required to post 10% of all the GME buys. So if that's 800m, they have to post another 80m. And there is no limit to it. As long as their clients are up P&L, the mark-to-market covers it.

But if RH takes in 500m of new money and 300m buys GME, then at minimum they are looking at posting 30m+ from just that exposure at NSCC. They cannot use client money - RH has to use their own resources to post. And if GME stock drops, RH has to post the loss pre-settlement.

This would also explain why RH drew its credit lines and said vague things about clearing requirements.

...

The policy goal here is to avoid the central plumbing entities from taking credit risk. In reality, such regulations raise costs and create barriers to entry. It raises profits for entities like DTCC (which owns NSCC and is itself owned by Wall St)

...

So @aoc is right to ask how it can be that Robinhood stopped its clients from buying certain securities. And what she'll find is that the reason is that Dodd-Frank requires brokers like RH to post collateral to cover their clients' trading risk pre-settlement.

And it isn't the Fed or SEC who sets the rules. It's the Wall St owned central clearing entity itself, DTCC, that makes its own rules. So when the retail masses decided to squeeze the short-sellers, in the middle of crushing them, it was govt regulations which tripped them up.

Update: the plot thickens ... @The_DTCC may have exercised its right to add additional margin charges for a set of these stocks. It's a Margin Liquidity Adjustment Charge.

...

=> mit anderen Worten: erhöhte (dynamische) Margin-Anforderungen bei RH:

• NSCC = National Securities Clearing Corporation: https://www.investopedia.com/terms/n/nscc.asp

..die im Wesentlich darauf abzielt, daß RH vorschriftmäßig ihren "appropriate Required Fund Deposit (i.e., margin)"-Anforderungen nachkam letzte Woche. Hier gibt es unzählige Einträge dazu:

https://www.federalregister.gov/documents/search?conditions%…

..und zwar nicht nur durch die DTCC (siehe am Ende), sondern auch durch die NSCC, einer Tochter der DTCC:

Stichwörter:

• Dodd-Frank

• VaR

• Gap Risk Measure

• Deposit Floor Calc

• Mark-to-Market

Also: 29.1. -- https://twitter.com/KralcTrebor/status/1354952686165225478

Ok - here's my best explanation of why @RobinhoodApp restricted trading in the short-squeeze stocks.

Spoiler: the story isn't the Ken Griffen called Janet Yellen who instructed DTCC to raise margin on Robinhood to force them to shut down the speculative buying.

Here goes ...

...

NSCC is the entity that takes that credit risk. It matches up the net buyers and sellers, post-trade, and handles the exchange of cash for security. To mitigate the credit risk that one of the clearing brokers fails, they demand the brokers post a clearing deposit with them.

...

These deposits are held in the Clearing Fund at the NSCC.

...

They had 10.5bn in the Clearing Fund as of Sep 30, 2020.

This is the regime post-Dodd-Frank. NSCC updated it's rules in 2018 to improve the VaR calc and to add the Gap Risk Measure.

How did this impact Robinhood?

...

Now 99% 2d VaR is much higher. It should be 20x higher for their net portfolio, but the formula will smooth it out some. Maybe it's ~4x bigger. So just on VaR, they have to post 120m now. That they should have.

The Gap Risk Measure is what kills them.

If GME is over 30% of their net unsettled portfolio, then they are required to post 10% of all the GME buys. So if that's 800m, they have to post another 80m. And there is no limit to it. As long as their clients are up P&L, the mark-to-market covers it.

But if RH takes in 500m of new money and 300m buys GME, then at minimum they are looking at posting 30m+ from just that exposure at NSCC. They cannot use client money - RH has to use their own resources to post. And if GME stock drops, RH has to post the loss pre-settlement.

This would also explain why RH drew its credit lines and said vague things about clearing requirements.

...

The policy goal here is to avoid the central plumbing entities from taking credit risk. In reality, such regulations raise costs and create barriers to entry. It raises profits for entities like DTCC (which owns NSCC and is itself owned by Wall St)

...

So @aoc is right to ask how it can be that Robinhood stopped its clients from buying certain securities. And what she'll find is that the reason is that Dodd-Frank requires brokers like RH to post collateral to cover their clients' trading risk pre-settlement.

And it isn't the Fed or SEC who sets the rules. It's the Wall St owned central clearing entity itself, DTCC, that makes its own rules. So when the retail masses decided to squeeze the short-sellers, in the middle of crushing them, it was govt regulations which tripped them up.

Update: the plot thickens ... @The_DTCC may have exercised its right to add additional margin charges for a set of these stocks. It's a Margin Liquidity Adjustment Charge.

...

=> mit anderen Worten: erhöhte (dynamische) Margin-Anforderungen bei RH:

31.1. Vladimir Tenev, CEO RH -- Clubhouse:

...

He said while he was asleep, at 3:30 a.m. Pacific time last Thursday, Robinhood’s operations team got a file from the National Securities Clearing Corporation (NSCC).

“We have to put up money to the NSCC based on some factors including things like the volatility of the trading activity into certain securities. And this is the equities business so it’s based on, stock trading and not options trading or anything else,” he said.

“So they give us a file with the deposit and the request was around $3 billion, which is, you know, about an order of magnitude more than what it typically is,” said Tenev.

Musk asked how that was calculated, and commented that it seemed “weird” that you get a “$3 billion demand, you know, at 3:30 a.m. in the morning, just suddenly out of nowhere.”

“Robinhood up until that point has raised around $2 billion in total venture capital, up until now. So it’s a big number, like $3 billion is a large number, right?” responded Tenev, who added that they don’t have the full context about what was going on at the NSCC to make those calculations.

“I wouldn’t impude shadiness to it or anything like that, and actually you know the NSCC was reasonable…they worked with us to actually lower it. So it was unprecedented activity,” said Tenev. He said an eventual conversation with “higher ups” at the NSCC led to that $3 billion number being dropped to $1.4 billion, but still left a “high number.”

He said they then proposed marking the most volatile stocks “positioning closing only,” and then the NSCC responded by saying the deposit was $700 million, which Robinhood paid. He said that explains why they had to mark some positions “closing only,” even as they knew it wasn’t a great outcome for customers.

“Part of what’s been really difficult is Robinhood stands for democratizing access for stocks, but we had no choice in this case,” he said.

Tenev also explained why they just restricted buying and not selling. “The fact of the matter is, people get really pissed off if they’re holding stocks and they want to sell and they can’t. So that’s categorically worse,” he said, adding that he believes lots of other brokers were in the same situation.

“Basically, what people are wondering is did you sell your clients down the river,” asked Musk of Tenev, who said Robinhood has to “comply with requirements,” like other financial institutions.

Tenev said the team raised over a billion dollars in capital, so that when markets open on Monday, they can relax the most stringent limits on trade. But he told Musk and the audience that there will always be some “theoretical limits.

...

Tesla CEO Elon Musk calls Robinhood CEO ‘Vlad the stock impaler’ and grills him over the GameStop saga

https://www.marketwatch.com/story/tesla-ceo-elon-musk-calls-…

...

He said while he was asleep, at 3:30 a.m. Pacific time last Thursday, Robinhood’s operations team got a file from the National Securities Clearing Corporation (NSCC).

“We have to put up money to the NSCC based on some factors including things like the volatility of the trading activity into certain securities. And this is the equities business so it’s based on, stock trading and not options trading or anything else,” he said.

“So they give us a file with the deposit and the request was around $3 billion, which is, you know, about an order of magnitude more than what it typically is,” said Tenev.

Musk asked how that was calculated, and commented that it seemed “weird” that you get a “$3 billion demand, you know, at 3:30 a.m. in the morning, just suddenly out of nowhere.”

“Robinhood up until that point has raised around $2 billion in total venture capital, up until now. So it’s a big number, like $3 billion is a large number, right?” responded Tenev, who added that they don’t have the full context about what was going on at the NSCC to make those calculations.

“I wouldn’t impude shadiness to it or anything like that, and actually you know the NSCC was reasonable…they worked with us to actually lower it. So it was unprecedented activity,” said Tenev. He said an eventual conversation with “higher ups” at the NSCC led to that $3 billion number being dropped to $1.4 billion, but still left a “high number.”

He said they then proposed marking the most volatile stocks “positioning closing only,” and then the NSCC responded by saying the deposit was $700 million, which Robinhood paid. He said that explains why they had to mark some positions “closing only,” even as they knew it wasn’t a great outcome for customers.

“Part of what’s been really difficult is Robinhood stands for democratizing access for stocks, but we had no choice in this case,” he said.

Tenev also explained why they just restricted buying and not selling. “The fact of the matter is, people get really pissed off if they’re holding stocks and they want to sell and they can’t. So that’s categorically worse,” he said, adding that he believes lots of other brokers were in the same situation.

“Basically, what people are wondering is did you sell your clients down the river,” asked Musk of Tenev, who said Robinhood has to “comply with requirements,” like other financial institutions.

Tenev said the team raised over a billion dollars in capital, so that when markets open on Monday, they can relax the most stringent limits on trade. But he told Musk and the audience that there will always be some “theoretical limits.

...

Tesla CEO Elon Musk calls Robinhood CEO ‘Vlad the stock impaler’ and grills him over the GameStop saga

https://www.marketwatch.com/story/tesla-ceo-elon-musk-calls-…

WSJ: 1.2.

Robinhood Raises Another $2.4 Billion From Shareholders

The $3.4 billion raised since last Thursday is more than the company has raised in its entire prior existence

https://www.wsj.com/articles/robinhood-raises-another-2-4-bi…

Robinhood Markets Inc. raised another $2.4 billion from shareholders, days after investors agreed to pump $1 billion into the online brokerage to help it ride out a trading frenzy in popular stocks including GameStop Inc.

The huge infusion—the $3.4 billion raised since last Thursday is more than the company has raised in total up until that point—gives Robinhood a war chest to cover a surge in collateral requirements stemming from the trading boom, the people said.

It should also allow the company to support the hundreds of thousands of new accounts users opened since Thursday and to remove many of the trading restrictions that angered customers of the popular brokerage, the people said.

The fundraising deal was structured as a note that conveys the option to buy additional shares at a discount later, the people said.

...

__

FC: das sieht für mich aus wie die Flucht aus der Krise. Man will offenbar die vielen neuen Interessenten auch als User gewinnen und mit einem Konto versorgen und nicht zur Konkurrenz schicken, was natürlich Fragen aufwerfen würde

Robinhood Raises Another $2.4 Billion From Shareholders

The $3.4 billion raised since last Thursday is more than the company has raised in its entire prior existence

https://www.wsj.com/articles/robinhood-raises-another-2-4-bi…

Robinhood Markets Inc. raised another $2.4 billion from shareholders, days after investors agreed to pump $1 billion into the online brokerage to help it ride out a trading frenzy in popular stocks including GameStop Inc.

The huge infusion—the $3.4 billion raised since last Thursday is more than the company has raised in total up until that point—gives Robinhood a war chest to cover a surge in collateral requirements stemming from the trading boom, the people said.

It should also allow the company to support the hundreds of thousands of new accounts users opened since Thursday and to remove many of the trading restrictions that angered customers of the popular brokerage, the people said.

The fundraising deal was structured as a note that conveys the option to buy additional shares at a discount later, the people said.

...

__

FC: das sieht für mich aus wie die Flucht aus der Krise. Man will offenbar die vielen neuen Interessenten auch als User gewinnen und mit einem Konto versorgen und nicht zur Konkurrenz schicken, was natürlich Fragen aufwerfen würde

Dumme Frage, aber warum gibt es diesen Beitrag hier bei M$?

Antwort auf Beitrag Nr.: 66.756.379 von faultcode am 01.02.21 20:24:54..und noch mehr Geld - jetzt wird's komisch:

Robinhood Eyes Raising $1 Billion More of Debt, Reuters Says

https://finance.yahoo.com/news/robinhood-explores-raising-1-…

Updated Mon, February 1, 2021, 10:25 PM

...

Robinhood Markets has had discussions with banks about raising another $1 billion of debt as the stock brokerage app grapples to keep filling orders amid a Reddit-fueled trading mania focused on heavily shorted stocks, Reuters reported.

Any fresh capital would be separate from the $3.4 billion that’s been raised by the firm in the past few days, including $2.4 billion announced Monday, the news organization reported, citing people that it didn’t name.

The company’s biggest backers have been plowing money into the brokerage at an unprecedented pace as the firm faces outraged customers, increased regulatory scrutiny and questions about its plans for an initial public offering.

Robinhood started negotiations with banks about expanding its lines of credit or arranging a new one after it drained its revolving debt facility during last week’s frenetic trading, Reuters said, citing one of its sources, who it said asked not to be identified because the matter is confidential. Robinhood declined to comment to Reuters. A representative for the company didn’t immediately respond to Bloomberg News when asked to comment.

Robinhood told investors it would use the bulk of its earlier-announced funds as collateral at the industry’s central clearinghouse, the Depository Trust & Clearing Corp., according to a person familiar with the matter.

...

Robinhood Eyes Raising $1 Billion More of Debt, Reuters Says

https://finance.yahoo.com/news/robinhood-explores-raising-1-…

Updated Mon, February 1, 2021, 10:25 PM

...

Robinhood Markets has had discussions with banks about raising another $1 billion of debt as the stock brokerage app grapples to keep filling orders amid a Reddit-fueled trading mania focused on heavily shorted stocks, Reuters reported.

Any fresh capital would be separate from the $3.4 billion that’s been raised by the firm in the past few days, including $2.4 billion announced Monday, the news organization reported, citing people that it didn’t name.

The company’s biggest backers have been plowing money into the brokerage at an unprecedented pace as the firm faces outraged customers, increased regulatory scrutiny and questions about its plans for an initial public offering.

Robinhood started negotiations with banks about expanding its lines of credit or arranging a new one after it drained its revolving debt facility during last week’s frenetic trading, Reuters said, citing one of its sources, who it said asked not to be identified because the matter is confidential. Robinhood declined to comment to Reuters. A representative for the company didn’t immediately respond to Bloomberg News when asked to comment.

Robinhood told investors it would use the bulk of its earlier-announced funds as collateral at the industry’s central clearinghouse, the Depository Trust & Clearing Corp., according to a person familiar with the matter.

...

Antwort auf Beitrag Nr.: 66.759.361 von SLCoolJ am 01.02.21 22:49:39Warum nur?

Antwort auf Beitrag Nr.: 66.734.059 von faultcode am 31.01.21 23:31:48

nun übertreibt er es. So wird er zum Außenseiter, egal wie viel Geld er hat:

https://twitter.com/YungMillennials/status/13566727605927485…

Chamath: These motherf...... should go to jail.

<gemeint sind die RH-Macher>

Zitat von faultcode: Chamath Palihapitiya mittendrin statt nur dabei:

...

nun übertreibt er es. So wird er zum Außenseiter, egal wie viel Geld er hat:

https://twitter.com/YungMillennials/status/13566727605927485…

Chamath: These motherf...... should go to jail.

<gemeint sind die RH-Macher>

Antwort auf Beitrag Nr.: 66.781.372 von faultcode am 02.02.21 19:59:12Warum machst du so sinnlos hier weiter, faultcode?

Antwort auf Beitrag Nr.: 66.760.531 von faultcode am 02.02.21 02:40:395.2.

Die Online-Broker-App Robinhood teilte mit, dass die temporären Handelsbeschränkungen für alle Aktien inkl. GameStop und AMC Entertainment aufgehoben wurden.

Zuvor durften nicht mehr als 500 GameStop-Aktien gehandelt werden, der Erwerb von AMC-Aktien war auf 5.500 gedeckelt.

Der Online-Broker hatte vergangene Woche kurzfristige Kaufbeschränkungen eingeführt, weil die von der Clearing-Stelle geforderten Einlagen für Aktien um das Zehnfache erhöht wurden....

https://www.godmode-trader.de/artikel/robinhood-hebt-handels…

Die Online-Broker-App Robinhood teilte mit, dass die temporären Handelsbeschränkungen für alle Aktien inkl. GameStop und AMC Entertainment aufgehoben wurden.

Zuvor durften nicht mehr als 500 GameStop-Aktien gehandelt werden, der Erwerb von AMC-Aktien war auf 5.500 gedeckelt.

Der Online-Broker hatte vergangene Woche kurzfristige Kaufbeschränkungen eingeführt, weil die von der Clearing-Stelle geforderten Einlagen für Aktien um das Zehnfache erhöht wurden....

https://www.godmode-trader.de/artikel/robinhood-hebt-handels…

!

Dieser Beitrag wurde von SelfMODus moderiert. Grund: Schreiben Sie bitte Diskussionsbeiträge zum Thema des Threads.Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,17 | |

| -1,14 | |

| -0,57 | |

| +0,67 | |

| +0,23 | |

| +0,35 | |

| -1,79 | |

| +0,76 | |

| -0,50 | |

| +1,54 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 172 | ||

| 121 | ||

| 78 | ||

| 58 | ||

| 57 | ||

| 55 | ||

| 54 | ||

| 51 | ||

| 44 | ||

| 40 |

18.04.24 · dpa-AFX · Apple |

18.04.24 · dpa-AFX · Boeing |

17.04.24 · dpa-AFX · Amazon |

17.04.24 · dpa-AFX · Microsoft |

17.04.24 · Aktienwelt360 · Apple |

17.04.24 · dpa-AFX · Microsoft |

16.04.24 · PR Newswire (dt.) · Microsoft |

16.04.24 · dpa-AFX · Beiersdorf |

16.04.24 · dpa-AFX · Microsoft |

| Zeit | Titel |

|---|---|

| 17.04.24 | |

| 12.04.24 | |

| 18.07.23 | |

| 27.04.23 |