Goldman Sachs (Seite 4)

eröffnet am 13.01.21 23:05:32 von

neuester Beitrag 16.01.24 13:51:42 von

neuester Beitrag 16.01.24 13:51:42 von

Beiträge: 45

ID: 1.338.614

ID: 1.338.614

Aufrufe heute: 1

Gesamt: 4.700

Gesamt: 4.700

Aktive User: 0

ISIN: US38141G1040 · WKN: 920332 · Symbol: GOS

397,70

EUR

+0,42 %

+1,65 EUR

Letzter Kurs 12:13:14 Tradegate

Neuigkeiten

09:59 Uhr · wallstreetONLINE Redaktion |

| Goldman Sachs Group Aktien jetzt im kostenlosen Demokonto handeln!Anzeige |

04:30 Uhr · wallstreetONLINE Redaktion |

23.04.24 · wallstreetONLINE Redaktion |

22.04.24 · dpa-AFX |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +500,00 | |

| 0,6800 | +312,12 | |

| 1,6800 | +15,87 | |

| 2,1400 | +12,93 | |

| 1,0900 | +11,32 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,1100 | -9,89 | |

| 9,0700 | -12,45 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 | |

| 0,5338 | -31,13 |

Beitrag zu dieser Diskussion schreiben

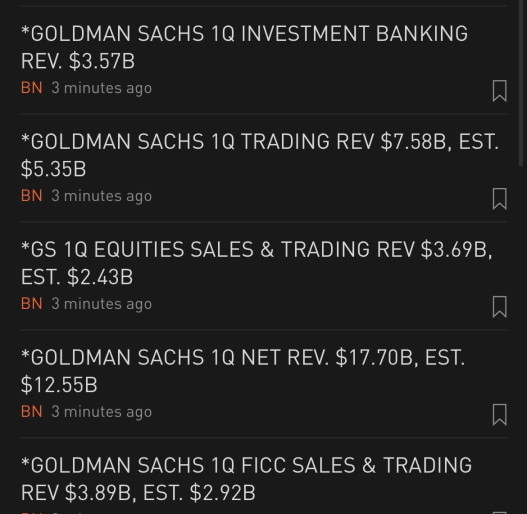

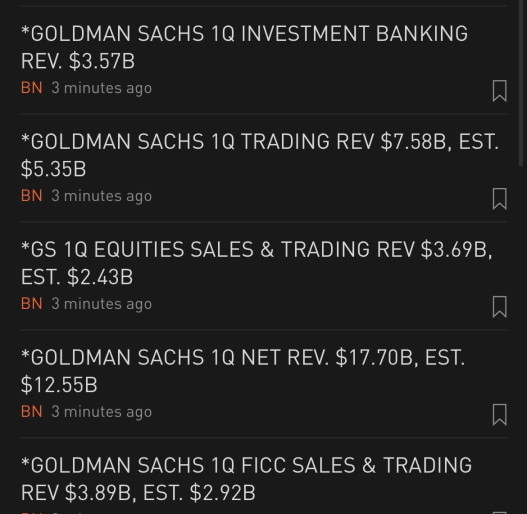

Antwort auf Beitrag Nr.: 67.697.713 von faultcode am 03.04.21 19:25:00hat sich, und anderes, für GS gelohnt:

Antwort auf Beitrag Nr.: 67.697.608 von faultcode am 03.04.21 18:56:45

3.4.

They can do what they want’: Archegos and the $6tn world of the family office

https://www.ft.com/content/c319839d-d185-4e8a-bbc7-659bebe58…

...

3.4.

They can do what they want’: Archegos and the $6tn world of the family office

https://www.ft.com/content/c319839d-d185-4e8a-bbc7-659bebe58…

...

Antwort auf Beitrag Nr.: 67.681.771 von faultcode am 01.04.21 14:56:355:27 PM · Apr 3, 2021

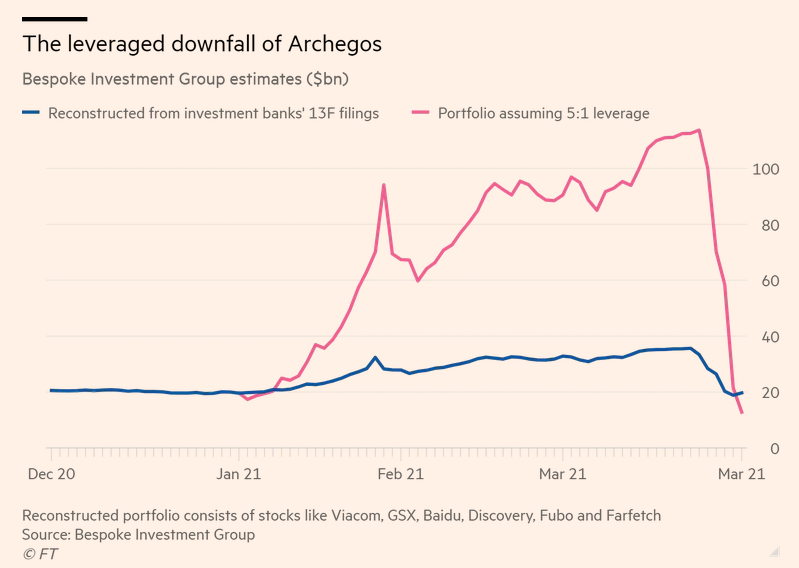

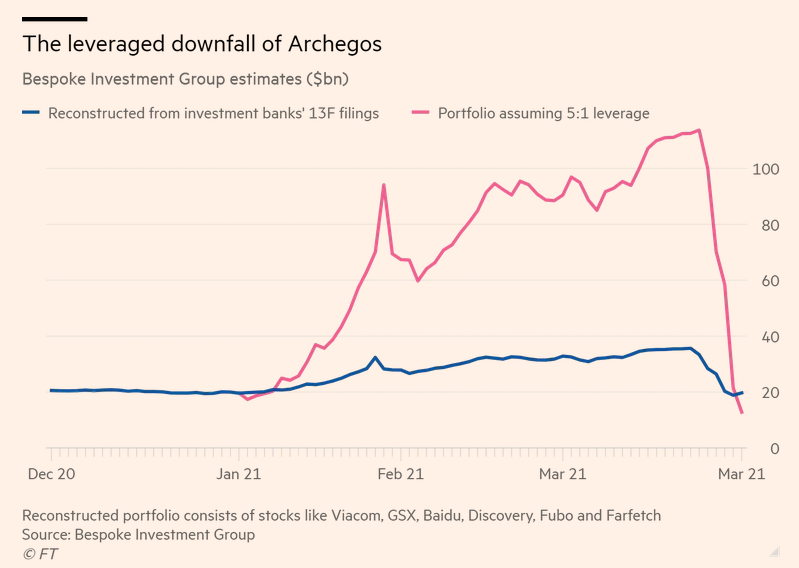

ARCHEGOS CAPITAL LOST $110 BILLION IN 5 DAYS USING 500% LEVERAGE -FT

https://twitter.com/Fxhedgers/status/1378368609827713030

ARCHEGOS CAPITAL LOST $110 BILLION IN 5 DAYS USING 500% LEVERAGE -FT

https://twitter.com/Fxhedgers/status/1378368609827713030

Antwort auf Beitrag Nr.: 67.665.838 von faultcode am 31.03.21 12:32:291.4.

Archegos Blowup Puts Spotlight on Gaps in Swap Regulation

Critics say swaps contracts used by the firm have long been used to avoid SEC’s disclosure rules

https://www.wsj.com/articles/archegos-blowup-puts-spotlight-…

...

The blowup of Archegos Capital Management is spurring calls for tougher regulation of the shadowy swap trades that fueled billions of dollars of losses at global investment banks.

Former regulators and financial-reform advocates say one rule change, in particular, could have prevented the debacle: requiring greater disclosures of the bets that investors such as Archegos place on companies using swaps.

Archegos—the family investment vehicle of hedge-fund veteran Bill Hwang—established large, concentrated positions in ViacomCBS Inc., Chinese internet giant Baidu Inc. and other companies. It used a mix of shares and derivative contracts called total return swaps. Such swaps allowed Archegos to put on huge trades with relatively small upfront payments, but exposed the firm to severe losses when the trades went bad.

Total return swaps are brokered by Wall Street banks. They provide investors with exposure to the profits or losses of stocks or other assets, without the investor actually holding the underlying shares. Archegos’s strategy backfired in recent weeks after ViacomCBS and other stocks sold off.

Mr. Hwang’s firm was unable to meet its obligations to its banking partners, which in turn liquidated large chunks of stock they had amassed to underpin the trades. Among the banks now facing steep losses are Credit Suisse Group AG and Nomura Holdings Inc.

...

Archegos Blowup Puts Spotlight on Gaps in Swap Regulation

Critics say swaps contracts used by the firm have long been used to avoid SEC’s disclosure rules

https://www.wsj.com/articles/archegos-blowup-puts-spotlight-…

...

The blowup of Archegos Capital Management is spurring calls for tougher regulation of the shadowy swap trades that fueled billions of dollars of losses at global investment banks.

Former regulators and financial-reform advocates say one rule change, in particular, could have prevented the debacle: requiring greater disclosures of the bets that investors such as Archegos place on companies using swaps.

Archegos—the family investment vehicle of hedge-fund veteran Bill Hwang—established large, concentrated positions in ViacomCBS Inc., Chinese internet giant Baidu Inc. and other companies. It used a mix of shares and derivative contracts called total return swaps. Such swaps allowed Archegos to put on huge trades with relatively small upfront payments, but exposed the firm to severe losses when the trades went bad.

Total return swaps are brokered by Wall Street banks. They provide investors with exposure to the profits or losses of stocks or other assets, without the investor actually holding the underlying shares. Archegos’s strategy backfired in recent weeks after ViacomCBS and other stocks sold off.

Mr. Hwang’s firm was unable to meet its obligations to its banking partners, which in turn liquidated large chunks of stock they had amassed to underpin the trades. Among the banks now facing steep losses are Credit Suisse Group AG and Nomura Holdings Inc.

...

Antwort auf Beitrag Nr.: 67.665.736 von faultcode am 31.03.21 12:26:57

ARCHEGOS USED THE SAME COLLATERAL TO ENTER TRS CONTRACTS WITH UP TO SEVEN BANKS BOOSTING LEVERAGE AS HIGH AS 700% - SOURCES

https://twitter.com/acpandy/status/1377187837204787205

ARCHEGOS USED THE SAME COLLATERAL TO ENTER TRS CONTRACTS WITH UP TO SEVEN BANKS BOOSTING LEVERAGE AS HIGH AS 700% - SOURCES

https://twitter.com/acpandy/status/1377187837204787205

Antwort auf Beitrag Nr.: 67.651.279 von faultcode am 30.03.21 13:06:59

Antwort auf Beitrag Nr.: 67.646.320 von faultcode am 30.03.21 01:43:00*WALL STREET BANKS SUMMONED BY REGULATORS AFTER HWANG’S BLOWUP

https://twitter.com/LONGCONVEXITY/status/1376682523917492225

https://twitter.com/LONGCONVEXITY/status/1376682523917492225

Antwort auf Beitrag Nr.: 67.637.590 von faultcode am 29.03.21 12:48:37

How Bill Hwang got back into banks’ good books — then blew them up

Prime brokers shook off concerns about Archegos as they eyed lucrative lending

https://www.ft.com/content/b7e0f57b-3751-42b8-8a17-eb7749f4d…

...

“No one has ever seen anything like this before,” said an executive at a Wall Street bank. “The scale, the potential implications for our business, and how so many banks could be so taken-in by either their own greed or by an otherwise interesting investor.”

...

...

Hwang was seen as a compelling prospective client by prime brokers, the potentially lucrative but risky division of investment banks that loans cash and securities to hedge funds and processes their trades.

Concerns about his reputation and history were offset by a sense of the huge opportunities from dealing with him, according to two of Archegos’s prime brokers. He is known as an “aggressive, moneymaking genius”, according to one analyst note, who grew Archegos from assets of about $200m at its 2012 launch to almost $10bn in just nine years.

The fee-hungry investment banks were ravenous for Hwang’s trading commissions and desperate to lend him money so he could magnify his bets. Those included taking outsized positions in stocks such as Chinese technology company Baidu and US media giant Viacom.

...

How was Hwang able to build such large stakes in companies and remain largely undetected? The answer lies in a type of financial instrument called total return swaps.

Also known as contracts-for-difference, swaps are derivatives that allow investors to pay a fee and in turn receive cash based on the performance of an underlying asset. The bank owns the underlying security and in the event of any losses, payments are due from the hedge fund to the bank.

Swaps have boomed in popularity but have been criticised as they allow investors to amass stakes in companies without disclosing their holdings the way they would have to do with equity stakes of a similar size. They are often used by activist funds to disguise their positions as they build positions in target companies.

...

Archegos transacted almost exclusively in total return swaps, said several people familiar with the fund’s operations. And it further magnified its footprint by holding the swaps with multiple banks.

Prime brokerages may have not been aware of the extent of their own exposure to Archegos or being racked up at rival banks, said a number of people involved.

...

A number of the banks were lending to Archegos so that it was as much as eight times levered, meaning for every one stock the fund bought, the bank would lend it seven more, according to people familiar with the matter. In some trades, leverage ratios may have hit as high as 20 times, one person with knowledge of the fund said.

...

“If you’re holding everything as swaps, the reality of what you have to declare to your banks is very little,” said one hedge fund executive with knowledge of trading the instruments.

Despite the limited disclosure, the Archegos affair raises questions about banks’ risk management, which is likely to attract the attention of regulators.

“It’s not so much the quantum of the bank’s lending that is the issue, it’s whether the bank believed it had appropriately hedged itself and whether it was comfortable in the collateral it had taken for the loan in a potential liquidation scenario,” said a senior Wall Street trader.

An executive at a large broker said: “This is why the big banks all blew themselves up in 2008 — over-the-counter derivatives with leverage via a prime broker. Banks are better capitalised now, so this shouldn’t kill any one of them, but it will ruin people’s party and reawaken the regulators.”

One Tokyo-based banker familiar with the situation said: “You get a pretty good understanding of the general situation around Hwang, and the kind of calculations these prime brokers were all making about risk and reward when you look at the way Goldman behaved.”

For years the hedge fund manager was blacklisted by the US bank, which “felt like a no-brainer considering Hwang’s reputation. Then suddenly they are doing everything they can to get him as a client and lend him money,” the banker added.

“So it’s greed trumping fear, right until that stopped last week.”

total return swaps = CFD's

29.3.How Bill Hwang got back into banks’ good books — then blew them up

Prime brokers shook off concerns about Archegos as they eyed lucrative lending

https://www.ft.com/content/b7e0f57b-3751-42b8-8a17-eb7749f4d…

...

“No one has ever seen anything like this before,” said an executive at a Wall Street bank. “The scale, the potential implications for our business, and how so many banks could be so taken-in by either their own greed or by an otherwise interesting investor.”

...

...

Hwang was seen as a compelling prospective client by prime brokers, the potentially lucrative but risky division of investment banks that loans cash and securities to hedge funds and processes their trades.

Concerns about his reputation and history were offset by a sense of the huge opportunities from dealing with him, according to two of Archegos’s prime brokers. He is known as an “aggressive, moneymaking genius”, according to one analyst note, who grew Archegos from assets of about $200m at its 2012 launch to almost $10bn in just nine years.

The fee-hungry investment banks were ravenous for Hwang’s trading commissions and desperate to lend him money so he could magnify his bets. Those included taking outsized positions in stocks such as Chinese technology company Baidu and US media giant Viacom.

...

How was Hwang able to build such large stakes in companies and remain largely undetected? The answer lies in a type of financial instrument called total return swaps.

Also known as contracts-for-difference, swaps are derivatives that allow investors to pay a fee and in turn receive cash based on the performance of an underlying asset. The bank owns the underlying security and in the event of any losses, payments are due from the hedge fund to the bank.

Swaps have boomed in popularity but have been criticised as they allow investors to amass stakes in companies without disclosing their holdings the way they would have to do with equity stakes of a similar size. They are often used by activist funds to disguise their positions as they build positions in target companies.

...

Archegos transacted almost exclusively in total return swaps, said several people familiar with the fund’s operations. And it further magnified its footprint by holding the swaps with multiple banks.

Prime brokerages may have not been aware of the extent of their own exposure to Archegos or being racked up at rival banks, said a number of people involved.

...

A number of the banks were lending to Archegos so that it was as much as eight times levered, meaning for every one stock the fund bought, the bank would lend it seven more, according to people familiar with the matter. In some trades, leverage ratios may have hit as high as 20 times, one person with knowledge of the fund said.

...

“If you’re holding everything as swaps, the reality of what you have to declare to your banks is very little,” said one hedge fund executive with knowledge of trading the instruments.

Despite the limited disclosure, the Archegos affair raises questions about banks’ risk management, which is likely to attract the attention of regulators.

“It’s not so much the quantum of the bank’s lending that is the issue, it’s whether the bank believed it had appropriately hedged itself and whether it was comfortable in the collateral it had taken for the loan in a potential liquidation scenario,” said a senior Wall Street trader.

An executive at a large broker said: “This is why the big banks all blew themselves up in 2008 — over-the-counter derivatives with leverage via a prime broker. Banks are better capitalised now, so this shouldn’t kill any one of them, but it will ruin people’s party and reawaken the regulators.”

One Tokyo-based banker familiar with the situation said: “You get a pretty good understanding of the general situation around Hwang, and the kind of calculations these prime brokers were all making about risk and reward when you look at the way Goldman behaved.”

For years the hedge fund manager was blacklisted by the US bank, which “felt like a no-brainer considering Hwang’s reputation. Then suddenly they are doing everything they can to get him as a client and lend him money,” the banker added.

“So it’s greed trumping fear, right until that stopped last week.”

Antwort auf Beitrag Nr.: 67.637.590 von faultcode am 29.03.21 12:48:37...

The SEC has been monitoring the situation with Bill Hwang’s investment firm Archegos Capital since last week

...

https://twitter.com/business/status/1376561218706636804

=> da hat die SEC ja richtig aufgepasst. "Last week" könnte auch am Freitag gewesen sein

und noch etwas:

...Goldman Sachs is telling shareholders and clients that any losses it faces from Archegos are likely to be immaterial, a person familiar with the matter said....

=> das ist eine schöne Umschreibung für (mutmaßliches) Front running

The SEC has been monitoring the situation with Bill Hwang’s investment firm Archegos Capital since last week

...

https://twitter.com/business/status/1376561218706636804

=> da hat die SEC ja richtig aufgepasst. "Last week" könnte auch am Freitag gewesen sein

und noch etwas:

...Goldman Sachs is telling shareholders and clients that any losses it faces from Archegos are likely to be immaterial, a person familiar with the matter said....

=> das ist eine schöne Umschreibung für (mutmaßliches) Front running

Antwort auf Beitrag Nr.: 67.637.476 von faultcode am 29.03.21 12:42:5029.3.

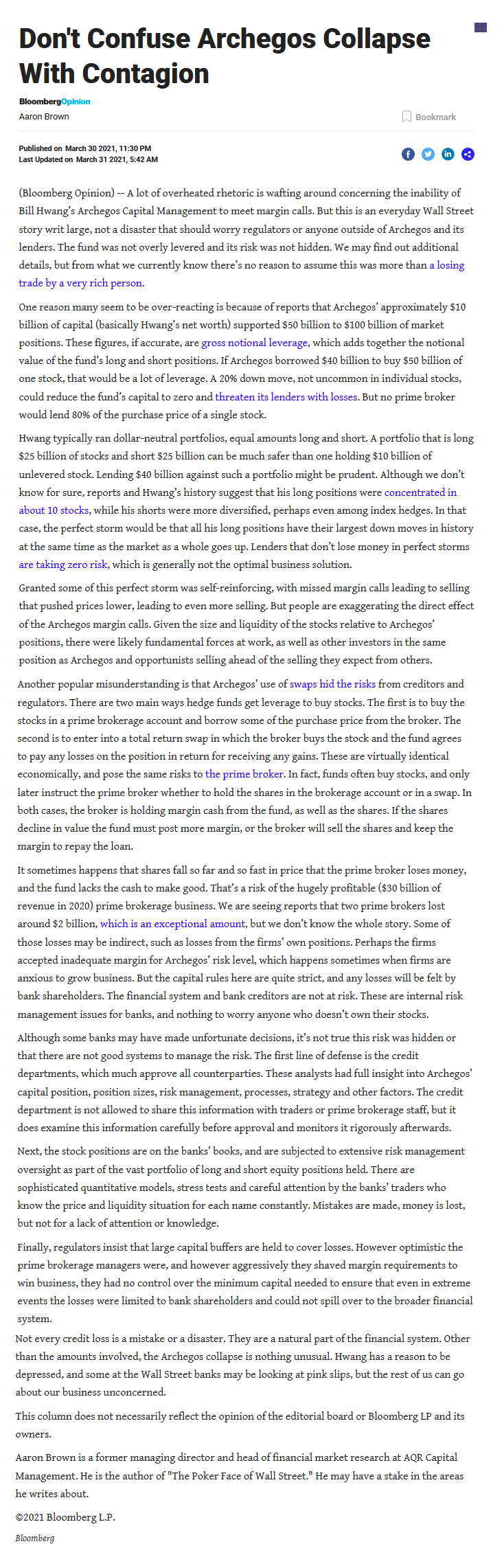

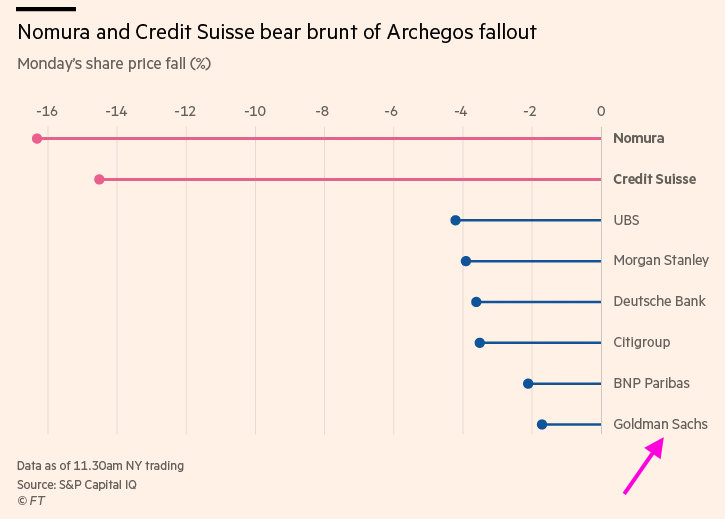

Credit Suisse and Nomura warn of losses after Archegos-linked sell-off

Banks face earnings hit following $20bn stock fire sale by prime brokerage client

https://www.ft.com/content/073509cd-fe45-44d2-afac-cace611b6…

...

Hedge funds in Hong Kong and Tokyo said on Monday that traders were braced for further block sell-offs in stocks associated with Archegos and other funds that could also be forced to unwind heavily leveraged positions, such as Teng Yue Partners, when trading opens in the US on Monday. Teng Yue was not immediately available for comment.

Hideyasu Ban, an analyst at Jefferies, said a $2bn loss estimate logged in the March quarter would wipe out most of Nomura’s pre-tax profits for the second half of the financial year ending this week.

Other prime brokers that had provided leverage to Archegos said the problems at Nomura and Credit Suisse related to being slower in offloading share blocks into the market compared with their peers, notably Goldman Sachs and Morgan Stanley.

An executive at a Wall Street bank in Hong Kong said: “It is unclear why Nomura sat on their hands and racked up these large losses.”

Another Tokyo-based banker said the extremely high level of leverage Nomura appeared to have extended to Archegos was “baffling”.

...

An executive at a global hedge fund in Hong Kong said: “It is surprising that a China-oriented fund was using Nomura and being granted so much leverage by a Japanese bank. It looks to have been at least four times what a long/short equity fund would normally get.”

Teng Yue, run by fellow Tiger cub Tao Li, has also been linked to the sell-off that hit shares in US media groups and Chinese technology business GSX Techedu last week, according to prime brokers and traders in Hong Kong.

Bankers in Tokyo familiar with the circumstances surrounding the heavy sell-off of Archegos assets described the event as a possible “Lehman moment” that would force multiple lenders to recognise that leverage extended to the fund had created excessive risk.

Nomura and Credit Suisse were among at least five banks that provided prime brokerage services to Archegos alongside Goldman Sachs, Morgan Stanley and UBS, according to people close to the matter.

Some banks banned all trading globally with Hwang after he settled with US regulators over illegal trading charges in 2012 and was banned from trading in Hong Kong in 2014.

Credit Suisse and Nomura warn of losses after Archegos-linked sell-off

Banks face earnings hit following $20bn stock fire sale by prime brokerage client

https://www.ft.com/content/073509cd-fe45-44d2-afac-cace611b6…

...

Hedge funds in Hong Kong and Tokyo said on Monday that traders were braced for further block sell-offs in stocks associated with Archegos and other funds that could also be forced to unwind heavily leveraged positions, such as Teng Yue Partners, when trading opens in the US on Monday. Teng Yue was not immediately available for comment.

Hideyasu Ban, an analyst at Jefferies, said a $2bn loss estimate logged in the March quarter would wipe out most of Nomura’s pre-tax profits for the second half of the financial year ending this week.

Other prime brokers that had provided leverage to Archegos said the problems at Nomura and Credit Suisse related to being slower in offloading share blocks into the market compared with their peers, notably Goldman Sachs and Morgan Stanley.

An executive at a Wall Street bank in Hong Kong said: “It is unclear why Nomura sat on their hands and racked up these large losses.”

Another Tokyo-based banker said the extremely high level of leverage Nomura appeared to have extended to Archegos was “baffling”.

...

An executive at a global hedge fund in Hong Kong said: “It is surprising that a China-oriented fund was using Nomura and being granted so much leverage by a Japanese bank. It looks to have been at least four times what a long/short equity fund would normally get.”

Teng Yue, run by fellow Tiger cub Tao Li, has also been linked to the sell-off that hit shares in US media groups and Chinese technology business GSX Techedu last week, according to prime brokers and traders in Hong Kong.

Bankers in Tokyo familiar with the circumstances surrounding the heavy sell-off of Archegos assets described the event as a possible “Lehman moment” that would force multiple lenders to recognise that leverage extended to the fund had created excessive risk.

Nomura and Credit Suisse were among at least five banks that provided prime brokerage services to Archegos alongside Goldman Sachs, Morgan Stanley and UBS, according to people close to the matter.

Some banks banned all trading globally with Hwang after he settled with US regulators over illegal trading charges in 2012 and was banned from trading in Hong Kong in 2014.

09:59 Uhr · wallstreetONLINE Redaktion · Goldman Sachs Group |

04:30 Uhr · wallstreetONLINE Redaktion · Boeing |

23.04.24 · wallstreetONLINE Redaktion · JPMorgan Chase |

22.04.24 · dpa-AFX · Verizon Communications |

17.04.24 · wO Newsflash · Carl Zeiss Meditec |

16.04.24 · dpa-AFX · Beiersdorf |

16.04.24 · dpa-AFX · Morgan Stanley |

16.04.24 · BörsenNEWS.de · Goldman Sachs Group |

15.04.24 · wO Newsflash · Honeywell International |