TECHNIP ENERGIES - die alte Technip/Frankreich (EPC) ohne Subsea

eröffnet am 04.03.21 17:35:04 von

neuester Beitrag 30.11.23 13:41:03 von

neuester Beitrag 30.11.23 13:41:03 von

Beiträge: 49

ID: 1.343.871

ID: 1.343.871

Aufrufe heute: 0

Gesamt: 7.951

Gesamt: 7.951

Aktive User: 0

ISIN: NL0014559478 · WKN: A2QNZT

22,420

EUR

-3,03 %

-0,700 EUR

Letzter Kurs 24.04.24 Lang & Schwarz

Neuigkeiten

23.04.24 · globenewswire |

22.04.24 · globenewswire |

Technip Energies Awarded a Substantial Contract for TotalEnergies and OQ’s Marsa LNG Project in Oman 22.04.24 · globenewswire |

19.04.24 · globenewswire |

15.04.24 · globenewswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,990 | +38,93 | |

| 62,82 | +20,00 | |

| 11,82 | +19,51 | |

| 1.075,60 | +15,93 | |

| 1,030 | +10,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,610 | -6,71 | |

| 20,030 | -7,61 | |

| 6,7200 | -8,82 | |

| 4,7400 | -15,36 | |

| 20,000 | -33,33 |

Beitrag zu dieser Diskussion schreiben

30.11.

Technip Energies and John Cockerill Reach Closing of Rely, a New Company Dedicated to Integrated Green Hydrogen and Power-to-X Solutions

https://www.wallstreet-online.de/nachricht/17593002-technip-…

...

Technip Energies and John Cockerill acknowledge the need to accelerate technology development to support net-zero ambitions. The creation of Rely responds to this urgent need to scale up green hydrogen and power-to-X(1) solutions to decarbonize hard-to-abate industries.

Rely offers end-to-end large-scale solutions, from pre-Final Investment Decision services including technical and financial advisory through to proprietary technologies, project execution, and operation and maintenance.

Rely also fuses a commitment to a standardized approach, developing a unique portfolio of solutions for project of 100MW capacity and above, leveraging the technology and engineering expertise of its parent companies.

With a unique offering integrating all electrolyzer solutions, Rely will bridge green electrons to molecules and help customers reach their decarbonization goals.

Headquartered in Brussels, Belgium, Rely is an asset light joint-venture, 60%-owned by Technip Energies and 40%-owned by John Cockerill, harnessing the expertise of more than 200 hydrogen specialists working across the globe.

...

Technip Energies and John Cockerill Reach Closing of Rely, a New Company Dedicated to Integrated Green Hydrogen and Power-to-X Solutions

https://www.wallstreet-online.de/nachricht/17593002-technip-…

...

Technip Energies and John Cockerill acknowledge the need to accelerate technology development to support net-zero ambitions. The creation of Rely responds to this urgent need to scale up green hydrogen and power-to-X(1) solutions to decarbonize hard-to-abate industries.

Rely offers end-to-end large-scale solutions, from pre-Final Investment Decision services including technical and financial advisory through to proprietary technologies, project execution, and operation and maintenance.

Rely also fuses a commitment to a standardized approach, developing a unique portfolio of solutions for project of 100MW capacity and above, leveraging the technology and engineering expertise of its parent companies.

With a unique offering integrating all electrolyzer solutions, Rely will bridge green electrons to molecules and help customers reach their decarbonization goals.

Headquartered in Brussels, Belgium, Rely is an asset light joint-venture, 60%-owned by Technip Energies and 40%-owned by John Cockerill, harnessing the expertise of more than 200 hydrogen specialists working across the globe.

...

Antwort auf Beitrag Nr.: 74.735.684 von faultcode am 02.11.23 13:54:07

2022:

• Project Delivery: 77.7% -- und selbst diese Zahl muss man selber ausrechnen

• Technology, Products & Services (TPS): 22.3%

Ich wüsste schon gerne, wie hoch mittlerweile der Anteil des mMn Risiko-Geschäfts Offshore wind ist. "Offshore wind" taucht im AR2022 47-mal auf

Aber dort ("Floating Offshore Wind") sieht man große Chancen:

Floating offshore wind technology is key to decarbonize the world by providing renewable electricity. From approximately 120 MW currently to 60 GW installed by 2040, the Group forecasts a rapid growth, especially in Western Europe.

Capitalizing on a 50-year offshore track record and as an already well-recognized global leader in floating solutions, the Group is an ideal partner for offshore renewables projects.

In 2022, a strategic collaboration agreement with Equinor was signed to develop floating wind steel semi-substructures and further enhance industrialization. A second strategic agreement with Skyborn Renewables (formerly WPD Offshore) was also signed aiming to join forces on floating offshore wind developments.

<AR2022>

Floating Offshore Wind

was mir in den Berichten von Technip Energies fehlt, ist eine Sektor-Umsatz-Aufteilung, also nicht nur:2022:

• Project Delivery: 77.7% -- und selbst diese Zahl muss man selber ausrechnen

• Technology, Products & Services (TPS): 22.3%

Ich wüsste schon gerne, wie hoch mittlerweile der Anteil des mMn Risiko-Geschäfts Offshore wind ist. "Offshore wind" taucht im AR2022 47-mal auf

Aber dort ("Floating Offshore Wind") sieht man große Chancen:

Floating offshore wind technology is key to decarbonize the world by providing renewable electricity. From approximately 120 MW currently to 60 GW installed by 2040, the Group forecasts a rapid growth, especially in Western Europe.

Capitalizing on a 50-year offshore track record and as an already well-recognized global leader in floating solutions, the Group is an ideal partner for offshore renewables projects.

In 2022, a strategic collaboration agreement with Equinor was signed to develop floating wind steel semi-substructures and further enhance industrialization. A second strategic agreement with Skyborn Renewables (formerly WPD Offshore) was also signed aiming to join forces on floating offshore wind developments.

<AR2022>

Q3: https://investors.technipenergies.com/news-releases/news-rel…

...

...

9M 2023 Adjusted revenue decreased by 24% year-over-year to €2,977.8 million. The continued ramp-up of activity on Qatar NFE and strong volumes in downstream projects, including ethylene, were more than offset by significantly lower revenue contribution from LNG projects in Russia following the completion of the warranty phase on Yamal LNG in 2022 and the exit from Arctic LNG 2.

...

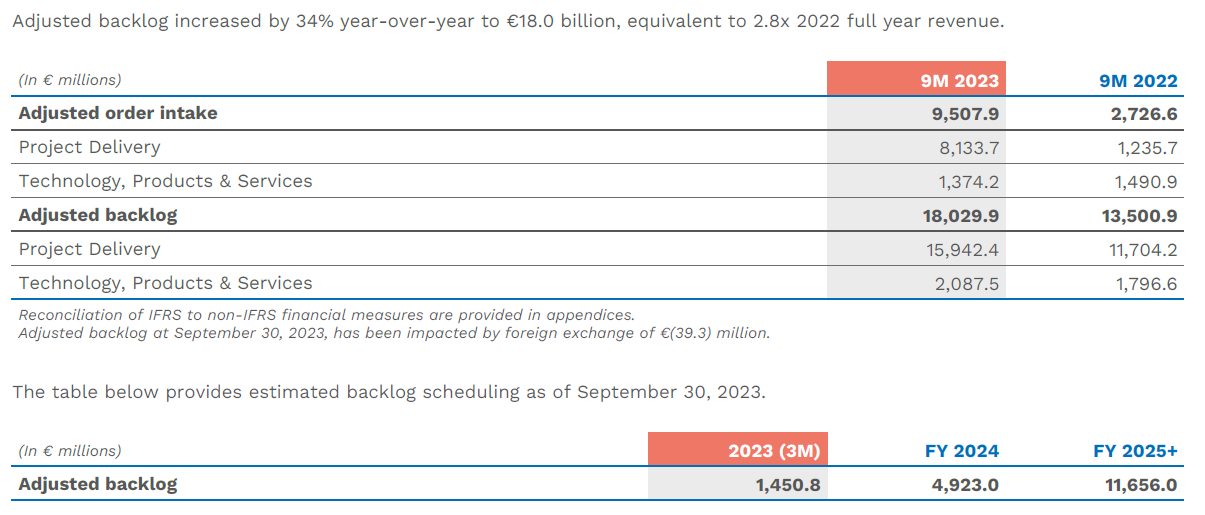

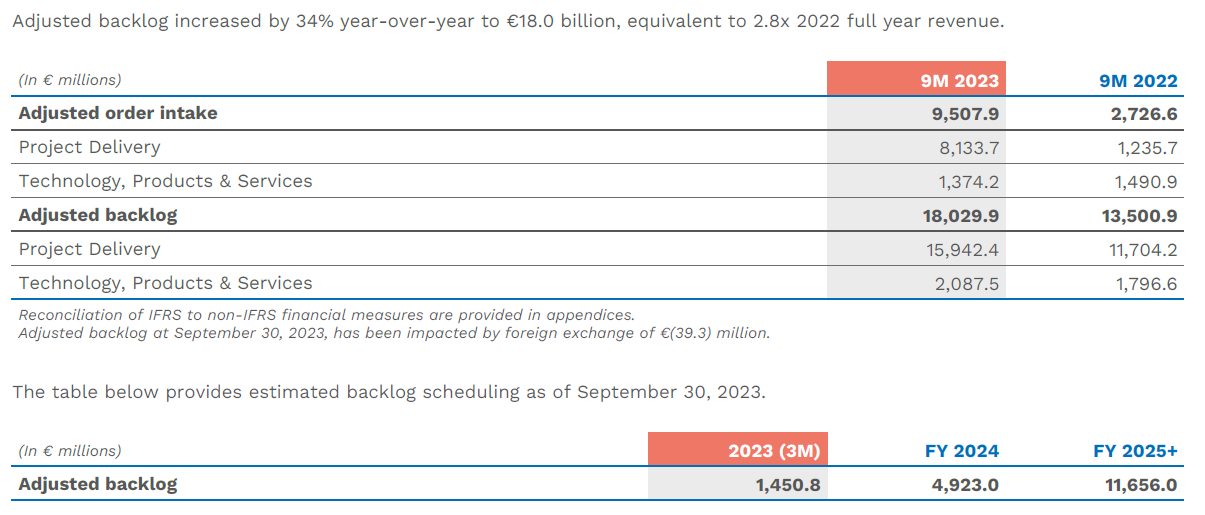

=> der allgemeine Ausfall Russland's als West-LNG-Lieferant hielt auch im Q3 an. Der Adjusted backlog nahm nur leicht ab von 18,892.3Mio € auf 18,029.9Mio € => -4.6%

=>

...

...

9M 2023 Adjusted revenue decreased by 24% year-over-year to €2,977.8 million. The continued ramp-up of activity on Qatar NFE and strong volumes in downstream projects, including ethylene, were more than offset by significantly lower revenue contribution from LNG projects in Russia following the completion of the warranty phase on Yamal LNG in 2022 and the exit from Arctic LNG 2.

...

=> der allgemeine Ausfall Russland's als West-LNG-Lieferant hielt auch im Q3 an. Der Adjusted backlog nahm nur leicht ab von 18,892.3Mio € auf 18,029.9Mio € => -4.6%

=>

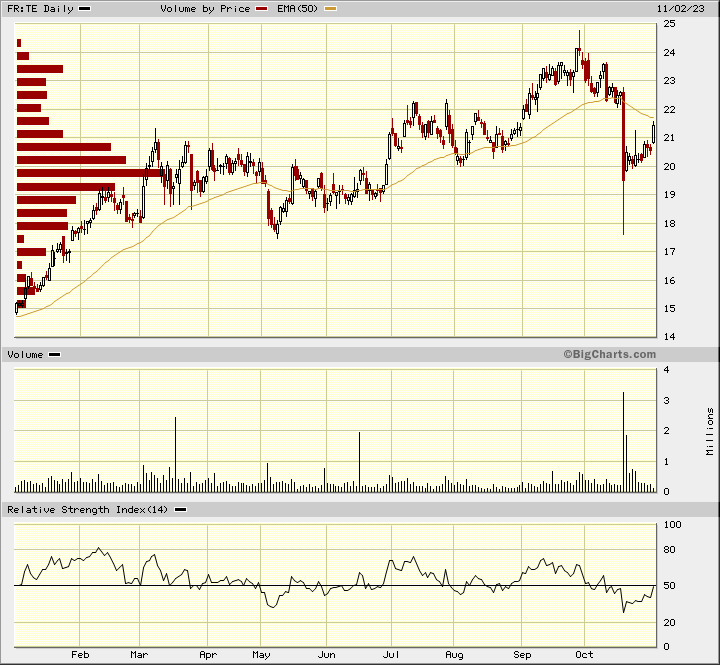

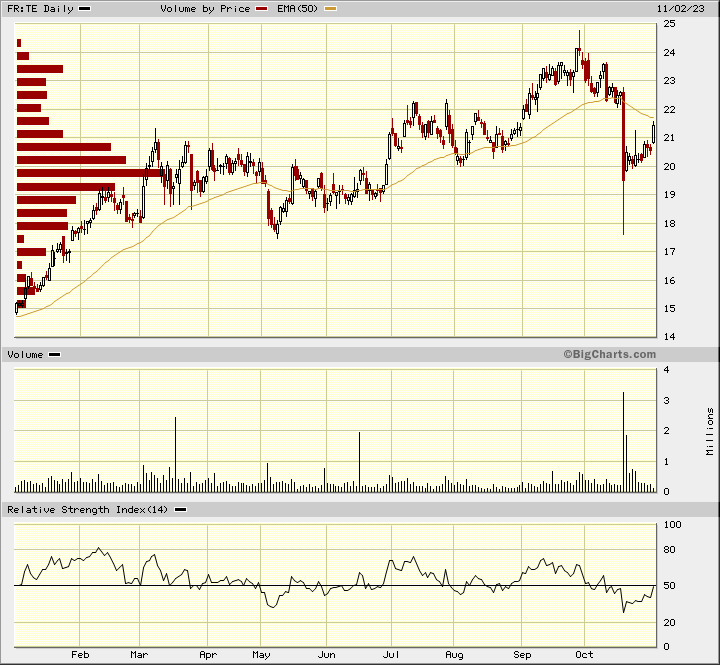

Ohje, hier wurde ja heute deutlich gegrillt...

Le Monde berichtet über probleme bei Compliance with sanctions on Arctic LNG...

Le Monde berichtet über probleme bei Compliance with sanctions on Arctic LNG...

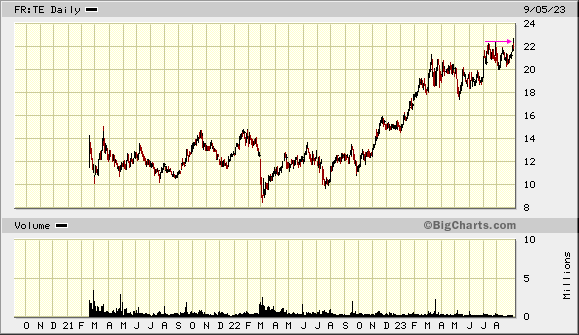

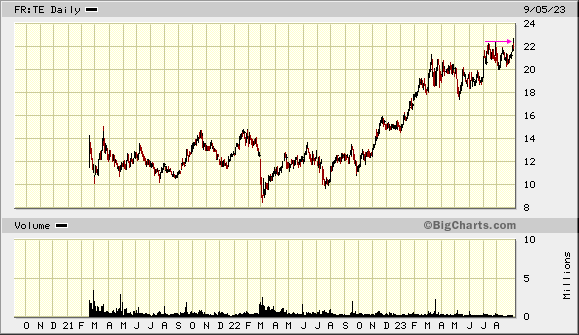

neues Allzeithoch:

siehe auch:

5.9.

Wettbewerbsfähigkeit im Nachbarland: Frankreich – das bessere Deutschland

Eine Kolumne von Michael Sauga

Präsident Macron ist unpopulär, aber erfolgreich. Seine Reformen haben jenen Aufschwung gebracht, der hierzulande schmerzlich vermisst wird.

https://www.spiegel.de/wirtschaft/wirtschaftsstandort-frankr…

...

TECHNIP ENERGIES ist formal ein NL-Unternehmen, aber nur weniger als 400 Beschäftigte sind dort zu finden (AR2022) = 2.1%.

Vorrangig, also operativ, ist es immer noch mMn ein FR-Unternehmen: Top-3-Standorte demnach (AR2022):

Breakdown of payroll workforce by country (the most significant countries):

1. France 22.4%

2.India 21.1%

3. Italy 10.1%

...

siehe auch:

5.9.

Wettbewerbsfähigkeit im Nachbarland: Frankreich – das bessere Deutschland

Eine Kolumne von Michael Sauga

Präsident Macron ist unpopulär, aber erfolgreich. Seine Reformen haben jenen Aufschwung gebracht, der hierzulande schmerzlich vermisst wird.

https://www.spiegel.de/wirtschaft/wirtschaftsstandort-frankr…

...

TECHNIP ENERGIES ist formal ein NL-Unternehmen, aber nur weniger als 400 Beschäftigte sind dort zu finden (AR2022) = 2.1%.

Vorrangig, also operativ, ist es immer noch mMn ein FR-Unternehmen: Top-3-Standorte demnach (AR2022):

Breakdown of payroll workforce by country (the most significant countries):

1. France 22.4%

2.India 21.1%

3. Italy 10.1%

...

27.7.

Technip Energies Financial Results First Half 2023

https://investors.technipenergies.com/news-releases/news-rel…

• Raising adj. rec. EBIT margin outlook from 6.7% - 7.2% to 7.0% - 7.5% supported by robust first half profitability

• Adjusted order intake of €9.0bn driven by major LNG award and TPS momentum; record adjusted backlog of ~€19bn

• Exit from Arctic LNG 2 project completed

• Active deployment of strategy: Canopy by T.EN™ for CCUS, ethylene eFurnace pilot, and acquisition of Processium

...

Technip Energies Financial Results First Half 2023

https://investors.technipenergies.com/news-releases/news-rel…

• Raising adj. rec. EBIT margin outlook from 6.7% - 7.2% to 7.0% - 7.5% supported by robust first half profitability

• Adjusted order intake of €9.0bn driven by major LNG award and TPS momentum; record adjusted backlog of ~€19bn

• Exit from Arctic LNG 2 project completed

• Active deployment of strategy: Canopy by T.EN™ for CCUS, ethylene eFurnace pilot, and acquisition of Processium

...

Antwort auf Beitrag Nr.: 74.138.855 von faultcode am 11.07.23 20:35:39Es würde mehr helfen deutsche Beiträge zu erstellen!

11.7.

Technip Energies and LanzaTech to Collaborate on Breakthrough CO2-to-Ethylene Technology

https://www.technipenergies.com/en/media/news/technip-energi…

...

Technip Energies and LanzaTech Global, Inc. signed a Joint Collaboration Agreement to create a new pathway to sustainable ethylene utilizing their combined technologies. Together LanzaTech’s carbon capture and utilization technology with Technip Energies’ Hummingbird® technology transform waste carbon into ethylene, the most common building block in petrochemicals.

Ethylene is a building block for thousands of chemicals and materials, including plastics, detergents, and coatings that keep hospitals sterile, people safe, and food fresh. Its traditional production process is also one of the largest sources of carbon dioxide emissions in the chemical industry and remains one of its most challenging processes to decarbonize. This new joint process uses carbon emissions as the starting point rather than virgin fossil carbon. First, up to 95% of the CO2 in the flue gas is captured from the furnaces of an ethylene cracker and mixed with hydrogen. Next LanzaTech’s biorecycling technology transforms the captured waste carbon into ethanol. Finally, Technip Energies’ Hummingbird® technology dehydrates the ethanol to ethylene.

Technip Energies and LanzaTech have collaborated on other sustainable solutions since 2020, including a partnership with Borealis and On, the Swiss running shoe company, to make EVA foam for the sole of running shoes. Technip Energies also partners with LanzaJet, an independent company formed and spun off by LanzaTech, which includes the Hummingbird® technology in the LanzaJet™ Alcohol-to-Jet process which makes sustainable aviation fuel from ethanol.

...

Technip Energies and LanzaTech to Collaborate on Breakthrough CO2-to-Ethylene Technology

https://www.technipenergies.com/en/media/news/technip-energi…

...

Technip Energies and LanzaTech Global, Inc. signed a Joint Collaboration Agreement to create a new pathway to sustainable ethylene utilizing their combined technologies. Together LanzaTech’s carbon capture and utilization technology with Technip Energies’ Hummingbird® technology transform waste carbon into ethylene, the most common building block in petrochemicals.

Ethylene is a building block for thousands of chemicals and materials, including plastics, detergents, and coatings that keep hospitals sterile, people safe, and food fresh. Its traditional production process is also one of the largest sources of carbon dioxide emissions in the chemical industry and remains one of its most challenging processes to decarbonize. This new joint process uses carbon emissions as the starting point rather than virgin fossil carbon. First, up to 95% of the CO2 in the flue gas is captured from the furnaces of an ethylene cracker and mixed with hydrogen. Next LanzaTech’s biorecycling technology transforms the captured waste carbon into ethanol. Finally, Technip Energies’ Hummingbird® technology dehydrates the ethanol to ethylene.

Technip Energies and LanzaTech have collaborated on other sustainable solutions since 2020, including a partnership with Borealis and On, the Swiss running shoe company, to make EVA foam for the sole of running shoes. Technip Energies also partners with LanzaJet, an independent company formed and spun off by LanzaTech, which includes the Hummingbird® technology in the LanzaJet™ Alcohol-to-Jet process which makes sustainable aviation fuel from ethanol.

...

3.7.

Technip Energies Acquires the Research and Development Company Processium to Accelerate on Technology Development for a Net Zero Trajectory

https://investors.technipenergies.com/news-releases/news-rel…

...

Technip Energies (Paris:TE) (ISIN:NL0014559478) announces the acquisition of Processium, an expert company in process development, equipped with laboratory and piloting facilities located in Lyon, France.

Processium is an industrial development partner designing and developing next-generation processes to support the energy transition and enhance manufacturing competitiveness in the field of sustainable chemicals.

With this acquisition, Technip Energies will pursue its strategic objective of accelerating the development of new processes and technologies to meet the pressing needs of a fast-growing market, driven by sustainability goals. Technip Energies will strengthen its R&D portfolio and enlarge its service offer, taking benefit from the highly skilled workforce of Processium with specific competencies in reactor design and scale-up, as well as downstream purification and processing know-how.

The modern and reputable innovation center provides process development services that accelerate and de-risk new technology introduction for clients ranging from startups to large industrial companies. The integration with Technip Energies will create unique offerings for its clients to support new process development and generate added value for both companies.

...

=> Processium: https://www.processium.com/en/

Technip Energies Acquires the Research and Development Company Processium to Accelerate on Technology Development for a Net Zero Trajectory

https://investors.technipenergies.com/news-releases/news-rel…

...

Technip Energies (Paris:TE) (ISIN:NL0014559478) announces the acquisition of Processium, an expert company in process development, equipped with laboratory and piloting facilities located in Lyon, France.

Processium is an industrial development partner designing and developing next-generation processes to support the energy transition and enhance manufacturing competitiveness in the field of sustainable chemicals.

With this acquisition, Technip Energies will pursue its strategic objective of accelerating the development of new processes and technologies to meet the pressing needs of a fast-growing market, driven by sustainability goals. Technip Energies will strengthen its R&D portfolio and enlarge its service offer, taking benefit from the highly skilled workforce of Processium with specific competencies in reactor design and scale-up, as well as downstream purification and processing know-how.

The modern and reputable innovation center provides process development services that accelerate and de-risk new technology introduction for clients ranging from startups to large industrial companies. The integration with Technip Energies will create unique offerings for its clients to support new process development and generate added value for both companies.

...

=> Processium: https://www.processium.com/en/

TECHNIP ENERGIES - die alte Technip/Frankreich (EPC) ohne Subsea