LYNAS - Faktenthread, Analysen, Querverweise u. Meldungen zum Unternehmen - 500 Beiträge pro Seite (Seite 4)

eröffnet am 25.04.07 13:15:18 von

neuester Beitrag 31.03.24 09:13:03 von

neuester Beitrag 31.03.24 09:13:03 von

Beiträge: 3.527

ID: 1.126.458

ID: 1.126.458

Aufrufe heute: 22

Gesamt: 784.703

Gesamt: 784.703

Aktive User: 0

ISIN: AU000000LYC6 · WKN: 871899 · Symbol: LYI

3,8010

EUR

-1,04 %

-0,0400 EUR

Letzter Kurs 16:02:17 Tradegate

Neuigkeiten

18.04.24 · Der Aktionär TV |

23.01.24 · kapitalerhoehungen.de |

22.01.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 55,80 | +15,41 | |

| 29,17 | +14,48 | |

| 0,7999 | +14,27 | |

| 15,550 | +13,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,1800 | -9,17 | |

| 5,4800 | -9,42 | |

| 186,20 | -10,48 | |

| 4,2300 | -17,86 | |

| 46,59 | -98,01 |

Aus dem HC-Forum zu Lynas von Heute der höchstbewertete Beitrag sagt IMHO alles über die Gefühlslage der dortigen Aktionäre in Bezug auf den Deal mit Forge: http://www.hotcopper.com.au/post_single.asp?fid=1&tid=144314…

"Mate i've got a hundred different companies that i've been watching for years that go nowhere but no one says anything about them."

I currently have investments in 27 companies. In the past I have held shares in many more. I have NEVER had an investment in a company where the CEO has so openly used his position in one company to take advantage of that position to transfer assets from that company to another for his own personal advantage.

I'd call that theft.

I'll fight that.

Relentlessly.

--------------------------------------------------------------------------------

Thinking outside the square.

--------------------------------------------------------------------------------

http://www.theage.com.au/business/lynas-takes-hit-on-delay-f…

Lynas takes hit on delay fears Barry FitzGerald

April 28, 2011.

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

"Mate i've got a hundred different companies that i've been watching for years that go nowhere but no one says anything about them."

I currently have investments in 27 companies. In the past I have held shares in many more. I have NEVER had an investment in a company where the CEO has so openly used his position in one company to take advantage of that position to transfer assets from that company to another for his own personal advantage.

I'd call that theft.

I'll fight that.

Relentlessly.

--------------------------------------------------------------------------------

Thinking outside the square.

--------------------------------------------------------------------------------

http://www.theage.com.au/business/lynas-takes-hit-on-delay-f…

Lynas takes hit on delay fears Barry FitzGerald

April 28, 2011.

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

Wie alle Lynas Aktionäre warte ich gespannt auf die Bekanntgabe des Erhalts der Betriebserlaubnis für die Konzentrationsanlage in Mt.Weld. Nach

- Verzögerungen durch einen chinesischen Lieferanten (Chinesen)

- Verzögerung durch stürmisches, regnerisches Wetter (Wetter)

- unerwartete Anforderungen der australischen Behörden (Behörden)

müssen als nächste Begründungen schon ausserplanetarische Ursachen herhalten müssen. Es wird Zeit für handfeste Fakten (allein Kundenaufträge helfen nicht). Die erste Anlage muss endlich in Betrieb gehen.

http://www.lynascorp.com/page.asp?category_id=2&page_id=40

Lynas expects to satisfy those requirements by the 3rd or 4th week of April, and understands that start up of the Mount Weld Concentration Plant will occur upon satisfaction of those requirements.

http://www.reuters.com/article/2011/03/16/lynas-idUSL3E7EG3G…

Ich hoffe es gibt nicht wieder (negative) Überraschungen in den nächsten Tagen.

- Verzögerungen durch einen chinesischen Lieferanten (Chinesen)

- Verzögerung durch stürmisches, regnerisches Wetter (Wetter)

- unerwartete Anforderungen der australischen Behörden (Behörden)

müssen als nächste Begründungen schon ausserplanetarische Ursachen herhalten müssen. Es wird Zeit für handfeste Fakten (allein Kundenaufträge helfen nicht). Die erste Anlage muss endlich in Betrieb gehen.

http://www.lynascorp.com/page.asp?category_id=2&page_id=40

Lynas expects to satisfy those requirements by the 3rd or 4th week of April, and understands that start up of the Mount Weld Concentration Plant will occur upon satisfaction of those requirements.

http://www.reuters.com/article/2011/03/16/lynas-idUSL3E7EG3G…

Ich hoffe es gibt nicht wieder (negative) Überraschungen in den nächsten Tagen.

LYC Lynas Corporation Limited

April 2011

29th Quarterly Cashflow Report

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=632867

Auf 14-Seiten:

29th Quarterly Activities Report

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=632868

QUARTERLY REPORT

FOR THE PERIOD ENDING 31 MARCH 2011

HIGHLIGHTS

• Handover of the Concentration Plant in Western Australia from the construction contractor was completed on 31 March 2011. The first feed of ore is scheduled to occur within approximately two weeks.

• Lynas Advanced Materials Plant (LAMP) in Malaysia remains on time as at 31 March 2011; with the first feed to kiln at the LAMP on target for September of 2011, and Lynas welcomes appointment of an independent panel of international experts to conduct a one-month review of the health, safety and environmental aspects of the LAMP to address public concern in Malaysia.

• Basic Engineering Design for Phase 2 of the LAMP was completed during the quarter, and the tender process for the engineering, construction, procurement and commissioning contract is underway.

• Sojitz and Lynas executed binding financing, distribution & agency and availability agreements on 30 March 2011. The financing agreement formed the basis of a financing package to raise a total of US$325 million.

• Successful completion of the settlement formalities for the purchase of the Kangankunde Rare Earths Deposit (KGK), Malawi, Africa

• Signing of a new long term supply agreement with a major Rare Earths consumer for the supply of Mount Weld Rare Earths.

• Prices continue to increase post quarter-end and as at 27 April 2011 the average price for the Mount Weld Rare Earths composition was US$160.32/kg REO on a FOB China basis.

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

April 2011

29th Quarterly Cashflow Report

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=632867

Auf 14-Seiten:

29th Quarterly Activities Report

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=632868

QUARTERLY REPORT

FOR THE PERIOD ENDING 31 MARCH 2011

HIGHLIGHTS

• Handover of the Concentration Plant in Western Australia from the construction contractor was completed on 31 March 2011. The first feed of ore is scheduled to occur within approximately two weeks.

• Lynas Advanced Materials Plant (LAMP) in Malaysia remains on time as at 31 March 2011; with the first feed to kiln at the LAMP on target for September of 2011, and Lynas welcomes appointment of an independent panel of international experts to conduct a one-month review of the health, safety and environmental aspects of the LAMP to address public concern in Malaysia.

• Basic Engineering Design for Phase 2 of the LAMP was completed during the quarter, and the tender process for the engineering, construction, procurement and commissioning contract is underway.

• Sojitz and Lynas executed binding financing, distribution & agency and availability agreements on 30 March 2011. The financing agreement formed the basis of a financing package to raise a total of US$325 million.

• Successful completion of the settlement formalities for the purchase of the Kangankunde Rare Earths Deposit (KGK), Malawi, Africa

• Signing of a new long term supply agreement with a major Rare Earths consumer for the supply of Mount Weld Rare Earths.

• Prices continue to increase post quarter-end and as at 27 April 2011 the average price for the Mount Weld Rare Earths composition was US$160.32/kg REO on a FOB China basis.

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

Habe die Aktie schon länger im Blick und jetzt auch im Besitz,... denke die geht noch langsam wieder auf mind. 1,80 Euro!

Antwort auf Beitrag Nr.: 41.428.511 von Ostseelurch am 29.04.11 11:27:55Habe bis Heute kein Hehl daraus gemacht das der Kurs von Lynas bei Produktionsbeginn IMHO bis 1,50€ steigen kann und das ich auf Grund des zukünftig gigantischen Potential von Lynas nach Produktionbeginns nicht vor Ende 2012 überhaupt über einen Verkauf nachdenken werde.

NC in Sippenhaft!?

http://www.smh.com.au/business/accusations-of-insider-tradin…

Accusations of insider trading dog a darling of the bright young set Stuart Washington

April 29, 2011.

...

...

http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

http://www.australianrareearths.com/rare-earths-news.html

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

@ ein schönes WE

Grüsse JoJo

NC in Sippenhaft!?

http://www.smh.com.au/business/accusations-of-insider-tradin…

Accusations of insider trading dog a darling of the bright young set Stuart Washington

April 29, 2011.

...

...

http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

http://www.australianrareearths.com/rare-earths-news.html

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

@ ein schönes WE

Grüsse JoJo

LYC Lynas Corporation Limited

May 2011

2nd Successful completion of A$20 million Share Purchase Plan

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=632951

2 May 2011

Not for release or distribution in the United States

Successful completion of A$20 million

Share Purchase Plan

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

@ eine erfolgreiche Woche

Grüsse JoJo

May 2011

2nd Successful completion of A$20 million Share Purchase Plan

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=632951

2 May 2011

Not for release or distribution in the United States

Successful completion of A$20 million

Share Purchase Plan

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

@ eine erfolgreiche Woche

Grüsse JoJo

Antwort auf Beitrag Nr.: 41.437.207 von JoJo49 am 02.05.11 09:45:05Noch eine hochbewertete Aussage/Meinung von Heute aus dem HC-Forum zu Lynas die ich voll und ganz teile:

http://www.hotcopper.com.au/post_single.asp?fid=1&tid=144723…

re: lynas, a value investment... (nursery)

Forum: ASX - By Stock (Back)

Code: LYC - LYNAS CORPORATION LIMITED ( $2.09 | Price Chart | $3,533.81M | Announcements | Google LYC)

Post: 6659899

Reply to: #6659884 from qiktrade Views: 419

Posted: 02/05/11 07:16 Stock Price (at time of posting): $2.09 Sentiment: Buy Disclosure: Stock Held From: 121.217.xxx.xxx

---------------------------------------------------------------------------------------------------------------------------------

IF and it is a BIG IF, Lynas has a problem with operating in Malaysia because of the Thorium issue just imagine how much trouble others will have operating in Australia or the USA because of the handling of any radio active materials. Bear in mind also that the rare earths at Mt Weld are only associated with low levels of thorium whereas some deposits are asociated with Uranium and higher levels of Thorium.

Lynas will overcome the problem so for me it is not in any way an issue. Managements eye OFF the ball is the BIG issue.

--------------------------------------------------------------------------------

Thinking outside the square.

Grüsse JoJo

http://www.hotcopper.com.au/post_single.asp?fid=1&tid=144723…

re: lynas, a value investment... (nursery)

Forum: ASX - By Stock (Back)

Code: LYC - LYNAS CORPORATION LIMITED ( $2.09 | Price Chart | $3,533.81M | Announcements | Google LYC)

Post: 6659899

Reply to: #6659884 from qiktrade Views: 419

Posted: 02/05/11 07:16 Stock Price (at time of posting): $2.09 Sentiment: Buy Disclosure: Stock Held From: 121.217.xxx.xxx

---------------------------------------------------------------------------------------------------------------------------------

IF and it is a BIG IF, Lynas has a problem with operating in Malaysia because of the Thorium issue just imagine how much trouble others will have operating in Australia or the USA because of the handling of any radio active materials. Bear in mind also that the rare earths at Mt Weld are only associated with low levels of thorium whereas some deposits are asociated with Uranium and higher levels of Thorium.

Lynas will overcome the problem so for me it is not in any way an issue. Managements eye OFF the ball is the BIG issue.

--------------------------------------------------------------------------------

Thinking outside the square.

Grüsse JoJo

Antwort auf Beitrag Nr.: 41.437.806 von JoJo49 am 02.05.11 11:16:47da hat der australische Schreiber schon recht...es gibt zwar das Thoriumproblem, welches meiner Meinung nach aber " deutlicher heisser gekocht wird, als es gegessen werdn dürfte".

gruß

gruß

LYC Lynas Corporation Limited

May 2011

3rd Notice under Section 708A(5)(e) of the Corporations Act

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=633077

3rd Final Figures and Appendix 3B - A$20 million SPP

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=633076

3 May 2011

Not for release or distribution in the United States

Final Results - A$20 million Share Purchase Plan

Lynas Corporation Limited (ASX: LYC, OTC: LYSDY) (Lynas or the Company) is now able

to confirm the final figures for its A$20 million share purchase plan (SPP).

Lynas received applications for approximately A$58.9 million worth of new fully paid ordinary

shares (New Shares). Lynas has scaled back the SPP in accordance with the terms of the

SPP, to approximately A$20 million. Under the scale back, all eligible shareholders who

applied for shares will receive 828 New Shares. A total of 9,755,496 New Shares will be

allotted under the SPP on 3 May 2011 at the issue price of $2.05.

Excess application payments will be refunded, without interest, as soon as practicable after

the allotment date.

Attached is an Appendix 3B setting out the final allotment details.

Proceeds of the SPP together with the recently completed institutional placement will be

used to fund additional expenditure including preliminary work on the Kangankunde Deposit

in Malawi, the purchase of additional equipment and first fill chemicals for the Lynas

Advanced Material Plant in Malaysia and general working capital for the company.

The SPP was underwritten by J.P. Morgan Australia Limited.

Page 2 of 2

Disclaimer

This announcement does not constitute an offer to sell, or the solicitation of an offer to buy,

any securities in the United States or in any other jurisdiction. Any securities discussed in this

announcement have not been, and will not be, registered under the U.S. Securities Act of

1933 or the securities laws of any state or other jurisdiction of the United States, and may not

be offered or sold in the United States except in transactions exempt from, or not subject to,

the registration requirements of the U.S. Securities Act and applicable securities laws of any

state or other jurisdiction of the United States.

About Lynas Corporation

Lynas owns the richest known deposit of Rare Earths, also known as Lanthanides, in the

world at Mount Weld, near Laverton in Western Australia. This deposit underpins Lynas’

strategy to create a reliable, fully integrated source of Rare Earths supply from the mine

through to customers in the global Rare Earths industry.

Lynas will concentrate the ore mined at Mount Weld in a Concentration Plant approximately

1.5km from the mine. The concentrate produced by the Concentration Plant will be shipped

in sea containers and transported by road and ship to the east coast of Malaysia to the Lynas

Advanced Materials Plant (LAMP) within the Gebeng Industrial Estate, Kuantan, Pahang,

Malaysia, to process the Mount Weld concentrate through to separated Rare Earths products

Engineering and construction of both the Concentration Plant in Western Australia and the

LAMP remain within budget. The first feed of ore into the Concentration Plant in Western

Australia is scheduled to commence in the next few weeks. The first feed of concentrate to

the kiln at the LAMP in Malaysia is scheduled for September 2011. Lynas has received all

required approvals to construct both plants, and is in the process of applying for all preoperation

and operation approvals.

The company plans to become the benchmark for security of supply and a world leader in

quality and environmental responsibility to an international customer base, with production

anticipated to commence in 2011.

‘Rare Earths’ is the term given to fifteen metallic elements known as the lanthanide series,

plus yttrium. They play a key role in green environmental products, from energy efficient

compact fluorescent light bulbs (CFLs) to hybrid cars, automotive catalytic converters and

wind turbine generators. They are also essential in the development and manufacturing of

many modern technological products, from hard disc drives to flat panel displays, iPods and

magnetic resonance imaging (MRI) scans.

Lynas American Depositary Receipts (ADRs) trade under the code LYSDY (CUSIP number

551073208). The Bank of New York Mellon is the depositary bank in respect of Lynas

ADRs.

For further information please contact Nicholas Curtis or Matthew James on

+61 (0)2 8259 7100 or visit www.lynascorp.com

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

May 2011

3rd Notice under Section 708A(5)(e) of the Corporations Act

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=633077

3rd Final Figures and Appendix 3B - A$20 million SPP

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=633076

3 May 2011

Not for release or distribution in the United States

Final Results - A$20 million Share Purchase Plan

Lynas Corporation Limited (ASX: LYC, OTC: LYSDY) (Lynas or the Company) is now able

to confirm the final figures for its A$20 million share purchase plan (SPP).

Lynas received applications for approximately A$58.9 million worth of new fully paid ordinary

shares (New Shares). Lynas has scaled back the SPP in accordance with the terms of the

SPP, to approximately A$20 million. Under the scale back, all eligible shareholders who

applied for shares will receive 828 New Shares. A total of 9,755,496 New Shares will be

allotted under the SPP on 3 May 2011 at the issue price of $2.05.

Excess application payments will be refunded, without interest, as soon as practicable after

the allotment date.

Attached is an Appendix 3B setting out the final allotment details.

Proceeds of the SPP together with the recently completed institutional placement will be

used to fund additional expenditure including preliminary work on the Kangankunde Deposit

in Malawi, the purchase of additional equipment and first fill chemicals for the Lynas

Advanced Material Plant in Malaysia and general working capital for the company.

The SPP was underwritten by J.P. Morgan Australia Limited.

Page 2 of 2

Disclaimer

This announcement does not constitute an offer to sell, or the solicitation of an offer to buy,

any securities in the United States or in any other jurisdiction. Any securities discussed in this

announcement have not been, and will not be, registered under the U.S. Securities Act of

1933 or the securities laws of any state or other jurisdiction of the United States, and may not

be offered or sold in the United States except in transactions exempt from, or not subject to,

the registration requirements of the U.S. Securities Act and applicable securities laws of any

state or other jurisdiction of the United States.

About Lynas Corporation

Lynas owns the richest known deposit of Rare Earths, also known as Lanthanides, in the

world at Mount Weld, near Laverton in Western Australia. This deposit underpins Lynas’

strategy to create a reliable, fully integrated source of Rare Earths supply from the mine

through to customers in the global Rare Earths industry.

Lynas will concentrate the ore mined at Mount Weld in a Concentration Plant approximately

1.5km from the mine. The concentrate produced by the Concentration Plant will be shipped

in sea containers and transported by road and ship to the east coast of Malaysia to the Lynas

Advanced Materials Plant (LAMP) within the Gebeng Industrial Estate, Kuantan, Pahang,

Malaysia, to process the Mount Weld concentrate through to separated Rare Earths products

Engineering and construction of both the Concentration Plant in Western Australia and the

LAMP remain within budget. The first feed of ore into the Concentration Plant in Western

Australia is scheduled to commence in the next few weeks. The first feed of concentrate to

the kiln at the LAMP in Malaysia is scheduled for September 2011. Lynas has received all

required approvals to construct both plants, and is in the process of applying for all preoperation

and operation approvals.

The company plans to become the benchmark for security of supply and a world leader in

quality and environmental responsibility to an international customer base, with production

anticipated to commence in 2011.

‘Rare Earths’ is the term given to fifteen metallic elements known as the lanthanide series,

plus yttrium. They play a key role in green environmental products, from energy efficient

compact fluorescent light bulbs (CFLs) to hybrid cars, automotive catalytic converters and

wind turbine generators. They are also essential in the development and manufacturing of

many modern technological products, from hard disc drives to flat panel displays, iPods and

magnetic resonance imaging (MRI) scans.

Lynas American Depositary Receipts (ADRs) trade under the code LYSDY (CUSIP number

551073208). The Bank of New York Mellon is the depositary bank in respect of Lynas

ADRs.

For further information please contact Nicholas Curtis or Matthew James on

+61 (0)2 8259 7100 or visit www.lynascorp.com

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

http://www.vision6.com.au/ch/22416/2dvczjk/1427835/d98ddn1k1…

QUARTERLY REPORT

FOR THE PERIOD ENDING 31 MARCH 2011

HIGHLIGHTS

• Handover of the Concentration Plant in Western Australia from the construction contractor was completed on 31 March 2011. The first feed of ore is scheduled to occur within approximately two weeks.

• Lynas Advanced Materials Plant (LAMP) in Malaysia remains on time as at 31 March 2011; with the first feed to kiln at the LAMP on target for September of 2011, and Lynas welcomes appointment of an independent panel of international experts to conduct a one-month review of the health, safety and environmental aspects of the LAMP to address public concern in Malaysia.

• Basic Engineering Design for Phase 2 of the LAMP was completed during the quarter, and the tender process for the engineering, construction, procurement and commissioning contract is underway.

• Sojitz and Lynas executed binding financing, distribution & agency and availability agreements on 30 March 2011. The financing agreement formed the basis of a financing package to raise a total of US$325 million.

• Successful completion of the settlement formalities for the purchase of the Kangankunde Rare Earths Deposit (KGK), Malawi, Africa

• Signing of a new long term supply agreement with a major Rare Earths consumer for the supply of Mount Weld Rare Earths.

• Prices continue to increase post quarter-end and as at 27 April 2011 the average price for the Mount Weld Rare Earths composition was US$160.32/kg REO on a FOB China basis.

Seite 1 von 14

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

QUARTERLY REPORT

FOR THE PERIOD ENDING 31 MARCH 2011

HIGHLIGHTS

• Handover of the Concentration Plant in Western Australia from the construction contractor was completed on 31 March 2011. The first feed of ore is scheduled to occur within approximately two weeks.

• Lynas Advanced Materials Plant (LAMP) in Malaysia remains on time as at 31 March 2011; with the first feed to kiln at the LAMP on target for September of 2011, and Lynas welcomes appointment of an independent panel of international experts to conduct a one-month review of the health, safety and environmental aspects of the LAMP to address public concern in Malaysia.

• Basic Engineering Design for Phase 2 of the LAMP was completed during the quarter, and the tender process for the engineering, construction, procurement and commissioning contract is underway.

• Sojitz and Lynas executed binding financing, distribution & agency and availability agreements on 30 March 2011. The financing agreement formed the basis of a financing package to raise a total of US$325 million.

• Successful completion of the settlement formalities for the purchase of the Kangankunde Rare Earths Deposit (KGK), Malawi, Africa

• Signing of a new long term supply agreement with a major Rare Earths consumer for the supply of Mount Weld Rare Earths.

• Prices continue to increase post quarter-end and as at 27 April 2011 the average price for the Mount Weld Rare Earths composition was US$160.32/kg REO on a FOB China basis.

Seite 1 von 14

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

Ein Posting aus dem HC-Forum zu Lynas von Heute die auf das Potential und somit auf den Wert vom Crown-Deposit hinweist sowie ihn Lynas in der folgenden Veröffentlichung 2007 selber dargestellt hat: http://www.hotcopper.com.au/post_single.asp?fid=1&tid=145143…

"That said, experts generally agree that certain individual elements, particularly neodymium, dysprosium, europium, terbium, and yttrium, will remain in short supply."

Note the high concentration of all these elements, incl. Yt, in the Crown deposit.

Crown is an incredibly valuable asset for the future and has the potential for 1900TPA of Ne alone, approx $500M PA at current prices.

Pg 19: http://www.lynascorp.com/content/upload/files/Presentations/…" target="_blank" rel="nofollow ugc noopener">http://www.lynascorp.com/content/upload/files/Presentations/…

Grüsse JoJo

"That said, experts generally agree that certain individual elements, particularly neodymium, dysprosium, europium, terbium, and yttrium, will remain in short supply."

Note the high concentration of all these elements, incl. Yt, in the Crown deposit.

Crown is an incredibly valuable asset for the future and has the potential for 1900TPA of Ne alone, approx $500M PA at current prices.

Pg 19: http://www.lynascorp.com/content/upload/files/Presentations/…" target="_blank" rel="nofollow ugc noopener">http://www.lynascorp.com/content/upload/files/Presentations/…

Grüsse JoJo

Antwort auf Beitrag Nr.: 41.450.123 von JoJo49 am 04.05.11 11:41:40...und noch ein hoch bewertestes HC-Posting/Meinung zu Lynas mit einer aktuellen Einschätzung: http://www.hotcopper.com.au/post_single.asp?fid=1&tid=144955…

I think the assumption that China would use influence to prevent the LAMP going forward misreads what the Chinese are trying to do. They clearly want to encourage non-Chinese supply and they may well be importing in a few years time. To undermine LAMP would be a massive blow to non-Chinese supply. The simple fact of the matter is that the Mayalasian situation has arisen largely out of legitimate health concerns from some people who are living nearby.It is perfectly understandable that they would want to know that their health will not suffer, particularly given that Mitsubishi issues. Sure there is some politics going on, but that is teh fundamental issue. Now, as long as Lynas can clearly establish to the Committee of Experts that its operation will not adversely affect health, then we are ok. If Lynas cannot establish that then I would be quite disgusted that I have been misled and have become an investor in a company that is building a plant that could seriously harm or kill people. I am quite confident however that that is not the case.

Grüsse JoJo

I think the assumption that China would use influence to prevent the LAMP going forward misreads what the Chinese are trying to do. They clearly want to encourage non-Chinese supply and they may well be importing in a few years time. To undermine LAMP would be a massive blow to non-Chinese supply. The simple fact of the matter is that the Mayalasian situation has arisen largely out of legitimate health concerns from some people who are living nearby.It is perfectly understandable that they would want to know that their health will not suffer, particularly given that Mitsubishi issues. Sure there is some politics going on, but that is teh fundamental issue. Now, as long as Lynas can clearly establish to the Committee of Experts that its operation will not adversely affect health, then we are ok. If Lynas cannot establish that then I would be quite disgusted that I have been misled and have become an investor in a company that is building a plant that could seriously harm or kill people. I am quite confident however that that is not the case.

Grüsse JoJo

Antwort auf Beitrag Nr.: 41.450.266 von JoJo49 am 04.05.11 11:59:01...dazu ein aktueller Bericht zum Thema Thorium und Sicherheit der LAMP in Malaysia:

http://www.cnbc.com/id/42880772" target="_blank" rel="nofollow ugc noopener">http://www.cnbc.com/id/42880772

IAEA panel to advise Malaysia on rare earths plant

Published: Tuesday, 3 May 2011 | 12:26 PM ET

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

http://www.cnbc.com/id/42880772" target="_blank" rel="nofollow ugc noopener">http://www.cnbc.com/id/42880772

IAEA panel to advise Malaysia on rare earths plant

Published: Tuesday, 3 May 2011 | 12:26 PM ET

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Grüsse JoJo

Für @ die immer aktuell über Lynas und die LAMP in Malysia informiert sein möchten: http://www.themalaysianinsider.com/search/tag/lynas

Daraus der neuste Bericht: http://www.themalaysianinsider.com/bahasa/article/isu-lynas-…

Isu Lynas: IAEA tubuh panel pakar nasihat Malaysia

May 04, 2011

VIENNA, 4 Mei — Agensi nuklear Pertubuhan Bangsa-Bangsa Bersatu (PBB) akan membentuk panel bebas bagi menasihat kerajaan Malaysia berhubung potensi risiko yang akan diterima kesan daripada projek loji pemprosesan nadir bumi oleh syarikat perlombongan Australia, Lynas Corporation, kata agensi itu.

Pendirian itu dibuat selepas Malaysia meminta Agensi Tenaga Atom Antarabangsa (IAEA) di Vienna untuk membantu mengesan kesan yang akan diterima penduduk setempat terutamanya membentuk panel bebas bagi mengkaji tahap kesihatan dan keselamatan sekiranya projek itu diteruskan.

Ekoran projek loji pemprosesan nadir bumi itu, ia mendapat bantahan keras daripada aktivis yang mengatakan Malaysia akan menjadi lokasi pembuangan sisa radioaktif selain akan menyebabkan tahap kesihatan terjejas.

“Melalui program kerjasama teknikal IAEA, agensi akan menyokong usaha misi pakar antabangsa untuk mengkaji projek Lynas agar ia mematuhi piawaian keselamatan antarabangsa dan keperluan yang baik akan memberikan faedah terhadap aspek keselamatan projek Lynas,” katanya dalam satu kenyataan.

“Misi itu dijadualkan bermula pada 29 Mei 2011,” katanya.

Bulan lalu, Lynas berkata Malaysia hanya memerlukan kajian selama satu bulan berhubung kesan radioaktif dan tidak akan menangguhkan pembinaan loji pemprosesan itu.

Bernama sebelum ini melaporkan Menteri Perdagangan Antarabangsa dan Industri Datuk Seri Mustapa Mohamed berkata satu panel bebas akan ditubuhkan secepat yang mungkin bagi menjalankan kajian terhadap aspek kesihatan dan keselamatan loji itu bagi menolak kebimbangan bahawa ia menimbulkan ancaman radioaktif, yang berpotensi menyekat bekalan dari China.

Kajian itu dijangka siap dalam tempoh sebulan.

Lynas Malaysia berkata loji pemprosesan itu menerima bahan mentah dari firma Mount Weld di Barat Australia.

Pemprosesan nadir bumi digunakan untuk mencipta alat berteknologi tinggi termasuk telefon pinta dan kenderaan hidbrid.

Pembeli termasuk dari China, Amerika Syarikat dan negara-negara Eropah bergantung kepada bahan mentah yang mana kini mereka bergantung sehingga 95 peratus bekalan dari China.

Cadangan pembinaan loji pemprosesan nadir bumi di Gebeng dekat Kuantan akan mejadikan ia sebagai pengeluar terbesar selepas China.

Pegawai syarikat berkenaan berkata keuntungan yang akan diperoleh dari projek loji pemprosesan nadir bumi Malaysia akan mencecah sehingga 22,000 tan, dan ia akan memenuhi keperluan selain China menjelang 2013.

Googleübersetzt: http://translate.google.de/translate?hl=de&sl=ms&tl=de&u=htt…

Goldman Sachs rechnet mit weiteren Exportbeschränkungen von REO durch China auf Grund des stark steigenden Bedarfs im eigenen Land was für uns eigendlich nichts neues darstellt.

http://www.bloomberg.com/news/2011-05-05/china-may-further-r…

China May Further Reduce Rare Earth Quotas, Goldman Sachs Says

By Rebecca Keenan - May 5, 2011 2:22 AM GMT+0200

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Wohl auch aus diesen Gründen hat Goldman Sachs ein neues kursfristiges Kursziel auf 3,75 $ hochgeschraubt.

Wer den kpl. Bericht einsehen möchte kann sich auf dem folgenden Link anmelden: http://afr.com/p/markets/market_wrap/lynas_corporation_07nkt…

Lynas Corporation

PUBLISHED : -1 hours -54 minutes ago | UPDATED: -7 hours -25 minutes ago PUBLISHED: 05 May 2011

Goldman Sachs has initiated coverage of rare earths company Lynas Corporation with a “buy” recommendation and a price target of $3.75, but says the stock represents “above-average” risk.

Grüsse JoJo

Daraus der neuste Bericht: http://www.themalaysianinsider.com/bahasa/article/isu-lynas-…

Isu Lynas: IAEA tubuh panel pakar nasihat Malaysia

May 04, 2011

VIENNA, 4 Mei — Agensi nuklear Pertubuhan Bangsa-Bangsa Bersatu (PBB) akan membentuk panel bebas bagi menasihat kerajaan Malaysia berhubung potensi risiko yang akan diterima kesan daripada projek loji pemprosesan nadir bumi oleh syarikat perlombongan Australia, Lynas Corporation, kata agensi itu.

Pendirian itu dibuat selepas Malaysia meminta Agensi Tenaga Atom Antarabangsa (IAEA) di Vienna untuk membantu mengesan kesan yang akan diterima penduduk setempat terutamanya membentuk panel bebas bagi mengkaji tahap kesihatan dan keselamatan sekiranya projek itu diteruskan.

Ekoran projek loji pemprosesan nadir bumi itu, ia mendapat bantahan keras daripada aktivis yang mengatakan Malaysia akan menjadi lokasi pembuangan sisa radioaktif selain akan menyebabkan tahap kesihatan terjejas.

“Melalui program kerjasama teknikal IAEA, agensi akan menyokong usaha misi pakar antabangsa untuk mengkaji projek Lynas agar ia mematuhi piawaian keselamatan antarabangsa dan keperluan yang baik akan memberikan faedah terhadap aspek keselamatan projek Lynas,” katanya dalam satu kenyataan.

“Misi itu dijadualkan bermula pada 29 Mei 2011,” katanya.

Bulan lalu, Lynas berkata Malaysia hanya memerlukan kajian selama satu bulan berhubung kesan radioaktif dan tidak akan menangguhkan pembinaan loji pemprosesan itu.

Bernama sebelum ini melaporkan Menteri Perdagangan Antarabangsa dan Industri Datuk Seri Mustapa Mohamed berkata satu panel bebas akan ditubuhkan secepat yang mungkin bagi menjalankan kajian terhadap aspek kesihatan dan keselamatan loji itu bagi menolak kebimbangan bahawa ia menimbulkan ancaman radioaktif, yang berpotensi menyekat bekalan dari China.

Kajian itu dijangka siap dalam tempoh sebulan.

Lynas Malaysia berkata loji pemprosesan itu menerima bahan mentah dari firma Mount Weld di Barat Australia.

Pemprosesan nadir bumi digunakan untuk mencipta alat berteknologi tinggi termasuk telefon pinta dan kenderaan hidbrid.

Pembeli termasuk dari China, Amerika Syarikat dan negara-negara Eropah bergantung kepada bahan mentah yang mana kini mereka bergantung sehingga 95 peratus bekalan dari China.

Cadangan pembinaan loji pemprosesan nadir bumi di Gebeng dekat Kuantan akan mejadikan ia sebagai pengeluar terbesar selepas China.

Pegawai syarikat berkenaan berkata keuntungan yang akan diperoleh dari projek loji pemprosesan nadir bumi Malaysia akan mencecah sehingga 22,000 tan, dan ia akan memenuhi keperluan selain China menjelang 2013.

Googleübersetzt: http://translate.google.de/translate?hl=de&sl=ms&tl=de&u=htt…

Goldman Sachs rechnet mit weiteren Exportbeschränkungen von REO durch China auf Grund des stark steigenden Bedarfs im eigenen Land was für uns eigendlich nichts neues darstellt.

http://www.bloomberg.com/news/2011-05-05/china-may-further-r…

China May Further Reduce Rare Earth Quotas, Goldman Sachs Says

By Rebecca Keenan - May 5, 2011 2:22 AM GMT+0200

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

Wohl auch aus diesen Gründen hat Goldman Sachs ein neues kursfristiges Kursziel auf 3,75 $ hochgeschraubt.

Wer den kpl. Bericht einsehen möchte kann sich auf dem folgenden Link anmelden: http://afr.com/p/markets/market_wrap/lynas_corporation_07nkt…

Lynas Corporation

PUBLISHED : -1 hours -54 minutes ago | UPDATED: -7 hours -25 minutes ago PUBLISHED: 05 May 2011

Goldman Sachs has initiated coverage of rare earths company Lynas Corporation with a “buy” recommendation and a price target of $3.75, but says the stock represents “above-average” risk.

Grüsse JoJo

Ganz schlauer Artikel  vom Wall Street Journal von heute.

vom Wall Street Journal von heute.

http://online.wsj.com/article/SB1000142405274870399270457630…

* ASIA TECHNOLOGY* MAY 5, 2011, 12:55 P.M. ET

A Warning on Rare Earth Elements

By DAVID FICKLING

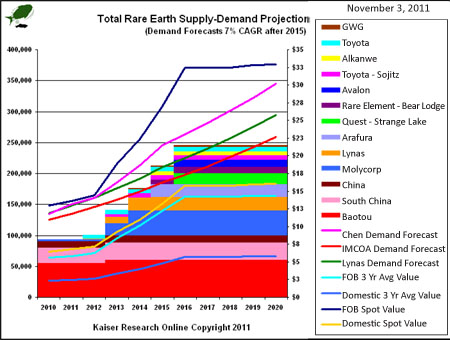

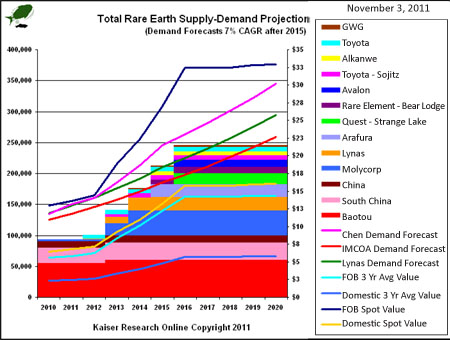

SYDNEY—Demand for rare earth elements that has driven up prices more than tenfold since 2009 is likely to be met by a surplus of supply by 2013, as Western companies start up new mines to compete with the Chinese firms that now dominate the market, Goldman Sachs analysts predicted Thursday.

...

Prices of rare earths hovered between $5 a kilogram and $20 a kilo from the early 1990s until 2010. But a 40% cut in export quotas by China, which accounts for 90% of global rare earth production, sent prices soaring. The basket price of rare earths held in Lynas Corp. Ltd.'s Mount Weld deposit in western Australia—the largest non-Chinese mine, due to come to production in the next few years—has jumped to an average of $162.66 kilos from just $10.32 kilos in 2009.

Goldman's view differs from that of miners. In a presentation last month, Lynas forecast that global demand for rare earths, which include neodymium, cerium and lanthanum, will outstrip supply this year by 35,000 tons this year and in 2012. Annual supply shortfalls of around 20,000 tons are expected in 2013 and 2014, it added. It predicted long-term prices in the $120/kg-to-$180/kg range.

Lynas Chief Executive Nicholas Curtis says China is on the verge of becoming a net importer of the elements, a transformation that would be similar to those that drove major shifts in global markets for coal in 2009 and oil in the mid-1990s, and could accentuate the current price spike.

"China will become a net importer because its consumption for its own domestic value-added industry is going to drive very high [demand] growth for these resources. They've explored every inch of China for what's available and if they had more rare earths deposits of any size, it would be being developed now," he said in a recent interview.

Lynas shares have risen fourfold since China announced the quota cuts in July 2010.

Goldman Sachs analyst Malcolm Southwood, however, said the price boom is nearing its peak. The supply deficit will peak at 18,734 tons this year, equivalent to 13.2% of a forecast 141,524 tons of demand, before the market slips into a slight surplus in 2013, he said in the report published Thursday. The surplus will rise to 5,860 tons or 3.2% of projected demand in the following year, the report said.

Initially, at least, prices will likely continue to rise, he said. The basket price for the Mount Weld rare earths should climb to $227 a kilogram next year, a gain of about 40%. Prices may eventually moderate to an average of $82 a kilogram, but that will happen only in 2015, the third consecutive year of a global surplus, the report said.

....

"Lynas has said their production costs are $10 per kilogram. If they think they can sell their material at $150 a kilogram, a markup of 15 times, I don't know customers are going to be prepared to pay for it," said Dudley Kingsnorth, executive director of Industrial Minerals Company of Australia, a rare earths analysis house.

"Once these new mines come onstream, there will be a fall in price, and if miners insist on multiples of 15-20, they're going to face more competitors. They're going to have to face a little bit of reality."

vom Wall Street Journal von heute.

vom Wall Street Journal von heute.http://online.wsj.com/article/SB1000142405274870399270457630…

* ASIA TECHNOLOGY* MAY 5, 2011, 12:55 P.M. ET

A Warning on Rare Earth Elements

By DAVID FICKLING

SYDNEY—Demand for rare earth elements that has driven up prices more than tenfold since 2009 is likely to be met by a surplus of supply by 2013, as Western companies start up new mines to compete with the Chinese firms that now dominate the market, Goldman Sachs analysts predicted Thursday.

...

Prices of rare earths hovered between $5 a kilogram and $20 a kilo from the early 1990s until 2010. But a 40% cut in export quotas by China, which accounts for 90% of global rare earth production, sent prices soaring. The basket price of rare earths held in Lynas Corp. Ltd.'s Mount Weld deposit in western Australia—the largest non-Chinese mine, due to come to production in the next few years—has jumped to an average of $162.66 kilos from just $10.32 kilos in 2009.

Goldman's view differs from that of miners. In a presentation last month, Lynas forecast that global demand for rare earths, which include neodymium, cerium and lanthanum, will outstrip supply this year by 35,000 tons this year and in 2012. Annual supply shortfalls of around 20,000 tons are expected in 2013 and 2014, it added. It predicted long-term prices in the $120/kg-to-$180/kg range.

Lynas Chief Executive Nicholas Curtis says China is on the verge of becoming a net importer of the elements, a transformation that would be similar to those that drove major shifts in global markets for coal in 2009 and oil in the mid-1990s, and could accentuate the current price spike.

"China will become a net importer because its consumption for its own domestic value-added industry is going to drive very high [demand] growth for these resources. They've explored every inch of China for what's available and if they had more rare earths deposits of any size, it would be being developed now," he said in a recent interview.

Lynas shares have risen fourfold since China announced the quota cuts in July 2010.

Goldman Sachs analyst Malcolm Southwood, however, said the price boom is nearing its peak. The supply deficit will peak at 18,734 tons this year, equivalent to 13.2% of a forecast 141,524 tons of demand, before the market slips into a slight surplus in 2013, he said in the report published Thursday. The surplus will rise to 5,860 tons or 3.2% of projected demand in the following year, the report said.

Initially, at least, prices will likely continue to rise, he said. The basket price for the Mount Weld rare earths should climb to $227 a kilogram next year, a gain of about 40%. Prices may eventually moderate to an average of $82 a kilogram, but that will happen only in 2015, the third consecutive year of a global surplus, the report said.

....

"Lynas has said their production costs are $10 per kilogram. If they think they can sell their material at $150 a kilogram, a markup of 15 times, I don't know customers are going to be prepared to pay for it," said Dudley Kingsnorth, executive director of Industrial Minerals Company of Australia, a rare earths analysis house.

"Once these new mines come onstream, there will be a fall in price, and if miners insist on multiples of 15-20, they're going to face more competitors. They're going to have to face a little bit of reality."

INTERVIEW: Malaysia Expects FDI To Rise Over 20% In 2011 - Minister

By Ankur Relia

Of DOW JONES NEWSWIRES

3 May 2011

KUALA LUMPUR (Dow Jones)--Malaysia expects foreign direct investment in the country to rise more than 20% in 2011 from a year earlier, and doesn't expect fresh conditions placed on a rare earths plant being constructed by an Australian firm to deter other foreign investors, the country's trade minister said Tuesday.

Foreign direct investment in the country is expected to reach close to $11.0 billion this year, Minister of International Trade and Industry Mustapa Mohamed told Dow Jones Newswires Tuesday.

"Our policy on foreign investment is very clear and has been very consistent," Mustapa said. "Going forward we believe it (FDI) will gather momentum."

Investments are the centrepiece of the government's Economic Transformation Program, which it embarked on last year to raise Malaysia's average per capita income to $15,000 by 2020 from about $7,000 at present. The program calls for an investment of $450 billion over 10 years, and Mustapa said more than 20% of the investment will come from FDI.

The FDI target for this year will be an increase from $9.0 billion last year, which was a big jump from the low of $1.4 billion that the Southeast Asian nation attracted in 2009, in the aftermath of the global economic recession that hit in 2008.

Malaysia has been lagging behind its neighbors such as Thailand and Indonesia in recent years in attracting foreign investments. Mustapa said that part of the reason for this is Malaysia has higher wages than these countries.

"We can't compete with some of these countries, because our wages are a lot higher. Also, we have been rejecting some of the investments" that fall below the country's minimum wage criterion. He didn't elaborate.

The minister also downplayed worries that recent publicity over new conditions placed on Lynas Corp.'s (LYC.AU) planned rare earths processing plant in the eastern state of Pahang could discourage foreign investors.

"This is the first time that we are faced with this kind of situation, partly because it deals with rare earths, and partly because public interest in it coincided with happenings in Fukushima," Mustapa said.

"But as far as the government is concerned, we are not applying any new rules to Lynas, or resorting to new interpretations of long-established guidelines for investors. What we are doing is simply taking an added measure to ensure that the conditions of the manufacturing license granted in 2008 are adhered to," he added.

"The manufacturing licence granted to Lynas has not been withdrawn, and neither has it been suspended," he said.

Lynas, which plans to become the largest producer of rare earths outside China, was granted a manufacturing license in January 2008 to process rare earths, which are used in many high-technology and energy-efficient applications.

Last month, Malaysia said it would appoint an independent panel of international experts to assess the environmental impact of the plant after it drew protests from residents and green groups over its environmental and health implications amid worries it would produce large amounts of radioactive waste.

Mustapa said the panel, which is likely to be established over the next few days, will complete its job within one month of its appointment.

Hört sich alles sehr vernünftig an.

Malaysia will keine Bananenrepublik sein.

Ich sehe allem sehr gelassen entgegegen. Big Money, too big too fail.

http://www.themalaysianinsider.com/malaysia/article/australi…

Australia not as competitive as Malaysia, says Lynas

KUALA LUMPUR, May 6 — Australia’s Lynas Corp claims it picked Malaysia for its controversial rare earth refinery as it was more competitive than its home country.

The miner will source the radioactive ore which produces the precious element from Australia before shipping it to Kuantan.

In a video posted on its Facebook page last night, executive chairman Nicholas Curtis said the original plan was to build the plant in Australia but the company found that “it doesn’t work.”

“Australia is unfortunately not competitive in the chemical industry the way the east coast of Malaysia is,” he said of the site in the Gebeng industrial zone near Kuantan.

Although reports say the plant may generate up to one per cent of the Malaysian GDP, critics have questioned the real economic benefit of the project, pointing to the 12-year tax holiday Lynas is set to get as a pioneer status company.

Still, the government estimates RM2.3 billion investments spinoffs from the plant that will be operable in September after over two years of construction.

Science, Technology and Innovation Minister Datuk Seri Maximus Johnity Ongkili told Parliament last month that RM300 million has already been poured in for two factories in Gebeng that will produce the hydrochloric and sulphuric acid needed to extract the rare earth metals.

The Australian miner has faced opposition to its RM700 million plant from environmentalists and local residents who fear a repeat of the radiation pollution from a similar plant in Bukit Merah, Ipoh.

The Asian Rare Earth (ARE) plant in Perak has been linked to birth defects and at least eight cases of leukaemia in the past five years, seven of which were fatal.

Nearly 20 years after it was shuttered, it is still the subject of a massive RM300 million cleanup exercise.

Those opposed to the plant, including PKR vice president and Kuantan MP Fuziah Salleh, have repeatedly questioned whether the project was brought to Malaysia because Australia would not accept the radioactive waste from the process.

..

Curtis said in the video that the company chose Malaysia because “we like Malaysia, the infrastructure and most importantly the people.”

In a recent telephone interview with The Malaysian Insider, corporate and business development vice president Matthew James said that the company chose Malaysia instead of refining the ore in Australia, due to savings in already available infrastructure and labour.

He said that the plant would need a larger supply of water, natural gas, industrial land and chemicals such as lime and sulphuric and hydrochloric acid — all readily available in Malaysia.

...

http://www.theaustralian.com.au/business/news/lynas-shares-s…

Lynas shares soar as rare earths continue to shine

* Michael Bennet* From: The Australian * May 06, 2011 12:00AM

RARE earths prices are expected to continue their extraordinary rise in the next 18 months before "some softening" from 2013, sending shares in leading producer Lynas Corporation soaring.

In a note to clients yesterday, Goldman Sachs said the supply of rare earths would remain "severely" constrained until at least 2013, which would drive prices higher, before moving into surplus.

The news sent Lynas, which Goldman yesterday made a buy, up more than 8 per cent, or 17c, to close at $2.20.

Rare earths are a relatively abundant group of metals, with diverse uses from light bulbs to mobile phones, but there are limited economic resources outside China, which accounts for 95 per cent of global production.

China last year tightened its clampdown on export quotas and illegal production which, combined with rising demand, caused supply to fall into deficit and prices to soar.

Lynas this month said the basket price of rare earths from its Mount Weld mine in Western Australia, one of the largest and highest grade resources, was $US162.66 a kilogram, compared with an average of $US10.32 in 2009.

Goldman analyst Malcolm Southwood tipped this basket to rise 40 per cent to $US227 a kg in 2012, as China further cuts its export quota, before cooling in the following years to $US82 by 2015, as projects outside China came on line.

The two biggest mines outside China are Lynas's Mt Weld and US Miner Molycorp's Mountain Pass project in California, which would reduce the peak shortfall this year of 18,730 tonnes to 11,300 tonnes in 2012, Mr Southwood said.

As each miner further boosted production, Mr Southwood said, rare earths would return to a "modest" surplus of 313 tonnes in 2013 before rising to 5860 tonnes in 2014.

...

Australia not as competitive as Malaysia, says Lynas

KUALA LUMPUR, May 6 — Australia’s Lynas Corp claims it picked Malaysia for its controversial rare earth refinery as it was more competitive than its home country.

The miner will source the radioactive ore which produces the precious element from Australia before shipping it to Kuantan.

In a video posted on its Facebook page last night, executive chairman Nicholas Curtis said the original plan was to build the plant in Australia but the company found that “it doesn’t work.”

“Australia is unfortunately not competitive in the chemical industry the way the east coast of Malaysia is,” he said of the site in the Gebeng industrial zone near Kuantan.

Although reports say the plant may generate up to one per cent of the Malaysian GDP, critics have questioned the real economic benefit of the project, pointing to the 12-year tax holiday Lynas is set to get as a pioneer status company.

Still, the government estimates RM2.3 billion investments spinoffs from the plant that will be operable in September after over two years of construction.

Science, Technology and Innovation Minister Datuk Seri Maximus Johnity Ongkili told Parliament last month that RM300 million has already been poured in for two factories in Gebeng that will produce the hydrochloric and sulphuric acid needed to extract the rare earth metals.

The Australian miner has faced opposition to its RM700 million plant from environmentalists and local residents who fear a repeat of the radiation pollution from a similar plant in Bukit Merah, Ipoh.

The Asian Rare Earth (ARE) plant in Perak has been linked to birth defects and at least eight cases of leukaemia in the past five years, seven of which were fatal.

Nearly 20 years after it was shuttered, it is still the subject of a massive RM300 million cleanup exercise.

Those opposed to the plant, including PKR vice president and Kuantan MP Fuziah Salleh, have repeatedly questioned whether the project was brought to Malaysia because Australia would not accept the radioactive waste from the process.

..

Curtis said in the video that the company chose Malaysia because “we like Malaysia, the infrastructure and most importantly the people.”

In a recent telephone interview with The Malaysian Insider, corporate and business development vice president Matthew James said that the company chose Malaysia instead of refining the ore in Australia, due to savings in already available infrastructure and labour.

He said that the plant would need a larger supply of water, natural gas, industrial land and chemicals such as lime and sulphuric and hydrochloric acid — all readily available in Malaysia.

...

http://www.theaustralian.com.au/business/news/lynas-shares-s…

Lynas shares soar as rare earths continue to shine

* Michael Bennet* From: The Australian * May 06, 2011 12:00AM

RARE earths prices are expected to continue their extraordinary rise in the next 18 months before "some softening" from 2013, sending shares in leading producer Lynas Corporation soaring.

In a note to clients yesterday, Goldman Sachs said the supply of rare earths would remain "severely" constrained until at least 2013, which would drive prices higher, before moving into surplus.

The news sent Lynas, which Goldman yesterday made a buy, up more than 8 per cent, or 17c, to close at $2.20.

Rare earths are a relatively abundant group of metals, with diverse uses from light bulbs to mobile phones, but there are limited economic resources outside China, which accounts for 95 per cent of global production.

China last year tightened its clampdown on export quotas and illegal production which, combined with rising demand, caused supply to fall into deficit and prices to soar.

Lynas this month said the basket price of rare earths from its Mount Weld mine in Western Australia, one of the largest and highest grade resources, was $US162.66 a kilogram, compared with an average of $US10.32 in 2009.

Goldman analyst Malcolm Southwood tipped this basket to rise 40 per cent to $US227 a kg in 2012, as China further cuts its export quota, before cooling in the following years to $US82 by 2015, as projects outside China came on line.

The two biggest mines outside China are Lynas's Mt Weld and US Miner Molycorp's Mountain Pass project in California, which would reduce the peak shortfall this year of 18,730 tonnes to 11,300 tonnes in 2012, Mr Southwood said.

As each miner further boosted production, Mr Southwood said, rare earths would return to a "modest" surplus of 313 tonnes in 2013 before rising to 5860 tonnes in 2014.

...

LYC Lynas Corporation Limited

May 2011

9th Change of Director`s Interest Notices

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=633857

9th QUARTERLY REPORT INVESTOR RELATIONS CALLS

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=633856

9 May 2011

LYNAS QUARTERLY REPORT INVESTOR RELATIONS CALLS

Lynas Corporation Limited (ASX: LYC) will hold conference calls to discuss the Quarterly Report for

the period ending 31 March 2011 that was lodged with the ASX on 29 April 2011. There will be a

Q&A session at the end of the calls. Details of the calls are noted below.

Participants should dial a telephone access number (listed below) prior to the start time, as

registration may take a few minutes. They will be greeted by an operator and asked for their

confirmation code (listed below). Participants will be placed in a listen-only mode with music until the

moderator or speaker starts the conference.

The first call will be held on Thursday 12 May at 0800hrs (Sydney time).Please see dial-in details below:

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

@ eine erfolgreiche Woche

Grüsse JoJo

May 2011

9th Change of Director`s Interest Notices

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=633857

9th QUARTERLY REPORT INVESTOR RELATIONS CALLS

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=633856

9 May 2011

LYNAS QUARTERLY REPORT INVESTOR RELATIONS CALLS

Lynas Corporation Limited (ASX: LYC) will hold conference calls to discuss the Quarterly Report for

the period ending 31 March 2011 that was lodged with the ASX on 29 April 2011. There will be a

Q&A session at the end of the calls. Details of the calls are noted below.

Participants should dial a telephone access number (listed below) prior to the start time, as

registration may take a few minutes. They will be greeted by an operator and asked for their

confirmation code (listed below). Participants will be placed in a listen-only mode with music until the

moderator or speaker starts the conference.

The first call will be held on Thursday 12 May at 0800hrs (Sydney time).Please see dial-in details below:

...

...

Googleübersetzt: http://translate.google.de/translate?js=n&prev=_t&hl=de&ie=U…

@ eine erfolgreiche Woche

Grüsse JoJo

http://www.rareearthsandstrategicmetals.com.au/Event.aspx?id…

Rare Earths and Strategic Metals 2011

21 - 22 June, 2011, WatersEdge, Sydney, NSW

Googleübersetzt: http://translate.googleusercontent.com/translate_c?hl=de&ie=…

Grüsse JoJo

Rare Earths and Strategic Metals 2011

21 - 22 June, 2011, WatersEdge, Sydney, NSW

Googleübersetzt: http://translate.googleusercontent.com/translate_c?hl=de&ie=…

Grüsse JoJo

Erinnert mich irgendwie an den Bäcker...

http://web7.v1316.ncsrv.de/attachments/EMT_Spezial_Seltene_E…

...da empfehle ich doch lieber mal ein IMHO hervorragendes Buch zum Thema: http://www.financebooks.de/xist4c/web/Seltene-Erden---Der-wi…

Grüsse JoJo

http://web7.v1316.ncsrv.de/attachments/EMT_Spezial_Seltene_E…

...da empfehle ich doch lieber mal ein IMHO hervorragendes Buch zum Thema: http://www.financebooks.de/xist4c/web/Seltene-Erden---Der-wi…

Grüsse JoJo

Zitat von JoJo49: Erinnert mich irgendwie an den Bäcker...

http://web7.v1316.ncsrv.de/attachments/EMT_Spezial_Seltene_E…

Grüsse JoJo

Der Link geht nicht...hast Du noch eine andere Quelle dafür ?

Vorab schon mal Danke...

gruß

power

Antwort auf Beitrag Nr.: 41.476.160 von power_48 am 10.05.11 06:42:46Hallo power,

das ist nun wirklich kein Beinbruch das dieser Artikel nicht mehr im Netz zur Verfühgung steht, da hast du nichts verpaßt.

Solche Infos tausche ich immer mit befreundeten/bekannten Usern aus die die unterschiedlichsten Abbos haben.

Ich hoffe damit sind auch die Fragen, die ich per BM bekommen habe, beantwortet, obwohl ich schon gewundert habe das gerade auf IMHO solch einen Schmarrn überhaupt nachgefragt wird.

Habe den Link hauptsächlich eingestellt um auf das folgende Buch aufmerksam zu machen.

Darum noch mal ein Hinweis auf das wirklich lesenswerte Buch:

Seltene Erden - Der wichtigste Rohstoff des 21. Jahrhunderts

Investieren Sie jetzt in den Rohstoff von morgen!

http://www.financebooks.de/upload_financebooks_sr01_alless01…

Inhaltsverzeichnis

Die wichtigsten Begriffe .................................................... 15

Vorwort von Don Bubar,

CEO & President von Av alon Rare Metals .......................19

Einleitung ............................................................................... 23

Kapitel 1

Was sind Technologiemetalle? ......................................... 27

Kapitel 2

was sind seltene erden? ...................................................... 35

Kapitel 3

Seltene Erden – die einzelnen Elemente ......................... 43

Kapitel 4

Die Verwandten der Seltenen Erden ............................... 83

Kapitel 5

Die geschichte der Produktion von

Seltenen Erden ....................................................................... 89

Kapitel 6

Die wichtigsten Anwendungen –

heute und in der Zukunft ................................................... 97

12

Kapitel 7

SeltenE erden in der Nanotechnologie ...................... 105

Gastbeitrag von Marco Beckmann, CEO der nanostart AG

Kapitel 8

DIE Weitreichenden Folgen fehlender Versorgung ..113

Kapitel 9

Stichwort Ressourcenknappheit .....................................119

Kapitel 10

Recycling – eine neue Versorgungsquelle? .................123

Kapitel 11

Seltene Erden und Politik .................................................127

Kapitel 12

Seltene Erden bis zum Jahr 2015 .......................................137

Kapitel 13

Investieren in Explorationsaktien .................................151

Kapitel 14

Investmentchancen mit Seltenen Erden .......................167

Alkane Resources .....................................................................184

Ara fura Resources ...................................................................186

Avalon Rar e Metals ..................................................................188

China Rar e Ear th Holdings ....................................................190

Comm erce Resources ...............................................................192

Da cha Stra tegic Metals .......................................................... 194

Fr ontier Rar e Ear ths ............................................................... 196

Gr eat Western Minera ls .......................................................... 198

Gr eenland Minera ls .................................................................200

Hudson Resources ....................................................................202

13

Lynas Corp. ...................................................................................204

Matam ec Explora tions ............................................................206

Molycorp .....................................................................................208

Neo Material Technologies ...................................................210

Quest Rar e Minera ls ................................................................. 212

Rar e Ear th Metals ..................................................................... 214

Rar e Element Resources .......................................................... 216

Stans Energy ............................................................................... 218

Ta sma n Metals ............................................................................220

Ucore Rar e Metals ....................................................................222

Kapitel 15

Der Börsengang von Molycorp im Sommer 2010 ........ 227

Kapitel 16

Fazit: Seltene-Erden-Aktien –

vielleicht doch nur ein Hype? ............................................ 237

Anhang: Interview Jack Lifton ........................................247

Glossar .................................................................................. 253

informationsQuellen ....................................................... 259

Grüsse JoJo

das ist nun wirklich kein Beinbruch das dieser Artikel nicht mehr im Netz zur Verfühgung steht, da hast du nichts verpaßt.

Solche Infos tausche ich immer mit befreundeten/bekannten Usern aus die die unterschiedlichsten Abbos haben.

Ich hoffe damit sind auch die Fragen, die ich per BM bekommen habe, beantwortet, obwohl ich schon gewundert habe das gerade auf IMHO solch einen Schmarrn überhaupt nachgefragt wird.

Habe den Link hauptsächlich eingestellt um auf das folgende Buch aufmerksam zu machen.

Darum noch mal ein Hinweis auf das wirklich lesenswerte Buch:

Seltene Erden - Der wichtigste Rohstoff des 21. Jahrhunderts

Investieren Sie jetzt in den Rohstoff von morgen!

http://www.financebooks.de/upload_financebooks_sr01_alless01…

Inhaltsverzeichnis

Die wichtigsten Begriffe .................................................... 15

Vorwort von Don Bubar,

CEO & President von Av alon Rare Metals .......................19

Einleitung ............................................................................... 23

Kapitel 1

Was sind Technologiemetalle? ......................................... 27

Kapitel 2

was sind seltene erden? ...................................................... 35

Kapitel 3

Seltene Erden – die einzelnen Elemente ......................... 43

Kapitel 4

Die Verwandten der Seltenen Erden ............................... 83

Kapitel 5

Die geschichte der Produktion von

Seltenen Erden ....................................................................... 89

Kapitel 6

Die wichtigsten Anwendungen –

heute und in der Zukunft ................................................... 97

12

Kapitel 7

SeltenE erden in der Nanotechnologie ...................... 105

Gastbeitrag von Marco Beckmann, CEO der nanostart AG

Kapitel 8

DIE Weitreichenden Folgen fehlender Versorgung ..113

Kapitel 9

Stichwort Ressourcenknappheit .....................................119

Kapitel 10

Recycling – eine neue Versorgungsquelle? .................123

Kapitel 11

Seltene Erden und Politik .................................................127

Kapitel 12

Seltene Erden bis zum Jahr 2015 .......................................137

Kapitel 13

Investieren in Explorationsaktien .................................151

Kapitel 14

Investmentchancen mit Seltenen Erden .......................167

Alkane Resources .....................................................................184

Ara fura Resources ...................................................................186

Avalon Rar e Metals ..................................................................188

China Rar e Ear th Holdings ....................................................190

Comm erce Resources ...............................................................192

Da cha Stra tegic Metals .......................................................... 194

Fr ontier Rar e Ear ths ............................................................... 196

Gr eat Western Minera ls .......................................................... 198

Gr eenland Minera ls .................................................................200

Hudson Resources ....................................................................202

13

Lynas Corp. ...................................................................................204

Matam ec Explora tions ............................................................206

Molycorp .....................................................................................208

Neo Material Technologies ...................................................210

Quest Rar e Minera ls ................................................................. 212

Rar e Ear th Metals ..................................................................... 214

Rar e Element Resources .......................................................... 216

Stans Energy ............................................................................... 218

Ta sma n Metals ............................................................................220

Ucore Rar e Metals ....................................................................222

Kapitel 15

Der Börsengang von Molycorp im Sommer 2010 ........ 227

Kapitel 16

Fazit: Seltene-Erden-Aktien –

vielleicht doch nur ein Hype? ............................................ 237

Anhang: Interview Jack Lifton ........................................247

Glossar .................................................................................. 253

informationsQuellen ....................................................... 259

Grüsse JoJo

http://www.aktiencheck.de/analysen/Artikel-Lynas_steht_unmit…

Lynas steht unmittelbar vor dem Erreichen des Produzentenstatus

09.05.11 12:55

Hot Stocks Investor

Endingen (aktiencheck.de AG) - Die Experten von "Hot Stocks Investor" stufen die Aktie von Lynas als ausgezeichnete strategische Position im Bereich Seltene Erden ein.

Die Gesellschaft stehe unmittelbar vor dem Erreichen des Produzentenstatus und verfüge außerhalb Chinas über eines der am weitesten fortgeschrittensten Projekte.

Die Vorkommen des Mount Weld-Projekts würden auf rund 1,4 Mio. Tonnen geschätzt und ab dem dritten Quartal solle die Produktion aufgenommen werden. Diese solle sich zunächst auf rund 11.000 Tonnen pro Jahr belaufen und später auf 22.000 Tonnen p.a. ausgeweitet werden.

Schon in den letzten Monaten habe Lynas langfristige Abnahmeverträge im Volumen von über 1 Mrd. USD vereinbaren können und darüber hinaus sei eine strategische Zusammenarbeit mit dem japanischen Großkonzern Sojitz (ISIN JP3663900003 / WKN 255124) verkündet worden.

Einzelne Analysten seien von Lynas begeistert. So hätten zum Beispiel die Analysten von Goldman Sachs den Titel in ihrer Ersteinschätzung ein Kursziel von 3,75 Australische Dollar (AUD) zugesprochen. Auf Basis derer Gewinnschätzungen betrage das KGV 2012e nur 6,9 und das für 2013e lediglich 1,5.

Die Experten von "Hot Stocks Investor" stufen die Aktie von Lynas als ausgezeichnete strategische Position im Bereich Seltene Erden ein. (Ausgabe 09 vom 09.05.2011) (09.05.2011/ac/a/a)

Offenlegung von möglichen Interessenskonflikten:

Mögliche Interessenskonflikte können Sie auf der Site des Erstellers/ der Quelle der Analyse einsehen.

http://www.aktiencheck.de/871899-Lynas-Aktie-Profil

Grüsse JoJo

Lynas steht unmittelbar vor dem Erreichen des Produzentenstatus

09.05.11 12:55

Hot Stocks Investor

Endingen (aktiencheck.de AG) - Die Experten von "Hot Stocks Investor" stufen die Aktie von Lynas als ausgezeichnete strategische Position im Bereich Seltene Erden ein.

Die Gesellschaft stehe unmittelbar vor dem Erreichen des Produzentenstatus und verfüge außerhalb Chinas über eines der am weitesten fortgeschrittensten Projekte.

Die Vorkommen des Mount Weld-Projekts würden auf rund 1,4 Mio. Tonnen geschätzt und ab dem dritten Quartal solle die Produktion aufgenommen werden. Diese solle sich zunächst auf rund 11.000 Tonnen pro Jahr belaufen und später auf 22.000 Tonnen p.a. ausgeweitet werden.

Schon in den letzten Monaten habe Lynas langfristige Abnahmeverträge im Volumen von über 1 Mrd. USD vereinbaren können und darüber hinaus sei eine strategische Zusammenarbeit mit dem japanischen Großkonzern Sojitz (ISIN JP3663900003 / WKN 255124) verkündet worden.

Einzelne Analysten seien von Lynas begeistert. So hätten zum Beispiel die Analysten von Goldman Sachs den Titel in ihrer Ersteinschätzung ein Kursziel von 3,75 Australische Dollar (AUD) zugesprochen. Auf Basis derer Gewinnschätzungen betrage das KGV 2012e nur 6,9 und das für 2013e lediglich 1,5.

Die Experten von "Hot Stocks Investor" stufen die Aktie von Lynas als ausgezeichnete strategische Position im Bereich Seltene Erden ein. (Ausgabe 09 vom 09.05.2011) (09.05.2011/ac/a/a)

Offenlegung von möglichen Interessenskonflikten:

Mögliche Interessenskonflikte können Sie auf der Site des Erstellers/ der Quelle der Analyse einsehen.

http://www.aktiencheck.de/871899-Lynas-Aktie-Profil

Grüsse JoJo

Da kann sich jeder mal ein Bild zu folgendem Artikel und Gedanken machen, was dieses Szenario, dass z.Z. in Malaysia um die LAMP getrieben wird, für all die REE-Explorer/Firmen bedeutet die in Länder wie den USA, Kanada, Australien usw., mit ihren scharfen Umweltvorschreften und starken, aktiven Umweltverbänden, die in den nächsten Jahren in Produktion gehen wollen und die in ihrem Deposit, im Vergelich zu Lynas, einen 10-fach höheren und mehr Anteil haben.

Grüsse JoJo

http://www.themalaysianinsider.com/malaysia/article/western-…

Western Australia said no to Lynas, Pahang Bar reveals

By Debra Chong

May 10, 2011

The site of the Lynas plant in Gebeng. — File pic

KUANTAN, May 10 — The Pahang Bar revealed today a Western Australian local council had “vigorously” opposed Lynas Corp building a rare earth refinery in its home state as the main reason for the Australian miner to ship its ore some 3,000km to Malaysia to be processed.

State Bar chief Hon Kai Ping said his team of lawyers had unearthed the minutes of the meeting of the Council of the Shire of Northam dating back to November 23, 2005 which recorded the local government “vigorously opposes the siting of a hazardous waste disposal and treatment plant at the Avon Industrial Park (in Meenar) based on the negative perceptions that the location will cause to Grass Valley, the Town of Northam and the Avon region.”

The document, Hon added, stated among other things: “The Town of Northam, along with other Councils in the Avon Valley, has been promoting the Valley as a clean and green tourism and lifestyle experience. Having a hazardous waste site on the Town’s doorstep would undo a lot of the work that has been undertaken by Council…”

“Pahang Bar is not certain but this may or may not throw some light as to why the proposal was not proceeded with despite all the convenience of distance as there is a highway running from Mount Weld, Laverton to the Town of Northam with no necessity of shipping the ore overseas,” Hon said in a statement today.