Petrohunter nach dem Turnaround! Restart eines Tenbaggers? - 500 Beiträge pro Seite (Seite 8)

eröffnet am 19.08.07 11:33:23 von

neuester Beitrag 29.12.18 14:00:41 von

neuester Beitrag 29.12.18 14:00:41 von

Beiträge: 4.967

ID: 1.131.882

ID: 1.131.882

Aufrufe heute: 5

Gesamt: 659.961

Gesamt: 659.961

Aktive User: 0

ISIN: US71649T1043 · WKN: A0KE9M

0,0003

USD

0,00 %

0,0000 USD

Letzter Kurs 16.07.16 Nasdaq OTC

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,9600 | +22,77 | |

| 38.600,00 | +9,66 | |

| 1,3025 | +9,00 | |

| 4,8700 | +7,51 | |

| 16,800 | +6,87 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0500 | -12,50 | |

| 11,560 | -13,64 | |

| 1.050,01 | -14,28 | |

| 12,100 | -17,12 | |

| 1,3900 | -17,51 |

msg on july 15 on the farmer’s board by tensleep

Petro Hawk being bought and all shale stocks in US up so far today.PetroHawk up another 14 dollars.Lets find some.Paul from Phun did call back said they own 25% ,no upfront costs to develope,but that they have 1 mil. in assests and owe in excess of 68 mil. Don't quite understand their position in OZ.It is complicated,so if Falcon sells 65% I don't know how that effects Phun,cause it is thru equity positions.So I sold and bought FO.

Hier hat tensleep insofern recht, als diese Zusammenhänge im accounting echt ziemlich kompliziert erscheinen auf den ersten Blick.

Note 4 — Equity Investment (seite 10 )(Q 2 2011 PHUN)

As of March 31, 2011 and September 30, 2010, we held approximately 50,000,000 shares in Falcon Oil & Gas Australia Limited (“Falcon Australia”), a related party. We have accounted for this investment under the equity method. As of March 31, 2011 and September 30, 2010, our basis in this investment had been reduced to $nil as the result of historical losses of $164,506 recorded during the fiscal year ended September 30, 2010.

Note 2 — Summary of Significant Accounting Policies

...

As shown in the accompanying financial statements, we have an accumulated deficit of $288,655,790 and our current assets exceeded our current liabilities by $12,461,108 as of March 31, 2011.

Die equity method verfälscht also in gewisser Weise die wirklichen Verhältnisse. Die Schulden sind in der Tat sauhoch, und wer wüsste das besser als Paul von PHUN...auf der anderen Seite sind aber die faktischen assets doch höher als die liabilities, was aber im equity accounting nicht erscheint...

Hiermit wird man sich noch beschäftigen müssen. Tensleeps Probleme mit dem mögliche farm in von Hess sind allerdings weniger nachvollziehbar. Petro behält seine, von mir aus 23 oder 24 oder 25 % an Falcon Australia, es sei denn weitere Investoren steigen in Falcon Australia zu, dann verschieben sich die Verhältnisse entsprechend. Was das working interest von PHUN von 10 % betrifft, heißt das dann vor allen Dingen, dass PUN in der weiteren Entwicklung erst mal weniger berappen müsste. -- Aber wir haben noch unsere 50% in den neuen permits in Beetaloo usw...

Ich wollte nichts weiter als diese Problematik einmal kurz anreißen, die auch tensleep hier zurecht aufwirft...

Man kann aber meiner Meinug nach sagen alles halb so wild, auch die Schulden von PHUN, die fast ausschließlich related parties betreffen, wenn, ja wenn die Sache operativ funzt... das ist das Entscheidende, der entscheidende Punkt, und wie könnte es auch anders sein?...Phun lässt dann seine Schulden locker hinter sich im Laufe von Jahren... die einzusetzenden Beträge bei einem funktionierenden Beetaloo werden die aktuellen Schulden von PHUN bei weitem in den Schatten stellen...

Eine ausgesprochen spannende und einstweilen komplizierte Entwicklung, da muss ich tensleep rechtgeben...wenn Beetaloo funktioniert reisst Bruner mit Paltar und JV-Patrnern PHUN mitraus ist meine Prognose.........wie auch immer...was ist mit Sinovus?.........es dauert Jahre und es muss operativ klappen.........und genau das steht in den Sternen

Petro Hawk being bought and all shale stocks in US up so far today.PetroHawk up another 14 dollars.Lets find some.Paul from Phun did call back said they own 25% ,no upfront costs to develope,but that they have 1 mil. in assests and owe in excess of 68 mil. Don't quite understand their position in OZ.It is complicated,so if Falcon sells 65% I don't know how that effects Phun,cause it is thru equity positions.So I sold and bought FO.

Hier hat tensleep insofern recht, als diese Zusammenhänge im accounting echt ziemlich kompliziert erscheinen auf den ersten Blick.

Note 4 — Equity Investment (seite 10 )(Q 2 2011 PHUN)

As of March 31, 2011 and September 30, 2010, we held approximately 50,000,000 shares in Falcon Oil & Gas Australia Limited (“Falcon Australia”), a related party. We have accounted for this investment under the equity method. As of March 31, 2011 and September 30, 2010, our basis in this investment had been reduced to $nil as the result of historical losses of $164,506 recorded during the fiscal year ended September 30, 2010.

Note 2 — Summary of Significant Accounting Policies

...

As shown in the accompanying financial statements, we have an accumulated deficit of $288,655,790 and our current assets exceeded our current liabilities by $12,461,108 as of March 31, 2011.

Die equity method verfälscht also in gewisser Weise die wirklichen Verhältnisse. Die Schulden sind in der Tat sauhoch, und wer wüsste das besser als Paul von PHUN...auf der anderen Seite sind aber die faktischen assets doch höher als die liabilities, was aber im equity accounting nicht erscheint...

Hiermit wird man sich noch beschäftigen müssen. Tensleeps Probleme mit dem mögliche farm in von Hess sind allerdings weniger nachvollziehbar. Petro behält seine, von mir aus 23 oder 24 oder 25 % an Falcon Australia, es sei denn weitere Investoren steigen in Falcon Australia zu, dann verschieben sich die Verhältnisse entsprechend. Was das working interest von PHUN von 10 % betrifft, heißt das dann vor allen Dingen, dass PUN in der weiteren Entwicklung erst mal weniger berappen müsste. -- Aber wir haben noch unsere 50% in den neuen permits in Beetaloo usw...

Ich wollte nichts weiter als diese Problematik einmal kurz anreißen, die auch tensleep hier zurecht aufwirft...

Man kann aber meiner Meinug nach sagen alles halb so wild, auch die Schulden von PHUN, die fast ausschließlich related parties betreffen, wenn, ja wenn die Sache operativ funzt... das ist das Entscheidende, der entscheidende Punkt, und wie könnte es auch anders sein?...Phun lässt dann seine Schulden locker hinter sich im Laufe von Jahren... die einzusetzenden Beträge bei einem funktionierenden Beetaloo werden die aktuellen Schulden von PHUN bei weitem in den Schatten stellen...

Eine ausgesprochen spannende und einstweilen komplizierte Entwicklung, da muss ich tensleep rechtgeben...wenn Beetaloo funktioniert reisst Bruner mit Paltar und JV-Patrnern PHUN mitraus ist meine Prognose.........wie auch immer...was ist mit Sinovus?.........es dauert Jahre und es muss operativ klappen.........und genau das steht in den Sternen

Antwort auf Beitrag Nr.: 41.813.185 von auriga am 20.07.11 00:06:39Der Handel in D ist jetzt komplett eingestellt.

Antwort auf Beitrag Nr.: 41.814.645 von xsusi am 20.07.11 10:52:30Hi Susi...how do you do?...also, bin gerade nach hause gekommen und sehe in D drei Kursstellungen, in S 0,013 EUR, allerdings zur Zeit im bid und ask tote Hose, in FFM EUR 0,012, nach wie vor mit diesem etwas eigenartigen zu niedrigen 3.000.000-bid, dafür aber mit ask 0,023 EUR ausgeglichen mit 125 000 und in Xetra eine Kursstellung mit 0,012 EUR, ebenfalls bid und ask 0, wie in S...http://www.finanztreff.de/kurse_einzelkurs_boersen,i,303964.…...verhielt sich das vor ein paar Stunden anders?...zur Zeit wird eben auch wenig getradet in PHUN, ich finde das ganz verständlich, aber jeder hat hier seinen eigenen Ansatz...ist halt ein wenig schade, dass wir so lange warten müssen, bis sich dann entsprechend etwas tut, wie auch immer, aber was solls, ansonsten geht es ja immer weiter voran...in USA sehe ich an sich ein normales BILd, dazugesagt, die OTC M G-Seite wird zur Zeit überabeitet und hängt deshalb etwas...see you, A

Antwort auf Beitrag Nr.: 41.816.469 von auriga am 20.07.11 14:36:51Ich wollte heute ne Vk Order eingeben dann kam dass das Wertpapier an keinem zulaessigen Handelplatz handelbar ist.

Antwort auf Beitrag Nr.: 41.816.676 von xsusi am 20.07.11 15:01:47Bin gerade erneut reingekommen. Achtung, Aktie hat derzeit keinen neuen Preis oder kann nicht gehandelt werden! erscheint bei mir bei mir für FFM und Xetra. -- Stuttgart hat ja auch in der Anzeige keinen neuen Preis zur Zeit. -- In USA läufts normal. -- Müssen wir mal schauen...

Antwort auf Beitrag Nr.: 41.818.587 von auriga am 20.07.11 18:33:05Das ist schon uebel

Antwort auf Beitrag Nr.: 41.818.995 von xsusi am 20.07.11 19:38:28Ich habe gerade eine mail an die Handelsüberwachungsstelle in FFM geschickt. Weiß aber nicht, ob die Kollegen heute noch antworten, oder jetzt schon mehr Richtung Feierabend unterwegs sind.

Antwort auf Beitrag Nr.: 41.819.079 von auriga am 20.07.11 19:51:05Die werden den Handel eingestellt haben weil kaum Handel stattfindet.

Mal sehen was du für ne Antwort bekommst.

Mal sehen was du für ne Antwort bekommst.

Antwort auf Beitrag Nr.: 41.819.276 von xsusi am 20.07.11 20:19:35Also, ich denke mal in Stuttgart läuft die Sache wieder wie gewohnt...in FFM-Xetra-Parkett als auch in Xetra ist der Handel von PHUN in D zur Zeit eingestellt...die Frage ist warum... man konnte leider in FFM mit der neuen Xetra-Taxung nicht zufrieden sein, man kann fast sagen, sie hat nicht gut funktioniert...eine Dauertiefstellung im bid ist nicht angängig, allenfalls vorübergehend...dies wundert mich schon für FFM...

Von:huest@deutsche-boerse.com

An: ....................@t-online.de

Betreff:Re: Petrohunter Energy ISIN: US71649T1043 (Call ID:........)

Datum:21.07.2011, 12:11

Sehr geehrter Herr ...............,

bei dem von Ihnen genannten Wertpapier Petrohunter Energy, ISIN

US71649T1043, Börsenkürzel D7E, war auf der elektronischen

Handelsplattform Xetra der letzte Handelstag der 27.05.2011. An der

Frankfurter Wertpapierbörse war der letzte Handelstag der 01.07.2011. Die

Daten vom Börsenplatz Stuttgart müssen Sie bitte dort erfragen, da wir zu

anderen Börsenplätze außer Frankfurt und Xetra keine Aussagen treffen

können.

Bei weiteren Fragen wenden Sie sich bitte an die innerhalb Deutschlands

gebührenfreie Rufnummer 0800-2302023.

Aus dem Ausland erreichen Sie uns unter +49 69 / 211-11310.

Mit freundlichen Grüßen

Uschi Vormbaum

Handelsüberwachungsstelle der

Frankfurter Wertpapierbörse

----------------------------------------------------------------------------

Frankfurter Wertpapierbörse

Management Board/Geschäftsführer:

Frank Gerstenschläger (Chairman/Vorsitzender),

Rainer Riess (Deputy Chairman/stellv. Vorsitzender),

Roger Müller.

-----------------------------------------

Diese E-Mail enthaelt vertrauliche oder rechtlich ....

The information contained in this message is confidential .....

Legally required information for business correspondence/

Gesetzliche Pflichtangaben fuer Geschaeftskorrespondenz:

http://deutsche-boerse.com/letterhead

Von:huest@deutsche-boerse.com

An: ....................@t-online.de

Betreff:Re: Petrohunter Energy ISIN: US71649T1043 (Call ID:........)

Datum:21.07.2011, 12:11

Sehr geehrter Herr ...............,

bei dem von Ihnen genannten Wertpapier Petrohunter Energy, ISIN

US71649T1043, Börsenkürzel D7E, war auf der elektronischen

Handelsplattform Xetra der letzte Handelstag der 27.05.2011. An der

Frankfurter Wertpapierbörse war der letzte Handelstag der 01.07.2011. Die

Daten vom Börsenplatz Stuttgart müssen Sie bitte dort erfragen, da wir zu

anderen Börsenplätze außer Frankfurt und Xetra keine Aussagen treffen

können.

Bei weiteren Fragen wenden Sie sich bitte an die innerhalb Deutschlands

gebührenfreie Rufnummer 0800-2302023.

Aus dem Ausland erreichen Sie uns unter +49 69 / 211-11310.

Mit freundlichen Grüßen

Uschi Vormbaum

Handelsüberwachungsstelle der

Frankfurter Wertpapierbörse

----------------------------------------------------------------------------

Frankfurter Wertpapierbörse

Management Board/Geschäftsführer:

Frank Gerstenschläger (Chairman/Vorsitzender),

Rainer Riess (Deputy Chairman/stellv. Vorsitzender),

Roger Müller.

-----------------------------------------

Diese E-Mail enthaelt vertrauliche oder rechtlich ....

The information contained in this message is confidential .....

Legally required information for business correspondence/

Gesetzliche Pflichtangaben fuer Geschaeftskorrespondenz:

http://deutsche-boerse.com/letterhead

Antwort auf Beitrag Nr.: 41.823.574 von auriga am 21.07.11 13:50:16http://www.finanztreff.de/kurse_einzelkurs_detail,i,304589.h…

Zitat von xsusi: Die werden den Handel eingestellt haben weil kaum Handel stattfindet...

Ich würde sagen, bei dem aktuellen spärlichen trading-Aufkommen in Petrohunter reicht die Stuttgarter Liquität allemal aus...falls irgendwann in PHUN mal wieder die Post abgehen sollte, werden sich andere Börsen auch wieder anschließen, inclusive L und S, da bin ich sicher...falls das was wird mit PHUN......

Testtrading in Stuttgart , I quess...

, I quess... ...die Liquidität unserer schwäbischen fReunde hält gnadenlos stand...

...die Liquidität unserer schwäbischen fReunde hält gnadenlos stand...

Stuttgart

Times & Sales

http://www.finanztreff.de/kurse_einzelkurs_times,i,304589.ht…

http://www.finanztreff.de/kurse_einzelkurs_detail,i,304589.h…

, I quess...

, I quess... ...die Liquidität unserer schwäbischen fReunde hält gnadenlos stand...

...die Liquidität unserer schwäbischen fReunde hält gnadenlos stand...

Stuttgart

Times & Sales

Zeit Kurs Volumen

13:27:42 0,010 950

12:54:55 0,010 1250

11:55:53 0,010 250

10:19:50 0,010 3000

08:18:07 0,012 0

http://www.finanztreff.de/kurse_einzelkurs_times,i,304589.ht…

http://www.finanztreff.de/kurse_einzelkurs_detail,i,304589.h…

Zu der Handelseinstellung in Frankfurt am Main bezüglich XETRA und FFM-XETRA fällt mir zusätzlich in der Tat ein, dass wir auch an der OTC BB eine Ablöschung von PHUN miterleben durften....dieses hatte in New York damit zu tun, dass zu wenig bids und asks reinkamen in die OTC BB, die damit ihre festen Vorgaben hatte, sobald ein gewisser Bereich geentert wird, ist automatisch Schluss...dies war in New York dadurch zustande gekommen, dass die broker-dealer keinen Bock mehr auf die OTC BB hatten und zur OTC MM G gewechselt sind wie beschrieben...ich denke in FFM verhält es sich ähnlich, Susi’s quite right... in New York kann die OTC BB jederzeit reaktiviert werden -- ja, ich weiß, auch das habe ich schon gebracht -- und ähnlich verhält es sich auch mit FRankfurt, als auch mit M und B...etc...wann haben die Schwaben die Schnauze auch voll?

die Schnauze auch voll?

die Schnauze auch voll?

die Schnauze auch voll?

Nicht dass die sich zunehmend verarscht fühlen...0,010...250.........0,010...950............und so, und dann sagen...das warsch freunde...adele

HESS REPORTS ESTIMATED RESULTS FOR THE SECOND QUARTER OF 2011

Second Quarter Highlights:

• Net income was $607 million, up from $375 million in the second quarter of 2010

• Net cash provided by operating activities was $1,689 million, up from $981 million in

the second quarter of 2010

• Oil and gas production was 372,000 barrels of oil equivalent per day, compared with

415,000 in the second quarter of 2010

• Capital and exploratory expenditures were $1,490 million, up from $963 million in the

second quarter of 2010

NEW YORK, July 27, 2011 -- Hess Corporation (NYSE: HES) reported net income of

$607 million for the second quarter of 2011 up from $375 million for the second quarter of

2010. The after-tax income (loss) by major operating activity was as follows:

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9M…

http://phx.corporate-ir.net/phoenix.zhtml?c=101801&p=irol-ev…

Second Quarter Highlights:

• Net income was $607 million, up from $375 million in the second quarter of 2010

• Net cash provided by operating activities was $1,689 million, up from $981 million in

the second quarter of 2010

• Oil and gas production was 372,000 barrels of oil equivalent per day, compared with

415,000 in the second quarter of 2010

• Capital and exploratory expenditures were $1,490 million, up from $963 million in the

second quarter of 2010

NEW YORK, July 27, 2011 -- Hess Corporation (NYSE: HES) reported net income of

$607 million for the second quarter of 2011 up from $375 million for the second quarter of

2010. The after-tax income (loss) by major operating activity was as follows:

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9M…

http://phx.corporate-ir.net/phoenix.zhtml?c=101801&p=irol-ev…

hallo auriga

Sollten nicht heuer (da letztes Jahr wegen Wetter verschoben) endlich die S 1 Bohrungen durchgeführt werden. Ist da was im Gange ?

Sollten nicht heuer (da letztes Jahr wegen Wetter verschoben) endlich die S 1 Bohrungen durchgeführt werden. Ist da was im Gange ?

hallo corona...die aktuellste info aus erster hand ist sicherlich die von rob selbst ende juni...jamesL hat über einen private investors call berichtet...

This is what Rob reported: There is still about 8 inches of water covering the Shenandoah-1 well. He expects the rig will be on the well by the end of July. After they finish drilling to the target depth, the crew will then come in to test 5 levels with flow rates for each level. After the flow rates are completed and fully documents (I believe with some planned fracturing) they will then re-cap the well. Rob stated that the purpose of the Shenandoah-1 well is to obtain additional intelligence that will tell them where to drill next. This information will be shared with Hess.

A press release is coming that will announce the completion of the participation agreement and joint operating agreement arrangements with Hess. Hess will then commence with their US$40 million 2D seismic work program, which will go well (no pun intented) into next year (2012). The full details of the agreement can be found in the Letter of Intent.

http://agoracom.com/ir/Falcon/forums/discussion/topics/48988…

bei dir alles klar?...see you...auriga

This is what Rob reported: There is still about 8 inches of water covering the Shenandoah-1 well. He expects the rig will be on the well by the end of July. After they finish drilling to the target depth, the crew will then come in to test 5 levels with flow rates for each level. After the flow rates are completed and fully documents (I believe with some planned fracturing) they will then re-cap the well. Rob stated that the purpose of the Shenandoah-1 well is to obtain additional intelligence that will tell them where to drill next. This information will be shared with Hess.

A press release is coming that will announce the completion of the participation agreement and joint operating agreement arrangements with Hess. Hess will then commence with their US$40 million 2D seismic work program, which will go well (no pun intented) into next year (2012). The full details of the agreement can be found in the Letter of Intent.

http://agoracom.com/ir/Falcon/forums/discussion/topics/48988…

bei dir alles klar?...see you...auriga

weekend really got me i guess...so here’s one for w : o.... .... http://www.youtube.com/watch_popup?v=oJdsGQ5n8_I

.... http://www.youtube.com/watch_popup?v=oJdsGQ5n8_I

...lets have a good one...cheers

.... http://www.youtube.com/watch_popup?v=oJdsGQ5n8_I

.... http://www.youtube.com/watch_popup?v=oJdsGQ5n8_I...lets have a good one...cheers

...not only the weekend at last, but also w : o got me a little bit higher, as well as of course falcon and phunny, proceeding in time finally...so far...but just staying on w : o...being critical all the time, I now have to confess, well done w : o, views are working exactly now, and now it’s just us to get higher reading frequencies, not you any more...but which surely will appear in time if only we will succeed operationally in due course, but of course this is written in the stars...isn’t it...for now what is being to be said is congrats...well done w : o, very very well done ...like it... ...http://www.youtube.com/watch_popup?v=_xe3cwkLY5c

...http://www.youtube.com/watch_popup?v=_xe3cwkLY5c

...http://www.youtube.com/watch_popup?v=_xe3cwkLY5c

...http://www.youtube.com/watch_popup?v=_xe3cwkLY5c

what’s that...muss flippen holen gehen...für alle frühaufsteher bitte ich um entschuldigung...lasst euch den kaffee schmecken...montag um 5 bin ich wieder bei euch...sollte ich weniger posten?...see you on facebook.... ..... http://www.youtube.com/watch?v=hKaIehw4ItY&feature=related

..... http://www.youtube.com/watch?v=hKaIehw4ItY&feature=related

..... http://www.youtube.com/watch?v=hKaIehw4ItY&feature=related

..... http://www.youtube.com/watch?v=hKaIehw4ItY&feature=related

Antwort auf Beitrag Nr.: 41.869.669 von auriga am 31.07.11 07:21:04guess i pressed the wrong button here on sunday.........being like watching paint dry, in these days, how tensleep expressed it, especially also if one takes a look at the headings on the farmer’s board.........some fracks to be prepared and undertaken not far from daly water in the australian outback...that will take time and a long long phase of shooting seismic by hess will take time as well.........but stock market and economics is a broad field and one also can follow FO and PHUN quasi en passant........btw...there’s no more xetra-trading of falcon now just the same as PHUN

http://www.otcmarkets.com/stock/phun/quote

http://www.finanztreff.de/kurse_einzelkurs_boersen,i,303964.…

http://tmx.quotemedia.com/quote.php?qm_symbol=FO&locale=EN

http://www.finanztreff.de/kurse_einzelkurs_boersen,i,6285.ht…

http://www.otcmarkets.com/stock/phun/quote

http://www.finanztreff.de/kurse_einzelkurs_boersen,i,303964.…

http://tmx.quotemedia.com/quote.php?qm_symbol=FO&locale=EN

http://www.finanztreff.de/kurse_einzelkurs_boersen,i,6285.ht…

fundsache in den colorado energy news unter oil and gas headlines

Company Accused of Walking

The Colorado Oil and Gas Conservation Commission is investigating an oil and gas company accused of walking away from wells in Rio Blanco County. West Hawk Energy is accused of leaving behind eight wells needing attention and pads that must be cleaned up and reclaimed.

http://www.canadianbusiness.com/article/37228--energy-compan…

Ja, also, das wäre Petro nicht passiert...was wird aus den buckskin assets...ich kann mir nicht vorstellen dass es das in piceance gewesen sein soll...wie war das... patience...patience my ass.........i’m going to kill something......... http://cgi.ebay.com/PATIENCE-MY-ASS-IM-GOING-KILL-SOMETHING-…... http://agoracom.com/ir/Falcon/forums/discussion/topics/49388…" target="_blank" rel="nofollow ugc noopener">http://agoracom.com/ir/Falcon/forums/discussion/topics/49388…

Company Accused of Walking

The Colorado Oil and Gas Conservation Commission is investigating an oil and gas company accused of walking away from wells in Rio Blanco County. West Hawk Energy is accused of leaving behind eight wells needing attention and pads that must be cleaned up and reclaimed.

http://www.canadianbusiness.com/article/37228--energy-compan…

Ja, also, das wäre Petro nicht passiert...was wird aus den buckskin assets...ich kann mir nicht vorstellen dass es das in piceance gewesen sein soll...wie war das... patience...patience my ass.........i’m going to kill something......... http://cgi.ebay.com/PATIENCE-MY-ASS-IM-GOING-KILL-SOMETHING-…... http://agoracom.com/ir/Falcon/forums/discussion/topics/49388…" target="_blank" rel="nofollow ugc noopener">http://agoracom.com/ir/Falcon/forums/discussion/topics/49388…

Falcon Oil & Gas Ltd. to Present at EnerCom's The Oil & Gas Conference 16

DENVER, COLORADO--(Marketwire - Aug. 2, 2011) - Falcon Oil Gas Ltd. (TSX VENTURE:FO) announced today that the Company will be presenting at EnerCom's The Oil and Gas Conference 16 in Denver, Colorado. Falcon's presentation is scheduled to begin at 4:50 p.m. MDT (6:50 p.m. EDT) on Wednesday, Aug. 17.

The slide presentation and a link to the live webcast will be available through the Company's website at www.falconoilandgas.com on the day of the presentation.

About Falcon Oil Gas Ltd.

Falcon Oil Gas Ltd. is an international oil and gas exploration and production company, headquartered in Denver, Colorado, incorporated in British Columbia, Canada, and trading on the TSX Venture Exchange under the symbol "FO." The company specializes in the business of unconventional and conventional oil and gas exploration and production and holds interests in prospective properties in Australia, Hungary, and South Africa.

For additional information about Falcon Oil Gas, please visit our website at www.falconoilandgas.com.

Certain information in this press release may constitute forward-looking information. This information is based on current expectations that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. Falcon assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to Falcon. Additional information identifying risks and uncertainties is contained in Falcon's filings with the Canadian securities regulators, which filings are available at www.sedar.com .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

http://tmx.quotemedia.com/article.php?newsid=43513327&qm_sym…

DENVER, COLORADO--(Marketwire - Aug. 2, 2011) - Falcon Oil Gas Ltd. (TSX VENTURE:FO) announced today that the Company will be presenting at EnerCom's The Oil and Gas Conference 16 in Denver, Colorado. Falcon's presentation is scheduled to begin at 4:50 p.m. MDT (6:50 p.m. EDT) on Wednesday, Aug. 17.

The slide presentation and a link to the live webcast will be available through the Company's website at www.falconoilandgas.com on the day of the presentation.

About Falcon Oil Gas Ltd.

Falcon Oil Gas Ltd. is an international oil and gas exploration and production company, headquartered in Denver, Colorado, incorporated in British Columbia, Canada, and trading on the TSX Venture Exchange under the symbol "FO." The company specializes in the business of unconventional and conventional oil and gas exploration and production and holds interests in prospective properties in Australia, Hungary, and South Africa.

For additional information about Falcon Oil Gas, please visit our website at www.falconoilandgas.com.

Certain information in this press release may constitute forward-looking information. This information is based on current expectations that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. Falcon assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to Falcon. Additional information identifying risks and uncertainties is contained in Falcon's filings with the Canadian securities regulators, which filings are available at www.sedar.com .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

http://tmx.quotemedia.com/article.php?newsid=43513327&qm_sym…

Form 10-Q - Quarterly report [Sections 13 or 15(d)] SEC Accession No. 0001144204-11-043650 ---- Filing Date 2011-08-03 ---- Accepted 2011-08-03 15:26:37 ----Documents 9---- Period of Report 2011-06-30 ----Filing Date Changed 2011-08-03 ---- Interactive Data

.......................................................................................................................................................

Interactive Data

http://www.sec.gov/cgi-bin/viewer?action=view&cik=1298824&ac…

Documents

http://www.sec.gov/Archives/edgar/data/1298824/0001144204110…

SEC filings

http://www.sec.gov/cgi-bin/browse-edgar?company=petrohunter&…

.......................................................................................................................................................

Interactive Data

http://www.sec.gov/cgi-bin/viewer?action=view&cik=1298824&ac…

Documents

http://www.sec.gov/Archives/edgar/data/1298824/0001144204110…

SEC filings

http://www.sec.gov/cgi-bin/browse-edgar?company=petrohunter&…

Antwort auf Beitrag Nr.: 41.893.809 von auriga am 04.08.11 17:30:34After reading the narrowly mixed new Quarterly Report of PHUN in terms of Q 3 FY 2011 , one could easily imagine that PHUN is quite 2000 light years from home ...thus far in HD... as to lower digital subscriber line, just turn down HD to avoid interruptions ...otherwise with obligate interruptions it’s actually getting bloody fucking

Ich dachte mir, ich bringe die aktuelle Übersicht noch kurz auf den Stand. Bei den beiden größeren charts hatte ich eine Möglichkeit angetestet, die den chart am Einstellungstag arretiert, das ist aber in diesem Zusammenhang hier weniger zu beabsichtigen letzendlich, deshalb jetzt die Korrektur mit den weiterlaufenden Jahrescharts bei PHUN und FO. Man hat diese zwar sowieso parat, eine Übersicht in der Zusammenstellung bietet aber einen zusätzlichen Zugriff gleich im thread, falls man ab und an einmal hier reinschaut...jedenfalls dieser Tage...

Bei Falcon und Petrohunter scheint mir alles OK zu sein so weit, so weit man das eben im aktuellen Ablauf erwarten darf, der Q 3 von PHUN ist auf dem Stand, nur operative Erfolge können PHUN letztendlich aus den SChulden herausbringen, und das geht ohne Frage schon los mit dem aktuellen Testen. Das aktuelle testing ist ein erster weiterer WEgweiser und Hess hat dann 50 % Möglichkeiten den Weg mit seismic weiter zu gestalten bis zur Entscheidung des operativen Fortschreitens etc...

Ein leichtes Abfallen bisher der Kurse von Petrohunter und Falcon hat natürlich auch mit den großen Marktlagen zu tun, deren weitere Entwicklung schon offen ist, klar, ich erwarte aber für mich eine Konsolidierung im Laufe dieser Woche der Weltmärkte, na ja, schauen wir halt mal...

Was soll S&P anderes machen, als etwa die USA nach vorgegebenen und nachvollziehbaren Kritien einzuschätzen? Das erwarten wir generell von allen zu begutachtendnen Werten. In Europa ist nun Italien dran und darüber hinaus hielten gesamteuropäisch Barrosos Nerven den aktuellen Anforderungen nicht stand, was ist mit uns Börsianern, wir müssen unseren mentalen Ansatz an der Börse auch stetig immer wieder ein bisschen stärken und verbessern.

Also, es ist jetzt nicht der Zeitpunkt eine Seminararbeit zu schreiben über FO und PHUN und die Weltmarktlage bezüglich USA, China, Europa usw...ich muss morgen wieder früh raus...lach...lach

Wünsche einen guten Wochenstart und bis die Tage

http://tmx.quotemedia.com/quote.php?qm_symbol=FO&locale=EN

http://www.otcmarkets.com/stock/FOLGF/quote

http://www.finanztreff.de/kurse_einzelkurs_boersen,i,6285.ht…

Bei Falcon und Petrohunter scheint mir alles OK zu sein so weit, so weit man das eben im aktuellen Ablauf erwarten darf, der Q 3 von PHUN ist auf dem Stand, nur operative Erfolge können PHUN letztendlich aus den SChulden herausbringen, und das geht ohne Frage schon los mit dem aktuellen Testen. Das aktuelle testing ist ein erster weiterer WEgweiser und Hess hat dann 50 % Möglichkeiten den Weg mit seismic weiter zu gestalten bis zur Entscheidung des operativen Fortschreitens etc...

Ein leichtes Abfallen bisher der Kurse von Petrohunter und Falcon hat natürlich auch mit den großen Marktlagen zu tun, deren weitere Entwicklung schon offen ist, klar, ich erwarte aber für mich eine Konsolidierung im Laufe dieser Woche der Weltmärkte, na ja, schauen wir halt mal...

Was soll S&P anderes machen, als etwa die USA nach vorgegebenen und nachvollziehbaren Kritien einzuschätzen? Das erwarten wir generell von allen zu begutachtendnen Werten. In Europa ist nun Italien dran und darüber hinaus hielten gesamteuropäisch Barrosos Nerven den aktuellen Anforderungen nicht stand, was ist mit uns Börsianern, wir müssen unseren mentalen Ansatz an der Börse auch stetig immer wieder ein bisschen stärken und verbessern.

Also, es ist jetzt nicht der Zeitpunkt eine Seminararbeit zu schreiben über FO und PHUN und die Weltmarktlage bezüglich USA, China, Europa usw...ich muss morgen wieder früh raus...lach...lach

Wünsche einen guten Wochenstart und bis die Tage

http://tmx.quotemedia.com/quote.php?qm_symbol=FO&locale=EN

http://www.otcmarkets.com/stock/FOLGF/quote

http://www.finanztreff.de/kurse_einzelkurs_boersen,i,6285.ht…

PS ►Die OTC markets group Seiten hängen penetrant und die real time quotes werden zur Zeit nur eingeschränkt angezeigt, wenn überhaupt, auch die Übersicht nur mit Verzögerung...dies hängt mit dem Umbau der Seite zusammen...im übrigen wird ein sponsoring von den companies gefordert, an die wir uns als Investoren wenden sollen, falls sie es selbst nicht merken oder wahrnehmen, dass dies jetzt nötig erscheint...im übrigen haben auch die broker-dealer Möglichkeiten die quotes ausführlicher einzustellen...man kann abwarten wie sich das in der Anzeige entwickelt oder aber auch jetzt schon an PHUN und FO schreiben, dass sie sich kümmern sollen bezüglich OTC MM G...interessant dieser Tage, was man auch in der finanztreff-anzeige erkennen kann, dass der FO-Handel in USA pinkmäßig höher ist als in Toronto...die Briten handeln ja z B auch ganz gerne über die Pink sheets FO und PHUN über OTC MM G dann jetzt sowieso, vorher OTCBB

Bezüglich des Webcasts morgen ( inthiscase hat ja auch nochmal drauf hingewiesen) erscheint auf der Falcon-Seite eine neue Präsentation von Rod Wallis, ganz nett zu blättern, enthält einige neue Bildchen ( z B zeigt eines die weitere Ausdehnung des Wassers um den S#1 herum im outback nach dem Jahrhundertregen) und en paar Zusatzinfos...06 50 PM Eastern Daylight Time, das dürfte ja bei uns 00 50 am Donnerstag(Morgen) sein, wenn ich das jetzt richtig sehe...na ist doch immer mal ganz nett, so ne Präsentation, und ich denke mal, auch wichtig, immer wieder neue Werbung zu machen und so( obwohl ja Marco jetzt endlich Taten sehen will :-) ). Also wenn das so spät ist, weiß ich jetzt noch gar nicht ob ich mir das direkt anhöre...am DO um 05 00 aufstehen...na ja...mal schauen, oder eben dann die Aufzeichnung

Falcon Oil & Gas Ltd. to Present at EnerCom's The Oil & Gas Conference 16

DENVER, COLORADO--(Marketwire - Aug. 2, 2011) - Falcon Oil Gas Ltd. (TSX VENTURE:FO) announced today that the Company will be presenting at EnerCom's The Oil and Gas Conference 16 in Denver, Colorado. Falcon's presentation is scheduled to begin at 4:50 p.m. MDT (6:50 p.m. EDT) on Wednesday, Aug. 17.

The slide presentation and a link to the live webcast will be available through the Company's website at www.falconoilandgas.com on the day of the presentation.

Falcon Oil & Gas Ltd. to Present at EnerCom's The Oil & Gas Conference 16

DENVER, COLORADO--(Marketwire - Aug. 2, 2011) - Falcon Oil Gas Ltd. (TSX VENTURE:FO) announced today that the Company will be presenting at EnerCom's The Oil and Gas Conference 16 in Denver, Colorado. Falcon's presentation is scheduled to begin at 4:50 p.m. MDT (6:50 p.m. EDT) on Wednesday, Aug. 17.

The slide presentation and a link to the live webcast will be available through the Company's website at www.falconoilandgas.com on the day of the presentation.

ps : habe mir das luftbild nach dem regen gerade nochmal angeschaut und es bestätigt sich, was texas mal an corona geschrieben hat, »wanns im outback emoal richtig schifft, kommst nur mid em hubschrauber zur site«

in terms of the beetaloo basin

Australia – We’re not in Kansas

●Remote

●Service areas can be thousands of miles away

●Existing Rail, Road and even a small gas pipeline

●In 7 million acres in Australia there are 14 land owners- “kitchen tables” not “town halls” Ranches and Traditional Owners

Australia – What’s next

●Deal encompasses EP76, EP98 and EP117, excluding (yellow) approx. 100,000 acres of EP98 around Shendandoah-1 and EP99

●Hess to acquire between 3000 and 4000km 2D seismic starting in 2011

●Elects to go forward to earn 62.5%

●Hess drills and evaluates five wells

Australia – Unique Challenges

●Falcon drilled the Shenandoah#1 in 2009 in the “dry season”,

●....but lack of equipment in Australia due to flooding in Eastern Australia prevented testing in 2010

●It’s dry for 6 months and wet for 6 months....usually....

●Wettest year in the Northern Territries for almost 100 years

Australia – One step at a time

●Getestet sollen werden Lower Kyalla Unconventional Wet Shale Gas, Moroak Sandstone Wet Gas und Velkerri Unconventional Dry Shale Gas.

●Moroak sandstone befindet sich dabei zwischen Kyalla und Velkerri.

●In 2009 wurde der Shenandoah#1 auf eine Tiefe von 2714 Metern gebracht.

●Offset water wells will be sampled and monitored by independent 3rd party before, during and after testing

PS: die pdf von Rod (früher Petrohunter) wurde erstellt am 03 08 2011 16:23:58...come and get it Rod ...http://www.youtube.com/watch_popup?v=Bk57K4OGrAg&feature=fee…

...http://www.youtube.com/watch_popup?v=Bk57K4OGrAg&feature=fee…

may you do well[/url]

Australia – We’re not in Kansas

●Remote

●Service areas can be thousands of miles away

●Existing Rail, Road and even a small gas pipeline

●In 7 million acres in Australia there are 14 land owners- “kitchen tables” not “town halls” Ranches and Traditional Owners

Australia – What’s next

●Deal encompasses EP76, EP98 and EP117, excluding (yellow) approx. 100,000 acres of EP98 around Shendandoah-1 and EP99

●Hess to acquire between 3000 and 4000km 2D seismic starting in 2011

●Elects to go forward to earn 62.5%

●Hess drills and evaluates five wells

Australia – Unique Challenges

●Falcon drilled the Shenandoah#1 in 2009 in the “dry season”,

●....but lack of equipment in Australia due to flooding in Eastern Australia prevented testing in 2010

●It’s dry for 6 months and wet for 6 months....usually....

●Wettest year in the Northern Territries for almost 100 years

Australia – One step at a time

●Getestet sollen werden Lower Kyalla Unconventional Wet Shale Gas, Moroak Sandstone Wet Gas und Velkerri Unconventional Dry Shale Gas.

●Moroak sandstone befindet sich dabei zwischen Kyalla und Velkerri.

●In 2009 wurde der Shenandoah#1 auf eine Tiefe von 2714 Metern gebracht.

●Offset water wells will be sampled and monitored by independent 3rd party before, during and after testing

PS: die pdf von Rod (früher Petrohunter) wurde erstellt am 03 08 2011 16:23:58...come and get it Rod

...http://www.youtube.com/watch_popup?v=Bk57K4OGrAg&feature=fee…

...http://www.youtube.com/watch_popup?v=Bk57K4OGrAg&feature=fee…may you do well[/url]

Hier also nochmal der link zu der pdf von Falcon zur Präsentation heute in Denver August 17, 2011 Falcon Presentation from EnerCom's The Oil & Gas Conference 16....der webcast-zugang ist wohl noch in Arbeit...EnerCom Live Webcast, August 17, 2011 at 6:50 EST(die wallis-präsentation von gestern erscheint nun korrekt unter Platts Oil & Gas Shale Developer - June 2011, war gestern noch unter enercom eingeordnet...macht ja nichts...jetzt erst mal bayern -- zürich schauen...ist ja jetzt fast die komplette nationalelf unter heynckes(lach)...neuer...botang badstuber lahm, hinten fehlt nur noch ein rechter außenverteidiger und wir haben die komplette national-abwehr( ja, ich weiß mertesacker, friedrich, hummels und andere sind auch noch da))http://www.falconoilandgas.com/

falls ich es jetzt richtig verstanden habe, soll das shenandoh-testing dann im vierten quartal 2011 stattfinden...jetzt im august 2011 -- wie man ja auch auf den bildern sieht -- noch ne ganze menge wasser, also eine leichte verzögerung, aber man ist am ball.........kurz und trocken durchpräsentiert von rob -- auch ahlbrandt im saal unter den anwesenden -- fand ich ganz gut gemacht( obwohl ich schon ziemlich müde bin)...man liest sich

Gerade jetzt wo operativ die SAche in Gang kommt in Australien notiert PHUN auf neuen Tiefständen, auch geschuldet der Gesamtmarktentwicklung, die sich noch nicht wieder eingependelt hat, die großen Märkte nach wie vor verunsichert, Rezession antizipiert, so auch bezüglich DAX, die Banken könnten sich wieder misstrauen, die Kreditvergabe erneut hängen, etc

Bei PHUN ist wichtig zu wissen, dass die drei neuen permits von Sweetpea PHUN enorm voranbringen können in Verbindung mit dem 50 % farm-in von Paltar in Australien. In 2012 könnten die ersten beiden Genehmigungen kommen parallel zu einem floating von Paltar durch Bruner an der ASX.

Wie immer schon bei Petrohunter gab es weitere options für Directors im Bereich USD 0,15 doch schon basal zumindest ganz ambitioniert. Hält PHUN durch bis zu den Sweetpea-permits ergibt sich eine ganz neue Situation, gelingt es Bruner Partner in die Exploration in die outskirts von Beetaloo zu holen.

Was wäre wenn Sweetpea gar ein listing an der ASX gelänge? Wie ist der Zusammenhang zusätzlich mit Sinova? Schulden sind fun hat Schäfer mal geschrieben, na ja, er hat jetzt ne neue Firma, Partner für finanzielle Freiheit, und auch schon so manche Schuldensituation überstanden, genauso wie Kosto, kleine Randbemerkung, nur so, ich denke dabei auch an meine eigene Situation, in der ebenfalls so einige Punkte auch zur Zeit wieder noch zu den ungelösten Problemen gehören.

Es gibt in Petrohunter 187 Anteilseigner of record, bei denen an sich die Musik spielt. PHUN muss 1 2 3 Jahre durchhalten, und die Situation kann ganz anders aussehen.

Man kann an sich nur hoffen dass sich PHUN mit dem testing von Falcon Australia etwas stabilisieren kann und erneut erst mal über den Winter kommt.

Wäre ja schade, wenn jetzt wo das core asset zu laufen beginnt PHUN schwächeln würde. Gerade jetzt brauchte es das nicht. Aber so ist Börse.

............

............

Wo ist eigentlich River

Überhaupt muss man sagen, dass die Diskussion in Falcon und Petrohunter zur Zeit etwas eingeschlafen ist. Schade eigentlich. Wo gibt’s schon zwei pennystocks, die zusammen fast ne Milliarde USD verbraten und schwere assets erfolgreich verkauft haben und trotzdem mit Exxon, Hess und vielleicht bald Shell kommunizieren, und zwar geschäftlich, am Rande der Existenz, was ganz besonders für PHUN gilt, und sich gleichzeitig anheischig machen, mit Gorgon zu konkurrieren? Wo gibt’s denn so was. Was macht Oring? Verkauft der gerade wieder FO shares? Unglaublich eigentlich

Bei PHUN ist wichtig zu wissen, dass die drei neuen permits von Sweetpea PHUN enorm voranbringen können in Verbindung mit dem 50 % farm-in von Paltar in Australien. In 2012 könnten die ersten beiden Genehmigungen kommen parallel zu einem floating von Paltar durch Bruner an der ASX.

Wie immer schon bei Petrohunter gab es weitere options für Directors im Bereich USD 0,15 doch schon basal zumindest ganz ambitioniert. Hält PHUN durch bis zu den Sweetpea-permits ergibt sich eine ganz neue Situation, gelingt es Bruner Partner in die Exploration in die outskirts von Beetaloo zu holen.

Was wäre wenn Sweetpea gar ein listing an der ASX gelänge? Wie ist der Zusammenhang zusätzlich mit Sinova? Schulden sind fun hat Schäfer mal geschrieben, na ja, er hat jetzt ne neue Firma, Partner für finanzielle Freiheit, und auch schon so manche Schuldensituation überstanden, genauso wie Kosto, kleine Randbemerkung, nur so, ich denke dabei auch an meine eigene Situation, in der ebenfalls so einige Punkte auch zur Zeit wieder noch zu den ungelösten Problemen gehören.

Es gibt in Petrohunter 187 Anteilseigner of record, bei denen an sich die Musik spielt. PHUN muss 1 2 3 Jahre durchhalten, und die Situation kann ganz anders aussehen.

Man kann an sich nur hoffen dass sich PHUN mit dem testing von Falcon Australia etwas stabilisieren kann und erneut erst mal über den Winter kommt.

Wäre ja schade, wenn jetzt wo das core asset zu laufen beginnt PHUN schwächeln würde. Gerade jetzt brauchte es das nicht. Aber so ist Börse.

Wo ist eigentlich River

Überhaupt muss man sagen, dass die Diskussion in Falcon und Petrohunter zur Zeit etwas eingeschlafen ist. Schade eigentlich. Wo gibt’s schon zwei pennystocks, die zusammen fast ne Milliarde USD verbraten und schwere assets erfolgreich verkauft haben und trotzdem mit Exxon, Hess und vielleicht bald Shell kommunizieren, und zwar geschäftlich, am Rande der Existenz, was ganz besonders für PHUN gilt, und sich gleichzeitig anheischig machen, mit Gorgon zu konkurrieren? Wo gibt’s denn so was. Was macht Oring? Verkauft der gerade wieder FO shares? Unglaublich eigentlich

Paltar scheint die erste Company in der neu gegründeten Wotan Group zu sein, der sich Bruner näher annimmt, und wie könnte es auch anders sein, denn das Kern-Asset von Petrohunter als auch von Sub Sweetpea ist auch das erste Kernasset der Wotan Group über Paltar, nämlich das Beetaloo Basin.

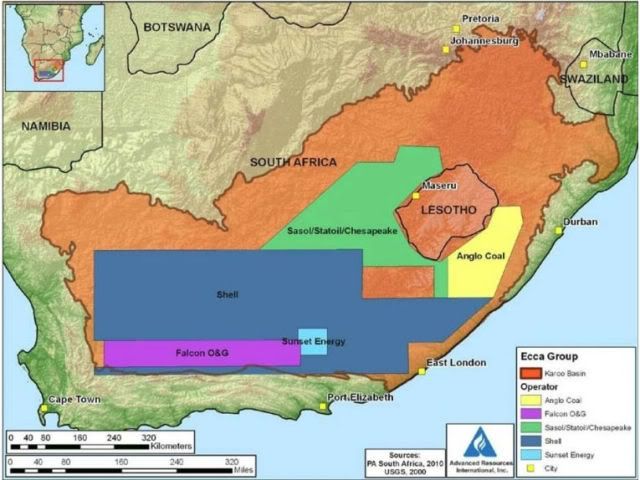

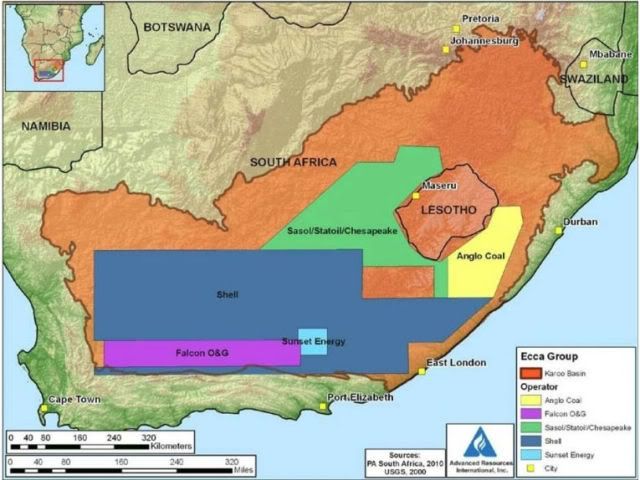

Paltar Petroleum is focused on the acquisition of, and exploration for, ‘unconventional’ oil and gas projects around the world. The company’s management, led by Chief Executive Officer, Marc A. Bruner, has a track record of identifying large unconventional projects worldwide. Such projects have included the Mako Through (40 TCF) in Hungary, the Karoo Basin (30 TCF) in South Africa, the Uinta Basin (6.2 TCF) in Utah and the Pinedale Anticline (23.5 TCF) in the Green River Basin, Wyoming and the Pennaco Energy project (2 TCF) in the Powder River Basin, all located in North America, and the Beetaloo Basin (estimated recoverable potential reserves of 64 TCF and 17 billion barrels of oil) located in the Northern Territory, 600 km south of Darwin, Australia. Paltar, through its joint venture agreement with 50% partner, Sweetpea Petroleum Pty Ltd, has applied for 3 licences in the Beetaloo Basin (EPA 136, EPA 143 and EPA 197).

Paltar’s tenement applications are located around 4 other exploration permits held by Falcon Oil & Gas Australia Limited. Paltar believes that Falcon has discovered one of the world’s largest in place oil and gas deposits. Independent engineering firm Ryder Scott report states an estimated potential resource of approximately 500 billion barrels of oil, and 500 trillion cubic feet of gas in place. There are two world class shales over 800 metres thick. The sweet spots are remarkably consistent in thickness and are regionally pervasive. Paltar believes these shales and sweet spots extend into its adjacent property of over 2 million acres.

Paltar’s objective will involve entering strategic joint ventures with major oil and gas companies, including up-front payments and significant work programs to progress projects towards production.

The Beetaloo Basin, located around 600km south of Darwin in Australia’s Northern Territory, is one of the few remaining virtually unexplored, onshore sedimentary basins. The basin is a Pre-Cambrian Basin that has more than 3000 metres of sediment column in which the identification of source rocks has been confirmed on the two unconventional oil and gas generating geological formations of the Kyalla and Velkerri Shale. Each source rock is widespread, with thickness of up to 800 metres. There are also indications that high quality conventional reservoirs exist.

Beetaloo’s Exploration History

In the 1980’s a subsidiary of Rio Tinto drilled 12 wells across the Beetaloo Basin accumulating over 27,000 feet of core data, and these cores, which were subsequently stored in Northern Territory warehouses, represented the basis of independent information for Ryder Scott’s filed Report with Toronto Stock Exchange (www.sedar.com) in May 2010, which estimated a potential resource of the Beetaloo Basin of 17 billion barrels of recoverable oil and 64 TCF of natural gas.

The technology to develop these types of unconventional oil and gas deposits throughout the world were not developed until the late 1990’s in the United States, principally in the formations of the Barnett Shale in Texas, and the Pinedale Anticline in Wyoming.

Falcon Oil & Gas Australia Limited, a subsidiary of Falcon Oil & Gas Ltd, owns 4 exploration permits EP 98, EP 117, EP 76 and EP 99 in the Beetaloo Basin, and have recently drilled a well called Shenandoah-1 on EP 98.

Paltar believes that Falcon has discovered one of the world’s largest in place oil and gas deposits. The prospectivity of the Beetaloo Basin was confirmed in April 2011 when Hess Corporation (Hess) entered into an agreement to acquire a 62.5% working interest in the Falcon Australia's exploration permits in the Beetaloo Basin with Hess set to undertake a USD $40.0 Million seismic surveying program this year. Hess can then elect to continue to the next phase of work which includes conducting a five well program to further explore the area, beginning in 2012.

Land

The Ministry of Mines and Energy in the Northern Territory is responsible for managing oil and gas operations in the Northern Territory. Paltar, through its Joint Development Agreement with its 50% partner, Sweetpea Petroleum Pty Ltd, has applied for three licences in the Beetaloo Basin (EPA 136, EPA 143 and EPA 197). These tenement applications are located around 4 other exploration permits held by Falcon Oil & Gas Australia Limited.

Regional Infrastructure and Markets

A pipeline corridor, railroad and Stuart Highway run through EPA 143 and near EPA 197 to Darwin. Trucking and rail appear to be the first option to transport products. The current pipeline is too small to be of any significant use for the transport of gas.

However, once commercial operations have demonstrated the viability of gas reserves, it is anticipated a large pipeline will be laid to Darwin to access the existing LNG facilities and planned projects. Access to market for oil production would be much quicker because road train and railroad to Darwin can transport it. Darwin has a deep-water port capable of handling oil production. Oil could be transported to Singapore refineries for processing. Currently, Conoco Phillips’s LNG plant in Darwin Harbor is the only exporter of LNG in Darwin. Sufficient supply exists from Bayu-Udan field in the Timor Sea. Index and its partner Total, also plan to export LNG. Phase one is estimated at 8 million metric tons of LNG per year. It is estimated the plant will be operational by 2015. This also requires building an 850 Km sub-sea pipeline.

What is Unconventional Oil and Gas?

Unconventional oil and gas can be broadly defined as oil and natural gas that cannot be economically exploited using conventional vertical wells. Unconventional reservoirs hold continuous oil and gas accumulations over large areas but, due to their low permeability, have low oil and gas flow rates (in comparison to conventional reservoirs). Due to these low flow rates, unconventional reservoirs were commonly overlooked as commercial sources of natural gas.

New Technologies Paving the Way

Until the early 1990s, the low flow rates of the vast majority of unconventional reservoirs made the oil and gas contained within un-economic to extract. But with the introduction of new technologies, such as horizontal drilling and fracture stimulation, these previously-overlooked sources of gas became more and more economically feasible. These new methods were pioneered in the United States, notably on the Barnett Shale, which is now one of the largest unconventional gas-producing basins in the United States.

Horizontal Drilling and Fracture Stimulation

Horizontal wells drill laterally through the oil and gas reservoir increasing the exposure of the well to the gas accumulation. Generally, horizontal wells can produce up to four times as much as vertical wells, but only cost around three times as much. Fracture stimulation, however, increases gas flow rates by fracturing the source rock through the high pressure injection of a fluid. This fluid contains a ‘proppant’, such as sand, to keep the fractures open when the fluid is extracted, allowing the oil and/or natural gas to flow.

Source: Schlumberger

Board & Management

Marc Alan Bruner - Chairman

Marc A Bruner is a leader in the development of unconventional oil and gas projects worldwide. His track record of identifying large unconventional projects includes the Mako Through (40 TCF) in Hungary, the Karoo Basin (30 TCF) in South Africa, the Uinta Basin (6.2 TCF) in Utah and the Pinedale Anticline (23.5 TCF) in the Green River Basin, Wyoming and the Pennaco Energy project (2 TCF) in the Powder River Basin, all located in North America, and the Beetaloo Basin (estimated recoverable potential reserves of 64 TCF and 17 billion barrels of oil) located in the Northern Territory, 600 km south of Darwin, Australia.

With more than 30 years experience in the industry, Mr Bruner has worked with world renowned geologists, Ben Law and Tom Albrandt to identify unconventional oil and gas opportunities in the United States of America and internationally. Mr Bruner’s major successes have included the development of the Pinedale Anticline in the Green River Basin of western Wyoming, now recognised as the fourth largest unconventional natural gas field in the United States, and the exploration and development of successful coal bed methane properties in the Powder River Basin.

Mr Bruner has founded a number of successful international oil and gas companies including Ultra Petroleum Corporation in 1996, a US$7 billion NYSE company focused on the development of the Pinedale Anticline unconventional oil and gas project, Pennaco Energy in 1997, focused on the exploration and development of unconventional oil and gas leases of coal bed methane properties located in the Powder River Basin, subsequently sold to Marathon Oil for US$500 million, and Falcon Oil and Gas in 2005, a Toronto Stock Exchange listed company which acquires, explores and develops large acreage positions of unconventional oil and gas resources.

With these companies Mr Bruner has negotiated major commercial transactions with global oil and gas companies, Halliburton, Marathon Oil, Exxon Mobil and Hess Corporation.

Most recently, Mr Bruner founded Paltar Petroleum to develop an extensive unconventional oil and gas play in Australia’s Beetaloo Basin, potentially one of the world’s largest untapped shale deposits.

Ben Law – Chief Geologist

Mr Law’s 35 years of research on unconventional gas systems has led to US and international recognition as an expert in basin-centred gas (Tight Gas) and coalbed methane systems. He is renowned for recognising and documenting the occurrence of numerous basin-centred gas systems worldwide, including the Powder River Basin of Wyoming, Greater Green River Basin of Wyoming, Colorado, and Utah, Colombia River Basin in Washington, Timan-Pechora Basin in Russia, Dnieper-Donets Basin in Ukraine, Taranaki Basin in New Zealand and the Beetaloo Basin in Australia.

From 2004-2011 Mr Law worked with Falcon Oil and Gas Ltd where he was responsible for the global search for unconventional hydrocarbon accumulations. During his tenure with Falcon he was instrumental in the identification and acquisition of conventional and unconventional oil and gas properties in Hungary, Romania, Australia, and South Africa.

Mr Law has published more than 195 papers, books and abstracts on petroleum and coal geology and was Founder and Co-Chairman of the American Association of Petroleum Geologists and Co-Chairman from 1997 – 2003. He has received numerous industry accolades including Rocky Mountain Association of Geologists Outstanding Scientist Award, 1997, Robert H.Dott, Sr. Memorial Award for best AAPG Special Publication 2000, honorary editor for the Chinese Oil and Gas Journal from 2004 until present, and in 2010, was an invited speaker at the 376th Xiangshan Science Conference in Beijing, China.

Carmen J (Tony) Lotito – Executive Vice President

Mr. Lotito served during the period 2007 - 2010 as the Executive Vice President - Business Development of Falcon Oil and Gas Ltd, the TSX Venture Exchange-listed Canadian parent and the following Falcon wholly-owned subsidiaries: TXM Oil and Gas Exploration Kft and TXM Marketing Trading & Service, LLC (Hungary); Mako Energy Corporation and Falcon Oil & Gas USA, Inc (USA); and Falcon Oil & Gas Australia Limited (Australia). As part of his tenure with Falcon Oil and Gas Ltd, Mr Lotito also served as a Director for each of these subsidiary companies.

Mr. Lotito was a financial consultant for over 34 years to domestic and international clients which also includes working as an Audit Manager for nine years for a national public accounting firm after graduating in 1967 with a B.S. degree in accounting from the University of Southern California.

David Henty Sutton - Director

David has many years experience in stock broking and investment banking. He was Executive Chairman from 2002 to 2010 of Martin Place Securities Pty Limited, a boutique investment firm holding an AFS Licence, where his responsibilities included management of corporate finance, advisory, and stockbroking activities with the firm. David currently owns and manages Dayton Way Financial Pty Limited, a boutique financial services company focusing on the global resources sector.

Prior to his current role he was a partner and Director of several stock exchange member firms including Clarke & Co and Macnab Clarke and more recently, a Director of TA Securities, Hudson Securities and Terrain Securities.

He became a member of the Stock Exchange of Melbourne and subsequently, Australian Stock Exchange Limited.

Darrel John Causbrook - Director

Darrel Causbrook is a Chartered Accountant with over 30 years experience in the accountancy profession, having worked for both large and mid-sized accounting firms. Over 10 years ago, Darrel established his own accounting practice, providing business and strategic advice to a variety of industries. Darrel’s professional interest includes financial reporting and corporate governance.

He holds a Bachelor of Commerce Degree, is a Fellow of Institute of Chartered Accountants in Australia, CPA Australia and Taxation Institute of Australia and is a member of Australian Institute of Company Directors.

Hamish Leslie McIntosh - Director

Hamish McIntosh is a licensed financial planner. He has worked for a number of large and small private banking firms. For the last 10 years he has been the majority shareholder and managing director of KWM Financial Consultants Pty Limited. Hamish specialises in providing financial advice to high net wealth individuals and private organisations.

He holds a Bachelor of Commerce Degree, is a Chartered Financial Planner and Member of the Financial Planning Association.

Soweit zur ersten ausführlicheren Vorstellung eines weiteren Joint Venture Partners von Petrohunter, so Sweetpea, im Beetaloo Basin, nämlich Paltar Petroleum Limited L10, 32 Martin Place Sydney NSW 2000 Australia. Gebraucht werden unsere drei weiteren permits, die über Sweetpea laufen, ein listing von Bruner, erste operative Ansätze, strategic partners und die Zusammenarbeit mit Sinovus. Erstes Zeitfenster: 1 - 3 Jahre

Paltar Petroleum

Paltar Petroleum is focused on the acquisition of, and exploration for, ‘unconventional’ oil and gas projects around the world. The company’s management, led by Chief Executive Officer, Marc A. Bruner, has a track record of identifying large unconventional projects worldwide. Such projects have included the Mako Through (40 TCF) in Hungary, the Karoo Basin (30 TCF) in South Africa, the Uinta Basin (6.2 TCF) in Utah and the Pinedale Anticline (23.5 TCF) in the Green River Basin, Wyoming and the Pennaco Energy project (2 TCF) in the Powder River Basin, all located in North America, and the Beetaloo Basin (estimated recoverable potential reserves of 64 TCF and 17 billion barrels of oil) located in the Northern Territory, 600 km south of Darwin, Australia. Paltar, through its joint venture agreement with 50% partner, Sweetpea Petroleum Pty Ltd, has applied for 3 licences in the Beetaloo Basin (EPA 136, EPA 143 and EPA 197).

Paltar’s tenement applications are located around 4 other exploration permits held by Falcon Oil & Gas Australia Limited. Paltar believes that Falcon has discovered one of the world’s largest in place oil and gas deposits. Independent engineering firm Ryder Scott report states an estimated potential resource of approximately 500 billion barrels of oil, and 500 trillion cubic feet of gas in place. There are two world class shales over 800 metres thick. The sweet spots are remarkably consistent in thickness and are regionally pervasive. Paltar believes these shales and sweet spots extend into its adjacent property of over 2 million acres.

Paltar’s objective will involve entering strategic joint ventures with major oil and gas companies, including up-front payments and significant work programs to progress projects towards production.

The Beetaloo Basin, located around 600km south of Darwin in Australia’s Northern Territory, is one of the few remaining virtually unexplored, onshore sedimentary basins. The basin is a Pre-Cambrian Basin that has more than 3000 metres of sediment column in which the identification of source rocks has been confirmed on the two unconventional oil and gas generating geological formations of the Kyalla and Velkerri Shale. Each source rock is widespread, with thickness of up to 800 metres. There are also indications that high quality conventional reservoirs exist.

Beetaloo’s Exploration History

In the 1980’s a subsidiary of Rio Tinto drilled 12 wells across the Beetaloo Basin accumulating over 27,000 feet of core data, and these cores, which were subsequently stored in Northern Territory warehouses, represented the basis of independent information for Ryder Scott’s filed Report with Toronto Stock Exchange (www.sedar.com) in May 2010, which estimated a potential resource of the Beetaloo Basin of 17 billion barrels of recoverable oil and 64 TCF of natural gas.

The technology to develop these types of unconventional oil and gas deposits throughout the world were not developed until the late 1990’s in the United States, principally in the formations of the Barnett Shale in Texas, and the Pinedale Anticline in Wyoming.

Falcon Oil & Gas Australia Limited, a subsidiary of Falcon Oil & Gas Ltd, owns 4 exploration permits EP 98, EP 117, EP 76 and EP 99 in the Beetaloo Basin, and have recently drilled a well called Shenandoah-1 on EP 98.

Paltar believes that Falcon has discovered one of the world’s largest in place oil and gas deposits. The prospectivity of the Beetaloo Basin was confirmed in April 2011 when Hess Corporation (Hess) entered into an agreement to acquire a 62.5% working interest in the Falcon Australia's exploration permits in the Beetaloo Basin with Hess set to undertake a USD $40.0 Million seismic surveying program this year. Hess can then elect to continue to the next phase of work which includes conducting a five well program to further explore the area, beginning in 2012.

Land

The Ministry of Mines and Energy in the Northern Territory is responsible for managing oil and gas operations in the Northern Territory. Paltar, through its Joint Development Agreement with its 50% partner, Sweetpea Petroleum Pty Ltd, has applied for three licences in the Beetaloo Basin (EPA 136, EPA 143 and EPA 197). These tenement applications are located around 4 other exploration permits held by Falcon Oil & Gas Australia Limited.

Regional Infrastructure and Markets

A pipeline corridor, railroad and Stuart Highway run through EPA 143 and near EPA 197 to Darwin. Trucking and rail appear to be the first option to transport products. The current pipeline is too small to be of any significant use for the transport of gas.

However, once commercial operations have demonstrated the viability of gas reserves, it is anticipated a large pipeline will be laid to Darwin to access the existing LNG facilities and planned projects. Access to market for oil production would be much quicker because road train and railroad to Darwin can transport it. Darwin has a deep-water port capable of handling oil production. Oil could be transported to Singapore refineries for processing. Currently, Conoco Phillips’s LNG plant in Darwin Harbor is the only exporter of LNG in Darwin. Sufficient supply exists from Bayu-Udan field in the Timor Sea. Index and its partner Total, also plan to export LNG. Phase one is estimated at 8 million metric tons of LNG per year. It is estimated the plant will be operational by 2015. This also requires building an 850 Km sub-sea pipeline.

What is Unconventional Oil and Gas?

Unconventional oil and gas can be broadly defined as oil and natural gas that cannot be economically exploited using conventional vertical wells. Unconventional reservoirs hold continuous oil and gas accumulations over large areas but, due to their low permeability, have low oil and gas flow rates (in comparison to conventional reservoirs). Due to these low flow rates, unconventional reservoirs were commonly overlooked as commercial sources of natural gas.

New Technologies Paving the Way

Until the early 1990s, the low flow rates of the vast majority of unconventional reservoirs made the oil and gas contained within un-economic to extract. But with the introduction of new technologies, such as horizontal drilling and fracture stimulation, these previously-overlooked sources of gas became more and more economically feasible. These new methods were pioneered in the United States, notably on the Barnett Shale, which is now one of the largest unconventional gas-producing basins in the United States.

Horizontal Drilling and Fracture Stimulation

Horizontal wells drill laterally through the oil and gas reservoir increasing the exposure of the well to the gas accumulation. Generally, horizontal wells can produce up to four times as much as vertical wells, but only cost around three times as much. Fracture stimulation, however, increases gas flow rates by fracturing the source rock through the high pressure injection of a fluid. This fluid contains a ‘proppant’, such as sand, to keep the fractures open when the fluid is extracted, allowing the oil and/or natural gas to flow.

Source: Schlumberger

Board & Management

Marc Alan Bruner - Chairman

Marc A Bruner is a leader in the development of unconventional oil and gas projects worldwide. His track record of identifying large unconventional projects includes the Mako Through (40 TCF) in Hungary, the Karoo Basin (30 TCF) in South Africa, the Uinta Basin (6.2 TCF) in Utah and the Pinedale Anticline (23.5 TCF) in the Green River Basin, Wyoming and the Pennaco Energy project (2 TCF) in the Powder River Basin, all located in North America, and the Beetaloo Basin (estimated recoverable potential reserves of 64 TCF and 17 billion barrels of oil) located in the Northern Territory, 600 km south of Darwin, Australia.

With more than 30 years experience in the industry, Mr Bruner has worked with world renowned geologists, Ben Law and Tom Albrandt to identify unconventional oil and gas opportunities in the United States of America and internationally. Mr Bruner’s major successes have included the development of the Pinedale Anticline in the Green River Basin of western Wyoming, now recognised as the fourth largest unconventional natural gas field in the United States, and the exploration and development of successful coal bed methane properties in the Powder River Basin.

Mr Bruner has founded a number of successful international oil and gas companies including Ultra Petroleum Corporation in 1996, a US$7 billion NYSE company focused on the development of the Pinedale Anticline unconventional oil and gas project, Pennaco Energy in 1997, focused on the exploration and development of unconventional oil and gas leases of coal bed methane properties located in the Powder River Basin, subsequently sold to Marathon Oil for US$500 million, and Falcon Oil and Gas in 2005, a Toronto Stock Exchange listed company which acquires, explores and develops large acreage positions of unconventional oil and gas resources.

With these companies Mr Bruner has negotiated major commercial transactions with global oil and gas companies, Halliburton, Marathon Oil, Exxon Mobil and Hess Corporation.

Most recently, Mr Bruner founded Paltar Petroleum to develop an extensive unconventional oil and gas play in Australia’s Beetaloo Basin, potentially one of the world’s largest untapped shale deposits.

Ben Law – Chief Geologist

Mr Law’s 35 years of research on unconventional gas systems has led to US and international recognition as an expert in basin-centred gas (Tight Gas) and coalbed methane systems. He is renowned for recognising and documenting the occurrence of numerous basin-centred gas systems worldwide, including the Powder River Basin of Wyoming, Greater Green River Basin of Wyoming, Colorado, and Utah, Colombia River Basin in Washington, Timan-Pechora Basin in Russia, Dnieper-Donets Basin in Ukraine, Taranaki Basin in New Zealand and the Beetaloo Basin in Australia.

From 2004-2011 Mr Law worked with Falcon Oil and Gas Ltd where he was responsible for the global search for unconventional hydrocarbon accumulations. During his tenure with Falcon he was instrumental in the identification and acquisition of conventional and unconventional oil and gas properties in Hungary, Romania, Australia, and South Africa.

Mr Law has published more than 195 papers, books and abstracts on petroleum and coal geology and was Founder and Co-Chairman of the American Association of Petroleum Geologists and Co-Chairman from 1997 – 2003. He has received numerous industry accolades including Rocky Mountain Association of Geologists Outstanding Scientist Award, 1997, Robert H.Dott, Sr. Memorial Award for best AAPG Special Publication 2000, honorary editor for the Chinese Oil and Gas Journal from 2004 until present, and in 2010, was an invited speaker at the 376th Xiangshan Science Conference in Beijing, China.

Carmen J (Tony) Lotito – Executive Vice President

Mr. Lotito served during the period 2007 - 2010 as the Executive Vice President - Business Development of Falcon Oil and Gas Ltd, the TSX Venture Exchange-listed Canadian parent and the following Falcon wholly-owned subsidiaries: TXM Oil and Gas Exploration Kft and TXM Marketing Trading & Service, LLC (Hungary); Mako Energy Corporation and Falcon Oil & Gas USA, Inc (USA); and Falcon Oil & Gas Australia Limited (Australia). As part of his tenure with Falcon Oil and Gas Ltd, Mr Lotito also served as a Director for each of these subsidiary companies.

Mr. Lotito was a financial consultant for over 34 years to domestic and international clients which also includes working as an Audit Manager for nine years for a national public accounting firm after graduating in 1967 with a B.S. degree in accounting from the University of Southern California.

David Henty Sutton - Director

David has many years experience in stock broking and investment banking. He was Executive Chairman from 2002 to 2010 of Martin Place Securities Pty Limited, a boutique investment firm holding an AFS Licence, where his responsibilities included management of corporate finance, advisory, and stockbroking activities with the firm. David currently owns and manages Dayton Way Financial Pty Limited, a boutique financial services company focusing on the global resources sector.

Prior to his current role he was a partner and Director of several stock exchange member firms including Clarke & Co and Macnab Clarke and more recently, a Director of TA Securities, Hudson Securities and Terrain Securities.

He became a member of the Stock Exchange of Melbourne and subsequently, Australian Stock Exchange Limited.

Darrel John Causbrook - Director

Darrel Causbrook is a Chartered Accountant with over 30 years experience in the accountancy profession, having worked for both large and mid-sized accounting firms. Over 10 years ago, Darrel established his own accounting practice, providing business and strategic advice to a variety of industries. Darrel’s professional interest includes financial reporting and corporate governance.

He holds a Bachelor of Commerce Degree, is a Fellow of Institute of Chartered Accountants in Australia, CPA Australia and Taxation Institute of Australia and is a member of Australian Institute of Company Directors.

Hamish Leslie McIntosh - Director

Hamish McIntosh is a licensed financial planner. He has worked for a number of large and small private banking firms. For the last 10 years he has been the majority shareholder and managing director of KWM Financial Consultants Pty Limited. Hamish specialises in providing financial advice to high net wealth individuals and private organisations.

He holds a Bachelor of Commerce Degree, is a Chartered Financial Planner and Member of the Financial Planning Association.

Soweit zur ersten ausführlicheren Vorstellung eines weiteren Joint Venture Partners von Petrohunter, so Sweetpea, im Beetaloo Basin, nämlich Paltar Petroleum Limited L10, 32 Martin Place Sydney NSW 2000 Australia. Gebraucht werden unsere drei weiteren permits, die über Sweetpea laufen, ein listing von Bruner, erste operative Ansätze, strategic partners und die Zusammenarbeit mit Sinovus. Erstes Zeitfenster: 1 - 3 Jahre

Paltar Petroleum

Antwort auf Beitrag Nr.: 41.993.310 von auriga am 23.08.11 23:09:06Ich seh mein Geld wohl nicht mehr...

Antwort auf Beitrag Nr.: 41.995.609 von xsusi am 24.08.11 13:59:28Hi Susi...ja, ein allzu tiefer Kurs macht natürlich auch keinen Spaß...die große Krise trifft nun mal auch die kleinsten Companies mit und deshalb ist PHUN jetzt noch tiefer...in D will zur Zeit d7e kaum jemand handeln, deshalb ist die Kursstellung in Stuttgart jetzt auch schon wieder überfällig...was uns bleibt ist was Paul am Telefon gesagt hat, PHUN hält seinen Anteil in Beetaloo, und keiner kennt die Schulden von PHUN besser als Paul Maniscalco, denn er macht das accounting bei PHUN...von der Company kommt zur Zeit der Hauptsatz, wir warten ab, was bei Shenandoah rauskommt, zahlen muss PHUN zur Zeit nichts dafür, danach wartet man auf Hess’ seismic und auf die drei neuen permits und einige Aktionen von Marc in den outskirts von Beetaloo...wie gesagt, die Frage ist ob der SP von PHUN durchhält...tut er das, könnte sich eine riesige Chance ergeben...fällt er ganz ab wars das und wir können diesen thread einstellen...solange der SP in USA hält ist es OK...die Interessen der größeren Anteilseigner in PHUN sind wohl kaum ein Auflösen der Firma...see you...A

kann man sich eigentlich etwas noch langweiligeres vorstellen als das farmer’s board?...paint dry?...this is like watching paint dry

Antwort auf Beitrag Nr.: 42.009.493 von auriga am 26.08.11 21:43:29Ja momentan ist es wirklich langweilig. Glaubst du dass sich der Kurs noch mal nachhaltig erholt?

Antwort auf Beitrag Nr.: 42.011.370 von xsusi am 27.08.11 18:59:44hallo Susi...ja, gute Frage.........ich kann mir das durchaus vorstellen, denn die Beteiligungen des Asset-Lieferanten Sweetpea wiegen recht schwer...die Randgebiete von Beetaloo sind an sich genauso vielversprechend wie das Landesinnere der Region, denn da wo die seismic nach außen hin variiert wird ein sogenannter Überschiebungsgürtel ( thrust belt) vermutet, in dem die Möglichkeit von großen konventionellen als auch unkonventionellen Zielobjekten ( also hydrocarbons, sprich ÖL und Gas ) durchaus vorliegt...dies ist in der seismic jetzt schon zu erkennen....an diese westliche Zone von Beetaloo dockt Bruner gerade an mit Sweetpea und Paltar...hierbei ist allerdings das erste von mir angedeutete Zeitfenster von 1 - 3 Jahren durchaus zu beachten...mir wäre es allerdings schon lieber PHUN würde sich bis Ende des Jahres wieder etwas stabilisieren, im Bereich USD 0,2 -- 0,4, auf dieser Basis lässt sich besser nach vorne schauen...meiner Meinung nach hätte PHUN das fundamental als auch finanziell bezogen allemal verdient, aber niemand steckt ja darin, wie du ja selbst weißt, es ist eben offen wie sich das Papier entwickelt.........btw......... M D and A et Interim financial statements von Falcon sind raus (Associated Documents)...........wünsche dir noch ein schönes Wochenende und bis die Tage...A

ja ja, das wäre schon schön USD 0,2 -- 0,4, klar........gemeint habe ich allerdings in der Tat 0,02 -- 0,04 USD......gut Ding will Weile haben und diese Verwechslung passiert mir glaube ich nicht das erste mal......wenn man tagtäglich mit Kursen von D Postbank D Bank D Post Porsche VW et al arbeitet ist der Abfall natürlich drastisch...nun, dies macht den besonderen Charme von Sweetpea aus , glaube ich

, glaube ich

, glaube ich

, glaube ich

Falcon Oil & Gas Ltd. Announces the Filing of Its Interim Financial Statements and Accompanying MD&A and Letter to Shareholders