>>> Ucore hebt ab <<< - 500 Beiträge pro Seite (Seite 3)

eröffnet am 19.08.09 11:06:50 von

neuester Beitrag 25.04.24 08:24:05 von

neuester Beitrag 25.04.24 08:24:05 von

Beiträge: 2.722

ID: 1.152.491

ID: 1.152.491

Aufrufe heute: 78

Gesamt: 240.366

Gesamt: 240.366

Aktive User: 0

ISIN: CA90348V3011 · WKN: A2QJQ4 · Symbol: UURAF

0,4650

USD

+0,45 %

+0,0021 USD

Letzter Kurs 21:49:30 Nasdaq OTC

Neuigkeiten

10.01.24 · GOLDINVEST.de Anzeige |

22.12.23 · wallstreetONLINE NewsUpdate |

22.12.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 29,98 | +18,24 | |

| 16,040 | +17,34 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 2,1800 | -9,17 | |

| 46,59 | -98,01 |

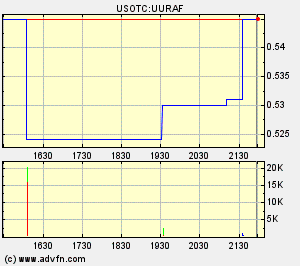

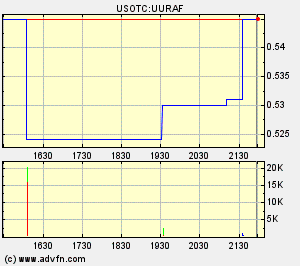

Die OTC in USA handelt, Kurs aktuell 0,61 US$!

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?s…

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?s…

@nicolani: Die brauchen doch keine KE, wenn sie den Rüstungsauftrag haben.

Ucore Reports Dysprosium Separation Breakthrough

http://finance.yahoo.com/news/ucore-reports-dysprosium-separ…

http://finance.yahoo.com/news/ucore-reports-dysprosium-separ…

Zitat von Langstrumpf2: Ucore Reports Dysprosium Separation Breakthrough

http://finance.yahoo.com/news/ucore-reports-dysprosium-separ…

...

Dr. Hammen, the inventor of the successful process of separating and purifying REEs by SPE, presented the application of the technology to the separation and purification of REE in liquid solutions. He discussed the results utilizing SPE columns specifically developed to improve the speed and expected economy, compared to existing solvent extraction technology, of REE separation and purification. The innovative REE separation method produces chemical transfers of selective elements from a mixed concentrate solution to a solid phase within a few seconds. The SPE columns have the capacity to purify large tonnage of dissolved rare earth-bearing compounds in small flow-through extraction units. This technology is expected to allow for the separation of individual REEs from Bokan in an efficient and economic manner, prospectively reducing processing plant CAPEX and OPEX to a fraction of traditional procedures.

...

http://ucore.com/DrHammen2012.pdf

COM 2012, Sept 30-October 3; Niagara Falls, Ontario

By Jack Lifton and Richard Hammen

COM 2012, Sept 30-October 3; Niagara Falls, Ontario

By Jack Lifton and Richard Hammen

"This announcement not only enhances our pending Preliminary Economic Assessment (PEA), but sets the stage for our post-PEA work towards mapping a complete mine-to-metal strategy for heavy REE's in the United States."

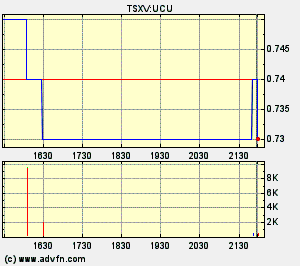

Börsenhandel wird wieder aufgenommen:

Resumption: 11:45 AM ET

Company: Ucore Rare Metals Inc.

TSX-Venture Symbol: UCU

Börsenhandel wird wieder aufgenommen:

Resumption: 11:45 AM ET

Company: Ucore Rare Metals Inc.

TSX-Venture Symbol: UCU

Kanada handelt wieder!

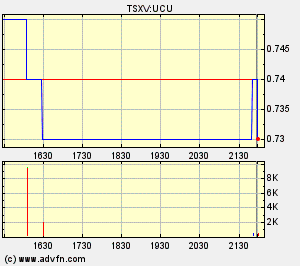

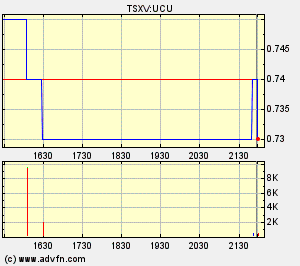

Jetzt kommt hier richtig Volumen rein, bereits über 1,2 Mio Stücke an beiden Börsen gehandelt:

Jetzt kommt hier richtig Volumen rein, bereits über 1,2 Mio Stücke an beiden Börsen gehandelt:

Ucore Reports Dysprosium Separation Breakthrough

03.10.2012 17:03 Uhr | Marketwire

http://www.goldseiten.de/artikel/150791--Ucore-Reports-Dyspr…

03.10.2012 17:03 Uhr | Marketwire

http://www.goldseiten.de/artikel/150791--Ucore-Reports-Dyspr…

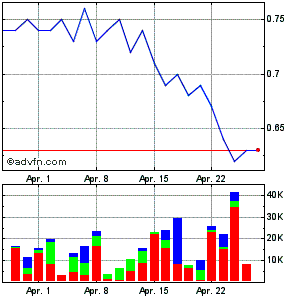

Unglaublich: 0,64 Can$, das 52-Wochen-Hoch!!

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?s…

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?s…

http://ucore.com/ByronKing_October3_2012.pdf

...

October 3, 2012

Fabulous News From Ucore

Dear ESI Reader:

This morning, at the request of management, Canadian authorities halted

trading in shares of Ucore Rare Metals (UCU: TSXV).

Apparently, there's more "news" pending, and I suspect that it'll be good news.

Later in the morning, Ucore shares resumed trading, after the company formally announced that it has successfully separated dysprosium (Dy), neodymium (Nd) and erbium (Er) from the other rare earth elements (REE) found in a sample of ore from the company's Bokan Mountain deposit in Alaska.

This is FABULOUS news! It's a great day for Ucore! It's a great day for Ucore shareholders! It's a great day for America (and Canada!), because this is a technology TRIUMPH!!!

Yesterday, I discussed how Ucore has just received a major contract from the U.S. Defense Logistics Agency (DLA). I also told you that this week, Ucore is sponsoring a technical presentation by Dr. Richard Hammen on its novel "spider web" technology. The spider web talk is at a major international scientific conference in Canada.

As I discussed yesterday, the DLA contract is the real McCoy. You don't get new government contracts in a time of major economic contraction at the Pentagon unless you've got something real up your sleeve.

Now Ucore has revealed its cards TODAY at the conference in Canada. Ucore announced metal separation, via its pioneering spider web process. This is serious technology!

Honestly, we haven't seen a metallurgical breakthrough like this in a long, long, long time. I'm tempted to make a comparison to the breakthrough days of the Manhattan Project.

I've been saying great things about Ucore.

Yesterday, Ucore shares soared nearly 35% yesterday, in extremely heavy trading.

The pros, funds, and institutions piled in later in the day and bought with both hands. Indeed, there was a nearly 10% spike in the final half hour extremely unusual in a market where people often sell off and take profits at the end of the day.

If you bought into Ucore yesterday, or in the past months, pat yourself on the back. I believe there are great things coming down the track. You're in early.

Now that we know what Dr. Hammen and his team have accomplished, with their spider web tech, it's time for the market to absorb it.

If you already own Ucore shares, I suspect you're nicely positioned for strong gains going forward.

I'll update things as I learn more.

If you're doing well with Ucore Rare Metals or any of the other investment ideas in ESI, now's the perfect time to renew your commitment to ESI (at a limited time, massive discount). I've asked the powers that be in Baltimore to give you the BEST offer possible.

That's all for now. Thanks for reading ESI. Best wishes...

Byron W. King

...

...

October 3, 2012

Fabulous News From Ucore

Dear ESI Reader:

This morning, at the request of management, Canadian authorities halted

trading in shares of Ucore Rare Metals (UCU: TSXV).

Apparently, there's more "news" pending, and I suspect that it'll be good news.

Later in the morning, Ucore shares resumed trading, after the company formally announced that it has successfully separated dysprosium (Dy), neodymium (Nd) and erbium (Er) from the other rare earth elements (REE) found in a sample of ore from the company's Bokan Mountain deposit in Alaska.

This is FABULOUS news! It's a great day for Ucore! It's a great day for Ucore shareholders! It's a great day for America (and Canada!), because this is a technology TRIUMPH!!!

Yesterday, I discussed how Ucore has just received a major contract from the U.S. Defense Logistics Agency (DLA). I also told you that this week, Ucore is sponsoring a technical presentation by Dr. Richard Hammen on its novel "spider web" technology. The spider web talk is at a major international scientific conference in Canada.

As I discussed yesterday, the DLA contract is the real McCoy. You don't get new government contracts in a time of major economic contraction at the Pentagon unless you've got something real up your sleeve.

Now Ucore has revealed its cards TODAY at the conference in Canada. Ucore announced metal separation, via its pioneering spider web process. This is serious technology!

Honestly, we haven't seen a metallurgical breakthrough like this in a long, long, long time. I'm tempted to make a comparison to the breakthrough days of the Manhattan Project.

I've been saying great things about Ucore.

Yesterday, Ucore shares soared nearly 35% yesterday, in extremely heavy trading.

The pros, funds, and institutions piled in later in the day and bought with both hands. Indeed, there was a nearly 10% spike in the final half hour extremely unusual in a market where people often sell off and take profits at the end of the day.

If you bought into Ucore yesterday, or in the past months, pat yourself on the back. I believe there are great things coming down the track. You're in early.

Now that we know what Dr. Hammen and his team have accomplished, with their spider web tech, it's time for the market to absorb it.

If you already own Ucore shares, I suspect you're nicely positioned for strong gains going forward.

I'll update things as I learn more.

If you're doing well with Ucore Rare Metals or any of the other investment ideas in ESI, now's the perfect time to renew your commitment to ESI (at a limited time, massive discount). I've asked the powers that be in Baltimore to give you the BEST offer possible.

That's all for now. Thanks for reading ESI. Best wishes...

Byron W. King

...

http://www.discoveryinvesting.com/uploads/MNs__Thursday_Octo…

...

To be clear, there are a number of companies that “have what the market needs” and we give various weightings to the Ten Factors, but today we choose to focus on one company we have written on in the past and are shareholders of: Ucore Rare Metals (UCU:TSXV).

...

...

To be clear, there are a number of companies that “have what the market needs” and we give various weightings to the Ten Factors, but today we choose to focus on one company we have written on in the past and are shareholders of: Ucore Rare Metals (UCU:TSXV).

...

http://www.energy.senate.gov/public/index.cfm/republican-new…

...

October 4, 2012

Sen. Murkowski Congratulates Ucore Rare Metals on Defense Department Agreement

WASHINGTON, D.C. – U.S. Sen. Lisa Murkowski, R-Alaska, today congratulated Ucore Rare Metals Inc. on reaching an agreement with the U.S. Defense Department allowing the company to continue its work on understanding the vast potential for production of heavy rare earth elements in Alaska.

“This announcement is great news for Alaska and for the United States, where our need for a secure and domestic supply of rare earth elements is an urgent challenge,” Murkowski said. “These and other critical minerals are essential in the manufacturing of everything from modern defense equipment to clean energy technologies.”

Sens. Murkowski wrote to U.S. Defense Secretary Leon Panetta on March 1, encouraging the Defense Department to support Ucore’s work.

“I am proud of Alaska for continuing to provide the energy, minerals, and other materials needed to create jobs and restore economic growth to the country. And I am pleased to see the Defense Department playing such a constructive role in pursuing these opportunities,” Murkowski said.

Murkowski also continues to work to support and remove any unnecessary bureaucratic obstacles to progress at the Bokan Mountain site, and similar prospects elsewhere in Southeast Alaska and across the country.

...

...

October 4, 2012

Sen. Murkowski Congratulates Ucore Rare Metals on Defense Department Agreement

WASHINGTON, D.C. – U.S. Sen. Lisa Murkowski, R-Alaska, today congratulated Ucore Rare Metals Inc. on reaching an agreement with the U.S. Defense Department allowing the company to continue its work on understanding the vast potential for production of heavy rare earth elements in Alaska.

“This announcement is great news for Alaska and for the United States, where our need for a secure and domestic supply of rare earth elements is an urgent challenge,” Murkowski said. “These and other critical minerals are essential in the manufacturing of everything from modern defense equipment to clean energy technologies.”

Sens. Murkowski wrote to U.S. Defense Secretary Leon Panetta on March 1, encouraging the Defense Department to support Ucore’s work.

“I am proud of Alaska for continuing to provide the energy, minerals, and other materials needed to create jobs and restore economic growth to the country. And I am pleased to see the Defense Department playing such a constructive role in pursuing these opportunities,” Murkowski said.

Murkowski also continues to work to support and remove any unnecessary bureaucratic obstacles to progress at the Bokan Mountain site, and similar prospects elsewhere in Southeast Alaska and across the country.

...

http://db.tt/feI7U3wI

...

(Juneau, AK) – The Minerals Industry Research Laboratory (MIRL) at the University of Alaska Fairbanks will conduct primary research on techniques for processing rare earth minerals under contract to the Alaska Department of Commerce, Community, and Economic Development (DCCED). Dr. Rajive Ganguli, director of the MIRL, will serve as principal investigator.

The objective of the research is to identify the best sequencing of processing methods, such as froth flotation and direct leaching, to reduce processing costs, increase recovery rates, and other possible discoveries. The handling of waste rock will also be examined.

Governor Sean Parnell has said critical and strategic minerals are a priority development opportunity for the state. Rare earth minerals are classified as critical and strategic minerals because of the projected demand, level of domestic production, and current reliance on imports. The U.S. Geological Service classifies indium, manganese, the platinum group metals, niobium, and rare earth minerals as critical and strategic minerals.

In addition to DCCED, the Alaska Departments of Natural Resources and Transportation have been tasked with identifying the resources, infrastructure, and business development opportunities needed to bring the state’s rare earth resources to market.

“With known rare earth prospects in southeast and Interior Alaska, and ongoing exploration, this research project will help the State of Alaska to better assess rare earth mining activity, water mobility, and other questions that will arise when considering permit applications,” said Ed Fogels, deputy commissioner with the Department of Natural Resources (DNR). DNR is currently engaged in a multi-year assessment to better understand the locations, distribution, and quantities of high potential rare earth deposits.

“The research that Dr. Ganguli and his colleagues are undertaking will inform the state’s efforts as we continue to look at rare earth development opportunities,” said DCCED commissioner Susan Bell. “Alaska is well positioned to be a stable source of rare earth minerals. This research is another building block toward understanding and realizing that potential.”

According to Bell, research activities will begin this fall and continue through the upcoming academic year. Additional analysis and review will continue through project completion sometime in late 2013.

...

...

(Juneau, AK) – The Minerals Industry Research Laboratory (MIRL) at the University of Alaska Fairbanks will conduct primary research on techniques for processing rare earth minerals under contract to the Alaska Department of Commerce, Community, and Economic Development (DCCED). Dr. Rajive Ganguli, director of the MIRL, will serve as principal investigator.

The objective of the research is to identify the best sequencing of processing methods, such as froth flotation and direct leaching, to reduce processing costs, increase recovery rates, and other possible discoveries. The handling of waste rock will also be examined.

Governor Sean Parnell has said critical and strategic minerals are a priority development opportunity for the state. Rare earth minerals are classified as critical and strategic minerals because of the projected demand, level of domestic production, and current reliance on imports. The U.S. Geological Service classifies indium, manganese, the platinum group metals, niobium, and rare earth minerals as critical and strategic minerals.

In addition to DCCED, the Alaska Departments of Natural Resources and Transportation have been tasked with identifying the resources, infrastructure, and business development opportunities needed to bring the state’s rare earth resources to market.

“With known rare earth prospects in southeast and Interior Alaska, and ongoing exploration, this research project will help the State of Alaska to better assess rare earth mining activity, water mobility, and other questions that will arise when considering permit applications,” said Ed Fogels, deputy commissioner with the Department of Natural Resources (DNR). DNR is currently engaged in a multi-year assessment to better understand the locations, distribution, and quantities of high potential rare earth deposits.

“The research that Dr. Ganguli and his colleagues are undertaking will inform the state’s efforts as we continue to look at rare earth development opportunities,” said DCCED commissioner Susan Bell. “Alaska is well positioned to be a stable source of rare earth minerals. This research is another building block toward understanding and realizing that potential.”

According to Bell, research activities will begin this fall and continue through the upcoming academic year. Additional analysis and review will continue through project completion sometime in late 2013.

...

Rare Earth Elements in National Defense:

Background, Oversight Issues, and Options

for Congress

Valerie Bailey Grasso

Specialist in Defense Acquisition

September 5, 2012

http://www.fas.org/sgp/crs/natsec/R41744.pdf

Background, Oversight Issues, and Options

for Congress

Valerie Bailey Grasso

Specialist in Defense Acquisition

September 5, 2012

http://www.fas.org/sgp/crs/natsec/R41744.pdf

Where Non-Chinese Heavy Rare Earths Will Originate

By Jack Lifton

September 17, 2012

http://www.resourceinvestor.com/2012/09/17/where-non-chinese…

By Jack Lifton

September 17, 2012

http://www.resourceinvestor.com/2012/09/17/where-non-chinese…

Pari aktuell 0,48 Euro

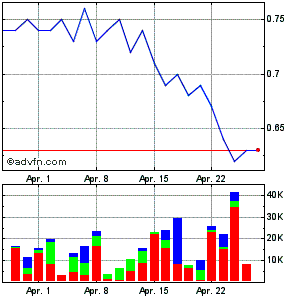

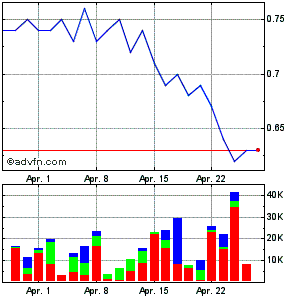

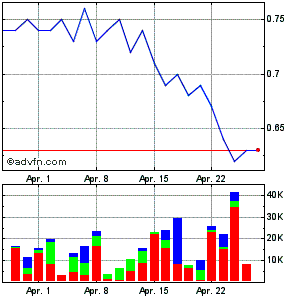

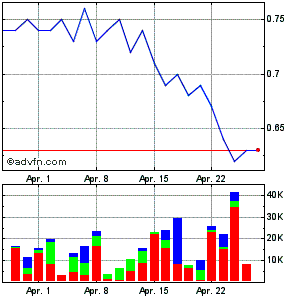

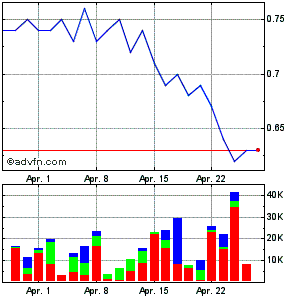

Antwort auf Beitrag Nr.: 43.691.586 von Videomart am 08.10.12 23:05:00Die Frage die sich bei so einem Chart stellt ist:

Gewinne mitnehmen, die Welle reiten und die Konso ausnutzen, oder drinbleiben und sich dann ärgern, mal wieder zuzulassen, dass aus grün rot geworden ist...?

Gewinne mitnehmen, die Welle reiten und die Konso ausnutzen, oder drinbleiben und sich dann ärgern, mal wieder zuzulassen, dass aus grün rot geworden ist...?

Antwort auf Beitrag Nr.: 43.691.624 von Dirkix am 08.10.12 23:23:28Gute Frage!!

Was bei Explorern "normalerweise" ohne weitere News passiert, kennt man ja hinreichend, eine positive Entwicklung hängt dann höchstens noch

vom allgemeinen Marktverlauf ab.

Erstaunlicherweise ist Stans Energy zügig wieder abgesackt, Ucore jedoch nicht! Keine Ahnung, was der Grund dafür ist...

Was bei Explorern "normalerweise" ohne weitere News passiert, kennt man ja hinreichend, eine positive Entwicklung hängt dann höchstens noch

vom allgemeinen Marktverlauf ab.

Erstaunlicherweise ist Stans Energy zügig wieder abgesackt, Ucore jedoch nicht! Keine Ahnung, was der Grund dafür ist...

Zitat von Videomart: Gute Frage!!

Was bei Explorern "normalerweise" ohne weitere News passiert, kennt man ja hinreichend, eine positive Entwicklung hängt dann höchstens noch

vom allgemeinen Marktverlauf ab.

Erstaunlicherweise ist Stans Energy zügig wieder abgesackt, Ucore jedoch nicht! Keine Ahnung, was der Grund dafür ist...

Na ja, Bokan ist halt in den USA und nicht in einem ehemaligen Ostblock Staat. Nur ein Ansatz einer Erklärung.

Das ist die einfachste Erklrung, aber wohl völlig richtig!

Es stellt sich nur die Frage, warum Stans trotz des "Länderrisikos"

überhaupt erst so exorbitant steigt...

Ucore heute erneut äusserst stabil:

Es stellt sich nur die Frage, warum Stans trotz des "Länderrisikos"

überhaupt erst so exorbitant steigt...

Ucore heute erneut äusserst stabil:

eine echte perle!! läuft auch ohne news!!

Turnaround Rally In Heavy Rare Earths As U.S. Develops Independent Supply Chain

http://goldstocktrades.com/blog/2012/10/12/turnaround-rally-…

...

The mixed action in the rare earth sector may be highlighting one company which has been outperforming and making significant progress. Suffice it to say that we hope to publish this update on the rare earths that will suggest to our subscribers the positive direction in which the sector is heading, especially as we witness the U.S. Department of Defense take a step in reestablishing American rare earth independence.

I wish good luck to those who were boasting their short trades in the rare earths and paper profits. This may rapidly be coming to an end as the heavy rare earth sector is about to reverse higher as Western Nations take a stand and develop their own supply of these critical materials crucial for our latest military technologies such as drones, stealth helicopters and guided smart missiles.

We expect a significant rally in this sector which being thinly traded might place the short sellers in peril as they attempt to exit their positions. Sufficient volume may not be there to give the naysayers enough exit room through which to leave the theater once the word fire is realized. We are witnessing global currency wars, trade wars and territorial disputes in the South China Seas. Tensions between China and Japan have increased over many issues but are extremely focussed on expanding their natural resources for which they are desperately looking around the world.

Gold Stock Trades expects a turnaround rally in this wildly oversold resource area, which is still relatively unknown by the public crowd. There are developments that may be reversing the 18 month basing process and indeed trap the disbelievers. Included in these possibilities is the bearish sentiment that the less advanced rare earth companies have inadequate cash reserves needed to proceed with development. This interpretation may have been advocated actively by the larger cap Molycorp(MCP) and Lynas (LYSCF) who is deficient in the heavy rare earths. This thesis did not take into consideration the distinction between heavy and light rare earths in coming to their conclusion.

...

http://goldstocktrades.com/blog/2012/10/12/turnaround-rally-…

...

The mixed action in the rare earth sector may be highlighting one company which has been outperforming and making significant progress. Suffice it to say that we hope to publish this update on the rare earths that will suggest to our subscribers the positive direction in which the sector is heading, especially as we witness the U.S. Department of Defense take a step in reestablishing American rare earth independence.

I wish good luck to those who were boasting their short trades in the rare earths and paper profits. This may rapidly be coming to an end as the heavy rare earth sector is about to reverse higher as Western Nations take a stand and develop their own supply of these critical materials crucial for our latest military technologies such as drones, stealth helicopters and guided smart missiles.

We expect a significant rally in this sector which being thinly traded might place the short sellers in peril as they attempt to exit their positions. Sufficient volume may not be there to give the naysayers enough exit room through which to leave the theater once the word fire is realized. We are witnessing global currency wars, trade wars and territorial disputes in the South China Seas. Tensions between China and Japan have increased over many issues but are extremely focussed on expanding their natural resources for which they are desperately looking around the world.

Gold Stock Trades expects a turnaround rally in this wildly oversold resource area, which is still relatively unknown by the public crowd. There are developments that may be reversing the 18 month basing process and indeed trap the disbelievers. Included in these possibilities is the bearish sentiment that the less advanced rare earth companies have inadequate cash reserves needed to proceed with development. This interpretation may have been advocated actively by the larger cap Molycorp(MCP) and Lynas (LYSCF) who is deficient in the heavy rare earths. This thesis did not take into consideration the distinction between heavy and light rare earths in coming to their conclusion.

...

na dann steht die pea ja auch bald an!!

We will see.

The DOD’s Bold Move Will Reward Rare Earths Investors (REMX, MCP, REE, QRM, IAG, RIO, BHP)

http://etfdailynews.com/2012/10/16/the-dods-bold-move-will-r…

...

The Critical Metals Report: Jeb, the U.S. Department of Defense (DOD) recently took the unusual step of contracting with Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX) to conduct a mineralogical and metallurgical study on the company’s Bokan Mountain heavy rare earth element (HREE) property in Southern Alaska. Tell our readers why that matters.

Jeb Handwerger: It matters because the DOD is now a huge potential partner for Ucore. After researching and studying all domestic rare earth element (REE) assets, it identified the company’s Bokan Mountain project as the key HREE resource. It put a stamp of approval and credibility on Ucore as the primary resource for its domestic supply chain.

...

http://etfdailynews.com/2012/10/16/the-dods-bold-move-will-r…

...

The Critical Metals Report: Jeb, the U.S. Department of Defense (DOD) recently took the unusual step of contracting with Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX) to conduct a mineralogical and metallurgical study on the company’s Bokan Mountain heavy rare earth element (HREE) property in Southern Alaska. Tell our readers why that matters.

Jeb Handwerger: It matters because the DOD is now a huge potential partner for Ucore. After researching and studying all domestic rare earth element (REE) assets, it identified the company’s Bokan Mountain project as the key HREE resource. It put a stamp of approval and credibility on Ucore as the primary resource for its domestic supply chain.

...

http://proedgewire.com/rare-earth-intel/china-to-stockpile-h…

...

Jack Lifton on October 18, 2012 at 5:13 AM said:

Hongpo,

Have rare earth price drops within China been sustained over a long enough period of time to have directly affected the recent earnings of the company’s you name? If so then those companies either have a very large profit margin or make their money from other things. How else to explain that they are still in profit at all even after such large drops in selling prices. I was told that Ziangxi stated that “after the reorganization of the REE industry in their sector is completed” their, Ziangxi’s cost of processing per kilogram will be around 25. If this is true then Ziangxi has a very long way to go before it can lose money on REE prices. In fact even if their cost is USD$25/kg rather than 25 reniminbi/kg they would still make money on neodymium and on the heavier rare earths.

No matter which currency the 25 stated above turns out to be the costs of producing rare earths in China will be less than producing them outside of China. I have a difficult time understanding why American investors simply accept bald statements from REE juniors about low cost production when we are given no data to back them up. I think if we had a normalized set of costs of goods sold and we knew exactly which of the underlying costs were distributed we would then we could rank the REE producers and juniors honestly and brutally as to their probability of success in the real world where the lowest cost, lowest priced producer of a commodity is the survivor. The Chinese domestic market is currently undergoing such a “shakeout” and contrary to some of the commentary this will result in lower cost more competitive producers.

I suspect that after the Chinese shakeout now underway that Chinese politicians will lift the protective veil of quotas and allow the large profitable survivors to export just enough to keep them profitable in the case of the light rare earths. I also suspect that Chinese demand and the limitations of its domestic supply will require the production of heavy rare earths outside of China. The winners will be the lowest cost, lowest selling price, producers of the products that the markets demand. There is room in the non Chinese market for one major LREE supplier to the Japan, one to the USA, and one to Europe. The is concomitantly room for several HREE suppliers to China, and to each of the minor markets (relative to China) just named.

I don’t know if Molycorp will survive it’s increasingly complex and changing business model, and I don’t know if Lynas will overcome the political problem I has in Malaysia. I think it is foolish for investors to overlook Rare Element Resources and even Frontier as LREE players. Each Has an advantage of lower break even than the other large potential LREE suppliers. For HREEs I am betting on Ucore in the USA, Tasman in Europe, and I am watching Tantalus, in Madagascar, and the two Australians, Hastings and Northern Minerals. But even when I add to this group those producing HREEs as byproducts, such as Alkane, Orbite Aluminae, and AMR (private) I do not get enough production of the HREEs to allow even a doubling of the world’s production by 2020.

I must therefore predict a decoupling of LREE and HREE prices.

Investors need to do the math.

...

...

Jack Lifton on October 18, 2012 at 5:13 AM said:

Hongpo,

Have rare earth price drops within China been sustained over a long enough period of time to have directly affected the recent earnings of the company’s you name? If so then those companies either have a very large profit margin or make their money from other things. How else to explain that they are still in profit at all even after such large drops in selling prices. I was told that Ziangxi stated that “after the reorganization of the REE industry in their sector is completed” their, Ziangxi’s cost of processing per kilogram will be around 25. If this is true then Ziangxi has a very long way to go before it can lose money on REE prices. In fact even if their cost is USD$25/kg rather than 25 reniminbi/kg they would still make money on neodymium and on the heavier rare earths.

No matter which currency the 25 stated above turns out to be the costs of producing rare earths in China will be less than producing them outside of China. I have a difficult time understanding why American investors simply accept bald statements from REE juniors about low cost production when we are given no data to back them up. I think if we had a normalized set of costs of goods sold and we knew exactly which of the underlying costs were distributed we would then we could rank the REE producers and juniors honestly and brutally as to their probability of success in the real world where the lowest cost, lowest priced producer of a commodity is the survivor. The Chinese domestic market is currently undergoing such a “shakeout” and contrary to some of the commentary this will result in lower cost more competitive producers.

I suspect that after the Chinese shakeout now underway that Chinese politicians will lift the protective veil of quotas and allow the large profitable survivors to export just enough to keep them profitable in the case of the light rare earths. I also suspect that Chinese demand and the limitations of its domestic supply will require the production of heavy rare earths outside of China. The winners will be the lowest cost, lowest selling price, producers of the products that the markets demand. There is room in the non Chinese market for one major LREE supplier to the Japan, one to the USA, and one to Europe. The is concomitantly room for several HREE suppliers to China, and to each of the minor markets (relative to China) just named.

I don’t know if Molycorp will survive it’s increasingly complex and changing business model, and I don’t know if Lynas will overcome the political problem I has in Malaysia. I think it is foolish for investors to overlook Rare Element Resources and even Frontier as LREE players. Each Has an advantage of lower break even than the other large potential LREE suppliers. For HREEs I am betting on Ucore in the USA, Tasman in Europe, and I am watching Tantalus, in Madagascar, and the two Australians, Hastings and Northern Minerals. But even when I add to this group those producing HREEs as byproducts, such as Alkane, Orbite Aluminae, and AMR (private) I do not get enough production of the HREEs to allow even a doubling of the world’s production by 2020.

I must therefore predict a decoupling of LREE and HREE prices.

Investors need to do the math.

...

http://www.dodsbir.net/sitis/display_topic.asp?Bookmark=4282…

http://www.dodsbir.net/sitis/display_topic.asp?Bookmark=4282…

http://www.dodsbir.net/sitis/display_topic.asp?Bookmark=4282…

OSD STTR 12.B Topic Descriptions

OSD12-T01 TITLE: Advanced Separation Technologies for Extraction of Rare Earth Elements (REE)

TECHNOLOGY AREAS: Materials/Processes

OBJECTIVE: The objective of this research is to conduct fundamental surface chemistry measurements and demonstrate the use of these data to laboratory and small scale froth flotation systems so that more effective recovery can be achieved than with existing methods.

DESCRIPTION: A critical step in the extraction of elements from ore, especially rare earth elements that are found in complex minerals, is separation. Froth flotation is a highly versatile method for physically separating particles based on differences in the ability of air bubbles to selectively adhere to specific mineral surfaces in a mineral/water slurry. The particles with attached air bubbles are then carried to the surface and removed, while the particles that remain are completely wetted stay in the liquid phase. Froth flotation is an attractive approach, but its effectiveness is limited for the rare earth minerals as they occur as phosphates, carbonates, fluorides, silicates and oxides with gangue minerals, which often share physical properties. By providing another tool for separation, increased understanding of localized surface chemistries in complex rare earth minerals could enable affordable processes that improve grades, recoveries, capital costs and operating costs for separation of rare earth elements from their ores. The techniques used to characterize surface chemistry in flotation relate to methods to make selective minerals hydrophobic by adjusting the surface charge so that ionic collectors may be adsorbed. In the case of non-sulfide minerals this is complicated by the fact that the waste materials are also non-sulfide, so very small differences in surface chemistry properties are observed. Finding chemical methods to selectively adsorb collectors onto the desired minerals requires additional fundamental understanding of the surface ions (potential determining ions) and charges (electrochemical potentials) encountered. The work, coupled with the development of a fundamental understanding can lead to greatly improved processes for concentration by froth flotation.

PHASE I: In the phase I effort, the investigators need to explore the fundamental surface chemistry measurements (zeta potential, contact angle, micro-flotation tests) on pure rare earth mineral samples to evaluate various alternatives chemistries for selective froth flotation. Pure mineral samples need to be acquired, crushed, ground, screened, and analyzed using chemical and X-ray diffraction techniques. The surface chemistry measurements will be made as a function of collector type, pH, feed rate, particle size, mineral composition (phosphate, carbonate, fluoride, oxide, silicate), surface modification chemicals, etc. Attention will also be paid to the principal gangue minerals that occur in these ore bodies. Models are to be developed to describe and understand the surface chemistry and relate this to separation efficiency. Process environmental impact will also be a factor of evaluation.

PHASE II: In the phase II effort, the investigators shall evaluate and validate the process models, modify the process models and analyze and characterize the efficiency and the environmental impact of the separation methodology using real crushed ores using standard large scale laboratory flotation equipment. Modification of the models, as necessary, based on the test results, will be conducted and retested to determine the range of their applicability. This will demonstrate the effect of this increased understanding on the grades and recoveries obtained by determining (1) the Ratio of Concentration and (2) the Percent REE Recovered. This then could be compared to conventional methods in order to demonstrate increased value and/or reduced operating costs as a function of ore type and original concentration. Separation variability as a function of REE ore composition should be assessed. If viable, scalability will be evaluated and preliminary drawings of pilot plant floth floatation system will be planned.

PHASE III: Working with industry, a pilot plant sized floth floatation system is constructed and various crushed commercial ores will feed to determine separation efficiency based on (1) the Ratio of Concentration and (2) the Percent REE Recovered.

PRIVATE SECTOR COMMERCIAL POTENTIAL/DUAL-USE APPLICATIONS: The modeling of surface chemistries for froth floatation will lead to greater separation efficiencies and benefit the domestic mineral extractive companies specializing in rare earth recovery and production. More secure, domestic REE sources would be of great strategic importance to the Department of Defense for many applications where REE are utilized.

REFERENCES:

1. Q. Min, Y.Y. Duan, X.F. Peng, A.S. Mujumdar, C. Hsu, “Froth Flotation of Mineral Particles: Mechanism”, Drying Technology, v. 26 (8), 985-995 (2008).

2. S. Farrokhpay, “The Significance of Froth Stability in Mineral Flotation – A Review”, Advances in Colloid and Interface Science, v. 166 (1-2) 1-7 (2011).

3. N. Barbian, E. Ventura-Medina, J.J. Cilliers, “Dynamic Froth Stability in Froth Flotation”, v. 16(11), 1111-1116 (2003).

KEYWORDS: froth floatation, surface chemistry, rare earth separation, ore separation, recovery, hydrophilic, hydrophobic, wetting, air bubbles

OSD12-T02 TITLE: Novel Primary Processing of Scarce Element Ores

TECHNOLOGY AREAS: Materials/Processes

OBJECTIVE: The objective of this project is to develop and demonstrate at a relevant laboratory scale a novel, efficient, and environmentally friendly approach to the extraction, concentration, and separation of rare-earth elements from common ore stocks. This project supports the goals of the Materials Genome Initiative (MGI) in the area of Integrated Computational Materials Engineering (ICME).

DESCRIPTION: The rare-earth elements find uses in hundreds of high tech applications, including cellular telephones, laptop computers, iPods, critical military applications, and green technologies. These reactive metals have a natural abundance that is similar to that of copper. Their high costs and relative scarcity are due to the high cost of their separation, concentration, and extraction from the ores. Current methods involve the leaching of the rare-earth elements from the ore, solvent ion-exchange reactions to concentrate the elements, followed by roasting. From this concentrated state, reduction using an adaptation of the Kroll process, that is the formation of halide gasses from the oxides followed by reduction using an alkali metal, is typical.

The environmental issues behind the mining of rare-earth elements are also a concern. Using concentrated sulfuric acid leaching with high temperature calcination techniques, producing one ton of calcined rare earth ore generates: up to 12,000 m3 of waste gas containing ore dust concentrate, hydrofluoric acid, sulfur dioxide, and sulfuric acid; along with approximately 75 m3 of acidic wastewater; plus up to one ton of radioactive wet waste residue. Many ores contain Thorium, a radioactive element; so that the ore dust effluents, and residuals, are radioactive and contain many toxic heavy metals. Without special treatments, these waste products pose the threat of contaminating local water supplies and producing far-field environmental damage. The disposal of tailings, the components of the ore left behind after rare-earth extraction, also contributes to the problem. Most operations simply place tailings in large land impoundments for storage. These also present long-term environmental challenges without special treatment.

A novel means of separation and fractionation of the multiple species in the ores, and concentrating these elements into separate streams using less-aggressive techniques environmentally, could enable the increased availability of these elements for engineering applications. Over the past decade, a number of liquid-liquid ion extraction processes for rare-earth elements have become available. These, however, involve the use of toxic organic compounds that require sophisticated handling technologies to work safely in an industrial scale extraction process. Novel chemistries for the extraction, concentration, and separation of these elements that a processing plant can implement in an environmentally benign manner would improve the availability, decrease the costs of extraction, and decrease the environmental impact of the extraction operations. The objective of this project is to develop and demonstrate a more environmentally benign technique for the extraction, concentration, and separation of rare-earth elements from ores.

PHASE I: The successful phase I project will develop and define concept chemistries, along with basic engineering evaluations of the relative suitabilities of the approaches and outlines of the likely relative environmental impacts.

PHASE II: The successful phase II project will down-select a concept extraction system from the phase I effort and perform detailed chemical engineering design on the proposed process. The investigators will show through combinations of modeling, simulation, and relevant experiments that the final design is suitable for insertion into a mining/extraction process.

PHASE III: Mining operations require the concentration, and separation of the relevant elements from the ores prior to subsequent purification and processing to final form. An efficient controllable process which is either environmentally benign, or can be easily controlled for minimal environmental impact, will decrease dramatically the overall costs associated with the extraction and enable mining and ore processing for deposits which are not currently profitable for exploitation.

PRIVATE SECTOR COMMERCIAL POTENTIAL/DUAL-USE APPLICATIONS: The materials system developed in this project can play an important role in reducing the overall environmental impact and total cost of producing rare-earth compounds from ore systems. This we anticipate will increase the availability of these scarce materials, and reduce the overall costs for obtaining them. This will make significant changes in the ways that we can use these scarce materials in new designs.

REFERENCES:

1. C.K.Gupta, and N.Krishnamurthy, Extractive Metallurgy of Rare Earths, CRC Press, 2005.

2. House of Commons, Science and Technology Committee, Strategically important metals: Fifth Report of Session 2010–12, The Stationery Office Limited, London, UK, 2011.

3. “New opportunities for metals extraction and waste treatment by electrochemical processing in molten salts”,Donald R. Sadoway, Journal of Materials Research 10 (1995) 487-492.

4. “Emerging molten salt technologies for metals production”, Derek J. Fray, Journal of the Minerals, Metals and Materials Society 53 (2001) 27-31.

5. “The direct electrorefining of copper matte”, Douglas J. McKay, Journal of the Minerals, Metals and Materials Society 45 (1993) 44-48.

KEYWORDS: MGI; ICME; rare-earths; extractive metallurgy; electrolysis; environmental impact.

OSD12-T03 TITLE: Novel Electrolytic Extraction Processes for Scarce Elements

TECHNOLOGY AREAS: Materials/Processes

OBJECTIVE: The objective of this project is to design an electrode/electrolyte system for the electrolytic reduction of rare-earth and scarce metals directly from refined feedstocks. This project also supports the goals of the Materials Genome Initiative (MGI) in the area of Integrated Computational Materials Engineering (ICME).

DESCRIPTION: The rare-earth elements find uses in hundreds of high tech applications, including cellular telephones, laptop computers, iPods, critical military applications, and green technologies. These reactive metals have a natural abundance that is similar to that of copper. Their high costs and relative scarcity are due to the high cost of their separation, concentration, and extraction from the ores. Current methods involve the leaching of the rare-earth elements from the ore, solvent ion-exchange reactions to concentrate the elements, followed by roasting. From this concentrated state, reduction using an adaptation of the Kroll process, that is the formation of halide gasses from the oxides followed by reduction using an alkali metal, is typical.

The environmental issues behind the mining of rare-earth elements are also a concern. For typical extraction processing technologies, every ton of rare-earth metal produced results in as much as 9 kg of fluorine and 15 kg of possibly radioactive dust residues.

The electrolytic extraction of metals from the native ore chemistries is entering production for a number of systems. The process offers the advantage of scientific simplicity, though a number of technological issues loom important in using the process in production. Among these are the stability of the electrodes, the chemistry of the electrolyte, and the delivery of electrical power. To minimize costs and maximize utility, the use of a non-consumable anode is extremely important. Such an electrode must be capable of maintaining integrity at high temperatures in molten oxides and/or sulfides, and resistant to attack by high-activity oxygen in these conditions. Many prospective commercial operations use carbon as an anode, but it is consumed in the process to form gaseous CO2. This adds to the costs, and the environmental impact of the process. The objective of this project is to design and develop an anode material, with the associated electrolyte system, for electrolytic reduction of reactive rare-earth elements that has both the high temperature structural and chemical stability.

PHASE I: The successful phase I project will identify the conditions necessary for a successful electrode/electrolyte system. The investigators will then identify a group of electrode and electrolyte system chemistries, and show through thermokinetic models and simulations that the selected systems have a high likelihood of performing acceptably in the design.

PHASE II: The successful phase II project will perform validations of the preliminary electrode/electrolyte designs, and down-select a design for detail design work. The detail design work will require the development of thermokinetic data to predict system behavior in service, and the validation of the data and models prior to final design.

PHASE III: Mining operations, and materials recyclers, will implement this new technology system to reduce the costs and environmental impact of any new processing operations they might introduce.

PRIVATE SECTOR COMMERCIAL POTENTIAL/DUAL-USE APPLICATIONS: The materials system developed in this project can play an important role in reducing the overall environmental impact and total cost of producing metal from ore systems. This we anticipate will increase the availability of these scarce materials, and reduce the overall costs for obtaining them. This will make significant changes in the ways that we can use these scarce materials in new designs.

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

http://www.dodsbir.net/sitis/display_topic.asp?Bookmark=4282…

http://www.dodsbir.net/sitis/display_topic.asp?Bookmark=4282…

OSD STTR 12.B Topic Descriptions

OSD12-T01 TITLE: Advanced Separation Technologies for Extraction of Rare Earth Elements (REE)

TECHNOLOGY AREAS: Materials/Processes

OBJECTIVE: The objective of this research is to conduct fundamental surface chemistry measurements and demonstrate the use of these data to laboratory and small scale froth flotation systems so that more effective recovery can be achieved than with existing methods.

DESCRIPTION: A critical step in the extraction of elements from ore, especially rare earth elements that are found in complex minerals, is separation. Froth flotation is a highly versatile method for physically separating particles based on differences in the ability of air bubbles to selectively adhere to specific mineral surfaces in a mineral/water slurry. The particles with attached air bubbles are then carried to the surface and removed, while the particles that remain are completely wetted stay in the liquid phase. Froth flotation is an attractive approach, but its effectiveness is limited for the rare earth minerals as they occur as phosphates, carbonates, fluorides, silicates and oxides with gangue minerals, which often share physical properties. By providing another tool for separation, increased understanding of localized surface chemistries in complex rare earth minerals could enable affordable processes that improve grades, recoveries, capital costs and operating costs for separation of rare earth elements from their ores. The techniques used to characterize surface chemistry in flotation relate to methods to make selective minerals hydrophobic by adjusting the surface charge so that ionic collectors may be adsorbed. In the case of non-sulfide minerals this is complicated by the fact that the waste materials are also non-sulfide, so very small differences in surface chemistry properties are observed. Finding chemical methods to selectively adsorb collectors onto the desired minerals requires additional fundamental understanding of the surface ions (potential determining ions) and charges (electrochemical potentials) encountered. The work, coupled with the development of a fundamental understanding can lead to greatly improved processes for concentration by froth flotation.

PHASE I: In the phase I effort, the investigators need to explore the fundamental surface chemistry measurements (zeta potential, contact angle, micro-flotation tests) on pure rare earth mineral samples to evaluate various alternatives chemistries for selective froth flotation. Pure mineral samples need to be acquired, crushed, ground, screened, and analyzed using chemical and X-ray diffraction techniques. The surface chemistry measurements will be made as a function of collector type, pH, feed rate, particle size, mineral composition (phosphate, carbonate, fluoride, oxide, silicate), surface modification chemicals, etc. Attention will also be paid to the principal gangue minerals that occur in these ore bodies. Models are to be developed to describe and understand the surface chemistry and relate this to separation efficiency. Process environmental impact will also be a factor of evaluation.

PHASE II: In the phase II effort, the investigators shall evaluate and validate the process models, modify the process models and analyze and characterize the efficiency and the environmental impact of the separation methodology using real crushed ores using standard large scale laboratory flotation equipment. Modification of the models, as necessary, based on the test results, will be conducted and retested to determine the range of their applicability. This will demonstrate the effect of this increased understanding on the grades and recoveries obtained by determining (1) the Ratio of Concentration and (2) the Percent REE Recovered. This then could be compared to conventional methods in order to demonstrate increased value and/or reduced operating costs as a function of ore type and original concentration. Separation variability as a function of REE ore composition should be assessed. If viable, scalability will be evaluated and preliminary drawings of pilot plant floth floatation system will be planned.

PHASE III: Working with industry, a pilot plant sized floth floatation system is constructed and various crushed commercial ores will feed to determine separation efficiency based on (1) the Ratio of Concentration and (2) the Percent REE Recovered.

PRIVATE SECTOR COMMERCIAL POTENTIAL/DUAL-USE APPLICATIONS: The modeling of surface chemistries for froth floatation will lead to greater separation efficiencies and benefit the domestic mineral extractive companies specializing in rare earth recovery and production. More secure, domestic REE sources would be of great strategic importance to the Department of Defense for many applications where REE are utilized.

REFERENCES:

1. Q. Min, Y.Y. Duan, X.F. Peng, A.S. Mujumdar, C. Hsu, “Froth Flotation of Mineral Particles: Mechanism”, Drying Technology, v. 26 (8), 985-995 (2008).

2. S. Farrokhpay, “The Significance of Froth Stability in Mineral Flotation – A Review”, Advances in Colloid and Interface Science, v. 166 (1-2) 1-7 (2011).

3. N. Barbian, E. Ventura-Medina, J.J. Cilliers, “Dynamic Froth Stability in Froth Flotation”, v. 16(11), 1111-1116 (2003).

KEYWORDS: froth floatation, surface chemistry, rare earth separation, ore separation, recovery, hydrophilic, hydrophobic, wetting, air bubbles

OSD12-T02 TITLE: Novel Primary Processing of Scarce Element Ores

TECHNOLOGY AREAS: Materials/Processes

OBJECTIVE: The objective of this project is to develop and demonstrate at a relevant laboratory scale a novel, efficient, and environmentally friendly approach to the extraction, concentration, and separation of rare-earth elements from common ore stocks. This project supports the goals of the Materials Genome Initiative (MGI) in the area of Integrated Computational Materials Engineering (ICME).

DESCRIPTION: The rare-earth elements find uses in hundreds of high tech applications, including cellular telephones, laptop computers, iPods, critical military applications, and green technologies. These reactive metals have a natural abundance that is similar to that of copper. Their high costs and relative scarcity are due to the high cost of their separation, concentration, and extraction from the ores. Current methods involve the leaching of the rare-earth elements from the ore, solvent ion-exchange reactions to concentrate the elements, followed by roasting. From this concentrated state, reduction using an adaptation of the Kroll process, that is the formation of halide gasses from the oxides followed by reduction using an alkali metal, is typical.

The environmental issues behind the mining of rare-earth elements are also a concern. Using concentrated sulfuric acid leaching with high temperature calcination techniques, producing one ton of calcined rare earth ore generates: up to 12,000 m3 of waste gas containing ore dust concentrate, hydrofluoric acid, sulfur dioxide, and sulfuric acid; along with approximately 75 m3 of acidic wastewater; plus up to one ton of radioactive wet waste residue. Many ores contain Thorium, a radioactive element; so that the ore dust effluents, and residuals, are radioactive and contain many toxic heavy metals. Without special treatments, these waste products pose the threat of contaminating local water supplies and producing far-field environmental damage. The disposal of tailings, the components of the ore left behind after rare-earth extraction, also contributes to the problem. Most operations simply place tailings in large land impoundments for storage. These also present long-term environmental challenges without special treatment.

A novel means of separation and fractionation of the multiple species in the ores, and concentrating these elements into separate streams using less-aggressive techniques environmentally, could enable the increased availability of these elements for engineering applications. Over the past decade, a number of liquid-liquid ion extraction processes for rare-earth elements have become available. These, however, involve the use of toxic organic compounds that require sophisticated handling technologies to work safely in an industrial scale extraction process. Novel chemistries for the extraction, concentration, and separation of these elements that a processing plant can implement in an environmentally benign manner would improve the availability, decrease the costs of extraction, and decrease the environmental impact of the extraction operations. The objective of this project is to develop and demonstrate a more environmentally benign technique for the extraction, concentration, and separation of rare-earth elements from ores.

PHASE I: The successful phase I project will develop and define concept chemistries, along with basic engineering evaluations of the relative suitabilities of the approaches and outlines of the likely relative environmental impacts.

PHASE II: The successful phase II project will down-select a concept extraction system from the phase I effort and perform detailed chemical engineering design on the proposed process. The investigators will show through combinations of modeling, simulation, and relevant experiments that the final design is suitable for insertion into a mining/extraction process.

PHASE III: Mining operations require the concentration, and separation of the relevant elements from the ores prior to subsequent purification and processing to final form. An efficient controllable process which is either environmentally benign, or can be easily controlled for minimal environmental impact, will decrease dramatically the overall costs associated with the extraction and enable mining and ore processing for deposits which are not currently profitable for exploitation.

PRIVATE SECTOR COMMERCIAL POTENTIAL/DUAL-USE APPLICATIONS: The materials system developed in this project can play an important role in reducing the overall environmental impact and total cost of producing rare-earth compounds from ore systems. This we anticipate will increase the availability of these scarce materials, and reduce the overall costs for obtaining them. This will make significant changes in the ways that we can use these scarce materials in new designs.

REFERENCES:

1. C.K.Gupta, and N.Krishnamurthy, Extractive Metallurgy of Rare Earths, CRC Press, 2005.

2. House of Commons, Science and Technology Committee, Strategically important metals: Fifth Report of Session 2010–12, The Stationery Office Limited, London, UK, 2011.

3. “New opportunities for metals extraction and waste treatment by electrochemical processing in molten salts”,Donald R. Sadoway, Journal of Materials Research 10 (1995) 487-492.

4. “Emerging molten salt technologies for metals production”, Derek J. Fray, Journal of the Minerals, Metals and Materials Society 53 (2001) 27-31.

5. “The direct electrorefining of copper matte”, Douglas J. McKay, Journal of the Minerals, Metals and Materials Society 45 (1993) 44-48.

KEYWORDS: MGI; ICME; rare-earths; extractive metallurgy; electrolysis; environmental impact.

OSD12-T03 TITLE: Novel Electrolytic Extraction Processes for Scarce Elements

TECHNOLOGY AREAS: Materials/Processes

OBJECTIVE: The objective of this project is to design an electrode/electrolyte system for the electrolytic reduction of rare-earth and scarce metals directly from refined feedstocks. This project also supports the goals of the Materials Genome Initiative (MGI) in the area of Integrated Computational Materials Engineering (ICME).

DESCRIPTION: The rare-earth elements find uses in hundreds of high tech applications, including cellular telephones, laptop computers, iPods, critical military applications, and green technologies. These reactive metals have a natural abundance that is similar to that of copper. Their high costs and relative scarcity are due to the high cost of their separation, concentration, and extraction from the ores. Current methods involve the leaching of the rare-earth elements from the ore, solvent ion-exchange reactions to concentrate the elements, followed by roasting. From this concentrated state, reduction using an adaptation of the Kroll process, that is the formation of halide gasses from the oxides followed by reduction using an alkali metal, is typical.

The environmental issues behind the mining of rare-earth elements are also a concern. For typical extraction processing technologies, every ton of rare-earth metal produced results in as much as 9 kg of fluorine and 15 kg of possibly radioactive dust residues.

The electrolytic extraction of metals from the native ore chemistries is entering production for a number of systems. The process offers the advantage of scientific simplicity, though a number of technological issues loom important in using the process in production. Among these are the stability of the electrodes, the chemistry of the electrolyte, and the delivery of electrical power. To minimize costs and maximize utility, the use of a non-consumable anode is extremely important. Such an electrode must be capable of maintaining integrity at high temperatures in molten oxides and/or sulfides, and resistant to attack by high-activity oxygen in these conditions. Many prospective commercial operations use carbon as an anode, but it is consumed in the process to form gaseous CO2. This adds to the costs, and the environmental impact of the process. The objective of this project is to design and develop an anode material, with the associated electrolyte system, for electrolytic reduction of reactive rare-earth elements that has both the high temperature structural and chemical stability.

PHASE I: The successful phase I project will identify the conditions necessary for a successful electrode/electrolyte system. The investigators will then identify a group of electrode and electrolyte system chemistries, and show through thermokinetic models and simulations that the selected systems have a high likelihood of performing acceptably in the design.

PHASE II: The successful phase II project will perform validations of the preliminary electrode/electrolyte designs, and down-select a design for detail design work. The detail design work will require the development of thermokinetic data to predict system behavior in service, and the validation of the data and models prior to final design.

PHASE III: Mining operations, and materials recyclers, will implement this new technology system to reduce the costs and environmental impact of any new processing operations they might introduce.

PRIVATE SECTOR COMMERCIAL POTENTIAL/DUAL-USE APPLICATIONS: The materials system developed in this project can play an important role in reducing the overall environmental impact and total cost of producing metal from ore systems. This we anticipate will increase the availability of these scarce materials, and reduce the overall costs for obtaining them. This will make significant changes in the ways that we can use these scarce materials in new designs.

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

http://rareearthinvestingnews.com/8270-ucore-rare-metals-ucu…

...

Ucore Rare Metals Attracting Interest from DOD

Monday October 22, 2012, 4:30am PDT

By Vivien Diniz - Exclusive to Rare Earth Investing News

---------------------------------------------------------------------------

With most rare earth attention focused on Lynas Corporation’s (ASX:LYC) ongoing court battle, many investors are now shifting their attention to explorers and producers that offer less public and political opposition and more upside potential.

Rare Earth Investing News sat down with Jim McKenzie, president and CEO of Ucore Rare Metals (TSXV:UCU), a development-phase mining company focused on establishing rare metal resources with near-term production potential.

The company gained increased attention recently when it announced that the US Department of Defense (DOD) signed a contract to conduct a mineralogical and metallurgical study on its Bokan Mountain heavy rare earth element (HREE) property in Southeast Alaska.

...

...

Ucore Rare Metals Attracting Interest from DOD

Monday October 22, 2012, 4:30am PDT

By Vivien Diniz - Exclusive to Rare Earth Investing News

---------------------------------------------------------------------------

With most rare earth attention focused on Lynas Corporation’s (ASX:LYC) ongoing court battle, many investors are now shifting their attention to explorers and producers that offer less public and political opposition and more upside potential.

Rare Earth Investing News sat down with Jim McKenzie, president and CEO of Ucore Rare Metals (TSXV:UCU), a development-phase mining company focused on establishing rare metal resources with near-term production potential.

The company gained increased attention recently when it announced that the US Department of Defense (DOD) signed a contract to conduct a mineralogical and metallurgical study on its Bokan Mountain heavy rare earth element (HREE) property in Southeast Alaska.

...

http://www.theaureport.com/pub/na/14623

...

TCMR: Who is the other Nova Scotia company you wanted to mention?

MN: Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX) has a HREE project in southeast Alaska. The Bokan Mountain project is located near Ketchikan, Alaska. The company is rapidly advancing the project and has recently completed several "firsts," which investors may not have taken into account. It recently announced successful separation of HREEs including dysprosium, neodymium and erbium, producing a purified salable product. In addition, this process nearly removes all of the undesirable elements including iron, uranium and thorium, which may be returned to the mine in paste backfill together with all of the mine tailings. This means Ucore's Bokan operation will have minimal daylight expression at surface and a very small environmental footprint.

TCMR: The paste backfill must have pretty good appeal for government regulators.

MN: That is certainly correct, but Ucore has impressed several layers of government in Alaska, and the U.S. The U.S. Department of Defense has recognized the importance of the project in securing a sustainable North American resource of HREEs. It has also received support from its congressional representative to advance road access and other infrastructure developments in national lands. The state of Alaska also sees the potential for drawing value-added businesses to Alaska, like permanent magnet manufacturers. Support includes ongoing financial support for metallurgical study at the University of Alaska Fairbanks, and support for developing cheaper hydropower alternatives near the mine. The company is currently reviewing the latest solid-phase extraction that removes deleterious elements, purifying the concentrate on a molecular level.

TCMR: How does Ucore's resource at Bokan Mountain stand up?

MN: Bokan Mountain has an Inferred resource of about 5.3 Mt of 0.65% TREO, of which 40% is enriched by HREEs. This is a modest initial resource estimate. The project is open to expansion, and it has excellent potential for value enhancement with the new solid-phase extraction process. The positive results of the study have led the company to delay completion of the PEA, but it has good potential for accelerating in improving the confidence in the bankable feasibility study. Upon completion of the PEA, Ucore will also be able to actively pursue off-take partners. From our vantage point, we see its partnership with the Department of Defense as providing substantial long-term support, mitigating political risk.

TCMR: When will interest increase in REE companies like Namibia Rare Earths and Ucore?

MN: I think the market is always looking for a bottom and is ready to start accumulating companies that look like winners. Ucore's recent price movement supports this idea. The market is looking for companies with the ability to jump the metallurgical hurdle. This is why Namibia Rare Earths, while less advanced than Ucore, still presents a deep-value exploration opportunity.

TCMR:Thank you, Mike.

MN: My pleasure.

...

...

TCMR: Who is the other Nova Scotia company you wanted to mention?

MN: Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX) has a HREE project in southeast Alaska. The Bokan Mountain project is located near Ketchikan, Alaska. The company is rapidly advancing the project and has recently completed several "firsts," which investors may not have taken into account. It recently announced successful separation of HREEs including dysprosium, neodymium and erbium, producing a purified salable product. In addition, this process nearly removes all of the undesirable elements including iron, uranium and thorium, which may be returned to the mine in paste backfill together with all of the mine tailings. This means Ucore's Bokan operation will have minimal daylight expression at surface and a very small environmental footprint.

TCMR: The paste backfill must have pretty good appeal for government regulators.

MN: That is certainly correct, but Ucore has impressed several layers of government in Alaska, and the U.S. The U.S. Department of Defense has recognized the importance of the project in securing a sustainable North American resource of HREEs. It has also received support from its congressional representative to advance road access and other infrastructure developments in national lands. The state of Alaska also sees the potential for drawing value-added businesses to Alaska, like permanent magnet manufacturers. Support includes ongoing financial support for metallurgical study at the University of Alaska Fairbanks, and support for developing cheaper hydropower alternatives near the mine. The company is currently reviewing the latest solid-phase extraction that removes deleterious elements, purifying the concentrate on a molecular level.

TCMR: How does Ucore's resource at Bokan Mountain stand up?

MN: Bokan Mountain has an Inferred resource of about 5.3 Mt of 0.65% TREO, of which 40% is enriched by HREEs. This is a modest initial resource estimate. The project is open to expansion, and it has excellent potential for value enhancement with the new solid-phase extraction process. The positive results of the study have led the company to delay completion of the PEA, but it has good potential for accelerating in improving the confidence in the bankable feasibility study. Upon completion of the PEA, Ucore will also be able to actively pursue off-take partners. From our vantage point, we see its partnership with the Department of Defense as providing substantial long-term support, mitigating political risk.

TCMR: When will interest increase in REE companies like Namibia Rare Earths and Ucore?

MN: I think the market is always looking for a bottom and is ready to start accumulating companies that look like winners. Ucore's recent price movement supports this idea. The market is looking for companies with the ability to jump the metallurgical hurdle. This is why Namibia Rare Earths, while less advanced than Ucore, still presents a deep-value exploration opportunity.

TCMR:Thank you, Mike.

MN: My pleasure.

...

http://www.petroleumnews.com/pntruncate/138624872.shtml

...

Mining News: Pentagon gets footing at Bokan Mountain

Department of Defense inks deal with Ucore for heavy REE deposit in SE Alaska, state-of-the-art method for extracting rare earths

...

...

Mining News: Pentagon gets footing at Bokan Mountain

Department of Defense inks deal with Ucore for heavy REE deposit in SE Alaska, state-of-the-art method for extracting rare earths

...

Zitat von Videomart: HRE-Preise fallen weiter...

http://www.metal-pages.com/metalprices/rareearths/

Sieht heute schon wieder anders aus. Innerchinesischen Preise steigen wieder etwas an. LaOxid FOB sinkt dagegen weiter.

http://www.stockopedia.co.uk/content/social-media-lifting-th…

...

They're doing it over there...

Two examples of small caps using social media effectively are Australia-based explorer Iron Road (ASX:IRD), which is using it to highlight its A$2.5 billion iron ore project in Southern Australia and to engage with investors. It is also now using social media to raise its profile in China, a key market for iron ore, via a local social media platform called Sina Weibo. Iron Road is looking to social media to support its fund raising efforts to advance its project. The other example is Canada-based rare earths explorer Ucore Rare Metals (CVE:UCU), which has developed a very large following on Twitter, bigger even than mining giant Anglo American (LON:AAL). It also uses it's website as a very effective multimedia platform and education centre for investors. As a result it enjoys a much higher profile than most of the other junior rare earths explorers many of which struggle to gain investor recognition.

...

...

They're doing it over there...

Two examples of small caps using social media effectively are Australia-based explorer Iron Road (ASX:IRD), which is using it to highlight its A$2.5 billion iron ore project in Southern Australia and to engage with investors. It is also now using social media to raise its profile in China, a key market for iron ore, via a local social media platform called Sina Weibo. Iron Road is looking to social media to support its fund raising efforts to advance its project. The other example is Canada-based rare earths explorer Ucore Rare Metals (CVE:UCU), which has developed a very large following on Twitter, bigger even than mining giant Anglo American (LON:AAL). It also uses it's website as a very effective multimedia platform and education centre for investors. As a result it enjoys a much higher profile than most of the other junior rare earths explorers many of which struggle to gain investor recognition.

...

Reuters:

Kazakh nuclear firm and Japan's Sumitomo launch rare earth plant

Fri Nov 2, 2012 4:47pm IST

* Joint venture to produce 1,500 tonnes a year

* Focus on heavy rare earths, Japanese market

* Aims to reduce dependence on China

http://in.reuters.com/article/2012/11/02/rareearths-kazakhst…

Kazakh nuclear firm and Japan's Sumitomo launch rare earth plant

Fri Nov 2, 2012 4:47pm IST

* Joint venture to produce 1,500 tonnes a year

* Focus on heavy rare earths, Japanese market

* Aims to reduce dependence on China

http://in.reuters.com/article/2012/11/02/rareearths-kazakhst…

Nov 2, 2012 - 03:20 AM AKST

2012 Alaska Miners Association Convention

“The Business of Mining” Sheraton Hotel, Anchorage, Nov. 5-11.

Session 2

Wednesday afternoon, Nov. 7

3:00 Jim Barker, Ucore Rare Metals

Rare Earth, Tin, Tungsten Alluvial Exploration in the Ruby Batholith in Central Alaska

http://www.alaskajournal.com/Alaska-Journal-of-Commerce/Nove…

2012 Alaska Miners Association Convention

“The Business of Mining” Sheraton Hotel, Anchorage, Nov. 5-11.

Session 2

Wednesday afternoon, Nov. 7

3:00 Jim Barker, Ucore Rare Metals

Rare Earth, Tin, Tungsten Alluvial Exploration in the Ruby Batholith in Central Alaska

http://www.alaskajournal.com/Alaska-Journal-of-Commerce/Nove…

Antwort auf Beitrag Nr.: 43.782.033 von Videomart am 03.11.12 01:01:02Session 6

Friday afternoon, Nov. 9

2:00 Ken Collison, Ucore Rare Metals Inc.

"Bokan Mountain Project"

Friday afternoon, Nov. 9

2:00 Ken Collison, Ucore Rare Metals Inc.

"Bokan Mountain Project"

Ich möchte das gerne mich euch teilen. Das Ganze ist noch 4 Tage und 10 Stunden verfügbar. Falls jemand in der Lage ist, das mitzuschneiden, dann wäre ich dankbar. Hier der Beitrag:

FYI - in addition to the scheduled replay via GoToWebinar later today, we are now offering an "on-demand" replay of the webinar for the next 6 days, directly at the following link:

http://www.techmetalsresearch.com/webinar/replay/

After clicking play you may need to give the player a few seconds to start, but it should get up and running and you'll be able to watch and listen.

FYI - in addition to the scheduled replay via GoToWebinar later today, we are now offering an "on-demand" replay of the webinar for the next 6 days, directly at the following link:

http://www.techmetalsresearch.com/webinar/replay/

After clicking play you may need to give the player a few seconds to start, but it should get up and running and you'll be able to watch and listen.

Department of Energy Backing Rare Earth Recycling

Monday November 5, 2012, 4:30am PST

By Adam Currie - Exclusive to Rare Earth Investing News

http://resourceinvestingnews.com/45495-department-of-energy-…

Monday November 5, 2012, 4:30am PST

By Adam Currie - Exclusive to Rare Earth Investing News

http://resourceinvestingnews.com/45495-department-of-energy-…

http://washpost.bloomberg.com/Story?docId=1376-MCEK916S972E0…

...

The U.S. Department of Defense and Asia’s biggest carmaker are working with Canada’s Ucore Rare Metals Inc. and Matamec Explorations Inc., which are developing North American mines that would boost supplies of so-called heavy rare earths. Those are the less-abundant members of a group of 17 chemically similar elements critical to make a host of products from wind turbines to high-performance magnets for cars and weapons.