Amarin - The Science Of Lipid Therapy - 500 Beiträge pro Seite (Seite 2)

eröffnet am 03.01.14 20:10:32 von

neuester Beitrag 04.04.24 15:47:54 von

neuester Beitrag 04.04.24 15:47:54 von

Beiträge: 1.840

ID: 1.190.027

ID: 1.190.027

Aufrufe heute: 4

Gesamt: 156.369

Gesamt: 156.369

Aktive User: 0

ISIN: US0231112063 · WKN: A0NBNG · Symbol: AMRN

0,8557

USD

-2,61 %

-0,0229 USD

Letzter Kurs 21:20:53 Nasdaq

Neuigkeiten

24.04.24 · globenewswire |

22.04.24 · globenewswire |

15.04.24 · globenewswire |

Amarin Highlights Key Data Providing Mechanistic Insights into Eicosapentaenoic Acid (EPA) at ACC.24 08.04.24 · globenewswire |

06.04.24 · globenewswire |

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7296 | +25,04 | |

| 6,0000 | +25,00 | |

| 9,5000 | +18,75 | |

| 0,6400 | +18,52 | |

| 1,0900 | +14,74 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8410 | -17,06 | |

| 9,7200 | -19,60 | |

| 4,0000 | -27,27 | |

| 2,7280 | -29,14 | |

| 14,510 | -32,32 |

Amarin Jumps After Diabetes Association Adds Drug to Its 'Must Have' List

The American Diabetes Association adds Amarin's Vascepa drug to its standard of care recommendation list.

Tony Owusu

Mar 28, 2019 8:11 AM EDT

Istock

Shares of pharmaceutical company Amarin (AMRN) were up more than 6% in premarket Thursday after the company's Vascepa drug was added to the American Diabetes Association's Standards of Medical Care in Diabetes list for 2019.

The drug, along with a specialized diet, has been shown to reduce triglyceride levels in adult patients with severe hypertriglyceridemia. Amarin has agreed to give the Food and Drug Administration data to support the ADA's finding in order expand Vascepa's FDA label to include its recommendation.

"As we have commenced transmission of data to the FDA for the submission of our sNDA seeking an expansion of the Vascepa label based on the landmark REDUCE-IT results, we are pleased by ADA's acknowledgement of the importance of the REDUCE-IT results in its 2019 update of the Standards of Care," said Dr. Craig B. Granowitz, senior vice president and chief medical officer of Amarin.

Amarin said that Vascepa works without raising bad cholesterol when a four-gram dose is taken daily.

The American Diabetes Association adds Amarin's Vascepa drug to its standard of care recommendation list.

Tony Owusu

Mar 28, 2019 8:11 AM EDT

Istock

Shares of pharmaceutical company Amarin (AMRN) were up more than 6% in premarket Thursday after the company's Vascepa drug was added to the American Diabetes Association's Standards of Medical Care in Diabetes list for 2019.

The drug, along with a specialized diet, has been shown to reduce triglyceride levels in adult patients with severe hypertriglyceridemia. Amarin has agreed to give the Food and Drug Administration data to support the ADA's finding in order expand Vascepa's FDA label to include its recommendation.

"As we have commenced transmission of data to the FDA for the submission of our sNDA seeking an expansion of the Vascepa label based on the landmark REDUCE-IT results, we are pleased by ADA's acknowledgement of the importance of the REDUCE-IT results in its 2019 update of the Standards of Care," said Dr. Craig B. Granowitz, senior vice president and chief medical officer of Amarin.

Amarin said that Vascepa works without raising bad cholesterol when a four-gram dose is taken daily.

Amarin takes application to expand Vascepa label to the FDA as M&A chatter heats up

by Natalie Grover

— on March 29, 2019 06:16 AM EDT

Updated: 08:26 AM

PDF

Having unveiled an unexpected set of heart protective results for their fish oil-derived pill Vascepa, Amarin is marching ahead to fulfill blockbuster expectations for its cholesterol-lowering drug by submitting an application to expand Vascepa’s label to include the reduction in cardiovascular risk.

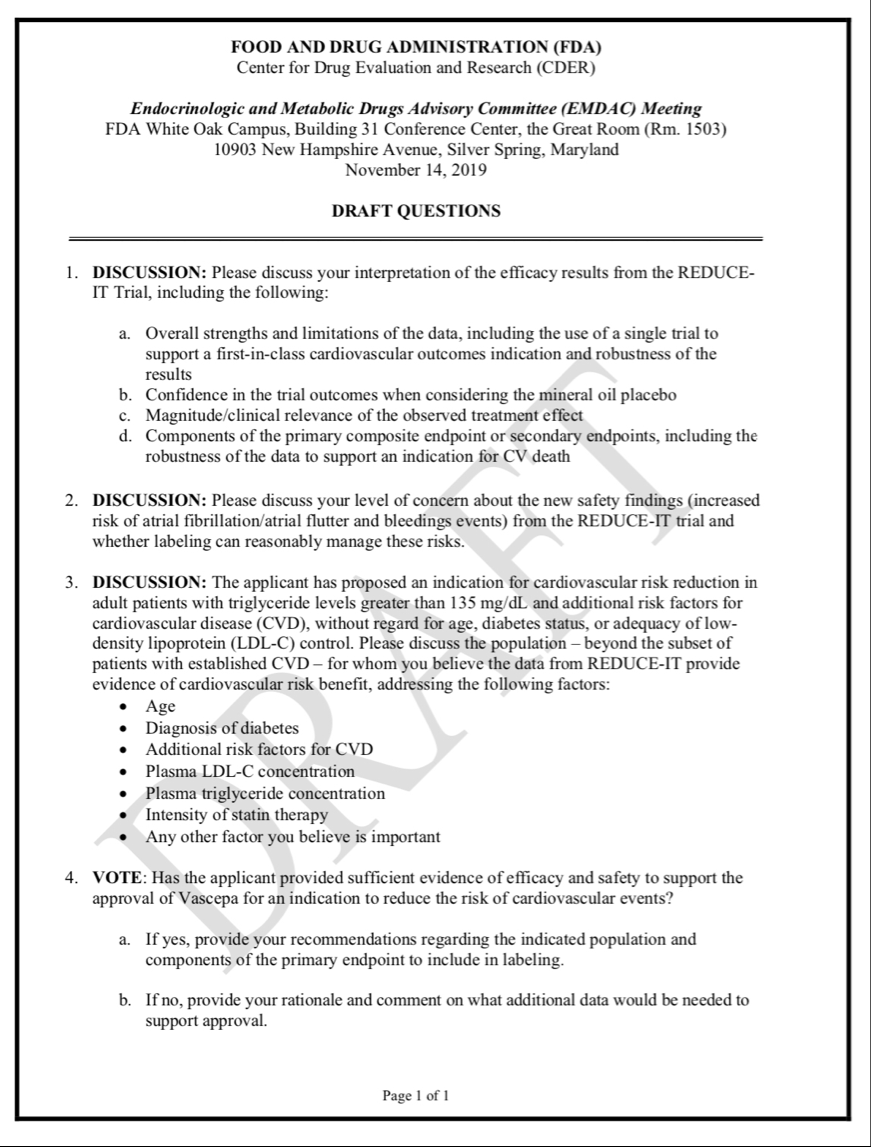

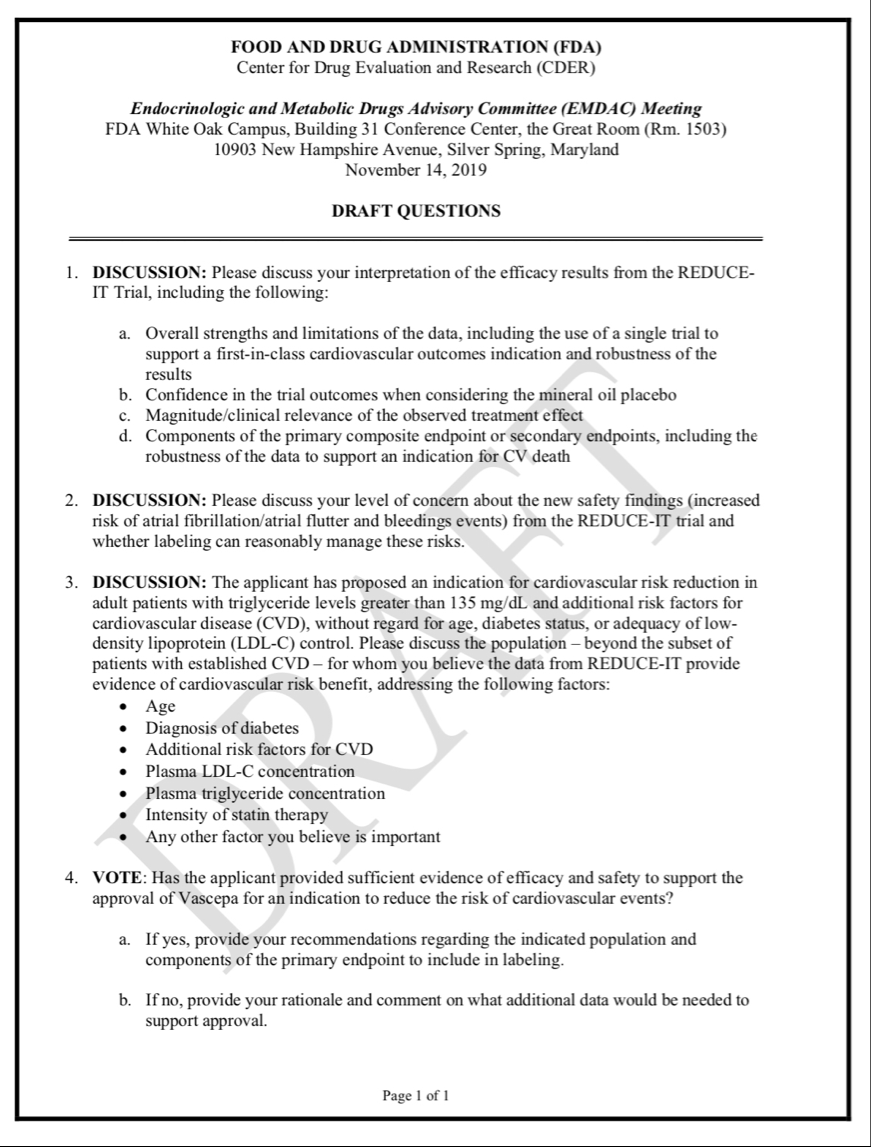

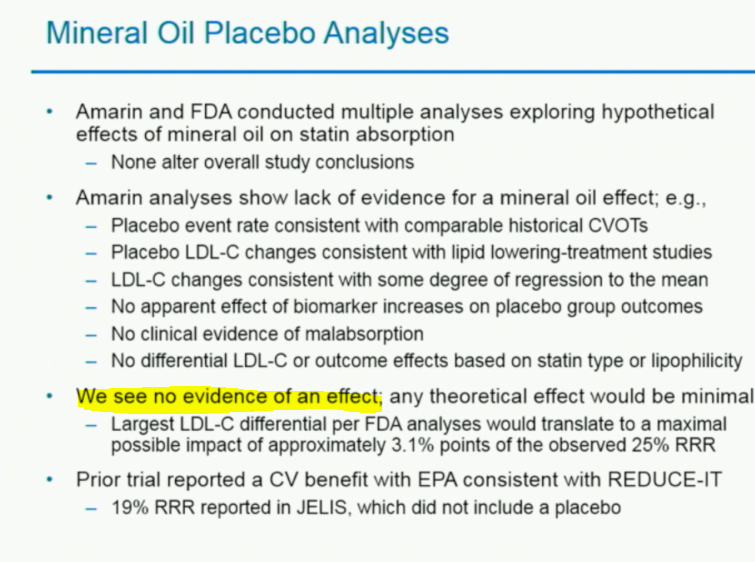

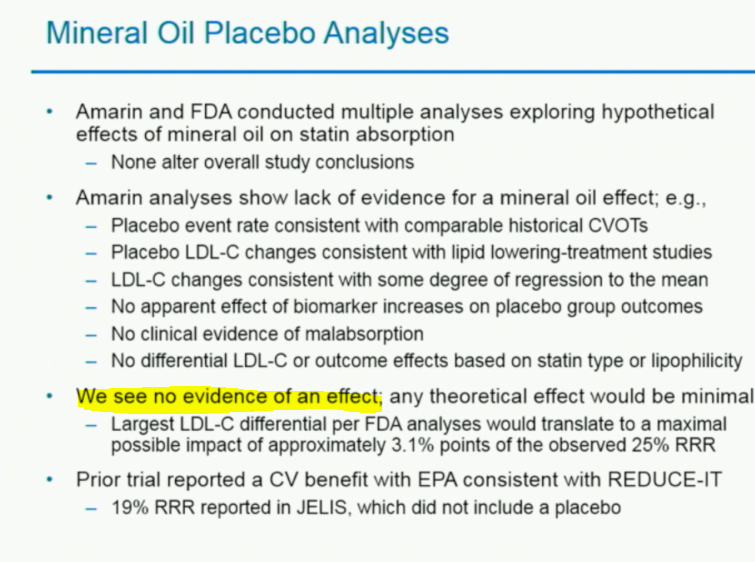

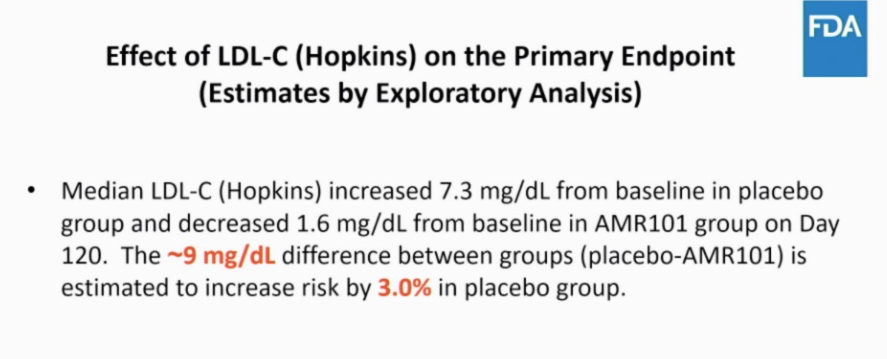

The company sparked a flurry of M&A chatter after revealing data from the REDUCE-IT study last year — a 25% reduction in the risk for the first occurrence of a major cardio event, and a 26% reduction for 3-point MACE, a composite of cardiovascular death, nonfatal heart attack and nonfatal stroke — although concerns about the impact of the mineral oil placebo on the results prompted lingering questions. Earlier this month, Amarin debuted its exploratory analysis of the trial, with researchers suggesting a 30% reduction in cardiovascular events compared to the placebo arm.

John Thero

“The REDUCE-IT results support that approximately 1 fewer major cardiovascular adverse event would occur on average for every 6 patients treated with Vascepa for 5 years on top of statin therapy compared to placebo,” Amarin chief John Thero said in a statement.

On Thursday, Amarin said it was operating under the assumption that the sNDA will be reviewed over a standard ten months resulting in a PDUFA date near the end of January 2020, and that it expects the regulator with organize an advisory committee meeting of outside experts to deliberate and recommend whether Vascepa’s label should be expanded before the FDA makes its final decision.

Earlier in the week, the American Diabetes Association issued fresh “standards of care” guidelines to include Vascepa. They recommended that Vascepa “be considered for patients with diabetes and atherosclerotic cardiovascular disease or other cardiac risk factors on a statin with controlled LDL-C, but with elevated triglycerides to reduce cardiovascular risk.”

Vascepa, which generated about $229 million in 2018 sales, comprises omega-3 acid called EPA derived from fish — was originally approved in 2012 for patients with severe hypertriglyceridemia. It is reasonably priced with an annual price tag of roughly $2400, Amarin contends, adding that the majority of insured patients insurance who obtain Vascepa prescriptions pay a monthly co-pay charge of $9.99 or less.

Meanwhile, PCSK9 inhibitors that were approved in 2015 carried a price close to $14,000 and were pegged to attain blockbuster status for their ability to dramatically lower levels of LDL cholesterol, facing pushback from insurers for their high sticker prices that led to lower adoption than expected, despite later trials that demonstrated they also significantly cut the risk of heart attacks and stroke. Following Amgen’s decision to slash the price of its PCSK9 drug Repatha by 60% to $5,850 last year, the team behind their main rival treatment, Praluent — Regeneron $REGN and Sanofi $SNY — have followed suit with the same discount, beginning early March.

In 2016, Amarin $AMRN won a landmark ruling against the FDA, which allowed the drugmaker to exercise its first amendment rights by promoting Vascepa for off-label uses as long as it does so ‘truthfully.’ The company was also seeking to market the drug to patients with not just severe triglyceride levels, but those considered to have ‘high’ levels of the blood fat.

by Natalie Grover

— on March 29, 2019 06:16 AM EDT

Updated: 08:26 AM

Having unveiled an unexpected set of heart protective results for their fish oil-derived pill Vascepa, Amarin is marching ahead to fulfill blockbuster expectations for its cholesterol-lowering drug by submitting an application to expand Vascepa’s label to include the reduction in cardiovascular risk.

The company sparked a flurry of M&A chatter after revealing data from the REDUCE-IT study last year — a 25% reduction in the risk for the first occurrence of a major cardio event, and a 26% reduction for 3-point MACE, a composite of cardiovascular death, nonfatal heart attack and nonfatal stroke — although concerns about the impact of the mineral oil placebo on the results prompted lingering questions. Earlier this month, Amarin debuted its exploratory analysis of the trial, with researchers suggesting a 30% reduction in cardiovascular events compared to the placebo arm.

John Thero

“The REDUCE-IT results support that approximately 1 fewer major cardiovascular adverse event would occur on average for every 6 patients treated with Vascepa for 5 years on top of statin therapy compared to placebo,” Amarin chief John Thero said in a statement.

On Thursday, Amarin said it was operating under the assumption that the sNDA will be reviewed over a standard ten months resulting in a PDUFA date near the end of January 2020, and that it expects the regulator with organize an advisory committee meeting of outside experts to deliberate and recommend whether Vascepa’s label should be expanded before the FDA makes its final decision.

Earlier in the week, the American Diabetes Association issued fresh “standards of care” guidelines to include Vascepa. They recommended that Vascepa “be considered for patients with diabetes and atherosclerotic cardiovascular disease or other cardiac risk factors on a statin with controlled LDL-C, but with elevated triglycerides to reduce cardiovascular risk.”

Vascepa, which generated about $229 million in 2018 sales, comprises omega-3 acid called EPA derived from fish — was originally approved in 2012 for patients with severe hypertriglyceridemia. It is reasonably priced with an annual price tag of roughly $2400, Amarin contends, adding that the majority of insured patients insurance who obtain Vascepa prescriptions pay a monthly co-pay charge of $9.99 or less.

Meanwhile, PCSK9 inhibitors that were approved in 2015 carried a price close to $14,000 and were pegged to attain blockbuster status for their ability to dramatically lower levels of LDL cholesterol, facing pushback from insurers for their high sticker prices that led to lower adoption than expected, despite later trials that demonstrated they also significantly cut the risk of heart attacks and stroke. Following Amgen’s decision to slash the price of its PCSK9 drug Repatha by 60% to $5,850 last year, the team behind their main rival treatment, Praluent — Regeneron $REGN and Sanofi $SNY — have followed suit with the same discount, beginning early March.

In 2016, Amarin $AMRN won a landmark ruling against the FDA, which allowed the drugmaker to exercise its first amendment rights by promoting Vascepa for off-label uses as long as it does so ‘truthfully.’ The company was also seeking to market the drug to patients with not just severe triglyceride levels, but those considered to have ‘high’ levels of the blood fat.

Heute haben wir einen schönen Anstieg, $23.30 wäre das nächste Ziel, schönes Wochenende.

Jefferies-Potential Beat On Growing Q1 Vascepa Sales - Debate on Expectations $30 target Price

Potential Beat On Growing Q1 Vascepa Sales - Debate on Expectations

Michael J. Yee, Andrew Tsai, Kelechi Chikere, Ph.D., Arshad Haider

April 24, 2019

Key Takeaway

AMRN could report Q1 EPS results in the first week of May and we note IMS scripts have reached all-time highs over the past 9 of 10 weeks, tracking to perhaps ~$75-80M and possibly well above consensus $67M (4 ests). 2019 guidance of $350M would then look conservative and too low. For 2019, we are above at $385M and above cons $365M and guidance could eventually move higher towards our estimate.

Insights

Weekly scripts appear to reach record highs, setting up AMRN for a pot'l Q1 sales beat

Despite management cautioning to expect seasonality in Q1, scripts are up +16% Q/Q (accelerated even more than the +13-15% in Q4) - appearing to track to ~$75-80M in Q1 vs cons $67M (4 ests) and Jefferies at $79M. Historically, Vascepa sales have declined in Q1 over the past couple of years, but we see an increase this year instead due to 1) major new CVOT data during Q4 now published in the NEJM, 2) huge salesforce increase to 400 from 150 recently, and 3) positive doc channel checks suggesting reimbursement has not been much issue. We also note Q4 reported sales were even higher than third-party data (+40% vs +13%) suggesting Q1 IMS script data could be inaccurate (under-capturing) as well although management recently confirmed weekly scripts are tracking fairly accurately to AMRN's internal datapoints. Bigger picture, 2019 guidance of $350M appears conservative and only suggests an $80M+$85M+$90M+$95M trajectory (i.e. modest growth), even though sales grew by a whopping $20M+ Q/Q to $77M in Q4.

Additional Q1 dynamics and thoughts

We acknowledge some buysiders think a beat is already expected given third-party data is available though we argue confirming these strong results after last quarters doubt (huge beat in Q4) would be positive and it means consensus is going up. We also understand the stock has been in a trading range from teens to low $20s and investors seem to want to debate "M&A takeout or bust" more than anything with bears saying no takeout until litigation is settled and FDA label expansion confirmed.

Our estimated $79M in Q1 considers 1) a +9% price increase Dec 2018, 2) offset by increased gross to net typical of Q1, and 3) higher capture of 75% vs 72% for Q4 to be conservative. We can derive Q1 sales of ~$80M were we to assume a G2N of 55% (vs 50% for other quarters). Alternatively, adjusting the capture to historical of 83% (our est) would yield Q sales closer to the $70-75M range, which would still be above consensus estimates of $67M.

Our doctors consistently provide positive feedback on Vascepa

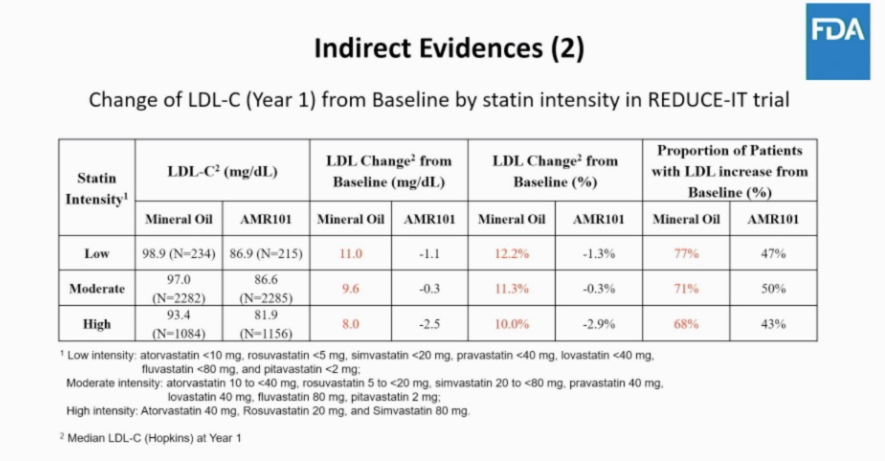

Anecdotally, docs inform us they have "accelerated their prescriptions" post the Nov 2018 AHA conference. The LDL increase in the placebo arm (mineral oil) has not deterred docs from prescribing Vascepa. From our NYC Doc Panel day last month, post the data, one doc increased his prescriptions by 3x-4x to 10/month, while the other doctor now prescribes it several times a month. The latter was formerly not a strong believer in triglyceride (TG) therapies unless patients exceeded the >500mg/dL threshold, but he now envisions his overall usage for "elevated" TG patients to increase as he becomes more familiar and comfortable and reimbursement has been easy.

Company Description

Amarin Corporation

Amarin Corporation, headquartered in Dublin, Ireland and Bedminster, New Jersey is a biopharmaceutical company focused on the commercialization and development of therapeutics to improve cardiovascular health. Amarin's approved drug, Vascepa, is an ultra-pure, EPA-only, omega-3 fatty acid, oral product for the treatment of severe high triglycerides and mixed dyslipidemia. The company’s cardiovascular programs capitalize on Amarin's expertise in the field of lipid science and the known therapeutic benefits of essential fatty acids in treating cardiovascular disease. AMRN reported a positive REDUCE-IT CVOT result in September 2018.

Company Valuation/Risks

Amarin Corporation

Our $30 PT is DCF-based. Risks: clinical, regulatory, a

Potential Beat On Growing Q1 Vascepa Sales - Debate on Expectations

Michael J. Yee, Andrew Tsai, Kelechi Chikere, Ph.D., Arshad Haider

April 24, 2019

Key Takeaway

AMRN could report Q1 EPS results in the first week of May and we note IMS scripts have reached all-time highs over the past 9 of 10 weeks, tracking to perhaps ~$75-80M and possibly well above consensus $67M (4 ests). 2019 guidance of $350M would then look conservative and too low. For 2019, we are above at $385M and above cons $365M and guidance could eventually move higher towards our estimate.

Insights

Weekly scripts appear to reach record highs, setting up AMRN for a pot'l Q1 sales beat

Despite management cautioning to expect seasonality in Q1, scripts are up +16% Q/Q (accelerated even more than the +13-15% in Q4) - appearing to track to ~$75-80M in Q1 vs cons $67M (4 ests) and Jefferies at $79M. Historically, Vascepa sales have declined in Q1 over the past couple of years, but we see an increase this year instead due to 1) major new CVOT data during Q4 now published in the NEJM, 2) huge salesforce increase to 400 from 150 recently, and 3) positive doc channel checks suggesting reimbursement has not been much issue. We also note Q4 reported sales were even higher than third-party data (+40% vs +13%) suggesting Q1 IMS script data could be inaccurate (under-capturing) as well although management recently confirmed weekly scripts are tracking fairly accurately to AMRN's internal datapoints. Bigger picture, 2019 guidance of $350M appears conservative and only suggests an $80M+$85M+$90M+$95M trajectory (i.e. modest growth), even though sales grew by a whopping $20M+ Q/Q to $77M in Q4.

Additional Q1 dynamics and thoughts

We acknowledge some buysiders think a beat is already expected given third-party data is available though we argue confirming these strong results after last quarters doubt (huge beat in Q4) would be positive and it means consensus is going up. We also understand the stock has been in a trading range from teens to low $20s and investors seem to want to debate "M&A takeout or bust" more than anything with bears saying no takeout until litigation is settled and FDA label expansion confirmed.

Our estimated $79M in Q1 considers 1) a +9% price increase Dec 2018, 2) offset by increased gross to net typical of Q1, and 3) higher capture of 75% vs 72% for Q4 to be conservative. We can derive Q1 sales of ~$80M were we to assume a G2N of 55% (vs 50% for other quarters). Alternatively, adjusting the capture to historical of 83% (our est) would yield Q sales closer to the $70-75M range, which would still be above consensus estimates of $67M.

Our doctors consistently provide positive feedback on Vascepa

Anecdotally, docs inform us they have "accelerated their prescriptions" post the Nov 2018 AHA conference. The LDL increase in the placebo arm (mineral oil) has not deterred docs from prescribing Vascepa. From our NYC Doc Panel day last month, post the data, one doc increased his prescriptions by 3x-4x to 10/month, while the other doctor now prescribes it several times a month. The latter was formerly not a strong believer in triglyceride (TG) therapies unless patients exceeded the >500mg/dL threshold, but he now envisions his overall usage for "elevated" TG patients to increase as he becomes more familiar and comfortable and reimbursement has been easy.

Company Description

Amarin Corporation

Amarin Corporation, headquartered in Dublin, Ireland and Bedminster, New Jersey is a biopharmaceutical company focused on the commercialization and development of therapeutics to improve cardiovascular health. Amarin's approved drug, Vascepa, is an ultra-pure, EPA-only, omega-3 fatty acid, oral product for the treatment of severe high triglycerides and mixed dyslipidemia. The company’s cardiovascular programs capitalize on Amarin's expertise in the field of lipid science and the known therapeutic benefits of essential fatty acids in treating cardiovascular disease. AMRN reported a positive REDUCE-IT CVOT result in September 2018.

Company Valuation/Risks

Amarin Corporation

Our $30 PT is DCF-based. Risks: clinical, regulatory, a

New Drug Submission Filed for Vascepa® with Health Canada

GlobeNewswire•April 29, 2019

BEDMINSTER, N.J., and DUBLIN, Ireland, April 29, 2019 (GLOBE NEWSWIRE) -- Amarin Corporation plc (AMRN), a pharmaceutical company focused on improving cardiovascular health, today announced that its licensee in Canada, HLS Therapeutics Inc. (HLS.TO), has filed a New Drug Submission (“NDS”) with Health Canada for Vascepa® (icosapent ethyl) capsules. The NDS seeks an indication for promotion of Vascepa in Canada to reduce the risk of major adverse cardiovascular events (“MACE”) in statin-treated patients with elevated triglycerides and other risk factors. This is the first submission of Vascepa to Health Canada for any indication and, if approved, Vascepa will be the first drug approved in Canada for this important indication.

As previously announced, Vascepa has been granted priority review status by Health Canada. Priority review could accelerate the launch of Vascepa in the Canadian market by up to four-and-a-half months if the product is ultimately approved by Health Canada. Priority review status may be granted to regulatory filings in Canada for new treatments that potentially address serious, life-threatening conditions for which no drug is currently marketed in Canada, and for which there is substantial evidence of clinical effectiveness of that new treatment.

While the NDS includes results from the REDUCE-IT™ cardiovascular outcomes study of Vascepa, review of this regulatory submission in Canada is anticipated to be independent of the review of the supplemental new drug application which Amarin recently filed with the U.S. Food and Drug Administration regarding Vascepa based on the same clinical study results.

“We are hopeful that Vascepa will soon be approved to treat at-risk patients in Canada and we applaud HLS Therapeutics for moving rapidly with this filing,” commented Amarin’s president and chief executive officer, John F. Thero. “Cardiovascular disease is a major health issue in Canada as it is throughout the world. Vascepa provides physicians with a new treatment option to address cardiovascular risks beyond cholesterol management for at-risk patients.”

GlobeNewswire•April 29, 2019

BEDMINSTER, N.J., and DUBLIN, Ireland, April 29, 2019 (GLOBE NEWSWIRE) -- Amarin Corporation plc (AMRN), a pharmaceutical company focused on improving cardiovascular health, today announced that its licensee in Canada, HLS Therapeutics Inc. (HLS.TO), has filed a New Drug Submission (“NDS”) with Health Canada for Vascepa® (icosapent ethyl) capsules. The NDS seeks an indication for promotion of Vascepa in Canada to reduce the risk of major adverse cardiovascular events (“MACE”) in statin-treated patients with elevated triglycerides and other risk factors. This is the first submission of Vascepa to Health Canada for any indication and, if approved, Vascepa will be the first drug approved in Canada for this important indication.

As previously announced, Vascepa has been granted priority review status by Health Canada. Priority review could accelerate the launch of Vascepa in the Canadian market by up to four-and-a-half months if the product is ultimately approved by Health Canada. Priority review status may be granted to regulatory filings in Canada for new treatments that potentially address serious, life-threatening conditions for which no drug is currently marketed in Canada, and for which there is substantial evidence of clinical effectiveness of that new treatment.

While the NDS includes results from the REDUCE-IT™ cardiovascular outcomes study of Vascepa, review of this regulatory submission in Canada is anticipated to be independent of the review of the supplemental new drug application which Amarin recently filed with the U.S. Food and Drug Administration regarding Vascepa based on the same clinical study results.

“We are hopeful that Vascepa will soon be approved to treat at-risk patients in Canada and we applaud HLS Therapeutics for moving rapidly with this filing,” commented Amarin’s president and chief executive officer, John F. Thero. “Cardiovascular disease is a major health issue in Canada as it is throughout the world. Vascepa provides physicians with a new treatment option to address cardiovascular risks beyond cholesterol management for at-risk patients.”

Amarin selloff creates attractive entry point, says Citi Citi analyst Joel Beatty believes the selloff yesterday in shares of Amarin (AMRN) brings an attractive entry point. He raised his price target for the stock to $23 from $20 and keeps a Buy rating on the name. The analyst sees five potential upside catalysts this year, including a likely supportive ICER cost-effectiveness review and potential priority review from the FDA. Further, while an acquisition of Amarin is possible, the company acquiring The Medicines Co. (MDCO) or Esperion (ESPR) "could also be a viable path," says Beatty.

Read more at:

https://thefly.com/landingPageNews.php?id=2901824

Read more at:

https://thefly.com/landingPageNews.php?id=2901824

Amarin to seek European approval for heart drug Vascepa

Clinical trials show Irish company’s fish-oil drug cut incidence of heart attacks and strokes

about 20 hours ago

Dominic Coyle

Amarin chief executive John Thero: ‘Our guidance is for 50 per cent greater growth over the prior year’

Amarin chief executive John Thero: ‘Our guidance is for 50 per cent greater growth over the prior year’

Irish drug company Amarin will seek European approval for its cardiovascular drug Vascepa before the end of the year.

The drug is in the process of seeking broader FDA approval in the US as well, following clinical trial results last year which showed its fish-oil drug dramatically cut the incidence of heart attack and strokes in high-risk patients.

Until now,it has been approved only for the treatment of patients with very high levels of blood fats – indicators of cardiovascular risk – as a treatment to reduce those levels, but without making any claims on cardiovascular events.

Chief executive John Thero said the company was “hoping to have submitted in Europe sometime towards the end of the year”. Amarin, which is based in Dublin but operates largely in the United States, has yet to decide whether it will manage the European rollout in-house or through partnerships with other companies.

‘Death benefits’

Citing the 25 per cent reduction in risk of an adverse cardiovascular event – such as a heart attack or stroke – and a 20 per cent reduction in deaths among high-risk patients, Mr Thero said: “You don’t even see those death benefits with statins. It is rare to see a reduction in these outcome studies in death.

“And we have more recently shown that not only do we reduce the first occurrence of a cardiovascular event but, even if someone has had a heart attack, we help to prevent the second occurrence, a third occurrence. So essentially, over a five-year period, we have one fewer cardiovascular event for every six patients treated. And that’s a number I’ve not seen before,” he said, noting that the equivalent number for statins is around one in 45.

The company said it has seen a strong increase in prescribing of Vascepa by both cardiologists and endocrinologists, as well as GPs, since its clinical trial results were published.

“In the first four months after we had the new data, we had more new physicians prescribing the product than we had in the previous nine months on aggregate,” said Mr Thero.

Bullish expectations

But he cautioned against overly bullish expectations against the company’s target for sales this year of $350 million.

“We don’t yet have an [expanded] label for the product and our sales force, two-thirds of it is brand new, and we only have one reported quarter at this point,” Mr Thero said. “That quarter did go better than expected, but it is only one quarter . Our guidance is for 50 per cent greater growth over the prior year.

“Each quarter last year got better [in sales] and we would expect each quarter this year to get better,” he said. “I do really think of this year as a step [in the company’s development]. It’s sort of that second phase and it is the third phase that really excites.

One in three adults have some risk for cardiovascular disease and we want them to be asking their doctors about it

“From the beginning, we recognised that what we needed was a label approved for cardiovascular risk prevention and it is [now] right around the corner. And that’s really where things begin.”

Mr Thero said an expanded permission on its label would see a further significant increase in its sales force and, for the first time, would allow the company to start promoting the drug directly to consumers for the first time as a therapy that can help prevent heart attacks and strokes.

“One in three adults have some risk for cardiovascular disease and we want them to be asking their doctors about it,” he said.

Cardiovascular disease is also the single biggest cause of death in Ireland, accounting for up to 10,000 deaths a year, according to the Irish Heart Foundation. That is one-third of all deaths, it says, and one in five of all premature deaths.

Clinical trials show Irish company’s fish-oil drug cut incidence of heart attacks and strokes

about 20 hours ago

Dominic Coyle

Amarin chief executive John Thero: ‘Our guidance is for 50 per cent greater growth over the prior year’

Amarin chief executive John Thero: ‘Our guidance is for 50 per cent greater growth over the prior year’

Irish drug company Amarin will seek European approval for its cardiovascular drug Vascepa before the end of the year.

The drug is in the process of seeking broader FDA approval in the US as well, following clinical trial results last year which showed its fish-oil drug dramatically cut the incidence of heart attack and strokes in high-risk patients.

Until now,it has been approved only for the treatment of patients with very high levels of blood fats – indicators of cardiovascular risk – as a treatment to reduce those levels, but without making any claims on cardiovascular events.

Chief executive John Thero said the company was “hoping to have submitted in Europe sometime towards the end of the year”. Amarin, which is based in Dublin but operates largely in the United States, has yet to decide whether it will manage the European rollout in-house or through partnerships with other companies.

‘Death benefits’

Citing the 25 per cent reduction in risk of an adverse cardiovascular event – such as a heart attack or stroke – and a 20 per cent reduction in deaths among high-risk patients, Mr Thero said: “You don’t even see those death benefits with statins. It is rare to see a reduction in these outcome studies in death.

“And we have more recently shown that not only do we reduce the first occurrence of a cardiovascular event but, even if someone has had a heart attack, we help to prevent the second occurrence, a third occurrence. So essentially, over a five-year period, we have one fewer cardiovascular event for every six patients treated. And that’s a number I’ve not seen before,” he said, noting that the equivalent number for statins is around one in 45.

The company said it has seen a strong increase in prescribing of Vascepa by both cardiologists and endocrinologists, as well as GPs, since its clinical trial results were published.

“In the first four months after we had the new data, we had more new physicians prescribing the product than we had in the previous nine months on aggregate,” said Mr Thero.

Bullish expectations

But he cautioned against overly bullish expectations against the company’s target for sales this year of $350 million.

“We don’t yet have an [expanded] label for the product and our sales force, two-thirds of it is brand new, and we only have one reported quarter at this point,” Mr Thero said. “That quarter did go better than expected, but it is only one quarter . Our guidance is for 50 per cent greater growth over the prior year.

“Each quarter last year got better [in sales] and we would expect each quarter this year to get better,” he said. “I do really think of this year as a step [in the company’s development]. It’s sort of that second phase and it is the third phase that really excites.

One in three adults have some risk for cardiovascular disease and we want them to be asking their doctors about it

“From the beginning, we recognised that what we needed was a label approved for cardiovascular risk prevention and it is [now] right around the corner. And that’s really where things begin.”

Mr Thero said an expanded permission on its label would see a further significant increase in its sales force and, for the first time, would allow the company to start promoting the drug directly to consumers for the first time as a therapy that can help prevent heart attacks and strokes.

“One in three adults have some risk for cardiovascular disease and we want them to be asking their doctors about it,” he said.

Cardiovascular disease is also the single biggest cause of death in Ireland, accounting for up to 10,000 deaths a year, according to the Irish Heart Foundation. That is one-third of all deaths, it says, and one in five of all premature deaths.

"Halbzeitbericht" -Händler Jon Najarian entdeckt ungewöhnliche Optionsaktivitäten in Aktien von Square und Amarin

https://finance.yahoo.com/video/options-traders-hip-square-1…

https://finance.yahoo.com/video/options-traders-hip-square-1…

Supergeil, burn shorties burn:

U.S. FDA Grants Priority Review for Vascepa® (Icosapent Ethyl) Supplemental New Drug Application Seeking Cardiovascular Risk Reduction Indication

GlobeNewswire•May 29, 2019

- PDUFA date assigned is September 28, 2019, four months sooner than expected

- Vascepa, assuming approval, will be first drug indicated to reduce residual cardiovascular risk in patients with statin-managed LDL-C cholesterol, but persistent elevated triglycerides, as studied in the landmark REDUCE-IT™ cardiovascular outcomes study

- Cardiovascular disease is the No. 1 cause of death for U.S. men and women

- Amarin is accelerating plans for commercial expansion, based on Priority Review designation

BEDMINSTER, N.J. and DUBLIN, Ireland, May 29, 2019 (GLOBE NEWSWIRE) -- Amarin Corporation plc (AMRN) announced today that its supplemental new drug application (sNDA) for Vascepa® (icosapent ethyl) capsules has been accepted for filing and granted Priority Review designation by the U.S. Food and Drug Administration (FDA). The Prescription Drug User Fee Act (PDUFA) goal date assigned by the FDA for this sNDA is September 28, 2019. Because of the Priority Review designation, the timing of this PDUFA date is four months earlier than the anticipated standard ten-month review for applications.

Assuming FDA approval, Vascepa will be the first drug indicated to reduce residual cardiovascular risk in patients with statin-managed LDL-C cholesterol, but persistent elevated triglycerides, an important indicator of cardiovascular disease. This is a serious health challenge experienced by millions of people.

The FDA grants Priority Review designation to applications for drugs that, if approved, have the potential to offer significant improvements in the effectiveness and safety of the treatment of serious conditions when compared to standard applications.

“We expect earlier approval of an expanded indication for Vascepa to lead to faster improvements in care for millions of patients with residual cardiovascular risk after statin therapy,” said John F. Thero, president and chief executive officer of Amarin. “These patients will be the focus of our planned expanded REDUCE-ITTM promotional efforts. We are very pleased that the FDA has accepted our application and granted it priority review. We believe the unprecedented REDUCE-IT results position Amarin to lead a transformative change in clinical practice for preventative treatment of cardiovascular disease, the leading cause of death for both men and women in the United States. Our plans to significantly expand promotion of Vascepa following label expansion are being accelerated to reflect the upcoming PDUFA date."

sNDA Based on Landmark REDUCE-IT Trial

The sNDA for Vascepa is based on the landmark REDUCE-IT cardiovascular outcomes study, primary results of which were published in The New England Journal of Medicine in November 2018.1 Additional results and analysis of total recurrent events observed were subsequently published in the Journal of American College of Cardiology in March 2019.2 Vascepa is currently indicated as an adjunct to diet to reduce triglyceride (TG) levels in adult patients with severe (TG >500 mg/dL) hypertriglyceridemia, an important but much smaller patient population than can be addressed with an approval of this sNDA.

In REDUCE-IT, Vascepa achieved the primary endpoint with a 25% relative risk reduction compared to placebo (95% confidence interval [CI], 0.68-0.83; p<0.001) in the first occurrence of a major adverse cardiovascular event (MACE) in the intent-to-treat population. In REDUCE-IT, MACE consisted of a composite of cardiovascular death, nonfatal myocardial infarction (MI or heart attack), nonfatal stroke, coronary revascularization (procedures such as stents and by-pass) and unstable angina requiring hospitalization.

As further evidence of the robustness of the REDUCE-IT results, Vascepa achieved the study’s key secondary endpoint with a 26% relative risk reduction (HR, 0.74; 95% CI, 0.65-0.83; p<0.001) in 3-point MACE in the intent-to-treat population consisting of a composite of cardiovascular death, nonfatal heart attack and nonfatal stroke. Vascepa also achieved seven other secondary endpoints in the pre-specified hierarchical order below the key secondary endpoint, including a 20% relative risk reduction in cardiovascular death compared to placebo (HR, 0.80; 95% CI, 0.66-0.98; p=0.03). REDUCE-IT, a global study of 8,179 statin-treated adults with elevated CV risk, was performed based on a special protocol assessment (SPA) agreement with the FDA.

In REDUCE-IT, adverse events occurring with Vascepa use at greater than 5% and greater than placebo were: peripheral edema (6.5% Vascepa versus 5.0%), although there was no increase in the rate of heart failure in Vascepa patients; constipation (5.4% Vascepa versus 3.6%), although mineral oil, as used as placebo, is known to lower constipation; and atrial fibrillation (5.3% Vascepa versus 3.9%), although there were reductions in rates of cardiac arrest, sudden death and myocardial infarctions observed in Vascepa patients. More information on safety data associated with REDUCE-IT is provided below and in the published results.

FDA Advisory Committee Update

In its sNDA filing acceptance communication to Amarin, the FDA did not indicate whether it plans to hold an advisory committee (AdCom) meeting to discuss this application. Amarin previously expressed that it believes an AdCom meeting organized by the FDA in conjunction with its review of the expanded label for Vascepa is likely. It is not uncommon for clarification on this topic to be provided by the FDA later in its review process.

About Amarin

Amarin Corporation plc. is a rapidly growing, innovative pharmaceutical company focused on developing therapeutics to improve cardiovascular health. Amarin’s product development program leverages its extensive experience in polyunsaturated fatty acids and lipid science. Vascepa (icosapent ethyl) is Amarin's first FDA-approved drug and is available by prescription in the United States, Lebanon and the United Arab Emirates. Amarin’s commercial partners are pursuing additional regulatory approvals for Vascepa in Canada, China and the Middle East. For more information about Amarin, visit www.amarincorp.com.

More About REDUCE-IT

REDUCE-IT1, an 8,179-patient cardiovascular outcomes study, was completed in 2018. REDUCE-IT was the first multinational cardiovascular outcomes study that evaluated the effect of prescription pure EPA therapy as an add-on to statins in patients with high cardiovascular risk who, despite stable statin therapy, had elevated triglyceride levels (at least 135 mg/dL). A large portion of the male and female patients enrolled in this outcomes study were diagnosed with type 2 diabetes.

More information on the REDUCE-IT study results can be found at www.amarincorp.com.

About Cardiovascular Disease

Worldwide, cardiovascular disease (CVD) remains the No. 1 killer of men and women. In the United States CVD leads to one in every three deaths – one death approximately every 38 seconds – with annual treatment cost in excess of $500 billion.3, 4

Multiple primary and secondary prevention trials have shown a significant reduction of 25% to 35% in the risk of cardiovascular events with statin therapy, leaving significant persistent residual risk despite the achievement of target LDL-C levels.5

Beyond the cardiovascular risk associated with LDL-C, genetic, epidemiologic, clinical and real-world data suggest that patients with elevated triglycerides (TG) (fats in the blood), and TG-rich lipoproteins, are at increased risk for cardiovascular disease.6, 7, 8, 9

About Vascepa (icosapent ethyl) Capsules

Vascepa (icosapent ethyl) capsules are a single-molecule prescription product consisting of the omega-3 acid commonly known as EPA in ethyl-ester form. Vascepa is not fish oil, but is derived from fish through a stringent and complex FDA-regulated manufacturing process designed to effectively eliminate impurities and isolate and protect the single molecule active ingredient from degradation. Vascepa, known in scientific literature as AMR101, has been designated a new chemical entity by the FDA. Amarin has been issued multiple patents internationally based on the unique clinical profile of Vascepa, including the drug’s ability to lower triglyceride levels in relevant patient populations without raising LDL-cholesterol levels.

Indication and Usage Based on Current FDA-Approved Label (not including REDUCE-IT results)

Vascepa (icosapent ethyl) is indicated as an adjunct to diet to reduce triglyceride (TG) levels in adult patients with severe (≥500 mg/dL) hypertriglyceridemia.

The effect of Vascepa on the risk for pancreatitis and cardiovascular mortality and morbidity in patients with severe hypertriglyceridemia has not been determined.

Important Safety Information for Vascepa Based on Current FDA-Approved Label (not including REDUCE-IT results) (Includes Data from Two 12-Week Studies (n=622) (MARINE and ANCHOR) of Patients with Triglycerides Values of 200 to 2000 mg/dL)

Vascepa is contraindicated in patients with known hypersensitivity (e.g., anaphylactic reaction) to Vascepa or any of its components.

In patients with hepatic impairment, monitor ALT and AST levels periodically during therapy.

Use with caution in patients with known hypersensitivity to fish and/or shellfish.

The most common reported adverse reaction (incidence >2% and greater than placebo) was arthralgia (2.3% for Vascepa, 1.0% for placebo). There was no reported adverse reaction >3% and greater than placebo.

Adverse events and product complaints may be reported by calling 1-855-VASCEPA or the FDA at 1-800-FDA-1088.

Patients receiving treatment with Vascepa and other drugs affecting coagulation (e.g., anti-platelet agents) should be monitored periodically.

Patients should be advised to swallow Vascepa capsules whole; not to break open, crush, dissolve, or chew Vascepa.

FULL VASCEPA PRESCRIBING INFORMATION CAN BE FOUND AT WWW.VASCEPA.COM.

Important Safety Information for Vascepa based on REDUCE-IT, as previously reported in The New England Journal of Medicine1 publication of the primary results of the REDUCE-IT study:

Excluding the major adverse cardiovascular events (MACE) results described above, overall adverse event rates in REDUCE-IT were similar across the statin plus Vascepa and the statin plus placebo treatment groups.

There were no significant differences between treatments in the overall rate of treatment emergent adverse events or serious adverse events leading to withdrawal of study drug.

There was no serious adverse event (SAE) occurring at a frequency of >2% which occurred at a numerically higher rate in the statin plus Vascepa treatment group than in the statin plus placebo treatment group.

Adverse events (AEs) occurring in 5% or greater of patients and more frequently with Vascepa than placebo were:

– peripheral edema (6.5% Vascepa patients versus 5.0% placebo patients), although there was no increase in the rate of heart failure in Vascepa patients

– constipation (5.4% Vascepa patients versus 3.6% placebo patients), although mineral oil, as used as placebo, is known to lower constipation, and

– atrial fibrillation (5.3% Vascepa patients versus 3.9% placebo patients), although there were reductions in rates of cardiac arrest, sudden death and myocardial infarctions observed in Vascepa patients

There were numerically more SAEs related to bleeding in the statin plus Vascepa treatment group although overall rates were low with no fatal bleeding observed in either group and no significant difference in adjudicated hemorrhagic stroke or serious central nervous system or gastrointestinal bleeding events between treatments.

In summary, Vascepa was well tolerated with a safety profile generally consistent with clinical experience associated with omega-3 fatty acids and current FDA-approved labeling of such products.

Vascepa has been approved for use by the United States Food and Drug Administration (FDA) as an adjunct to diet to reduce triglyceride levels in adult patients with severe (≥500 mg/dL) hypertriglyceridemia. FDA has not reviewed and opined on a supplemental new drug application related to REDUCE-IT. FDA has not reviewed the information herein or determined whether to approve Vascepa for use to reduce the risk of MACE. Nothing in this press release should be construed as promoting the use of Vascepa in any indication that has not been approved by the FDA.

Important Cautionary Information About These Data

Further REDUCE-IT data assessment and data release could yield additional useful information to inform greater understanding of the trial outcome. For example, detailed data assessment by regulatory authorities, such as the FDA and Health Canada, will continue and take several months to complete and announce. The final evaluation by regulatory authorities of the totality of efficacy and safety data from REDUCE-IT may include some or all of the following, as well as other considerations: new information or analyses affecting the degree of treatment benefit on studied endpoints; study conduct and data robustness, quality, integrity and consistency; additional safety data considerations and risk/benefit considerations; and consideration of REDUCE-IT results in the context of other clinical studies. Because regulatory reviews are typically fluid and not definitive interactions between sponsor and agency on individual elements of an application and related information, Amarin does not plan to update investors on ongoing communications with regulatory authorities. Amarin plans to announce the final outcome of such regulatory reviews when appropriate.

Recurrent event analyses for the total primary endpoint events and for the total key secondary endpoint in REDUCE-IT as published in the Journal of the American College of Cardiology were conducted using a series of statistical models. These analyses were tertiary or exploratory endpoints; most of the models used were prespecified and one was post hoc. Each recurrent event statistical model has inherent strengths and weaknesses, with no single model considered definitive or outperforming the other models, and this is an evolving field of science. Nonetheless, results from the total primary and total key secondary endpoint events analyses are consistent across the various recurrent event statistical models and are also consistent with the original primary and secondary endpoint results. Together, the REDUCE-IT recurrent event analyses and the original primary and key secondary endpoint analyses support the robustness of the clinical benefit of Vascepa therapy in reducing cardiovascular risk.

Forward-Looking Statements

This press release contains forward-looking statements, including expectations regarding FDA regulatory review, the applicability and reliability of REDUCE-IT results, expected outcome and timing of review elements and market dynamics for Vascepa. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. In addition, Amarin's ability to effectively commercialize Vascepa will depend in part on its ability to continue to effectively finance its business, efforts of third parties, its ability to gain regulatory approvals, create market demand for Vascepa through education, marketing and sales activities, to achieve market acceptance of Vascepa, to receive adequate levels of reimbursement from third-party payers, to develop and maintain a consistent source of commercial supply at a competitive price, to comply with legal and regulatory requirements in connection with the sale and promotion of Vascepa and to maintain patent protection for Vascepa. Among the factors that could cause actual results to differ materially from those described or projected herein include the following: uncertainties associated generally with research and development, clinical trials and related regulatory reviews and approvals; the risk that sales may not meet expectations and related cost may increase beyond expectations; the risk that patents may not be upheld in patent litigation and applications may not result in issued patents sufficient to protect the Vascepa franchise. A further list and description of these risks, uncertainties and other risks associated with an investment in Amarin can be found in Amarin's filings with the U.S. Securities and Exchange Commission, including its most recent quarterly report on Form 10-Q. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Amarin undertakes no obligation to update or revise the information contained in this press release, whether as a result of new information, future events or circumstances or otherwise.

Availability of Other Information About Amarin

Investors and others should note that Amarin communicates with its investors and the public using the company website (www.amarincorp.com), the investor relations website (investor.amarincorp.com), including but not limited to investor presentations and investor FAQs, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that Amarin posts on these channels and websites could be deemed to be material information. As a result, Amarin encourages investors, the media, and others interested in Amarin to review the information that is posted on these channels, including the investor relations website, on a regular basis. This list of channels may be updated from time to time on Amarin’s investor relations website and may include social media channels. The contents of Amarin’s website or these channels, or any other website that may be accessed from its website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933.

References

1 Bhatt DL, Steg PG, Miller M, et al. Cardiovascular Risk Reduction with Icosapent Ethyl for Hypertriglyceridemia. N Engl J Med 2019;380:11-22.

2 Bhatt DL, Steg PG, Miller M, et al. Effects of Icosapent Ethyl on Total Ischemic Events: From REDUCE-IT. J Am Coll Cardiol 2019. Epub ahead of print. https://doi.org/10.1016/j.jacc.2019.02.032.

3 American Heart Association. 2018. Disease and Stroke Statistics-2018 Update.

4 American Heart Association. 2017. Cardiovascular disease: A costly burden for America projections through 2035.

5 Ganda OP, Bhatt DL, Mason RP, et al. Unmet need for adjunctive dyslipidemia therapy in hypertriglyceridemia management. J Am Coll Cardiol. 2018;72(3):330-343.

6 Budoff M. Triglycerides and triglyceride-rich lipoproteins in the causal pathway of cardiovascular disease. Am J Cardiol. 2016;118:138-145.

7 Toth PP, Granowitz C, Hull M, et al. High triglycerides are associated with increased cardiovascular events, medical costs, and resource use: A real-world administrative claims analysis of statin-treated patients with high residual cardiovascular risk. J Am Heart Assoc. 2018;7(15):e008740.

8 Nordestgaard BG. Triglyceride-rich lipoproteins and atherosclerotic cardiovascular disease - New insights from epidemiology, genetics, and biology. Circ Res. 2016;118:547-563.

9 Nordestgaard BG, Varbo A. Triglycerides and cardiovascular disease. Lancet. 2014;384:626–635.

Amarin Contact Information

Investor Relations:

Elisabeth Schwartz

Investor Relations

Amarin Corporation plc

In U.S.: +1 (908) 719-1315

investor.relations@amarincorp.com

Lee M. Stern

Trout Group

In U.S.: +1 (646) 378-2992

lstern@troutgroup.com

Media Inquiries:

Gwen Fisher

Corporate Communications

Amarin Corporation plc

In U.S.: +1 (908) 325-0735

PR@amarincorp.com

Contact:

U.S. FDA Grants Priority Review for Vascepa® (Icosapent Ethyl) Supplemental New Drug Application Seeking Cardiovascular Risk Reduction Indication

GlobeNewswire•May 29, 2019

- PDUFA date assigned is September 28, 2019, four months sooner than expected

- Vascepa, assuming approval, will be first drug indicated to reduce residual cardiovascular risk in patients with statin-managed LDL-C cholesterol, but persistent elevated triglycerides, as studied in the landmark REDUCE-IT™ cardiovascular outcomes study

- Cardiovascular disease is the No. 1 cause of death for U.S. men and women

- Amarin is accelerating plans for commercial expansion, based on Priority Review designation

BEDMINSTER, N.J. and DUBLIN, Ireland, May 29, 2019 (GLOBE NEWSWIRE) -- Amarin Corporation plc (AMRN) announced today that its supplemental new drug application (sNDA) for Vascepa® (icosapent ethyl) capsules has been accepted for filing and granted Priority Review designation by the U.S. Food and Drug Administration (FDA). The Prescription Drug User Fee Act (PDUFA) goal date assigned by the FDA for this sNDA is September 28, 2019. Because of the Priority Review designation, the timing of this PDUFA date is four months earlier than the anticipated standard ten-month review for applications.

Assuming FDA approval, Vascepa will be the first drug indicated to reduce residual cardiovascular risk in patients with statin-managed LDL-C cholesterol, but persistent elevated triglycerides, an important indicator of cardiovascular disease. This is a serious health challenge experienced by millions of people.

The FDA grants Priority Review designation to applications for drugs that, if approved, have the potential to offer significant improvements in the effectiveness and safety of the treatment of serious conditions when compared to standard applications.

“We expect earlier approval of an expanded indication for Vascepa to lead to faster improvements in care for millions of patients with residual cardiovascular risk after statin therapy,” said John F. Thero, president and chief executive officer of Amarin. “These patients will be the focus of our planned expanded REDUCE-ITTM promotional efforts. We are very pleased that the FDA has accepted our application and granted it priority review. We believe the unprecedented REDUCE-IT results position Amarin to lead a transformative change in clinical practice for preventative treatment of cardiovascular disease, the leading cause of death for both men and women in the United States. Our plans to significantly expand promotion of Vascepa following label expansion are being accelerated to reflect the upcoming PDUFA date."

sNDA Based on Landmark REDUCE-IT Trial

The sNDA for Vascepa is based on the landmark REDUCE-IT cardiovascular outcomes study, primary results of which were published in The New England Journal of Medicine in November 2018.1 Additional results and analysis of total recurrent events observed were subsequently published in the Journal of American College of Cardiology in March 2019.2 Vascepa is currently indicated as an adjunct to diet to reduce triglyceride (TG) levels in adult patients with severe (TG >500 mg/dL) hypertriglyceridemia, an important but much smaller patient population than can be addressed with an approval of this sNDA.

In REDUCE-IT, Vascepa achieved the primary endpoint with a 25% relative risk reduction compared to placebo (95% confidence interval [CI], 0.68-0.83; p<0.001) in the first occurrence of a major adverse cardiovascular event (MACE) in the intent-to-treat population. In REDUCE-IT, MACE consisted of a composite of cardiovascular death, nonfatal myocardial infarction (MI or heart attack), nonfatal stroke, coronary revascularization (procedures such as stents and by-pass) and unstable angina requiring hospitalization.

As further evidence of the robustness of the REDUCE-IT results, Vascepa achieved the study’s key secondary endpoint with a 26% relative risk reduction (HR, 0.74; 95% CI, 0.65-0.83; p<0.001) in 3-point MACE in the intent-to-treat population consisting of a composite of cardiovascular death, nonfatal heart attack and nonfatal stroke. Vascepa also achieved seven other secondary endpoints in the pre-specified hierarchical order below the key secondary endpoint, including a 20% relative risk reduction in cardiovascular death compared to placebo (HR, 0.80; 95% CI, 0.66-0.98; p=0.03). REDUCE-IT, a global study of 8,179 statin-treated adults with elevated CV risk, was performed based on a special protocol assessment (SPA) agreement with the FDA.

In REDUCE-IT, adverse events occurring with Vascepa use at greater than 5% and greater than placebo were: peripheral edema (6.5% Vascepa versus 5.0%), although there was no increase in the rate of heart failure in Vascepa patients; constipation (5.4% Vascepa versus 3.6%), although mineral oil, as used as placebo, is known to lower constipation; and atrial fibrillation (5.3% Vascepa versus 3.9%), although there were reductions in rates of cardiac arrest, sudden death and myocardial infarctions observed in Vascepa patients. More information on safety data associated with REDUCE-IT is provided below and in the published results.

FDA Advisory Committee Update

In its sNDA filing acceptance communication to Amarin, the FDA did not indicate whether it plans to hold an advisory committee (AdCom) meeting to discuss this application. Amarin previously expressed that it believes an AdCom meeting organized by the FDA in conjunction with its review of the expanded label for Vascepa is likely. It is not uncommon for clarification on this topic to be provided by the FDA later in its review process.

About Amarin

Amarin Corporation plc. is a rapidly growing, innovative pharmaceutical company focused on developing therapeutics to improve cardiovascular health. Amarin’s product development program leverages its extensive experience in polyunsaturated fatty acids and lipid science. Vascepa (icosapent ethyl) is Amarin's first FDA-approved drug and is available by prescription in the United States, Lebanon and the United Arab Emirates. Amarin’s commercial partners are pursuing additional regulatory approvals for Vascepa in Canada, China and the Middle East. For more information about Amarin, visit www.amarincorp.com.

More About REDUCE-IT

REDUCE-IT1, an 8,179-patient cardiovascular outcomes study, was completed in 2018. REDUCE-IT was the first multinational cardiovascular outcomes study that evaluated the effect of prescription pure EPA therapy as an add-on to statins in patients with high cardiovascular risk who, despite stable statin therapy, had elevated triglyceride levels (at least 135 mg/dL). A large portion of the male and female patients enrolled in this outcomes study were diagnosed with type 2 diabetes.

More information on the REDUCE-IT study results can be found at www.amarincorp.com.

About Cardiovascular Disease

Worldwide, cardiovascular disease (CVD) remains the No. 1 killer of men and women. In the United States CVD leads to one in every three deaths – one death approximately every 38 seconds – with annual treatment cost in excess of $500 billion.3, 4

Multiple primary and secondary prevention trials have shown a significant reduction of 25% to 35% in the risk of cardiovascular events with statin therapy, leaving significant persistent residual risk despite the achievement of target LDL-C levels.5

Beyond the cardiovascular risk associated with LDL-C, genetic, epidemiologic, clinical and real-world data suggest that patients with elevated triglycerides (TG) (fats in the blood), and TG-rich lipoproteins, are at increased risk for cardiovascular disease.6, 7, 8, 9

About Vascepa (icosapent ethyl) Capsules

Vascepa (icosapent ethyl) capsules are a single-molecule prescription product consisting of the omega-3 acid commonly known as EPA in ethyl-ester form. Vascepa is not fish oil, but is derived from fish through a stringent and complex FDA-regulated manufacturing process designed to effectively eliminate impurities and isolate and protect the single molecule active ingredient from degradation. Vascepa, known in scientific literature as AMR101, has been designated a new chemical entity by the FDA. Amarin has been issued multiple patents internationally based on the unique clinical profile of Vascepa, including the drug’s ability to lower triglyceride levels in relevant patient populations without raising LDL-cholesterol levels.

Indication and Usage Based on Current FDA-Approved Label (not including REDUCE-IT results)

Vascepa (icosapent ethyl) is indicated as an adjunct to diet to reduce triglyceride (TG) levels in adult patients with severe (≥500 mg/dL) hypertriglyceridemia.

The effect of Vascepa on the risk for pancreatitis and cardiovascular mortality and morbidity in patients with severe hypertriglyceridemia has not been determined.

Important Safety Information for Vascepa Based on Current FDA-Approved Label (not including REDUCE-IT results) (Includes Data from Two 12-Week Studies (n=622) (MARINE and ANCHOR) of Patients with Triglycerides Values of 200 to 2000 mg/dL)

Vascepa is contraindicated in patients with known hypersensitivity (e.g., anaphylactic reaction) to Vascepa or any of its components.

In patients with hepatic impairment, monitor ALT and AST levels periodically during therapy.

Use with caution in patients with known hypersensitivity to fish and/or shellfish.

The most common reported adverse reaction (incidence >2% and greater than placebo) was arthralgia (2.3% for Vascepa, 1.0% for placebo). There was no reported adverse reaction >3% and greater than placebo.

Adverse events and product complaints may be reported by calling 1-855-VASCEPA or the FDA at 1-800-FDA-1088.

Patients receiving treatment with Vascepa and other drugs affecting coagulation (e.g., anti-platelet agents) should be monitored periodically.

Patients should be advised to swallow Vascepa capsules whole; not to break open, crush, dissolve, or chew Vascepa.

FULL VASCEPA PRESCRIBING INFORMATION CAN BE FOUND AT WWW.VASCEPA.COM.

Important Safety Information for Vascepa based on REDUCE-IT, as previously reported in The New England Journal of Medicine1 publication of the primary results of the REDUCE-IT study:

Excluding the major adverse cardiovascular events (MACE) results described above, overall adverse event rates in REDUCE-IT were similar across the statin plus Vascepa and the statin plus placebo treatment groups.

There were no significant differences between treatments in the overall rate of treatment emergent adverse events or serious adverse events leading to withdrawal of study drug.

There was no serious adverse event (SAE) occurring at a frequency of >2% which occurred at a numerically higher rate in the statin plus Vascepa treatment group than in the statin plus placebo treatment group.

Adverse events (AEs) occurring in 5% or greater of patients and more frequently with Vascepa than placebo were:

– peripheral edema (6.5% Vascepa patients versus 5.0% placebo patients), although there was no increase in the rate of heart failure in Vascepa patients

– constipation (5.4% Vascepa patients versus 3.6% placebo patients), although mineral oil, as used as placebo, is known to lower constipation, and

– atrial fibrillation (5.3% Vascepa patients versus 3.9% placebo patients), although there were reductions in rates of cardiac arrest, sudden death and myocardial infarctions observed in Vascepa patients

There were numerically more SAEs related to bleeding in the statin plus Vascepa treatment group although overall rates were low with no fatal bleeding observed in either group and no significant difference in adjudicated hemorrhagic stroke or serious central nervous system or gastrointestinal bleeding events between treatments.

In summary, Vascepa was well tolerated with a safety profile generally consistent with clinical experience associated with omega-3 fatty acids and current FDA-approved labeling of such products.

Vascepa has been approved for use by the United States Food and Drug Administration (FDA) as an adjunct to diet to reduce triglyceride levels in adult patients with severe (≥500 mg/dL) hypertriglyceridemia. FDA has not reviewed and opined on a supplemental new drug application related to REDUCE-IT. FDA has not reviewed the information herein or determined whether to approve Vascepa for use to reduce the risk of MACE. Nothing in this press release should be construed as promoting the use of Vascepa in any indication that has not been approved by the FDA.

Important Cautionary Information About These Data

Further REDUCE-IT data assessment and data release could yield additional useful information to inform greater understanding of the trial outcome. For example, detailed data assessment by regulatory authorities, such as the FDA and Health Canada, will continue and take several months to complete and announce. The final evaluation by regulatory authorities of the totality of efficacy and safety data from REDUCE-IT may include some or all of the following, as well as other considerations: new information or analyses affecting the degree of treatment benefit on studied endpoints; study conduct and data robustness, quality, integrity and consistency; additional safety data considerations and risk/benefit considerations; and consideration of REDUCE-IT results in the context of other clinical studies. Because regulatory reviews are typically fluid and not definitive interactions between sponsor and agency on individual elements of an application and related information, Amarin does not plan to update investors on ongoing communications with regulatory authorities. Amarin plans to announce the final outcome of such regulatory reviews when appropriate.

Recurrent event analyses for the total primary endpoint events and for the total key secondary endpoint in REDUCE-IT as published in the Journal of the American College of Cardiology were conducted using a series of statistical models. These analyses were tertiary or exploratory endpoints; most of the models used were prespecified and one was post hoc. Each recurrent event statistical model has inherent strengths and weaknesses, with no single model considered definitive or outperforming the other models, and this is an evolving field of science. Nonetheless, results from the total primary and total key secondary endpoint events analyses are consistent across the various recurrent event statistical models and are also consistent with the original primary and secondary endpoint results. Together, the REDUCE-IT recurrent event analyses and the original primary and key secondary endpoint analyses support the robustness of the clinical benefit of Vascepa therapy in reducing cardiovascular risk.

Forward-Looking Statements

This press release contains forward-looking statements, including expectations regarding FDA regulatory review, the applicability and reliability of REDUCE-IT results, expected outcome and timing of review elements and market dynamics for Vascepa. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. In addition, Amarin's ability to effectively commercialize Vascepa will depend in part on its ability to continue to effectively finance its business, efforts of third parties, its ability to gain regulatory approvals, create market demand for Vascepa through education, marketing and sales activities, to achieve market acceptance of Vascepa, to receive adequate levels of reimbursement from third-party payers, to develop and maintain a consistent source of commercial supply at a competitive price, to comply with legal and regulatory requirements in connection with the sale and promotion of Vascepa and to maintain patent protection for Vascepa. Among the factors that could cause actual results to differ materially from those described or projected herein include the following: uncertainties associated generally with research and development, clinical trials and related regulatory reviews and approvals; the risk that sales may not meet expectations and related cost may increase beyond expectations; the risk that patents may not be upheld in patent litigation and applications may not result in issued patents sufficient to protect the Vascepa franchise. A further list and description of these risks, uncertainties and other risks associated with an investment in Amarin can be found in Amarin's filings with the U.S. Securities and Exchange Commission, including its most recent quarterly report on Form 10-Q. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Amarin undertakes no obligation to update or revise the information contained in this press release, whether as a result of new information, future events or circumstances or otherwise.

Availability of Other Information About Amarin

Investors and others should note that Amarin communicates with its investors and the public using the company website (www.amarincorp.com), the investor relations website (investor.amarincorp.com), including but not limited to investor presentations and investor FAQs, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that Amarin posts on these channels and websites could be deemed to be material information. As a result, Amarin encourages investors, the media, and others interested in Amarin to review the information that is posted on these channels, including the investor relations website, on a regular basis. This list of channels may be updated from time to time on Amarin’s investor relations website and may include social media channels. The contents of Amarin’s website or these channels, or any other website that may be accessed from its website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933.

References

1 Bhatt DL, Steg PG, Miller M, et al. Cardiovascular Risk Reduction with Icosapent Ethyl for Hypertriglyceridemia. N Engl J Med 2019;380:11-22.

2 Bhatt DL, Steg PG, Miller M, et al. Effects of Icosapent Ethyl on Total Ischemic Events: From REDUCE-IT. J Am Coll Cardiol 2019. Epub ahead of print. https://doi.org/10.1016/j.jacc.2019.02.032.

3 American Heart Association. 2018. Disease and Stroke Statistics-2018 Update.

4 American Heart Association. 2017. Cardiovascular disease: A costly burden for America projections through 2035.

5 Ganda OP, Bhatt DL, Mason RP, et al. Unmet need for adjunctive dyslipidemia therapy in hypertriglyceridemia management. J Am Coll Cardiol. 2018;72(3):330-343.

6 Budoff M. Triglycerides and triglyceride-rich lipoproteins in the causal pathway of cardiovascular disease. Am J Cardiol. 2016;118:138-145.

7 Toth PP, Granowitz C, Hull M, et al. High triglycerides are associated with increased cardiovascular events, medical costs, and resource use: A real-world administrative claims analysis of statin-treated patients with high residual cardiovascular risk. J Am Heart Assoc. 2018;7(15):e008740.

8 Nordestgaard BG. Triglyceride-rich lipoproteins and atherosclerotic cardiovascular disease - New insights from epidemiology, genetics, and biology. Circ Res. 2016;118:547-563.

9 Nordestgaard BG, Varbo A. Triglycerides and cardiovascular disease. Lancet. 2014;384:626–635.

Amarin Contact Information

Investor Relations:

Elisabeth Schwartz

Investor Relations

Amarin Corporation plc

In U.S.: +1 (908) 719-1315

investor.relations@amarincorp.com

Lee M. Stern

Trout Group

In U.S.: +1 (646) 378-2992

lstern@troutgroup.com

Media Inquiries:

Gwen Fisher

Corporate Communications

Amarin Corporation plc

In U.S.: +1 (908) 325-0735

PR@amarincorp.com

Contact:

Die Meldung FDA Grants Priority Review, für das überdurchschnittliche Volumen

von Call Optionen.

Opinion: These 6 biotech stocks are promising takeover targets

by Micheal Brush

Amarin AMRN, + 8,70% hat ein Medikament gegen Herz-Kreislauf-Erkrankungen namens Vascepa. Es ist eine verschreibungspflichtige Omega-3-Fettsäure-Kapsel, die Triglycerid bei Menschen mit erhöhten Blutspiegel reduziert. Eine im vergangenen September veröffentlichte Studie zeigte, dass Vascepa das Risiko für Herz-Kreislauf-Erkrankungen um 25% senkte. Amarin hat bei der FDA die Ausweitung der Bezeichnung Vascepa auf Patienten mit einem Risiko für Herz-Kreislauf-Probleme, Herzinfarkt und Schlaganfall beantragt.

Vascepa ist kein Fischöl, das als rezeptfreies Mittel gegen Herz-Kreislauf-Probleme diskreditiert wurde. Vascepa wird jedoch durch einen Prozess aus Fisch gewonnen, der Verunreinigungen beseitigt, einen Wirkstoff isoliert und ihn vor Abbau schützt. Yee beschreibt Amarin als einen der offensichtlichen Übernahmekandidaten. "Wir sind weiterhin der Meinung, dass Vascepa viele Kisten als potenzieller Blockbuster betrachtet, der sich in den Händen der großen weltweiten Pharmadistribution noch besser behaupten würde", sagt er.

von Call Optionen.

Opinion: These 6 biotech stocks are promising takeover targets

by Micheal Brush

Amarin AMRN, + 8,70% hat ein Medikament gegen Herz-Kreislauf-Erkrankungen namens Vascepa. Es ist eine verschreibungspflichtige Omega-3-Fettsäure-Kapsel, die Triglycerid bei Menschen mit erhöhten Blutspiegel reduziert. Eine im vergangenen September veröffentlichte Studie zeigte, dass Vascepa das Risiko für Herz-Kreislauf-Erkrankungen um 25% senkte. Amarin hat bei der FDA die Ausweitung der Bezeichnung Vascepa auf Patienten mit einem Risiko für Herz-Kreislauf-Probleme, Herzinfarkt und Schlaganfall beantragt.

Vascepa ist kein Fischöl, das als rezeptfreies Mittel gegen Herz-Kreislauf-Probleme diskreditiert wurde. Vascepa wird jedoch durch einen Prozess aus Fisch gewonnen, der Verunreinigungen beseitigt, einen Wirkstoff isoliert und ihn vor Abbau schützt. Yee beschreibt Amarin als einen der offensichtlichen Übernahmekandidaten. "Wir sind weiterhin der Meinung, dass Vascepa viele Kisten als potenzieller Blockbuster betrachtet, der sich in den Händen der großen weltweiten Pharmadistribution noch besser behaupten würde", sagt er.

H.C. Wainwright Survey Shows Substantial Runway For Amarin Corporation's (AMRN) Vascepa

June 26, 2019 8:21 AM

H.C. Wainwright analyst Andrew Fein reiterated a Buy rating and $51.00 price target on Amarin Corporation (NASDAQ: AMRN) after conducted ...

on Amarin Corporation (NASDAQ: AMRN) after conducted ...

(Premium-only article. Please sign in or upgrade to SI Premium to view.)

Categories

Analyst Comments

June 26, 2019 8:21 AM

H.C. Wainwright analyst Andrew Fein reiterated a Buy rating and $51.00 price target

on Amarin Corporation (NASDAQ: AMRN) after conducted ...

on Amarin Corporation (NASDAQ: AMRN) after conducted ...(Premium-only article. Please sign in or upgrade to SI Premium to view.)

Categories

Analyst Comments

$51 Full Report

H.C. Wainwright analyst Andrew Fein raised the price target on Amarin Corporation (NASDAQ: AMRN) to $51.00 (from $31.00) while maintaining a Buy rating.