Rohstoffe, Angebot/Nachfrage - 500 Beiträge pro Seite (Seite 4)

eröffnet am 11.09.14 08:32:17 von

neuester Beitrag 02.11.19 22:08:46 von

neuester Beitrag 02.11.19 22:08:46 von

Beiträge: 2.052

ID: 1.198.959

ID: 1.198.959

Aufrufe heute: 0

Gesamt: 67.810

Gesamt: 67.810

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 18 Minuten | 10970 | |

| vor 44 Minuten | 8118 | |

| vor 20 Minuten | 5015 | |

| heute 21:42 | 4159 | |

| vor 1 Stunde | 3769 | |

| vor 45 Minuten | 3617 | |

| vor 1 Stunde | 2846 | |

| vor 38 Minuten | 2727 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.075,00 | +0,33 | 239 | |||

| 2. | 34. | 1,3800 | -1,43 | 102 | |||

| 3. | 4. | 0,1890 | -2,58 | 81 | |||

| 4. | 3. | 172,21 | +6,22 | 78 | |||

| 5. | 2. | 9,3325 | -3,69 | 77 | |||

| 6. | 14. | 7,0010 | +4,17 | 53 | |||

| 7. | 18. | 22,240 | -3,22 | 40 | |||

| 8. | 6. | 0,0160 | -24,17 | 38 |

Antwort auf Beitrag Nr.: 55.951.862 von Popeye82 am 14.10.17 06:18:11

Antwort auf Beitrag Nr.: 55.951.868 von Popeye82 am 14.10.17 06:29:10Largest Gold Discovery in >133 Years

"The Chinese government has actively launched numerous policies to guide and support the development of the non-ferrous

metals industry. The “One Belt and One Road” Summit Forum for International Cooperation was held in Beijing in May this

year, which is expected to create new development opportunities for the non-ferrous metals industry. Many countries

participating in the “One Belt and One Road” initiative are rich in mineral resources, which is strongly complementary with

China as the major consuming country. Strengthening investments in mineral resources exploration and development and

cooperation with countries within the “One Belt and One Road” sphere would play a vital role in strengthening China’s

diversified supply sourcing and enhancing its risk protection capabilities. Furthermore, “One Belt and One Road” would

promote the trade development of bulk commodities, thus potentially driving up commodity prices from the import and

export perspective.

As an important participant of China’s “One Belt and One Road” initiative, Myanmar has a strategic geographical location

and is the largest neighbor of China in terms of size, with a long border between the two countries. In April, Htin Kyaw,

President of Myanmar who has taken office for more than a year, visited China for the first time. During the visit, he

proclaimed that the participation in “One Belt and One Road” would strengthen Myanmar’s cooperation with other countries,

and also provide development opportunities for the country in trade, investment and infrastructure construction. Cooperation

in the field of mineral resources is an important integral part of the “One Belt and One Road” strategy. Myanmar has rich

mineral resources. However, its mineral resource exploration, development, and mining capabilities are relatively antiquated,

and its infrastructure is lacking. By making use of China’s strength in equipment, technology and capital, Myanmar could

develop the mining industry and its economy, and at the same time, help optimize China’s mining industry structure.

Looking forward to the second half of 2017 at the international market, the basic metal market is expected to experience

some adjustment fluctuations. In terms of LME copper, as the anticipated impact of U.S. interest rate increase is falling, the

LME copper setback would stabilize. Conversely, copper demand may stall because of the upcoming consumption decline

during the off season, so the LME copper is expected to experience some adjustments. For LME zinc, cancelled warehouse

warrants for LME zinc have increased apparently, indicating that the zinc stock is in decline. Couple that with the anticipated

tight supply should lend support to the zinc price, experiencing some fluctuations.

In the domestic market, the development of the non-ferrous metal industry will face both challenges and opportunities in the

second half of 2017. The commodity market will be subject to a cautiously-optimistic environment and continue to be slightly

fluctuative. Being an important development sector in the “One Belt and One Road” strategy, the non-ferrous metal industry

should seek opportunities to make positive reforms on the supply side,

and increase profitability and stabilize development

simultaneously."

www.internet.com

metals industry. The “One Belt and One Road” Summit Forum for International Cooperation was held in Beijing in May this

year, which is expected to create new development opportunities for the non-ferrous metals industry. Many countries

participating in the “One Belt and One Road” initiative are rich in mineral resources, which is strongly complementary with

China as the major consuming country. Strengthening investments in mineral resources exploration and development and

cooperation with countries within the “One Belt and One Road” sphere would play a vital role in strengthening China’s

diversified supply sourcing and enhancing its risk protection capabilities. Furthermore, “One Belt and One Road” would

promote the trade development of bulk commodities, thus potentially driving up commodity prices from the import and

export perspective.

As an important participant of China’s “One Belt and One Road” initiative, Myanmar has a strategic geographical location

and is the largest neighbor of China in terms of size, with a long border between the two countries. In April, Htin Kyaw,

President of Myanmar who has taken office for more than a year, visited China for the first time. During the visit, he

proclaimed that the participation in “One Belt and One Road” would strengthen Myanmar’s cooperation with other countries,

and also provide development opportunities for the country in trade, investment and infrastructure construction. Cooperation

in the field of mineral resources is an important integral part of the “One Belt and One Road” strategy. Myanmar has rich

mineral resources. However, its mineral resource exploration, development, and mining capabilities are relatively antiquated,

and its infrastructure is lacking. By making use of China’s strength in equipment, technology and capital, Myanmar could

develop the mining industry and its economy, and at the same time, help optimize China’s mining industry structure.

Looking forward to the second half of 2017 at the international market, the basic metal market is expected to experience

some adjustment fluctuations. In terms of LME copper, as the anticipated impact of U.S. interest rate increase is falling, the

LME copper setback would stabilize. Conversely, copper demand may stall because of the upcoming consumption decline

during the off season, so the LME copper is expected to experience some adjustments. For LME zinc, cancelled warehouse

warrants for LME zinc have increased apparently, indicating that the zinc stock is in decline. Couple that with the anticipated

tight supply should lend support to the zinc price, experiencing some fluctuations.

In the domestic market, the development of the non-ferrous metal industry will face both challenges and opportunities in the

second half of 2017. The commodity market will be subject to a cautiously-optimistic environment and continue to be slightly

fluctuative. Being an important development sector in the “One Belt and One Road” strategy, the non-ferrous metal industry

should seek opportunities to make positive reforms on the supply side,

and increase profitability and stabilize development

simultaneously."

www.internet.com

Antwort auf Beitrag Nr.: 55.966.428 von Popeye82 am 17.10.17 15:34:44er kann SPRECHEN

(muss wohl studiert haben)

(muss wohl studiert haben)

Antwort auf Beitrag Nr.: 55.966.629 von Popeye82 am 17.10.17 15:57:06er kann auch noch SEHEN

(wohl hochbegabt)

(wohl hochbegabt)

Antwort auf Beitrag Nr.: 55.999.827 von Popeye82 am 22.10.17 01:07:42HISTORIC shift of risks

http://www.ey.com/Publication/vwLUAssets/ey-top-10-business-…

http://www.ey.com/gl/en/industries/mining---metals/business-…

http://www.ey.com/Publication/vwLUAssets/ey-top-10-business-…

http://www.ey.com/gl/en/industries/mining---metals/business-…

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://arizonasonoranewsservice.com/wordpress/wp-content/uploads/2017/09/queen-mine-3-500x333.jpg

[/url]http://arizonasonoranewsservice.com/arizona-looks-to-make-a-…

Antwort auf Beitrag Nr.: 56.053.403 von Popeye82 am 29.10.17 18:18:50

aussie hunters

Antwort auf Beitrag Nr.: 56.067.638 von Popeye82 am 31.10.17 19:21:06

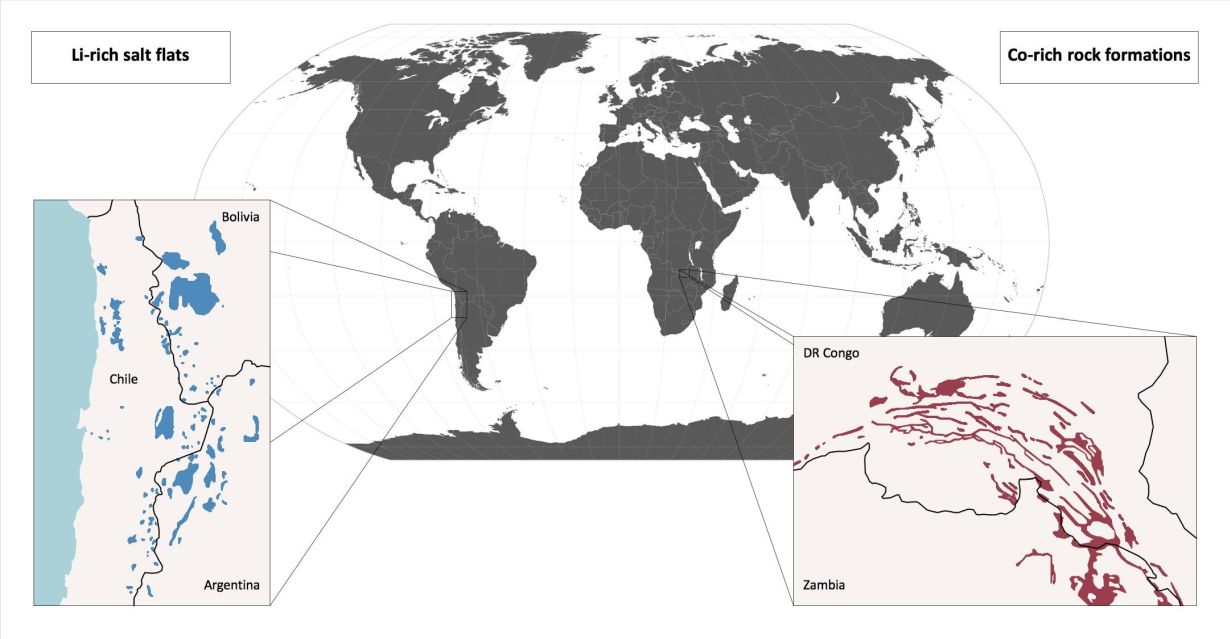

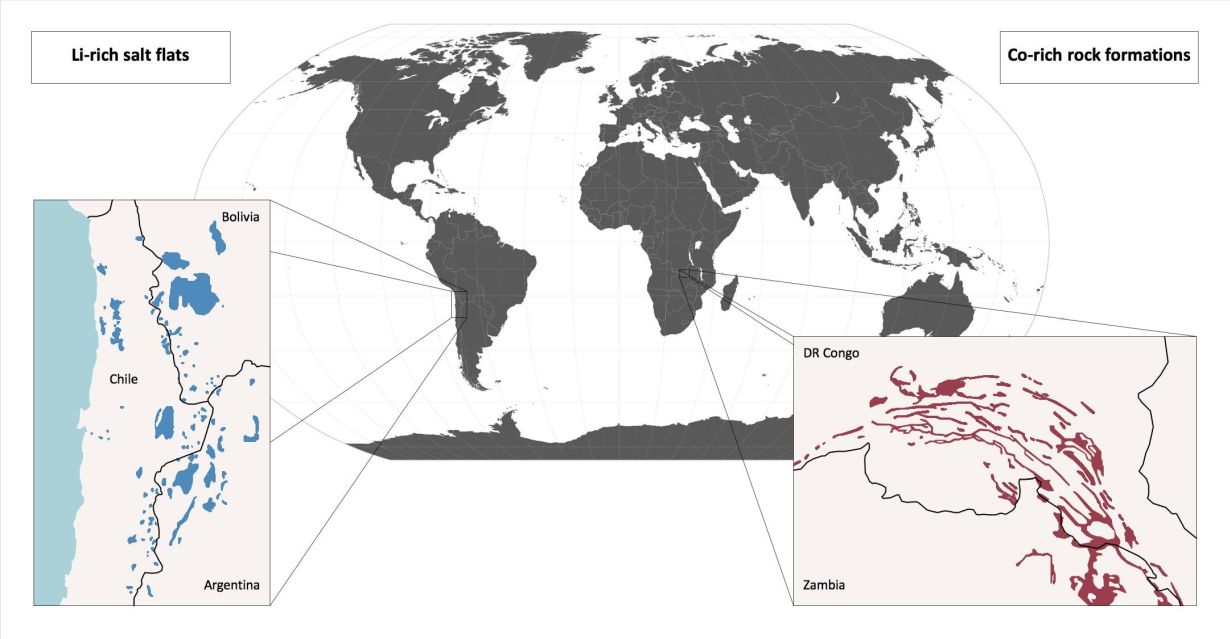

Approximately 98% of the world’s supply of cobalt comes from copper and nickel production, with 15 mines representing half of the world’s supply. This makes the supply stream for cobalt highly sensitive to disruptions caused by mine related issues. A recent example was the shutdown of copper mining in the Katanga Province in the DRC due low copper prices, which cut 3% of the world’s cobalt supply.

http://benchmarkminerals.com/where-is-new-lithium-ion-batter…

"Rise of the lithium ion battery megafactories: what does 2018 hold?

11th December 2017Announcements, Batteries, Benchmark, Gigafactory, Megafactory, TeslaBenchmark Mineral Intelligence

Since Benchmark Mineral Intelligence coined the term Battery Megafactory in 2014 the landscape of the lithium ion battery industry has changed significantly.

Early on, Benchmark noticed a step change in the way battery supply and demand was developing and the corresponding growth in the size of planned cell production plants on a multi-gigawatt scale. These larger facilities, with a capacity of producing 1GWh or more of cells per year (megafactories) were to become the new standard for the industry.

At the time, there were only three planned plants, Tesla’s Gigafactory in the US, LG Chem’s plant in Nanjing, China and Foxconn’s plant in Anhui, China which didn’t make it off the drawing board.

Today the Benchmark Mineral Intelligence megafactory tracker includes 26 battery cell plants that are either in production and due to expand capacity or new operations due to be in production by 2021.

The combined planned capacity of these plants is 344.5GWh. To put that into perspective total lithium ion cell demand in 2017 is estimated at 100GWh.

In the past 3 years China has been leading the way in investment for these megafactories, but more recently the rest of the world – most notably Europe – has woken up to the energy storage revolution and the need for locally produced cells.

China is still by far the dominant force in the industry with 49% of planned capacity totalling 169 GWh, the most recently added Chinese megafactory to the tracker was number 24, Great Power’s planned 10GWh plant in Guangzhou.

Following China is the EU, totalling 23% of planned capacity or 78.5GWh. Prior to 2017, the EU was falling far behind the rest of the world, with just one plant planned by LG Chem in Poland with 5GWh capacity.

The acceleration of activity in the European market was driven by two facilities – TerraE’s 34GWh facility in Germany and Northvolt’s 32GWh offering in Sweden. Europe is also the home for megafactory number 25, SK Innovations plant in Hungary with a capacity of 7.5 GWh.

Whilst the US is third on the list, with 53GWh and 15% of capacity it is worth noting that Tesla has further expansions planned for the Gigafactory beyond 2021 and have stated publicly that they expect to be able to achieve 150GWh out of the plant, no small feat as they get to grips with the mass market scale of production of the Model 3.

Lithium ion in 2018? More of the same

So what does the future hold? Benchmark expects the trend to continue into 2018 with new plant announcements likely.

Tesla is still to release official details of the planned facility in Shanghai , China which we fully expect to become a vertically integrated battery facility, and there will likely be further offerings (or joint ventures) from other auto manufacturers looking to build the foundations to become leaders in the EV space.

Raw material security is now firmly on the agenda of many major auto manufacturers – VW and China’s Great Wall Motor have been the most active in trying to secure lithium and cobalt of late.

However, the question remains whether auto majors are fully comfortable with their lithium ion battery supply of which the vast majority of near term new capacity is being build in China.

Europe, especially, is some way behind in the race to build out new cell capacity while North America is still heavily reliant on a successful Tesla Gigafactory ramp up and if successful will still be captive supply for world’s highest profile EV manufacturer.

And while many megafactories are being announced, how many will be realised, at what capacity and by when? This is one of the biggest risks the auto manufacturers face in the next 5 years.

Further battery supply growth expectations may seem excessive considering the new lithium ion battery pipeline is at the 344.5GWh mark… but the industry needs it.

Benchmark forecasts world lithium ion battery demand to grow by between 6 and 7 times by 2026 which will require a battery pipeline of nearly double what we have today.

Constructing the plants is relatively easy if the funding and drive is there from the battery manufacturers, but if and when that problem is solved an even bigger one is faced: sourcing the raw materials to feed them and building out the supply chains for the 21st century energy storage revolution.

Benchmark Mineral Intelligence is the industry’s leading source of lithium ion battery market data and analysis. We publish monthly price assessments for lithium, graphite and cobalt.

Each year we also host the Benchmark World Tour investment seminars and industry conferences, Cathodes Conference and Graphite + Anodes.

To subscribe or for more email: info@benchmarkminerals.com

WATCH: Star appeal: Elon Musk shows Leo DiCaprio the Tesla Gigafactory"

"Rise of the lithium ion battery megafactories: what does 2018 hold?

11th December 2017Announcements, Batteries, Benchmark, Gigafactory, Megafactory, TeslaBenchmark Mineral Intelligence

Since Benchmark Mineral Intelligence coined the term Battery Megafactory in 2014 the landscape of the lithium ion battery industry has changed significantly.

Early on, Benchmark noticed a step change in the way battery supply and demand was developing and the corresponding growth in the size of planned cell production plants on a multi-gigawatt scale. These larger facilities, with a capacity of producing 1GWh or more of cells per year (megafactories) were to become the new standard for the industry.

At the time, there were only three planned plants, Tesla’s Gigafactory in the US, LG Chem’s plant in Nanjing, China and Foxconn’s plant in Anhui, China which didn’t make it off the drawing board.

Today the Benchmark Mineral Intelligence megafactory tracker includes 26 battery cell plants that are either in production and due to expand capacity or new operations due to be in production by 2021.

The combined planned capacity of these plants is 344.5GWh. To put that into perspective total lithium ion cell demand in 2017 is estimated at 100GWh.

In the past 3 years China has been leading the way in investment for these megafactories, but more recently the rest of the world – most notably Europe – has woken up to the energy storage revolution and the need for locally produced cells.

China is still by far the dominant force in the industry with 49% of planned capacity totalling 169 GWh, the most recently added Chinese megafactory to the tracker was number 24, Great Power’s planned 10GWh plant in Guangzhou.

Following China is the EU, totalling 23% of planned capacity or 78.5GWh. Prior to 2017, the EU was falling far behind the rest of the world, with just one plant planned by LG Chem in Poland with 5GWh capacity.

The acceleration of activity in the European market was driven by two facilities – TerraE’s 34GWh facility in Germany and Northvolt’s 32GWh offering in Sweden. Europe is also the home for megafactory number 25, SK Innovations plant in Hungary with a capacity of 7.5 GWh.

Whilst the US is third on the list, with 53GWh and 15% of capacity it is worth noting that Tesla has further expansions planned for the Gigafactory beyond 2021 and have stated publicly that they expect to be able to achieve 150GWh out of the plant, no small feat as they get to grips with the mass market scale of production of the Model 3.

Lithium ion in 2018? More of the same

So what does the future hold? Benchmark expects the trend to continue into 2018 with new plant announcements likely.

Tesla is still to release official details of the planned facility in Shanghai , China which we fully expect to become a vertically integrated battery facility, and there will likely be further offerings (or joint ventures) from other auto manufacturers looking to build the foundations to become leaders in the EV space.

Raw material security is now firmly on the agenda of many major auto manufacturers – VW and China’s Great Wall Motor have been the most active in trying to secure lithium and cobalt of late.

However, the question remains whether auto majors are fully comfortable with their lithium ion battery supply of which the vast majority of near term new capacity is being build in China.

Europe, especially, is some way behind in the race to build out new cell capacity while North America is still heavily reliant on a successful Tesla Gigafactory ramp up and if successful will still be captive supply for world’s highest profile EV manufacturer.

And while many megafactories are being announced, how many will be realised, at what capacity and by when? This is one of the biggest risks the auto manufacturers face in the next 5 years.

Further battery supply growth expectations may seem excessive considering the new lithium ion battery pipeline is at the 344.5GWh mark… but the industry needs it.

Benchmark forecasts world lithium ion battery demand to grow by between 6 and 7 times by 2026 which will require a battery pipeline of nearly double what we have today.

Constructing the plants is relatively easy if the funding and drive is there from the battery manufacturers, but if and when that problem is solved an even bigger one is faced: sourcing the raw materials to feed them and building out the supply chains for the 21st century energy storage revolution.

Benchmark Mineral Intelligence is the industry’s leading source of lithium ion battery market data and analysis. We publish monthly price assessments for lithium, graphite and cobalt.

Each year we also host the Benchmark World Tour investment seminars and industry conferences, Cathodes Conference and Graphite + Anodes.

To subscribe or for more email: info@benchmarkminerals.com

WATCH: Star appeal: Elon Musk shows Leo DiCaprio the Tesla Gigafactory"

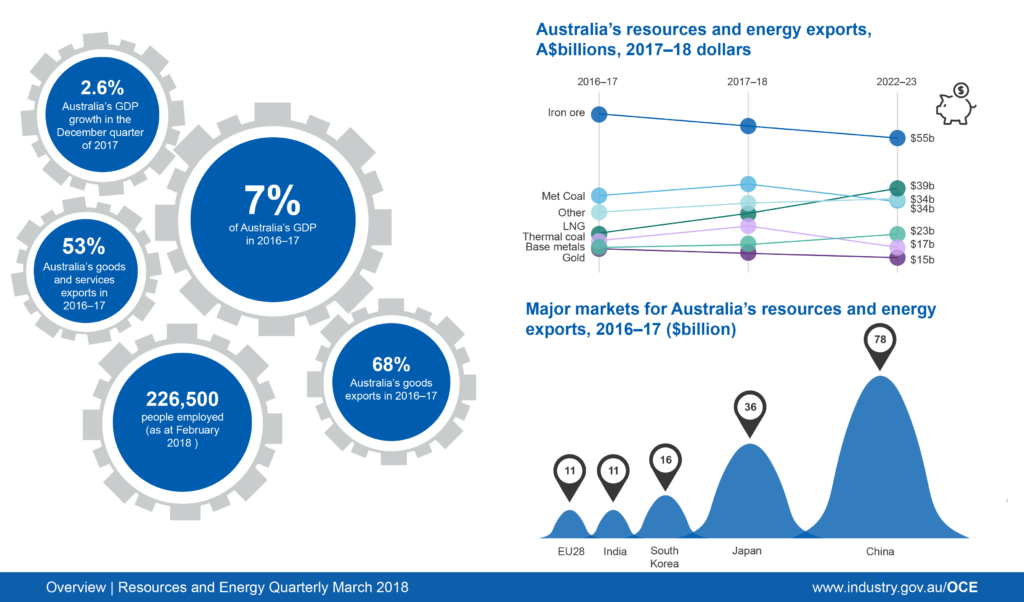

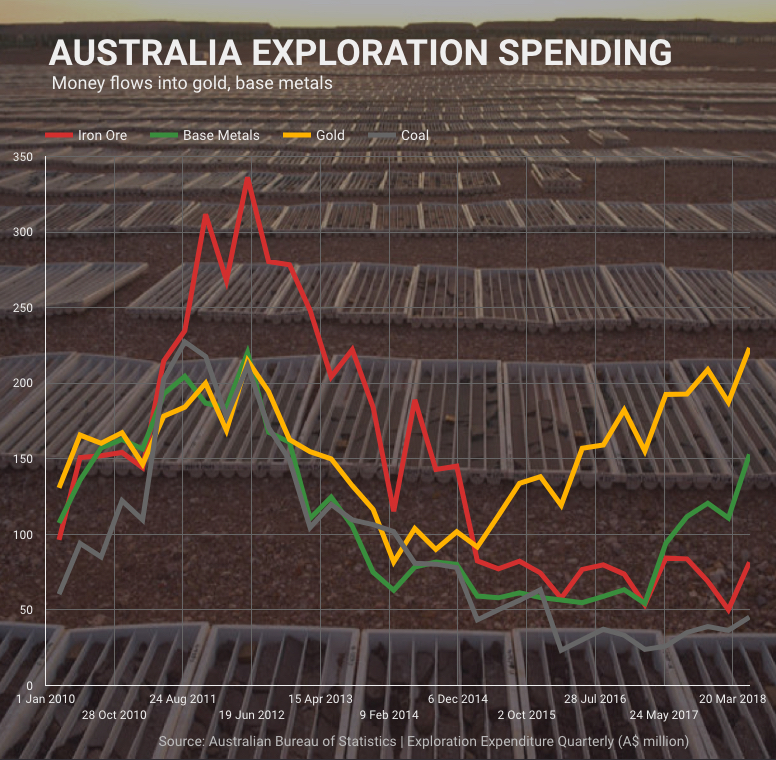

http://www.australianmining.com.au/news/resources-industry-r…

"Resources industry recovery to gather momentum in 2018: analysts

December 11, 2017News Australian Mining

Mining’s recovery in Australia has been forecast to accelerate into 2018 and beyond.

According to BIS Oxford Economics’ Mining in Australia 2017 to 2032 report, mining exploration, production and maintenance are all expected to lift significantly through 2018.

BIS has forecast the industry to track even higher in subsequent years as strengthening global economic growth supports commodity prices and underwrites new investment and mining operations expenditure.

Mining production only grew 2.5 per cent in 2016/17, according to Australian Bureau of Statistics (ABS) data, but BIS expects growth to accelerate to 5.5 per cent in 2017/18, with even stronger growth over the remainder of the decade.

“The enormous investment boom is now translating into production, particularly within oil and gas, where Australia is expected to become the leading LNG (liquefied natural gas) exporter by 2022,” BIS Oxford Economics Economist Rubhen Jeya said.

“Growth in mining production will be roughly double the pace of the national economy over the next five years.”

According to BIS, the completion of a $200 billion wave of LNG projects over the coming year will see aggregate investment decline further over the next two years.

The forecaster added, however, that this masked the start of a new cycle of investment across a range of commodities including copper, gold, coal and iron ore.

“The completion of the Wheatstone, Ichthys and Prelude projects will subtract a further $20 billion in mining investment over the next two years,” BIS Oxford Economics construction, maintenance and mining associate director Adrian Hart said.

“But excluding oil and gas, mining investment elsewhere is expected to grow at a double-digit pace over 2017/18 and 2018/19 – and will also continue to grow robustly through the subsequent three years.

“Considering that most LNG investment from here represents imports in any case, the time has come to stop blaming the mining investment bust as the reason behind sluggish Australian economic growth.”

The stronger investment outlook does not include Adani’s $16 billion Carmichael coal project in the Galilee Basin, which has not been included in BIS’s base case scenario for the next five years.

Hart said the Carmichael project was unlikely to proceed given long-term steaming coal price projections, relatively high development costs and risks to finance.

“But there are other coal projects which have re-opened or been put back into development because of stronger coal prices compared to the trough in early 2016. The outlook for coal remains positive, although prices may slip back a little in 2018,” Hart said.

“If the Adani coal project did eventuate, there would be significant upside to Queensland’s coal production forecasts, but not until the 2020s.

“In the meantime, such a large investment would likely erode confidence to invest in coal elsewhere, with negative implications for investment and production in the Hunter region, traditionally Australia’s largest thermal coal exporter.”

Higher prices for most commodities over the past year have led to a turnaround in exploration activity, BIS reported. The forecaster estimates exploration activity to rise 8.7 per cent in 2017/18 – and nearly 40 per cent over the next five years."

"Resources industry recovery to gather momentum in 2018: analysts

December 11, 2017News Australian Mining

Mining’s recovery in Australia has been forecast to accelerate into 2018 and beyond.

According to BIS Oxford Economics’ Mining in Australia 2017 to 2032 report, mining exploration, production and maintenance are all expected to lift significantly through 2018.

BIS has forecast the industry to track even higher in subsequent years as strengthening global economic growth supports commodity prices and underwrites new investment and mining operations expenditure.

Mining production only grew 2.5 per cent in 2016/17, according to Australian Bureau of Statistics (ABS) data, but BIS expects growth to accelerate to 5.5 per cent in 2017/18, with even stronger growth over the remainder of the decade.

“The enormous investment boom is now translating into production, particularly within oil and gas, where Australia is expected to become the leading LNG (liquefied natural gas) exporter by 2022,” BIS Oxford Economics Economist Rubhen Jeya said.

“Growth in mining production will be roughly double the pace of the national economy over the next five years.”

According to BIS, the completion of a $200 billion wave of LNG projects over the coming year will see aggregate investment decline further over the next two years.

The forecaster added, however, that this masked the start of a new cycle of investment across a range of commodities including copper, gold, coal and iron ore.

“The completion of the Wheatstone, Ichthys and Prelude projects will subtract a further $20 billion in mining investment over the next two years,” BIS Oxford Economics construction, maintenance and mining associate director Adrian Hart said.

“But excluding oil and gas, mining investment elsewhere is expected to grow at a double-digit pace over 2017/18 and 2018/19 – and will also continue to grow robustly through the subsequent three years.

“Considering that most LNG investment from here represents imports in any case, the time has come to stop blaming the mining investment bust as the reason behind sluggish Australian economic growth.”

The stronger investment outlook does not include Adani’s $16 billion Carmichael coal project in the Galilee Basin, which has not been included in BIS’s base case scenario for the next five years.

Hart said the Carmichael project was unlikely to proceed given long-term steaming coal price projections, relatively high development costs and risks to finance.

“But there are other coal projects which have re-opened or been put back into development because of stronger coal prices compared to the trough in early 2016. The outlook for coal remains positive, although prices may slip back a little in 2018,” Hart said.

“If the Adani coal project did eventuate, there would be significant upside to Queensland’s coal production forecasts, but not until the 2020s.

“In the meantime, such a large investment would likely erode confidence to invest in coal elsewhere, with negative implications for investment and production in the Hunter region, traditionally Australia’s largest thermal coal exporter.”

Higher prices for most commodities over the past year have led to a turnaround in exploration activity, BIS reported. The forecaster estimates exploration activity to rise 8.7 per cent in 2017/18 – and nearly 40 per cent over the next five years."

"Der grösste Absatzmarkt für REEs ist ebenfalls China and sie erhöhen weiterhin ihre Importe an REE-Feedstock (Rohmaterial), um ihre stets wachsende Downstream-Produktionsindustrie zu stillen.“

Ryan Castilloux: „Wird ein westliches Unternehmen, das einen Deal mit einem chine- sischen Unternehmen hat, unat- traktiver für andere Länder und Unternehmen?

Ich denke nicht. Am Ende des Tages ist China der weltweit grösste Nachfrage- markt für REEs und dieses Nachfrage- niveau wächst schneller als jede ande- re Region. Darüberhinaus gibt es in der Welt ausserhalb Chinas (mit Ausnahme von Japan) einen Mangel an Produk- tionskapazität zur Umwandlung von REE-Feedstock und REO (“Rare Earth Oxides“) zu Metallen, Legierungen, Magneten und anderen Mehrwert- produkten, die globale Konsumenten wollen. Daher macht es Sinn, dass aufstrebende Produzenten im Westen erwarten sollten, wenigstens etwas von ihrem Output an Käufer in China zu verkaufen.“

Rockstone Research: „Auf der diesjährigen REE-Konferenz in Hongkong wurde argumentiert, dass China viel mehr an der Wertschöpfung interessiert sei, die sich aus der Weiterverabeitung mit REEs ergibt, anstatt nur die Feedstock-Kornkammer für sich und den Rest der Welt zu sein. In dieser Hinsicht haben einige Redner argumentiert – allerdings am überzeugendsten Ryan Castilloux von Adamas Intelligence – dass China mit aller Wahrscheinlichkeit in absehbarer Zukunft ein Netto-Importeur von REE-Feedstock wird!“ "

Ryan Castilloux: „Wird ein westliches Unternehmen, das einen Deal mit einem chine- sischen Unternehmen hat, unat- traktiver für andere Länder und Unternehmen?

Ich denke nicht. Am Ende des Tages ist China der weltweit grösste Nachfrage- markt für REEs und dieses Nachfrage- niveau wächst schneller als jede ande- re Region. Darüberhinaus gibt es in der Welt ausserhalb Chinas (mit Ausnahme von Japan) einen Mangel an Produk- tionskapazität zur Umwandlung von REE-Feedstock und REO (“Rare Earth Oxides“) zu Metallen, Legierungen, Magneten und anderen Mehrwert- produkten, die globale Konsumenten wollen. Daher macht es Sinn, dass aufstrebende Produzenten im Westen erwarten sollten, wenigstens etwas von ihrem Output an Käufer in China zu verkaufen.“

Rockstone Research: „Auf der diesjährigen REE-Konferenz in Hongkong wurde argumentiert, dass China viel mehr an der Wertschöpfung interessiert sei, die sich aus der Weiterverabeitung mit REEs ergibt, anstatt nur die Feedstock-Kornkammer für sich und den Rest der Welt zu sein. In dieser Hinsicht haben einige Redner argumentiert – allerdings am überzeugendsten Ryan Castilloux von Adamas Intelligence – dass China mit aller Wahrscheinlichkeit in absehbarer Zukunft ein Netto-Importeur von REE-Feedstock wird!“ "

"Ucore Applauds Signing

of 2018 National Defense Authorization Act

December 13, 2017 - HALIFAX, NOVA SCOTIA - Ucore Rare Metals, Inc. (TSXV:UCU) (OTCQX:UURAF) ("Ucore" or the "Company") is pleased to comment on the signing yesterday of the 2018 National Defense Authorization Act by President Trump. The Act features a number of initiatives of strategic importance to Ucore, including the authorization for $5 million in funding for the development of strategic materials technologies at the Army Research Laboratory ("ARL") during the coming fiscal year.

The $5 million program has direct import to Ucore, as the funds have been set aside for the "development of improved manufacturing technology for separation, extraction, smelter, sintering, leaching, processing, beneficiation, or production of specialty metals such as lanthanide elements..." The lanthanide elements comprise the suite of metals more commonly referred to as the Rare Earth Elements. As previously stated in a report by the Senate Armed Services Committee, this significant funding is allocated for domestic producers that the Department believes are likely to initiate commercial production of such materials within the next five years.

"This historic legislation demonstrates our unwavering commitment to our men and women in uniform -- the greatest fighting force in the history of the world," commented President Trump. "The National Defense Authorization Act could not come at a more opportune or important time. In recent years, our military has undergone a series of deep budget cuts that have severely impacted our readiness, shrunk our capabilities, and placed substantial burdens on our warfighters. Today, with the signing of this defense bill, we accelerate the process of fully restoring America's military might."

"This is an important step towards promoting a secure supply of critical materials such as rare earth elements," said Jim McKenzie, President & CEO of Ucore. "By authorizing this funding, Congress has reaffirmed the importance of strengthening supply chains for strategic and critical materials. Ucore enthusiastically looks forward to competing for the Army Research Lab's funding."

"As an industry leader in extraction and beneficiation technologies, we are ideally suited to assist the US Department of Defense in promoting supply chain security for strategic and critical materials," said Steve Izatt, President and CEO of IBC Advanced Technologies. "Molecular Recognition Technology ("MRT") provides a domestic platform for the technical capabilities needed to safely and sustainably create a stable U.S. supply chain for these strategic materials."

The House of Representatives and the Senate passed the $700 billion bill for fiscal year 2018 in mid-November, and the 2018 National Defense Authorization Act approving spending levels for U.S. military efforts was signed into law by the President Tuesday afternoon at the White House.

About IBC

IBC Advanced Technologies, Inc. is an award-winning, green chemistry selective separations company based on innovative MRT products. IBC is headquartered in American Fork, Utah, with manufacturing facilities in Utah and Houston, Texas. IBC has supplied industrial, governmental and academic customers worldwide with environmentally friendly products, processes and services for over 29 years. IBC specializes in MRT, utilizing green chemistry to achieve highly selective separations of metal ions in complex matrices. Based on Nobel Prize-winning technology (1987), IBC's proprietary products and processes are used worldwide by premier metals refining and mining companies such as Tanaka Kikinzoku K.K. (Japan), Asarco Grupo Mexico (USA), Impala Platinum Ltd. (South Africa), and Sino Platinum (China). In 2014, the Japanese Government (Mitsubishi Research, Inc.) awarded to IBC a highly competitive subsidy grant, "Demonstration Project for Seawater Purification Technologies", concerning the selective separation of the radionuclides strontium and cesium from contaminated seawater at Fukushima, Japan.

IBC's expertise is illustrated by its extensive development and commercialization of separations systems for platinum group metals ("PGM's") at a world level. PGM's are analogous to REE, in that they are considered difficult to selectively separate due to their constituent chemical similarities. The Ucore-IBC alliance builds on IBC's proven capabilities to develop, scale-up and commercialize selective separations systems for a number of diverse and complex applications. See www.ibcmrt.com for additional information.

About Ucore

Ucore Rare Metals is a development-phase company focused on rare metals resources, extraction and beneficiation technologies with near term potential for production, growth and scalability. On March 3, 2015, Ucore announced the development of a joint venture with IBC for the deployment of Molecular Recognition Technology for REE and multi-metallic tailings processing applications in North America and associated world markets. The Company has a 100% ownership stake in the Bokan project. On March 31, 2014, Ucore announced the unanimous support of the Alaska State Legislature for the investment of up to USD $145 Million in the Bokan project at the discretion of the Alaska Import Development and Export Agency ("AIDEA").

For further information, please contact Mr. Jim McKenzie, President and Chief Executive Officer of Ucore Rare Metals Inc. at: +1 (902) 482-5214 or visit <http://www.ucore.com>."

of 2018 National Defense Authorization Act

December 13, 2017 - HALIFAX, NOVA SCOTIA - Ucore Rare Metals, Inc. (TSXV:UCU) (OTCQX:UURAF) ("Ucore" or the "Company") is pleased to comment on the signing yesterday of the 2018 National Defense Authorization Act by President Trump. The Act features a number of initiatives of strategic importance to Ucore, including the authorization for $5 million in funding for the development of strategic materials technologies at the Army Research Laboratory ("ARL") during the coming fiscal year.

The $5 million program has direct import to Ucore, as the funds have been set aside for the "development of improved manufacturing technology for separation, extraction, smelter, sintering, leaching, processing, beneficiation, or production of specialty metals such as lanthanide elements..." The lanthanide elements comprise the suite of metals more commonly referred to as the Rare Earth Elements. As previously stated in a report by the Senate Armed Services Committee, this significant funding is allocated for domestic producers that the Department believes are likely to initiate commercial production of such materials within the next five years.

"This historic legislation demonstrates our unwavering commitment to our men and women in uniform -- the greatest fighting force in the history of the world," commented President Trump. "The National Defense Authorization Act could not come at a more opportune or important time. In recent years, our military has undergone a series of deep budget cuts that have severely impacted our readiness, shrunk our capabilities, and placed substantial burdens on our warfighters. Today, with the signing of this defense bill, we accelerate the process of fully restoring America's military might."

"This is an important step towards promoting a secure supply of critical materials such as rare earth elements," said Jim McKenzie, President & CEO of Ucore. "By authorizing this funding, Congress has reaffirmed the importance of strengthening supply chains for strategic and critical materials. Ucore enthusiastically looks forward to competing for the Army Research Lab's funding."

"As an industry leader in extraction and beneficiation technologies, we are ideally suited to assist the US Department of Defense in promoting supply chain security for strategic and critical materials," said Steve Izatt, President and CEO of IBC Advanced Technologies. "Molecular Recognition Technology ("MRT") provides a domestic platform for the technical capabilities needed to safely and sustainably create a stable U.S. supply chain for these strategic materials."

The House of Representatives and the Senate passed the $700 billion bill for fiscal year 2018 in mid-November, and the 2018 National Defense Authorization Act approving spending levels for U.S. military efforts was signed into law by the President Tuesday afternoon at the White House.

About IBC

IBC Advanced Technologies, Inc. is an award-winning, green chemistry selective separations company based on innovative MRT products. IBC is headquartered in American Fork, Utah, with manufacturing facilities in Utah and Houston, Texas. IBC has supplied industrial, governmental and academic customers worldwide with environmentally friendly products, processes and services for over 29 years. IBC specializes in MRT, utilizing green chemistry to achieve highly selective separations of metal ions in complex matrices. Based on Nobel Prize-winning technology (1987), IBC's proprietary products and processes are used worldwide by premier metals refining and mining companies such as Tanaka Kikinzoku K.K. (Japan), Asarco Grupo Mexico (USA), Impala Platinum Ltd. (South Africa), and Sino Platinum (China). In 2014, the Japanese Government (Mitsubishi Research, Inc.) awarded to IBC a highly competitive subsidy grant, "Demonstration Project for Seawater Purification Technologies", concerning the selective separation of the radionuclides strontium and cesium from contaminated seawater at Fukushima, Japan.

IBC's expertise is illustrated by its extensive development and commercialization of separations systems for platinum group metals ("PGM's") at a world level. PGM's are analogous to REE, in that they are considered difficult to selectively separate due to their constituent chemical similarities. The Ucore-IBC alliance builds on IBC's proven capabilities to develop, scale-up and commercialize selective separations systems for a number of diverse and complex applications. See www.ibcmrt.com for additional information.

About Ucore

Ucore Rare Metals is a development-phase company focused on rare metals resources, extraction and beneficiation technologies with near term potential for production, growth and scalability. On March 3, 2015, Ucore announced the development of a joint venture with IBC for the deployment of Molecular Recognition Technology for REE and multi-metallic tailings processing applications in North America and associated world markets. The Company has a 100% ownership stake in the Bokan project. On March 31, 2014, Ucore announced the unanimous support of the Alaska State Legislature for the investment of up to USD $145 Million in the Bokan project at the discretion of the Alaska Import Development and Export Agency ("AIDEA").

For further information, please contact Mr. Jim McKenzie, President and Chief Executive Officer of Ucore Rare Metals Inc. at: +1 (902) 482-5214 or visit <http://www.ucore.com>."

Antwort auf Beitrag Nr.: 56.507.675 von Popeye82 am 20.12.17 18:22:08

http://www.mining-technology.com/news/national-australia-ban…

"National Australia Bank to stop funding new thermal coal projects

Share

The National Australia Bank (NAB) has opted to stop extending financial support to future thermal coal mining operations.

According to the banking institution, the decision is intended to ensure an orderly transition to a low-carbon economy.

However, NAB will continue to support its existing customers across the mining and energy sectors, including those with existing coal assets.

In a statement, NAB said: “An orderly approach to the low-carbon transition is critical to ensure Australians can continue to have access to secure, reliable and affordable energy and support our economy.”

Last month, Commonwealth Bank indicated to its shareholders that there would be a likely decline in its financial support for the coal industry.

Welcoming NAB’s decision, Greenpeace campaigner Jonathan Moylan said: “This is a market-leading position for an Australian bank and is even stronger than the position taken by Commonwealth Bank last month because it is formal policy.”

“All over the world, financial institutions are turning their backs on coal after realising its contribution to climate change.”

“All over the world, financial institutions are turning their backs on coal

after realising its contribution to climate change and the damage it does to the health of communities and the planet.”

after realising its contribution to climate change and the damage it does to the health of communities and the planet.”The decision comes at a time when companies worldwide from several industries are taking steps to ensure the rise in temperate is limited to 1.5°C, in accordance with the Paris agreement.

Earlier this month, Dutch multinational banking and financial services firm ING revealed its policy initiative to nearly eliminate exposure to coal power generation by 2025.

The firm will stop funding utility companies that are dependent on coal for more than 5% of their energy.

In 2015, Rio Tinto chose to extend its greenhouse gas emissions reduction programme to 2020."

Antwort auf Beitrag Nr.: 56.507.675 von Popeye82 am 20.12.17 18:22:08

http://investor-magazin.de/2631hannan-metals-zink-in-irland-…

http://investor-magazin.de/2631hannan-metals-zink-in-irland-…

http://www.businesslive.co.za/bd/companies/mining/2017-12-28…

"Kinshasa — Mining companies in the Democratic Republic of Congo have urged legislators to rethink new legislation that could lead to acrimony between the government and the industry.

Local subsidiaries of Glencore, China Molybdenum, Randgold Resources, Ivanhoe Mines and MMG sent a letter, which has been seen by Bloomberg, to Leon Kengo wa Dondo and Aubin Minaku, respectively the presidents of the senate and national assembly.

They asked them to "suspend the process of adopting the text in its current version" and to "organise a true consultation of the mining industry".

On December 8, the national assembly approved legislation that increases royalties on copper, cobalt and gold to 3.5%, introduces a profit-windfall tax and doubles the state’s free share to 10%. It also reduces the period during which contract stability is guaranteed to five years from 10 years.

The bill has been transferred to the senate and, if passed, will be sent to President Joseph Kabila to be signed into law.

While parliament closed on December 15 and its regular business resumes only in mid-March, an extraordinary session of both chambers is scheduled to start on January 2.

The senate is due to examine the mining legislation, according to a statement signed by Minaku on December 17.

The new law would "significantly lessen the confidence of investors in the regulatory environment" of Congo and discourage investment, according to the letter. It would reduce the state’s tax receipts from mining and also threaten jobs, social programmes and infrastructure projects, the companies said.

Mining Minister Martin Kabwelulu did not respond to calls and text messages.

‘Lasting dispute’

Congo is Africa’s biggest copper producer and the world’s largest source of cobalt. The current mining law, which was promoted by the World Bank and adopted in 2002, attracted billions of dollars of investment from mining companies including the letter’s signatories, as well as Freeport McMoRan.

While the economy has grown, two-thirds of the population of about 80-million people live on less than $2 a day and the annual budget has never exceeded $10bn.

The government first introduced the revised mining code to parliament in 2015 and withdrew it before it was debated on account of a slump in metal prices and fierce industry opposition.

The state-owned mining company Gecamines has claimed that revenue generated by its partnerships with major mining companies have been lower than expected and the government hopes to take a larger share following the resurgence of key commodities.

The price of copper has risen 31% so far in 2017 while cobalt is up 130% in the year.

Last year, Congo produced 1.02-million tonnes of copper and 68,822 tonnes of cobalt, the key battery component of electric vehicles.

The mining industry’s concerns have not been heard and proposed modifications have been "largely ignored", according to the letter.

Such an approach is likely to cause "a lasting dispute" as the companies and their shareholders will "protect their investments by all domestic and international means at their disposal", it says.

The signatories offered to support a consultation to come up with another mining code during 2018.

The dispute echoes the South African Chamber of Mines’ battle with the Department of Mineral Resources and minister Mosebenzi Zwane over the third iteration of the Mining Charter.

Bloomberg"

http://www.kitco.com/news/2017-12-29/These-Are-The-3-Compani…

"Editor's Note: View Kitco News' full 2018 outlook coverage

(Kitco News) - Known as a fan favorite, the Expert Series brings together well-known investors and Kitco regulars to find out where they will be putting their money in 2018.

This year, in a new twist to the feature Kitco News has asked some of the most influential mining sector newsletter writers how they would invest $100K in the mining sector.

While the mining sector has struggled to maintain momentum, 2017 has been anything but boring with new assets like cryptocurrencies making waves in financial markets. What does 2018 have in store? Check out what the mining experts have to say!

Experts: Brent Cook & Joe Mazumdar

Claim to Fame: creator and co-editor of Exploration Insights

1. How would you invest $100k in the mining sector in 2018?

We will continue to invest in junior mining companies whose upside potential is underpinned by exploration success. Given the a dearth of quality, high margin projects held by major and mid-tier producers, our focus will be on early stage exploration projects seeking these projects. This is especially true in the gold sector where the gold price is range bound with a strong resistance level at US$1,300 per ounce and marginal resources are the norm. Given the poor financing environment for non-cash flowing junior explorers, we will have a certain portion of our portfolio invested in active prospect generators that are signing deals with major producers who are ‘running to stand still’ with respect to their reserve and production growth opportunities.

Our commodity focus will be on precious metals such as gold and silver, base metals such as copper and zinc, and battery metals such as lithium. Assets in mining friendly jurisdictions, with progressive tax and royalty structures that allow companies to generate a return that is commensurate with the risks they absorb, will also be an important investment criteria.

2. What will affect gold most in 2018?

Given the current global geopolitical environment, the number of potential scenarios for 2018 are almost infinite. In our view the extended bull market run is long in the tooth and we suspect that the underlying risks pose the potential for several black swan events that could very well come to the forefront in 2018. Higher interest rates are coming; however, the number of rate hikes are the question and some are already baked into the current gold price, so any changes to the forecast is critical. The consensus forecast is for three rate hikes in the New Year but a new head of the Federal Reserve will be appointed, so we are not sure what impact this will have.

The reforms in the US tax code and low interest rates have supported the US equity markets suggesting that greed eclipses fear at this stage. This is reflected in the low volatility rates (VIX<10) and high valuations of very risky speculations across the board. The lack of fear has curtailed the demand for safe haven assets. In 2017, the surge in cryptocurrencies such as Bitcoin, which was up ~19x to a mid-December peak, has hived off some of the safe haven and ‘store of value’ demand from gold.

Gold prices have been supported predominantly by investment demand, specifically ETFs, over the past year hence any changes on this source of demand would have a significant near term impact on it. Although inflows have slowed, they remained net positive in 2017. Any combination of additional interest rate hikes than forecast, strong equity markets, and a continued expansion of investor interest in cryptocurrencies would be negative for gold in 2018.

3. What do you see as 3 top mining companies for 2018? Why?

Our choices for top companies in 2018 are all involved in exploration or prospect generating and provide exposure to gold, silver, copper, zinc, and lithium.

Advantage Lithium (AAL.V)- An explorer in the ‘Lithium Triangle’ of northwest Argentina in a joint venture with Orocobre (ORL.T, ORE.ASX)—the only lithium producer in the Salar de Olaroz-Cauchari. AAL’s property package straddles a lithium development play operated by a joint venture between a major producer, Sociedad Quimica y Minera SA (SQM.NYSE), and Lithium Americas (LAC.T).

Tinka Resources (TK.V)- The zinc explorer achieved its goal of expanding the Ayawilca resource through the discovery of South Ayawilca in 2017, and both the market (+265% year to date at Nov 11, 2017 peak) and the industry (Winner of the 2017 Mining Journal Explorer of the Year Award) have recognized its efforts. The company delineated a high grade zinc resource containing 5.6 billion pounds grading 7.3% zinc equivalent at its wholly-owned Ayawilca project in a prolific belt of central Peru in November 2017, and continues to drill to infill and expand the resource outline and quantify the potential of its land package. We have owned Tinka since PDAC 2017 and continue to recommend the stock due to the paucity of high quality zinc projects in mining friendly jurisdictions.

Evrim Resources (EVM.V)- This Americas focused prospect generator has recently signed significant project earn-ins for different projects, including a copper porphyry in eastern British Columbia (Axe project) with a major copper producer, Antofagasta Minerals (ANTO.LSE). EVM is taking full advantage of the lack of grassroots exploration projects generated by major precious and base metal producers and has planned a grand total of 24,000 to 34,000 meters of drilling for 2018; therefore, plenty of newsflow to come. It also has five active joint ventures and a regional exploration alliance in its assets.

4. What 3 investments would you avoid in 2018? Why?

We will most likely avoid adding uranium producers, leveraged gold plays, and primary cobalt explorers to our portfolio in 2018. We think that the uranium inventory overhang on the market is significant and will require a few years before it becomes manageable. In the interim producers are looking at spot prices of US$20-25 per pound of U3O8 with no significant long term contracts being signed at higher levels. More curtailments by major uranium producers will help, along with a faster rise in global demand.

As gold producers have been writing off millions of ounces of reserves due to the challenging economics of high cost gold production at reserve prices levels closer to current spot levels, we don’t think that marginal gold assets will catch a bid in 2018 with respect to M&A.

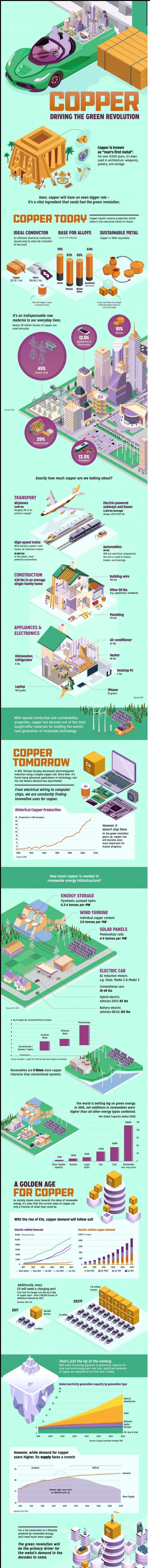

Primary cobalt producers will be on the high end of the cost curve as the vast majority of production is as a by-product from copper and nickel production. Also, we are concerned that evolving battery technology may require less cobalt. We prefer to gain exposure to the growth in electric vehicles’ production via the sector’s demand for lithium and copper.

5. If you could describe 2017 in one word, what would it be?

“Twilight-Zone” - We had anticipated a ‘Twilight-Zone’ scenario for 2017 and we think the description remains appropriate. On the global front an emotionally unstable narcissist became the most powerful man in the world, a mentally unstable man gained nuclear capabilities, Brexit lumbered forward, facts became illusory, the Mid-east splintered even more and stock markets and speculative assets surged.

Within the mining sector, the flow of funds dwindled as institutional money dried up, yet a very few exploration stories headed to the moon (at least temporarily). We witnessed individual junior exploration companies stocks gaining 100’s to 1,000’s of percent based on visual descriptions of core, geophysical anomalies and big concept ideas, but minimal hard data. We think this is a another indication that reality, facts and science took a back seat to hype, ignorance and greed in 2017. This can’t continue indefinitely and we expect (hope) that hard data and reality will gain credence in 2018.

6. What are your thoughts on bitcoin in 2018?

Although we recognize the value of blockchain technology, in our opinion cryptocurrencies are the poster child of the “twilight-zone” speculative world of 2017. These are complex algorithms requiring massive amounts of energy to produce something with a cost of mining that is unpredictable and, that only exists on your hard-drive and in the minds of those who own them.

Exploration Insights intends to stick with what we know best--mining and exploration with the confidence that quality mineral deposits will always be valuable.

7. Any additional comments

We think 2018 will be a volatile year for nearly all investment classes with uncertainty and greed being the driving force. This means that in the mining and exploration sector one will not be able to rely on a “greater fool” buying your mistakes. Due diligence with regard to geological, resource, social and political aspects of any metal project will be critical to winning or losing on investments in this sector.

By Neils Christensen

For Kitco News "

Setting Up a Canadian 'Supercluster'; the Canadian Government is offering C$950,000,000, to five 'superclusters', that serve as innovation hubs for their respective industries. The Ontario mining submission proposes to reduce Canadian mining's energy +water use, +environmental footprint. Julian Turner examines the project's feasibility

http://www.nridigital.com/mine-digital-magazine/january-2018…

http://www.nridigital.com/mine-digital-magazine/january-2018…

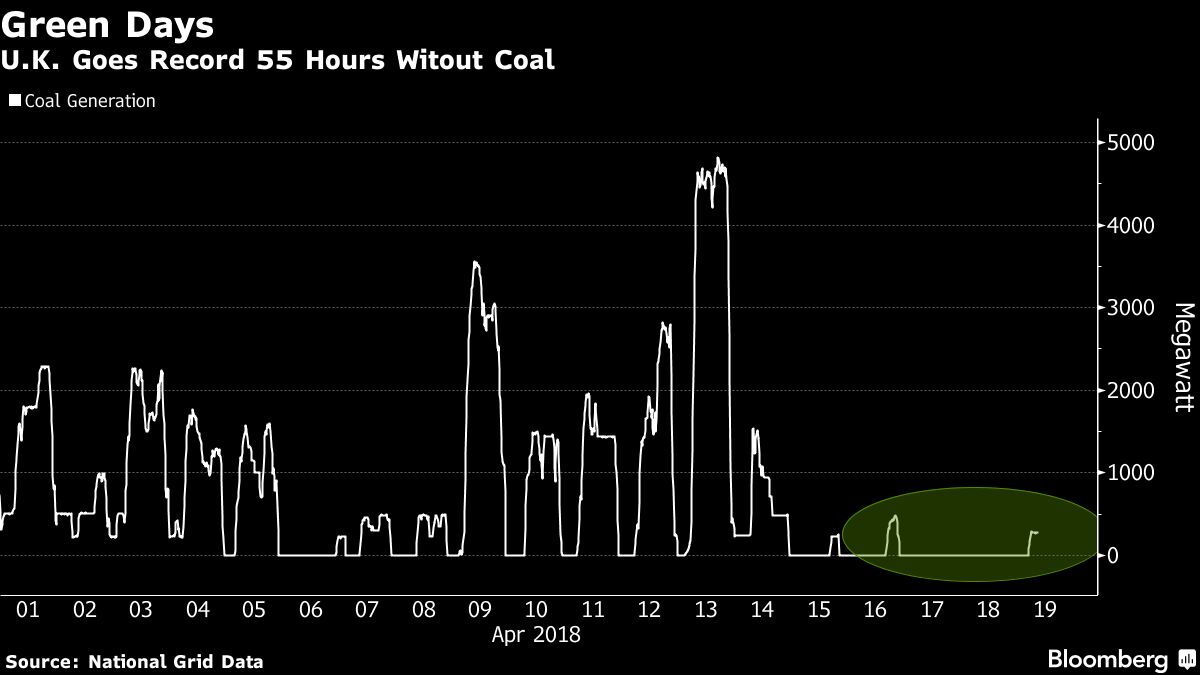

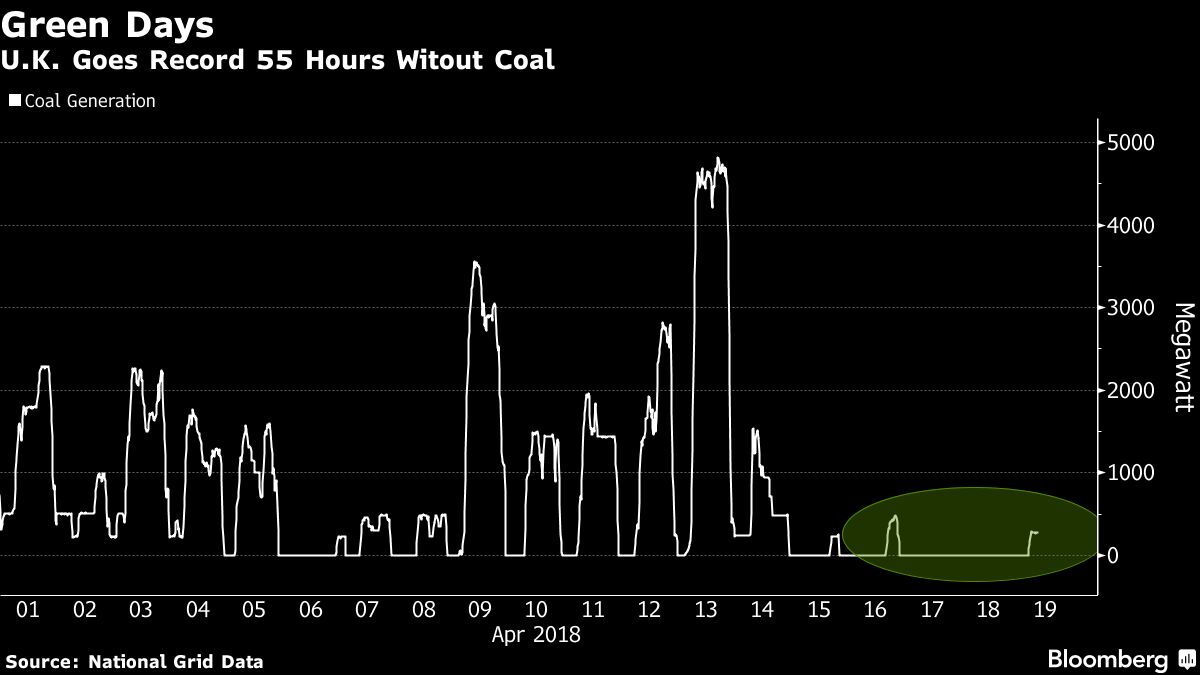

"Coal should be replaced with clean technologies, well before the 2025 deadline"; the UK government has published its plan to phase out unabated coal use by 2025 after consulting on proposals on how to achieve this target

http://www.mining-journal.com/politics/news/1310453/-coal-re…

"The prime minister announced in September last year that the government would proceed with regulating the closure of coal power generation units after already cutting emissions by over 40% since 1990.

Through the consulting, the department for business, energy and industrial strategy has decided to introduce an emissions intensity limit of 450g of CO2 per kilowatt-hour on, or from, October 1, 2025. The limit will be applied to units that burn any solid fossil fuel, but not to those that convert fully to other fuels.

"We consider that the appropriate means to guarantee the closure of unabated coal by 2025 will be to set a new emissions intensity limit to generating units, which provides coal generators with more flexible options of investing to reduce emissions to a level in line with our decarbonisation pathway," the department said in a document on government response to the consultations.

By the government's assessment, the closures of unabated coal would yield guaranteed reductions of 15 million tonnes of carbon dioxide, which in turn would guarantee lower harmful air pollution such as sulphur dioxide, nitrogen oxides and particulate matter.

"The UK has been at the forefront of encouraging the world to move towards clean growth and is proud to have been one of the first countries to commit to ending unabated coal generation," it said.

Greenpeace UK head of energy Hannah Martin praised the plan as "significant progress on making coal history," adding that the government shared credit for this with millions of UK citizens who had supported the move.

"But it is important that this is carried through, and the government must provide enough parliamentary time to do it properly. Coal should be replaced with clean technologies well before the 2025 deadline if we are to stay global leaders in tackling climate change," she said.

The department said in the document that it had considered bringing the date forward, but had assessed 2025 as appropriate, taking into account the need to ensure security of electricity supplies, maintain affordability and the benefits of emissions reductions.

The majority of remaining coal power stations are expected to close by the early 2020s, with only around 1.3 gigawatts of unabated coal capacity likely to still remain by 2025. These closures will be supported by the relatively poor economics for coal generation and the effects of carbon pricing.

The country has been lowering the use of coal generation in the electricity system since it launched the consultation in November 2016, largely driven by the country's carbon price support and the increase in low carbon generation on the system.

The department noted that the level of coal generation in 2016 fell to 9% of overall power generation, from 22% in 2015, and, in the June quarter of 2017, it fell to a record low of 2%.

Over the same period, low-carbon generation supplied more than 53% of electricity and, in April 2017, it had the first 24-hour period without coal on the system since 1882."

http://www.mining-journal.com/politics/news/1310453/-coal-re…

"The prime minister announced in September last year that the government would proceed with regulating the closure of coal power generation units after already cutting emissions by over 40% since 1990.

Through the consulting, the department for business, energy and industrial strategy has decided to introduce an emissions intensity limit of 450g of CO2 per kilowatt-hour on, or from, October 1, 2025. The limit will be applied to units that burn any solid fossil fuel, but not to those that convert fully to other fuels.

"We consider that the appropriate means to guarantee the closure of unabated coal by 2025 will be to set a new emissions intensity limit to generating units, which provides coal generators with more flexible options of investing to reduce emissions to a level in line with our decarbonisation pathway," the department said in a document on government response to the consultations.

By the government's assessment, the closures of unabated coal would yield guaranteed reductions of 15 million tonnes of carbon dioxide, which in turn would guarantee lower harmful air pollution such as sulphur dioxide, nitrogen oxides and particulate matter.

"The UK has been at the forefront of encouraging the world to move towards clean growth and is proud to have been one of the first countries to commit to ending unabated coal generation," it said.

Greenpeace UK head of energy Hannah Martin praised the plan as "significant progress on making coal history," adding that the government shared credit for this with millions of UK citizens who had supported the move.

"But it is important that this is carried through, and the government must provide enough parliamentary time to do it properly. Coal should be replaced with clean technologies well before the 2025 deadline if we are to stay global leaders in tackling climate change," she said.

The department said in the document that it had considered bringing the date forward, but had assessed 2025 as appropriate, taking into account the need to ensure security of electricity supplies, maintain affordability and the benefits of emissions reductions.

The majority of remaining coal power stations are expected to close by the early 2020s, with only around 1.3 gigawatts of unabated coal capacity likely to still remain by 2025. These closures will be supported by the relatively poor economics for coal generation and the effects of carbon pricing.

The country has been lowering the use of coal generation in the electricity system since it launched the consultation in November 2016, largely driven by the country's carbon price support and the increase in low carbon generation on the system.

The department noted that the level of coal generation in 2016 fell to 9% of overall power generation, from 22% in 2015, and, in the June quarter of 2017, it fell to a record low of 2%.

Over the same period, low-carbon generation supplied more than 53% of electricity and, in April 2017, it had the first 24-hour period without coal on the system since 1882."

Antwort auf Beitrag Nr.: 56.637.881 von Popeye82 am 06.01.18 16:41:55WHAAAT is coal

http://www.worldcoal.org/sites/default/files/resources_files…

http://www.worldcoal.org/sites/default/files/resources_files…

ONE step closer

(eventual colonization of outer space)

http://www.mining.com/planetary-resources-step-closer-mining…

(eventual colonization of outer space)

http://www.mining.com/planetary-resources-step-closer-mining…

Antwort auf Beitrag Nr.: 56.708.696 von Popeye82 am 13.01.18 19:18:41the truth will ALWAYS win

https://ceo.ca/@ocotilloredux/zinc-mining-ramblings-the-summ…

https://ceo.ca/@ocotilloredux/zinc-mining-ramblings-the-summ…

- The diamond blockchain will be open to everyone in the industry, offering the potential for monitoring each and every stone. (Image: Copacabana | Shutterstock.) -

http://www.mining.com/de-beers-readies-technology-aimed-remo…

http://www.debeersgroup.com/en/news/company-news/company-new…

"De Beers readies technology aimed at eliminating ‘conflict diamonds’

Firm is developing open platform that traces rocks from mine to buyer

Anglo American’s De Beers, the world’s largest rough diamond producer by value, plans to launch this year the first industry-wide blockchain platform, which will enable greater tracking of gems being traded worldwide.

The technology, which De Beers began developing last year, allows tracing each diamond throughout the entire value chain — from mine to buyer. It would make of the company an industry leader in terms of ensuring both that gems don’t come from war zones where they could be used to finance violence, and their authenticity.

"The open platform will trace the diamonds’ route through the value chain, from mine to consumer, ensuring their authenticity and that they are not from conflict zones."

Despite the establishment of the Kimberley Process in 2003, aimed at removing those so-called conflict diamonds from the supply chain, experts say trafficking of precious rocks is still ongoing.

De Beers believes its development should help solve that problem. “Diamonds hold enduring value and represent some of life’s most meaningful moments, so it’s essential to provide assurance that a diamond is conflict-free and natural,” chief executive Bruce Cleaver said in a statement.

“We are very excited about this initiative and the benefits it could deliver across the diamond value chain, from producers through to retailers and consumers,” he added.

Blockchain is a shared database of transactions maintained by a network of computers on the Internet, currently being employed in the bitcoin sector.

De Beers decided to develop its diamond blockchain platform following mounting concerns from customers, who wanted proof the diamonds they were acquiring had not been used to fund conflicts.

The company sells its diamonds mostly to authorized buyers at a series of so-called “sights” in Botswana, Namibia and South Africa. Then, they are normally sent to be polished or cut before ending up with retailers."

Antwort auf Beitrag Nr.: 56.637.881 von Popeye82 am 06.01.18 16:41:55http://www.thebull.com.au/articles/a/71460-bhp-to-exit-globa…

"BHP to exit global coal body over climate change policy

Share

19.12.2017 03:33 PM

The world's biggest miner BHP said Tuesday it would leave the World Coal Association and review its membership of the US Chamber of Commerce membership to show support for action on climate change.

The Anglo-Australia giant has been undertaking a review of its industry group memberships to see if their stances aligned with the firm's view that climate change had to be tackled with emissions reductions and the use of renewable energy.

The 22-page report, released Tuesday, found the organisations as well as the Minerals Council of Australia held different positions from BHP.

It said it was making a preliminary decision to part ways with the WCA, which would be reviewed by March next year.

The global lobby group had favoured the dumping of a clean energy target, which supports investment in renewables in Australia, as it preferred the use of cleaner coal technologies instead.

In contrast, BHP said it held a policy of tackling climate change through encouraging both the use of renewable energy and cleaner technologies.

BHP said it also disagreed with the US Chamber of Commerce's rejection of the Paris Agreement and a carbon-pricing policy, and would decide on whether to leave the organisation by March.

"Emissions reductions are necessary to mitigate climate change," the report said, outlining BHP's stance in support of the Paris pact.

"An effective global framework to reduce emissions should use a portfolio of complementary measures, including a price signal on carbon."

The Paris deal was sealed under previous US president Barack Obama, but his successor and climate sceptic Donald Trump pulled out of it in June.

The miner said it would remain in the MCA as the firm was still benefiting from its membership, but threatened to quit the Australian group if it did not refrain from lobbying in favour of coal power.

The decision to exit the WCA came as some governments look move away from coal-fired power, a key driver of global warming and air pollution.

Global demand for the fossil fuel is forecast to remain flat between 2017 and 2022, resulting in a "decade of stagnation for coal consumption", the International Energy Agency said Monday.

Rio Tinto, the world's second-largest miner, in September completed the sale of most of its Australian coal assets to China-backed Yancoal.

Rio's divestment drive is expected to lead to a complete exit from the coal sector."

"BHP to exit global coal body over climate change policy

Share

19.12.2017 03:33 PM

The world's biggest miner BHP said Tuesday it would leave the World Coal Association and review its membership of the US Chamber of Commerce membership to show support for action on climate change.

The Anglo-Australia giant has been undertaking a review of its industry group memberships to see if their stances aligned with the firm's view that climate change had to be tackled with emissions reductions and the use of renewable energy.

The 22-page report, released Tuesday, found the organisations as well as the Minerals Council of Australia held different positions from BHP.

It said it was making a preliminary decision to part ways with the WCA, which would be reviewed by March next year.

The global lobby group had favoured the dumping of a clean energy target, which supports investment in renewables in Australia, as it preferred the use of cleaner coal technologies instead.

In contrast, BHP said it held a policy of tackling climate change through encouraging both the use of renewable energy and cleaner technologies.

BHP said it also disagreed with the US Chamber of Commerce's rejection of the Paris Agreement and a carbon-pricing policy, and would decide on whether to leave the organisation by March.

"Emissions reductions are necessary to mitigate climate change," the report said, outlining BHP's stance in support of the Paris pact.

"An effective global framework to reduce emissions should use a portfolio of complementary measures, including a price signal on carbon."

The Paris deal was sealed under previous US president Barack Obama, but his successor and climate sceptic Donald Trump pulled out of it in June.

The miner said it would remain in the MCA as the firm was still benefiting from its membership, but threatened to quit the Australian group if it did not refrain from lobbying in favour of coal power.

The decision to exit the WCA came as some governments look move away from coal-fired power, a key driver of global warming and air pollution.

Global demand for the fossil fuel is forecast to remain flat between 2017 and 2022, resulting in a "decade of stagnation for coal consumption", the International Energy Agency said Monday.

Rio Tinto, the world's second-largest miner, in September completed the sale of most of its Australian coal assets to China-backed Yancoal.

Rio's divestment drive is expected to lead to a complete exit from the coal sector."

Antwort auf Beitrag Nr.: 56.760.552 von Popeye82 am 18.01.18 20:17:17http://www.bhp.com/media-and-insights/reports-and-presentati…

"Andrew Mackenzie, Chief Executive Officer

German-Australian Chamber of Industry and Commerce Asia-Pacific Regional Conference, Perth, 4 November 2017.

Check against delivery.

President Steinmeier, Prime Minister Turnbull, Prime Minister Alka-tiri, and visiting foreign dignitaries. Premier McGowan, Minister Cormann, other Government Ministers and parliamentarians, Dr Lienhard and ladies and gentlemen.

It is always good to be in Western Australia - home of our Pilbara iron ore operations, nickel business and half of our Petroleum division. We employ more than 16,000 people here and are proud of our many contributions to this great state. Our success has been, and will continue to be, made possible by our strong relations with the WA government and with the people and local communities they represent.

I am pleased that so many people from so many different backgrounds have come together at this conference. Though many of us are already connected by business, government and culture, we can deepen these relations over the weekend and make new ones.

As a research fellow in Aachen and Jülich from 2000 to 2002 I built many friendships and a love of Germany that remain strong today.

The diplomatic relations between Australia and Germany span decades and have led to partnerships on trade, investment and innovation. We share common values on open trade, beliefs in fairness, inclusion and cultural diversity, and a commitment to multilateral solutions to the world’s biggest challenges and opportunities.

Three years ago, the Australia-Germany Advisory Group, under my predecessor as President of the German-Australian Chamber of Commerce, Lucy Turnbull, developed a plan for more trade and investment between our countries and for greater cooperation in science and education. All designed to get the world and our countries on a higher growth path for the sake of those who feel left behind and of young people, and for the environment.

This plan is now affected by increased concerns about globalisation.

The America First policy of the Trump administration, the results of many European votes, and arguably the outcome of the NZ election, appear in conflict with the liberal multilateral consensus.

Although Kanzler Merkel won the most votes in Germany’s recent election, the increase in AfD’s share in a country that has invested so heavily in social infrastructure so its people benefit from a global connected economy confirms that these concerns about globalisation are widespread.

Globalisation is seen as the reason why many people have been left behind. And everyone here today is touched by this. For me the decisions by the United States to withdraw from the TPP and Paris are a big disappointment, as I campaigned hard for both of them.

No global company can afford to ignore the challenge of those who feel left behind.

I applaud the actions by the Australian and German governments, and Germany’s leadership in the margins of this year’s G20, to establish stronger bilateral frameworks and partnerships that allow business and governments to work and grow together.

I have three suggestions for business to get behind the Advisory Group’s agenda that Lucy Turnbull started.

First, business must work with governments to secure even greater bilateral and multilateral cooperation.

For example, the Australian-EU Free Trade Agreement will provide benefits to both. In my role as President of the German-Australian Chamber of Commerce I have promoted the use of German technology to keep Australian mining at the forefront of innovation.

In my recent conversations with the Mexican Foreign Affairs Minister I learnt that Mexico, where we are a major investor, now searches for ways (along with many others, including Australia) to resuscitate the TPP. I strongly endorse this and I encourage businesses here today to do the same.

But diplomacy and trade deals are only one part. We require an even more skilled workforce, equipped to compete and be more productive in the future.

This brings me to my second suggestion. Business has to invest more, alongside government, in research and development, in training and education, to make sure we have a workforce and society proficient in science, technology, engineering and maths (or STEM).

We can learn from Germany’s commitment to lifelong technical and vocational education through Technische Hochschulen, Berfusschulen, the dual apprenticeship system and vocational training on the job that I have experienced first hand.

At BHP we continue to invest in significant STEM initiatives. Our Foundation has a focus on joint projects with government and communities on education equity because we believe in the power of education to drive progress, and to lift people out of poverty and away from armed conflicts.

We also have commercial reasons for this investment. We want tomorrow’s workers to have the skills to tackle tomorrow’s challenges and opportunities. A talent pool attuned to the future.

Third, business and multinational companies must make a stronger case to the publics of Australia and Germany that we are a force for good in society and the world.

That we invest to create jobs (in the case of BHP, well-paid, rural jobs) and to renew our economies so that we share the benefits of globalisation with our communities and younger people.

So that voters, then politicians, are drawn to towards us to increase our power to do good.

For too long as businesses we have complained and blamed others for the opposition to globalisation. I believe now is the time for us to act, to defend with conviction our principles, to champion the values of multilateralism and of progress. So business and political leaders in Europe and the Asia-Pacific region have to promote fairness, free trade and globalisation, and the broader benefits that business and multinational companies bring to the World. And invest in research and development, education and training.

Germany and Australia start from a good place. Germany - a strong, influential and admired nation - has the opportunity to lead Europe and the Northern Hemisphere, while Australia continues to play a critical role in the Asia-Pacific and the Southern Hemisphere.

As the world pivots towards the Asia-Pacific to secure its economic future, we must make sure both our nations’ influence is felt.

China now enjoys new influence, in part from the size and growth of its economy.

In the long term, however, less will be possible in Asia-Pacific if the best of the China model is not combined, through our influence, with best practices from the liberal multilateral consensus.

The security and prosperity of our individual businesses, and our individual nations and populations, rely on our ability to work freely, innovatively and cooperatively with each other.

Our social licence depends on it. The future global economy requires it.

We will all benefit from a better educated and more skilled workforce, from more advances in science and engineering, from increased capital investment. Coupled to and enhanced by freer trade, open borders and global cooperation, and a greater sense of fairness in the world. All of which are at the heart of our democracies and our business communities.

Thank you."

"Andrew Mackenzie, Chief Executive Officer

German-Australian Chamber of Industry and Commerce Asia-Pacific Regional Conference, Perth, 4 November 2017.

Check against delivery.

President Steinmeier, Prime Minister Turnbull, Prime Minister Alka-tiri, and visiting foreign dignitaries. Premier McGowan, Minister Cormann, other Government Ministers and parliamentarians, Dr Lienhard and ladies and gentlemen.

It is always good to be in Western Australia - home of our Pilbara iron ore operations, nickel business and half of our Petroleum division. We employ more than 16,000 people here and are proud of our many contributions to this great state. Our success has been, and will continue to be, made possible by our strong relations with the WA government and with the people and local communities they represent.