B2Gold: Der Top-Performer im Goldsektor, WKN A0M889 - 500 Beiträge pro Seite

eröffnet am 03.07.16 13:29:15 von

neuester Beitrag 16.04.24 04:16:36 von

neuester Beitrag 16.04.24 04:16:36 von

Beiträge: 1.159

ID: 1.234.579

ID: 1.234.579

Aufrufe heute: 473

Gesamt: 137.401

Gesamt: 137.401

Aktive User: 0

ISIN: CA11777Q2099 · WKN: A0M889 · Symbol: BTO

3,7500

CAD

-5,78 %

-0,2300 CAD

Letzter Kurs 15.04.24 Toronto

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 15.04.24 | ||

| 15.04.24 | ||

| 15.04.24 | ||

| 15.04.24 | ||

| 15.04.24 |

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 15.04.24 | ||

| 15.04.24 | ||

| 09.04.24 | ||

| 15.04.24 | ||

| 12.04.24 |

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 05.04.24 | ||

| 07.04.24 | ||

| 05.04.24 | ||

| 15.04.24 | ||

| 15.04.24 |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8500 | +34,92 | |

| 2,4600 | +11,82 | |

| 2,4000 | +9,89 | |

| 15.700,00 | +9,79 | |

| 5,1500 | +8,65 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8345 | -10,56 | |

| 1,0500 | -12,50 | |

| 0,7696 | -13,53 | |

| 28,53 | -14,71 | |

| 47,20 | -98,03 |

Neues Forum zur B2Gold-Aktie, da ich das frühere Forum mit alten Bezeichnung "5BG" für ungeeignet halte, die Aktie bei Suchanfragen immer direkt zu finden und richtig zuzuordnen.

Im alten Forum habe ich viele Posts veröffentlicht und daher finde ich, daß die Aktie ein Forum mit der aktuell korrekten Firmenbezeichnung verdient.

Ich hoffe, daß viele Mitstreiter aus dem alten qualitativ hochwertigen Forum sowie neue Interessenten ihre Posts jetzt hier veröffentlichen.

Zum Start und Reinkommen einige wesentliche Vorabinfos zu B2Gold basierend auf Posts des vorherigen Forums:

cervical schrieb am 16.03.16 14:55:00

Beitrag Nr. 247 (51.993.029)

Fekola-Projekt durchfinanziert

B2Gold – Aktie nach 200 Mio. USD-Finanzierung im Aufwind

Um fast 9% schossen die Aktien der kanadischen B2Gold (WKN A0M889 / TSX BTO) nach oben, nachdem das Unternehmen zwei Deals mit einem Volumen von insgesamt mehr als 200 Mio. Dollar meldete. Damit hat B2Gold sein Goldprojekt Fekola bis zur Produktion durchfinanziert.

Zum einen gab das Unternehmen einen Vorwärtsverkauf im Umfang von 120 Mio. USD mit den Banken, die B2Gold bereits unterstützen, bekannt. Dafür soll das Unternehmen 2017 und 2018 rund 86.200 Unzen Gold an das Konsortium liefern, die einen Gegenwert von rund 100 Mio. USD haben. Das stellt ungefähr 7% bzw. 5% der für 2017 bzw. 2018 vorhergesagten Produktion dar.

Die Zahl der zu liefernden Unzen beruhe dabei auf einem Goldpreis von 1.248 USD pro Unze, erklärte B2Gold. Man gehe davon aus, für die restlichen 20 Mio. USD eine weitere Vorwärtsverkaufsvereinbarung abzuschließen, hieß es weiter.

B2Gold erklärte zudem, dass man eine Vereinbarung mit Caterpillar im Wert von 81 Mio. USD über die Finanzierung der Fahrzeugflotte und anderen Equipments für Fekola, das Projekt gehört dem Unternehmen zu 90%, unterzeichnet habe. Diese Summe wird B2Gold für fünf Jahre zur Verfügung stehen und ist in 20 gleichen Quartalsraten zurückzuzahlen. Gleichzeitig erhöhte B2Gold seine Equipmentfinanzierung mit Caterpillar in Bezug auf die Goldmine Otjikoto in Namibia um 4,5 auf 45,4 Mio. USD.

B2Gold hatte das Fekola-Projekt, das in Mali an der Grenze zum Senegal liegt, als Teil der 570 Mio. Dollar schweren Übernahme von Papillon Resources 2014 erworben. Die Lagerstätte weist 3,72 Mio. Unzen Gold bei durchschnittlich 2,35 Gramm Gold pro Tonne auf.

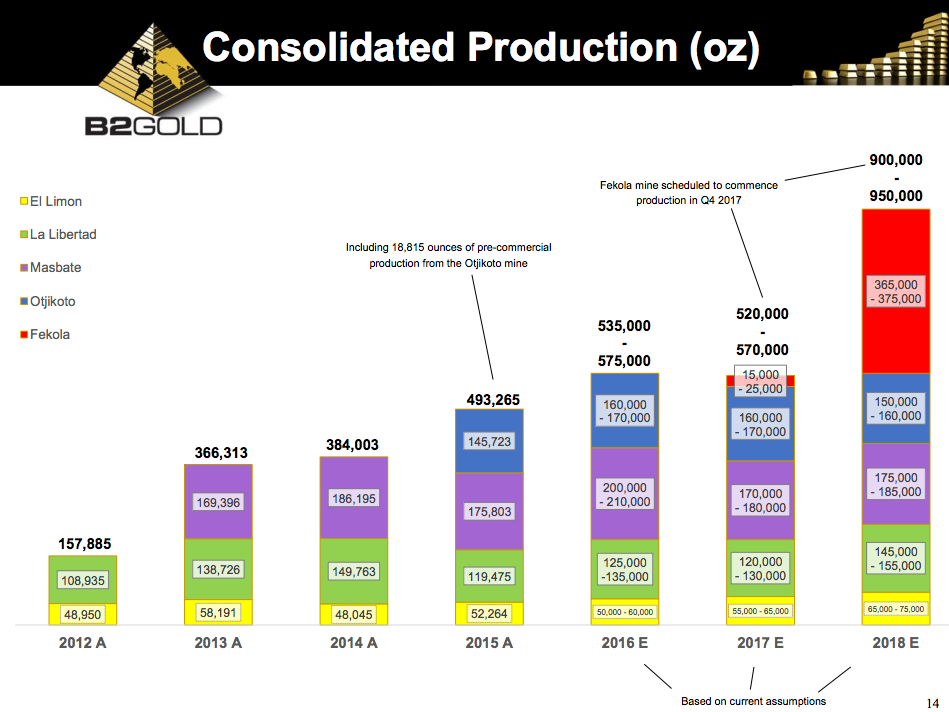

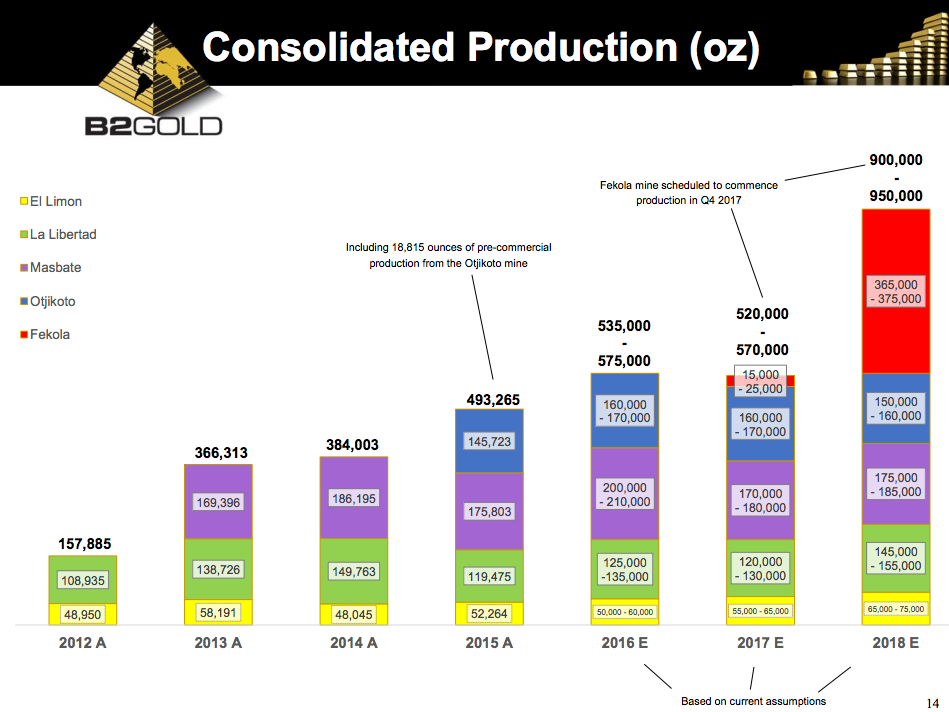

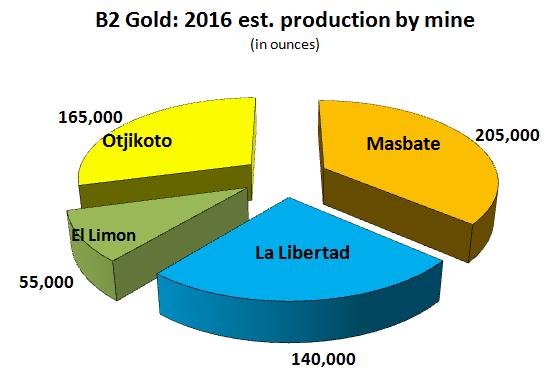

Seit 2009 hat B2Gold Akquisitionen im Wert von 1,9 Mrd. Dollar getätigt. Das Unternehmen rechnet für 2016 mit einer Goldproduktion von 510.000 bis 550.000 Unzen. Diese soll 2018 dann 800.000 bis 850.000 Unzen betragen, wenn auch die Minen in Namibia, auf den Philippinen und in Nicaragua in Betrieb sind.

http://www.goldinvest.de/index.php/b2gold-aktie-nach-200-mio…

cervical schrieb am 22.03.16 15:31:22

Beitrag Nr. 254 (52.035.437)

Dieses Quartal geht in die Geschichtsbücher ein

Lieber Leser,

das kanadische Goldbergbau-Unternehmen B2Gold erlebte einen wahrhaften güldenen Spätherbst. Denn das Ergebnis für das Schlussquartal 2015 brach eine Vielzahl an Rekordmarken.

Rekordfördermenge

Der erste Rekord betraf die Fördermenge. B2Gold konnte insgesamt 131.469 Unzen Gold zutage fördern. Damit übertraf man das Ergebnis aus dem Vergleichszeitraum des Vorjahrs um 18 %. Während dieser Zeit konnte das Unternehmen 127.482 Unzen Gold verkaufen und erlöste bei einem Durchschnittspreis von 1.090 Dollar insgesamt 139 Mio. Dollar.

Förderkosten sind der Knüller

Was aus meiner Sicht aber ein wirklicher Knüller ist, sind die Förderkosten, zu denen B2Gold operiert. So betrugen die operativen Betriebskosten lediglich 527 Dollar je Unze. Damit lag das Unternehmen 119 Dollar oder 18 % unter den Vorjahreskosten. Auch die Gesamtbetriebskosten verharrten bei branchenweit niedrigen 807 Dollar. Im Vorjahr zahlte man noch 139 Dollar mehr, was auf eine Kostenersparnis von 15 % hinauslief.

Selbst bei niedrigem Goldpreis noch Rendite

In der Praxis bedeutet dies, dass B2Gold auch bei einem niedrigen Goldpreis von 1.000 Dollar je Feinunze noch mit Gewinn wirtschaftet. Vor dieser Aufgabe musste die Konkurrenz in der Vergangenheit oft genug kapitulieren. Bei dem jetzt steigenden Goldpreis ist die Marge natürlich nochmals ungleich größer.

Reichlich Cashflow für Investitionen

Diese positive Entwicklung schlägt sich auch im Cashflow nieder. Der Barmittelzufluss wuchs um 7,4 Mio. Dollar (18 %) an und liegt nun bei 48,5 Mio. Dollar, was einer Quote von 5 Cent je Aktie entspricht. Mit diesem Kapital lässt sich nun kräftig investieren. So konnte B2Gold zu Jahresende zwei wichtige Kredite finanzieren, die zur vollständigen Übernahme der Fekola Mine in Mali dienen sollen.

http://www.wallstreet-online.de/nachricht/8456123-b2gold-qua…

iwanowski schrieb am 07.04.16 09:51:50

Beitrag Nr. 264 (52.136.127)

"...Fünf Goldaktien, die direkt am Goldpreis hängen

RBC-Nordamerika-Goldaktien-Favorit bei einem Goldpreisanstieg auf 1.300 Dollar, Nummer zwei: B2Gold Corp. (WKN: A0M889, 2,12 Kanada-Dollar, 1,42 Euro)

Nach zunächst starken Einbußen zum Jahresauftakt dürften sich die Aktionäre von B2Gold mittlerweile über eine bisher starke Performance-Bilanz in diesem Jahr freuen. Gemessen an dem am 25. Januar bei 0,90 Kanada-Dollar markierten Zwischentief hat der Aktienkurs des zu den Tier II-Produzenten zählenden Unternehmens seitdem um 135,6 Prozent zugelegt.

Das Ende der Fahnenstange muss damit aber noch nicht erreicht sein. Selbst beim Basisszenario der RBC, das von einem langfristigen Goldpreis von 1.250 Dollar ausgeht, veranschlagen die Analysten das Kursziel auf 2,50 Kanada-Dollar. Der Berechnung bei einem Goldpreis von 1.300 Dollar zufolge, wären bei dieser Konstellation sogar 3,00 Dollar drin - ein potenzieller Anstieg von rund 65 Prozent. Wobei selbst das noch klar unter dem im April 2012 bei 4,50 Kanada-Dollar aufgestellten Rekordhoch liegen würde.

Zur Begründung für die zuversichtliche Beurteilung der Aktie verweist RBC auf die Aussicht auf eine steigende Produktion, sinkende Kosten und dem Schub, der davon ausgehen wird, wenn 2018 die Fekola-Mine in Mali voll in Betrieb gehen dürfte. Für die ersten fünf Jahre wird die Produktion dort auf 350.000 Unten Gold zu Kosten von 525 Dollar je Feinunze geschätzt. Die Goldproduktion insgesamt würde sich dadurch dann im Jahr 2018 auf 860.000 Unten erhöhen.

Durch jüngst vollzogene Kapitalmaßnahmen sei der Ausbau dieser Abbaustätte sichergestellt und dadurch sei viel Unsicherheit vom Aktienkurs genommen worden. Im Vergleich mit ähnlich großen Konkurrenten sei der Titel nach wie vor mit einem Bewertungsabschlag ausgestattet. Durch Aktivitäten in Namibia, den Philippinen, Nicaragua und Mali ist aber ein erhöhtes Länderrisiko bei dieser Gesellschaft zu beachten.

Was die Unternehmensentwicklung angeht, hat B2Gold für das vierte Quartal 2015 eine rekordhohe Produktion von 131.469 Unzen gemeldet. Die Einnahmen aus dem Goldverkauf wurden auf 139 Million Dollar beziffert bei Verkaufspreisen von im Schnitt 1.090 Dollar pro Unze. Die konsolidierten operativen Kosten wurden auf 527 Dollar je Unzen beziffert, was verglichen mit dem vierten Quartal 2015 18 Prozent weniger waren. Die gesamten Produktionskosten beliefen sich auf 807 Dollar, eine Reduktion von 15 Prozent. Für 2016 werden die Gesamtproduktionskosten bei 895-925 Dollar je Unze gesehen und die Produktion zwischen 510.000 und 550.000 Unzen..."

aus Börse-Online, April 2016

edorado schrieb am 28.04.16 09:00:23

Beitrag Nr. 272 (52.295.170)

Q1-Meldung Frisch von Reuters:

Markets | Thu Apr 28, 2016 2:15am EDT

Related: Stocks, Markets

BRIEF-B2gold Qtrly gold revenue of $144.3 million

B2gold Corp

* B2gold corp. Reports quarterly gold production for first quarter 2016

* Qtrly consolidated gold production of 127,844 ounces; 10% greater than in same period in 2015

* Qtrly gold sales of 120,899 ounces

* Qtrly gold revenue of $144.3 million

* Says on track to meet 2016 consolidated gold production guidance of between 510,000 to 550,000 ounces

* Says masbate mine gold production exceeded budget by 16%

edorado schrieb am 30.04.16 12:35:08

Beitrag Nr. 274 (52.315.825)

Hohes Kursplus. B2Gold wird seine Ergebnisse auf Veranstaltungen für Analysten & Fondsmanager präsentieren. Das sollte die Aktienkursentwicklung weiter positiv antreiben, denn die Quartalsergebnisse vom Donnerstag waren sehr gut. Zudem steigt der Goldpreis, woraus wiederum Ergebnissprünge bei Unternehmen und Aktienbewertung zu erwarten sind.

Anbei angekündigte Teilnahmen von B2Gold an Konferenzen von Banken für Fondsmanager und Institutionelle Investoren:

Bank of America Merrill Lynch 2016 Global Metals, Mining & Steel Conference - Miami

Tuesday, May 10 - Thursday, May 12

Fontainebleau Miami Beach, Miami Beach, Florida

Q1 2016 Results Conference Call – Vancouver

Thursday, May 12, 2016 10:00 AM PST

Webcast and Conference Call Dial-In Details to follow

AGM - Vancouver

Friday, June 10, 2016 2:00 PM - 4:00 PM

Spanish Ballroom

Rosewood Hotel Georgia, 801 West Georgia Street, Vancouver, BC

RBC Capital Markets Global Mining & Materials Conference - Boston

Tuesday, June 14 - Wednesday, June 15

Boston Harbor Hotel, Boston, MA

edorado schrieb am 18.05.16 10:30:40

Beitrag Nr. 280 (52.428.552)

Es hagelt Kaufempfehlungen. Gewinnschätzungen wurden noch mal erhöht. Aktuell dieses Quartal $0.01 (FY2016 earnings at $0.06 EPS), in FY 2018 dann $0.23 pro Jahr!!!!!

Dundee Securities Comments on B2Gold Corp.’s Q2 2016 Earnings (BTO)

Posted on May 18, 2016 by Matt Cooper in Analyst Articles - Estimates, Investing

B2Gold Corp. logoB2Gold Corp. (TSE:BTO) – Stock analysts at Dundee Securities issued their Q2 2016 earnings per share (EPS) estimates for shares of B2Gold Corp. in a research report issued on Thursday, Zacks Investment Research reports. Dundee Securities analyst R. Stewart expects that the firm will earn $0.01 per share for the quarter. Dundee Securities currently has a “Buy” rating and a $2.50 target price on the stock. Dundee Securities also issued estimates for B2Gold Corp.’s FY2016 earnings at $0.06 EPS, FY2017 earnings at $0.12 EPS and FY2018 earnings at $0.23 EPS.

Several other research firms have also recently weighed in on BTO. Canaccord Genuity upped their price target on shares of B2Gold Corp. from C$2.75 to C$3.50 in a report on Tuesday, May 3rd.

National Bank Financial upped their price target on shares of B2Gold Corp. from C$2.75 to C$3.05 and gave the company an “outperform” rating in a report on Thursday, May 12th.

CIBC upped their price target on shares of B2Gold Corp. from C$3.25 to C$3.50 in a report on Friday, May 13th.

RBC Capital upped their price target on shares of B2Gold Corp. from C$3.00 to C$3.50 and gave the company an “outperform” rating in a report on Friday, May 13th. Finally,

One equities research analyst has rated the stock with a hold rating, ten have assigned a buy rating and one has issued a strong buy rating to the stock.

edorado schrieb am 29.06.16 16:14:49

Beitrag Nr. 287 (52.723.498)

Positive Ergebnisse bei Probebohrungen in B2Gold-Explorationslagerstätten!!!

29.06.2016 | 09:34

Marketwired·Mehr Nachrichten von Marketwired

B2Gold 2016 Exploration Update: West Africa / Positive Drill Results for B2Gold's Fekola and Kiaka Projects

VANCOUVER, BRITISH COLUMBIA -- (Marketwired) -- 06/29/16 -- B2Gold Corp. (TSX: BTO)(NYSE MKT: BTG)(NAMIBIAN: B2G) ("B2Gold" or the "Company") is pleased to announce an exploration update for its Fekola and Kiaka projects in West Africa (Mali and Burkina Faso, respectively). All dollar figures are in United States dollars unless otherwise indicated.

Highlights of the new drill results include 15.50 metres at 8.49 g/t (grams per tonne) gold from a diamond drill hole north of the Fekola deposit; 26 metres at 5.44 g/t gold from reverse circulation drilling in a new zone of saprolite-hosted gold mineralization in the Fekola area; and 16 metres at 4.16 g/t gold, including 6 metres at 9.90 g/t gold, intersected in a new target area during the reconnaissance aircore drilling program in the Kiaka area.

The significance of the highlighted (outlined below) and previous positive drill results (released in January this year) at the Fekola project is that they demonstrate the potential for the area to host additional zones of open-pittable gold mineralization similar to the Fekola deposit, as well as significant zones of saprolite-hosted gold mineralization. In addition, deeper drilling below the Fekola deposit returned positive results that indicate the potential for underground mining in the future. Based on the exploration potential and success to date, the Company is constructing the Fekola mine with a +25% design factor. This means that the throughput of ore at Fekola could reach up to 5 million tonnes per year in the initial years of production, beyond the optimized feasibility study's(1) estimated throughput of 4 million tonnes per year. This increase may only require approximately $15 million to $20 million of additional capital expenditure and could potentially increase annual production by up to 20% (subject to final mine planning), surpassing initial projections of approximately 350,000 ounces of gold per year.

To date at the Kiaka project, the positive exploration drill results at the new Toega prospects near the Kiaka deposit indicate the presence of new, potentially higher-grade gold zones. Preliminary internal studies indicate that combining the potential higher-grade ore from the Toega zones with ore from the lower-grade Kiaka deposit could have a very positive effect on the economics of the project. An aggressive 2016 exploration drilling program is intended to further explore and conduct infill drilling at the new, higher-grade gold zones along with metallurgical testing and base line permitting work. The Company's objective is to release an initial resource estimate on the main Toega prospect by the end of 2016.

Based on the positive drill results to date, the exploration budget for West Africa has been increased by $5.5 million, from $9.8 to approximately $15 million. The 2016 exploration budget at the Fekola and Kiaka projects is now $11.4 million and $3.6 million, respectively. B2Gold's total global exploration budget for 2016 is now $35.4 million.

Exploration Results:

... (siehe Unternehmensmeldung, mehrere Seiten Report...)

Im alten Forum habe ich viele Posts veröffentlicht und daher finde ich, daß die Aktie ein Forum mit der aktuell korrekten Firmenbezeichnung verdient.

Ich hoffe, daß viele Mitstreiter aus dem alten qualitativ hochwertigen Forum sowie neue Interessenten ihre Posts jetzt hier veröffentlichen.

Zum Start und Reinkommen einige wesentliche Vorabinfos zu B2Gold basierend auf Posts des vorherigen Forums:

cervical schrieb am 16.03.16 14:55:00

Beitrag Nr. 247 (51.993.029)

Fekola-Projekt durchfinanziert

B2Gold – Aktie nach 200 Mio. USD-Finanzierung im Aufwind

Um fast 9% schossen die Aktien der kanadischen B2Gold (WKN A0M889 / TSX BTO) nach oben, nachdem das Unternehmen zwei Deals mit einem Volumen von insgesamt mehr als 200 Mio. Dollar meldete. Damit hat B2Gold sein Goldprojekt Fekola bis zur Produktion durchfinanziert.

Zum einen gab das Unternehmen einen Vorwärtsverkauf im Umfang von 120 Mio. USD mit den Banken, die B2Gold bereits unterstützen, bekannt. Dafür soll das Unternehmen 2017 und 2018 rund 86.200 Unzen Gold an das Konsortium liefern, die einen Gegenwert von rund 100 Mio. USD haben. Das stellt ungefähr 7% bzw. 5% der für 2017 bzw. 2018 vorhergesagten Produktion dar.

Die Zahl der zu liefernden Unzen beruhe dabei auf einem Goldpreis von 1.248 USD pro Unze, erklärte B2Gold. Man gehe davon aus, für die restlichen 20 Mio. USD eine weitere Vorwärtsverkaufsvereinbarung abzuschließen, hieß es weiter.

B2Gold erklärte zudem, dass man eine Vereinbarung mit Caterpillar im Wert von 81 Mio. USD über die Finanzierung der Fahrzeugflotte und anderen Equipments für Fekola, das Projekt gehört dem Unternehmen zu 90%, unterzeichnet habe. Diese Summe wird B2Gold für fünf Jahre zur Verfügung stehen und ist in 20 gleichen Quartalsraten zurückzuzahlen. Gleichzeitig erhöhte B2Gold seine Equipmentfinanzierung mit Caterpillar in Bezug auf die Goldmine Otjikoto in Namibia um 4,5 auf 45,4 Mio. USD.

B2Gold hatte das Fekola-Projekt, das in Mali an der Grenze zum Senegal liegt, als Teil der 570 Mio. Dollar schweren Übernahme von Papillon Resources 2014 erworben. Die Lagerstätte weist 3,72 Mio. Unzen Gold bei durchschnittlich 2,35 Gramm Gold pro Tonne auf.

Seit 2009 hat B2Gold Akquisitionen im Wert von 1,9 Mrd. Dollar getätigt. Das Unternehmen rechnet für 2016 mit einer Goldproduktion von 510.000 bis 550.000 Unzen. Diese soll 2018 dann 800.000 bis 850.000 Unzen betragen, wenn auch die Minen in Namibia, auf den Philippinen und in Nicaragua in Betrieb sind.

http://www.goldinvest.de/index.php/b2gold-aktie-nach-200-mio…

cervical schrieb am 22.03.16 15:31:22

Beitrag Nr. 254 (52.035.437)

Dieses Quartal geht in die Geschichtsbücher ein

Lieber Leser,

das kanadische Goldbergbau-Unternehmen B2Gold erlebte einen wahrhaften güldenen Spätherbst. Denn das Ergebnis für das Schlussquartal 2015 brach eine Vielzahl an Rekordmarken.

Rekordfördermenge

Der erste Rekord betraf die Fördermenge. B2Gold konnte insgesamt 131.469 Unzen Gold zutage fördern. Damit übertraf man das Ergebnis aus dem Vergleichszeitraum des Vorjahrs um 18 %. Während dieser Zeit konnte das Unternehmen 127.482 Unzen Gold verkaufen und erlöste bei einem Durchschnittspreis von 1.090 Dollar insgesamt 139 Mio. Dollar.

Förderkosten sind der Knüller

Was aus meiner Sicht aber ein wirklicher Knüller ist, sind die Förderkosten, zu denen B2Gold operiert. So betrugen die operativen Betriebskosten lediglich 527 Dollar je Unze. Damit lag das Unternehmen 119 Dollar oder 18 % unter den Vorjahreskosten. Auch die Gesamtbetriebskosten verharrten bei branchenweit niedrigen 807 Dollar. Im Vorjahr zahlte man noch 139 Dollar mehr, was auf eine Kostenersparnis von 15 % hinauslief.

Selbst bei niedrigem Goldpreis noch Rendite

In der Praxis bedeutet dies, dass B2Gold auch bei einem niedrigen Goldpreis von 1.000 Dollar je Feinunze noch mit Gewinn wirtschaftet. Vor dieser Aufgabe musste die Konkurrenz in der Vergangenheit oft genug kapitulieren. Bei dem jetzt steigenden Goldpreis ist die Marge natürlich nochmals ungleich größer.

Reichlich Cashflow für Investitionen

Diese positive Entwicklung schlägt sich auch im Cashflow nieder. Der Barmittelzufluss wuchs um 7,4 Mio. Dollar (18 %) an und liegt nun bei 48,5 Mio. Dollar, was einer Quote von 5 Cent je Aktie entspricht. Mit diesem Kapital lässt sich nun kräftig investieren. So konnte B2Gold zu Jahresende zwei wichtige Kredite finanzieren, die zur vollständigen Übernahme der Fekola Mine in Mali dienen sollen.

http://www.wallstreet-online.de/nachricht/8456123-b2gold-qua…

iwanowski schrieb am 07.04.16 09:51:50

Beitrag Nr. 264 (52.136.127)

"...Fünf Goldaktien, die direkt am Goldpreis hängen

RBC-Nordamerika-Goldaktien-Favorit bei einem Goldpreisanstieg auf 1.300 Dollar, Nummer zwei: B2Gold Corp. (WKN: A0M889, 2,12 Kanada-Dollar, 1,42 Euro)

Nach zunächst starken Einbußen zum Jahresauftakt dürften sich die Aktionäre von B2Gold mittlerweile über eine bisher starke Performance-Bilanz in diesem Jahr freuen. Gemessen an dem am 25. Januar bei 0,90 Kanada-Dollar markierten Zwischentief hat der Aktienkurs des zu den Tier II-Produzenten zählenden Unternehmens seitdem um 135,6 Prozent zugelegt.

Das Ende der Fahnenstange muss damit aber noch nicht erreicht sein. Selbst beim Basisszenario der RBC, das von einem langfristigen Goldpreis von 1.250 Dollar ausgeht, veranschlagen die Analysten das Kursziel auf 2,50 Kanada-Dollar. Der Berechnung bei einem Goldpreis von 1.300 Dollar zufolge, wären bei dieser Konstellation sogar 3,00 Dollar drin - ein potenzieller Anstieg von rund 65 Prozent. Wobei selbst das noch klar unter dem im April 2012 bei 4,50 Kanada-Dollar aufgestellten Rekordhoch liegen würde.

Zur Begründung für die zuversichtliche Beurteilung der Aktie verweist RBC auf die Aussicht auf eine steigende Produktion, sinkende Kosten und dem Schub, der davon ausgehen wird, wenn 2018 die Fekola-Mine in Mali voll in Betrieb gehen dürfte. Für die ersten fünf Jahre wird die Produktion dort auf 350.000 Unten Gold zu Kosten von 525 Dollar je Feinunze geschätzt. Die Goldproduktion insgesamt würde sich dadurch dann im Jahr 2018 auf 860.000 Unten erhöhen.

Durch jüngst vollzogene Kapitalmaßnahmen sei der Ausbau dieser Abbaustätte sichergestellt und dadurch sei viel Unsicherheit vom Aktienkurs genommen worden. Im Vergleich mit ähnlich großen Konkurrenten sei der Titel nach wie vor mit einem Bewertungsabschlag ausgestattet. Durch Aktivitäten in Namibia, den Philippinen, Nicaragua und Mali ist aber ein erhöhtes Länderrisiko bei dieser Gesellschaft zu beachten.

Was die Unternehmensentwicklung angeht, hat B2Gold für das vierte Quartal 2015 eine rekordhohe Produktion von 131.469 Unzen gemeldet. Die Einnahmen aus dem Goldverkauf wurden auf 139 Million Dollar beziffert bei Verkaufspreisen von im Schnitt 1.090 Dollar pro Unze. Die konsolidierten operativen Kosten wurden auf 527 Dollar je Unzen beziffert, was verglichen mit dem vierten Quartal 2015 18 Prozent weniger waren. Die gesamten Produktionskosten beliefen sich auf 807 Dollar, eine Reduktion von 15 Prozent. Für 2016 werden die Gesamtproduktionskosten bei 895-925 Dollar je Unze gesehen und die Produktion zwischen 510.000 und 550.000 Unzen..."

aus Börse-Online, April 2016

edorado schrieb am 28.04.16 09:00:23

Beitrag Nr. 272 (52.295.170)

Q1-Meldung Frisch von Reuters:

Markets | Thu Apr 28, 2016 2:15am EDT

Related: Stocks, Markets

BRIEF-B2gold Qtrly gold revenue of $144.3 million

B2gold Corp

* B2gold corp. Reports quarterly gold production for first quarter 2016

* Qtrly consolidated gold production of 127,844 ounces; 10% greater than in same period in 2015

* Qtrly gold sales of 120,899 ounces

* Qtrly gold revenue of $144.3 million

* Says on track to meet 2016 consolidated gold production guidance of between 510,000 to 550,000 ounces

* Says masbate mine gold production exceeded budget by 16%

edorado schrieb am 30.04.16 12:35:08

Beitrag Nr. 274 (52.315.825)

Hohes Kursplus. B2Gold wird seine Ergebnisse auf Veranstaltungen für Analysten & Fondsmanager präsentieren. Das sollte die Aktienkursentwicklung weiter positiv antreiben, denn die Quartalsergebnisse vom Donnerstag waren sehr gut. Zudem steigt der Goldpreis, woraus wiederum Ergebnissprünge bei Unternehmen und Aktienbewertung zu erwarten sind.

Anbei angekündigte Teilnahmen von B2Gold an Konferenzen von Banken für Fondsmanager und Institutionelle Investoren:

Bank of America Merrill Lynch 2016 Global Metals, Mining & Steel Conference - Miami

Tuesday, May 10 - Thursday, May 12

Fontainebleau Miami Beach, Miami Beach, Florida

Q1 2016 Results Conference Call – Vancouver

Thursday, May 12, 2016 10:00 AM PST

Webcast and Conference Call Dial-In Details to follow

AGM - Vancouver

Friday, June 10, 2016 2:00 PM - 4:00 PM

Spanish Ballroom

Rosewood Hotel Georgia, 801 West Georgia Street, Vancouver, BC

RBC Capital Markets Global Mining & Materials Conference - Boston

Tuesday, June 14 - Wednesday, June 15

Boston Harbor Hotel, Boston, MA

edorado schrieb am 18.05.16 10:30:40

Beitrag Nr. 280 (52.428.552)

Es hagelt Kaufempfehlungen. Gewinnschätzungen wurden noch mal erhöht. Aktuell dieses Quartal $0.01 (FY2016 earnings at $0.06 EPS), in FY 2018 dann $0.23 pro Jahr!!!!!

Dundee Securities Comments on B2Gold Corp.’s Q2 2016 Earnings (BTO)

Posted on May 18, 2016 by Matt Cooper in Analyst Articles - Estimates, Investing

B2Gold Corp. logoB2Gold Corp. (TSE:BTO) – Stock analysts at Dundee Securities issued their Q2 2016 earnings per share (EPS) estimates for shares of B2Gold Corp. in a research report issued on Thursday, Zacks Investment Research reports. Dundee Securities analyst R. Stewart expects that the firm will earn $0.01 per share for the quarter. Dundee Securities currently has a “Buy” rating and a $2.50 target price on the stock. Dundee Securities also issued estimates for B2Gold Corp.’s FY2016 earnings at $0.06 EPS, FY2017 earnings at $0.12 EPS and FY2018 earnings at $0.23 EPS.

Several other research firms have also recently weighed in on BTO. Canaccord Genuity upped their price target on shares of B2Gold Corp. from C$2.75 to C$3.50 in a report on Tuesday, May 3rd.

National Bank Financial upped their price target on shares of B2Gold Corp. from C$2.75 to C$3.05 and gave the company an “outperform” rating in a report on Thursday, May 12th.

CIBC upped their price target on shares of B2Gold Corp. from C$3.25 to C$3.50 in a report on Friday, May 13th.

RBC Capital upped their price target on shares of B2Gold Corp. from C$3.00 to C$3.50 and gave the company an “outperform” rating in a report on Friday, May 13th. Finally,

One equities research analyst has rated the stock with a hold rating, ten have assigned a buy rating and one has issued a strong buy rating to the stock.

edorado schrieb am 29.06.16 16:14:49

Beitrag Nr. 287 (52.723.498)

Positive Ergebnisse bei Probebohrungen in B2Gold-Explorationslagerstätten!!!

29.06.2016 | 09:34

Marketwired·Mehr Nachrichten von Marketwired

B2Gold 2016 Exploration Update: West Africa / Positive Drill Results for B2Gold's Fekola and Kiaka Projects

VANCOUVER, BRITISH COLUMBIA -- (Marketwired) -- 06/29/16 -- B2Gold Corp. (TSX: BTO)(NYSE MKT: BTG)(NAMIBIAN: B2G) ("B2Gold" or the "Company") is pleased to announce an exploration update for its Fekola and Kiaka projects in West Africa (Mali and Burkina Faso, respectively). All dollar figures are in United States dollars unless otherwise indicated.

Highlights of the new drill results include 15.50 metres at 8.49 g/t (grams per tonne) gold from a diamond drill hole north of the Fekola deposit; 26 metres at 5.44 g/t gold from reverse circulation drilling in a new zone of saprolite-hosted gold mineralization in the Fekola area; and 16 metres at 4.16 g/t gold, including 6 metres at 9.90 g/t gold, intersected in a new target area during the reconnaissance aircore drilling program in the Kiaka area.

The significance of the highlighted (outlined below) and previous positive drill results (released in January this year) at the Fekola project is that they demonstrate the potential for the area to host additional zones of open-pittable gold mineralization similar to the Fekola deposit, as well as significant zones of saprolite-hosted gold mineralization. In addition, deeper drilling below the Fekola deposit returned positive results that indicate the potential for underground mining in the future. Based on the exploration potential and success to date, the Company is constructing the Fekola mine with a +25% design factor. This means that the throughput of ore at Fekola could reach up to 5 million tonnes per year in the initial years of production, beyond the optimized feasibility study's(1) estimated throughput of 4 million tonnes per year. This increase may only require approximately $15 million to $20 million of additional capital expenditure and could potentially increase annual production by up to 20% (subject to final mine planning), surpassing initial projections of approximately 350,000 ounces of gold per year.

To date at the Kiaka project, the positive exploration drill results at the new Toega prospects near the Kiaka deposit indicate the presence of new, potentially higher-grade gold zones. Preliminary internal studies indicate that combining the potential higher-grade ore from the Toega zones with ore from the lower-grade Kiaka deposit could have a very positive effect on the economics of the project. An aggressive 2016 exploration drilling program is intended to further explore and conduct infill drilling at the new, higher-grade gold zones along with metallurgical testing and base line permitting work. The Company's objective is to release an initial resource estimate on the main Toega prospect by the end of 2016.

Based on the positive drill results to date, the exploration budget for West Africa has been increased by $5.5 million, from $9.8 to approximately $15 million. The 2016 exploration budget at the Fekola and Kiaka projects is now $11.4 million and $3.6 million, respectively. B2Gold's total global exploration budget for 2016 is now $35.4 million.

Exploration Results:

... (siehe Unternehmensmeldung, mehrere Seiten Report...)

Habe die WKN einpflegen lassen.

B2Gold Corp. (BTO) Price Target Raised to C$3.75 at Raymond James

Posted on June 28, 2016 by Robert Jamerson in Analyst Articles - CA, Investing

B2Gold Corp. logoB2Gold Corp. (TSE:BTO) had its price target lifted by Raymond James from C$2.75 to C$3.75 in a research report sent to investors on Monday morning.

Posted on June 28, 2016 by Robert Jamerson in Analyst Articles - CA, Investing

B2Gold Corp. logoB2Gold Corp. (TSE:BTO) had its price target lifted by Raymond James from C$2.75 to C$3.75 in a research report sent to investors on Monday morning.

Antwort auf Beitrag Nr.: 52.752.982 von edorado am 03.07.16 14:31:26Sind die wirklich nicht überbewertet? Wie sind die diversen Ratios (KGV, KCV, KBV, EV/Reserven etc.)?

Aus meiner Sicht unterbewertet, da das Unternehmen ein Wachstumsprogramm (Minenausbau und neue Minen) gestartet hat und bis 2018 eine Produktionserhöhung von 494.000 Unzen (2015) auf 850.000 Unzen (2018) erreichen will. Für 2016 ca. 550.000 Unzen.

Gleichzeitig Kostensenkungsprogramm in schon produzierenden Minen.

Zudem gleichzeitig steigender Goldpreis, womit die Umsätze in der GuV-Rechnung und der Cash Flow stark ansteigen.

Gesamtproduktionskosten pro Unze liegen bisher mit den Wachstumsinvestitionen bei ca. 925$ pro Unze. Goldpreis zur Zeit bei ca. 1350$ pro Unze. Bleibt ein satter Gewinn...

Für weitere Kennzahlen siehe http://www.b2gold.com/investors/highlights/#shareholders

Haben dort eine gute Corporate Presentation.

Gleichzeitig Kostensenkungsprogramm in schon produzierenden Minen.

Zudem gleichzeitig steigender Goldpreis, womit die Umsätze in der GuV-Rechnung und der Cash Flow stark ansteigen.

Gesamtproduktionskosten pro Unze liegen bisher mit den Wachstumsinvestitionen bei ca. 925$ pro Unze. Goldpreis zur Zeit bei ca. 1350$ pro Unze. Bleibt ein satter Gewinn...

Für weitere Kennzahlen siehe http://www.b2gold.com/investors/highlights/#shareholders

Haben dort eine gute Corporate Presentation.

Passend zu meinen vorherigen Ausführungen heute nun die Erhöhung der Gewinnschätzungen durch Analysten.

National Bank Financial Analysts Raise Earnings Estimates for B2Gold Corp. (BTO)

Posted on July 6, 2016 by John Miller in Analyst Articles - Estimates, Investing

B2Gold Corp. logoB2Gold Corp. (TSE:BTO) – Equities researchers at National Bank Financial raised their FY2016 earnings estimates for B2Gold Corp. in a report released on Thursday. National Bank Financial analyst S. Parsons now expects that the brokerage will post earnings per share of $0.14 for the year, up from their previous forecast of $0.12. National Bank Financial has a “Outperform” rating and a $3.05 price objective on the stock. National Bank Financial also issued estimates for B2Gold Corp.’s FY2017 earnings at $0.10 EPS and FY2018 earnings at $0.22 EPS.

National Bank Financial Analysts Raise Earnings Estimates for B2Gold Corp. (BTO)

Posted on July 6, 2016 by John Miller in Analyst Articles - Estimates, Investing

B2Gold Corp. logoB2Gold Corp. (TSE:BTO) – Equities researchers at National Bank Financial raised their FY2016 earnings estimates for B2Gold Corp. in a report released on Thursday. National Bank Financial analyst S. Parsons now expects that the brokerage will post earnings per share of $0.14 for the year, up from their previous forecast of $0.12. National Bank Financial has a “Outperform” rating and a $3.05 price objective on the stock. National Bank Financial also issued estimates for B2Gold Corp.’s FY2017 earnings at $0.10 EPS and FY2018 earnings at $0.22 EPS.

Analyst erhöht 1 Tag vor Quartalszahlen das Kursziel von B2Gold um ca. 30%!!!!!

Gerade noch geschafft vor den dann gemeldeten Spitzenergebnissen.

Jaja, diese Experten haben den Durchblick ...

Während hier von mir und in einem weiteren Forum schon seit langem auf das enorme Gewinn- und Kurspotential der Aktie hingewiesen wird.

B2Gold Corp. (BTO) Price Target Raised to C$4.75 at Canaccord Genuity

Posted on July 12, 2016 by Jamal Genner in Analyst Articles - CA, Investing

B2Gold Corp. (TSE:BTO) had its price objective raised by equities researchers at Canaccord Genuity from C$3.50 to C$4.75 in a research report issued to clients and investors on Tuesday.

Gerade noch geschafft vor den dann gemeldeten Spitzenergebnissen.

Jaja, diese Experten haben den Durchblick ...

Während hier von mir und in einem weiteren Forum schon seit langem auf das enorme Gewinn- und Kurspotential der Aktie hingewiesen wird.

B2Gold Corp. (BTO) Price Target Raised to C$4.75 at Canaccord Genuity

Posted on July 12, 2016 by Jamal Genner in Analyst Articles - CA, Investing

B2Gold Corp. (TSE:BTO) had its price objective raised by equities researchers at Canaccord Genuity from C$3.50 to C$4.75 in a research report issued to clients and investors on Tuesday.

Anbei die Ergebnismeldung zu 2Q von B2Gold.

Läuft super: Rekordwerte!!!

B2Gold (BTG) Announces Record Q2, H116 Production Results

July 13, 2016 10:07 AM EDT

BTG Hot Sheet

Price: $3.01 --0%

B2Gold Corp. (NYSE: BTG) announces record gold production and revenue for the second quarter and first half of 2016. All dollar figures are in United States dollars unless otherwise indicated.

2016 Second Quarter Highlights

-- Record quarterly consolidated gold production of 135,242 ounces, 4% (or

5,697 ounces) above budget and 11% (or 13,676 ounces) greater than the

same period in 2015

-- Record gold revenue of $164.8 million on record sales of 130,829 ounces

at an average price of $1,260 per ounce, an increase in revenue of 21%

over the same period in 2015

-- Masbate mine gold production of 57,188 ounces, 27% (or 12,159 ounces)

above budget

-- Company is on track to meet its 2016 annual guidance of 510,000 to

550,000 ounces of gold production at cash operating costs of between

$560 to $595 per ounce and all-in sustaining costs of between $895 to

$925 per ounce

-- Construction of the Fekola mine is progressing well, on schedule and on

budget, to commence production in late 2017

-- Additional positive exploration drill results reported for the Fekola

and Kiaka projects

-- Received 2015 Award for Social Responsibility in Nicaragua

2016 First-Half Highlights

-- Record half-year consolidated gold production of 263,086 ounces, 6% (or

14,663 ounces) above budget and 11% (or 25,661 ounces) over the same

period in 2015

-- Record consolidated half-year gold revenue of $309.1 million on record

sales of 251,728 ounces at an average price of $1,228 per ounce

-- Masbate mine gold production of 109,915 ounces, 21% (or 19,403 ounces)

above budget

-- Completed a series of prepaid gold sales transactions totaling $120

million

-- Signed commitment letter to enter into a Euro equivalent $80.9 million

Equipment Facility with Caterpillar Financial SARL for the Fekola

project

Gold Production

Consolidated gold production in the second quarter of 2016 was another quarterly record of 135,242 ounces, 4% (or 5,697 ounces) above budget and 11% (or 13,676 ounces) higher than the second quarter of 2015. The increase in gold production was attributable to the continued strong operational performance of the Masbate mine in the Philippines. Gold production at the Otjikoto mine was in-line with expectations despite the previously reported pit slope failure on the Phase 1 pit access ramp on April 26, 2016. A new ramp was successfully constructed and mining of the Phase 1 pit resumed in mid-June.

Consolidated gold production for the first half of 2016 was a half-year record of 263,086 ounces, 6% (or 14,663 ounces) above budget and 11% (or 25,661 ounces, including 18,815 ounces of pre-commercial production from the Otjikoto mine) higher than the same period in 2015.

B2Gold is projecting another record year for gold production in 2016. Consolidated gold production in 2016 is expected to be in the range of 510,000 to 550,000 ounces. Gold production for the year is scheduled to be weighted to the second half of the year, mainly due to higher forecast grades at the Otjikoto, Libertad and Limon mines (as discussed in the "Operations" section below). Consolidated cash operating costs in 2016 are expected to be in the range of $560 to $595 per ounce, compared to $616 per ounce in 2015. The Company's consolidated all-in sustaining costs are also expected to be lower and be in the range of $895 to $925 per ounce, compared to $947 per ounce in 2015.

Gold Revenue

Consolidated gold revenue in the second quarter of 2016 was a quarterly record of $164.8 million on record sales of 130,829 ounces at an average price of $1,260 per ounce compared to $136.5 million on sales of 114,423 ounces at an average price of $1,193 per ounce in the second quarter of 2015. The 21% increase in gold revenue was mainly attributable to a 14% increase in gold sales volume and a 6% increase in the average realized gold price.

Consolidated gold revenue for the first half of 2016 was a half-year record of $309.1 million on record sales of 251,728 ounces at an average price of $1,228 per ounce compared to $275.4 million (or $298.5 million including $23.1 million of pre-commercial sales from the Otjikoto mine) on sales of 229,222 ounces (or 247,688 ounces including 18,466 ounces of pre-commercial sales from the Otjikoto mine) at an average price of $1,201 per ounce in the first half of 2015.

Operations

Mine-by-mine gold production in the second quarter and first half of 2016 was as follows:

----------------------------------------------------------------------------

Mine Q2 2016 First-Half 2016 2016 Guidance

Production Production (ounces)

(ounces) (ounces)

----------------------------------------------------------------------------

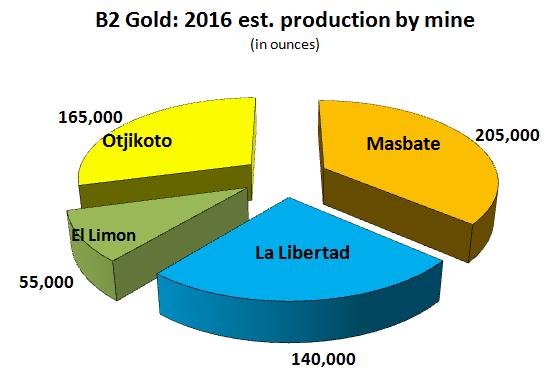

Masbate 57,188 109,915 175,000 - 185,000

----------------------------------------------------------------------------

Otjikoto 36,172 71,875 160,000 - 170,000

----------------------------------------------------------------------------

La Libertad 30,807 60,005 125,000 - 135,000

----------------------------------------------------------------------------

El Limon 11,075 21,291 50,000 - 60,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

B2Gold Consolidated 135,242 263,086 510,000 - 550,000

----------------------------------------------------------------------------

Masbate mine - the Philippines

The Masbate mine in the Philippines continued its very strong operational performance into the second quarter of 2016, producing 57,188 ounces of gold (the second highest quarterly production ever for the mine), 27% (or 12,159 ounces) above budget and 39% (or 15,952 ounces) higher than the second quarter of 2015. Gold production improved against budget mainly due to better grades from the Main Vein pit combined with higher throughput and recoveries driven by higher than budgeted oxide ore from the Colorado pit. Mill throughput for the second quarter of 2016 was 1,699,705 tonnes compared to a budget of 1,652,085 tonnes and 1,768,928 tonnes in the second quarter of 2015. The average gold grade processed was 1.40 g/t compared to a budgeted grade of 1.19 g/t and second quarter 2015 grades of 0.96 g/t. Mill recoveries averaged 75.0% which was better than budgeted recoveries of 71.3% and slightly below the second quarter of 2015 of 75.8%. Recoveries in the second quarter of 2016 were better than budget as the Company processed 31% oxide material and 69% sulfide/transitional material in the quarter versus a budget of 17% and 83%, respectively. The Company expects to mine a similar ratio of oxide ore (33%) and sulfide/transitional ore (67%) against a budget of 22% oxide ore and 78% sulfide/transitional ore in the third quarter of 2016. The trend of higher than budgeted grades from the Main Vein pit is also expected to continue into the third quarter.

The Company is in the process of completing a process plant upgrade at the Masbate mine. The work will be completed in phases and is expected to be commissioned and in production by the end of the third quarter of 2016. Process plant upgrades consisting of additional leaching/adsorption tankage and an oxygenation system were brought online at the end of June. Further upgrades in progress include a carbon harvest screen, carbon regeneration kiln, and added tailings pumps. The purpose of the plant upgrade is to continue to promote improved gold recovery and higher throughput.

Year-to-date, gold production at the Masbate mine was 109,915 ounces, significantly above budget by 21% (or 19,403 ounces) and 26% (or 22,438 ounces) higher than the first half of 2015.

For full-year 2016, the Masbate mine's gold production is expected to meet or exceed the high end of its production guidance range of 175,000 to 185,000 ounces (at cash operating costs of $620 to $660 per ounce).

On March 31, 2016, the extension of the Masbate mine's income tax holiday was approved for an additional year to June 2017.

Otjikoto mine - Namibia

The Otjikoto mine in Namibia produced 36,172 ounces of gold in the second quarter of 2016, comparable to budget (of 37,426 ounces) and 36,963 ounces produced in the second quarter of 2015. Gold production was largely unaffected despite the previously reported pit slope failure on the Phase 1 pit access ramp on April 26, 2016.

Following the slope failure, a recovery plan to regain access to the Phase 1 pit was developed. The plan called for a temporary new access ramp to be established by mid-June to be utilized until the Phase 1 pit becomes depleted, expected in November 2016. The new ramp was successfully constructed and mining of the Phase 1 pit resumed in mid-June. During the construction of the new ramp, mill feed had been mainly sourced from the medium-grade ore stockpile, and supplemented with high-grade ore extracted from the Phase 2 pit (as part of the Phase 2 pre-stripping activities).

With the successful completion of the plant expansion project in the third quarter of 2015, the budgeted annual throughput rate for 2016 was increased from 2.5 million tonnes per year to 3.3 million tonnes per year. For the second quarter of 2016, the Otjikoto mill achieved record quarterly throughput of 890,704 tonnes, 8% above budget (of 821,184 tonnes) and 25% higher than the second quarter of 2015 (of 711,462 tonnes). The average mill recoveries for the second quarter of 2016 were 98.0%, compared to a budget of 97.0% and recoveries during the same period of the previous year of 98.7%. The average gold grade processed was 1.29 g /t compared to a budget of 1.43 g /t and 1.63 g /t in the prior-year quarter. Gold grades were negatively impacted in the quarter by the ramp failure which had restricted access to the high-grade ore at the Phase 1 pit. However, gold production remained largely unaffected as higher mill throughput and recoveries offset the lower grades.

During the first half of 2016, the Otjikoto mine produced 71,875 ounces of gold, approximately in-line with budget (of 73,079 ounces) and 6% higher compared to 68,097 ounces (including 18,815 ounces of pre- commercial production) produced in the first half of 2015.

With access to the higher grade Phase 1 pit being re-established for the second half of 2016 and the positive mill throughput/recoveries, there is no impact to the Otjikoto mine's 2016 annual guidance of 160,000 to 170,000 ounces of gold production at cash operating costs of $400 to $440 per ounce. Gold production at Otjikoto is weighted to the second half of the year, due to higher anticipated grades as the Phase 1 pit is completed. The high-grade Wolfshag open pit, scheduled to enter production towards the end of the fourth quarter of 2016, is expected to increase production in 2017 and beyond. A new life of mine plan, based on the new grade model and geotechnical data including mining from the open-pit component of the Wolfshag deposit, is expected to be completed in the fourth quarter of 2016. Following the promising results of an internal scoping study, a detailed engineering study of Wolfshag underground mining will commence in the third quarter of 2016, with results to be delivered in 2017.

La Libertad mine - Nicaragua

In the second quarter of 2016, La Libertad mine in Nicaragua produced 30,807 ounces of gold, approximately 7% (or 2,423 ounces) below budget. Mining from the higher grade Jabali Antena pit was scheduled to commence in the second quarter of 2016. However, the Company has experienced additional delays in relocation and permitting activities. As a result, average process grades for the quarter were lower than anticipated (1.75 g/t compared to budget of 1.90 g/t). The Company now anticipates that the Jabali Antena pit will enter the production stream in late 2016, upon completion of the resettlement activities and receipt of remaining mining permits. Gold production in the second quarter of 2016 was 11% (or 3,126 ounces) higher than the second quarter of 2015. During the second quarter of 2016, La Libertad had better grade than the same period in 2015, mainly due to the processing of higher grades from the Jabali Central pit and Mojon underground. The mill continues to operate well processing 579,756 tonnes (Q2 2015 - 573,807 tonnes) with gold recoveries averaging 94.8% (Q2 2015 - 94.5%). Both throughput and recoveries were as budgeted.

In the first half of 2016, La Libertad mine produced 60,005 ounces of gold, slightly above budget (of 59,214 ounces) and 13% higher compared to 53,007 ounces produced in the first half of 2015.

By modifying the 2016 mine schedule to mine additional material from Jabali Central and Mojon underground, the Company expects that any 2016 production shortfalls arising from delays in accessing ore at the Jabali Antena pit can be offset. Therefore, La Libertad still expects to meet its 2016 guidance of between 125,000 to 135,000 ounces of gold in 2016 at cash operating costs of approximately $650 to $680 per ounce. Gold production at La Libertad is expected to be weighted towards the second half of the year, due to higher forecast processed grades. Under the 2016 modified mine plan, La Libertad's mill feed in the second half of the year is forecast to contain a higher percentage of high-grade ore from Jabali Central and Mojon underground (replacing low-grade spent ore) versus the first half of the year.

On May 5, 2016, the Company received the 2015 Award for Social Responsibility in Nicaragua related to its work on the settlement project to date. The award recognizes the Company's commitment to social development projects that benefit the local communities in which it operates.

El Limon mine - Nicaragua

El Limon open-pit and underground mine in Nicaragua produced 11,075 ounces of gold in the second quarter of 2016, 2,785 ounces below budget and 4,611 ounces lower than the same quarter last year. Gold production was lower than budget due to 20% lower (than planned) mill throughput (99,947 tonnes compared to budget of 126,477 tonnes). The reduced throughput partly reflects the timing for downtime (13 days) related to the SAG ring gear change-out which had been originally planned for the first quarter of 2016 but was deferred to the second quarter. The mill restart on April 24 after completion of the planned work has been without issue. Fleet haulage equipment availability during the quarter also affected the quantity of ore available for process during May and June. The delivery of two additional haulage trucks is expected in early August. The average mill recoveries for the second quarter of 2016 were 94.5%, compared to a budget of 93.5% and recoveries during the same period of the previous year of 94.4%. The average gold grade processed was 3.65 g /t compared to a budget of 3.65 g /t and 4.13 g /t in the prior-year quarter. Gold production at El Limon in the second quarter of 2015 reflected higher processed grades and throughput.

For the first half of 2016, El Limon mine produced 21,291 ounces of gold, 4,327 ounces below budget and 7,553 ounces lower than the first six months of 2015.

With the higher grade areas now accessible and improvements in haulage, the Company expects that El Limon, which represents approximately 10% of B2Gold's 2016 consolidated gold production, will be able to meet its 2016 guidance. El Limon mine is projected to produce approximately 50,000 to 60,000 ounces of gold in 2016 at cash operating costs of approximately $610 to $650 per ounce. Gold production in the mine plan is weighted to the second half of the year, reflecting improving grades in July through December, 2016.

Development

Fekola project - Mali

In the second quarter of 2016, B2Gold's construction team continued to develop the Fekola project in Mali which remains on schedule and on budget to commence production in late 2017. Significant activities during the quarter included:

-- Working on the spillway at the water dam;

-- Diversion ditch and settlement pond completed on the west side of the

pit;

-- Removal of material from the pit for construction of the RoM Pad;

-- Concrete pouring in the mill area has commenced (mill, tanks, reclaim

tunnel, crusher);

-- Structural steel has started arriving at site;

-- Power plant construction has commenced;

-- Detailed engineering and ordering of long lead items remain on schedule;

-- Increased workforce to approximately 800 employees and contractors.

On June 11, 2015, the Company announced robust results from the optimized Feasibility Study at the Fekola project. According to the Feasibility Study, the current average annual gold production for the first seven years will be approximately 350,000 ounces per year at average cash operating costs of $418 per ounce (based on low-grade stockpiling in the initial years of operation) and for the life of mine plan approximately 276,000 ounces per year at average cash operating costs of $552 per ounce.

On June 29, 2016, the Company announced an exploration update for its Fekola project. Based on the positive drill results to date (at both surface and underground) and exploration potential, the Company is constructing the Fekola mine with a +25% design factor. This means that the throughput of ore at Fekola could reach up to 5 million tonnes per year in the initial years of production, beyond the optimized feasibility study's estimated throughput of 4 million tonnes per year. This increase may only require approximately $15 million to $20 million of additional capital expenditure and could potentially increase annual production by up to 20% (subject to mine planning), surpassing initial projections of approximately 350,000 ounces of gold per year.

Läuft super: Rekordwerte!!!

B2Gold (BTG) Announces Record Q2, H116 Production Results

July 13, 2016 10:07 AM EDT

BTG Hot Sheet

Price: $3.01 --0%

B2Gold Corp. (NYSE: BTG) announces record gold production and revenue for the second quarter and first half of 2016. All dollar figures are in United States dollars unless otherwise indicated.

2016 Second Quarter Highlights

-- Record quarterly consolidated gold production of 135,242 ounces, 4% (or

5,697 ounces) above budget and 11% (or 13,676 ounces) greater than the

same period in 2015

-- Record gold revenue of $164.8 million on record sales of 130,829 ounces

at an average price of $1,260 per ounce, an increase in revenue of 21%

over the same period in 2015

-- Masbate mine gold production of 57,188 ounces, 27% (or 12,159 ounces)

above budget

-- Company is on track to meet its 2016 annual guidance of 510,000 to

550,000 ounces of gold production at cash operating costs of between

$560 to $595 per ounce and all-in sustaining costs of between $895 to

$925 per ounce

-- Construction of the Fekola mine is progressing well, on schedule and on

budget, to commence production in late 2017

-- Additional positive exploration drill results reported for the Fekola

and Kiaka projects

-- Received 2015 Award for Social Responsibility in Nicaragua

2016 First-Half Highlights

-- Record half-year consolidated gold production of 263,086 ounces, 6% (or

14,663 ounces) above budget and 11% (or 25,661 ounces) over the same

period in 2015

-- Record consolidated half-year gold revenue of $309.1 million on record

sales of 251,728 ounces at an average price of $1,228 per ounce

-- Masbate mine gold production of 109,915 ounces, 21% (or 19,403 ounces)

above budget

-- Completed a series of prepaid gold sales transactions totaling $120

million

-- Signed commitment letter to enter into a Euro equivalent $80.9 million

Equipment Facility with Caterpillar Financial SARL for the Fekola

project

Gold Production

Consolidated gold production in the second quarter of 2016 was another quarterly record of 135,242 ounces, 4% (or 5,697 ounces) above budget and 11% (or 13,676 ounces) higher than the second quarter of 2015. The increase in gold production was attributable to the continued strong operational performance of the Masbate mine in the Philippines. Gold production at the Otjikoto mine was in-line with expectations despite the previously reported pit slope failure on the Phase 1 pit access ramp on April 26, 2016. A new ramp was successfully constructed and mining of the Phase 1 pit resumed in mid-June.

Consolidated gold production for the first half of 2016 was a half-year record of 263,086 ounces, 6% (or 14,663 ounces) above budget and 11% (or 25,661 ounces, including 18,815 ounces of pre-commercial production from the Otjikoto mine) higher than the same period in 2015.

B2Gold is projecting another record year for gold production in 2016. Consolidated gold production in 2016 is expected to be in the range of 510,000 to 550,000 ounces. Gold production for the year is scheduled to be weighted to the second half of the year, mainly due to higher forecast grades at the Otjikoto, Libertad and Limon mines (as discussed in the "Operations" section below). Consolidated cash operating costs in 2016 are expected to be in the range of $560 to $595 per ounce, compared to $616 per ounce in 2015. The Company's consolidated all-in sustaining costs are also expected to be lower and be in the range of $895 to $925 per ounce, compared to $947 per ounce in 2015.

Gold Revenue

Consolidated gold revenue in the second quarter of 2016 was a quarterly record of $164.8 million on record sales of 130,829 ounces at an average price of $1,260 per ounce compared to $136.5 million on sales of 114,423 ounces at an average price of $1,193 per ounce in the second quarter of 2015. The 21% increase in gold revenue was mainly attributable to a 14% increase in gold sales volume and a 6% increase in the average realized gold price.

Consolidated gold revenue for the first half of 2016 was a half-year record of $309.1 million on record sales of 251,728 ounces at an average price of $1,228 per ounce compared to $275.4 million (or $298.5 million including $23.1 million of pre-commercial sales from the Otjikoto mine) on sales of 229,222 ounces (or 247,688 ounces including 18,466 ounces of pre-commercial sales from the Otjikoto mine) at an average price of $1,201 per ounce in the first half of 2015.

Operations

Mine-by-mine gold production in the second quarter and first half of 2016 was as follows:

----------------------------------------------------------------------------

Mine Q2 2016 First-Half 2016 2016 Guidance

Production Production (ounces)

(ounces) (ounces)

----------------------------------------------------------------------------

Masbate 57,188 109,915 175,000 - 185,000

----------------------------------------------------------------------------

Otjikoto 36,172 71,875 160,000 - 170,000

----------------------------------------------------------------------------

La Libertad 30,807 60,005 125,000 - 135,000

----------------------------------------------------------------------------

El Limon 11,075 21,291 50,000 - 60,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

B2Gold Consolidated 135,242 263,086 510,000 - 550,000

----------------------------------------------------------------------------

Masbate mine - the Philippines

The Masbate mine in the Philippines continued its very strong operational performance into the second quarter of 2016, producing 57,188 ounces of gold (the second highest quarterly production ever for the mine), 27% (or 12,159 ounces) above budget and 39% (or 15,952 ounces) higher than the second quarter of 2015. Gold production improved against budget mainly due to better grades from the Main Vein pit combined with higher throughput and recoveries driven by higher than budgeted oxide ore from the Colorado pit. Mill throughput for the second quarter of 2016 was 1,699,705 tonnes compared to a budget of 1,652,085 tonnes and 1,768,928 tonnes in the second quarter of 2015. The average gold grade processed was 1.40 g/t compared to a budgeted grade of 1.19 g/t and second quarter 2015 grades of 0.96 g/t. Mill recoveries averaged 75.0% which was better than budgeted recoveries of 71.3% and slightly below the second quarter of 2015 of 75.8%. Recoveries in the second quarter of 2016 were better than budget as the Company processed 31% oxide material and 69% sulfide/transitional material in the quarter versus a budget of 17% and 83%, respectively. The Company expects to mine a similar ratio of oxide ore (33%) and sulfide/transitional ore (67%) against a budget of 22% oxide ore and 78% sulfide/transitional ore in the third quarter of 2016. The trend of higher than budgeted grades from the Main Vein pit is also expected to continue into the third quarter.

The Company is in the process of completing a process plant upgrade at the Masbate mine. The work will be completed in phases and is expected to be commissioned and in production by the end of the third quarter of 2016. Process plant upgrades consisting of additional leaching/adsorption tankage and an oxygenation system were brought online at the end of June. Further upgrades in progress include a carbon harvest screen, carbon regeneration kiln, and added tailings pumps. The purpose of the plant upgrade is to continue to promote improved gold recovery and higher throughput.

Year-to-date, gold production at the Masbate mine was 109,915 ounces, significantly above budget by 21% (or 19,403 ounces) and 26% (or 22,438 ounces) higher than the first half of 2015.

For full-year 2016, the Masbate mine's gold production is expected to meet or exceed the high end of its production guidance range of 175,000 to 185,000 ounces (at cash operating costs of $620 to $660 per ounce).

On March 31, 2016, the extension of the Masbate mine's income tax holiday was approved for an additional year to June 2017.

Otjikoto mine - Namibia

The Otjikoto mine in Namibia produced 36,172 ounces of gold in the second quarter of 2016, comparable to budget (of 37,426 ounces) and 36,963 ounces produced in the second quarter of 2015. Gold production was largely unaffected despite the previously reported pit slope failure on the Phase 1 pit access ramp on April 26, 2016.

Following the slope failure, a recovery plan to regain access to the Phase 1 pit was developed. The plan called for a temporary new access ramp to be established by mid-June to be utilized until the Phase 1 pit becomes depleted, expected in November 2016. The new ramp was successfully constructed and mining of the Phase 1 pit resumed in mid-June. During the construction of the new ramp, mill feed had been mainly sourced from the medium-grade ore stockpile, and supplemented with high-grade ore extracted from the Phase 2 pit (as part of the Phase 2 pre-stripping activities).

With the successful completion of the plant expansion project in the third quarter of 2015, the budgeted annual throughput rate for 2016 was increased from 2.5 million tonnes per year to 3.3 million tonnes per year. For the second quarter of 2016, the Otjikoto mill achieved record quarterly throughput of 890,704 tonnes, 8% above budget (of 821,184 tonnes) and 25% higher than the second quarter of 2015 (of 711,462 tonnes). The average mill recoveries for the second quarter of 2016 were 98.0%, compared to a budget of 97.0% and recoveries during the same period of the previous year of 98.7%. The average gold grade processed was 1.29 g /t compared to a budget of 1.43 g /t and 1.63 g /t in the prior-year quarter. Gold grades were negatively impacted in the quarter by the ramp failure which had restricted access to the high-grade ore at the Phase 1 pit. However, gold production remained largely unaffected as higher mill throughput and recoveries offset the lower grades.

During the first half of 2016, the Otjikoto mine produced 71,875 ounces of gold, approximately in-line with budget (of 73,079 ounces) and 6% higher compared to 68,097 ounces (including 18,815 ounces of pre- commercial production) produced in the first half of 2015.

With access to the higher grade Phase 1 pit being re-established for the second half of 2016 and the positive mill throughput/recoveries, there is no impact to the Otjikoto mine's 2016 annual guidance of 160,000 to 170,000 ounces of gold production at cash operating costs of $400 to $440 per ounce. Gold production at Otjikoto is weighted to the second half of the year, due to higher anticipated grades as the Phase 1 pit is completed. The high-grade Wolfshag open pit, scheduled to enter production towards the end of the fourth quarter of 2016, is expected to increase production in 2017 and beyond. A new life of mine plan, based on the new grade model and geotechnical data including mining from the open-pit component of the Wolfshag deposit, is expected to be completed in the fourth quarter of 2016. Following the promising results of an internal scoping study, a detailed engineering study of Wolfshag underground mining will commence in the third quarter of 2016, with results to be delivered in 2017.

La Libertad mine - Nicaragua

In the second quarter of 2016, La Libertad mine in Nicaragua produced 30,807 ounces of gold, approximately 7% (or 2,423 ounces) below budget. Mining from the higher grade Jabali Antena pit was scheduled to commence in the second quarter of 2016. However, the Company has experienced additional delays in relocation and permitting activities. As a result, average process grades for the quarter were lower than anticipated (1.75 g/t compared to budget of 1.90 g/t). The Company now anticipates that the Jabali Antena pit will enter the production stream in late 2016, upon completion of the resettlement activities and receipt of remaining mining permits. Gold production in the second quarter of 2016 was 11% (or 3,126 ounces) higher than the second quarter of 2015. During the second quarter of 2016, La Libertad had better grade than the same period in 2015, mainly due to the processing of higher grades from the Jabali Central pit and Mojon underground. The mill continues to operate well processing 579,756 tonnes (Q2 2015 - 573,807 tonnes) with gold recoveries averaging 94.8% (Q2 2015 - 94.5%). Both throughput and recoveries were as budgeted.

In the first half of 2016, La Libertad mine produced 60,005 ounces of gold, slightly above budget (of 59,214 ounces) and 13% higher compared to 53,007 ounces produced in the first half of 2015.

By modifying the 2016 mine schedule to mine additional material from Jabali Central and Mojon underground, the Company expects that any 2016 production shortfalls arising from delays in accessing ore at the Jabali Antena pit can be offset. Therefore, La Libertad still expects to meet its 2016 guidance of between 125,000 to 135,000 ounces of gold in 2016 at cash operating costs of approximately $650 to $680 per ounce. Gold production at La Libertad is expected to be weighted towards the second half of the year, due to higher forecast processed grades. Under the 2016 modified mine plan, La Libertad's mill feed in the second half of the year is forecast to contain a higher percentage of high-grade ore from Jabali Central and Mojon underground (replacing low-grade spent ore) versus the first half of the year.

On May 5, 2016, the Company received the 2015 Award for Social Responsibility in Nicaragua related to its work on the settlement project to date. The award recognizes the Company's commitment to social development projects that benefit the local communities in which it operates.

El Limon mine - Nicaragua

El Limon open-pit and underground mine in Nicaragua produced 11,075 ounces of gold in the second quarter of 2016, 2,785 ounces below budget and 4,611 ounces lower than the same quarter last year. Gold production was lower than budget due to 20% lower (than planned) mill throughput (99,947 tonnes compared to budget of 126,477 tonnes). The reduced throughput partly reflects the timing for downtime (13 days) related to the SAG ring gear change-out which had been originally planned for the first quarter of 2016 but was deferred to the second quarter. The mill restart on April 24 after completion of the planned work has been without issue. Fleet haulage equipment availability during the quarter also affected the quantity of ore available for process during May and June. The delivery of two additional haulage trucks is expected in early August. The average mill recoveries for the second quarter of 2016 were 94.5%, compared to a budget of 93.5% and recoveries during the same period of the previous year of 94.4%. The average gold grade processed was 3.65 g /t compared to a budget of 3.65 g /t and 4.13 g /t in the prior-year quarter. Gold production at El Limon in the second quarter of 2015 reflected higher processed grades and throughput.

For the first half of 2016, El Limon mine produced 21,291 ounces of gold, 4,327 ounces below budget and 7,553 ounces lower than the first six months of 2015.

With the higher grade areas now accessible and improvements in haulage, the Company expects that El Limon, which represents approximately 10% of B2Gold's 2016 consolidated gold production, will be able to meet its 2016 guidance. El Limon mine is projected to produce approximately 50,000 to 60,000 ounces of gold in 2016 at cash operating costs of approximately $610 to $650 per ounce. Gold production in the mine plan is weighted to the second half of the year, reflecting improving grades in July through December, 2016.

Development

Fekola project - Mali

In the second quarter of 2016, B2Gold's construction team continued to develop the Fekola project in Mali which remains on schedule and on budget to commence production in late 2017. Significant activities during the quarter included:

-- Working on the spillway at the water dam;

-- Diversion ditch and settlement pond completed on the west side of the

pit;

-- Removal of material from the pit for construction of the RoM Pad;

-- Concrete pouring in the mill area has commenced (mill, tanks, reclaim

tunnel, crusher);

-- Structural steel has started arriving at site;

-- Power plant construction has commenced;

-- Detailed engineering and ordering of long lead items remain on schedule;

-- Increased workforce to approximately 800 employees and contractors.

On June 11, 2015, the Company announced robust results from the optimized Feasibility Study at the Fekola project. According to the Feasibility Study, the current average annual gold production for the first seven years will be approximately 350,000 ounces per year at average cash operating costs of $418 per ounce (based on low-grade stockpiling in the initial years of operation) and for the life of mine plan approximately 276,000 ounces per year at average cash operating costs of $552 per ounce.

On June 29, 2016, the Company announced an exploration update for its Fekola project. Based on the positive drill results to date (at both surface and underground) and exploration potential, the Company is constructing the Fekola mine with a +25% design factor. This means that the throughput of ore at Fekola could reach up to 5 million tonnes per year in the initial years of production, beyond the optimized feasibility study's estimated throughput of 4 million tonnes per year. This increase may only require approximately $15 million to $20 million of additional capital expenditure and could potentially increase annual production by up to 20% (subject to mine planning), surpassing initial projections of approximately 350,000 ounces of gold per year.

Kommentar von Mining Weekly:

B2Gold stock rises to new 52-week high on buoyant Q2 production

14th July 2016

TORONTO (miningweekly.com) – The TSX-listed stock of miner B2Gold on Wednesday rose to a new 52-week high of C$4 apiece after the company reported record output for the three months to June.

Vancouver-based B2Gold said Wednesday it achieved a new consolidated gold production record of 135 242 oz, 4%, or 5 697 oz, above budget and 11%, or 13 676 oz, more than the same period in 2015.

Not surprisingly, B2Gold reported record gold revenue of $164.8-million on record sales of 130 829 oz at an average price of $1 260/oz, an increase in revenue of 21% over the same period in 2015.

The Masbate mine, in the Philippines, produced 27% more gold, or 12 159 oz more than planned at 57 188 oz.

The company advised that it was on track to meet its 2016 production guidance of 510 000 oz to 550 000 oz at cash operating costs of between $560/oz and $595/oz and all-in sustaining costs of between $895/oz and $925/oz.

Meanwhile, construction of the 350 000 oz/y Fekola mine, in Mali, was progressing well, on schedule and on budget, with first production slated for late 2017.

B2Gold stock rises to new 52-week high on buoyant Q2 production

14th July 2016

TORONTO (miningweekly.com) – The TSX-listed stock of miner B2Gold on Wednesday rose to a new 52-week high of C$4 apiece after the company reported record output for the three months to June.

Vancouver-based B2Gold said Wednesday it achieved a new consolidated gold production record of 135 242 oz, 4%, or 5 697 oz, above budget and 11%, or 13 676 oz, more than the same period in 2015.

Not surprisingly, B2Gold reported record gold revenue of $164.8-million on record sales of 130 829 oz at an average price of $1 260/oz, an increase in revenue of 21% over the same period in 2015.

The Masbate mine, in the Philippines, produced 27% more gold, or 12 159 oz more than planned at 57 188 oz.

The company advised that it was on track to meet its 2016 production guidance of 510 000 oz to 550 000 oz at cash operating costs of between $560/oz and $595/oz and all-in sustaining costs of between $895/oz and $925/oz.

Meanwhile, construction of the 350 000 oz/y Fekola mine, in Mali, was progressing well, on schedule and on budget, with first production slated for late 2017.

Erste positive Analysteneinschätzung nach Ergebnismeldung.

Scotiabank Reiterates “Outperform” Rating for B2Gold Corp. (BTO)

Posted on July 15, 2016 by John Miller in Analyst Articles - CA, Investing

B2Gold Corp. (TSE:BTO)‘s stock had its “outperform” rating reissued by equities research analysts at Scotiabank in a research report issued on Wednesday.

Scotiabank Reiterates “Outperform” Rating for B2Gold Corp. (BTO)

Posted on July 15, 2016 by John Miller in Analyst Articles - CA, Investing

B2Gold Corp. (TSE:BTO)‘s stock had its “outperform” rating reissued by equities research analysts at Scotiabank in a research report issued on Wednesday.

Und noch zu gemeldeten Rekordergebnis von B2Gold ein deutschsprachiger Kommentar:

B2Gold – Rekordproduktion schickt Aktie auf 52 Wochenhoch

goldinvest.de, Björn Junker | 14.07.2016, 10:41

Die Aktie des kanadischen Goldproduzenten B2Gold (WKN A0M889) erreichte am gestrigen Mittwoch zwischenzeitlich ein neues 52-Wochenhoch von 4 CAD, nachdem das Unternehmen für das zweite Quartal einen Produktionsrekord meldete.

B2Gold teilte mit, dass man in den drei Monaten bis Ende Juni insgesamt 135.242 Unzen des Gelben Metalls produzierte. Das sind 4% oder 5.697 Unzen mehr als geplant sowie 11% oder 13.676 Unzen mehr als im gleichen Zeitraum 2015.

Entsprechend meldete das Unternehmen auch einen Rekordumsatz in Höhe von 164,8 Mio. Dollar aus dem Verkauf von 130.829 Unzen Gold zu einem durchschnittlichen Verkaufspreis von 1.260 Dollar pro Unze. Das stell einen Umsatzanstieg gegenüber dem zweiten Quartal 2015 von 21% dar.

Dabei produzierte die Masbate-Mine auf den Philippinen mit 57.188 Unzen Gold 27% oder 12.159 Unzen mehr als geplant.

B2Gold teilte – wenig verwunderlich – mit, dass man auf dem besten Wege sei, das Produktionsziel für 2016 von 510.000 bis 550.000 Unzen Gold zu erreichen. Das Unternehmen rechnet dabei mit operativen Cashkosten von 560 bis 595 Dollar pro Unze sowie so genannten „all-in sustaining costs“ (AISC) zwischen 895 und 925 Dollar pro Unze.

Darüber hinaus gab man bekannt, dass die Fekola-Mine in Mali, die 350.000 Unzen Gold pro Jahr produzieren soll, wie geplant – im Zeit- und Budgetrahmen – voranschreite. Ende 2017 soll dort das erste Gold produziert werden.

B2Gold – Rekordproduktion schickt Aktie auf 52 Wochenhoch

goldinvest.de, Björn Junker | 14.07.2016, 10:41

Die Aktie des kanadischen Goldproduzenten B2Gold (WKN A0M889) erreichte am gestrigen Mittwoch zwischenzeitlich ein neues 52-Wochenhoch von 4 CAD, nachdem das Unternehmen für das zweite Quartal einen Produktionsrekord meldete.

B2Gold teilte mit, dass man in den drei Monaten bis Ende Juni insgesamt 135.242 Unzen des Gelben Metalls produzierte. Das sind 4% oder 5.697 Unzen mehr als geplant sowie 11% oder 13.676 Unzen mehr als im gleichen Zeitraum 2015.

Entsprechend meldete das Unternehmen auch einen Rekordumsatz in Höhe von 164,8 Mio. Dollar aus dem Verkauf von 130.829 Unzen Gold zu einem durchschnittlichen Verkaufspreis von 1.260 Dollar pro Unze. Das stell einen Umsatzanstieg gegenüber dem zweiten Quartal 2015 von 21% dar.

Dabei produzierte die Masbate-Mine auf den Philippinen mit 57.188 Unzen Gold 27% oder 12.159 Unzen mehr als geplant.

B2Gold teilte – wenig verwunderlich – mit, dass man auf dem besten Wege sei, das Produktionsziel für 2016 von 510.000 bis 550.000 Unzen Gold zu erreichen. Das Unternehmen rechnet dabei mit operativen Cashkosten von 560 bis 595 Dollar pro Unze sowie so genannten „all-in sustaining costs“ (AISC) zwischen 895 und 925 Dollar pro Unze.

Darüber hinaus gab man bekannt, dass die Fekola-Mine in Mali, die 350.000 Unzen Gold pro Jahr produzieren soll, wie geplant – im Zeit- und Budgetrahmen – voranschreite. Ende 2017 soll dort das erste Gold produziert werden.

Achtet mal auf die wesentlichen Details in den vorherigen Posts zu den Quartalsergebnissen:

- Rekord-Produktion

- Rekord-Umsatz

- Coole Gewinnspanne: All in Costs 895-925$, Verkaufspreis Gold im 2. Quartal ca 1260$, seitdem ist der Goldpreis aktuell aber um ca. 100$ gestiegen und wird noch weiter steigen!

- B2 Gold hat mit den Ergebnissen seine eigene bisherige Quartalsplanung übertroffen. D.h. wenn es so weiter läuft, werden auch die nächsten Quartale und das Jahresergebnis in seinen Prognosen übertroffen!!!

- Rekord-Produktion

- Rekord-Umsatz

- Coole Gewinnspanne: All in Costs 895-925$, Verkaufspreis Gold im 2. Quartal ca 1260$, seitdem ist der Goldpreis aktuell aber um ca. 100$ gestiegen und wird noch weiter steigen!

- B2 Gold hat mit den Ergebnissen seine eigene bisherige Quartalsplanung übertroffen. D.h. wenn es so weiter läuft, werden auch die nächsten Quartale und das Jahresergebnis in seinen Prognosen übertroffen!!!

Interessant und sehr positiv ist die fallende Short-Ratio bei B2gold.