Anlagen- und Maschinenbau für Minenbetreiber etc. - 500 Beiträge pro Seite

eröffnet am 08.02.17 20:51:00 von

neuester Beitrag 18.04.24 11:14:43 von

neuester Beitrag 18.04.24 11:14:43 von

Beiträge: 117

ID: 1.246.436

ID: 1.246.436

Aufrufe heute: 2

Gesamt: 8.763

Gesamt: 8.763

Aktive User: 0

ISIN: FI0009014575 · WKN: A0LBTW · Symbol: M6Q

11,080

EUR

0,00 %

0,000 EUR

Letzter Kurs 11:04:11 Tradegate

Werte aus der Branche Maschinenbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 45,80 | +69,63 | |

| 15,670 | +19,98 | |

| 51,00 | +15,91 | |

| 14,740 | +14,30 | |

| 0,6120 | +14,29 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,430 | -9,31 | |

| 7,9900 | -11,42 | |

| 0,6800 | -12,26 | |

| 6,0400 | -13,71 | |

| 305,50 | -13,94 |

Noch kein Thread zu Outotec? Na dann wird es aber Zeit.

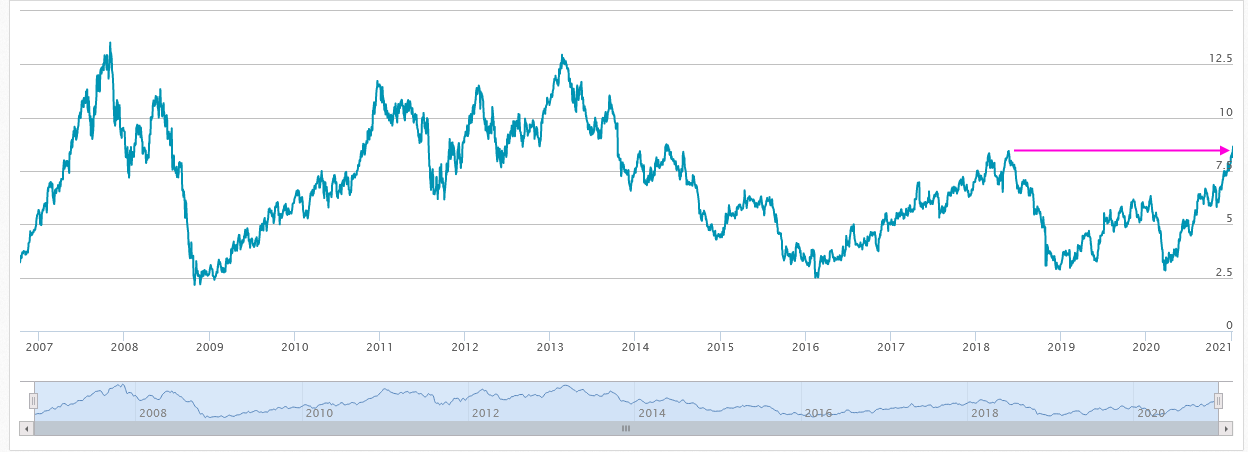

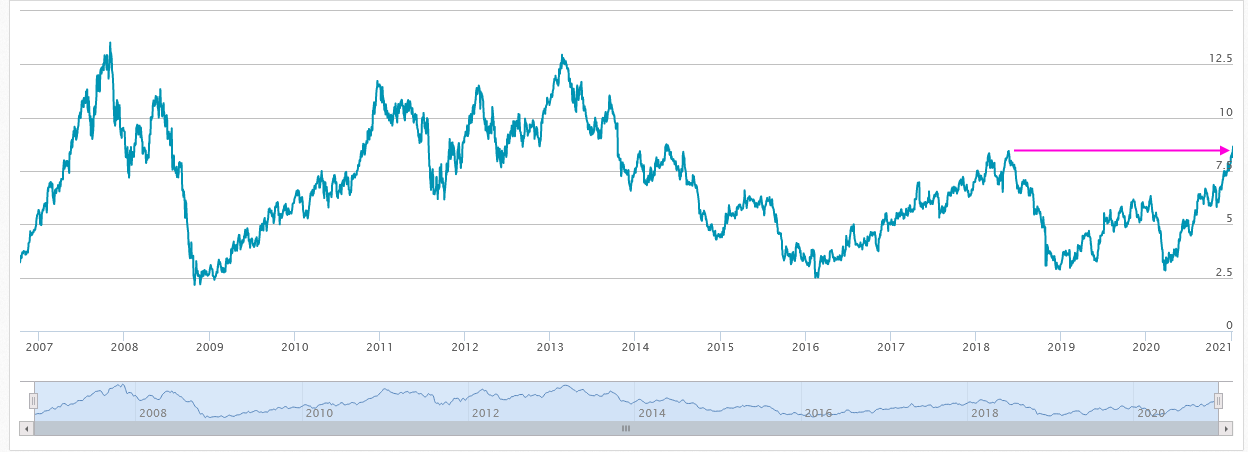

Der Katalysator (obwohl schon gut gelaufen seit Februar 2016) ist die zu vermutende Bereitschaft von Minenwerten und nachgeordneten Weiterverarbeitern (hier der XAU für Gold- und Silberminen z.B.) wieder, also ab gestern, in Prozesse und Maschinen bei sich erholenden Rohstoffpreisen für Metalle und Halbmetalle zu investieren.

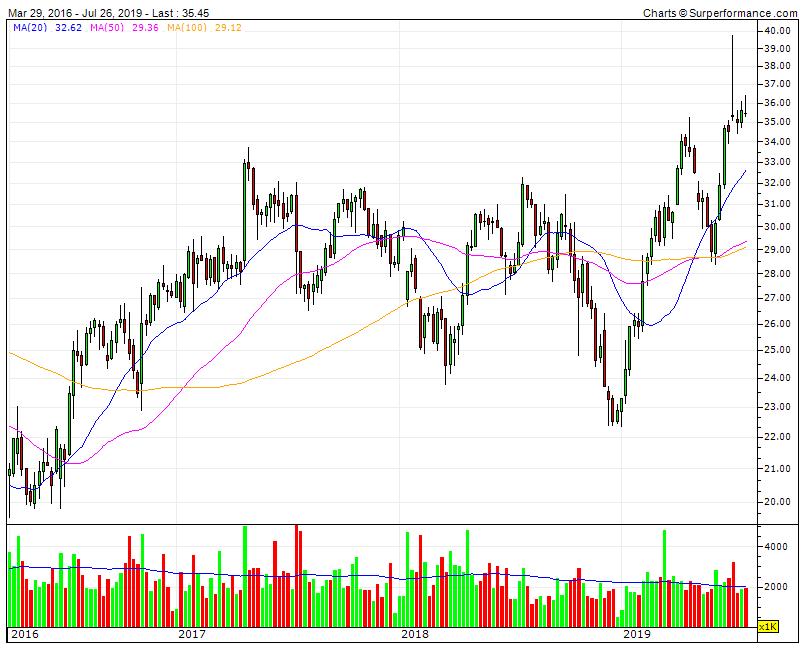

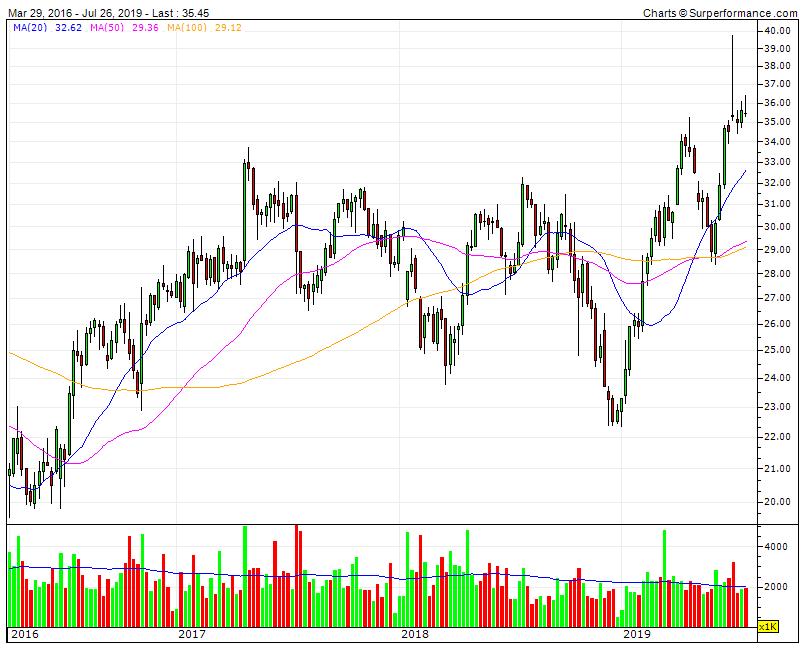

Man erkennt: manchmal läuft Outotec (OTE) voraus, machmal im Gleichklang und manchmal hinterher; lösen kann sich dieser Wert allerdings auch nicht von den Rohstoffpreisen (bei allem Fokus auf geschäftsstabilisierenden "Service"):

Der Katalysator (obwohl schon gut gelaufen seit Februar 2016) ist die zu vermutende Bereitschaft von Minenwerten und nachgeordneten Weiterverarbeitern (hier der XAU für Gold- und Silberminen z.B.) wieder, also ab gestern, in Prozesse und Maschinen bei sich erholenden Rohstoffpreisen für Metalle und Halbmetalle zu investieren.

Man erkennt: manchmal läuft Outotec (OTE) voraus, machmal im Gleichklang und manchmal hinterher; lösen kann sich dieser Wert allerdings auch nicht von den Rohstoffpreisen (bei allem Fokus auf geschäftsstabilisierenden "Service"):

Wettbewerber

Wettbewerber von http://new.outotec.com/ sind u.a. (teilweise):- TechnipFMC (also die fusionierten Technip/FR und FMC/US, nun GB00BDSFG982), die aber als Hauptgeschäft Öl&Gas betreiben (subsea, marine, ...)

- kundenseitige Wartungsabteilungen

- FLSMIDTH (DK0010234467)

- ...

Mir fällt allerdings kein Wert (private/public) ein, der irgendwie ein 1:1 Wettbewerber in seiner Gesamtheit zu OTE sein könnte; am ehestens vermutlich noch FLSMIDTH, welche 17% und 7% ihres Geschäftes mit Kupfer (Cu) bzw. Gold (Au) machen (aber am meisten mit Zement, nämlich 32%, und dann noch Kohle, Eisenerz, Dünger, ...).

Also will ich mich nicht mehr weiter mit Wettbewerbern aufhalten; sondern hier nur so als Hintergrund-Info...

2 Geschäftsbereiche

Es gibt 2 Geschäftsbereiche (lt. Eigenaussage):- Minerals Processing, also der hier wirklich interessante Bereich und..

- Metals, Energy & Water

Die Idee ist, dass man bei 1.0g Gold in 1.0 Tonne Erz einfach nicht um die Anlagen und/oder Maschinen und das Prozess-Knowhow ("Recoveries") von OTE - oder einem Wettbewerber - herumkommt, zumindest nur schwer (i.S.v. "Me too!").

Laut dem NRH-(Natural Resource Holdings)-Report "2013 Ranking Gold Mines & Deposits" http://www.visualcapitalist.com/wp-content/uploads/2013/11/g… liegt der Durchschnitts-Goldgehalt bei 1.01g/t in den betrachteten 580 Lagerstätten mit mehr als 1m oz Au Resourcen; was natürlich von vielen Parametern abhängt, v.a. dem Goldpreis, aber auch von technologischen Faktoren. Dieser Durchschnittswert ändert sich also von Jahr zu Jahr, siehe dort S.13/40.

Das gute ist nun: je höher der Goldpreis, um so niedriger der Gold-Gehalt in Reserven und Resourcen, umso mehr besteht - tendenziell - Investitionsbedarf, und wenn's auch nur mal Wartung und Inspektion von aussen ist, und bei der Gelegenheit man auch noch mal über dies und das reden könnte...

Und was für Au gilt, gilt dann demnach auch für Cu und Ag (Silber) usw.

Minerals Processing als Hoffung und Favorit

(ich entnehme das der momentanen Homepage, aber auch den (letzten) Eigen-Berichten etc. falls man danach fragen sollte...)Minerals Processing stellt mit Sales €361m (in 2016Q1-3 vs. €402 für 2015Q1-3)

ggü.

Metals, Energy & Water mit Sales €392 (in 2016Q1-3 vs. €494 für 2015Q1-3)

zunächst das etwas kleinere Standbein dar, allerdings mit anderer, positiver Dynamik:

Order intake:

Minerals Processing: €462m in in 2016Q1-3 vs. €393 für 2015Q1-3 => +18% (in €)

Metals, Energy & Water: €263m in in 2016Q1-3 vs. €530 für 2015Q1-3 => -50% (in €)

Sales zeigen das auch (mit dem z.Z. kleineren Standbein):

Minerals Processing: 2015+2016 (jew. Q1-3) = €402m + €361m = €763m

Metals, Energy & Water: 2015+2016 (jew. Q1-3) = €494m + €392m = €886m

Man hat also Metals, Energy & Water mit dabei, ob man nun will oder nicht.

Zumindest kurzfristig könnte man von gegenseitiger Stabilisierung sprechen; ob ein Blick in die Vergangenheit hilft, weiss ich nicht, und die Zukunft von Metals, Energy & Water sieht mau aus ("actively working on improving our performance, especially in the Metals, Energy & Water segment...").

=> kann eigentlich nur heissen: Minerals Processing wird aller Voraussicht nach mittelfristig mehr Gewicht bekommen. Ein Plus-Argument in meinen Augen.

Obiges muss/sollte man jedenfalls wissen; ich jedenfalls bin keiner, der Siemens kaufen würde, weil Windkraft gerade gut läuft, da man bei diesem Extrem-Beispiel mind. z.Z. 3 Bereiche (wie immer definiert) bekommt, die gerade gar nicht gut laufen (bei Siemens sage ich immer: kauf besser den DAX...).

Der Chef ist immer die allerwichtigste Person

(...zumindest sollte es so sein).OTE CEO (Markku Teräsvasara) ist neu seit 2016-10 und arbeitete zuvor bei Atlas Copco (SE0006886750 z.B.) und dort zuletzt als Bereichleiter "Mining and Rock Excavation Service Division"; bei Atlas Copco insgesamt seit 1997.

Das gefällt mir, weil Atlas Copco seit mind. 15 Jahren Shareholdervalue liefert, was ich von sehr vielen Anlagen- und Maschinenbauern definitiv nicht sagen kann.

1.Frage: warum ist er dann Chef hier? Na, weil er wohl gefragt wurde und er Chef werden wollte. Atlas Copco hat ja schon einen seit 2009.

2.Frage: was war mit dem alten Chef, CEO Pertti Korhonen? Wenn ich hier bei den Meldungen zwischen den Zeilen lese, wurde der wohl rausgeschmissen:

Outotec's Board of Directors and Pertti Korhonen have agreed that Pertti Korhonen will leave the duties of the Chief Executive Officer with immediate effect....CFO Jari Ålgars will be the acting CEO until the new CEO will commence his duties. (http://www.4-traders.com/OUTOTEC-OYJ-1412510/news/Outotec-Ma…)

Hier noch eine Meldung aus der Zeit fallender Rohstoffpreise, nämlich Oktober 2014:

...the company could have benefitted if it had shifted focus earlier to the more stable business of providing maintenance and other services for mining companies... (http://www.dailymail.co.uk/wires/reuters/article-2814374/Fin…)

Autsch!

Shareholder-Struktur - keine Übernahme-Fantasie

eine Kleinigkeit noch:nachdem der finnische Staat z.Z. rund 15% an OTE (indirekt über Solidium Oy) hält - und seinen Anteil offenbar von 10% erhöhte in jüngerer Vergangenheit, sind mögliche Übernahmen zwar interessant, aber ohne Chance.

Übrigens ist OTE selber eine M&A-Maschine, und das nicht erst seit gestern, in einem (immer noch) fragmentierten Markt (siehe Präsi...).

Antwort auf Beitrag Nr.: 54.275.924 von faultcode am 08.02.17 23:00:35

http://www.outotec.com/en/About-us/Acquisitions/Lurgi-Metall…

Lurgi z.B.

die älteren Semester hier erinnern sich noch vielleicht an Lurgi und das bei der dt. Metallgesellschaft. Nun, Teile davon sind bei OTE seit 2001 gelandet:http://www.outotec.com/en/About-us/Acquisitions/Lurgi-Metall…

mal wieder ein grösserer Flagschiff-Auftrag

http://new.outotec.com/company/media/news/2017/outotec-to-de… 2017Q1

Der sehr gute order intake wird herausgestellt:

Der Markt nimmt die Zahlen doch eher ernüchtert auf mit aktuell -1.5% bei leicht positivem Gesamtumfeld:

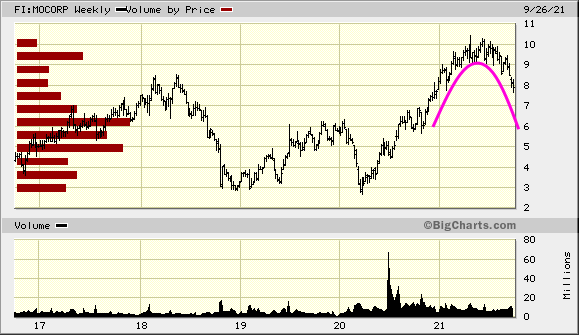

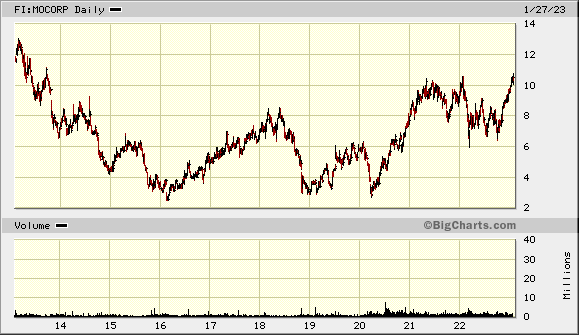

=> sell on news, v.a. da das Teil zuletzt ganz gut lief:

Hallo ich habe mal eine Frage kommt dir Firma Outotec auch mit sehr niedrigen "Erzgehalte" zurecht und schafft es Gewinn zu machen?

The historical resource consisted of 224 million tonnes ("mt") averaging 0.597% Cu equivalent ("eqv") (6.54% S, 0.25% Cu, 0.16g/t Au, and 8.86g/t Ag) at a cut-off grade of 0.336% Cu eqv from geologic Zones A, B, and C. A historical sulphide reserve from Zone A consists of 64.8mt averaging 0.737% Cu eqv (8.63% S, 0.27% Cu, 0.21g/t Au, and 2.59g/t Ag) at the same 0.336% Cu eqv cut-off grade

The historical resource consisted of 224 million tonnes ("mt") averaging 0.597% Cu equivalent ("eqv") (6.54% S, 0.25% Cu, 0.16g/t Au, and 8.86g/t Ag) at a cut-off grade of 0.336% Cu eqv from geologic Zones A, B, and C. A historical sulphide reserve from Zone A consists of 64.8mt averaging 0.737% Cu eqv (8.63% S, 0.27% Cu, 0.21g/t Au, and 2.59g/t Ag) at the same 0.336% Cu eqv cut-off grade

Antwort auf Beitrag Nr.: 54.940.013 von freddy1989 am 14.05.17 10:59:10

http://www.monumentmining.com/de/mengapur.asp?send=now&Repor…

Beides scheint auf diese Lagestätte zuzutreffen (low grade and complex, polymetallic).

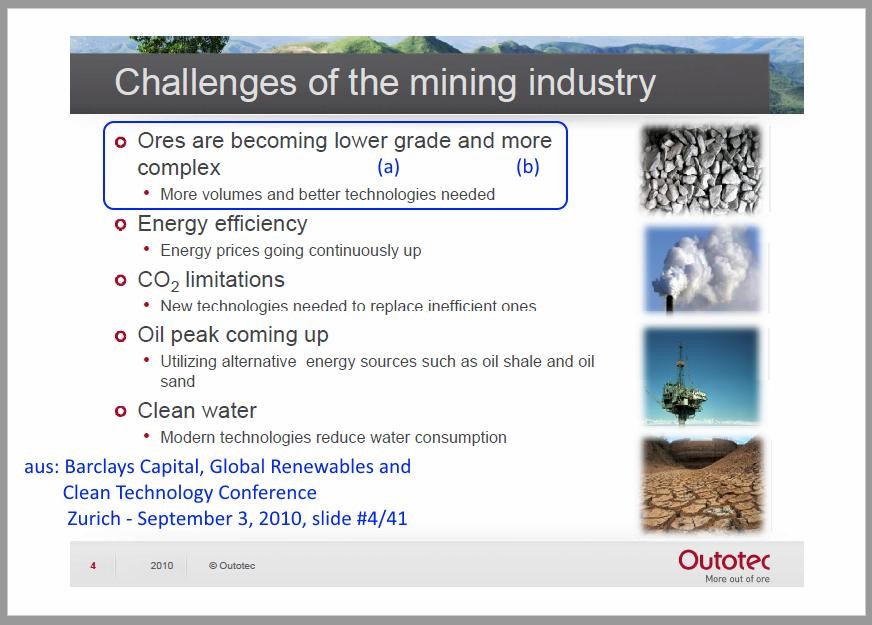

(a) sehr niedrigen "Erzgehalte":

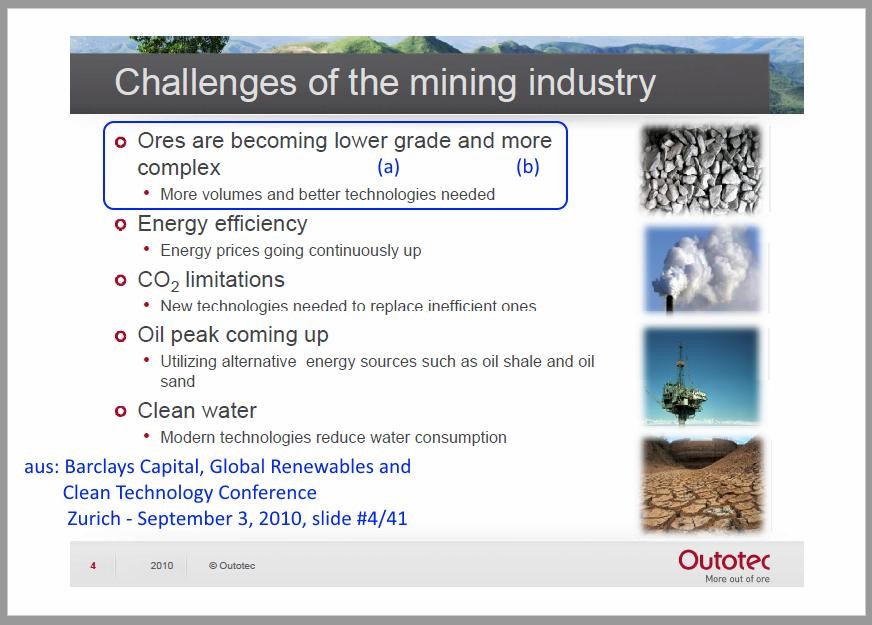

- nach Eigenangaben ja. OTE ist diese zunehmende Problematik (und damit Geschäftschance) spätestens seit 2010 bekannt:

(b) ...schafft es Gewinn zu machen:

Die Frage ist hier für wen? Bei sich selbst (b1) oder den Kunden (b2) - ein ewiger Wettstreit:

(b1) OTE hat ein mit den Rohstoffpreisen auffallend schwankendes Geschäft, trotz zweitem Standbein "Metals, Energy & Water"- und ist daher definitiv kein Buy&Hold-Wert. 2016 schloss man beim oper. Ergebnis negativ ab, und davor war es lange auch nicht besonders gut (aber positiv). Man muss dabei auch immer "Metals, Energy & Water" im Sinn haben, nicht nur "Minerals Processing".

(b2) hier gäbe es zwei Möglichkeiten:

(b2a) die Kunden fragen: die mäkeln aber immer und überall (nicht nur bei OTE), oder..

(b2b) ..die OTE-Lösungen mit denen des Wettbewerbs (siehe oben) von möglichst unabh. Stelle bewerten lassen, also z.B. den einschlägigen Minerals Engineering-Unternehmen. Da habe ich keinen Einblick, und strebe ihn auch nicht an.

Ich kann aber zu (b2a) sagen, dass für ein erfolgreiches Projekt mit geringhaltigen Erzen es mMn erheblich auf die qualifizierte Mitarbeit des Kunden drauf ankommt. Wahrscheintlich läuft bei einem Kunden eine vergleichbare Lösung recht gut, und der andere kämpft jahrelang damit (Wasserprobleme, Knowhow, ...).

Lower grades and more complex ores

Obiges scheint von Monument Mining in Malaysia zu sein:http://www.monumentmining.com/de/mengapur.asp?send=now&Repor…

Beides scheint auf diese Lagestätte zuzutreffen (low grade and complex, polymetallic).

(a) sehr niedrigen "Erzgehalte":

- nach Eigenangaben ja. OTE ist diese zunehmende Problematik (und damit Geschäftschance) spätestens seit 2010 bekannt:

(b) ...schafft es Gewinn zu machen:

Die Frage ist hier für wen? Bei sich selbst (b1) oder den Kunden (b2) - ein ewiger Wettstreit:

(b1) OTE hat ein mit den Rohstoffpreisen auffallend schwankendes Geschäft, trotz zweitem Standbein "Metals, Energy & Water"- und ist daher definitiv kein Buy&Hold-Wert. 2016 schloss man beim oper. Ergebnis negativ ab, und davor war es lange auch nicht besonders gut (aber positiv). Man muss dabei auch immer "Metals, Energy & Water" im Sinn haben, nicht nur "Minerals Processing".

(b2) hier gäbe es zwei Möglichkeiten:

(b2a) die Kunden fragen: die mäkeln aber immer und überall (nicht nur bei OTE), oder..

(b2b) ..die OTE-Lösungen mit denen des Wettbewerbs (siehe oben) von möglichst unabh. Stelle bewerten lassen, also z.B. den einschlägigen Minerals Engineering-Unternehmen. Da habe ich keinen Einblick, und strebe ihn auch nicht an.

Ich kann aber zu (b2a) sagen, dass für ein erfolgreiches Projekt mit geringhaltigen Erzen es mMn erheblich auf die qualifizierte Mitarbeit des Kunden drauf ankommt. Wahrscheintlich läuft bei einem Kunden eine vergleichbare Lösung recht gut, und der andere kämpft jahrelang damit (Wasserprobleme, Knowhow, ...).

Outotec to deliver grinding equipment for the Gruyere Gold Project in Australia

Man verdient somit (hoffentlich) auch an unseren Freunden hier von Gold Road Resources:http://www.wallstreet-online.de/diskussion/1160717-381-390/g…

Ich glaub das nun mal so:

Outotec's high-performance SAG mills are renowned for their reliability and maintainability. Our deep process knowledge and advanced mill technology will provide the foundation for this large and efficient plant", says Kimmo Kontola, head of Outotec's Minerals Processing business unit.

aus: http://new.outotec.com/company/media/news/2017/-outotec-to-d…

Hallo mal nee Frage die Technolgie der Goldgewinnung besonders bei niedrig Geradigen Projekten ist wirklich sehr interessant.

Aber wie hoch sind die ALL IN Cost bei einer Outotex Sulfiderz Goldanlage?

Weiss jemand was so eine Anlage kostet 1 Million Tonnen Verarbeitungskapazität im Jahr?

Aber wie hoch sind die ALL IN Cost bei einer Outotex Sulfiderz Goldanlage?

Weiss jemand was so eine Anlage kostet 1 Million Tonnen Verarbeitungskapazität im Jahr?

Outotec goes Lithium

Da schau her; das ist das erste Mal, dass ich mitbekomme, dass OTE auch an Lithium carbonate-Produzenten liefert:Outotec to deliver lithium technology to South America

http://www.outotec.com/company/media/news/2017/outotec-to-de…

Ein Detail:

- diese Lieferung fällt unter den ansonsten schwachen Geschäftsbereich Metals, Energy & Water, und nicht unter Minerals Processing.

Kunde wird nicht genannt.

Aktie reagiert aber nicht besonders, und ist voll synchron mit dem Markt (OMXH) und daher leicht im Minus.

Gut, ganz Finnland ist ja auch voll im Urlaub.

Outotec to deliver process equipment and services to a gold project in West Africa

hier flattern momentan die Auftrage im Tagesrhytmus ein:http://www.outotec.com/company/media/news/2017/outotec-to-de…

=>

...delivery of process equipment and services to a greenfield gold project in West Africa. Outotec's contract value is approximately EUR 13 million...

=> da kann sich nun jeder seinen Goldminer in dieser Ecke mit IBN 2018Q2/Q3 raussuchen; einer der so was bestellt hat:

- 6 MW SAG mill,

- a 6 MW ball mill,

- a pre-leach thickener

Hallo gibt es bei Outotec eine Liste seiner aktuellen Projekte?

Oder wo man rausfinden kann wer gerade etwas bei Outotec sozusagen bestellt hat der BIOX Prozess wird wohl dringend für das Sulfiderz benötigt bei vielen Minern...

Kennt jemand Minenunternehmen außer die Fosterville Mine glaube ich heißt die die BIOX in klein nutzen wie lösen die anderen Miner das Sulfidproblem?

Oder wo man rausfinden kann wer gerade etwas bei Outotec sozusagen bestellt hat der BIOX Prozess wird wohl dringend für das Sulfiderz benötigt bei vielen Minern...

Kennt jemand Minenunternehmen außer die Fosterville Mine glaube ich heißt die die BIOX in klein nutzen wie lösen die anderen Miner das Sulfidproblem?

Faktoren

Früher hiess das mal "Fundamental-Analyse", heute sprechen alle von "Faktoren".Nachdem OTE so vorgelegt hat, mal der nüchterne Blick auf die "Faktoren":

P/E:

2016: -0-

2017: ca. 45!!

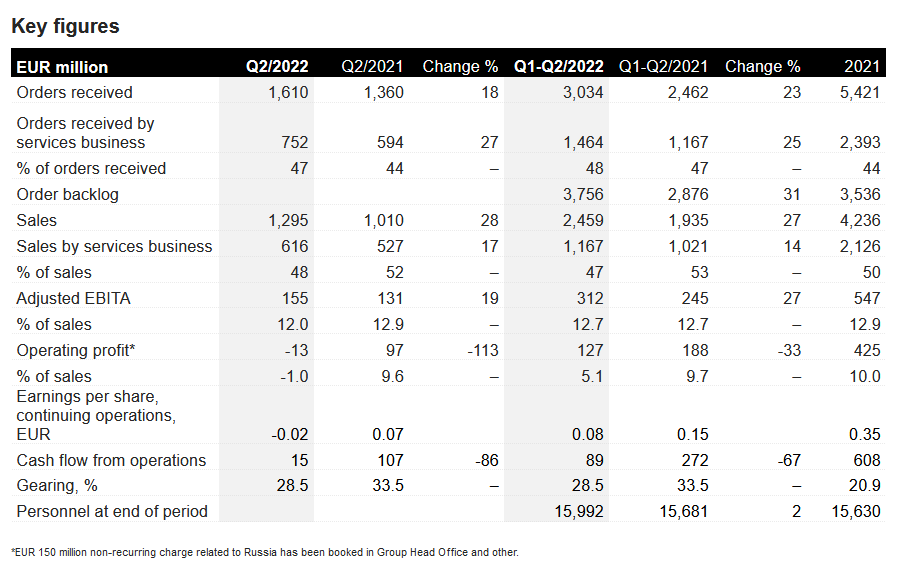

2018: ca. 18...26

2019: ca. 19

2020: ca. 13

Quellen: FactSet 12.7. u.ä.

Noch ein interessanter Aspekt:

- wenn alles gut geht, dann könnte der Umsatz bis 2020 um 50% zulegen bzgl. Basis 2016.

(mM dazu: Skepsis: Minerals Processing: ja - siehe heute, aber bei Metals, Energy & Water wäre ich sehr zurückhaltend)

Für 2017 könnte es schon wieder Dividende geben: EUR0.05?

=> man sieht: steile Bewertung z.Z. - aber Zykliker.

Auf der anderen Seite: man stelle sich mal vor: Cu bei USD4, Au bei USD1800 --> dann kennt das Ding kein Halten mehr...

=> d.h., momentan haben wir vom heiligen Gral des Investierens (QVG) nur Q und G, aber kein V!

(QVG = Quality, Value, Growth)

Antwort auf Beitrag Nr.: 55.311.160 von faultcode am 12.07.17 16:54:20

Quelle: http://www.miningmagazine.com/equipment/mineral-processing/o…

Noch ein Anlagenbild dazu gefunden

So, oder so ähnlich soll das wohl aussehen:

Quelle: http://www.miningmagazine.com/equipment/mineral-processing/o…

2017Q2 -> -11% nach unten heute

https://www.wallstreet-online.de/nachricht/9772589-outotec-s…=> Sell on mixed news Tag heute. Minerals OK.

Metals, Energy & Water ziemlich schlecht eigentlich:

Customer activity in Metals, Energy & Water improved from 2016 but timing of decisions regarding large investments is still difficult to foresee.

Gold, aluminum, copper, lithium and zinc projects were most active.

The Middle East, and Central and South America as well as Russia were more active than other market areas. In addition, markets in South East Asia and Australia as well as Europe became more active in the second quarter. Competition remains intense.

Order intake +34%

Gross margin um fast 3% gesunken

Eigentlich sind die Jahresprognosen 2017 vor zwei Tagen noch ganz leicht angehoben worden. Dabei bleibt es auch.

Ich denke, eine Problem hier ist nun der starke USD - und das - wie für alle EU Maschinenbau-Zykliker - noch eine ganze Weile.

Personalumfang ging zurück - immer ein guter Indikator mMn.

=> das wird hier erstmal seitwärts weiterlaufen.

__

Hallo kennt sich jemand mit den "Outotec Sulfidkupferprozess" der Firma aus?und ob dieser Prozess auch bei Polymetallprojekten funktioniert?

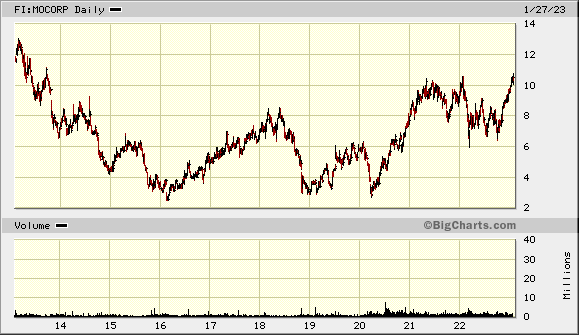

Anklopfen am Widerstand EUR7

=> ich würde sagen, wir müssen im derzeitigen Umfeld noch mindestens einmal mehr Anlauf nehmen, um die EUR7 zu knacken:

=> d.h., erst beim 3. oder 4. Anlauf sind die EUR7 zu knacken.

Outotec to deliver minerals processing technology and services to MMC Norilsk Nickel in Russia

http://www.outotec.com/company/media/news/2017/outotec-to-de…=>

...The contract value booked in Outotec's 2017 third quarter order intake is over EUR 13 million.

Kola MMC produces annually 383,000 tonnes of nickel concentrate in Zapolyarny. Outotec's scope includes engineering, the delivery of filtration, thickening, flotation and analyzer equipment, as well as training and site services. The deliveries will take place at the end of 2018...

Delivery of gold processing technology to Fruta Del Norte in Ecuador

für Lundin Gold.http://www.outotec.com/company/media/news/2017/outotec-to-de…

=>

contract value over EUR 10 million

Fruta del Norte, property of Lundin Gold, is one of the world's largest, highest grade undeveloped gold deposits, with reserves estimated at about 4.8 million ounces of gold and 6.3 million ounces of silver. Fruta Del Norte is expected to produce approximately 325,000 ounces of gold a year over a 15-year mine life.

Outotec's scope includes process engineering and the delivery of grinding mills, flotation, thickening and filtration technology packages. The deliveries will take place before the end of 2018.

=> das sollte doch (mind.) 15 Jahre lang schöne Service-Aufträge generieren...

Hallo geht alles sehr ordentlich vorran bei der Firma.

Was meint ihr ob der BIOX Prozess bei der Firma sich weiter durchsetzten wird bei dem Sulfidgolderzen?

Was meint ihr ob der BIOX Prozess bei der Firma sich weiter durchsetzten wird bei dem Sulfidgolderzen?

2017Q3

=> Wachstum in Zukunft nicht mehr ganz so stark --> siehe (leichte) Abnahme beim Order backlog at end of period

Kommt Zeit, kommt (wieder) Schub

Outotec to deliver minerals processing equipment to Australiahttp://www.outotec.com/company/media/news/2017/outotec-to-de…

=>

Outotec has been awarded orders for the delivery of process equipment for a greenfield copper concentrator in Australia. The contract value booked in Outotec's 2017 fourth quarter order intake is approximately EUR 17 million.

Outotec's scope of delivery includes semi-autogenous (SAG) and ball mills, HIGmill® high intensity grinding mill, flotation cells, sampler and automation technology, plus thickeners for concentrate and tailings treatment. The deliveries will take place during 2018.

=> wer könnte der Besteller sein?

..solche Mühlen werden nun auch nicht gerade alle naslang in Australien bestellt und geliefert.

Grossorder Kongo

Scheint wohl dringend zu sein mit Kobalt aus dem Kongo:Outotec has been awarded a contract by Shalina Resources Limited for the delivery of copper and cobalt processing technology to the Mutoshi project near Kolwezi in the Democratic Republic of Congo. The order value, approximately EUR 65 million, is booked in Outotec's 2017 fourth quarter order intake.

http://www.outotec.com/company/media/news/2017/outotec-to-de…

Outotec to deliver minerals processing technology to Turkey

http://www.outotec.com/company/media/news/2017/outotec-to-de…=>

Outotec has been awarded a contract for the delivery of minerals processing technology to a new copper concentrator to be built in Turkey. The contract value booked in Outotec's 2017 fourth quarter order intake is approximately EUR 13 million.

Outotec's scope includes engineering of the concentrator and the delivery of main process equipment including a semi-autogenous and a ball mill, a HIGmill for regrinding, pumps, thickeners, flotation cells, analyzers, and automation. Outotec's deliveries will start in the first half of 2018...

=> kein Kunde genannt.

Antwort auf Beitrag Nr.: 56.517.506 von faultcode am 21.12.17 14:45:42

http://www.canadianminingjournal.com/news/tailings-outotec-c…

News

Hey hallo leider nicht viel los hier hier eine aktuelle News....http://www.canadianminingjournal.com/news/tailings-outotec-c…

Antwort auf Beitrag Nr.: 56.622.314 von freddy1989 am 05.01.18 06:05:35

=>

...Outotec is holding a series of webinars on tailings and water management in early 2018. The first, on Jan. 24, will introduce thickening, and this will be followed by sessions on tailings filtration and water treatment. Each webinar will cover the topic from equipment to plant, taking a holistic view of the issues that enable and constrain the technology.

=> mit solchen kostengünstigeren pre-engineered plant designs kann man - hoffentlich - auch im unteren Marktsegment ganz neue Kundenkreise erschliessen, für die bislang - aus Kostengründen - eine Outotec-Lösung nicht in Frage kam.

pre-engineered plant designs

interessant:=>

...Outotec is holding a series of webinars on tailings and water management in early 2018. The first, on Jan. 24, will introduce thickening, and this will be followed by sessions on tailings filtration and water treatment. Each webinar will cover the topic from equipment to plant, taking a holistic view of the issues that enable and constrain the technology.

=> mit solchen kostengünstigeren pre-engineered plant designs kann man - hoffentlich - auch im unteren Marktsegment ganz neue Kundenkreise erschliessen, für die bislang - aus Kostengründen - eine Outotec-Lösung nicht in Frage kam.

Antwort auf Beitrag Nr.: 56.451.485 von faultcode am 14.12.17 17:52:45

=>

...Outotec has been awarded a contract by Shalina Resources Limited for the delivery of advanced sulfuric acid plant technology to the Mutoshi project near Kolwezi in the Democratic Republic of Congo. The order value, approximately EUR 33 million, is booked in Outotec's 2018 first quarter order intake.

Outotec's scope includes the delivery of three skid mounted, modular sulfuric acid plants that will produce the acid and SO2 gas required in the process of the new Mutoshi copper-cobalt plant...

Outotec to deliver modular sulfuric acid plants for Shalina Resources in the Democratic Republic of Congo

https://www.outotec.com/company/media/news/2018/outotec-to-d…=>

...Outotec has been awarded a contract by Shalina Resources Limited for the delivery of advanced sulfuric acid plant technology to the Mutoshi project near Kolwezi in the Democratic Republic of Congo. The order value, approximately EUR 33 million, is booked in Outotec's 2018 first quarter order intake.

Outotec's scope includes the delivery of three skid mounted, modular sulfuric acid plants that will produce the acid and SO2 gas required in the process of the new Mutoshi copper-cobalt plant...

Outotec to deliver pelletizing technology to China

https://www.outotec.com/company/media/news/2018/outotec-to-d…=>...Outotec has agreed on the design and delivery of two iron ore pelletizing plants for Shougang Jingtang United Iron & Steel Co. Ltd. in Caofeidian, China. The contract, valued at over EUR 40 million, has been booked in Outotec's first quarter order intake.

The two pelletizing plants, each with annual capacity of four million tonnes of iron ore pellets, will be based on Outotec's modern traveling grate technology. The technology enables large capacities with low operational costs and low energy consumption.

The plants are expected to be commissioned in 2019...

=> +31% in den letzten 12 Monaten - das nur so nebenbei.

Outotec awarded a large iron ore pelletizing plant and filter press order from India

https://globenewswire.com/news-release/2018/03/14/1422134/0/…=>

...Outotec has signed a contract with an Indian customer for the delivery of an iron ore pelletizing plant and filters for the expansion of their existing operations. The order value exceeds EUR 50 million and is booked in Outotec's 2018 first quarter order intake.

Outotec's scope of delivery includes basic engineering and process technology for a traveling grate pelletizing plant, key process equipment and eleven filter presses for dewatering of concentrate as well as advisory services for erection and commissioning. The new pellet plant will have efficient heat recovery, which enables energy efficient and environmentally sound operation. The plant is expected to be commissioned at the end of 2019...

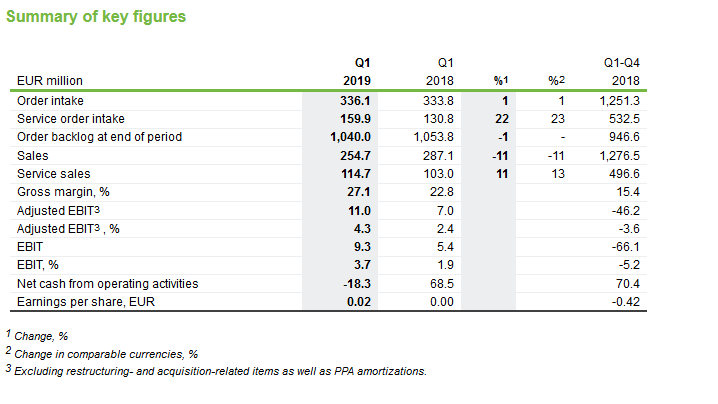

2018Q1

=> Order intake wieder gestiegen -- Rest auch OK

=> Kursabschlag bei dieser Aktie mMn völlig übertrieben heute mit z.Z. -10%

http://www.nasdaqomxnordic.com/aktier/microsite?Instrument=H…

Problemfeld bleibt aber:

The Metals, Energy & Water segment improved slightly, but remained unprofitable.

Outotec to deliver technology for Boliden's sulfuric acid plant in Sweden

OUTOTEC OYJ PRESS RELEASEE JUNE 20, 2018 AT 3:30 PMOutotec has agreed with the Sweden-based mining company Boliden on the design and delivery of an absorption section to be built for the sulfuric acid plant at the Rönnskär smelter. The order has been booked in Outotec's 2018 second quarter order intake. Typically orders of this size and scope are valued at over EUR 10 million.

The Boliden Rönnskär plant is one of the world's most efficient copper smelters. The new absorption section designed by Outotec will be able to process the future gas volume from the upstream smelting process with high energy recovery...

=> Rönnskär plant:

https://www.boliden.com/operations/smelters/boliden-ronnskar

Outotec to deliver technology for a tin smelter in Indonesia

OUTOTEC OYJ PRESS RELEASE JUNE 29, 2018 AT 1:00 PMOutotec has agreed with the Indonesian PT TIMAH Tbk (TIMAH) for the design and delivery of Outotec Ausmelt® Top Submerged Lance (TSL) technology and equipment for a new tin smelter, to be located at the existing tin smelter site at Muntok, Indonesia. The order has been booked in Outotec's 2018 second quarter order intake. The contract value is not disclosed, but orders of this size and scope are typically valued at over EUR 10 million.

Outotec and TIMAH entered into agreements for a technology license and process and basic engineering in 2017. Now, the scope of Outotec's delivery includes detailed engineering and supply of core proprietary equipment for the Ausmelt core technology package.

TIMAH is Indonesia's largest integrated tin miner and tin processor, as well as one the world's largest refined tin exporter.

Outotec's deliverables will take place over the next 2 years, and the TIMAH Ausmelt plant, to be designed to process tin concentrates for production of 45,000 tonnes of crude tin per annum, is expected to become operational in 2020.

"We are pleased to cooperate with TIMAH and provide them with our proven, cost effective and environmentally friendly Outotec Ausmelt furnace process at their new smelter. The Ausmelt technology is widely used in tin production around the world," says Kalle Härkki, Head of Outotec's Metals, Energy & Water business.

Antwort auf Beitrag Nr.: 58.100.677 von faultcode am 29.06.18 17:22:50

Outotec has been awarded a contract for the delivery of flotation cells and automation for a base metal concentrator in Kazakhstan. The approximately EUR 15 million order has been booked in Outotec's 2018 second quarter order intake.

"We are happy to support our customer in their efforts to improve their production processes and environmental performance. Outotec's energy-efficient flotation cells and advanced process automation solutions contribute to stable concentrate production and improved yield", says Kimmo Kontola, head of Minerals Processing business at Outotec.

Outotec to deliver minerals processing equipment to Kazakhstan

https://globenewswire.com/news-release/2018/07/05/1533692/0/…Outotec has been awarded a contract for the delivery of flotation cells and automation for a base metal concentrator in Kazakhstan. The approximately EUR 15 million order has been booked in Outotec's 2018 second quarter order intake.

"We are happy to support our customer in their efforts to improve their production processes and environmental performance. Outotec's energy-efficient flotation cells and advanced process automation solutions contribute to stable concentrate production and improved yield", says Kimmo Kontola, head of Minerals Processing business at Outotec.

Antwort auf Beitrag Nr.: 58.144.559 von faultcode am 05.07.18 14:17:09und noch einer:

Outotec to deliver a 35 MW biomass power plant to Turkey

Outotec has signed a contract for the EPC delivery of a new 35 MW gross electrical biomass power plant to be built in Turkey. The order value is approximately EUR 55 million which has been booked in Outotec's 2018 second quarter order intake.

Outotec is responsible for engineering, procurement and construction of the plant excluding the civil works. Based on Outotec's proprietary fluidized bed technology, the main process components in the delivery are the biomass storage system, fluidized bed boiler, turbine and the flue gas treatment system.

The new plant designed by Outotec will be located close to the biomass sources in the agricultural area, where the disposal from large farms is becoming an environmental concern. The plant will generate green electricity to the national grid and produce clean fertilizer as a byproduct.

Designed to operate below the strict European emission limits, the plant is expected to be fully operational in 2020.

"This is a great achievement for Outotec and one of the first projects of the Turkish initiative for promoting green energy out of biomass.

In 2016, we delivered and commissioned one of Turkey's first 30 MW power plants based on alternative fuel and are now happy to provide our fluidized bed technology for another green energy project," says Kalle Härkki, head of Outotec's Metals, Energy & Water business.

Outotec to deliver a 35 MW biomass power plant to Turkey

Outotec has signed a contract for the EPC delivery of a new 35 MW gross electrical biomass power plant to be built in Turkey. The order value is approximately EUR 55 million which has been booked in Outotec's 2018 second quarter order intake.

Outotec is responsible for engineering, procurement and construction of the plant excluding the civil works. Based on Outotec's proprietary fluidized bed technology, the main process components in the delivery are the biomass storage system, fluidized bed boiler, turbine and the flue gas treatment system.

The new plant designed by Outotec will be located close to the biomass sources in the agricultural area, where the disposal from large farms is becoming an environmental concern. The plant will generate green electricity to the national grid and produce clean fertilizer as a byproduct.

Designed to operate below the strict European emission limits, the plant is expected to be fully operational in 2020.

"This is a great achievement for Outotec and one of the first projects of the Turkish initiative for promoting green energy out of biomass.

In 2016, we delivered and commissioned one of Turkey's first 30 MW power plants based on alternative fuel and are now happy to provide our fluidized bed technology for another green energy project," says Kalle Härkki, head of Outotec's Metals, Energy & Water business.

Antwort auf Beitrag Nr.: 58.158.800 von faultcode am 06.07.18 23:50:48..und wieder einer:

Outotec to deliver minerals processing technology to Russia

https://globenewswire.com/news-release/2018/07/13/1537040/0/…

=>

Outotec has signed a contract for the delivery of minerals processing technology and equipment to a concentrator plant in Russia. The contract value booked in Outotec's 2018 second quarter order intake is approximately EUR 24 million. The equipment will be delivered as a natural part of the already started project.

"We are happy to support our customer's target to improve the environmental performance of their operations. Outotec's dewatering, flotation, automation and analyzer solutions are designed for efficient and environmentally sound concentrate production. In addition, the included extensive advisory service package ensures fast ramp-up and performance of the concentrator plant", says Kimmo Kontola, head of Outotec's Minerals Processing business.

Outotec to deliver minerals processing technology to Russia

https://globenewswire.com/news-release/2018/07/13/1537040/0/…

=>

Outotec has signed a contract for the delivery of minerals processing technology and equipment to a concentrator plant in Russia. The contract value booked in Outotec's 2018 second quarter order intake is approximately EUR 24 million. The equipment will be delivered as a natural part of the already started project.

"We are happy to support our customer's target to improve the environmental performance of their operations. Outotec's dewatering, flotation, automation and analyzer solutions are designed for efficient and environmentally sound concentrate production. In addition, the included extensive advisory service package ensures fast ramp-up and performance of the concentrator plant", says Kimmo Kontola, head of Outotec's Minerals Processing business.

Antwort auf Beitrag Nr.: 58.207.670 von faultcode am 13.07.18 14:09:16Hi weiss jemand ob der BIOX Process der Firma wirklich so gut ist? ich habe gelesen das die Fosterville Mine in Australien angeblich US$743 und 95% Recovery hat...

Was haltet ihr von dem BIOX Prozess als Lösung für das viele Sulfiderz in der Minen weltweit?

Was haltet ihr von dem BIOX Prozess als Lösung für das viele Sulfiderz in der Minen weltweit?

2018Q2

=> Kurs erholt sich wieder --> -1.3% NASDAQ OMX NORDIC

Antwort auf Beitrag Nr.: 58.297.481 von faultcode am 25.07.18 12:23:52hier's ist einer überzeugt von Outotec:

In accordance with the Securities Market Act, Chapter 9, Section 5, Catella Fondförvaltning AB, Sweden (556533-6210) has informed that its holdings in shares of Outotec Oyj (OTE1V) on October 16, 2018 has exceeded 5%, and is 5.008% with 9,171,005 shares.

https://www.wallstreet-online.de/nachricht/10939242-change-t…

https://www.catella.com/en/sweden/catella-fonder

In accordance with the Securities Market Act, Chapter 9, Section 5, Catella Fondförvaltning AB, Sweden (556533-6210) has informed that its holdings in shares of Outotec Oyj (OTE1V) on October 16, 2018 has exceeded 5%, and is 5.008% with 9,171,005 shares.

https://www.wallstreet-online.de/nachricht/10939242-change-t…

https://www.catella.com/en/sweden/catella-fonder

Antwort auf Beitrag Nr.: 58.992.357 von faultcode am 18.10.18 14:00:51

=>

OUTOTEC OYJ STOCK EXCHANGE RELEASE OCTOBER 26, 2018 at 9:00 AM

Outotec warns about possible material additional costs related to a large project

Outotec has delivered a first-of-its-kind ilmenite smelter, with two large alternating current (AC) electric furnaces, as part of a greenfield plant delivery signed in 2012. Both furnaces had their challenges during the original start-ups in 2015 and 2016. Furnace 1 was repaired and rebuilt, but during the ongoing start-up of the repaired furnace, there were problems and the start-up operation was terminated. Investigation of the furnace will be made when the furnace has cooled down, which takes approximately one month.

Currently it is estimated that potentially rebuilding a new furnace will take approximately one year. At this point, the cause of the problem with the start-up is not clear. In addition, it is too early to assess the total financial impact of any repairs that may be required. If it transpires that responsibility for this incident rests with Outotec, then the cost for Outotec will be material. In that case, it would have a material impact to Outotec's 2018 adjusted EBIT.

Outotec announces additional information when available.

Outotec will announce its Q3/2018 interim report on October 31, 2018.

-27% -- Outotec warns about possible material additional costs related to a large project

zu früh!=>

OUTOTEC OYJ STOCK EXCHANGE RELEASE OCTOBER 26, 2018 at 9:00 AM

Outotec warns about possible material additional costs related to a large project

Outotec has delivered a first-of-its-kind ilmenite smelter, with two large alternating current (AC) electric furnaces, as part of a greenfield plant delivery signed in 2012. Both furnaces had their challenges during the original start-ups in 2015 and 2016. Furnace 1 was repaired and rebuilt, but during the ongoing start-up of the repaired furnace, there were problems and the start-up operation was terminated. Investigation of the furnace will be made when the furnace has cooled down, which takes approximately one month.

Currently it is estimated that potentially rebuilding a new furnace will take approximately one year. At this point, the cause of the problem with the start-up is not clear. In addition, it is too early to assess the total financial impact of any repairs that may be required. If it transpires that responsibility for this incident rests with Outotec, then the cost for Outotec will be material. In that case, it would have a material impact to Outotec's 2018 adjusted EBIT.

Outotec announces additional information when available.

Outotec will announce its Q3/2018 interim report on October 31, 2018.

Antwort auf Beitrag Nr.: 59.064.655 von faultcode am 26.10.18 13:01:28Cristal Global aus Saudi-Arabien war's:

https://www.reuters.com/article/outotec-results-project/upda…

=>

...

It did not name the project but in effect indicated that it concerned a furnace ordered by chemicals company Cristal Global in Saudi Arabia. Outotec has previously said that the value of the turnkey deal of the smelter with two furnaces was 350 million euros ($398 million).

“Both furnaces had their challenges during the original start-ups in 2015 and 2016. Furnace 1 was repaired and rebuilt, but during the ongoing start-up of the repaired furnace, there were problems and the start-up operation was terminated,” Outotec said in a statement.

Cristal was not immediately available for a comment.

...

https://www.reuters.com/article/outotec-results-project/upda…

=>

...

It did not name the project but in effect indicated that it concerned a furnace ordered by chemicals company Cristal Global in Saudi Arabia. Outotec has previously said that the value of the turnkey deal of the smelter with two furnaces was 350 million euros ($398 million).

“Both furnaces had their challenges during the original start-ups in 2015 and 2016. Furnace 1 was repaired and rebuilt, but during the ongoing start-up of the repaired furnace, there were problems and the start-up operation was terminated,” Outotec said in a statement.

Cristal was not immediately available for a comment.

...

Antwort auf Beitrag Nr.: 59.068.618 von faultcode am 26.10.18 19:02:49

=>

...

On October 26, 2018, we had to announce problems in our delivery of the ilmenite smelter project contracted in 2012. We have now agreed with our customer, National Titanium Dioxide Company (Cristal), to work together to examine and identify the root causes of the problems in the ilmenite smelter project.

At this point, it is too early to assess the total financial impact of the needed repair. If it appears that Outotec has caused the root cause to this incident, the cost for Outotec will be material, which would also impact our 2018 adjusted EBIT.

We expect the demand outlook for our technologies and services to remain good. However, major investments continue to develop relatively slowly", summarized President & CEO Markku Teräsvasara.

...

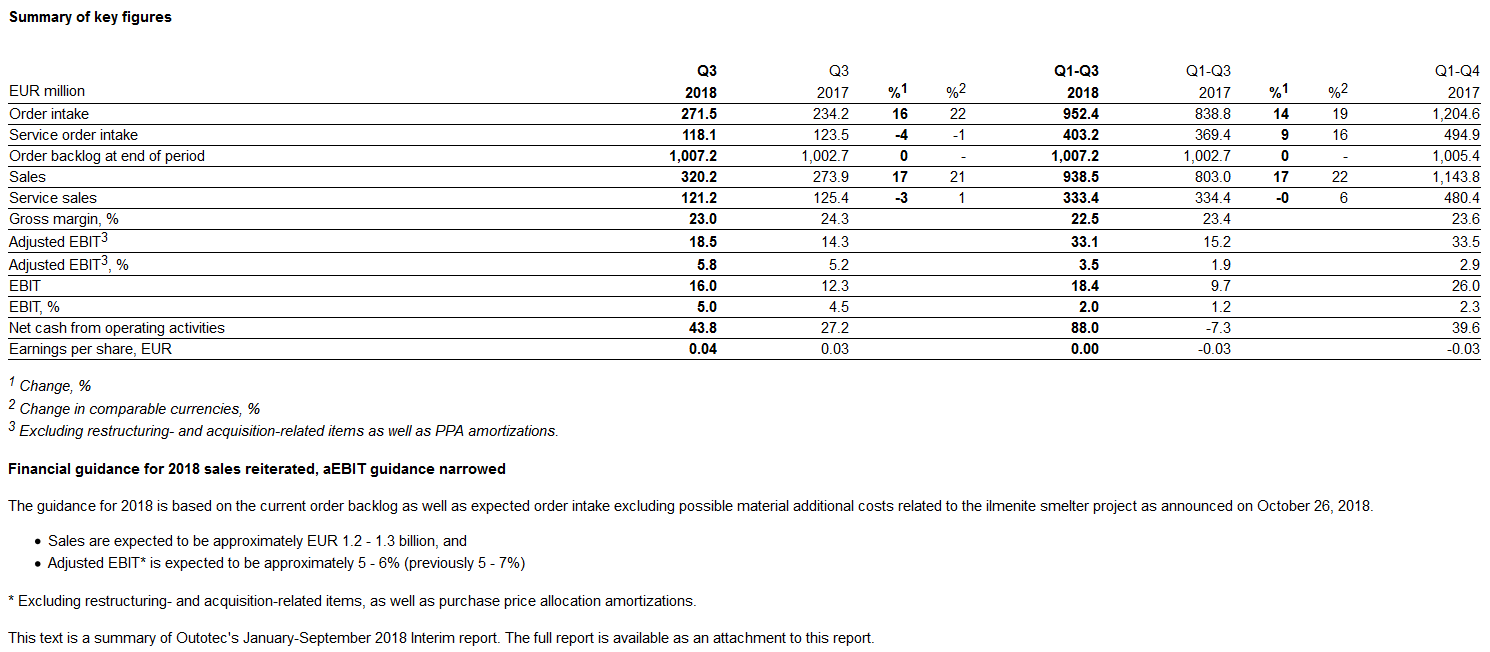

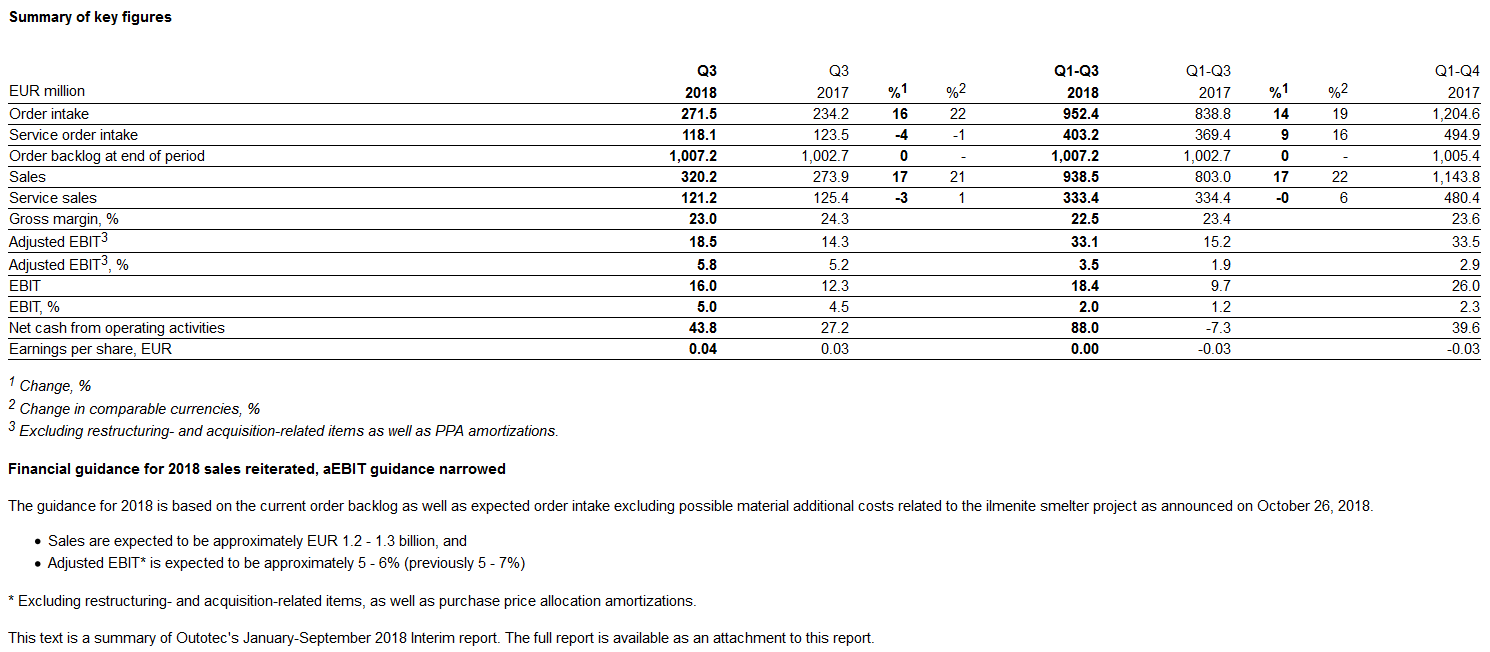

Outotec's interim report January-September 2018

https://globenewswire.com/news-release/2018/10/31/1639893/0/…=>

...

On October 26, 2018, we had to announce problems in our delivery of the ilmenite smelter project contracted in 2012. We have now agreed with our customer, National Titanium Dioxide Company (Cristal), to work together to examine and identify the root causes of the problems in the ilmenite smelter project.

At this point, it is too early to assess the total financial impact of the needed repair. If it appears that Outotec has caused the root cause to this incident, the cost for Outotec will be material, which would also impact our 2018 adjusted EBIT.

We expect the demand outlook for our technologies and services to remain good. However, major investments continue to develop relatively slowly", summarized President & CEO Markku Teräsvasara.

...

Antwort auf Beitrag Nr.: 59.104.307 von faultcode am 31.10.18 14:18:54

=>

...Outotec and Terrafame Ltd, a Finnish multi-metal company, have agreed on the delivery of pressure leaching and solvent extraction technologies for a battery chemicals plant to be built in Sotkamo, Finland. The total order value booked in the fourth quarter order intake is approximately EUR 34 million.

Outotec has been Terrafame's partner for development of this project already in the pre-feasibility study phase. Outotec's scope of delivery comprises the technology and engineering of the leaching and solvent extraction plants, supply of proprietary equipment as well as advisory services for installation, training, commissioning and start-up.

The battery chemicals plant, expected to be ready for commissioning in 2020, will have the capacity of producing annually approximately 170,000 tonnes of nickel sulfate and approximately 7,400 tonnes of cobalt sulfate to be used for batteries of electric vehicles. As a by-product, the plant will produce approximately 115,000 tonnes of ammonium sulfate per year used as a fertilizer and in process industry...

Outotec to deliver battery chemicals production technology for Terrafame in Finland

https://www.wallstreet-online.de/nachricht/11063225-outotec-…=>

...Outotec and Terrafame Ltd, a Finnish multi-metal company, have agreed on the delivery of pressure leaching and solvent extraction technologies for a battery chemicals plant to be built in Sotkamo, Finland. The total order value booked in the fourth quarter order intake is approximately EUR 34 million.

Outotec has been Terrafame's partner for development of this project already in the pre-feasibility study phase. Outotec's scope of delivery comprises the technology and engineering of the leaching and solvent extraction plants, supply of proprietary equipment as well as advisory services for installation, training, commissioning and start-up.

The battery chemicals plant, expected to be ready for commissioning in 2020, will have the capacity of producing annually approximately 170,000 tonnes of nickel sulfate and approximately 7,400 tonnes of cobalt sulfate to be used for batteries of electric vehicles. As a by-product, the plant will produce approximately 115,000 tonnes of ammonium sulfate per year used as a fertilizer and in process industry...

Antwort auf Beitrag Nr.: 59.369.915 von faultcode am 05.12.18 15:12:29

=>

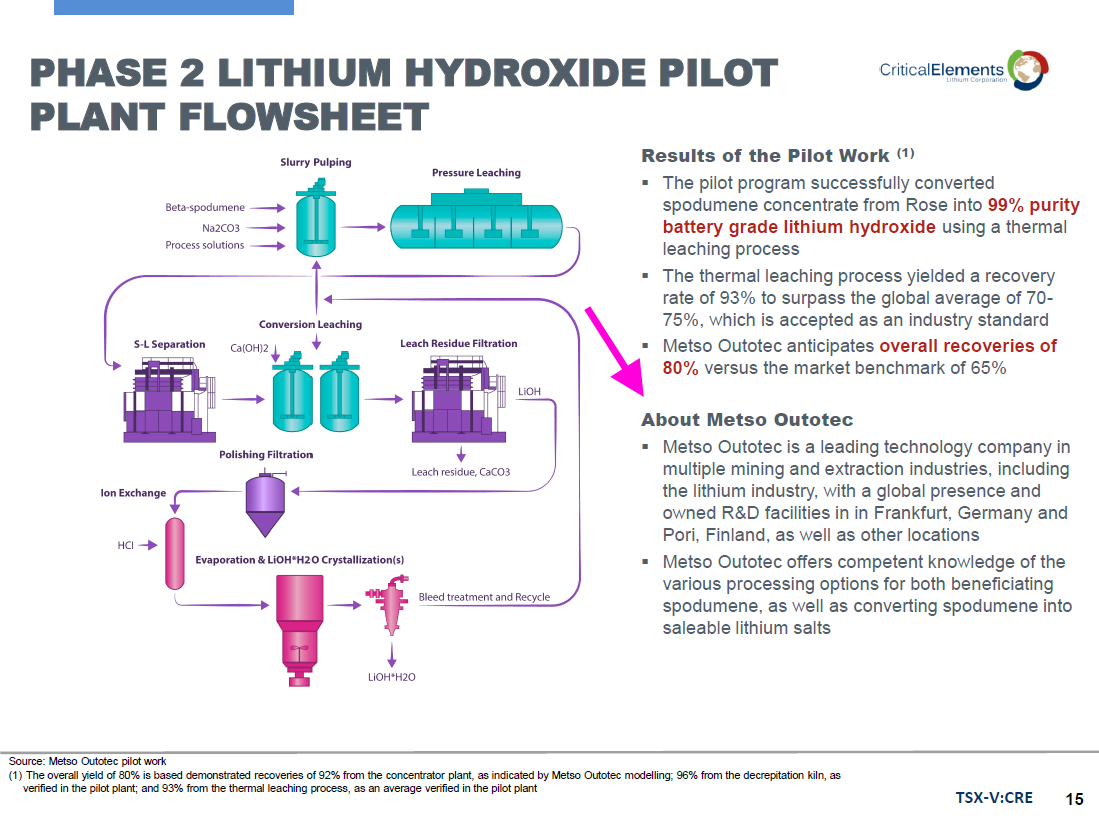

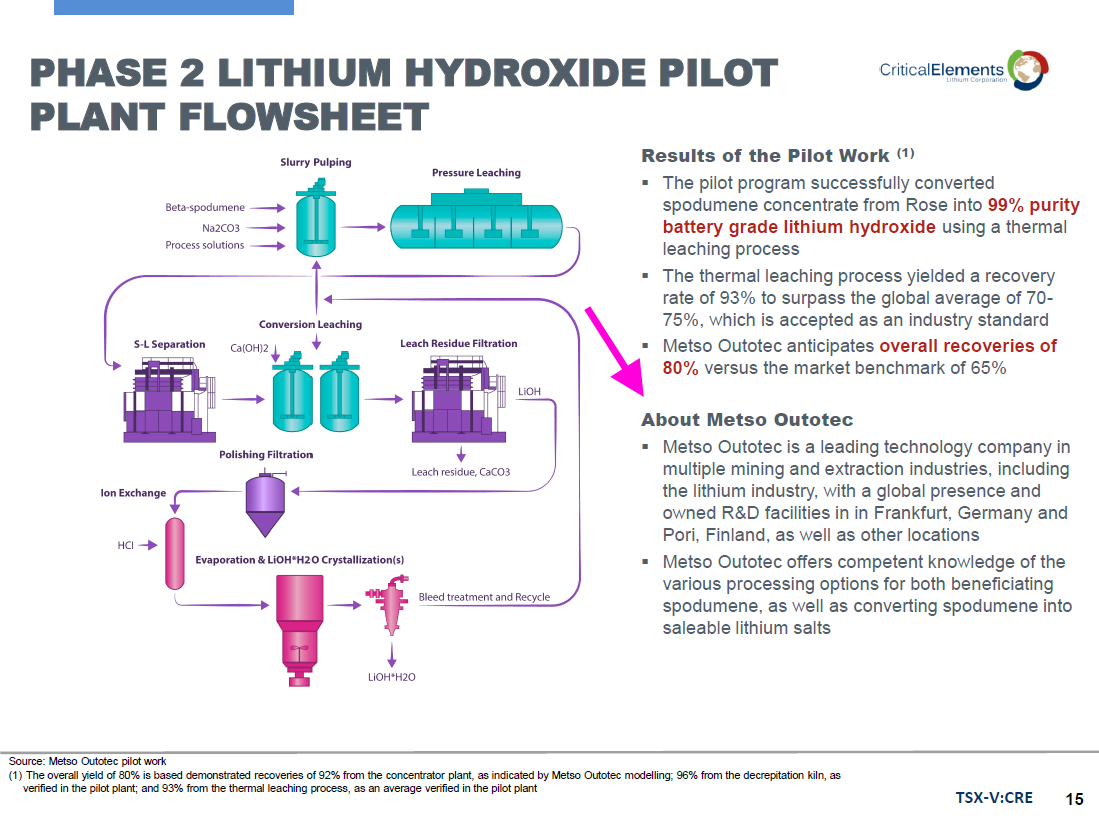

...Outotec has been awarded a contract for the delivery of filtration technology and services for a lithium processing plant in Australia. The approximately EUR 12 million order has been booked in Outotec's 2019 first quarter order intake.

Outotec's scope in this order includes design and delivery of proprietary Outotec Larox pressure filters as well as installation and commissioning advisory services and spare parts. When complete, the plant will convert spodumene concentrate into lithium hydroxide.

"We are pleased to cooperate with our customer in producing a world class project. At Outotec, we have expertise to offer sustainable solutions for extracting lithium from brines and spodumene ores up to battery grade lithium salts. We are well positioned in this growing market for lithium processing technologies," notes Kimmo Kontola, head of Outotec's Minerals Processing business...

=> im Li-Sektor mischen nun einige globale Anlagenbauer mit

Outotec to deliver filtration technology for a lithium processing plant in Australia

https://www.wallstreet-online.de/nachricht/11219514-outotec-…=>

...Outotec has been awarded a contract for the delivery of filtration technology and services for a lithium processing plant in Australia. The approximately EUR 12 million order has been booked in Outotec's 2019 first quarter order intake.

Outotec's scope in this order includes design and delivery of proprietary Outotec Larox pressure filters as well as installation and commissioning advisory services and spare parts. When complete, the plant will convert spodumene concentrate into lithium hydroxide.

"We are pleased to cooperate with our customer in producing a world class project. At Outotec, we have expertise to offer sustainable solutions for extracting lithium from brines and spodumene ores up to battery grade lithium salts. We are well positioned in this growing market for lithium processing technologies," notes Kimmo Kontola, head of Outotec's Minerals Processing business...

=> im Li-Sektor mischen nun einige globale Anlagenbauer mit

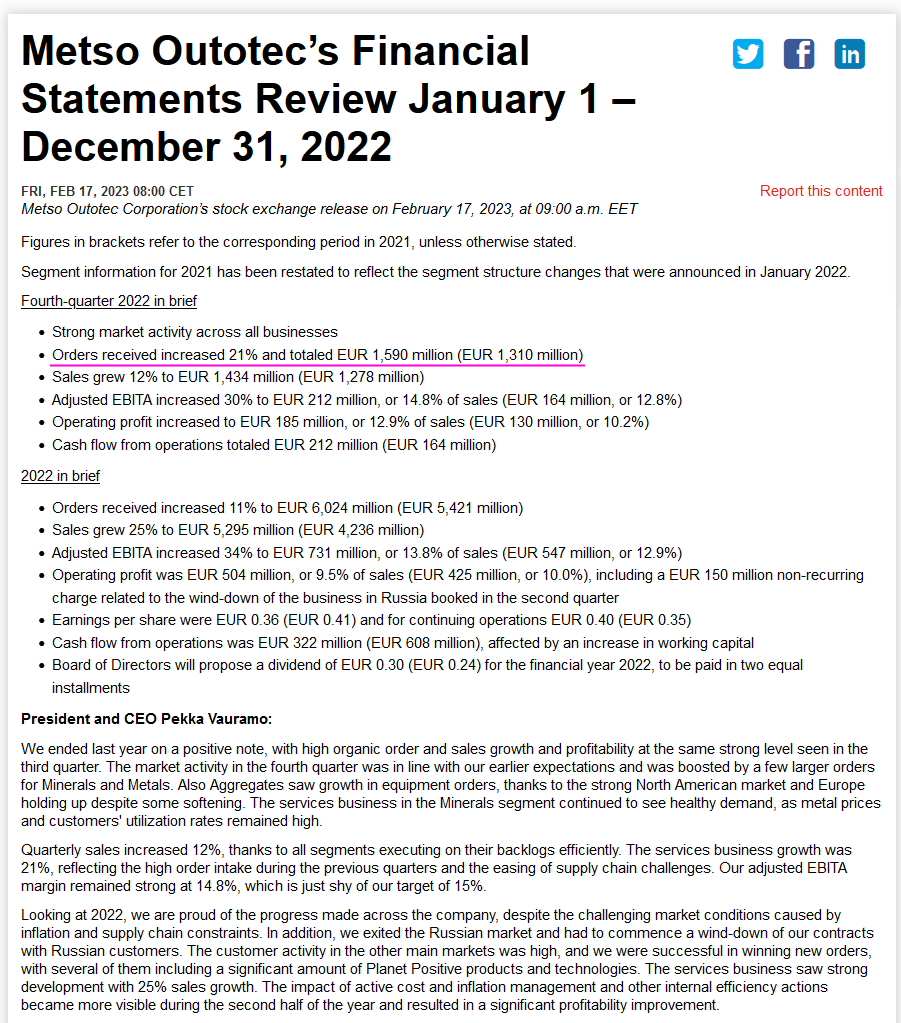

Outotec's Financial Statements Review January-December 2018 -- ilmenite smelter project

https://www.outotec.com/company/media/news/2019/outotecs-fin…=>

...

Financial guidance for 2019

Based on the current market outlook, we expect our sales to increase, and our aEBIT* to increase significantly from the 2018 aEBIT (EUR 63.8 million) without the provision for the ilmenite smelter project.

*Excluding restructuring- and acquisition-related items, as well as PPA amortizations...

=> Schadensprovision in SA ("provision for the ilmenite smelter project"):

Outotec has made a EUR 110 million provision for possible costs relating to the ilmenite smelter project in Saudi Arabia (Stock Exchange Releases on May 31, 2012; October 26, 2018; October 30, 2018 and February 8, 2019).

The currently estimated provision is based on progress made with the analysis of the furnace. The provision is booked in Outotec's fourth quarter 2018 result. The outcome of the analysis, together with other factors such as Outotec's contractual position, will determine the eventual liability and financial impact of this incident for Outotec.

Antwort auf Beitrag Nr.: 59.824.404 von faultcode am 08.02.19 13:26:56aus den "FINANCIAL STATEMENTS AND REPORT BY THE BOARD OF DIRECTORS":

=>

• die Personalstruktur ist viel zu Europa-lastig

• auch ist der Order backlog recht lau (*)

• Kupfer ist hier das maßgebliche Metall, und zwar mit Abstand

(*) das ist interessant, da es auch heißen könnte, daß bei den betreffenden Rohstoffen es weiter Preisauftrieb geben könnte, da die Kunden von Outotec sich mit Aufträgen wiederholt zurückhalten. Stichwort: Kapazitäten

=>

• die Personalstruktur ist viel zu Europa-lastig

• auch ist der Order backlog recht lau (*)

• Kupfer ist hier das maßgebliche Metall, und zwar mit Abstand

(*) das ist interessant, da es auch heißen könnte, daß bei den betreffenden Rohstoffen es weiter Preisauftrieb geben könnte, da die Kunden von Outotec sich mit Aufträgen wiederholt zurückhalten. Stichwort: Kapazitäten

Antwort auf Beitrag Nr.: 59.931.599 von faultcode am 21.02.19 13:34:41

=>

...Outotec has signed a contract with the Moroccan OCP Group for the delivery of a sulfuric acid plant for fertilizer production. The approximately EUR 80 million order has been booked into Outotec's 2019 first quarter order intake.

Outotec's delivery includes the engineering, procurement and construction of the plant, which is based on Outotec's sulfur burning system. The new acid plant will incorporate advanced proprietary technologies such as HEROS heat recovery system as well as a converter, absorption towers and an acid distribution system that are made of the Edmeston SX stainless steel alloy.

With more than 20 acid plants and several mining sites, OCP Group is a global fertilizer producer and leader in the phosphate industry. The acid plant will be built in connection with their existing chemical complexes and support in OCP's fertilizer production from phosphate rock from their mining processes as a raw material.

"Outotec's sulfuric acid technology has proven to be one of the leading technologies for decades. We are honored that OCP has selected our design for their new plant. With our leading technologies providing benefits such as safety, high reliability and enhanced heat recovery we are happy to help OCP reach their sustainability targets," says Kalle Härkki, head of Outotec's Metals, Energy & Water business...

Outotec to deliver sulfuric acid plant to Morocco

https://www.wallstreet-online.de/nachricht/11305794-outotec-…=>

...Outotec has signed a contract with the Moroccan OCP Group for the delivery of a sulfuric acid plant for fertilizer production. The approximately EUR 80 million order has been booked into Outotec's 2019 first quarter order intake.

Outotec's delivery includes the engineering, procurement and construction of the plant, which is based on Outotec's sulfur burning system. The new acid plant will incorporate advanced proprietary technologies such as HEROS heat recovery system as well as a converter, absorption towers and an acid distribution system that are made of the Edmeston SX stainless steel alloy.

With more than 20 acid plants and several mining sites, OCP Group is a global fertilizer producer and leader in the phosphate industry. The acid plant will be built in connection with their existing chemical complexes and support in OCP's fertilizer production from phosphate rock from their mining processes as a raw material.

"Outotec's sulfuric acid technology has proven to be one of the leading technologies for decades. We are honored that OCP has selected our design for their new plant. With our leading technologies providing benefits such as safety, high reliability and enhanced heat recovery we are happy to help OCP reach their sustainability targets," says Kalle Härkki, head of Outotec's Metals, Energy & Water business...

Antwort auf Beitrag Nr.: 60.087.504 von faultcode am 13.03.19 11:26:19

=>

...Outotec and Russian iron ore pellet producer JSC Stoilensky GOK (S-GOK), which is a part of NLMK Group, have entered into a contract to expand S-GOK's pellet plant located in Stary Oskol, Russia. The approximately EUR 15 million order has been booked in Outotec's 2019 first quarter order intake.

Outotec has delivered the technology for S-GOK's pellet plant (press release September 12, 2011), which has been in operation since 2017. The annual capacity of the pellet plant will be increased from 6 to 8 million tonnes. Outotec will be responsible for the engineering, supply of key equipment and automation system as well as advisory services for installation and commissioning of the expansion. Outotec's latest technology improvements in green pelletizing, cooling air process, and pallet car changing system will be applied, together with a digital solution package. Outotec's deliveries will take place at the end of 2020...

Outotec awarded a pellet plant expansion contract by JSC Stoilensky GOK in Russia

https://www.wallstreet-online.de/nachricht/11342867-outotec-…=>

...Outotec and Russian iron ore pellet producer JSC Stoilensky GOK (S-GOK), which is a part of NLMK Group, have entered into a contract to expand S-GOK's pellet plant located in Stary Oskol, Russia. The approximately EUR 15 million order has been booked in Outotec's 2019 first quarter order intake.

Outotec has delivered the technology for S-GOK's pellet plant (press release September 12, 2011), which has been in operation since 2017. The annual capacity of the pellet plant will be increased from 6 to 8 million tonnes. Outotec will be responsible for the engineering, supply of key equipment and automation system as well as advisory services for installation and commissioning of the expansion. Outotec's latest technology improvements in green pelletizing, cooling air process, and pallet car changing system will be applied, together with a digital solution package. Outotec's deliveries will take place at the end of 2020...

Saudi Arabian Mining Company (Ma'aden) awarded Outotec a EUR 140 million gold processing plant order

ganz dicker Auftrag und sehr wichtig --> heißt das doch, daß die Sache mit dem Ofen doch nicht so schlimm ist, um einen anderen Großauftrag in Saudi Arabia zu blockieren:https://www.wallstreet-online.de/nachricht/11417822-saudi-ar…

=>

...In a major international competitive bidding process, the Saudi Arabian Mining Company (Ma'aden) has awarded the consortium of Outotec and Larsen & Toubro with an engineering, procurement and construction contract to build a greenfield mineral concentrator and gold processing plant in the Kingdom of Saudi Arabia.

Outotec's share of the project is over EUR 140 million. The order is almost evenly shared between the reporting segments and will be booked into Outotec's second quarter 2019 order intake. The total value of the project is approximately EUR 540 million...

Outotec's delivery includes basic and detail engineering, procurement and delivery of process equipment, commissioning, start-up assistance and training services. The new gold processing plant is due to be completed in 2022. Ma'aden is the champion of the Saudi Arabian mining industry, and now internationally recognized mining company with global presence.

The Mansourah & Massarah mines and processing plant will be built in the Central Arabian gold region. The processing plant will be capable of processing up to four million tonnes of ore per annum. The concentrator and the gold processing plant is designed producing an average of 250,000 ounces of gold per year over the life of mine...

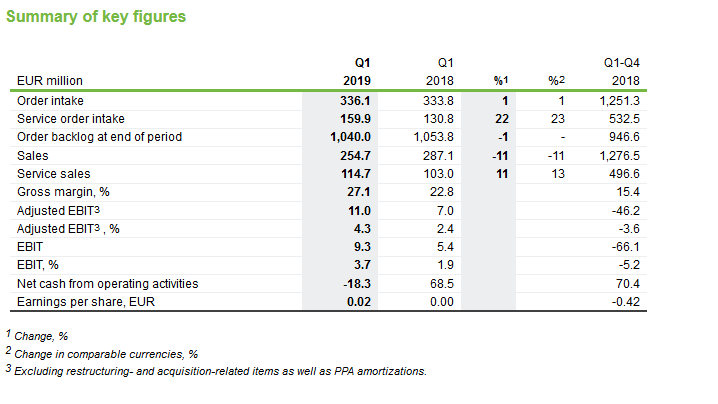

Antwort auf Beitrag Nr.: 60.457.277 von faultcode am 30.04.19 14:59:06

=>

2019Q1

https://www.wallstreet-online.de/nachricht/11437383-outotec-…=>

Antwort auf Beitrag Nr.: 60.515.757 von faultcode am 08.05.19 13:01:35

=>

...Outotec has been awarded a contract to design and deliver a mine paste backfill system to OZ Minerals' Prominent Hill mine. The contract price is EUR 15 million and it has been booked into Outotec's 2019 second quarter order intake.

Outotec's supply includes the design and delivery of a complete paste backfill system as well as detailed design of the underground distribution network and fill management systems. The new paste backfill plant will be based on a unique process design, which allows flexibility to use continuously produced fresh tailings or store filter cake to meet the future backfill needs of the underground mining operation.

The new facility is expected to have a capacity of 215 m3 per hour...

Outotec to deliver a mine paste backfill system to Australia

https://www.wallstreet-online.de/nachricht/11458247-outotec-…=>

...Outotec has been awarded a contract to design and deliver a mine paste backfill system to OZ Minerals' Prominent Hill mine. The contract price is EUR 15 million and it has been booked into Outotec's 2019 second quarter order intake.

Outotec's supply includes the design and delivery of a complete paste backfill system as well as detailed design of the underground distribution network and fill management systems. The new paste backfill plant will be based on a unique process design, which allows flexibility to use continuously produced fresh tailings or store filter cake to meet the future backfill needs of the underground mining operation.

The new facility is expected to have a capacity of 215 m3 per hour...

Grossauftrag: Outotec awarded EUR 250 million copper plant for Baikal Mining Company in Russia

eigentlich: sehr großer Auftraghttps://www.wallstreet-online.de/nachricht/11514756-outotec-…

=>

...In addition to Outotec's announcement on June 7, 2019 at 2:10 pm, Outotec has now signed a contract with Baikal Mining Company for the design and delivery of a greenfield copper concentrator and hydrometallurgical plant for the Udokan project located in the Kalarsky District in the Russian Far East.

The contract price is approximately EUR 250 million of which approximately EUR 35 million will be booked in Outotec's second quarter order intake. Roughly two thirds of the order will be booked for Minerals Processing and one third for Metals, Energy & Water segment.

Outotec's delivery includes basic and detail engineering of the concentrator and copper hydrometallurgical plant, procurement, delivery of main process equipment as well as installation supervision, training and start-up services.

The new metallurgical complex is expected to operate with the annual capacity of 12 million tonnes of ore and producing 130,000 tonnes of copper as high grade sulphide concentrate and as cathodes. Outotec's main deliveries are expected to take place in 2020.

"Udokan is the world's third largest known undeveloped copper deposit. We are extremely pleased about being selected as a technology partner in this significant project. Our proven technologies and services enable Baikal Mining Company to develop their operations in a sustainable way and get the best value from their assets," says Markku Teräsvasara, CEO of Outotec.

"As a result of years of research, together with leading Russian and international engineering companies, we have developed a unique flowsheet for processing the Udokan copper deposit. With Outotec's expertise and technologies we can automate the processes to the maximum extent," says Valery Kazikayev Chairman of the Board of Directors of the Baikal Mining Company...

=> das Desaster in Saudi Arabien ist damit aber noch nicht ausgestanden:

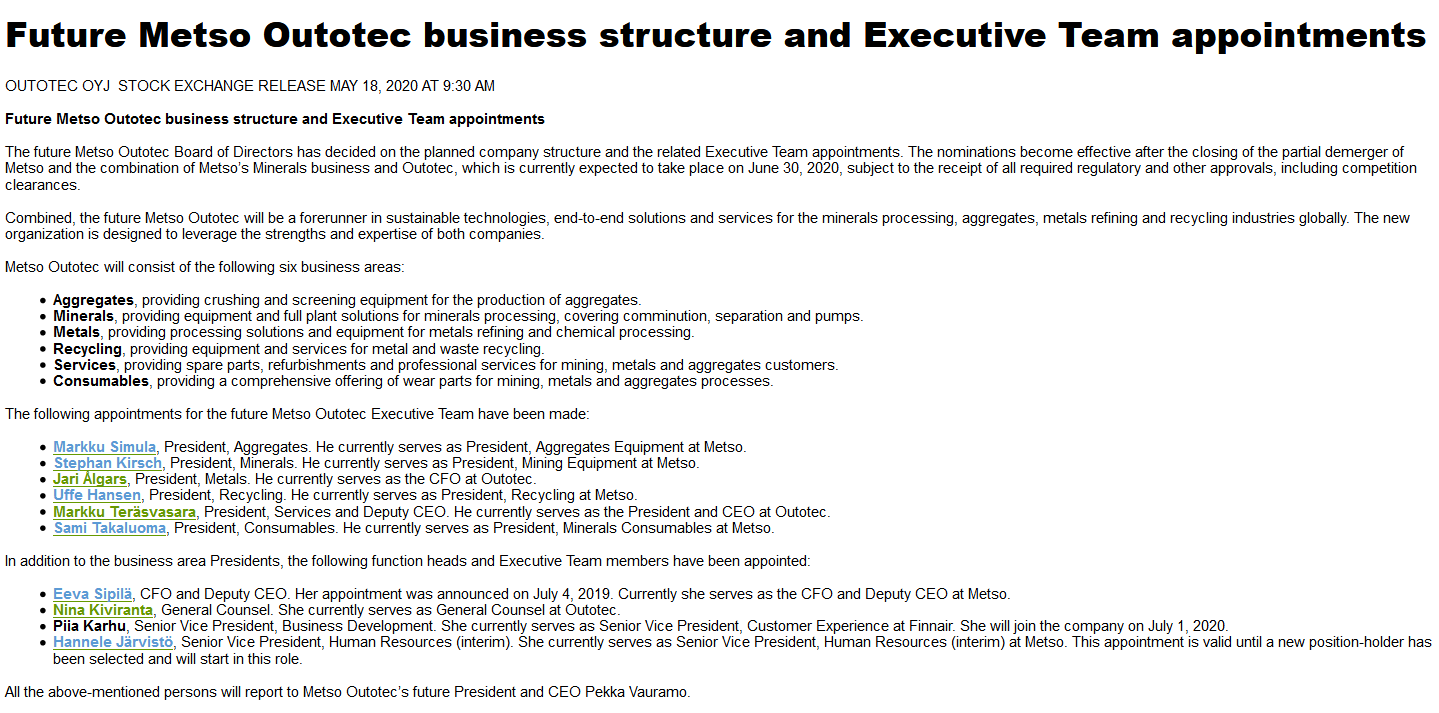

Combination of Metso Minerals and Outotec – Metso Flow Control to Become an Independent Company

https://markets.businessinsider.com/news/stocks/combination-…--> in einfach:

* Metso Minerals ohne Flow Control (=Ventile) + Outotec => Metso Outotec

=>

...

Combination of Metso Minerals and Outotec to Create a Leading Company in Process Technology, Equipment and Services Serving the Minerals, Metals and Aggregates Industries

Metso Flow Control to Become a Separately Listed Independent Flow Control Equipment and Services Company under the Name of Neles

Transaction Highlights

* Metso and Outotec have agreed to combine Metso Minerals and Outotec to create a leading company in process technology, equipment and services serving the minerals, metals and aggregates industries. The Combined Company, comprising Metso Minerals and Outotec (but excluding Metso Flow Control), will be named “Metso Outotec”. It had illustrative combined sales of €3.9 billion in 2018 (approximately €4.2 billion including the impact of the recently announced acquisition of McCloskey by Metso)

* Metso Flow Control will be a pure-play listed entity under the name of Neles with 2018 sales of €593 million

* The combination of Metso Minerals and Outotec is highly complementary and will create a unique company in the industry. Metso Outotec will leverage the strengths of both companies, including technology and R&D, product and process excellence, scale and global service offering footprint. The combination will deliver significant benefits to all stakeholders

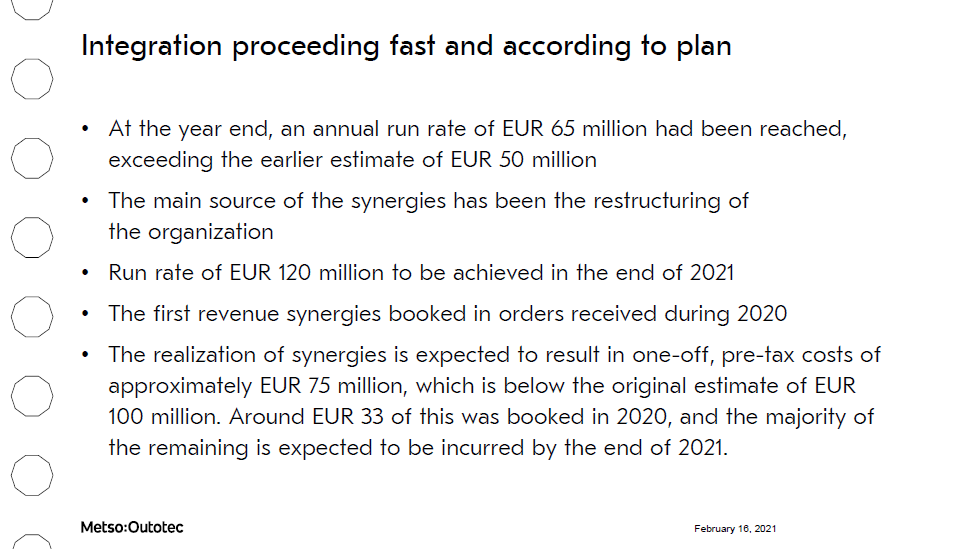

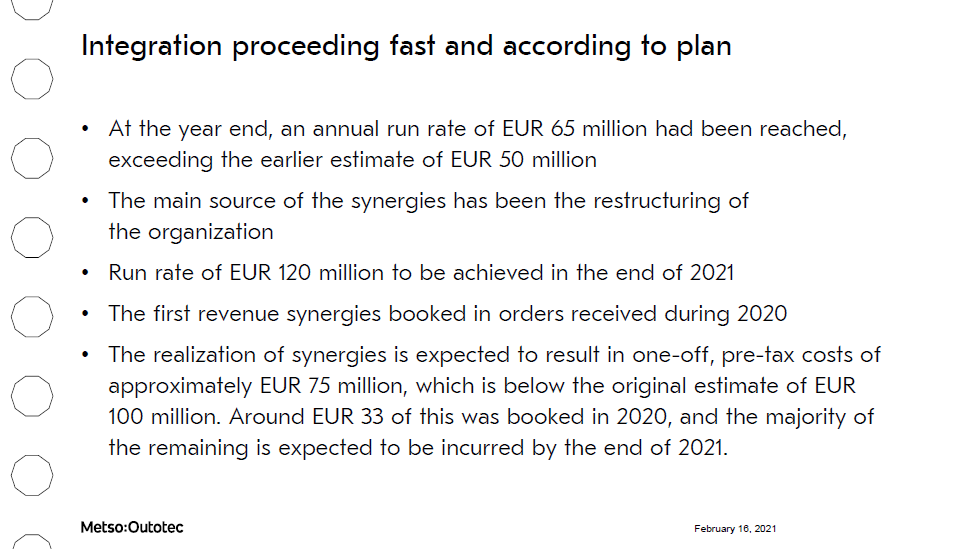

* Metso Minerals and Outotec expect to achieve run-rate annual pre-tax cost synergies of at least €100 million, and run-rate annual revenue synergies of at least €150 million, delivering significant value for shareholders

* The recently announced acquisition of McCloskey is expected to complement the business profile of Metso Outotec, expanding and strengthening the aggregates business

* Metso Outotec will benefit from strong free cash flow and a solid capital structure and will aim for an investment grade credit rating in line with the current Metso rating

* The dividend policy for Metso Outotec will be determined by the board of Metso Outotec following completion of the transaction. However, Metso Outotec is expected to have the capacity for an attractive dividend policy, consistent with Metso’s current dividend policy, while maintaining a strong balance sheet

* The combination will be implemented through a partial demerger of Metso, in which all assets and liabilities of Metso that relate to Metso Minerals will transfer to Outotec in exchange for newly-issued shares in Outotec to be delivered to Metso shareholders. Outotec shareholders will continue to own their shares in Outotec

* Upon completion, Metso shareholders will receive 4.3 newly-issued shares in Outotec for each share owned in Metso on the record date. This implies Metso shareholders would own approximately 78.0% of the shares and votes of Metso Outotec, and Outotec shareholders would own approximately 22.0% of the shares and votes of Metso Outotec. In addition, Metso shareholders will retain their current shares in Metso, which will be renamed Neles

* The current CEO of Metso, Mr. Pekka Vauramo, will become Metso Outotec’s CEO, and the current CEO of Outotec, Mr. Markku Teräsvasara, will become the Deputy CEO of Metso Outotec. Ms. Eeva Sipilä will become the CFO and Deputy CEO of Metso Outotec

* The board of Metso Outotec will include board members from both companies. It is proposed that Metso Outotec’s Chairman will be Mr. Mikael Lilius and that the Vice Chairman will be Mr. Matti Alahuhta

* The transaction is unanimously recommended by the boards of Metso and Outotec to their respective shareholders. The transaction is subject to, among other items, approval by a majority of two-thirds of votes cast and shares represented at the respective EGMs of Metso and Outotec in respect of the transaction, and regulatory approvals including competition clearances. As the transaction is proposed to be implemented by way of a partial demerger of Metso, it is also subject to a statutory creditor hearing process of Metso’s creditors

* Shareholders representing 33.6% of the shares and votes of Metso and shareholders representing 24.8% of the shares and votes of Outotec have irrevocably undertaken to vote in favor of the transaction

* Metso Outotec will apply and seek to develop the sustainability agendas of Metso and Outotec across the enlarged group

* A €1.55 billion backup and term loan facilities agreement has been entered into with Nordea Bank Abp initially for the benefit of Metso but which, upon completion of the transaction, will transfer to Metso Outotec to address certain potential financing and refinancing needs arising from or in connection with the transaction

* Metso Outotec’s headquarters will be in Helsinki, Finland and it will maintain its listing on Nasdaq Helsinki

* Completion is expected in the second quarter of 2020, subject to the approval of the transaction by the EGMs of both Metso and Outotec, the statutory creditor hearing process and receipt of all required regulatory and other approvals

..

Antwort auf Beitrag Nr.: 60.955.039 von faultcode am 04.07.19 15:11:37

+22%

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Antwort auf Beitrag Nr.: 60.955.060 von faultcode am 04.07.19 15:15:02

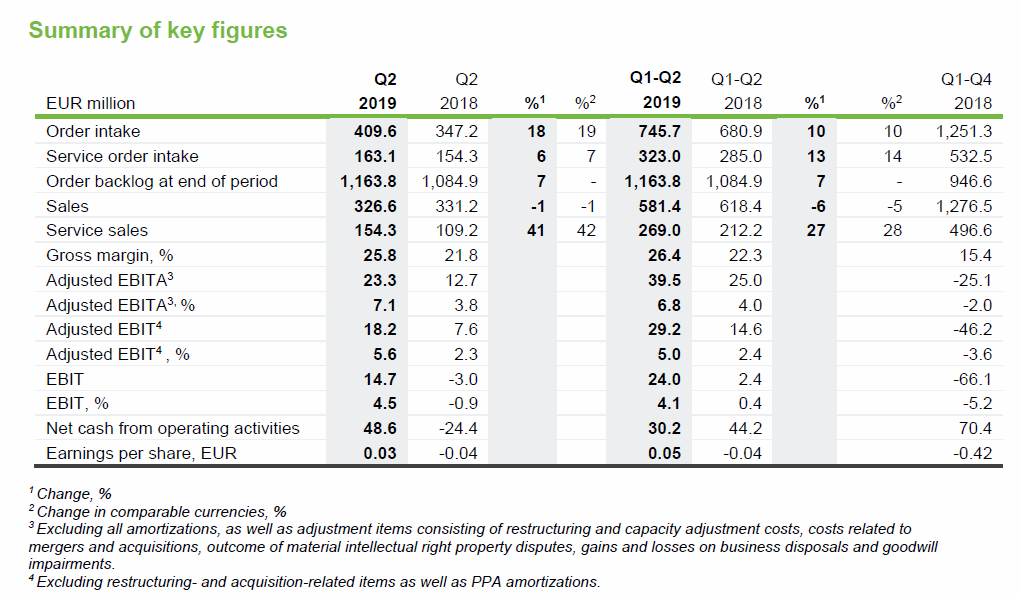

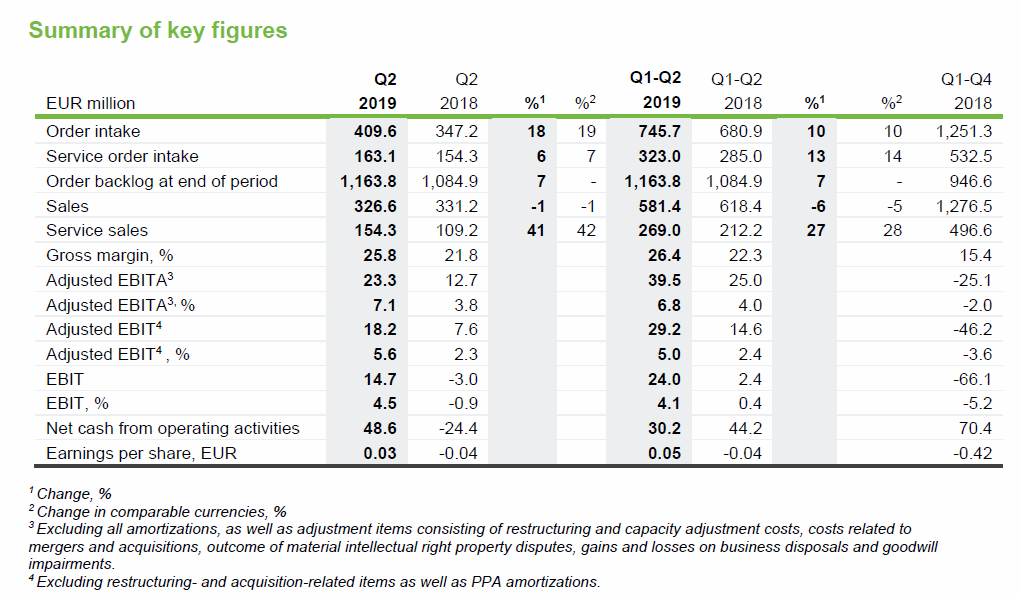

“The market for minerals and metals processing technologies continued to be active during the first half of the year. Our order intake increased by 10% from last year in the reporting period and by 18% in the second quarter. Received orders included approximately EUR 140 million gold processing plant as well as a copper concentrator and hydrometallurgical plant of approximately EUR 250 million, of which EUR 35 million was recorded in the second quarter order intake.

Sales were slightly lower for the reporting period compared to the previous year. Sales for the second quarter were on the same level as during the previous year. This was primarily due to fewer plant and equipment deliveries resulting from the lower order intake during H2 2018. Our efforts to improve the service supply chain and delivery achieved good results. Service sales increased by 27% during the reporting period and 41% during the second quarter. Profitability significantly improved both in absolute and relative terms due to the sales mix and better project execution.

The profitability of the Metals, Energy & Water segment is developing in the right direction but is still unsatisfactory. Cash flow for the reporting period was solid as a result of positive development in trade receivables and for the second quarter due to increased customer advance payments.

R&D activities continued to provide valuable benefits to our customers. For example, we introduced a next generation Outotec Paste Thickener, designed especially for tailings treatment. Tailings dewatering and disposal is a challenge that every mining operation has to confront. We also introduced the FP-S Filter Press as a cost-effective product for a wide range of standard filtration applications.

Negotiations concerning the ilmenite smelter project are ongoing, and we remain confident that the EUR 110 million provision made in the last quarter of 2018 is adequate.

On July 4th, we announced the planned combination of Outotec and Metso Minerals. The strengths of these companies are highly complementary and with this merger we are creating a leading company in process technology, equipment and services serving the minerals, metals and aggregates industries. Completion is expected in the second quarter of 2020.

The new company Metso Outotec will be able to leverage the heritage of both companies: technology and R&D, product and process excellence, scale and global service footprint. I am excited about this new strategic direction into which we are heading......

=>

--> (überraschend) gute Zahlen -- eigentlich Superzahlen mMn

--> der Metso-Kurs hat auch schon zuletzt angezogen:

Outotec’s half year financial report 2019

Strong growth in order intake and service sales, significant improvement in profitability“The market for minerals and metals processing technologies continued to be active during the first half of the year. Our order intake increased by 10% from last year in the reporting period and by 18% in the second quarter. Received orders included approximately EUR 140 million gold processing plant as well as a copper concentrator and hydrometallurgical plant of approximately EUR 250 million, of which EUR 35 million was recorded in the second quarter order intake.

Sales were slightly lower for the reporting period compared to the previous year. Sales for the second quarter were on the same level as during the previous year. This was primarily due to fewer plant and equipment deliveries resulting from the lower order intake during H2 2018. Our efforts to improve the service supply chain and delivery achieved good results. Service sales increased by 27% during the reporting period and 41% during the second quarter. Profitability significantly improved both in absolute and relative terms due to the sales mix and better project execution.

The profitability of the Metals, Energy & Water segment is developing in the right direction but is still unsatisfactory. Cash flow for the reporting period was solid as a result of positive development in trade receivables and for the second quarter due to increased customer advance payments.

R&D activities continued to provide valuable benefits to our customers. For example, we introduced a next generation Outotec Paste Thickener, designed especially for tailings treatment. Tailings dewatering and disposal is a challenge that every mining operation has to confront. We also introduced the FP-S Filter Press as a cost-effective product for a wide range of standard filtration applications.

Negotiations concerning the ilmenite smelter project are ongoing, and we remain confident that the EUR 110 million provision made in the last quarter of 2018 is adequate.

On July 4th, we announced the planned combination of Outotec and Metso Minerals. The strengths of these companies are highly complementary and with this merger we are creating a leading company in process technology, equipment and services serving the minerals, metals and aggregates industries. Completion is expected in the second quarter of 2020.

The new company Metso Outotec will be able to leverage the heritage of both companies: technology and R&D, product and process excellence, scale and global service footprint. I am excited about this new strategic direction into which we are heading......

=>

--> (überraschend) gute Zahlen -- eigentlich Superzahlen mMn

--> der Metso-Kurs hat auch schon zuletzt angezogen:

Outotec delivers coated titanium anodes to Glencore Nikkelverk AS new copper tankhouse in Norway

OUTOTEC OYJ PRESS RELEASE OCTOBER 10.10.2019 AT 10:00 AMOutotec has agreed with Glencore Nikkelverk AS on the delivery of coated Titanium Anodes to the new tankhouse for copper electrowinning plant in Norway. The delivery will include over 5,000 of the new mixed metal oxide coated titanium anodes. The order value, booked into Outotec’s third quarter order intake, is approximately EUR 10 million.

Glencore Nikkleverk refinery in Kristiansand Norway produces approximately 40,000 tonnes of copper per annum. Outotec's coated titanium anodes were tested on-site for 5 years, and the results verified that Outotec anodes will operate at a significant reduction in energy consumption and provide higher current efficiency than traditional lead anodes.

Outotec Coated Titanium Anodes provide totally lead-free electrowinning operations and increased occupational health and safety by eliminating lead and lead sludge handling. The end result for Glencore Nikkelverk AS is green technology electrowinning operations with higher quality copper product at lower energy consumption and operating costs.

"This is one more reference delivery of Outotec Coated Titanium Anodes in the copper electrowinning industry. The energy efficiency benefits and lower operating costs of our anodes enable Glencore Nikkelverk to improve their profitability in a sustainable way”, says Kalle Härkki, head of Outotec's Metals, Energy & Water business area...

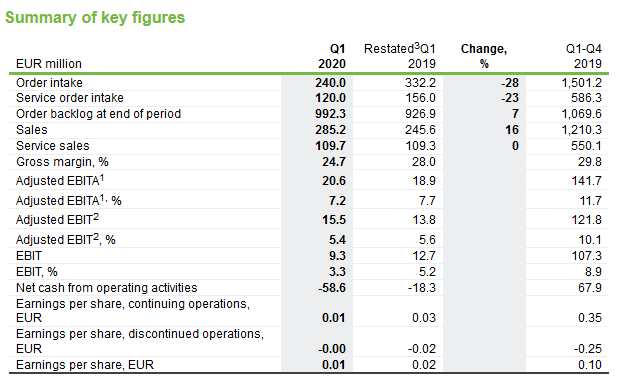

Outotec's interim report January-September 2019

25.10.https://www.outotec.com/company/media/news/2019/outotecs-int…

=> sehr gute Zahlen:

...We remain positive about the current market outlook for mining and metals and reiterate our guidance for 2019,” concludes President & CEO Markku Teräsvasara.

30.1.

Outotec and Neste introduce 100% bio-based diluent as a new solution for metals extraction

https://finance.yahoo.com/news/outotec-neste-introduce-100-b…

...

Outotec and Neste have jointly verified the viability of applying Neste MY Renewable Isoalkane™ as a fully bio-based diluent for extracting metals in hydrometallurgical processes. The diluent is based on Neste’s NEXBTL technology and produced entirely from bio-based waste and residue raw materials.

Laboratory studies and pilot trials at the Outotec Research Center in Pori and Neste’s Technology Center in Porvoo, Finland, confirmed the high-level performance of the product for solvent extraction of copper, and it can be also used for other base metals.

Thanks to its renewable origins and being readily biodegradable, the bio-based diluent reduces environmental risk and has a remarkably smaller carbon footprint over its life cycle when compared to fossil equivalents. Moreover, Neste MY Renewable Isoalkane evaporates at a lower rate, which improves copper extraction efficiency and safety due to significantly reduced volatile organic compounds (VOCs).

Neste MY Renewable Isoalkane is fully compatible with conventional fossil diluents at solvent extraction plants, and it can be introduced into the extraction process without any downtime.

...

Outotec and Neste have agreed to cooperate in introducing the Neste MY Renewable Isoalkane to metal producers. Outotec will provide technical industry expertise, whereas Neste will be responsible for the production, sales and deliveries of the bio-based diluent to the solvent extraction sites globally.

...

Outotec and Neste introduce 100% bio-based diluent as a new solution for metals extraction

https://finance.yahoo.com/news/outotec-neste-introduce-100-b…

...

Outotec and Neste have jointly verified the viability of applying Neste MY Renewable Isoalkane™ as a fully bio-based diluent for extracting metals in hydrometallurgical processes. The diluent is based on Neste’s NEXBTL technology and produced entirely from bio-based waste and residue raw materials.

Laboratory studies and pilot trials at the Outotec Research Center in Pori and Neste’s Technology Center in Porvoo, Finland, confirmed the high-level performance of the product for solvent extraction of copper, and it can be also used for other base metals.

Thanks to its renewable origins and being readily biodegradable, the bio-based diluent reduces environmental risk and has a remarkably smaller carbon footprint over its life cycle when compared to fossil equivalents. Moreover, Neste MY Renewable Isoalkane evaporates at a lower rate, which improves copper extraction efficiency and safety due to significantly reduced volatile organic compounds (VOCs).

Neste MY Renewable Isoalkane is fully compatible with conventional fossil diluents at solvent extraction plants, and it can be introduced into the extraction process without any downtime.

...

Outotec and Neste have agreed to cooperate in introducing the Neste MY Renewable Isoalkane to metal producers. Outotec will provide technical industry expertise, whereas Neste will be responsible for the production, sales and deliveries of the bio-based diluent to the solvent extraction sites globally.

...

6.2.

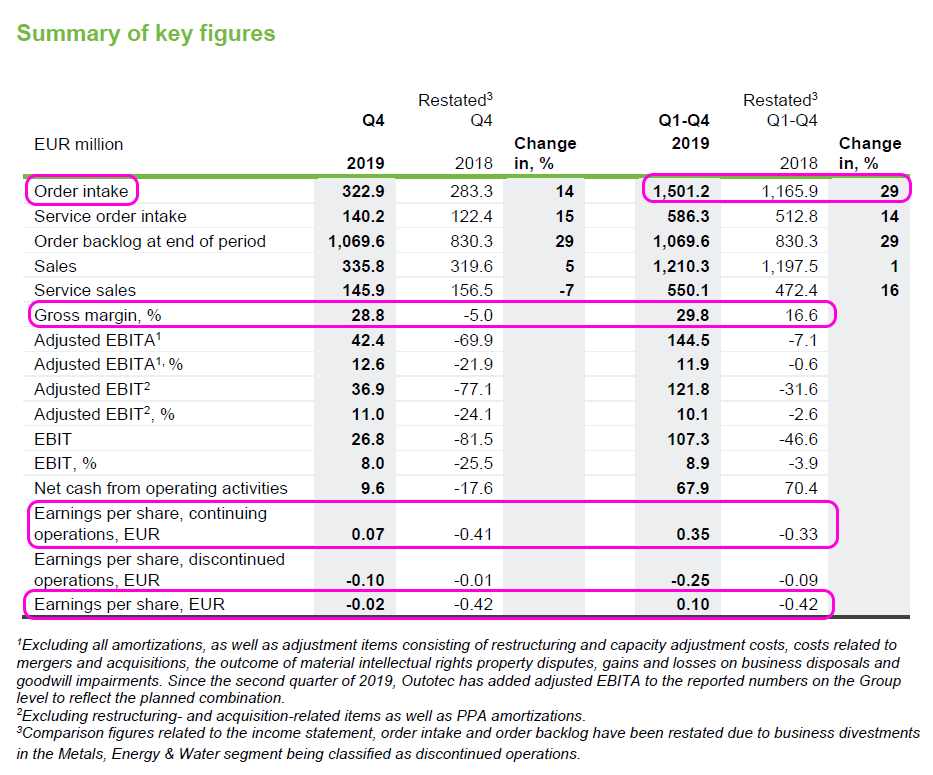

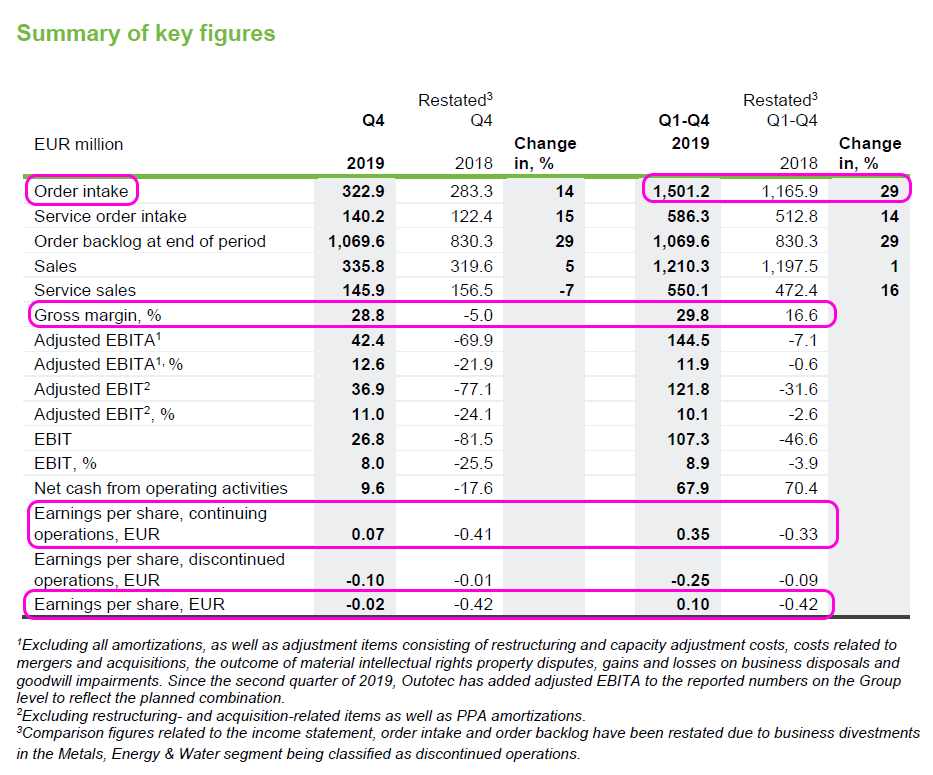

Outotec's Financial Statements Review January-December 2019

https://www.wallstreet-online.de/nachricht/12139324-outotec-…

=>

Rock 'n' Roll:

...

THE COMBINATION OF OUTOTEC AND METSO MINERALS

Outotec and Metso have previously communicated that the completion of the combination of Outotec and Metso’s Minerals business is expected to take place in the second quarter of 2020, subject to the receipt of all required regulatory and other approvals, including competition clearances.

Considering the progress of the regulatory approval process, Outotec and Metso currently expect the completion of the combination of Outotec and Metso’s Minerals business to take place on June 30, 2020, subject to the receipt of all required regulatory and other approvals, including competition clearances.

...

OUTLOOK FOR 2020

The market activity in minerals processing and metals refining is currently expected to remain at present level. Copper, gold and nickel projects are expected to continue to be the most active. The timing of large investments is uncertain.

Outotec will not issue Group financial guidance for 2020, as the combination of Outotec and Metso’s Minerals business is currently expected to take place on June 30, 2020. This remains subject to the receipt of all required regulatory and other approvals, including competition clearances.

...

(FC: Format)

Outotec's Financial Statements Review January-December 2019

https://www.wallstreet-online.de/nachricht/12139324-outotec-…

=>

Rock 'n' Roll:

...

THE COMBINATION OF OUTOTEC AND METSO MINERALS

Outotec and Metso have previously communicated that the completion of the combination of Outotec and Metso’s Minerals business is expected to take place in the second quarter of 2020, subject to the receipt of all required regulatory and other approvals, including competition clearances.

Considering the progress of the regulatory approval process, Outotec and Metso currently expect the completion of the combination of Outotec and Metso’s Minerals business to take place on June 30, 2020, subject to the receipt of all required regulatory and other approvals, including competition clearances.

...

OUTLOOK FOR 2020

The market activity in minerals processing and metals refining is currently expected to remain at present level. Copper, gold and nickel projects are expected to continue to be the most active. The timing of large investments is uncertain.

Outotec will not issue Group financial guidance for 2020, as the combination of Outotec and Metso’s Minerals business is currently expected to take place on June 30, 2020. This remains subject to the receipt of all required regulatory and other approvals, including competition clearances.

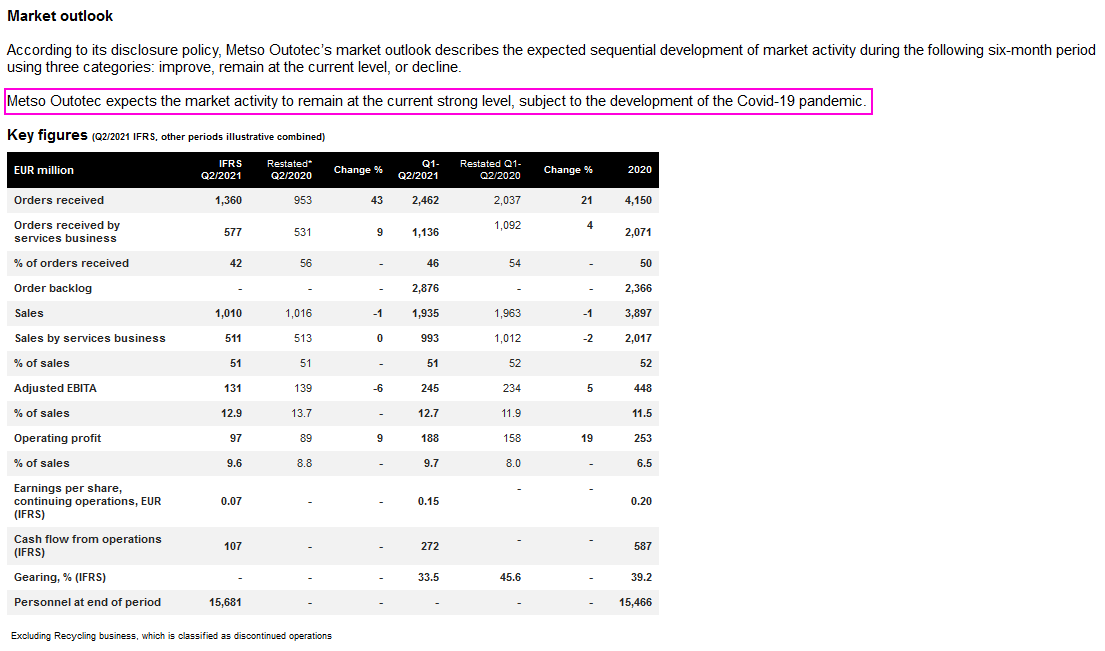

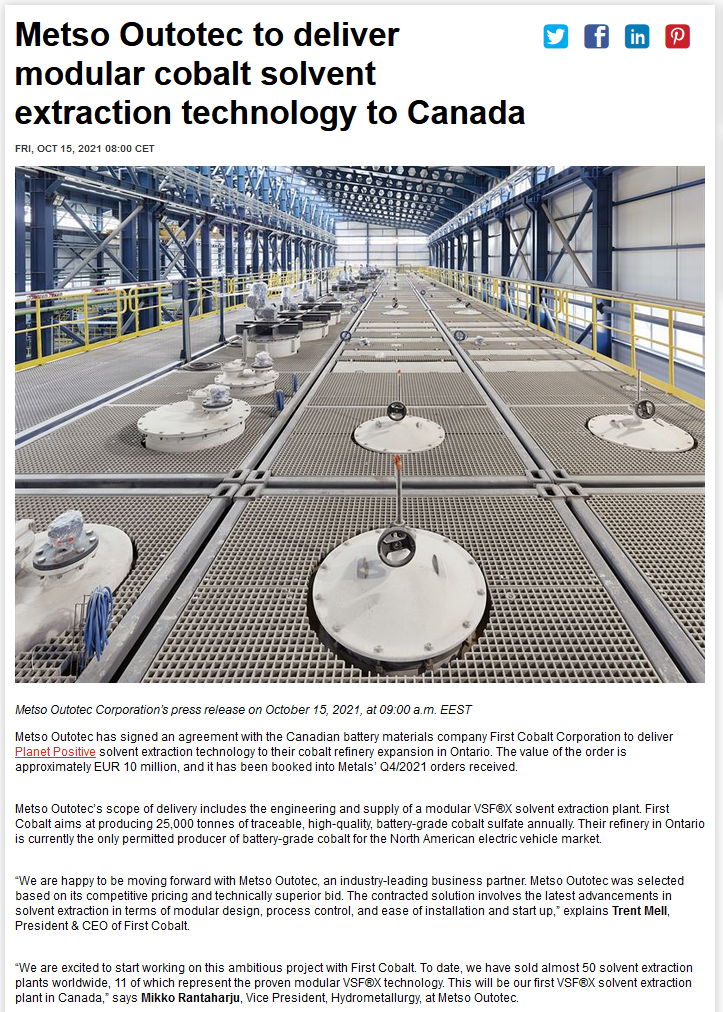

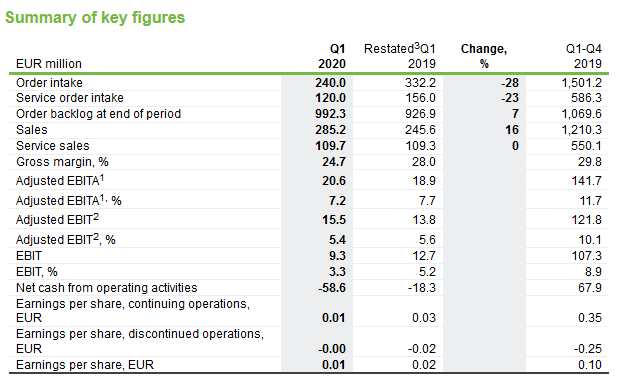

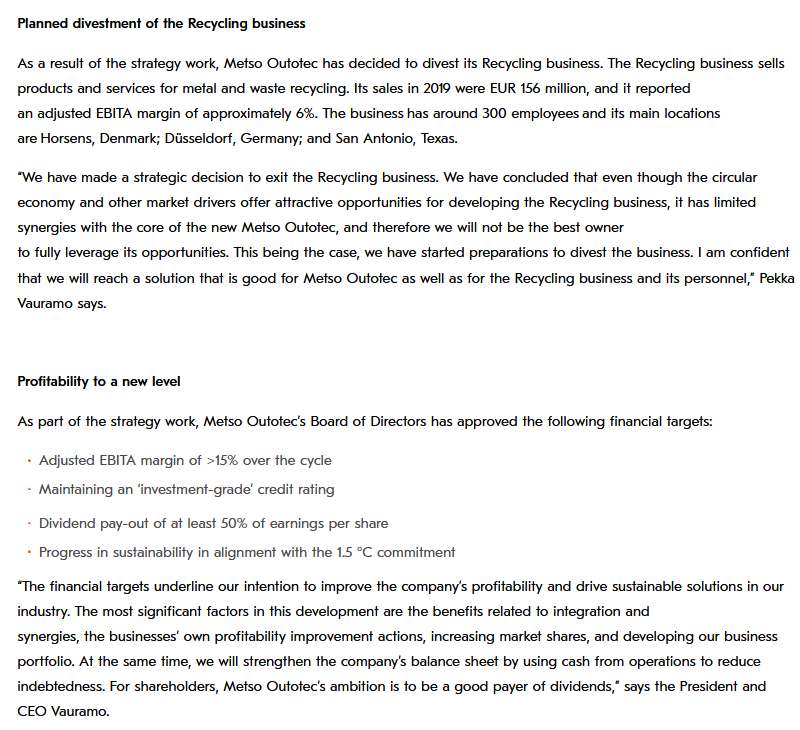

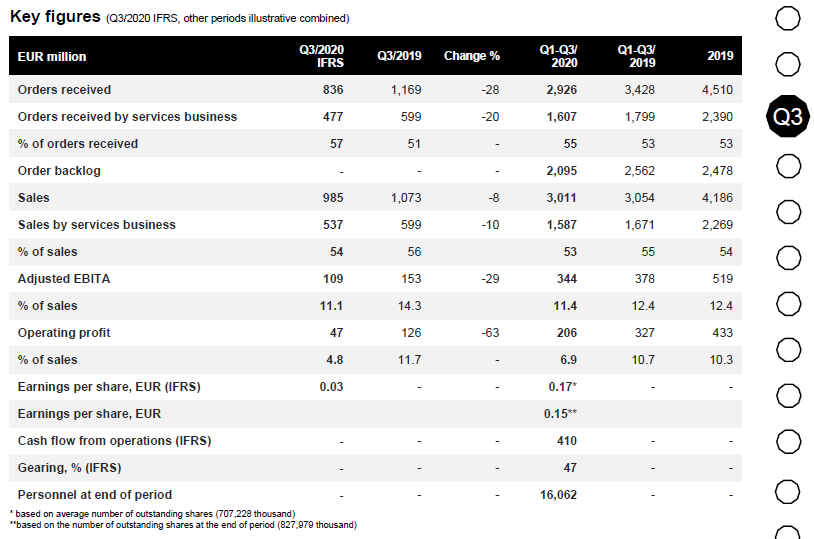

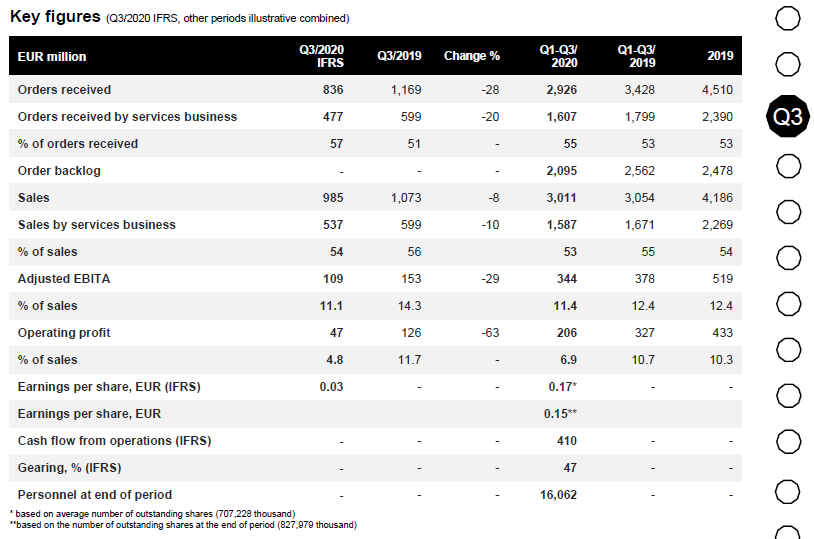

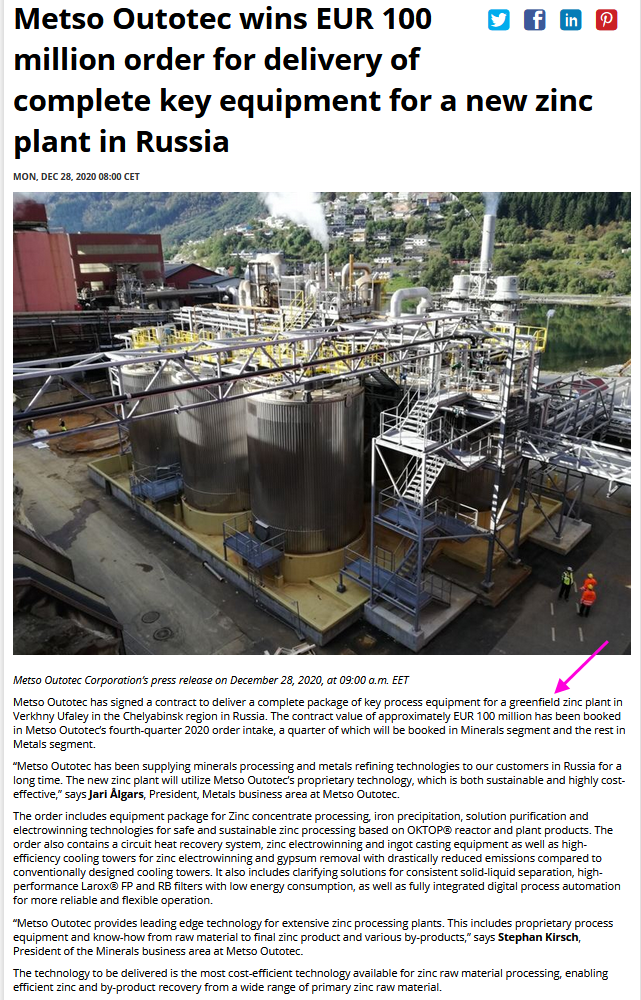

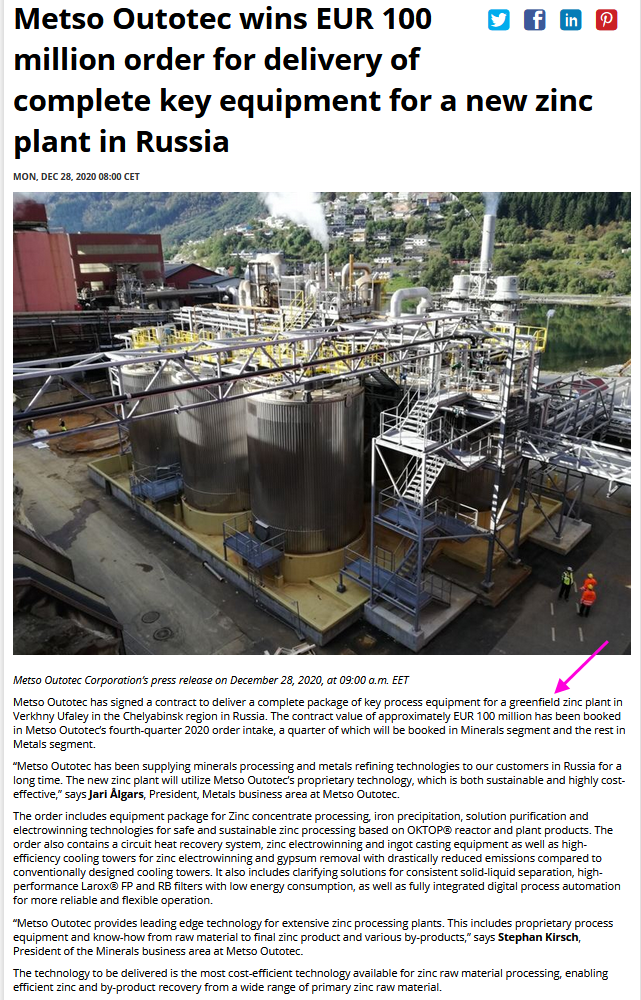

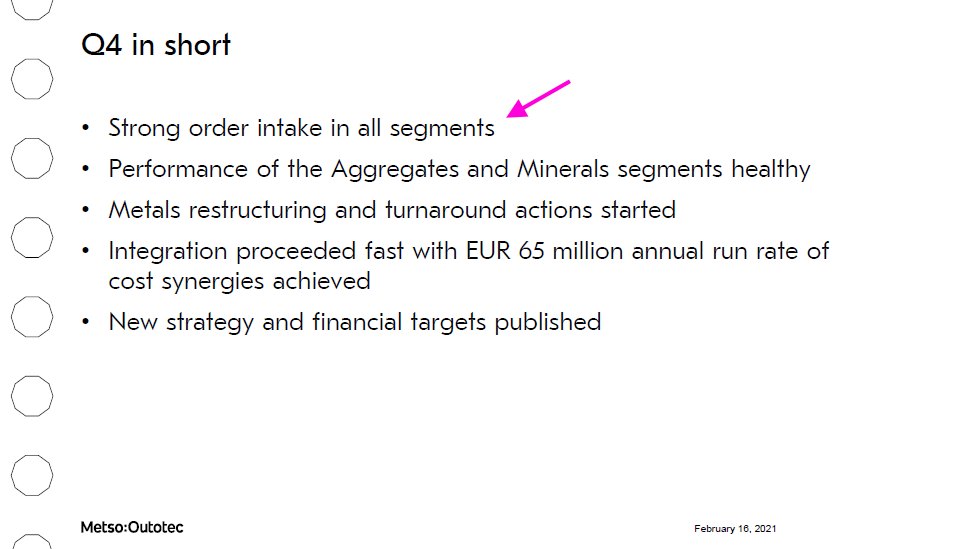

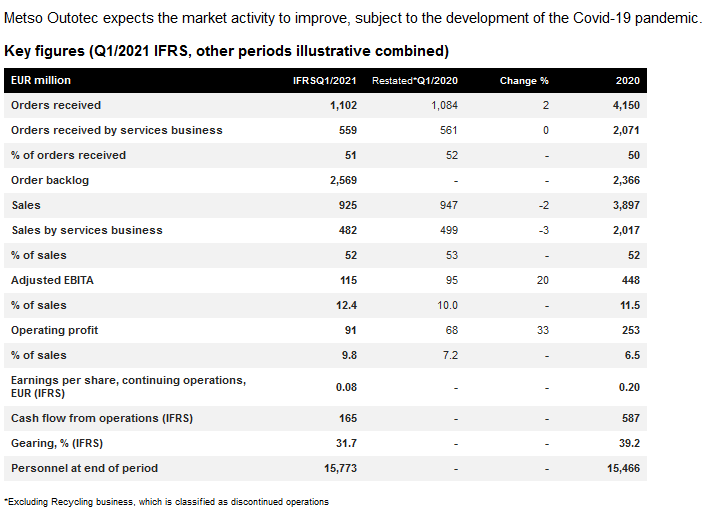

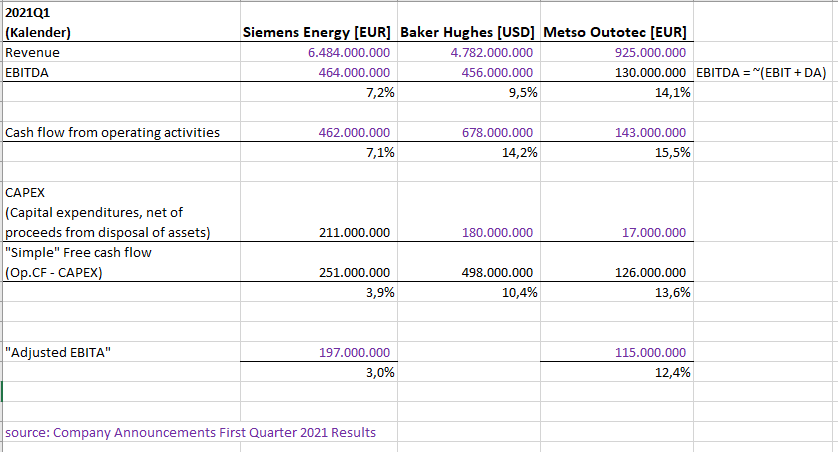

...