Bearing Lithium - 500 Beiträge pro Seite

eröffnet am 19.06.17 10:34:50 von

neuester Beitrag 10.12.22 15:40:17 von

neuester Beitrag 10.12.22 15:40:17 von

Beiträge: 203

ID: 1.255.505

ID: 1.255.505

Aufrufe heute: 0

Gesamt: 10.587

Gesamt: 10.587

Aktive User: 0

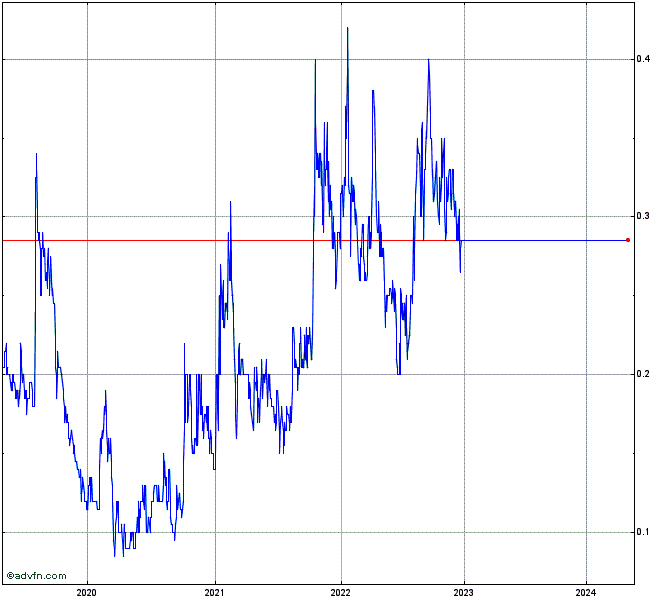

ISIN: CA0738981087 · WKN: A2NB29

0,1805

EUR

-5,50 %

-0,0105 EUR

Letzter Kurs 15.12.22 Tradegate

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9900 | +90,38 | |

| 0,9898 | +41,20 | |

| 14,000 | +26,13 | |

| 198,20 | +19,98 | |

| 246,10 | +16,25 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6.700,00 | -6,94 | |

| 11.521,50 | -9,88 | |

| 3,1200 | -10,60 | |

| 8,9000 | -11,00 | |

| 1,5800 | -11,73 |

Nachdem wochenlang gar nichts passiert ist kommt jetzt ein wenig Bewegung in diese Aktie. Weiß jemand mehr über dieses Unternehmen? Hatte die Aktie nur gekauft, weil da Lithium drin steht.

Antwort auf Beitrag Nr.: 55.162.826 von Willy1901 am 19.06.17 10:34:50http://www.marketwatch.com/investing/stock/brgrf/profile

Antwort auf Beitrag Nr.: 55.162.826 von Willy1901 am 19.06.17 10:34:50

Die haben Die "Assets" Einer Firma namens "Li3 Energy" übernommen(Anteil),

das möglicherweise sehr schlagkräftig sein kann.

ich kannte Die VorgängerAG,

die habens aber im Prinzip "verbockt"

Die haben Die "Assets" Einer Firma namens "Li3 Energy" übernommen(Anteil),

das möglicherweise sehr schlagkräftig sein kann.

ich kannte Die VorgängerAG,

die habens aber im Prinzip "verbockt"

Ja, sehr schwierig Informationen zu dieser Aktie zu bekommen.

das kennt iht bestimmt schon aus dem Mai

https://www.wallstreet-online.de/nachricht/9542479-nebenwert…

https://www.wallstreet-online.de/nachricht/9542479-nebenwert…

Antwort auf Beitrag Nr.: 55.354.112 von clonecrash am 19.07.17 12:32:49Ja, das ist bekannt. Aktuellere News gibt es auch auf stockwatch

Antwort auf Beitrag Nr.: 55.165.337 von Popeye82 am 19.06.17 17:04:44

www.bearingresources.ca/announcements/bearing-announces-jorc…

www.bearingresources.ca/announcements/bearing-announces-jorc…

ich hab mal ein paar geholt, nochmal nachkaufen hab ich eingeplant.

Von der Ressource bin ich überzeugt, leider nicht von der Fähigkeit der Produktion.

Von der Ressource bin ich überzeugt, leider nicht von der Fähigkeit der Produktion.

Heute über den Verteiler erhalten:

Dear Shareholder,

We are pleased to announce that the Gold Newsletter, published by Brein Lundin, has recommended Bearing Lithium in the October 2017 edition. A summary of the article is presented below and further details can be found on the Gold Newsletter website at https://goldnewsletter.com.

Bearing Lithium

BRZ.V; BRGRF.OB

604-262-8835

bearinglithium.com

With the lithium trend showing no signs of abating, I’ve been on the lookout for undervalued ways to play the trend for the last year or so. I’ve finally found just the ticket in Bearing Lithium.

The big risk factor that had prevented me from recommending Bearing until now was SEC approval of its merger with Li3 Energy. With that approval now recently secured, this seems like the perfect time to add the company to our portfolio.

The Li3 transaction has brought with it an interest in the Maricunga project, the highest-grade undeveloped lithium brine project in the world. The company will own 17.7% of the project when all the dust settles in 2018, and it will be carried through feasibility through most of 2018. So, Bearing will maintain exposure to Maricunga with no project-level expenditures required.

A prefeasibility study by on the project is due by late October-early November, and will probably show an operating rate for the processing facility of 20,000-25,000 tonnes/year at very high grades. The feasibility study will follow in Q2 2018 and will be bankable.

In short, rapid news flow now is forthcoming — much of it has been happening behind the scenes while the company was quietly awaiting SEC approval for the merger. By way of analogy, peer companies in the lithium exploration/development space have seen bigger companies, most notably Ganfeng, supply needed development financing in exchange for stakes in projects and/or off-take agreements. So it’s possible that

Bearing will not have any need to finance its share of construction costs at Maricunga.

In terms of what’s possible on the valuation side, Lithium Americas is the best and probably only relevant comparison for Bearing. Lithium Americas’ deposit is 1.5 million tonnes at a grade of 600 mg/L with

a cash operating cost of $2,495/tonne. Lithium Americas owns 45% of the project, which is estimated to produce 25,000 tonnes/year over a 40-year mine life. The project’s NPV is C$1.1 billion, but the market is valuing project at around C$1.5 billion (Lithium Americas has a C$680 million market cap).

By way of comparison, Maricunga has a 2.2 million-tonne resource at 1.7 times the grade (1,100 mg/L). It is also looking at 20,000-25,000 tonnes annual production, with a resource that is two times greater in terms of grade. The market is currently valuing Bearing at around C$40 million, so you can ascribe value to the entire Maricunga project of roughly C$220 million. In short, with the upcoming prefeasibility study likely to show a very favorable comparison with Lithium Americas’ project, Bearing could be in line for a major rerating.

Which is why I’m recommending it now.

Between the red-hot lithium market and the upcoming study, Bearing’s market value looks likely to accelerate up from here. It’s a buy at current levels. (Disclosure: I do not own Bearing Lithium at this time.)

https://goldnewsletter.com.

Dear Shareholder,

We are pleased to announce that the Gold Newsletter, published by Brein Lundin, has recommended Bearing Lithium in the October 2017 edition. A summary of the article is presented below and further details can be found on the Gold Newsletter website at https://goldnewsletter.com.

Bearing Lithium

BRZ.V; BRGRF.OB

604-262-8835

bearinglithium.com

With the lithium trend showing no signs of abating, I’ve been on the lookout for undervalued ways to play the trend for the last year or so. I’ve finally found just the ticket in Bearing Lithium.

The big risk factor that had prevented me from recommending Bearing until now was SEC approval of its merger with Li3 Energy. With that approval now recently secured, this seems like the perfect time to add the company to our portfolio.

The Li3 transaction has brought with it an interest in the Maricunga project, the highest-grade undeveloped lithium brine project in the world. The company will own 17.7% of the project when all the dust settles in 2018, and it will be carried through feasibility through most of 2018. So, Bearing will maintain exposure to Maricunga with no project-level expenditures required.

A prefeasibility study by on the project is due by late October-early November, and will probably show an operating rate for the processing facility of 20,000-25,000 tonnes/year at very high grades. The feasibility study will follow in Q2 2018 and will be bankable.

In short, rapid news flow now is forthcoming — much of it has been happening behind the scenes while the company was quietly awaiting SEC approval for the merger. By way of analogy, peer companies in the lithium exploration/development space have seen bigger companies, most notably Ganfeng, supply needed development financing in exchange for stakes in projects and/or off-take agreements. So it’s possible that

Bearing will not have any need to finance its share of construction costs at Maricunga.

In terms of what’s possible on the valuation side, Lithium Americas is the best and probably only relevant comparison for Bearing. Lithium Americas’ deposit is 1.5 million tonnes at a grade of 600 mg/L with

a cash operating cost of $2,495/tonne. Lithium Americas owns 45% of the project, which is estimated to produce 25,000 tonnes/year over a 40-year mine life. The project’s NPV is C$1.1 billion, but the market is valuing project at around C$1.5 billion (Lithium Americas has a C$680 million market cap).

By way of comparison, Maricunga has a 2.2 million-tonne resource at 1.7 times the grade (1,100 mg/L). It is also looking at 20,000-25,000 tonnes annual production, with a resource that is two times greater in terms of grade. The market is currently valuing Bearing at around C$40 million, so you can ascribe value to the entire Maricunga project of roughly C$220 million. In short, with the upcoming prefeasibility study likely to show a very favorable comparison with Lithium Americas’ project, Bearing could be in line for a major rerating.

Which is why I’m recommending it now.

Between the red-hot lithium market and the upcoming study, Bearing’s market value looks likely to accelerate up from here. It’s a buy at current levels. (Disclosure: I do not own Bearing Lithium at this time.)

https://goldnewsletter.com.

Antwort auf Beitrag Nr.: 55.889.209 von married am 05.10.17 19:23:09Zum letzten Absatz meint die Übersetzungssoftware

"Zwischen dem rotglühenden Lithiummarkt und der anstehenden Studie dürfte sich der Marktwert von Bearing von hier aus beschleunigen. Es ist ein Kauf auf dem aktuellen Niveau".

"Zwischen dem rotglühenden Lithiummarkt und der anstehenden Studie dürfte sich der Marktwert von Bearing von hier aus beschleunigen. Es ist ein Kauf auf dem aktuellen Niveau".

Canada hat heute geschlossen....und schon bekommen deutsche Käufer hier

die Aktien unter pari

die Aktien unter pari

Ein Schelm wer Böses dabei denkt !

"options to directors, officers and consultants of the company .... at an exercise price of 80 cents. "

Ob deshalb wohl der Kurs um die 80 cents wie festgenagelt war .... die letzte Zeit .... trotz der guten news.

Dann sollte er ( der Kurs ) ja bald wieder durchstarten können.

Bearing grants options to buy 1.25 million shares

2017-10-06 19:01 ET - News Release

Mr. Jeremy Poirier reports

BEARING ANNOUNCES GRANT OF STOCK OPTIONS

Bearing Lithium Corp.'s board of directors has approved the grant of incentive options to directors, officers and consultants of the company to purchase up to 1.25 million common shares. The options are exercisable on or before Oct. 6, 2022, at an exercise price of 80 cents.

About Bearing Lithium Corp.

Bearing's primary asset is a free-carried 17.7-per-cent interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only preproduction project in Chile. Over $30-million (U.S.) has been invested in the project to date, and all expenditures through 2018, including the delivery of a definitive feasibility study in the first half of 2018, are fully financed by Bearing's earn-in joint venture partner. Bearing also holds a portfolio of grassroots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aBRZ-2513…

"options to directors, officers and consultants of the company .... at an exercise price of 80 cents. "

Ob deshalb wohl der Kurs um die 80 cents wie festgenagelt war .... die letzte Zeit .... trotz der guten news.

Dann sollte er ( der Kurs ) ja bald wieder durchstarten können.

Bearing grants options to buy 1.25 million shares

2017-10-06 19:01 ET - News Release

Mr. Jeremy Poirier reports

BEARING ANNOUNCES GRANT OF STOCK OPTIONS

Bearing Lithium Corp.'s board of directors has approved the grant of incentive options to directors, officers and consultants of the company to purchase up to 1.25 million common shares. The options are exercisable on or before Oct. 6, 2022, at an exercise price of 80 cents.

About Bearing Lithium Corp.

Bearing's primary asset is a free-carried 17.7-per-cent interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only preproduction project in Chile. Over $30-million (U.S.) has been invested in the project to date, and all expenditures through 2018, including the delivery of a definitive feasibility study in the first half of 2018, are fully financed by Bearing's earn-in joint venture partner. Bearing also holds a portfolio of grassroots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aBRZ-2513…

Und der hier musste natürlich vorher auch noch bedient werden zu 0.80 ... und hofft damit auch reich zu werden.

Vancouver, British Columbia--(Newsfile Corp. - October 10, 2017) - Bearing Lithium Corp. (TSXV: BRZ) (OTCQB: BRGRF) (FSE: B6K1) ("Bearing" or the "Company") is pleased to announce the appointment of Mr. Don Hains to the Advisory Board.

Mr. Hains is an industrial minerals exploration and economic geologist with more than 30 years of experience in development, use and analysis of industrial minerals properties and materials. He has held product research and business development responsibilities with Fiberglas Canada Inc. and Domtar Construction Materials, and has been consulting in the field of industrial minerals markets and economics for the past 30 years. His experience encompasses most of the industrial minerals and several specialty metals, especially antimony, lithium, tantalum, niobium, gallium, germanium and rare earths. Assignments have ranged from valuation reports to feasibility and market studies. He is a registered professional geoscientist in Ontario and a Professional Member of the SME. Don is the author of the Best Practice Guidelines for Reporting of Lithium Brine Resources and Reserves and a co-author of the Best Practice Guidelines for Reporting on Industrial Minerals Resources and Reserves. These guideline documents provide recommended best practice when reporting resources and reserves under NI 43-101.

Jeremy Poirier, Bearing's president and Chief Executive Officer, commented: "We are excited to have Don Hains join Bearing's Advisory Board. Don is well regarded as a global lithium expert, having worked on dozens of lithium projects worldwide, and having authored the guidelines for best practices for lithium brine resources under NI 43-101. Don brings a wealth of experience and we welcome him to the company."

In connection with his appointment, Mr. Hains has been granted 30,000 incentive stock options ("Options"). Each Option allows him to acquire one common share of the Company at an exercise price of $0.80 for a period of four years.

About Bearing Lithium Corp.

Bearing Lithium Corp. is a mineral exploration and development company, primarily focused on lithium. Its primary asset is a free-carried 17.7% interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only pre-production project in Chile. Over US$30 million has been invested in the project to date and all expenditures through 2018, including the delivery of a Definitive Feasibility Study in H1/18, are fully-funded by their earn-in joint-venture partner. Bearing also holds a portfolio of grass-roots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

https://finance.yahoo.com/news/bearing-announces-appointment…

Vancouver, British Columbia--(Newsfile Corp. - October 10, 2017) - Bearing Lithium Corp. (TSXV: BRZ) (OTCQB: BRGRF) (FSE: B6K1) ("Bearing" or the "Company") is pleased to announce the appointment of Mr. Don Hains to the Advisory Board.

Mr. Hains is an industrial minerals exploration and economic geologist with more than 30 years of experience in development, use and analysis of industrial minerals properties and materials. He has held product research and business development responsibilities with Fiberglas Canada Inc. and Domtar Construction Materials, and has been consulting in the field of industrial minerals markets and economics for the past 30 years. His experience encompasses most of the industrial minerals and several specialty metals, especially antimony, lithium, tantalum, niobium, gallium, germanium and rare earths. Assignments have ranged from valuation reports to feasibility and market studies. He is a registered professional geoscientist in Ontario and a Professional Member of the SME. Don is the author of the Best Practice Guidelines for Reporting of Lithium Brine Resources and Reserves and a co-author of the Best Practice Guidelines for Reporting on Industrial Minerals Resources and Reserves. These guideline documents provide recommended best practice when reporting resources and reserves under NI 43-101.

Jeremy Poirier, Bearing's president and Chief Executive Officer, commented: "We are excited to have Don Hains join Bearing's Advisory Board. Don is well regarded as a global lithium expert, having worked on dozens of lithium projects worldwide, and having authored the guidelines for best practices for lithium brine resources under NI 43-101. Don brings a wealth of experience and we welcome him to the company."

In connection with his appointment, Mr. Hains has been granted 30,000 incentive stock options ("Options"). Each Option allows him to acquire one common share of the Company at an exercise price of $0.80 for a period of four years.

About Bearing Lithium Corp.

Bearing Lithium Corp. is a mineral exploration and development company, primarily focused on lithium. Its primary asset is a free-carried 17.7% interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only pre-production project in Chile. Over US$30 million has been invested in the project to date and all expenditures through 2018, including the delivery of a Definitive Feasibility Study in H1/18, are fully-funded by their earn-in joint-venture partner. Bearing also holds a portfolio of grass-roots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

https://finance.yahoo.com/news/bearing-announces-appointment…

Antwort auf Beitrag Nr.: 55.920.890 von married am 10.10.17 16:06:50Sorry, natürlich 10.10.

Gab es heute irgend eine Börsenbrief-Empfehlung ?

Gestern gab es die zu 0.52

10.10.2017 17:38:11 0,6050 3.000

10.10.2017 17:07:23 0,5980 1.000

10.10.2017 12:41:10 0,5590 2.500

09.10.2017 18:54:16 0,5220 3.000

09.10.2017 17:51:46 0,5170 4.700

09.10.2017 17:51:39 0,5220 3.800

09.10.2017 17:51:28 0,5320 3.800

Grins

und zugleich die Antwort auf die Frage nach den eher verhaltenen Kusbewegungen gestern

( die den Kurs verzweifelt um die 0.86 halten sollten, nachdem Tage vorher noch Optionen zu 0.80 ausgegeben werden konnten )

Bearing Announces the Appointment of Jonathan Lee to the Advisory Board

Vancouver, British Columbia - Bearing Lithium Corp. ("Bearing" or the "Company") (TSX Venture: BRZ) (OTCQB: BRGRF) (FRANKFURT: B6K1) is pleased to announce the appointment of Mr. Jonathan Lee to the Advisory Board.

Mr. Lee is currently president of JGL Partners LLC, which provides consulting services on credit restructurings, municipal workouts, strategy, and capital allocation. Prior to this, Mr. Lee was a Senior Investment Analyst for a Boston based investment fund, Geologic Resource Partners LLP. In his role Mr. Lee determined suitable investments for the fund in both public and private mining and metals opportunities. Prior, Mr. Lee was an equity research analyst with a Toronto based investment bank. Additionally, Mr. Lee has advised a number of clients in the public markets sector on project due diligence, structuring, capital allocation, and strategic options. Prior, Mr. Lee was an environmental engineer for Camp, Dresser & McKee, Inc., where he designed, constructed and managed treatment facilities for EPA projects listed under the National Priorities List. Mr. Lee holds an MBA from the NYU Stern School of Business and a BSc degree in Chemical Engineering from Tufts University where he graduated cum laude.

Jeremy Poirier, Bearing's president and Chief Executive Officer, commented: "We are excited to have Jonathan Lee join Bearing’s Advisory Board. Jonathan brings a wealth of experience on the capital markets and valuation side which complements the skill set of our other board members.”

In connection with his appointment, Mr. Lee has been granted 50,000 incentive stock options (“Options”). Each Option allows him to acquire one common share of the Company at an exercise price of $0.86 for a period of four years.

About Bearing Lithium Corp.

Bearing Lithium Corp. is a mineral exploration and development company, primarily focused on lithium. Its primary asset is a free-carried 17.7% interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only pre-production project in Chile. Over US$30 million has been invested in the project to date and all expenditures through 2018, including the delivery of a Definitive Feasibility Study in H1/18, are fully-funded by their earn-in joint-venture partner. Bearing also holds a portfolio of grass-roots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

ON BEHALF OF THE BOARD

Signed "Jeremy Poirier"

Jeremy Poirier, President and CEO

FOR FURTHER INFORMATION PLEASE CONTACT:

Jeremy Poirier-- President and CEO Bearing Lithium - Telephone: 1-604-262-8835

und zugleich die Antwort auf die Frage nach den eher verhaltenen Kusbewegungen gestern

( die den Kurs verzweifelt um die 0.86 halten sollten, nachdem Tage vorher noch Optionen zu 0.80 ausgegeben werden konnten )

Bearing Announces the Appointment of Jonathan Lee to the Advisory Board

Vancouver, British Columbia - Bearing Lithium Corp. ("Bearing" or the "Company") (TSX Venture: BRZ) (OTCQB: BRGRF) (FRANKFURT: B6K1) is pleased to announce the appointment of Mr. Jonathan Lee to the Advisory Board.

Mr. Lee is currently president of JGL Partners LLC, which provides consulting services on credit restructurings, municipal workouts, strategy, and capital allocation. Prior to this, Mr. Lee was a Senior Investment Analyst for a Boston based investment fund, Geologic Resource Partners LLP. In his role Mr. Lee determined suitable investments for the fund in both public and private mining and metals opportunities. Prior, Mr. Lee was an equity research analyst with a Toronto based investment bank. Additionally, Mr. Lee has advised a number of clients in the public markets sector on project due diligence, structuring, capital allocation, and strategic options. Prior, Mr. Lee was an environmental engineer for Camp, Dresser & McKee, Inc., where he designed, constructed and managed treatment facilities for EPA projects listed under the National Priorities List. Mr. Lee holds an MBA from the NYU Stern School of Business and a BSc degree in Chemical Engineering from Tufts University where he graduated cum laude.

Jeremy Poirier, Bearing's president and Chief Executive Officer, commented: "We are excited to have Jonathan Lee join Bearing’s Advisory Board. Jonathan brings a wealth of experience on the capital markets and valuation side which complements the skill set of our other board members.”

In connection with his appointment, Mr. Lee has been granted 50,000 incentive stock options (“Options”). Each Option allows him to acquire one common share of the Company at an exercise price of $0.86 for a period of four years.

About Bearing Lithium Corp.

Bearing Lithium Corp. is a mineral exploration and development company, primarily focused on lithium. Its primary asset is a free-carried 17.7% interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only pre-production project in Chile. Over US$30 million has been invested in the project to date and all expenditures through 2018, including the delivery of a Definitive Feasibility Study in H1/18, are fully-funded by their earn-in joint-venture partner. Bearing also holds a portfolio of grass-roots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

ON BEHALF OF THE BOARD

Signed "Jeremy Poirier"

Jeremy Poirier, President and CEO

FOR FURTHER INFORMATION PLEASE CONTACT:

Jeremy Poirier-- President and CEO Bearing Lithium - Telephone: 1-604-262-8835

http://lithiumpowerinternational.com/asx-announcements/

und dort zu lesen unter

Hallgarten & Company Report on Maricunga Project Site Visit

Tuesday, 31 October 2017

Bearing Resources (BRZ.v)

This TSX-V listed entity is the final resting place (well, for now) of the remnant of the Li3 stake in the

Maricunga project. It currently has a market capitalization of around CAD$37mn. In September of 2017

it received approval to acquire via a stock issuance all the shares of Li3 Energy Inc. Assuming completion

of the transactions contemplated by the Li3 Definitive Agreement, Bearing will hold an undivided 17.7%

interest in the project, with Lithium Power International is earning into the project by funding US$22

million in project expenditures to through to the delivery of a Definitive Feasibility Study. The talks to

cement the Li3 takeover dragged on for around a year with the stock of BRZ peaking at over $1.50 per

share in February and now standing at around half that level. While Bearing has a free carry until LPI’s

expenditure commitment is fulfilled (around $9mn is still required to be spent) after that point Bearing

will have to invest pro-rata in all works, or face dilution.

This stock is clearly over-valued in comparison to LPI. If one puts an enterprise value of $50mn (market

cap plus cash plus residual share of LPI earn-in) on BRZ for a 17.7% stake then LPI with 50% of the

project should have an enterprise value of $140mn, which is 50% higher than its current valuation

Was nicht bedeuten muss, dass der BRZ Aktienkurs schnell fallen muss, eher vielleicht sogar hochgezogen wird , zumal die letzten Tage ja einige Optionen ausgeübt und weitere sogar verlängert wurden:

2017-10-30 16:13 C:BRZ 0.77 Miscellaneous Bearing Lithium warrant extension

2017-10-26 18:37 C:BRZ 0.79 News Release Bearing to extend expiry of 1.43 million warrants

2017-10-23 08:59 C:BRZ 0.78 News Release Bearing Lithium receives $3.12M from warrant exercis

Alternativ könnte sich natürlich auch LPI nach oben entwickeln und somit von ( zu ) hohen BRZ - Kursen profitieren.

Wachsamkeit ist hier auf jeden Fall angesagt.

und dort zu lesen unter

Hallgarten & Company Report on Maricunga Project Site Visit

Tuesday, 31 October 2017

Bearing Resources (BRZ.v)

This TSX-V listed entity is the final resting place (well, for now) of the remnant of the Li3 stake in the

Maricunga project. It currently has a market capitalization of around CAD$37mn. In September of 2017

it received approval to acquire via a stock issuance all the shares of Li3 Energy Inc. Assuming completion

of the transactions contemplated by the Li3 Definitive Agreement, Bearing will hold an undivided 17.7%

interest in the project, with Lithium Power International is earning into the project by funding US$22

million in project expenditures to through to the delivery of a Definitive Feasibility Study. The talks to

cement the Li3 takeover dragged on for around a year with the stock of BRZ peaking at over $1.50 per

share in February and now standing at around half that level. While Bearing has a free carry until LPI’s

expenditure commitment is fulfilled (around $9mn is still required to be spent) after that point Bearing

will have to invest pro-rata in all works, or face dilution.

This stock is clearly over-valued in comparison to LPI. If one puts an enterprise value of $50mn (market

cap plus cash plus residual share of LPI earn-in) on BRZ for a 17.7% stake then LPI with 50% of the

project should have an enterprise value of $140mn, which is 50% higher than its current valuation

Was nicht bedeuten muss, dass der BRZ Aktienkurs schnell fallen muss, eher vielleicht sogar hochgezogen wird , zumal die letzten Tage ja einige Optionen ausgeübt und weitere sogar verlängert wurden:

2017-10-30 16:13 C:BRZ 0.77 Miscellaneous Bearing Lithium warrant extension

2017-10-26 18:37 C:BRZ 0.79 News Release Bearing to extend expiry of 1.43 million warrants

2017-10-23 08:59 C:BRZ 0.78 News Release Bearing Lithium receives $3.12M from warrant exercis

Alternativ könnte sich natürlich auch LPI nach oben entwickeln und somit von ( zu ) hohen BRZ - Kursen profitieren.

Wachsamkeit ist hier auf jeden Fall angesagt.

Antwort auf Beitrag Nr.: 56.074.844 von married am 01.11.17 17:40:16"Alternativ könnte sich natürlich auch LPI nach oben entwickeln und somit von ( zu ) hohen BRZ - Kursen profitieren"

Gesagt ---- getan. LPI heute morgen zu Ende der Börsensitzung in Australien + 14 % bei sechsfachem Tagesumsatz. Die LPIO ( Optionen ) + 316 %

Hier wird über einen Einstieg der chinesischen FULIN GROUP in die Lithium Liegenschaft gesprochen.

LPI hält bekanntlich 50% am Lithium Vorkommen, Bearing 17 %

Nun hat Bearing plötzlich wieder enormen Nachholbedarf im Kurs ( heute 0,53 EURO ), der ja bekanntlich schon bei 0,70 lag. Sollten sich die Chinesen tatsächlich engagieren / engagiert haben, könnte Bearings 17% Anteil sehr teuer verkauft werden.

Gesagt ---- getan. LPI heute morgen zu Ende der Börsensitzung in Australien + 14 % bei sechsfachem Tagesumsatz. Die LPIO ( Optionen ) + 316 %

Hier wird über einen Einstieg der chinesischen FULIN GROUP in die Lithium Liegenschaft gesprochen.

LPI hält bekanntlich 50% am Lithium Vorkommen, Bearing 17 %

Nun hat Bearing plötzlich wieder enormen Nachholbedarf im Kurs ( heute 0,53 EURO ), der ja bekanntlich schon bei 0,70 lag. Sollten sich die Chinesen tatsächlich engagieren / engagiert haben, könnte Bearings 17% Anteil sehr teuer verkauft werden.

Antwort auf Beitrag Nr.: 56.205.675 von married am 17.11.17 08:46:18Na also:

Lithium Power shares rise as Chinese show interest 17th November 2017

By: Esmarie Swanepoel Creamer Media Senior Deputy Editor: Australasia PERTH (miningweekly.com)

– The share price of Lithium Power International increased by nearly 9% on Friday on news of Chinese interest at the Maricunga lithium brine project, in Chile. Lithium Power on Friday confirmed that its Chilean joint venture partner has entered into discussions with Chinese major Fulin Group, over a possible investment in the Maricunga project, in which Lithium Power holds a 50% interest. Advertisement A draft memorandum of understanding (MoU) outlined that Fulin and Minera Salar Blanco SA (MSB) would investigate cooperation between the two companies, including a potential equity purchase in MSB of between 20% and 50%, and a funding agreement to provide the necessary equity and debt associated with the capital expenditure for the project. The Maricunga project is regarded as the highest quality pre-production lithium project in Chile, and lies to the south of the Atacama Salar, which hosts two lithium brine operations. Advertisement Lithium Power shares were trading at a high of 67.5c a share on Friday, up from a low of 57c a share.

http://www.miningweekly.com/article/lithium-power-shares-ris…

Lithium Power shares rise as Chinese show interest 17th November 2017

By: Esmarie Swanepoel Creamer Media Senior Deputy Editor: Australasia PERTH (miningweekly.com)

– The share price of Lithium Power International increased by nearly 9% on Friday on news of Chinese interest at the Maricunga lithium brine project, in Chile. Lithium Power on Friday confirmed that its Chilean joint venture partner has entered into discussions with Chinese major Fulin Group, over a possible investment in the Maricunga project, in which Lithium Power holds a 50% interest. Advertisement A draft memorandum of understanding (MoU) outlined that Fulin and Minera Salar Blanco SA (MSB) would investigate cooperation between the two companies, including a potential equity purchase in MSB of between 20% and 50%, and a funding agreement to provide the necessary equity and debt associated with the capital expenditure for the project. The Maricunga project is regarded as the highest quality pre-production lithium project in Chile, and lies to the south of the Atacama Salar, which hosts two lithium brine operations. Advertisement Lithium Power shares were trading at a high of 67.5c a share on Friday, up from a low of 57c a share.

http://www.miningweekly.com/article/lithium-power-shares-ris…

Soeben wird gemeldet:

VANCOUVER, British Columbia, Nov. 17, 2017 (GLOBE NEWSWIRE) -- Bearing Lithium Corp.

("Bearing" or the "Company") (BRZ.V) (BRGRF) (B6K1.F) confirms that Minera Salar Blanco SA (“MSB”), the company that holds the Maricunga lithium brine project and which Bearing Lithium has a free-carried 17.7% interest in, has entered into discussions with the Fulin Group, a major Chinese consolidated company.

Bearing confirms that MSB has entered into a non-binding Memorandum of Understanding (“MOU”) to explore cooperation opportunities between the two companies which includes a potential equity purchase in MSB ranging from 20 – 50% and a funding agreement to provide the necessary equity and debt to fund the construction and development costs for the project. For this potential investment, Fulin seeks to secure a direct project interest, offtake and marketing rights. Bearing wishes to reaffirm that the MOU under discussion is non-binding and any potential transaction would be subject to due diligence, agreement of the commercial terms, entry into legally binding documentation and all parties obtaining all the required regulatory and MSB shareholder approval. Given the stage of discussions, there is no certainty that any transaction will be entered into and updates will be provided if and when material developments occur.

Bearing Lithium’s President and CEO, Jeremy Poirier, commented, “The global interest from major companies reaffirms the value of the Maricunga project. We will continue to evaluate all opportunities from interested parties to maximize value for our shareholders.”

About Fulin Group

The Sichuan Fulin Industrial Group Co., Ltd. (“Fulin Group”) is a holding company was incorporated in 1995 and is based in Miayang, China. The company engages in the manufacturing and marketing of automobiles in China.

About Bearing Lithium Corp.

Bearing Lithium Corp. is a mineral exploration and development company, primarily focused on lithium. Its primary asset is a free-carried 17.7% interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only pre-production project in Chile. Over US$30 million has been invested in the project to date and all expenditures through 2018, including the delivery of a Definitive Feasibility Study in H1/18, are fully-funded by their earn-in joint-venture partner. Bearing also holds a portfolio of grass-roots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

ON BEHALF OF THE BOARD

https://finance.yahoo.com/news/bearing-confirms-chinese-indu…" target="_blank" rel="nofollow ugc noopener">

https://finance.yahoo.com/news/bearing-confirms-chinese-indu…

Ist das hin - und her - Gezappe beim Kurs die Ruhe vor dem Sturm ?

Wichtige news - flows sind in diesem Quartal noch angesagt :

Process Design Testwork

Further to the previous announcement (c.f. June 13th, 2017 press release), the Maricunga joint venture is currently working with tier 1 equipment suppliers including Veolia, GEA, Andritz and FLSmidth to undertake pilot plant test work utilizing brine sourced from the Maricunga project. Brine from the project has now been concentrated to a 5% lithium solution, with the subsequent pilot plant test work to produce lithium carbonate (Li2CO3) and potash (KCl) expected by the end of the year (Q4/17). The testwork is focused on optimizing the lithium and potassium production at the lowest cost process. Testwork is well advanced and in the coming months, final adjustments will be made to optimise the brine polishing sequence, which will also be completed by year-end 2017.

Mehr unter: http://www.bearingresources.ca/announcements/bearing-announc…

Wichtige news - flows sind in diesem Quartal noch angesagt :

Process Design Testwork

Further to the previous announcement (c.f. June 13th, 2017 press release), the Maricunga joint venture is currently working with tier 1 equipment suppliers including Veolia, GEA, Andritz and FLSmidth to undertake pilot plant test work utilizing brine sourced from the Maricunga project. Brine from the project has now been concentrated to a 5% lithium solution, with the subsequent pilot plant test work to produce lithium carbonate (Li2CO3) and potash (KCl) expected by the end of the year (Q4/17). The testwork is focused on optimizing the lithium and potassium production at the lowest cost process. Testwork is well advanced and in the coming months, final adjustments will be made to optimise the brine polishing sequence, which will also be completed by year-end 2017.

Mehr unter: http://www.bearingresources.ca/announcements/bearing-announc…

.........As for high grade lithium, the world’s best comes from Chile, one corner in the vaunted “lithium triangle” of Chile, Argentina and Bolivia, home to over half of the world’s identified lithium resources. A closer look shows Chile to host the highest-grade lithium brine salars, more succinctly the Salar de Atacama, famous for its high-grade, low-cost operations that accounts for about 40% of global lithium production and 100% of Chile’s lithium production.

If progress holds its course as it looks like it will, a watershed moment is on the horizon for Chile with another salar potentially coming online in the next three to five years. The Maricunga project is the highest-grade, undeveloped lithium salar in the Americas, second in lithium grade to only Salar de Atacama. Recognized as the highest-grade pre-production lithium brine project in the world, the Maricunga lithium project is a joint venture between Bearing Lithium Resources (TSX-Venture:BRZ)(OTCQB: BRGRF), privately-held Minera Salar Blanco and Lithium Power International (ASX:LPI) which prior to finalizing the Maricunga JV in Sep of 2016, was instrumental in growing the resource by 3.7 fold from the previous 2012 estimate.

Mehr unter:

http://www.allpennystocks.com/SpotLight/22/Bearing-Lithium-C…

If progress holds its course as it looks like it will, a watershed moment is on the horizon for Chile with another salar potentially coming online in the next three to five years. The Maricunga project is the highest-grade, undeveloped lithium salar in the Americas, second in lithium grade to only Salar de Atacama. Recognized as the highest-grade pre-production lithium brine project in the world, the Maricunga lithium project is a joint venture between Bearing Lithium Resources (TSX-Venture:BRZ)(OTCQB: BRGRF), privately-held Minera Salar Blanco and Lithium Power International (ASX:LPI) which prior to finalizing the Maricunga JV in Sep of 2016, was instrumental in growing the resource by 3.7 fold from the previous 2012 estimate.

Mehr unter:

http://www.allpennystocks.com/SpotLight/22/Bearing-Lithium-C…

20.000 Tonnen lithium carbonate pro Jahr wäre schon ein Hammer

Bearing to base Maricunga PEA on 20,000t Li2CO3/year

2017-11-30 08:18 ET - News Release

Mr. Jeremy Poirier reports

BEARING ANNOUNCES PEA TO BE BASED ON 20,000 TONNES OF LITHIUM CARBONATE PER YEAR

Bearing Lithium Corp. has provided an update on the Maricunga lithium brine project in Chile. Bearing will hold a final 17.7% interest in the Maricunga Project along with Minera Salar Blanco ("MSB") and Lithium Power International Limited ("Lithium Power") at 32.3% and 50% respectively pursuant to a joint venture arrangement (the "Joint Venture"). Under the terms of the Joint Venture, Lithium Power is earning into the project by funding exploration and development costs with both Bearing and MSB having a free carry until the completion of a definitive feasibility study.

As previously disclosed, WorleyParsons, a global engineering firm, has been appointed by the Joint-Venture to lead the project design which culminates in a definitive feasibility study. Prior to the delivery of the definitive feasibility study in 2018, a preliminary economic assessment ("PEA") is anticipated to be released before year-end 2017. The PEA will be based on an estimated production rate of 20,000 tonnes of lithium carbonate per year. The PEA will include process flow diagram of major units, process description to define the concentration and purification, equipment list, general arrangement of production ponds, plant block diagram and conceptual report for electrical generation. The study will also include capital and operational expenditures and after-tax cash flow forecasts and cash flow sensitivity to key inputs.

Jeremy Poirier, Bearing Lithium President and CEO commented: "The PEA on Maricunga is an important milestone that shows the excellent progress of the project and its true potential as a world class lithium project. As the most advanced development project in Chile, Maricunga's PEA represents yet another step to build shareholder value to our flagship asset."

Frits Reidel, CPG, who is a technical consultant to the Company and is a qualified person within the context of National Instrument 43-101, has read and takes responsibility for this news release. Frits Reidel is independent (as such term is used in National Instrument of Ni 43-101) of the Company.

Engagement of Investor Relations Provider

In addition, the Company engaged Portfolio Wealth Global LLC ("PWG"), an affiliate of Future Money Trends LLC, to provide certain financial publishing and digital marketing services during the period from September 30 to December 30, 2017. In exchange for providing these services, PWG has received a fee of US$225,000. To the knowledge of the Company, no principal of PWG owns any securities of the Company. PWG is a California based financial newsletter.

About Bearing Lithium Corp.

Bearing Lithium Corp. is a mineral exploration and development company, primarily focused on lithium. Its primary asset is a free-carried 17.7% interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only pre-production project in Chile. Over US$30 million has been invested in the project to date and all expenditures through 2018, including the delivery of a Definitive Feasibility Study in mid-2018, are fully-funded by their earn-in joint-venture partner. Bearing also holds a portfolio of grass-roots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

We seek Safe Harbor.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aBRZ-2540…

© 2017 Canjex Publishing Ltd. All rights reserved.

Bearing to base Maricunga PEA on 20,000t Li2CO3/year

2017-11-30 08:18 ET - News Release

Mr. Jeremy Poirier reports

BEARING ANNOUNCES PEA TO BE BASED ON 20,000 TONNES OF LITHIUM CARBONATE PER YEAR

Bearing Lithium Corp. has provided an update on the Maricunga lithium brine project in Chile. Bearing will hold a final 17.7% interest in the Maricunga Project along with Minera Salar Blanco ("MSB") and Lithium Power International Limited ("Lithium Power") at 32.3% and 50% respectively pursuant to a joint venture arrangement (the "Joint Venture"). Under the terms of the Joint Venture, Lithium Power is earning into the project by funding exploration and development costs with both Bearing and MSB having a free carry until the completion of a definitive feasibility study.

As previously disclosed, WorleyParsons, a global engineering firm, has been appointed by the Joint-Venture to lead the project design which culminates in a definitive feasibility study. Prior to the delivery of the definitive feasibility study in 2018, a preliminary economic assessment ("PEA") is anticipated to be released before year-end 2017. The PEA will be based on an estimated production rate of 20,000 tonnes of lithium carbonate per year. The PEA will include process flow diagram of major units, process description to define the concentration and purification, equipment list, general arrangement of production ponds, plant block diagram and conceptual report for electrical generation. The study will also include capital and operational expenditures and after-tax cash flow forecasts and cash flow sensitivity to key inputs.

Jeremy Poirier, Bearing Lithium President and CEO commented: "The PEA on Maricunga is an important milestone that shows the excellent progress of the project and its true potential as a world class lithium project. As the most advanced development project in Chile, Maricunga's PEA represents yet another step to build shareholder value to our flagship asset."

Frits Reidel, CPG, who is a technical consultant to the Company and is a qualified person within the context of National Instrument 43-101, has read and takes responsibility for this news release. Frits Reidel is independent (as such term is used in National Instrument of Ni 43-101) of the Company.

Engagement of Investor Relations Provider

In addition, the Company engaged Portfolio Wealth Global LLC ("PWG"), an affiliate of Future Money Trends LLC, to provide certain financial publishing and digital marketing services during the period from September 30 to December 30, 2017. In exchange for providing these services, PWG has received a fee of US$225,000. To the knowledge of the Company, no principal of PWG owns any securities of the Company. PWG is a California based financial newsletter.

About Bearing Lithium Corp.

Bearing Lithium Corp. is a mineral exploration and development company, primarily focused on lithium. Its primary asset is a free-carried 17.7% interest in the Maricunga lithium brine project in Chile. The Maricunga project represents one of the highest-grade lithium brine salars globally and the only pre-production project in Chile. Over US$30 million has been invested in the project to date and all expenditures through 2018, including the delivery of a Definitive Feasibility Study in mid-2018, are fully-funded by their earn-in joint-venture partner. Bearing also holds a portfolio of grass-roots exploration projects in the gold district of the Yukon, which are currently optioned to Golden Predator, and a lithium project in Nevada, which is currently optioned to First Division Ventures Inc.

We seek Safe Harbor.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aBRZ-2540…

© 2017 Canjex Publishing Ltd. All rights reserved.

Wohin geht Aktienkurs?

Bearing Lithium 05.12.2017 Hauptversammlunghttp://www.finanzen.net/aktien/Bearing_Lithium-Aktie

VANCOUVER, BC / ACCESSWIRE / December 4, 2017 /

A Comparison of Lithium Brine Projects:

Bearing Lithium's Maricunga is the highest grade undeveloped lithium project in the world (1,160 mg/L). The project's development stage only trails Orocobre Ltd.'s Salar de Olaroz in Jujuy, Argentina, and Lithium Americas' Cauchari. In particular, the Salar de Olaroz, which has already begun production, hosts an NI 43-101 measured and indicated resource of 6.4 million tonnes of lithium carbonate equivalent, but with a much lower grade at 690 mg/L.

However, compared with the more advanced operations, Bearing Lithium's Maricunga has a higher grade and a free-carried interest.

The Future of Lithium Market Lies In Chile:

The government has full support for lithium mining. $975 million has been injected in funding to Codelco;

Lithium brine mining in Chile is more economical and efficient than in other jurisdictions;

Chile’s massive reserves with unrivaled lithium concentrations will play a key role in the booming EV and lithium markets;

Lithium supply is unable to keep up with demand in the near future, hence lithium prices will keep rising;

Chinese and Korean investors are also showing confidence in this market, with talks of building a $2 billion giga-factory to rival Tesla.

Mehr - bzw. der ganze Artikel - unter: https://finance.yahoo.com/news/chile-worlds-biggest-lithium-…

A Comparison of Lithium Brine Projects:

Bearing Lithium's Maricunga is the highest grade undeveloped lithium project in the world (1,160 mg/L). The project's development stage only trails Orocobre Ltd.'s Salar de Olaroz in Jujuy, Argentina, and Lithium Americas' Cauchari. In particular, the Salar de Olaroz, which has already begun production, hosts an NI 43-101 measured and indicated resource of 6.4 million tonnes of lithium carbonate equivalent, but with a much lower grade at 690 mg/L.

However, compared with the more advanced operations, Bearing Lithium's Maricunga has a higher grade and a free-carried interest.

The Future of Lithium Market Lies In Chile:

The government has full support for lithium mining. $975 million has been injected in funding to Codelco;

Lithium brine mining in Chile is more economical and efficient than in other jurisdictions;

Chile’s massive reserves with unrivaled lithium concentrations will play a key role in the booming EV and lithium markets;

Lithium supply is unable to keep up with demand in the near future, hence lithium prices will keep rising;

Chinese and Korean investors are also showing confidence in this market, with talks of building a $2 billion giga-factory to rival Tesla.

Mehr - bzw. der ganze Artikel - unter: https://finance.yahoo.com/news/chile-worlds-biggest-lithium-…

Dec 6 2017 at 11:31 AM Updated Dec 6 2017 at 3:40 PM

More smoke surrounds Rio Tinto and Chilean lithium A meeting between Rio Tinto and the Chilean government has reignited speculation about a bid for lithium assets.

Könnte auch für Bearings Anteil dort interessant werden:

http://www.afr.com/business/mining/more-smoke-surrounds-rio-…

More smoke surrounds Rio Tinto and Chilean lithium A meeting between Rio Tinto and the Chilean government has reignited speculation about a bid for lithium assets.

Könnte auch für Bearings Anteil dort interessant werden:

http://www.afr.com/business/mining/more-smoke-surrounds-rio-…

Baystreet Staff - Tuesday, December 12, 2017

The Race is On to Secure Lithium Supply Channels

According to CNBC, China is beating the U.S. and other countries in a worldwide competition to lock-down supplies of lithium, a critical metal used in nearly every rechargeable battery in electric vehicles.

Against the backdrop of China looking to push the roll-out of EVs to combat a major pollution problem and other countries like Norway, Britain, France and India wanting to give combustion-engine cars the boot, there is an eruption gurgling in the global EV market that has companies big and small looking to squarely address what very well could be a shortfall in battery-grade lithium supplies in the future.

The old axiom goes along the lines of, "If you want to hunt for big game, go where big game has been seen before." Extrapolating that adage to lithium means, "look to Chile,” where the Salar de Atacama in the northern part of the country provides every bit of the country’s lithium production and about 40% of the world’s production annually.

Some of the highest-grade lithium in the world is found in Chilean dry salt lakes. Furthermore, the country is known to host about 7.5 million metric tonnes of lithium, more than double that of the next closest competitor, China at 3.2 million metric tonnes, and over half of the world’s known lithium reserves.

While Atacama is a household name in lithium circles, the nearby Maricunga salar is recognized as the highest-grade undeveloped lithium salar in the Americas and highest-grade pre-production lithium brine project in the world.

The leading player in the space is a joint venture between Bearing Lithium Resources (TSX-Venture:BRZ)(OTCQB:BRGRF), privately-held Minera Salar Blanco and Lithium Power International (ASX:LPI).

Currently, LPI is shouldering all of the financing for the project through a definitive feasibility study expected in 1H 2018 in order to earn a 50% stake (currently at 32.5%), with the remainder to be owned by Minera (32.3%) and Bearing Lithium (17.7%).

Ahead of the feasibility study, investors are looking for a preliminary economic assessment by the end of 2017. The PEA will be based on an estimated production rate of 20,000 tonnes of lithium carbonate per year and cover the gamut of information on the project, including, but not limited to, a process flow diagram, equipment list, concentration and purification process info, production pond plan, capital and operational expense estimate and other cash flow components.

More than $30 million has been invested in the 4,463-acre Maricunga project, mostly through Minera and Li3 Energy, a company acquired by Bearing Lithium in October. Together, the JV has already grown the resource nearly four-fold from a 2012 estimate in what is highly anticipated to be a world-class, low-cost project with a long mine life.

Commercial production is targeted for as early as 2020 and no later than 2022, thanks to a grandfather clause and the fact that Maricunga is close to all the necessary infrastructure (port, roads, electricity, workers, etc.).

The project hosts a National Instrument 43-101 Measured and Indicated resource of 1.7 million tonnes of lithium carbonate equivalent (LCE) at a grade of 1,143 mg/L lithium plus an Inferred resource of 400,000 tonnes of LCE at a grade of 1,289 mg/L.

Moreover, the NI estimate is only calculated to a depth of 200 metres. Recent drilling shows mineralization still open at depth of 360 metres, with seismic surveying and geophysics showing the basin to potentially extend greater than 500 metres in depth.

The JV partners enjoy the benefit of the project being grandfathered in under previous Chilean mining code, which permits for lithium to be immediately extracted from the salar. This fact gives Bearing and partners a competitive edge over others that could languish in regulatory red tape for years before advancing a project in the region, time that cannot afford to be wasted in light of the need for lithium for Li-ion batteries.

Another edge for future lithium sales goes to the JV with Minera entering into discussion last month with the Fulin Group, a large Chinese consolidation company. A memorandum of understanding has been penned between Fulin and Minera to discuss Fulin potentially taking between a 20-50% stake in Minera and providing the necessary funding to cover construction and development costs at the project. While negotiations are in the early stages and consummation of any deal is not assured, the interest reaffirms the value of the Maricunga project.

Lending further credence to the potential of the property, steel-making giant Pohang Iron & Steel invested $18 million in Li3 Energy and still holds a 7% stake in Bearing Lithium. Pohang has developed a revolutionary rapid lithium extraction technology that can cut extract lithium from brine in as little as eight hours, versus over a year by conventional methods.

As it is setting up, Bearing Lithium, who also controls a lithium property in Nevada optioned to First Division Ventures and gold assets in the Yukon optioned to Golden Predator, is putting together a tremendous final quarter to 2017 and setting the stage for what should be a prosperous 2018.

Surprisingly, Wall and Bay Streets haven’t fully caught on to this little gem with big partners in the most promising lithium salar the world has to offer. As sure as the EV evolution is coming, it’s just as likely Bearing Lithium won’t continue to fly under the radar of investors.

http://www.baystreet.ca/articles/stockstowatch/34838/The-Rac…

The Race is On to Secure Lithium Supply Channels

According to CNBC, China is beating the U.S. and other countries in a worldwide competition to lock-down supplies of lithium, a critical metal used in nearly every rechargeable battery in electric vehicles.

Against the backdrop of China looking to push the roll-out of EVs to combat a major pollution problem and other countries like Norway, Britain, France and India wanting to give combustion-engine cars the boot, there is an eruption gurgling in the global EV market that has companies big and small looking to squarely address what very well could be a shortfall in battery-grade lithium supplies in the future.

The old axiom goes along the lines of, "If you want to hunt for big game, go where big game has been seen before." Extrapolating that adage to lithium means, "look to Chile,” where the Salar de Atacama in the northern part of the country provides every bit of the country’s lithium production and about 40% of the world’s production annually.

Some of the highest-grade lithium in the world is found in Chilean dry salt lakes. Furthermore, the country is known to host about 7.5 million metric tonnes of lithium, more than double that of the next closest competitor, China at 3.2 million metric tonnes, and over half of the world’s known lithium reserves.

While Atacama is a household name in lithium circles, the nearby Maricunga salar is recognized as the highest-grade undeveloped lithium salar in the Americas and highest-grade pre-production lithium brine project in the world.

The leading player in the space is a joint venture between Bearing Lithium Resources (TSX-Venture:BRZ)(OTCQB:BRGRF), privately-held Minera Salar Blanco and Lithium Power International (ASX:LPI).

Currently, LPI is shouldering all of the financing for the project through a definitive feasibility study expected in 1H 2018 in order to earn a 50% stake (currently at 32.5%), with the remainder to be owned by Minera (32.3%) and Bearing Lithium (17.7%).

Ahead of the feasibility study, investors are looking for a preliminary economic assessment by the end of 2017. The PEA will be based on an estimated production rate of 20,000 tonnes of lithium carbonate per year and cover the gamut of information on the project, including, but not limited to, a process flow diagram, equipment list, concentration and purification process info, production pond plan, capital and operational expense estimate and other cash flow components.

More than $30 million has been invested in the 4,463-acre Maricunga project, mostly through Minera and Li3 Energy, a company acquired by Bearing Lithium in October. Together, the JV has already grown the resource nearly four-fold from a 2012 estimate in what is highly anticipated to be a world-class, low-cost project with a long mine life.

Commercial production is targeted for as early as 2020 and no later than 2022, thanks to a grandfather clause and the fact that Maricunga is close to all the necessary infrastructure (port, roads, electricity, workers, etc.).

The project hosts a National Instrument 43-101 Measured and Indicated resource of 1.7 million tonnes of lithium carbonate equivalent (LCE) at a grade of 1,143 mg/L lithium plus an Inferred resource of 400,000 tonnes of LCE at a grade of 1,289 mg/L.

Moreover, the NI estimate is only calculated to a depth of 200 metres. Recent drilling shows mineralization still open at depth of 360 metres, with seismic surveying and geophysics showing the basin to potentially extend greater than 500 metres in depth.

The JV partners enjoy the benefit of the project being grandfathered in under previous Chilean mining code, which permits for lithium to be immediately extracted from the salar. This fact gives Bearing and partners a competitive edge over others that could languish in regulatory red tape for years before advancing a project in the region, time that cannot afford to be wasted in light of the need for lithium for Li-ion batteries.

Another edge for future lithium sales goes to the JV with Minera entering into discussion last month with the Fulin Group, a large Chinese consolidation company. A memorandum of understanding has been penned between Fulin and Minera to discuss Fulin potentially taking between a 20-50% stake in Minera and providing the necessary funding to cover construction and development costs at the project. While negotiations are in the early stages and consummation of any deal is not assured, the interest reaffirms the value of the Maricunga project.

Lending further credence to the potential of the property, steel-making giant Pohang Iron & Steel invested $18 million in Li3 Energy and still holds a 7% stake in Bearing Lithium. Pohang has developed a revolutionary rapid lithium extraction technology that can cut extract lithium from brine in as little as eight hours, versus over a year by conventional methods.

As it is setting up, Bearing Lithium, who also controls a lithium property in Nevada optioned to First Division Ventures and gold assets in the Yukon optioned to Golden Predator, is putting together a tremendous final quarter to 2017 and setting the stage for what should be a prosperous 2018.

Surprisingly, Wall and Bay Streets haven’t fully caught on to this little gem with big partners in the most promising lithium salar the world has to offer. As sure as the EV evolution is coming, it’s just as likely Bearing Lithium won’t continue to fly under the radar of investors.

http://www.baystreet.ca/articles/stockstowatch/34838/The-Rac…

Nachdem die Wahlen in Chile vorüber sind und der Unternehmer / Minen - freundliche Pinera neuer Präsident wird, kann man auch wieder eine BEARING ( mit ihrem Lithium - Anteil in Chile ) anfassen.

BRZ's australische Partner, die LPI, hat es heute morgen schon vorgemacht mit + 12,3 %.

The latest on Chile's presidential runoff election (all times local):

9:30 p.m.

Former Chilean President Sebastian Pinera is thanking supporters after he easily won the country's presidential runoff election Sunday.

The one-time airline magnate says he is humbled by the "magnificent triumph" and is calling for unity among Chileans.

Electoral officials say the conservative Pinera has 54.6 percent of the votes to nearly 45.4 percent for center-left Sen. Alejandro Guillier, with nearly all votes counted.

BRZ's australische Partner, die LPI, hat es heute morgen schon vorgemacht mit + 12,3 %.

The latest on Chile's presidential runoff election (all times local):

9:30 p.m.

Former Chilean President Sebastian Pinera is thanking supporters after he easily won the country's presidential runoff election Sunday.

The one-time airline magnate says he is humbled by the "magnificent triumph" and is calling for unity among Chileans.

Electoral officials say the conservative Pinera has 54.6 percent of the votes to nearly 45.4 percent for center-left Sen. Alejandro Guillier, with nearly all votes counted.

Im Moment noch trading-halt in Canada

wegen dieser news:

Und die liest sich schon Mal gut:

Bearing Lithium Corp.: Maricunga Preliminary Economic Assessment (PEA) Highlights

Low Cost and Short Payback

ANCOUVER, British Columbia, Dec. 19, 2017 (GLOBE NEWSWIRE) -- Bearing Lithium Corp. ("Bearing" or the "Company") (TSX Venture:BRZ) (BRGRF) (B6K1.F) is pleased to announce the results from a Preliminary Economic Assessment (“PEA”) prepared in accordance with National Instrument 43-101 on the Maricunga lithium brine project located in Chile (the “Maricunga Project”). The report titled “Preliminary Assessment and Economic Evaluation of the Minera Salar Blanco Project” was prepared by WorleyParsons for the Maricunga joint-venture company, Minera Salar Blanco, and will be filed on SEDAR (www.sedar.com) within the coming days. Upon completion of an earn-in by it’s joint-venture partner, Bearing Lithium will hold a final 17.7% interest in the Maricunga project along with Minera Salar Blanco SpA at 32.3% and Lithium Power International at 50%. Under the terms of the earn-in, Lithium Power is funding all exploration and development costs with both Bearing and MSB having a free carry through to the completion of a definitive feasibility study.

NI 43-101 Preliminary Economic Assessment (PEA) Highlights

The Maricunga Lithium Brine project’s Preliminary Economic Assessment (PEA) supports 20,000 tonnes per annum (t/a) production of lithium carbonate (LCE) and 74,000t/a potassium chloride fertilizer (KCl) over 20 years.

Project NPV is estimated to be US$1.049B before tax at 8% discount rate, providing an IRR of 23.4%.

Payback in 2 years and 11 months based on a 2-year ramp up period.

Project operating cost places Maricunga among most efficient producers with lithium carbonate production cost of US$2,938 per tonne (/t) FOB in Chile, reducing to US$2,635/t with credits from KCl by-product.

Project development cost estimated at US$366M excluding KCl, plus indirect costs of 14.2% (US$55M) and 18.6% (US$83M) contingency.

The project is progressing to a feasibility study, providing improved certainty regarding reserves, metallurgical design, equipment and operational risks.

Conventional evaporation pond and process technology used to minimise operational risks.

PEA completed by Tier-1 engineering consultancy WorleyParsons to international standards. Accuracy of operating and capital cost estimates expected within a +/- 25% range.

“The release of this PEA is an important milestone for the Maricunga project. Prepared by Worley Parsons alongside MSB’s technical team, the level of detail and information of the report meets international standards and demonstrates the world class nature of Maricunga. The study demonstrates a very positive and robust outcome that justifies completion of a full feasibility study. The operating expenditure estimate places Maricunga in the lower quartile on the cost curve, at US$2,938/t (excluding KCl), with a payback of less than three years. We are excited to continue advancing the Maricunga project and congratulate the MSB project management team for its effort and success.” Jeremy Poirier, President and CEO of Bearing commented.

Alles Weitere unter: https://finance.yahoo.com/news/bearing-lithium-corp-maricung…

wegen dieser news:

Und die liest sich schon Mal gut:

Bearing Lithium Corp.: Maricunga Preliminary Economic Assessment (PEA) Highlights

Low Cost and Short Payback

ANCOUVER, British Columbia, Dec. 19, 2017 (GLOBE NEWSWIRE) -- Bearing Lithium Corp. ("Bearing" or the "Company") (TSX Venture:BRZ) (BRGRF) (B6K1.F) is pleased to announce the results from a Preliminary Economic Assessment (“PEA”) prepared in accordance with National Instrument 43-101 on the Maricunga lithium brine project located in Chile (the “Maricunga Project”). The report titled “Preliminary Assessment and Economic Evaluation of the Minera Salar Blanco Project” was prepared by WorleyParsons for the Maricunga joint-venture company, Minera Salar Blanco, and will be filed on SEDAR (www.sedar.com) within the coming days. Upon completion of an earn-in by it’s joint-venture partner, Bearing Lithium will hold a final 17.7% interest in the Maricunga project along with Minera Salar Blanco SpA at 32.3% and Lithium Power International at 50%. Under the terms of the earn-in, Lithium Power is funding all exploration and development costs with both Bearing and MSB having a free carry through to the completion of a definitive feasibility study.

NI 43-101 Preliminary Economic Assessment (PEA) Highlights

The Maricunga Lithium Brine project’s Preliminary Economic Assessment (PEA) supports 20,000 tonnes per annum (t/a) production of lithium carbonate (LCE) and 74,000t/a potassium chloride fertilizer (KCl) over 20 years.

Project NPV is estimated to be US$1.049B before tax at 8% discount rate, providing an IRR of 23.4%.

Payback in 2 years and 11 months based on a 2-year ramp up period.

Project operating cost places Maricunga among most efficient producers with lithium carbonate production cost of US$2,938 per tonne (/t) FOB in Chile, reducing to US$2,635/t with credits from KCl by-product.

Project development cost estimated at US$366M excluding KCl, plus indirect costs of 14.2% (US$55M) and 18.6% (US$83M) contingency.

The project is progressing to a feasibility study, providing improved certainty regarding reserves, metallurgical design, equipment and operational risks.

Conventional evaporation pond and process technology used to minimise operational risks.

PEA completed by Tier-1 engineering consultancy WorleyParsons to international standards. Accuracy of operating and capital cost estimates expected within a +/- 25% range.

“The release of this PEA is an important milestone for the Maricunga project. Prepared by Worley Parsons alongside MSB’s technical team, the level of detail and information of the report meets international standards and demonstrates the world class nature of Maricunga. The study demonstrates a very positive and robust outcome that justifies completion of a full feasibility study. The operating expenditure estimate places Maricunga in the lower quartile on the cost curve, at US$2,938/t (excluding KCl), with a payback of less than three years. We are excited to continue advancing the Maricunga project and congratulate the MSB project management team for its effort and success.” Jeremy Poirier, President and CEO of Bearing commented.

Alles Weitere unter: https://finance.yahoo.com/news/bearing-lithium-corp-maricung…

Antwort auf Beitrag Nr.: 56.495.744 von married am 19.12.17 20:20:01

Finde die Daten aber eigentlich nicht schlecht und mit dem neuen Chilenischen Präsidenten scheint das politische Risiko auch geringer zu werden.

20 000 T pa

Scheint einige zu enttäuschen.Finde die Daten aber eigentlich nicht schlecht und mit dem neuen Chilenischen Präsidenten scheint das politische Risiko auch geringer zu werden.

Na, das ist doch Mal ne' Hausnummer

Ford Plans $11 Billion Investment, 40 Electrified Vehicles by 2022

Investor News

16 January 2018

Ford Plans $11 Billion Investment, 40 Electrified Vehicles by 2022

The following article from Reuters at the North American International Auto show in Detroit, Michigan. The original article can be found at the following URL.

DETROIT (Reuters) - Ford Motor Co (F.N) will significantly increase its planned investments in electric vehicles to $11 billion by 2022 and have 40 hybrid and fully electric vehicles in its model lineup, Chairman Bill Ford said on Sunday at the Detroit auto show.

The investment figure is sharply higher than a previously announced target of $4.5 billion by 2020, Ford executives said, and includes the costs of developing dedicated electric vehicle architectures. Ford’s engineering, research and development expenses for 2016, the last full year available, were $7.3 billion, up from $6.7 billion in 2015.

Ford Chief Executive Jim Hackett told investors in October the automaker would slash $14 billion in costs over the next five years and shift capital investment away from sedans and internal combustion engines to develop more trucks and electric and hybrid cars.

Of the 40 electrified vehicles Ford plans for its global lineup by 2022, 16 will be fully electric and the rest will be plug-in hybrids, executives said.

“We’re all in on this and we’re taking our mainstream vehicles, our most iconic vehicles, and we’re electrifying them,” Ford told reporters. “If we want to be successful with electrification, we have to do it with vehicles that are already popular.”

General Motors Co (GM.N), Toyota Motor Corp (7203.T) and Volkswagen AG (VOWG_p.DE) have already outlined aggressive plans to expand their electric vehicle offerings and target consumers who want luxury, performance and an SUV body style - or all three attributes in the same vehicle.

Mainstream auto makers are reacting in part to pressure from regulators in China, Europe and California to slash carbon emissions from fossil fuels. They also are under pressure from Tesla Inc ( TSLA.O)’s success in creating electric sedans and SUVs that inspire would-be owners to line up outside showrooms and flood the company with orders.

GM said last year it would add 20 new battery electric and fuel cell vehicles to its global lineup by 2023, financed by robust profits from traditional internal combustion engine vehicles in the United States and China.

GM Chief Executive Mary Barra has promised investors the Detroit automaker will make money selling electric cars by 2021.

Volkswagen said in November it would spend $40 billion on electric cars, autonomous driving and new mobility services by the end of 2022 – significantly more than when it announced two months earlier it would invest more than 20 billion euros on electric and self-driving cars through 2030.

Toyota is racing to commercialize a breakthrough battery technology during the first half of the 2020s with the potential to cut the cost of making electric cars.

Ford’s additional investments in electric vehicles contrasted with many of the vehicle launches at the Detroit show which featured trucks and SUVs. On Sunday evening, Daimler AG (DAIGn.DE) unveiled its new G-class SUV, a bulky off roader, in an abandoned movie theater in downtown Detroit once used as a set for the movie “8 Mile.”

Daimler CEO Dieter Zetsche hinted to Former California Gov. Arnold Schwarzenegger during an exchange on stage next to the G-class that Daimler would someday have an electric version of the vehicle.

SUVs figured in Ford’s electric vehicle presentation. The automaker’s president of global markets, Jim Farley, said on Sunday that Ford would bring a high-performance electric utility vehicle to market by 2020. The company will begin production of a hybrid version of its popular F-150 truck at a plant in Dearborn, Michigan, in 2020.

“What we learned from this first cycle of electrification is people want really nice products,” Farley said.

‘THINK BIG’

Ford’s shift to the electric vehicle strategy has been more than six months in the making after Hackett replaced former Chief Executive Mark Fields in May.

The plan was finalized in recent months after an extensive review, a person familiar with the process said. In October, Ford disclosed it had formed a team to accelerate global development of electric vehicles, whose mission is to “think big” and “make quicker decisions.”

Some of the electric vehicles will be produced with Ford’s JV in China aimed at the Chinese market. One aim of Ford’s “Team Edison” is to identify and develop electric-vehicle partnerships with other companies, including suppliers, in some markets, according to Sherif Marakby, vice president of autonomous vehicles and electrification.

China, India, France and the United Kingdom all have announced plans to phase out vehicles powered by combustion engines and fossil fuels between 2030 and 2040.

ON BEHALF OF THE BOARD

Signed "Jeremy Poirier"

Jeremy Poirier, President and CEO

FOR FURTHER INFORMATION PLEASE CONTACT:

Jeremy Poirier-- President and CEO Bearing Lithium - Telephone: 1-604-262-8835

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This press release includes certain "forward-looking information” and "forward-looking statements” (collectively "forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operating or financial performance of the Company, are forward-looking statements.