Signal Gold [ Anaconda Mining ] auf dem Weg in eine goldige Zukunft! - 500 Beiträge pro Seite

eröffnet am 01.01.18 17:06:11 von

neuester Beitrag 10.04.24 13:41:35 von

neuester Beitrag 10.04.24 13:41:35 von

Beiträge: 1.455

ID: 1.270.505

ID: 1.270.505

Aufrufe heute: 5

Gesamt: 107.956

Gesamt: 107.956

Aktive User: 0

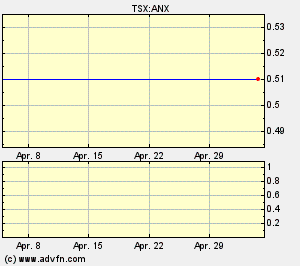

ISIN: CA82664T1012 · WKN: A3DK3Q · Symbol: SGNL

0,1150

CAD

0,00 %

0,0000 CAD

Letzter Kurs 23.04.24 Toronto

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 1,7500 | +15,13 | |

| 11,180 | +14,08 | |

| 208,00 | +13,60 | |

| 11,250 | +12,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7000 | -12,49 | |

| 0,7250 | -14,71 | |

| 4,2300 | -17,86 | |

| 0,9000 | -25,00 | |

| 46,80 | -98,06 |

Herzlich Willkommen an alle Investierten und Interessierten bei Anaconda Mining.

Eine Kanadische Goldmine welche durch Fusion, Akquise und Produktionserweiterung nun in neue Kursregionen durchstarten sollte.

Ich wünsche allerseits viel Erfolg mit diesem Investment!

IQ4U

Eine Kanadische Goldmine welche durch Fusion, Akquise und Produktionserweiterung nun in neue Kursregionen durchstarten sollte.

Ich wünsche allerseits viel Erfolg mit diesem Investment!

IQ4U

Ich wünsche allen Goldies ein gutes, gesundes und erfolgreiches neues Jahr!

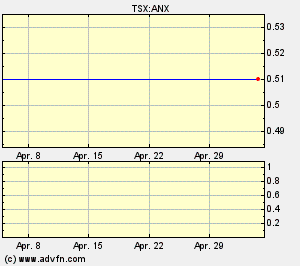

Mal sehen wann sich die Schlange erhebt von den 0,10 CAD in Richtung 0,15...

Mit großem Volumen steigt der Kurs.

Na, wenn das mal nicht was positives ist nach so langer Zeit des Darbens...

2018 könnte unser Jahr werden hier mit der Schlange...

Na, wenn das mal nicht was positives ist nach so langer Zeit des Darbens...

2018 könnte unser Jahr werden hier mit der Schlange...

Anaconda Mining produces 10,002 ounces of gold and generates $15.4M in gold sales for the seven month period ended December 31, 2017

CNW GroupJanuary 11, 2018

TORONTO , Jan. 11, 2018 /CNW/ - Anaconda Mining Inc. ("Anaconda" or the "Company") (ANX.TO) is pleased to announce production results and certain financial information for the four month and seven month periods ended December 31, 2017 . The Company recently announced a change to its fiscal year end to December 31 , from its previous fiscal year end of May 31 . Consequently, the Company will report audited financial results for the seven month transitional fiscal year from June 1, 2017 to December 31, 2017 (the "Transition Year").

Anaconda Mining Inc. (CNW Group/Anaconda Mining Inc.)

Anaconda Mining Inc. (CNW Group/Anaconda Mining Inc.)

More

All dollar amounts are in Canadian Dollars. The Company expects to file its full audited financial statements and management discussion and analysis for the Transition Year by March 1, 2018 .

Highlights for the seven month Transition Year Ended December 31, 2017

•Anaconda produced 10,002 ounces of gold and sold 9,509 ounces during the Transition Year ended December 31, 2017 , on track to exceed original guidance of 15,500 ounces for the twelve month period ending May 31, 2018 , or pro-rated guidance of 9,042 ounces for the seven month period;

•The Company generated $15.4 million in revenue at an average sale price of $1,615 per ounce, and earned a further $0.8 million from the sale of waste rock as aggregate from its Point Rousse Project;

•The Pine Cove Mill achieved throughput of 275,640 tonnes during the seven months ended December 31, 2017 , reflecting a throughput rate of 1,316 tonnes per day, an 8% improvement over the previous fiscal year;

•Anaconda mined 382,111 tonnes of ore during the Transition Year at a strip ratio of 1.8 waste tonnes to ore tonnes, a 65% reduction from the previous fiscal year strip ratio of 5.1;

•Anaconda has extended mining in the Pine Cove Pit into early 2018, and has commenced planning for the transition to the Stog'er Tight deposit;

•Anaconda strengthened its Point Rousse infrastructure with the government approval to convert the Pine Cove Pit into a tailings facility with a 15-year storage capacity based on existing throughput rates;

•The Company announced a Mineral Resource for the Argyle Deposit, located 4.5 kilometres from the Pine Cove Mill, comprising 543,000 tonnes of Indicated Resources at 2.19 g/t (38,300 ounces) and 517,000 tonnes of Inferred Resources at 1.8 g/t (30,300 ounces);

•With the completion of a $3 million non-brokered private placement in October 2017 , the Company is undertaking extension and infill drill programs at the Goldboro Project and the Point Rousse Project.

President and CEO, Dustin Angelo , stated, "The Point Rousse Project achieved strong performance across all metrics for the Transition Year, and with gold production of 10,002 ounces, the Company was well on track to exceed its guidance of 15,500 ounces for the fiscal year that was to end May 31, 2018 . Looking ahead to 2018, Point Rousse will be transitioning to the higher grade Stog'er Tight deposit by the end of Q2 2018, and the Company is guiding to 18,000 ounces of gold production. Anaconda will also be putting into service its in-pit tailings facility, and progressing with the permitting process for the recently announced Argyle deposit, located only 4.5 kilometres from the Pine Cove Mill."

2018 Guidance

For the 2018 calendar year, the Company is projecting to produce and sell approximately 18,000 ounces of gold, which at a budgeted gold price of $1,550 will generate revenue of approximately $28.0 million . The increase over the previous fiscal year guidance of 15,500 ounces reflects the increasing grade profile as the mine operation transitions to the Stog'er Tight deposit. Production in the first two quarters is expected to be primarily from remaining mining in the Pine Cove Pit and the existing ore stockpiles, with ore delivery from Stog'er Tight expected to commence in late Q2 2018. Quarterly mill throughput is expected to remain consistent throughout the year, as lower relative tonnage from Stog'er Tight is supplemented by marginal ore stockpiles. Operating cash costs for the full year are expected to be around $1,100 per ounce of gold sold, consistent with historical levels over the past three years, with a decreasing operating cost per ounce profile in the later part of 2018 as the operation transitions fully to higher-grade ore production from Stog'er Tight.

Operating Statistics for the Transition Year Ended December 31, 2017

...

Quelle: https://finance.yahoo.com/news/anaconda-mining-produces-10-0…

CNW GroupJanuary 11, 2018

TORONTO , Jan. 11, 2018 /CNW/ - Anaconda Mining Inc. ("Anaconda" or the "Company") (ANX.TO) is pleased to announce production results and certain financial information for the four month and seven month periods ended December 31, 2017 . The Company recently announced a change to its fiscal year end to December 31 , from its previous fiscal year end of May 31 . Consequently, the Company will report audited financial results for the seven month transitional fiscal year from June 1, 2017 to December 31, 2017 (the "Transition Year").

Anaconda Mining Inc. (CNW Group/Anaconda Mining Inc.)

Anaconda Mining Inc. (CNW Group/Anaconda Mining Inc.)

More

All dollar amounts are in Canadian Dollars. The Company expects to file its full audited financial statements and management discussion and analysis for the Transition Year by March 1, 2018 .

Highlights for the seven month Transition Year Ended December 31, 2017

•Anaconda produced 10,002 ounces of gold and sold 9,509 ounces during the Transition Year ended December 31, 2017 , on track to exceed original guidance of 15,500 ounces for the twelve month period ending May 31, 2018 , or pro-rated guidance of 9,042 ounces for the seven month period;

•The Company generated $15.4 million in revenue at an average sale price of $1,615 per ounce, and earned a further $0.8 million from the sale of waste rock as aggregate from its Point Rousse Project;

•The Pine Cove Mill achieved throughput of 275,640 tonnes during the seven months ended December 31, 2017 , reflecting a throughput rate of 1,316 tonnes per day, an 8% improvement over the previous fiscal year;

•Anaconda mined 382,111 tonnes of ore during the Transition Year at a strip ratio of 1.8 waste tonnes to ore tonnes, a 65% reduction from the previous fiscal year strip ratio of 5.1;

•Anaconda has extended mining in the Pine Cove Pit into early 2018, and has commenced planning for the transition to the Stog'er Tight deposit;

•Anaconda strengthened its Point Rousse infrastructure with the government approval to convert the Pine Cove Pit into a tailings facility with a 15-year storage capacity based on existing throughput rates;

•The Company announced a Mineral Resource for the Argyle Deposit, located 4.5 kilometres from the Pine Cove Mill, comprising 543,000 tonnes of Indicated Resources at 2.19 g/t (38,300 ounces) and 517,000 tonnes of Inferred Resources at 1.8 g/t (30,300 ounces);

•With the completion of a $3 million non-brokered private placement in October 2017 , the Company is undertaking extension and infill drill programs at the Goldboro Project and the Point Rousse Project.

President and CEO, Dustin Angelo , stated, "The Point Rousse Project achieved strong performance across all metrics for the Transition Year, and with gold production of 10,002 ounces, the Company was well on track to exceed its guidance of 15,500 ounces for the fiscal year that was to end May 31, 2018 . Looking ahead to 2018, Point Rousse will be transitioning to the higher grade Stog'er Tight deposit by the end of Q2 2018, and the Company is guiding to 18,000 ounces of gold production. Anaconda will also be putting into service its in-pit tailings facility, and progressing with the permitting process for the recently announced Argyle deposit, located only 4.5 kilometres from the Pine Cove Mill."

2018 Guidance

For the 2018 calendar year, the Company is projecting to produce and sell approximately 18,000 ounces of gold, which at a budgeted gold price of $1,550 will generate revenue of approximately $28.0 million . The increase over the previous fiscal year guidance of 15,500 ounces reflects the increasing grade profile as the mine operation transitions to the Stog'er Tight deposit. Production in the first two quarters is expected to be primarily from remaining mining in the Pine Cove Pit and the existing ore stockpiles, with ore delivery from Stog'er Tight expected to commence in late Q2 2018. Quarterly mill throughput is expected to remain consistent throughout the year, as lower relative tonnage from Stog'er Tight is supplemented by marginal ore stockpiles. Operating cash costs for the full year are expected to be around $1,100 per ounce of gold sold, consistent with historical levels over the past three years, with a decreasing operating cost per ounce profile in the later part of 2018 as the operation transitions fully to higher-grade ore production from Stog'er Tight.

Operating Statistics for the Transition Year Ended December 31, 2017

...

Quelle: https://finance.yahoo.com/news/anaconda-mining-produces-10-0…

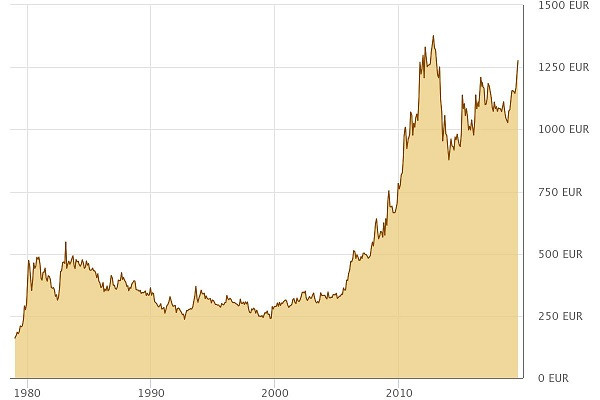

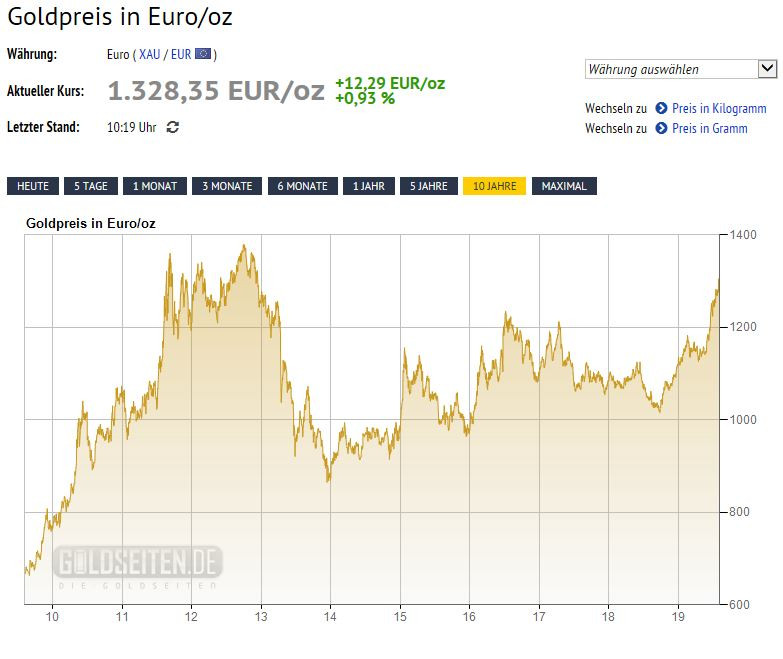

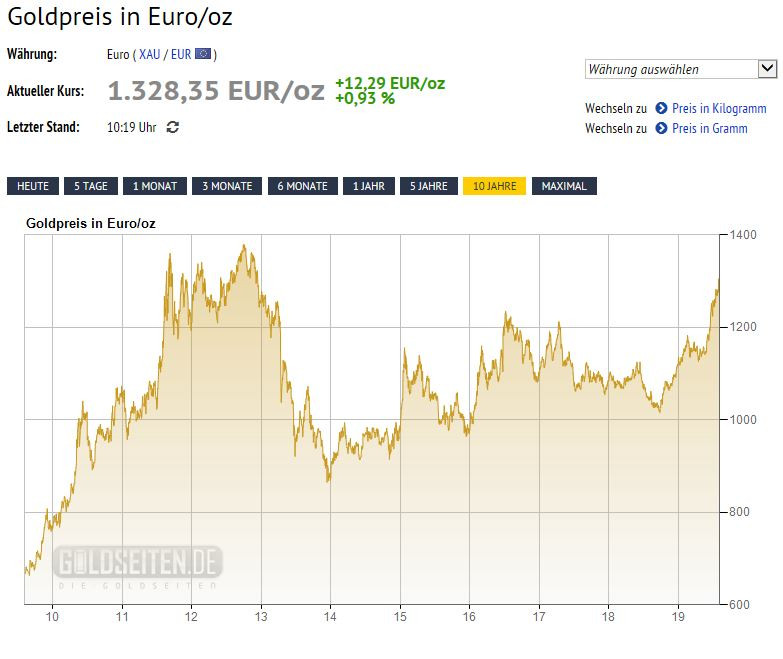

Schöner Lauf des Goldpreises derzeit.

Mal sehen, ob er sich nun hält und vielleicht auch weiter steigt in Richtung 1400 oder gar 1500 USD.

Dazu kommt das Goldboro Projekt mit dem Plan die jährliche Produktion mittelfristig auf 50.000 Unzen jährlich und langfristig in Richtung 100.000 Unzen zu steigern...

Es scheinen nun endlich die goldenen Zeiten für die Aktionäre angebrochen zu sein.

Mein Keller ist gut gefüllt mit Anaconda Aktien.

Schönes Wochenende Euch allen!

IQ

Mal sehen, ob er sich nun hält und vielleicht auch weiter steigt in Richtung 1400 oder gar 1500 USD.

Dazu kommt das Goldboro Projekt mit dem Plan die jährliche Produktion mittelfristig auf 50.000 Unzen jährlich und langfristig in Richtung 100.000 Unzen zu steigern...

Es scheinen nun endlich die goldenen Zeiten für die Aktionäre angebrochen zu sein.

Mein Keller ist gut gefüllt mit Anaconda Aktien.

Schönes Wochenende Euch allen!

IQ

Wie geil ist das denn nun heute wieder...?

So viel Spass hat uns die Schlange ja schon Jahre nicht mehr gemacht...

So viel Spass hat uns die Schlange ja schon Jahre nicht mehr gemacht...

Antwort auf Beitrag Nr.: 56.708.636 von IQ4U am 13.01.18 19:03:44

Denke auch, dass Anaconda aktuell günstig bewertet ist. Wenn man bis 2020 die 50.000 Unzen jährlich produziert und den aktuellen Gewinn pro Unze von 400 CAD auch auf das Jahr 2020 fortschreibt, käme man dann auf einen Ertrag von 20 Mio Cad. Ich denke dann wäre eine Marktkapitalisierung von 200 Mio angemessen. Da wir heute eine Marktkapitalisierung von um die 50 Mio haben, ist Anaconda aktuell sicher nicht teuer.

Zitat von IQ4U: Schöner Lauf des Goldpreises derzeit.

Mal sehen, ob er sich nun hält und vielleicht auch weiter steigt in Richtung 1400 oder gar 1500 USD.

Dazu kommt das Goldboro Projekt mit dem Plan die jährliche Produktion mittelfristig auf 50.000 Unzen jährlich und langfristig in Richtung 100.000 Unzen zu steigern...

Es scheinen nun endlich die goldenen Zeiten für die Aktionäre angebrochen zu sein.

Mein Keller ist gut gefüllt mit Anaconda Aktien.

Schönes Wochenende Euch allen!

IQ

Denke auch, dass Anaconda aktuell günstig bewertet ist. Wenn man bis 2020 die 50.000 Unzen jährlich produziert und den aktuellen Gewinn pro Unze von 400 CAD auch auf das Jahr 2020 fortschreibt, käme man dann auf einen Ertrag von 20 Mio Cad. Ich denke dann wäre eine Marktkapitalisierung von 200 Mio angemessen. Da wir heute eine Marktkapitalisierung von um die 50 Mio haben, ist Anaconda aktuell sicher nicht teuer.

Anaconda's Goldboro PEA pegs NPV at $120-million

2018-01-17 07:13 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING ANNOUNCES POSITIVE PRELIMINARY ECONOMIC ASSESSMENT FOR THE GOLDBORO GOLD PROJECT

Anaconda Mining Inc. has released the positive results of an independent preliminary economic assessment study (PEA) on the 100-per-cent-owned Goldboro gold project located in the eastern goldfields of Guysborough county, Nova Scotia, Canada. The PEA provides a base-case assessment of developing the Goldboro mineral resource by open-pit and underground mining, on-site concentration through gravity and flotation circuits and leaching of the concentrate, and a gold recovery at Anaconda's Pine Cove mill in Newfoundland.

Goldboro project PEA highlights

The base-case scenario utilizes a long-term gold price of $1,550. A summary of the certain assumptions and results from the PEA are indicated below:

Undiscounted cash flow before income and mining taxes of $189-million;

Pretax net present value (NPV) at a 7-per-cent discount rate of $120-million and a pretax internal rate of return (IRR) of 38 per cent implying a pretax payback period of 2.9 years;

Total capital expenditures of $89-million, including preproduction capital expenditures of $47-million;

Undiscounted cash flow after income and mining taxes of $106-million;

After-tax NPV at a discount rate of 7 per cent of $61-million and an after-tax IRR of 26 per cent, implying an after-tax payback period of 3.4 years;

Life of mine (LOM) of 8.8 years, with 2.4 million tonnes of potential mill feed at an average grade of 5.13 grams per tonne (g/t) and recovery rate of 93.6 per cent, resulting in gold production of 375,900 ounces;

Mining rate of 600 tonnes per day (tpd) of mineralized material at an average open-pit grade of 2.99 g/t and underground grade of 6.83 g/t; processing at 800 tpd (600 tpd of run-of-mine high-grade material and rehandle of 200 tpd of stockpiled open-pit lower-grade material);

Average annual gold production of 41,770 ounces with up to 62,000 ounces in year 5;

LOM average operating cash cost of $654 per ounce (about $525 (U.S.) per ounce) and all-in sustaining cash cost of $797 per ounce (about $640 (U.S.) per ounce) at an 0.80 USD:CAD exchange rate;

Potential for up to 200 jobs at the peak of production.

"The positive preliminary economic assessment marks another significant milestone for Anaconda. It validates our Goldboro investment thesis and illustrates the significant financial potential inherent in the project. Of strategic importance, the base-case scenario outlined in the study envisions the creation of our second centre of operations while leveraging our existing infrastructure and operating experience in Atlantic Canada. We have a project generating high NPVs at various discount rates, a 2.9-year pretax payback period and a pretax IRR close to 40 per cent. We will use the results of the preliminary economic assessment to optimize the economics, expand the mineral resources and move closer to demonstrating the feasibility of building a mine at Goldboro. We believe this has the potential to be a tremendous project for all stakeholders," said Dustin Angelo, president and chief executive officer.

Description of Goldboro project and PEA

The PEA has been developed by various independent consultants -- WSP Canada Inc. responsible for the open-pit and underground mining, surface infrastructure, tailings facility, and project economics; Thibault and Associates Inc. was responsible for all processing aspects of the project; and Mercator Geological Services Ltd. was responsible for the mineral resource estimate.

The base-case scenario outlined in the PEA includes the development of the Goldboro mineral resource by open-pit and underground mining, on-site concentration through gravity and flotation circuits and the leaching of the concentrate and recovery of gold at Anaconda's fully permitted and operational Pine Cove mill in Newfoundland.

Other development scenarios were considered during the evaluation process, including an underground mining only scenario as well as the shipping of whole ore to Pine Cove mill, and will be documented in the upcoming National Instrument 43-101 technical report for the PEA.

Cash flow analysis

The results of the discounted cash flow analysis are presented in the associated tables. NPV, IRR and payback values for the project are estimated on a pretax and after-tax basis. The base-case scenario assumes a long-term gold price of $1,550 and a discount rate of 7 per cent. The gold price sensitivity on a pretax and after-tax basis as presented in the associated table, respectively, demonstrate the significant potential increase in the NPV and IRR of the project should the gold price continue to trade in a range of $1,600 to $1,700 per ounce.

PRETAX DISCOUNTED NPV -- GOLD PRICE SENSITIVITY

Pretax NPV* ($M) Gold price ($/ounce)

Base case

$1,450 $1,500 $1,550 $1,600 $1,700

Discount 0% $152 $171 $189 $208 $245

Rates 5% $107 $122 $137 $152 $182

base case 7% $93 $107 $120 $134 $162

10% $74 $86 $99 $111 $135

IRR (%) 32 35 38 41 47

Payback -- years 3.2 3.1 2.9 2.8 2.6

AFTER-TAX DISCOUNTED NPV -- GOLD PRICE SENSITIVITY

After-tax NPV* ($M) Gold price ($/ounce)

Base case

$1,450 $1,500 $1,550 $1,600 $1,700

Discount 0% $84 $95 $106 $117 $140

Rates 5% $53 $63 $72 $81 $99

base case 7% $44 $52 $61 $69 $86

10% $31 $39 $46 $54 $69

IRR (%) 21% 23% 26 28% 33%

Payback -- years 3.8 3.6 3.4 3.3 3.0

After-tax cash flows reflect a combined federal and provincial tax rate of 31 per cent and the Nova Scotia Mining Tax, calculated on the basis of the greater of 2 per cent of net revenue or 15 per cent of net income from the mine operation.

The company carries tax pools that have not been incorporated into the asset-level economic analysis, which have the potential to increase the after-tax value of the project. The estimated tax loss pools available as at Dec. 31, 2017, were as follows: non-capital losses of $10.0-million, cumulative canadian exploration expense of $7.0-million and cumulative Canadian development expenses of $4.5-million.

Operating cost

The PEA estimates that the project will produce approximately 375,900 ounces of gold during the life of the project, or an average of 41,770 ounces per year at an estimated 8.8-year LOM. Maintenance, parts and repairs are estimated based on industry-standard factors for these costs. Mining costs are estimated, based on third party contractor rates of $4.07 per tonne for open-pit material mined at a strip ratio of 7.3, and $91.12 for underground plant feed. Processing costs are projected at $19.98 per tonne of material concentrated on site and $4.12 for processing activity at the Anaconda's Pine Cove mill in Newfoundland.

Details of the estimated operating costs, and other charges, are presented in the associated tables.

OPERATING COSTS

Production years 8.8

Mining -- open pit (OP) $36.4M

Mining -- underground (UG) $123.7M

Processing -- on-site $48.6M

Processing -- off-site $10.0M

General and administrative $17.4M

Transportation concentrate $9.8M

Total operating costs $246.0M

UNIT OPERATING COSTS

Mining -- OP $/t mined $4.07

Mining -- UG $/t UG PMF 91.12

Processing -- on-site $/t mill 19.98

Processing -- off-site $/t mill 4.12

General and administrative $/t mill 7.16

Transportation concentrate $/t mill 4.01

Sustaining capital costs

Mining -- UG $/t UG PMF 27.61

Capital cost

Mining capital costs, summarized in the associated table, were estimated based on a detailed equipment schedule matched to the mining production schedule. Total capital costs for the life of the project were estimated at $74-million plus a 20-per-cent contingency for a total of $89-million, including preproduction capital expenditures of $47-million and $42-million during years 1 and 2 for underground development. Sustaining capital through the life of the project is estimated at $50-million and covers cost of underground development, tailings expansion, reclamation and contingencies. Preproduction, production and total capital expenditures are shown in the associated table.

CAPITAL COST

Cost item/description Preproduction Production years 1 and 2 Sustaining years 3 plus Total

($M) ($M) ($M) ($M)

Open pit mining 0.6 0.4 0.1 1.0

Underground mining 0.0 32.5 37.5 70.0

Process plant 18.8 0.0 0.0 18.8

Power, electrical and

instrumentation 3.4 0.0 0.0 3.4

Site prep and infrastructure 3.0 1.7 0.0 4.7

Water management 0.5 0.2 0.0 0.7

Tailings management facilities 4.8 0.0 5.0 9.8

Indirect capital 7.8 0.5 0.0 8.2

Contingency 7.8 6.9 2.8 17.6

Reclamation and closure 0.0 0.2 4.2 4.4

Total capital cost 46.7 42.2 49.7 138.6

* Plant capital cost including indirect costs and EPCM (engineering, procurement and construction management) are

estimated at $19.4-million.

Total capital cost is estimated at $24.2-million using 25-per-cent contingency.

Mining and processing

The PEA is based on a conventional truck-and-shovel, 600 tpd open-pit mining operation at a single pit transitioning to underground mining in year 3.

The base-case scenario contemplates mining 600 tpd of mineralized material and concentrating at 800 tpd. Lower-grade open-pit material, not initially scheduled for processing, will be stockpiled and blended over the life of mine. The open-pit production period is roughly three years and the entire production period, including underground mining is 8.8 years.

Goldboro run-of-mine mineralized material will be upgraded at the Goldboro mine site to a gravity and flotation concentrate using a conventional recovery methods consisting of crushing, grinding, gravity and flotation circuits. Concentrate produced at Goldboro would be transported to Anaconda's existing mill facility at Point Rousse, Nfld., for final processing. At Point Rousse, the company uses leaching, filtration and Merrill Crowe to recover gold in solution and makes dore bullion bars on-site. A flow sheet was developed by Thibault based on a bench-scale metallurgical testing program conducted in 2017. Based on bench-scale assessment of gold recovery by gravity, flotation and cyanide leaching of the flotation concentrate and typical in-plant recovery of gold by Merrill Crowe and furnace operations, the overall potential recovery of gold from processing of Goldboro feedstock was established as 93.6 per cent.

Sensitivities

As indicated in the associated table, project cash flow is particularly sensitive to changes in the price of gold while relatively less sensitive to changes in recovery, operating costs and capital expenditures. The associated table shows the effect on the pretax economics of increasing or decreasing the price of gold, capital expenditures, operating costs and recovery estimates for the project by up to plus or minus 20 per cent.

SENSITIVITY VALUE RANGES

Variable Units Downside Downside Base case Upside Upside

Au recovery % variation -10.00% -5.00% 0.00% 1.50%

84.24% 88.92% 93.60% 95.00%

NPV (7%), M$ 78 99 120 127

IRR (%) 28.4 33.5 38.4 39.8

payback (years) 3.4 3.2 2.9 2.9

Au price % variation -20.00% -10.00% 0.00% 10.00% 20.00%

NPV (7%), M$ 35 78 120 163 206

IRR (%) 17.4 28.4 38.4 47.7 56.6

payback (years) 4.2 3.4 2.9 2.6 2.3

Operating cost % variation 20.00% 10.00% 0.00% -10.00% -20.00%

NPV (7%), M$ 84 102 120 139 157

IRR (%) 29.2 33.8 38.4 42.9 47.6

payback (years) 3.4 3.2 2.9 2.7 2.6

Capital expenditure s % variation 20.00% 10.00% 0.00% -10.00% -20.00%

NPV (7%), M$ 97 109 120 132 144

IRR (%) 29.6 33.7 38.4 43.7 49.9

payback (years) 3.4 3.2 2.9 2.7 2.5

Mineral resource

The mineral resource estimate which formed the basis of the PEA, is set out in the associated table and was prepared by Mercator under the supervision of Michael Cullen, PGeo, an independent qualified person, as defined in National Instrument 43-101. The effective date of this mineral resource estimate is Jan. 1, 2018. The resource estimate is based on validated results of 272 surface drill holes and 119 underground drill holes, for a total of 66,743 metres of diamond drilling that was completed between 1984 and 2015. Modelling was performed using GEOVIA Surpac 6.8 software with gold grades estimated for inferred and indicated category mineral resources using inverse-distance-squared (ID2) interpolation methodology and capped 1.0-metre downhole assay composites. Measured category blocks are restricted to a metallurgical bulk composite digital solid within which grade was interpolated using nearest neighbour methodology. Indicated mineral resources are defined as all other interpolated blocks with at least three contributing drill holes having a maximum average distance of 50 m from the block centroid. Inferred mineral resources are defined as all remaining interpolated blocks that occur within the various belt model solids. Block size is two metres by two metres by two metres. Partial percentage volume assignment was used to estimate volume of solid models within the block model. The drilling-defined deposit is divided into three spatial domains for modelling purposes, these being the Boston Richardson zone, the West Goldbrook zone and the East Goldbrook zone. At a long-term metal price of $1,550 per ounce, reasonable prospects are considered to exist for eventual economic extraction of mineral resources defined at a 0.5 g/t Au cut-off value within limits of the conceptual final pit shell prepared by WSP. Mineral resources defined external to this pit shell are reported at a 2.0 g/t Au cut-off value and are considered to have reasonable prospects for eventual economic extraction using underground mining methods at the same long-term gold price. Additional information about the mineral resource modelling methodology will be documented in the upcoming NI 43-101 technical report for the PEA.

GOLDBORO MINERAL RESOURCE ESTIMATE -- EFFECTIVE JAN. 1, 2018

Resource type Au cut-off Category Tonnes AuTroy ounces

(g/t) (rounded) (g/t) (rounded)

Open pit 0.50 measured 397,000 2.88 36,800

indicated 662,000 3.09 65,800

measured and indicated 1,059,000 3.01 102,500

inferred 45,000 2.54 3,700

Underground 2.00 measured 22,000 4.7 3,300

indicated 2,564,000 5.09 419,600

measured and indicated 2,586,000 5.09 422,900

inferred 2,497,000 4.28 343,600

Combined open pit

and underground 0.50/2.00 measured 419,000 2.98 40,100

indicated 3,226,000 4.68 485,400

measured and indicated 3,645,000 4.48 525,400

inferred 2,542,000 4.25 347,300

Mineral resource estimate notes

1. Mineral resources were prepared in accordance with NI 43-101 and the CIM Definition Standards (2014). Mineral resources that are not mineral reserves do not have demonstrated economic viability.

2.Open-pit mineral resources are reported at a cut-off grade of 0.5 g/t gold that is based on a gold price of $1,550/ounce and a gold processing recovery factor of 95 per cent, these include PEA base-case open-pit resources that have an estimated life-of-mine strip ratio of 7.3:1 (waste tonnes:PEA tonne).

3.Appropriate mining costs, processing costs, metal recoveries and interramp pit slope angles were used by WSP to generate the pit design.

4.Rounding may result in apparent summation differences between tonnes, grade and contained metal content.

5.Tonnage and grade measurements are in metric units. Contained gold ounces are in troy ounces.

6. Contributing assay composites were capped at 80 g/t Au

7.A density factor of 2.7 grams per cubic metre was applied to all blocks.

The measured and indicated mineral resource category gold inventories in the associated table for combined open-pit and underground resources total 525,400 ounces and the inferred mineral resource category gold inventory for combined open-pit and underground resources total 347,300 ounces.

Qualified persons

This news release has been reviewed and approved by the below-noted qualified persons. The qualified persons have reviewed or verified all information for which they are individually responsible, including sampling, analytical and test results underlying the information or opinions contained herein.

Gordana Slepcev, PEng, chief operating officer, and Paul McNeill, PGeo, vice-president, exploration, with Anaconda Mining, qualified persons;

Michael Cullen, PGeo, of Mercator Geological Services Ltd., an independent qualified person, under NI 43-101;

Joanne Robinson, PEng, principal mine engineer of WSP, an independent qualified person, under NI 43-101;

Garth Liukko, PEng, senior engineer of WSP, an independent qualified person, under NI 43-101;

Sebastian Bertelegni, Ing, director, mining infrastructure, of WSP, an independent qualified person, under NI 43-101;

J. Dean Thibault, PEng, senior process chemical engineer of Thibault & Associates Inc., a qualified person under NI 43-101.

Technical report

For readers to fully understand the information in this news release, they should read the PEA technical report in its entirety which the company expects to file in accordance with NI 43-101 within 45 days from the date of this news release on SEDAR and it will be available at that time on the Anaconda Mining website, including all qualifications, assumptions and exclusions that relate to the PEA. The technical report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Risks and opportunities

As with all mining ventures, a large number of risks and opportunities can affect the outcome of the project. Most of these risks and opportunities are based on uncertainty, such as lack of scientific information (test results, drill results) or the lack of control over external factors (metal prices, exchange rates).

Subsequent higher-level engineering studies would be required to further refine these risks and opportunities, identify new risks and opportunities, and define strategies for risk mitigation or opportunity implementation

The PEA identified a number of principal risks for the project which are summarized below:

Geological interpretation and mineral resource classification (27 per cent of the mineral resources used in the mine plan are inferred mineral resources);

Due to a relatively small number of metallurgical samples tested, larger variations in mineralogy and metal recovery may exist than have been observed to date;

Geotechnical and hydrogeological considerations;

No information on baseline groundwater quality;

No physical characterization of the tailings material has been done;

No waste rock characterization has been done;

Construction management and cost containment during development of the project;

High exposure to potential escalation of costs associated with latent ground conditions due to need for dewatering dikes and large, shallow tailings management facility;

Increased operating cost and/or capital cost;

Reduced metal prices.

Anaconda has completed environmental baseline studies for Goldboro during spring and summer of 2017 with hydrology and hydrogeology studies initiated late in the fall. Geotechnical investigation for underground mine, open-pit and dump designs were completed up to the prefeasibility study levels. This information will be available during the winter of 2018 and would be used in preparation of the environmental assessment registration and further engineering studies.

Several potential opportunities to improve the accuracy of the results of the project contemplated under the PEA have been identified. Examples include, but may not be limited to:

Expansion of the Goldboro deposit through drilling: The deposit is open at the depth and along strike and geological and geophysical studies indicate the structure-hosting gold mineralization may continue both east and west of the current resource as well as down plunge. Addition of further resources through drilling has the potential to add resources and increase LOM and economics.

More refined pit optimization parameters could result in better optimized open-pit limits than the pit shell selected for the PEA.

Improved hydrogeological and geotechnical understanding may increase pit slope angles or underground design inputs over those used in the PEA.

The company plans to investigate other mining methods that would lead to a decrease in the underground mine development cost.

Geotechnical construction fill materials may be sourced locally from the site and will be confirmed with a site investigation geotechnical laboratory program.

Further metallurgical testing and refining milling processes may result in improved recoveries.

The potential exists to upgrade the mineral resource classification of the deposit.

Tax credits were transferred from Orex.

Improved metal prices.

About Anaconda Mining Inc.

Anaconda is a Toronto Stock Exchange-listed gold mining, exploration and development company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The company operates the Point Rousse Project located in the Baie Verte mining district in Newfoundland, comprising the Pine Cove open-pit mine, the fully permitted Pine Cove mill and tailings facility, the Stog'er Tight mine, and the Argyle deposit, as well as approximately 5,800 hectares of prospective gold-bearing property.

We seek Safe Harbor.

© 2018 Canjex Publishing Ltd. All rights reserved.

Quelle: https://www.stockwatch.com/News/Item.aspx?bid=Z-C:ANX-255798…

2018-01-17 07:13 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING ANNOUNCES POSITIVE PRELIMINARY ECONOMIC ASSESSMENT FOR THE GOLDBORO GOLD PROJECT

Anaconda Mining Inc. has released the positive results of an independent preliminary economic assessment study (PEA) on the 100-per-cent-owned Goldboro gold project located in the eastern goldfields of Guysborough county, Nova Scotia, Canada. The PEA provides a base-case assessment of developing the Goldboro mineral resource by open-pit and underground mining, on-site concentration through gravity and flotation circuits and leaching of the concentrate, and a gold recovery at Anaconda's Pine Cove mill in Newfoundland.

Goldboro project PEA highlights

The base-case scenario utilizes a long-term gold price of $1,550. A summary of the certain assumptions and results from the PEA are indicated below:

Undiscounted cash flow before income and mining taxes of $189-million;

Pretax net present value (NPV) at a 7-per-cent discount rate of $120-million and a pretax internal rate of return (IRR) of 38 per cent implying a pretax payback period of 2.9 years;

Total capital expenditures of $89-million, including preproduction capital expenditures of $47-million;

Undiscounted cash flow after income and mining taxes of $106-million;

After-tax NPV at a discount rate of 7 per cent of $61-million and an after-tax IRR of 26 per cent, implying an after-tax payback period of 3.4 years;

Life of mine (LOM) of 8.8 years, with 2.4 million tonnes of potential mill feed at an average grade of 5.13 grams per tonne (g/t) and recovery rate of 93.6 per cent, resulting in gold production of 375,900 ounces;

Mining rate of 600 tonnes per day (tpd) of mineralized material at an average open-pit grade of 2.99 g/t and underground grade of 6.83 g/t; processing at 800 tpd (600 tpd of run-of-mine high-grade material and rehandle of 200 tpd of stockpiled open-pit lower-grade material);

Average annual gold production of 41,770 ounces with up to 62,000 ounces in year 5;

LOM average operating cash cost of $654 per ounce (about $525 (U.S.) per ounce) and all-in sustaining cash cost of $797 per ounce (about $640 (U.S.) per ounce) at an 0.80 USD:CAD exchange rate;

Potential for up to 200 jobs at the peak of production.

"The positive preliminary economic assessment marks another significant milestone for Anaconda. It validates our Goldboro investment thesis and illustrates the significant financial potential inherent in the project. Of strategic importance, the base-case scenario outlined in the study envisions the creation of our second centre of operations while leveraging our existing infrastructure and operating experience in Atlantic Canada. We have a project generating high NPVs at various discount rates, a 2.9-year pretax payback period and a pretax IRR close to 40 per cent. We will use the results of the preliminary economic assessment to optimize the economics, expand the mineral resources and move closer to demonstrating the feasibility of building a mine at Goldboro. We believe this has the potential to be a tremendous project for all stakeholders," said Dustin Angelo, president and chief executive officer.

Description of Goldboro project and PEA

The PEA has been developed by various independent consultants -- WSP Canada Inc. responsible for the open-pit and underground mining, surface infrastructure, tailings facility, and project economics; Thibault and Associates Inc. was responsible for all processing aspects of the project; and Mercator Geological Services Ltd. was responsible for the mineral resource estimate.

The base-case scenario outlined in the PEA includes the development of the Goldboro mineral resource by open-pit and underground mining, on-site concentration through gravity and flotation circuits and the leaching of the concentrate and recovery of gold at Anaconda's fully permitted and operational Pine Cove mill in Newfoundland.

Other development scenarios were considered during the evaluation process, including an underground mining only scenario as well as the shipping of whole ore to Pine Cove mill, and will be documented in the upcoming National Instrument 43-101 technical report for the PEA.

Cash flow analysis

The results of the discounted cash flow analysis are presented in the associated tables. NPV, IRR and payback values for the project are estimated on a pretax and after-tax basis. The base-case scenario assumes a long-term gold price of $1,550 and a discount rate of 7 per cent. The gold price sensitivity on a pretax and after-tax basis as presented in the associated table, respectively, demonstrate the significant potential increase in the NPV and IRR of the project should the gold price continue to trade in a range of $1,600 to $1,700 per ounce.

PRETAX DISCOUNTED NPV -- GOLD PRICE SENSITIVITY

Pretax NPV* ($M) Gold price ($/ounce)

Base case

$1,450 $1,500 $1,550 $1,600 $1,700

Discount 0% $152 $171 $189 $208 $245

Rates 5% $107 $122 $137 $152 $182

base case 7% $93 $107 $120 $134 $162

10% $74 $86 $99 $111 $135

IRR (%) 32 35 38 41 47

Payback -- years 3.2 3.1 2.9 2.8 2.6

AFTER-TAX DISCOUNTED NPV -- GOLD PRICE SENSITIVITY

After-tax NPV* ($M) Gold price ($/ounce)

Base case

$1,450 $1,500 $1,550 $1,600 $1,700

Discount 0% $84 $95 $106 $117 $140

Rates 5% $53 $63 $72 $81 $99

base case 7% $44 $52 $61 $69 $86

10% $31 $39 $46 $54 $69

IRR (%) 21% 23% 26 28% 33%

Payback -- years 3.8 3.6 3.4 3.3 3.0

After-tax cash flows reflect a combined federal and provincial tax rate of 31 per cent and the Nova Scotia Mining Tax, calculated on the basis of the greater of 2 per cent of net revenue or 15 per cent of net income from the mine operation.

The company carries tax pools that have not been incorporated into the asset-level economic analysis, which have the potential to increase the after-tax value of the project. The estimated tax loss pools available as at Dec. 31, 2017, were as follows: non-capital losses of $10.0-million, cumulative canadian exploration expense of $7.0-million and cumulative Canadian development expenses of $4.5-million.

Operating cost

The PEA estimates that the project will produce approximately 375,900 ounces of gold during the life of the project, or an average of 41,770 ounces per year at an estimated 8.8-year LOM. Maintenance, parts and repairs are estimated based on industry-standard factors for these costs. Mining costs are estimated, based on third party contractor rates of $4.07 per tonne for open-pit material mined at a strip ratio of 7.3, and $91.12 for underground plant feed. Processing costs are projected at $19.98 per tonne of material concentrated on site and $4.12 for processing activity at the Anaconda's Pine Cove mill in Newfoundland.

Details of the estimated operating costs, and other charges, are presented in the associated tables.

OPERATING COSTS

Production years 8.8

Mining -- open pit (OP) $36.4M

Mining -- underground (UG) $123.7M

Processing -- on-site $48.6M

Processing -- off-site $10.0M

General and administrative $17.4M

Transportation concentrate $9.8M

Total operating costs $246.0M

UNIT OPERATING COSTS

Mining -- OP $/t mined $4.07

Mining -- UG $/t UG PMF 91.12

Processing -- on-site $/t mill 19.98

Processing -- off-site $/t mill 4.12

General and administrative $/t mill 7.16

Transportation concentrate $/t mill 4.01

Sustaining capital costs

Mining -- UG $/t UG PMF 27.61

Capital cost

Mining capital costs, summarized in the associated table, were estimated based on a detailed equipment schedule matched to the mining production schedule. Total capital costs for the life of the project were estimated at $74-million plus a 20-per-cent contingency for a total of $89-million, including preproduction capital expenditures of $47-million and $42-million during years 1 and 2 for underground development. Sustaining capital through the life of the project is estimated at $50-million and covers cost of underground development, tailings expansion, reclamation and contingencies. Preproduction, production and total capital expenditures are shown in the associated table.

CAPITAL COST

Cost item/description Preproduction Production years 1 and 2 Sustaining years 3 plus Total

($M) ($M) ($M) ($M)

Open pit mining 0.6 0.4 0.1 1.0

Underground mining 0.0 32.5 37.5 70.0

Process plant 18.8 0.0 0.0 18.8

Power, electrical and

instrumentation 3.4 0.0 0.0 3.4

Site prep and infrastructure 3.0 1.7 0.0 4.7

Water management 0.5 0.2 0.0 0.7

Tailings management facilities 4.8 0.0 5.0 9.8

Indirect capital 7.8 0.5 0.0 8.2

Contingency 7.8 6.9 2.8 17.6

Reclamation and closure 0.0 0.2 4.2 4.4

Total capital cost 46.7 42.2 49.7 138.6

* Plant capital cost including indirect costs and EPCM (engineering, procurement and construction management) are

estimated at $19.4-million.

Total capital cost is estimated at $24.2-million using 25-per-cent contingency.

Mining and processing

The PEA is based on a conventional truck-and-shovel, 600 tpd open-pit mining operation at a single pit transitioning to underground mining in year 3.

The base-case scenario contemplates mining 600 tpd of mineralized material and concentrating at 800 tpd. Lower-grade open-pit material, not initially scheduled for processing, will be stockpiled and blended over the life of mine. The open-pit production period is roughly three years and the entire production period, including underground mining is 8.8 years.

Goldboro run-of-mine mineralized material will be upgraded at the Goldboro mine site to a gravity and flotation concentrate using a conventional recovery methods consisting of crushing, grinding, gravity and flotation circuits. Concentrate produced at Goldboro would be transported to Anaconda's existing mill facility at Point Rousse, Nfld., for final processing. At Point Rousse, the company uses leaching, filtration and Merrill Crowe to recover gold in solution and makes dore bullion bars on-site. A flow sheet was developed by Thibault based on a bench-scale metallurgical testing program conducted in 2017. Based on bench-scale assessment of gold recovery by gravity, flotation and cyanide leaching of the flotation concentrate and typical in-plant recovery of gold by Merrill Crowe and furnace operations, the overall potential recovery of gold from processing of Goldboro feedstock was established as 93.6 per cent.

Sensitivities

As indicated in the associated table, project cash flow is particularly sensitive to changes in the price of gold while relatively less sensitive to changes in recovery, operating costs and capital expenditures. The associated table shows the effect on the pretax economics of increasing or decreasing the price of gold, capital expenditures, operating costs and recovery estimates for the project by up to plus or minus 20 per cent.

SENSITIVITY VALUE RANGES

Variable Units Downside Downside Base case Upside Upside

Au recovery % variation -10.00% -5.00% 0.00% 1.50%

84.24% 88.92% 93.60% 95.00%

NPV (7%), M$ 78 99 120 127

IRR (%) 28.4 33.5 38.4 39.8

payback (years) 3.4 3.2 2.9 2.9

Au price % variation -20.00% -10.00% 0.00% 10.00% 20.00%

NPV (7%), M$ 35 78 120 163 206

IRR (%) 17.4 28.4 38.4 47.7 56.6

payback (years) 4.2 3.4 2.9 2.6 2.3

Operating cost % variation 20.00% 10.00% 0.00% -10.00% -20.00%

NPV (7%), M$ 84 102 120 139 157

IRR (%) 29.2 33.8 38.4 42.9 47.6

payback (years) 3.4 3.2 2.9 2.7 2.6

Capital expenditure s % variation 20.00% 10.00% 0.00% -10.00% -20.00%

NPV (7%), M$ 97 109 120 132 144

IRR (%) 29.6 33.7 38.4 43.7 49.9

payback (years) 3.4 3.2 2.9 2.7 2.5

Mineral resource

The mineral resource estimate which formed the basis of the PEA, is set out in the associated table and was prepared by Mercator under the supervision of Michael Cullen, PGeo, an independent qualified person, as defined in National Instrument 43-101. The effective date of this mineral resource estimate is Jan. 1, 2018. The resource estimate is based on validated results of 272 surface drill holes and 119 underground drill holes, for a total of 66,743 metres of diamond drilling that was completed between 1984 and 2015. Modelling was performed using GEOVIA Surpac 6.8 software with gold grades estimated for inferred and indicated category mineral resources using inverse-distance-squared (ID2) interpolation methodology and capped 1.0-metre downhole assay composites. Measured category blocks are restricted to a metallurgical bulk composite digital solid within which grade was interpolated using nearest neighbour methodology. Indicated mineral resources are defined as all other interpolated blocks with at least three contributing drill holes having a maximum average distance of 50 m from the block centroid. Inferred mineral resources are defined as all remaining interpolated blocks that occur within the various belt model solids. Block size is two metres by two metres by two metres. Partial percentage volume assignment was used to estimate volume of solid models within the block model. The drilling-defined deposit is divided into three spatial domains for modelling purposes, these being the Boston Richardson zone, the West Goldbrook zone and the East Goldbrook zone. At a long-term metal price of $1,550 per ounce, reasonable prospects are considered to exist for eventual economic extraction of mineral resources defined at a 0.5 g/t Au cut-off value within limits of the conceptual final pit shell prepared by WSP. Mineral resources defined external to this pit shell are reported at a 2.0 g/t Au cut-off value and are considered to have reasonable prospects for eventual economic extraction using underground mining methods at the same long-term gold price. Additional information about the mineral resource modelling methodology will be documented in the upcoming NI 43-101 technical report for the PEA.

GOLDBORO MINERAL RESOURCE ESTIMATE -- EFFECTIVE JAN. 1, 2018

Resource type Au cut-off Category Tonnes AuTroy ounces

(g/t) (rounded) (g/t) (rounded)

Open pit 0.50 measured 397,000 2.88 36,800

indicated 662,000 3.09 65,800

measured and indicated 1,059,000 3.01 102,500

inferred 45,000 2.54 3,700

Underground 2.00 measured 22,000 4.7 3,300

indicated 2,564,000 5.09 419,600

measured and indicated 2,586,000 5.09 422,900

inferred 2,497,000 4.28 343,600

Combined open pit

and underground 0.50/2.00 measured 419,000 2.98 40,100

indicated 3,226,000 4.68 485,400

measured and indicated 3,645,000 4.48 525,400

inferred 2,542,000 4.25 347,300

Mineral resource estimate notes

1. Mineral resources were prepared in accordance with NI 43-101 and the CIM Definition Standards (2014). Mineral resources that are not mineral reserves do not have demonstrated economic viability.

2.Open-pit mineral resources are reported at a cut-off grade of 0.5 g/t gold that is based on a gold price of $1,550/ounce and a gold processing recovery factor of 95 per cent, these include PEA base-case open-pit resources that have an estimated life-of-mine strip ratio of 7.3:1 (waste tonnes:PEA tonne).

3.Appropriate mining costs, processing costs, metal recoveries and interramp pit slope angles were used by WSP to generate the pit design.

4.Rounding may result in apparent summation differences between tonnes, grade and contained metal content.

5.Tonnage and grade measurements are in metric units. Contained gold ounces are in troy ounces.

6. Contributing assay composites were capped at 80 g/t Au

7.A density factor of 2.7 grams per cubic metre was applied to all blocks.

The measured and indicated mineral resource category gold inventories in the associated table for combined open-pit and underground resources total 525,400 ounces and the inferred mineral resource category gold inventory for combined open-pit and underground resources total 347,300 ounces.

Qualified persons

This news release has been reviewed and approved by the below-noted qualified persons. The qualified persons have reviewed or verified all information for which they are individually responsible, including sampling, analytical and test results underlying the information or opinions contained herein.

Gordana Slepcev, PEng, chief operating officer, and Paul McNeill, PGeo, vice-president, exploration, with Anaconda Mining, qualified persons;

Michael Cullen, PGeo, of Mercator Geological Services Ltd., an independent qualified person, under NI 43-101;

Joanne Robinson, PEng, principal mine engineer of WSP, an independent qualified person, under NI 43-101;

Garth Liukko, PEng, senior engineer of WSP, an independent qualified person, under NI 43-101;

Sebastian Bertelegni, Ing, director, mining infrastructure, of WSP, an independent qualified person, under NI 43-101;

J. Dean Thibault, PEng, senior process chemical engineer of Thibault & Associates Inc., a qualified person under NI 43-101.

Technical report

For readers to fully understand the information in this news release, they should read the PEA technical report in its entirety which the company expects to file in accordance with NI 43-101 within 45 days from the date of this news release on SEDAR and it will be available at that time on the Anaconda Mining website, including all qualifications, assumptions and exclusions that relate to the PEA. The technical report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Risks and opportunities

As with all mining ventures, a large number of risks and opportunities can affect the outcome of the project. Most of these risks and opportunities are based on uncertainty, such as lack of scientific information (test results, drill results) or the lack of control over external factors (metal prices, exchange rates).

Subsequent higher-level engineering studies would be required to further refine these risks and opportunities, identify new risks and opportunities, and define strategies for risk mitigation or opportunity implementation

The PEA identified a number of principal risks for the project which are summarized below:

Geological interpretation and mineral resource classification (27 per cent of the mineral resources used in the mine plan are inferred mineral resources);

Due to a relatively small number of metallurgical samples tested, larger variations in mineralogy and metal recovery may exist than have been observed to date;

Geotechnical and hydrogeological considerations;

No information on baseline groundwater quality;

No physical characterization of the tailings material has been done;

No waste rock characterization has been done;

Construction management and cost containment during development of the project;

High exposure to potential escalation of costs associated with latent ground conditions due to need for dewatering dikes and large, shallow tailings management facility;

Increased operating cost and/or capital cost;

Reduced metal prices.

Anaconda has completed environmental baseline studies for Goldboro during spring and summer of 2017 with hydrology and hydrogeology studies initiated late in the fall. Geotechnical investigation for underground mine, open-pit and dump designs were completed up to the prefeasibility study levels. This information will be available during the winter of 2018 and would be used in preparation of the environmental assessment registration and further engineering studies.

Several potential opportunities to improve the accuracy of the results of the project contemplated under the PEA have been identified. Examples include, but may not be limited to:

Expansion of the Goldboro deposit through drilling: The deposit is open at the depth and along strike and geological and geophysical studies indicate the structure-hosting gold mineralization may continue both east and west of the current resource as well as down plunge. Addition of further resources through drilling has the potential to add resources and increase LOM and economics.

More refined pit optimization parameters could result in better optimized open-pit limits than the pit shell selected for the PEA.

Improved hydrogeological and geotechnical understanding may increase pit slope angles or underground design inputs over those used in the PEA.

The company plans to investigate other mining methods that would lead to a decrease in the underground mine development cost.

Geotechnical construction fill materials may be sourced locally from the site and will be confirmed with a site investigation geotechnical laboratory program.

Further metallurgical testing and refining milling processes may result in improved recoveries.

The potential exists to upgrade the mineral resource classification of the deposit.

Tax credits were transferred from Orex.

Improved metal prices.

About Anaconda Mining Inc.

Anaconda is a Toronto Stock Exchange-listed gold mining, exploration and development company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The company operates the Point Rousse Project located in the Baie Verte mining district in Newfoundland, comprising the Pine Cove open-pit mine, the fully permitted Pine Cove mill and tailings facility, the Stog'er Tight mine, and the Argyle deposit, as well as approximately 5,800 hectares of prospective gold-bearing property.

We seek Safe Harbor.

© 2018 Canjex Publishing Ltd. All rights reserved.

Quelle: https://www.stockwatch.com/News/Item.aspx?bid=Z-C:ANX-255798…

Anaconda arranges 1:4 share rollback

2018-01-17 09:19 ET - News Release

Mr. Dustin Angelo reports

ANACONDA ANNOUNCES SHARE CONSOLIDATION

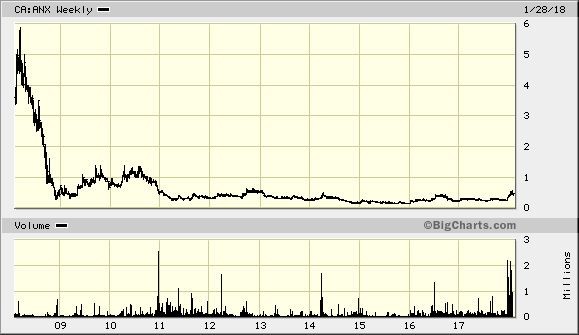

Anaconda Mining Inc. is proceeding with its proposed consolidation of its share capital on the basis of four existing common shares for one new common share. The share consolidation was previously approved by shareholders at a meeting held on May 8, 2017, and has been conditionally approved by the Toronto Stock Exchange.

Currently, a total of 423,430,258 common shares in the capital of the company are issued and outstanding. Accordingly, once put into effect on the basis of four existing common shares for one new common share, a total of approximately 105,857,564 common shares in the capital of the company would be issued and outstanding, assuming no other change in the issued capital. The share consolidation is anticipated to become effective on or about Jan. 18, 2018.

The company's common shares are expected to begin trading on the Toronto Stock Exchange on a consolidated basis under the same trading symbol ANX on or about Jan. 22, 2018. The new CUSIP and ISIN numbers for the consolidated shares are 03240P207 and CA03240P2070, respectively. Shareholders who hold their shares through a securities broker or dealer, bank or trust company, will not be required to take any action with respect to the share consolidation. Letters of transmittal will be mailed to the registered holders of the company's common shares, requesting that they forward their preconsolidation share certificates to the company's transfer agent, TSX Trust Company, for exchange for new share certificates representing their common shares on a postconsolidation basis. No fractional shares will be issued in connection with the share consolidation.

The share consolidation will also affect the company's granted stock options and issued warrants at the effective date. At the time of the share consolidation, the number, exchange basis or exercise price of all stock options and warrants will be adjusted, as applicable, to reflect the one-for-four share consolidation. The actual adjustment will be made by the company in consultation with its advisers.

Please refer to the management information circular of the company dated April 3, 2017, for additional details on the share consolidation. The circular is available on the company's profile on SEDAR.

About Anaconda Mining Inc.

Anaconda is a TSX-listed gold mining, exploration and development company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The company operates the Point Rousse Project located in the Baie Verte mining district in Newfoundland, comprising the Pine Cove open-pit mine, the fully permitted Pine Cove mill and tailings facility, the Stog'er Tight mine, and the Argyle deposit, as well as approximately 5,800 hectares of prospective gold-bearing property.

We seek Safe Harbor.

© 2018 Canjex Publishing Ltd. All rights reserved.

Quelle: https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aANX-2558…

2018-01-17 09:19 ET - News Release

Mr. Dustin Angelo reports

ANACONDA ANNOUNCES SHARE CONSOLIDATION

Anaconda Mining Inc. is proceeding with its proposed consolidation of its share capital on the basis of four existing common shares for one new common share. The share consolidation was previously approved by shareholders at a meeting held on May 8, 2017, and has been conditionally approved by the Toronto Stock Exchange.

Currently, a total of 423,430,258 common shares in the capital of the company are issued and outstanding. Accordingly, once put into effect on the basis of four existing common shares for one new common share, a total of approximately 105,857,564 common shares in the capital of the company would be issued and outstanding, assuming no other change in the issued capital. The share consolidation is anticipated to become effective on or about Jan. 18, 2018.

The company's common shares are expected to begin trading on the Toronto Stock Exchange on a consolidated basis under the same trading symbol ANX on or about Jan. 22, 2018. The new CUSIP and ISIN numbers for the consolidated shares are 03240P207 and CA03240P2070, respectively. Shareholders who hold their shares through a securities broker or dealer, bank or trust company, will not be required to take any action with respect to the share consolidation. Letters of transmittal will be mailed to the registered holders of the company's common shares, requesting that they forward their preconsolidation share certificates to the company's transfer agent, TSX Trust Company, for exchange for new share certificates representing their common shares on a postconsolidation basis. No fractional shares will be issued in connection with the share consolidation.

The share consolidation will also affect the company's granted stock options and issued warrants at the effective date. At the time of the share consolidation, the number, exchange basis or exercise price of all stock options and warrants will be adjusted, as applicable, to reflect the one-for-four share consolidation. The actual adjustment will be made by the company in consultation with its advisers.

Please refer to the management information circular of the company dated April 3, 2017, for additional details on the share consolidation. The circular is available on the company's profile on SEDAR.

About Anaconda Mining Inc.

Anaconda is a TSX-listed gold mining, exploration and development company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The company operates the Point Rousse Project located in the Baie Verte mining district in Newfoundland, comprising the Pine Cove open-pit mine, the fully permitted Pine Cove mill and tailings facility, the Stog'er Tight mine, and the Argyle deposit, as well as approximately 5,800 hectares of prospective gold-bearing property.

We seek Safe Harbor.

© 2018 Canjex Publishing Ltd. All rights reserved.

Quelle: https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aANX-2558…

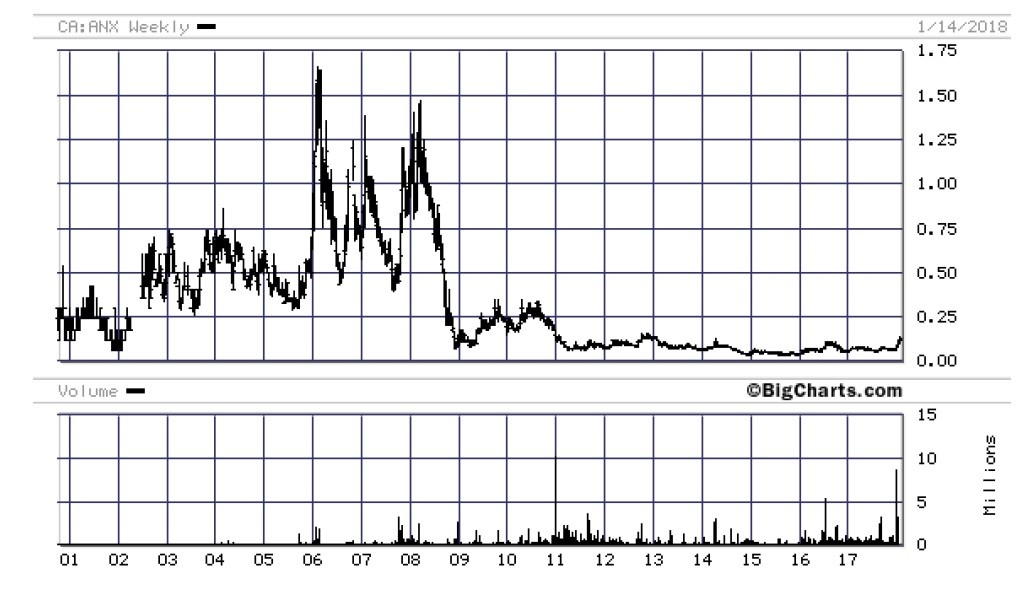

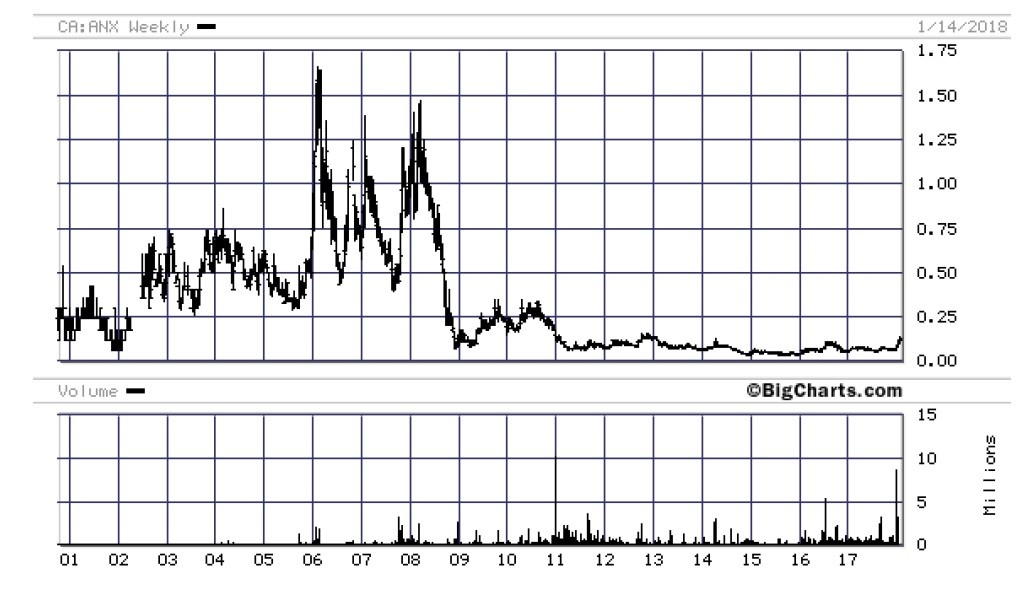

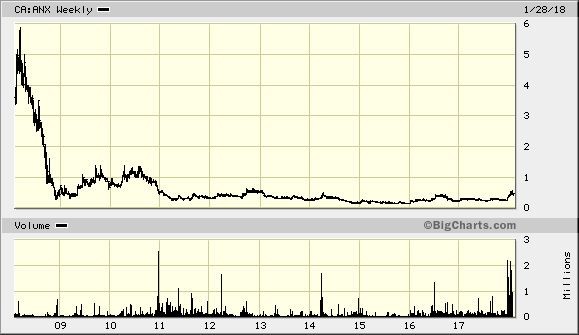

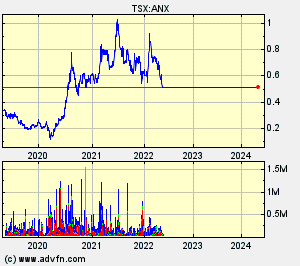

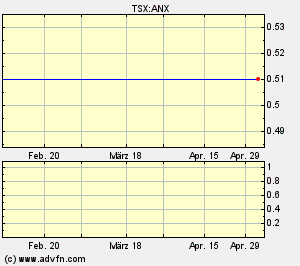

In die alten Höhen aus den Jahren 2006-2009 müssen wir wieder hinkommen...

Anaconda Mining completes one-for-four rollback

2018-01-18 07:56 ET - News Release

Mr. Dustin Angelo reports

ANACONDA ANNOUNCES COMPLETION OF SHARE CONSOLIDATION

Anaconda Mining Inc. has completed the previously announced proposed consolidation of its share capital on the basis of four existing common shares for one new common share. As a result of the share consolidation, the 423,430,258 common shares issued and outstanding were consolidated to approximately 105,857,564 common shares.

The company's common shares are expected to begin trading on the Toronto Stock Exchange on a consolidated basis under the same trading symbol ANX on or about Jan. 22, 2018.

The new Cusip and ISIN numbers for the consolidated shares are 03240P207 and CA03240P2070, respectively. Shareholders who hold their shares through a securities broker or dealer, bank or trust company, will not be required to take any action with respect to the share consolidation. Letters of transmittal will be mailed to the registered holders of the company's common shares, requesting that they forward their preconsolidation share certificates to the company's transfer agent, TSX Trust Company, for exchange for new share certificates representing their common shares on a postconsolidation basis. No fractional shares will be issued in connection with the consolidation.

As a result of the share consolidation, the number, exchange basis or exercise price of all stock options and warrants will be adjusted, as applicable, to reflect the one-for-four share consolidation. The actual adjustment will be made by the company in consultation with its advisers.

The share consolidation was previously approved by shareholders at a meeting held on May 8, 2017, and has been conditionally approved by the TSX. Please refer to the management information circular of the company dated April 3, 2017, for additional details on the share consolidation. The circular is available on the company's profile on SEDAR.

About Anaconda Mining Inc.

Anaconda Mining is a gold mining, development and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The company operates the Point Rousse project located in the Baie Verte mining district in Newfoundland, comprising the Pine Cove open-pit mine, the fully permitted Pine Cove mill and tailings facility, the Stog'er Tight and Argyle deposits, and approximately 5,800 hectares of prospective gold-bearing property. In addition, Anaconda is developing the Goldboro project in Nova Scotia, a high-grade mineral resource, with the potential to leverage existing infrastructure at the company's Point Rousse project.

We seek Safe Harbor.

© 2018 Canjex Publishing Ltd. All rights reserved.

Quelle: http://wwwa.stockwatch.com/News/Item.aspx?bid=Z-C%3aANX-2558…

2018-01-18 07:56 ET - News Release

Mr. Dustin Angelo reports

ANACONDA ANNOUNCES COMPLETION OF SHARE CONSOLIDATION

Anaconda Mining Inc. has completed the previously announced proposed consolidation of its share capital on the basis of four existing common shares for one new common share. As a result of the share consolidation, the 423,430,258 common shares issued and outstanding were consolidated to approximately 105,857,564 common shares.

The company's common shares are expected to begin trading on the Toronto Stock Exchange on a consolidated basis under the same trading symbol ANX on or about Jan. 22, 2018.

The new Cusip and ISIN numbers for the consolidated shares are 03240P207 and CA03240P2070, respectively. Shareholders who hold their shares through a securities broker or dealer, bank or trust company, will not be required to take any action with respect to the share consolidation. Letters of transmittal will be mailed to the registered holders of the company's common shares, requesting that they forward their preconsolidation share certificates to the company's transfer agent, TSX Trust Company, for exchange for new share certificates representing their common shares on a postconsolidation basis. No fractional shares will be issued in connection with the consolidation.

As a result of the share consolidation, the number, exchange basis or exercise price of all stock options and warrants will be adjusted, as applicable, to reflect the one-for-four share consolidation. The actual adjustment will be made by the company in consultation with its advisers.

The share consolidation was previously approved by shareholders at a meeting held on May 8, 2017, and has been conditionally approved by the TSX. Please refer to the management information circular of the company dated April 3, 2017, for additional details on the share consolidation. The circular is available on the company's profile on SEDAR.

About Anaconda Mining Inc.

Anaconda Mining is a gold mining, development and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The company operates the Point Rousse project located in the Baie Verte mining district in Newfoundland, comprising the Pine Cove open-pit mine, the fully permitted Pine Cove mill and tailings facility, the Stog'er Tight and Argyle deposits, and approximately 5,800 hectares of prospective gold-bearing property. In addition, Anaconda is developing the Goldboro project in Nova Scotia, a high-grade mineral resource, with the potential to leverage existing infrastructure at the company's Point Rousse project.

We seek Safe Harbor.

© 2018 Canjex Publishing Ltd. All rights reserved.

Quelle: http://wwwa.stockwatch.com/News/Item.aspx?bid=Z-C%3aANX-2558…

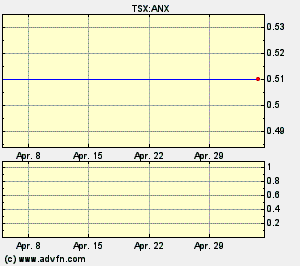

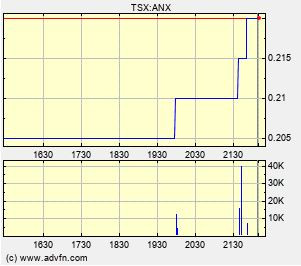

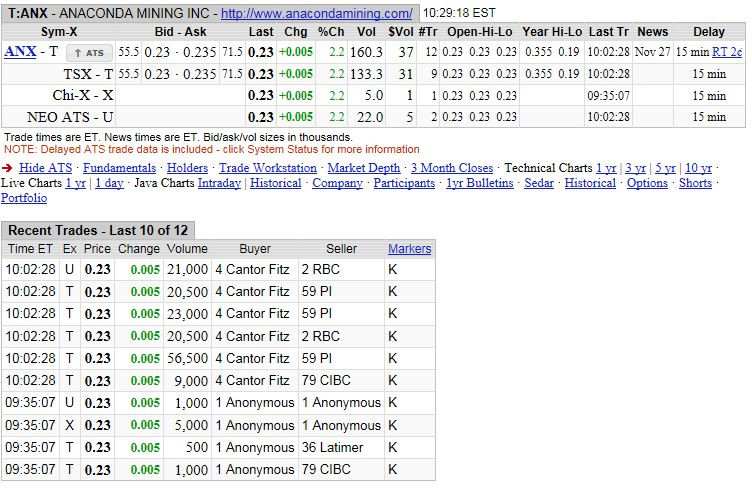

So, jetzt ist es also amtlich:

Am kommenden Montag, 22.01.2018 wird die Aktienkonsolidierung stattgefunden haben und dann sollten noch 105 Mio. Anaconda Aktien handelbar sein.

Der zu erhoffende Kurs sind aktuell 0,44 CAD.

Gehandelt wird weiterhin an der Kanadischen Hauptbörse in Toronto.

Wie im Kanadischen Board zu lesen war ist es wohl so, dass ab 2 CAD Kurs ein Aktienkredit möglich ist in Kanada. Dann kann damit gerechnet werden, dass Privatinvestoren einen Aktienkredit aufnehmen, um weitere Aktien zu kaufen, um von der zukünftigen Entwicklung zu profitieren.

Immerhin sind als Ziel bis 2020 50.000 Unzen Goldproduktion jährlich angepeilt.

SL - SC

Am kommenden Montag, 22.01.2018 wird die Aktienkonsolidierung stattgefunden haben und dann sollten noch 105 Mio. Anaconda Aktien handelbar sein.

Der zu erhoffende Kurs sind aktuell 0,44 CAD.

Gehandelt wird weiterhin an der Kanadischen Hauptbörse in Toronto.

Wie im Kanadischen Board zu lesen war ist es wohl so, dass ab 2 CAD Kurs ein Aktienkredit möglich ist in Kanada. Dann kann damit gerechnet werden, dass Privatinvestoren einen Aktienkredit aufnehmen, um weitere Aktien zu kaufen, um von der zukünftigen Entwicklung zu profitieren.

Immerhin sind als Ziel bis 2020 50.000 Unzen Goldproduktion jährlich angepeilt.

SL - SC

Zitat aus dem Kanadischen Board:

RE:The Anaconda Shuffle

Good Morning Bouts

I have a totally different and positive perspective on ANX.

I am pleased that the consolidation is now behind us. Yes, I do anticipate another financing to move Goldboro and ANX's other properties along the path to production. I like the fact that once Goldboro is in production that the company will be making 10's of millions in profits (with little or no debt) AND for much longer than the current 8.8 years as per the latest PEA...a necessary evil in getting there IS consolidation AND another financing. What would you propose the company do to keep the lights on - rob a bank for more cash?

Post financing I see nothing but a bright future for this company. They will have the cash necessary to move Goldboro forward, further explore the current prospects on the island. Their company goal is 100,000 ounces per year and I think they have the trained workforce AND management team to get there.

Post consolidation/financing, there will be nothing but a steady stream of PRs enhancing all current Projects. What do you think the stock price will do...UP!

Once again, look at ABG they have 186million shares outstanding are currently going into commercial production in Nova Scotia and are trading ~$1.50/share. I believe that ANX can go higher than that given the minimal debt load they have compared to ABG, so I am hanging around to make multiple time more cash than I have made already as a newbie to ANX thank you very much.

Post consolidation I see investors looking at ANX as a very undervalued company (as already noted by Bob Moriarty) with a very attractive outstanding share count (Bob's only concern is now taken care of thanks to the consolidation)...the fact that they are away from the 10 cent range is a bonus.

If you read about where the price of gold is anticipated to go (UP from the key $1320USD mark), then that can just be an added bonus for investors (and ANX's bottom line) to take a look at companies like ANX and jump in.

Looking forward to Bob's report, more drill results from Goldboro and advanced projects on the island. I am in for the long haul and have been keen on Goldboro for far too many years...AXN has a very bright future and I firmly believe that the ANX management team will get us to the next level.

Good luck with your investments folks....this one is a no brainer IMHO

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

RE:The Anaconda Shuffle

Good Morning Bouts

I have a totally different and positive perspective on ANX.

I am pleased that the consolidation is now behind us. Yes, I do anticipate another financing to move Goldboro and ANX's other properties along the path to production. I like the fact that once Goldboro is in production that the company will be making 10's of millions in profits (with little or no debt) AND for much longer than the current 8.8 years as per the latest PEA...a necessary evil in getting there IS consolidation AND another financing. What would you propose the company do to keep the lights on - rob a bank for more cash?

Post financing I see nothing but a bright future for this company. They will have the cash necessary to move Goldboro forward, further explore the current prospects on the island. Their company goal is 100,000 ounces per year and I think they have the trained workforce AND management team to get there.

Post consolidation/financing, there will be nothing but a steady stream of PRs enhancing all current Projects. What do you think the stock price will do...UP!

Once again, look at ABG they have 186million shares outstanding are currently going into commercial production in Nova Scotia and are trading ~$1.50/share. I believe that ANX can go higher than that given the minimal debt load they have compared to ABG, so I am hanging around to make multiple time more cash than I have made already as a newbie to ANX thank you very much.

Post consolidation I see investors looking at ANX as a very undervalued company (as already noted by Bob Moriarty) with a very attractive outstanding share count (Bob's only concern is now taken care of thanks to the consolidation)...the fact that they are away from the 10 cent range is a bonus.

If you read about where the price of gold is anticipated to go (UP from the key $1320USD mark), then that can just be an added bonus for investors (and ANX's bottom line) to take a look at companies like ANX and jump in.

Looking forward to Bob's report, more drill results from Goldboro and advanced projects on the island. I am in for the long haul and have been keen on Goldboro for far too many years...AXN has a very bright future and I firmly believe that the ANX management team will get us to the next level.

Good luck with your investments folks....this one is a no brainer IMHO

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Hier findet Ihr übrigens eine News- und Faktensammlung über Anaconda:

https://www.wallstreet-online.de/diskussion/1092236-421-430/…

https://www.wallstreet-online.de/diskussion/1092236-421-430/…

Ein Poster im Kanadischen Board meint einen größeren Investor erkenne zu können auf der Käuferseite:

Golden Future Great to see #22 Fidelity Investments - Forbes.com buying ANX Fidelity Investments is the nation's largest mutual fund company and one of the largest providers of financial services. Headquartered in Boston, Fidelity provides financial services to 24 million individuals and Institutions. This share consolidation will be like water off a Ducks back. No worries . We will be seeing a big influx of $$ MONEY soon.

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Neue Anaconda Website seit gestern:

Thanks @Newton: Anaconda has a new website and a new New website today: http://anacondamining.com/ And new presentation coming soon.

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Dieser Poster sieht es als positiv, dass kein Verkaufsdruck aufkommt nach der Share-Consolidation...

RE:RE:RE:Anaconda Announces Share Consolidation okay kids,,,this is a thinly traded stock until recently.. I am not seeing any mass selling. Penny flippers bailing. Look at the bids. I will ride out storm.

Good Luck to All

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Kennt Ihr eigentlich die Facebook Seite von Anacondamining?

https://de-de.facebook.com/AnacondaMining/ Dieser User sieht alle Investoren als zukünftige Gewinner nach diesen News

RE:RE:RE:Anaconda Announces Share Consolidation They waited quite some time to pull the trigger on this reverse split. The question is what made this the right time? I suspect that they expect good news on the horizon will blunt the effect of the reverse split. It makes me wonder about the pending drill results, especially the deeper holes. All the ex Orex shareholders who averaged down at 1 cent are probably the biggest winners in all of this. Congratulations to them! I think going forward we are all going to be winners with this stock.

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Was meint Ihr eigentlich was mit dem Goldpreis passiert, wenn Bitcon und Co. wieder im Erdboden versinken...?

Ich denke Gold und Silber werden stetig weiter steigen.Mittlerweile ist ja der Abwärtstrend seit 2012 nach oben durchbrochen...

Er hier sieht Anaconda von nun an als stetig steigend und einen klaren KAUF