Gold Fields Ltd. Sp Adr (GFI) - 500 Beiträge pro Seite

eröffnet am 12.06.02 20:26:05 von

neuester Beitrag 03.12.03 09:40:00 von

neuester Beitrag 03.12.03 09:40:00 von

Beiträge: 216

ID: 597.109

ID: 597.109

Aufrufe heute: 0

Gesamt: 10.408

Gesamt: 10.408

Aktive User: 0

ISIN: ZAE000018123 · WKN: 856777

15,725

EUR

+0,16 %

+0,025 EUR

Letzter Kurs 07:38:14 Lang & Schwarz

Neuigkeiten

15.04.24 · Der Aktionär TV |

10.04.24 · Markus Weingran |

19.03.24 · ratgebergeld.at Anzeige |

12.03.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 1,7500 | +15,13 | |

| 11,180 | +14,08 | |

| 208,00 | +13,60 | |

| 11,250 | +12,73 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7000 | -12,49 | |

| 0,7250 | -14,71 | |

| 4,2300 | -17,86 | |

| 0,9000 | -25,00 | |

| 46,74 | -98,00 |

Auf Gold setzen. Rallye seitdem ich beobachtete das GFI über $10 ging. Ich hoffe dieses Mal ein Stück zu bekommen.

peter.wedemeier1

peter.wedemeier1

Jay Taylor Recommends the Following Stock: GFI

Updated: Wednesday, June 19, 2002 06:01 AM ET

CHICAGO, June 19 /PRNewswire/ -- The gold rally continues to move higher and Jay Taylor`s Gold and Technology stock model portfolio is up +56.9% YTD while the S&P 500 continues to fall. Read an excerpt from Jay`s article regarding the Fed`s monetary policy and which stock he is currently recommending. http://www.featuredexpert2.zacks.com .

Here are the highlights from the Featured Expert column:

GOLD FIELDS LIMITED (NYSE: GFI, news, msgs) produced 3.66 million ounces during its fiscal year during fiscal 6/30/01. With a cash cost of US$195 per ounce, GFI was able to generate an operating profit of US$103 million for the year. However, after writing off $233 million related mostly to a reduction in the carrying value a former property, the company reported a net loss of $208 million.

Based on a $270 gold price, the company`s reserves at its last fiscal yearend were 144 million ounces of which 37 million ounces were below existing mine workings leaving the company with a total of 104 million ounces located above existing infrastructure. With the exception of 6.8 million ounces on the company`s Tarkwa project in Ghana, most all gold reserves are in South Africa, which does quite frankly concern us. Given political uprising in surrounding countries as well as unreported anarchy in South Africa itself, I am very concerned about the longer-term prospects for Goldfields. No doubt the company`s board of directors shares that concern so that the mandate given to CEO Chris Thompson has been to internationalize the company.

Toward that end, management announced on September 21st that it had successfully bid for the St. Ives and Agnew gold operations in Western Australia for $180 million in cash plus new Gold Fields shares valued at US$52 million. Together the operations will add about 600,000 ounces of gold to the company annual production and about 4 million ounces of reserves. Assuming we are right in our assumption that we are in the early stages of a gold bull market, I would not be surprised to see Goldfields begin to become active outside of South African, including North America in more acquisitions in the future. That should mean some very exciting and profitable times our "B", "C" and "D" quality stocks that are listed on the back page of our monthly newsletter.

Improving Profitability

With the price of gold on the rise and with the company cutting cash costs to $160 per ounce, GFI boosted profits during the quarter ending 3/31/02 to US$67 million. Operating profits rose to US$149 million. The company produced 1,081,000 ounces of gold during the quarter.

Anyway you cut it, GFI is a premier gold producer that is worthy of inclusion as an "A" quality gold stock included in our Model Portfolio.

To find out more about Taylor`s portfolio and his "on fire" gold shares, click: http://www.featuredexpert3.zacks.com .

Visit: www.Zacks.com

Updated: Wednesday, June 19, 2002 06:01 AM ET

CHICAGO, June 19 /PRNewswire/ -- The gold rally continues to move higher and Jay Taylor`s Gold and Technology stock model portfolio is up +56.9% YTD while the S&P 500 continues to fall. Read an excerpt from Jay`s article regarding the Fed`s monetary policy and which stock he is currently recommending. http://www.featuredexpert2.zacks.com .

Here are the highlights from the Featured Expert column:

GOLD FIELDS LIMITED (NYSE: GFI, news, msgs) produced 3.66 million ounces during its fiscal year during fiscal 6/30/01. With a cash cost of US$195 per ounce, GFI was able to generate an operating profit of US$103 million for the year. However, after writing off $233 million related mostly to a reduction in the carrying value a former property, the company reported a net loss of $208 million.

Based on a $270 gold price, the company`s reserves at its last fiscal yearend were 144 million ounces of which 37 million ounces were below existing mine workings leaving the company with a total of 104 million ounces located above existing infrastructure. With the exception of 6.8 million ounces on the company`s Tarkwa project in Ghana, most all gold reserves are in South Africa, which does quite frankly concern us. Given political uprising in surrounding countries as well as unreported anarchy in South Africa itself, I am very concerned about the longer-term prospects for Goldfields. No doubt the company`s board of directors shares that concern so that the mandate given to CEO Chris Thompson has been to internationalize the company.

Toward that end, management announced on September 21st that it had successfully bid for the St. Ives and Agnew gold operations in Western Australia for $180 million in cash plus new Gold Fields shares valued at US$52 million. Together the operations will add about 600,000 ounces of gold to the company annual production and about 4 million ounces of reserves. Assuming we are right in our assumption that we are in the early stages of a gold bull market, I would not be surprised to see Goldfields begin to become active outside of South African, including North America in more acquisitions in the future. That should mean some very exciting and profitable times our "B", "C" and "D" quality stocks that are listed on the back page of our monthly newsletter.

Improving Profitability

With the price of gold on the rise and with the company cutting cash costs to $160 per ounce, GFI boosted profits during the quarter ending 3/31/02 to US$67 million. Operating profits rose to US$149 million. The company produced 1,081,000 ounces of gold during the quarter.

Anyway you cut it, GFI is a premier gold producer that is worthy of inclusion as an "A" quality gold stock included in our Model Portfolio.

To find out more about Taylor`s portfolio and his "on fire" gold shares, click: http://www.featuredexpert3.zacks.com .

Visit: www.Zacks.com

Die Marktrallye (GFI) am Freitag zum Handelsende und die Fortsetzung am Montag.

Nun kommen die Gewinnwarnungen wieder: ADM/AAPL etc... viele der 30 DOW Werte sind in charttechnisch ernsten Formationen. Die Nasdaq ist in wirklichen Schwierigkeiten.

Ich denke wie sehen bei GFI noch dieses Jahr die $15,-.

GFI sagt, sie wollen 300 Tonnen mehr Gold produzieren in jedem der kommenden Jahre. Ich schätze die Lieferungen und der Bedarf werden bald nach oben zeigen. Dazu kommt, das Gold unten ist.

peter.wedemeier1

Nun kommen die Gewinnwarnungen wieder: ADM/AAPL etc... viele der 30 DOW Werte sind in charttechnisch ernsten Formationen. Die Nasdaq ist in wirklichen Schwierigkeiten.

Ich denke wie sehen bei GFI noch dieses Jahr die $15,-.

GFI sagt, sie wollen 300 Tonnen mehr Gold produzieren in jedem der kommenden Jahre. Ich schätze die Lieferungen und der Bedarf werden bald nach oben zeigen. Dazu kommt, das Gold unten ist.

peter.wedemeier1

Der Platz wo man sein sollte. (Precious Metals).

Eine von vielen in der Minenindustrie (Gold/Silber) die einen positiven Chart haben. Gute Minen, gute Assets und ein gutes Management. $16-17 sollten kurzfristig drin sein. Die $20 Range sollte auch ohne Schwierigkeiten kommen.

peter.wedemeier1

Eine von vielen in der Minenindustrie (Gold/Silber) die einen positiven Chart haben. Gute Minen, gute Assets und ein gutes Management. $16-17 sollten kurzfristig drin sein. Die $20 Range sollte auch ohne Schwierigkeiten kommen.

peter.wedemeier1

Seit 1929 gibt es mehr Jahre indem der Goldpreis relativ zu dem DOW JOnes gefallen ist. In anderen Worten, Aktien waren im generellen seit 1929 ein besseres Investment als Gold. Aber wenn man Geschichte studiert hat, dann weiß man, das nichts für ewig ist und das der Grund des Wechsels im Anlegerverhalten gegeben oder eine Konstante ist.

Sicher, wenn man in Gold investiert hat man nicht mehr Sicherheit als jedermann sonst, aber man kann ein Paar von schnellen Punkten machen.

Es ist klar, das Aktien historisch noch sehr überbewertet sind. Nehmen z.B. einen Blick auf den Chart von dem Kurs des DOW JONES gegenüber dem Goldkurs, typischerweise DOW/GOLD Ratio genannt. So einen Chart kannst du auf folgender Homepage sehen:

http://www.kitco.com/ind/Saville/june192000.html .

Wer weiß es sicher? Nicht ich, das ist sicher.

Aber in der Betrachtung der aktuellen Weltlage, welche für mich erscheint zum Vorteil von Gold, ich meine das man in der kurzen bis mittleren Frist beim Investieren in Gold mehr Geld machen kann, als die Bullen vom Aktienmarkt.

Dieser Kommentar ist nicht weiter als meine einfache, unprofessionelle Meinung.

peter.wedemeier1

Sicher, wenn man in Gold investiert hat man nicht mehr Sicherheit als jedermann sonst, aber man kann ein Paar von schnellen Punkten machen.

Es ist klar, das Aktien historisch noch sehr überbewertet sind. Nehmen z.B. einen Blick auf den Chart von dem Kurs des DOW JONES gegenüber dem Goldkurs, typischerweise DOW/GOLD Ratio genannt. So einen Chart kannst du auf folgender Homepage sehen:

http://www.kitco.com/ind/Saville/june192000.html .

Wer weiß es sicher? Nicht ich, das ist sicher.

Aber in der Betrachtung der aktuellen Weltlage, welche für mich erscheint zum Vorteil von Gold, ich meine das man in der kurzen bis mittleren Frist beim Investieren in Gold mehr Geld machen kann, als die Bullen vom Aktienmarkt.

Dieser Kommentar ist nicht weiter als meine einfache, unprofessionelle Meinung.

peter.wedemeier1

http://www.kitco.com/ind/Saville/june192002.html

Dieses ist die korrekte Adresse!

Dieses ist die korrekte Adresse!

Ich glaube dort gibt es mehr hinzuzufügen zu der kürzlichen Stärke von Gold gegenüber der Schwäche im Aktienmarkt.

Nasdaq Composite in totalen Schwierigkeiten Ziel: 800 Punkte,

S&P 500 Ziel: 500 Punkte, DOW Jones Ziel: <8000 Punkte.

Das ganze Aktiensystem ist kaputt! Der Dollar ist ein System zu 100% geregelt. Der Greenback steht unter dem vollen Glauben und Kredit der FED. Ich sehe die Parität zu dem Euro ziemlich bald. Es existieren in den USA!!! mittlerweile Kursziele von 1,15 gegenüber dem Greenback. Dieses alles wird das Gold beflügeln! Die US Regierung setzt mit Ihrem eigenen Sozialsystem und Ihrer Politik (seit dem Anfang der Bush Regierung)Ihre eigenen Bürger zur Disposition (Sozialsystem)!

Wie sollen sich dabei die Ausländer der USA fühlen? die Hunderte von Millionen investieren wollen? Wir können dieses ja täglich sehen indem der Goldpreis und Silberpreis steigt sowie der Euro! Es ist offensichtlich warum dort ein schlechter Rausch raus dem Dollarraum existiert. Und wie wird immer gesagt, wenn die USA am Aktienmarkt wackelt, dann haben wir eine Grippe. Fazit: Raus aus dem gesamten Aktienmarkt und ein in Gold und Silberwerte!

peter.wedemeier1

Nasdaq Composite in totalen Schwierigkeiten Ziel: 800 Punkte,

S&P 500 Ziel: 500 Punkte, DOW Jones Ziel: <8000 Punkte.

Das ganze Aktiensystem ist kaputt! Der Dollar ist ein System zu 100% geregelt. Der Greenback steht unter dem vollen Glauben und Kredit der FED. Ich sehe die Parität zu dem Euro ziemlich bald. Es existieren in den USA!!! mittlerweile Kursziele von 1,15 gegenüber dem Greenback. Dieses alles wird das Gold beflügeln! Die US Regierung setzt mit Ihrem eigenen Sozialsystem und Ihrer Politik (seit dem Anfang der Bush Regierung)Ihre eigenen Bürger zur Disposition (Sozialsystem)!

Wie sollen sich dabei die Ausländer der USA fühlen? die Hunderte von Millionen investieren wollen? Wir können dieses ja täglich sehen indem der Goldpreis und Silberpreis steigt sowie der Euro! Es ist offensichtlich warum dort ein schlechter Rausch raus dem Dollarraum existiert. Und wie wird immer gesagt, wenn die USA am Aktienmarkt wackelt, dann haben wir eine Grippe. Fazit: Raus aus dem gesamten Aktienmarkt und ein in Gold und Silberwerte!

peter.wedemeier1

Ich fasse es nicht.

Peterle, der Monsterbär!

Eigentlich ein untrügliches Anzeichen, dass eine kleine Rallye nicht mehr weit sein kann.

Und jetzt die Quizfrage: Wer wird am Ende dieser Rallye wieder bullish sein?

Erster Preis für alle richtigen Antworten: Geld, soviel man will.

Peterle, der Monsterbär!

Eigentlich ein untrügliches Anzeichen, dass eine kleine Rallye nicht mehr weit sein kann.

Und jetzt die Quizfrage: Wer wird am Ende dieser Rallye wieder bullish sein?

Erster Preis für alle richtigen Antworten: Geld, soviel man will.

Gold kaufen und halten kann ein begründbares Investment in Zeiten von ökonomisch und politisch gestörten Konditionen sein. Solche Zeiten werden oft angezeigt von Extremen in paper financial asset (z.B. Aktienmarktblasen) und werden angezeigt von negativen realen Zinsen. Ich glaube wir sind ein einem solchen Zeitrahmen.

Wie auch immer, mit dem Bruch des Dollars durch seinen key support bei 108 (Dollar Index) gibt es dort ein Problem für den Aktienmarkt (weltweit) und den Dollar. Ich bin mit Goldaktien long und bleibe es auch.

peter.wedemeier1

Wie auch immer, mit dem Bruch des Dollars durch seinen key support bei 108 (Dollar Index) gibt es dort ein Problem für den Aktienmarkt (weltweit) und den Dollar. Ich bin mit Goldaktien long und bleibe es auch.

peter.wedemeier1

@Peter

Vor nicht allzulanger Zeit hast du einen Bullenmarkt vorhergesagt.

Jetzt auf einmal schreibts du etwas völlig Gegensätzliches.

Das du long bleibst hast du auch bei ORCL, CHKP, ... geschrieben.

Deine jetzigen Aussagen machen dich total unglaubwürdig, denn weder

hat sich etwas am politischen Umfeld, noch an den Unternehmensergebnissen

verändert.

Vor nicht allzulanger Zeit hast du einen Bullenmarkt vorhergesagt.

Jetzt auf einmal schreibts du etwas völlig Gegensätzliches.

Das du long bleibst hast du auch bei ORCL, CHKP, ... geschrieben.

Deine jetzigen Aussagen machen dich total unglaubwürdig, denn weder

hat sich etwas am politischen Umfeld, noch an den Unternehmensergebnissen

verändert.

Ich habe schon lange den Absprung von dieser Tech Scheiße gefunden. Der breite Gesamtmarkt (DOW und Nasdaq) geht gerade die Toilette hinunter (die großen Pistolen machen gerade Multi-Jahrestiefs)während der Gold und Silbermarkt in den frühen Stufen eines neuen bull market sich befindet. Also habe ich nur noch Gold- und Silberwerte in meinem Depot neben ein paar aussichtsreichen Turnaround Spekulationen (EKC, OWC, ACK, CIB, SYX, GRA).

peter.wedemeier1

peter.wedemeier1

Ich denke Gold hat eine Menge mehr zu rennen langfristig. Siehe Puplava, zum Beispiel, für Gründe:

http://www.financialsense.com/stormwatch/update.htm

Wow, Geld verläßt Gold schnell heute um anderen Interessen nachzujagen. Habe dieses nicht so schnell erwartet. Irgendwelche Kommentare von irgendjemand?

Ich glaube dort gibt es starke fundamentale Gründe für die Bewegung beim Gold.

Der heutige Exodus wenn der Markt ein bißchen dreht überrascht. Etwas Exodus natürlich, aber soviel, ich weiß nicht warum. Scheint das Gold gerade am Rennen ist aufgrund der Angst vor Aktienbewertungen, Bilanzfälschungen, Handelsbilanzdefizit, Enron etc. Ich habe geglaubt es ist viel tiefer als das. Der Markt hat eine Tendenz zu Fehlsignalen wie die Jungs versuchen die Leute mit einem fake aus Gold rauszujagen. Nur ich lasse mich aber nicht faken!

peter.wedemeier1

http://www.financialsense.com/stormwatch/update.htm

Wow, Geld verläßt Gold schnell heute um anderen Interessen nachzujagen. Habe dieses nicht so schnell erwartet. Irgendwelche Kommentare von irgendjemand?

Ich glaube dort gibt es starke fundamentale Gründe für die Bewegung beim Gold.

Der heutige Exodus wenn der Markt ein bißchen dreht überrascht. Etwas Exodus natürlich, aber soviel, ich weiß nicht warum. Scheint das Gold gerade am Rennen ist aufgrund der Angst vor Aktienbewertungen, Bilanzfälschungen, Handelsbilanzdefizit, Enron etc. Ich habe geglaubt es ist viel tiefer als das. Der Markt hat eine Tendenz zu Fehlsignalen wie die Jungs versuchen die Leute mit einem fake aus Gold rauszujagen. Nur ich lasse mich aber nicht faken!

peter.wedemeier1

Haste wohl bei Thai-Ginseng und Edelstahl -$ einige Inspirationen im Goldboard geholt.

Mann oh mann,....Gf gabs bei unter 5T€uretten lange Zeit und man konnte sie bei Stücker 13 locker vertickern.

cu DL...der Goldbug

Mann oh mann,....Gf gabs bei unter 5T€uretten lange Zeit und man konnte sie bei Stücker 13 locker vertickern.

cu DL...der Goldbug

@Peter,

Du bist nicht zufällig hauptberuflich Dolmetscher???

NH

Du bist nicht zufällig hauptberuflich Dolmetscher???

NH

Gold bei $400 steht nicht außer Frage.

Sehe für einen Pullback hier bei Gold mit einer potenziellen Sommer Rallye. Aber $400 könnten passieren bis Ende 2003. Inflation, mehr Terroristenaktivitäten, Markt Crash könnten leicht pushen das Gold nach oben und vorbei an der $400er Marke.

peter.wedemeier1

Sehe für einen Pullback hier bei Gold mit einer potenziellen Sommer Rallye. Aber $400 könnten passieren bis Ende 2003. Inflation, mehr Terroristenaktivitäten, Markt Crash könnten leicht pushen das Gold nach oben und vorbei an der $400er Marke.

peter.wedemeier1

@Peter

Echt Käse was du da schreibst.(#11)

Wochenlang hast du die Technolgieaktien in den Himmer gelobt,

obwohl ein Abwärtstrend nicht zu übersehen war. Trotz Warnungen

bist du weiterhin ORCL, GNSS, ... treu geblieben, hast von long

geredet, sogar von nachkaufen, trotzdem alles dagegensprach.

Jetzt schreibts du, du hast den Absprung schon lange von der

"Tech-Sch..." gefunden. Das kann ja wohl so nicht stimmen, wenn man

sich deine Postings anschaut.

Echt Käse was du da schreibst.(#11)

Wochenlang hast du die Technolgieaktien in den Himmer gelobt,

obwohl ein Abwärtstrend nicht zu übersehen war. Trotz Warnungen

bist du weiterhin ORCL, GNSS, ... treu geblieben, hast von long

geredet, sogar von nachkaufen, trotzdem alles dagegensprach.

Jetzt schreibts du, du hast den Absprung schon lange von der

"Tech-Sch..." gefunden. Das kann ja wohl so nicht stimmen, wenn man

sich deine Postings anschaut.

Key Resistance Niveau von $10,01 bis 12,375.

Retest von $15-17,15 -> Retest vom Tief -> Retest vom breakout Punkt bei $19,-.

Langfristiges Kursziel = $20,63 - 22,30, nach dem Rausnehmen auf Volumen von $17,15.

peter.wedemeier1

Retest von $15-17,15 -> Retest vom Tief -> Retest vom breakout Punkt bei $19,-.

Langfristiges Kursziel = $20,63 - 22,30, nach dem Rausnehmen auf Volumen von $17,15.

peter.wedemeier1

peter.wede ist nun mal wirklich

einer der dümmsten bezahlten

pusher/basher im board !

aber daher HERVORRAGENDER !!!

kontraindikator

danke peter

einer der dümmsten bezahlten

pusher/basher im board !

aber daher HERVORRAGENDER !!!

kontraindikator

danke peter

Der US-Chart zeigt mir einen Inverted Hammer, dieses ist eine bullishe Kerze.

GFI wird bald ausbrechen und weiter nach oben steigen. Im Moment wird versucht die schwachen Hände abzuschütteln. Gold ist nur Leute mit der Stärke, es auch zu händeln.

Mit dem USD Index schnell fallend und den Unternehmensskandalen, den Weltereignissen muß der Goldpreis nach oben steigen. Die ökonomischen Daten und Gewinne/Dollar-Kollaps sagen mir, das die Rezession wieder kommt und das wir auf den Weg zu inflationären Zeiten sind. Die US-Wirtschaft befindet sich in massiven Schwierigkeiten.

Der kurzfristige Widerstand bei dieser Aktie ist $16,- mit dem Kursziel bei $30,-. Für das Gold haben wir die meist positiven Fundamentals seit 10 Jahren.

peter.wedemeier1

GFI wird bald ausbrechen und weiter nach oben steigen. Im Moment wird versucht die schwachen Hände abzuschütteln. Gold ist nur Leute mit der Stärke, es auch zu händeln.

Mit dem USD Index schnell fallend und den Unternehmensskandalen, den Weltereignissen muß der Goldpreis nach oben steigen. Die ökonomischen Daten und Gewinne/Dollar-Kollaps sagen mir, das die Rezession wieder kommt und das wir auf den Weg zu inflationären Zeiten sind. Die US-Wirtschaft befindet sich in massiven Schwierigkeiten.

Der kurzfristige Widerstand bei dieser Aktie ist $16,- mit dem Kursziel bei $30,-. Für das Gold haben wir die meist positiven Fundamentals seit 10 Jahren.

peter.wedemeier1

GOLD FIELDS >Best gold & silver stocks for the half-year bei den gewichteten Gewinnen durch Aktienkurs und Marktkapitalisierung die Nr. 1 http://www.mips1.net/MGGold.nsf/Current/4225685F0043D1B28525…

@Hütchenspieler

"peter.wedemeier" ist in der Tat ein guter Kontra-Indikator.

Aber er ist bestimmt keine wirkliche Person.

Es handelt sich offenbar um systematische postings aus den USA.

Wenn man sich die threads genau durchliest, merkt man, dass vieles durch Übersetzungsprogramme generiert wurde (vielleicht murkst machmal auch ein nicht besonders sprachgewandter Deutsch-Amerikaner daran herum).

Man merkt an den Kampagnen jedenfalls genau, welchen Müll die Mafia gerade loswerden will.

"peter.wedemeier" ist in der Tat ein guter Kontra-Indikator.

Aber er ist bestimmt keine wirkliche Person.

Es handelt sich offenbar um systematische postings aus den USA.

Wenn man sich die threads genau durchliest, merkt man, dass vieles durch Übersetzungsprogramme generiert wurde (vielleicht murkst machmal auch ein nicht besonders sprachgewandter Deutsch-Amerikaner daran herum).

Man merkt an den Kampagnen jedenfalls genau, welchen Müll die Mafia gerade loswerden will.

Mutual Funds

This bear is betting on Nasdaq 500

The Prudent Bear Fund is up a whopping 109% in the last 27 months. Its manager, David Tice, thinks he has plenty of room to run yet and sees the Nasdaq falling deeper into the hole.

By Timothy Middleton

Timothy Middleton

Is going from 5,000 to 500 on the Nasdaq Composite ($COMPX) imaginable?

It sure is to some people. The benchmark tumbled 71% from its peak in March of 2000 to the end of June, hitting a five-year low. The distance to 500 from here would be less, just another 63%.

Bears have made a killing on the move so far, and David Tice predicts there are more fortunes to be made by selling the country short. Selling short is highly unpopular -- and, since Sept. 11, something a lot of people see as vaguely unpatriotic, as well -- but his Prudent Bear Fund (BEARX) is up 109% in the last 27 months.

“Unfortunately, markets overshoot their fair value,” says Tice, whose Dallas-based fund is approaching a five-year high. “We will correct excesses and imbalances, and we have an imbalance -- a maladjusted U.S. economy where there’s too much debt in the system.” He thinks the Nasdaq “could easily fall to 500,” as the Dow Jones Industrial Average ($INDU) tumbles another 67% to below 3,000.

Investors who cling to their stocks, which is most of us, are confident Tice is wrong. “I think it’s too late” to make money by betting on a steep further decline, says Sheldon Jacobs, editor of the No-Load Fund Investor newsletter. He notes some gold funds, the only sector in which Tice is long, tumbled 20% last month.

“I think we’re going to have a real slow summer,” Jacobs says, “but I remain -- for not a lot of reasons -- hopeful that we’ll get a bull market in either the fourth quarter or the first quarter.”

Tice is betting the carnage will continue. The 18-year bull market that ended in 2000 was preceded by 17 years of bear market. “We have gone from record low participation by individual investors to a record high, and what happens in secular bear markets is you wash all of that out,” he says. The process has, he thinks, about 15 years to go.

A bear sharpens his teeth

For 14 years, Tice has published research for institutional investors in a report called "Behind the Numbers". He launched his mutual fund at the end of 1995, which he admits was four years too early, as it lost money in each of them. “Remember, 1996 was the year that Greenspan called what was going on `irrational exuberance,`” he says. “Our mistake was that we didn’t think policy makers would let the bubble get so far out of control.”

What the Fed missed, Tice thinks, is that massive inflation was occurring in the late 1990s, which would have called for much tighter monetary policy, except that it wasn’t happening in goods and services, which is where everyone looks, but in assets such as stocks and real estate.

Even today, after a huge fall, the price-to-earnings ratio of the stocks in the S&P 500 Index ($INX) is 30. When the last bear market ended, in 1982, it was 7.

Tice sponsored a symposium in the fall of 1999, predicting a massive crash. At the same time, he demonstrated the depth of his research by predicting a tumble in shares of Tyco International (TYC, news, msgs), criticizing the conglomerate’s accounting.

The shares were trading north of $50 when he published that opinion, and they fell to less than $40 within three months. Subsequently they surged to more than $60, however, and Tyco became a darling of growth investors as it resisted the bear market in 2000 and 2001.

Now those accounting methods have become controversial again, and the stock is down to less than $13.

Profiting from tech`s collapse

Tice`s investors have benefited the most, however, from the collapse of the technology sector. One of his most spectacular shorts was Juniper Networks (JNPR, news, msgs), which went from a high of nearly $220 in the fall of 2000 to its current price below $7.

“It was obvious the entire telecommunications market was in disarray,” he says. Juniper had been gaining market share on Cisco Systems (CSCO, news, msgs), but remained a niche player highly vulnerable to cutbacks in capital spending. That’s what happened.

He still thinks technology is too richly priced, and is currently shorting IBM (IBM, news, msgs). “IBM has, we think, taken quite a bit of latitude in its accounting,” Tice says. Much of the company’s revenues derive from services, rather than goods, and he says that opens the door to slippery numbers.

Also, the high-tech company’s share price hasn’t fallen nearly as sharply as that of other many tech companies. It trades around $70. The high was around $130 in the summer of 2000.

Shorts account for roughly 80% of Tice’s $330 million of assets, with the balance evenly divided between long positions in gold stocks and a few special situations. He trimmed the gold position in the spring, as the group surged, but retained Goldcorp (GG, news, msgs). The Canadian mining company produces gold for about $70 an ounce and is selling it currently for more than $300.

When the bear gets bitten

Investing with the bears is, however, fraught with its own problems. The upside on a short position is the difference between its current price and zero; in other words, it’s limited. There is no limit on the downside.

Short squeezes, or organized efforts to ratchet up a share’s price in order to bankrupt shorts, are often successful. Tice acknowledges this and uses put options and other derivatives to lessen his exposure to short squeezes. Still, the risk can’t be eliminated.

Also, there are many profitable alternatives to big-cap U.S. stocks. Value and small-company investors have largely sidestepped the bear. So have investors in basic industries like manufacturing. Bond investors have also done well.

Overseas, moreover, Japan has staged a serious rally -- the Nikkei 225 index ($NI225) is up 14.3% since early February. And emerging markets have been rallying as well. Investing in these markets carries its own share of risks, but they are easier for most investors to understand than the risk in short-selling.

Finally, there is serious timing risk in bear-market investing, because buried within a secular bear market will be some cyclical bulls, each one capable of squeezing shorts mercilessly.

For example, a secular bear market began in 1965, but that downward slide was reversed in 1970, when the Nifty Fifty rally took the S&P 500 up nearly 30%. The index was crushed again in 1973.

So a prudent investor has to make two decisions before approaching the Prudent Bear Fund. He first has to accept the argument that major indices will continue sliding nearly as much as they already have, only excruciatingly slowly. He then has to believe no cyclical rally will spring up anytime soon to savage him as much as the bear market already has.

I’m with Jacobs. Whatever you call what lies ahead -- secular or cyclical (bicyclical?) -- I think the easy money has been made on the bear side. The risk of some sustained good news is just too great.

Dow Jones geht unter 7.000 (vielleicht unter 6.000) der Nasdaq Composite wird unter 1.000 gehen.

This bear is betting on Nasdaq 500

The Prudent Bear Fund is up a whopping 109% in the last 27 months. Its manager, David Tice, thinks he has plenty of room to run yet and sees the Nasdaq falling deeper into the hole.

By Timothy Middleton

Timothy Middleton

Is going from 5,000 to 500 on the Nasdaq Composite ($COMPX) imaginable?

It sure is to some people. The benchmark tumbled 71% from its peak in March of 2000 to the end of June, hitting a five-year low. The distance to 500 from here would be less, just another 63%.

Bears have made a killing on the move so far, and David Tice predicts there are more fortunes to be made by selling the country short. Selling short is highly unpopular -- and, since Sept. 11, something a lot of people see as vaguely unpatriotic, as well -- but his Prudent Bear Fund (BEARX) is up 109% in the last 27 months.

“Unfortunately, markets overshoot their fair value,” says Tice, whose Dallas-based fund is approaching a five-year high. “We will correct excesses and imbalances, and we have an imbalance -- a maladjusted U.S. economy where there’s too much debt in the system.” He thinks the Nasdaq “could easily fall to 500,” as the Dow Jones Industrial Average ($INDU) tumbles another 67% to below 3,000.

Investors who cling to their stocks, which is most of us, are confident Tice is wrong. “I think it’s too late” to make money by betting on a steep further decline, says Sheldon Jacobs, editor of the No-Load Fund Investor newsletter. He notes some gold funds, the only sector in which Tice is long, tumbled 20% last month.

“I think we’re going to have a real slow summer,” Jacobs says, “but I remain -- for not a lot of reasons -- hopeful that we’ll get a bull market in either the fourth quarter or the first quarter.”

Tice is betting the carnage will continue. The 18-year bull market that ended in 2000 was preceded by 17 years of bear market. “We have gone from record low participation by individual investors to a record high, and what happens in secular bear markets is you wash all of that out,” he says. The process has, he thinks, about 15 years to go.

A bear sharpens his teeth

For 14 years, Tice has published research for institutional investors in a report called "Behind the Numbers". He launched his mutual fund at the end of 1995, which he admits was four years too early, as it lost money in each of them. “Remember, 1996 was the year that Greenspan called what was going on `irrational exuberance,`” he says. “Our mistake was that we didn’t think policy makers would let the bubble get so far out of control.”

What the Fed missed, Tice thinks, is that massive inflation was occurring in the late 1990s, which would have called for much tighter monetary policy, except that it wasn’t happening in goods and services, which is where everyone looks, but in assets such as stocks and real estate.

Even today, after a huge fall, the price-to-earnings ratio of the stocks in the S&P 500 Index ($INX) is 30. When the last bear market ended, in 1982, it was 7.

Tice sponsored a symposium in the fall of 1999, predicting a massive crash. At the same time, he demonstrated the depth of his research by predicting a tumble in shares of Tyco International (TYC, news, msgs), criticizing the conglomerate’s accounting.

The shares were trading north of $50 when he published that opinion, and they fell to less than $40 within three months. Subsequently they surged to more than $60, however, and Tyco became a darling of growth investors as it resisted the bear market in 2000 and 2001.

Now those accounting methods have become controversial again, and the stock is down to less than $13.

Profiting from tech`s collapse

Tice`s investors have benefited the most, however, from the collapse of the technology sector. One of his most spectacular shorts was Juniper Networks (JNPR, news, msgs), which went from a high of nearly $220 in the fall of 2000 to its current price below $7.

“It was obvious the entire telecommunications market was in disarray,” he says. Juniper had been gaining market share on Cisco Systems (CSCO, news, msgs), but remained a niche player highly vulnerable to cutbacks in capital spending. That’s what happened.

He still thinks technology is too richly priced, and is currently shorting IBM (IBM, news, msgs). “IBM has, we think, taken quite a bit of latitude in its accounting,” Tice says. Much of the company’s revenues derive from services, rather than goods, and he says that opens the door to slippery numbers.

Also, the high-tech company’s share price hasn’t fallen nearly as sharply as that of other many tech companies. It trades around $70. The high was around $130 in the summer of 2000.

Shorts account for roughly 80% of Tice’s $330 million of assets, with the balance evenly divided between long positions in gold stocks and a few special situations. He trimmed the gold position in the spring, as the group surged, but retained Goldcorp (GG, news, msgs). The Canadian mining company produces gold for about $70 an ounce and is selling it currently for more than $300.

When the bear gets bitten

Investing with the bears is, however, fraught with its own problems. The upside on a short position is the difference between its current price and zero; in other words, it’s limited. There is no limit on the downside.

Short squeezes, or organized efforts to ratchet up a share’s price in order to bankrupt shorts, are often successful. Tice acknowledges this and uses put options and other derivatives to lessen his exposure to short squeezes. Still, the risk can’t be eliminated.

Also, there are many profitable alternatives to big-cap U.S. stocks. Value and small-company investors have largely sidestepped the bear. So have investors in basic industries like manufacturing. Bond investors have also done well.

Overseas, moreover, Japan has staged a serious rally -- the Nikkei 225 index ($NI225) is up 14.3% since early February. And emerging markets have been rallying as well. Investing in these markets carries its own share of risks, but they are easier for most investors to understand than the risk in short-selling.

Finally, there is serious timing risk in bear-market investing, because buried within a secular bear market will be some cyclical bulls, each one capable of squeezing shorts mercilessly.

For example, a secular bear market began in 1965, but that downward slide was reversed in 1970, when the Nifty Fifty rally took the S&P 500 up nearly 30%. The index was crushed again in 1973.

So a prudent investor has to make two decisions before approaching the Prudent Bear Fund. He first has to accept the argument that major indices will continue sliding nearly as much as they already have, only excruciatingly slowly. He then has to believe no cyclical rally will spring up anytime soon to savage him as much as the bear market already has.

I’m with Jacobs. Whatever you call what lies ahead -- secular or cyclical (bicyclical?) -- I think the easy money has been made on the bear side. The risk of some sustained good news is just too great.

Dow Jones geht unter 7.000 (vielleicht unter 6.000) der Nasdaq Composite wird unter 1.000 gehen.

Sehr ungewöhnliche, nachbörsliche Aktion beim Gold.

Plötzlich und exakt um 17.38 kamen folgende Hauptblöcke (Transaktionen) herein bei allen Haupt Goldminenaktien. Ich nehme mal an, das dieses Fondskäufe waren:

NEM: 185200 shares @ 17:38

GFI: 222000 shares @ 17:38

HGMCY: 75500 shares @ 17:38

AU: 105000 shares @ 17:38

AEM: 321000 shares @ 17:38

ABX: 255800 shares @ 17:38

GG: 85900 shares @ 17:38

MDG: 35800 shares @ 17:38

PDG: 155900 shares @ 17:38

Plötzlich und exakt um 17.38 kamen folgende Hauptblöcke (Transaktionen) herein bei allen Haupt Goldminenaktien. Ich nehme mal an, das dieses Fondskäufe waren:

NEM: 185200 shares @ 17:38

GFI: 222000 shares @ 17:38

HGMCY: 75500 shares @ 17:38

AU: 105000 shares @ 17:38

AEM: 321000 shares @ 17:38

ABX: 255800 shares @ 17:38

GG: 85900 shares @ 17:38

MDG: 35800 shares @ 17:38

PDG: 155900 shares @ 17:38

Der XAU hat nach oben gedreht und GFI ist über 20% gestiegen von seinen Tiefs. Wir werden bei dem XAU am nächsten freitag die 80 brechen.

Diese großen Transaktionen nachbörslich kommt von Mutual Fonds, die das "normale" Trading während des Tages nicht unterbrechen wollen. Wie auch immer, im letzten Monat konnte man herausfinden, das meistens am tag die Goldminenaktien verprügelt wurden und das Level II herausfand, das dieses vor allem von Goldman Sachs gehandhabt worden ist. Dieses führt mich zur folgenden Spekulation: das an den Tagen, an denen das PPT verkauft GFI, HGMCY, ABX, AU und GFI short, sie Ihre Short Verkäufe durch GS nachbörslich wieder eindecken und einen Gewinn generieren für die nächste Intervention. Gerade wie das ACCESS System nach COMEX Schluß um den Goldpreis nach unten zu treiben, es scheint das PPT zu arbeiten wie der nachbörsliche Handel.

peter.wedemeier1

Diese großen Transaktionen nachbörslich kommt von Mutual Fonds, die das "normale" Trading während des Tages nicht unterbrechen wollen. Wie auch immer, im letzten Monat konnte man herausfinden, das meistens am tag die Goldminenaktien verprügelt wurden und das Level II herausfand, das dieses vor allem von Goldman Sachs gehandhabt worden ist. Dieses führt mich zur folgenden Spekulation: das an den Tagen, an denen das PPT verkauft GFI, HGMCY, ABX, AU und GFI short, sie Ihre Short Verkäufe durch GS nachbörslich wieder eindecken und einen Gewinn generieren für die nächste Intervention. Gerade wie das ACCESS System nach COMEX Schluß um den Goldpreis nach unten zu treiben, es scheint das PPT zu arbeiten wie der nachbörsliche Handel.

peter.wedemeier1

GFI wird bald auf neue Höhen steigen. Seine Profitabilität und der Goldpreis, Dollar und die Aktien vom Dow Jones und der Nasdaq werden die Gründe dafür sein. GFI sollte auf $17+ stehen.

- Sie haben einen der besten Minen Engineers der Welt, Ian Cockerill.

-150 Millionen Unzen an Reserven in Südafrika, Ghana und Australien. Davon sind 1/3 bis 1/2 leicht erreichbar. 50 - 75 Millionen zu den schon erklärten Unzen werden hinzugefügt, so das man auf eine Gesamtsumme von 135 - 160 Millionen Unzen kommt. Die 50 - 75 Millionen Unzen sind durchschnittliches Gold von 7,0 gm/to. vs. 6,4 gm/to für die aktuellen 85 Millionen Unzen.

- Mit dem steigenden Goldpreis und fallender Weltproduktion (2-4%/Jahr), die Planungen von GFI Thomson/Cockerill sind auf dem Weg die Lieferungen zu steigern auf 5 - 6 Millionen Unzen/Jahr. Die 85 Millionen Unzen repräsentieren 17 Jahre, die 135 Millionen Unzen repräsentieren 27 Jahre und die 160 Millionen Unzen repräsentieren 32 Jahre. Ein wirklich langes und profitables Leben. Im Gegensatz zu anderen Minen, die gewöhnlich ein 4 - 5 Jahres Leben haben.

- Das Finnland GFI Projekt; Oktokumpu hat wirklich ein Super $$$ Wert. Es wird gezeigt in jeder GFI Präsentation und wird erwähnt in jedem GFI Management Interview. GFI hat einen Anteil von 51%. Die 11 - 12 Millionen Unzen die öffentlich im Februar 2002 berichtet wurden, haben sich seitdem verdoppelt auf 22 - 24 Millionen Unzen. Annähernd 6 Millionen Unzen Pd und 8 Millionen Unzen Pt bei der letzten Zählung und die Exploration setzt sich fort in dem Reef Gebiet.

Engineering Produktionspläne für neue Objekte sind gesteigert worden. Neue geplante Objekte sind 500.000 Unzen am Anfang nun auf 1 Million bis 2 Millionen Unzen pro Jahr kurz danach. Ein direkter Käufer wird eher antizipiert. Der gesamte Weltverbrauch von Pd und Pt beträgt 6 - 7 Millionen Unzen pro Jahr.

- Der Guatemala CA Gold Besitz, in Partnerschaft mit Radius Exploration ist ein sehr vielversprechendes ProjektGFI Geologen zeigen sich überrascht von den ersten Ergebnissen von den Tambor, Bella Vista und Tierra Blanca Gebieten. Multi-Unzen Werte sind gefunden worden in den Felsen und Strömen von den vielen Goldzonen, die lokalisiert sind und Bohrprogramme befinden sich auf dem Weg seit dem 2. Quartal 2002.

- Der aktuelle Netto-Wert bei den herstellenden Facilities in ZA, Ghana & Australien beträgt mehrere Hunderte von Mils und mehr sind geplant wie GFI bewegt sich von 4,5 mils Unzen/Jahr auf 5 mils Unzen/Jahr.

- Der Netto-Wert von GFI BIOX bio-oxidation lizensierte Technologie ist berücksichtigt in der US $ mils und wird höher um so höher der Goldpreis steigt. Dieses macht die verbleibende Recovery ökonomischer.

Um Gold von Sulfide Mineralien zu befreien werden thiobacillius bacteria Reaktoren eingesetzt. Andererseits würden mehrere Refraktionelle Operationen aufeinanderfolgend in einem nitric acid Bad benötigt. Typische Gold Recoverys von mehr als 90% gebrauchen GFI`s BIOX Technologie. Dort gibt es mehrere existierende kommerzielle BIOX Facilities in Südafrika, Brasilien, Australien (2), Ghana und Peru. Neue Facilitäten sind geplant und Technologie Lizensen sind unterschrieben für Projekte in Uzbekistan (2), Griechenland und Australien.

Für weitergehende Informationen besuchen Sie bitte die Webseite:

http://www.goldfiels.co.za

Bei allen diesen guten Nachrichten sollte GFI bei $17+ stehen.

- Sie haben einen der besten Minen Engineers der Welt, Ian Cockerill.

-150 Millionen Unzen an Reserven in Südafrika, Ghana und Australien. Davon sind 1/3 bis 1/2 leicht erreichbar. 50 - 75 Millionen zu den schon erklärten Unzen werden hinzugefügt, so das man auf eine Gesamtsumme von 135 - 160 Millionen Unzen kommt. Die 50 - 75 Millionen Unzen sind durchschnittliches Gold von 7,0 gm/to. vs. 6,4 gm/to für die aktuellen 85 Millionen Unzen.

- Mit dem steigenden Goldpreis und fallender Weltproduktion (2-4%/Jahr), die Planungen von GFI Thomson/Cockerill sind auf dem Weg die Lieferungen zu steigern auf 5 - 6 Millionen Unzen/Jahr. Die 85 Millionen Unzen repräsentieren 17 Jahre, die 135 Millionen Unzen repräsentieren 27 Jahre und die 160 Millionen Unzen repräsentieren 32 Jahre. Ein wirklich langes und profitables Leben. Im Gegensatz zu anderen Minen, die gewöhnlich ein 4 - 5 Jahres Leben haben.

- Das Finnland GFI Projekt; Oktokumpu hat wirklich ein Super $$$ Wert. Es wird gezeigt in jeder GFI Präsentation und wird erwähnt in jedem GFI Management Interview. GFI hat einen Anteil von 51%. Die 11 - 12 Millionen Unzen die öffentlich im Februar 2002 berichtet wurden, haben sich seitdem verdoppelt auf 22 - 24 Millionen Unzen. Annähernd 6 Millionen Unzen Pd und 8 Millionen Unzen Pt bei der letzten Zählung und die Exploration setzt sich fort in dem Reef Gebiet.

Engineering Produktionspläne für neue Objekte sind gesteigert worden. Neue geplante Objekte sind 500.000 Unzen am Anfang nun auf 1 Million bis 2 Millionen Unzen pro Jahr kurz danach. Ein direkter Käufer wird eher antizipiert. Der gesamte Weltverbrauch von Pd und Pt beträgt 6 - 7 Millionen Unzen pro Jahr.

- Der Guatemala CA Gold Besitz, in Partnerschaft mit Radius Exploration ist ein sehr vielversprechendes ProjektGFI Geologen zeigen sich überrascht von den ersten Ergebnissen von den Tambor, Bella Vista und Tierra Blanca Gebieten. Multi-Unzen Werte sind gefunden worden in den Felsen und Strömen von den vielen Goldzonen, die lokalisiert sind und Bohrprogramme befinden sich auf dem Weg seit dem 2. Quartal 2002.

- Der aktuelle Netto-Wert bei den herstellenden Facilities in ZA, Ghana & Australien beträgt mehrere Hunderte von Mils und mehr sind geplant wie GFI bewegt sich von 4,5 mils Unzen/Jahr auf 5 mils Unzen/Jahr.

- Der Netto-Wert von GFI BIOX bio-oxidation lizensierte Technologie ist berücksichtigt in der US $ mils und wird höher um so höher der Goldpreis steigt. Dieses macht die verbleibende Recovery ökonomischer.

Um Gold von Sulfide Mineralien zu befreien werden thiobacillius bacteria Reaktoren eingesetzt. Andererseits würden mehrere Refraktionelle Operationen aufeinanderfolgend in einem nitric acid Bad benötigt. Typische Gold Recoverys von mehr als 90% gebrauchen GFI`s BIOX Technologie. Dort gibt es mehrere existierende kommerzielle BIOX Facilities in Südafrika, Brasilien, Australien (2), Ghana und Peru. Neue Facilitäten sind geplant und Technologie Lizensen sind unterschrieben für Projekte in Uzbekistan (2), Griechenland und Australien.

Für weitergehende Informationen besuchen Sie bitte die Webseite:

http://www.goldfiels.co.za

Bei allen diesen guten Nachrichten sollte GFI bei $17+ stehen.

Gold Fields und Newmont Mining sind Top Werte in dem Goldsektor! Auch Meridian Gold ist ein Topwert in diesem Sektor! Und für ein Silberspiel Pan American Silver, der Topwert in dem Silbersektor! Investments bei den oben genannten Werten bringen dir mehr Return zurück, als ein Investment in einen 1000 g Barren, wegen:

- der Dividende, die dir bezahlt wird,

- den Splits, die durchgeführt werden,

und dem Merger Potenzial bei den Werten.

Weitere Faktoren:

- Starte jetzt mit deinem Investment nach dem Pullback,

- füge zu deinen Holdings bei Pullbacks hinzu,

- bleibe investiert, wissend was du besitzt,

- sei dir aufgrund deiner Angst nicht dein schlimmster Feind,

- der Goldmarkt wird dich niemals mehr verletzen können als du dir selbst verletzen kannst.

Gold befindet sich am Anfang von einem sehr langen (Jahre, Jahrzehnte) bull market. Also viel Glück bei deinen Investments in diesem Sektor. Vergiß die Dow Jones-, DAX-, Nasdaq- und Nemax-Werte!

peter.wedemeier1

peter.wedemeier1

- der Dividende, die dir bezahlt wird,

- den Splits, die durchgeführt werden,

und dem Merger Potenzial bei den Werten.

Weitere Faktoren:

- Starte jetzt mit deinem Investment nach dem Pullback,

- füge zu deinen Holdings bei Pullbacks hinzu,

- bleibe investiert, wissend was du besitzt,

- sei dir aufgrund deiner Angst nicht dein schlimmster Feind,

- der Goldmarkt wird dich niemals mehr verletzen können als du dir selbst verletzen kannst.

Gold befindet sich am Anfang von einem sehr langen (Jahre, Jahrzehnte) bull market. Also viel Glück bei deinen Investments in diesem Sektor. Vergiß die Dow Jones-, DAX-, Nasdaq- und Nemax-Werte!

peter.wedemeier1

peter.wedemeier1

Der Kurs von GFI liegt jetzt seit ungefähr einer Woche etwas zurück. Wenn die Minen sich mehr erholen sollten, dann wird GFI diese anführen. Und Montag wird ein positver Tag werden.

Wenn wir die kleine Hürde bei $330,- bald nehmen, die nur im Wege ist bei der schnellen Bewegung über $500-600, dann wird GFI bei $40+++ gehandelt werden.

peter.wedemeier1

peter.wedemeier1

Go for the gold!

Source: African Business

Publication date: 2002-07-01

Arrival time: 2002-08-03

MINING NOTEBOOK

In these unsure times, everybody wants a bit of certainty - and that means good, old fashioned gold. But for how long will the high prices hold? Is it time to invest in the yellow metal or pull out?

Rafiq Ahmed has the answers.

In times of international uncertainties, investors turn to more tangible assets, such as real estate and precious metals. Gold possesses the distinctive characteristics of money: it serves as a medium of exchange, a store of wealth (long-- term savings) and a unit of value. Besides gold holdings, investors are lately showing preference for gold bars, gold coins, paper (metal certificates) and specialist funds (which invest exclusively in gold mining company shares), monitored by the FTSE Gold Mines Index.

This index, which tracks gold equity markets in the Americas, Africa and Australasia, boasts market capitalisation of $50.63bn and has generated a 62% return in the year to June 2002. The gold price surged through the key resistance level of $320 a troy ounce (oz) in late May and touched $330/oz in Hong Kong in June before slipping back because of light profit-taking by investment funds.

There have been seven short-lived rallies since February 1996 when gold hit $420oz. However, most analysts believe the market`s upside potentials now have solid fundamentals. Kelvin Williams, marketing director of AngloGold, the world`s largest gold producer, said: "Unlike other price rallies in recent years, where the gold price has tended to rise on the back of a single issue or incident, the current price improvement has been built on a number of favourable circumstances for gold."

The positive factors underpinning gold`s new-found lustre among institutional and private investors are:

*A marked turnaround in investor sentiment largely because of geopolitical tensions, which if sustained over the coming months, can prove crucial in reviving the industry`s fortunes. Chris Thompson, chief executive of Gold Fields, remarked: "People are feeling far less secure than previously. Gold has always been the investment that people reach for when they feel uncomfortable."

*The substantial reductions in producer-- hedging, i.e. forward- selling on the gold derivative markets. This indicates limited downside risk for gold prices. Lately, there has been a marked change in producers` hedging strategies. Jonathan Best, AngloGold`s financial director explained: "We`ve continued to manage our hedge book aggressively and we are taking out the weaker positions in the hedge book right now so that going forward, we don`t have a long period when we will be receiving lower prices or incurring an opportunity loss." AngloGold has cut its hedging positions by about 105.74t during the past six months.

Heavy hedge-book loses?

According to Gold Fields` findings, hedge-book financial losses to producers could be heavy over the next few years if prices surge to between $330/oz and $345/oz. Macquarie Bank (Australia) estimates that total hedge-book of gold miners world-wide may drop by 400t in 2002.

Therefore, the supply of bullion in the markets will become tighter because of declining producer-hedging and robust investment demand should buoy the price of gold.

*Global mine production is expected to decline this year or next thanks to greater consolidation and rationalisation within the industry during the past two years.

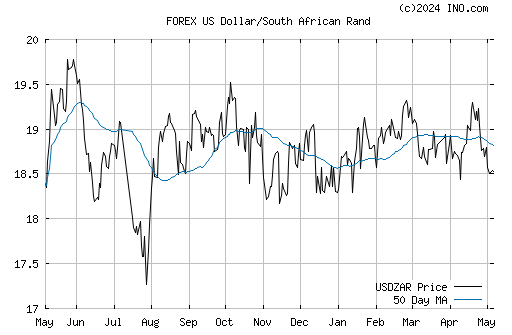

*The gold rally was also helped by the US dollar`s weakness against a number of other major currencies. A softer greenback versus the euro and the yen, in fact, reduces gold prices in many other currencies, thereby making the precious metal more attractive to buyers in Asia-Pacific and Europe. The greenback and gold have a counter-cyclical relationship. If the dollar surges, bullion prices fall and vice versa.

*Lower US money market rates are discouraging speculative short- selling of gold by international hedge funds. In times of rising US interest rates, it`s profitable for hedge funds to borrow gold from the bullion banks, sell it and place the money in high-yielding cash- deposits and major OECD-country Treasury securities.

*The lacklustre performances of stock markets in America and Western Europe have also had an impact on the price of gold. This in turn, reflects doubts about the health of global economic recovery and hence revival in corporate earnings. During the past year, gold investments have outperformed bonds and equities. The World Gold Council writes: "People buy gold when there is a stock market crash or things are unstable because gold tends to hold its value. Cash is eroded by inflation, but gold bullion tends to rise in value. It is usually seen as a hedge against inflation."

Controlled bullion sales

The September 1999 Washington Accord commits 20 of the world`s leading central banks and international financial institutions (the Bank for International Settlements and the IMF together control 85% of the globe`s bullion reserves), to hold gold as a reserve asset and to limit gold sales to 4001 per annum until September 2004.

The signatories have also agreed not to increase their gold- leasing programmes and expand the use of gold futures and options during this period. The central banks are complying with the accord, thus eliminating the market`s fear of an uncontrolled heavy official selling. Gold-producing countries in Africa and South America would of course welcome an extension of the Central Banks` Gold Agreement after 2004.

Central banks world-wide hold more than 33,000t as part of their foreign currency reserves, equivalent to 13 years of current mine production. The five-main official holders of gold reserves are the US Federal Reserves Board (8,148t); Germany`s Bundesbank (3,4560; Banque de France (3,025t); Banca d`Italia (2,45 10 and the Swiss National Bank (2,151t).

Supply-deficit

The demand for gold has continued to surpass the supply of newly- mined gold for many years. According to the latest report, "Gold Survey 2002," compiled by Londonbased Gold Fields Mineral Services (GFMS), world-wide mine production in 2001 totalled 2,604t, against aggregate gold usages in jewellery, fabricated products and investments of 3,483t. The jewellery sector accounts for 75% - 80% of gold offtake, especially in Asia and the Middle East.

Despite sustained falls in gold output, South Africa still remains the world`s largest producer (394t) last year. GFMS report shows that 80% of SA production comes from mines owned by AngloGold, Gold Fields and Harmony. Other major producers are America, Australia, Indonesia - which owns the world`s biggest gold-mine, Grasberg (which produced 108t) - China, Russia and Canada.

Last year`s average spot price was $271/oz while total production costs averaged $228/oz. Future trends

Some prime investment banks like UBS Warburg, Deutsche Bank, HSBC and Barclays Capital are anticipating gold to average above $300/oz this year and between $320/oz-$340/oz in 2003. GFMS provides more cautious forecasts of between $285/oz and $315/oz over the next year. The yellow metal`s 10-year moving average is $331 /oz.

But stronger prices of $350/oz-$380/oz, though unlikely in the near-term, would trigger profit-taking and renewed producer-- hedging, thus weighing on the markets. Also, more marginal mines in South Africa and elsewhere will be brought back into production and increasing supplies should ultimately lead to lower prices.

It`s important to note that the current geopolitical and macroeconomic conditions in the US and Europe are very different from the great bull-market of 1980/81, when gold skyrocketed to $800/ oz, following the invasion of Afghanistan by the Former Soviet Union and the start of Iran-Iraq war.

Source: African Business

Publication date: 2002-07-01

Arrival time: 2002-08-03

MINING NOTEBOOK

In these unsure times, everybody wants a bit of certainty - and that means good, old fashioned gold. But for how long will the high prices hold? Is it time to invest in the yellow metal or pull out?

Rafiq Ahmed has the answers.

In times of international uncertainties, investors turn to more tangible assets, such as real estate and precious metals. Gold possesses the distinctive characteristics of money: it serves as a medium of exchange, a store of wealth (long-- term savings) and a unit of value. Besides gold holdings, investors are lately showing preference for gold bars, gold coins, paper (metal certificates) and specialist funds (which invest exclusively in gold mining company shares), monitored by the FTSE Gold Mines Index.

This index, which tracks gold equity markets in the Americas, Africa and Australasia, boasts market capitalisation of $50.63bn and has generated a 62% return in the year to June 2002. The gold price surged through the key resistance level of $320 a troy ounce (oz) in late May and touched $330/oz in Hong Kong in June before slipping back because of light profit-taking by investment funds.

There have been seven short-lived rallies since February 1996 when gold hit $420oz. However, most analysts believe the market`s upside potentials now have solid fundamentals. Kelvin Williams, marketing director of AngloGold, the world`s largest gold producer, said: "Unlike other price rallies in recent years, where the gold price has tended to rise on the back of a single issue or incident, the current price improvement has been built on a number of favourable circumstances for gold."

The positive factors underpinning gold`s new-found lustre among institutional and private investors are:

*A marked turnaround in investor sentiment largely because of geopolitical tensions, which if sustained over the coming months, can prove crucial in reviving the industry`s fortunes. Chris Thompson, chief executive of Gold Fields, remarked: "People are feeling far less secure than previously. Gold has always been the investment that people reach for when they feel uncomfortable."

*The substantial reductions in producer-- hedging, i.e. forward- selling on the gold derivative markets. This indicates limited downside risk for gold prices. Lately, there has been a marked change in producers` hedging strategies. Jonathan Best, AngloGold`s financial director explained: "We`ve continued to manage our hedge book aggressively and we are taking out the weaker positions in the hedge book right now so that going forward, we don`t have a long period when we will be receiving lower prices or incurring an opportunity loss." AngloGold has cut its hedging positions by about 105.74t during the past six months.

Heavy hedge-book loses?

According to Gold Fields` findings, hedge-book financial losses to producers could be heavy over the next few years if prices surge to between $330/oz and $345/oz. Macquarie Bank (Australia) estimates that total hedge-book of gold miners world-wide may drop by 400t in 2002.

Therefore, the supply of bullion in the markets will become tighter because of declining producer-hedging and robust investment demand should buoy the price of gold.

*Global mine production is expected to decline this year or next thanks to greater consolidation and rationalisation within the industry during the past two years.

*The gold rally was also helped by the US dollar`s weakness against a number of other major currencies. A softer greenback versus the euro and the yen, in fact, reduces gold prices in many other currencies, thereby making the precious metal more attractive to buyers in Asia-Pacific and Europe. The greenback and gold have a counter-cyclical relationship. If the dollar surges, bullion prices fall and vice versa.

*Lower US money market rates are discouraging speculative short- selling of gold by international hedge funds. In times of rising US interest rates, it`s profitable for hedge funds to borrow gold from the bullion banks, sell it and place the money in high-yielding cash- deposits and major OECD-country Treasury securities.

*The lacklustre performances of stock markets in America and Western Europe have also had an impact on the price of gold. This in turn, reflects doubts about the health of global economic recovery and hence revival in corporate earnings. During the past year, gold investments have outperformed bonds and equities. The World Gold Council writes: "People buy gold when there is a stock market crash or things are unstable because gold tends to hold its value. Cash is eroded by inflation, but gold bullion tends to rise in value. It is usually seen as a hedge against inflation."

Controlled bullion sales

The September 1999 Washington Accord commits 20 of the world`s leading central banks and international financial institutions (the Bank for International Settlements and the IMF together control 85% of the globe`s bullion reserves), to hold gold as a reserve asset and to limit gold sales to 4001 per annum until September 2004.

The signatories have also agreed not to increase their gold- leasing programmes and expand the use of gold futures and options during this period. The central banks are complying with the accord, thus eliminating the market`s fear of an uncontrolled heavy official selling. Gold-producing countries in Africa and South America would of course welcome an extension of the Central Banks` Gold Agreement after 2004.

Central banks world-wide hold more than 33,000t as part of their foreign currency reserves, equivalent to 13 years of current mine production. The five-main official holders of gold reserves are the US Federal Reserves Board (8,148t); Germany`s Bundesbank (3,4560; Banque de France (3,025t); Banca d`Italia (2,45 10 and the Swiss National Bank (2,151t).

Supply-deficit

The demand for gold has continued to surpass the supply of newly- mined gold for many years. According to the latest report, "Gold Survey 2002," compiled by Londonbased Gold Fields Mineral Services (GFMS), world-wide mine production in 2001 totalled 2,604t, against aggregate gold usages in jewellery, fabricated products and investments of 3,483t. The jewellery sector accounts for 75% - 80% of gold offtake, especially in Asia and the Middle East.

Despite sustained falls in gold output, South Africa still remains the world`s largest producer (394t) last year. GFMS report shows that 80% of SA production comes from mines owned by AngloGold, Gold Fields and Harmony. Other major producers are America, Australia, Indonesia - which owns the world`s biggest gold-mine, Grasberg (which produced 108t) - China, Russia and Canada.

Last year`s average spot price was $271/oz while total production costs averaged $228/oz. Future trends

Some prime investment banks like UBS Warburg, Deutsche Bank, HSBC and Barclays Capital are anticipating gold to average above $300/oz this year and between $320/oz-$340/oz in 2003. GFMS provides more cautious forecasts of between $285/oz and $315/oz over the next year. The yellow metal`s 10-year moving average is $331 /oz.

But stronger prices of $350/oz-$380/oz, though unlikely in the near-term, would trigger profit-taking and renewed producer-- hedging, thus weighing on the markets. Also, more marginal mines in South Africa and elsewhere will be brought back into production and increasing supplies should ultimately lead to lower prices.

It`s important to note that the current geopolitical and macroeconomic conditions in the US and Europe are very different from the great bull-market of 1980/81, when gold skyrocketed to $800/ oz, following the invasion of Afghanistan by the Former Soviet Union and the start of Iran-Iraq war.

Newmont`s Lassonde sees gold at US$350/oz

Michael Quinn

05 August 2002

"We are [at the beginning of] a fundamental gold bull market," the president of the world`s largest gold producer said, offering US$340-350/oz as a possible price 18-24 months ahead, with the caveat that it could be "much higher".

According to Lassonde, a key driver of price rises in the next few years will be devaluation of the US dollar, with recent history seen as a good guide. Lassonde said the US dollar fell against a basket of other currencies in 1985 by 33%, with gold rising in the same period some 60% from US$300/oz to US$500/oz.

He noted the US trade account was about US$440 billion in the red, requiring an inflow of around US$1.3 billion daily to service the deficit. "There`s a law that says what can`t go on forever, stops. Well, it`s stopped," Lassonde said. The US dollar has thus far fallen around 10%, and "I think its going to go further", he added.

On correlations with the S&P500, Lassonde pointed to the 1930s (when the S&P fell 63% and gold went up 69%), 1960s (S&P down 34%, gold up 347%), while the current bear market sees the S&P down 35% - "and in my view has a long way to go" - and gold is up 11%.

On production fundamentals, Lassonde believes prices south of US$325/oz are unsustainable for gold miners, with the weakness of the price over the last few years ensuring reduced production out to 2005.

He said the return on capital by the gold industry at a US$275/oz gold price was 3% while the cost of capital was 9%. "Nobody makes money at US$275/oz," he said.

Lassonde also said the days of hedging - "the bane of this industry for 10 years" - are over, with contangos reaching a mere $3/oz per year.

On Lassonde`s calculations, every 100t hedged/brought to market drops the price by US$5/oz. On this basis the 300-400t worth of reduced hedging expected in the current year will add US$15-20 to the gold price.

At a press conference following the presentation, Lassonde mentioned Newmont was working with the World Gold Council on a new gold investment product that could take up 500-1000t of gold annually.

And he said a new CEO of the WGC would be announced within months and that the appointment, which featured a well-known, credible personality, would indicate the future direction of the peak body.

On operational matters, Newmont will begin grinding trials pertaining to the Boddington project in Western Australia early next year, while the review of the Superpit in Kalgoorlie should be completed by the end of 2002.

And Newmont`s Australasian chief John Dow said work continued to be promising at Golden Grove, where the discoveries of copper and zinc have been equivalent to around 5Moz of gold grading around half-an-ounce.

Michael Quinn

05 August 2002

"We are [at the beginning of] a fundamental gold bull market," the president of the world`s largest gold producer said, offering US$340-350/oz as a possible price 18-24 months ahead, with the caveat that it could be "much higher".

According to Lassonde, a key driver of price rises in the next few years will be devaluation of the US dollar, with recent history seen as a good guide. Lassonde said the US dollar fell against a basket of other currencies in 1985 by 33%, with gold rising in the same period some 60% from US$300/oz to US$500/oz.

He noted the US trade account was about US$440 billion in the red, requiring an inflow of around US$1.3 billion daily to service the deficit. "There`s a law that says what can`t go on forever, stops. Well, it`s stopped," Lassonde said. The US dollar has thus far fallen around 10%, and "I think its going to go further", he added.

On correlations with the S&P500, Lassonde pointed to the 1930s (when the S&P fell 63% and gold went up 69%), 1960s (S&P down 34%, gold up 347%), while the current bear market sees the S&P down 35% - "and in my view has a long way to go" - and gold is up 11%.

On production fundamentals, Lassonde believes prices south of US$325/oz are unsustainable for gold miners, with the weakness of the price over the last few years ensuring reduced production out to 2005.

He said the return on capital by the gold industry at a US$275/oz gold price was 3% while the cost of capital was 9%. "Nobody makes money at US$275/oz," he said.

Lassonde also said the days of hedging - "the bane of this industry for 10 years" - are over, with contangos reaching a mere $3/oz per year.

On Lassonde`s calculations, every 100t hedged/brought to market drops the price by US$5/oz. On this basis the 300-400t worth of reduced hedging expected in the current year will add US$15-20 to the gold price.

At a press conference following the presentation, Lassonde mentioned Newmont was working with the World Gold Council on a new gold investment product that could take up 500-1000t of gold annually.

And he said a new CEO of the WGC would be announced within months and that the appointment, which featured a well-known, credible personality, would indicate the future direction of the peak body.

On operational matters, Newmont will begin grinding trials pertaining to the Boddington project in Western Australia early next year, while the review of the Superpit in Kalgoorlie should be completed by the end of 2002.

And Newmont`s Australasian chief John Dow said work continued to be promising at Golden Grove, where the discoveries of copper and zinc have been equivalent to around 5Moz of gold grading around half-an-ounce.

Inflation, Deflation oder Stagflation! Der Dollar wird kollabieren, wenn die Investoren dieses gesamte Dilemma einmal endgültig (innerhalb eines Monats nach meiner Einschätzung) begreifen! Und dieses wird den Dow Jones ; DAX ; Nasadaq ; Nemax brutal crashen lassen. Meine Einschätzung: 4000 - 5000 beim Dow Jones. Und wenn Amerika hustet, dann hat Euiropa eine starke Grippe!!!

Die stagnierende Wirtschaft neben der importierten Inflation aufgrund eines kollabierenden Dollars wird eine

S T A G F L A T I O N !!!

als Ergebnis haben. Und wenn der normale Investor dieses endgültig begreifen wird, dann wird er den breiten Markt brutal crashen lassen.

peter.wedemeier1

Die stagnierende Wirtschaft neben der importierten Inflation aufgrund eines kollabierenden Dollars wird eine

S T A G F L A T I O N !!!

als Ergebnis haben. Und wenn der normale Investor dieses endgültig begreifen wird, dann wird er den breiten Markt brutal crashen lassen.

peter.wedemeier1

Unser zukünftiges P/E ist zu niedrig. Value und Fundamentals kommen gelegentlich ins Spiel. Auch sieht es danach aus, als ob die Südafrikaner die Majors wieder anführen werden. Unsere 300% Quartals Gewinnsteigerung gegenüber 2001 verdient Respekt, im Vergleich zu durchschnittlichen S&P Aktien und Nasdaq Aktien.

peter.wedemeier1

peter.wedemeier1

GFI`s Momentum hat klar nach oben gedreht und ist kurz davor, das sich wichtige MA`s kreuzen.

XAU...Momentum hat nach oben gedreht.

Gold... Momentum hat nach oben gedreht.

Wir sind in guter Verfassung mit dem ganzen Momentum, das nach oben zeigt. (sicher: es sieht besser aus als vor ein Paar Wochen!!!)

peter.wedemeier1

XAU...Momentum hat nach oben gedreht.

Gold... Momentum hat nach oben gedreht.

Wir sind in guter Verfassung mit dem ganzen Momentum, das nach oben zeigt. (sicher: es sieht besser aus als vor ein Paar Wochen!!!)

peter.wedemeier1

THE INDUSTRY ABANDONS "HEDGING"

You know from my past commentaries and reporting on gold that the practice of central banks’ selling or leasing gold to various parties--who, in the case of leased gold, then sell it in the hopes of buying it back at a lower price later--was the chief factor in gold’s bear market declines. A close second, however, was the somewhat similar practice on the part of major gold producers to sell gold still in the ground, in order to lock in a certain price. Generally, the practice known as "hedging"--which took a few different forms, some of which were highly speculative--served to short-circuit any rallies in the gold price. It seemed that any time gold would get some traction, one or more big producers would "forward sell" large amounts of gold. In effect, this was their own vote of "no confidence" in gold’s ability to move higher, and their way of trying to keep cash flow and earnings afloat. In one sense, these companies could hardly be blamed for trying to do the best for their shareholders, given gold’s generally bearish environment for so long. Many, however, considered the hedgers--chief among them Barrick Gold and the above-mentioned Anglo Gold--as pariahs.

A "shot across the bow" for these larger concerns and others came in the spike in late 1999. To a certain extent--and without confusing you unduly in explaining it--the practice of hedging on the part of miners acts much the same way as does a short sale. For as long as the gold price stays at or below the price at which future production was sold, all is well. However, if the current, spot price rises much above that same level, the value of having made those hedges is diminished. Further, in the cases where miners themselves have actually borrowed gold outright (or entered into some kind of derivative contract) they can be faced with margin calls, negative values in their "hedge books," or both.

This happened during the 1999 spike to two companies. Ashanti Goldfields of Ghana racked up enormous paper losses on its derivative portfolio (i.e.--hedge book) and for a while teetered on the brink of bankruptcy. Its banking counterparts who had "dibs" on these hedges had the ability to demand substantial cash payments from Ashanti, in order to cover the amounts by which the hedges were now in the red. At the eleventh hour--and assisted by the ultimately successful efforts to rein in gold’s advance--Ashanti managed to barely stay in business. Similarly, Canadian producer Cambior got into trouble with its hedge book.

Though these were the two most publicized examples, you’d better believe that hearts were suddenly pounding fast in other gold mining board rooms. All of a sudden, companies deemed by many (including themselves) as geniuses were being looked at with a jaundiced eye. Maybe it wouldn’t be good after all for some companies if gold did finally go up--and all of a sudden, those few investors interested at the time in gold demanded some answers as to how individual companies would fare if gold finally did turn around.

In the immediate aftermath of this near-disaster, a couple companies came out and announced they were moving away from the practice of hedging. Early on, these announcements--led initially by Placer Dome and Gold Fields--were motivated as much by the companies’ desires to allay fears over their solvency as by any real confidence that gold’s bear market was drawing to a close. Still, there did not seem to be an industry-wide consensus--or motivation--for a practically wholesale abandonment of the practice of hedging.

That changed, however, with the closing in January of Newmont Mining’s acquisition of Canadian-based Franco Nevada, and the Australian miner Normandy. As you’ll remember, I wrote extensively on the months-long struggle between Newmont and Anglo Gold for Normandy in particular; and, far from being your typical battle over an appealing target, this turned into a battle between hedgers (Anglo) and non-hedgers (Newmont.) The non-hedgers won; and both leading up to its acquisition and since, Newmont--now the world’s largest producer--has worn its status on its sleeve.

A number of long-time gold market bulls pointed to Newmont’s victory as the most significant gold market event in decades. And so it was. For, one by one, the most notable hedgers among gold producers have come out and embraced the old-time religion of being bullish for and an advocate of their own product. Before they’d hardly had time to lick their wounds and swallow some pride after losing the battle for Normandy, Anglo Gold came out and said that it would rather switch than fight. In a series of announcements, the big South African miner has said it is "aggressively" unwinding its hedge book.

In a February 5 interview with the Financial Times, Anglo’s Executive Director for Marketing Kelvin Williams indicated that his company would allow its hedge book to "erode" during 2002, while watching for "upside opportunities."

"We think there is a solid floor under the physical gold market," he explained. "And there is no longer a constituency of speculators eager to play the market from the short side. . ."

As gold’s price has continued to rise this Spring, Anglo has occasionally repeated its earlier announcements that it was unwinding its hedges, so as to take better advantage of the rising cash price. Especially conspicuous in recent weeks, though, has been the management of Barrick Gold, the so-called "king" of the hedgers. That company has--similarly to Anglo--been going out of its way at times to assure the market and its own investors that, (1) it, too, is unwinding its hedge book and now selling at least some production into the spot market for the first time in many years, and (2) it has no intention of short-circuiting the rise in gold’s price by adding new hedges.

Except in the most learned gold bug circles and among those who have taken the time to analyze the markets, this story has not received nearly sufficient attention. Coupled with the declining mine supply, the virtual wholesale abandonment of hedging has written the epitaph to the long, nasty bear market endured by gold for so long.