!!! Silber !!! +++ Heute so billig wie vor 30 Jahren !!! - 500 Beiträge pro Seite

eröffnet am 01.06.03 10:59:36 von

neuester Beitrag 14.07.03 20:12:16 von

neuester Beitrag 14.07.03 20:12:16 von

Beiträge: 97

ID: 738.162

ID: 738.162

Aufrufe heute: 0

Gesamt: 11.917

Gesamt: 11.917

Aktive User: 0

ISIN: CA7847301032 · WKN: A2DVLE · Symbol: ZSV

4,8400

EUR

-0,96 %

-0,0470 EUR

Letzter Kurs 14:26:14 Tradegate

Neuigkeiten

17.04.24 · Business Wire (engl.) |

12.04.24 · wO Chartvergleich |

06.04.24 · Business Wire (engl.) |

31.03.24 · Business Wire (engl.) |

27.03.24 · Business Wire (engl.) |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 13,170 | +15,32 | |

| 46,82 | +12,12 | |

| 41,11 | +9,98 | |

| 1,4000 | +8,95 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 103,80 | -9,50 | |

| 5,5500 | -11,55 | |

| 0,6800 | -15,00 | |

| 4,2300 | -17,86 | |

| 0,9000 | -25,00 |

Silber

Heute so billig wie vor 30 Jahren!

In Euro, Franken, etc. gerechnet noch billiger.

88 x billiger als Gold, obwohl Silber in der Natur nur gerade mal 7 x häufiger vorkommt als Gold, und die Silberlager heute fast aufgebraucht sind, und bereits zur Zeit ca. 14 volle Welt Jahresproduktionen Silber short verkauft wurden.

Falls man zusätzlich 30 Jahre Kaufkraft Verlust des US Dollars mit berücksichtigt, erscheinen die heutigen Silber Preise wie

ein schlechter Witz.

Dass die Produktion von Silber, der Nachfrage seit Jahren nicht schritthalten kann, und ein seit Jahren grosses Produktionsdefizit besteht, muss ich den meisten Anlegern nicht mehr besonders erwähnen.

http://www.weigl-fdl.de/angebotsdefizit.html

Der Grund dafür dass dieser Silber Preis Manipulations Skandal bis jetzt überhaupt noch aufrecht erhalten werden konnte, ist die Tatsache, dass Silber als sogenanntes "Abfallprodukt" bei der Förderung von anderen Produkten wie Gold, Kupfer, Blei, Zink, etc. anfällt, und von den Förderfirmen gerade zu den Preisen verkauft werden, die vom Silber Cabal vorgegeben werden.

Die Produktionsdefizite wurden seit Jahren mittels Silberenthortung, und Recycling ausgeglichen. Diese Silberlager sind jetzt aber aufgebraucht.

Siehe:

http://www.wallstreet-online.de/ws/community/board/thread.ph…

Die reinen Silber Minen, sind von Ausnahmen einmal abgesehen, entweder stillgelegt worden, oder in Konkurs gegangen. Amerikanische Silber Minen zum Beispiel benötigen Silberpreise von mindestens 6 bis 7 Dollar, um überhaupt nur daran zu denken, die Silberproduktion wieder rentabel aufnehmen zu können.

Physisches Silber, strong buy!!!

Weitere Informationsquellen zum Silber:

http://www.silver-investor.com

http://www.weigl-fdl.de

http://www.the-privateer.com

http://www.butlerresearch.com/archive_free.html

http://www.sharelynx.net/Markets/Master.htm

http://www.silverinstitute.org

Heute so billig wie vor 30 Jahren!

In Euro, Franken, etc. gerechnet noch billiger.

88 x billiger als Gold, obwohl Silber in der Natur nur gerade mal 7 x häufiger vorkommt als Gold, und die Silberlager heute fast aufgebraucht sind, und bereits zur Zeit ca. 14 volle Welt Jahresproduktionen Silber short verkauft wurden.

Falls man zusätzlich 30 Jahre Kaufkraft Verlust des US Dollars mit berücksichtigt, erscheinen die heutigen Silber Preise wie

ein schlechter Witz.

Dass die Produktion von Silber, der Nachfrage seit Jahren nicht schritthalten kann, und ein seit Jahren grosses Produktionsdefizit besteht, muss ich den meisten Anlegern nicht mehr besonders erwähnen.

http://www.weigl-fdl.de/angebotsdefizit.html

Der Grund dafür dass dieser Silber Preis Manipulations Skandal bis jetzt überhaupt noch aufrecht erhalten werden konnte, ist die Tatsache, dass Silber als sogenanntes "Abfallprodukt" bei der Förderung von anderen Produkten wie Gold, Kupfer, Blei, Zink, etc. anfällt, und von den Förderfirmen gerade zu den Preisen verkauft werden, die vom Silber Cabal vorgegeben werden.

Die Produktionsdefizite wurden seit Jahren mittels Silberenthortung, und Recycling ausgeglichen. Diese Silberlager sind jetzt aber aufgebraucht.

Siehe:

http://www.wallstreet-online.de/ws/community/board/thread.ph…

Die reinen Silber Minen, sind von Ausnahmen einmal abgesehen, entweder stillgelegt worden, oder in Konkurs gegangen. Amerikanische Silber Minen zum Beispiel benötigen Silberpreise von mindestens 6 bis 7 Dollar, um überhaupt nur daran zu denken, die Silberproduktion wieder rentabel aufnehmen zu können.

Physisches Silber, strong buy!!!

Weitere Informationsquellen zum Silber:

http://www.silver-investor.com

http://www.weigl-fdl.de

http://www.the-privateer.com

http://www.butlerresearch.com/archive_free.html

http://www.sharelynx.net/Markets/Master.htm

http://www.silverinstitute.org

Hallo Thai!

Vielen Dank für deine Beiträge!

10% meines Depot`s bestehen aus Silber-Call`s .

So langsam wird`s Zeit mit einem Preisanstieg!!!

Vielen Dank für deine Beiträge!

10% meines Depot`s bestehen aus Silber-Call`s .

So langsam wird`s Zeit mit einem Preisanstieg!!!

Hi Thaiguru

sawaddee kap

Hoert sich ja echt geil an!in Physisches Silber zu investieren.

Hab schon ne Explorer Aktie und Zwar Donner Minerals,

die bohren nach Nickel in Canada.

Kann ich auch bei Consors kaufen?

Kennst Du weigl www.weigl , sind die Konditionen dort ok?

MfG Lima

sawaddee kap

Hoert sich ja echt geil an!in Physisches Silber zu investieren.

Hab schon ne Explorer Aktie und Zwar Donner Minerals,

die bohren nach Nickel in Canada.

Kann ich auch bei Consors kaufen?

Kennst Du weigl www.weigl , sind die Konditionen dort ok?

MfG Lima

Interessanter als Gold erscheint Silber allemal!

Damit hat es sich aber auch schon.

Obige Tabelle zeigt ja sehr schön was rauskommt bei der Anlage in physische Güter. Lagerkosten sind auch noch zu berücksichtigen!!

Damit hat es sich aber auch schon.

Obige Tabelle zeigt ja sehr schön was rauskommt bei der Anlage in physische Güter. Lagerkosten sind auch noch zu berücksichtigen!!

Übrigens, schaut mal nach was mit dem Silberpreis von 1929-1932 passiert ist.

Auch sehr lehrreich, wie ich denke.

Auch sehr lehrreich, wie ich denke.

@Lima2000

Physisches Silber bei Consors kaufen?

Glaube geht eher nicht.

Kennst Du weigl www.weigl?

Die Homepage kenne ich schon lange, auch den Silber Rundbrief von Weigl. Kund war ich dort aber bis jetzt nicht, da ich in Thailand lebe.

Sind die Konditionen dort ok?

Mir ist bis jetzt nichts nachteiliges bekannt geworden.

Silber kaufst Du zur Zeit wohl am günstigsten bei E-Bay, als Silber Münzen, oder Medallien aus allen möglichen Länder. Vielfach erhält man diese Silber Münzen grösstenteils zu sehr günstigen Preisen. Vor allem wenn es sich um grössere Sammlungen von Exotischen Silbermünzen handelt. Einfach die Angebote prüfen, Reinheit, und Gewicht beachten, und etwas rechnen. Falls der Preis nicht mehr als max. 15% - 20% über dem reinen Silberwert liegt, zugreifen.

Zum Vergleich: Die bekannten 1 Unzen US Silber Eagles kosten in den USA bei Händlern wie z.Bsp. http://www.kitco.com, oder http://www.usagold.com ca. 6.50 Dollar, plus Versandkosten!

In Deutschland werden sie von vielen Händlern, und Banken mit einem noch grösseren Aufpreis verkauft.

Gruss

ThaiGuru

Physisches Silber bei Consors kaufen?

Glaube geht eher nicht.

Kennst Du weigl www.weigl?

Die Homepage kenne ich schon lange, auch den Silber Rundbrief von Weigl. Kund war ich dort aber bis jetzt nicht, da ich in Thailand lebe.

Sind die Konditionen dort ok?

Mir ist bis jetzt nichts nachteiliges bekannt geworden.

Silber kaufst Du zur Zeit wohl am günstigsten bei E-Bay, als Silber Münzen, oder Medallien aus allen möglichen Länder. Vielfach erhält man diese Silber Münzen grösstenteils zu sehr günstigen Preisen. Vor allem wenn es sich um grössere Sammlungen von Exotischen Silbermünzen handelt. Einfach die Angebote prüfen, Reinheit, und Gewicht beachten, und etwas rechnen. Falls der Preis nicht mehr als max. 15% - 20% über dem reinen Silberwert liegt, zugreifen.

Zum Vergleich: Die bekannten 1 Unzen US Silber Eagles kosten in den USA bei Händlern wie z.Bsp. http://www.kitco.com, oder http://www.usagold.com ca. 6.50 Dollar, plus Versandkosten!

In Deutschland werden sie von vielen Händlern, und Banken mit einem noch grösseren Aufpreis verkauft.

Gruss

ThaiGuru

Weigl liefert aber auch kein Silber aus...

Das Silber wird in den USA irgendwo gelagert.

Insiderin007

Das Silber wird in den USA irgendwo gelagert.

Insiderin007

Wollte eigentlich einen Chart über den Kaufkraftverlust des US Dollars seit 1900 einstellen, um einem "540 Punkte Nemax50 Enthusiasten" zu ermöglichen seine Scheuklappen neu zu justieren.

Habe leider keinen Auftreiben können.

Seit 1945 sieht man aber auch schon sehr deutlich wie der Dollar immer weiter an Kaufkraft verliert.

Wenn man z.Bsp. als Ausgangslage den Silberpreis von 1945 zum Vergleich heranzieht, damals 0.52 Dollar pro Unze, müsste der Preis einer Unze heute, Kaufkraft bereinigt, bei mindestens ca. 5.- Dollar liegen.

Damals bestand aber noch kein seit über 13 Jahren anhaltendes Produktionsdefizit von durchschnittlich pro Jahr ca. 100 Millionen Unzen beim Silber, es gab auch praktisch keine Vorwärtsverkäufe, und schon gar nicht die Shortpositionen von 14 Jahresproduktionen Silber von heute. Zudem waren im Gegensatz zu heute die stategischen Silberlager voll, und nicht leer. Die Münzen der allermeisten Länder dieser Erde besassen einen grossen Silber Anteil in der Legierung, der ursprünglich meistens dem Nominalwert der Münzen entsprach, und bestanden nicht nur aus einer praktisch wertlosen Kupfer/Nickel/weiss was ich Legierung, wie es heute leider der Fall ist.

Habe leider keinen Auftreiben können.

Seit 1945 sieht man aber auch schon sehr deutlich wie der Dollar immer weiter an Kaufkraft verliert.

Wenn man z.Bsp. als Ausgangslage den Silberpreis von 1945 zum Vergleich heranzieht, damals 0.52 Dollar pro Unze, müsste der Preis einer Unze heute, Kaufkraft bereinigt, bei mindestens ca. 5.- Dollar liegen.

Damals bestand aber noch kein seit über 13 Jahren anhaltendes Produktionsdefizit von durchschnittlich pro Jahr ca. 100 Millionen Unzen beim Silber, es gab auch praktisch keine Vorwärtsverkäufe, und schon gar nicht die Shortpositionen von 14 Jahresproduktionen Silber von heute. Zudem waren im Gegensatz zu heute die stategischen Silberlager voll, und nicht leer. Die Münzen der allermeisten Länder dieser Erde besassen einen grossen Silber Anteil in der Legierung, der ursprünglich meistens dem Nominalwert der Münzen entsprach, und bestanden nicht nur aus einer praktisch wertlosen Kupfer/Nickel/weiss was ich Legierung, wie es heute leider der Fall ist.

514, Thai. Nicht 540.

Ich bestreite ja gar nicht, dass Silber real heute billiger ist als früher. Ich interpretiere diesen Umstand im Gegensatz zu Dir nur anders. Das ist halt, auch und gerade langfristig, eine schlechte Geldanlage. Aus basta.

Und noch dazu ziemlich konjunkturabhängig.

Würde ich so argumentieren wie Du, könnte ich sagen, schau der Nemax war mal auf 8000, jetzt muss man kaufen, ist ja viel billiger.

Ich bestreite ja gar nicht, dass Silber real heute billiger ist als früher. Ich interpretiere diesen Umstand im Gegensatz zu Dir nur anders. Das ist halt, auch und gerade langfristig, eine schlechte Geldanlage. Aus basta.

Und noch dazu ziemlich konjunkturabhängig.

Würde ich so argumentieren wie Du, könnte ich sagen, schau der Nemax war mal auf 8000, jetzt muss man kaufen, ist ja viel billiger.

Bitte sehr, da hast was längeres. Kaufkraft von 100 englischen Pfund, 1800-2001. US-Dollar hab ich grad nicht da.

@Pfandbrief

Glauben macht seelig!

Aber Fundamentaldaten können nun mal nicht dauernd ausser Kraft gesetz werden. Vor allem nicht das Gesetz von Angebot und Nachfrage.

Du selbst hast ja leider so gedacht beim Nemax, und lagst komplet daneben. Genauso mit dem was Du noch vor Monaten zur Preisentwicklung bei Gold vorausgesagt hast. Falls Du sie schon vergessen hast, hole ich sie Dir gerne nochmals hervor. Aktien am Dax und TecDax sind m.M.n. auch heute noch, von einigen Ausnahmen abgesehen, stark überbewertet.

Mit Deiner Einschätzung zur zukünftigen Preisentwicklung beim Silber, wirst Du wieder komplet daneben liegen.

Silber, und Silberaktien sind neben Gold und Goldaktien, "DIE" Anlage Chance des Jahrzehnts schlechthin!

Das Du das nicht so siehst, ist Dein gutes Recht, und verwundert mich auch nicht bei Deiner eigenen Art die Sachlage zu analysieren.

Gruss

ThaiGuru

Glauben macht seelig!

Aber Fundamentaldaten können nun mal nicht dauernd ausser Kraft gesetz werden. Vor allem nicht das Gesetz von Angebot und Nachfrage.

Du selbst hast ja leider so gedacht beim Nemax, und lagst komplet daneben. Genauso mit dem was Du noch vor Monaten zur Preisentwicklung bei Gold vorausgesagt hast. Falls Du sie schon vergessen hast, hole ich sie Dir gerne nochmals hervor. Aktien am Dax und TecDax sind m.M.n. auch heute noch, von einigen Ausnahmen abgesehen, stark überbewertet.

Mit Deiner Einschätzung zur zukünftigen Preisentwicklung beim Silber, wirst Du wieder komplet daneben liegen.

Silber, und Silberaktien sind neben Gold und Goldaktien, "DIE" Anlage Chance des Jahrzehnts schlechthin!

Das Du das nicht so siehst, ist Dein gutes Recht, und verwundert mich auch nicht bei Deiner eigenen Art die Sachlage zu analysieren.

Gruss

ThaiGuru

Ah ja.

Silberaktien? Wie verträgt sich das mit der Feststellung aus #1:

Die reinen Silber Minen, sind von Ausnahmen einmal abgesehen, entweder stillgelegt worden, oder in Konkurs gegangen.

Silberaktien? Wie verträgt sich das mit der Feststellung aus #1:

Die reinen Silber Minen, sind von Ausnahmen einmal abgesehen, entweder stillgelegt worden, oder in Konkurs gegangen.

@Pfandbrief

Genau diese Denkweise ist es vermutlich die verhindert, dass Du eine zukünftige positive Preisentwicklung beim Silber nicht erkennen kannst.

Eben gerade weil sich die Produktion von Silber für sehr viele Minen nicht rentiert, und dadurch der Betrieb stillgelegt wurde, oder werden muss, bedeutet doch nichts anderes, als dass die Silber Preise massiv zu tief liegen.

Falls dieser Zustand weiter anhalten wird, würde die Silberproduktion zwangsläufig, wohlgemerkt bei einem schon über 13 Jahre anhaltenden Produktionsdefizit, noch weiter zurückgehen, und das Problem der Unterversorgung der Industrie noch vergrössern. Bei von Dir ja anscheinend angenommen, noch weiter fallenden Silberpreis Notierungen, bedeutete das auch für einige jetzt noch produzierende Silber Minen, Existenzgefärdung, mit der daraus folgenden Produktionseinstellung. Du solltest einmal etwas die Billanzen von Silberminen analysieren, bevor Du solche total an der Realität vorbeiziehenden Aeusserungen machst.

Wie, und zu welchem Silber Preis, glaubst Du wohl, können die 14 Jahresproduktionen Silber, die von einigen Silber Cabal Banken bereits auf dem Papier verkauft wurden, (Dieses Silber muss irgenwann auch mal geliefert werden!) in einem Silbermarkt erworben werden können, wo sich eine Silberpreis Produktion quasi nicht mehr lohnt, in dem Silberproduzenten in den Konkurs getrieben wurden, und werden, und in dem jetzt schon viel zu wenig Silber vorhanden ist, um den heute nötigen Bedarf zu decken.

An eine Wiederentdeckung der Anleger von Silber als Anlageinstrument, möchte ich jetzt nicht einmal denken.

Weisst Du überhaupt wie klein der gesammte Silbermarkt ist?

Schon ein Bruchteil dessen, was heute in den ebenso noch sehr kleinen Goldmarkt als Anlagegelder fliesst, würde ausreichen um die Silberpreise explodieren zu lassen.

Deine Aussage das Silber ein schlechtes Investment darstelle, darfst Du selber gerne weiter glauben.

Die Zeit wird zeigen, was das wirkliche Preis Potenzial von Silber ist. Sehr lange kann es eh nicht mehr dauern. Bis dahin kaufe ich physisches Silber, weil Silber heute zu Preisen erworben werden kann, bei denen sich die Produktion für die meisten reinen Silberproduzenten nicht einmal mehr lohnt, und ich davon überzeugt bin, dass genau das der Grund ist, warum trotz der Jahrelangen Silberpreis Manipulation, die übrigens auch heute noch anhält, schlussendlich die Fundamentaldaten dem Silber zu einem bedeutend höheren Preis verhelfen werden.

Gruss

ThaiGuru

Genau diese Denkweise ist es vermutlich die verhindert, dass Du eine zukünftige positive Preisentwicklung beim Silber nicht erkennen kannst.

Eben gerade weil sich die Produktion von Silber für sehr viele Minen nicht rentiert, und dadurch der Betrieb stillgelegt wurde, oder werden muss, bedeutet doch nichts anderes, als dass die Silber Preise massiv zu tief liegen.

Falls dieser Zustand weiter anhalten wird, würde die Silberproduktion zwangsläufig, wohlgemerkt bei einem schon über 13 Jahre anhaltenden Produktionsdefizit, noch weiter zurückgehen, und das Problem der Unterversorgung der Industrie noch vergrössern. Bei von Dir ja anscheinend angenommen, noch weiter fallenden Silberpreis Notierungen, bedeutete das auch für einige jetzt noch produzierende Silber Minen, Existenzgefärdung, mit der daraus folgenden Produktionseinstellung. Du solltest einmal etwas die Billanzen von Silberminen analysieren, bevor Du solche total an der Realität vorbeiziehenden Aeusserungen machst.

Wie, und zu welchem Silber Preis, glaubst Du wohl, können die 14 Jahresproduktionen Silber, die von einigen Silber Cabal Banken bereits auf dem Papier verkauft wurden, (Dieses Silber muss irgenwann auch mal geliefert werden!) in einem Silbermarkt erworben werden können, wo sich eine Silberpreis Produktion quasi nicht mehr lohnt, in dem Silberproduzenten in den Konkurs getrieben wurden, und werden, und in dem jetzt schon viel zu wenig Silber vorhanden ist, um den heute nötigen Bedarf zu decken.

An eine Wiederentdeckung der Anleger von Silber als Anlageinstrument, möchte ich jetzt nicht einmal denken.

Weisst Du überhaupt wie klein der gesammte Silbermarkt ist?

Schon ein Bruchteil dessen, was heute in den ebenso noch sehr kleinen Goldmarkt als Anlagegelder fliesst, würde ausreichen um die Silberpreise explodieren zu lassen.

Deine Aussage das Silber ein schlechtes Investment darstelle, darfst Du selber gerne weiter glauben.

Die Zeit wird zeigen, was das wirkliche Preis Potenzial von Silber ist. Sehr lange kann es eh nicht mehr dauern. Bis dahin kaufe ich physisches Silber, weil Silber heute zu Preisen erworben werden kann, bei denen sich die Produktion für die meisten reinen Silberproduzenten nicht einmal mehr lohnt, und ich davon überzeugt bin, dass genau das der Grund ist, warum trotz der Jahrelangen Silberpreis Manipulation, die übrigens auch heute noch anhält, schlussendlich die Fundamentaldaten dem Silber zu einem bedeutend höheren Preis verhelfen werden.

Gruss

ThaiGuru

Du solltest einmal etwas die Billanzen von Silberminen analysieren, bevor Du solche total an der Realität vorbeiziehenden Aeusserungen machst.

Hab` überhaupt keine Äußerung gemacht, wundere mich nur, wie das mit dem Konkursszenario oben zusammenpaßt.

Von mir aus -- sag halt welche Silberminen noch nicht pleite oder stillgelegt sind -- dann kann man sich ja mal die Bilanzen ansehen. Wenn möglich nicht intransparente Kleinstläden.

Bei richtiger Bewertung sind solche Aktien (im Gegensatz zu physischem Silber!) vielleicht nicht mal so schlecht als Anlage. Ich habe selbst ja auch Rohstoffwerte, aber natürlich kein Gold & Silber -- siehe z.B. Thread: 12 % Dividendenrendite mit schwarzem Gold - UK Coal. Die Bewertung muß aber schon recht günstig sein, sonst kommt für mich kein Investment in Frage.

Ich krieg` heutzutage ja schließlich Aktien aller Art zu Ausverkaufspreisen nachgeschmissen.

Hab` überhaupt keine Äußerung gemacht, wundere mich nur, wie das mit dem Konkursszenario oben zusammenpaßt.

Von mir aus -- sag halt welche Silberminen noch nicht pleite oder stillgelegt sind -- dann kann man sich ja mal die Bilanzen ansehen. Wenn möglich nicht intransparente Kleinstläden.

Bei richtiger Bewertung sind solche Aktien (im Gegensatz zu physischem Silber!) vielleicht nicht mal so schlecht als Anlage. Ich habe selbst ja auch Rohstoffwerte, aber natürlich kein Gold & Silber -- siehe z.B. Thread: 12 % Dividendenrendite mit schwarzem Gold - UK Coal. Die Bewertung muß aber schon recht günstig sein, sonst kommt für mich kein Investment in Frage.

Ich krieg` heutzutage ja schließlich Aktien aller Art zu Ausverkaufspreisen nachgeschmissen.

"Ich krieg` heutzutage ja schließlich Aktien aller Art zu Ausverkaufspreisen nachgeschmissen."

Aktien sind sautauer ! Und um so tiefer sie fallen um so teuerer werden sie fundamental betrachtet, das is das Motto der letzten 3 Jahre !

Nicht wahr Thai und die anderen ganzen Goldspasten ?

Aktien sind sautauer ! Und um so tiefer sie fallen um so teuerer werden sie fundamental betrachtet, das is das Motto der letzten 3 Jahre !

Nicht wahr Thai und die anderen ganzen Goldspasten ?

Anhand dieser beiden Langzeit Preistabellen, kann man unschwer erkennen, dass das Verhältnis der Preise von Gold und Silber 1864, dem des natürlichen Vorkommens von Gold und Silber in der Natur entsprach, nähmlich 1:7.

Wie man sieht kostete bereits 1864 eine Unze Silber 2.93 Dollar!

Im Jahr 1864, kostete eine Unze Gold 20.65

1964 betrug das Verhältnis Gold - Silber 1:7

1945 betrug das Verhältnis Gold - Silber 1:30

1974 betrug das Verhältnis Gold - Silber 1:36

1979 betrug das Verhältnis Gold - Silber 1:14

1980 betrug das Verhältnis Gold - Silber 1:37

Am letzten Freitag betrug das Preisverhältnis Gold - Silber 1:80

Wie man sieht kostete bereits 1864 eine Unze Silber 2.93 Dollar!

Im Jahr 1864, kostete eine Unze Gold 20.65

1964 betrug das Verhältnis Gold - Silber 1:7

1945 betrug das Verhältnis Gold - Silber 1:30

1974 betrug das Verhältnis Gold - Silber 1:36

1979 betrug das Verhältnis Gold - Silber 1:14

1980 betrug das Verhältnis Gold - Silber 1:37

Am letzten Freitag betrug das Preisverhältnis Gold - Silber 1:80

Am letzten Freitag betrug das Preisverhältnis Gold - Silber 1:80

Hast recht, das wird fallen.

Fragt sich nur wie.

Hast recht, das wird fallen.

Fragt sich nur wie.

Korrektur:

Posting # 16

1864 betrug das Verhältnis Gold - Silber 1:7

Posting # 16

1864 betrug das Verhältnis Gold - Silber 1:7

By James Turk, Editor

The Freemarket Gold & Money Report

Letter No. 325

May, 2003

© 2003 by The Freemarket Gold & Money Report

I continue to hear the horror stories. A subscriber tells me that the bank where he stores his silver announced a three-fold increase in fees. His bank therefore recommended that he sell his silver "because it is expensive to store and has been a poor investment." When he gave his bank notice that he intended to move his silver to another location, the bank backed down and said that his storage fee would not change.

I advised him to move the silver anyway. My reason? It

appeared to me that his bank was too eager to get him to

liquidate his silver. Maybe their trading desk is short

physical silver and is looking to get its hands on any

silver it can. If that is the case, who knows how safe his

silver really is?

Another subscriber tells me that his bank raised his

storage fees for silver to 2 percent per annum, apparently

thinking that additional expense burden would prod him

into selling. Again, his bank told him that silver has been a poor investment and should therefore be sold.

My response was: Why has his bank suddenly taken this great concern for the customer`s well being after having ignored him and his silver for years?

And the horror stories are not just for silver. I also have been told things about gold that make one wonder about the factors that are driving some banks to act as they are with regard to metal placed with them for safekeeping.

The result of their actions has directly affected their treatment of customers who store precious metals with them. It appears that these banks are eyeing up the

metal stored in safekeeping for a purpose. And it is all

but certain that the banks taking these steps are not

doing it for their customers` best interests.

The sad fact is that most people do not completely

understand the intricacies of storing precious metals.

As a result, many people do not fully appreciate the

risks they are taking with their gold and silver, which

ironically has been bought by many people in order

to provide a risk-free way to hold some of their wealth.

Consequently, I have prepared this primer to provide

you with three storage basics to help you avoid

needless risks with your gold and silver.

1) Unallocated vs. allocated. These are the two most basic methods of storage. When you store on an allocated basis, you continue to own the gold/silver. There is no transfer of title. With allocated gold/silver, you deliver gold/silver bars to the vault

under a contractual agreement that the exact same bars

will be redelivered back to you upon request. But with

unallocated gold/silver you become an unsecured creditor of the bullion bank, and thus, in an unallocated account you are at risk of the bullion bank`s insolvency. So when you store gold, or silver, it should be allocated.

2) Pool accounts. This term is used to mean that your gold or silver is commingled with the gold/silver of other people, which is easy to do because gold/silver is a fungible commodity. There are advantages to pooled gold/silver, generally relating to economies of scale and the resulting reduced fees that are charged when the gold of many people is pooled. Pooled gold/silver can be allocated and unallocated. For example, in GoldMoney all gold is allocated, and each user owns his respective portion of the pool of allocated gold, which again is the way that all gold should be stored. But in contrast to the storage arrangements of GoldMoney, the pooled gold of some firms is unallocated. Thus customers of these firms own unallocated gold, which means that you are a general creditor of the firm and at risk of the firm`s insolvency. Pool accounts are advantageous to use, and I do recommend them -- but only when the pool holds allocated gold. Avoid all other pool accounts.

3) "Gold" and "Silver" certificates. These certificates are common, and are perhaps the most misunderstood type of storage because they are not storage at all. The name is a misnomer because you really don`t own gold, or silver. All you own is someone`s promise to pay gold, or silver to you, which is the basic nature of any "certificate." Let`s say you have some dollars and you go to your bank to make a deposit. As evidence of the transaction, the bank gives you a "certificate of deposit." You no longer own the money, and you now become an unsecured general creditor of the bank. This same principle describes how the so-called "gold/silver certificates" work. You don`t really own gold, or silver. Instead, you are an unsecured general creditor of the bank, trading firm, or mint that issued you the certificate.

In summary, everyone who owns gold. or silver has to distinguish between paper and physical gold,or silver, which are very different things.

I recommend that everyone own physical gold, or silver and

there are two ways to accomplish this objective -- either

you take possession of the gold/silver yourself or place your gold in allocated storage. There are no other alternatives.

If you take possession of the gold, you must then be

willing to manage the responsibilities of holding physical

metal, and to take those required steps to make sure

that it is safely stored and insured. You also have to be

certain that you are purchasing gold from a reliable

dealer so that you are not receiving gold-plated bars

of lead or other base metal.

If you place your gold, or silver with others for storage, I recommend that your gold/silver be allocated. Do not place your gold/silver at risk in any way, and do not hold gold certificates.

Gold, ans silver certificates are not gold/silver, despite what banks, firms, or mints may tell you. These companies will usually offer you all kinds of inducements to take their certificates -- free "storage" being the most common. But there is no such thing as a free lunch.

If a bank or mint is storing gold/silver for you for free, it`s because you are a general creditor of that bank or

mint, which is now using your gold, or silver to generate

income.

Unallocated gold and silver certificates are not gold, or silver. It is just someone`s promise to pay you gold, or silver and in a crisis -- which is precisely when you need that gold/silver -- it is likely that there will be a default on their payment of gold to you.

The bottom line here is quite simple: Make sure your

gold, or silver is allocated. Do not take the risk of "gold or silver certificates."

----------------------------------------------------

To subscribe to GATA`s dispatches, send an e-mail to:

gata-subscribe@yahoogroups.com

The Freemarket Gold & Money Report

Letter No. 325

May, 2003

© 2003 by The Freemarket Gold & Money Report

I continue to hear the horror stories. A subscriber tells me that the bank where he stores his silver announced a three-fold increase in fees. His bank therefore recommended that he sell his silver "because it is expensive to store and has been a poor investment." When he gave his bank notice that he intended to move his silver to another location, the bank backed down and said that his storage fee would not change.

I advised him to move the silver anyway. My reason? It

appeared to me that his bank was too eager to get him to

liquidate his silver. Maybe their trading desk is short

physical silver and is looking to get its hands on any

silver it can. If that is the case, who knows how safe his

silver really is?

Another subscriber tells me that his bank raised his

storage fees for silver to 2 percent per annum, apparently

thinking that additional expense burden would prod him

into selling. Again, his bank told him that silver has been a poor investment and should therefore be sold.

My response was: Why has his bank suddenly taken this great concern for the customer`s well being after having ignored him and his silver for years?

And the horror stories are not just for silver. I also have been told things about gold that make one wonder about the factors that are driving some banks to act as they are with regard to metal placed with them for safekeeping.

The result of their actions has directly affected their treatment of customers who store precious metals with them. It appears that these banks are eyeing up the

metal stored in safekeeping for a purpose. And it is all

but certain that the banks taking these steps are not

doing it for their customers` best interests.

The sad fact is that most people do not completely

understand the intricacies of storing precious metals.

As a result, many people do not fully appreciate the

risks they are taking with their gold and silver, which

ironically has been bought by many people in order

to provide a risk-free way to hold some of their wealth.

Consequently, I have prepared this primer to provide

you with three storage basics to help you avoid

needless risks with your gold and silver.

1) Unallocated vs. allocated. These are the two most basic methods of storage. When you store on an allocated basis, you continue to own the gold/silver. There is no transfer of title. With allocated gold/silver, you deliver gold/silver bars to the vault

under a contractual agreement that the exact same bars

will be redelivered back to you upon request. But with

unallocated gold/silver you become an unsecured creditor of the bullion bank, and thus, in an unallocated account you are at risk of the bullion bank`s insolvency. So when you store gold, or silver, it should be allocated.

2) Pool accounts. This term is used to mean that your gold or silver is commingled with the gold/silver of other people, which is easy to do because gold/silver is a fungible commodity. There are advantages to pooled gold/silver, generally relating to economies of scale and the resulting reduced fees that are charged when the gold of many people is pooled. Pooled gold/silver can be allocated and unallocated. For example, in GoldMoney all gold is allocated, and each user owns his respective portion of the pool of allocated gold, which again is the way that all gold should be stored. But in contrast to the storage arrangements of GoldMoney, the pooled gold of some firms is unallocated. Thus customers of these firms own unallocated gold, which means that you are a general creditor of the firm and at risk of the firm`s insolvency. Pool accounts are advantageous to use, and I do recommend them -- but only when the pool holds allocated gold. Avoid all other pool accounts.

3) "Gold" and "Silver" certificates. These certificates are common, and are perhaps the most misunderstood type of storage because they are not storage at all. The name is a misnomer because you really don`t own gold, or silver. All you own is someone`s promise to pay gold, or silver to you, which is the basic nature of any "certificate." Let`s say you have some dollars and you go to your bank to make a deposit. As evidence of the transaction, the bank gives you a "certificate of deposit." You no longer own the money, and you now become an unsecured general creditor of the bank. This same principle describes how the so-called "gold/silver certificates" work. You don`t really own gold, or silver. Instead, you are an unsecured general creditor of the bank, trading firm, or mint that issued you the certificate.

In summary, everyone who owns gold. or silver has to distinguish between paper and physical gold,or silver, which are very different things.

I recommend that everyone own physical gold, or silver and

there are two ways to accomplish this objective -- either

you take possession of the gold/silver yourself or place your gold in allocated storage. There are no other alternatives.

If you take possession of the gold, you must then be

willing to manage the responsibilities of holding physical

metal, and to take those required steps to make sure

that it is safely stored and insured. You also have to be

certain that you are purchasing gold from a reliable

dealer so that you are not receiving gold-plated bars

of lead or other base metal.

If you place your gold, or silver with others for storage, I recommend that your gold/silver be allocated. Do not place your gold/silver at risk in any way, and do not hold gold certificates.

Gold, ans silver certificates are not gold/silver, despite what banks, firms, or mints may tell you. These companies will usually offer you all kinds of inducements to take their certificates -- free "storage" being the most common. But there is no such thing as a free lunch.

If a bank or mint is storing gold/silver for you for free, it`s because you are a general creditor of that bank or

mint, which is now using your gold, or silver to generate

income.

Unallocated gold and silver certificates are not gold, or silver. It is just someone`s promise to pay you gold, or silver and in a crisis -- which is precisely when you need that gold/silver -- it is likely that there will be a default on their payment of gold to you.

The bottom line here is quite simple: Make sure your

gold, or silver is allocated. Do not take the risk of "gold or silver certificates."

----------------------------------------------------

To subscribe to GATA`s dispatches, send an e-mail to:

gata-subscribe@yahoogroups.com

hallo, Thaiguru und alle Silberfreaks!

Ausser Silber gibt es viele andere seltene Metalle, die noch viel billiger sind, bspw. Neodynium, die magnetischen Eigenschaften sind einfqach der Hammer, habe einen Neodynium-Magneten zu Hause, der bei einem Eigengewicht von ca. 100g 400kg trägt.

Wer will, kann diese Magneten bei mir dank Direktimport für 50€/Stück kaufen, meiner Meinung nach mehr Potential(Flugzeug-Elektromotoren/Autonabenbremsen mit Energieeinspeisung bei geringem Gewicht, Magnetfeldgeneratoren) als popeliges Silber, das zugegebenermassen gut als wasserreiniger verwendet werden kann.

Wer jetzt gut investiert, kann enorm gewinnen, warum nicht in Zukunftstechnologien?

Grüsse!

DG

Ausser Silber gibt es viele andere seltene Metalle, die noch viel billiger sind, bspw. Neodynium, die magnetischen Eigenschaften sind einfqach der Hammer, habe einen Neodynium-Magneten zu Hause, der bei einem Eigengewicht von ca. 100g 400kg trägt.

Wer will, kann diese Magneten bei mir dank Direktimport für 50€/Stück kaufen, meiner Meinung nach mehr Potential(Flugzeug-Elektromotoren/Autonabenbremsen mit Energieeinspeisung bei geringem Gewicht, Magnetfeldgeneratoren) als popeliges Silber, das zugegebenermassen gut als wasserreiniger verwendet werden kann.

Wer jetzt gut investiert, kann enorm gewinnen, warum nicht in Zukunftstechnologien?

Grüsse!

DG

Um wieviel kannst mir Iridium beschaffen, Der_Glueckliche?

Quelle:

http://www.gold-eagle.com/editorials_02/morgan060302pv.html

Using the work of Frank Veneroso, the high estimate of gold leasing is roughly half the available supply.6 This is indeed a serious condition but not nearly as serious as the silver situation.

If we look at the total amount of gold leased versus total supply of gold, we see about half has been leased.

Now let us look at the silver situation. Nearly twice the amount of available silver (bullion) has been leased

it looks nice don´t think twice

action speak louder than words

(physische Silberkäufe z.B. in China wären wichtig )

Silber ist allerdings ein Industriemetall

in Rezessionsphasen dürfte der Silberverbrauch rückläufig sein.

In der Elektronik wird Silber benötigt z.B. bei HF-Spulen

wegen des skin-Effekts.

Handyproduktion dürfte Silber verbrauchen (schätze ich

so mal mit dem gesunden Menschenverstand)

http://www.gold-eagle.com/editorials_02/morgan060302pv.html

Using the work of Frank Veneroso, the high estimate of gold leasing is roughly half the available supply.6 This is indeed a serious condition but not nearly as serious as the silver situation.

If we look at the total amount of gold leased versus total supply of gold, we see about half has been leased.

Now let us look at the silver situation. Nearly twice the amount of available silver (bullion) has been leased

it looks nice don´t think twice

action speak louder than words

(physische Silberkäufe z.B. in China wären wichtig )

Silber ist allerdings ein Industriemetall

in Rezessionsphasen dürfte der Silberverbrauch rückläufig sein.

In der Elektronik wird Silber benötigt z.B. bei HF-Spulen

wegen des skin-Effekts.

Handyproduktion dürfte Silber verbrauchen (schätze ich

so mal mit dem gesunden Menschenverstand)

@Pfandbrief:Willst Du Solarzellen bauen?

Ne, ich finde nur Iridium im Vergleich zu anderen Edelmetallen ziemlich "preiswert".

"Um wieviel kannst mir Iridium beschaffen, Der_Glueckliche?"

Pah, Iridium....warum nicht was Interessantes beschaffen, wo die ganze Familie dran Spaß hat?

Also der Glückliche, kaufe von Dir gerne ein 50 kg-Faß Kaliumcyanid, auch Strychnin und Schwefellost sind interessante Partysubstanzen

Pah, Iridium....warum nicht was Interessantes beschaffen, wo die ganze Familie dran Spaß hat?

Also der Glückliche, kaufe von Dir gerne ein 50 kg-Faß Kaliumcyanid, auch Strychnin und Schwefellost sind interessante Partysubstanzen

Kaliumcyanid is doch was für Weichlinge...

Glücklicher, wieviel kostet bei Dir das Gramm Plutonium?

Glücklicher, wieviel kostet bei Dir das Gramm Plutonium?

@Keepitshort

Danke für den sehr interessanten Link!

Du hast natürlich völlig Recht mit Deiner Aussage, dass bei einer Wirtschaftskriese (Rezession) die Nachfrage der Industrie nach Silber zurück geht. Nur, und jetzt kommt das ABER, es wird in einer Rezession auch automatisch weniger Silber gefördert. In einer Rezession wird ja auch weniger Kupfer, etc. verbraucht, und die Produktion wird gedrosselt. Doch genau bei der Produktion von Kupfer fällt ein Grossteil der Silberproduktion, als "Abfallprodukt" an.

In der Vergangenheit lief das doch so:

Hochkonjunktur = Starke Kupfer Nachfrage + viel "Abfallprodukt" Silber !

Schlechte Konjunktur = weniger Kupfer Nachfrage + weniger "Abfallprodukt" Silber !

Rezession = Einbruch der Kupfer Nachfrage + sehr wenig "Abfallprodukt" Silber !

Da die weltweite Silber Produktion zu ca. 60% bei der Förderung anderer Metalle, als Beiprodukt "Abfallprodukt" entsteht, sollten wir uns nicht allzustark Befürchtungen hingeben, dass Silber wegen einer Rezession, auf einmal wieder im Ueberfluss vorhanden wäre.

Im Gegenteil, sehe ich die reale Chance, dass bei einer Rezession, und niedrigst Zinsen, die Nachfrage nach Silber als Anlage Instrument zur Werterhaltung, wiederenteckt wird. Ein Monetärer Wert, wird Silber heute von den meisten Anlegern zwar abgesprochen, doch glaube ich, dass sich das wieder ändern könnte, falls wir wirklich einen globalen Wirtschafts Crash erleben sollten, der ja jetzt heute schon von verschiedenster, selbst von prominenter Seite, prognostiziert wird.

Gruss

ThaiGuru

PS:

Diese eindrücklichen Graphiken aus Deinem verlinkten Bericht zum Silber, sollten auch hier im Thread einen Platz finden.

Danke für den sehr interessanten Link!

Du hast natürlich völlig Recht mit Deiner Aussage, dass bei einer Wirtschaftskriese (Rezession) die Nachfrage der Industrie nach Silber zurück geht. Nur, und jetzt kommt das ABER, es wird in einer Rezession auch automatisch weniger Silber gefördert. In einer Rezession wird ja auch weniger Kupfer, etc. verbraucht, und die Produktion wird gedrosselt. Doch genau bei der Produktion von Kupfer fällt ein Grossteil der Silberproduktion, als "Abfallprodukt" an.

In der Vergangenheit lief das doch so:

Hochkonjunktur = Starke Kupfer Nachfrage + viel "Abfallprodukt" Silber !

Schlechte Konjunktur = weniger Kupfer Nachfrage + weniger "Abfallprodukt" Silber !

Rezession = Einbruch der Kupfer Nachfrage + sehr wenig "Abfallprodukt" Silber !

Da die weltweite Silber Produktion zu ca. 60% bei der Förderung anderer Metalle, als Beiprodukt "Abfallprodukt" entsteht, sollten wir uns nicht allzustark Befürchtungen hingeben, dass Silber wegen einer Rezession, auf einmal wieder im Ueberfluss vorhanden wäre.

Im Gegenteil, sehe ich die reale Chance, dass bei einer Rezession, und niedrigst Zinsen, die Nachfrage nach Silber als Anlage Instrument zur Werterhaltung, wiederenteckt wird. Ein Monetärer Wert, wird Silber heute von den meisten Anlegern zwar abgesprochen, doch glaube ich, dass sich das wieder ändern könnte, falls wir wirklich einen globalen Wirtschafts Crash erleben sollten, der ja jetzt heute schon von verschiedenster, selbst von prominenter Seite, prognostiziert wird.

Gruss

ThaiGuru

PS:

Diese eindrücklichen Graphiken aus Deinem verlinkten Bericht zum Silber, sollten auch hier im Thread einen Platz finden.

Steve Saville zur Silberpreisentwicklung

http://www.speculative-investor.com/new/article.html

Our long-term view (a view that we`ve held for the past 2 years) is that the silver price will either keep pace with the gold price during the current decade as it did during the 1970s (with gold leading during the initial phase of the bull market and silver then catching up at some point), or it will under-perform. We see very little prospect of the silver price trending higher relative to gold over the next several years. This view was originally based on our long-term outlooks for economic growth and the US$ and has subsequently been supported by the performance of the silver/gold ratio.

http://www.speculative-investor.com/new/article.html

Our long-term view (a view that we`ve held for the past 2 years) is that the silver price will either keep pace with the gold price during the current decade as it did during the 1970s (with gold leading during the initial phase of the bull market and silver then catching up at some point), or it will under-perform. We see very little prospect of the silver price trending higher relative to gold over the next several years. This view was originally based on our long-term outlooks for economic growth and the US$ and has subsequently been supported by the performance of the silver/gold ratio.

die meisten Notenbanken besitzen kein physisches Silber mehr.

der Silberpreis wird im westenlichen über den Termin-Future-Handel bewegt

der Silberpreis wird im westenlichen über den Termin-Future-Handel bewegt

Wenn tatsächlich mal stärkerer Silberbedarf/Nachfrage entsteht, dann dürfte bei Silber gut abgehen.

Leider sehe ich kein Anlass warum das in Zukunft so sein sollte. Die Industrienachfrage wirds kaum sein, wenn die Weltwirtschaft in Arsch geht. Also was Eure Aufgabe ist: Überzeugt Wall Street !

Leider sehe ich kein Anlass warum das in Zukunft so sein sollte. Die Industrienachfrage wirds kaum sein, wenn die Weltwirtschaft in Arsch geht. Also was Eure Aufgabe ist: Überzeugt Wall Street !

Hallo zusammen !

Ich hätte mal eine Frage an die hier versammelten Silber Experten:

Welche Silberminen Aktie würdet ihr kaufen, wenn ihr von einem starken Anstieg vom Silber in den nächsten Jahren ausgeht.

(Bitte keine "high risk" Gesellschaften.)

Ich als Ahnungsloser wäre für alle Empfehlungen und Info-Tipps super dankbar !

Vielen Dank schon mal

Alpha_User

PS:Was haltet Ihr von "COEUR D`ALENE" ?

Ich hätte mal eine Frage an die hier versammelten Silber Experten:

Welche Silberminen Aktie würdet ihr kaufen, wenn ihr von einem starken Anstieg vom Silber in den nächsten Jahren ausgeht.

(Bitte keine "high risk" Gesellschaften.)

Ich als Ahnungsloser wäre für alle Empfehlungen und Info-Tipps super dankbar !

Vielen Dank schon mal

Alpha_User

PS:Was haltet Ihr von "COEUR D`ALENE" ?

Bill Gates hat PAAS (15%) gekauft. Haben riesige Silberreserven im Boden.

SSRI ist kleiner aber leider schon zu stark gelaufen.

CDE hat anscheinend Schulden und braucht b a l d mal höhere Silberpreise.

Dies nur so auf die Schnelle als rein persönliche Meinung

Gruss

TFischer

SSRI ist kleiner aber leider schon zu stark gelaufen.

CDE hat anscheinend Schulden und braucht b a l d mal höhere Silberpreise.

Dies nur so auf die Schnelle als rein persönliche Meinung

Gruss

TFischer

Zihlmann sieht einen Einstiegspunkt zwischen 4,40 und 4,50 mit guten Chancen des breaks bei 4,85:

http://www.gold-eagle.com/editorials_03/zihlmann060503.html

http://www.gold-eagle.com/editorials_03/zihlmann060503.html

@ TFischer & btrend

Zuerst mal vielen Dank !

Wenn hier jemand einen reinen Silbermimen Fond kennt, oder auch ein Zertifikat (Basket) mit Silberminen und langer Laufzeit, bitte hier die WKN reinposten.

Ich habe da nämlich nichts gefunden.

Noch eine Frage:

Weiss hier zufällig jemand in welche Silberminen Soros &Co investiert haben ?

Ich weiss, das sind nervige Anfängerfragen, aber man möge mir bitte verzeihen.

Zuerst mal vielen Dank !

Wenn hier jemand einen reinen Silbermimen Fond kennt, oder auch ein Zertifikat (Basket) mit Silberminen und langer Laufzeit, bitte hier die WKN reinposten.

Ich habe da nämlich nichts gefunden.

Noch eine Frage:

Weiss hier zufällig jemand in welche Silberminen Soros &Co investiert haben ?

Ich weiss, das sind nervige Anfängerfragen, aber man möge mir bitte verzeihen.

Soros ist in Apex Silver (SIL) investiert. Und wo ich Soros höre, höre ich Hedgefond.......

Gruss

TFischer

Gruss

TFischer

@ TFischer

Danke !

Danke !

Ich frage mich wirklich bei scheinbar so klaren Zahlen des Silberdefizits, warum Silber nicht teurer ist. Kann mir das einer hier beantworten ? Was stimmt da nicht ? An Verschwörungstheorien mit Preismanipulationen glaube ich nicht.

@silverpwd

Wenigstens hast auch Du anscheinend gemerkt, dass falls die offiziellen Zahlen beim Silber stimmen, irgend etwas nicht ganz stimmt kann mit den Silberpreisen.

Immerhin schon mal etwas!

Da Du rein prinzipiell, "Preismanipulationen" und eine "Interessenswahrung" einiger weniger Banken im Silber Geschäft, (das hat mit Verschwörung nichts, und mit Theorie rein gar nichts zu tun) zum vornherein kategorisch auszuschliessen scheinst, wirst Du selbst verdammt grosse Mühe haben die Ursachen, und Zusammenhänge über diese anormalität beim Silber Preis zu verstehen.

Uebrigens:

Die Ratio Gold / Silber hat sich heute noch zusätzlich erhöht, da ja Gold entgegen Deiner Voraussage heute so schön gestiegen ist, und steht jetzt bei 1:82!

Silber ist jetzt also 82 x billiger wie Gold, obwohl es in der Natur nur 7 x häufiger vorkommt als Gold.

Gruss

ThaiGuru

Wenigstens hast auch Du anscheinend gemerkt, dass falls die offiziellen Zahlen beim Silber stimmen, irgend etwas nicht ganz stimmt kann mit den Silberpreisen.

Immerhin schon mal etwas!

Da Du rein prinzipiell, "Preismanipulationen" und eine "Interessenswahrung" einiger weniger Banken im Silber Geschäft, (das hat mit Verschwörung nichts, und mit Theorie rein gar nichts zu tun) zum vornherein kategorisch auszuschliessen scheinst, wirst Du selbst verdammt grosse Mühe haben die Ursachen, und Zusammenhänge über diese anormalität beim Silber Preis zu verstehen.

Uebrigens:

Die Ratio Gold / Silber hat sich heute noch zusätzlich erhöht, da ja Gold entgegen Deiner Voraussage heute so schön gestiegen ist, und steht jetzt bei 1:82!

Silber ist jetzt also 82 x billiger wie Gold, obwohl es in der Natur nur 7 x häufiger vorkommt als Gold.

Gruss

ThaiGuru

@silverpwd

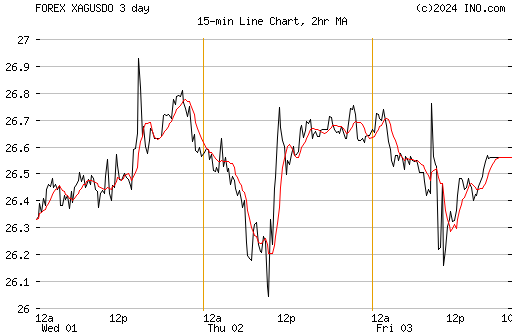

Anormalitäten gibts auch beim Gold Preis, wie der heutige Chart zeigt!

Anormalitäten gibts auch beim Gold Preis, wie der heutige Chart zeigt!

@Thai

An Gold bin ich und werde ich auch nie interessiert sein. Bei Gold sind mir die Lager zu voll und zu viele Spekulaten unterwegs, zu viel Abhängigkeit vom Dollar, zu viel Geschreie usw.

Silber sehe ich zugegebenermassen nach etwas Recherche anders. Die Lager sind leer, es besteht (wenn die Zahlen stimmen) seit langem ein Produktionsdefizit, was zwangsläufig zu Preisteigerungen führen wird.

Ich hab mir mal nen paar SSRI reingeholt, nix grosses, nur zm Verdacht hin, dass es passen könnte.

An Gold bin ich und werde ich auch nie interessiert sein. Bei Gold sind mir die Lager zu voll und zu viele Spekulaten unterwegs, zu viel Abhängigkeit vom Dollar, zu viel Geschreie usw.

Silber sehe ich zugegebenermassen nach etwas Recherche anders. Die Lager sind leer, es besteht (wenn die Zahlen stimmen) seit langem ein Produktionsdefizit, was zwangsläufig zu Preisteigerungen führen wird.

Ich hab mir mal nen paar SSRI reingeholt, nix grosses, nur zm Verdacht hin, dass es passen könnte.

Das Silber heute bei einem steigenden Dollar, steigenden Börsen, und einem stark fallenden Goldpreis trotzdem anzieht, ist etwas ungewöhnlich, wenn man das Preisverhalten beim Silber mit den vergangenen Entwicklungen vergleicht.

Sehr bullisch würde ich meinen!

Gruss

ThaiGuru

Sehr bullisch würde ich meinen!

Gruss

ThaiGuru

Und außerdem sind wir auf einem 600-Jahres-Tief, gemessen in 1998-Dollars:

Nächster Versuch, ein Bild einzulinken:

Technisch sind wir seit gestern übern Berg.

Man beachte die Stochastik, die auf diesem Nivea eigentlich immer einen Trendwechsel eingeleitet hat.

Ausserdem haben wir gesten den kurzfristigen Abwärtstrend verlassen.

Sehr positiv erscheint mir auch, dass der Trend schon vor dem zentralen Wiederstand bei 4,35-4,40€ gedreht hat.

Viele Grüsse

Mysti

Man beachte die Stochastik, die auf diesem Nivea eigentlich immer einen Trendwechsel eingeleitet hat.

Ausserdem haben wir gesten den kurzfristigen Abwärtstrend verlassen.

Sehr positiv erscheint mir auch, dass der Trend schon vor dem zentralen Wiederstand bei 4,35-4,40€ gedreht hat.

Viele Grüsse

Mysti

Ob es mehr wird als eine Gegenreaktion im Abwärtstrend,

muss man natürlich abwarten, aber kurzfristig geht es m.E. erstmal nach oben.

Viele Grüsse

Mysti

muss man natürlich abwarten, aber kurzfristig geht es m.E. erstmal nach oben.

Viele Grüsse

Mysti

@ Mystifikator

Hi,

wie kommt man an die Charts die du in #45 verwendest ?

Bei der Dresdner Bank habe ich alles abgesucht, aber nichts gefunden.

Danke für Hinweise

Alpha_User

Hi,

wie kommt man an die Charts die du in #45 verwendest ?

Bei der Dresdner Bank habe ich alles abgesucht, aber nichts gefunden.

Danke für Hinweise

Alpha_User

die Charts von Zihlmann zum Silber sind auch ganz gut

http://www.gold-eagle.com/editorials_03/zihlmann060503.html

http://www.gold-eagle.com/editorials_03/zihlmann060503.html

@ Alpha _User

Die gibt es bei der Dresdner Bank offiziell auch gar nicht, soviel ich weiss.

Da muss man selber basteln.

Für Silber in Euro verwendest du diese URL:

http://mispk.dresdner-bank.de/charts/charts_pvk?Rc=XAGEUR%3D…

Für Silber in US Dollar diese:

http://mispk.dresdner-bank.de/charts/charts_pvk?Rc=XAG%3D&Ti…

Wenn du in der URL andere Werte einträgst, kannst du die dann manuell einstellen.

Schau dir die URL mal ganz genau an.

Zs=30 - - - - - ist der Zeitraum hier also 30 Tagen, Zs=1 für intraday.

An=MACD&An2=SlowStoch - - - - - sind die Indikatoren, "none" für keine Anzeige

avg1=100&avg2=200 - - - - - sind die gleitenden Durchschnitte, "none" für keine Anzeige Beispiel: avg1=none&avg2=none

Ho=410&Br=746&ChartHoehe=258 - - - - - die grösse der Charts

Den Rest habe ich noch nicht rausgefunden.

Wenn du ein Zeitintervall von 1, also intraday wählst, müsste das sogar realtime sein.

Einfach mal probieren.

Viele Grüsse

Mysti

Die gibt es bei der Dresdner Bank offiziell auch gar nicht, soviel ich weiss.

Da muss man selber basteln.

Für Silber in Euro verwendest du diese URL:

http://mispk.dresdner-bank.de/charts/charts_pvk?Rc=XAGEUR%3D…

Für Silber in US Dollar diese:

http://mispk.dresdner-bank.de/charts/charts_pvk?Rc=XAG%3D&Ti…

Wenn du in der URL andere Werte einträgst, kannst du die dann manuell einstellen.

Schau dir die URL mal ganz genau an.

Zs=30 - - - - - ist der Zeitraum hier also 30 Tagen, Zs=1 für intraday.

An=MACD&An2=SlowStoch - - - - - sind die Indikatoren, "none" für keine Anzeige

avg1=100&avg2=200 - - - - - sind die gleitenden Durchschnitte, "none" für keine Anzeige Beispiel: avg1=none&avg2=none

Ho=410&Br=746&ChartHoehe=258 - - - - - die grösse der Charts

Den Rest habe ich noch nicht rausgefunden.

Wenn du ein Zeitintervall von 1, also intraday wählst, müsste das sogar realtime sein.

Einfach mal probieren.

Viele Grüsse

Mysti

@Mystifikator

Dieser von Dir in der FAZ entdeckte in sich positive Bericht zum Silber Geschehen, sollte auch noch in vollem Umfang hier gepostet werden.

Gruss

ThaiGuru

http://www.faz.net/s/Rub3B5979848A5C48F18F2FF729A7211ACE/Doc…

Rohstoff-1x1

Silber glänzt matter als Gold

21. März 2003 Mit Silber war in den vergangenen Jahren kein richtiger Staat zu machen. Der aktuelle Preis von 4,34 Dollar für die Feinunze wurde auch schon in den frühen 70er Jahren notiert und ist die seit 1990 weitgehend gültige Preisrange.

Die Lethargie, die sich in den relativ stabilen Preisen ausdrückt, wurde auch nicht nachhaltig dadurch beeinträchtigt, dass sich mit Warren Buffett, Bill Gates und George Soros die reichsten Männer dieser Welt seit einiger Zeit zu einem Engagement im Silber entschieden haben.

Noch keine Renaissance in Sicht

Dabei hatte Silber in den 70er Jahren einmal einen legendären Ruf erworben. Verantworltich dafür waren damals die Aktivitäten der Gebrüder Hunt. Diese hatten mit massiven Käufen den Silbermarkt derart manipuliert, dass die Preise von 1,50 Dollar im Jahr 1972 bis auf 48,70 Dollar im Jahr 1980 explodierten, ehe der Markt dann in sich zusammenbrach.

(Was dem Author dieses Berichtes anscheinend nicht bekannt z…

Von Turbulenzen dieser Art ist dieser Tage wenig zu spüren. Von der teilweise zu beobachtenden Renaissance einzelner Rohstoffe ist das Silber jedenfalls kaum erfasst worden. Auch den zwischenzeitlichen Aufschwung beim Gold hat es nur unterproportional mitgemacht. Und nach der jüngst zu verzeichnenden Preisabschwächung bleibt sogar abzuwarten, ob sich die zu Jahresbeginn von 18 Analysten erwartete Preisverbesserung auf 4,92 Dollar im Jahresvergleich realisieren lässt.

Chronisches Angebotsdefizit

Bei der seit Jahren müden Preisentwicklung spielt vermutlich eine wesentliche Rolle, dass Silber nicht mehr als Spekulationsinstrument wahrgenommen wird, sondern mehr als Industriemetall. Und da die Weltkonjunktur nicht richtig läuft, kommt eben auch der Preis nicht in Schwung.

Allerdings mutet die Preisstabilität vor dem Hintergrund schon erstaunlich an, dass das Angebot die Nachfrage seit Jahren übersteigt. So schätzen Experten wegen steigender Nachfrage das Angebotsdefizit im Jahr 2003 auf 163,0 Millionen Unzen. Das ist nicht nur der höchste Wert aller Zeiten sondern wäre auch die Verängerung der seit dem Jahr 1990 immer wieder jedes Jahr zu konstatierenden Defizite. Da sich die Lagerbestände gleichzeitig auf einem tiefen Niveau bewegen, könnte die Rechnung der Milliardäre Buffett, Gates und Soros vielleicht doch noch irgend wann aufgehen.

Silber ist hinter Gold zurückgefallen

Doch noch scheint die Zeiten für das Silber nicht gekommen zu sein. Bis es soweit ist, können sich die Investoren mit dem Studium der Geschichte und der Hintergrund des Edelmetalls beschäftigen. Bei diesen Recherchen, wobei der seit 1990 vom The Silver Institute publizierte World Silver Survey 2002 wertvolle Hilfe leisten kann, werden sie feststellen, dass Silber nach Kupfer und Gold das dritte Gebrauchsmetall war, welches die Menschen benutzten.

Dabei galt Silber zunächst als wertvoller als Gold, doch dieses Verhältnis hat sich längst gewandelt und im relativen Vergleich ist Silber in den vergangenen Jahren immer weiter zurückgefallen. Dabei hat vielleicht auch eine Rolle gespielt, dass Silber zwar ein seltenes Element ist, es aber etwa 20mal häufiger als Gold vorkommt.

Silber hat viele brauchbare Eigenschaften

Das chemische Symbol "Ag" für Silber, das einen Schmelzpunkt von 961,93 Grad Celcius hat, wurde von J.J. Berzelius im Jahre 1814 eingeführt und es steht an 67. Stelle der Elementhäufigkeit. Allgemein handelt es sich bei Silber um ein weißglänzendes und weiches Edelmetall. Es ist nach Gold das dehnbarste Metall und kann zu feinen, blaugrün durchscheinenden Folien von Blattsilber ausgewalzt werden. Das Edelmetall besitzt die beste elektrische und thermische Leitfähigkeit aller Metalle.

Es wird mit den meisten anderen Metallen - mit Ausnahme von Eisen und Cobalt legiert. Silber besitzt von allen Substanzen der Erde das höchste Reflexions- und Absorptionsvermögen für Licht. Diese Eigenschaft erklärt den strahlend weißen Metallglanz des Silbers. Nachgefragt und genutzt wird es vor allem in der Industrie, der Fotografie sowie der Silberwaren- und Schmuckindustrie.

Leicht manipulierbarer Markt

Die größten Produzentenländer sind Mexiko, USA, Peru, Kanada und Australien und als die größten Unternehmen gelten Industrias Penoles aus Mexiko, Polska Miedz aus Polen und BHP Minerals aus Australien.

In manchen Publikationen wird der Gesamtwert aller Silbermünzen und -barren, die jetzt für den Markt verfügbar sind, auf nur ungefähr 3,5 Milliarden Dollar beziffert. Bei 2,5 Milliarden Dollar ist die jährliche Produktion des Silbers um ein Achtel geringer als die des Goldmarktes.

Auch dies ist ein Indiz dafür, wie schnell der Preis in Bewegung geraten kann, wenn sich erst einmal mehr Investoren als nur die genannten Milliardäre dazu entscheiden sollten, dass Silber wieder eine lohnende Geldanlage sein könnte.

Dieser von Dir in der FAZ entdeckte in sich positive Bericht zum Silber Geschehen, sollte auch noch in vollem Umfang hier gepostet werden.

Gruss

ThaiGuru

http://www.faz.net/s/Rub3B5979848A5C48F18F2FF729A7211ACE/Doc…

Rohstoff-1x1

Silber glänzt matter als Gold

21. März 2003 Mit Silber war in den vergangenen Jahren kein richtiger Staat zu machen. Der aktuelle Preis von 4,34 Dollar für die Feinunze wurde auch schon in den frühen 70er Jahren notiert und ist die seit 1990 weitgehend gültige Preisrange.

Die Lethargie, die sich in den relativ stabilen Preisen ausdrückt, wurde auch nicht nachhaltig dadurch beeinträchtigt, dass sich mit Warren Buffett, Bill Gates und George Soros die reichsten Männer dieser Welt seit einiger Zeit zu einem Engagement im Silber entschieden haben.

Noch keine Renaissance in Sicht

Dabei hatte Silber in den 70er Jahren einmal einen legendären Ruf erworben. Verantworltich dafür waren damals die Aktivitäten der Gebrüder Hunt. Diese hatten mit massiven Käufen den Silbermarkt derart manipuliert, dass die Preise von 1,50 Dollar im Jahr 1972 bis auf 48,70 Dollar im Jahr 1980 explodierten, ehe der Markt dann in sich zusammenbrach.

(Was dem Author dieses Berichtes anscheinend nicht bekannt z…

Von Turbulenzen dieser Art ist dieser Tage wenig zu spüren. Von der teilweise zu beobachtenden Renaissance einzelner Rohstoffe ist das Silber jedenfalls kaum erfasst worden. Auch den zwischenzeitlichen Aufschwung beim Gold hat es nur unterproportional mitgemacht. Und nach der jüngst zu verzeichnenden Preisabschwächung bleibt sogar abzuwarten, ob sich die zu Jahresbeginn von 18 Analysten erwartete Preisverbesserung auf 4,92 Dollar im Jahresvergleich realisieren lässt.

Chronisches Angebotsdefizit

Bei der seit Jahren müden Preisentwicklung spielt vermutlich eine wesentliche Rolle, dass Silber nicht mehr als Spekulationsinstrument wahrgenommen wird, sondern mehr als Industriemetall. Und da die Weltkonjunktur nicht richtig läuft, kommt eben auch der Preis nicht in Schwung.

Allerdings mutet die Preisstabilität vor dem Hintergrund schon erstaunlich an, dass das Angebot die Nachfrage seit Jahren übersteigt. So schätzen Experten wegen steigender Nachfrage das Angebotsdefizit im Jahr 2003 auf 163,0 Millionen Unzen. Das ist nicht nur der höchste Wert aller Zeiten sondern wäre auch die Verängerung der seit dem Jahr 1990 immer wieder jedes Jahr zu konstatierenden Defizite. Da sich die Lagerbestände gleichzeitig auf einem tiefen Niveau bewegen, könnte die Rechnung der Milliardäre Buffett, Gates und Soros vielleicht doch noch irgend wann aufgehen.

Silber ist hinter Gold zurückgefallen

Doch noch scheint die Zeiten für das Silber nicht gekommen zu sein. Bis es soweit ist, können sich die Investoren mit dem Studium der Geschichte und der Hintergrund des Edelmetalls beschäftigen. Bei diesen Recherchen, wobei der seit 1990 vom The Silver Institute publizierte World Silver Survey 2002 wertvolle Hilfe leisten kann, werden sie feststellen, dass Silber nach Kupfer und Gold das dritte Gebrauchsmetall war, welches die Menschen benutzten.

Dabei galt Silber zunächst als wertvoller als Gold, doch dieses Verhältnis hat sich längst gewandelt und im relativen Vergleich ist Silber in den vergangenen Jahren immer weiter zurückgefallen. Dabei hat vielleicht auch eine Rolle gespielt, dass Silber zwar ein seltenes Element ist, es aber etwa 20mal häufiger als Gold vorkommt.

Silber hat viele brauchbare Eigenschaften

Das chemische Symbol "Ag" für Silber, das einen Schmelzpunkt von 961,93 Grad Celcius hat, wurde von J.J. Berzelius im Jahre 1814 eingeführt und es steht an 67. Stelle der Elementhäufigkeit. Allgemein handelt es sich bei Silber um ein weißglänzendes und weiches Edelmetall. Es ist nach Gold das dehnbarste Metall und kann zu feinen, blaugrün durchscheinenden Folien von Blattsilber ausgewalzt werden. Das Edelmetall besitzt die beste elektrische und thermische Leitfähigkeit aller Metalle.

Es wird mit den meisten anderen Metallen - mit Ausnahme von Eisen und Cobalt legiert. Silber besitzt von allen Substanzen der Erde das höchste Reflexions- und Absorptionsvermögen für Licht. Diese Eigenschaft erklärt den strahlend weißen Metallglanz des Silbers. Nachgefragt und genutzt wird es vor allem in der Industrie, der Fotografie sowie der Silberwaren- und Schmuckindustrie.

Leicht manipulierbarer Markt

Die größten Produzentenländer sind Mexiko, USA, Peru, Kanada und Australien und als die größten Unternehmen gelten Industrias Penoles aus Mexiko, Polska Miedz aus Polen und BHP Minerals aus Australien.

In manchen Publikationen wird der Gesamtwert aller Silbermünzen und -barren, die jetzt für den Markt verfügbar sind, auf nur ungefähr 3,5 Milliarden Dollar beziffert. Bei 2,5 Milliarden Dollar ist die jährliche Produktion des Silbers um ein Achtel geringer als die des Goldmarktes.

Auch dies ist ein Indiz dafür, wie schnell der Preis in Bewegung geraten kann, wenn sich erst einmal mehr Investoren als nur die genannten Milliardäre dazu entscheiden sollten, dass Silber wieder eine lohnende Geldanlage sein könnte.

@ ThaiGuru

Dann gehören hier aber auch alle Charts rein.

Tag - - - Woche - - - Monat

Quartal - - - Jahr - - - alle Daten

Viele Grüsse

Mysti

Dann gehören hier aber auch alle Charts rein.

Tag - - - Woche - - - Monat

Quartal - - - Jahr - - - alle Daten

Viele Grüsse

Mysti

@ Mysti

Funktioniert ! Toller Trick !

Toller Trick !

Vielen Dank !!!

Alpha_User

Funktioniert !

Toller Trick !

Toller Trick !

Vielen Dank !!!

Alpha_User

Bei ebay soll es noch ganz wenige Silberbarren

1.000 gramm geben.

1.000 gramm geben.

ich hab mal nachgezählt

es sind sechs stück a 1 kilogramm

und einer von 5 kilogramm

gruss fiesje

es sind sechs stück a 1 kilogramm

und einer von 5 kilogramm

gruss fiesje

Ein Mix aus Silber und Gold ist doch auch nicht schlecht, oder?

Cardero Resources hat beides und super Bohrergebnisse

http://www.cardero.com/properties/condor_yacu/

Sollte es möglich sein, diese Resourcen wirtschaftlich abzubauen, was im Moment geprüft wird, dürfte sich der Preis für Cardero vervielfachen. Steigt dann auch noch der Goldpreis weiter und Silber zieht nach, gibt es ein Feuerwerk. Cardero gibt es nur an der TSX unter dem Kürzel V.CDU. Aktuell zahlt man CAD1,63 bei. Durchschnittsvolumen ca 60000Stk/ Handelstag, 20,446,935 Aktien sind ausgegeben.

Vielleicht sagen dem Ein oder Anderen von euch die Namen etwas

Current Directors and Officers:

Henk Van Alphen (President & Director)

John A. Toffan (Director)

Ken M. Carter (Director)

Leonard J. Harris (Director)

Marla Mees (Corporate Secretary)

Corporate Address:

Suite 900 475 Howe Street

Vancouver, B.C. V6C 2B3

Good luck!

Neono

Cardero Resources hat beides und super Bohrergebnisse

http://www.cardero.com/properties/condor_yacu/

Sollte es möglich sein, diese Resourcen wirtschaftlich abzubauen, was im Moment geprüft wird, dürfte sich der Preis für Cardero vervielfachen. Steigt dann auch noch der Goldpreis weiter und Silber zieht nach, gibt es ein Feuerwerk. Cardero gibt es nur an der TSX unter dem Kürzel V.CDU. Aktuell zahlt man CAD1,63 bei. Durchschnittsvolumen ca 60000Stk/ Handelstag, 20,446,935 Aktien sind ausgegeben.

Vielleicht sagen dem Ein oder Anderen von euch die Namen etwas

Current Directors and Officers:

Henk Van Alphen (President & Director)

John A. Toffan (Director)

Ken M. Carter (Director)

Leonard J. Harris (Director)

Marla Mees (Corporate Secretary)

Corporate Address:

Suite 900 475 Howe Street

Vancouver, B.C. V6C 2B3

Good luck!

Neono

@Hallo Mysti

Danke für den super chartlink!(Arbeite mich gerade nach längerer "Edelmetallabstinenz" wieder in die Silbermaterie ein...)

Das mit der "1" für den intradaychart klappt auch gut:

Danke für den super chartlink!(Arbeite mich gerade nach längerer "Edelmetallabstinenz" wieder in die Silbermaterie ein...)

Das mit der "1" für den intradaychart klappt auch gut:

Hi Wasserzeichen,

ist halt nur etwas Tüftelei.

Wenn du andere Indikatoren verwenden möchtest, kannst du noch Mom für Momentum und RSI für Relative Stärke eingeben.

(Sonst haben die nur noch Vol für Volumen, das bringt aber nichts.)

Ich verstehe nur nicht, warum die Dresdner Bank das nicht offiziell anbietet, wenn die die Daten eh schon haben.

Viele Grüsse

Mysti

ist halt nur etwas Tüftelei.

Wenn du andere Indikatoren verwenden möchtest, kannst du noch Mom für Momentum und RSI für Relative Stärke eingeben.

(Sonst haben die nur noch Vol für Volumen, das bringt aber nichts.)

Ich verstehe nur nicht, warum die Dresdner Bank das nicht offiziell anbietet, wenn die die Daten eh schon haben.

Viele Grüsse

Mysti

THE MERITS OF BUYING $ILVER NOW kazvestor

6/5/2003 7:04:02 PM

Note that I am simply an individual investor. Read my report below and use your own sense of logic and common sense. If you have any questions/comments or want to discuss the details of any section below feel free to post and/or shoot me a message.

I`ll be surprised if such a long post is accepted by the system but here goes.....

THE MERITS OF BUYING $ILVER NOW

Here is most of the $ilver “story” below with many web site references. It involves the use of logic and common sense to analyze the events surrounding $ilver.

I. $ilver Supply/Demand imbalance: The #1 reason to buy $ilver is because there has been consistently more user demand than producer supply for 14 years. During this time over 1500 Moz. (Million ounces) has been consumed from the world $ilver stockpiles and used for industrial applications (mostly electronics), photography, jewelry & $ilverware, and coins & medals. Last year 586 Moz. was mined from the Earth and 185 Moz. was recycled (mostly from photographical $ilver applications) for a total supply of 771 Moz. Meanwhile the total demand was 838 Moz. Therefore last year 67 Moz. was consumed from world stockpiles of $ilver. After 14 years of deficits the world stockpiles are extremely low. It is impossible for this deficit to continue much longer. Supply must soon come into equilibrium with demand. Either demand must fall substantially and/or supply must increase substantially. $ilver is essential for our electronics rich world with new applications and uses for $ilver consistently being discovered (as you can see at http://www.silverinstitute.org/newsdesk.html such as http://www.silverinstitute.org/news/pr10oct02.html and http://www.silverinstitute.org/news/pr11apr03.html ) with very little likelihood of a significant decline in industrial demand going forward. Therefore supply must increase to meet the demand. However, starting new mines to produce $ilver costs $7-$10+ per ounce. Therefore the price of $ilver MUST go up to encourage new mines to be tapped. It is smart to own something which has and will continue to have more demand than supply at a given price. This simple supply/demand disequilibrium analysis is mentioned by Warren Buffett as the main reason he bought a large chunk of the world stockpile of $ilver http://www.berkshirehathaway.com/news/feb03981.html

II. $ilver is scarce: There is very little physical $ilver that can be purchased for less than $5/oz. possibly less than 10 Moz., definitely less than 100 Moz. which is small change in today`s investment world. Even up to $10 there is most likely less than 500 Moz. available for new investment.

Proof of scarcity:

1) The U.S. govt. had 2500 Moz. of $ilver left after it discontinued making 90% $ilver dimes/quarters/half dollar coins over 30 years ago. As of the end of 2002 it had none left. In 2003 the U.S. govt. is making market purchases averaging almost 1 Moz. per month to mint it`s now popular American Eagle 1 oz. coins. http://www.silverinstitute.org/news/pr06aug02.html

2) The official Comex warehouses for investor $ilver storage in the U.S. used to have over 300 Moz. 10 years ago http://www.silverinstitute.org/news/prsinv.htm

Now the Comex has 105 Moz. http://www.nymex.com/jsp/markets/sil_fut_wareho.jsp

3) European bullion bank vaults had over 550 Moz. in 1990 and less than

300Moz. at the end of 2001 (of which 129 Moz. is owned by Warren Buffett).

4) Total government stockpiles of $ilver is estimated to be under 100 Moz. after

4 years of very heavy selling (mostly by China).

I expect there will soon be publicized shortage of $ilver. You definitely want to own $ilver before any shortage is widely publicized.

III. $ilver is cheap: Despite the scarcity of $ilver that has developed from 14 years of supply deficits the price is at all-time lows ($4.55). At its peak in 1980 $ilver went over $50/oz. (equivalent to $150 in today`s dollars) when a small group tried to corner the market in it. You can review price data charts for the last 20 years by going to http://www.kitco.com/charts/liveSilver.html

$ilver is especially cheap relative to gold. At various times in the last 30 years 20-100 ounces of $ilver could buy you 1 oz. gold. Right now you need 80 oz. $ilver to buy 1 oz. gold; thus making $ilver relatively cheaper. http://www.cairns.net.au/~sharefin/Charts/AuAG1lt.gif

One of the main reasons why $ilver remained cheap in the 1990s despite big supply deficits is because most investors were selling their $ilver holdings to buy into the popular stock market companies. This selling of $ilver peaked in 2000 along with the stock market. From 1999 to now governments (mostly China) have helped fill the supply/demand gap by selling their holdings. Going forward, China should curtail its selling of $ilver since it realizes it`s rapidly growing economy will soon be needing more $ilver that it can produce internally.

Another important reason why $ilver prices have remained low is because most mines that produce $ilver produce it as a byproduct. Mining companies that primarily produce zinc, lead, copper, and gold often extract $ilver as well. In fact 70-75% of the $ilver mined around the world is a byproduct of mining other metals.

http://www.silverinstitute.org/production.html

This results in the supply of $ilver being inelastic to the price of $ilver. Whether the price of $ilver goes up or down substantially its supply will not vary much. Effectively the supply of $ilver is governed more by the prices of zinc, lead, copper, and gold. If the prices of those metals are lower, some mines will reduce mining activities and thereby mine less $ilver as well; and vise versa. So, although some primary producing mines have closed operations over the last 13 years due to being unprofitable operations under $5/oz. the supply of $ilver has not been significantly affected since primary $ilver mines make up a minority of $ilver production. A price of over $7 is needed to encourage new primary production of $ilver.

IV. The smartest people own $ilver now: At major turning points of asset prices the overwhelming majority of investors are always wrong. After a 23 year bear market in $ilver, most investors have sold their holdings. Those that remain are disciplined savvy long-term investors like Warren Buffett that bought 129 Moz. in 1997 at $5.05/oz. http://www.berkshirehathaway.com/news/feb03981.html

Other billionaires that are invested in $ilver include George Soros, Lawrence Tisch, and Bill Gates who own shares over various $ilver mining stocks. So if we look at the 105 Moz. that is in storage at the Comex warehouses as mentioned above; it is likely that over 90 Moz. maybe 100+ Moz. is owned by people that will not sell anywhere near these prices. Most will not sell even if $ilver goes to $10 next month.

V. Major short positions in $ilver: Another major reason for the incredibly low price in $ilver is that there have been massive amounts of shorting of $ilver in the last 15 years. There have been 2 major reasons for $ilver short selling over the years.

1) $ilver producers enter into forward sale contracts to make delivery of future production at prearranged prices. For example, the biggest U.S. producer and shorter of $ilver is Barrick Gold (ABX:NYSE). They produce 20 Moz. of $ilver per year but were short almost 50 Moz. in $ilver at the end of 2002. Effectively that`s 2.5 years of pre-sold production which limits future supply. In February ABX made a press release that included the mention that they would start reducing their short position in various ways including making delivery on their forward contracts using current production. This means most of their 20 Moz. production will not be supplied to the market this year but will go to fulfill their previous delivery contracts. Thus adding to this year`s supply deficit numbers.