Nur Fakten und Wichtiges zu Anaconda - 500 Beiträge pro Seite (Seite 2)

eröffnet am 05.11.06 14:43:48 von

neuester Beitrag 10.04.24 13:32:52 von

neuester Beitrag 10.04.24 13:32:52 von

Beiträge: 613

ID: 1.092.236

ID: 1.092.236

Aufrufe heute: 1

Gesamt: 41.285

Gesamt: 41.285

Aktive User: 0

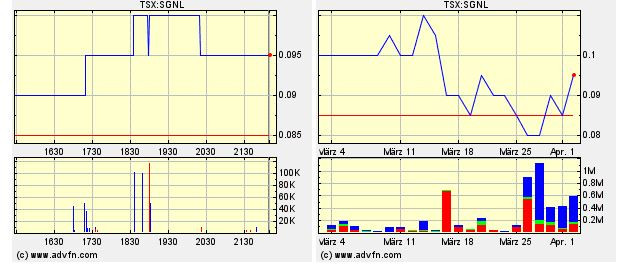

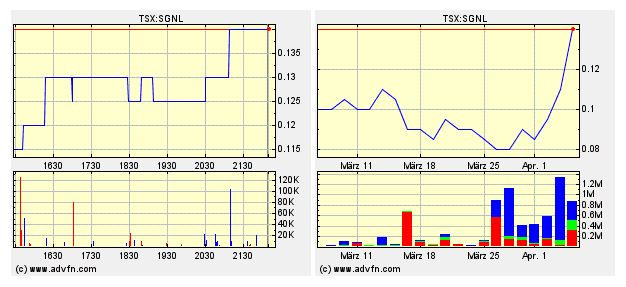

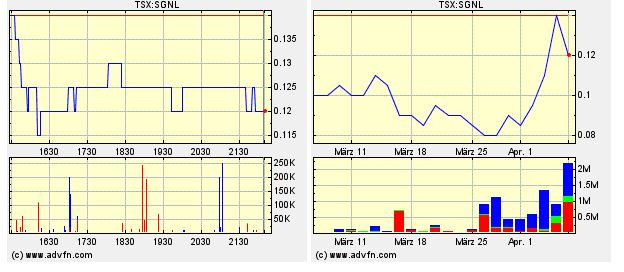

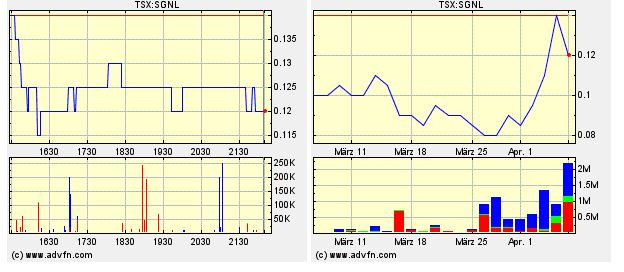

ISIN: CA82664T1012 · WKN: A3DK3Q · Symbol: SGNL

0,1100

CAD

0,00 %

0,0000 CAD

Letzter Kurs 17.04.24 Toronto

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3900 | +13,01 | |

| 0,7000 | +11,11 | |

| 1,4000 | +10,24 | |

| 37,18 | +10,00 | |

| 17,930 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5900 | -8,09 | |

| 2,1800 | -9,17 | |

| 69,05 | -9,48 | |

| 154,95 | -9,76 | |

| 0,7997 | -12,16 |

Aus dem Kanadischen Board:

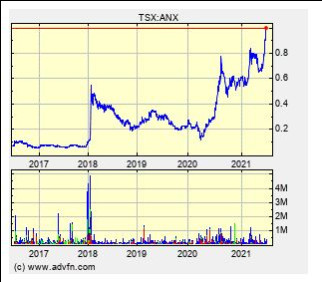

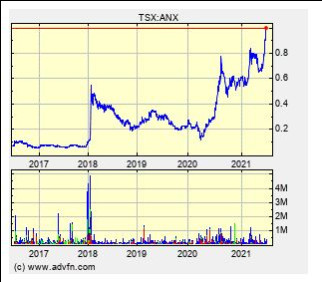

Also from the new presentation: Near-Term Growth Catalysts Numerous Development milestones on course to achieve annual production ~ 50,000–60,000 Oz of gold by 2021

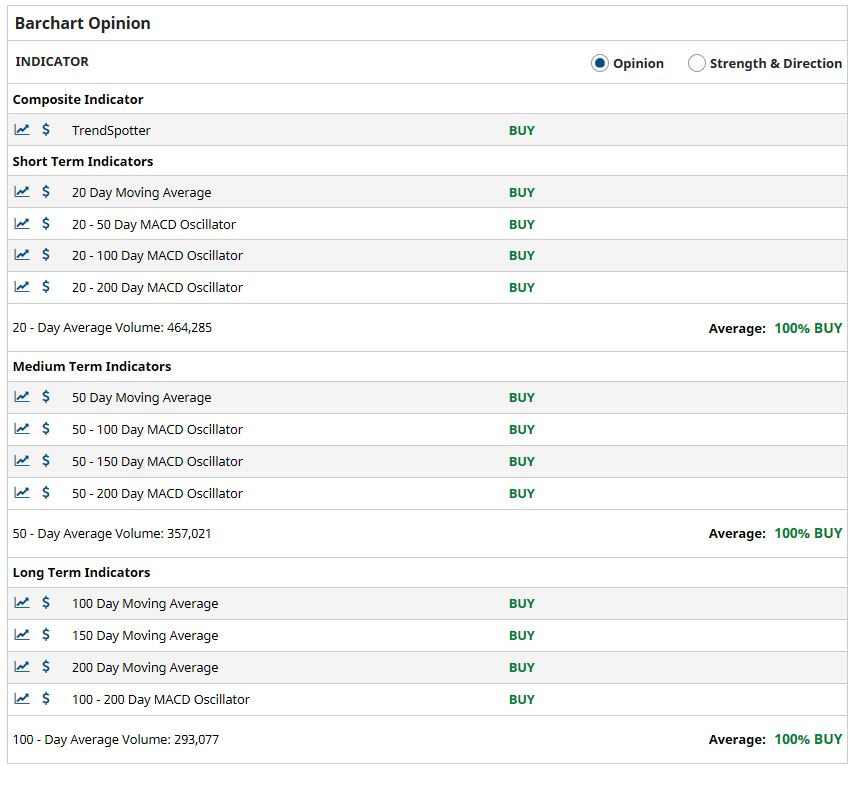

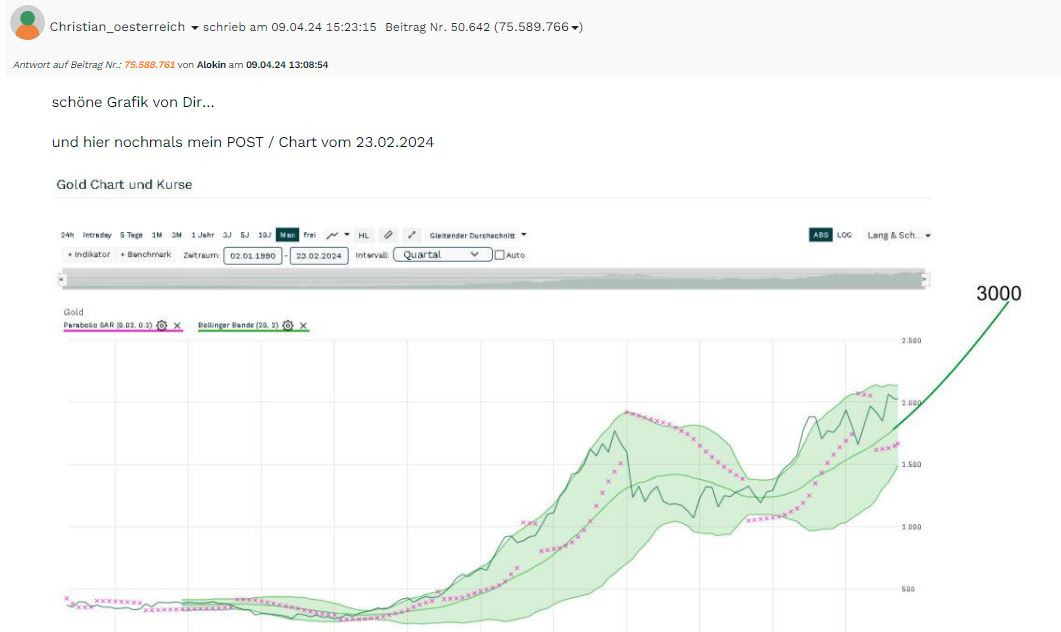

2021 is not far away. I can't imagine the global banking system raising interest rates for many years. Therefore, money will be devalued increasingly for years to come. Gold will only go up. Anaconda is timing this picture perfect if you ask me:-) Read more at https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-421-430/…

Also from the new presentation: Near-Term Growth Catalysts Numerous Development milestones on course to achieve annual production ~ 50,000–60,000 Oz of gold by 2021

2021 is not far away. I can't imagine the global banking system raising interest rates for many years. Therefore, money will be devalued increasingly for years to come. Gold will only go up. Anaconda is timing this picture perfect if you ask me:-) Read more at https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-421-430/…

Schnellere und effizientere Goldproduktion für Goldboro geplant:

Anaconda Mining plans changes to proposed Goldboro mine Company now wants to process gold bars at Eastern Shore site A company that wants to develop a gold mine on the Eastern Shore is making significant changes to its proposal. Anaconda Mining originally planned to create a 125-hectare surface and underground gold mine just outside Goldboro, N.S., about 250 kilometres east of Halifax. The proposal called for ore to be processed on site and then for gold concentrate to be trucked to the company's Point Rousse processing facility near Baie Verte, N.L., via the North Sydney ferry... Quele: https://www.cbc.ca/news/canada/nova-scotia/anaconda-mining-g…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-431-440/…

Anaconda Mining plans changes to proposed Goldboro mine Company now wants to process gold bars at Eastern Shore site A company that wants to develop a gold mine on the Eastern Shore is making significant changes to its proposal. Anaconda Mining originally planned to create a 125-hectare surface and underground gold mine just outside Goldboro, N.S., about 250 kilometres east of Halifax. The proposal called for ore to be processed on site and then for gold concentrate to be trucked to the company's Point Rousse processing facility near Baie Verte, N.L., via the North Sydney ferry... Quele: https://www.cbc.ca/news/canada/nova-scotia/anaconda-mining-g…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-431-440/…

Aus dem Kanadischen Board:

goldking345 December 16, 2019 - 06:50 PM 82 Reads Post# 30461218 Fun with numbers.... Let's say they can get to 150k ounces per year...lets say that the share count goes up to 250 million shares...and let's say gold is $1700 per ounce US in 2 years or so.... Just roughly....say their AISC is $700...that's a $1000 per ounce profit x 150k ounces or $150 million clams...What's that in earnings? .60 cents? Slap a 10x multiple on that and you have a $6 stock...give it a 20x PE and you have a $12 stock Let's say they only get to 100k ounces.....That's $100 million in profit or .40 cents per share...at the same 10x multiple it's a $4 stock at a 20 multiple it's $8 Toss in some debt, dilution an aquisition, some extra expenses....even if the AISC was $800 they are still banking a $90 million per year profit. Be real conservative and figure on .25 cents per share profit....

We're still headed for $2.50 minium to as much as $5 per share

What's the problem here? Patience....This is a serious wealth generator if they execute as planned. We're half way there with Goldboro....the rest is only going to get easier. Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-431-440/…

goldking345 December 16, 2019 - 06:50 PM 82 Reads Post# 30461218 Fun with numbers.... Let's say they can get to 150k ounces per year...lets say that the share count goes up to 250 million shares...and let's say gold is $1700 per ounce US in 2 years or so.... Just roughly....say their AISC is $700...that's a $1000 per ounce profit x 150k ounces or $150 million clams...What's that in earnings? .60 cents? Slap a 10x multiple on that and you have a $6 stock...give it a 20x PE and you have a $12 stock Let's say they only get to 100k ounces.....That's $100 million in profit or .40 cents per share...at the same 10x multiple it's a $4 stock at a 20 multiple it's $8 Toss in some debt, dilution an aquisition, some extra expenses....even if the AISC was $800 they are still banking a $90 million per year profit. Be real conservative and figure on .25 cents per share profit....

We're still headed for $2.50 minium to as much as $5 per share

What's the problem here? Patience....This is a serious wealth generator if they execute as planned. We're half way there with Goldboro....the rest is only going to get easier. Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-431-440/…

Anaconda files Goldboro mineral resource estimate

2019-12-18 12:09 ET - News Release

Mr. Kevin Bullock reports ANACONDA MINING FILES UPDATED RESOURCE ESTIMATE FOR THE GOLDBORO GOLD PROJECT Anaconda Mining Inc. has filed a technical report prepared in accordance with National Instrument 43-101 regarding an updated mineral resource estimate for its 100-per-cent-owned Goldboro gold project in Nova Scotia, Canada. The technical report is available under the Company's profile on SEDAR at www.sedar.com and on the Company's website at www.anacondamining.com. The technical report, entitled "Goldboro Gold Project: Resource Update Phase 2, Guysborough County, Nova Scotia" and which is dated December 18, 2019, and with an effective date of August 21, 2019, was authored by independent qualified persons Todd McCracken, P.Geo. of WSP Canada Inc. and Robert Raponi, P. Eng., of Ausenco Engineering Canada Inc. A portion of the 2019 diamond drilling (BR-19-77 to BR-19-85 totaling 603 m) on the Project was funded by the Government of Nova Scotia through a Mineral Resources Development Fund, through a shared funding exploration grant MRDF-2019-SF-053. This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", and Todd McCracken, P. Geo., Manager - Mining, WSP Canada Inc., an "Independent Qualified Person" under National Instrument 43-101 Standard for Disclosure for Mineral Projects. ABOUT ANACONDA Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study. We seek Safe Harbor. 2019 Canjex Publishing Ltd. All rights reserved.

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-441-450/…

2019-12-18 12:09 ET - News Release

Mr. Kevin Bullock reports ANACONDA MINING FILES UPDATED RESOURCE ESTIMATE FOR THE GOLDBORO GOLD PROJECT Anaconda Mining Inc. has filed a technical report prepared in accordance with National Instrument 43-101 regarding an updated mineral resource estimate for its 100-per-cent-owned Goldboro gold project in Nova Scotia, Canada. The technical report is available under the Company's profile on SEDAR at www.sedar.com and on the Company's website at www.anacondamining.com. The technical report, entitled "Goldboro Gold Project: Resource Update Phase 2, Guysborough County, Nova Scotia" and which is dated December 18, 2019, and with an effective date of August 21, 2019, was authored by independent qualified persons Todd McCracken, P.Geo. of WSP Canada Inc. and Robert Raponi, P. Eng., of Ausenco Engineering Canada Inc. A portion of the 2019 diamond drilling (BR-19-77 to BR-19-85 totaling 603 m) on the Project was funded by the Government of Nova Scotia through a Mineral Resources Development Fund, through a shared funding exploration grant MRDF-2019-SF-053. This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", and Todd McCracken, P. Geo., Manager - Mining, WSP Canada Inc., an "Independent Qualified Person" under National Instrument 43-101 Standard for Disclosure for Mineral Projects. ABOUT ANACONDA Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study. We seek Safe Harbor. 2019 Canjex Publishing Ltd. All rights reserved.

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-441-450/…

Anaconda Mining Announces Positive Results From Goldboro Bulk Sample Program

[16-January-2020] TORONTO, Jan. 16, 2020 /CNW/ -

Anaconda Mining Inc. ("Anaconda" or the "Company") (ANX: TSX) (OTCQX: ANXGF) is pleased to announce the results of an underground bulk sample program (the "Bulk Sample") undertaken at its 100%-owned Goldboro Gold Project ("Goldboro" or the "Project") located in Nova Scotia, Canada. The objectives of the Bulk Sample were to confirm the geological interpretation of the deposit, test for spatial and grade continuity of the mineralized structures, validate key assumptions of the updated Mineral Resource model, and test certain types of mining methods. Key Takeaways of the Bulk Sample •Successfully tested a large area within the 2019 Mineral Resource Estimate1 with respect to continuity of gold grade and geological interpretation, confirming the position and continuity of mineralized zones; •The average diluted mine grade based on grade control samples2 of 3.51 g/t gold reconciles well with the average undiluted grade of the Mineral Resource block model of 3.81 g/t gold in the area of the Bulk Sample (both capped at 80 g/t); •The average head grade of 3.81 g/t gold from the Pine Cove Mill shows a positive reconciliation of 8.5% to the mine grade of 3.51 g/t gold, demonstrating an upside bias within an acceptable range; •High gravity recovery of 51%, confirming metallurgical test work; and •Demonstration of excellent ground conditions through test mining and successful testing of certain underground mining methods to optimally extract the Mineral Resource. Quelle: http://crweworld.com/article/news-provided-by-pr-newswire/13…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-461-470/…

[16-January-2020] TORONTO, Jan. 16, 2020 /CNW/ -

Anaconda Mining Inc. ("Anaconda" or the "Company") (ANX: TSX) (OTCQX: ANXGF) is pleased to announce the results of an underground bulk sample program (the "Bulk Sample") undertaken at its 100%-owned Goldboro Gold Project ("Goldboro" or the "Project") located in Nova Scotia, Canada. The objectives of the Bulk Sample were to confirm the geological interpretation of the deposit, test for spatial and grade continuity of the mineralized structures, validate key assumptions of the updated Mineral Resource model, and test certain types of mining methods. Key Takeaways of the Bulk Sample •Successfully tested a large area within the 2019 Mineral Resource Estimate1 with respect to continuity of gold grade and geological interpretation, confirming the position and continuity of mineralized zones; •The average diluted mine grade based on grade control samples2 of 3.51 g/t gold reconciles well with the average undiluted grade of the Mineral Resource block model of 3.81 g/t gold in the area of the Bulk Sample (both capped at 80 g/t); •The average head grade of 3.81 g/t gold from the Pine Cove Mill shows a positive reconciliation of 8.5% to the mine grade of 3.51 g/t gold, demonstrating an upside bias within an acceptable range; •High gravity recovery of 51%, confirming metallurgical test work; and •Demonstration of excellent ground conditions through test mining and successful testing of certain underground mining methods to optimally extract the Mineral Resource. Quelle: http://crweworld.com/article/news-provided-by-pr-newswire/13…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-461-470/…

Anaconda produces 15,211 oz Au at Point Rousse in 2019

2020-01-22 07:35 ET - News Release

Mr. Kevin Bullock reports ANACONDA MINING ANNOUNCES Q4 AND FULL YEAR 2019 PRODUCTION RESULTS AND PROVIDES 2020 GUIDANCE Anaconda Mining Inc. has released production results and certain financial information for the three months and year ended Dec. 31, 2019. The company expects to file its full audited annual financial statements and management discussion and analysis by March 2, 2020. During the fourth quarter of 2019, the company processed the Goldboro bulk sample at its Pine Cove mill (see press release dated Jan. 16, 2020). Fourth quarter and annual mill statistics are presented both including the bulk sample and on a Point Rousse stand-alone basis. Proceeds from gold recovered and sold from the bulk sample will be recorded as a credit against the Goldboro exploration and evaluation asset, and the related processing costs at the Pine Cove mill will also be reallocated to the Goldboro asset on a proportionate basis. 2019 highlights: Anaconda sold 16,362 ounces of gold in 2019 from production at the Point Rousse complex, generating metal revenue of $29.5-million at an average sales price of $1,804 ($1,360 (U.S.)) per ounce of gold. As at Dec. 31, the company also had over 420 ounces in gold dore inventory, which was subsequently sold in January. The company also sold 903 ounces in 2019 from the processing of the Goldboro bulk sample at the Pine Cove mill, generating a further $1.8-million in proceeds that will be recorded as a credit against the Goldboro asset. Anaconda produced 15,211 ounces of gold in 2019 at the Point Rousse complex, below its revised guidance of 16,000 to 17,000 ounces due to increased throughput time for the bulk sample to maximize recovery, displacing Pine Cove ore, and lower grades in the fourth quarter of 2019 due to changes in mine sequencing. The Pine Cove mill achieved annual throughput of 401,499 tonnes during 2019, including 9,785 tonnes from the bulk sample, down from 2018 due to low mill availability in the second quarter resulting from unplanned maintenance of the regrind mill and the decision to accelerate other maintenance programs to minimize future downtime. Mine operations moved 413,139 tonnes of ore during the year at an average grade of 1.54 grams per tonne at a strip ratio of 4.3 waste tonnes to ore tonnes. The company extended the amortization of its term loan with Royal Bank of Canada, providing enhanced financial flexibility as the company continues to advance the Goldboro gold project and Tilt Cove project. As at Dec. 31, 2019, the company had a cash balance of $4.4-million, preliminary working capital of $2.7-million, and additional available liquidity of $1-million from an undrawn revolving line of credit facility. "While 2019 had its challenges at the Point Rousse complex, Anaconda is pleased that the mine and mill operations are back on track and the company was able to sell 16,362 ounces of gold during the year to generate $29.5-million in revenue. With the critical investments made in the mill, a strengthened operations management team and improved preventative maintenance programs, Point Rousse is well positioned entering 2020 where we are guiding to produce 18,000 to 19,000 ounces of gold from continued mining in the Pine Cove pit. We continue to advance the Argyle project and plan to commence development in the middle of 2020, with production expected to start in early 2021. We are also pleased to have restructured our term loan with the Royal Bank of Canada, which, together with our cash position at the end of 2019 and ongoing cash flow generation from the Point Rousse complex, position us to advance the high-grade Goldboro gold project to a shovel-ready state and to execute a robust exploration drill program at our prospective Tilt Cove gold project," said Kevin Bullock, president and chief executive officer, Anaconda Mining. 2020 guidance Anaconda is projecting to produce and sell between 18,000 and 19,000 ounces of gold in 2020, which, at a budgeted gold price of $1,800 (approximately $1,350 (U.S.)), will generate approximately $33.3-million of revenue. Mill feed in 2020 will be exclusively from mining in the Pine Cove pit, as the company has continued to successfully expand the mining operations at Pine Cove, which is well understood geologically and from a mining perspective, limiting technical risk. The company continues to progress the Argyle project, where infill drilling is ongoing, with development expected to commence towards the middle of 2020. The company has now received a mining lease for Argyle and has submitted the development and rehabilitation plan for review by the Department of Natural Resources in Newfoundland. Operating cash costs per ounce for the full year are expected to be between $1,050 and $1,100 per ounce of gold sold ($775 (U.S.) to $825 (U.S.) at an approximate exchange rate of 0.75), which is consistent with historical levels for the Point Rousse complex, although expected to be higher earlier in 2020 due to the grade profile of the mine plan. OPERATING STATISTICS FOR THE THREE MONTHS AND YEAR ENDED DEC. 31, 2019 Three months Three months ended ended Year ended Year ended Dec. 31, 2019 Dec. 31, 2018 Dec. 31, 2019 Dec. 31, 2018 Mine statistics Ore production (tonnes) 123,302 99,998 413,139 328,291 Waste production (tonnes) 518,698 300,952 1,771,408 1,288,306 Total material moved (tonnes) 642,000 400,950 2,184,547 1,616,597 Waste:ore ratio 4.2 3.0 4.3 3.9 Mill statistics -- including bulk sample Availability (%) 97.1 93.7 89.6 96.0 Dry tonnes processed 110,474 110,547 401,499 461,439 Tonnes per day (tpd) 1,236 1,282 1,228 1,317 Grade (grams per tonne) 1.49 1.93 1.52 1.56 Recovery (%) 83.1 89.1 82.3 86.7 Gold ounces recovered 4,411 6,125 16,181 20,149 Gold ounces sold 4,209 6,120 17,265 19,290 Excluding the operating results from the bulk sample, the Pine Cove mill statistics specifically for production from the Point Rousse complex are as shown in the associated table. Dry tonnes processed 100,689 110,547 391,714 461,439 Tonnes per day (tpd) 1,318 1,282 1,248 1,317 Grade (grams per tonne) 1.27 1.93 1.46 1.56 Recovery (%) 84.0 89.1 82.8 86.7 Gold ounces produced 3,441 6,125 15,211 20,149 Gold ounces sold 3,306 6,120 16,362 19,290 Operations overview for the year ended Dec. 31, 2019 Anaconda sold 17,265 ounces of gold in 2019 to generate metal revenue of $29.5-million at an average realized gold price of $1,804 per ounce ($1,360 (U.S.)), including 903 ounces from the bulk sample. During the fourth quarter, the company sold 3,306 ounces of gold from production from the Point Rousse complex, generating metal revenue of $6.5-million at an average realized gold price of $1,966 per ounce ($1,489 (U.S.)). Anaconda generated a further $1.8-million in proceeds from gold recovered and sold from the bulk sample. As at Dec. 31, 2019, the company had over 420 ounces of gold dore inventory, which was sold in January. The Point Rousse complex produced 15,211 ounces of gold during 2019, below the revised guidance of 16,000 to 17,000 ounces of gold. The underperformance relative to guidance was mainly the result of a slower-than-planned throughput rate for the bulk sample to maximize recovery, which displaced Pine Cove ore, and lower grades during the fourth quarter as slope conditions required a change to mine sequencing. The company does not anticipate such issue going forward as the required stripping for the pushback in the Pine Cove pit was completed in 2019. Point Rousse mill operations The Pine Cove mill processing facility re-established itself as a cornerstone asset of the company, after a challenging first half of the year when unplanned maintenance of the regrind mill impacted mill availability, which in turn impacted throughput and recovery. Anaconda took the opportunity to accelerate other planned maintenance programs, invest in critical spares, bolster preventative maintenance programs and appoint experienced senior mining leadership to minimize future mill downtime and ensure the sustainability of the operation. The Pine Cove mill has returned to consistent operations, milling a total of 110,474 tonnes during the fourth quarter, including 9,875 tonnes from the bulk sample. Mill throughput has continued to increase since the company addressed second quarter challenges, achieving 1,282 tonnes per day in the third quarter and further increasing to 1,318 tonnes per day in the fourth quarter for Pine Cove mill feed (noting that the mill throughput rate was purposely slowed for the processing of the bulk sample to maximize recoveries on Goldboro material). Similarly, mill availability returned to historical levels of 97 per cent for the second half of the year, up significantly from 85.8 per cent in the second quarter of 2019. Average grade during the fourth quarter was 1.27 g/t from ore feed predominantly from Pine Cove, lower than planned due to a change in the mine sequence, and a decrease compared with the corresponding period of 2018 when mill feed was predominantly from the higher-grade Stog'er Tight mine. The mill achieved an average recovery rate for Point Rousse ore feed of 84.0 per cent during the fourth quarter, a significant increase from 74.7 per cent in the second quarter of 2019, resulting in quarterly gold production of 3,441 ounces. Including the mill throughput from the bulk sample, the Pine Cove mill recovered 4,411 ounces of gold at an overall average recovery rate of 83.1 per cent during Q4 2019. Point Rousse mine operations During the fourth quarter, the mine operation produced 123,302 tonnes of ore mainly from the Pine Cove pit and some residual mining at Stog'er Tight, an 8-per-cent decrease from Q3 2019 as slope conditions on the western wall resulted in a change to mine sequencing, which also impacted the mined grade and the total material moved for the quarter. In general, mined tonnes have increased in the third and fourth quarters of 2019 compared with the first half of the year, when mining activity was focused at Stog'er Tight and on the development of the Pine Cove pit. The mine operations achieved a strip ratio of 4.2 waste tonnes to ore tonnes in Q4 2019, consistent with the third quarter when mine activity transitioned from development in the first half of the year into mine production. In 2020, the strip ratio for Pine Cove pit production is expected to decrease further. As at Dec. 31, 2019, the mine operation had stockpiled over 57,950 tonnes of ore with an estimated average grade of 1.31 g/t. Going forward into 2020, the mine operations will remain focused on production from the south and southwest areas of the Pine Cove pit. Royal Bank term loan The company is also pleased to announce that it has extended the amortization period on its term loan with Royal Bank of Canada to April, 2022. The amended term loan will provide the company with enhanced financial flexibility in 2020 as it continues to advance the Goldboro gold project and the Tilt Cove gold project. The term loan continues to have the support of Export Development Canada (EDC), which has issued a performance guarantee over half of the outstanding amount. The term loan carries a fixed interest rate of 4.6 per cent and performance guarantee fee by EDC of 1.85 per cent, payable quarterly based on the proportional amount outstanding. As at Dec. 31, 2019, there was $3.4-million outstanding on the term loan. Qualified person Gordana Slepcev, PEng, chief operating officer, Anaconda Mining, is a qualified person as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release. About Anaconda Mining Inc. Anaconda is a Toronto Stock Exchange- and OTCQX-listed gold mining, development and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte mining district of Newfoundland which includes the fully permitted Pine Cove mill, tailings facility and deepwater port, as well as about 11,000 hectares of highly prospective mineral lands including those adjacent to the past-producing, high-grade Nugget Pond mine at its Tilt Cove gold project. Anaconda is also developing the Goldboro gold project in Nova Scotia, a high-grade resource and the subject of a continuing feasibility study. We seek Safe Harbor. 2020 Canjex Publishing Ltd. All rights reserved.

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-471-480/…

2020-01-22 07:35 ET - News Release

Mr. Kevin Bullock reports ANACONDA MINING ANNOUNCES Q4 AND FULL YEAR 2019 PRODUCTION RESULTS AND PROVIDES 2020 GUIDANCE Anaconda Mining Inc. has released production results and certain financial information for the three months and year ended Dec. 31, 2019. The company expects to file its full audited annual financial statements and management discussion and analysis by March 2, 2020. During the fourth quarter of 2019, the company processed the Goldboro bulk sample at its Pine Cove mill (see press release dated Jan. 16, 2020). Fourth quarter and annual mill statistics are presented both including the bulk sample and on a Point Rousse stand-alone basis. Proceeds from gold recovered and sold from the bulk sample will be recorded as a credit against the Goldboro exploration and evaluation asset, and the related processing costs at the Pine Cove mill will also be reallocated to the Goldboro asset on a proportionate basis. 2019 highlights: Anaconda sold 16,362 ounces of gold in 2019 from production at the Point Rousse complex, generating metal revenue of $29.5-million at an average sales price of $1,804 ($1,360 (U.S.)) per ounce of gold. As at Dec. 31, the company also had over 420 ounces in gold dore inventory, which was subsequently sold in January. The company also sold 903 ounces in 2019 from the processing of the Goldboro bulk sample at the Pine Cove mill, generating a further $1.8-million in proceeds that will be recorded as a credit against the Goldboro asset. Anaconda produced 15,211 ounces of gold in 2019 at the Point Rousse complex, below its revised guidance of 16,000 to 17,000 ounces due to increased throughput time for the bulk sample to maximize recovery, displacing Pine Cove ore, and lower grades in the fourth quarter of 2019 due to changes in mine sequencing. The Pine Cove mill achieved annual throughput of 401,499 tonnes during 2019, including 9,785 tonnes from the bulk sample, down from 2018 due to low mill availability in the second quarter resulting from unplanned maintenance of the regrind mill and the decision to accelerate other maintenance programs to minimize future downtime. Mine operations moved 413,139 tonnes of ore during the year at an average grade of 1.54 grams per tonne at a strip ratio of 4.3 waste tonnes to ore tonnes. The company extended the amortization of its term loan with Royal Bank of Canada, providing enhanced financial flexibility as the company continues to advance the Goldboro gold project and Tilt Cove project. As at Dec. 31, 2019, the company had a cash balance of $4.4-million, preliminary working capital of $2.7-million, and additional available liquidity of $1-million from an undrawn revolving line of credit facility. "While 2019 had its challenges at the Point Rousse complex, Anaconda is pleased that the mine and mill operations are back on track and the company was able to sell 16,362 ounces of gold during the year to generate $29.5-million in revenue. With the critical investments made in the mill, a strengthened operations management team and improved preventative maintenance programs, Point Rousse is well positioned entering 2020 where we are guiding to produce 18,000 to 19,000 ounces of gold from continued mining in the Pine Cove pit. We continue to advance the Argyle project and plan to commence development in the middle of 2020, with production expected to start in early 2021. We are also pleased to have restructured our term loan with the Royal Bank of Canada, which, together with our cash position at the end of 2019 and ongoing cash flow generation from the Point Rousse complex, position us to advance the high-grade Goldboro gold project to a shovel-ready state and to execute a robust exploration drill program at our prospective Tilt Cove gold project," said Kevin Bullock, president and chief executive officer, Anaconda Mining. 2020 guidance Anaconda is projecting to produce and sell between 18,000 and 19,000 ounces of gold in 2020, which, at a budgeted gold price of $1,800 (approximately $1,350 (U.S.)), will generate approximately $33.3-million of revenue. Mill feed in 2020 will be exclusively from mining in the Pine Cove pit, as the company has continued to successfully expand the mining operations at Pine Cove, which is well understood geologically and from a mining perspective, limiting technical risk. The company continues to progress the Argyle project, where infill drilling is ongoing, with development expected to commence towards the middle of 2020. The company has now received a mining lease for Argyle and has submitted the development and rehabilitation plan for review by the Department of Natural Resources in Newfoundland. Operating cash costs per ounce for the full year are expected to be between $1,050 and $1,100 per ounce of gold sold ($775 (U.S.) to $825 (U.S.) at an approximate exchange rate of 0.75), which is consistent with historical levels for the Point Rousse complex, although expected to be higher earlier in 2020 due to the grade profile of the mine plan. OPERATING STATISTICS FOR THE THREE MONTHS AND YEAR ENDED DEC. 31, 2019 Three months Three months ended ended Year ended Year ended Dec. 31, 2019 Dec. 31, 2018 Dec. 31, 2019 Dec. 31, 2018 Mine statistics Ore production (tonnes) 123,302 99,998 413,139 328,291 Waste production (tonnes) 518,698 300,952 1,771,408 1,288,306 Total material moved (tonnes) 642,000 400,950 2,184,547 1,616,597 Waste:ore ratio 4.2 3.0 4.3 3.9 Mill statistics -- including bulk sample Availability (%) 97.1 93.7 89.6 96.0 Dry tonnes processed 110,474 110,547 401,499 461,439 Tonnes per day (tpd) 1,236 1,282 1,228 1,317 Grade (grams per tonne) 1.49 1.93 1.52 1.56 Recovery (%) 83.1 89.1 82.3 86.7 Gold ounces recovered 4,411 6,125 16,181 20,149 Gold ounces sold 4,209 6,120 17,265 19,290 Excluding the operating results from the bulk sample, the Pine Cove mill statistics specifically for production from the Point Rousse complex are as shown in the associated table. Dry tonnes processed 100,689 110,547 391,714 461,439 Tonnes per day (tpd) 1,318 1,282 1,248 1,317 Grade (grams per tonne) 1.27 1.93 1.46 1.56 Recovery (%) 84.0 89.1 82.8 86.7 Gold ounces produced 3,441 6,125 15,211 20,149 Gold ounces sold 3,306 6,120 16,362 19,290 Operations overview for the year ended Dec. 31, 2019 Anaconda sold 17,265 ounces of gold in 2019 to generate metal revenue of $29.5-million at an average realized gold price of $1,804 per ounce ($1,360 (U.S.)), including 903 ounces from the bulk sample. During the fourth quarter, the company sold 3,306 ounces of gold from production from the Point Rousse complex, generating metal revenue of $6.5-million at an average realized gold price of $1,966 per ounce ($1,489 (U.S.)). Anaconda generated a further $1.8-million in proceeds from gold recovered and sold from the bulk sample. As at Dec. 31, 2019, the company had over 420 ounces of gold dore inventory, which was sold in January. The Point Rousse complex produced 15,211 ounces of gold during 2019, below the revised guidance of 16,000 to 17,000 ounces of gold. The underperformance relative to guidance was mainly the result of a slower-than-planned throughput rate for the bulk sample to maximize recovery, which displaced Pine Cove ore, and lower grades during the fourth quarter as slope conditions required a change to mine sequencing. The company does not anticipate such issue going forward as the required stripping for the pushback in the Pine Cove pit was completed in 2019. Point Rousse mill operations The Pine Cove mill processing facility re-established itself as a cornerstone asset of the company, after a challenging first half of the year when unplanned maintenance of the regrind mill impacted mill availability, which in turn impacted throughput and recovery. Anaconda took the opportunity to accelerate other planned maintenance programs, invest in critical spares, bolster preventative maintenance programs and appoint experienced senior mining leadership to minimize future mill downtime and ensure the sustainability of the operation. The Pine Cove mill has returned to consistent operations, milling a total of 110,474 tonnes during the fourth quarter, including 9,875 tonnes from the bulk sample. Mill throughput has continued to increase since the company addressed second quarter challenges, achieving 1,282 tonnes per day in the third quarter and further increasing to 1,318 tonnes per day in the fourth quarter for Pine Cove mill feed (noting that the mill throughput rate was purposely slowed for the processing of the bulk sample to maximize recoveries on Goldboro material). Similarly, mill availability returned to historical levels of 97 per cent for the second half of the year, up significantly from 85.8 per cent in the second quarter of 2019. Average grade during the fourth quarter was 1.27 g/t from ore feed predominantly from Pine Cove, lower than planned due to a change in the mine sequence, and a decrease compared with the corresponding period of 2018 when mill feed was predominantly from the higher-grade Stog'er Tight mine. The mill achieved an average recovery rate for Point Rousse ore feed of 84.0 per cent during the fourth quarter, a significant increase from 74.7 per cent in the second quarter of 2019, resulting in quarterly gold production of 3,441 ounces. Including the mill throughput from the bulk sample, the Pine Cove mill recovered 4,411 ounces of gold at an overall average recovery rate of 83.1 per cent during Q4 2019. Point Rousse mine operations During the fourth quarter, the mine operation produced 123,302 tonnes of ore mainly from the Pine Cove pit and some residual mining at Stog'er Tight, an 8-per-cent decrease from Q3 2019 as slope conditions on the western wall resulted in a change to mine sequencing, which also impacted the mined grade and the total material moved for the quarter. In general, mined tonnes have increased in the third and fourth quarters of 2019 compared with the first half of the year, when mining activity was focused at Stog'er Tight and on the development of the Pine Cove pit. The mine operations achieved a strip ratio of 4.2 waste tonnes to ore tonnes in Q4 2019, consistent with the third quarter when mine activity transitioned from development in the first half of the year into mine production. In 2020, the strip ratio for Pine Cove pit production is expected to decrease further. As at Dec. 31, 2019, the mine operation had stockpiled over 57,950 tonnes of ore with an estimated average grade of 1.31 g/t. Going forward into 2020, the mine operations will remain focused on production from the south and southwest areas of the Pine Cove pit. Royal Bank term loan The company is also pleased to announce that it has extended the amortization period on its term loan with Royal Bank of Canada to April, 2022. The amended term loan will provide the company with enhanced financial flexibility in 2020 as it continues to advance the Goldboro gold project and the Tilt Cove gold project. The term loan continues to have the support of Export Development Canada (EDC), which has issued a performance guarantee over half of the outstanding amount. The term loan carries a fixed interest rate of 4.6 per cent and performance guarantee fee by EDC of 1.85 per cent, payable quarterly based on the proportional amount outstanding. As at Dec. 31, 2019, there was $3.4-million outstanding on the term loan. Qualified person Gordana Slepcev, PEng, chief operating officer, Anaconda Mining, is a qualified person as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release. About Anaconda Mining Inc. Anaconda is a Toronto Stock Exchange- and OTCQX-listed gold mining, development and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte mining district of Newfoundland which includes the fully permitted Pine Cove mill, tailings facility and deepwater port, as well as about 11,000 hectares of highly prospective mineral lands including those adjacent to the past-producing, high-grade Nugget Pond mine at its Tilt Cove gold project. Anaconda is also developing the Goldboro gold project in Nova Scotia, a high-grade resource and the subject of a continuing feasibility study. We seek Safe Harbor. 2020 Canjex Publishing Ltd. All rights reserved.

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-471-480/…

Anaconda Mining Announces Management Changes

TORONTO, ON / ACCESSWIRE / February 6, 2020 /

Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX)(OTCQX:ANXGF) is today announcing that as a result of restructuring activities to facilitate the next stages of the development of the Goldboro Gold Project, Gordana Slepcev has stepped down from the position of Chief Operating Officer. Given the advanced stages of the Goldboro Gold Project and the related Feasibility Study, as well as the strong general management and mine and mill performance at the Company's Point Rousse Complex in Newfoundland, the Company has no plans to fill this position at this time.

"I want to thank Gordana for her commitment and contributions to Anaconda Mining over the past six plus years, and wish her well in her future endeavours."

~ Kevin Bullock, President and CEO at Anaconda Mining Inc.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2018, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

Anaconda Mining Inc.

Lynn Hammond

VP, Public Relations

(709) 330-1260

lhammond@anacondamining.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

SOURCE: Anaconda Mining Inc

https://www.anacondamining.com/prviewer/release_only/id/4222…

View source version on accesswire.com:

https://www.accesswire.com/575440/Anaconda-Mining-Announces-…

TORONTO, ON / ACCESSWIRE / February 6, 2020 /

Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX)(OTCQX:ANXGF) is today announcing that as a result of restructuring activities to facilitate the next stages of the development of the Goldboro Gold Project, Gordana Slepcev has stepped down from the position of Chief Operating Officer. Given the advanced stages of the Goldboro Gold Project and the related Feasibility Study, as well as the strong general management and mine and mill performance at the Company's Point Rousse Complex in Newfoundland, the Company has no plans to fill this position at this time.

"I want to thank Gordana for her commitment and contributions to Anaconda Mining over the past six plus years, and wish her well in her future endeavours."

~ Kevin Bullock, President and CEO at Anaconda Mining Inc.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2018, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

Anaconda Mining Inc.

Lynn Hammond

VP, Public Relations

(709) 330-1260

lhammond@anacondamining.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

SOURCE: Anaconda Mining Inc

https://www.anacondamining.com/prviewer/release_only/id/4222…

View source version on accesswire.com:

https://www.accesswire.com/575440/Anaconda-Mining-Announces-…

Anaconda Mining Initiates 9,500 Metre Drill Program At It's Tilt Cove and Point Rousse Projects

TORONTO, ON / ACCESSWIRE / February 27, 2020 /

Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) (OTCQX:ANXGF) is pleased to announce a 9,500 metre drill program on priority exploration targets at the Tilt Cove Gold Project ("Tilt Cove") and the Point Rousse Project ("Point Rousse") (the "Winter Exploration Program"). Both projects are located within the Baie Verte Mining District in Newfoundland, and benefit from proximity to the Company's operating Pine Cove Mill and permitted in-pit tailings facility.

The Winter Exploration Program will comprise a combination of 8,000 metres of diamond drilling and 1,500 metres of percussion drilling, including:

•A 4,000 metre diamond drill program at Tilt Cove to test priority targets, particularly beneath frozen lakes (ponds), with the goal of discovering a Nugget Pond-style gold deposit. Priority targets associated with down-ice gold in soil anomalies, geophysical anomalies and similar host rocks to the Nugget Pond Mine include West Pond, East Pond, Red Cliff Pond and Long Pond.

•A 1,500 metre diamond drill program and a 1,000 metre percussion drill program at the Argyle Deposit at the Point Rousse Project, focused on infill and expansion drilling to support the development plan.

•A 500 metre diamond drill plan at the Pine Cove Pit to test the potential for expansion at the south side of the Pine Cove Pit. Recent percussion drilling in the area indicate there are mineralized zones outside of the current resource model and that the area may be open for further expansion of resources.

•A program of 1,500 metres of infill and expansion diamond drilling and a 500 metre percussion drill program to test the 278 Zone, located 500 metres southwest of the Stog'er Tight Mine.

•At Pine Cove East, 500 metres of diamond drilling to test three IP anomalies in similar rocks to those hosting the Pine Cove Deposit located one kilometre east of the Pine Cove Mill.

"Our exploration strategy is to discover high-grade resources in the Baie Vert Mining District and leverage our Pine Cove Mill and permitted tailings capacity. The Winter Exploration Program at Tilt Cove provides a unique opportunity to efficiently drill test high-grade targets at West Pond, East Pond and Red Cliff Pond by drilling from the frozen ponds. These untested targets, which are coincident with the Nugget Pond Horizon, cover a cumulative 3.3 kilometres of strike extent that is largely covered by ponds. Each of these targets have similar geological and geophysical signatures to the nearby high-grade Nugget Pond Mine. At Point Rousse, we believe there continues to be opportunity to extend the mine life of our operations, and drilling will be focused on infill and expansion of mineral resources at the Argyle Deposit and the Pine Cove Mine. We will also be testing the potential for discoveries at the 278 Zone near the Stog'er Tight Mine and Pine Cove East, all proximal to the Pine Cove Mill."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

Tilt Cove Drilling Program

The Tilt Cove Project is a significant, recently consolidated land package encompassing the same geological trend as the past producing, high-grade Nugget Pond Mine, which had an average recovered grade of 9.85 grams per tonne ("g/t") gold. Tilt Cove covers a 20-kilometre strike extent of the Betts Cove Complex, a highly prospective geological terrane that includes the Nugget Pond Horizon ("NPH"). The NPH is an iron-rich sedimentary unit that hosts the past-producing Nugget Pond Mine (Exhibit A) and is located approximately 45 kilometres east of the Pine Cove Mine and Mill Complex.

The Winter Exploration Program follows the initial trenching and drilling announced on November 27, 2019. This short program included trenching and 371 metres of diamond drilling in five holes at the Growler Showing and was cut short due to weather constraints and site conditions. Results from this initial program are expected to be available in Q1 of 2020.

Priority targets to be tested by 4,000 metres of diamond drilling at Tilt Cove include:

•The West Pond Target - 1,000 metres of drilling is designed to test a portion of a 1.3-kilometre long target beneath West Pond. Drilling will test a section of the NPH associated with a zone of low magnetic intensity or magnetic break and gold-in-soil anomalies located to the southeast in a down-ice glacial direction.

•The Red Cliff Pond Target - 1,000 metres of drilling is designed to test a portion of a 1.2-kilometre long target beneath Red Cliff Pond. Drilling will test magnetic breaks along the NPH where previous exploration has outlined grab samples assaying up to 5.56 g/t gold and historic drillholes assaying 1.92 g/t gold over 4.3 metres (ddh 77597).

•East Pond Target - 1,000 metres of drilling is designed to test a 800-metre long target at East Pond. Drilling will test magnetic breaks along the NPH from the shoreline and from the ice where historic drilling has intersected footwall mineralization similar to the Nugget Pond Mine including 5.74 g/t gold over 0.5 metres (RCP-97-01); 10.30 g/t gold over 0.5 metres (RCP-97-02); 1.16 g/t gold over 3.4 metres (RCP-97-02); and 4.90 g/t gold over 0.5 metres (RCP-98-01).

•Long Pond Target - 1,000 metre of drilling is designed to test a portion of a 4.0-kilometre long alteration zone and associated magnetic and induced polarization anomalies at the contact between ultramafic and younger felsic volcanic rocks. The Long Pond Target includes six gold (+/- copper) prospects over its strike length that includes Long Pond Prospect. The Long Pond Prospect comprises an altered and mineralized zone exposed over a 125 metre strike length is up to 35 metres wide, with individual quartz veins up to 2-metres wide. Grab samples from the prospect have returned assays up to 75.90 g/t gold with abundant visible gold. Historic drilling has returned assays of up to 21.5 g/t gold over 1.19 metres (ddh 77502).

Point Rousse Drilling Program

The Point Rousse Project includes the prospective gold trend know as the Scrape Trend, which includes three deposits at Pine Cove, Stog'er Tight, Argyle, in addition to numerous prospects and showings, all located within eight kilometres of the operating Pine Cove Mill. Anaconda has been mining at the Pine Cove Mine continuously for more than 10 years and has developed significant mining infrastructure including the Pine Cove Mill, an in-pit tailings facility with a 15-year life at current throughput rates, and a deep-water port.

Priority targets to be tested by 4,000 metres of diamond drilling and 1,500 metres of percussion drilling within the Scrape Trend of the Point Rousse Project include:

•Argyle Deposit - 1,500 metres of diamond drilling and 1,000 metres of percussion drilling are designed to infill and expand on the Argyle Deposit.

•Pine Cove Mine - 500 metres of infill and expansion drilling will test shallow mineralization (< 30 vertical metres) for open-pit expansion at the south side of the Pine Cove Mine. Drilling is being completed to verify percussion results and to support continuing expansion of the Pine Cove Mine.

•278 Zone (Stog'er Tight Mine) - 1,500 metres of diamond drilling and 500 metres of percussion drilling are designed to infill and expand the 278 Zone, located 500 metres southwest of the Stog'er Tight Mine. Previous drilling at the 278 Zone returned assays 1.28 g/t gold over 8.8 metres (BN-16-278; see news release dated October 27, 2016).

•Pine Cove East - 500 metres of diamond drilling to test three IP anomalies in similar rocks to those hosting the Pine Cove Deposit located 1 kilometre east of the Pine Cove Mine.

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

Grab samples and composited assays from historical drill core are compiled from historic reports and data filed with the Department of Natural Resources, Newfoundland and Labrador. Sufficient work has not been completed by Anaconda geologists and QPs to verify the validity of these composited assays.

A version of this press release will be available in French on Anaconda's website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2018, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

Anaconda Mining Inc.

Lynn Hammond

VP, Public Relations

(709) 330-1260

lhammond@anacondamining.com

Exhibit A. A map showing the location of high priority exploration targets including the West Pond, East Pond, Red Cliff Pond and Long Pond. Gold-in-soil anomalies are shown in black polygons and are located down-ice (southeast) of the Nugget Pond and Red Cliff Horizons where drill target areas at West Pond and Redcliff Pond are located. The Nugget Pond Deposit was situated immediately up-ice of a similar gold-in-soil anomaly.

Exhibit B. A map showing the location of high priority exploration targets including the Argyle, 278 Zone (Stog'er Tight Mine), Pine Cove and Pine Cove East targets.

SOURCE: Anaconda Mining Inc.

https://www.anacondamining.com/prviewer/release_only/id/4244…

View source version on accesswire.com:

https://www.accesswire.com/578136/Anaconda-Mining-Initiates-…

TORONTO, ON / ACCESSWIRE / February 27, 2020 /

Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) (OTCQX:ANXGF) is pleased to announce a 9,500 metre drill program on priority exploration targets at the Tilt Cove Gold Project ("Tilt Cove") and the Point Rousse Project ("Point Rousse") (the "Winter Exploration Program"). Both projects are located within the Baie Verte Mining District in Newfoundland, and benefit from proximity to the Company's operating Pine Cove Mill and permitted in-pit tailings facility.

The Winter Exploration Program will comprise a combination of 8,000 metres of diamond drilling and 1,500 metres of percussion drilling, including:

•A 4,000 metre diamond drill program at Tilt Cove to test priority targets, particularly beneath frozen lakes (ponds), with the goal of discovering a Nugget Pond-style gold deposit. Priority targets associated with down-ice gold in soil anomalies, geophysical anomalies and similar host rocks to the Nugget Pond Mine include West Pond, East Pond, Red Cliff Pond and Long Pond.

•A 1,500 metre diamond drill program and a 1,000 metre percussion drill program at the Argyle Deposit at the Point Rousse Project, focused on infill and expansion drilling to support the development plan.

•A 500 metre diamond drill plan at the Pine Cove Pit to test the potential for expansion at the south side of the Pine Cove Pit. Recent percussion drilling in the area indicate there are mineralized zones outside of the current resource model and that the area may be open for further expansion of resources.

•A program of 1,500 metres of infill and expansion diamond drilling and a 500 metre percussion drill program to test the 278 Zone, located 500 metres southwest of the Stog'er Tight Mine.

•At Pine Cove East, 500 metres of diamond drilling to test three IP anomalies in similar rocks to those hosting the Pine Cove Deposit located one kilometre east of the Pine Cove Mill.

"Our exploration strategy is to discover high-grade resources in the Baie Vert Mining District and leverage our Pine Cove Mill and permitted tailings capacity. The Winter Exploration Program at Tilt Cove provides a unique opportunity to efficiently drill test high-grade targets at West Pond, East Pond and Red Cliff Pond by drilling from the frozen ponds. These untested targets, which are coincident with the Nugget Pond Horizon, cover a cumulative 3.3 kilometres of strike extent that is largely covered by ponds. Each of these targets have similar geological and geophysical signatures to the nearby high-grade Nugget Pond Mine. At Point Rousse, we believe there continues to be opportunity to extend the mine life of our operations, and drilling will be focused on infill and expansion of mineral resources at the Argyle Deposit and the Pine Cove Mine. We will also be testing the potential for discoveries at the 278 Zone near the Stog'er Tight Mine and Pine Cove East, all proximal to the Pine Cove Mill."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

Tilt Cove Drilling Program

The Tilt Cove Project is a significant, recently consolidated land package encompassing the same geological trend as the past producing, high-grade Nugget Pond Mine, which had an average recovered grade of 9.85 grams per tonne ("g/t") gold. Tilt Cove covers a 20-kilometre strike extent of the Betts Cove Complex, a highly prospective geological terrane that includes the Nugget Pond Horizon ("NPH"). The NPH is an iron-rich sedimentary unit that hosts the past-producing Nugget Pond Mine (Exhibit A) and is located approximately 45 kilometres east of the Pine Cove Mine and Mill Complex.

The Winter Exploration Program follows the initial trenching and drilling announced on November 27, 2019. This short program included trenching and 371 metres of diamond drilling in five holes at the Growler Showing and was cut short due to weather constraints and site conditions. Results from this initial program are expected to be available in Q1 of 2020.

Priority targets to be tested by 4,000 metres of diamond drilling at Tilt Cove include:

•The West Pond Target - 1,000 metres of drilling is designed to test a portion of a 1.3-kilometre long target beneath West Pond. Drilling will test a section of the NPH associated with a zone of low magnetic intensity or magnetic break and gold-in-soil anomalies located to the southeast in a down-ice glacial direction.

•The Red Cliff Pond Target - 1,000 metres of drilling is designed to test a portion of a 1.2-kilometre long target beneath Red Cliff Pond. Drilling will test magnetic breaks along the NPH where previous exploration has outlined grab samples assaying up to 5.56 g/t gold and historic drillholes assaying 1.92 g/t gold over 4.3 metres (ddh 77597).

•East Pond Target - 1,000 metres of drilling is designed to test a 800-metre long target at East Pond. Drilling will test magnetic breaks along the NPH from the shoreline and from the ice where historic drilling has intersected footwall mineralization similar to the Nugget Pond Mine including 5.74 g/t gold over 0.5 metres (RCP-97-01); 10.30 g/t gold over 0.5 metres (RCP-97-02); 1.16 g/t gold over 3.4 metres (RCP-97-02); and 4.90 g/t gold over 0.5 metres (RCP-98-01).

•Long Pond Target - 1,000 metre of drilling is designed to test a portion of a 4.0-kilometre long alteration zone and associated magnetic and induced polarization anomalies at the contact between ultramafic and younger felsic volcanic rocks. The Long Pond Target includes six gold (+/- copper) prospects over its strike length that includes Long Pond Prospect. The Long Pond Prospect comprises an altered and mineralized zone exposed over a 125 metre strike length is up to 35 metres wide, with individual quartz veins up to 2-metres wide. Grab samples from the prospect have returned assays up to 75.90 g/t gold with abundant visible gold. Historic drilling has returned assays of up to 21.5 g/t gold over 1.19 metres (ddh 77502).

Point Rousse Drilling Program

The Point Rousse Project includes the prospective gold trend know as the Scrape Trend, which includes three deposits at Pine Cove, Stog'er Tight, Argyle, in addition to numerous prospects and showings, all located within eight kilometres of the operating Pine Cove Mill. Anaconda has been mining at the Pine Cove Mine continuously for more than 10 years and has developed significant mining infrastructure including the Pine Cove Mill, an in-pit tailings facility with a 15-year life at current throughput rates, and a deep-water port.

Priority targets to be tested by 4,000 metres of diamond drilling and 1,500 metres of percussion drilling within the Scrape Trend of the Point Rousse Project include:

•Argyle Deposit - 1,500 metres of diamond drilling and 1,000 metres of percussion drilling are designed to infill and expand on the Argyle Deposit.

•Pine Cove Mine - 500 metres of infill and expansion drilling will test shallow mineralization (< 30 vertical metres) for open-pit expansion at the south side of the Pine Cove Mine. Drilling is being completed to verify percussion results and to support continuing expansion of the Pine Cove Mine.

•278 Zone (Stog'er Tight Mine) - 1,500 metres of diamond drilling and 500 metres of percussion drilling are designed to infill and expand the 278 Zone, located 500 metres southwest of the Stog'er Tight Mine. Previous drilling at the 278 Zone returned assays 1.28 g/t gold over 8.8 metres (BN-16-278; see news release dated October 27, 2016).

•Pine Cove East - 500 metres of diamond drilling to test three IP anomalies in similar rocks to those hosting the Pine Cove Deposit located 1 kilometre east of the Pine Cove Mine.

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

Grab samples and composited assays from historical drill core are compiled from historic reports and data filed with the Department of Natural Resources, Newfoundland and Labrador. Sufficient work has not been completed by Anaconda geologists and QPs to verify the validity of these composited assays.

A version of this press release will be available in French on Anaconda's website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2018, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

Anaconda Mining Inc.

Lynn Hammond

VP, Public Relations

(709) 330-1260

lhammond@anacondamining.com

Exhibit A. A map showing the location of high priority exploration targets including the West Pond, East Pond, Red Cliff Pond and Long Pond. Gold-in-soil anomalies are shown in black polygons and are located down-ice (southeast) of the Nugget Pond and Red Cliff Horizons where drill target areas at West Pond and Redcliff Pond are located. The Nugget Pond Deposit was situated immediately up-ice of a similar gold-in-soil anomaly.

Exhibit B. A map showing the location of high priority exploration targets including the Argyle, 278 Zone (Stog'er Tight Mine), Pine Cove and Pine Cove East targets.

SOURCE: Anaconda Mining Inc.

https://www.anacondamining.com/prviewer/release_only/id/4244…

View source version on accesswire.com:

https://www.accesswire.com/578136/Anaconda-Mining-Initiates-…

Anaconda MINING REPORTS Fourth QUARTER and Full Year 2019 Financial Results; GENERATES $9.9 Million in EBITDA From the Point Rousse COMPLEX

TORONTO, ON / ACCESSWIRE / March 2, 2020 /

Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) (OTCQX:ANXGF) is pleased to report its financial and operating results for the three months and year ended December 31, 2019 ("Q4 2019"). The Company's audited consolidated financial statements, management discussion & analysis, and annual information form can be found at www.sedar.com and the Company's website, www.anacondamining.com. All dollar amounts are in Canadian dollars unless otherwise noted.

Highlights for the Year Ended December 31, 2019

•Anaconda sold 16,362 ounces of gold in 2019 from production at the Point Rousse Complex, generating metal revenue of $29.5 million at an average sales price* of C$1,804 (US$1,360) per ounce of gold.

•The Company also sold 903 ounces from the processing of the Goldboro Bulk Sample at the Pine Cove Mill in Q4 2019, generating a further $1.8 million in proceeds.

•Anaconda produced 15,211 ounces of gold in 2019 at the Point Rousse Complex, below its revised guidance of 16,000 to 17,000 ounces due to increased throughput time for the Bulk Sample to maximize recovery, displacing Pine Cove ore, and lower grades in Q4 2019 due to changes in mine sequencing.

•Operating cash costs per ounce sold* at the Point Rousse Project in Q4 2019 were $1,371 (US$1,039), and $1,165 (US$878) for the year ended December 31, 2019, below the Company's revised annual guidance of $1,325 and $1,375 per ounce of gold sold as a result of better than planned throughput and grade in Q3 2019.

•All-in sustaining cash costs per ounce sold*, including corporate administration and sustaining capital expenditures, was $1,693 (US$1,282) for Q4 2019, and $1,655 (US$1,247) for the full year.

•In 2019, the Company invested $10.9 million in its exploration and development projects, including $9.2 million on the Goldboro Gold Project in Nova Scotia relating to the feasibility study, permitting, the bulk sample, and ongoing diamond drilling programs.

•The Point Rousse Complex generated EBITDA* of $1.6 million in Q4 2019 and $9.9 million for the year ended December 31, 2019, compared with $2.9 million and $12.2 million for the respective 2018 periods.

•Net income for the year ended December 31, 2019 was $373,047, or $0.00 per share, compared to net loss of $1,693,413, or $0.01 per share, for the year ended December 31, 2018.

•The Company extended the amortization of its term loan with the Royal Bank of Canada, providing enhanced financial flexibility as the Company continues to advance the Goldboro Gold Project and Tilt Cove Project.

•As at December 31, 2019, the Company had a cash balance of $4.4 million, working capital* of $2.7 million, and additional available liquidity of $1,000,000 from an undrawn revolving line of credit facility.

*Refer to Non-IFRS Measures section below. A full reconciliation of Non-IFRS Measures can be found in the Management Discussion and Analysis as at and for the year ended December 31, 2019.