Hi-Crush Partners LP - auf Sand gebaut - 500 Beiträge pro Seite

eröffnet am 30.07.13 18:15:53 von

neuester Beitrag 23.07.18 17:31:32 von

neuester Beitrag 23.07.18 17:31:32 von

Beiträge: 199

ID: 1.184.343

ID: 1.184.343

Aufrufe heute: 0

Gesamt: 7.241

Gesamt: 7.241

Aktive User: 0

ISIN: US4283371098 · WKN: A1J2SL

0,0140

EUR

0,00 %

0,0000 EUR

Letzter Kurs 08.12.20 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,065 | +8,59 | |

| 15,250 | +8,16 | |

| 4,8700 | +7,51 | |

| 16,800 | +6,87 | |

| 12,750 | +5,81 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.050,01 | -14,28 | |

| 12,445 | -16,76 | |

| 35,25 | -17,07 | |

| 3,3272 | -22,62 | |

| 0,6100 | -26,95 |

Hi-Crush Partners LP hab ich neben US Silica als 2. Sandwert für mich entdeckt.

Kleine Tranche wird geordert.

Website http://hicrushpartners.com

Research:

http://seekingalpha.com/article/1488052-pounding-the-sand-fo…

http://finance.yahoo.com/news/hi-crush-partners-lp-reports-1…

MK um die 300 Mio USD. KGV wohl derzeit um die 10!

Fazit von seeking alpha:

Although Hi-Crush Partners has more business risk than many midstream MLPs, the market punished the stock too harshly after the announcement of the terminated contract. The long-term supply-demand outlook appears favorable and pricing in the spot market has improved.

Obwohl Hi-Crush Partner mehr unternehmerisches Risiko als viele Midstream MLPs hat, bestraft der Markt die Aktie nach der Ankündigung des gekündigten Vertrages zu hart. Die langfristige Aussichten von Angebot und Nachfrage erscheint günstig und Preise auf dem Spotmarkt hat sich verbesser

Although Hi-Crush Partners has more business risk than many midstream MLPs, the market punished the stock too harshly after the announcement of the terminated contract. The long-term supply-demand outlook appears favorable and pricing in the spot market has improved.

Obwohl Hi-Crush Partner mehr unternehmerisches Risiko als viele Midstream MLPs hat, bestraft der Markt die Aktie nach der Ankündigung des gekündigten Vertrages zu hart. Die langfristige Aussichten von Angebot und Nachfrage erscheint günstig und Preise auf dem Spotmarkt hat sich verbesser

Kurs seit IPO in 2012:

Zum Vergleich US Silica - ebenfalls seit IPO:

Zum Vergleich US Silica - ebenfalls seit IPO:

My Investment Strategy to Add Fracking to My Portfolio

http://www.fool.com/investing/general/2013/07/11/my-investme…

http://www.fool.com/investing/general/2013/07/11/my-investme…

Fragen zu MK am besten beo Google Finance: (Comdirect ist falsch)

https://www.google.com/finance?cid=802830394700167

Range 22.32 - 22.98

52 week 13.21 - 24.25

Mkt cap 609.85M

P/E 8.01

Div/yield 0.47/8.50

EPS 2.79

Shares 27.29M

Inst. own 19%

https://www.google.com/finance?cid=802830394700167

Range 22.32 - 22.98

52 week 13.21 - 24.25

Mkt cap 609.85M

P/E 8.01

Div/yield 0.47/8.50

EPS 2.79

Shares 27.29M

Inst. own 19%

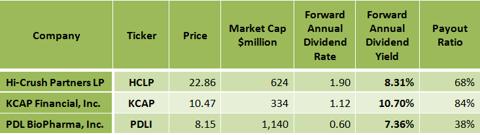

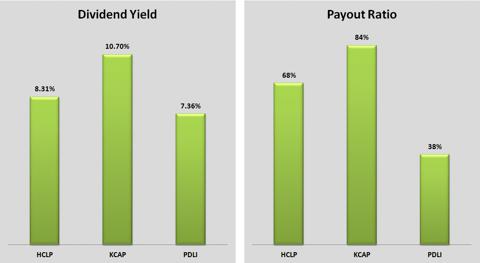

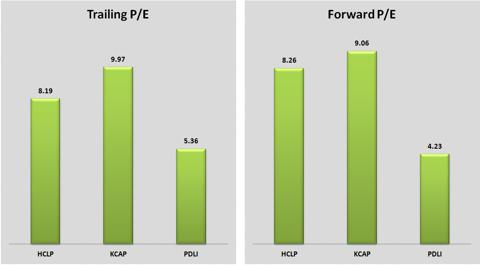

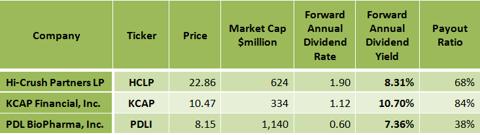

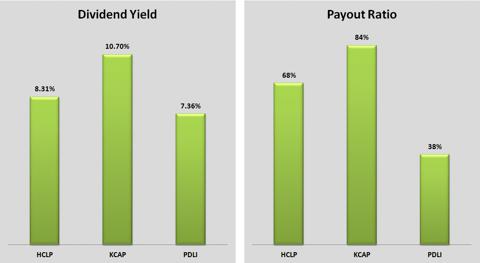

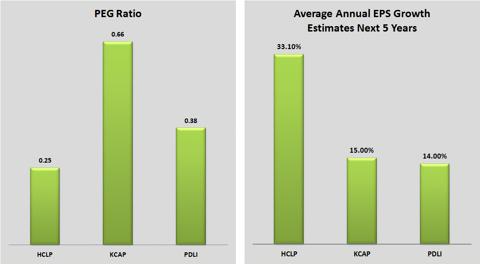

3 High-Yielding Stocks With A Very Low PEG Ratio

http://seekingalpha.com/article/1585302-3-high-yielding-stoc…

http://seekingalpha.com/article/1585302-3-high-yielding-stoc…

Houston, Texas - July 31, 2013 - Hi-Crush Partners LP (NYSE: HCLP), or Hi-Crush, announced today that it will release its second quarter 2013 results before the New York Stock Exchange opens on Wednesday, August 14, 2013.

... dann hab ich auch alles durch geforstet:

3 Cheapest Basic Material Dividend Stocks With Highest YTD Performance

http://www.trefis.com/stock/acet/articles/195684/3-cheapest-…

Hab übrigens gekauft... schaun wir mal...

3 Cheapest Basic Material Dividend Stocks With Highest YTD Performance

http://www.trefis.com/stock/acet/articles/195684/3-cheapest-…

Hab übrigens gekauft... schaun wir mal...

hier noch ein sehr interessanter beitrag:

Behind the fracking boom, a sand mining rush

http://www.wbez.org/news/behind-fracking-boom-sand-mining-ru…

>>> Demand has skyrocketed. The demand for silica sand suddenly shot through the roof with the growth of the fracking industry in the late 2000s. In 2011, U.S. silica consumption was over 26 million tons; in 2012, the U.S. Geological Survey reported it had nearly doubled to over 45 million tons. Prices spiked for a couple years, although now companies in Illinois and Wisconsin report the pricing has leveled out as supply begins to meet demand. The owner of Mississippi Sand, LLC says his sand will sell for $100-$150 per ton, including transportation.

<<<

Behind the fracking boom, a sand mining rush

http://www.wbez.org/news/behind-fracking-boom-sand-mining-ru…

>>> Demand has skyrocketed. The demand for silica sand suddenly shot through the roof with the growth of the fracking industry in the late 2000s. In 2011, U.S. silica consumption was over 26 million tons; in 2012, the U.S. Geological Survey reported it had nearly doubled to over 45 million tons. Prices spiked for a couple years, although now companies in Illinois and Wisconsin report the pricing has leveled out as supply begins to meet demand. The owner of Mississippi Sand, LLC says his sand will sell for $100-$150 per ton, including transportation.

<<<

Zahlen beim "großen Bruder" US silica:

http://phx.corporate-ir.net/phoenix.zhtml?c=247793&p=irol-ne…

U.S. Silica Holdings, Inc. Reaffirms Guidance, Announces Second Quarter 2013 Results and Declares Quarterly Dividend

Record revenue of $129.8 million increased 24% over the second quarter of 2012

Oil and gas volumes increased 44% over the same period in 2012

Company reaffirming full-year Adjusted EBITDA guidance of $165 million to $175 million

Declares regular quarterly cash dividend of $0.125 per share

Announces initial investment in new Greenfield site

http://phx.corporate-ir.net/phoenix.zhtml?c=247793&p=irol-ne…

U.S. Silica Holdings, Inc. Reaffirms Guidance, Announces Second Quarter 2013 Results and Declares Quarterly Dividend

Record revenue of $129.8 million increased 24% over the second quarter of 2012

Oil and gas volumes increased 44% over the same period in 2012

Company reaffirming full-year Adjusted EBITDA guidance of $165 million to $175 million

Declares regular quarterly cash dividend of $0.125 per share

Announces initial investment in new Greenfield site

Air, water, transporatation concerns expressed at sand mining seminar

http://www.leadertelegram.com/news/front_page/article_569212…

http://www.leadertelegram.com/news/front_page/article_569212…

Ultra Petroleum Corp. (UPL), Hi-Crush Partners LP (HCLP): U.S. Energy Department Says Fracking Not A Problem

Read more at http://www.insidermonkey.com/blog/ultra-petroleum-corp-upl-h…

Read more at http://www.insidermonkey.com/blog/ultra-petroleum-corp-upl-h…

Hintergrundinfos:

Mr. Sandman – Getting proppant to the wellhead

http://www.ogfj.com/articles/2013/08/mr-sandman-getting-prop…

Mr. Sandman – Getting proppant to the wellhead

http://www.ogfj.com/articles/2013/08/mr-sandman-getting-prop…

Proppants Market in North America

North American demand to exceed 100 billion pounds Proppants have been one of the most dynamic products in the North American market over the past decade, with sales increases outperforming most other industrial sectors. While growth is expected to slow somewhat from the heady early years, double digit gains are still expected, with overall demand reaching over 100 billion pounds in 2017, valued at more than $10 billion. Proppants are a relatively simple product, as most of the volume used is raw sand, but they have been critical to the expansion of oil and gas production in North America, setting off a chain of events that is revitalizing other North American manufacturing industries.

weiter lesen:

http://www.sacbee.com/2013/08/07/5631010/proppants-market-in…

North American demand to exceed 100 billion pounds Proppants have been one of the most dynamic products in the North American market over the past decade, with sales increases outperforming most other industrial sectors. While growth is expected to slow somewhat from the heady early years, double digit gains are still expected, with overall demand reaching over 100 billion pounds in 2017, valued at more than $10 billion. Proppants are a relatively simple product, as most of the volume used is raw sand, but they have been critical to the expansion of oil and gas production in North America, setting off a chain of events that is revitalizing other North American manufacturing industries.

weiter lesen:

http://www.sacbee.com/2013/08/07/5631010/proppants-market-in…

Proppant market expected to expand along with shale activity

http://www.bizjournals.com/sanantonio/blog/2013/08/proppant-…

http://www.bizjournals.com/sanantonio/blog/2013/08/proppant-…

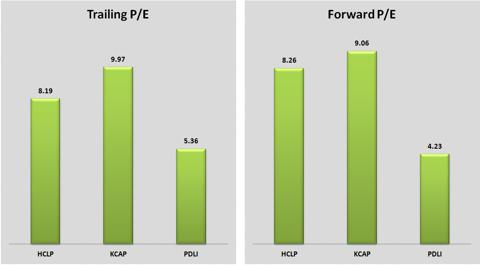

kleiner Vergleich:

+++++++++++++++Hi-Crush++++++++++++++++++++++ +US Silica+++++++++++++++++

+++++++++++++++Hi-Crush++++++++++++++++++++++ +US Silica+++++++++++++++++

1 Trend That Could Make This Stock a Big Winner

http://www.fool.com/investing/general/2013/08/09/1-trend-tha…

......Oil and gas producers are starting to see the benefits of using more proppants per well, which should yield big long-term returns for proppant makers. Specifically, I think Hi-Crush is in a great position to reward investors over the long-term because it's a pure play and structured as an MLP. That's why I think this trend could make Hi-Crush a big winner.

http://www.fool.com/investing/general/2013/08/09/1-trend-tha…

......Oil and gas producers are starting to see the benefits of using more proppants per well, which should yield big long-term returns for proppant makers. Specifically, I think Hi-Crush is in a great position to reward investors over the long-term because it's a pure play and structured as an MLP. That's why I think this trend could make Hi-Crush a big winner.

!

Dieser Beitrag wurde von MODernist moderiert. Grund: auf eigenen Wunsch des Users

Antwort auf Beitrag Nr.: 45.221.579 von XIO am 10.08.13 00:59:44http://www.microsofttranslator.com/bv.aspx?from=en&to=de&a=h…

High-Yielding Stocks Portfolio That Outperformed By A Big Margin

http://seekingalpha.com/article/1628612-high-yielding-stocks…

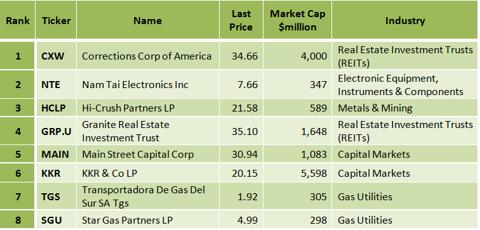

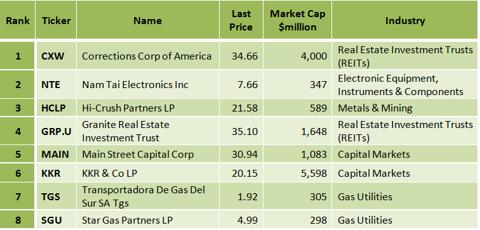

-The stock does not trade over-the-counter [OTC].

-Price is greater than 1.00.

-Market cap is greater than $100 million.

-Dividend yield is greater than 5.0%.

-The payout ratio is less than 100%.

-Total debt to equity is less than 1.0.

-The eight stocks with the lowest payout ratio among all the stocks that complied with the first six demands

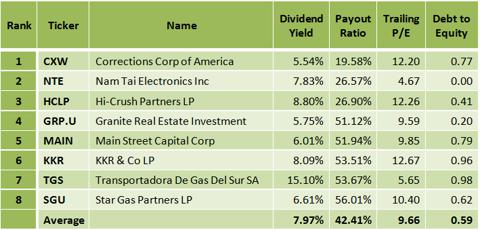

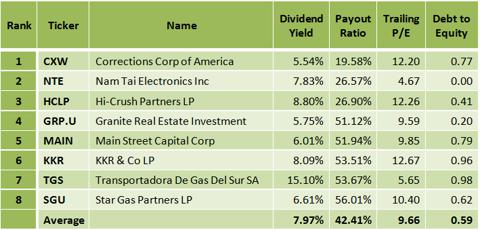

The table below presents the dividend yield, the payout ratio, the trailing P/E, and the total debt to equity for the eight companies.

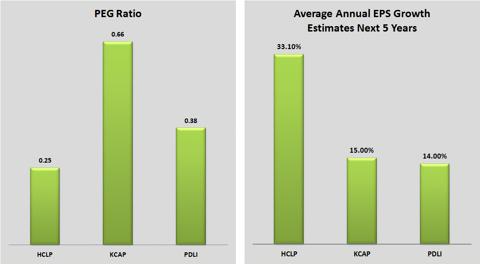

Hi-Crush Partners has a very low debt (total debt to equity is only 0.41), and it has a low trailing P/E of 12.26 and a very low forward P/E of 7.79. The PEG ratio is extremely low at 0.23, and the average annual earnings growth estimates for the next five years is very high at 33.1%. The forward annual dividend yield is very high at 8.80%, and the payout ratio is at 26.9%.

HCLP will report its latest quarterly financial results on August 13. HCLP is expected to post a profit of $0.51. The reported results will probably affect the stock price in the short term.

The compelling valuation metrics, the very rich dividend, and the very strong earnings growth prospects are all factors that make HCLP stock quite attractive.

http://seekingalpha.com/article/1628612-high-yielding-stocks…

-The stock does not trade over-the-counter [OTC].

-Price is greater than 1.00.

-Market cap is greater than $100 million.

-Dividend yield is greater than 5.0%.

-The payout ratio is less than 100%.

-Total debt to equity is less than 1.0.

-The eight stocks with the lowest payout ratio among all the stocks that complied with the first six demands

The table below presents the dividend yield, the payout ratio, the trailing P/E, and the total debt to equity for the eight companies.

Hi-Crush Partners has a very low debt (total debt to equity is only 0.41), and it has a low trailing P/E of 12.26 and a very low forward P/E of 7.79. The PEG ratio is extremely low at 0.23, and the average annual earnings growth estimates for the next five years is very high at 33.1%. The forward annual dividend yield is very high at 8.80%, and the payout ratio is at 26.9%.

HCLP will report its latest quarterly financial results on August 13. HCLP is expected to post a profit of $0.51. The reported results will probably affect the stock price in the short term.

The compelling valuation metrics, the very rich dividend, and the very strong earnings growth prospects are all factors that make HCLP stock quite attractive.

News Release

Hi-Crush Partners LP Reports Second Quarter 2013 Results

Houston, Texas, August 14, 2013 - Hi-Crush Partners LP (NYSE: HCLP), "Hi-Crush" or the "Partnership", today reported net income of $14.7 million, or $0.53 per limited partner unit, for the second quarter of 2013. Second quarter results include a net income contribution of $0.7 million, or $0.025 per limited partner unit, for D&I for the period beginning June 11, 2013, when Hi-Crush completed the D&I transaction, and ending June 30, 2013.

Overview of Financial Results

"The second quarter was marked by trends that were favorable to Hi-Crush," said Robert Rasmus, Co-Chief Executive Officer of Hi-Crush. "Not only did we see an extension of positive trends from the first quarter, including rising proppant intensity and a move towards 24-hour operations, but we also saw striking results from producers in the Marcellus and encouraging well results from producers in the Utica. Our acquisition of D&I was timely, and we see trends that will continue to propel demand in the near-term."

Revenues for the quarter ended June 30, 2013 totaled $27.1 million and reflects an average selling price in line with projections. Hi-Crush sold 358,162 tons of frac sand produced from the Wyeville facility for the quarter ended June 30, 2013. D&I contributed an additional 56,473 tons in frac sand sales for the period beginning June 11, 2013 and ending June 30, 2013. For the quarter ended June 30, 2013, distributable cash flow was $15.6 million and earnings before interest, taxes, depreciation and amortization ("EBITDA") was $16.4 million.

"Our customers met or exceeded their contract terms in the second quarter, and volumes were trending up throughout the quarter as we transferred contracted tons from Augusta and our customers took advantage of beneficial pricing," said James Whipkey, Co-Chief Executive Officer of Hi-Crush. "This, combined with our sales under spot arrangements, resulted in our Wyeville plant operating at almost full capacity for the quarter and achieving record levels of production in the month of June. With D&I now integrated into Hi-Crush, we see many opportunities ahead to increase volumes across our consolidated company."

On July 17, 2013, Hi-Crush declared its second quarter cash distribution of $0.475 per unit for all common and subordinated units. This amount corresponds to the minimum quarterly cash distribution of $0.475 per unit, or $1.90 on an annualized basis and will be paid on August 15, 2013 to all common and subordinated unitholders of record on August 1, 2013.

Hi-Crush Partners LP Reports Second Quarter 2013 Results

Houston, Texas, August 14, 2013 - Hi-Crush Partners LP (NYSE: HCLP), "Hi-Crush" or the "Partnership", today reported net income of $14.7 million, or $0.53 per limited partner unit, for the second quarter of 2013. Second quarter results include a net income contribution of $0.7 million, or $0.025 per limited partner unit, for D&I for the period beginning June 11, 2013, when Hi-Crush completed the D&I transaction, and ending June 30, 2013.

Overview of Financial Results

"The second quarter was marked by trends that were favorable to Hi-Crush," said Robert Rasmus, Co-Chief Executive Officer of Hi-Crush. "Not only did we see an extension of positive trends from the first quarter, including rising proppant intensity and a move towards 24-hour operations, but we also saw striking results from producers in the Marcellus and encouraging well results from producers in the Utica. Our acquisition of D&I was timely, and we see trends that will continue to propel demand in the near-term."

Revenues for the quarter ended June 30, 2013 totaled $27.1 million and reflects an average selling price in line with projections. Hi-Crush sold 358,162 tons of frac sand produced from the Wyeville facility for the quarter ended June 30, 2013. D&I contributed an additional 56,473 tons in frac sand sales for the period beginning June 11, 2013 and ending June 30, 2013. For the quarter ended June 30, 2013, distributable cash flow was $15.6 million and earnings before interest, taxes, depreciation and amortization ("EBITDA") was $16.4 million.

"Our customers met or exceeded their contract terms in the second quarter, and volumes were trending up throughout the quarter as we transferred contracted tons from Augusta and our customers took advantage of beneficial pricing," said James Whipkey, Co-Chief Executive Officer of Hi-Crush. "This, combined with our sales under spot arrangements, resulted in our Wyeville plant operating at almost full capacity for the quarter and achieving record levels of production in the month of June. With D&I now integrated into Hi-Crush, we see many opportunities ahead to increase volumes across our consolidated company."

On July 17, 2013, Hi-Crush declared its second quarter cash distribution of $0.475 per unit for all common and subordinated units. This amount corresponds to the minimum quarterly cash distribution of $0.475 per unit, or $1.90 on an annualized basis and will be paid on August 15, 2013 to all common and subordinated unitholders of record on August 1, 2013.

Hi-Crush Partners' CEO Discusses Q2 2013 Results - Earnings Call Transcript

http://seekingalpha.com/article/1634952-hi-crush-partners-ce…

http://seekingalpha.com/article/1634952-hi-crush-partners-ce…

Der Vollständigkeit halber noch von mir nachgereicht:

aktueller Kommentar von heute auf fool.com:

http://www.fool.com/investing/general/2013/08/14/this-stock-…

Final Foolish thoughts

Hi-Crush is in the right place at the right time to really benefit from long-term proppant trends. As a low-cost leader, this income-focused MLP should deliver solid distributions to investors for years to come. Even though its business might be sand, it is rock solid, and therefore so is its distribution to investors.

http://www.fool.com/investing/general/2013/08/14/this-stock-…

Final Foolish thoughts

Hi-Crush is in the right place at the right time to really benefit from long-term proppant trends. As a low-cost leader, this income-focused MLP should deliver solid distributions to investors for years to come. Even though its business might be sand, it is rock solid, and therefore so is its distribution to investors.

Materials Stocks: One to Buy, One to Sell

Materials are seriously underperforming the S&P 500 in 2013

Aug 15, 2013

http://investorplace.com/2013/08/materials-stocks-one-to-buy…

Materials are seriously underperforming the S&P 500 in 2013

Aug 15, 2013

http://investorplace.com/2013/08/materials-stocks-one-to-buy…

Hi-Crush Partners LP Announces Appointment of John Kevin Poorman to the Board of Directors

Houston, Texas - August 15, 2013 - Hi-Crush Partners LP (NYSE: HCLP), or Hi-Crush, today announced the appointment of Mr. John Kevin Poorman to Hi-Crush's Board of Directors. The election of Mr. Poorman brings the number of Directors to nine members. Mr. Poorman will also serve on the Audit and Conflicts Committees.

Commenting on this appointment, Bob Rasmus, Co-Chief Executive Officer of Hi-Crush said, "We are delighted to have someone with John's experience managing growth investments join our Board of Directors. He has a solid track record for value creation and prudent investment that will help provide strategic direction and additional expertise to both our well-rounded Board of Directors and Hi-Crush unitholders."

Mr. Poorman is currently the Chief Executive Officer of Pritzker Realty Group, LLC and its affiliate, PSP Capital Partners, L.L.C., Chicago-based investment advisory firms. In addition, he is the Executive Chairman of Vi Senior Living.

In addition to his responsibilities at Pritzker Realty Group, LLC and PSP Capital Partners, Mr. Poorman is the Chairman of the Board of Trustees of the Loyola University of New Orleans and serves as a director of The New Orleans Jazz Orchestra.

Mr. Poorman holds both Bachelor of Science and Juris Doctor degrees from the University of Oklahoma.

Houston, Texas - August 15, 2013 - Hi-Crush Partners LP (NYSE: HCLP), or Hi-Crush, today announced the appointment of Mr. John Kevin Poorman to Hi-Crush's Board of Directors. The election of Mr. Poorman brings the number of Directors to nine members. Mr. Poorman will also serve on the Audit and Conflicts Committees.

Commenting on this appointment, Bob Rasmus, Co-Chief Executive Officer of Hi-Crush said, "We are delighted to have someone with John's experience managing growth investments join our Board of Directors. He has a solid track record for value creation and prudent investment that will help provide strategic direction and additional expertise to both our well-rounded Board of Directors and Hi-Crush unitholders."

Mr. Poorman is currently the Chief Executive Officer of Pritzker Realty Group, LLC and its affiliate, PSP Capital Partners, L.L.C., Chicago-based investment advisory firms. In addition, he is the Executive Chairman of Vi Senior Living.

In addition to his responsibilities at Pritzker Realty Group, LLC and PSP Capital Partners, Mr. Poorman is the Chairman of the Board of Trustees of the Loyola University of New Orleans and serves as a director of The New Orleans Jazz Orchestra.

Mr. Poorman holds both Bachelor of Science and Juris Doctor degrees from the University of Oklahoma.

Hi-Crush Partners LP (NASDAQ:HCLP) had its target price raised by Barclays Capital from $22.00 to $25.00. Barclays Capital currently has an overweight rating on the stock.

Hi-Crush Partners LP (NASDAQ:HCLP) had its price target boosted by Raymond James from $22.00 to $25.00. They currently have an outperform rating on the stock.

Hi-Crush Partners LP (NASDAQ:HCLP) had its price target raised by RBC Capital from $23.00 to $26.00. The firm currently has an outperform rating on the stock

http://zolmax.com/research-analysts-price-target-changes-for…

Hi-Crush Partners LP (NASDAQ:HCLP) had its price target boosted by Raymond James from $22.00 to $25.00. They currently have an outperform rating on the stock.

Hi-Crush Partners LP (NASDAQ:HCLP) had its price target raised by RBC Capital from $23.00 to $26.00. The firm currently has an outperform rating on the stock

http://zolmax.com/research-analysts-price-target-changes-for…

Houston, Texas - August 16, 2013 - Hi-Crush Partners LP (NYSE: HCLP), or Hi-Crush, announced today that Chief Financial Officer Laura Fulton was named CFO of the Year by the Houston Business Journal on August 16. Fulton received the award in the small public company and community impact categories at an awards ceremony that honored the best Chief Financial Officers in the region.

The Houston Business Journal noted Fulton's accomplishments in supervising and mentoring a financial team, her work in identifying and executing on strategic investments at Hi-Crush, and her leadership in the greater Houston community. The Houston Business Journal offers the award to recognize the region's top financial officers.

Fulton was appointed CFO of Hi-Crush in 2012. A senior member of the company's management team, Fulton oversees financial systems, financial reporting, internal audit, cost analysis and strategic investment. Before joining Hi-Crush, she was the CFO of AEI Services, LLC, and held roles of increasing responsibility for twelve years at Lyondell Chemical Company.

Fulton is affiliated with several national organizations and currently serves as a Director of Targa Resources Corp. She holds a bachelor's degree in Accounting from Texas A&M University.

The Houston Business Journal noted Fulton's accomplishments in supervising and mentoring a financial team, her work in identifying and executing on strategic investments at Hi-Crush, and her leadership in the greater Houston community. The Houston Business Journal offers the award to recognize the region's top financial officers.

Fulton was appointed CFO of Hi-Crush in 2012. A senior member of the company's management team, Fulton oversees financial systems, financial reporting, internal audit, cost analysis and strategic investment. Before joining Hi-Crush, she was the CFO of AEI Services, LLC, and held roles of increasing responsibility for twelve years at Lyondell Chemical Company.

Fulton is affiliated with several national organizations and currently serves as a Director of Targa Resources Corp. She holds a bachelor's degree in Accounting from Texas A&M University.

nähern uns dem ATH

MLP 2.0: The 'Nontraditional' Yield Hunt

http://seekingalpha.com/article/1649202-mlp-2-0-the-nontradi…

http://seekingalpha.com/article/1649202-mlp-2-0-the-nontradi…

ATH wurde geknackt

Big Texas frac sand company eyes 3rd Wisconsin facility

http://www.startribune.com/blogs/220854041.html

Hi-Crush Partners of Houston, Texas, is getting close to making a public announcement about its latest frac sand mining project in western Wisconsin. The publicly traded company has been negotiating with property owners in Trempealeau County on hilly, agricultural lands between the City of Independence and the county seat of Whitehall.

On Monday of this week, six local property owners and Hi-Crush Whitehall LLC submitted a Petition for Direct Annexation by Unanimous Approval to the City of Whitehall. Tina Kay Sass, the city's administrator, said the company is preparing to present its plans in early September. The Hi-Crush project also would involve adjoining land that would be annexed by the City of Independence, directly west of Whitehall. Most if not all of the combined frac sand site currently lies in Lincoln Township, which would be compensated in some way for losing a chunk of its tax base under a possible intergovernmental agreement.

Hi-Crush was launched in mid-2011 as a frac sand supplier to the oil and gas industry. It has become a major player in Wisconsin, the nation's No. 1 frac sand producing state, by operating mines located in Wyeville (600 acres) and Augusta (1,000 acres.) The size of the Whitehall-Independence site could possibly rival Augusta in size.

The Trempealeau County Board of Supervisors this week adopted a moratorium of up to one year against additional permitting of frac sand facilities, but it's not clear if the temporary ban would slow the Hi-Crush project. For instance, there was testimony at the public hearing for the moratorium that cities within the county could continue to issue new frac sand operating permits. Annexation of frac sand sites by cities has become a hot topic in Trempealeau County and elsewhere in Wisconsin because it undercuts county control of a major new land use and robs townships and counties of important tax base.

http://www.startribune.com/blogs/220854041.html

Hi-Crush Partners of Houston, Texas, is getting close to making a public announcement about its latest frac sand mining project in western Wisconsin. The publicly traded company has been negotiating with property owners in Trempealeau County on hilly, agricultural lands between the City of Independence and the county seat of Whitehall.

On Monday of this week, six local property owners and Hi-Crush Whitehall LLC submitted a Petition for Direct Annexation by Unanimous Approval to the City of Whitehall. Tina Kay Sass, the city's administrator, said the company is preparing to present its plans in early September. The Hi-Crush project also would involve adjoining land that would be annexed by the City of Independence, directly west of Whitehall. Most if not all of the combined frac sand site currently lies in Lincoln Township, which would be compensated in some way for losing a chunk of its tax base under a possible intergovernmental agreement.

Hi-Crush was launched in mid-2011 as a frac sand supplier to the oil and gas industry. It has become a major player in Wisconsin, the nation's No. 1 frac sand producing state, by operating mines located in Wyeville (600 acres) and Augusta (1,000 acres.) The size of the Whitehall-Independence site could possibly rival Augusta in size.

The Trempealeau County Board of Supervisors this week adopted a moratorium of up to one year against additional permitting of frac sand facilities, but it's not clear if the temporary ban would slow the Hi-Crush project. For instance, there was testimony at the public hearing for the moratorium that cities within the county could continue to issue new frac sand operating permits. Annexation of frac sand sites by cities has become a hot topic in Trempealeau County and elsewhere in Wisconsin because it undercuts county control of a major new land use and robs townships and counties of important tax base.

. und die 25 angekratzt...

momentan viel freude mit Hi-Crush

momentan viel freude mit Hi-Crush

The Shuman Law Firm Investigates Hi-Crush Partners LP

http://online.wsj.com/article/PR-CO-20130826-903846.html

http://online.wsj.com/article/PR-CO-20130826-903846.html

Zitat von XIO: The Shuman Law Firm Investigates Hi-Crush Partners LP

http://online.wsj.com/article/PR-CO-20130826-903846.html

.. scheint nicht besonders zu "jucken"

Facebook Seite der gegender der 3. Sandmine

https://www.facebook.com/pages/Save-Our-Town-Whitehall/53429…

https://www.facebook.com/pages/Save-Our-Town-Whitehall/53429…

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9N…

Proppants-market-could-be-worth-10bn-by-2017

http://www.indmin.com/Article/3251450/Channel/19561/Proppant…

für die Freunde der Astrologie:

Hi-Crush, High Yield

http://www.forbes.com/sites/johndobosz/2013/09/09/hi-crush-h…

After bottoming out in 2008 below 5 million barrels per day, U.S. oil production has surged above 7 million bpd every month this year, according to the Energy Information Administration. Feeding that increase is hydraulic fracturing, which requires high-pressure water and special sands that break up below-ground rock formations to free up oil and gas deposits.

Hi-Crush Partners (HCLP) is crushing it, literally. The master limited partnership owns a pit in

Wyeville, Wis., where it just doubled production capacity of its “northern white” proppant sand used in fracking. It also bought D&I Silica, making it the biggest supplier to drillers in the Marcellus and Utica shale formations in the Northeast.

Hi-Crush is up 54% this year but still trades at just 10.3 times forward earnings, and the yield is a juicy 8.1%.

http://www.forbes.com/sites/johndobosz/2013/09/09/hi-crush-h…

After bottoming out in 2008 below 5 million barrels per day, U.S. oil production has surged above 7 million bpd every month this year, according to the Energy Information Administration. Feeding that increase is hydraulic fracturing, which requires high-pressure water and special sands that break up below-ground rock formations to free up oil and gas deposits.

Hi-Crush Partners (HCLP) is crushing it, literally. The master limited partnership owns a pit in

Wyeville, Wis., where it just doubled production capacity of its “northern white” proppant sand used in fracking. It also bought D&I Silica, making it the biggest supplier to drillers in the Marcellus and Utica shale formations in the Northeast.

Hi-Crush is up 54% this year but still trades at just 10.3 times forward earnings, and the yield is a juicy 8.1%.

Neues ATH

Texas fördert mer Öl, als der IRAN

Texas fördert mer Öl, als der IRAN

Fracking Moves U.S. Crude Output to Highest Level Since 1989

http://www.bloomberg.com/news/2013-09-11/fracking-pushes-u-s…

Crown Castle’s REIT move indicative of industry trends, experts say

http://www.bizjournals.com/houston/blog/nuts-and-bolts/2013/…

....Furthermore, he compared the popularity of REITs to the popularity of master-limited partnerships, which are prevalent in the oil and gas industry. MLPs, like REITs, provide tax advantages to companies. Also, they were initially popular in pipeline companies, but are now more prevalent in other oilfield companies, such as frac sand providers like Hi-Crush Partners LP (NYSE: HCLP)

http://www.bizjournals.com/houston/blog/nuts-and-bolts/2013/…

....Furthermore, he compared the popularity of REITs to the popularity of master-limited partnerships, which are prevalent in the oil and gas industry. MLPs, like REITs, provide tax advantages to companies. Also, they were initially popular in pipeline companies, but are now more prevalent in other oilfield companies, such as frac sand providers like Hi-Crush Partners LP (NYSE: HCLP)

Company Looks To Build Frac Sand Mine In Trempealeau County Despite Moratorium

http://news.wpr.org/post/company-looks-build-frac-sand-mine-…

Despite a one-year ban on new frac sand operations in Trempealeau County, a Texas-based company is looking to build one by using a loophole.

Hi-Crush Proppants has been working for more than a year to get approval to build an $80 million, 700-acre mine and processing center in the Town of Lincoln. At the end of August, the Trempealeau County Board passed a moratorium that blocks any new sand facility from being approved for one year.

Hi-Crush seems to have found a way around that: General counsel Mark Skolas says the company has petitioned to have their property annexed by the neighboring cities of Whitehall and Independence.

“We’re ready to make our investment in the community right now,” says Skolas. “With the moratorium, we really felt we didn’t have another option but to seek annexation where we could move forward on a more expedited basis.”

Because county zoning rules don’t apply to cities and villages, Hi-Crush won’t have to abide by the moratorium if it’s annexed.

Sally Miller, a county board member who wrote the moratorium, says annexation is not in the best interest of the community. But Hi-Crush CEO Bob Rasmus says they need to move forward.

The annexation, if approved, will have big implications for the Town of Lincoln. County Board Chair Jack Speerstra says they'll lose any control over the facility and money generated by it: “Annexation takes tax base away from the township that we’ll never have back.”

Rasmus says they'll begin construction as soon as they are annexed with hopes of beginning mining next spring.

http://news.wpr.org/post/company-looks-build-frac-sand-mine-…

Despite a one-year ban on new frac sand operations in Trempealeau County, a Texas-based company is looking to build one by using a loophole.

Hi-Crush Proppants has been working for more than a year to get approval to build an $80 million, 700-acre mine and processing center in the Town of Lincoln. At the end of August, the Trempealeau County Board passed a moratorium that blocks any new sand facility from being approved for one year.

Hi-Crush seems to have found a way around that: General counsel Mark Skolas says the company has petitioned to have their property annexed by the neighboring cities of Whitehall and Independence.

“We’re ready to make our investment in the community right now,” says Skolas. “With the moratorium, we really felt we didn’t have another option but to seek annexation where we could move forward on a more expedited basis.”

Because county zoning rules don’t apply to cities and villages, Hi-Crush won’t have to abide by the moratorium if it’s annexed.

Sally Miller, a county board member who wrote the moratorium, says annexation is not in the best interest of the community. But Hi-Crush CEO Bob Rasmus says they need to move forward.

The annexation, if approved, will have big implications for the Town of Lincoln. County Board Chair Jack Speerstra says they'll lose any control over the facility and money generated by it: “Annexation takes tax base away from the township that we’ll never have back.”

Rasmus says they'll begin construction as soon as they are annexed with hopes of beginning mining next spring.

3-mining-stocks-that-are-up-in-2013

http://www.insidermonkey.com/blog/hi-crush-partners-lp-hclp-…

http://www.insidermonkey.com/blog/hi-crush-partners-lp-hclp-…

Sand mine proposal raises concerns in Whitehall, Independence area

http://www.leadertelegram.com/news/front_page/article_bfa3e9…

http://www.leadertelegram.com/news/front_page/article_bfa3e9…

Sep 16, 2013, 4:26pm CDT

Hi-Crush tries to move roadblocks for Wisconsin expansion

http://www.bizjournals.com/houston/news/2013/09/16/hi-crush-…

Hi-Crush tries to move roadblocks for Wisconsin expansion

http://www.bizjournals.com/houston/news/2013/09/16/hi-crush-…

heute zumindest schon mal kurz über 25 USD geschaut

I ca. 1 Monat gibts das nächste quarterly dividend announcement.

Sollte nix dazwischen kommen, spekuliere ich auf 27-28 USD

Sollte nix dazwischen kommen, spekuliere ich auf 27-28 USD

un ab gehts

NYSE stocks posting largest percentage increases

http://www.barchart.com/headlines/story/12741435/nyse-stocks…

NEW YORK (AP) — A look at the 10 biggest percentage gainers on New York Stock Exchange at 1 p.m.:

Marin Software Inc. rose 5.4 percent to $12.94.

Dominion Resources Black Warrior Trust rose 5.0 percent to $5.45.

Accretive Health Inc. rose 5.0 percent to $9.80.

SunEdison Inc. rose 4.9 percent to $7.64.

New Resident Inv rose 4.6 percent to $6.69.

Nortel Inversora SA rose 4.4 percent to $19.99.

ServiceNow Inc. rose 3.7 percent to $51.16.

YuMe Inc. rose 3.3 percent to $10.20.

Salesforce.com Inc. rose 3.0 percent to $51.41.

Hi-Crush Partners LP rose 3.0 percent to $25.69.

http://www.barchart.com/headlines/story/12741435/nyse-stocks…

NEW YORK (AP) — A look at the 10 biggest percentage gainers on New York Stock Exchange at 1 p.m.:

Marin Software Inc. rose 5.4 percent to $12.94.

Dominion Resources Black Warrior Trust rose 5.0 percent to $5.45.

Accretive Health Inc. rose 5.0 percent to $9.80.

SunEdison Inc. rose 4.9 percent to $7.64.

New Resident Inv rose 4.6 percent to $6.69.

Nortel Inversora SA rose 4.4 percent to $19.99.

ServiceNow Inc. rose 3.7 percent to $51.16.

YuMe Inc. rose 3.3 percent to $10.20.

Salesforce.com Inc. rose 3.0 percent to $51.41.

Hi-Crush Partners LP rose 3.0 percent to $25.69.

Sand mine meeting ends without public discussion

http://www.weau.com/news/headlines/Sand-mine-meeting-ends-wi…

http://www.weau.com/news/headlines/Sand-mine-meeting-ends-wi…

hoffe, die 27 wird heute zumindest mal angekratzt:

Antwort auf Beitrag Nr.: 45.518.355 von XIO am 26.09.13 07:04:15.. was hiermit erfolgte

Heute könnten die 27 zum Feierabend stehen

HCLP - Hi-Crush Partners LP - Rated a Hold - Company Analysis and ASR Ranking

http://finance.yahoo.com/q?s=HCLP

http://finance.yahoo.com/q?s=HCLP

3 Dividend Small Caps With Very Strong Growth Prospects Currently In Uptrend

http://seekingalpha.com/article/1719802-3-dividend-small-cap…

Knoll, Inc. (KNL)

Hi-Crush Partners LP (HCLP)

U.S. Silica Holdings, Inc. (SLCA)

Hi-Crush Partners LP (HCLP)

Hi-Crush Partners LP operates as a producer of monocrystalline sand. Monocrystalline sand is a mineral that is used as a proppant to enhance the recovery rates of hydrocarbons from oil and natural gas wells.

Hi-Crush Partners has a very low trailing P/E of 9.08 and a very low forward P/E of 10.28. The PEG ratio is extremely low at 0.27, and the average annual earnings growth estimate for the next five years is very high at 33.15%. The forward annual dividend yield is very high at 7.04%, and the payout ratio is only 15.9%.

The HCLP stock price is 9.04% above its 20-day simple moving average, 14.80% above its 50-day simple moving average and 38.29% above its 200-day simple moving average. That indicates a short-term, mid-term and long-term uptrend.

On August 14, Hi-Crush Partners reported its second-quarter financial results, which beat EPS expectations by $0.03 and beat on revenues. The company reported net income of $14.7 million, or $0.53 per limited partner unit, for the second quarter of 2013. Second quarter results include a net income contribution of $0.7 million, or $0.025 per limited partner unit, for D&I for the period beginning June 11, 2013, when Hi-Crush completed the D&I transaction, and ending June 30, 2013.

Hi-Crush Partners has very strong earnings growth prospects, and considering its compelling valuation metrics, and the fact that the stock is in an uptrend, HCLP stock can move higher. Furthermore, the very rich dividend represents a gratifying income.

Risks to the expected capital gain and to the dividend payment include; a downturn in the U.S. economy, and a decline in the price of natural gas and oil.

http://seekingalpha.com/article/1719802-3-dividend-small-cap…

Knoll, Inc. (KNL)

Hi-Crush Partners LP (HCLP)

U.S. Silica Holdings, Inc. (SLCA)

Hi-Crush Partners LP (HCLP)

Hi-Crush Partners LP operates as a producer of monocrystalline sand. Monocrystalline sand is a mineral that is used as a proppant to enhance the recovery rates of hydrocarbons from oil and natural gas wells.

Hi-Crush Partners has a very low trailing P/E of 9.08 and a very low forward P/E of 10.28. The PEG ratio is extremely low at 0.27, and the average annual earnings growth estimate for the next five years is very high at 33.15%. The forward annual dividend yield is very high at 7.04%, and the payout ratio is only 15.9%.

The HCLP stock price is 9.04% above its 20-day simple moving average, 14.80% above its 50-day simple moving average and 38.29% above its 200-day simple moving average. That indicates a short-term, mid-term and long-term uptrend.

On August 14, Hi-Crush Partners reported its second-quarter financial results, which beat EPS expectations by $0.03 and beat on revenues. The company reported net income of $14.7 million, or $0.53 per limited partner unit, for the second quarter of 2013. Second quarter results include a net income contribution of $0.7 million, or $0.025 per limited partner unit, for D&I for the period beginning June 11, 2013, when Hi-Crush completed the D&I transaction, and ending June 30, 2013.

Hi-Crush Partners has very strong earnings growth prospects, and considering its compelling valuation metrics, and the fact that the stock is in an uptrend, HCLP stock can move higher. Furthermore, the very rich dividend represents a gratifying income.

Risks to the expected capital gain and to the dividend payment include; a downturn in the U.S. economy, and a decline in the price of natural gas and oil.

Exclusive Interview - Investor

A Non-Traditional MLP

http://www.moneyshow.com/investing/article/43/VideoTrans-326…

One example is Hi-Crush LP. This company, HCLP is the symbol; the company makes or mines proppant. Proppant is basically sand that is put in fracturing fluid, when you fracture an oil or gas well. What it does, when you fracture a well, you are basically artificially creating cracks in the reservoir that help aid the flow of oil or gas into the well. Proppant actually keeps those fractures open once you relieve the pressure of the fracturing fluid. Most proppants in the country, about 75% is raw sand and they have a bunch of mines in Wisconsin, which, believe it or not, is the Saudi Arabia of proppant sands.

SPEAKER 1: That is interesting. I thought it was just cows and cheese.

ELLIOT: Right, exactly. It is about 80% or more than 80% of the proppant sand produced in the US comes from the State of Wisconsin and more than 90% comes from that part of the Upper Midwest. They own a couple of mines there, very low cost of production, access to unit trains, which allows them to very cheaply move the proppant sand from their mines to their customers.

SPEAKER 1: I was going to ask you if that was the mode of transportation.

ELLIOT: Yeah, that is typically the mode of transportation and with a unit train, unit trains are kind of like an express service so it is kind of like the express lane of the highway. They don’t stop the train to add additional cars from other companies so it moves with a faster velocity and they also have a lower cost per train carload whereas they obviously have a lot more carloads than average. Your average well in the US might have 500 tons of proppant in it when you fracture our share wells so that is a lot to move so they typically do use rail to transport that. It has over an 8% yield and I think it will probably be able to grow at about 10% or 15% annualized in the next few years.

SPEAKER 1: Wow. What is the approximate price of it right now>

ELLIOT: Well, you know, HCLP is trading up in the $25 area and I would lo

Hi-Crush: The Frac Sand MLP

http://www.fool.com/investing/general/2013/09/30/hi-crush-th…

>>>At only $770 million, Hi-Crush could be a much bigger company. It's not unreasonable to expect sustained, double-digit earnings growth here. Even with the overhang of secondary offerings, Hi-Crush could be a lot higher.<<<

http://www.fool.com/investing/general/2013/09/30/hi-crush-th…

>>>At only $770 million, Hi-Crush could be a much bigger company. It's not unreasonable to expect sustained, double-digit earnings growth here. Even with the overhang of secondary offerings, Hi-Crush could be a lot higher.<<<

City weighs options on sand mine annexation

http://www.weau.com/home/headlines/City-weighs-options-on-sa…

http://www.microsofttranslator.com/bv.aspx?from=&to=de&a=htt…

Nächster angriff auf die 27 dollar

Hammer-finish auf neuem ATH

Geniale news heute !!!!!!!!!!!!!

Ich halte mittlerweile Kurse um die 40 $ nicht für ausgeschlossen

Zitat von XIO: finance.yahoo./news/hi-crush-partners-announces-settlement-1…

falscher Link.. der hier geht: http://phx.corporate-ir.net/phoenix.zhtml?c=251388&p=irol-ne…

Houston, Texas - October 10, 2013-Hi-Crush Partners LP (NYSE: HCLP), or Hi-Crush, today announced that Hi-Crush Operating LLC, a wholly owned subsidiary of Hi-Crush, has reached an amicable settlement with Baker Hughes Oilfield Operations, Inc., or Baker Hughes, in the previously disclosed litigation between the parties and have filed with the State District Court of Harris County, Texas a Joint Motion to Dismiss with Prejudice with respect to all claims and counterclaims asserted in the lawsuit. In connection with the settlement, Hi-Crush and Baker Hughes have entered into a six-year supply agreement for the sale of Northern White frac sand by Hi-Crush to Baker Hughes.

James Whipkey, Co-Chief Executive Officer of Hi-Crush, said, "We are very pleased to have amicably resolved this matter with Baker Hughes and to strengthen our relationship with them by entering into a six-year supply agreement. We consider Baker Hughes a valuable partner as we continue to expand our market presence."

Interessante Beiträge:

Hi-Crush Partners Yields 7% And Dividend To Start Increasing Significantly

http://seekingalpha.com/article/1740882-hi-crush-partners-yi…

It's Not Too Late To Earn Over 9% From This Undervalued, Fast-Growing High Dividend Stock

http://seekingalpha.com/article/1741392-its-not-too-late-to-…

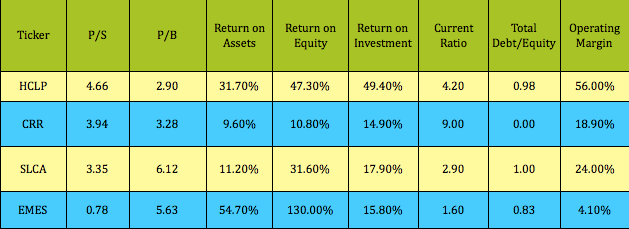

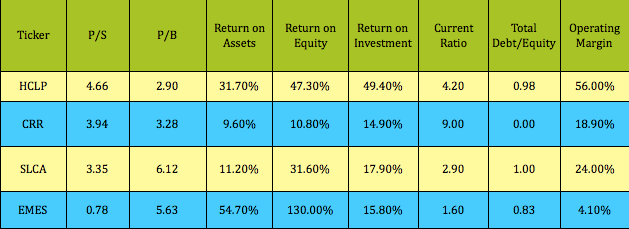

Financials and More Valuations: Small caps HCLP and EMES both have attractive Management Efficiency ratios. However, as a low cost producer with a logistical edge, HCLP has the highest Operating Margin in this group:

Hi-Crush Partners Yields 7% And Dividend To Start Increasing Significantly

http://seekingalpha.com/article/1740882-hi-crush-partners-yi…

It's Not Too Late To Earn Over 9% From This Undervalued, Fast-Growing High Dividend Stock

http://seekingalpha.com/article/1741392-its-not-too-late-to-…

Financials and More Valuations: Small caps HCLP and EMES both have attractive Management Efficiency ratios. However, as a low cost producer with a logistical edge, HCLP has the highest Operating Margin in this group:

http://www.fool.com/investing/dividends-income/2013/10/11/im…

Meiner Meinung nach eine Fehleinschätzung, gerade weil Baker Hughes erst zum Ende der Woche wieder als Geschäftsparner gewonnen wurde, geht es weiter aufwärts.

Meiner Meinung nach eine Fehleinschätzung, gerade weil Baker Hughes erst zum Ende der Woche wieder als Geschäftsparner gewonnen wurde, geht es weiter aufwärts.

Hi-Crush Partners LP Receives Buy Rating from Barclays Capital (HCLP)

http://www.wkrb13.com/markets/218981/hi-crush-partners-lp-re…

aus dem Vorposting:

With the acquisition of D&I and the settlement of the Baker Hughes lawsuit, Hi-Crush Partners should handily be able to increase the quarterly dividend to $0.55 by the end of next year. That is a 7.5% yield on the current $29 share price, but if the company is increasing the dividend by 3% per quarter, the market will push the yield down into the 5% to 6% range, possibly lower. At a 6% yield on the target dividend rate, HCLP should be priced at $36 or better by the end of 2014.

http://www.wkrb13.com/markets/218981/hi-crush-partners-lp-re…

aus dem Vorposting:

With the acquisition of D&I and the settlement of the Baker Hughes lawsuit, Hi-Crush Partners should handily be able to increase the quarterly dividend to $0.55 by the end of next year. That is a 7.5% yield on the current $29 share price, but if the company is increasing the dividend by 3% per quarter, the market will push the yield down into the 5% to 6% range, possibly lower. At a 6% yield on the target dividend rate, HCLP should be priced at $36 or better by the end of 2014.

Interessantes PDF zum Thema Frac sand:

Frac sand frenzy - Industrial Minerals

http://www.google.de/url?sa=t&rct=j&q=&esrc=s&source=web&cd=…

Frac sand frenzy - Industrial Minerals

http://www.google.de/url?sa=t&rct=j&q=&esrc=s&source=web&cd=…

Hab mich heute erstmal von Hi Crush getrennt und komplett in US Silica umgeschichtet, die Analysten sehen da momentan mehr Potential.

denke, da wird sich öfters eine Gelegenheit zum hin und her switchen bieten.

denke, da wird sich öfters eine Gelegenheit zum hin und her switchen bieten.

US proppant consumption expected to grow by 8% per annum through 2015, from 63 billion pounds in 2013

http://www.sacbee.com/2013/10/14/5819605/pacwest-launches-mo…

http://www.sacbee.com/2013/10/14/5819605/pacwest-launches-mo…

Hi-Crush Partners LP (NASDAQ:HCLP) announced a quarterly dividend on Monday, October 21st, AnalystRatingsNetwork.com reports. Investors of record on Friday, November 1st will be paid a dividend of $0.49 per share on Friday, November 15th. This represents a $1.96 annualized dividend and a dividend yield of 6.16%. The ex-dividend date is Wednesday, October 30th. This is an increase from Hi-Crush Partners LP’s previous quarterly dividend of $0.48.

Wisconsin at 'global epicenter' of frac sand mining industry

Read more: http://host.madison.com/news/local/writers/mike_ivey/wiscons…

Read more: http://host.madison.com/news/local/writers/mike_ivey/wiscons…

Sehr interessantes Thema. In Deutschland gibt es auch große Quarzsandvorkommen. Besonders interessant z.B. die Gegend um Haltern am See und die Lausitz. Ersteres ist übrigens auch genau das Gebiet mit dem größten Shalegaspotential in Deutschland.

Hi-Crush Partners LP : Announces Timing of Third Quarter 2013 Financial Results and Conference Call

Hi-Crush Partners LP (NYSE: HCLP), or Hi-Crush, announced today that it will release its third quarter 2013 results before the New York Stock Exchange opens on Wednesday, November 6, 2013. This release will be followed by a conference call for investors at 9:00 a.m. Central Time (10:00 a.m. Eastern Time) to discuss Hi-Crush's third quarter 2013 results. Hosting the call will be Robert E. Rasmus, Co-Chief Executive Officer, James M. Whipkey, Co-Chief Executive Officer and Laura

Hi-Crush Partners LP (NYSE: HCLP), or Hi-Crush, announced today that it will release its third quarter 2013 results before the New York Stock Exchange opens on Wednesday, November 6, 2013. This release will be followed by a conference call for investors at 9:00 a.m. Central Time (10:00 a.m. Eastern Time) to discuss Hi-Crush's third quarter 2013 results. Hosting the call will be Robert E. Rasmus, Co-Chief Executive Officer, James M. Whipkey, Co-Chief Executive Officer and Laura

Independence OKs frac sand annexation

http://lacrossetribune.com/news/independence-oks-frac-sand-a…

Independence Common Council members gave the green light to annex a portion of the city’s land Monday night after denying the request a week ago.

The council rejected the estimated 250-acre annexation proposed by Hi-Crush Proppants LLC during a meeting Oct. 22, but brought the petition back for a special session to vote again.

The annexation was approved in a 5-1 vote. Council member Nancy Knudtson voted no.

The Independence annexation is one part of a $100-million project that would annex land from the town of Lincoln to establish a frac sand mine to be located in both the cities of Independence and Whitehall. According to Hi-Crush officials, the mine’s wet plant would be connected to the dry plant via conveyor system and there would be a potential for as many as 300 rail cars, depending upon their size.

Hi-Crush CEO Bob Rasmus said the mine would provide 61 full-time jobs for Independence and Whitehall residents if it were OK’d for operation, and assured the council the company was “in it for the long run.”

“We want to contribute to the community economically,” he said. “We want to invest.”

Independence Mayor Robert Baecker said the council decided to reconsider the annexation after member Brad Rebarchek “missed a piece of information” during last week’s meeting and was “under the assumption that it was not a unanimous annexation.” All the landowners agreed to the annexation.

“As mayor, I thought it would be a good thing to bring back to the table,” Baecker said. “He said it would have changed his vote.”

The re-vote also allowed newly appointed council member Valerie McCormick to get up speed with the project and vote, Baecker said. McCormick abstained during last week’s meeting, when the annexation was denied 3-2.

Independence resident Ruth Marsolek was upset with the vote. “To me it’s cut and dry,” she said. “They’re going to do what they want to do.

http://lacrossetribune.com/news/independence-oks-frac-sand-a…

Independence Common Council members gave the green light to annex a portion of the city’s land Monday night after denying the request a week ago.

The council rejected the estimated 250-acre annexation proposed by Hi-Crush Proppants LLC during a meeting Oct. 22, but brought the petition back for a special session to vote again.

The annexation was approved in a 5-1 vote. Council member Nancy Knudtson voted no.

The Independence annexation is one part of a $100-million project that would annex land from the town of Lincoln to establish a frac sand mine to be located in both the cities of Independence and Whitehall. According to Hi-Crush officials, the mine’s wet plant would be connected to the dry plant via conveyor system and there would be a potential for as many as 300 rail cars, depending upon their size.

Hi-Crush CEO Bob Rasmus said the mine would provide 61 full-time jobs for Independence and Whitehall residents if it were OK’d for operation, and assured the council the company was “in it for the long run.”

“We want to contribute to the community economically,” he said. “We want to invest.”

Independence Mayor Robert Baecker said the council decided to reconsider the annexation after member Brad Rebarchek “missed a piece of information” during last week’s meeting and was “under the assumption that it was not a unanimous annexation.” All the landowners agreed to the annexation.

“As mayor, I thought it would be a good thing to bring back to the table,” Baecker said. “He said it would have changed his vote.”

The re-vote also allowed newly appointed council member Valerie McCormick to get up speed with the project and vote, Baecker said. McCormick abstained during last week’s meeting, when the annexation was denied 3-2.

Independence resident Ruth Marsolek was upset with the vote. “To me it’s cut and dry,” she said. “They’re going to do what they want to do.

http://seekingalpha.com/article/1780022-investors-remain-pat…

Investors Remain Patient But Caution Is Still In Order

3 Stock Ideas for this Market

I selected the following stocks from a custom search looking undervalued growth stocks with recent upward analyst revisions in MyStockFinder (*all data below from Yahoo! Finance and Reuters):

Apple Inc. - Technology

Trading for 13x current earnings and 12x forward earnings estimates

Positive earnings surprise in last three quarters

Beat on revenue, earnings, and iPhone units, but missed slightly on iPad units in Q3

Analysts have revised earnings estimates up for next quarter in last 30 days

0.40% projected EPS growth for current quarter, 10% next year, 15% over the next 5 years

Hi-Crush Partners LP (HCLP) - Energy

Trading for 33x current earnings and 11x forward earnings estimates

Analysts revised EPS estimates up in last 30 days for the current quarter

100% projected EPS growth for the current quarter, 41% this year, 33% over the next 5 years

Altisource Residential Corporation (RESI) - Financials

Trading for 40x current earnings and 13X forward earnings

Analysts revised EPS estimates up in last 7 days

133% projected EPS growth next year, 20% over the next 5 years

Investors Remain Patient But Caution Is Still In Order

3 Stock Ideas for this Market

I selected the following stocks from a custom search looking undervalued growth stocks with recent upward analyst revisions in MyStockFinder (*all data below from Yahoo! Finance and Reuters):

Apple Inc. - Technology

Trading for 13x current earnings and 12x forward earnings estimates

Positive earnings surprise in last three quarters

Beat on revenue, earnings, and iPhone units, but missed slightly on iPad units in Q3

Analysts have revised earnings estimates up for next quarter in last 30 days

0.40% projected EPS growth for current quarter, 10% next year, 15% over the next 5 years

Hi-Crush Partners LP (HCLP) - Energy

Trading for 33x current earnings and 11x forward earnings estimates

Analysts revised EPS estimates up in last 30 days for the current quarter

100% projected EPS growth for the current quarter, 41% this year, 33% over the next 5 years

Altisource Residential Corporation (RESI) - Financials

Trading for 40x current earnings and 13X forward earnings

Analysts revised EPS estimates up in last 7 days

133% projected EPS growth next year, 20% over the next 5 years

$100 million frac sand project gets a boost from annexation vote

http://www.wqow.com/story/23886719/2013/11/05/frac-sand-proj…

Whitehall (WQOW) - A $100 million project is another step closer to becoming a reality. Last night, the city of Whitehall annexed land to be used by Hi Crush, which is a frac sand company. Independence did the same a week ago. Hi Crush says the project would be similar in scope to its current facility in Augusta.

Hi Crush says it would hire 60 to 65 full time employees starting at, at least $15 an hour.

Trempealeau County does have a frac sand moratorium in place. The annexation allows the company to get around the moratorium but it still faces hurdles in both communities.

The mining reserves are in Whitehall so the reclamation plan would have to be approved there. A conditional use permit for the rail spur and dry plant would have to get the green light in independence.

Hi Crush says it would like to start construction this fall. Mining wouldn't begin until next year, at the earliest.

http://www.wqow.com/story/23886719/2013/11/05/frac-sand-proj…

Whitehall (WQOW) - A $100 million project is another step closer to becoming a reality. Last night, the city of Whitehall annexed land to be used by Hi Crush, which is a frac sand company. Independence did the same a week ago. Hi Crush says the project would be similar in scope to its current facility in Augusta.

Hi Crush says it would hire 60 to 65 full time employees starting at, at least $15 an hour.

Trempealeau County does have a frac sand moratorium in place. The annexation allows the company to get around the moratorium but it still faces hurdles in both communities.

The mining reserves are in Whitehall so the reclamation plan would have to be approved there. A conditional use permit for the rail spur and dry plant would have to get the green light in independence.

Hi Crush says it would like to start construction this fall. Mining wouldn't begin until next year, at the earliest.

Another Company Skirts Trempealeau County Frac Sand Mining Ban

http://news.wpr.org/post/another-company-skirts-trempealeau-…

http://news.wpr.org/post/another-company-skirts-trempealeau-…

Hi-Crush Partners LP Reports Third Quarter 2013 Results

Houston, Texas, November 6, 2013 - Hi-Crush Partners LP (NYSE: HCLP), "Hi-Crush" or the "Partnership", today reported third quarter results. Net income was $15.0 million, or $0.52 per limited partner unit, for the third quarter of 2013 and $40.5 million, or $1.45 per limited partner unit, for the nine months ended September 30, 2013.

The Partnership reported earnings before interest, taxes and depreciation and amortization ("EBITDA") of $19.2 million for the third quarter of 2013 and $47.0 million for the nine months ended September 30, 2013. EBITDA was impacted by an estimated $1.5 million due to delays in volumes taken by contract customers at the end of the quarter, as well as $1.1 million of litigation costs and non-cash inventory costs related to the D&I acquisition that are not expected to reoccur in the fourth quarter.

The Partnership's distributable cash flow for the third quarter of 2013 of $17.6 million corresponds to distribution coverage of 1.24 times the total $14.1 million in total distributions to be paid on November 15, 2013.

"We are seeing the benefits of the D&I acquisition flow through our results as we sold over 530,000 tons of frac sand in the third quarter and increased the number of customers we are serving to more than 25. We were also excited to announce the amicable settlement of the Baker Hughes litigation in early October and, in connection with the settlement, the entry into a six-year supply agreement with Baker Hughes." said James M. Whipkey, Co-Chief Executive Officer of Hi-Crush. "During the quarter, our Wyeville plant operated at close to nameplate capacity and began producing 100-mesh sand. With our distribution network, we see many opportunities ahead to increase volumes across our consolidated company."

Revenues for the quarter ended September 30, 2013 totaled $43.5 million on sales of 533,239 tons of frac sand and transload services. The average selling price of frac sand, reflecting the mix between pricing for delivery at the production facility and at the destination, was $73 per ton.

"New technology continues to drive demand for high quality proppant ever higher." said Robert E. Rasmus, Co-Chief Executive Officer of Hi-Crush. "With our low-cost operations, strategic niche in the Marcellus and Utica, and broad logistics capabilities, we are well-positioned to continue to increase our market share." Production cost for sand produced and delivered from the Wyeville facility was $13.10 per ton during the quarter.

On October 17, 2013, Hi-Crush declared its third quarter cash distribution of $0.49 per unit for all common and subordinated units, or $1.96 on an annualized basis. This amount corresponds to a 3% increase from the minimum quarterly cash distribution of $0.475 per unit, and will be paid on November 15, 2013 to all common and subordinated unitholders of record on November 1, 2013.

Houston, Texas, November 6, 2013 - Hi-Crush Partners LP (NYSE: HCLP), "Hi-Crush" or the "Partnership", today reported third quarter results. Net income was $15.0 million, or $0.52 per limited partner unit, for the third quarter of 2013 and $40.5 million, or $1.45 per limited partner unit, for the nine months ended September 30, 2013.

The Partnership reported earnings before interest, taxes and depreciation and amortization ("EBITDA") of $19.2 million for the third quarter of 2013 and $47.0 million for the nine months ended September 30, 2013. EBITDA was impacted by an estimated $1.5 million due to delays in volumes taken by contract customers at the end of the quarter, as well as $1.1 million of litigation costs and non-cash inventory costs related to the D&I acquisition that are not expected to reoccur in the fourth quarter.

The Partnership's distributable cash flow for the third quarter of 2013 of $17.6 million corresponds to distribution coverage of 1.24 times the total $14.1 million in total distributions to be paid on November 15, 2013.

"We are seeing the benefits of the D&I acquisition flow through our results as we sold over 530,000 tons of frac sand in the third quarter and increased the number of customers we are serving to more than 25. We were also excited to announce the amicable settlement of the Baker Hughes litigation in early October and, in connection with the settlement, the entry into a six-year supply agreement with Baker Hughes." said James M. Whipkey, Co-Chief Executive Officer of Hi-Crush. "During the quarter, our Wyeville plant operated at close to nameplate capacity and began producing 100-mesh sand. With our distribution network, we see many opportunities ahead to increase volumes across our consolidated company."

Revenues for the quarter ended September 30, 2013 totaled $43.5 million on sales of 533,239 tons of frac sand and transload services. The average selling price of frac sand, reflecting the mix between pricing for delivery at the production facility and at the destination, was $73 per ton.

"New technology continues to drive demand for high quality proppant ever higher." said Robert E. Rasmus, Co-Chief Executive Officer of Hi-Crush. "With our low-cost operations, strategic niche in the Marcellus and Utica, and broad logistics capabilities, we are well-positioned to continue to increase our market share." Production cost for sand produced and delivered from the Wyeville facility was $13.10 per ton during the quarter.

On October 17, 2013, Hi-Crush declared its third quarter cash distribution of $0.49 per unit for all common and subordinated units, or $1.96 on an annualized basis. This amount corresponds to a 3% increase from the minimum quarterly cash distribution of $0.475 per unit, and will be paid on November 15, 2013 to all common and subordinated unitholders of record on November 1, 2013.

Hi XIO

Bin völlig neu in diesem Thread und nur durch "Zufall" mal vorbei gekommen. Ich habe gerade in der ARD einen Bericht aus den USA "BOOM oder BLASE" - Wie Fracking die Welt verändert, gesehen. Scheinbar bist Du ja im "Sandsektor" schon lange dabei, und dies mit Erfolg. Glückwunsch! Gibt es im Bereich Fracking noch weitere Player, die du spielst? Habe gelesen du hast komplett auf SLCA US Silica gewechselt.

Macht es aktuell noch Sinn in die Branche einzusteigen, oder ist der Zug schon weg? Und, wo würdest du noch einsteigen? Das Fracking ist ja ein MEGA-Markt, da ist ja das Spielfeld für die Minen nicht gerade klein. Gibt es auch Chemikalienhändler (Zusatzstoffe für das Fracking) die du handelst.

Wäre um ein paar Tipps oder Infos sehr dankbar.

Ansonsten viel Erfolg - werde mal ein Auge auf dem Wert und XIO behalten

Bin völlig neu in diesem Thread und nur durch "Zufall" mal vorbei gekommen. Ich habe gerade in der ARD einen Bericht aus den USA "BOOM oder BLASE" - Wie Fracking die Welt verändert, gesehen. Scheinbar bist Du ja im "Sandsektor" schon lange dabei, und dies mit Erfolg. Glückwunsch! Gibt es im Bereich Fracking noch weitere Player, die du spielst? Habe gelesen du hast komplett auf SLCA US Silica gewechselt.

Macht es aktuell noch Sinn in die Branche einzusteigen, oder ist der Zug schon weg? Und, wo würdest du noch einsteigen? Das Fracking ist ja ein MEGA-Markt, da ist ja das Spielfeld für die Minen nicht gerade klein. Gibt es auch Chemikalienhändler (Zusatzstoffe für das Fracking) die du handelst.

Wäre um ein paar Tipps oder Infos sehr dankbar.

Ansonsten viel Erfolg - werde mal ein Auge auf dem Wert und XIO behalten

Antwort auf Beitrag Nr.: 45.778.386 von barrique am 07.11.13 01:20:17MOin... kleine Schwächephasen nutzen, ansonsten noch relativ unentdecktes wachstunsthema, die firmen sind alle relativ dividende orientiert und schreiben schwarze Zahlen.

es gibt gar nicht so vile Börsen-notierte Sand Unternehmen

HCLP ist ein puerer Frac Sand Play

US Silica ist mehr diversiviziert

Des weiteren beobachten:

Carbo Ceramics

Victory Nickel (Vicktory Silica) - early Play, Hi Risk

Emerge Energy Services (machen gerade einen Run)

Image Resources (Australien)

Zusätzlich bin ich derzeit an OCI Resources dran, die machen aber keinen Sand, aber interessanten Dividende Forcast

es gibt gar nicht so vile Börsen-notierte Sand Unternehmen

HCLP ist ein puerer Frac Sand Play

US Silica ist mehr diversiviziert

Des weiteren beobachten:

Carbo Ceramics

Victory Nickel (Vicktory Silica) - early Play, Hi Risk

Emerge Energy Services (machen gerade einen Run)

Image Resources (Australien)

Zusätzlich bin ich derzeit an OCI Resources dran, die machen aber keinen Sand, aber interessanten Dividende Forcast

Hi-Crush Partners Has Big Bottom-Line Miss

Fracking sand producer Hi-Crush Partners (NYSE: HCLP ) reported third-quarter results

today before the markets opened, showing that it posted net revenues of $43.5 million, a big 73% increase from the same period in the previous year, and just ahead of the $40.36 million Capital IQ consensus estimate.

While net income came in at $15 million, or $0.52 per share, down from the $16.17 million, or $0.33 per share, in the same period in 2012, it was $0.14-per-share worse than the CapIQ estimates of $0.66 per share.

Hi-Crush had its IPO on Aug. 16, 2012, so the above results include the period from then through Sept. 30, 2012, as well as from the predecessor company period of July 1 through Aug. 31, 2012, which is why the results may seem skewed.

However, Hi-Crush says results were hurt by an estimated $1.5 million due to delays in volumes taken by contract customers as well as litigation and inventory costs related to D&I Silica that it acquired in June for $95 million cash, though they're not expected to recur in the fourth quarter.

The fracking sand producer didn't provide guidance for the coming quarter, but analysts anticipate Hi-Crush Partners will post earnings of $0.68 per share in the fourth quarter on revenues of $40.25 million.

Fracking sand producer Hi-Crush Partners (NYSE: HCLP ) reported third-quarter results

today before the markets opened, showing that it posted net revenues of $43.5 million, a big 73% increase from the same period in the previous year, and just ahead of the $40.36 million Capital IQ consensus estimate.

While net income came in at $15 million, or $0.52 per share, down from the $16.17 million, or $0.33 per share, in the same period in 2012, it was $0.14-per-share worse than the CapIQ estimates of $0.66 per share.

Hi-Crush had its IPO on Aug. 16, 2012, so the above results include the period from then through Sept. 30, 2012, as well as from the predecessor company period of July 1 through Aug. 31, 2012, which is why the results may seem skewed.

However, Hi-Crush says results were hurt by an estimated $1.5 million due to delays in volumes taken by contract customers as well as litigation and inventory costs related to D&I Silica that it acquired in June for $95 million cash, though they're not expected to recur in the fourth quarter.

The fracking sand producer didn't provide guidance for the coming quarter, but analysts anticipate Hi-Crush Partners will post earnings of $0.68 per share in the fourth quarter on revenues of $40.25 million.

Antwort auf Beitrag Nr.: 45.778.538 von XIO am 07.11.13 06:48:08Hi XIO

Danke für die Ausführungen. Ja, ich denke auch, hier ist für die nächste Zeit noch so einiges drin. Da der Wert schon heftig gelaufen ist, tut so manche Konso auch mal gut. Mal schauen, wann und ob ich einen guten (und halbwegs sicheren) Einstieg finde. Bin für alle Infos und Tipps offen (handeln werde natürlich ich).LG.

Danke für die Ausführungen. Ja, ich denke auch, hier ist für die nächste Zeit noch so einiges drin. Da der Wert schon heftig gelaufen ist, tut so manche Konso auch mal gut. Mal schauen, wann und ob ich einen guten (und halbwegs sicheren) Einstieg finde. Bin für alle Infos und Tipps offen (handeln werde natürlich ich).LG.

Antwort auf Beitrag Nr.: 45.785.724 von barrique am 07.11.13 18:05:15Konso läuft gerade ... es bieten sich wieder chancen.

Hi-Crush Partners LP PT Raised to $34.00 (HCLP)

http://tickerreport.com/banking-finance/75639/hi-crush-partn…

http://tickerreport.com/banking-finance/75639/hi-crush-partn…

Hi-Crush Partners LP Announces Secondary Offering of Common Units by Hi-Crush Proppants LLC

http://finance.yahoo.com/news/hi-crush-partners-lp-announces…

Houston, Texas, November 21, 2013 - Hi-Crush Partners LP (HCLP), "Hi-Crush" or the "Partnership," today announced the commencement, subject to market conditions, of a secondary public offering of 702,851 common units representing limited partner interests in the Partnership by Hi-Crush Proppants LLC (the "Selling Unitholder"). The Selling Unitholder owns Hi-Crush GP LLC, the Partnership`s general partner. After giving effect to the sale of common units by the Selling Unitholder in the proposed offering, the Selling Unitholder will continue to own all of the Partnership`s incentive distribution rights, 13,640,351 subordinated units and 3,750,000 Class B Units. The Partnership will not receive any proceeds from the sale of common units in the offering, and the number of common units outstanding will remain unchanged.

http://finance.yahoo.com/news/hi-crush-partners-lp-announces…

Houston, Texas, November 21, 2013 - Hi-Crush Partners LP (HCLP), "Hi-Crush" or the "Partnership," today announced the commencement, subject to market conditions, of a secondary public offering of 702,851 common units representing limited partner interests in the Partnership by Hi-Crush Proppants LLC (the "Selling Unitholder"). The Selling Unitholder owns Hi-Crush GP LLC, the Partnership`s general partner. After giving effect to the sale of common units by the Selling Unitholder in the proposed offering, the Selling Unitholder will continue to own all of the Partnership`s incentive distribution rights, 13,640,351 subordinated units and 3,750,000 Class B Units. The Partnership will not receive any proceeds from the sale of common units in the offering, and the number of common units outstanding will remain unchanged.

As Sand Miners Ask Cities To Shield Them, Trempealeau County May Ease Rules

http://news.wpr.org/post/sand-miners-ask-cities-shield-them-…

http://news.wpr.org/post/sand-miners-ask-cities-shield-them-…

Hi Crush Partners LP: Uptrend Will Continue

http://seekingalpha.com/article/1865891-hi-crush-partners-lp…

http://seekingalpha.com/article/1865891-hi-crush-partners-lp…

Frac sand hits the front page in New York

Frac sand made it onto the front page of the Wall Street Journal this week, showcasing just how buoyant the US hydraulic fracturing (fracking) industry has become.

In contrast to the usually negative press the industry receives due to environmental controversy, the article highlighted the increase in demand for frac sand, which has risen 25% since 2011, according to PacWest.

The consulting firm outlined further that demand is expected to continue to rise, increasing a further 20% over the next two years.

In Fracking, Sand Is the New Gold

Energy Boom Fuels Demand for Key Ingredient Used in Drilling Wells; 100 Sand Mines in Wisconsin

http://online.wsj.com/news/articles/SB1000142405270230486840…

Frac sand made it onto the front page of the Wall Street Journal this week, showcasing just how buoyant the US hydraulic fracturing (fracking) industry has become.

In contrast to the usually negative press the industry receives due to environmental controversy, the article highlighted the increase in demand for frac sand, which has risen 25% since 2011, according to PacWest.

The consulting firm outlined further that demand is expected to continue to rise, increasing a further 20% over the next two years.

In Fracking, Sand Is the New Gold

Energy Boom Fuels Demand for Key Ingredient Used in Drilling Wells; 100 Sand Mines in Wisconsin

http://online.wsj.com/news/articles/SB1000142405270230486840…

Hi-Crush job fair draws hundreds

http://www.wqow.com/story/24129153/2013/12/03/hi-crush-job-f…

http://www.wqow.com/story/24129153/2013/12/03/hi-crush-job-f…

auch gute am Ball!!!

Fracking

Amerika im Sandrausch