Freeport-McMoRan -- one of the cheapest companies in North America - Älteste Beiträge zuerst (Seite 99)

eröffnet am 29.05.07 06:45:54 von

neuester Beitrag 30.03.24 14:46:04 von

neuester Beitrag 30.03.24 14:46:04 von

Beiträge: 1.089

ID: 1.127.976

ID: 1.127.976

Aufrufe heute: 6

Gesamt: 112.060

Gesamt: 112.060

Aktive User: 0

ISIN: US35671D8570 · WKN: 896476

46,08

EUR

+2,43 %

+1,09 EUR

Letzter Kurs 22:45:14 Lang & Schwarz

Neuigkeiten

23.04.24 · wallstreetONLINE Redaktion |

Freeport-McMoRan First-Quarter 2024 Financial and Operating Results Release Available on Its Website 23.04.24 · Business Wire (engl.) |

17.04.24 · wallstreetONLINE Redaktion |

16.04.24 · Sharedeals |

16.04.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 29,95 | +18,12 | |

| 16,040 | +17,34 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8925 | -7,27 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 2,1800 | -9,17 | |

| 46,59 | -98,01 |

Antwort auf Beitrag Nr.: 61.649.781 von NickelChrome am 08.10.19 19:21:45

07.11.2019 15:30:11 10,9200 353.456 Eröffnungsauktion an der NYSE

Da gingen meine letzten 800 über den Tresen

Geht ab wie ne Rakete 11,33 USD +0,70 (6,59 %)

Für nächste Woche brauchen wir Cash das wird alles Humpy Trumpy oder so

Zitat von NickelChrome: 1000 Stück zu 8,52 USD ... Land unter

Schöner doppelter Boden .... Na ja wenigstens das Zwischenhoch ausgenutzt und 2,40 USD günstiger eingesackt

07.11.2019 15:30:11 10,9200 353.456 Eröffnungsauktion an der NYSE

Da gingen meine letzten 800 über den Tresen

Geht ab wie ne Rakete 11,33 USD +0,70 (6,59 %)

Für nächste Woche brauchen wir Cash das wird alles Humpy Trumpy oder so

Ich habe eine Doku über die Grasberg Freeport Mine in West Papua gesehen.

Nachdem ich jetzt über die politischen Verhältnisse in diesem Land bescheid weiß, kommt für mich persönlich ein Investment in diese Aktie nicht in Frage.

Bereit 2006 hat der Norwegische Pensionsfond seine Aktien von Rio Tinto aus Ethischen Gründen verkauft. Rio Tinto hält Anteile an der Grasberg Mine.

Für alle die mehr darüber wissen wollen, sollten mal danach googeln, wie sich Indonesien das Land Papua einverleibt hat.

Nachdem ich jetzt über die politischen Verhältnisse in diesem Land bescheid weiß, kommt für mich persönlich ein Investment in diese Aktie nicht in Frage.

Bereit 2006 hat der Norwegische Pensionsfond seine Aktien von Rio Tinto aus Ethischen Gründen verkauft. Rio Tinto hält Anteile an der Grasberg Mine.

Für alle die mehr darüber wissen wollen, sollten mal danach googeln, wie sich Indonesien das Land Papua einverleibt hat.

23.1.

Freeport-McMoRan tops earnings estimates for Q4

https://www.marketwatch.com/story/freeport-mcmoran-tops-earn…

Freeport-McMoRan Inc. said Thursday it had net income of $9 million, or less than 1 cent a share, in the fourth quarter, down from $485 million, or 33 cents a share, in the year-earlier period.

Adjusted per-share earnings came to 2 cents, ahead of the FactSet consensus for breakeven. The copper and gold miner said revenue rose to $3.911 billion from $3.684 billion, well ahead of the $3.698 billion FactSet consensus.

Sales of copper totaled 906 million pounds, sales of gold came to 317 thousand ounces and sales of molybdenum came to 22 million pounds in the quarter. For 2020, the company is expecting sales of about 3.5 billion pounds of copper, 0.8 million ounces of gold and 88 million pounds of molybdenum, including 725 million pounds of copper, 105 thousand ounces of gold and 22 million pounds of molybdenum in the first quarter.

Capital expenditures are expected to come to $2.8 billion in 2020 after $2.65 billion in 2019, and will fund underground development...

(FC: Format)

--> pre-market z.Z. -3%

Freeport-McMoRan tops earnings estimates for Q4

https://www.marketwatch.com/story/freeport-mcmoran-tops-earn…

Freeport-McMoRan Inc. said Thursday it had net income of $9 million, or less than 1 cent a share, in the fourth quarter, down from $485 million, or 33 cents a share, in the year-earlier period.

Adjusted per-share earnings came to 2 cents, ahead of the FactSet consensus for breakeven. The copper and gold miner said revenue rose to $3.911 billion from $3.684 billion, well ahead of the $3.698 billion FactSet consensus.

Sales of copper totaled 906 million pounds, sales of gold came to 317 thousand ounces and sales of molybdenum came to 22 million pounds in the quarter. For 2020, the company is expecting sales of about 3.5 billion pounds of copper, 0.8 million ounces of gold and 88 million pounds of molybdenum, including 725 million pounds of copper, 105 thousand ounces of gold and 22 million pounds of molybdenum in the first quarter.

Capital expenditures are expected to come to $2.8 billion in 2020 after $2.65 billion in 2019, and will fund underground development...

(FC: Format)

--> pre-market z.Z. -3%

6.2.

Barrick Gold denies Freeport-McMoran tie-up in the works

https://finance.yahoo.com/news/barrick-gold-denies-freeport-…

...

Barrick Gold is not looking to merge with copper miner Freeport-McMoran, CEO Mark Bristow said on Thursday, although he is interested in the company's Grasberg mine in Indonesia, and indicated he wants to expand in the Pacific Rim.

Rumours the world's second-largest gold miner planned to combine with Freeport are "completely wrong", Bristow told Reuters on the sidelines of the Mining Indaba conference in Cape Town.

But he said he was interested in Freeport's Grasberg mine in Indonesia - the world's largest gold mine, and second-largest copper mine.

"People say, are you interested in Grasberg? I say I have to be, it's a tier one asset," he said. Tier one assets refer to high-grade, long-life mines.

The CEO wants to grow Barrick's copper business to capitalise on a projected increase in demand because of the rising popularity of electric vehicles.

"If you're going to be a world-class gold miner, you're going to have to accept copper. In ten years' time the most strategic metal on this planet is copper, if you believe the EV story, and I do," said Bristow.

He cautioned, however, that he was far from finding a deal that would work.

Freeport-McMoran, which traces its roots back to 1834, could bring with it legacy risk, he said.

"Freeport is a very old company and it has bought lots of very old companies so there's risk, rehabilitation liabilities... and also you would never want to go in a place like Indonesia without proper due diligence," he said.

Freeport-McMoran's CEO has said he would consider acquisitions, mergers, or other deals once three ongoing expansion projects finish by 2022.

PAPUA NEW GUINEA OFFER

Struggling with unrest at the Porgera mine in Papua New Guinea (PNG), Bristow told Reuters that Barrick offered the government a 52% share of the economic benefits of the mine in response to government demands for a larger stake.

"Our principle is 50-50, like we did with Tanzania," he said. "In fact in this case we will pay a little bit more than 50."

Barrick last month signed a deal with Tanzania that gave the state a 16% stake in each of the company's three gold mines in the country and an equal share of the economic benefits from the mines, ending a bitter tax dispute.

If Barrick succeeds in resolving the dispute in PNG, the market will be more comfortable with the company taking on more risk in the copper- and gold-rich Pacific Rim, Bristow said.

Papua New Guinea called off negotiations with ExxonMobil on the P'nyang gas project last Friday, blaming the energy giant for inflexibility over the government's demand for a bigger stake.

Asked about the Lumwana copper mine in Zambia, Bristow said he wouldn't necessarily sell it, and could instead look for a partner in Zambia or a deal with a copper processor...

Barrick Gold denies Freeport-McMoran tie-up in the works

https://finance.yahoo.com/news/barrick-gold-denies-freeport-…

...

Barrick Gold is not looking to merge with copper miner Freeport-McMoran, CEO Mark Bristow said on Thursday, although he is interested in the company's Grasberg mine in Indonesia, and indicated he wants to expand in the Pacific Rim.

Rumours the world's second-largest gold miner planned to combine with Freeport are "completely wrong", Bristow told Reuters on the sidelines of the Mining Indaba conference in Cape Town.

But he said he was interested in Freeport's Grasberg mine in Indonesia - the world's largest gold mine, and second-largest copper mine.

"People say, are you interested in Grasberg? I say I have to be, it's a tier one asset," he said. Tier one assets refer to high-grade, long-life mines.

The CEO wants to grow Barrick's copper business to capitalise on a projected increase in demand because of the rising popularity of electric vehicles.

"If you're going to be a world-class gold miner, you're going to have to accept copper. In ten years' time the most strategic metal on this planet is copper, if you believe the EV story, and I do," said Bristow.

He cautioned, however, that he was far from finding a deal that would work.

Freeport-McMoran, which traces its roots back to 1834, could bring with it legacy risk, he said.

"Freeport is a very old company and it has bought lots of very old companies so there's risk, rehabilitation liabilities... and also you would never want to go in a place like Indonesia without proper due diligence," he said.

Freeport-McMoran's CEO has said he would consider acquisitions, mergers, or other deals once three ongoing expansion projects finish by 2022.

PAPUA NEW GUINEA OFFER

Struggling with unrest at the Porgera mine in Papua New Guinea (PNG), Bristow told Reuters that Barrick offered the government a 52% share of the economic benefits of the mine in response to government demands for a larger stake.

"Our principle is 50-50, like we did with Tanzania," he said. "In fact in this case we will pay a little bit more than 50."

Barrick last month signed a deal with Tanzania that gave the state a 16% stake in each of the company's three gold mines in the country and an equal share of the economic benefits from the mines, ending a bitter tax dispute.

If Barrick succeeds in resolving the dispute in PNG, the market will be more comfortable with the company taking on more risk in the copper- and gold-rich Pacific Rim, Bristow said.

Papua New Guinea called off negotiations with ExxonMobil on the P'nyang gas project last Friday, blaming the energy giant for inflexibility over the government's demand for a bigger stake.

Asked about the Lumwana copper mine in Zambia, Bristow said he wouldn't necessarily sell it, and could instead look for a partner in Zambia or a deal with a copper processor...

Antwort auf Beitrag Nr.: 62.608.873 von faultcode am 06.02.20 22:35:2312.2.

Barrick Gold CEO Expects to Beat $1.5 Billion Asset-Sale Target

https://www.bnnbloomberg.ca/barrick-gold-ceo-expects-to-beat…

...

In December, Bristow said Barrick may some day look into a possible merger with Freeport-McMoRan Inc., the largest publicly traded copper producer. On Wednesday, Bristow said that idea is still at a conceptual stage, but could include anything from a merger to the acquisition of Freeport assets. “Copper is the most strategic metal,” Bristow said.

...

--> ich bin nicht so sicher, ob die USA Freeport-McMoRan (unter dieser Administration) so einfach "hergeben" wollen

--> siehe wie das mit Newmont und Barrick und Goldcorp 2019 lief

=> Newmont blieb amerikanisch und Barrick kanadisch mit dem Nevada-JV in der Mitte (für Gold)

Barrick Gold CEO Expects to Beat $1.5 Billion Asset-Sale Target

https://www.bnnbloomberg.ca/barrick-gold-ceo-expects-to-beat…

...

In December, Bristow said Barrick may some day look into a possible merger with Freeport-McMoRan Inc., the largest publicly traded copper producer. On Wednesday, Bristow said that idea is still at a conceptual stage, but could include anything from a merger to the acquisition of Freeport assets. “Copper is the most strategic metal,” Bristow said.

...

--> ich bin nicht so sicher, ob die USA Freeport-McMoRan (unter dieser Administration) so einfach "hergeben" wollen

--> siehe wie das mit Newmont und Barrick und Goldcorp 2019 lief

=> Newmont blieb amerikanisch und Barrick kanadisch mit dem Nevada-JV in der Mitte (für Gold)

Antwort auf Beitrag Nr.: 62.659.426 von faultcode am 12.02.20 16:53:5119.2.

Freeport Indonesia aims for August kick-off of construction on new copper smelter

https://finance.yahoo.com/news/freeport-indonesia-aims-augus…

...

Freeport Indonesia, operator of Grasberg, the world's second-biggest copper mine, expects to start construction of a new smelter in August, its chief executive said on Wednesday.

Front-end engineering and design for the $3 billion smelter has been concluded and ground preparation is expected to finish in around three months, said Tony Wenas, chief executive of PT Freeport Indonesia, a unit of Freeport-McMoran Inc.

Construction of a smelter is part of Freeport-McMoran's deal with the Indonesian government to maintain its mining rights at Grasberg until 2041, and the U.S. company has said it is committed to building one by Dec. 21, 2023.

"Ground preparation will be finished soon, maybe in two to three months, and it will be followed immediately by physical construction," Wenas told a parliamentary committee.

The smelter, to be located in East Java, is expected to consume 2 million tonnes of copper concentrate a year and produce between 500,000 tonnes to 600,000 tonnes of copper cathodes annually, he said.

The new plant will add to its existing smelting output of 300,000 tonnes of cathodes a year.

Wenas said the company is in talks with nine banks to secure $2.8 billion in loans to help finance the construction.

Meanwhile, the company has started to transition to underground mining at Grasberg in Indonesia's Papua province, which is expected to affect its copper output.

Output from the mine in 2020 is expected at around 50% of its "normal level" at around 210,000 tonnes of ore per day, with output to return to normal in 2022.

Freeport Indonesia expects to produce more than 1 million tonnes of copper concentrate this year, spokesman Riza Pratama said.

,,,

Freeport Indonesia aims for August kick-off of construction on new copper smelter

https://finance.yahoo.com/news/freeport-indonesia-aims-augus…

...

Freeport Indonesia, operator of Grasberg, the world's second-biggest copper mine, expects to start construction of a new smelter in August, its chief executive said on Wednesday.

Front-end engineering and design for the $3 billion smelter has been concluded and ground preparation is expected to finish in around three months, said Tony Wenas, chief executive of PT Freeport Indonesia, a unit of Freeport-McMoran Inc.

Construction of a smelter is part of Freeport-McMoran's deal with the Indonesian government to maintain its mining rights at Grasberg until 2041, and the U.S. company has said it is committed to building one by Dec. 21, 2023.

"Ground preparation will be finished soon, maybe in two to three months, and it will be followed immediately by physical construction," Wenas told a parliamentary committee.

The smelter, to be located in East Java, is expected to consume 2 million tonnes of copper concentrate a year and produce between 500,000 tonnes to 600,000 tonnes of copper cathodes annually, he said.

The new plant will add to its existing smelting output of 300,000 tonnes of cathodes a year.

Wenas said the company is in talks with nine banks to secure $2.8 billion in loans to help finance the construction.

Meanwhile, the company has started to transition to underground mining at Grasberg in Indonesia's Papua province, which is expected to affect its copper output.

Output from the mine in 2020 is expected at around 50% of its "normal level" at around 210,000 tonnes of ore per day, with output to return to normal in 2022.

Freeport Indonesia expects to produce more than 1 million tonnes of copper concentrate this year, spokesman Riza Pratama said.

,,,

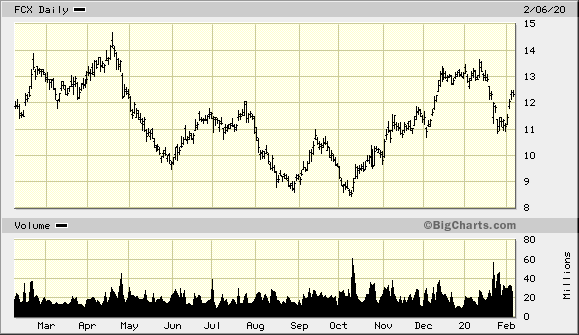

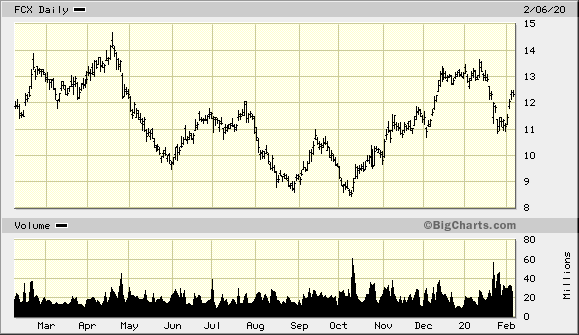

Hap Sneddon discusses Freeport-McMoRan

https://www.bnnbloomberg.ca/video/hap-sneddon-discusses-free…

https://www.bnnbloomberg.ca/video/hap-sneddon-discusses-free…

lohnt sich wohl jetzt einzusteigen?

23.3.

Freeport-McMoRan to cut costs, suspends dividend

https://finance.yahoo.com/news/freeport-mcmoran-cut-costs-su…

...

Freeport-McMoRan Inc said on Monday it will cut costs, and warned that the revised operating plans would lead to temporary reductions in copper and molybdenum production in the Americas.

The world's largest publicly traded copper producer also said it would suspend the quarterly cash dividend of $0.05 per share, in the face of the COVID-19 pandemic and global economic uncertainties...

Freeport-McMoRan to cut costs, suspends dividend

https://finance.yahoo.com/news/freeport-mcmoran-cut-costs-su…

...

Freeport-McMoRan Inc said on Monday it will cut costs, and warned that the revised operating plans would lead to temporary reductions in copper and molybdenum production in the Americas.

The world's largest publicly traded copper producer also said it would suspend the quarterly cash dividend of $0.05 per share, in the face of the COVID-19 pandemic and global economic uncertainties...

Wir warten auf das Doppeltief und Vertrauem Kupfer + Gold

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +3,73 | |

| +1,57 | |

| +0,55 | |

| +12,59 | |

| +0,76 | |

| +0,72 | |

| +1,64 | |

| +1,89 | |

| +0,52 | |

| +1,45 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 241 | ||

| 93 | ||

| 83 | ||

| 77 | ||

| 73 | ||

| 53 | ||

| 45 | ||

| 38 | ||

| 37 | ||

| 34 |

23.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

17.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

16.04.24 · Sharedeals · Freeport-McMoRan |

16.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

04.04.24 · dpa-AFX · Freeport-McMoRan |

29.03.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

19.03.24 · Gold-Silber-Rohstofftrends · BHP Group |