Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share - Älteste Beiträge zuerst (Seite 8) | Diskussion im Forum

eröffnet am 17.09.15 13:06:55 von

neuester Beitrag 18.12.23 18:35:21 von

neuester Beitrag 18.12.23 18:35:21 von

Beiträge: 117

ID: 1.218.621

ID: 1.218.621

Aufrufe heute: 0

Gesamt: 6.811

Gesamt: 6.811

Aktive User: 0

ISIN: US7185461040 · WKN: A1JWQU · Symbol: PSX

158,84

USD

+1,14 %

+1,79 USD

Letzter Kurs 23:05:00 NYSE

Neuigkeiten

03.04.24 · Business Wire (engl.) |

02.04.24 · wO Newsflash |

01.04.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

29.02.24 · Business Wire (engl.) |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,0800 | +43,06 | |

| 12,990 | +38,93 | |

| 0,5070 | +31,52 | |

| 17,200 | +27,31 | |

| 1,0200 | +24,39 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,7200 | -8,82 | |

| 0,740 | -8,89 | |

| 7,1700 | -9,58 | |

| 0,6500 | -12,16 | |

| 20,000 | -33,33 |

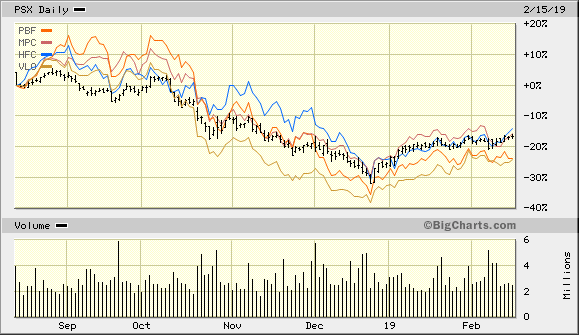

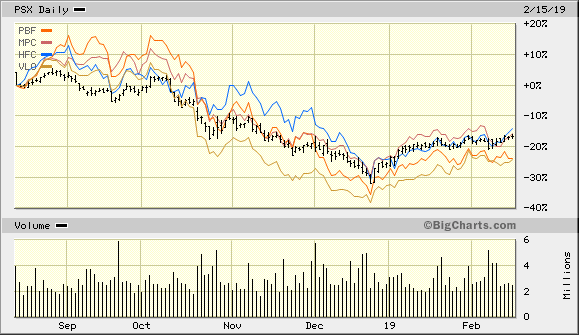

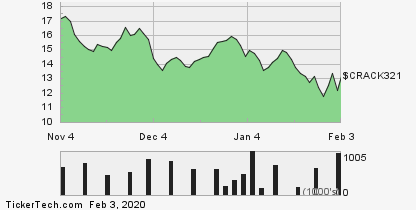

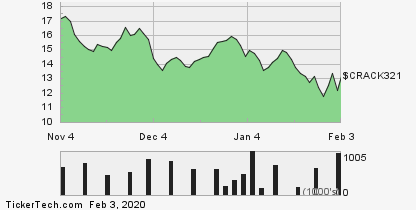

Antwort auf Beitrag Nr.: 59.593.100 von faultcode am 09.01.19 14:44:446m-Rückschau:

--> US oil refiners machen alle dasselbe

--> US oil refiners machen alle dasselbe

HOUSTON (AP) _ Phillips 66 (PSX) on Tuesday reported first-quarter net income of $204 million.

On a per-share basis, the Houston-based company said it had net income of 44 cents. Earnings, adjusted for non-recurring gains, were 40 cents per share.

etwas nachgekauft.

div erhöhung (3,60$?) sollte ja kommen.

On a per-share basis, the Houston-based company said it had net income of 44 cents. Earnings, adjusted for non-recurring gains, were 40 cents per share.

etwas nachgekauft.

div erhöhung (3,60$?) sollte ja kommen.

Antwort auf Beitrag Nr.: 60.458.672 von biviol1 am 30.04.19 17:38:00kommt!

--> May 17 -- $0.90 (vorher $0.80)

--> May 17 -- $0.90 (vorher $0.80)

UPDATE 2-Intensifying storm shuts U.S. coastal refinery, adding to energy production losses

Saison geht wieder los:11.7.

Threatened flooding from a tropical storm in the U.S. Gulf of Mexico that cut nearly a third of the region's oil production has forced the shutdown of a coastal refinery, pushing oil and gasoline prices higher on Thursday.

Phillips 66 said it expected to complete the closing of its 253,600-barrel-per-day (bpd) Alliance, Louisiana, refinery on Thursday after local authorities ordered a mandatory evacuation of the area.

Pipeline operator Enbridge evacuated staff from three offshore platforms and halted operations on some deepwater Gulf of Mexico natural gas pipelines.

Oil companies have shut a third of offshore U.S. Gulf of Mexico production ahead of Tropical Storm Barry, which could become a Hurricane late Friday, according to a National Weather Service (NWS) forecast.

At least 17 offshore oil and gas platforms operated by Anadarko Petroleum, Chevron, Royal Dutch Shell and others were evacuated, and many halted production, according to company reports.

Crude futures, which rose more than 4% on Wednesday, were fractionally higher on Thursday, with U.S. crude trading at $60.69, the highest since May. Gasoline futures also rose a fraction.

The storm's predicted path puts landfall near two of the nation's four operating liquefied natural gas (LNG) export terminals, Cheniere Energy's Sabine Pass and Sempra Energy's Cameron plants.

Data provider Refinitiv said natural gas output in the Lower 48 states could drop to a seven-week low of 87.2 billion cubic feet per day (bcfd) on Thursday due to the closings, from a record high of 91.1 bcfd on July 5.

On Thursday morning, the storm was about 95 miles (150 km) southeast of the mouth of the Mississippi River, moving west at about 5 miles per hour (7 km per hour). It could make landfall on Saturday on the Louisiana coast and bring up to 15 inches (38 cm) of rain to the central Gulf Coast, forecasters said.

The potential storm could become a Category 1 hurricane with winds of at least 74 mph (119 kph) and drive ocean water up the Mississippi, forecasters said. The storm surge is projected to bring 3 feet to 6 feet (.9 meter to 1.8 meters) to shore, worsening flooding from heavy rains, according to the weather service.

The Alliance refinery sits next to the river 39 miles (63 km) south of New Orleans. The last hurricane to flood the refinery was 2012's Hurricane Isaac. The refinery was also shut by Hurricane Gustav in 2008 and Hurricane Katrina in 2005.

In 2017, Hurricane Nate led Phillips 66 to shut the refinery, which was restarted within days as the storm turned away from the area.

PBF Energy and Valero Energy Corp do not plan to idle their refineries in Chalmette and Meraux, Louisiana, sources familiar with plant operations said on Thursday morning...

https://www.globalwitness.org/en/campaigns/oil-gas-and-minin…

wer verdient mehr daran transport oder verarbeitung?

wer verdient mehr daran transport oder verarbeitung?

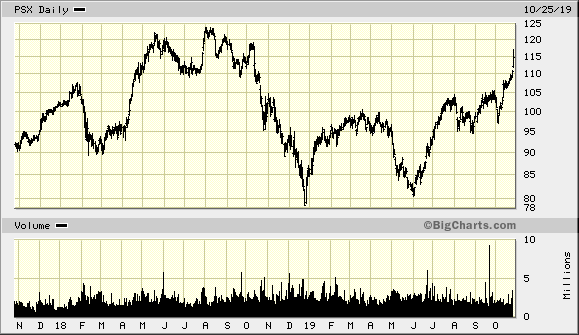

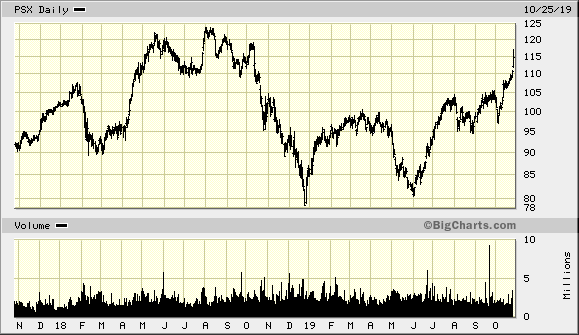

Antwort auf Beitrag Nr.: 61.015.481 von faultcode am 12.07.19 19:26:5925.10.

Refiner Phillips 66 beats profit estimates on fuel sales strength

https://finance.yahoo.com/news/1-refiner-phillips-66-beats-1…

=>

...U.S. refiner Phillips 66 beat estimates for quarterly profit on Friday, boosted by strong performance in its fuel sales business.

Phillips 66 processes, transports, stores and markets fuels and products and has been redesigning its Phillips 66, 76 and Conoco branded sites in the United States.

The efforts paid off with adjusted earnings in the segment jumping nearly 30% to $498 million.

Refined product exports rose nearly 16% to 220,000 barrels per day in the third quarter, the company said.

Net earnings fell to $712 million, or $1.58 per share, in the third quarter ended Sept. 30, from $1.49 billion, or $3.18 per share, a year earlier.

Excluding a $690 million impairment related to investments in DCP Midstream, the company earned $3.11 per share...

Refiner Phillips 66 beats profit estimates on fuel sales strength

https://finance.yahoo.com/news/1-refiner-phillips-66-beats-1…

=>

...U.S. refiner Phillips 66 beat estimates for quarterly profit on Friday, boosted by strong performance in its fuel sales business.

Phillips 66 processes, transports, stores and markets fuels and products and has been redesigning its Phillips 66, 76 and Conoco branded sites in the United States.

The efforts paid off with adjusted earnings in the segment jumping nearly 30% to $498 million.

Refined product exports rose nearly 16% to 220,000 barrels per day in the third quarter, the company said.

Net earnings fell to $712 million, or $1.58 per share, in the third quarter ended Sept. 30, from $1.49 billion, or $3.18 per share, a year earlier.

Excluding a $690 million impairment related to investments in DCP Midstream, the company earned $3.11 per share...

A Chinese national pleaded guilty on Tuesday to stealing trade secrets from U.S. petroleum company Phillips 66, where he worked on the research and development of next generation battery technologies , the U.S. Justice Department said.

, the U.S. Justice Department said.

https://finance.yahoo.com/news/1-chinese-national-pleads-gui…

, the U.S. Justice Department said.

, the U.S. Justice Department said.https://finance.yahoo.com/news/1-chinese-national-pleads-gui…

der US-Crack Spread steht zuletzt unter Druck:

https://www.energystockchannel.com/3-2-1-crack-spread/

https://www.energystockchannel.com/3-2-1-crack-spread/

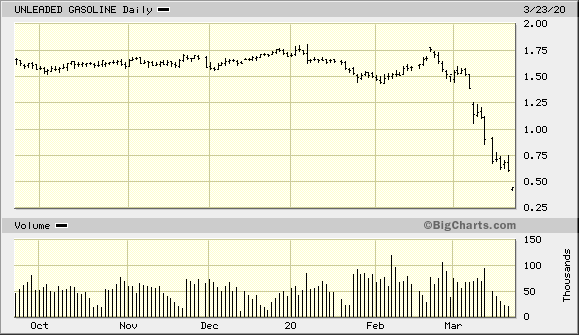

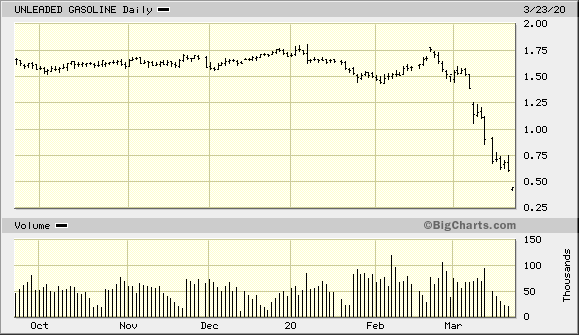

Antwort auf Beitrag Nr.: 62.578.009 von faultcode am 04.02.20 15:09:2324.3.

Phillips 66 cuts 2020 capex by $700 million, to temporarily suspend share buybacks

https://www.marketwatch.com/story/phillips-66-cuts-2020-cape…

Phillips 66 said Tuesday it is reducing 2020 capital spending by $700 million to $3.1 billion. The Houston-based energy and logistics company said it will defer and cancel certain discretionary proejcts and will reduce operationg costs by $500 million.

The company is temporarily suspending its share buyback program after buying back about $440 million worth in the first quarter. The company has secured a new $1 billion, 364-day term loan facility, which will provide additional liquidity to its existing $5 billion revolving credit facility. Phillips 66 Partners has a $750 million revolver.

"We will continue to closely monitor market conditions and evaluate the impact on our portfolio," Chief Executive Greg Garland said in a statement. "We are prepared to take additional action as needed."...

--> die Erlöspreise sind zuletzt brutal unter die Räder gekommen ("Shelter in place"); mehr als der Rohölpreis:

https://bigcharts.marketwatch.com/quickchart/quickchart.asp?…

Phillips 66 cuts 2020 capex by $700 million, to temporarily suspend share buybacks

https://www.marketwatch.com/story/phillips-66-cuts-2020-cape…

Phillips 66 said Tuesday it is reducing 2020 capital spending by $700 million to $3.1 billion. The Houston-based energy and logistics company said it will defer and cancel certain discretionary proejcts and will reduce operationg costs by $500 million.

The company is temporarily suspending its share buyback program after buying back about $440 million worth in the first quarter. The company has secured a new $1 billion, 364-day term loan facility, which will provide additional liquidity to its existing $5 billion revolving credit facility. Phillips 66 Partners has a $750 million revolver.

"We will continue to closely monitor market conditions and evaluate the impact on our portfolio," Chief Executive Greg Garland said in a statement. "We are prepared to take additional action as needed."...

--> die Erlöspreise sind zuletzt brutal unter die Räder gekommen ("Shelter in place"); mehr als der Rohölpreis:

https://bigcharts.marketwatch.com/quickchart/quickchart.asp?…

Hallo,

hat die US Fracking Industrie keine Produktion mehr so kann Phillips 66 auch kein Rohöl mehr durch die eigenen Raffinerien leiten. Die Tanks sind fast voll noch ein paar Wochen und die Raffinerien müssen gestoppt werden. Man hat aber hier auch noch ein Netz von 14000 Tankstellen welches Benzin/Diesel von Phillips 66 bekommen somit wird man immer noch einen Teil des Umsatzes machen können.

VG G

hat die US Fracking Industrie keine Produktion mehr so kann Phillips 66 auch kein Rohöl mehr durch die eigenen Raffinerien leiten. Die Tanks sind fast voll noch ein paar Wochen und die Raffinerien müssen gestoppt werden. Man hat aber hier auch noch ein Netz von 14000 Tankstellen welches Benzin/Diesel von Phillips 66 bekommen somit wird man immer noch einen Teil des Umsatzes machen können.

VG G

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +2,56 | |

| +1,47 | |

| +0,77 | |

| +2,85 | |

| -1,28 | |

| +0,15 | |

| +0,16 | |

| +0,30 | |

| -0,26 | |

| +0,60 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 219 | ||

| 135 | ||

| 81 | ||

| 61 | ||

| 49 | ||

| 45 | ||

| 43 | ||

| 41 | ||

| 34 | ||

| 30 |

Phillips 66 Reports Second-Quarter Earnings of $1.0 Billion or $1.84 Per Share