Südkorea-Bank: KB Financial Group - Älteste Beiträge zuerst

eröffnet am 13.06.18 16:41:14 von

neuester Beitrag 02.02.24 12:54:24 von

neuester Beitrag 02.02.24 12:54:24 von

Beiträge: 32

ID: 1.282.338

ID: 1.282.338

Aufrufe heute: 0

Gesamt: 3.867

Gesamt: 3.867

Aktive User: 0

ISIN: US48241A1051 · WKN: A0RAQX · Symbol: KBIA

48,00

EUR

+2,13 %

+1,00 EUR

Letzter Kurs 08:58:20 Tradegate

Neuigkeiten

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +500,00 | |

| 0,6800 | +312,12 | |

| 10,360 | +19,91 | |

| 1,6800 | +15,87 | |

| 0,8000 | +11,16 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,5100 | -10,99 | |

| 11,690 | -11,51 | |

| 1,5000 | -23,08 | |

| 0,7500 | -25,00 | |

| 0,5338 | -31,13 |

1.Posi.

Kim und Trump verstehen sich ja anscheinend ganz gut.

=> von teilweise sehr illiquiden Industriewerten - abseits von der allgegenwärtigen und staatstragenden Samsung - nehme ich Abstand.

=> bliebe nur alternativ:

(a) eine andere SK-Bank

und/oder

(b) ein SK-ETF

und/oder

(c) eine andere SK-Grossbank wie z.B.

• Shinhan Financial Group

• Industrial Bank Of Korea

• Hana Financial

=> und so entschied ich mich für "middle of the road" und einen liquiden, sponsored ADR (1:1).

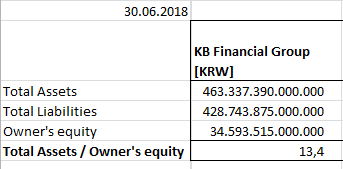

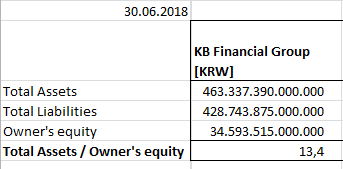

Ausserdem: KB macht SEC-filings. Ob's was hilft, was man eh - in Asien - nur hinterher :

:

https://www.nasdaq.com/symbol/kb/sec-filings

--> flottes Wachstum sollte man aber nicht unbedingt von keinem der obigen Institute (aus dem KOSPI 50) erwarten.

KOSPI 50-Komponenten:

https://de.investing.com/indices/kospi-50-components

Kim und Trump verstehen sich ja anscheinend ganz gut.

=> von teilweise sehr illiquiden Industriewerten - abseits von der allgegenwärtigen und staatstragenden Samsung - nehme ich Abstand.

=> bliebe nur alternativ:

(a) eine andere SK-Bank

und/oder

(b) ein SK-ETF

und/oder

(c) eine andere SK-Grossbank wie z.B.

• Shinhan Financial Group

• Industrial Bank Of Korea

• Hana Financial

=> und so entschied ich mich für "middle of the road" und einen liquiden, sponsored ADR (1:1).

Ausserdem: KB macht SEC-filings. Ob's was hilft, was man eh - in Asien - nur hinterher

:

:https://www.nasdaq.com/symbol/kb/sec-filings

--> flottes Wachstum sollte man aber nicht unbedingt von keinem der obigen Institute (aus dem KOSPI 50) erwarten.

KOSPI 50-Komponenten:

https://de.investing.com/indices/kospi-50-components

Antwort auf Beitrag Nr.: 57.977.532 von faultcode am 13.06.18 16:41:14North Korea reportedly wants a 'Vietnam-like' debut to the world economy

https://finance.yahoo.com/news/north-korea-reportedly-wants-…

=>

-- North Korean leader Kim Jong Un reportedly wants to follow a "Vietnam-like" opening of the country's economy.

-- Some analysts doubt that's possible given the country's troubled economic past and nature of the Kim regime.

-- It's also unclear if and when the US will lift sanctions on Pyongyang, which has gone back on vows to denuclearize before.

https://finance.yahoo.com/news/north-korea-reportedly-wants-…

=>

-- North Korean leader Kim Jong Un reportedly wants to follow a "Vietnam-like" opening of the country's economy.

-- Some analysts doubt that's possible given the country's troubled economic past and nature of the Kim regime.

-- It's also unclear if and when the US will lift sanctions on Pyongyang, which has gone back on vows to denuclearize before.

Antwort auf Beitrag Nr.: 57.981.114 von faultcode am 13.06.18 23:44:12Hintergrund: https://www.wallstreet-online.de/diskussion/1086090-92061-92…

=>

=> geht so...

=>

=> geht so...

South Korea Producer Price Index (PPI), 2009-2019

.

aus: WSJ, The Daily Shot

=> das sieht nicht gut aus...

Antwort auf Beitrag Nr.: 60.241.839 von faultcode am 31.03.19 23:47:08

https://www.usnews.com/news/business/articles/2019-07-17/sou…

=>

...South Korea's central bank on Thursday cut its policy rate for the first time in three years to shore up growth threatened by a trade dispute with Japan.

The Bank of Korea lowered its key interest rate by a quarter percentage point to 1.50% following a meeting of its monetary policy committee, which also cut its growth forecast for the country's economy this year from 2.5% to 2.2%.

The bank cited slowing exports and domestic investment and volatility in financial markets related to the trade war between the U.S. and China and Japanese curbs on certain technology exports to South Korea. The bank had hiked the rate by 0.25% points in November and last lowered borrowing costs in June 2016.

The bank said in a statement it will "carefully monitor developments such as the U.S.-China trade dispute, Japan's export restrictions, any changes in the economies and monetary policies of major countries ... and geopolitical risks, while examining their effects on domestic growth and inflation."

Lee Ju-yeol, the bank's governor, said South Korea's exports and domestic investment during the first half of the year were more sluggish than expected and that it's "hard to be optimistic about the (economic) conditions moving forward."

The rate cut came amid escalating tensions between South Korea and Japan over Tokyo's move to tighten controls on the exports of photoresists and two other chemicals to South Korean companies that use them to produce semiconductors and display screens for smartphones and TVs.

South Korea says the Japanese trade curbs could hurt its export-dependent economy and disrupt global supply chains. Lee said the bank's monetary policymakers assessed how the trade dispute could affect growth at the macroeconomic level.

South Korea has accused Japan of weaponizing trade to retaliate against South Korean court rulings calling for Japanese companies to compensate aging South Korean plaintiffs for forced labor during World War II, and plans to file a complaint with the World Trade Organization.

Tokyo says the materials affected by the export controls can be sent only to trustworthy trading partners. Without presenting specific examples, it has questioned Seoul's credibility in controlling the exports of arms and items that can be used both for civilian and military purposes.

South Korea is also bracing for the possibility that Japan will take further steps by removing it from a 27-country "whitelist" receiving preferential treatment in trade....

South Korea's Central Bank Lowers Rate Amid Japan Trade Row

17.7.https://www.usnews.com/news/business/articles/2019-07-17/sou…

=>

...South Korea's central bank on Thursday cut its policy rate for the first time in three years to shore up growth threatened by a trade dispute with Japan.

The Bank of Korea lowered its key interest rate by a quarter percentage point to 1.50% following a meeting of its monetary policy committee, which also cut its growth forecast for the country's economy this year from 2.5% to 2.2%.

The bank cited slowing exports and domestic investment and volatility in financial markets related to the trade war between the U.S. and China and Japanese curbs on certain technology exports to South Korea. The bank had hiked the rate by 0.25% points in November and last lowered borrowing costs in June 2016.

The bank said in a statement it will "carefully monitor developments such as the U.S.-China trade dispute, Japan's export restrictions, any changes in the economies and monetary policies of major countries ... and geopolitical risks, while examining their effects on domestic growth and inflation."

Lee Ju-yeol, the bank's governor, said South Korea's exports and domestic investment during the first half of the year were more sluggish than expected and that it's "hard to be optimistic about the (economic) conditions moving forward."

The rate cut came amid escalating tensions between South Korea and Japan over Tokyo's move to tighten controls on the exports of photoresists and two other chemicals to South Korean companies that use them to produce semiconductors and display screens for smartphones and TVs.

South Korea says the Japanese trade curbs could hurt its export-dependent economy and disrupt global supply chains. Lee said the bank's monetary policymakers assessed how the trade dispute could affect growth at the macroeconomic level.

South Korea has accused Japan of weaponizing trade to retaliate against South Korean court rulings calling for Japanese companies to compensate aging South Korean plaintiffs for forced labor during World War II, and plans to file a complaint with the World Trade Organization.

Tokyo says the materials affected by the export controls can be sent only to trustworthy trading partners. Without presenting specific examples, it has questioned Seoul's credibility in controlling the exports of arms and items that can be used both for civilian and military purposes.

South Korea is also bracing for the possibility that Japan will take further steps by removing it from a 27-country "whitelist" receiving preferential treatment in trade....

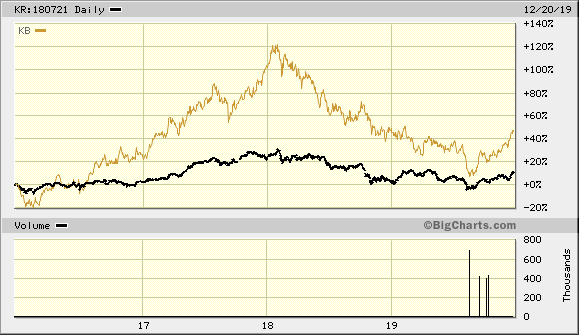

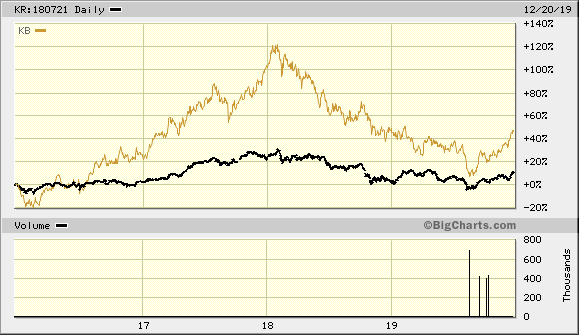

Antwort auf Beitrag Nr.: 61.055.380 von faultcode am 18.07.19 14:07:27hier wird mMn eine China-Erholung gespielt:

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?…

KR:180721 = KOSPI Composite (Kursindex)

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?…

KR:180721 = KOSPI Composite (Kursindex)

Antwort auf Beitrag Nr.: 62.208.822 von faultcode am 20.12.19 18:18:27Wie viel Dividende zahlen die???? Wollen die Körperschaftssteuer????

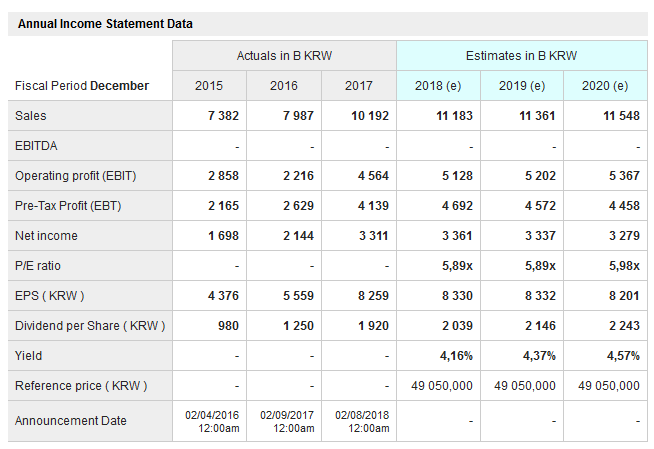

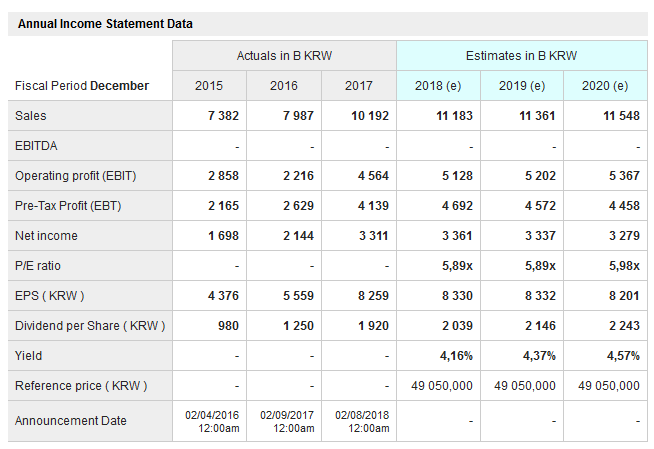

Antwort auf Beitrag Nr.: 62.209.194 von Fmüller am 20.12.19 19:02:07die Brutto-Dividenden-Rendite liegt z.Z. bei so 4%:

https://www.marketscreener.com/KB-FINANCIAL-GROUP-INC-650033…

--> aus dem Form 6-K sieht man die genauen Angaben (hier für FY2018):

Declaration of Dividends

A cash dividend of KRW 1,920 per common share was declared

Total dividend amount: KRW 759,736,452,480

Dividend yield: 4.0%

https://www.sec.gov/Archives/edgar/data/1445930/000119312519…

https://www.kbfg.com/Eng/ir/sec/Current/1/list.jsp?P=1&SEARC…

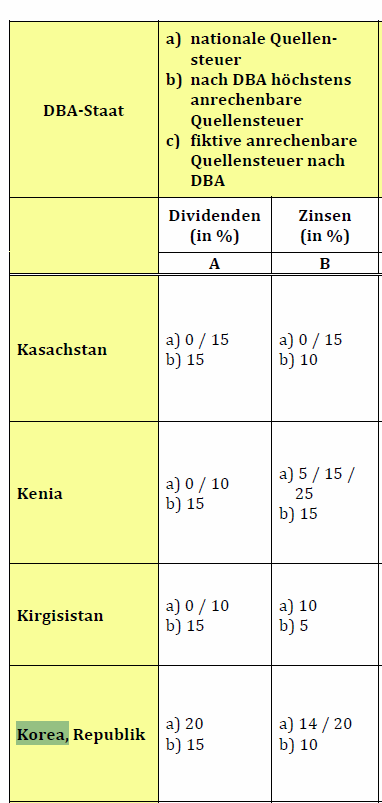

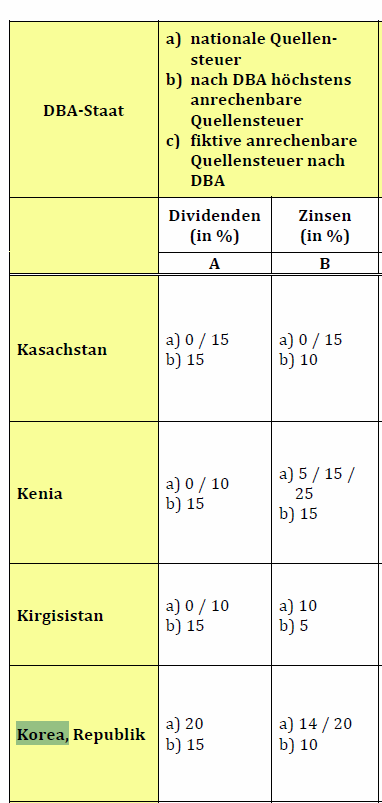

--> ja eine Quellensteuer/Withholding tax auf die Dividende wird einbehalten: 20% in Deutschland

https://www.bzst.de/SharedDocs/Downloads/DE/EU_OECD/anrechen…

https://www.marketscreener.com/KB-FINANCIAL-GROUP-INC-650033…

--> aus dem Form 6-K sieht man die genauen Angaben (hier für FY2018):

Declaration of Dividends

A cash dividend of KRW 1,920 per common share was declared

Total dividend amount: KRW 759,736,452,480

Dividend yield: 4.0%

https://www.sec.gov/Archives/edgar/data/1445930/000119312519…

https://www.kbfg.com/Eng/ir/sec/Current/1/list.jsp?P=1&SEARC…

--> ja eine Quellensteuer/Withholding tax auf die Dividende wird einbehalten: 20% in Deutschland

https://www.bzst.de/SharedDocs/Downloads/DE/EU_OECD/anrechen…

offenbar lieben Retailer auf der ganzen Welt anti-zyklisches Investieren/Spekulieren:

3.4.

Retail Investors Pump Money MoneyKorean Stocks Like Never Before

https://finance.yahoo.com/news/retail-investors-pump-money-k…

While the pros are shunning Korean stocks, the nation’s mom-and-pops are diving right in.

The benchmark Kospi index has rebounded almost 20% from a low in March, even as foreign and local funds kept fleeing the market, offloading some 24 trillion won ($19.5 billion) net of the gauge’s shares this year. That’s because retail investors -- known as “patriotic ants” for their herd behavior that’s propping up the market -- have been buying at a record pace. They’ve added 22 trillion won net of the equities, including the biggest quarterly additions since Bloomberg began compiling the data in 1997.

Known for their appetite for products ranging from complex structured notes to risky hedge funds, Korea’s individual traders usually favor short-term, speculative bets and account for nearly 60% of Kospi volume, according to NH Investment & Securities Co. The recent Bank of Korea rate cut is now also drawing wealthy investors with a long-term view to the nation’s $1 trillion stock market, Samsung Securities Co. said.

“Most retail investors were speculative traders, but recently I saw many wealthy people coming to the stock market,” said You Seung-Min, chief strategist at Samsung Securities. “Bank of Korea’s 50 basis-point cut seems to have shocked them. The government’s stronger regulations on real estate are pushing them to seek a return from stocks.”

Their favorite pick has been Samsung Electronics Co., the nation’s biggest stock, followed by peer SK Hynix Inc. Both have tumbled 16% this year. On Naver Corp., the nation’s biggest portal website, at least 80 community posts read, “Do you think it’s the right time to buy Samsung Electronics?” or “Samsung will never fail, it’s like a bond.”

“Samsung’s stock is probably a good investment for retail investors, as it is planning to offer about a 3% dividend yield for this year, higher than the interest rate in Korea,” said Chung Chang-won, an analyst at Nomura International Hong Kong Ltd. who noted it has become easier to invest in the shares since a split in 2018.

Korean regulators said in a Thursday statement that retail investors should refrain from “reckless buying” of the nation’s equities, especially with borrowed money. Leveraged investments in the market hit 10.5 trillion won on Feb. 25, the highest since June 2019, according to the latest data from the Korea Financial Investment Association.

“There is at least 1,000 trillion won of floating money in Korea,” Chung said. “They really have nowhere to invest.”

3.4.

Retail Investors Pump Money MoneyKorean Stocks Like Never Before

https://finance.yahoo.com/news/retail-investors-pump-money-k…

While the pros are shunning Korean stocks, the nation’s mom-and-pops are diving right in.

The benchmark Kospi index has rebounded almost 20% from a low in March, even as foreign and local funds kept fleeing the market, offloading some 24 trillion won ($19.5 billion) net of the gauge’s shares this year. That’s because retail investors -- known as “patriotic ants” for their herd behavior that’s propping up the market -- have been buying at a record pace. They’ve added 22 trillion won net of the equities, including the biggest quarterly additions since Bloomberg began compiling the data in 1997.

Known for their appetite for products ranging from complex structured notes to risky hedge funds, Korea’s individual traders usually favor short-term, speculative bets and account for nearly 60% of Kospi volume, according to NH Investment & Securities Co. The recent Bank of Korea rate cut is now also drawing wealthy investors with a long-term view to the nation’s $1 trillion stock market, Samsung Securities Co. said.

“Most retail investors were speculative traders, but recently I saw many wealthy people coming to the stock market,” said You Seung-Min, chief strategist at Samsung Securities. “Bank of Korea’s 50 basis-point cut seems to have shocked them. The government’s stronger regulations on real estate are pushing them to seek a return from stocks.”

Their favorite pick has been Samsung Electronics Co., the nation’s biggest stock, followed by peer SK Hynix Inc. Both have tumbled 16% this year. On Naver Corp., the nation’s biggest portal website, at least 80 community posts read, “Do you think it’s the right time to buy Samsung Electronics?” or “Samsung will never fail, it’s like a bond.”

“Samsung’s stock is probably a good investment for retail investors, as it is planning to offer about a 3% dividend yield for this year, higher than the interest rate in Korea,” said Chung Chang-won, an analyst at Nomura International Hong Kong Ltd. who noted it has become easier to invest in the shares since a split in 2018.

Korean regulators said in a Thursday statement that retail investors should refrain from “reckless buying” of the nation’s equities, especially with borrowed money. Leveraged investments in the market hit 10.5 trillion won on Feb. 25, the highest since June 2019, according to the latest data from the Korea Financial Investment Association.

“There is at least 1,000 trillion won of floating money in Korea,” Chung said. “They really have nowhere to invest.”

Antwort auf Beitrag Nr.: 63.226.425 von faultcode am 03.04.20 12:14:11

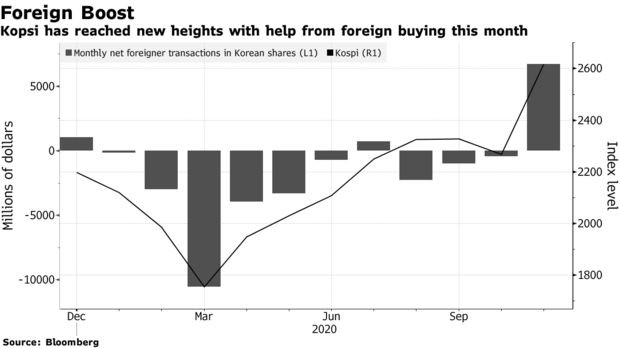

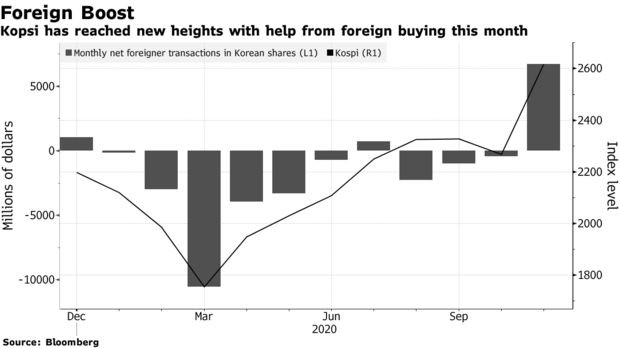

24.11.

From Asian Loser To Darling: South Korea’s Stocks Win Fund Fans

https://www.bloomberg.com/news/articles/2020-11-24/from-asia…

24.11.

From Asian Loser To Darling: South Korea’s Stocks Win Fund Fans

https://www.bloomberg.com/news/articles/2020-11-24/from-asia…

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,56 | |

| +0,10 | |

| -0,06 | |

| -2,23 | |

| +0,89 | |

| +0,22 | |

| +0,24 | |

| +0,54 | |

| +0,33 | |

| -0,23 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 185 | ||

| 126 | ||

| 90 | ||

| 66 | ||

| 65 | ||

| 50 | ||

| 41 | ||

| 32 | ||

| 32 | ||

| 31 |