Genta - Revolution in der Krebstherapie? - 500 Beiträge pro Seite (Seite 111)

eröffnet am 20.08.06 00:07:01 von

neuester Beitrag 05.03.14 13:45:53 von

neuester Beitrag 05.03.14 13:45:53 von

Beiträge: 55.414

ID: 1.077.896

ID: 1.077.896

Aufrufe heute: 21

Gesamt: 4.999.058

Gesamt: 4.999.058

Aktive User: 0

ISIN: US37245M8010 · WKN: A1H6PM

Werte aus der Branche Biotechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,155 | +21,04 | |

| 8,1400 | +20,41 | |

| 8,0200 | +19,35 | |

| 0,8232 | +17,25 | |

| 0,6600 | +15,79 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6700 | -26,58 | |

| 2,1300 | -34,41 | |

| 3,1600 | -38,64 | |

| 1,7000 | -49,40 | |

| 125,00 | -95,83 |

Antwort auf Beitrag Nr.: 43.233.661 von Scania01 am 31.05.12 17:59:48Ich sehe schon wieder 39 Millionen im Angebot. Wer traut sich noch ein paar zu kaufen?

Zitat von Expertchen007:....schnell rein...Rakete...Go Genta Go.....Up up.....0,50...1 US$.....schnell schnell..... !!!!

Hammer ...bald vielleicht Zulassung....Genta will Bayer kaufen glaub ich und auch alle anderen ( strebt klar 100% Marktbeherschung in allen Bereichen an - incl. Beiersdorf Hansplast Pflaster)....Go Genta GO !!!!!!!

Expertchen007, möchtest du ein paar smilies verwenden?!

Ich weiss nicht, was bei dir ernst und was Spaß ist.

Ich weiss nicht, was bei dir ernst und was Spaß ist.

Antwort auf Beitrag Nr.: 43.236.559 von realtimeinfo am 01.06.12 10:36:32Hi ,

na Du bist lustig -also noch eindeutiger und noch ironischer, kann ich sowas nicht schreiben.

Also es war natürlich Nonsens ist doch klar...oder meinst Du echt Genta kauft ca. 3000 Boitechunternehmen auf um die Weltherrschaft zu übernehmen.

na Du bist lustig -also noch eindeutiger und noch ironischer, kann ich sowas nicht schreiben.

Also es war natürlich Nonsens ist doch klar...oder meinst Du echt Genta kauft ca. 3000 Boitechunternehmen auf um die Weltherrschaft zu übernehmen.

Zitat von Expertchen007: Hi ,

na Du bist lustig -also noch eindeutiger und noch ironischer, kann ich sowas nicht schreiben.

Also es war natürlich Nonsens ist doch klar...oder meinst Du echt Genta kauft ca. 3000 Boitechunternehmen auf um die Weltherrschaft zu übernehmen.

Die MK hätten sie ja, jedenfalls, was Aktienanzahl anbetrifft und vorrausgesetzt, dass die Aktie enorm steigt.

Antwort auf Beitrag Nr.: 43.236.877 von Expertchen007 am 01.06.12 11:21:28Genta hat sicherlich keine Weltherrschaftsansprüche, aber zumindest als Weltmarktführer für Aktiendruckerei ist ihr ein vorderer Platz garantiert.

Antwort auf Beitrag Nr.: 43.239.911 von Boersenbeate am 01.06.12 19:34:08Nicht nur ein vorderer Platz sondern der unangefochtene Spitzenplatz für alle Ewigkeiten  !!!

!!!

!!!

!!!

Hab noch mal nachgelegt.

Und es schien als ob der MM mir so recht keine geben wollte.

Auf der Eingabemaske wurden keine Stücke angegeben. Sah so aus als

ob gar kein Handel mehr möglich war. Hab dann trotzdem mein Order

aufgegeben mit Limit 0,001, und nach erst ca. 10 Minuten wurde die

Order ausgeführt.

Normaler weise geht sowas viel schneller. Das sah nicht wie Abverkauf aus.

Hier ist irgend was im Busch!!!

Und es schien als ob der MM mir so recht keine geben wollte.

Auf der Eingabemaske wurden keine Stücke angegeben. Sah so aus als

ob gar kein Handel mehr möglich war. Hab dann trotzdem mein Order

aufgegeben mit Limit 0,001, und nach erst ca. 10 Minuten wurde die

Order ausgeführt.

Normaler weise geht sowas viel schneller. Das sah nicht wie Abverkauf aus.

Hier ist irgend was im Busch!!!

Antwort auf Beitrag Nr.: 43.241.814 von Scania01 am 02.06.12 11:23:38Ja klar ist hier wieder was im Busch

!

!

Der Kurs steht in US bei 0.0011 USD und wahrscheinlich hat sich der Makler gewundert , dass hier tatsächlich noch jemand zu 0.001 Euro kauft !

!

!

!Der Kurs steht in US bei 0.0011 USD und wahrscheinlich hat sich der Makler gewundert , dass hier tatsächlich noch jemand zu 0.001 Euro kauft

!

!

Und schaut euch mal die obere Kurve bei Bloomberg an.

Genta bald in der Gewinnzone???!!!

http://www.bloomberg.com/quote/GNTA:US/income-statement

Genta bald in der Gewinnzone???!!!

http://www.bloomberg.com/quote/GNTA:US/income-statement

Vielleicht machen die bald richtig Kohle mit "Ganite". Ihr zur Zeit einzigstes

Produkt. Hammer!!!

http://www.ganite.com/

Produkt. Hammer!!!

http://www.ganite.com/

Antwort auf Beitrag Nr.: 43.241.973 von Scania01 am 02.06.12 12:39:13Suchst du ein paar dumme Lemminge , die dir deine Shares nun teuer abkaufen oder was soll der Unsinn  ?

?

?

?

Antwort auf Beitrag Nr.: 43.242.037 von Scania01 am 02.06.12 13:12:13Ja, Börse kann so herrlich einfach sein. Nur immer den Candlesticks folgen und alle (!) werden gewinnen.

Bei Genta aktuell ein:

"Doji

Bullish Harami Cross"

Haut rein!

Bei Genta aktuell ein:

"Doji

Bullish Harami Cross"

Haut rein!

Antwort auf Beitrag Nr.: 43.242.144 von MrBean07 am 02.06.12 14:19:07Jungs ihr seit natürlich hier nicht investiert und meckert nur rum um die

anderen Lemminge natürlich daran zu hintern hier ein zu steigen.

Wie ehrenhaft ihr doch immer seit, sehr gütlich von euch. Wir werden

euch ein Denkmal bauen, im ewigen gedenken an die Warner mit erhobenen

Zeigefinger.

anderen Lemminge natürlich daran zu hintern hier ein zu steigen.

Wie ehrenhaft ihr doch immer seit, sehr gütlich von euch. Wir werden

euch ein Denkmal bauen, im ewigen gedenken an die Warner mit erhobenen

Zeigefinger.

After Hours Last Trade gestern 8 Mio zu 0,0012

Und Kauf und Verkaufs Verhältnis Gestern lt. ADVFN:

27 Millionen zu 7 Millionen.

Und Kauf und Verkaufs Verhältnis Gestern lt. ADVFN:

27 Millionen zu 7 Millionen.

Hier mal die Firmen, die Aktien von Genta halten.

http://www.otcbb.com/asp/tradeact_mv.asp?SearchBy=issue&Issu…

http://www.otcbb.com/asp/tradeact_mv.asp?SearchBy=issue&Issu…

Antwort auf Beitrag Nr.: 43.242.502 von Scania01 am 02.06.12 18:31:36Es handelt sich bei den Brokern nicht um die Menge der gehaltenen Aktien, aber um die Menge der getradeten Aktien pro MOnat. Gleichwohl finde ich diese Einstellung interessant, da sie einen guten Überblick liefert, so über Mai 2012. Aus unserem monthly share volume report geht so auch hervor, dass im Mai 2012 ►1,323,254,200 shares über den Tresen gingen, total share volume, beachtlich! Nite ist in diesem Zusammenhang besonders interessant, Knight Capital Americas, L.P. . .

http://www.otcbb.com/asp/tradeact_mv.asp?SearchBy=issue&Issu…

http://www.otcbb.com/asp/tradeact_mv.asp?SearchBy=issue&Issu…

Antwort auf Beitrag Nr.: 43.242.721 von auriga am 02.06.12 20:45:10Du hast recht, Umsätze der einzelnen Broker, sagt eigentlich nichts aus.

Danke für den Hinweis.

Danke für den Hinweis.

Antwort auf Beitrag Nr.: 43.242.884 von Scania01 am 02.06.12 22:27:56Nun ich würde nicht sagen dass diese Umsätze nichts aussagen, das tun sie sehr wohl. Genta hat ja auch einen Broker der direkt wandelt. Frage mich bitte nicht welcher das ist. Ich müsste ein altes filing raussuchen in dem das steht, aber er wird namentlich nicht genannt, das erinnere ich recht sicher, bleibt also eh offen!

You really don't understand how this works, do you?

The people selling it short are the finance people.

Everyone thinks they CONVERT-SELL, but when it is being pumped or moving up too fast, they often don't have the shares to sell yet. So, they SELL SHORT-CONVERT-COVER SHORT.

This has happened here before. Each time someone screams there will be a short squeeze. Then it never happens. That is why.

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…" target="_blank" rel="nofollow ugc noopener">http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

PS: Ich meine nicht dich mit you dont understand......gemeint ist ospreyeye........ http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

You really don't understand how this works, do you?

The people selling it short are the finance people.

Everyone thinks they CONVERT-SELL, but when it is being pumped or moving up too fast, they often don't have the shares to sell yet. So, they SELL SHORT-CONVERT-COVER SHORT.

This has happened here before. Each time someone screams there will be a short squeeze. Then it never happens. That is why.

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…" target="_blank" rel="nofollow ugc noopener">http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

PS: Ich meine nicht dich mit you dont understand......gemeint ist ospreyeye........ http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

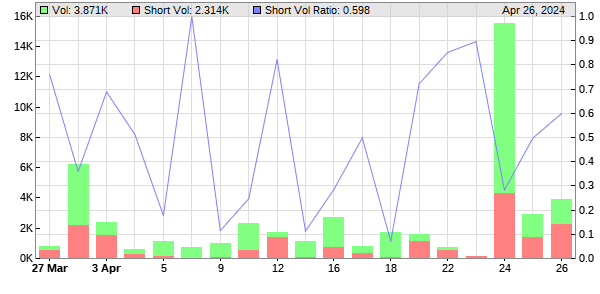

Antwort auf Beitrag Nr.: 43.242.919 von auriga am 02.06.12 22:50:05Kann mal einer die Tabelle erklären?

Antwort auf Beitrag Nr.: 43.243.509 von Scania01 am 03.06.12 12:21:33

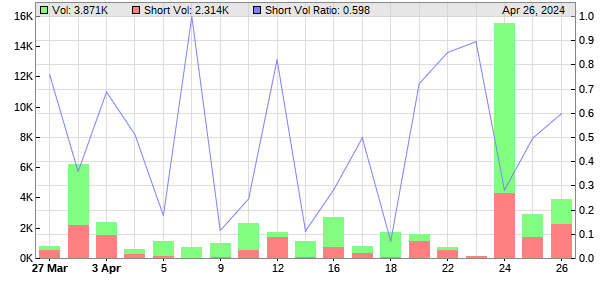

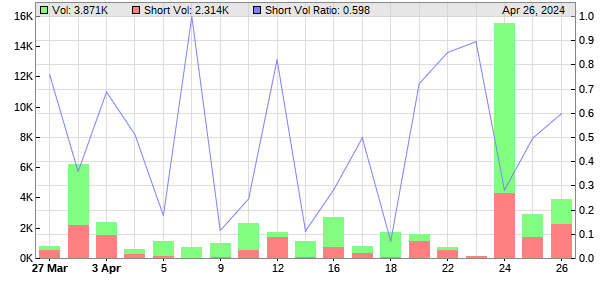

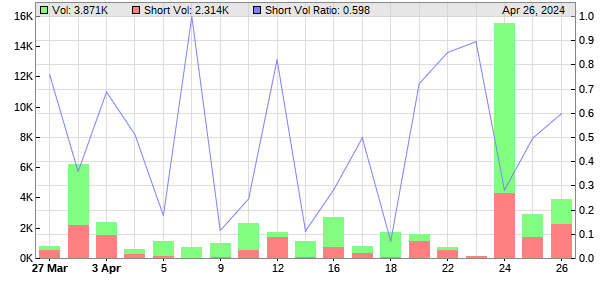

Gemeint ist in dem post die große Säule vom 22 05.....das Gesamtvolumen betrug 395 041 728....das Short-Volumen betrug 135 Mio....die blaue Linie gibt einen Anhaltspunkt für die Entwicklung des shortens, steigend, fallend, gleichbleibend, je nach dem.....Os vermutete am 23 05 einen short squeeze, fmr antwortete aber dieses sei nicht zu vermuten, da die Geldgeber von Genta selbst short gehen, wenn der SP zu schnell hochgeht oder sie gerade nicht genügend shares zum Abdrücken haben....also gehen sie short....dann wandeln sie.....dann covern sie ihre shortposition.......wie du mir geschrieben hast, ich sehe es also genauso andersherum, ein short squeeze ist überhaupt weniger zu vermuten , denn ich denke fmr hat recht und sieht diesen Zusammenhang korrekt.....das Geld wird knapper, das ist korrekt, es sollte circa ein Jahr reichen und man muss sich was neues einfallen lassen.....in USA wird deshalb auch schon über einen buy out spekuliert, aber das ist nur eine Möglichkeit, die auch noch Zeit hätte....das alte Finanzierungsmodell scheint mir noch nicht am Ende zu sein!

The trial -- a randomized, three-arm, Phase 2b study that is expected to accrue approximately 220 patients -- will be conducted at approximately 15 sites in the U.S. and Western Europe. Accrual is projected to take approximately 12 months, with approximately 12 months of followup. Tesetaxel is the leading oral taxane in clinical development.

Still a PII trial. So a PIII is still needed before the NDA.

Will take 24 months to complete. PIII another 3. Filing and waiting for approval, another 18 months. (Six and a half years to approval, if approved).

They have enough money to last less then a year without another deal, and another deal will cost BILLIONS more in shares.

Sure.

This need to be bought out. Soon.

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

Gemeint ist in dem post die große Säule vom 22 05.....das Gesamtvolumen betrug 395 041 728....das Short-Volumen betrug 135 Mio....die blaue Linie gibt einen Anhaltspunkt für die Entwicklung des shortens, steigend, fallend, gleichbleibend, je nach dem.....Os vermutete am 23 05 einen short squeeze, fmr antwortete aber dieses sei nicht zu vermuten, da die Geldgeber von Genta selbst short gehen, wenn der SP zu schnell hochgeht oder sie gerade nicht genügend shares zum Abdrücken haben....also gehen sie short....dann wandeln sie.....dann covern sie ihre shortposition.......wie du mir geschrieben hast, ich sehe es also genauso andersherum, ein short squeeze ist überhaupt weniger zu vermuten , denn ich denke fmr hat recht und sieht diesen Zusammenhang korrekt.....das Geld wird knapper, das ist korrekt, es sollte circa ein Jahr reichen und man muss sich was neues einfallen lassen.....in USA wird deshalb auch schon über einen buy out spekuliert, aber das ist nur eine Möglichkeit, die auch noch Zeit hätte....das alte Finanzierungsmodell scheint mir noch nicht am Ende zu sein!

The trial -- a randomized, three-arm, Phase 2b study that is expected to accrue approximately 220 patients -- will be conducted at approximately 15 sites in the U.S. and Western Europe. Accrual is projected to take approximately 12 months, with approximately 12 months of followup. Tesetaxel is the leading oral taxane in clinical development.

Still a PII trial. So a PIII is still needed before the NDA.

Will take 24 months to complete. PIII another 3. Filing and waiting for approval, another 18 months. (Six and a half years to approval, if approved).

They have enough money to last less then a year without another deal, and another deal will cost BILLIONS more in shares.

Sure.

This need to be bought out. Soon.

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

Antwort auf Beitrag Nr.: 43.243.803 von auriga am 03.06.12 15:14:44.das Geld wird knapper, das ist korrekt, es sollte circa ein Jahr reichen und man muss sich was neues einfallen lassen.....in USA wird deshalb auch schon über einen buy out spekuliert, aber das ist nur eine Möglichkeit, die auch noch Zeit hätte....das alte Finanzierungsmodell scheint mir noch nicht am Ende zu sein!

Sehe ich aber nicht so:

Die Ergebnisse kommen zu einem kritischen Zeitpunkt für die Berkeley Heights, New Jersey ansässige Pharmakonzern. In einem Dokument mit der Securities and Exchange Commission eingereicht hat Anfang dieses Monats, hieß es: "Zur Zeit ohne weitere Finanzierung, die Unternehmen davon ausgehen wird der Fonds im Juni 2012."

http://medcitynews.com/2012/05/advanced-breast-cancer-drug-p…

Sehe ich aber nicht so:

Die Ergebnisse kommen zu einem kritischen Zeitpunkt für die Berkeley Heights, New Jersey ansässige Pharmakonzern. In einem Dokument mit der Securities and Exchange Commission eingereicht hat Anfang dieses Monats, hieß es: "Zur Zeit ohne weitere Finanzierung, die Unternehmen davon ausgehen wird der Fonds im Juni 2012."

http://medcitynews.com/2012/05/advanced-breast-cancer-drug-p…

Antwort auf Beitrag Nr.: 43.243.835 von Scania01 am 03.06.12 15:40:20Ja, das stimmt. Ich erinnere die Stelle sehr gut, du hast den Text vor einigen Tagen eingestellt. Er stammt aus einem Mai-Filing.

http://www.sec.gov/cgi-bin/browse-edgar?company=GENTA&match=…

Müssten wir jetzt mal schauen aus welchem. War es nicht der Quartalsbericht? Ich vermute diese Zeilen datieren etwas zurück. Cash war im Mai circa 2,5 Mio USD. Also das reicht nicht bis Ende des Jahres oder so. Aber wenn weiter gewandelt wird ( 8 billions anstehend) kommt wieder Kohle rein....und es wurde ja wohl schon wieder gewandelt. Fmr meint die 8 billions....2 billions down 8 billions to go. . . .

The findings come at a critical time for the Berkeley Heights, New Jersey-based drugmaker. In a document filed with the Securities and Exchange Commission earlier this month, it said: “Presently, with no further financing, the company projects that it will run out of funds during June 2012.”

http://medcitynews.com/2012/05/advanced-breast-cancer-drug-p…

http://www.sec.gov/cgi-bin/browse-edgar?company=GENTA&match=…

Müssten wir jetzt mal schauen aus welchem. War es nicht der Quartalsbericht? Ich vermute diese Zeilen datieren etwas zurück. Cash war im Mai circa 2,5 Mio USD. Also das reicht nicht bis Ende des Jahres oder so. Aber wenn weiter gewandelt wird ( 8 billions anstehend) kommt wieder Kohle rein....und es wurde ja wohl schon wieder gewandelt. Fmr meint die 8 billions....2 billions down 8 billions to go. . . .

The findings come at a critical time for the Berkeley Heights, New Jersey-based drugmaker. In a document filed with the Securities and Exchange Commission earlier this month, it said: “Presently, with no further financing, the company projects that it will run out of funds during June 2012.”

http://medcitynews.com/2012/05/advanced-breast-cancer-drug-p…

Antwort auf Beitrag Nr.: 43.243.863 von auriga am 03.06.12 15:56:44Wenn weiter gewandelt wird hat aber Genta nichts davon. Das sind die

Wandelschuldverschreibungen wofür Genta schon Geld erhalten hat.

Und wie lange soll den noch Aktien auf den Markt kommen ohne das der

Kurs weiter einbricht und man nur noch mit Verlust wandelt.

Genta steht das Wasser bis zum Hals.

Wandelschuldverschreibungen wofür Genta schon Geld erhalten hat.

Und wie lange soll den noch Aktien auf den Markt kommen ohne das der

Kurs weiter einbricht und man nur noch mit Verlust wandelt.

Genta steht das Wasser bis zum Hals.

Antwort auf Beitrag Nr.: 43.243.885 von Scania01 am 03.06.12 16:06:16Ja, auch hier muss ich dir grundsätzlich zustimmen. Bei den Wandelanleihen( convertible bonds) gibt es allerdings verschiedene Modelle in verschiedenen Ländern!

Wandelschuldverschreibungen, die ein Umtauschrecht verbriefen, werden auch als Wandelanleihen bezeichnet. Wandelschuldverschreibungen, die ein Bezugsrecht verbriefen, werden auch Optionsanleihen genannt.

Bei Ausübung des Umtauschrechts, welches die Wandelanleihen verbriefen, findet eine Umschichtungsfinanzierung statt. Die Anleihen werden in Aktien, also Fremdkapital in Eigenkapital umgewandelt. Der eigentliche Finanzierungsvorgang ist die Ausgabe der Wandelanleihen. Bei Ausübung des Bezugsrechts, welches die Optionsanleihen verbriefen, tritt dagegen zum vorhandenen Fremdkapital zusätzliches Eigenkapital. Der Inhaber der Obligation ist dann zugleich Gläubiger und Gesellschafter der Aktiengesellschaft.

http://www.wirtschaftslexikon24.net/d/wandelschuldverschreib…

Wir dürfen auch nicht vergessen, dass es ja nicht nur um convertible notes alleine geht, sondern auch noch um warrants, also insgesamt um units, die noch weitere Bedingungen umfassen. Die Umwandlung der warrants würden dann aber definiv neues Geld reinbringen in Genta. Würdest du mir hier zustimmen?

Ansonsten muss man sagen dass USD 2,5 Mio allenfalls reichen sollten bis Ende des dritten Quartals 2012, respektive schon etwas früher verbraucht sein sollten.

Die Frage ist inwieweit man neue Noteholder ins Boot bekommt.

Und wie lange soll den noch Aktien auf den Markt kommen ohne das der

Kurs weiter einbricht und man nur noch mit Verlust wandelt.

Hierzu ist zu sagen dass die Geldgeber natürlich ein Interesse daran haben den Kurs innerhalb eines gewissen levels pendeln zu lassen.

Der aktuelle Wandlungspreis für convertible notes als auch für warrants ist übrigens zur Zeit USD 0.001, also ganz komfortabel. Er entspricht allen Ernstes dem Nennwert der Aktie.

According to another agreement entered among the Company and certain investors, the conversion price of the Company’s convertible notes, and the exercise price of the September 2011 Warrants, the December 2010 Warrants, defined below, and the March 2010 Warrants, defined below, were reset to $0.001 effective December 17, 2011. The conversion price reset on all of the Company’s convertible notes resulted in a full debt discount being recorded in an amount equal to the face value of the Company’s convertible notes on December 17, 2011. The Company is amortizing the resultant debt discounts over the terms of the notes through their maturity dates.

Seite 11

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

Wandlungspreis der convertible notes und exercise Preis von warrants ( s o) zurückgesetzt auf USD 0.001 wirksam ab Dec 17 2012.....stimmt mit dem converting of late schon überein, habs mal nachgerechnet....bei converted approximately $0.7 kommt man auf USD 0.00094 und bei converted approximately $0.4 kommt man auf USD 0.0011.....da es sich um genäherte Zahlen handelt bestätigt sich also in beiden Fällen der aktuelle conversion price von convertible notes mit USD 0.001!!!

Wandelschuldverschreibungen, die ein Umtauschrecht verbriefen, werden auch als Wandelanleihen bezeichnet. Wandelschuldverschreibungen, die ein Bezugsrecht verbriefen, werden auch Optionsanleihen genannt.

Bei Ausübung des Umtauschrechts, welches die Wandelanleihen verbriefen, findet eine Umschichtungsfinanzierung statt. Die Anleihen werden in Aktien, also Fremdkapital in Eigenkapital umgewandelt. Der eigentliche Finanzierungsvorgang ist die Ausgabe der Wandelanleihen. Bei Ausübung des Bezugsrechts, welches die Optionsanleihen verbriefen, tritt dagegen zum vorhandenen Fremdkapital zusätzliches Eigenkapital. Der Inhaber der Obligation ist dann zugleich Gläubiger und Gesellschafter der Aktiengesellschaft.

http://www.wirtschaftslexikon24.net/d/wandelschuldverschreib…

Wir dürfen auch nicht vergessen, dass es ja nicht nur um convertible notes alleine geht, sondern auch noch um warrants, also insgesamt um units, die noch weitere Bedingungen umfassen. Die Umwandlung der warrants würden dann aber definiv neues Geld reinbringen in Genta. Würdest du mir hier zustimmen?

Ansonsten muss man sagen dass USD 2,5 Mio allenfalls reichen sollten bis Ende des dritten Quartals 2012, respektive schon etwas früher verbraucht sein sollten.

Die Frage ist inwieweit man neue Noteholder ins Boot bekommt.

Und wie lange soll den noch Aktien auf den Markt kommen ohne das der

Kurs weiter einbricht und man nur noch mit Verlust wandelt.

Hierzu ist zu sagen dass die Geldgeber natürlich ein Interesse daran haben den Kurs innerhalb eines gewissen levels pendeln zu lassen.

Der aktuelle Wandlungspreis für convertible notes als auch für warrants ist übrigens zur Zeit USD 0.001, also ganz komfortabel. Er entspricht allen Ernstes dem Nennwert der Aktie.

According to another agreement entered among the Company and certain investors, the conversion price of the Company’s convertible notes, and the exercise price of the September 2011 Warrants, the December 2010 Warrants, defined below, and the March 2010 Warrants, defined below, were reset to $0.001 effective December 17, 2011. The conversion price reset on all of the Company’s convertible notes resulted in a full debt discount being recorded in an amount equal to the face value of the Company’s convertible notes on December 17, 2011. The Company is amortizing the resultant debt discounts over the terms of the notes through their maturity dates.

Seite 11

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

Wandlungspreis der convertible notes und exercise Preis von warrants ( s o) zurückgesetzt auf USD 0.001 wirksam ab Dec 17 2012.....stimmt mit dem converting of late schon überein, habs mal nachgerechnet....bei converted approximately $0.7 kommt man auf USD 0.00094 und bei converted approximately $0.4 kommt man auf USD 0.0011.....da es sich um genäherte Zahlen handelt bestätigt sich also in beiden Fällen der aktuelle conversion price von convertible notes mit USD 0.001!!!

Glaube das Genta die ASCO nutzen will um eventuell einen potentiellen Investor zu finden der die weitere Finanzierung der Studien

mit Tesetaxel absichert.

Wenn nicht, sehe ich schwarz!!!

Oder hat Genta doch noch einen Joker in der Tasche?

mit Tesetaxel absichert.

Wenn nicht, sehe ich schwarz!!!

Oder hat Genta doch noch einen Joker in der Tasche?

Quote: "Wir dürfen auch nicht vergessen, dass es ja nicht nur um convertible notes alleine geht, sondern auch noch um warrants, also insgesamt um units, die noch weitere Bedingungen umfassen. Die Umwandlung der warrants würden dann aber definiv neues Geld reinbringen in Genta. Würdest du mir hier zustimmen?"

Ja, da würde ich zumindest zustimmen. Warrants sind Anrechte, und diese konnen die Noteholder ausüben. Wann würden die Noteholder sie also ausüben wollen? Sie würden sie ausüben wollen, wenn sie keine Notes mehr in Shares wandeln wollen, und also noch zusätzlich ihre Anrechte zum Kauf von Aktien wahrnehmen wollen. So was würde dann passieren, wenn sie vom Erfolg von Genta überzeugt wären, weil Tesetaxel Ihnen Geld einbringen könnte.

Aber wir haben dazu meiner Meinung noch nicht den optimalen Zeitpunkt, denn Die Phase II wird irgendwann in den nächtsne Wochen/Monaten offiziell begonnen werden.

Ja, da würde ich zumindest zustimmen. Warrants sind Anrechte, und diese konnen die Noteholder ausüben. Wann würden die Noteholder sie also ausüben wollen? Sie würden sie ausüben wollen, wenn sie keine Notes mehr in Shares wandeln wollen, und also noch zusätzlich ihre Anrechte zum Kauf von Aktien wahrnehmen wollen. So was würde dann passieren, wenn sie vom Erfolg von Genta überzeugt wären, weil Tesetaxel Ihnen Geld einbringen könnte.

Aber wir haben dazu meiner Meinung noch nicht den optimalen Zeitpunkt, denn Die Phase II wird irgendwann in den nächtsne Wochen/Monaten offiziell begonnen werden.

Antwort auf Beitrag Nr.: 43.243.975 von auriga am 03.06.12 16:52:44Das heisst also, Noteholder vrdienen noch ca. 10 prozent am Wandeln, aber diese Spanne ist nicht mehr so gross wie vorher.

Antwort auf Beitrag Nr.: 43.246.196 von Boersenbeate am 04.06.12 12:04:25Warrants ausüben zieht im Allgemeinen eine restricted Phase nach sich, dass heißt die ausgeübten warrants sind als Aktien gelockt und werden nach einer bestimmten Zeit unlocked und können dann auf den Markt gebracht werden. -- Man sieht ja, dass die Wandlungspreise für warrants rückwirkend abgesenkt wurden, sept 11 warrants, dec 10 warrants, march 10 warrants. -- Das lädt zusätzlich ein zum exercise. -- Sind diese ausgeübten warrants = shares dann unlocked können sie genauso auf den Markt gebracht werden wie die shares aus den covertible notes. -- Die noteholder müssen also gar keine Genta shares sammeln sondern können sie genauso abstoßen wie die shares aus den convertible notes.

Wandlungspreis der convertible notes und exercise Preis von warrants ( s o) zurückgesetzt auf USD 0.001 wirksam ab Dec 17 2012.....stimmt mit dem converting of late schon überein, habs mal nachgerechnet....

►hier muss es heißen ►wirksam ab Dec 17 2011►logisch und ein ins Auge springender fehltip

Wandlungspreis der convertible notes und exercise Preis von warrants ( s o) zurückgesetzt auf USD 0.001 wirksam ab Dec 17 2012.....stimmt mit dem converting of late schon überein, habs mal nachgerechnet....

►hier muss es heißen ►wirksam ab Dec 17 2011►logisch und ein ins Auge springender fehltip

Antwort auf Beitrag Nr.: 43.246.771 von auriga am 04.06.12 14:21:24Aber sie üben Optionen aus Warrants derzeit noch nicht aus, weil sie derzeit noch genug Aktien aus der Noteswandelung bekommen. Wenn Genta aber auf dem Weg zum Erfolg ist, dann werden sie keine Aktien mehr aus Notes wandeln wollen, weil die Notes irgendwann einmal bedient werden könnten. Dann beziehen sie die Aktien aus den warrants, und halten diese sogar eventuell über das resticted date hinaus, weil sie erwarten, dass die Aktien noch mehr wert werden.

Dennoch sind die Noteholder, egal wie es kommt, immer fein raus. Sie müssen allerdings dann genauso geduldig sein, wie alle anderen, aber sobald das Ziel klar vor Augen ist, kann es aufwärts gehen.

Dennoch sind die Noteholder, egal wie es kommt, immer fein raus. Sie müssen allerdings dann genauso geduldig sein, wie alle anderen, aber sobald das Ziel klar vor Augen ist, kann es aufwärts gehen.

Antwort auf Beitrag Nr.: 43.246.911 von Boersenbeate am 04.06.12 15:00:43Klingt gut, aber die Firma muss ja auch überleben. Convertible notes wandeln bringt kein frisches Geld für Genta sondern nur für die noteholder. Wenn sie also Interesse an Genta haben ( sechseinhalb Jahre to go bis mögliches approval, wenn!) müssen sie die Firma stützen und verhindern dass sie out of money läuft. Können die Geldgeber also zusätzlich Kohle machen mit warrants, warum nicht? -- Und: warum werden gerade jetzt die exercise Preise rückwirkend reduziert wo es eng wird für Genta finanztechnisch?

Ich bin auch nicht sicher ob ein exercise von warrants zu einer weiteren dilution führen muss. That depends. Warrants können auch schon mitzählen zu den outstanding shares, auch wenn sie noch nicht geissued sind und zum Stimmrecht beitragen. Außerdem werden warrant Aktien teilweise auf escrow Konten geführt und sind auch so schon in der Gesamtrechnung mit darin. Wenn shares also unlocked werden gehen sie unter Umständen auf den Markt, ohne dass viel darüber geredet wird. Es genügt den restricted Zeitraum zu benennen und das unlocking. In dem Moment sind diese shares frei für den Markt!

Ich bin auch nicht sicher ob ein exercise von warrants zu einer weiteren dilution führen muss. That depends. Warrants können auch schon mitzählen zu den outstanding shares, auch wenn sie noch nicht geissued sind und zum Stimmrecht beitragen. Außerdem werden warrant Aktien teilweise auf escrow Konten geführt und sind auch so schon in der Gesamtrechnung mit darin. Wenn shares also unlocked werden gehen sie unter Umständen auf den Markt, ohne dass viel darüber geredet wird. Es genügt den restricted Zeitraum zu benennen und das unlocking. In dem Moment sind diese shares frei für den Markt!

Antwort auf Beitrag Nr.: 43.246.965 von auriga am 04.06.12 15:14:22Die Finanzierung würde weitergehen können, und zwar auf einem höheren Kursniveau. Wenn die Noteholder das Ziel vor Augen haben, dann können Sie mit der Übermacht Ihrer Shares den Kurs anheben, und Aktien aus den Warrants verkaufen. Mit dem eingenommenen Geld, was nicht zu knapp fliessen wird, kaufen Sie Genta wiederum die Notes ab. So bekommt genta wieder seine Notes los. Ein unendlicher Kreis. Das Ende wäre nur dann erreicht, wenn Genta tatsächlich eine Zulassung erhält und dann eventuell aufgekauft wird. Aber bis dahin dreht sich das Genta-Karusell weiter.

Antwort auf Beitrag Nr.: 43.246.999 von Boersenbeate am 04.06.12 15:22:01Ausübung der Warrants führt wahrscheinlich weiterhin zu einer dilution, aber es muss nicht sein, dass der Kurs dadurch stark nach unten beeinflusst wird, wenn nämlich die Noteholder diese Aktien in Erwartung noch höherer Nachfrage nach Aktien halten. Aber die Anzahl der ausstehenden Aktien würde sich trotzdem erhöhen, auch wenn sie nicht über den Markt verkauft werden.

Antwort auf Beitrag Nr.: 43.247.107 von Boersenbeate am 04.06.12 15:45:40Nur mal zur Anregung, auch Seite 11 Quartalsbericht....geht dann noch weiter....

. . .

According to another agreement entered among the Company and certain investors, the conversion price of the Company’s convertible notes, and the exercise price of the September 2011 Warrants, the December 2010 Warrants, defined below, and the March 2010 Warrants, defined below, were reset to $0.001 effective December 17, 2011. The conversion price reset on all of the Company’s convertible notes resulted in a full debt discount being recorded in an amount equal to the face value of the Company’s convertible notes on December 17, 2011. The Company is amortizing the resultant debt discounts over the terms of the notes through their maturity dates.

On December 19, 2011, three holders of September 2011 Debt Warrants totaling $2.9 million, exercised their warrants using a cashless exercise procedure and received September 2011 G Notes for $2.1 million. The aggregate intrinsic value of the difference between the market price of a share of the Company’s stock on December 19, 2011 and the conversion price of the notes was in excess of the face value of the September 2011 G Notes of $2.1 million, and a full debt discount was recorded in an amount equal to the face value of the notes. The Company is amortizing the resultant debt discount over the term of the notes through their maturity date.

The September 2011 Warrants and the September 2011 Debt Warrants both have anti-dilution protection and can be exercised using a cashless exercise procedure; warrants with these characteristics are accounted for as liabilities and marked-to-market over their lives. At March 31, 2012, the September 2011 Warrants and the September 2011 Debt Warrants were re-measured, in total, at $11.6 million based upon a Black-Scholes valuation model, resulting in income of $24.2 million on the Condensed Consolidated Statement of Operations for the three-month period ended March 31, 2012.

The September 2011 Warrants were valued at March 31, 2012 and December 31, 2011 using a Black-Scholes valuation model with the following assumptions:

. . .

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

. . .

According to another agreement entered among the Company and certain investors, the conversion price of the Company’s convertible notes, and the exercise price of the September 2011 Warrants, the December 2010 Warrants, defined below, and the March 2010 Warrants, defined below, were reset to $0.001 effective December 17, 2011. The conversion price reset on all of the Company’s convertible notes resulted in a full debt discount being recorded in an amount equal to the face value of the Company’s convertible notes on December 17, 2011. The Company is amortizing the resultant debt discounts over the terms of the notes through their maturity dates.

On December 19, 2011, three holders of September 2011 Debt Warrants totaling $2.9 million, exercised their warrants using a cashless exercise procedure and received September 2011 G Notes for $2.1 million. The aggregate intrinsic value of the difference between the market price of a share of the Company’s stock on December 19, 2011 and the conversion price of the notes was in excess of the face value of the September 2011 G Notes of $2.1 million, and a full debt discount was recorded in an amount equal to the face value of the notes. The Company is amortizing the resultant debt discount over the term of the notes through their maturity date.

The September 2011 Warrants and the September 2011 Debt Warrants both have anti-dilution protection and can be exercised using a cashless exercise procedure; warrants with these characteristics are accounted for as liabilities and marked-to-market over their lives. At March 31, 2012, the September 2011 Warrants and the September 2011 Debt Warrants were re-measured, in total, at $11.6 million based upon a Black-Scholes valuation model, resulting in income of $24.2 million on the Condensed Consolidated Statement of Operations for the three-month period ended March 31, 2012.

The September 2011 Warrants were valued at March 31, 2012 and December 31, 2011 using a Black-Scholes valuation model with the following assumptions:

. . .

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

Antwort auf Beitrag Nr.: 43.247.107 von Boersenbeate am 04.06.12 15:45:40Habe “nebenbei” zu tun, aber wenn ich hier in einer Pause mal neu draufschaue sieht mir das so aus, als üben die noteholder ihre warrants aus, bekommen dafür notes, convertieren dann die notes und drücken die shares in den Markt....ich vermute das ist es was fmr meint mit Geld ein Jahr.....unsere Stelle mit dem run out of money(Scania) steht am Anfang des Quartalsberichtes und ist eine Pflichtaussage, weil man ja auch vorher noch nicht weiß ob das mit den warrants und den notes klappt....aber jetzt nur mal auf die Schnelle kurz überschaut...

@Scania

In March 2012, the Company entered into an agreement with certain investors whereby the Company would issue up to $13.5 million of senior secured convertible notes and initially closed on a first transaction of $2.25 million of such notes.

Seite 6 Quartalsbericht

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

In diesem agreement könnte auch ein Aspekt der Lösung der Frage liegen, warum das Geld noch circa ein Jahr halten könnte. Nur: das agreement muss eben auch umfänglich umgesetzt werden, und solange dies nicht der Fall ist -- transaction i of USD 2,25 Mio -- muss eben im Quartalsbericht erscheinen >Presently, with no further financing, the Company projects that it will run out of funds during June 2012. Investors in the March 2012 transaction have the right, at each investor’s discretion, to purchase up to an additional $11.25 million of senior secured convertible notes having the same terms as the notes issued in the first transaction. The Company currently does not have any financing in place. If it is unable to raise additional funds, the Company could be required to reduce its spending plans, reduce its workforce, license one or more of its products or technologies that it would otherwise seek to commercialize itself, sell some or all of its assets, cease operations or even declare bankruptcy. There can be no assurance that the Company can obtain financing, if at all, or raise such additional funds, on terms acceptable to it.

In March 2012, the Company entered into an agreement with certain investors whereby the Company would issue up to $13.5 million of senior secured convertible notes and initially closed on a first transaction of $2.25 million of such notes.

Seite 6 Quartalsbericht

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

In diesem agreement könnte auch ein Aspekt der Lösung der Frage liegen, warum das Geld noch circa ein Jahr halten könnte. Nur: das agreement muss eben auch umfänglich umgesetzt werden, und solange dies nicht der Fall ist -- transaction i of USD 2,25 Mio -- muss eben im Quartalsbericht erscheinen >Presently, with no further financing, the Company projects that it will run out of funds during June 2012. Investors in the March 2012 transaction have the right, at each investor’s discretion, to purchase up to an additional $11.25 million of senior secured convertible notes having the same terms as the notes issued in the first transaction. The Company currently does not have any financing in place. If it is unable to raise additional funds, the Company could be required to reduce its spending plans, reduce its workforce, license one or more of its products or technologies that it would otherwise seek to commercialize itself, sell some or all of its assets, cease operations or even declare bankruptcy. There can be no assurance that the Company can obtain financing, if at all, or raise such additional funds, on terms acceptable to it.

Antwort auf Beitrag Nr.: 43.249.083 von auriga am 05.06.12 00:33:072,5 Millionen reichen nie und nimmer. Da sie ca. 1 Mill.

im Monat verbrennen Und selbst wenn nach dein Rechenbeispiel das doch reichen sollte dann bewegt sich

Genta am Rande der Pleite so dass der Kurs am unteren

Niveau rum tümpelt. Bis dann mal wieder ein RS möglich ist.

im Monat verbrennen Und selbst wenn nach dein Rechenbeispiel das doch reichen sollte dann bewegt sich

Genta am Rande der Pleite so dass der Kurs am unteren

Niveau rum tümpelt. Bis dann mal wieder ein RS möglich ist.

Antwort auf Beitrag Nr.: 43.249.083 von auriga am 05.06.12 00:33:07Mit disen ca. 12 Millionen kann man gut eine Firma bezahlen, die die Durchführung der Studien organisiert.

Allerdings gebe ich Dir Recht, dass das wohl nicht ewig reichen wird. Aber Tesetaxel geht in Phase III, und bei erfolg werden die Investoren sicherlich kein halbfertiges Produkt wollen. Das letzte Wegstück bis zur zulassung wird auch noch finanziert. Dann fliesst genug zurück.

Allerdings gebe ich Dir Recht, dass das wohl nicht ewig reichen wird. Aber Tesetaxel geht in Phase III, und bei erfolg werden die Investoren sicherlich kein halbfertiges Produkt wollen. Das letzte Wegstück bis zur zulassung wird auch noch finanziert. Dann fliesst genug zurück.

Antwort auf Beitrag Nr.: 43.251.268 von Boersenbeate am 05.06.12 16:04:271. würde das Geld nicht sehr weit reichen.....für die Forschung schon 2 x nicht

2. kommen dadurch rund 12 Milliarden mehr auf den Markt an Anteilen ( ist ja nix neues )

3. siehe Kurs 0,001 US$ derzeit aktuell...Tendenz klar in Richtung 0,0007 - dann wird das Expertchen007 mal wieder schwach und riskiert seinen üblichen 10 K US$ im 1 -2 Stunden Trade - so wie in 98 % aller Fälle seither in Genta...Ziel wie immer 12..14... oder auch mal 20 % .

4. nur so gehts

2. kommen dadurch rund 12 Milliarden mehr auf den Markt an Anteilen ( ist ja nix neues )

3. siehe Kurs 0,001 US$ derzeit aktuell...Tendenz klar in Richtung 0,0007 - dann wird das Expertchen007 mal wieder schwach und riskiert seinen üblichen 10 K US$ im 1 -2 Stunden Trade - so wie in 98 % aller Fälle seither in Genta...Ziel wie immer 12..14... oder auch mal 20 % .

4. nur so gehts

The number of outstanding shares of Genta Incorporated common stock par value $0.001 as of the date of this filing is 4,846,615,013.

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

Am 25. Mai waren es noch 2.65 MILLIARDEN Shares und nun sind es unfassbare 4.85 MILLIARDEN Shares

!!!

!!!

The number of outstanding shares of Genta Incorporated common stock par value $0.001 as of the date of this filing is 2,657,552,779.

Es sind innerhalb von 20 Tagen 2.2 MILLIARDEN neue Shares dazugekommen wovon laut Filings Ray 800 Mio , Siegel 550 Mio und Itri 650 Mio neue Shares bekommen haben !

!

http://www.genta.com/Investor_Relations/SEC_Filings.html

!!!

!!!The number of outstanding shares of Genta Incorporated common stock par value $0.001 as of the date of this filing is 2,657,552,779.

Es sind innerhalb von 20 Tagen 2.2 MILLIARDEN neue Shares dazugekommen wovon laut Filings Ray 800 Mio , Siegel 550 Mio und Itri 650 Mio neue Shares bekommen haben

!

!http://www.genta.com/Investor_Relations/SEC_Filings.html

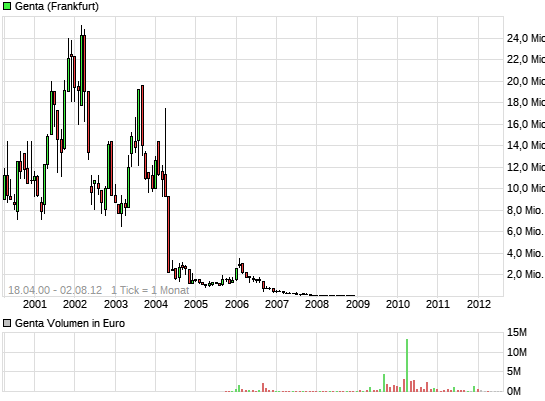

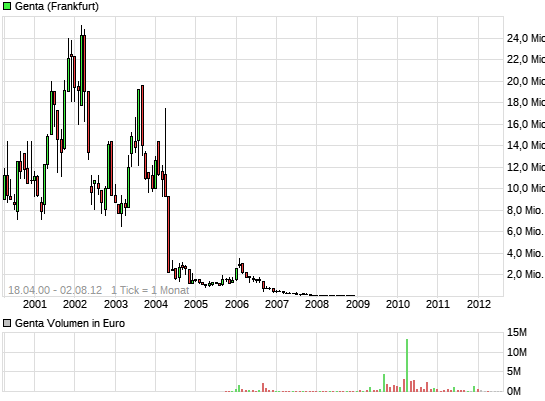

@ hoffihoff.

Wo finde ich bitte den langfrist Chart zu Genta? Bzw. was war jetzt das ATH?

Gruß

Schmithi

Wo finde ich bitte den langfrist Chart zu Genta? Bzw. was war jetzt das ATH?

Gruß

Schmithi

Antwort auf Beitrag Nr.: 43.290.021 von hoffihoff am 16.06.12 00:26:58Diese 2,2 Milliarden sind aber noch nicht verkauft. Soviel Umsätze waren

nicht in der letzten Zeit.

nicht in der letzten Zeit.

Antwort auf Beitrag Nr.: 43.290.228 von schmithi am 16.06.12 08:53:39Ein kleiner Blick darauf ( BITTE bei From: Jahr 2002 eingeben/ abändern ) .....http://investing.businessweek.com/research/stocks/snapshot/h…

http://investing.businessweek.com/research/stocks/snapshot/h…

http://investing.businessweek.com/research/stocks/snapshot/h…

so mancher Kollege hatte es 2004 schon geschnallt was so kommt !!!!

*************************************************************************

rotie1

schrieb am 31.05.04 13:51:41

Beitrag Nr.99

(13.265.265)

Antwort

Zitat

:O

:O

So ein Drecksladen! Das war doch wohl wieder Verarschung!

Ich habe mich auch schon gewundert: irgendwann kamen gute Ergebnisse von Genasense, die Probanden hätten ein wenig (ca. 30Minuten?????:cry länger überlebt als ohne das Medikament. Warum habe ich nicht auf mein Gefühl gehört und alles verkauft, da ich nach langer Zeit auch endlich wieder im Plus war mit Genta.

länger überlebt als ohne das Medikament. Warum habe ich nicht auf mein Gefühl gehört und alles verkauft, da ich nach langer Zeit auch endlich wieder im Plus war mit Genta. .

.

Dann heißt es, das Mittel ist zwar eigentlich gegen andere Krebsarten, aber man beantragt die Zulassung erstmal gegen Hautkrebs. ABLEHNUNG! Und jetzt stellt man die Entwicklung ganz ein? Was ist denn nun mit den anderen Krebsarten? Wahrscheinlich sind die Probanden mit Genasense eher gestorben als die, die das Medikament nicht genommen haben.

Was ist denn nun mit den anderen Krebsarten? Wahrscheinlich sind die Probanden mit Genasense eher gestorben als die, die das Medikament nicht genommen haben.

Läuft nicht in den USA eine Sammelklage gegen diese Betrüger, hat jemand Infos darüber?

P.S. Mein Mitgefühl gilt denjenigen, die Hoffnung auf Heilung durch Genasense hatten, nicht uns, die wir dadurch Geld verdienen wollten.

Avatar

rotie1

schrieb am 31.05.04 14:03:01

Beitrag Nr.100

(13.265.317)

Antwort

Zitat

BERKELEY HEIGHTS/BRIDGEWATER (Dow Jones-VWD)--Die Aventis SA, Straßburg, und die Genta Inc stellen die Entwicklung des Krebsmedikaments "Genasense" ein. Sie hätten sich zu diesem Schritt entschlossen, nachdem die US-Gesundheitsbehörde FDA sich Anfang Mai gegen die Zulassung des Präparats ausgesprochen habe, teilten die beiden Unternehmen am Freitag mit.

*************************************************************************

rotie1

schrieb am 31.05.04 13:51:41

Beitrag Nr.99

(13.265.265)

Antwort

Zitat

:O

:O

So ein Drecksladen! Das war doch wohl wieder Verarschung!

Ich habe mich auch schon gewundert: irgendwann kamen gute Ergebnisse von Genasense, die Probanden hätten ein wenig (ca. 30Minuten?????:cry

länger überlebt als ohne das Medikament. Warum habe ich nicht auf mein Gefühl gehört und alles verkauft, da ich nach langer Zeit auch endlich wieder im Plus war mit Genta.

länger überlebt als ohne das Medikament. Warum habe ich nicht auf mein Gefühl gehört und alles verkauft, da ich nach langer Zeit auch endlich wieder im Plus war mit Genta. .

.Dann heißt es, das Mittel ist zwar eigentlich gegen andere Krebsarten, aber man beantragt die Zulassung erstmal gegen Hautkrebs. ABLEHNUNG! Und jetzt stellt man die Entwicklung ganz ein?

Was ist denn nun mit den anderen Krebsarten? Wahrscheinlich sind die Probanden mit Genasense eher gestorben als die, die das Medikament nicht genommen haben.

Was ist denn nun mit den anderen Krebsarten? Wahrscheinlich sind die Probanden mit Genasense eher gestorben als die, die das Medikament nicht genommen haben.Läuft nicht in den USA eine Sammelklage gegen diese Betrüger, hat jemand Infos darüber?

P.S. Mein Mitgefühl gilt denjenigen, die Hoffnung auf Heilung durch Genasense hatten, nicht uns, die wir dadurch Geld verdienen wollten.

Avatar

rotie1

schrieb am 31.05.04 14:03:01

Beitrag Nr.100

(13.265.317)

Antwort

Zitat

BERKELEY HEIGHTS/BRIDGEWATER (Dow Jones-VWD)--Die Aventis SA, Straßburg, und die Genta Inc stellen die Entwicklung des Krebsmedikaments "Genasense" ein. Sie hätten sich zu diesem Schritt entschlossen, nachdem die US-Gesundheitsbehörde FDA sich Anfang Mai gegen die Zulassung des Präparats ausgesprochen habe, teilten die beiden Unternehmen am Freitag mit.

Genta Announces Agreement With FDA on Special Protocol Assessment of Phase 3 Trial of Tesetaxel as Initial Chemotherapy for Women With Metastatic Breast Cancer

2012-06-18 08:08 ET - News Release

Proposed trial to compare two oral single agents

Agreement secured on progression-free survival as primary endpoint

BERKELEY HEIGHTS, N.J. , June 18, 2012 (GLOBE NEWSWIRE) -- Genta Incorporated (GNTA) announced today that the Company has reached agreement with the U.S. Food and Drug Administration (FDA) under its Special Protocol Assessment (SPA) process for the Company's proposed Phase 3 trial of oral tesetaxel as initial chemotherapy for women with metastatic breast cancer. The SPA provides FDA agreement that the study design and planned analysis of this Phase 3 trial adequately address objectives necessary to support a regulatory submission. The Company also announced review completion and positive Scientific Advice on the same trial design from the European Medicines Agency (EMA).

"We are pleased to have reached agreement with FDA and EMA on the design of this pivotal Phase 3 trial of oral tesetaxel as 1st-line chemotherapy for women with advanced breast cancer," said Dr. Loretta M. Itri, Genta's President, Pharmaceutical Development, and Chief Medical Officer. "Key issues in this SPA are confirmation of intended positioning of tesetaxel as initial chemotherapy, as well as its use as a single agent rather than use restricted to a specific drug combination. In addition, we have confirmed with both FDA and EMA that tesetaxel can be compared with another commonly used oral agent, and that progression-free survival, rather than overall survival, will serve as an acceptable primary endpoint for registration in both the U.S. and EU. Final decision regarding timing and initiation of this trial will be made after initial results are available from our ongoing, randomized, Phase 2b trial in breast cancer."

About Special Protocol Assessments

A Special Protocol Assessment is a binding declaration between a sponsor and the FDA indicating that a proposed Phase 3 study design, endpoints, and statistical analyses are acceptable to support regulatory approval of the product. The process is intended to increase the likelihood that -- if the specified clinical trial protocols from the SPA are followed, the clinical trial endpoints are achieved and there is a favorable risk-benefit profile -- trial data may serve as the primary basis of an efficacy claim in support of a New Drug Application (NDA). Final marketing approval in the U.S. and EU will depend on study results, the magnitude of PFS improvement, and an overall evaluation of the benefit/risk profile. More information on Special Protocol Assessments can be viewed at: http://www.fda.gov/downloads/Drugs/GuidanceComplianceRegulat…

Tesetaxel in Advanced Breast Cancer

Genta is currently conducting a randomized Phase 2b trial of tesetaxel as initial chemotherapy for patients with recurrent or metastatic breast cancer in the U.S. and Western Europe. Patients who are HER2-negative (including so-called "triple negative" patients) may have received adjuvant chemotherapy and hormonal therapy. This study compares two treatment schedules of tesetaxel (administered once weekly for 3 weeks or once every 3 weeks) with capecitabine (Xeloda®; Hoffmann La Roche, Inc.) administered orally twice per day for 14 days. The primary endpoint of the trial is overall response rate; secondary endpoints include progression-free survival and safety. Previously, tesetaxel demonstrated antitumor activity in two Phase 2a studies using the every 3 week schedule. In both studies, tesetaxel was generally well-tolerated, and neutropenia was the most common Grade 3-4 adverse event. No hypersensitivity reactions have been observed in more than 500 patients treated with tesetaxel.

About Genta

Genta Incorporated is a biopharmaceutical company with a diversified product portfolio that is focused on delivering innovative products for the treatment of patients with cancer. The Company is developing tesetaxel, a novel, orally absorbed taxane that is in the same class of drugs as paclitaxel and docetaxel. As the leading oral taxane in clinical development, tesetaxel is being evaluated in randomized clinical trials that compare tesetaxel with standard chemotherapy in patients with gastric cancer and breast cancer, and as a single agent in prostate cancer. Genta is also exclusively marketing Ganite® (gallium nitrate injection) in the U.S, which is indicated for treatment of symptomatic patients with cancer-related hypercalcemia that is resistant to hydration. The Company has developed proprietary oral formulations of the active ingredient in Ganite® that may be useful as potential treatment for diseases associated with accelerated bone loss. For more information about Genta, please visit our website at: www.genta.com.

Safe Harbor

This press release may contain forward-looking statements with respect to business conducted by Genta Incorporated. By their nature, forward-looking statements and forecasts involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. Such forward-looking statements include those that express plan, anticipation, intent, contingency, goals, targets, or future developments and/or otherwise are not statements of historical fact. The words "potentially," "anticipates," "projects," "expects," "could," "calls for," and similar expressions also identify forward-looking statements. The Company does not undertake to update any forward-looking statements. Factors that could affect actual results include, without limitation, risks associated with:

the Company's ability to obtain necessary regulatory approval for its product candidates from regulatory agencies, such as the U.S. Food and Drug Administration and the European Medicines Agency;

the safety and efficacy of the Company's products or product candidates;

the commencement and completion of any clinical trials;

the Company's assessment of its clinical trials;

the Company's ability to develop, manufacture, license, or sell its products or product candidates;

the Company's ability to enter into and successfully execute any license and collaborative agreements;

the adequacy of the Company's capital resources and cash flow projections, the Company's ability to obtain sufficient financing to maintain the Company's planned operations, or the risk of bankruptcy;

the adequacy of the Company's patents and proprietary rights;

the impact of litigation that has been brought against the Company; and

the other risks described under Certain Risks and Uncertainties Related to the Company's Business, as contained in the Company's most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q.

There are a number of factors that could cause actual results and developments to differ materially. For a discussion of those risks and uncertainties, please see the Company's most recent Annual Report on Form 10-K and its most recent quarterly report on Form 10-Q.

CONTACT: Genta Investor Relations

info@genta.com

http://www.stockwatch.com/News/Item.aspx?bid=U-z0259498-U%3a…

2012-06-18 08:08 ET - News Release

Proposed trial to compare two oral single agents

Agreement secured on progression-free survival as primary endpoint

BERKELEY HEIGHTS, N.J. , June 18, 2012 (GLOBE NEWSWIRE) -- Genta Incorporated (GNTA) announced today that the Company has reached agreement with the U.S. Food and Drug Administration (FDA) under its Special Protocol Assessment (SPA) process for the Company's proposed Phase 3 trial of oral tesetaxel as initial chemotherapy for women with metastatic breast cancer. The SPA provides FDA agreement that the study design and planned analysis of this Phase 3 trial adequately address objectives necessary to support a regulatory submission. The Company also announced review completion and positive Scientific Advice on the same trial design from the European Medicines Agency (EMA).

"We are pleased to have reached agreement with FDA and EMA on the design of this pivotal Phase 3 trial of oral tesetaxel as 1st-line chemotherapy for women with advanced breast cancer," said Dr. Loretta M. Itri, Genta's President, Pharmaceutical Development, and Chief Medical Officer. "Key issues in this SPA are confirmation of intended positioning of tesetaxel as initial chemotherapy, as well as its use as a single agent rather than use restricted to a specific drug combination. In addition, we have confirmed with both FDA and EMA that tesetaxel can be compared with another commonly used oral agent, and that progression-free survival, rather than overall survival, will serve as an acceptable primary endpoint for registration in both the U.S. and EU. Final decision regarding timing and initiation of this trial will be made after initial results are available from our ongoing, randomized, Phase 2b trial in breast cancer."

About Special Protocol Assessments

A Special Protocol Assessment is a binding declaration between a sponsor and the FDA indicating that a proposed Phase 3 study design, endpoints, and statistical analyses are acceptable to support regulatory approval of the product. The process is intended to increase the likelihood that -- if the specified clinical trial protocols from the SPA are followed, the clinical trial endpoints are achieved and there is a favorable risk-benefit profile -- trial data may serve as the primary basis of an efficacy claim in support of a New Drug Application (NDA). Final marketing approval in the U.S. and EU will depend on study results, the magnitude of PFS improvement, and an overall evaluation of the benefit/risk profile. More information on Special Protocol Assessments can be viewed at: http://www.fda.gov/downloads/Drugs/GuidanceComplianceRegulat…

Tesetaxel in Advanced Breast Cancer

Genta is currently conducting a randomized Phase 2b trial of tesetaxel as initial chemotherapy for patients with recurrent or metastatic breast cancer in the U.S. and Western Europe. Patients who are HER2-negative (including so-called "triple negative" patients) may have received adjuvant chemotherapy and hormonal therapy. This study compares two treatment schedules of tesetaxel (administered once weekly for 3 weeks or once every 3 weeks) with capecitabine (Xeloda®; Hoffmann La Roche, Inc.) administered orally twice per day for 14 days. The primary endpoint of the trial is overall response rate; secondary endpoints include progression-free survival and safety. Previously, tesetaxel demonstrated antitumor activity in two Phase 2a studies using the every 3 week schedule. In both studies, tesetaxel was generally well-tolerated, and neutropenia was the most common Grade 3-4 adverse event. No hypersensitivity reactions have been observed in more than 500 patients treated with tesetaxel.

About Genta

Genta Incorporated is a biopharmaceutical company with a diversified product portfolio that is focused on delivering innovative products for the treatment of patients with cancer. The Company is developing tesetaxel, a novel, orally absorbed taxane that is in the same class of drugs as paclitaxel and docetaxel. As the leading oral taxane in clinical development, tesetaxel is being evaluated in randomized clinical trials that compare tesetaxel with standard chemotherapy in patients with gastric cancer and breast cancer, and as a single agent in prostate cancer. Genta is also exclusively marketing Ganite® (gallium nitrate injection) in the U.S, which is indicated for treatment of symptomatic patients with cancer-related hypercalcemia that is resistant to hydration. The Company has developed proprietary oral formulations of the active ingredient in Ganite® that may be useful as potential treatment for diseases associated with accelerated bone loss. For more information about Genta, please visit our website at: www.genta.com.

Safe Harbor

This press release may contain forward-looking statements with respect to business conducted by Genta Incorporated. By their nature, forward-looking statements and forecasts involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. Such forward-looking statements include those that express plan, anticipation, intent, contingency, goals, targets, or future developments and/or otherwise are not statements of historical fact. The words "potentially," "anticipates," "projects," "expects," "could," "calls for," and similar expressions also identify forward-looking statements. The Company does not undertake to update any forward-looking statements. Factors that could affect actual results include, without limitation, risks associated with:

the Company's ability to obtain necessary regulatory approval for its product candidates from regulatory agencies, such as the U.S. Food and Drug Administration and the European Medicines Agency;

the safety and efficacy of the Company's products or product candidates;

the commencement and completion of any clinical trials;

the Company's assessment of its clinical trials;

the Company's ability to develop, manufacture, license, or sell its products or product candidates;

the Company's ability to enter into and successfully execute any license and collaborative agreements;

the adequacy of the Company's capital resources and cash flow projections, the Company's ability to obtain sufficient financing to maintain the Company's planned operations, or the risk of bankruptcy;

the adequacy of the Company's patents and proprietary rights;

the impact of litigation that has been brought against the Company; and

the other risks described under Certain Risks and Uncertainties Related to the Company's Business, as contained in the Company's most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q.

There are a number of factors that could cause actual results and developments to differ materially. For a discussion of those risks and uncertainties, please see the Company's most recent Annual Report on Form 10-K and its most recent quarterly report on Form 10-Q.

CONTACT: Genta Investor Relations

info@genta.com

http://www.stockwatch.com/News/Item.aspx?bid=U-z0259498-U%3a…

Zitat von hoffihoff: Genta Announces Agreement With FDA on Special Protocol Assessment of Phase 3 Trial of Tesetaxel as Initial Chemotherapy for Women With Metastatic Breast Cancer

2012-06-18 08:08 ET - News Release

Proposed trial to compare two oral single agents

Agreement secured on progression-free survival as primary endpoint

BERKELEY HEIGHTS, N.J. , June 18, 2012 (GLOBE NEWSWIRE) -- Genta Incorporated (GNTA) announced today that the Company has reached agreement with the U.S. Food and Drug Administration (FDA) under its Special Protocol Assessment (SPA) process for the Company's proposed Phase 3 trial of oral tesetaxel as initial chemotherapy for women with metastatic breast cancer. The SPA provides FDA agreement that the study design and planned analysis of this Phase 3 trial adequately address objectives necessary to support a regulatory submission. The Company also announced review completion and positive Scientific Advice on the same trial design from the European Medicines Agency (EMA).

"We are pleased to have reached agreement with FDA and EMA on the design of this pivotal Phase 3 trial of oral tesetaxel as 1st-line chemotherapy for women with advanced breast cancer," said Dr. Loretta M. Itri, Genta's President, Pharmaceutical Development, and Chief Medical Officer. "Key issues in this SPA are confirmation of intended positioning of tesetaxel as initial chemotherapy, as well as its use as a single agent rather than use restricted to a specific drug combination. In addition, we have confirmed with both FDA and EMA that tesetaxel can be compared with another commonly used oral agent, and that progression-free survival, rather than overall survival, will serve as an acceptable primary endpoint for registration in both the U.S. and EU. Final decision regarding timing and initiation of this trial will be made after initial results are available from our ongoing, randomized, Phase 2b trial in breast cancer."

About Special Protocol Assessments

A Special Protocol Assessment is a binding declaration between a sponsor and the FDA indicating that a proposed Phase 3 study design, endpoints, and statistical analyses are acceptable to support regulatory approval of the product. The process is intended to increase the likelihood that -- if the specified clinical trial protocols from the SPA are followed, the clinical trial endpoints are achieved and there is a favorable risk-benefit profile -- trial data may serve as the primary basis of an efficacy claim in support of a New Drug Application (NDA). Final marketing approval in the U.S. and EU will depend on study results, the magnitude of PFS improvement, and an overall evaluation of the benefit/risk profile. More information on Special Protocol Assessments can be viewed at: http://www.fda.gov/downloads/Drugs/GuidanceComplianceRegulat…

Tesetaxel in Advanced Breast Cancer

Genta is currently conducting a randomized Phase 2b trial of tesetaxel as initial chemotherapy for patients with recurrent or metastatic breast cancer in the U.S. and Western Europe. Patients who are HER2-negative (including so-called "triple negative" patients) may have received adjuvant chemotherapy and hormonal therapy. This study compares two treatment schedules of tesetaxel (administered once weekly for 3 weeks or once every 3 weeks) with capecitabine (Xeloda®; Hoffmann La Roche, Inc.) administered orally twice per day for 14 days. The primary endpoint of the trial is overall response rate; secondary endpoints include progression-free survival and safety. Previously, tesetaxel demonstrated antitumor activity in two Phase 2a studies using the every 3 week schedule. In both studies, tesetaxel was generally well-tolerated, and neutropenia was the most common Grade 3-4 adverse event. No hypersensitivity reactions have been observed in more than 500 patients treated with tesetaxel.

About Genta

Genta Incorporated is a biopharmaceutical company with a diversified product portfolio that is focused on delivering innovative products for the treatment of patients with cancer. The Company is developing tesetaxel, a novel, orally absorbed taxane that is in the same class of drugs as paclitaxel and docetaxel. As the leading oral taxane in clinical development, tesetaxel is being evaluated in randomized clinical trials that compare tesetaxel with standard chemotherapy in patients with gastric cancer and breast cancer, and as a single agent in prostate cancer. Genta is also exclusively marketing Ganite® (gallium nitrate injection) in the U.S, which is indicated for treatment of symptomatic patients with cancer-related hypercalcemia that is resistant to hydration. The Company has developed proprietary oral formulations of the active ingredient in Ganite® that may be useful as potential treatment for diseases associated with accelerated bone loss. For more information about Genta, please visit our website at: www.genta.com.

Safe Harbor

This press release may contain forward-looking statements with respect to business conducted by Genta Incorporated. By their nature, forward-looking statements and forecasts involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. Such forward-looking statements include those that express plan, anticipation, intent, contingency, goals, targets, or future developments and/or otherwise are not statements of historical fact. The words "potentially," "anticipates," "projects," "expects," "could," "calls for," and similar expressions also identify forward-looking statements. The Company does not undertake to update any forward-looking statements. Factors that could affect actual results include, without limitation, risks associated with:

the Company's ability to obtain necessary regulatory approval for its product candidates from regulatory agencies, such as the U.S. Food and Drug Administration and the European Medicines Agency;

the safety and efficacy of the Company's products or product candidates;

the commencement and completion of any clinical trials;

the Company's assessment of its clinical trials;

the Company's ability to develop, manufacture, license, or sell its products or product candidates;

the Company's ability to enter into and successfully execute any license and collaborative agreements;

the adequacy of the Company's capital resources and cash flow projections, the Company's ability to obtain sufficient financing to maintain the Company's planned operations, or the risk of bankruptcy;

the adequacy of the Company's patents and proprietary rights;

the impact of litigation that has been brought against the Company; and

the other risks described under Certain Risks and Uncertainties Related to the Company's Business, as contained in the Company's most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q.

There are a number of factors that could cause actual results and developments to differ materially. For a discussion of those risks and uncertainties, please see the Company's most recent Annual Report on Form 10-K and its most recent quarterly report on Form 10-Q.

CONTACT: Genta Investor Relations

info@genta.com

http://www.stockwatch.com/News/Item.aspx?bid=U-z0259498-U%3a…

Und was ist eure Meinung dazu, ist es etwas Neues oder wollen sie wieder shares auf den Markt werfen (auch Expertchen007)?

Antwort auf Beitrag Nr.: 43.294.868 von realtimeinfo am 18.06.12 15:45:44Klinkt für mich so etwas nach Durchhalteparole...oder halt auch die Suche nach neuen Kleininvestoren.

" wollen " " kann " " sollte "........

" wollen " " kann " " sollte "........

Ja, das koennte passen: Suche nach Kleininvestoren. Und auch müssen wir immer das Thema beachten: Genta, Revolution in der Krebstherapie. Tesetaxol ist auf dem Weg, und hat das Potential, ein Blockbuster zu werden. Wenn auch schon wieder 5 Milliarden Aktien ausstehend sind.

Antwort auf Beitrag Nr.: 43.294.868 von realtimeinfo am 18.06.12 15:45:44Meine Meinung dazu ist, dass Genta sich mit den Aktien aus der Ausübung der Warrants gut eingedeckt hat - Die warrants haben sie billigst haben wollen, denn der Bezugspreis der Aktien aus den Warrants hängt von der Höhe des Kurses ab. Je billiger umso besser. Knapp 5 Milliarden Aktien ausstehend, ich glaube aber, dass dann für eine Zeit nicht mehr aus Notes gewandelt wird. Zur Not kann man aber immer wider weiter wandeln. Die Aktien werden dann aber in absehbarer Zeit sowieso wieder gesplittet.

Antwort auf Beitrag Nr.: 43.298.739 von Boersenbeate am 19.06.12 16:41:04Ich halte mir auch immer einen kleinen Vorrat.

Antwort auf Beitrag Nr.: 43.298.739 von Boersenbeate am 19.06.12 16:41:04Ne ganze Menge von den 2,2 Mrd shares sind restricted. So die an Ray (800 Mio), Siegel (550 Mio) und Itri (650 Mio). Also 2 Mrd shares sind restricted. Bleiben noch weitere 200 Mio neue shares. Die shares an Warrel Itri und Gary Siegel sind granted, d h umsonst!

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

Antwort auf Beitrag Nr.: 43.299.139 von auriga am 19.06.12 18:16:32Das sind Pakete , die bei einem Aktienkurs von 0.001 USD einen Wert von 550.000 bzw. 650.000 USD haben  !!!

!!!

Ist doch ein nettes Geschenk für die hervorragende "Arbeit" in den letzten Jahren

!

!

Diese Abzockke nimmt immer skurilere Ausmasse an und der abgezockte Lemming wird geradezu verhöhnt

!!!

!!!

!!!

!!!Ist doch ein nettes Geschenk für die hervorragende "Arbeit" in den letzten Jahren

!

!Diese Abzockke nimmt immer skurilere Ausmasse an und der abgezockte Lemming wird geradezu verhöhnt

!!!

!!!

Merkwürdig, heute verkauft fast keiner.

Ich würde ja sagen hier sammelt jemand.

Ich würde ja sagen hier sammelt jemand.

Antwort auf Beitrag Nr.: 43.299.364 von Scania01 am 19.06.12 19:25:00Ja, das stimmt schon.....21 Mio buys und 1,5 Mio sells laut ADVFN trades Z ZT.....zu beachten ist allerdings auch das erhöhte short Volumen vom Freitag....you remember the potential relationships?....zwar Spekulation aber passt zu den news of late!....nun wie auch immer.

Antwort auf Beitrag Nr.: 43.299.461 von auriga am 19.06.12 19:47:23short Volumen von MO 18...klar....sorry!

Antwort auf Beitrag Nr.: 43.299.461 von auriga am 19.06.12 19:47:23Ich denke die Aktie lässt sich nicht shorten?

Oder was hat das short Volumen für eine Bedeutung?

Oder was hat das short Volumen für eine Bedeutung?

Antwort auf Beitrag Nr.: 43.299.507 von Scania01 am 19.06.12 19:58:55Doch, sie lässt sich durchaus shorten. Das short volume vom MO beträgt 66.28 million GNTA shares, die short vol ratio über 50 %. Die news diesmal sind an sich recht gut IMHO. Wenn jemand nicht genug Genta shares zum Abdrücken vorrätig hat wenn der Kurs steigt nach guten news(diesmal ziemlich bescheidener Kursanstieg am MO aber immerhin!)....geht er eventuell short.....schließlich muss er die Aktien dann zurückkaufen...oder als Finance people etwa(aber nicht unbedingt) wandeln und mit den gewandelten shares covern....wir gingen mit iHub davon aus, dass durch die gewandelten gecoverten shares es zu keinem short squeeze kommt.

Antwort auf Beitrag Nr.: 43.299.583 von auriga am 19.06.12 20:20:43Du meinst aber damit , dass nur die Noteholder in der Lage sind zu shorten oder kennst du eine Möglichkeit bzw. einen Broker , bei dem man auch als normalsterblicher Anleger diese Aktie shorten kann  ?

?

?

?

Antwort auf Beitrag Nr.: 43.299.685 von hoffihoff am 19.06.12 20:44:39Wieso, muss das bloß ein normal sterblicher sein, kann das nicht auch

ein Außerirdischer tun?

Oder ein Hedgefond???

Weil es mal wieder nicht für Kleinanleger möglich ist!!!

ein Außerirdischer tun?

Oder ein Hedgefond???

Weil es mal wieder nicht für Kleinanleger möglich ist!!!

Antwort auf Beitrag Nr.: 43.299.723 von Scania01 am 19.06.12 20:50:46Die Noteholder sind ja die OTC-Finanzierungsfonds , die sich hier dumm und dämlich verdienen und das Modell mit dem zusätzlichen shorten und covern mit gewandelten Shares hatte mir einmal ein WO-User vor einigen Jahren bei einem anderen Wert ausführlicher erläutert !

Wenn ich hier eine Möglichkeit gehabt hätte , Genta zu shorten , könnte ich mich heute zur Ruhe setzen !

!

Wenn ich hier eine Möglichkeit gehabt hätte , Genta zu shorten , könnte ich mich heute zur Ruhe setzen

!

!

Antwort auf Beitrag Nr.: 43.299.755 von hoffihoff am 19.06.12 20:57:59Nun, die noteholder gehen eventuell direkt bei einem Endbroker short.... http://www.otcbb.com/asp/tradeact_mv.asp?SearchBy=issue&Issu…wenn sie es denn tun....es wurde auf iHub angenommen und als auch in der Vergangenheit bestätigt angenommen und es spricht einiges dafür, denn der short squeeze findet kaum statt....ansonsten geht es bestimmt auch für retail Anleger, ansonsten wären die über 60 Millionen vom Montag alles noteholder oder so .....bei den von mir schon zitierten Sino, Interactive Brokers, Saxo Bank kann ich mir das für gute Kunden durchaus vorstellen....ich habe auch Nordnet zitiert....selbst da würde ich das nicht ausschließen.

Zitat von auriga: Ne ganze Menge von den 2,2 Mrd shares sind restricted. So die an Ray (800 Mio), Siegel (550 Mio) und Itri (650 Mio). Also 2 Mrd shares sind restricted. Bleiben noch weitere 200 Mio neue shares. Die shares an Warrel Itri und Gary Siegel sind granted, d h umsonst!

http://www.sec.gov/Archives/edgar/data/880643/00014377491200…

Ich denke, dass sie die Periode, in der die Shares resticted sind, schon hinter sich haben. Sie müssen ja nur die warrants anmelden und kriegen sie dann ins Depot eingebucht. Deshalb denke ich, dass wegen der Meldung zu den 2 Mrd. neuen ausstehenden shares, diese aus der Ausübung der warrants stammen, aber die restricted periode, also die Zeitspanne, wo sie nicht darüber verfügen können, schon vergangen ist. Sonst würden die shares nämlich noch nicht zu den outstanding shares zählen.

Haben Warrel, Itri und Co eigentlich jemals selbst für diese Aktien bezahlt?

Zitat von hoffihoff: Du meinst aber damit , dass nur die Noteholder in der Lage sind zu shorten oder kennst du eine Möglichkeit bzw. einen Broker , bei dem man auch als normalsterblicher Anleger diese Aktie shorten kann?

Was mit short stehenden Aktien gemeint ist, ist wohl folgendes: Wer Aktien verkauft, bekommt den Verkaufspreis nicht sofort wieder gutgeschrieben, sondern erst nach 3 Tagen (das geht nur in den USA). In dieser Zeitspanne, zwischen Verkauf der Aktien und Gutschrift des Erlöses stehen die Aktien short. Und das ist ein Indikator, wie viel Leute eher verkauft als gekauft haben.

Antwort auf Beitrag Nr.: 43.299.918 von Boersenbeate am 19.06.12 21:43:18http://www.shortvolume.com/

I. Short Sales

A. What is a short sale?

A short sale is generally the sale of a stock you do not own (or that you will borrow for delivery).1 Short sellers believe the price of the stock will fall, or are seeking to hedge against potential price volatility in securities that they own.

If the price of the stock drops, short sellers buy the stock at the lower price and make a profit. If the price of the stock rises, short sellers will incur a loss. Short selling is used for many purposes, including to profit from an expected downward price movement, to provide liquidity in response to unanticipated buyer demand, or to hedge the risk of a long position in the same security or a related security.

. . .

http://www.sec.gov/spotlight/keyregshoissues.htm

I. Short Sales

A. What is a short sale?

A short sale is generally the sale of a stock you do not own (or that you will borrow for delivery).1 Short sellers believe the price of the stock will fall, or are seeking to hedge against potential price volatility in securities that they own.

If the price of the stock drops, short sellers buy the stock at the lower price and make a profit. If the price of the stock rises, short sellers will incur a loss. Short selling is used for many purposes, including to profit from an expected downward price movement, to provide liquidity in response to unanticipated buyer demand, or to hedge the risk of a long position in the same security or a related security.

. . .

http://www.sec.gov/spotlight/keyregshoissues.htm

Antwort auf Beitrag Nr.: 43.300.158 von auriga am 19.06.12 22:52:24Was denn nun, Leerverkauf oder abladen von Notes.

Deas ist ein großer Unterschied weil letzteres nicht wieder

zurück gekauft werden muss.

Deas ist ein großer Unterschied weil letzteres nicht wieder

zurück gekauft werden muss.

Zitat von auriga: http://www.shortvolume.com/

I. Short Sales

A. What is a short sale?

A short sale is generally the sale of a stock you do not own (or that you will borrow for delivery).1 Short sellers believe the price of the stock will fall, or are seeking to hedge against potential price volatility in securities that they own.

If the price of the stock drops, short sellers buy the stock at the lower price and make a profit. If the price of the stock rises, short sellers will incur a loss. Short selling is used for many purposes, including to profit from an expected downward price movement, to provide liquidity in response to unanticipated buyer demand, or to hedge the risk of a long position in the same security or a related security.

. . .

http://www.sec.gov/spotlight/keyregshoissues.htm

Das ist zwar richtig, aber was da steht ist echtes Short-selling, was man machen kann, wenn man ein Margin-Trading-Account hat, und wenn es eine "echte" Aktie ist. Mit Genta kann man das aber leider nicht machen.

Antwort auf Beitrag Nr.: 43.301.017 von Boersenbeate am 20.06.12 09:48:34Das geht schon, mit Naked Short Selling.

http://www.happyhotstock.de/hotstock-info/know-how/naked-sho…

http://www.happyhotstock.de/hotstock-info/know-how/naked-sho…