Diskussion zu Signal Gold [Anaconda Gold] (Seite 128)

eröffnet am 20.09.06 16:45:25 von

neuester Beitrag 18.05.24 13:58:19 von

neuester Beitrag 18.05.24 13:58:19 von

Beiträge: 36.205

ID: 1.083.231

ID: 1.083.231

Aufrufe heute: 3

Gesamt: 2.161.725

Gesamt: 2.161.725

Aktive User: 0

ISIN: CA82664T1012 · WKN: A3DK3Q · Symbol: Y8B

0,0660

EUR

-5,04 %

-0,0035 EUR

Letzter Kurs 24.05.24 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 60,30 | +50,00 | |

| 227,00 | +28,00 | |

| 13,160 | +22,19 | |

| 1.282,60 | +12,04 | |

| 0,7540 | +9,71 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14,843 | -8,77 | |

| 0,7500 | -9,09 | |

| 9,9500 | -9,95 | |

| 2,4300 | -11,31 | |

| 46,69 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Hallo Schlangenbeschwörer,

am Donnerstag ist wieder ein neuer Monat.

Da gibt es 50.000 neue Anacondas für´s Depot...

Good luck to all!

IQ

am Donnerstag ist wieder ein neuer Monat.

Da gibt es 50.000 neue Anacondas für´s Depot...

Good luck to all!

IQ

Anaconda Mining earns $195,449 in fiscal 2016

2016-08-26 07:20 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING SELLS 16,023 OUNCES AND GENERATES $7.0M OF EBITDA AT THE POINT ROUSSE PROJECT IN FISCAL 2016

Anaconda Mining Inc. has released its financial and operating results for the fiscal year ended May 31, 2016. The Company sold 16,023 ounces of gold in fiscal 2016 resulting in $24,361,471 in revenue at an average sales price of $1,520 (USD$1,151) per ounce. Cash cost per ounce sold at the Point Rousse Project for fiscal 2016 was $1,081 (USD$819). Earnings before interest, taxes, depreciation and amortization and other non-cash expenses ("EBITDA") at the project level were $7,036,401. Net income for the year ended May 31, 2016 was $195,449. As at May 31, 2016, the Company had cash and cash equivalents of $1,636,161 and net working capital of $819,322. All dollar amounts are in Canadian dollars unless otherwise noted.

President and CEO, Dustin Angelo, stated, "During fiscal 2016, the Company, for the first time ever, sold more than 16,000 ounces of gold, generating over $7.0M of EBITDA at the Point Rousse Project. It is the fifth year in a row Anaconda has generated positive cash flow from operations for a total of approximately $35 million in EBITDA at the project level over the five-year period. The Pine Cove Mill hit another new record level of ore processed, up 13% year over year, which offset the relatively lower grades we have been experiencing in the recent mine plan. During the year, the Company took its first step in mining and processing ore from Stog'er Tight, successfully demonstrating the ability to blend higher-grade ore through the Pine Cove Mill which is part of the Company's long-term strategy. Looking ahead to the next potential source of ore for the Pine Cove Mill, the Viking Project acquisition in February significantly increased our land package and resource base. We are poised for substantial growth, anchored by a continuously improving mill and the potential to expand our resource base and find higher-grade ore at our two projects."

The Company has budgeted to produce and sell over 16,000 ounces of gold in fiscal 2017 and generate over $24 million of revenue using a gold price of $1,500 per ounce. Due to an expected reduction in grade during the first half of fiscal 2017, Anaconda is projecting to generate lower EBITDA at the Point Rousse Project ($3.4 million) compared to fiscal 2016, most of which will come in the latter half of the fiscal year. The Company is currently undertaking a 17,000-metre drill program focusing on resource expansion as well as targeting higher-grade resources in an effort to increase, in the long-term, the average grade of ore going through the Pine Cove Mill and increase profitability.

Highlights for the year ended May 31, 2016

As at May 31, 2016, the Company had cash and cash equivalents of $1,636,161 and net working capital of $819,322. The Company sold 16,023 ounces of gold and generated $24,361,471 in revenue at an average sales price of $1,520 (USD$1,151) per ounce. Cash cost per ounce sold at the Point Rousse Project was $1,081 (USD$819). All-in sustaining cash cost per ounce sold ("AISC") (see Reconciliation of Non-GAAP Financial Measures), including corporate administration, capital expenditures and exploration costs was $1,522 (USD$1,152). The Pine Cove Mill processed 387,694 tonnes of ore at an average rate of 1,134 tonnes per operating day. Mill availability, recovery and head grade were 93%, 85% and 1.50 g/t respectively. Mining operations at the Pine Cove Pit produced 370,561 tonnes of ore and 2,366,842 tonnes of waste. Mining operations at the Stog'er Tight Deposit produced 27,260 tonnes of ore at an average grade of 2.22 g/t and 55,038 tonnes of waste. EBITDA (see Reconciliation of Non-GAAP Financial Measures) at the Point Rousse Project and on a consolidated basis were $7,036,401 and $4,335,115 respectively. Net income was $195,449. Purchase of property, mill and equipment was $3,079,646. Key items included mill automation and equipment upgrades of $1,241,000, tailing expansion and polishing pond construction of $804,000, construction of ore shed enclosure of $289,000 and pit development costs of $588,000 at Pine Cove and Stog'er Tight. Production stripping assets include additions of $1,883,022 and amortization of $37,258. Approximately $1,347,000 was spent at Point Rousse on exploration activities such as drilling, trenching, mapping and mineral resource estimates for the year ended May 31, 2016. On February 5, 2016, the Company completed the acquisition of the Viking Project.

Highlights subsequent to the year ended May 31, 2016

On July 13, 2016, the Company announced that it entered into a Line of Credit Agreement with the Royal Bank of Canada ("RBC") for a $1,000,000 revolving credit facility as well as a $500,000 revolving equipment lease line of credit. On July 27, 2016, the Company announced a $2,037,265 flow-through equity financing to fund a 17,000-metre diamond drilling campaign at the Point Rousse and Viking Projects which will focus on near-surface resource expansion as well as targeting relatively higher-grade mineral resources at four main areas - Stog'er Tight, Argyle, Goldenville and Viking.

Operations overvie w

During the year ended May 31, 2016, the gold sales volume of 16,023 ounces represented a 1% increase over fiscal 2015, largely due to increased mill availability, throughput and recovery. Average sales price for the year ended May 31, 2016 was $1,520 per ounce compared to $1,405 per ounce in fiscal 2015. As a result of the higher sales volume and gold price, gross revenue for the year ended May 31, 2016 of $24,361,471 was higher than fiscal 2015 by $2,127,400 or 10%.

MILLING OPERATIONS

The following table summarizes the key mill operating metrics for the years ended May 31, 2016 and 2015:

OPERATING STATISTICS: For the year ended

May 31 2016May 31 2015

Mill

Operating days 342 336

Availability 93% 92%

Dry tonnes processed 387,694 343,178

Tonnes per 24-hour period 1,134 1,021

Grade (grams per tonne) 1.50 1.72

Overall mill recovery 85% 84%

Gold sales volume (troy oz.) 16,023 15,821

The mill operated for 342 days during fiscal 2016; 6 additional days compared to fiscal 2015. Ore processed totaled 387,694 dry tonnes of ore resulting in an average run rate of 1,134 tonnes per operating day. Tonnes processed in fiscal 2016 was a 13% increase from fiscal 2015. Mill availability of 93% and recovery of 85% were both 1% higher respectively, compared to fiscal 2015.

The Company processed 25,158 tonnes of ore from the Stog'er Tight Property at an average grade of 2.22 g/t, producing 1,462 ounces of gold. During fiscal 2016, the Company has demonstrated the ability to successfully blend Stog'er Tight and Pine Cove ore through the Pine Cove Mill.

The Pine Cove Mill continues to demonstrate improvements in operations year-over-year attaining record levels of throughput. Initiatives during fiscal 2016 were centered around the mill automation project and equipment repairs and upgrades on the ball mill motor and other components. The repairs to the ball mill motor have enabled it to start up with a higher ball charge, which has helped improve throughput through the year. Mechanical issues with the regrind mill experienced in the third quarter were resolved and allowed the operation to maintain a stable feed size of concentrate to the leach tanks resulting in improvements in recovery. In fiscal 2017, the Company intends to focus on maintaining consistent and optimized operations. The mill automation project will play a significant role in streamlining and monitoring various processes which are expected to result in reduced costs and increased productivity during fiscal 2017.

MINING OPERATIONS

The following table summarizes the key mining operating metrics for the years ended May 31, 2016 and 2015:

OPERATING STATISTICS: For the year ended

May 31 2016May 31 2015

Mine - Total

Operating days 292 250

Ore production (tonnes) 397,821 321,532

Waste production (tonnes)2,421,880 1,762,312

Total production (tonnes)2,819,701 2,083,844

Waste: Ore ratio 6.1 5.5

Mine - Pine Cove Pit

Operating days 269 250

Ore production (tonnes) 370,561 321,532

Waste production (tonnes)2,366,842 1,762,312

Total production (tonnes)2,737,403 2,083,844

Waste: Ore ratio 6.4 5.5

Mine - Stog'er Tight

Operating days 23 -

Ore production (tonnes) 27,260 -

Waste production (tonnes)55,038 -

Total production (tonnes)82,298 -

Waste: Ore ratio 2.0 -

Mining operations included 269 days of production at the Pine Cove Pit and 23 days of production at the Stog'er Tight Deposit. Total production for fiscal 2016 resulted in 397,821 tonnes of ore and 2,421,880 tonnes of waste including 27,260 tonnes of ore and 55,038 tonnes of waste from Stog'er Tight. Tonnes mined in fiscal 2016 was 35% higher compared to fiscal 2015.

The Company reduced truck haul distance and cost per tonne of waste mined through use of the North Pit Waste Dump. The Company continuously explores various mine plan scenarios in order to maintain this benefit in mine production going forward. The increased levels of production per the mine plan are expected to continue as production is focused on Phase III of the Pine Cove Pit and material is required for construction of the tailings facility expansion in fiscal 2017.

Reconciliation of Non-GAAP financial measures

The Company has included certain non-GAAP financial measures in this document. These measures are not defined under IFRS and should not be considered in isolation. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these measures is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These measures are not necessarily standard and therefore may not be comparable to other issuers.

Adjusted net earnings measure the performance of the Company, excluding certain impacts which the Company believes are not reflective of the Company's underlying performance for the reporting period, such as the impact of foreign exchange gains and losses, impairment charges, and non-hedge derivative gains and losses. Although some of the items are recurring, the Company believes that they are not reflective of the underlying operating performance of its current business and are not necessarily indicative of future operating results.

The following table provides a reconciliation of adjusted net earnings for the years ended May 31, 2016 and 2015:

For the year ended

May 31 May 31

2016 2015

$ $

Net income (loss) 195,449 (2,774,766)

Adjusting items:

Foreign exchange gain (18,437) (11,927)

Unrealized loss on forward sales contract derivative31,595 65,800

Write down of Chilean assets - 2,260,158

Reclamation expense 60,062 57,432

Total adjustments 73,220 2,371,463

Adjusted net earnings (loss) 268,669 (403,303)

Cash cost per ounce sold is cost of sales before depreciation divided by gold ounces sold. All-in sustaining cash cost per ounce sold is cash cost, corporate administration, purchase of property, mill and equipment and purchase of exploration and evaluation assets divided by gold ounces sold.

The following table provides a reconciliation of cash cost per ounce sold and all-in sustaining cash cost per ounce sold for the years ended May 31, 2016 and 2015:

For the year ended

May 31 May 31

2016 2015

Cost of sales 21,159,053 21,695,290

Less: Depletion and depreciation (3,833,983)(4,288,132)

Cash operating cost 17,325,070 17,407,158

Corporate administration 2,630,745 2,032,265

Purchase of property, mill and equipment 3,079,646 1,745,818

Purchase of exploration and evaluation assets 1,346,567 1,745,058

All-in cash cost 24,382,028 22,930,299

Gold ounces sold 16,023 15,821

Cash cost per ounce sold 1,081 1,100

All-in sustaining cash cost per ounce sold 1,522 1,449

(in USD$)

Cash cost per ounce sold 819 951

All-in sustaining cash cost per ounce sold 1,152 1,315

EBITDA is earnings before finance expense, foreign exchange loss (gain), unrealized gain on forward sales contract derivative, share-based compensation, income tax recovery and depreciation and depletion. Point Rousse Project EBITDA is EBITDA before corporate administration, other revenues and expenses and write down of Chilean assets.

The following table provides a reconciliation of EBITDA for the years ended May 31, 2016 and 2015:

For the year ended

May 31 May 31

2016 2015

$ $

Net income (loss) 195,449 (2,774,766)

Add back:

Finance expense 3,573 433

Foreign exchange gain (18,437) (11,927)

Unrealized loss on forward sales contract derivative31,595 65,800

Share-based compensation 240,952 136,921

Deferred income tax expense (recovery) 48,000 (929,865)

Depletion and depreciation 3,833,9834,288,132

EBITDA 4,335,115774,728

Corporate administration 2,630,7452,032,265

Other (revenues) and expenses 70,541 (240,238)

Write down of Chilean assets - 2,260,158

Point Rousse Project EBITDA 7,036,4014,826,913

ABOUT ANACONDA

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse Project and an exploration/development project called the Viking Project in Newfoundland.

The Point Rousse Project is approximately 6,300 hectares of property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula and gold production to nearly 16,000 ounces per year. In an effort to expand production, it is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include five deposits and numerous prospects and showings, all within 8 km of the Pine Cove mill.

Anaconda also controls the Viking Project, which has approximately 6,225 hectares of property in White Bay, Newfoundland, approximately 100 km by water (180 km via road) from the Pine Cove mill. The project contains the Thor Deposit and other gold prospects and showings. The company's plan is to discover and develop more resources within these project areas and double annual production at the Pine Cove mill from its current rate of over 16,000 ounces to 30,000 ounces.

As the only pure play gold producer in Atlantic Canada, Anaconda Mining is turning the rock we live on into a growing and profitable resource. With a young and motivated workforce, innovative technology and the support of local suppliers, Anaconda is investing in the people of Newfoundland & Labrador and giving back to the communities in which we operate - building a better future for all our stakeholders, from the ground up.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

2016-08-26 07:20 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING SELLS 16,023 OUNCES AND GENERATES $7.0M OF EBITDA AT THE POINT ROUSSE PROJECT IN FISCAL 2016

Anaconda Mining Inc. has released its financial and operating results for the fiscal year ended May 31, 2016. The Company sold 16,023 ounces of gold in fiscal 2016 resulting in $24,361,471 in revenue at an average sales price of $1,520 (USD$1,151) per ounce. Cash cost per ounce sold at the Point Rousse Project for fiscal 2016 was $1,081 (USD$819). Earnings before interest, taxes, depreciation and amortization and other non-cash expenses ("EBITDA") at the project level were $7,036,401. Net income for the year ended May 31, 2016 was $195,449. As at May 31, 2016, the Company had cash and cash equivalents of $1,636,161 and net working capital of $819,322. All dollar amounts are in Canadian dollars unless otherwise noted.

President and CEO, Dustin Angelo, stated, "During fiscal 2016, the Company, for the first time ever, sold more than 16,000 ounces of gold, generating over $7.0M of EBITDA at the Point Rousse Project. It is the fifth year in a row Anaconda has generated positive cash flow from operations for a total of approximately $35 million in EBITDA at the project level over the five-year period. The Pine Cove Mill hit another new record level of ore processed, up 13% year over year, which offset the relatively lower grades we have been experiencing in the recent mine plan. During the year, the Company took its first step in mining and processing ore from Stog'er Tight, successfully demonstrating the ability to blend higher-grade ore through the Pine Cove Mill which is part of the Company's long-term strategy. Looking ahead to the next potential source of ore for the Pine Cove Mill, the Viking Project acquisition in February significantly increased our land package and resource base. We are poised for substantial growth, anchored by a continuously improving mill and the potential to expand our resource base and find higher-grade ore at our two projects."

The Company has budgeted to produce and sell over 16,000 ounces of gold in fiscal 2017 and generate over $24 million of revenue using a gold price of $1,500 per ounce. Due to an expected reduction in grade during the first half of fiscal 2017, Anaconda is projecting to generate lower EBITDA at the Point Rousse Project ($3.4 million) compared to fiscal 2016, most of which will come in the latter half of the fiscal year. The Company is currently undertaking a 17,000-metre drill program focusing on resource expansion as well as targeting higher-grade resources in an effort to increase, in the long-term, the average grade of ore going through the Pine Cove Mill and increase profitability.

Highlights for the year ended May 31, 2016

As at May 31, 2016, the Company had cash and cash equivalents of $1,636,161 and net working capital of $819,322. The Company sold 16,023 ounces of gold and generated $24,361,471 in revenue at an average sales price of $1,520 (USD$1,151) per ounce. Cash cost per ounce sold at the Point Rousse Project was $1,081 (USD$819). All-in sustaining cash cost per ounce sold ("AISC") (see Reconciliation of Non-GAAP Financial Measures), including corporate administration, capital expenditures and exploration costs was $1,522 (USD$1,152). The Pine Cove Mill processed 387,694 tonnes of ore at an average rate of 1,134 tonnes per operating day. Mill availability, recovery and head grade were 93%, 85% and 1.50 g/t respectively. Mining operations at the Pine Cove Pit produced 370,561 tonnes of ore and 2,366,842 tonnes of waste. Mining operations at the Stog'er Tight Deposit produced 27,260 tonnes of ore at an average grade of 2.22 g/t and 55,038 tonnes of waste. EBITDA (see Reconciliation of Non-GAAP Financial Measures) at the Point Rousse Project and on a consolidated basis were $7,036,401 and $4,335,115 respectively. Net income was $195,449. Purchase of property, mill and equipment was $3,079,646. Key items included mill automation and equipment upgrades of $1,241,000, tailing expansion and polishing pond construction of $804,000, construction of ore shed enclosure of $289,000 and pit development costs of $588,000 at Pine Cove and Stog'er Tight. Production stripping assets include additions of $1,883,022 and amortization of $37,258. Approximately $1,347,000 was spent at Point Rousse on exploration activities such as drilling, trenching, mapping and mineral resource estimates for the year ended May 31, 2016. On February 5, 2016, the Company completed the acquisition of the Viking Project.

Highlights subsequent to the year ended May 31, 2016

On July 13, 2016, the Company announced that it entered into a Line of Credit Agreement with the Royal Bank of Canada ("RBC") for a $1,000,000 revolving credit facility as well as a $500,000 revolving equipment lease line of credit. On July 27, 2016, the Company announced a $2,037,265 flow-through equity financing to fund a 17,000-metre diamond drilling campaign at the Point Rousse and Viking Projects which will focus on near-surface resource expansion as well as targeting relatively higher-grade mineral resources at four main areas - Stog'er Tight, Argyle, Goldenville and Viking.

Operations overvie w

During the year ended May 31, 2016, the gold sales volume of 16,023 ounces represented a 1% increase over fiscal 2015, largely due to increased mill availability, throughput and recovery. Average sales price for the year ended May 31, 2016 was $1,520 per ounce compared to $1,405 per ounce in fiscal 2015. As a result of the higher sales volume and gold price, gross revenue for the year ended May 31, 2016 of $24,361,471 was higher than fiscal 2015 by $2,127,400 or 10%.

MILLING OPERATIONS

The following table summarizes the key mill operating metrics for the years ended May 31, 2016 and 2015:

OPERATING STATISTICS: For the year ended

May 31 2016May 31 2015

Mill

Operating days 342 336

Availability 93% 92%

Dry tonnes processed 387,694 343,178

Tonnes per 24-hour period 1,134 1,021

Grade (grams per tonne) 1.50 1.72

Overall mill recovery 85% 84%

Gold sales volume (troy oz.) 16,023 15,821

The mill operated for 342 days during fiscal 2016; 6 additional days compared to fiscal 2015. Ore processed totaled 387,694 dry tonnes of ore resulting in an average run rate of 1,134 tonnes per operating day. Tonnes processed in fiscal 2016 was a 13% increase from fiscal 2015. Mill availability of 93% and recovery of 85% were both 1% higher respectively, compared to fiscal 2015.

The Company processed 25,158 tonnes of ore from the Stog'er Tight Property at an average grade of 2.22 g/t, producing 1,462 ounces of gold. During fiscal 2016, the Company has demonstrated the ability to successfully blend Stog'er Tight and Pine Cove ore through the Pine Cove Mill.

The Pine Cove Mill continues to demonstrate improvements in operations year-over-year attaining record levels of throughput. Initiatives during fiscal 2016 were centered around the mill automation project and equipment repairs and upgrades on the ball mill motor and other components. The repairs to the ball mill motor have enabled it to start up with a higher ball charge, which has helped improve throughput through the year. Mechanical issues with the regrind mill experienced in the third quarter were resolved and allowed the operation to maintain a stable feed size of concentrate to the leach tanks resulting in improvements in recovery. In fiscal 2017, the Company intends to focus on maintaining consistent and optimized operations. The mill automation project will play a significant role in streamlining and monitoring various processes which are expected to result in reduced costs and increased productivity during fiscal 2017.

MINING OPERATIONS

The following table summarizes the key mining operating metrics for the years ended May 31, 2016 and 2015:

OPERATING STATISTICS: For the year ended

May 31 2016May 31 2015

Mine - Total

Operating days 292 250

Ore production (tonnes) 397,821 321,532

Waste production (tonnes)2,421,880 1,762,312

Total production (tonnes)2,819,701 2,083,844

Waste: Ore ratio 6.1 5.5

Mine - Pine Cove Pit

Operating days 269 250

Ore production (tonnes) 370,561 321,532

Waste production (tonnes)2,366,842 1,762,312

Total production (tonnes)2,737,403 2,083,844

Waste: Ore ratio 6.4 5.5

Mine - Stog'er Tight

Operating days 23 -

Ore production (tonnes) 27,260 -

Waste production (tonnes)55,038 -

Total production (tonnes)82,298 -

Waste: Ore ratio 2.0 -

Mining operations included 269 days of production at the Pine Cove Pit and 23 days of production at the Stog'er Tight Deposit. Total production for fiscal 2016 resulted in 397,821 tonnes of ore and 2,421,880 tonnes of waste including 27,260 tonnes of ore and 55,038 tonnes of waste from Stog'er Tight. Tonnes mined in fiscal 2016 was 35% higher compared to fiscal 2015.

The Company reduced truck haul distance and cost per tonne of waste mined through use of the North Pit Waste Dump. The Company continuously explores various mine plan scenarios in order to maintain this benefit in mine production going forward. The increased levels of production per the mine plan are expected to continue as production is focused on Phase III of the Pine Cove Pit and material is required for construction of the tailings facility expansion in fiscal 2017.

Reconciliation of Non-GAAP financial measures

The Company has included certain non-GAAP financial measures in this document. These measures are not defined under IFRS and should not be considered in isolation. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these measures is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These measures are not necessarily standard and therefore may not be comparable to other issuers.

Adjusted net earnings measure the performance of the Company, excluding certain impacts which the Company believes are not reflective of the Company's underlying performance for the reporting period, such as the impact of foreign exchange gains and losses, impairment charges, and non-hedge derivative gains and losses. Although some of the items are recurring, the Company believes that they are not reflective of the underlying operating performance of its current business and are not necessarily indicative of future operating results.

The following table provides a reconciliation of adjusted net earnings for the years ended May 31, 2016 and 2015:

For the year ended

May 31 May 31

2016 2015

$ $

Net income (loss) 195,449 (2,774,766)

Adjusting items:

Foreign exchange gain (18,437) (11,927)

Unrealized loss on forward sales contract derivative31,595 65,800

Write down of Chilean assets - 2,260,158

Reclamation expense 60,062 57,432

Total adjustments 73,220 2,371,463

Adjusted net earnings (loss) 268,669 (403,303)

Cash cost per ounce sold is cost of sales before depreciation divided by gold ounces sold. All-in sustaining cash cost per ounce sold is cash cost, corporate administration, purchase of property, mill and equipment and purchase of exploration and evaluation assets divided by gold ounces sold.

The following table provides a reconciliation of cash cost per ounce sold and all-in sustaining cash cost per ounce sold for the years ended May 31, 2016 and 2015:

For the year ended

May 31 May 31

2016 2015

Cost of sales 21,159,053 21,695,290

Less: Depletion and depreciation (3,833,983)(4,288,132)

Cash operating cost 17,325,070 17,407,158

Corporate administration 2,630,745 2,032,265

Purchase of property, mill and equipment 3,079,646 1,745,818

Purchase of exploration and evaluation assets 1,346,567 1,745,058

All-in cash cost 24,382,028 22,930,299

Gold ounces sold 16,023 15,821

Cash cost per ounce sold 1,081 1,100

All-in sustaining cash cost per ounce sold 1,522 1,449

(in USD$)

Cash cost per ounce sold 819 951

All-in sustaining cash cost per ounce sold 1,152 1,315

EBITDA is earnings before finance expense, foreign exchange loss (gain), unrealized gain on forward sales contract derivative, share-based compensation, income tax recovery and depreciation and depletion. Point Rousse Project EBITDA is EBITDA before corporate administration, other revenues and expenses and write down of Chilean assets.

The following table provides a reconciliation of EBITDA for the years ended May 31, 2016 and 2015:

For the year ended

May 31 May 31

2016 2015

$ $

Net income (loss) 195,449 (2,774,766)

Add back:

Finance expense 3,573 433

Foreign exchange gain (18,437) (11,927)

Unrealized loss on forward sales contract derivative31,595 65,800

Share-based compensation 240,952 136,921

Deferred income tax expense (recovery) 48,000 (929,865)

Depletion and depreciation 3,833,9834,288,132

EBITDA 4,335,115774,728

Corporate administration 2,630,7452,032,265

Other (revenues) and expenses 70,541 (240,238)

Write down of Chilean assets - 2,260,158

Point Rousse Project EBITDA 7,036,4014,826,913

ABOUT ANACONDA

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse Project and an exploration/development project called the Viking Project in Newfoundland.

The Point Rousse Project is approximately 6,300 hectares of property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula and gold production to nearly 16,000 ounces per year. In an effort to expand production, it is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include five deposits and numerous prospects and showings, all within 8 km of the Pine Cove mill.

Anaconda also controls the Viking Project, which has approximately 6,225 hectares of property in White Bay, Newfoundland, approximately 100 km by water (180 km via road) from the Pine Cove mill. The project contains the Thor Deposit and other gold prospects and showings. The company's plan is to discover and develop more resources within these project areas and double annual production at the Pine Cove mill from its current rate of over 16,000 ounces to 30,000 ounces.

As the only pure play gold producer in Atlantic Canada, Anaconda Mining is turning the rock we live on into a growing and profitable resource. With a young and motivated workforce, innovative technology and the support of local suppliers, Anaconda is investing in the people of Newfoundland & Labrador and giving back to the communities in which we operate - building a better future for all our stakeholders, from the ground up.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

Antwort auf Beitrag Nr.: 53.115.192 von Toni_Trade am 23.08.16 08:28:23Grüße Dich!

Na, das wollen wir doch mal hoffen, dass da was im Busch ist.

Nach nunmehr 10 Jahren wird es Zeit für 50 bis 100 Cent.

Wollen wir mal sehen welche Goldgehalte gedrillt werden und ab wann die Produktion verdoppelt wird...

Good luck and buy cheap to sell high...

Na, das wollen wir doch mal hoffen, dass da was im Busch ist.

Nach nunmehr 10 Jahren wird es Zeit für 50 bis 100 Cent.

Wollen wir mal sehen welche Goldgehalte gedrillt werden und ab wann die Produktion verdoppelt wird...

Good luck and buy cheap to sell high...

Ist jetzt hier endlich was im Busch ?

Gruß Toni

Level II

... kann mir jemand einen Tipp geben wie man umsonst an TSX Level II Quotes kommt??In diesem Fall würde mich das Orderbuch von Anaconda interessieren

Danke vorab

Antwort auf Beitrag Nr.: 53.013.712 von IQ4U am 08.08.16 16:01:17

Jubiläum, Jubiläum, Jubiläum

Jubiläum, Jubiläum, Jubiläum

Heute haben wir zusammen die 2 Millionen geknackt

Eigentlich wollte ich dir ja den Vortritt geben, aber die restlichen 50 k vollzumachen, ging mir dann doch zu lange

Nächstes Ziel dann jetzt 3 Millionen, blöd nur wir sind jetzt glaube ich beide pleite

Zitat von IQ4U: ...habe mir ja noch ein paar gegönnt und somit halten wir beide nun 1,95 Mio Stücke...

Das wird gut werden! Habe gestern in der Frankfurter Allgemeinen Sonntagszeitung ein Interview mit einem Fondsmanager gelesen und auch dort wird Gold gekauft, denn die Staatsbanken kaufen ja zunehmend alle Anleihen vom Markt weg...

Also sollte Gold weiter steigen und die Produktion unserer Ana ja auch.

Ich halte meine Anas und werde damit noch gute Erträge einfahren.

Schau mal welchen Lauf Wealth Minerals hatte.

Dies erwarte ich für unsere Schlange auch noch...

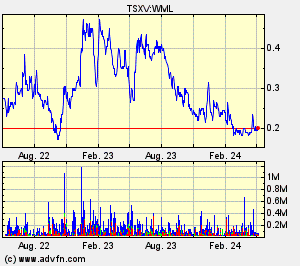

![]()

Dann die Hälfte bei 1,00 CAD verkaufen und den Rest laufen lassen.

Jubiläum, Jubiläum, Jubiläum

Jubiläum, Jubiläum, Jubiläum

Heute haben wir zusammen die 2 Millionen geknackt

Eigentlich wollte ich dir ja den Vortritt geben, aber die restlichen 50 k vollzumachen, ging mir dann doch zu lange

Nächstes Ziel dann jetzt 3 Millionen, blöd nur wir sind jetzt glaube ich beide pleite

Antwort auf Beitrag Nr.: 53.013.028 von Juchitzer50 am 08.08.16 14:37:01...habe mir ja noch ein paar gegönnt und somit halten wir beide nun 1,95 Mio Stücke...

Das wird gut werden! Habe gestern in der Frankfurter Allgemeinen Sonntagszeitung ein Interview mit einem Fondsmanager gelesen und auch dort wird Gold gekauft, denn die Staatsbanken kaufen ja zunehmend alle Anleihen vom Markt weg...

Also sollte Gold weiter steigen und die Produktion unserer Ana ja auch.

Ich halte meine Anas und werde damit noch gute Erträge einfahren.

Schau mal welchen Lauf Wealth Minerals hatte.

Dies erwarte ich für unsere Schlange auch noch...

Dann die Hälfte bei 1,00 CAD verkaufen und den Rest laufen lassen.

Das wird gut werden! Habe gestern in der Frankfurter Allgemeinen Sonntagszeitung ein Interview mit einem Fondsmanager gelesen und auch dort wird Gold gekauft, denn die Staatsbanken kaufen ja zunehmend alle Anleihen vom Markt weg...

Also sollte Gold weiter steigen und die Produktion unserer Ana ja auch.

Ich halte meine Anas und werde damit noch gute Erträge einfahren.

Schau mal welchen Lauf Wealth Minerals hatte.

Dies erwarte ich für unsere Schlange auch noch...

Dann die Hälfte bei 1,00 CAD verkaufen und den Rest laufen lassen.

Antwort auf Beitrag Nr.: 53.012.863 von IQ4U am 08.08.16 14:20:08

Ja 1,6 Millionen sind wirklich ziemlich wenig, aber wie du schon mal richtig sagtest, wenn 1,6 Mio nicht reichen, reichen 2 Mio auch nicht.

Deshalb belasse ich es selber bei 300 k Stück, für mich ist das die höchste Position im Portfolio, jetzt sind halt auch mal andere gefragt alles aufzukaufen, spätestens wenn die Produktion auf 30 k geht, sollte das doch noch mehr Investoren anziehen, von den Bohrergebnissen darf man glaub ich auch gespannt sein. Sollten ja noch dieses Jahr bekannt gegeben werden oder?

Zitat von IQ4U: Spaß beiseite, meine Familie ist noch da, aber es wäre schön, wenn die Schlange mal weiter anziehen würde sonst kaufe ich wirklich nochmal nach...

Ja 1,6 Millionen sind wirklich ziemlich wenig, aber wie du schon mal richtig sagtest, wenn 1,6 Mio nicht reichen, reichen 2 Mio auch nicht.

Deshalb belasse ich es selber bei 300 k Stück, für mich ist das die höchste Position im Portfolio, jetzt sind halt auch mal andere gefragt alles aufzukaufen, spätestens wenn die Produktion auf 30 k geht, sollte das doch noch mehr Investoren anziehen, von den Bohrergebnissen darf man glaub ich auch gespannt sein. Sollten ja noch dieses Jahr bekannt gegeben werden oder?

Antwort auf Beitrag Nr.: 52.992.811 von Juchitzer50 am 04.08.16 21:00:45Spaß beiseite, meine Familie ist noch da, aber es wäre schön, wenn die Schlange mal weiter anziehen würde sonst kaufe ich wirklich nochmal nach...

Antwort auf Beitrag Nr.: 52.992.811 von Juchitzer50 am 04.08.16 21:00:45

Ich habe gar keine Mitbewohner mehr!

Das hält doch im Kopf keiner aus nach mehr als 10Jahren und stetig mehr Anacondas...

Mal sehen, ob ich die 2 Mio. Noch voll bekomme oder nicht.

Zitat von Juchitzer50:Zitat von IQ4U: Hallo harry_limes,

Überlege nämlich auch noch weiter meine Position auszubauen...

Gute Nacht!

IQ

Wenn du so weiter machst, kannst du bald dein ganzes Haus mit Anaconda Aktien tapezieren. Was würden wohl deine Mitbewohner sagen, wenn Millionen von Anacondas von den Wänden und Decken runterschauen?

Ich habe gar keine Mitbewohner mehr!

Das hält doch im Kopf keiner aus nach mehr als 10Jahren und stetig mehr Anacondas...

Mal sehen, ob ich die 2 Mio. Noch voll bekomme oder nicht.

| Zeit | Titel |

|---|---|

| 10.04.24 | |

| 10.04.24 | |

| 10.04.24 | |

| 10.04.24 |