Globex Mining- Startschuss ??? (Seite 1271)

eröffnet am 15.11.05 13:07:13 von

neuester Beitrag 29.04.24 11:51:13 von

neuester Beitrag 29.04.24 11:51:13 von

Beiträge: 32.781

ID: 1.020.143

ID: 1.020.143

Aufrufe heute: 2

Gesamt: 2.344.565

Gesamt: 2.344.565

Aktive User: 0

ISIN: CA3799005093 · WKN: A1H735 · Symbol: GMX

0,9400

CAD

-2,08 %

-0,0200 CAD

Letzter Kurs 02.05.24 Toronto

Neuigkeiten

02.05.24 · ESG Aktien |

25.04.24 · globenewswire |

22.04.24 · kapitalerhoehungen.de |

18.04.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,1200 | +17,78 | |

| 9,8360 | +17,66 | |

| 85.089,50 | +16,19 | |

| 2,5900 | +13,85 | |

| 0,5340 | +12,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6865 | -6,92 | |

| 19,480 | -9,69 | |

| 183,20 | -19,30 | |

| 12,000 | -25,00 | |

| 46,60 | -97,97 |

Beitrag zu dieser Diskussion schreiben

Globex drills 6.47 m of 4.9% Zn, 8.95 g/t Au at Poirier

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:GMX-2229873

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:GMX-2229873

Antwort auf Beitrag Nr.: 48.344.341 von saltamonte am 17.11.14 22:03:19

danke für die zusammenstellung der infos

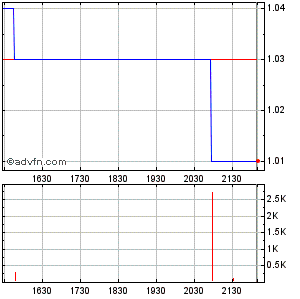

gmx heute an der tsx mit rekordverdächtigem umsatz - 700k gab es imo noch nie, wobei der niedrige kurs da natürlich eine rolle spielt.

gmx heute an der tsx mit rekordverdächtigem umsatz - 700k gab es imo noch nie, wobei der niedrige kurs da natürlich eine rolle spielt.

Antwort auf Beitrag Nr.: 48.284.596 von muenchenguru am 11.11.14 12:33:18Zusammengefasst alles in Ordnung bis auf den Aktienkurs:

Cash vorhanden, Umsätze in Ordnung, über 2m für Exploration vorgehalten, Finanziert für 2015, endlich ein Termin für Wood-Pandora Strategie 2015+ mit Osisko Besitzern für Dezember ausgemacht, klarer Fokus auf TTM, veroptionierte Projekte entwickeln sich weiter (TYP, GER, usw.), gute schlanke Kostenbasis, ... Grüße Sonic

Cash vorhanden, Umsätze in Ordnung, über 2m für Exploration vorgehalten, Finanziert für 2015, endlich ein Termin für Wood-Pandora Strategie 2015+ mit Osisko Besitzern für Dezember ausgemacht, klarer Fokus auf TTM, veroptionierte Projekte entwickeln sich weiter (TYP, GER, usw.), gute schlanke Kostenbasis, ... Grüße Sonic

Antwort auf Beitrag Nr.: 48.284.596 von muenchenguru am 11.11.14 12:33:18Property acquisitions:

During the nine month period ended September 30, 2014, the carrying value of the properties in Quebec increased by $144,197 representing cash outlays of $26,403 (2013 - $5,793), the issuance of 450,000 shares with an ascribed value of $118,000 and offsetting option income of $206.

On August 27, 2014, Globex announced the acquisition of 100% interest in the Santa Anna gold deposit located in La Reine Township, Quebec near the town of La Sarre. Two separate transactions were completed in order to acquire the property. A total of 450,000 shares and 150,000 share purchase warrants were paid to two vendors. The warrants are exercisable for Globex shares at a price of $0.45 per share for a period of two years. The shares which were issued under these transactions were valued at $0.26 per share representing the contract prices at the execution of the arrangements. The Corporation plans to compile all available information and review the project to determine the opportunities for increasing and qualifying resources at the property.

On October 14, 2014, Globex entered into an agreement with Midatlantic Minerals Inc. (“Midatlantic”) which would enable it to acquire five cells (HA!HA! Silica property, located in Boileau Township, Quebec) from Globex. The agreement provides for the payment of an advanced production royalty of $10,000 per year commencing on October 14, 2015 and an ongoing royalty of $1.25 per ton of rock mined and removed or sold from both the Globex cells and the adjoining Midatlantic cells. In the first four years of production minimum royalty payments of $10,000, $15,000, $20,000, $25,000 per year are guaranteed and $25,000 per year thereafter.

Assets:

Cash and cash equivalents, investments, and accounts receivable totalled $764,387 at September 30, 2014 (December 31, 2013 - $1,223,323) representing 2.9% of the total assets.

Cash reserved for exploration was $2,178,045 at September 30, 2014 (December 31, 2013 - $2,090,732). The net change reflects the impact of the May 5, 2014 “flow-through financing” of $1,857,500 and the qualified “flow-through” expenditures of $1,770,187 during 2014.

Working capital:

At September 30, 2014, the Corporation had cash and cash equivalents of $362,568 (December 31, 2013 - $164,380) and cash reserved for exploration of $2,178,045 (December 31, 2013 - $2,090,732). Investments of $205,154 (December 31, 2013 - $942,801) mainly reflect shares, recorded at fair value, in optionee companies received as consideration under mining option agreements.

At September 30, 2014, the Corporation’s working capital (based on current assets minus current liabilities) was $2,743,140 (December 31, 2013 - $2,765,352). The Corporation believes that based on the current cash and working capital position and its access to liquidity sources, it has sufficient resources readily available to meet its current exploration spending commitments and corporate and administrative requirements for the next twelve months.

Outlook - Unverändert:

Despite the publication of a positive Preliminary Economic Assessment and receipt of our mining lease on our Timmins Talc-Magnesite project, raising funds to complete a Preliminary Feasibility Study and to undertake the first phase of construction for the project is proving challenging. We have received significant interest, but have yet to raise all the necessary funds.

We continue to search for an appropriate property/partner or financing vehicle to exploit our patented technology for the recovery of gold from refractory gold ores and tailings and have signed a number of confidentiality agreements with interested parties. Numerous contacts have been made, but we have so far been unable to conclude a deal, in part because potential partners do not have the needed funds.

Although challenged by the scarcity of financing which impacts other junior mining companies, we have benefited from the recent increases in zinc prices which generated a significant stream of monthly royalties to fund our operations. Our view is that the current zinc prices will now rise more slowly for the remainder of 2014 and perhaps stabilize in 2015 as mines originally scheduled for shut down may continue production for a longer than expected period due to the increased zinc price. Despite, the challenges in the junior mining sector, Globex believes it is positioned with a combination of first class assets as well as the human and corporate resources necessary to achieve the strategic objectives outlined in our Corporate Focus. Our belief is supported by the financing that closed on May 5, 2014, which was oversubscribed.

We have concentrated to some degree on acquiring valuable assets that have been and continue to become available due to current difficult market conditions.

Lastly, we are actively exploring a goodly number of our assets and will be undertaking significant drill programs over the summer months.

During the nine month period ended September 30, 2014, the carrying value of the properties in Quebec increased by $144,197 representing cash outlays of $26,403 (2013 - $5,793), the issuance of 450,000 shares with an ascribed value of $118,000 and offsetting option income of $206.

On August 27, 2014, Globex announced the acquisition of 100% interest in the Santa Anna gold deposit located in La Reine Township, Quebec near the town of La Sarre. Two separate transactions were completed in order to acquire the property. A total of 450,000 shares and 150,000 share purchase warrants were paid to two vendors. The warrants are exercisable for Globex shares at a price of $0.45 per share for a period of two years. The shares which were issued under these transactions were valued at $0.26 per share representing the contract prices at the execution of the arrangements. The Corporation plans to compile all available information and review the project to determine the opportunities for increasing and qualifying resources at the property.

On October 14, 2014, Globex entered into an agreement with Midatlantic Minerals Inc. (“Midatlantic”) which would enable it to acquire five cells (HA!HA! Silica property, located in Boileau Township, Quebec) from Globex. The agreement provides for the payment of an advanced production royalty of $10,000 per year commencing on October 14, 2015 and an ongoing royalty of $1.25 per ton of rock mined and removed or sold from both the Globex cells and the adjoining Midatlantic cells. In the first four years of production minimum royalty payments of $10,000, $15,000, $20,000, $25,000 per year are guaranteed and $25,000 per year thereafter.

Assets:

Cash and cash equivalents, investments, and accounts receivable totalled $764,387 at September 30, 2014 (December 31, 2013 - $1,223,323) representing 2.9% of the total assets.

Cash reserved for exploration was $2,178,045 at September 30, 2014 (December 31, 2013 - $2,090,732). The net change reflects the impact of the May 5, 2014 “flow-through financing” of $1,857,500 and the qualified “flow-through” expenditures of $1,770,187 during 2014.

Working capital:

At September 30, 2014, the Corporation had cash and cash equivalents of $362,568 (December 31, 2013 - $164,380) and cash reserved for exploration of $2,178,045 (December 31, 2013 - $2,090,732). Investments of $205,154 (December 31, 2013 - $942,801) mainly reflect shares, recorded at fair value, in optionee companies received as consideration under mining option agreements.

At September 30, 2014, the Corporation’s working capital (based on current assets minus current liabilities) was $2,743,140 (December 31, 2013 - $2,765,352). The Corporation believes that based on the current cash and working capital position and its access to liquidity sources, it has sufficient resources readily available to meet its current exploration spending commitments and corporate and administrative requirements for the next twelve months.

Outlook - Unverändert:

Despite the publication of a positive Preliminary Economic Assessment and receipt of our mining lease on our Timmins Talc-Magnesite project, raising funds to complete a Preliminary Feasibility Study and to undertake the first phase of construction for the project is proving challenging. We have received significant interest, but have yet to raise all the necessary funds.

We continue to search for an appropriate property/partner or financing vehicle to exploit our patented technology for the recovery of gold from refractory gold ores and tailings and have signed a number of confidentiality agreements with interested parties. Numerous contacts have been made, but we have so far been unable to conclude a deal, in part because potential partners do not have the needed funds.

Although challenged by the scarcity of financing which impacts other junior mining companies, we have benefited from the recent increases in zinc prices which generated a significant stream of monthly royalties to fund our operations. Our view is that the current zinc prices will now rise more slowly for the remainder of 2014 and perhaps stabilize in 2015 as mines originally scheduled for shut down may continue production for a longer than expected period due to the increased zinc price. Despite, the challenges in the junior mining sector, Globex believes it is positioned with a combination of first class assets as well as the human and corporate resources necessary to achieve the strategic objectives outlined in our Corporate Focus. Our belief is supported by the financing that closed on May 5, 2014, which was oversubscribed.

We have concentrated to some degree on acquiring valuable assets that have been and continue to become available due to current difficult market conditions.

Lastly, we are actively exploring a goodly number of our assets and will be undertaking significant drill programs over the summer months.

Antwort auf Beitrag Nr.: 48.284.596 von muenchenguru am 11.11.14 12:33:18Quebec Projects:

During the third quarter of 2014, expenditures of $551,417 (2013 - $2,089,203) were incurred on Quebec exploration projects. The current year expenditures include follow-up drilling on projects such as the Eagle Mine, Smith-Zulapa, Tavernier-Tiblemont and the Wood-Pandora properties. They also include costs for revisiting some of our more advanced projects such as the Poirier Mine, Lyndhurst Mine and Nordeau property. The Corporation is also undertaking exploration on some of our newer acquisitions such as the Eau Jaune Lake, Champdoré, Courville and Lac Ontario properties.

Champdoré (Champdore/Razilly) - a 3-hole, 495 metre (‘m’) drill program was completed in late August. Drilling tested the potential for rare earth elements (REE) associated with a possible alkaline intrusion outlined by a circular magnetic anomaly. The circular magnetic feature was determined to be a gabbroic, non mineralized intrusion. An assessment report has been completed.

Lyndhurst (Destor/Poularies) – work to re-evaluate deep stratigraphic drilling at the Moses VMS zone and the under-explored eastern sector of the property continues. Additionally, rehabilitation work in connection with the exploration program on the Lyndhurst property continues at the old mine site.

Nordeau East and West (Vaquelin/Pershing) - after reviewing previous option holder Plato Gold Corp. drilling results at the Nordeau project undertaken from 2006 to 2011, over 1,500 m of untested core was sampled to close mineralized zones and to fill gaps between isolated gold intersections. Best individual results returned up to 8.13 gpt Au over 1.0 m. Two mineralized zones, not previously sampled in hole PG-06-21, returned 1.50 gpt Au over 11.8 m and 1.13 gpt Au over 9.0 m. A sampling report was completed.

Poirier (Poirier/Joutel) - a two-hole, 1,312 m drill program to test the Q zone at depth and a satellite orebody south of the Q zone started July 28 and was completed August 11. Best results came from hole P-14-002 intersecting massive sulphide mineralization grading 4.95 % Zinc (Zn) and 8.98 gpt silver (Ag) over 6.47 m (core length) including 7.48 % Zn and 12.61 gpt Ag over 3.23 m (core length). The 2014 drilling report is being completed; no additional work is planned for 2014.

Smith-Zulapa (Tiblemont) - a four hole 645 m drill program to test the lateral extension of the Smith–Zulapa mineralization was completed during the first week of August. The best results were intersected in hole SZ- 14-03 (1.68 gpt Au over 1.5 m) and in hole SZ-14-04 (5.97 gpt Au over 1.5 m). The shear zones show lateral continuity to the west but the mineralization in these structures in the granodiorite host rock returned lower grades than the historical values. The drilling report has been completed and no additional work is planned for 2014.

Tavernier-Tiblemont (Tiblemont) - a four hole 735 m drill program was performed during the month of July and August. Two holes tested the Maufort shear zone southern extension and the other two holes tested the lateral extension of the Blair showing. The current drilling at these two prospects did not return any gold values. A drilling report has been completed and efforts will be concentrated upon areas where our previous drilling returned economic grade and width gold intersections.

Turner Falls (Villedieu/Senezergues) - Studies are on-going to reconcile the analytical results derived from Globex’s high grade surface assays (commonly up to several percent TREO & Y2O3) as confirmed by detailed petrographic/microprobe analyses, and the lower REE metal concentrations in drill core. The 2013 drill report was completed but in 2014 more samples from 2013 drill core were taken and sent for analysis. Several assays returned values ranging from 1200 to 4800 ppm TREO & Y2O3. The best intersection come from hole TF-13-04 returning 0.357% TREO & Y2O3 over 8.04 m. A sampling report has yet to be completed. Recently Globex acquired by staking, several high grade rare earth occurrences adjacent to the property.

Wood-Pandora (Cadillac) - a four-hole drill program totaling 2,637 m started in early March and was completed in April. This program targeted possible extensions of some of the better 2012 and 2013 drill campaign gold intersections. One more hole (W14-113) was drilled in September replacing previously planned surface sampling and completing 2014 annual property assessment work requirements. The high-grade gold intersections from the 2012-2013 programs were not repeated (not uncommon with free gold), but the mineralized structures identified in previous drilling were intersected, showing continuity at depth. The following table presents some of the results related to the different mineralized structures intersected. Holes W14-109 to W14-112 were previously reported.

Globex and Canadian Malartic Partnership will meet in the fourth quarter to set objectives for the 2015 campaign.

Q4:

In the next quarter, drilling is planned for previously identified gold targets at the Beauchastel property and base metal VMS style targets at the Rich Lake and Vauze Mine properties for a total of approximately 2,200 metres. Field work including mapping and sampling programs will be undertaken on our Molyhill and Lac Turgeon properties. Geophysical work on certain properties planned for 2014 has been deferred to early 2015.

During the third quarter of 2014, expenditures of $551,417 (2013 - $2,089,203) were incurred on Quebec exploration projects. The current year expenditures include follow-up drilling on projects such as the Eagle Mine, Smith-Zulapa, Tavernier-Tiblemont and the Wood-Pandora properties. They also include costs for revisiting some of our more advanced projects such as the Poirier Mine, Lyndhurst Mine and Nordeau property. The Corporation is also undertaking exploration on some of our newer acquisitions such as the Eau Jaune Lake, Champdoré, Courville and Lac Ontario properties.

Champdoré (Champdore/Razilly) - a 3-hole, 495 metre (‘m’) drill program was completed in late August. Drilling tested the potential for rare earth elements (REE) associated with a possible alkaline intrusion outlined by a circular magnetic anomaly. The circular magnetic feature was determined to be a gabbroic, non mineralized intrusion. An assessment report has been completed.

Lyndhurst (Destor/Poularies) – work to re-evaluate deep stratigraphic drilling at the Moses VMS zone and the under-explored eastern sector of the property continues. Additionally, rehabilitation work in connection with the exploration program on the Lyndhurst property continues at the old mine site.

Nordeau East and West (Vaquelin/Pershing) - after reviewing previous option holder Plato Gold Corp. drilling results at the Nordeau project undertaken from 2006 to 2011, over 1,500 m of untested core was sampled to close mineralized zones and to fill gaps between isolated gold intersections. Best individual results returned up to 8.13 gpt Au over 1.0 m. Two mineralized zones, not previously sampled in hole PG-06-21, returned 1.50 gpt Au over 11.8 m and 1.13 gpt Au over 9.0 m. A sampling report was completed.

Poirier (Poirier/Joutel) - a two-hole, 1,312 m drill program to test the Q zone at depth and a satellite orebody south of the Q zone started July 28 and was completed August 11. Best results came from hole P-14-002 intersecting massive sulphide mineralization grading 4.95 % Zinc (Zn) and 8.98 gpt silver (Ag) over 6.47 m (core length) including 7.48 % Zn and 12.61 gpt Ag over 3.23 m (core length). The 2014 drilling report is being completed; no additional work is planned for 2014.

Smith-Zulapa (Tiblemont) - a four hole 645 m drill program to test the lateral extension of the Smith–Zulapa mineralization was completed during the first week of August. The best results were intersected in hole SZ- 14-03 (1.68 gpt Au over 1.5 m) and in hole SZ-14-04 (5.97 gpt Au over 1.5 m). The shear zones show lateral continuity to the west but the mineralization in these structures in the granodiorite host rock returned lower grades than the historical values. The drilling report has been completed and no additional work is planned for 2014.

Tavernier-Tiblemont (Tiblemont) - a four hole 735 m drill program was performed during the month of July and August. Two holes tested the Maufort shear zone southern extension and the other two holes tested the lateral extension of the Blair showing. The current drilling at these two prospects did not return any gold values. A drilling report has been completed and efforts will be concentrated upon areas where our previous drilling returned economic grade and width gold intersections.

Turner Falls (Villedieu/Senezergues) - Studies are on-going to reconcile the analytical results derived from Globex’s high grade surface assays (commonly up to several percent TREO & Y2O3) as confirmed by detailed petrographic/microprobe analyses, and the lower REE metal concentrations in drill core. The 2013 drill report was completed but in 2014 more samples from 2013 drill core were taken and sent for analysis. Several assays returned values ranging from 1200 to 4800 ppm TREO & Y2O3. The best intersection come from hole TF-13-04 returning 0.357% TREO & Y2O3 over 8.04 m. A sampling report has yet to be completed. Recently Globex acquired by staking, several high grade rare earth occurrences adjacent to the property.

Wood-Pandora (Cadillac) - a four-hole drill program totaling 2,637 m started in early March and was completed in April. This program targeted possible extensions of some of the better 2012 and 2013 drill campaign gold intersections. One more hole (W14-113) was drilled in September replacing previously planned surface sampling and completing 2014 annual property assessment work requirements. The high-grade gold intersections from the 2012-2013 programs were not repeated (not uncommon with free gold), but the mineralized structures identified in previous drilling were intersected, showing continuity at depth. The following table presents some of the results related to the different mineralized structures intersected. Holes W14-109 to W14-112 were previously reported.

Globex and Canadian Malartic Partnership will meet in the fourth quarter to set objectives for the 2015 campaign.

Q4:

In the next quarter, drilling is planned for previously identified gold targets at the Beauchastel property and base metal VMS style targets at the Rich Lake and Vauze Mine properties for a total of approximately 2,200 metres. Field work including mapping and sampling programs will be undertaken on our Molyhill and Lac Turgeon properties. Geophysical work on certain properties planned for 2014 has been deferred to early 2015.

Antwort auf Beitrag Nr.: 48.287.143 von muenchenguru am 11.11.14 15:48:03Highlights des Q3 Reportings:

Neu Filing bei Sedar:

Effective on October 28, 2014, Globex obtained Articles of Continuance under the Canada Business Corporations Act and is now a Canadian federal corporation governed by the Canada Business Corporations Act and is no longer governed by the Business Corporations Act (Québec). Globex’s continuance as a federal corporation was approved at Globex’s annual and special meeting of shareholders held on June 12, 2014.

In connection with Globex’s continuance as a federal corporation, its registered office has been changed from Rouyn-Noranda, Québec to 89 Belsize Drive, Toronto, Ontario M4S 1L3. In light of its new registered office, Globex intends to file an application with the Ontario Securities Commission to change its principal securities regulator from the Autorité des marchés financiers to the Ontario Securities Commission.

Strategie von Globex nochmal als Highlight:

Advancing the Timmins Talc-Magnesite project to the pre-feasibility stage while considering all options for optimizing the extraction and processing of the resource and obtaining the highest over-all value product lines which can be achieved;

Sales and optioning of properties; Despite market conditions Globex continues to control desirable assets which we continue to believe will attract partners;

Additional targeted exploration programs to improve our knowledge of properties in the portfolio with a view to creating more attractive assets; and

Identification of acquisition opportunities for properties we believe suffer from funding shortages and as such may become available.

Overview M9 Reporting:

For the nine month period ended September 30, 2014, the Corporation reported a net loss and comprehensive loss of $1,310,261 as compared to income of $386,394. The change in the 2014 results is mainly a result of (i) the decline in the fair value of financial assets and (ii) a provision for income and mining taxes in the current year as compared to a recovery in 2013 reflecting the impact of refiling prior year’s tax returns related to withholding taxes and also a reduced recovery for the sale of tax benefits (flow-through shares).

Revenues in Q3:

Revenues were $271,692 (2013 - $142,000) for the three month period ended September 30, 2014 which includes net option income of $100,000 (2013 - $142,000) and royalty income of $171,692 (2013 - $Nil).

Exploration Overview

Exploration expenditures for the nine month period ended September 30, 2014 totalled $1,807,676 (2013 - $4,169,688) which reflects eligible flow-through expenditures of $1,770,188 and non-flow through expenditures of $37,488.

TTM:

Work in the second and third quarter of 2014 focussed on completing additional drill core QEMSCAN analysis and continuation of the talc variability study. The Centre de Technologie Minerale et de Plasturgie (CTMP) located in Thetford Mines, Qc. completed talc flotation and micronizing work on thirty five composite samples from diamond drill holes. Plastic compounding and injection molding of this material has been completed. This ongoing test program is expected be completed later this year and will provide an assessment of TTM talc’s physical properties compared to existing talc products.

Expenditures incurred in the second quarter totaled $53,793. During the third quarter, we spent $154,155 on continuing the variability test study and initiated a further review of processing alternatives and financing requirements.

In the third quarter of 2014, Globex received results of tests on samples of talc concentrate which sought to test for the presence of asbestos. Very strict international standards are set for the presence of asbestos contaminants in industrial products. It is critical that talc samples contain no asbestos. Thirty five (35) composite samples representing 1,679.7 metres of drill core were submitted for testing. Each sample represented an average core length of 48 m and an average horizontal core width of 30.8 m. Every concentrate sample analysis indicated that no asbestos was present. Globex is very pleased that TTM talc meets or exceeds these standards. The results confirm earlier test work by Globex which also showed that no asbestos was present in TTM talc samples.

Also in 2014, testing of a new application for the use of magnesia was started. The objective of the testing was to assess the TTM magnesite’s suitability for other magnesia product streams. This information can be used in trade-off studies related to future ore processing options. The Corporation continues to review these applications.

During 2014 the Corporation continued analysing a series of financial models and scenarios using data from Globex's current PEA. These internal studies are designed to identify production “roll-out” options and project financing strategies.

Neu Filing bei Sedar:

Effective on October 28, 2014, Globex obtained Articles of Continuance under the Canada Business Corporations Act and is now a Canadian federal corporation governed by the Canada Business Corporations Act and is no longer governed by the Business Corporations Act (Québec). Globex’s continuance as a federal corporation was approved at Globex’s annual and special meeting of shareholders held on June 12, 2014.

In connection with Globex’s continuance as a federal corporation, its registered office has been changed from Rouyn-Noranda, Québec to 89 Belsize Drive, Toronto, Ontario M4S 1L3. In light of its new registered office, Globex intends to file an application with the Ontario Securities Commission to change its principal securities regulator from the Autorité des marchés financiers to the Ontario Securities Commission.

Strategie von Globex nochmal als Highlight:

Advancing the Timmins Talc-Magnesite project to the pre-feasibility stage while considering all options for optimizing the extraction and processing of the resource and obtaining the highest over-all value product lines which can be achieved;

Sales and optioning of properties; Despite market conditions Globex continues to control desirable assets which we continue to believe will attract partners;

Additional targeted exploration programs to improve our knowledge of properties in the portfolio with a view to creating more attractive assets; and

Identification of acquisition opportunities for properties we believe suffer from funding shortages and as such may become available.

Overview M9 Reporting:

For the nine month period ended September 30, 2014, the Corporation reported a net loss and comprehensive loss of $1,310,261 as compared to income of $386,394. The change in the 2014 results is mainly a result of (i) the decline in the fair value of financial assets and (ii) a provision for income and mining taxes in the current year as compared to a recovery in 2013 reflecting the impact of refiling prior year’s tax returns related to withholding taxes and also a reduced recovery for the sale of tax benefits (flow-through shares).

Revenues in Q3:

Revenues were $271,692 (2013 - $142,000) for the three month period ended September 30, 2014 which includes net option income of $100,000 (2013 - $142,000) and royalty income of $171,692 (2013 - $Nil).

Exploration Overview

Exploration expenditures for the nine month period ended September 30, 2014 totalled $1,807,676 (2013 - $4,169,688) which reflects eligible flow-through expenditures of $1,770,188 and non-flow through expenditures of $37,488.

TTM:

Work in the second and third quarter of 2014 focussed on completing additional drill core QEMSCAN analysis and continuation of the talc variability study. The Centre de Technologie Minerale et de Plasturgie (CTMP) located in Thetford Mines, Qc. completed talc flotation and micronizing work on thirty five composite samples from diamond drill holes. Plastic compounding and injection molding of this material has been completed. This ongoing test program is expected be completed later this year and will provide an assessment of TTM talc’s physical properties compared to existing talc products.

Expenditures incurred in the second quarter totaled $53,793. During the third quarter, we spent $154,155 on continuing the variability test study and initiated a further review of processing alternatives and financing requirements.

In the third quarter of 2014, Globex received results of tests on samples of talc concentrate which sought to test for the presence of asbestos. Very strict international standards are set for the presence of asbestos contaminants in industrial products. It is critical that talc samples contain no asbestos. Thirty five (35) composite samples representing 1,679.7 metres of drill core were submitted for testing. Each sample represented an average core length of 48 m and an average horizontal core width of 30.8 m. Every concentrate sample analysis indicated that no asbestos was present. Globex is very pleased that TTM talc meets or exceeds these standards. The results confirm earlier test work by Globex which also showed that no asbestos was present in TTM talc samples.

Also in 2014, testing of a new application for the use of magnesia was started. The objective of the testing was to assess the TTM magnesite’s suitability for other magnesia product streams. This information can be used in trade-off studies related to future ore processing options. The Corporation continues to review these applications.

During 2014 the Corporation continued analysing a series of financial models and scenarios using data from Globex's current PEA. These internal studies are designed to identify production “roll-out” options and project financing strategies.

Antwort auf Beitrag Nr.: 48.287.143 von muenchenguru am 11.11.14 15:48:03Läuft in die richtige Richtung bei GER ...

Glen Eagle Resources Inc.: Drilling Programs

MONTREAL, QUEBEC--(Marketwired - Nov. 17, 2014) - Glen Eagle Resources Inc. (TSX VENTURE:GER) (Glen Eagle or the Company) is pleased to announce that the drilling programs at the Authier Lithium and Moose Lake phosphate projects have been in preparations since late October. Each project has received an allotment of 2000 meters of drilling.

With both programs, the Company is implementing its objectives describe in the Management Discussion and Analysis (MDNA) section of its latest financial statement whereby Glen Eagle has made a commitment to develop all its assets in projects encompassing gold, phosphate and lithium.

The Company is also proud to announce that all its properties and concessions are in good standing and net of any debt as of this writing in a rather exceedingly difficult market. The properties include Lac Lisette and Moose Lake phosphate projects, Authier Lithium project (near feasibility study) and La Libertad gold project in process to be in production.

Gilles Laverdiere, P.Geo., a qualified person under NI 43-101 has approved the technical content presented herein.

For the latest information about Glen Eagle, please visit www.gleneagleresources.com.

"Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

Glen Eagle Resources Inc.

Jean Labrecque

President

450-229-4488

www.gleneagleresources.com

Glen Eagle Resources Inc.: Drilling Programs

MONTREAL, QUEBEC--(Marketwired - Nov. 17, 2014) - Glen Eagle Resources Inc. (TSX VENTURE:GER) (Glen Eagle or the Company) is pleased to announce that the drilling programs at the Authier Lithium and Moose Lake phosphate projects have been in preparations since late October. Each project has received an allotment of 2000 meters of drilling.

With both programs, the Company is implementing its objectives describe in the Management Discussion and Analysis (MDNA) section of its latest financial statement whereby Glen Eagle has made a commitment to develop all its assets in projects encompassing gold, phosphate and lithium.

The Company is also proud to announce that all its properties and concessions are in good standing and net of any debt as of this writing in a rather exceedingly difficult market. The properties include Lac Lisette and Moose Lake phosphate projects, Authier Lithium project (near feasibility study) and La Libertad gold project in process to be in production.

Gilles Laverdiere, P.Geo., a qualified person under NI 43-101 has approved the technical content presented herein.

For the latest information about Glen Eagle, please visit www.gleneagleresources.com.

"Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

Glen Eagle Resources Inc.

Jean Labrecque

President

450-229-4488

www.gleneagleresources.com

Antwort auf Beitrag Nr.: 48.284.596 von muenchenguru am 11.11.14 12:33:18Herzlichen Dank Guru für Deine Ausführungen!!!!! Sehr interessant ... werde morgen etwas mehr schreiben können ... kurzes Update zu NIP und NSX:

NIP hat ein PP über ca . 600k CAD durchgeführt und NSX ja die leben noch:

"NSGold Announces Share Consolidation and Proposed Private Placement Financing

(via Thenewswire.ca)

Bedford, Nova Scotia / TNW-ACCESSWIRE / - November 7, 2014 / NSGold Corporation (NSX:TSXV) ("NSGold" or the "Company") announces that it has received conditional approval from the TSX Venture Exchange ("Exchange") to consolidate its issued and outstanding common shares on the basis of one share for every ten shares issued and outstanding. The consolidation of NSGold's common shares was approved by NSGold's shareholders at an annual and special meeting of shareholders held on June 19, 2014.

Share Consolidation

The Company will announce the effective date of the share consolidation in a subsequent press release. The Company's common shares will continue to trade under the symbol NSX and the name of the Company will not change. As a result of the share consolidation, NSGold will have 4,355,377 issued and outstanding common shares, compared to 43,553,767 shares outstanding prior to the consolidation. No fractional shares will be issued and all fractional shares resulting from the consolidation will be rounded up or rounded down to the nearest whole number.

The Board of Directors believes that the proposed share consolidation will better position the Company to raise equity financing in light of the continuing difficult market conditions that exist for junior resource issuers.

NSGold will mail a letter of transmittal to its registered shareholders, who are required to exchange their current share certificates for new share certificates. Shareholders who hold their shares through a securities broker or dealer, bank or trust company will not be required to take any measures.

The share consolidation is subject to final Exchange approval.

Private Placement Financing and Ancillary Private Placement to Existing Shareholders

The board of directors of NSGold has approved a proposed private placement of a maximum of 3 million post-consolidation common shares. The price of the offering will be determined upon completion of the share consolidation. The offering will be made to accredited investors pursuant to National Instrument 45-106 - Prospectus and Registration Exemptions and to existing shareholders of the Company pursuant to Blanket Order No. 45-525 of the Nova Scotia Securities Commission and to similar prospectus exemptions in other provinces. NSGold will announce the details of the proposed private placement, including the price per share, in a subsequent press release.

Eligible shareholders wishing to participate in the ancillary private placement should contact Glenn Holmes, CEO of NSGold at 902 483 2308 or by email at info@nsgoldcorp.com

Closing of the proposed private placement offering is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals, including Exchange approval. The proceeds of the proposed private placement will be used for general corporate purposes

Van Hoof Industrial Holdings Ltd.

The Company's largest shareholder, Van Hoof Industrial Holdings Ltd. ("VHIH"), has indicated that it will enter into an agreement with the Company to settle the full amount of its loan, including accrued interest, of approximately $310,000, with the issuance of post-consolidation NSGold common shares. The loan from VHIH has a repayment date of January 5, 2015. The price used for calculating the number of post-consolidation common shares to be issued is anticipated to be the same price used for the private placement financing referred to above. VHIH presently (prior to the debt settlement) owns 12,301,100 common shares of the Company, which represents 28.2% of the issued number of common shares.

Furthermore, VHIH has indicated that it will be subscribing to the private placement financing in an amount such that VHIH will own between 45% and 55% of the issued number of post-consolidation shares.

Due to the fact that VHIH has ownership of more than 10% of the outstanding common shares of the Company, the "shares for debt" transaction may be considered a "related party transaction" for the purposes of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions and the Company is relying on exemptions from the formal valuation and minority approval requirements of Multilateral Instrument 61-101.

The completion of this transaction is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals, including Exchange approval.

About NSGold

NSGold Corporation is a mineral exploration company with a focus on gold properties in Nova Scotia, Canada. NSGold's principal property is the Mooseland Gold Property which has a 43-101 compliant inferred gold resource of 454,000 ounces. NSGold's shares are listed on the TSX Venture Exchange under the symbol NSX.

"

Grüße Sonic

NIP hat ein PP über ca . 600k CAD durchgeführt und NSX ja die leben noch:

"NSGold Announces Share Consolidation and Proposed Private Placement Financing

(via Thenewswire.ca)

Bedford, Nova Scotia / TNW-ACCESSWIRE / - November 7, 2014 / NSGold Corporation (NSX:TSXV) ("NSGold" or the "Company") announces that it has received conditional approval from the TSX Venture Exchange ("Exchange") to consolidate its issued and outstanding common shares on the basis of one share for every ten shares issued and outstanding. The consolidation of NSGold's common shares was approved by NSGold's shareholders at an annual and special meeting of shareholders held on June 19, 2014.

Share Consolidation

The Company will announce the effective date of the share consolidation in a subsequent press release. The Company's common shares will continue to trade under the symbol NSX and the name of the Company will not change. As a result of the share consolidation, NSGold will have 4,355,377 issued and outstanding common shares, compared to 43,553,767 shares outstanding prior to the consolidation. No fractional shares will be issued and all fractional shares resulting from the consolidation will be rounded up or rounded down to the nearest whole number.

The Board of Directors believes that the proposed share consolidation will better position the Company to raise equity financing in light of the continuing difficult market conditions that exist for junior resource issuers.

NSGold will mail a letter of transmittal to its registered shareholders, who are required to exchange their current share certificates for new share certificates. Shareholders who hold their shares through a securities broker or dealer, bank or trust company will not be required to take any measures.

The share consolidation is subject to final Exchange approval.

Private Placement Financing and Ancillary Private Placement to Existing Shareholders

The board of directors of NSGold has approved a proposed private placement of a maximum of 3 million post-consolidation common shares. The price of the offering will be determined upon completion of the share consolidation. The offering will be made to accredited investors pursuant to National Instrument 45-106 - Prospectus and Registration Exemptions and to existing shareholders of the Company pursuant to Blanket Order No. 45-525 of the Nova Scotia Securities Commission and to similar prospectus exemptions in other provinces. NSGold will announce the details of the proposed private placement, including the price per share, in a subsequent press release.

Eligible shareholders wishing to participate in the ancillary private placement should contact Glenn Holmes, CEO of NSGold at 902 483 2308 or by email at info@nsgoldcorp.com

Closing of the proposed private placement offering is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals, including Exchange approval. The proceeds of the proposed private placement will be used for general corporate purposes

Van Hoof Industrial Holdings Ltd.

The Company's largest shareholder, Van Hoof Industrial Holdings Ltd. ("VHIH"), has indicated that it will enter into an agreement with the Company to settle the full amount of its loan, including accrued interest, of approximately $310,000, with the issuance of post-consolidation NSGold common shares. The loan from VHIH has a repayment date of January 5, 2015. The price used for calculating the number of post-consolidation common shares to be issued is anticipated to be the same price used for the private placement financing referred to above. VHIH presently (prior to the debt settlement) owns 12,301,100 common shares of the Company, which represents 28.2% of the issued number of common shares.

Furthermore, VHIH has indicated that it will be subscribing to the private placement financing in an amount such that VHIH will own between 45% and 55% of the issued number of post-consolidation shares.

Due to the fact that VHIH has ownership of more than 10% of the outstanding common shares of the Company, the "shares for debt" transaction may be considered a "related party transaction" for the purposes of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions and the Company is relying on exemptions from the formal valuation and minority approval requirements of Multilateral Instrument 61-101.

The completion of this transaction is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals, including Exchange approval.

About NSGold

NSGold Corporation is a mineral exploration company with a focus on gold properties in Nova Scotia, Canada. NSGold's principal property is the Mooseland Gold Property which has a 43-101 compliant inferred gold resource of 454,000 ounces. NSGold's shares are listed on the TSX Venture Exchange under the symbol NSX.

"

Grüße Sonic

Antwort auf Beitrag Nr.: 48.284.098 von muenchenguru am 11.11.14 12:00:27

Hier der Vergleich der Reinheit des Talks v. TTM mit Produkten anderer Minen....

Hier der Vergleich der Reinheit des Talks v. TTM mit Produkten anderer Minen....

02.05.24 · ESG Aktien · Barrick Gold Corporation |

22.04.24 · kapitalerhoehungen.de · Rheinmetall |

16.04.24 · IR-News · Almonty Industries |

09.04.24 · kapitalerhoehungen.de · Bayer |

04.04.24 · Der Finanzinvestor · Barrick Gold Corporation |