ALCYONE RES LTD. SILBERPRODUZENT.. ehemals MACMIN Silver..wird sie es diesmal schaffen - 500 Beiträge pro Seite (Seite 11)

eröffnet am 16.11.09 18:24:28 von

neuester Beitrag 15.09.16 12:13:40 von

neuester Beitrag 15.09.16 12:13:40 von

Beiträge: 5.445

ID: 1.154.270

ID: 1.154.270

Aufrufe heute: 0

Gesamt: 660.666

Gesamt: 660.666

Aktive User: 0

ISIN: AU000000AYN6 · WKN: A0YC53

0,0001

USD

0,00 %

0,0000 USD

Letzter Kurs 26.11.15 Nasdaq OTC

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5500 | -8,33 | |

| 1,3160 | -9,12 | |

| 185,00 | -9,76 | |

| 0,7000 | -11,39 | |

| 12,000 | -25,00 |

Zitat von prallhans: Und KE gleich hintendran hängen.

richtig,

und anschließend neuer firmenname und wir haben macmin die dritte

und anschließend neuer firmenname und wir haben macmin die dritte

das geschwätz, wofür man die gelder letztendlich benötigt, sind doch unglaubliche augenwischerei. ist es nicht merkwürdig, dass es dem unternehmen nach dem neustart von macmin unter dem namen alcyone jahre später wie schuppen von den augen fällt, was man denn so alles benötigt um die mine dann doch mal profitabel betreiben zu können.

Antwort auf Beitrag Nr.: 44.577.055 von der-golfer am 06.05.13 19:53:30Danke für die Info´s ...

.... aber 01.07 Wiederaufnahme des Handels, ist echt eine

Frechheit von Alcyone

.... aber 01.07 Wiederaufnahme des Handels, ist echt eine

Frechheit von Alcyone

Ich habe nun erneut versucht Kontakt aufzunehmen - werde die

Antwort hier rein stellen ...

Antwort hier rein stellen ...

... wenn ich denn eine bekomme ;-)

musst das management um erlaubnis fragen, ob das klargeht. wurde auch schon mal lieb von einem ceo drauf hingewiesen, dass man das nicht wünscht.

Antwort auf Beitrag Nr.: 44.630.709 von sir_krisowaritschko am 14.05.13 14:24:13am liebsten würde ich denen was ganz anderes schicken....

Tradegate ist heute runtergetaxt wurden

von 0,011 auf 0,007 .... Wie kann das sein

bei Handelsaussetzung?

von 0,011 auf 0,007 .... Wie kann das sein

bei Handelsaussetzung?

Antwort auf Beitrag Nr.: 44.657.733 von hamburgundelbe am 17.05.13 06:53:23An der Heimatbörse: Tradinghalt

Tradegate? Interessiert in diesem Zusammenhang keine alte S.

Tradegate? Interessiert in diesem Zusammenhang keine alte S.

Antwort auf Beitrag Nr.: 44.657.751 von Krawallo29 am 17.05.13 07:00:39ah ok, da hast du wohl recht.

Gehandelt werden kann aber dennoch nirgendwo. Also nicht

nur Hält an der Heimatbörse ...

Gehandelt werden kann aber dennoch nirgendwo. Also nicht

nur Hält an der Heimatbörse ...

Antwort auf Beitrag Nr.: 44.657.831 von hamburgundelbe am 17.05.13 07:36:18Wo kein Interesse. da kein Handel

Alcyone Resources closes in on US$10M pre-payment for silver project in Queensland

Friday, May 17, 2013 by Bevis Yeo

Alcyone Resources (ASX: AYN) has signed an indicative non-binding proposal for a US$10 million silver pre-payment investment into the company that will allow it to realise current value from future expected output from its Texas Silver Project in Queensland.

The proposal provides for a Metal Stream of 15% of the life of mine of silver ounce from the project and the right to purchase this Metal Stream at a price equal to the lesser of US$6.50 an ounce or 80% of the prevailing market price.

It also provides for future investment in the company at a premium to market prices, via the issue of 200 million options to purchase shares at a 50% premium to the current 30 day volume weighted average price in the period immediately prior to the issue of options.

Separately, the company has raised a further $1.2 million in bridge financing by way of the issue of promissory notes to assist the company through to completion of the Rights Issue.

The wholly-owned Texas Silver Project is located 350 kilometres south southwest of Brisbane and 10 kilometres from the town of Texas.

It has a JORC Resource of 13.25 million tonnes at 54g/t silver for 23 million ounces of silver at the Twin Hills and Mt Gunyan Prospects.

About 1.2 million ounces of silver have been produced from heap leach operations during the ramp up phase between June 2011 and 31 March 2013.

The project has a current mine life of eight years at the nameplate capacity of 1.1 million tonnes per annum.

Proactive Investors Australia is the market leader in producing news, articles and research reports on ASX “Small and Mid-cap” stocks with distribution in Australia, UK, North America and Hong Kong / China.

Friday, May 17, 2013 by Bevis Yeo

Alcyone Resources (ASX: AYN) has signed an indicative non-binding proposal for a US$10 million silver pre-payment investment into the company that will allow it to realise current value from future expected output from its Texas Silver Project in Queensland.

The proposal provides for a Metal Stream of 15% of the life of mine of silver ounce from the project and the right to purchase this Metal Stream at a price equal to the lesser of US$6.50 an ounce or 80% of the prevailing market price.

It also provides for future investment in the company at a premium to market prices, via the issue of 200 million options to purchase shares at a 50% premium to the current 30 day volume weighted average price in the period immediately prior to the issue of options.

Separately, the company has raised a further $1.2 million in bridge financing by way of the issue of promissory notes to assist the company through to completion of the Rights Issue.

The wholly-owned Texas Silver Project is located 350 kilometres south southwest of Brisbane and 10 kilometres from the town of Texas.

It has a JORC Resource of 13.25 million tonnes at 54g/t silver for 23 million ounces of silver at the Twin Hills and Mt Gunyan Prospects.

About 1.2 million ounces of silver have been produced from heap leach operations during the ramp up phase between June 2011 and 31 March 2013.

The project has a current mine life of eight years at the nameplate capacity of 1.1 million tonnes per annum.

Proactive Investors Australia is the market leader in producing news, articles and research reports on ASX “Small and Mid-cap” stocks with distribution in Australia, UK, North America and Hong Kong / China.

wenn ich schon vorwärtsverkauf lese könnt ich mich bepissen vor lachen.

zwar lediglich 15 % aber zu lustigen konditionen. heißt, 80 % vom aktuellen marktpreis. derzeit also mal wunderbare 17 dollar

oh mein gott und schon wieder verwässerung zwar "nur" optionen, aber wenn die gezogen werden sinds mal wieder fix 200 millionen aktien zusätzlich.

zwar "nur" optionen, aber wenn die gezogen werden sinds mal wieder fix 200 millionen aktien zusätzlich.

zwar lediglich 15 % aber zu lustigen konditionen. heißt, 80 % vom aktuellen marktpreis. derzeit also mal wunderbare 17 dollar

oh mein gott und schon wieder verwässerung

zwar "nur" optionen, aber wenn die gezogen werden sinds mal wieder fix 200 millionen aktien zusätzlich.

zwar "nur" optionen, aber wenn die gezogen werden sinds mal wieder fix 200 millionen aktien zusätzlich.

Antwort auf Beitrag Nr.: 44.659.215 von Gernot05 am 17.05.13 10:21:23Danke für die Information!

Guten Morgen liebe Freunde,

die Chancen auf einen Gewinn stehen gut !

!

Die Frage ist ja nur, wann und zu welchem Kurs bist du eingestiegen, oder wirst du einsteigen! Ich oute mich nun einfach mal:

Ich bin bei 0,01 rein und von diesem Standpunkt und Einstiegskurs aus, sind meine Gewinnchancen gut! Kurz- sowie Langfrisitg!

Wenn der Handel endlich wieder startet, wird das Interesse nach so langer Zeit groß sein und die Käufe werden den Kurs erst einmal hoch treiben auf die 0,03! Bei meinem Einstiegskurs und für alle anderen bei diesem Einstiegsskurs gut, wir können abspringen und einen Gewinn mitnehmen.

auf die 0,03! Bei meinem Einstiegskurs und für alle anderen bei diesem Einstiegsskurs gut, wir können abspringen und einen Gewinn mitnehmen.

ODER

Wir warten noch ein wenig und nehmen noch einen höheren Gewinn mit. Für die nächsten Jahre ist der Abbau gescihert auch der Verkauf ist gesichert zu einem Teil, also sind alle Kosten gedeckt und alles zusätzlich abgebaute, bringt nur einen MEHRGEWINN!

ALLE die wesentlich höher rein sind, könnten sofort bei Start des Handels durch Nachkäufe Ihren Einstiegskurs verringern und eventuell nach sehr langer Wartezeit +- raus oder sogar auch einen Gewinn mitnehmen....

Lasst uns das Thema versuchen positiv anzugehen! Wir sitzen alle in einem Boot! Wir können hier nur Gewinne mitnehmen, wenn wir zusammen halten und uns Gegenseitig mit Informationen unterstützen!

Viele liebe Grüße meine Freunde

die Chancen auf einen Gewinn stehen gut

!

! Die Frage ist ja nur, wann und zu welchem Kurs bist du eingestiegen, oder wirst du einsteigen! Ich oute mich nun einfach mal:

Ich bin bei 0,01 rein und von diesem Standpunkt und Einstiegskurs aus, sind meine Gewinnchancen gut! Kurz- sowie Langfrisitg!

Wenn der Handel endlich wieder startet, wird das Interesse nach so langer Zeit groß sein und die Käufe werden den Kurs erst einmal hoch treiben

auf die 0,03! Bei meinem Einstiegskurs und für alle anderen bei diesem Einstiegsskurs gut, wir können abspringen und einen Gewinn mitnehmen.

auf die 0,03! Bei meinem Einstiegskurs und für alle anderen bei diesem Einstiegsskurs gut, wir können abspringen und einen Gewinn mitnehmen.ODER

Wir warten noch ein wenig und nehmen noch einen höheren Gewinn mit. Für die nächsten Jahre ist der Abbau gescihert auch der Verkauf ist gesichert zu einem Teil, also sind alle Kosten gedeckt und alles zusätzlich abgebaute, bringt nur einen MEHRGEWINN!

ALLE die wesentlich höher rein sind, könnten sofort bei Start des Handels durch Nachkäufe Ihren Einstiegskurs verringern und eventuell nach sehr langer Wartezeit +- raus oder sogar auch einen Gewinn mitnehmen....

Lasst uns das Thema versuchen positiv anzugehen! Wir sitzen alle in einem Boot! Wir können hier nur Gewinne mitnehmen, wenn wir zusammen halten und uns Gegenseitig mit Informationen unterstützen!

Viele liebe Grüße meine Freunde

Antwort auf Beitrag Nr.: 44.670.041 von hamburgundelbe am 19.05.13 10:19:46Moin hamburg,

ich hätte nichts dagegen, wenn deine Voraussagen eintreffen würden.

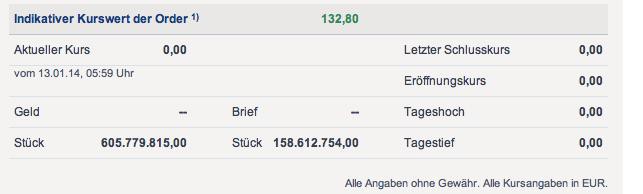

Aber was macht dich so sicher, dass Alcyone kurzfristig auf 0,03€ steigt? Immerhin liegt die Anzahl der Aktien und Optionen nach Abschluss der Kapitalmaßnahme zwischen 2,5 und 5 Mrd. (s. Präsentation). Das macht bei einer MK von zuletzt ca 15 Mio. € einen Kurs zwischen 0,006 und 0,002€...

ich hätte nichts dagegen, wenn deine Voraussagen eintreffen würden.

Aber was macht dich so sicher, dass Alcyone kurzfristig auf 0,03€ steigt? Immerhin liegt die Anzahl der Aktien und Optionen nach Abschluss der Kapitalmaßnahme zwischen 2,5 und 5 Mrd. (s. Präsentation). Das macht bei einer MK von zuletzt ca 15 Mio. € einen Kurs zwischen 0,006 und 0,002€...

Antwort auf Beitrag Nr.: 44.671.509 von der-golfer am 19.05.13 20:21:07 Genau so siehts aus....Da werden ne Menge rauswollen...nach dem Motto 'Verlustbegrenzung' Das Ding ist nach meiner meinung tot!!

Genau so siehts aus....Da werden ne Menge rauswollen...nach dem Motto 'Verlustbegrenzung' Das Ding ist nach meiner meinung tot!!

Genau so siehts aus....Da werden ne Menge rauswollen...nach dem Motto 'Verlustbegrenzung' Das Ding ist nach meiner meinung tot!!

Genau so siehts aus....Da werden ne Menge rauswollen...nach dem Motto 'Verlustbegrenzung' Das Ding ist nach meiner meinung tot!!

!

Dieser Beitrag wurde von MadMod moderiert. !

Dieser Beitrag wurde von MadMod moderiert. Grund: Korrespondierendes Posting wurde entfernt

Great Panther, Fortuna, Aurcana, Santa Cruz, Wildcat, ... Ach es gibt so viele die halb so viel Ärger bereiten.

Antwort auf Beitrag Nr.: 44.757.235 von prallhans am 31.05.13 12:29:33Hab gehört Todd Hoffmann und Parker Schnabel wollen die mehrheit von Alcyone erwerben!!

Antwort auf Beitrag Nr.: 44.757.785 von yoni am 31.05.13 13:31:38soweit ich das lesen konnte - steigt Benjamin Blümchen mit ein?

Maschmeyer vielleicht und Max Otte schreit: alcyone ist billig wie nie und alternativlos.

Nein ernsthaft: Ich habe das Geld abgeschrieben, es war Gott sei Dank nicht viel. Ich verstehe gar nicht, wie man so einen Aufwand um die Kapitalbeschaffung machen kann mit einem so schlechten Ergebnis. Ich denke da an Astur und Colt in meinem Depot, die hatten da nicht solche Probleme. Da muss also schon fundamental arg was im Busch sein, wenn´s so klemmt, sprich die Produktion wird nie die Erwartungen erfüllen.

Und AUstralien ist an sich vielleicht ein Problem, lest mal das hier:

http://www.rottmeyer.de/jobmotor-kaputt/

Nein ernsthaft: Ich habe das Geld abgeschrieben, es war Gott sei Dank nicht viel. Ich verstehe gar nicht, wie man so einen Aufwand um die Kapitalbeschaffung machen kann mit einem so schlechten Ergebnis. Ich denke da an Astur und Colt in meinem Depot, die hatten da nicht solche Probleme. Da muss also schon fundamental arg was im Busch sein, wenn´s so klemmt, sprich die Produktion wird nie die Erwartungen erfüllen.

Und AUstralien ist an sich vielleicht ein Problem, lest mal das hier:

http://www.rottmeyer.de/jobmotor-kaputt/

Antwort auf Beitrag Nr.: 44.758.769 von prallhans am 31.05.13 15:16:04Ja der Minensektor in australien hatte zweifellos eine Blase gebildet in den letzten Jahren!! In Erwartung immer weiter steigender Rohstoffkosten wurde investiert und Preise für übernahmen gzahlt als gäbs kein Morgen...Ebenso stiegen die Löhne und die Preise für Arbeitsgerät und Ersatzteile in astronomische Höhen..Dann wollte plötzlich die Regierung auch ihren Anteil in Form von höheren Steuern Jetzt kommt das böse Erwachen

Jetzt kommt das böse Erwachen

Jetzt kommt das böse Erwachen

Jetzt kommt das böse Erwachen

Nimmt jemand von euch teil an der KE? Die Bezugsrechte sind ja spottbillig, wenn ich mir anschaue, was ich mal gezahlt habe!

Einen Zock ist es mir vielleicht deshalb wert, was meint ihr?

Einen Zock ist es mir vielleicht deshalb wert, was meint ihr?

Antwort auf Beitrag Nr.: 44.779.063 von prallhans am 04.06.13 08:28:58Nööö Ich nehm nicht teil....Vermutlich werden viele sehr schnell vekaufen wollen wenn das wieder möglicht ist...

würde nicht noch mehr kohle in ein laden stecken bei dem weitestgehend unabschätzbar ist, ob die auf nen grünen zweig kommen. dann schwebt latent noch der reverse split im raume.

all das würde mich wohl abschrecken.

all das würde mich wohl abschrecken.

Antwort auf Beitrag Nr.: 44.779.063 von prallhans am 04.06.13 08:28:58 mit dem Gedanken habe ich auch schon gespielt ...

Antwort auf Beitrag Nr.: 44.781.523 von hamburgundelbe am 04.06.13 13:15:25Also ich rate zur Vorsicht....Befürchte das ist ein letzter Versuch nochmals die Aktionäre abzuzocken...Wenn dann alle raus wollen mit ihren neuen Aktien dürfte es eng am Ausgang werden...

Funktioniert nur, wenn der Silberpreis mal einen Satz nach oben macht. Dann dürfte ziemlich viel Phantasie in solche Werte kommen. Aber nur mit kleinem Geld. Gut - das ist kein Problem bei dem Kursstand.

Antwort auf Beitrag Nr.: 44.786.835 von prallhans am 04.06.13 23:28:18ja dann wäre es "eventuell" sinnvoll .... wann wird nochmal der TH beendet? Mitte July?

Viele Grüße an alle

Viele Grüße an alle

http://www.stockmarketwire.com/article/4610725/Alpha-Prospec…" target="_blank" rel="nofollow ugc noopener">http://www.stockmarketwire.com/article/4610725/Alpha-Prospec…

17 June 2013

Company Announcements Office

Australian Stock Exchange Limited

Level 4, 20 Bridge Street

SYDNEY NSW 2000

Dear Sir/Madam

ALCYONE RESOURCES LIMITED NON-RENOUNCEABLE RIGHTS ISSUE – DESPATCH OF

REPLACEMENT PROSPECTUS

Alcyone Resources Limited ( AYN or Company ) advises that it completed the despatch

of its replacement prospectus on 14 June 2013 in relation to its pro-rata non-

renounceable rights issue of one (2) fully paid ordinary share in the capital of the

Company ( Share ) for every three (1) Share held by eligible shareholders, together with 1

free attaching Option exercisable at $0.01 on or before 31 July 2015 for every 2 Shares

subscribed for, at an issue price of 0.5 cents per Share to raise up to approximately

$16,250,927 (before costs).

Yours faithfully

Trevor Harris

Company Secretary

Company Announcements Office

Australian Stock Exchange Limited

Level 4, 20 Bridge Street

SYDNEY NSW 2000

Dear Sir/Madam

ALCYONE RESOURCES LIMITED NON-RENOUNCEABLE RIGHTS ISSUE – DESPATCH OF

REPLACEMENT PROSPECTUS

Alcyone Resources Limited ( AYN or Company ) advises that it completed the despatch

of its replacement prospectus on 14 June 2013 in relation to its pro-rata non-

renounceable rights issue of one (2) fully paid ordinary share in the capital of the

Company ( Share ) for every three (1) Share held by eligible shareholders, together with 1

free attaching Option exercisable at $0.01 on or before 31 July 2015 for every 2 Shares

subscribed for, at an issue price of 0.5 cents per Share to raise up to approximately

$16,250,927 (before costs).

Yours faithfully

Trevor Harris

Company Secretary

Antwort auf Beitrag Nr.: 44.979.647 von hamburgundelbe am 04.07.13 08:45:55Guten Morgen,

kann jemand mal die Fakten kurz zusammenfassen....

Viele Grüße

qc

kann jemand mal die Fakten kurz zusammenfassen....

Viele Grüße

qc

Antwort auf Beitrag Nr.: 44.979.647 von hamburgundelbe am 04.07.13 08:45:55Hi hamburgundelbe,

Danke fürs einstellen. Ich hab mal ein bisserl hier im forum gegrundelt.

Wann da jemals wieder Handel ist, konnt ich nicht eruieren. Aber vor Mitte August wird das m.m.E. nix.

Lieg ich da in etwa richtig?

Vg

Keep

Danke fürs einstellen. Ich hab mal ein bisserl hier im forum gegrundelt.

Wann da jemals wieder Handel ist, konnt ich nicht eruieren. Aber vor Mitte August wird das m.m.E. nix.

Lieg ich da in etwa richtig?

Vg

Keep

Antwort auf Beitrag Nr.: 44.980.795 von keep-racing am 04.07.13 10:59:47Hi,

ja da hast du Recht. Ziel und auch kommuniziert wurde der 06.08.13

ja da hast du Recht. Ziel und auch kommuniziert wurde der 06.08.13

Hi, ich hab da mal ne Frage  Solange der Handel ausgesetzt ist kann man keine Aktien kaufen oder ? Wie sollte man da am besten vorgehen, damit man welche bekommt wenn die wieder an den Start geht ? Man weiss ja nicht wann es wieder losgeht und wie sich der Kurs entwickelt...hmm wäre toll wenn das jemand erklären kann.

Solange der Handel ausgesetzt ist kann man keine Aktien kaufen oder ? Wie sollte man da am besten vorgehen, damit man welche bekommt wenn die wieder an den Start geht ? Man weiss ja nicht wann es wieder losgeht und wie sich der Kurs entwickelt...hmm wäre toll wenn das jemand erklären kann.

Gruss

pampus

Solange der Handel ausgesetzt ist kann man keine Aktien kaufen oder ? Wie sollte man da am besten vorgehen, damit man welche bekommt wenn die wieder an den Start geht ? Man weiss ja nicht wann es wieder losgeht und wie sich der Kurs entwickelt...hmm wäre toll wenn das jemand erklären kann.

Solange der Handel ausgesetzt ist kann man keine Aktien kaufen oder ? Wie sollte man da am besten vorgehen, damit man welche bekommt wenn die wieder an den Start geht ? Man weiss ja nicht wann es wieder losgeht und wie sich der Kurs entwickelt...hmm wäre toll wenn das jemand erklären kann.Gruss

pampus

Antwort auf Beitrag Nr.: 44.986.727 von pampus am 05.07.13 00:14:55warten auf den 06.08 und los

Und wer macht mit von Euch? Könnte ja was werden dank Heliben kommt der Silberpreis genau zur richtigen Zeit in die Puschen.

Antwort auf Beitrag Nr.: 45.030.519 von prallhans am 12.07.13 01:11:57Icke - nach langem überlegen

Ich kann fast auch nicht widerstehen. Soviele Aktien, wie ich dann habe für so wenig Geld.

Nachdem ich das bei ein paar anderen Werten auch so gemacht habe.... bis 18.07. habe ich ja noch Zeit.

Der Chart ist so ein Strich nach unten. Eigentlich kann drunter nur noch die Ausbuchung erfolgen.

Nachdem ich das bei ein paar anderen Werten auch so gemacht habe.... bis 18.07. habe ich ja noch Zeit.

Der Chart ist so ein Strich nach unten. Eigentlich kann drunter nur noch die Ausbuchung erfolgen.

Antwort auf Beitrag Nr.: 45.032.335 von prallhans am 12.07.13 10:48:51Ich habe auch noch ein paar Tausend Bezugsrechte ...

Was genau muss ich bis zum 18.07. machen und was kostet mich das ?

Ich habe die Info zwar vor längerer Zeit auch von meiner DEPOT Bank erhalten, ist aber untergegangen.

Was genau muss ich bis zum 18.07. machen und was kostet mich das ?

Ich habe die Info zwar vor längerer Zeit auch von meiner DEPOT Bank erhalten, ist aber untergegangen.

Ich habe von der comdirect einen Brief bekommen, ob ich mitmache mit allen Bezugsrechten oder nur einem Teil davon. Nur 1 Seite zum Ankreuzen, die man dann einschicken oder faxen soll. Hast du bei deinem Broker ein elektronisches Postfach?

Toll, danke hamburgundelbe! Schade das mir keiner was sagen kann, wie man

die Aktien ordern soll. Ein Tipp wäre nett, denn ich hab mich jetzt bei einem Broker angemeldet und will ran an den Speck

Gruss

pampus

die Aktien ordern soll. Ein Tipp wäre nett, denn ich hab mich jetzt bei einem Broker angemeldet und will ran an den Speck

Gruss

pampus

Das australische Rohstoffmagazin "the Pick" hat einen interessanten Bericht zu Alcyone und weiteren Rohstofftiteln geschrieben:

http://www.smallcapinvestor.de/downloads/ThePick_260613_DEUT…

http://www.smallcapinvestor.de/downloads/ThePick_260613_DEUT…

Hier nochmal der Link:

http://www.smallcapinvestor.de/downloads/ThePick_260613_DEUT…

http://www.smallcapinvestor.de/downloads/ThePick_260613_DEUT…

Antwort auf Beitrag Nr.: 45.047.649 von Simi101 am 15.07.13 16:26:57klasse Link! Danke

Ja, auch die anderen Firmen - lesenswert.

Antwort auf Beitrag Nr.: 45.048.085 von hamburgundelbe am 15.07.13 17:24:10Hallo zusammen,

oute mich mal.

Bin dabei. Hoffentlich werf ich jetzt nicht gutes Geld -schlechtem nach.

Drück uns die Daumen

Vg

Keep

oute mich mal.

Bin dabei. Hoffentlich werf ich jetzt nicht gutes Geld -schlechtem nach.

Drück uns die Daumen

Vg

Keep

Bin auch dabei. Für das Geld kann man fast nichts falsch machen.

Mein EK 0,013839 .... daher bin ich ja auch dabei ;-)

Und man bekommt j noch Optionen dazu 2:1! Weiss gar nicht wohin mit den vielen Aktien

Im Ernst: der starke Minenmarkt heute könnte die Chance sein. Wenn SIlber und GOld jetzt nicht gleich wieder niedergeprügelt werden.

Im Ernst: der starke Minenmarkt heute könnte die Chance sein. Wenn SIlber und GOld jetzt nicht gleich wieder niedergeprügelt werden.

Antwort auf Beitrag Nr.: 45.058.959 von TimLuca am 16.07.13 23:47:18Ich sehe das jetzt auch eher mal kurzfristig. Und viel Geld ist es bei mir tatsächlich nicht. Langfristig investieren - nö!

Antwort auf Beitrag Nr.: 45.058.959 von TimLuca am 16.07.13 23:47:18jep .... für mich ne super chance meinen EK zu reduzieren, dann raus! ... oder mal abwarten was kommt

Ich sehe das jetzt auch eher mal kurzfristig. Und viel Geld ist es bei mir tatsächlich nicht. Langfristig investieren - nö!

Ein steigender Aktienpreis würde mich zwar für meine noch vorhandenen Aktien freuen, jedoch wie soll der Preis steigen wenn alle wie Du "kurzfristig" auf den schnellen Gewinn hoffen und sofort schmeißen.

Bei der Menge an Ausgegebenen Aktien zu dem Preis.

Tippe mal auf ein Eröffnungskurs 0,0035AUD

Sollte der Silberpreis sich mittelfristig nicht auf 50$-100$ bewegen wird das hier eh nichts mehr mit solchen Idioten im Management.

Ein steigender Aktienpreis würde mich zwar für meine noch vorhandenen Aktien freuen, jedoch wie soll der Preis steigen wenn alle wie Du "kurzfristig" auf den schnellen Gewinn hoffen und sofort schmeißen.

Bei der Menge an Ausgegebenen Aktien zu dem Preis.

Tippe mal auf ein Eröffnungskurs 0,0035AUD

Sollte der Silberpreis sich mittelfristig nicht auf 50$-100$ bewegen wird das hier eh nichts mehr mit solchen Idioten im Management.

Wie viel wird der Bezugsrechtverkauf bringen?

(,012- (ca. 0,0035))/2=0,00425 AUD oder nicht?

Gruß

CSG-Trader

(,012- (ca. 0,0035))/2=0,00425 AUD oder nicht?

Gruß

CSG-Trader

Zitat von hamburgundelbe: jep .... für mich ne super chance meinen EK zu reduzieren, dann raus! ... oder mal abwarten was kommt

Vermute diese strategie fahren sehr viele...Von daher muss man sehr schnell mit dem Verkauf sein...Und so hoch kann gold und silber gar nicht steigen um den Laden wieder in Fahrt zu bringen..

Zitat von yoni:Zitat von hamburgundelbe: jep .... für mich ne super chance meinen EK zu reduzieren, dann raus! ... oder mal abwarten was kommt

Vermute diese strategie fahren sehr viele...Von daher muss man sehr schnell mit dem Verkauf sein...Und so hoch kann gold und silber gar nicht steigen um den Laden wieder in Fahrt zu bringen..

abwarten, vielleicht bleib ich long

Antwort auf Beitrag Nr.: 45.149.989 von hamburgundelbe am 31.07.13 12:04:13Witzig...Meine Bank hat mir die Bezugsrechte mit wert Null eingebucht...aber nicht aufgefordert diesbezüglich tätig zu werden..Offenbar kennen die meine Gedanken..!! "Der chairman kann sich die Dinger sonstwo hinstecken"...

Meine devise...Reissleine ziehen und kein weiteres gutes Geld ,schlechtem Hinterherwerfen...

Meine devise...Reissleine ziehen und kein weiteres gutes Geld ,schlechtem Hinterherwerfen... Allen anderen wünsch ich dennoch viel glück

Allen anderen wünsch ich dennoch viel glück

Meine devise...Reissleine ziehen und kein weiteres gutes Geld ,schlechtem Hinterherwerfen...

Meine devise...Reissleine ziehen und kein weiteres gutes Geld ,schlechtem Hinterherwerfen... Allen anderen wünsch ich dennoch viel glück

Allen anderen wünsch ich dennoch viel glück

31.07.13 13:52

FONDS professionell

Wien (www.fondscheck.de) - Hedgefonds haben sich für einen weiteren Anstieg des Goldpreises positioniert. Wie die US-Aufsichtsbehörde CFTC (Commodity Futures Trading Commission) in ihrem jüngsten CoT-Wochenbericht mitteilte, haben die spekulativen Finanzinvestoren ihre Netto-Longpositionen - Long-Positionen minus Short-Positionen - um knapp 27 Prozent auf 70.067 und damit auf das höchste Niveau seit Februar dieses Jahres erhöht, berichten die Experten von "FONDS professionell".

In der Vorwoche seien es noch 55.535 Kontrakte gewesen, vor zwei Wochen nur 35.691. Dabei seien nach CoT-Bericht sowohl die Long-Positionen erhöht als auch die Short-Positionen reduziert worden. Ende Mai hätten noch die Short-Kontrakte auf Rekordniveau gestanden.

Der Goldpreis habe sich im Juli auch wieder erholt, nachdem er Ende Juni auf ein Drei-Jahrestief von umgerechnet rund 900 Euro pro Unze gefallen sei. Auslöser des Kurssturzes seien Spekulationen gewesen, die US-Notenbank FED könnte ihre Anleihekäufe schneller beenden als zunächst erwartet. Seitdem diese Furcht wieder abgenommen habe, ziehe auch der Goldpreis wieder an - inzwischen notiere er bei umgerechnet etwa 1.000 Euro. Hinzu komme, dass der Goldpreis eine starke Unterstützung von der physischen Nachfrage erfahre.

Auch bei anderen Edelmetallen gehe es nach oben. So sei laut CoT-Bericht bei Silber die Zahl der der Netto-Longpositionen um 31 Prozent auf 6.321 Kontrakte ausgeweitet worden, bei Platin sei die entsprechende Zahl um 14 Prozent und bei Palladium um vier Prozent gestiegen. (31.07.2013/fc/n/s)

FONDS professionell

Wien (www.fondscheck.de) - Hedgefonds haben sich für einen weiteren Anstieg des Goldpreises positioniert. Wie die US-Aufsichtsbehörde CFTC (Commodity Futures Trading Commission) in ihrem jüngsten CoT-Wochenbericht mitteilte, haben die spekulativen Finanzinvestoren ihre Netto-Longpositionen - Long-Positionen minus Short-Positionen - um knapp 27 Prozent auf 70.067 und damit auf das höchste Niveau seit Februar dieses Jahres erhöht, berichten die Experten von "FONDS professionell".

In der Vorwoche seien es noch 55.535 Kontrakte gewesen, vor zwei Wochen nur 35.691. Dabei seien nach CoT-Bericht sowohl die Long-Positionen erhöht als auch die Short-Positionen reduziert worden. Ende Mai hätten noch die Short-Kontrakte auf Rekordniveau gestanden.

Der Goldpreis habe sich im Juli auch wieder erholt, nachdem er Ende Juni auf ein Drei-Jahrestief von umgerechnet rund 900 Euro pro Unze gefallen sei. Auslöser des Kurssturzes seien Spekulationen gewesen, die US-Notenbank FED könnte ihre Anleihekäufe schneller beenden als zunächst erwartet. Seitdem diese Furcht wieder abgenommen habe, ziehe auch der Goldpreis wieder an - inzwischen notiere er bei umgerechnet etwa 1.000 Euro. Hinzu komme, dass der Goldpreis eine starke Unterstützung von der physischen Nachfrage erfahre.

Auch bei anderen Edelmetallen gehe es nach oben. So sei laut CoT-Bericht bei Silber die Zahl der der Netto-Longpositionen um 31 Prozent auf 6.321 Kontrakte ausgeweitet worden, bei Platin sei die entsprechende Zahl um 14 Prozent und bei Palladium um vier Prozent gestiegen. (31.07.2013/fc/n/s)

Antwort auf Beitrag Nr.: 45.181.369 von hamburgundelbe am 05.08.13 12:24:54hi Hamburgundelbe,

wann glaubst du werden die jemals wieder gehandelt?

vg

keep

wann glaubst du werden die jemals wieder gehandelt?

vg

keep

Antwort auf Beitrag Nr.: 45.181.911 von keep-racing am 05.08.13 13:42:55meine Stücke wurden heute eingebucht ....

... Handel sollte "morgen" starten. Mein letzter Stand

... Handel sollte "morgen" starten. Mein letzter Stand

Bei welcher Bank bist du denn ? Bei mir ist noch nix eingebucht.

Antwort auf Beitrag Nr.: 45.182.699 von prallhans am 05.08.13 15:20:32eingebucht und Gegenwert in € abgebucht

In diesem Fall ist es Cortal Consors

In diesem Fall ist es Cortal Consors

Antwort auf Beitrag Nr.: 45.182.779 von hamburgundelbe am 05.08.13 15:32:10bei mir is no nix, dwpbank und damit spk.....

mal schaun ob morgen was drin is....

vg

keep

mal schaun ob morgen was drin is....

vg

keep

comdirect. tote hose. habe nur die optionen ohne kurs.

Ich bin gespannt ob Wort gehalten wird und MORGEN der Handel startet

Wichtige Info

In Australien wird am Dienstag eine Zinssenkung durch die Reserve Bank of Australia erwartet. Im Vorfeld dessen halten sich die Investoren zurück. Derzeit liegt der Leitzins in Down Under bei 2,75 Prozent und könnte auf 2,5 Prozent gesenkt werden.

Interessant wird das Anlegerverhalten von 'down under' kurz nach der anstehende (hoffentlich dann geglückte) Leitzinssenkung.

Der Trend ist klar:

50% der vermögenden Aussies werden sich fragen was das Geld eigentlich noch wert sei, die andere 50% werden Investestionsgüter im Bereich von Edelmetallen auch "silber" um die allgemeine "Cash-Verwässerung" begegnen zu können

Wichtige Info

In Australien wird am Dienstag eine Zinssenkung durch die Reserve Bank of Australia erwartet. Im Vorfeld dessen halten sich die Investoren zurück. Derzeit liegt der Leitzins in Down Under bei 2,75 Prozent und könnte auf 2,5 Prozent gesenkt werden.

Interessant wird das Anlegerverhalten von 'down under' kurz nach der anstehende (hoffentlich dann geglückte) Leitzinssenkung.

Der Trend ist klar:

50% der vermögenden Aussies werden sich fragen was das Geld eigentlich noch wert sei, die andere 50% werden Investestionsgüter im Bereich von Edelmetallen auch "silber" um die allgemeine "Cash-Verwässerung" begegnen zu können

Quartalsbericht liest sich besser als erwartet!

Unbedingt einmal anschauen!

http://bc.video.brrmedia.com/services/player/bcpid2522818713…

Unbedingt einmal anschauen!

http://bc.video.brrmedia.com/services/player/bcpid2522818713…

Wurde am 02.08 abgerechnet zu 0,005 AUD

Bei mir jetzt auch im Depot zu 0,0034 Euro Kaufkurs. Allerdings fand wohl immer noch kein Handel statt.

Antwort auf Beitrag Nr.: 45.186.903 von prallhans am 06.08.13 08:39:26es hieß seinerzeit 06.08.13

Dear ....

Trading will commence when fund raising complete on 6 August.

Copies of all ASX announcements are posted on our website as pr below. There is a timetable of the fund raising on the eligible shareholder announcement.

Many thanks

Pam Ryan │ Executive Assistant

T:

F:

E:

W:

+61 (0)8 9476 3000

+61 (0)8 9368 1924

pryan@alcyone.com.au

www.alcyone.com.au

Trading will commence when fund raising complete on 6 August.

Copies of all ASX announcements are posted on our website as pr below. There is a timetable of the fund raising on the eligible shareholder announcement.

Many thanks

Pam Ryan │ Executive Assistant

T:

F:

E:

W:

+61 (0)8 9476 3000

+61 (0)8 9368 1924

pryan@alcyone.com.au

www.alcyone.com.au

Alles klar, dann wohl heute Nacht...

Antwort auf Beitrag Nr.: 45.187.291 von prallhans am 06.08.13 09:30:21ich hoffe

oder haben wir was verpasst? Aufschiebung oder oder

oder haben wir was verpasst? Aufschiebung oder oder

Zitat von hamburgundelbe: Ich bin gespannt ob Wort gehalten wird und MORGEN der Handel startet

Wichtige Info

In Australien wird am Dienstag eine Zinssenkung durch die Reserve Bank of Australia erwartet. Im Vorfeld dessen halten sich die Investoren zurück. Derzeit liegt der Leitzins in Down Under bei 2,75 Prozent und könnte auf 2,5 Prozent gesenkt werden.

Interessant wird das Anlegerverhalten von 'down under' kurz nach der anstehende (hoffentlich dann geglückte) Leitzinssenkung.

Der Trend ist klar:

50% der vermögenden Aussies werden sich fragen was das Geld eigentlich noch wert sei, die andere 50% werden Investestionsgüter im Bereich von Edelmetallen auch "silber" um die allgemeine "Cash-Verwässerung" begegnen zu können

SILBER WIRD MEHR UND MEHR GEFRAGT SEIN

According to the last Extension of Closing Date Announcement dated 18 July 2013, the anticipated lifting

of suspension is the 16 August 2013.

Also noch ein wenig Zeit, für alle die aufspringen wollen. Ich hab die Verlängerung verpasst.

of suspension is the 16 August 2013.

Also noch ein wenig Zeit, für alle die aufspringen wollen. Ich hab die Verlängerung verpasst.

Mein Gott, wäre das schön, wenn Alcyone bei diesem Umfeld schon unter uns wäre. Bin ja mal gespannt. Wenn das Closing Date am 18.08. ist, wie lange dauert es dann noch bis zum Handel? Eine Woche?

Übrigens ein ähnlicher Wert, von den Fähigkeiten des Managements und schiefgelaufenen Terminen, Zulassungen, technischen Unklarheiten ist Great Western Minerals. Und die läuft auch wieder.

Übrigens ein ähnlicher Wert, von den Fähigkeiten des Managements und schiefgelaufenen Terminen, Zulassungen, technischen Unklarheiten ist Great Western Minerals. Und die läuft auch wieder.

PERTH (miningweekly.com) – ASX-listed Alcyone Resources has started site work on the installation of the new crushing plant at its Texas silver mine, in Queensland, which would bring the plant’s capacity up to 1.1-million ounces a year.

Alcyone said on Tuesday that it had successfully crushed some 20 000 t of ore over the last week, and silver production was expected to start shortly.

The Texas project includes the TwinHIlls and Mount Gunyan mine, and started silver production in July 2011.

Alcyone recently signed a three-year offtake agreement over the project, valued at A$10-million. The company also received A$7.4-million under a rights issue and shortfall

W O W

das geht ja gut voran!!!

Wie gut, dass ich meine Stück SAFE habe!!! ich vermute mal, dass wir bei Wiederaufnahme ganz schnell die 0,02 EURO! sehen werden

mM

Viele Grüße

Alcyone said on Tuesday that it had successfully crushed some 20 000 t of ore over the last week, and silver production was expected to start shortly.

The Texas project includes the TwinHIlls and Mount Gunyan mine, and started silver production in July 2011.

Alcyone recently signed a three-year offtake agreement over the project, valued at A$10-million. The company also received A$7.4-million under a rights issue and shortfall

W O W

das geht ja gut voran!!!

Wie gut, dass ich meine Stück SAFE habe!!! ich vermute mal, dass wir bei Wiederaufnahme ganz schnell die 0,02 EURO! sehen werden

mM

Viele Grüße

Antwort auf Beitrag Nr.: 45.233.927 von prallhans am 12.08.13 20:43:32 16.08 soll der Handel aufgenommen werden ...

16.08 soll der Handel aufgenommen werden ...

Also mein LETZTER STAND ist

Handelsstart FREITAG 16.08.2013

Kann es auch kaum abwarten

16.08 soll der Handel aufgenommen werden ...

16.08 soll der Handel aufgenommen werden ...Also mein LETZTER STAND ist

Handelsstart FREITAG 16.08.2013

Kann es auch kaum abwarten

Ja, bin gespannt. Es werden ja gerade einige Minenleichen wiederbelebt, sprich es kommt VOlumen in die "Flatliner".

Wie erwartet,Kurs auf KE Niveau,konte ich mir sparen die KE mit zu finanzieren,man könnte jetzt bequem zum KE Kurs einkaufen,was solls hätte ja auch anders.....

Naja nicht ganz,man hätte die Gratisscheine nicht bekommen,aber wer weiss schon was die mal wert sind, ob überhaupt.

ACHTUG

Der HANDEL STARTET HEUTE NACHT in Australien -

beziehungsweise bei uns morgen früh !!!!

Der HANDEL STARTET HEUTE NACHT in Australien -

beziehungsweise bei uns morgen früh !!!!

???????????????? ist schon gestartet???? ohh mann GUTEN MORGEN !

STARK UNTERBEWERTET!!

http://www.asx.com.au/asxpdf/20130813/pdf/42hmn3rwhrstrp.pdf

Jetzt besteht hier noch die Chance günstig einzusteigen, bevor JEDERMANN aufmerksam wird!

http://www.asx.com.au/asxpdf/20130813/pdf/42hmn3rwhrstrp.pdf

Jetzt besteht hier noch die Chance günstig einzusteigen, bevor JEDERMANN aufmerksam wird!

wer verkauft denn da zu 0,005

Wir werden hier mit SICHERHEIT bald die 0,02 aufwärts sehen

ATTACKE

n.m.M.

Wir werden hier mit SICHERHEIT bald die 0,02 aufwärts sehen

ATTACKE

n.m.M.

Antwort auf Beitrag Nr.: 45.247.901 von hamburgundelbe am 14.08.13 12:58:30na da nehm ich doch ein paar Stücke.

Wir werden hier mit SICHERHEIT bald die 0,02 aufwärts sehen

Und in welchem Zeitfenster könnten wir das erwarten

Und in welchem Zeitfenster könnten wir das erwarten

Antwort auf Beitrag Nr.: 45.248.319 von pampus am 14.08.13 13:43:13Das ist die Definition von "bald" aus dem Duden:

in[nerhalb] kurzer Zeit, nach einem relativ kurzen Zeitraum

leicht, schnell, rasch

in[nerhalb] kurzer Zeit, nach einem relativ kurzen Zeitraum

leicht, schnell, rasch

Antwort auf Beitrag Nr.: 45.248.349 von LonelyLooser am 14.08.13 13:46:46kommt darauf an, wie es nun voran geht! Aber alle Weichen sind gestellt!

Und von Altlasten (S. Pressemitteilung heute) hat man sich auch getrennt.

Ich will die 0,01 - 0,015 innerhalb der nächsten 5 Handelstage sehen!

Viele Grüße

Und von Altlasten (S. Pressemitteilung heute) hat man sich auch getrennt.

Ich will die 0,01 - 0,015 innerhalb der nächsten 5 Handelstage sehen!

Viele Grüße

Antwort auf Beitrag Nr.: 45.248.387 von hamburgundelbe am 14.08.13 13:49:260,01 - 0,015 ...

Gerne.

Wo kann man denn die australischen Kurse sehen ?

Ansonsten wird ja schonmal fleissig gekauft. Könnte aber schon etwas mehr sein.

Gerne.

Wo kann man denn die australischen Kurse sehen ?

Ansonsten wird ja schonmal fleissig gekauft. Könnte aber schon etwas mehr sein.

Antwort auf Beitrag Nr.: 45.248.519 von LonelyLooser am 14.08.13 14:03:20http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode…

Antwort auf Beitrag Nr.: 45.248.655 von hamburgundelbe am 14.08.13 14:19:45Hi Hamburgundelbe,

bitte lach mich nicht aus, aber ich hab auch nachgekauft und nun 3 mal alcyone im depot drin. meinen altbestand, da doppelte an neuen mit neuer kennnr. , auch ok, aber nun nochmal ein weiteres mal alcyone mit der gleichen anzahl wie der vorbestand war.

Kannst du mir ein bisserl weiterhelfen und weißt du, wann und ob die mal wieder zusammengeworfen werden mit den kennummern. kommt man ja ganz durcheinander.

vg und schonmal danke im voraus.

keep

bitte lach mich nicht aus, aber ich hab auch nachgekauft und nun 3 mal alcyone im depot drin. meinen altbestand, da doppelte an neuen mit neuer kennnr. , auch ok, aber nun nochmal ein weiteres mal alcyone mit der gleichen anzahl wie der vorbestand war.

Kannst du mir ein bisserl weiterhelfen und weißt du, wann und ob die mal wieder zusammengeworfen werden mit den kennummern. kommt man ja ganz durcheinander.

vg und schonmal danke im voraus.

keep

und ab 00.00 Uhr MEZ gehts up

Antwort auf Beitrag Nr.: 45.250.785 von Mr_Greenthumb am 14.08.13 17:55:05Es ist 03:26 und es ist nichts passiert.......

http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode…

Gruß

qc

http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode…

Gruß

qc

Antwort auf Beitrag Nr.: 45.248.387 von hamburgundelbe am 14.08.13 13:49:2603:30 Uhr in Deutschland und die Kurse in Australien fallen:

http://www.alcyone.com.au/investor_centre/share_price_inform…

Gruß

qc

http://www.alcyone.com.au/investor_centre/share_price_inform…

Gruß

qc

leg Dich ganz ruhig wieder hin, es ist nichts passiert

leg Dich ganz ruhig wieder hin, es ist nichts passiert

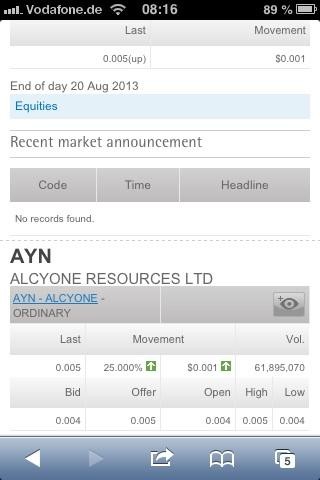

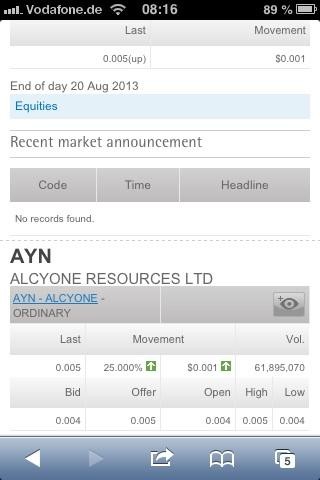

stabil auf 0,005 ! Der Boden ist gefunden!

Warum passiert in Australien nichts? Die haben den Handel doch auch schon wieder aufgenommen oder?

Antwort auf Beitrag Nr.: 45.254.369 von Mr_Greenthumb am 15.08.13 08:49:48jep .... Volumen diese Nacht: 31,434,460 Stücke

und wie gesagt stabil auf der 0,005 ! Jetzt heißt es auf die nächsten NEWS warten ... immerhin wird fleißig abgebaut und silber produziert

und wie gesagt stabil auf der 0,005 ! Jetzt heißt es auf die nächsten NEWS warten ... immerhin wird fleißig abgebaut und silber produziert

Mal grob übersetzt

BRIEF AN DIE AKTIONÄRE

Höhepunkte

Gestärkt Bilanz mit $ 5.200.000 in Deleveraging, $ 4.000.000 in bar, Summenstrom

Vermögenswerte von $ 9.000.000 und insgesamt Asset-Basis von $ 35.000.000;

Texas Silver Mine wieder aufgenommen Operations and Targeting Produktion von 95.000 Tonnen pro Monat

Post-Upgrade von Brecher im September 2013;

Silber Produktion bereit, Typenschild Kapazität von 80.000 Unzen Gold pro Monat in Q4 2013 zu erreichen;

Verbindung zum Netz-Power in Q4 erwartet, was zu geschätzten $ 12 Millionen Einsparungen für das Leben von Mine;

Transaktionen geprüft.

Sehr geehrte Aktionärinnen und Aktionäre

Alcyone Resources Limited hat ein hohes Maß an unternehmerischen Tätigkeit in den vergangenen sechs Monaten durchgeführt

unter einem neuen Vorstand und Management-Team.Seit meinem letzten Brief an Sie im April 2013, haben wir

erhebliche Fortschritte und ich möchte diese Gelegenheit nutzen, um Sie mit einem Update auf den Schlüssel liefern

Leistungen.

Bezugsrechtsemission Fertigstellung

Am 9. August 2013, bestätigt unser Unternehmen Erhalt von 7,4 Mio. EUR im Rahmen der Kapitalerhöhung und Unterdeckung,

Überschreitung der minimalen Rechte Ausgabe Anforderung von $ 6.000.000.Die Zuteilung der 2 für 1 Pro-rata-nicht-

verzichtbar Rechte Ausgabe wurde am 14. August 2013 abgeschlossen nach Abschluss aller Bedingungen für die

Ausgabe von Bezugsrechten.Zusammenfassend hat die Gesellschaft insgesamt Abonnement für die Kapitalerhöhung von 1484435537

Aktien und 742.217.769 kostenlose Möglichkeiten, mit 17,56% der Aktie der Gesellschaft registrieren Aufnahme ihrer Rechte.

Angesichts der aktuellen Bedingungen am Aktienmarkt in der Junior-Bergbausektor, ich freue mich zu berichten, dass die

Bezugsrechtsemission unterstreicht die starke finanzielle Unterstützung, die wir von Ihnen erhalten haben, um die Strategie der Umsetzung

ein Pure-Play-Silber-Produzenten mit einem Fokus auf Ertragswachstum unter einer Rekapitalisierung Struktur neben einem

neuer Vorstand und Management-Team.

Die Aktien des Unternehmens wurden an der Australian Securities Exchange am 14. August 2013 wieder zitiert nach einer

mehr als vier-Monats-Suspension als Teil einer wesentlichen unternehmerischen operative Überprüfung und Fundraising Prozess.

Bilanz und Kapitalstruktur

Der Vorstand vertrat die Auffassung, dass die Ausgabe von Bezugsrechten die am besten geeignete und gerechte Mechanismus, in dem war

erhöhen ausreichend Kapital durch den Aktienmärkten zu vereinfachen und zu de-Risiko Die Gesellschaft in der Bilanz.

Durch die Kapitalerhöhung hat die Gesellschaft 3.600.000 $ in Schulden und in Verbindung mit der Rückzahlung im Ruhestand

des Unternehmens $ 1.600.000 Pre-Pay-Anlage mit der Credit Suisse durch die Glattstellung der Gesellschaft Hedge

Position hat das Unternehmen zu entschulden von insgesamt 5.200.000 $ verwaltet.Zukünftig das Hauptaugenmerk ist zu einem profitablen Betrieb sein durch die Optimierung des Unternehmens Flaggschiff Silber-Projekt, das Texas

Silver Mine in Queensland.Das Unternehmen ist in einer starken Position, um die Mine Typenschild Produktion nehmen

Kapazität, Beendigung der Kapitalerhöhung mit 4.000.000 $ in bar, insgesamt Umlaufvermögen von $ 9.000.000 und insgesamt

Asset-Basis 35 Millionen Dollar und einem Net Asset Basis von USD 18 Mio..

Operationelle Ziele

Nach einer ausführlichen Lagebericht unter dem neuen Vorstand und Management-Team, war das Unternehmen

rekapitalisiert einen Key-Infrastruktur-Upgrade zu finanzieren und Produktionsvolumen erhöhen und gleichzeitig die Kosten zu

die Texas Silver Mine.Crushing Operationen wieder aufgenommen auf der 5 th

August und wird zum Auslaugen beginnen und

extrahieren Silber innerhalb von 14 Tagen.Die Großstillstand die Brecher Upgrade wurde für die letzten zwei geplant

Wochen im September und erwartet Typenschild Produktion von 95.000 Tonnen pro Monat zu erreichen während

Oktober, die die Grundlage für die Produktion von 80.000 Unzen Silber sowie pro Monat zur Verfügung stellt.Die

Unternehmen beabsichtigt, die Gelder für den Bau und die Inbetriebnahme der HV Stromleitung zu bedienen

Zugriff Netzstrom und reduzieren die Kosten für Strom von 0,38 Cent je k / w hr bis 0,18 Cent je k / w hr Realisierung

Einsparungen in Höhe von $ 12.000.000 Lebensdauer der Mine.Installation und Kauf von verschiedenen Kostenersparnis Einrichtungen werden auch

abgeschlossen in den nächsten 4 Monaten.Mining Produktion aus dem Tagebau Grube wird beginnen, sobald ROM

Lagerbestände wurden teilweise erschöpft.

Silver Purchase Agreement

Die Frist für die Bezugsrechtsemission war Gegenstand unseres Unternehmens erhalten $ 2.500.000 zusätzliche Finanzierung

und $ 2 Millionen in die Finanzierung von einem Off-take Fazilität Metall Streaming Vereinbarung ist bedingungslos.Am 6. Juni

2013 trat unsere Gesellschaft in eine 10 Millionen US $ Silver Purchase Agreement mit Powerline Value Fund, dass

bot eine Abnahmeverpflichtung für die Lieferung unserer Gesellschaft Silberproduktion von seiner Texas Silber

Bergwerk.Am 13. August 2013, bestätigt das Unternehmen, dass das Powerline-Abkommen hatte sich bedingungslos,

Abschluss einer Schlüsselkomponente der Kapitalerhöhung und dem das Unternehmen 45 Tage zu beginnen Zugriff

Finanzierung im Rahmen des Abkommens nach eigenem Ermessen.Die Notwendigkeit für das Unternehmen, um Mittel gemäß den Zugriff

Powerline Fazilität war immer von der Verfügbarkeit von Mitteln im Rahmen des 10 Mio. US $ bestimmt werden

Preciosa Metall Streaming Transaktion.Wie der Markt am 14. August 2013 angekündigt, hat die Gesellschaft

um die Transaktion zu beenden Preciosa und als solche will nun Fonds zeichnen, wie aus dem Powerline erforderlich Einrichtung.

Ausblick

Der Verwaltungsrat hat volles Vertrauen, dass diese strategische Wende nun erfolgreich mit der umgesetzt werden

Gelegenheit, starke Ergebnis-und Cash liefern fließt somit zur Maximierung des Shareholder Renditen.Wir möchten

Ihnen für die finanzielle Unterstützung, die Sie uns zur Verfügung gestellt haben sich in den vergangenen Monaten bedanken und freuen uns auf

Ihren Besuch auf unserer Hauptversammlung im November 2013.

Mit freundlichen Grüßen,

Paul D'Sylva

Vorsitzender

15. August 2013

BRIEF AN DIE AKTIONÄRE

Höhepunkte

Gestärkt Bilanz mit $ 5.200.000 in Deleveraging, $ 4.000.000 in bar, Summenstrom

Vermögenswerte von $ 9.000.000 und insgesamt Asset-Basis von $ 35.000.000;

Texas Silver Mine wieder aufgenommen Operations and Targeting Produktion von 95.000 Tonnen pro Monat

Post-Upgrade von Brecher im September 2013;

Silber Produktion bereit, Typenschild Kapazität von 80.000 Unzen Gold pro Monat in Q4 2013 zu erreichen;

Verbindung zum Netz-Power in Q4 erwartet, was zu geschätzten $ 12 Millionen Einsparungen für das Leben von Mine;

Transaktionen geprüft.

Sehr geehrte Aktionärinnen und Aktionäre

Alcyone Resources Limited hat ein hohes Maß an unternehmerischen Tätigkeit in den vergangenen sechs Monaten durchgeführt

unter einem neuen Vorstand und Management-Team.Seit meinem letzten Brief an Sie im April 2013, haben wir

erhebliche Fortschritte und ich möchte diese Gelegenheit nutzen, um Sie mit einem Update auf den Schlüssel liefern

Leistungen.

Bezugsrechtsemission Fertigstellung

Am 9. August 2013, bestätigt unser Unternehmen Erhalt von 7,4 Mio. EUR im Rahmen der Kapitalerhöhung und Unterdeckung,

Überschreitung der minimalen Rechte Ausgabe Anforderung von $ 6.000.000.Die Zuteilung der 2 für 1 Pro-rata-nicht-

verzichtbar Rechte Ausgabe wurde am 14. August 2013 abgeschlossen nach Abschluss aller Bedingungen für die

Ausgabe von Bezugsrechten.Zusammenfassend hat die Gesellschaft insgesamt Abonnement für die Kapitalerhöhung von 1484435537

Aktien und 742.217.769 kostenlose Möglichkeiten, mit 17,56% der Aktie der Gesellschaft registrieren Aufnahme ihrer Rechte.

Angesichts der aktuellen Bedingungen am Aktienmarkt in der Junior-Bergbausektor, ich freue mich zu berichten, dass die

Bezugsrechtsemission unterstreicht die starke finanzielle Unterstützung, die wir von Ihnen erhalten haben, um die Strategie der Umsetzung

ein Pure-Play-Silber-Produzenten mit einem Fokus auf Ertragswachstum unter einer Rekapitalisierung Struktur neben einem

neuer Vorstand und Management-Team.

Die Aktien des Unternehmens wurden an der Australian Securities Exchange am 14. August 2013 wieder zitiert nach einer

mehr als vier-Monats-Suspension als Teil einer wesentlichen unternehmerischen operative Überprüfung und Fundraising Prozess.

Bilanz und Kapitalstruktur

Der Vorstand vertrat die Auffassung, dass die Ausgabe von Bezugsrechten die am besten geeignete und gerechte Mechanismus, in dem war

erhöhen ausreichend Kapital durch den Aktienmärkten zu vereinfachen und zu de-Risiko Die Gesellschaft in der Bilanz.

Durch die Kapitalerhöhung hat die Gesellschaft 3.600.000 $ in Schulden und in Verbindung mit der Rückzahlung im Ruhestand

des Unternehmens $ 1.600.000 Pre-Pay-Anlage mit der Credit Suisse durch die Glattstellung der Gesellschaft Hedge

Position hat das Unternehmen zu entschulden von insgesamt 5.200.000 $ verwaltet.Zukünftig das Hauptaugenmerk ist zu einem profitablen Betrieb sein durch die Optimierung des Unternehmens Flaggschiff Silber-Projekt, das Texas

Silver Mine in Queensland.Das Unternehmen ist in einer starken Position, um die Mine Typenschild Produktion nehmen

Kapazität, Beendigung der Kapitalerhöhung mit 4.000.000 $ in bar, insgesamt Umlaufvermögen von $ 9.000.000 und insgesamt

Asset-Basis 35 Millionen Dollar und einem Net Asset Basis von USD 18 Mio..

Operationelle Ziele

Nach einer ausführlichen Lagebericht unter dem neuen Vorstand und Management-Team, war das Unternehmen

rekapitalisiert einen Key-Infrastruktur-Upgrade zu finanzieren und Produktionsvolumen erhöhen und gleichzeitig die Kosten zu

die Texas Silver Mine.Crushing Operationen wieder aufgenommen auf der 5 th

August und wird zum Auslaugen beginnen und

extrahieren Silber innerhalb von 14 Tagen.Die Großstillstand die Brecher Upgrade wurde für die letzten zwei geplant

Wochen im September und erwartet Typenschild Produktion von 95.000 Tonnen pro Monat zu erreichen während

Oktober, die die Grundlage für die Produktion von 80.000 Unzen Silber sowie pro Monat zur Verfügung stellt.Die

Unternehmen beabsichtigt, die Gelder für den Bau und die Inbetriebnahme der HV Stromleitung zu bedienen

Zugriff Netzstrom und reduzieren die Kosten für Strom von 0,38 Cent je k / w hr bis 0,18 Cent je k / w hr Realisierung

Einsparungen in Höhe von $ 12.000.000 Lebensdauer der Mine.Installation und Kauf von verschiedenen Kostenersparnis Einrichtungen werden auch

abgeschlossen in den nächsten 4 Monaten.Mining Produktion aus dem Tagebau Grube wird beginnen, sobald ROM

Lagerbestände wurden teilweise erschöpft.

Silver Purchase Agreement

Die Frist für die Bezugsrechtsemission war Gegenstand unseres Unternehmens erhalten $ 2.500.000 zusätzliche Finanzierung

und $ 2 Millionen in die Finanzierung von einem Off-take Fazilität Metall Streaming Vereinbarung ist bedingungslos.Am 6. Juni

2013 trat unsere Gesellschaft in eine 10 Millionen US $ Silver Purchase Agreement mit Powerline Value Fund, dass

bot eine Abnahmeverpflichtung für die Lieferung unserer Gesellschaft Silberproduktion von seiner Texas Silber

Bergwerk.Am 13. August 2013, bestätigt das Unternehmen, dass das Powerline-Abkommen hatte sich bedingungslos,

Abschluss einer Schlüsselkomponente der Kapitalerhöhung und dem das Unternehmen 45 Tage zu beginnen Zugriff

Finanzierung im Rahmen des Abkommens nach eigenem Ermessen.Die Notwendigkeit für das Unternehmen, um Mittel gemäß den Zugriff

Powerline Fazilität war immer von der Verfügbarkeit von Mitteln im Rahmen des 10 Mio. US $ bestimmt werden

Preciosa Metall Streaming Transaktion.Wie der Markt am 14. August 2013 angekündigt, hat die Gesellschaft

um die Transaktion zu beenden Preciosa und als solche will nun Fonds zeichnen, wie aus dem Powerline erforderlich Einrichtung.

Ausblick

Der Verwaltungsrat hat volles Vertrauen, dass diese strategische Wende nun erfolgreich mit der umgesetzt werden

Gelegenheit, starke Ergebnis-und Cash liefern fließt somit zur Maximierung des Shareholder Renditen.Wir möchten

Ihnen für die finanzielle Unterstützung, die Sie uns zur Verfügung gestellt haben sich in den vergangenen Monaten bedanken und freuen uns auf

Ihren Besuch auf unserer Hauptversammlung im November 2013.

Mit freundlichen Grüßen,

Paul D'Sylva

Vorsitzender

15. August 2013

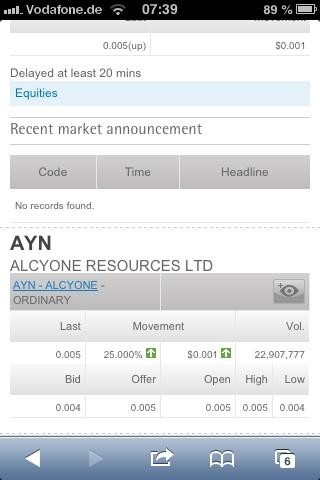

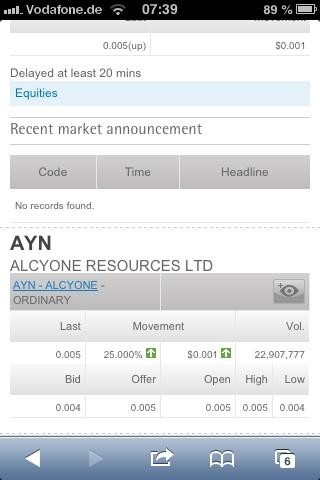

Danke hab die Handelsdaten aus Australien gefunden!

Schönes Übersetzungsprogramm hast du da gefunden.

Schönes Übersetzungsprogramm hast du da gefunden.

Antwort auf Beitrag Nr.: 45.255.583 von Mr_Greenthumb am 15.08.13 10:43:00 so dann kann es ja nun langsam aufwärts gehen

so dann kann es ja nun langsam aufwärts gehen

so dann kann es ja nun langsam aufwärts gehen

so dann kann es ja nun langsam aufwärts gehen

Interessant fand ich die Absage an Preciosa Streaming. Ein Chef dieser Firma ist nämlich Lenic Rodriguez, det auch bei Aurcana das Zepter schwingt.

Antwort auf Beitrag Nr.: 45.255.855 von prallhans am 15.08.13 11:09:41ja .... wobei Preciosa Streaming ne Abzockerbande ist

Kennst du die? Ich mache mir gerade Sorgen um mein Aurcana Engagement, vor allem weil Rodriguez da auch z.T. nicht immer ganz ehrlich war.

Antwort auf Beitrag Nr.: 45.258.705 von prallhans am 15.08.13 16:27:30das ist der Punkt (nicht immer "ganz" ehrlich ;-)

Aber deswegen bin ich FRPH das sich Alcyone von solchen

Unternehmen distanziert

Aber deswegen bin ich FRPH das sich Alcyone von solchen

Unternehmen distanziert

Wow und Silber springt 3% nach oben. Gefällt mir

Antwort auf Beitrag Nr.: 45.260.061 von Mr_Greenthumb am 15.08.13 19:05:54hoffentlich hilft's dem kurs....

Antwort auf Beitrag Nr.: 45.258.745 von hamburgundelbe am 15.08.13 16:31:02Der Wortlaut ist schon ganz schön krass und diese Distanzierung spricht für das neue MGMT und gegen das alte. Bin mal gespannt heute Nacht!

Silber wieder über 23 US-Dollar

Jetzt heißt es Geduld haben und in Ruhe (vorsichtig) nachlegen

Jetzt heißt es Geduld haben und in Ruhe (vorsichtig) nachlegen

Gold und Silber mit starkem Comeback – Zinsängste schicken Aktien abwärts

Gastautor: Benjamin Feingold | 16.08.2013, 09:20 | 10 Aufrufe | 0 |

Wir haben erst den zweiten Tag einer Korrektur erlebt, aber die Flucht in Sicherheit ist bereits in vollem Gang. Die Unruhen in Ägypten und der Zinsanstieg in den USA sorgen für Gewinnmitnahmen am Aktienmarkt und kräftige Kursgewinne bei Gold und Silber. Salzgitter reagiert auf ganz eigene Weise auf die Krise und will den Vorstand verkleinern. Bei der Lufthansa schmerzt heute eine Analystenherabstufung, die die Aktie noch einmal fallen lässt. Und was macht der Deri in dieser aufgeheizten Börsenstimmung? Nachdem er die Auf und Abs in diesem Jahr gut eingefangen hat, bleiben die Börsenampel noch auf grün, aber Anleger sollten jetzt einen genauen Blick auf die Entwicklung der Deri werfen. Genau wie auf unserer frische Einschätzung zu SAP, die wir heute früh präsentiert haben.

Sicherheit gefragt

Möglicherweise haben die bekannten Großinvestoren George Soros und John Paulson ihre Bestände im Gold-ETF, dem SPDR Gold Trust, zu früh abgebaut. Denn per Ende des vergangenen Quartals haben beide erklärt, ihre Anteile reduziert zu haben. Mit der sich verschlimmernden Situation in Ägypten und einem Kurseinbruch am Aktienmarkt, steigt das Bedürfnis nach Sicherheit und damit nach Edelmetallen. Gold steigt um etwa zwei und Silber sogar um mehr als fünf Prozent. Die Eskalation in Ägypten treibt auch den Rohölpreis nach oben, WTI klettert wieder über die 107 USD-Marke. Anleger, die weiter auf steigende Gold- und Silberpreise setzen wollen, können mit Knock-out-Bull-Papieren profitieren. Die ausgewählten Knock-outs sind moderat gehebelt: Gold (WKN CG2E43, Hebel 7), Silber (WKN DX77M1, Hebel 4). Für Pessimisten, die nach dem rasanten Anstieg auf eine Korrektur setzen wollen, bieten sich Knock-out-Bear-Papiere an: Gold (WKN NG0WML, Hebel 6,5), Silber (WKN VT8PSC, Hebel 4).

Gastautor: Benjamin Feingold | 16.08.2013, 09:20 | 10 Aufrufe | 0 |

Wir haben erst den zweiten Tag einer Korrektur erlebt, aber die Flucht in Sicherheit ist bereits in vollem Gang. Die Unruhen in Ägypten und der Zinsanstieg in den USA sorgen für Gewinnmitnahmen am Aktienmarkt und kräftige Kursgewinne bei Gold und Silber. Salzgitter reagiert auf ganz eigene Weise auf die Krise und will den Vorstand verkleinern. Bei der Lufthansa schmerzt heute eine Analystenherabstufung, die die Aktie noch einmal fallen lässt. Und was macht der Deri in dieser aufgeheizten Börsenstimmung? Nachdem er die Auf und Abs in diesem Jahr gut eingefangen hat, bleiben die Börsenampel noch auf grün, aber Anleger sollten jetzt einen genauen Blick auf die Entwicklung der Deri werfen. Genau wie auf unserer frische Einschätzung zu SAP, die wir heute früh präsentiert haben.

Sicherheit gefragt

Möglicherweise haben die bekannten Großinvestoren George Soros und John Paulson ihre Bestände im Gold-ETF, dem SPDR Gold Trust, zu früh abgebaut. Denn per Ende des vergangenen Quartals haben beide erklärt, ihre Anteile reduziert zu haben. Mit der sich verschlimmernden Situation in Ägypten und einem Kurseinbruch am Aktienmarkt, steigt das Bedürfnis nach Sicherheit und damit nach Edelmetallen. Gold steigt um etwa zwei und Silber sogar um mehr als fünf Prozent. Die Eskalation in Ägypten treibt auch den Rohölpreis nach oben, WTI klettert wieder über die 107 USD-Marke. Anleger, die weiter auf steigende Gold- und Silberpreise setzen wollen, können mit Knock-out-Bull-Papieren profitieren. Die ausgewählten Knock-outs sind moderat gehebelt: Gold (WKN CG2E43, Hebel 7), Silber (WKN DX77M1, Hebel 4). Für Pessimisten, die nach dem rasanten Anstieg auf eine Korrektur setzen wollen, bieten sich Knock-out-Bear-Papiere an: Gold (WKN NG0WML, Hebel 6,5), Silber (WKN VT8PSC, Hebel 4).

Irgendein Depp verkauft immerwieder Kleine Pakete zu 0,003 ins Bid. Zuletzt 300 Stück. Welcher Idiot kauft Aktien für 90 Cent und zahlt mindestens 5 Euro Tradinggebühren??? Die Grösseren Pakete gehen alle zu 0,004 weg. Das ist ne ganz schön teure Atr zu versuchen den Kurs zu drücken

Zitat von Mr_Greenthumb: Irgendein Depp verkauft immerwieder Kleine Pakete zu 0,003 ins Bid. Zuletzt 300 Stück. Welcher Idiot kauft Aktien für 90 Cent und zahlt mindestens 5 Euro Tradinggebühren??? Die Grösseren Pakete gehen alle zu 0,004 weg. Das ist ne ganz schön teure Atr zu versuchen den Kurs zu drücken

jep

echt blöd .... aber den Anstieg kann der die nicht verhindern bei steigendem Silberpreis und oder der nächsten guten News

echt blöd .... aber den Anstieg kann der die nicht verhindern bei steigendem Silberpreis und oder der nächsten guten News

Wann werden denn news erwartet?

Diese Handelswoche dürfte im Edelmetallbereich zu einer entscheidenden Weichenstellung führen. Angetrieben von Bedenken hinsichtlich der geopolitischen Sicherheitslage (Stichwort Ägypten und Naher Osten) wurden wichtige charttechnische Kaufsignale im Edelmetallbereich - vor allem bei Gold - generiert. Und sofort kam starker Kaufdruck auf. Das ist für ein wichtiges Indiz dafür, dass nun endlich die Erholungsrally gestartet ist. Die letzten Wochen, in der die Edelmetalle ihren Boden ausbildeten, hatten wir dazu genutzt, in unseren RohstoffJournal.de-Publikationen die Gold- und Silber(aktien)positionen noch einmal deutlich auszubauen. Insofern gilt für unsere Leser, die aufgelaufenen Gewinne laufen zu lassen. Doch auch für diejenigen, die noch nicht engagiert sind, gibt es derzeit einige, sehr gute Chancen.

http://www.rohstoff-welt.de/news/artikel.php?sid=44686#Rally…

Ausblick Silber

Ein ähnlich positives Bild gibt derzeit Silber ab. Wir billigen Silber - das ja immer ein wenig im Schatten des Goldes steht - sogar noch ein größeres Aufwärtspotential zu. Mit dem Sprung über die 20 US-Dollar lieferte Silber einen ersten Hinweis darauf, dass in Zukunft wieder mit höheren Notierungen zu rechnen sein wird. Mittlerweile wurden weitere Widerstände auf dem Weg nach oben geknackt. Neue Vitalität ist zu spüren. Ein Kursziel von 25 US-Dollar bis im Idealfall 30 US-Dollar auf Sicht von 4 bis 8 Wochen ist durchaus realistisch ...

http://www.rohstoff-welt.de/news/artikel.php?sid=44686#Rally…

Ausblick Silber

Ein ähnlich positives Bild gibt derzeit Silber ab. Wir billigen Silber - das ja immer ein wenig im Schatten des Goldes steht - sogar noch ein größeres Aufwärtspotential zu. Mit dem Sprung über die 20 US-Dollar lieferte Silber einen ersten Hinweis darauf, dass in Zukunft wieder mit höheren Notierungen zu rechnen sein wird. Mittlerweile wurden weitere Widerstände auf dem Weg nach oben geknackt. Neue Vitalität ist zu spüren. Ein Kursziel von 25 US-Dollar bis im Idealfall 30 US-Dollar auf Sicht von 4 bis 8 Wochen ist durchaus realistisch ...

War der 5 mio. Batzen zu 0,003 Euro in Frankfurt ein Arbitrage Geschäft unserer Australischen Freunde über einee europäischen Makler?

Wieder mit 24 Euro den Preis gedrückt wie im Kindergarten

... aber es wollen immer mehr einsteigen ;-)

könnte es sein um zu verhindern, dass der Kurs explodiert und damit ggf Aufsehen erregen würde... hängt jpm nicht mit in Alcyone drin ? Die sind doch scharf auf jede physische Unze um den Preis von Silber unten halten zu können.

Je günstiger die Minenkurse je günstiger das Silber, ein Schelm wer böses dabei denkt

Je günstiger die Minenkurse je günstiger das Silber, ein Schelm wer böses dabei denkt

http://www.alcyone.com.au/images/alcyone---eeshusheng.pdf

Alcyone Silver Streaming and Operations Update

Alternative Silver Streaming deal well advanced

Silver Recoveries re-commenced

Shutdown to complete Crusher upgrade scheduled

Alcyone Resources Limited ("Alcyone" or "the Company") is pleased to report that it is currently in discussions with a

number of precious metal streaming funds with respect to a silver purchase agreement (“SPA”).

The Company’s low-cost and long-life silver mine, in a politically stable jurisdiction, coupled with an experienced management team has proved to

be an attractive precious metal streaming opportunity to a number of significant international parties since the company

announced the Termination of the Preciosa agreement on 14 August 2013.

The anticipated agreement will, on completion, deliver an upfront payment to the Company of up to US$10 million in

exchange for the right to purchase up to 15% of the Company’s silver production from its Texas silver project at a low

fixed cost over the life of the mine. The Company is advancing to definitive transaction documents with one such party

and expects documentation to be agreed and completed within 4 weeks. The expected SPA will further accelerate the

production growth of the Company with significant development and operational expansion forecast upon completion.

The Company remains fully committed to delivering shareholder value from its Texas Silver Mine, located in QLD,

Australia, and is focused in the short term on ramping up production to nameplate capacity of in excess of 1M oz pa. The

Company is pleased to advise that following the re-start of crushing operations several weeks ago, silver recovery

operations have recommenced over the weekend, with the first shipment of doré bars expected prior to the end of

August. The initial stages of the upgrade to the crushing circuit were undertaken during the recent suspension of

operations, and the final works are now expected to occur during an operational shutdown in the last two weeks of

September. Once the upgrade is completed, the crushing circuit is expected to deliver 85,000t of crushed ore to the

leach heaps every month, providing the basis for a significant increase to historical production levels in early 2014.

Focus will move to the implementation of the previously announced reductions in power and mine input costs as soon as

practical.

Alcyone will provide further updates to shareholders with respect of its Texas Silver Mine and corporate activities in the

coming weeks.

Alcyone Silver Streaming and Operations Update

Alternative Silver Streaming deal well advanced

Silver Recoveries re-commenced

Shutdown to complete Crusher upgrade scheduled

Alcyone Resources Limited ("Alcyone" or "the Company") is pleased to report that it is currently in discussions with a

number of precious metal streaming funds with respect to a silver purchase agreement (“SPA”).

The Company’s low-cost and long-life silver mine, in a politically stable jurisdiction, coupled with an experienced management team has proved to

be an attractive precious metal streaming opportunity to a number of significant international parties since the company

announced the Termination of the Preciosa agreement on 14 August 2013.

The anticipated agreement will, on completion, deliver an upfront payment to the Company of up to US$10 million in

exchange for the right to purchase up to 15% of the Company’s silver production from its Texas silver project at a low

fixed cost over the life of the mine. The Company is advancing to definitive transaction documents with one such party

and expects documentation to be agreed and completed within 4 weeks. The expected SPA will further accelerate the

production growth of the Company with significant development and operational expansion forecast upon completion.

The Company remains fully committed to delivering shareholder value from its Texas Silver Mine, located in QLD,

Australia, and is focused in the short term on ramping up production to nameplate capacity of in excess of 1M oz pa. The

Company is pleased to advise that following the re-start of crushing operations several weeks ago, silver recovery

operations have recommenced over the weekend, with the first shipment of doré bars expected prior to the end of

August. The initial stages of the upgrade to the crushing circuit were undertaken during the recent suspension of

operations, and the final works are now expected to occur during an operational shutdown in the last two weeks of

September. Once the upgrade is completed, the crushing circuit is expected to deliver 85,000t of crushed ore to the

leach heaps every month, providing the basis for a significant increase to historical production levels in early 2014.

Focus will move to the implementation of the previously announced reductions in power and mine input costs as soon as

practical.

Alcyone will provide further updates to shareholders with respect of its Texas Silver Mine and corporate activities in the

coming weeks.

Man beachte:

"he Company is advancing to definitive transaction documents with one such party and expects documentation to be agreed and completed within 4 weeks. The expected SPA will further accelerate the production growth of the Company with significant development and operational expansion forecast upon completion."

"he Company is advancing to definitive transaction documents with one such party and expects documentation to be agreed and completed within 4 weeks. The expected SPA will further accelerate the production growth of the Company with significant development and operational expansion forecast upon completion."

Dann wird man den Kurs auch nicht mehr künstlich unten halten können

Wird die vielleicht mal ein Übernahmekandidat so toll aber hypergünstig wie die sind

Endlich mal SK auf der 0,005 drüben! Das bei einem

Volumen von 61 Mio. Stücken

Volumen von 61 Mio. Stücken

!

Dieser Beitrag wurde von a.mueller moderiert. Grund: Beleidigung

Auch hete erfolgreich auf der 0,005 bisher!

Immer das gleiche Spiel:

10:15 155.000 (Stk.) 0,004

08:57 25 (Stk.) 0,003

10:15 155.000 (Stk.) 0,004

08:57 25 (Stk.) 0,003

Schade der SK war dann doch die 0,004 heute in AUS

AYN

0.004 0% 0.004 0.005 0.005 0.005 0.004 37,841,602

AYN

0.004 0% 0.004 0.005 0.005 0.005 0.004 37,841,602

wann gehts auf

Irgenwie sieht das OB komisch aus:

http://cb.iguana2.com/netwealth2/depth/ayn

hat jemand noch ein anderes ???

http://cb.iguana2.com/netwealth2/depth/ayn

hat jemand noch ein anderes ???

Antwort auf Beitrag Nr.: 45.298.885 von speedlimiter am 22.08.13 01:35:51Was ist daran komisch?

Ein ideales Programm, um die aktuelle Situation in Australien zu sehen.

Ein ideales Programm, um die aktuelle Situation in Australien zu sehen.

DB Silberpreis 23,15 +1,18 % um 11:15

Das sind doch gute Aussichten

Das sind doch gute Aussichten

Ohne NEws wird hier meiner Meinung nach nicht viel passiern. Der Spread ist zu groß. Es werden und wurden immer wieder Käufer zu 0,003 bedient, die Setzen ihre Stücke dann vermutlich wieeder zum Großteil zu 0,004 zum Verkauf ins Ask und wollen 33% Gewinn mitnehmen.

Ausserdem wird der Kurs in Australien gemacht. Und dort kaufen immernoch viel zuviele für 0,004 AusDollar ein. Umgerechnt sind das weniger als 0,003 Euro. D.h. wer in Australien fur unter 0,003 Euro einkauft kann seine Stücke über einen Makler in Europa zu 0,004 Euro anbieten und bei Verkauf über 40% Gewinne erzielen. Die Käufe zu 0,005 usDollar haben sind meist recht überschaubar. Nach unten hin ist die 0,003 ohne News erstmal recht sicher, denke ich. Wennn das 10 mio. Funding gemeldett wird könnte Bewegung in den Wert kommen, solange ist der steigende Silbrpreis vermutlich nebensächlich.

Ausserdem wird der Kurs in Australien gemacht. Und dort kaufen immernoch viel zuviele für 0,004 AusDollar ein. Umgerechnt sind das weniger als 0,003 Euro. D.h. wer in Australien fur unter 0,003 Euro einkauft kann seine Stücke über einen Makler in Europa zu 0,004 Euro anbieten und bei Verkauf über 40% Gewinne erzielen. Die Käufe zu 0,005 usDollar haben sind meist recht überschaubar. Nach unten hin ist die 0,003 ohne News erstmal recht sicher, denke ich. Wennn das 10 mio. Funding gemeldett wird könnte Bewegung in den Wert kommen, solange ist der steigende Silbrpreis vermutlich nebensächlich.

Antwort auf Beitrag Nr.: 45.302.107 von Mr_Greenthumb am 22.08.13 12:37:05Hi,

alles auf den Punkt gebracht ... Dann hoffen wir mal auf

... Dann hoffen wir mal auf

die News zum 10 mio. Funding - wurde ja für "in wenigen Wochen"

angekündigt...

Dann kann es wirklich aufwärts gehen

alles auf den Punkt gebracht

... Dann hoffen wir mal auf

... Dann hoffen wir mal aufdie News zum 10 mio. Funding - wurde ja für "in wenigen Wochen"

angekündigt...

Dann kann es wirklich aufwärts gehen

Silberpreis profitiert

Goldnachfrage aus Indien liegt brach

Die unklaren Aussagen der Fed zum weiteren geldpolitischen Kurs treiben die Anleger erneut in Richtung "sicheren Hafen" Gold. Große Sprünge sind allerdings nicht drin, da der wichtige Nachfragemarkt Indien ausfällt. Von den Schwierigkeiten am Goldmarkt profitiert der Handel mit Silberschmuck.

http://www.n-tv.de/wirtschaft/marktberichte/Goldnachfrage-au…

Goldnachfrage aus Indien liegt brach

Die unklaren Aussagen der Fed zum weiteren geldpolitischen Kurs treiben die Anleger erneut in Richtung "sicheren Hafen" Gold. Große Sprünge sind allerdings nicht drin, da der wichtige Nachfragemarkt Indien ausfällt. Von den Schwierigkeiten am Goldmarkt profitiert der Handel mit Silberschmuck.

http://www.n-tv.de/wirtschaft/marktberichte/Goldnachfrage-au…

Operations Update, liest sich gut. Ich kann momentan nichts negatives finden.

http://asx.com.au/asxpdf/20130826/pdf/42hxb08zxkx0yt.pdf

http://asx.com.au/asxpdf/20130826/pdf/42hxb08zxkx0yt.pdf

Ich ebenfalls nicht!! Ds liest sich ja mal RICHTIG gut!

Pressemitteilungen 26. August 2013

Alcyone gießt Silberbarren nach Wiederbeginn von Full-Scale-Bergbau bei Twin Hills Silbermine Mine in Süd-Queensland Highlights

Alcyone beginnt wieder mit dem Ausgießen von Silberbarren bei seiner hochgradigen Operationen in Queensland;

Produktion wieder aufgenommen mit über 29.000 Tonnen zerkleinertem und über 68.000 Unzen für Auslaugung

Insgesamt 809.595 Unzen nun auf allen vier Leach Pads gestapelt

Silber-Spot Preis jetzt über US $ 24/oz.

Pressemitteilungen 26. August 2013

Alcyone gießt Silberbarren nach Wiederbeginn von Full-Scale-Bergbau bei Twin Hills Silbermine Mine in Süd-Queensland Highlights

Alcyone beginnt wieder mit dem Ausgießen von Silberbarren bei seiner hochgradigen Operationen in Queensland;

Produktion wieder aufgenommen mit über 29.000 Tonnen zerkleinertem und über 68.000 Unzen für Auslaugung

Insgesamt 809.595 Unzen nun auf allen vier Leach Pads gestapelt

Silber-Spot Preis jetzt über US $ 24/oz.

Zitat von hamburgundelbe: Ich ebenfalls nicht!! Ds liest sich ja mal RICHTIG gut!

Pressemitteilungen 26. August 2013

Alcyone gießt Silberbarren nach Wiederbeginn von Full-Scale-Bergbau bei Twin Hills Silbermine Mine in Süd-Queensland Highlights

Alcyone beginnt wieder mit dem Ausgießen von Silberbarren bei seiner hochgradigen Operationen in Queensland;

Produktion wieder aufgenommen mit über 29.000 Tonnen zerkleinertem und über 68.000 Unzen für Auslaugung

Insgesamt 809.595 Unzen nun auf allen vier Leach Pads gestapelt

Silber-Spot Preis jetzt über US $ 24/oz.

Und der Silberpreis steigt weiter!!

Wer verkauft denn da bloß noch immer zu

0,003 und 0,004 € ??? - Wir gehen jetzt demnächst in den Cent Bereich!

Wir enden immer wieder bei 0,004 in Australien obwohl zwischendurch auch 0,005 bezahlt werden.

Zitat von hamburgundelbe: Ich ebenfalls nicht!! Ds liest sich ja mal RICHTIG gut!

Pressemitteilungen 26. August 2013

Alcyone gießt Silberbarren nach Wiederbeginn von Full-Scale-Bergbau bei Twin Hills Silbermine Mine in Süd-Queensland Highlights

Alcyone beginnt wieder mit dem Ausgießen von Silberbarren bei seiner hochgradigen Operationen in Queensland;

Produktion wieder aufgenommen mit über 29.000 Tonnen zerkleinertem und über 68.000 Unzen für Auslaugung

Insgesamt 809.595 Unzen nun auf allen vier Leach Pads gestapelt

Silber-Spot Preis jetzt über US $ 24/oz.

Lassen wir die Nachricht sacken und warten mal, ob wir morgen endlich

mal über der 0,005 schließen! Eigentlich ein MUSS

TimLuca

ich würde gerne mal Deine Einschätzung hören. Was sagst Du zu der aktuellen Produktion und den gesteckten Zielen...

Vielen Dank im Voraus!

ich würde gerne mal Deine Einschätzung hören. Was sagst Du zu der aktuellen Produktion und den gesteckten Zielen...

Vielen Dank im Voraus!