Südkorea-Bank: KB Financial Group

eröffnet am 13.06.18 16:41:14 von

neuester Beitrag 02.02.24 12:54:24 von

neuester Beitrag 02.02.24 12:54:24 von

Beiträge: 32

ID: 1.282.338

ID: 1.282.338

Aufrufe heute: 0

Gesamt: 3.905

Gesamt: 3.905

Aktive User: 0

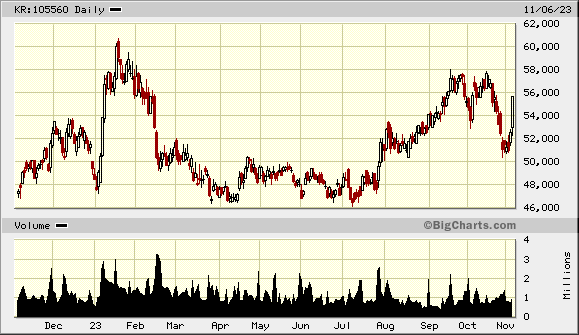

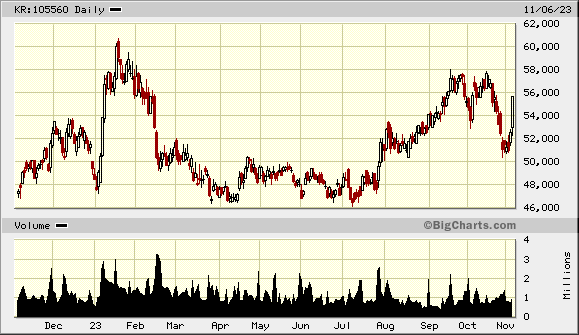

ISIN: US48241A1051 · WKN: A0RAQX

54,25

EUR

0,00 %

0,00 EUR

Letzter Kurs 13:00:51 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,2600 | +50,67 | |

| 1,3400 | +41,05 | |

| 21,60 | +9,26 | |

| 36,10 | +9,06 | |

| 0,7630 | +8,84 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,00 | -10,14 | |

| 12,080 | -10,52 | |

| 0,7500 | -14,29 | |

| 1,1000 | -14,73 | |

| 26,00 | -16,13 |

Beitrag zu dieser Diskussion schreiben

2.1.

Banks Bring Back Night Shifts as Korean Won Trading Hours Stretch Past Midnight

https://finance.yahoo.com/news/banks-bring-back-night-shifts…

...

Shinhan Bank started rostering traders to work nights in September, while Korea Development Bank, Woori Bank, Industrial Bank of Korea and NongHyup Bank have all taken steps toward doing the same. Suhyup Bank is planning to add more staff without specifying whether or not they will work at night.

“We are analyzing our middle and back offices along with IT and other related departments and preparing for any risks that may emerge in the first stages of the FX market reform,” Industrial Bank said in a statement released in response to a Bloomberg query.

Korea’s onshore dollar-won currency market is currently open from 9 a.m. until 3:30 p.m. Seoul time. The close will be set back until 2 a.m. the following morning starting from the second half of 2024, the government said early in 2023. The first tests will be held in February, the Seoul Foreign Exchange Committee announced Dec. 21.

The lengthening of won trading hours is part of Korea’s bid to improve access and boost the case for its equities to be included in MSCI’s developed-market stock index. The authorities said in February they ultimately want the won to trade 24 hours.

...

Banks Bring Back Night Shifts as Korean Won Trading Hours Stretch Past Midnight

https://finance.yahoo.com/news/banks-bring-back-night-shifts…

...

Shinhan Bank started rostering traders to work nights in September, while Korea Development Bank, Woori Bank, Industrial Bank of Korea and NongHyup Bank have all taken steps toward doing the same. Suhyup Bank is planning to add more staff without specifying whether or not they will work at night.

“We are analyzing our middle and back offices along with IT and other related departments and preparing for any risks that may emerge in the first stages of the FX market reform,” Industrial Bank said in a statement released in response to a Bloomberg query.

Korea’s onshore dollar-won currency market is currently open from 9 a.m. until 3:30 p.m. Seoul time. The close will be set back until 2 a.m. the following morning starting from the second half of 2024, the government said early in 2023. The first tests will be held in February, the Seoul Foreign Exchange Committee announced Dec. 21.

The lengthening of won trading hours is part of Korea’s bid to improve access and boost the case for its equities to be included in MSCI’s developed-market stock index. The authorities said in February they ultimately want the won to trade 24 hours.

...

22.12.

Top-performing Korea hedge fund is bullish on banks for 2024

https://www.businesstimes.com.sg/companies-markets/banking-f…

...

A HEDGE fund that has returned 30 per cent this year is bullish on Korean bank stocks on the view local policymakers will cut interest rates less than the market is forecasting.

The nation’s financial firms will also benefit as populist calls for tighter regulation ease after legislative elections due in April, according to Life Asset Management, which oversees the equivalent of US$643 million. Higher interest rates are generally favorable for banks as they enable them to have wider net interest margins.

“Those expecting a big rate cut by the Bank of Korea next year may be disappointed,” said Darren Kang, chief executive of Life Asset in Seoul. “Korea’s economy isn’t doing bad, with corporate earnings growth for next year expected to be the best in the world. For financial stocks, now is the time to buy.”

Local banks are also attractive due to their high dividend payouts and cheap valuations, Kang said. The hedge funds top picks include Woori Financial Group, which has relatively little exposure to the beleaguered real estate sector, and Meritz Financial Group, he said.

The Bank of Korea will probably lower its key rate by just 25 basis points next year to 3.25 per cent, based on the scenario that the Federal Reserve trims its benchmark by 75 basis points, Kang said. Economists are much more dovish, predicting the BOK will ease by 125 basis points over the course of 2024, according to a Bloomberg survey published this month.

...

Top-performing Korea hedge fund is bullish on banks for 2024

https://www.businesstimes.com.sg/companies-markets/banking-f…

...

A HEDGE fund that has returned 30 per cent this year is bullish on Korean bank stocks on the view local policymakers will cut interest rates less than the market is forecasting.

The nation’s financial firms will also benefit as populist calls for tighter regulation ease after legislative elections due in April, according to Life Asset Management, which oversees the equivalent of US$643 million. Higher interest rates are generally favorable for banks as they enable them to have wider net interest margins.

“Those expecting a big rate cut by the Bank of Korea next year may be disappointed,” said Darren Kang, chief executive of Life Asset in Seoul. “Korea’s economy isn’t doing bad, with corporate earnings growth for next year expected to be the best in the world. For financial stocks, now is the time to buy.”

Local banks are also attractive due to their high dividend payouts and cheap valuations, Kang said. The hedge funds top picks include Woori Financial Group, which has relatively little exposure to the beleaguered real estate sector, and Meritz Financial Group, he said.

The Bank of Korea will probably lower its key rate by just 25 basis points next year to 3.25 per cent, based on the scenario that the Federal Reserve trims its benchmark by 75 basis points, Kang said. Economists are much more dovish, predicting the BOK will ease by 125 basis points over the course of 2024, according to a Bloomberg survey published this month.

...

6.11.

Short-Selling Ban Sparks Biggest Rally in Korean Stocks Since 2020

https://finance.yahoo.com/news/south-korea-stocks-jump-natio…

...

South Korean stocks soared after the country reimposed a full ban on short-selling, a controversial move that regulators said was needed to stop the illegal use of a trading tactic deployed regularly by hedge funds and other investors around the world.

The nearly eight-month ban may help appease retail investors who have complained about the impact of shorting — the selling of borrowed shares by institutional investors — ahead of elections in April, several market watchers said. However, it could deter participation by foreign funds in the $1.7 trillion equity market and complicate Korea’s bid to seek a developed-market status in MSCI Inc.’s indexes.

The Kospi (^KS11) ended the day up 5.7% to cap its biggest gain since March 2020 amid a surge in trading volumes. Overseas investors were big buyers on a net basis, indicating that funds were covering short positions. Stocks that had recently witnessed an increase in short selling — including LG Energy Solution Ltd. and Posco Future M Co. — were among the biggest contributors to the benchmark’s advance. The small-cap Kosdaq Index jumped 7.3%.

...

=>

Short-Selling Ban Sparks Biggest Rally in Korean Stocks Since 2020

https://finance.yahoo.com/news/south-korea-stocks-jump-natio…

...

South Korean stocks soared after the country reimposed a full ban on short-selling, a controversial move that regulators said was needed to stop the illegal use of a trading tactic deployed regularly by hedge funds and other investors around the world.

The nearly eight-month ban may help appease retail investors who have complained about the impact of shorting — the selling of borrowed shares by institutional investors — ahead of elections in April, several market watchers said. However, it could deter participation by foreign funds in the $1.7 trillion equity market and complicate Korea’s bid to seek a developed-market status in MSCI Inc.’s indexes.

The Kospi (^KS11) ended the day up 5.7% to cap its biggest gain since March 2020 amid a surge in trading volumes. Overseas investors were big buyers on a net basis, indicating that funds were covering short positions. Stocks that had recently witnessed an increase in short selling — including LG Energy Solution Ltd. and Posco Future M Co. — were among the biggest contributors to the benchmark’s advance. The small-cap Kosdaq Index jumped 7.3%.

...

=>

5.7.

New Players Can Enter Korea’s Banking Sector for First Time in 30 Years

https://www.straitstimes.com/business/new-players-can-enter-…

...

South Korea will allow new players to enter its banking industry for the first time in 30 years to boost competition in the sector, which is currently dominated by five major banks.

The country’s financial regulator will permit licenses of nationwide commercial banks to existing financial companies, the Financial Services Commission (FSC) said in a statement on Wednesday, the first time it’s doing so since 1992 with the move seen as paving the way for lower interest rate costs for consumers.

Daegu Bank, a regional banking unit of DGB Financial Group Inc., has an intention to transform into a nationwide bank, according to the statement.

The country’s move comes after President Yoon Suk Yeol earlier this year criticized banks for having what it called a “money feast”: booking “easy” profits from the gap between interest rates on deposits and those on loans, while paying their executives big bonuses as borrowers struggled to pay high interest rates.

...

New Players Can Enter Korea’s Banking Sector for First Time in 30 Years

https://www.straitstimes.com/business/new-players-can-enter-…

...

South Korea will allow new players to enter its banking industry for the first time in 30 years to boost competition in the sector, which is currently dominated by five major banks.

The country’s financial regulator will permit licenses of nationwide commercial banks to existing financial companies, the Financial Services Commission (FSC) said in a statement on Wednesday, the first time it’s doing so since 1992 with the move seen as paving the way for lower interest rate costs for consumers.

Daegu Bank, a regional banking unit of DGB Financial Group Inc., has an intention to transform into a nationwide bank, according to the statement.

The country’s move comes after President Yoon Suk Yeol earlier this year criticized banks for having what it called a “money feast”: booking “easy” profits from the gap between interest rates on deposits and those on loans, while paying their executives big bonuses as borrowers struggled to pay high interest rates.

...

12.6.

Bank of Korea Warns of Financial Risk as Real Estate Loans Fail

https://finance.yahoo.com/news/bank-korea-warns-financial-ri…

...

Bank of Korea Governor Rhee Chang-yong flagged growing financial sector risks amid a rise in real estate loan delinquencies— even as the broader housing market slowly recovers.

“In the mid- to long-term, it is necessary to find a way to smoothly deleverage household debt in cooperation with relevant institutions so that financial imbalances don’t accumulate again,” Rhee said in the text of a speech he gave Monday to mark the central bank’s 73rd anniversary.

The BOK’s ability to address this risk may be more limited today since a bigger chunk of loans and assets has shifted to non-bank financial firms, which the BOK doesn’t oversee. The share of deposits by these alternative institutions has already exceeded that of banks, and they’re highly interconnected, he said in the text.

“As the importance of non-banking and the complexity of the system have increased, it is difficult to achieve the goal of financial stability for the entire national economy by targeting only banks,” Rhee said. He urged strengthened cooperation with supervisory authorities and “if necessary, measures to achieve financial stability goals should be devised.”

Rhee also spoke about overall economic conditions, saying that it’s yet too early to be confident that inflation is easing as core inflation is taking longer to cool. A “sophisticated policy response” is needed to address the changing dynamics of growth and price pressures, adding that the BOK needs to prepare for the possibility of changes in current account balance and appropriate liquidity levels.

...

Bank of Korea Warns of Financial Risk as Real Estate Loans Fail

https://finance.yahoo.com/news/bank-korea-warns-financial-ri…

...

Bank of Korea Governor Rhee Chang-yong flagged growing financial sector risks amid a rise in real estate loan delinquencies— even as the broader housing market slowly recovers.

“In the mid- to long-term, it is necessary to find a way to smoothly deleverage household debt in cooperation with relevant institutions so that financial imbalances don’t accumulate again,” Rhee said in the text of a speech he gave Monday to mark the central bank’s 73rd anniversary.

The BOK’s ability to address this risk may be more limited today since a bigger chunk of loans and assets has shifted to non-bank financial firms, which the BOK doesn’t oversee. The share of deposits by these alternative institutions has already exceeded that of banks, and they’re highly interconnected, he said in the text.

“As the importance of non-banking and the complexity of the system have increased, it is difficult to achieve the goal of financial stability for the entire national economy by targeting only banks,” Rhee said. He urged strengthened cooperation with supervisory authorities and “if necessary, measures to achieve financial stability goals should be devised.”

Rhee also spoke about overall economic conditions, saying that it’s yet too early to be confident that inflation is easing as core inflation is taking longer to cool. A “sophisticated policy response” is needed to address the changing dynamics of growth and price pressures, adding that the BOK needs to prepare for the possibility of changes in current account balance and appropriate liquidity levels.

...

31.5.

Korean Stocks Flirt With Bull Market as AI Mania Boosts Inflows

https://finance.yahoo.com/news/kospi-climbs-20-september-low…

...

South Korea’s equity benchmark flirted with bull market territory as a global investor frenzy for all things tied to artificial intelligence saw foreign funds accelerate purchases of the nation’s chipmakers.

An advance in the Kospi early Wednesday took its advance from a Sept. 30 low to 20%, before the gauge pulled back as weakening factory activity in China triggered broad weakness in Asia. The benchmark ended the day down 0.3%, but has still gained roughly 15% this year in one of the top performances in the region.

...

Korean Stocks Flirt With Bull Market as AI Mania Boosts Inflows

https://finance.yahoo.com/news/kospi-climbs-20-september-low…

...

South Korea’s equity benchmark flirted with bull market territory as a global investor frenzy for all things tied to artificial intelligence saw foreign funds accelerate purchases of the nation’s chipmakers.

An advance in the Kospi early Wednesday took its advance from a Sept. 30 low to 20%, before the gauge pulled back as weakening factory activity in China triggered broad weakness in Asia. The benchmark ended the day down 0.3%, but has still gained roughly 15% this year in one of the top performances in the region.

...

16.3.

South Korea Considers Requiring Banks to Hold More Capital as a Buffer

https://www.bnnbloomberg.ca/south-korea-considers-requiring-…

...

South Korea is mulling whether to require banks to hold more capital, as officials seek safeguard the financial system in the face an increase in interest rates and delinquencies.

The country is “actively considering” increasing its countercyclical capital buffer this year as well as introducing a system imposing additional capital on banks based on the results of stress tests, the Financial Services Commission said in a statement Thursday. The regulator cited increased uncertainties due to sharp rise in interest rates and the exchange rate. Household debt delinquencies were rising, it said.

Introduced in 2016, South Korea’s countercyclical capital buffer is currently set at 0%.

“Capital adequacy is relatively insufficient, and the possibility of a future capital ratio decline is increasing due to recent moves to increase dividends,” it said. Plans are due to be drawn up in the first half of the year, with implementation in the second half.

...

South Korea Considers Requiring Banks to Hold More Capital as a Buffer

https://www.bnnbloomberg.ca/south-korea-considers-requiring-…

...

South Korea is mulling whether to require banks to hold more capital, as officials seek safeguard the financial system in the face an increase in interest rates and delinquencies.

The country is “actively considering” increasing its countercyclical capital buffer this year as well as introducing a system imposing additional capital on banks based on the results of stress tests, the Financial Services Commission said in a statement Thursday. The regulator cited increased uncertainties due to sharp rise in interest rates and the exchange rate. Household debt delinquencies were rising, it said.

Introduced in 2016, South Korea’s countercyclical capital buffer is currently set at 0%.

“Capital adequacy is relatively insufficient, and the possibility of a future capital ratio decline is increasing due to recent moves to increase dividends,” it said. Plans are due to be drawn up in the first half of the year, with implementation in the second half.

...

...

The gloomy economic outlook may also weigh on corporate notes. South Korea lowered its economic growth forecast for next year while predicting inflation would stay elevated.

The nation will face challenges in exports and in attracting investments amid a global slowdown and a sluggish semiconductor market, while higher interest rates will limit how much consumer spending recovers, the Finance Ministry said earlier this month.

...

26.12.

Credit-Market Rebound Leaves Korea’s Weaker Firms Lagging Behind

https://finance.yahoo.com/news/credit-market-rebound-leaves-…

The gloomy economic outlook may also weigh on corporate notes. South Korea lowered its economic growth forecast for next year while predicting inflation would stay elevated.

The nation will face challenges in exports and in attracting investments amid a global slowdown and a sluggish semiconductor market, while higher interest rates will limit how much consumer spending recovers, the Finance Ministry said earlier this month.

...

26.12.

Credit-Market Rebound Leaves Korea’s Weaker Firms Lagging Behind

https://finance.yahoo.com/news/credit-market-rebound-leaves-…

8.12.

BOK Able to Supply More Liquidity to Prevent Year-End Crunch

https://finance.yahoo.com/news/bok-ready-more-liquidity-need…

...

The Bank of Korea is ready to provide more liquidity to stabilize short-term money markets if needed, Deputy Governor Lee Sang-hyeong said, as officials seek to head off a year-end cash crunch.

Uncertainty is high as financial institutions typically shift more money around at the end of the year, Lee said in a briefing on Thursday. The BOK would provide the additional infusion via repo transactions, he said.

Although the strains in Korea’s credit market have shown signs of easing in recent days, Lee’s comments underscore the fragility of the recovery. Following the default of a property developer, yields on short-term debt surged to their highest since the global financial crisis.

As part of a bevy of measures authorities in Seoul rushed out to staunch burgeoning meltdown, the BOK said in October it would provide 6 trillion won ($4.6 billion) of liquidity to securities firms and Korea Securities Finance Corp. via repos. Lee’s announcement on Thursday means that sum would increase.

The BOK also plans to conduct two to three repo auctions by the end of this year, starting Monday.

...

BOK Able to Supply More Liquidity to Prevent Year-End Crunch

https://finance.yahoo.com/news/bok-ready-more-liquidity-need…

...

The Bank of Korea is ready to provide more liquidity to stabilize short-term money markets if needed, Deputy Governor Lee Sang-hyeong said, as officials seek to head off a year-end cash crunch.

Uncertainty is high as financial institutions typically shift more money around at the end of the year, Lee said in a briefing on Thursday. The BOK would provide the additional infusion via repo transactions, he said.

Although the strains in Korea’s credit market have shown signs of easing in recent days, Lee’s comments underscore the fragility of the recovery. Following the default of a property developer, yields on short-term debt surged to their highest since the global financial crisis.

As part of a bevy of measures authorities in Seoul rushed out to staunch burgeoning meltdown, the BOK said in October it would provide 6 trillion won ($4.6 billion) of liquidity to securities firms and Korea Securities Finance Corp. via repos. Lee’s announcement on Thursday means that sum would increase.

The BOK also plans to conduct two to three repo auctions by the end of this year, starting Monday.

...