Türkiye Garanti Bankasi

eröffnet am 05.07.19 17:16:01 von

neuester Beitrag 21.12.23 13:34:34 von

neuester Beitrag 21.12.23 13:34:34 von

Beiträge: 39

ID: 1.306.828

ID: 1.306.828

Aufrufe heute: 0

Gesamt: 3.352

Gesamt: 3.352

Aktive User: 0

ISIN: US9001487019 · WKN: 909386

2,3300

EUR

+4,95 %

+0,1100 EUR

Letzter Kurs 13:10:32 Lang & Schwarz

Neuigkeiten

29.04.24 · EQS Group AG |

20.04.24 · EQS Group AG |

17.04.24 · EQS Group AG |

17.04.24 · EQS Group AG |

17.04.24 · EQS Group AG |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5400 | +26,23 | |

| 4,5000 | +15,38 | |

| 6,3000 | +14,55 | |

| 5,6500 | +11,88 | |

| 0,5010 | +9,48 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,5500 | -9,05 | |

| 5,1500 | -11,21 | |

| 10,799 | -12,20 | |

| 1,8775 | -14,17 | |

| 3,7500 | -15,73 |

Beitrag zu dieser Diskussion schreiben

21.12.

Türkische Notenbank stockt Leitzins erneut auf - baldiges Ende der Anhebungen erwartet

https://www.finanzen.net/nachricht/zinsen/vor-jahreswende-tu…

...

Die Währungshüter hoben den Schlüsselsatz auf 42,50 Prozent von 40,0 Prozent an, wie die Notenbank am Donnerstag mitteilte. Von Reuters befragte Experten hatten damit gerechnet. Es ist bereits der siebte Zinsschritt, seit die neue Zentralbankchefin Hafize Gaye Erkan im Juni das Ruder übernahm und die Geldpolitik auf einen straffen Kurs ausrichtete. Die Notenbank hatte das Zinsniveau dabei zuletzt dreimal in Folge um jeweils fünf Prozentpunkte nach oben geschleust.

...

Türkische Notenbank stockt Leitzins erneut auf - baldiges Ende der Anhebungen erwartet

https://www.finanzen.net/nachricht/zinsen/vor-jahreswende-tu…

...

Die Währungshüter hoben den Schlüsselsatz auf 42,50 Prozent von 40,0 Prozent an, wie die Notenbank am Donnerstag mitteilte. Von Reuters befragte Experten hatten damit gerechnet. Es ist bereits der siebte Zinsschritt, seit die neue Zentralbankchefin Hafize Gaye Erkan im Juni das Ruder übernahm und die Geldpolitik auf einen straffen Kurs ausrichtete. Die Notenbank hatte das Zinsniveau dabei zuletzt dreimal in Folge um jeweils fünf Prozentpunkte nach oben geschleust.

...

30.11.

S&P unexpectedly revises Turkey's outlook to positive, rating affirmed

https://www.nasdaq.com/articles/sp-unexpectedly-revises-turk…

...

S&P Global Ratings on Thursday revised Turkey's sovereign credit outlook to positive from stable on subsiding twin deficits and affirmed its rating at "B".

The move comes outside of a strict ratings calendar and S&P said the deviation complies with recent policy adjustments including last week's 10 percentage point hike in the central bank's benchmark rate to 40% as well as "the monthly current account surplus posted in September, and the recovery in usable reserves during the first 17 days of November."

...

S&P unexpectedly revises Turkey's outlook to positive, rating affirmed

https://www.nasdaq.com/articles/sp-unexpectedly-revises-turk…

...

S&P Global Ratings on Thursday revised Turkey's sovereign credit outlook to positive from stable on subsiding twin deficits and affirmed its rating at "B".

The move comes outside of a strict ratings calendar and S&P said the deviation complies with recent policy adjustments including last week's 10 percentage point hike in the central bank's benchmark rate to 40% as well as "the monthly current account surplus posted in September, and the recovery in usable reserves during the first 17 days of November."

...

23.11.

Turkey's central bank hikes interest rate by 500 basis points to 40%, well above expectations

https://www.msn.com/en-us/money/other/turkey-s-central-bank-…

...

• Turkey's central bank hiked its key interest rate to 40% on Thursday.

• The increase was double economists' expectations, who had forecast a 250-basis-point hike.

...

The move was seen as a continuation of the bank's attempt to combat high inflation and a weak lira, the Turkish currency. Inflation in the country came in at a whopping 61% in October.

Turkey's central bank hikes interest rate by 500 basis points to 40%, well above expectations

https://www.msn.com/en-us/money/other/turkey-s-central-bank-…

...

• Turkey's central bank hiked its key interest rate to 40% on Thursday.

• The increase was double economists' expectations, who had forecast a 250-basis-point hike.

...

The move was seen as a continuation of the bank's attempt to combat high inflation and a weak lira, the Turkish currency. Inflation in the country came in at a whopping 61% in October.

24.8.

Massive Zinsanhebung in der Türkei

https://www.n-tv.de/wirtschaft/der_boersen_tag/Massive-Zinsa…

...

Die türkische Notenbank hat angesichts der hohen Inflation den Leitzins deutlich stärker als erwartet angehoben. Der Leitzins steigt um 7,5 Prozentpunkte auf 25,0 Prozent, wie die Notenbank in Ankara nach ihrer geldpolitischen Sitzung mitteilte. Volkswirte hatten im Schnitt lediglich mit einem Leitzins von 20,0 Prozent gerechnet. Es war die dritte Zinserhöhung in Folge. Der Leitzins liegt aber weiter unter der Inflationsrate, die im Juli auf 47,8 Prozent gestiegen war.

Mit dem großen Zinsschritt am Donnerstag dürften die Notenbanker daher auch versucht haben, ihre Entschlossenheit im Kampf gegen die hohe Inflation zu untermauern. Die vor allem seit Mai im Wert nochmals deutlich gefallene türkische Lira legte am Devisenmarkt zu Euro und US-Dollar zu.

Massive Zinsanhebung in der Türkei

https://www.n-tv.de/wirtschaft/der_boersen_tag/Massive-Zinsa…

...

Die türkische Notenbank hat angesichts der hohen Inflation den Leitzins deutlich stärker als erwartet angehoben. Der Leitzins steigt um 7,5 Prozentpunkte auf 25,0 Prozent, wie die Notenbank in Ankara nach ihrer geldpolitischen Sitzung mitteilte. Volkswirte hatten im Schnitt lediglich mit einem Leitzins von 20,0 Prozent gerechnet. Es war die dritte Zinserhöhung in Folge. Der Leitzins liegt aber weiter unter der Inflationsrate, die im Juli auf 47,8 Prozent gestiegen war.

Mit dem großen Zinsschritt am Donnerstag dürften die Notenbanker daher auch versucht haben, ihre Entschlossenheit im Kampf gegen die hohe Inflation zu untermauern. Die vor allem seit Mai im Wert nochmals deutlich gefallene türkische Lira legte am Devisenmarkt zu Euro und US-Dollar zu.

21.8.

Turkish Banks Tumble After Central Bank’s Move, Bonds Rally

https://news.yahoo.com/turkish-banks-tumble-central-bank-080…

...

Via a regulation introduced over the weekend, the central bank aims to reduce Turks’ reliance on FX-linked deposit accounts and compel banks that fail to meet specific conversion targets into regular lira accounts to purchase additional government bonds.

The monetary authority also boosted the reserve requirement ratios for short-term FX deposits, which will force banks to park more foreign currency at the regulator.

The decision is expected to “increase Turkish lira deposit rates substantially, making them more attractive, while FX-protected lira deposit rates may decline sharply, reducing the scheme’s appeal,” Istanbul-based Oyak Securities wrote in a note. “The impact on foreign currency demand hinges on the lira deposit rates. Loan interest rates are likely to rise notably,” it said.

...

Turkish Banks Tumble After Central Bank’s Move, Bonds Rally

https://news.yahoo.com/turkish-banks-tumble-central-bank-080…

...

Via a regulation introduced over the weekend, the central bank aims to reduce Turks’ reliance on FX-linked deposit accounts and compel banks that fail to meet specific conversion targets into regular lira accounts to purchase additional government bonds.

The monetary authority also boosted the reserve requirement ratios for short-term FX deposits, which will force banks to park more foreign currency at the regulator.

The decision is expected to “increase Turkish lira deposit rates substantially, making them more attractive, while FX-protected lira deposit rates may decline sharply, reducing the scheme’s appeal,” Istanbul-based Oyak Securities wrote in a note. “The impact on foreign currency demand hinges on the lira deposit rates. Loan interest rates are likely to rise notably,” it said.

...

15.8.

Turkish Banks Jump After Moody’s Lifts Sector Outlook to Stable

https://finance.yahoo.com/news/turkish-banks-jump-moody-lift…

...

Moody’s Investors Service raised the Turkish banking system’s outlook to stable from negative, boosting the nation’s lenders to all-time highs.

The Borsa Istanbul Banking Sector Index, a gauge that tracks shares of Turkey’s listed lenders, reversed losses and rose as much as 4.1% to the highest level ever on a closing basis. It was trading 0.8% higher as of 4:42 p.m. in Istanbul.

The credit-rating firm said Tuesday that the turnaround in Turkey’s monetary policies following presidential elections in May was “positive” and supported banks’ operating conditions. High inflation, and a weakening lira may slow economic growth to a projected 4.2% at the end of 2023 from last year’s 5.6%, affecting banks’ asset quality, Moody’s analysts wrote in the report.

The upgrade to the sector outlook comes only days after Moody’s became the first of the top three rating firms to raise the possibility of giving Turkish sovereign debt a better assessment, citing an improvement in the country’s finances.

...

Turkish Banks Jump After Moody’s Lifts Sector Outlook to Stable

https://finance.yahoo.com/news/turkish-banks-jump-moody-lift…

...

Moody’s Investors Service raised the Turkish banking system’s outlook to stable from negative, boosting the nation’s lenders to all-time highs.

The Borsa Istanbul Banking Sector Index, a gauge that tracks shares of Turkey’s listed lenders, reversed losses and rose as much as 4.1% to the highest level ever on a closing basis. It was trading 0.8% higher as of 4:42 p.m. in Istanbul.

The credit-rating firm said Tuesday that the turnaround in Turkey’s monetary policies following presidential elections in May was “positive” and supported banks’ operating conditions. High inflation, and a weakening lira may slow economic growth to a projected 4.2% at the end of 2023 from last year’s 5.6%, affecting banks’ asset quality, Moody’s analysts wrote in the report.

The upgrade to the sector outlook comes only days after Moody’s became the first of the top three rating firms to raise the possibility of giving Turkish sovereign debt a better assessment, citing an improvement in the country’s finances.

...

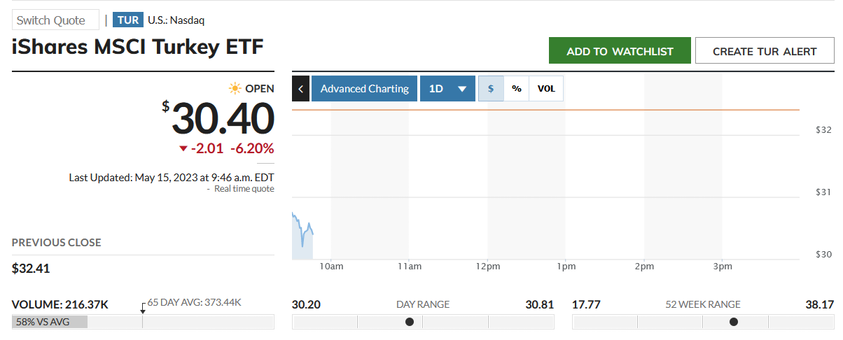

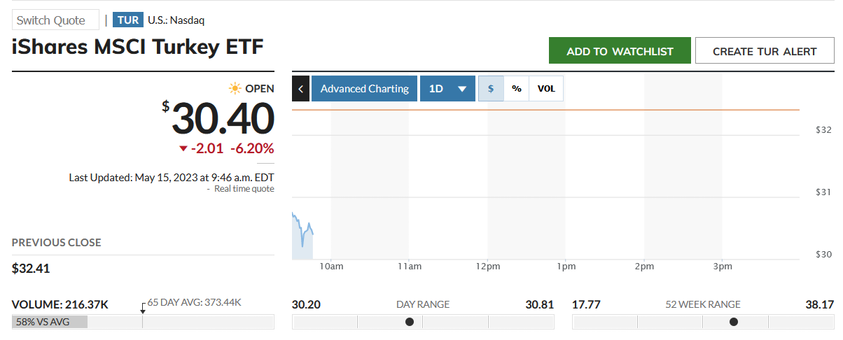

der türkische Aktienmarkt heute naheliegenderweise im Eimer (in U.S. dollar):

https://www.marketwatch.com/investing/fund/tur

https://www.marketwatch.com/investing/fund/tur

$TKGBY als eine Wette gegen die Wiederwahl von Erdoğan am Sonntag?

31.1.

HSBC Says It’s Payback Time for Turkey Banks After Inflation Win

https://finance.yahoo.com/news/hsbc-says-payback-time-turkey…

...

Turkish banks were among the biggest winners to emerge from the worst inflation crisis under President Recep Tayyip Erdogan but profits are expected to crater this year as lower inflation and regulatory pressures squeeze margins.

The combined earnings for the country’s six largest-listed lenders such as Akbank and Garanti may fall as much as 30% this year, according to Bloomberg Intelligence. HSBC Holdings Plc estimates that falling net interest income and inflationary pressures on costs may lead to a 34% drop in earnings.

After earning lucrative yields on bonds linked to consumer prices and subsidized currency protected deposits, “payback time has arrived for Turkish banks,” HSBC analyst Cihan Saraoglu said in a note. Higher deposit rates, lending caps and regulations that force banks to hold low-yield government debt while paying commission on FX reserves will see record profits get “taxed indirectly,” he said.

Banks in Turkey are part of a financial industry that’s been intensely micromanaged by authorities last year in an effort to channel cheaper credit to businesses and boost favored industries ahead of crucial presidential elections in May.

Fourth-quarter earnings are expected to be their highest ever, pushing full-year net income to a record, according to median estimates of analysts surveyed by Bloomberg. Across the industry, the combined profit for the nation’s lenders jumped more than fourfold to 433.5 billion liras last year, up from 92.9 billion liras in 2021, according to official data.

The bounce in earnings follows a period of ultra-loose monetary policy in the country after inflation soared to its highest level in over two decades. The relaxed policy created a borrowing opportunity for banks, who saw their net interest margins widen as they continued to lend out at higher rates. High inflation also boosted their earnings from bonds linked to consumer prices and led to faster loan and fee growth in nominal terms.

...

HSBC Says It’s Payback Time for Turkey Banks After Inflation Win

https://finance.yahoo.com/news/hsbc-says-payback-time-turkey…

...

Turkish banks were among the biggest winners to emerge from the worst inflation crisis under President Recep Tayyip Erdogan but profits are expected to crater this year as lower inflation and regulatory pressures squeeze margins.

The combined earnings for the country’s six largest-listed lenders such as Akbank and Garanti may fall as much as 30% this year, according to Bloomberg Intelligence. HSBC Holdings Plc estimates that falling net interest income and inflationary pressures on costs may lead to a 34% drop in earnings.

After earning lucrative yields on bonds linked to consumer prices and subsidized currency protected deposits, “payback time has arrived for Turkish banks,” HSBC analyst Cihan Saraoglu said in a note. Higher deposit rates, lending caps and regulations that force banks to hold low-yield government debt while paying commission on FX reserves will see record profits get “taxed indirectly,” he said.

Banks in Turkey are part of a financial industry that’s been intensely micromanaged by authorities last year in an effort to channel cheaper credit to businesses and boost favored industries ahead of crucial presidential elections in May.

Fourth-quarter earnings are expected to be their highest ever, pushing full-year net income to a record, according to median estimates of analysts surveyed by Bloomberg. Across the industry, the combined profit for the nation’s lenders jumped more than fourfold to 433.5 billion liras last year, up from 92.9 billion liras in 2021, according to official data.

The bounce in earnings follows a period of ultra-loose monetary policy in the country after inflation soared to its highest level in over two decades. The relaxed policy created a borrowing opportunity for banks, who saw their net interest margins widen as they continued to lend out at higher rates. High inflation also boosted their earnings from bonds linked to consumer prices and led to faster loan and fee growth in nominal terms.

...

türkische Aktien -- der Knaller 2022: