Westpac Banking

eröffnet am 08.06.22 13:06:57 von

neuester Beitrag 06.11.23 12:21:36 von

neuester Beitrag 06.11.23 12:21:36 von

Beiträge: 20

ID: 1.361.075

ID: 1.361.075

Aufrufe heute: 0

Gesamt: 2.488

Gesamt: 2.488

Aktive User: 0

ISIN: AU000000WBC1 · WKN: 854242 · Symbol: WBC

15,760

EUR

+1,04 %

+0,162 EUR

Letzter Kurs 09:40:35 Tradegate

Neuigkeiten

06.11.23 · EQS Group AG |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,2200 | +31,36 | |

| 32,00 | +27,95 | |

| 33,00 | +20,00 | |

| 12,700 | +19,81 | |

| 34,04 | +17,79 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,6000 | -14,50 | |

| 7,6500 | -25,66 | |

| 0,9927 | -29,60 | |

| 2,0000 | -33,33 | |

| 0,7500 | -34,78 |

Beitrag zu dieser Diskussion schreiben

6.11.

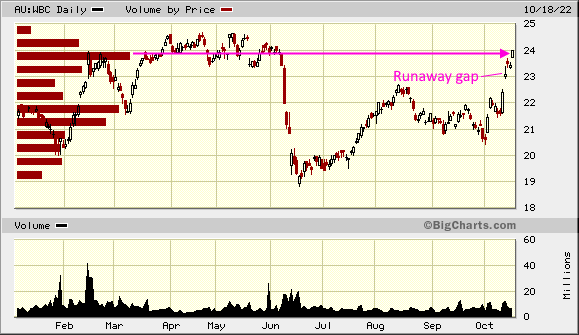

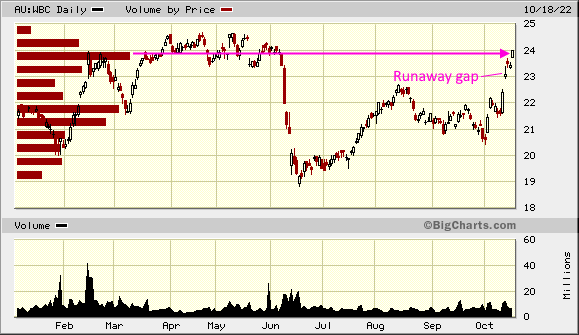

Westpac May Lose Laggard Status After Buyback and Dividend Hike

https://finance.yahoo.com/news/westpac-may-lose-laggard-stat…

...

Westpac Banking Corp.’s higher dividend and stock buyback puts the Australian lender on course to narrow its share-price under performance compared to peers.

The Sydney-based bank on Monday said it plans a A$1.5 billion ($980 million) share buyback and will pay a final dividend of 72 Australian cents per share. The stock rose 1.5% as of 10:40 a.m., paring this year loss to 6.6%.

“From a share price perspective, we believe investor disappointment may now have peaked,” Azib Khan, executive director for banks research at E&P, wrote in a report.

Westpac followed Macquarie Group Ltd.’s move last week to buy back stock, as Australian lenders tap surplus capital to return to shareholders. Meantime, bank bosses are preparing customers and investors for a challenging year ahead as inflation continues to bite and competition remains fierce.

...

Westpac May Lose Laggard Status After Buyback and Dividend Hike

https://finance.yahoo.com/news/westpac-may-lose-laggard-stat…

...

Westpac Banking Corp.’s higher dividend and stock buyback puts the Australian lender on course to narrow its share-price under performance compared to peers.

The Sydney-based bank on Monday said it plans a A$1.5 billion ($980 million) share buyback and will pay a final dividend of 72 Australian cents per share. The stock rose 1.5% as of 10:40 a.m., paring this year loss to 6.6%.

“From a share price perspective, we believe investor disappointment may now have peaked,” Azib Khan, executive director for banks research at E&P, wrote in a report.

Westpac followed Macquarie Group Ltd.’s move last week to buy back stock, as Australian lenders tap surplus capital to return to shareholders. Meantime, bank bosses are preparing customers and investors for a challenging year ahead as inflation continues to bite and competition remains fierce.

...

28.6.

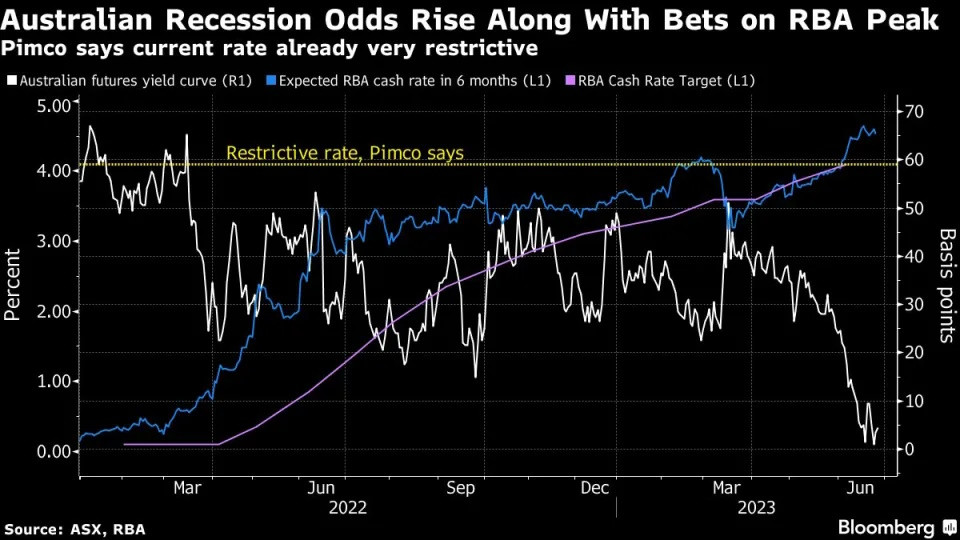

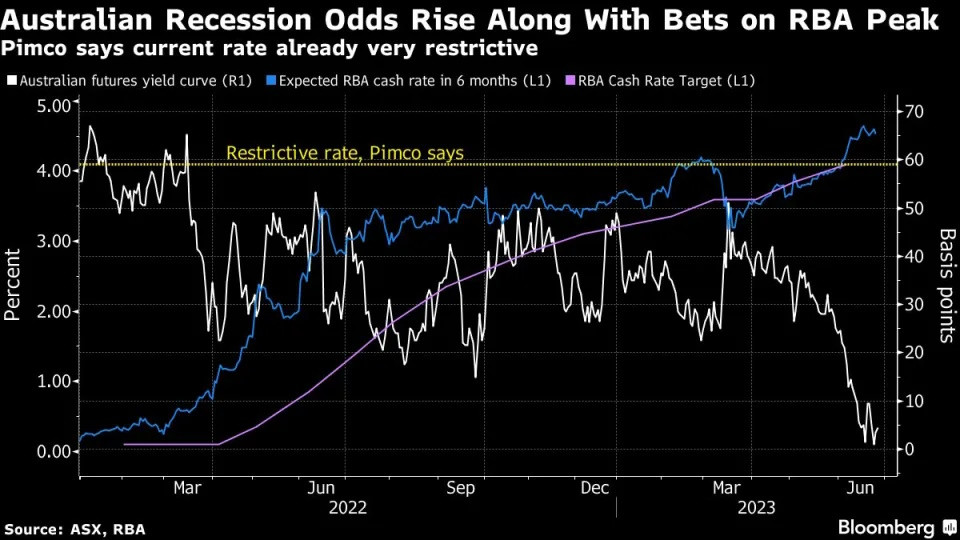

Pimco Loads Up on Aussie Bonds on Inevitable Recession Call

https://au.finance.yahoo.com/news/pimco-loads-aussie-bonds-i…

...

Pimco is buying government debt as it ramps up its stance from an underweight position, said Robert Mead, co-head of Asia-Pacific portfolio management in Sydney. High policy rates elsewhere, such as in the Eurozone, will lead to similar economic outcomes, making longer-dated bonds attractive, he said.

“We do think it’s inevitable,” Mead said of the prospects for a recession in Australia. “To the extent that the front ends of curves are now fully priced for those sorts of economic outcomes, we’re adding across the entire yield curve.”

Australia’s yield curve inverted this month for the first time since the lead-up to the global financial crisis, an indication that bond investors are bracing for a recession.

The central bank is under pressure to raise rates further after the latest jobs data, after having alternated between dovish and hawkish stances this year. The Reserve Bank of Australia has hiked 12 times since May 2022 to take the cash rate target to 4.1%, the fastest pace in a generation.

...

Pimco Loads Up on Aussie Bonds on Inevitable Recession Call

https://au.finance.yahoo.com/news/pimco-loads-aussie-bonds-i…

...

Pimco is buying government debt as it ramps up its stance from an underweight position, said Robert Mead, co-head of Asia-Pacific portfolio management in Sydney. High policy rates elsewhere, such as in the Eurozone, will lead to similar economic outcomes, making longer-dated bonds attractive, he said.

“We do think it’s inevitable,” Mead said of the prospects for a recession in Australia. “To the extent that the front ends of curves are now fully priced for those sorts of economic outcomes, we’re adding across the entire yield curve.”

Australia’s yield curve inverted this month for the first time since the lead-up to the global financial crisis, an indication that bond investors are bracing for a recession.

The central bank is under pressure to raise rates further after the latest jobs data, after having alternated between dovish and hawkish stances this year. The Reserve Bank of Australia has hiked 12 times since May 2022 to take the cash rate target to 4.1%, the fastest pace in a generation.

...

6.6.

Aussie bond yields and dollar rise after central bank delivers another surprise rate hike

https://www.msn.com/en-us/money/markets/aussie-bond-yields-a…

...

The Australian dollar and bond yields surged, while stocks fell on Tuesday after the Reserve Bank of Australia delivered a second-straight surprise interest rate hike, cautioning that that might not be the end of it.

The Aussie dollar climbed 0.7% to $0.6670, while the 10-year Australian bond yield rose 3.6 basis points to 3.826%. The S&P ASX 200 fell nearly 1% to, 7,147.

The RBA lifted the official cash rate by 25 basis points to 4.10%, its highest level since early 2012.

RBA Gov. Philip Lowe, who last week warned that higher wages and a lack of productivity growth could lead to more hikes, said in a statement that “further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame.” Whether or not more hikes will be carried out depends on the evolution of the economy and inflation, he added.

“Today’s decision could have gone either way, but in the past few weeks there has been a sea change in Australia when it comes to how the RBA is viewed as well as its competence,” said Michael Hewson, chief market analyst at CMC Markets UK, in a note to clients.

...

Aussie bond yields and dollar rise after central bank delivers another surprise rate hike

https://www.msn.com/en-us/money/markets/aussie-bond-yields-a…

...

The Australian dollar and bond yields surged, while stocks fell on Tuesday after the Reserve Bank of Australia delivered a second-straight surprise interest rate hike, cautioning that that might not be the end of it.

The Aussie dollar climbed 0.7% to $0.6670, while the 10-year Australian bond yield rose 3.6 basis points to 3.826%. The S&P ASX 200 fell nearly 1% to, 7,147.

The RBA lifted the official cash rate by 25 basis points to 4.10%, its highest level since early 2012.

RBA Gov. Philip Lowe, who last week warned that higher wages and a lack of productivity growth could lead to more hikes, said in a statement that “further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame.” Whether or not more hikes will be carried out depends on the evolution of the economy and inflation, he added.

“Today’s decision could have gone either way, but in the past few weeks there has been a sea change in Australia when it comes to how the RBA is viewed as well as its competence,” said Michael Hewson, chief market analyst at CMC Markets UK, in a note to clients.

...

2.5.

Australia Signals More Tightening After Surprise Rate Hike

https://finance.yahoo.com/news/australia-unexpectedly-hikes-…

...

Australia’s central bank signaled further policy tightening ahead after unexpectedly raising interest rates by a quarter-percentage point on Tuesday, sending the currency and bond yields surging.

The Reserve Bank increased its cash rate to 3.85%, the highest level since April 2012, in a decision predicted by only nine of 30 economists. Money markets rapidly revised up expectations for further moves and are now pricing in a rate of just under 4% by September, from around 3.6% before today’s decision.

The unexpected hike from a pause in April comes shortly after an independent review of the RBA recommended overhauling the current board set up and strengthening its communications. Treasurer Jim Chalmers is due in the next month or two to announce whether he will extend Governor Philip Lowe’s term or install someone new.

“The surprise hike suggests a shift in the RBA’s assessment of the tradeoff between growth and inflation,” said James McIntyre at Bloomberg Economics in Sydney. “An easing in offshore banking tensions and an upward revision to migration at home suggest greater comfort with downside growth risks.”

Australian government bonds slid after the decision as the prospect of higher rates curbed demand for government debt. The selloff pushed three-year yields 22 basis points higher, boosting the appeal of the Australian dollar, which strengthened more than 1%. The benchmark share index dropped 1.1% as higher borrowing costs may slow profit growth.

...

“Today’s move is a small step, against market expectations, that closes the policy gap with the likes of NZ, US,” said Jason Wong, currency strategist at Bank of New Zealand Ltd. “Bond market reaction of higher rates across the curve looks entirely appropriate, with the RBA needing more work to do to bring inflation down.”

Lowe has been under pressure over his communication after holding on too long to his pandemic-era message that rates were unlikely to rise before 2024. The RBA began hiking aggressively from May 2022 and then pivoted earlier than global counterparts to smaller increases.

“The RBA are seen as pretty idiosyncratic and have been more choppy in their tone vs the Fed who have been on a much more consistent messaging path,” said Laura Fitzsimmons, executive director of macro rates and FX sales at JPMorgan Chase & Co. in Sydney.

Su-Lin Ong, chief economist at Royal Bank of Canada, said the tweaks in the statement imply a change to the RBA’s reaction function from just a month ago, referring to a new phrase in the final paragraph about returning inflation to its 2-3% target within “a reasonable timeframe.”

“This phrase suggests a quicker return to within target inflation before mid-25 may be desirable even if the economy and labor market is weaker,” she said.

Lowe’s statement provided updated quarterly forecasts that will be released in full on Friday. They were little changed from three months ago and showed inflation easing to 4.5% this year — from 7% in the first quarter — and down to 3% in mid-2025; gross domestic product is seen advancing 1.25% this year.

Lowe pointed to unit labor costs rising “briskly” while productivity growth is subdued, adding the board “remains alert” to the risk of a price-wage spiral.

The RBA chief will give a speech in Perth at 9.20 pm Sydney time when he will likely further explain the board’s thinking. A short question-and-answer session will follow the address.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe,” Lowe said in today’s statement. “The board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.”

Australia Signals More Tightening After Surprise Rate Hike

https://finance.yahoo.com/news/australia-unexpectedly-hikes-…

...

Australia’s central bank signaled further policy tightening ahead after unexpectedly raising interest rates by a quarter-percentage point on Tuesday, sending the currency and bond yields surging.

The Reserve Bank increased its cash rate to 3.85%, the highest level since April 2012, in a decision predicted by only nine of 30 economists. Money markets rapidly revised up expectations for further moves and are now pricing in a rate of just under 4% by September, from around 3.6% before today’s decision.

The unexpected hike from a pause in April comes shortly after an independent review of the RBA recommended overhauling the current board set up and strengthening its communications. Treasurer Jim Chalmers is due in the next month or two to announce whether he will extend Governor Philip Lowe’s term or install someone new.

“The surprise hike suggests a shift in the RBA’s assessment of the tradeoff between growth and inflation,” said James McIntyre at Bloomberg Economics in Sydney. “An easing in offshore banking tensions and an upward revision to migration at home suggest greater comfort with downside growth risks.”

Australian government bonds slid after the decision as the prospect of higher rates curbed demand for government debt. The selloff pushed three-year yields 22 basis points higher, boosting the appeal of the Australian dollar, which strengthened more than 1%. The benchmark share index dropped 1.1% as higher borrowing costs may slow profit growth.

...

“Today’s move is a small step, against market expectations, that closes the policy gap with the likes of NZ, US,” said Jason Wong, currency strategist at Bank of New Zealand Ltd. “Bond market reaction of higher rates across the curve looks entirely appropriate, with the RBA needing more work to do to bring inflation down.”

Lowe has been under pressure over his communication after holding on too long to his pandemic-era message that rates were unlikely to rise before 2024. The RBA began hiking aggressively from May 2022 and then pivoted earlier than global counterparts to smaller increases.

“The RBA are seen as pretty idiosyncratic and have been more choppy in their tone vs the Fed who have been on a much more consistent messaging path,” said Laura Fitzsimmons, executive director of macro rates and FX sales at JPMorgan Chase & Co. in Sydney.

Su-Lin Ong, chief economist at Royal Bank of Canada, said the tweaks in the statement imply a change to the RBA’s reaction function from just a month ago, referring to a new phrase in the final paragraph about returning inflation to its 2-3% target within “a reasonable timeframe.”

“This phrase suggests a quicker return to within target inflation before mid-25 may be desirable even if the economy and labor market is weaker,” she said.

Lowe’s statement provided updated quarterly forecasts that will be released in full on Friday. They were little changed from three months ago and showed inflation easing to 4.5% this year — from 7% in the first quarter — and down to 3% in mid-2025; gross domestic product is seen advancing 1.25% this year.

Lowe pointed to unit labor costs rising “briskly” while productivity growth is subdued, adding the board “remains alert” to the risk of a price-wage spiral.

The RBA chief will give a speech in Perth at 9.20 pm Sydney time when he will likely further explain the board’s thinking. A short question-and-answer session will follow the address.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe,” Lowe said in today’s statement. “The board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.”

4.4.

...

Zu den Verlierern am Devisenmarkt zählte am Morgen der Australische Dollar, der im Handel mit allen anderen wichtigen Währungen unter Druck stand. Am Morgen hatte die Notenbank des Landes den Leitzins unverändert bei 3,60 Prozent belassen.

Im vergangenen Jahr hatte die Zentralbank von Australien den Leitzins im Kampf gegen die hohe Inflation noch deutlich angehoben.

...

https://www.finanzen.net/nachricht/devisen/devisen-im-blick-…

...

Zu den Verlierern am Devisenmarkt zählte am Morgen der Australische Dollar, der im Handel mit allen anderen wichtigen Währungen unter Druck stand. Am Morgen hatte die Notenbank des Landes den Leitzins unverändert bei 3,60 Prozent belassen.

Im vergangenen Jahr hatte die Zentralbank von Australien den Leitzins im Kampf gegen die hohe Inflation noch deutlich angehoben.

...

https://www.finanzen.net/nachricht/devisen/devisen-im-blick-…

8.2.

Australia Central Bank’s Peak Rate Now Seen at 3.85%, Poll Shows

https://www.bloomberg.com/news/articles/2023-02-08/australia…

...

Australia’s central bank will raise its benchmark interest rate to a peak of 3.85% from May, economists said in an upgrade of their forecasts following Governor Philip Lowe’s hawkish policy statement.

The median estimate was lifted by a quarter-percentage point after Lowe said that further hikes will be needed “over the months ahead” and his decision to drop a qualifier that the Reserve Bank wasn’t on a pre-set policy path. It raised the cash rate to 3.35% on Tuesday.

...

Australia Central Bank’s Peak Rate Now Seen at 3.85%, Poll Shows

https://www.bloomberg.com/news/articles/2023-02-08/australia…

...

Australia’s central bank will raise its benchmark interest rate to a peak of 3.85% from May, economists said in an upgrade of their forecasts following Governor Philip Lowe’s hawkish policy statement.

The median estimate was lifted by a quarter-percentage point after Lowe said that further hikes will be needed “over the months ahead” and his decision to drop a qualifier that the Reserve Bank wasn’t on a pre-set policy path. It raised the cash rate to 3.35% on Tuesday.

...

11.1.

Australia rate bets firm after stronger inflation, retail sales

https://www.businesstimes.com.sg/international/australia-rat…

...

Traders firmed up bets on a 25-basis-point hike after the data, seeing odds of better than 80 per cent that the RBA raises rates by that amount. They continue to anticipate that the Australian central bank will increase its benchmark to about 3.9 per cent later this year.

The data highlight the ongoing strength of Australia’s economy as households tap savings built up during the pandemic to finance spending and consumer price growth remains elevated.

...

Australia rate bets firm after stronger inflation, retail sales

https://www.businesstimes.com.sg/international/australia-rat…

...

Traders firmed up bets on a 25-basis-point hike after the data, seeing odds of better than 80 per cent that the RBA raises rates by that amount. They continue to anticipate that the Australian central bank will increase its benchmark to about 3.9 per cent later this year.

The data highlight the ongoing strength of Australia’s economy as households tap savings built up during the pandemic to finance spending and consumer price growth remains elevated.

...

5.12.

Australia Set to Raise Rates as Tightening Cycle Approaches End

https://au.finance.yahoo.com/news/australia-set-raise-rates-…

...

All-but one economist sees the Reserve Bank of Australia hiking by a quarter-percentage point to 3.1% on Tuesday, with the sole exception forecasting a 15 basis-point move. Some economists expect the RBA to pause in 2023, while others see a couple more hikes, reflecting its aim to cool inflation without slowing the economy too much.

That contrasts with New Zealand, which has boosted rates by 4 percentage points and sees more to come, and the Federal Reserve which has hiked by 3.75 points since March and is also expected to go further. Both are willing to risk recession -- New Zealand forecasts one -- as they try to crush inflation.

...

Achtung:

Westpac Banking