NJOM-3 - neue Bohrung

eröffnet am 23.06.22 15:15:20 von

neuester Beitrag 18.12.23 20:33:26 von

neuester Beitrag 18.12.23 20:33:26 von

Beiträge: 17

ID: 1.361.480

ID: 1.361.480

Aufrufe heute: 0

Gesamt: 1.291

Gesamt: 1.291

Aktive User: 0

ISIN: GB00BZ6D6J81 · WKN: A2AGHV · Symbol: TRP

0,0002

GBP

0,00 %

0,0000 GBP

Letzter Kurs 03.05.24 London

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.300,00 | +23,81 | |

| 0,7920 | +22,22 | |

| 19,650 | +11,77 | |

| 1,2800 | +10,34 | |

| 86,77 | +10,04 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,060 | -12,32 | |

| 1,590 | -15,43 | |

| 1,050 | -17,32 | |

| 0,510 | -20,31 | |

| 0,7400 | -22,11 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 74.926.300 von texas2 am 07.12.23 10:03:49https://www.proactiveinvestors.co.uk/companies/news/1036432/…

Tower Resources set for 2024 well as it inks hotly anticipated rig contract

Published: 08:14 18 Dec 2023 GMT

Written by: Jamie Ashcroft

About this content

View

Tower Resources PLC

AIM:TRP

Tower Resources PLC - Tower Resources set for 2024 well as it inks hotly anticipated rig contract

Tower Resources PLC (AIM:TRP) today announces the signing of the rig contract for the NJOM-3 well, offshore Cameroon, marking a hotly anticipated project milestone.

The company and its investors can now look forward to drilling the key well in 2024, as pencilled in previously.

It has signed up the Norve jack-up rig expected to be available in Cameroon between April and August 2024. Subject to rig availability, Tower expects to spud NJOM-3 in either the second or third quarter of 2024.

Significantly, clarity of the drill schedule is expected to help advance farm-out talks into a conclusion – which in turn promises to deliver needed project funding.

Chief executive Jeremy Asher described it as “a significant step forward in the development of Tower’s Cameroon assets”.

“The Norve Rig was chosen both for its high specification and its anticipated window of availability,” Asher said in a statement.

"Our next steps will be to finalise the documentation of the Thali license extension with the Ministry of Mines, Industry and Technological Development (MINMIDT), and to move our farm-out discussions with multiple parties towards a conclusion, we hope during the first quarter of 2024.

“As we have explained in the past, our plan is to fund the well primarily with asset-level financing, and we still believe that is realistic.”

Tower, meanwhile, today raised an additional £600,000 of capital via share subscription supported by Asher, who put in £80,000.

“I have chosen to participate in this fundraising myself, as I have in several of our previous recent fundraisings, reflecting my personal commitment to this project and my confidence in its success," Asher added.

Tower Resources set for 2024 well as it inks hotly anticipated rig contract

Published: 08:14 18 Dec 2023 GMT

Written by: Jamie Ashcroft

About this content

View

Tower Resources PLC

AIM:TRP

Tower Resources PLC - Tower Resources set for 2024 well as it inks hotly anticipated rig contract

Tower Resources PLC (AIM:TRP) today announces the signing of the rig contract for the NJOM-3 well, offshore Cameroon, marking a hotly anticipated project milestone.

The company and its investors can now look forward to drilling the key well in 2024, as pencilled in previously.

It has signed up the Norve jack-up rig expected to be available in Cameroon between April and August 2024. Subject to rig availability, Tower expects to spud NJOM-3 in either the second or third quarter of 2024.

Significantly, clarity of the drill schedule is expected to help advance farm-out talks into a conclusion – which in turn promises to deliver needed project funding.

Chief executive Jeremy Asher described it as “a significant step forward in the development of Tower’s Cameroon assets”.

“The Norve Rig was chosen both for its high specification and its anticipated window of availability,” Asher said in a statement.

"Our next steps will be to finalise the documentation of the Thali license extension with the Ministry of Mines, Industry and Technological Development (MINMIDT), and to move our farm-out discussions with multiple parties towards a conclusion, we hope during the first quarter of 2024.

“As we have explained in the past, our plan is to fund the well primarily with asset-level financing, and we still believe that is realistic.”

Tower, meanwhile, today raised an additional £600,000 of capital via share subscription supported by Asher, who put in £80,000.

“I have chosen to participate in this fundraising myself, as I have in several of our previous recent fundraisings, reflecting my personal commitment to this project and my confidence in its success," Asher added.

Antwort auf Beitrag Nr.: 73.119.075 von texas2 am 18.01.23 22:28:49https://www.towerresources.co.uk/wp-content/uploads/2023/12/…

Antwort auf Beitrag Nr.: 73.105.056 von texas2 am 17.01.23 11:31:56auf das Plus von gestern, erfolgten heute ein paar Gewinnmitnahmen ...

... aber heute rund 35% im Plus in London, von Leuten, die wahrscheinlich glauben dass sich die Wahrscheinlichkeit erhöht hat dass die Bohrung tatsächlich kommt.

Malcy`s Kommentar:

Slowly but surely Jeremy Asher is putting the final pieces of the funding for the Thali PSC well in Cameroon and this time it’s not him signing the cheque either. Last time I saw Jeremy Asher back in Cape Town he remained positive and really rather laid back, the upside remains substantial…

Malcy`s Kommentar:

Slowly but surely Jeremy Asher is putting the final pieces of the funding for the Thali PSC well in Cameroon and this time it’s not him signing the cheque either. Last time I saw Jeremy Asher back in Cape Town he remained positive and really rather laid back, the upside remains substantial…

Antwort auf Beitrag Nr.: 72.788.567 von texas2 am 21.11.22 11:52:29erst einmal werden weitere Aktien zu 0,001 p (dh hoffentliche Pfund und nicht pence) verkauft; kein Wunder dass der Kurs erst einmal weiter runter geht

Mon, 16th Jan 2023 07:00

RNS Number : 7498M

Tower Resources PLC

16 January 2023

16 January 2023

Tower Resources plc

("Tower" or the "Company")

Institutional Placing of up to US$6 million with Energy Exploration Capital Partners LLC

Tower Resources plc (AIM: TRP), the Africa-focused energy company, is pleased to announce the completion of an institutional placing (the "Placing") to Energy Exploration Capital Partners, LLC ("EECP" or the "Placee"), a U.S.-based institutional investor, pursuant to an investment deed (the "Deed").

Institutional Placing:

The Placing will initially raise US$1,250,000 as a placing to the Placee of new ordinary shares (with nominal value of 0.001p each) in the Company ("Shares") worth US$1,362,500. Following the initial placing, the Placee will invest, at the request of the Company, up to US$1,750,000 in the aggregate for Shares worth US$1,907,500 in the aggregate, no earlier than three months and no later than eight months after the initial placing (such period, the "Commitment Period", and collectively, such investments, the "Second Placing"). If required by the Company, a further US$3,000,000 may be raised from the Placee for Shares worth an equivalent amount, with the Placee's consent. Further information regarding the Placing is set out below.

The proceeds from the Placing will be used by Tower to fund work programme commitments in respect of its licenses in Cameroon, Namibia and South Africa as well as for general working capital purposes.

Jeremy Asher, Tower's Chairman and CEO, commented:

"We are very pleased to announce this placing to EECP. The placing has been structured specifically to fit alongside the intended bank financing led by BGFI Bank Group, which is presently awaiting group credit committee approval. The timing and amounts are flexible, to enable us to accommodate other sources of financing if we wish, and to adapt to the final schedule of the NJOM-3 well on the Njonji structure in our Thali PSC area in Cameroon. We are continuing to discuss alternative rig options for this critical well, which will be targeting the appraisal and testing of 18 million barrels (pMean) of Contingent Resources and will also be penetrating additional potential reservoirs containing further prospective resources unconnected to the original two Njonji discovery wells. We are excited to be moving forward with this transformative project."

Details of the Placing

Each placing under the Deed will be made by way of the Placee prepaying for Shares to be issued at the Placee's request within twenty-four months of the date of the placing (the "Placing Shares"), at the Placement Price, but subject to the Floor Price, as set out below.

The Placement Price of the Placing Shares will initially be equal to 0.36p per Share, representing a premium of approximately 130% to the closing price of Tower's Shares on 13 January 2023. Subject to the Floor Price described below, the Placement Price will reset after the initial month to the average of the five daily volume-weighted average prices selected by the Placee during a specified period immediately prior to the date of the Placee's notice to issue Placing Shares, less an 8% discount, rounded down to the nearest fiftieth of a pence.

The Placee will be entitled to a long-term hold benefit of a 10% (rather than 8%) discount to the above-mentioned formula for Placing Shares if the Placing Shares are issued after the first anniversary of the initial investment. In addition, the Company may benefit from share price appreciation following issuance of Placing Shares: if an issuance of shares to the Placee would result in the effective discount to the prevailing market price of the Company's shares being in excess of 25%, the Placement Price will be increased by half of such excess.

Further, the Placement Price will not be the subject of a ceiling and will be the subject of the Floor Price of 0.1p per Share. If the Placement Price formula results in a price that is less than the Floor Price, the Company may elect not to issue shares and instead opt to repay the applicable placement amount in cash, with a 9% premium, subject to the Placee's right to receive Placing Shares at the Floor Price in lieu of such cash repayment.

The Company may at any time repay one half of the outstanding balance of each placing in relation to which Placing Shares have not yet been issued, with a 5% premium.

The Placee has agreed to certain substantial limitations on its ability to resell or otherwise dispose of the Shares it receives. The Placee is also contractually precluded from shorting the Company's Shares.

Application will be made to the London Stock Exchange for any ordinary shares issued and allotted in relation to the placing to be admitted to trading on AIM. Such ordinary shares will only be issued to the extent that the Company has corporate authority to do so.

The Placee will not be obligated to invest in the Second Placing, if the market price of the Shares has decreased to below 0.1p and does not recover to above that level within three months after the Placee notifies the Company thereof. The Company may not, in any given month during the Commitment Period, request that the Placee fund proceeds of the Second Placing that, together with outstanding balance of the initial placing in relation to which shares have not been issued, exceed 14.99% of the Company's market capitalisation. For clarity, for the benefit of the Company, this limitation will apply to the proceeds of the Second Placing in a given month only and not in the aggregate. The Second Placing may be funded in one or more tranches, subject to the foregoing limitation, and may be accelerated by the Placee.

The Company will issue to the Placee 105,000,000 Shares in satisfaction of a fee. The Company has applied for admission of these Shares to trading on the AIM ("Admission"), and Admission is expected to become effective on or about 20 January 2023. On Admission, these shares will rank pari passu with all existing ordinary shares in the Company.

Concurrent with the initial placing, the Company will issue 82,000,000 of the Placing Shares to the Placee, with the balance to be issued as set out above. The Company has applied for admission of these Shares to trading on the AIM, and this is expected to become effective on or about 20 January 2023. On admission, these shares will rank pari passu with all existing ordinary shares in the Company. In lieu of applying these Placing Shares towards the aggregate number of Placing Shares to be issued, the Placee may make an additional cash payment to the Company.

Total Voting Rights:

Following Admission of these Shares, the Company will have 3,741,437,955 Shares in issue with each Share carrying the right to one vote. There are no Shares currently held in treasury. The total number of voting rights in the Company is therefore 3,741,437,955 and this figure may be used by shareholders as the denominator for the calculations by which they determine if they are required to notify their interest in, or a change to their interest in, the Company under the Disclosure Guidance and Transparency Rules of the Financial Conduct Authority.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR'). Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.

Contacts:

....

ECP is a leading investor across energy transition, electrification and decarbonization infrastructure assets, including power generation, renewables and storage solutions, environmental infrastructure and sustainability, efficiency & reliability assets.

Founded 2005, 17-year history, $27billion in capital commitments 600+limited partners globally!

https://www.ecpgp.com/

Mon, 16th Jan 2023 07:00

RNS Number : 7498M

Tower Resources PLC

16 January 2023

16 January 2023

Tower Resources plc

("Tower" or the "Company")

Institutional Placing of up to US$6 million with Energy Exploration Capital Partners LLC

Tower Resources plc (AIM: TRP), the Africa-focused energy company, is pleased to announce the completion of an institutional placing (the "Placing") to Energy Exploration Capital Partners, LLC ("EECP" or the "Placee"), a U.S.-based institutional investor, pursuant to an investment deed (the "Deed").

Institutional Placing:

The Placing will initially raise US$1,250,000 as a placing to the Placee of new ordinary shares (with nominal value of 0.001p each) in the Company ("Shares") worth US$1,362,500. Following the initial placing, the Placee will invest, at the request of the Company, up to US$1,750,000 in the aggregate for Shares worth US$1,907,500 in the aggregate, no earlier than three months and no later than eight months after the initial placing (such period, the "Commitment Period", and collectively, such investments, the "Second Placing"). If required by the Company, a further US$3,000,000 may be raised from the Placee for Shares worth an equivalent amount, with the Placee's consent. Further information regarding the Placing is set out below.

The proceeds from the Placing will be used by Tower to fund work programme commitments in respect of its licenses in Cameroon, Namibia and South Africa as well as for general working capital purposes.

Jeremy Asher, Tower's Chairman and CEO, commented:

"We are very pleased to announce this placing to EECP. The placing has been structured specifically to fit alongside the intended bank financing led by BGFI Bank Group, which is presently awaiting group credit committee approval. The timing and amounts are flexible, to enable us to accommodate other sources of financing if we wish, and to adapt to the final schedule of the NJOM-3 well on the Njonji structure in our Thali PSC area in Cameroon. We are continuing to discuss alternative rig options for this critical well, which will be targeting the appraisal and testing of 18 million barrels (pMean) of Contingent Resources and will also be penetrating additional potential reservoirs containing further prospective resources unconnected to the original two Njonji discovery wells. We are excited to be moving forward with this transformative project."

Details of the Placing

Each placing under the Deed will be made by way of the Placee prepaying for Shares to be issued at the Placee's request within twenty-four months of the date of the placing (the "Placing Shares"), at the Placement Price, but subject to the Floor Price, as set out below.

The Placement Price of the Placing Shares will initially be equal to 0.36p per Share, representing a premium of approximately 130% to the closing price of Tower's Shares on 13 January 2023. Subject to the Floor Price described below, the Placement Price will reset after the initial month to the average of the five daily volume-weighted average prices selected by the Placee during a specified period immediately prior to the date of the Placee's notice to issue Placing Shares, less an 8% discount, rounded down to the nearest fiftieth of a pence.

The Placee will be entitled to a long-term hold benefit of a 10% (rather than 8%) discount to the above-mentioned formula for Placing Shares if the Placing Shares are issued after the first anniversary of the initial investment. In addition, the Company may benefit from share price appreciation following issuance of Placing Shares: if an issuance of shares to the Placee would result in the effective discount to the prevailing market price of the Company's shares being in excess of 25%, the Placement Price will be increased by half of such excess.

Further, the Placement Price will not be the subject of a ceiling and will be the subject of the Floor Price of 0.1p per Share. If the Placement Price formula results in a price that is less than the Floor Price, the Company may elect not to issue shares and instead opt to repay the applicable placement amount in cash, with a 9% premium, subject to the Placee's right to receive Placing Shares at the Floor Price in lieu of such cash repayment.

The Company may at any time repay one half of the outstanding balance of each placing in relation to which Placing Shares have not yet been issued, with a 5% premium.

The Placee has agreed to certain substantial limitations on its ability to resell or otherwise dispose of the Shares it receives. The Placee is also contractually precluded from shorting the Company's Shares.

Application will be made to the London Stock Exchange for any ordinary shares issued and allotted in relation to the placing to be admitted to trading on AIM. Such ordinary shares will only be issued to the extent that the Company has corporate authority to do so.

The Placee will not be obligated to invest in the Second Placing, if the market price of the Shares has decreased to below 0.1p and does not recover to above that level within three months after the Placee notifies the Company thereof. The Company may not, in any given month during the Commitment Period, request that the Placee fund proceeds of the Second Placing that, together with outstanding balance of the initial placing in relation to which shares have not been issued, exceed 14.99% of the Company's market capitalisation. For clarity, for the benefit of the Company, this limitation will apply to the proceeds of the Second Placing in a given month only and not in the aggregate. The Second Placing may be funded in one or more tranches, subject to the foregoing limitation, and may be accelerated by the Placee.

The Company will issue to the Placee 105,000,000 Shares in satisfaction of a fee. The Company has applied for admission of these Shares to trading on the AIM ("Admission"), and Admission is expected to become effective on or about 20 January 2023. On Admission, these shares will rank pari passu with all existing ordinary shares in the Company.

Concurrent with the initial placing, the Company will issue 82,000,000 of the Placing Shares to the Placee, with the balance to be issued as set out above. The Company has applied for admission of these Shares to trading on the AIM, and this is expected to become effective on or about 20 January 2023. On admission, these shares will rank pari passu with all existing ordinary shares in the Company. In lieu of applying these Placing Shares towards the aggregate number of Placing Shares to be issued, the Placee may make an additional cash payment to the Company.

Total Voting Rights:

Following Admission of these Shares, the Company will have 3,741,437,955 Shares in issue with each Share carrying the right to one vote. There are no Shares currently held in treasury. The total number of voting rights in the Company is therefore 3,741,437,955 and this figure may be used by shareholders as the denominator for the calculations by which they determine if they are required to notify their interest in, or a change to their interest in, the Company under the Disclosure Guidance and Transparency Rules of the Financial Conduct Authority.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR'). Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.

Contacts:

....

ECP is a leading investor across energy transition, electrification and decarbonization infrastructure assets, including power generation, renewables and storage solutions, environmental infrastructure and sustainability, efficiency & reliability assets.

Founded 2005, 17-year history, $27billion in capital commitments 600+limited partners globally!

https://www.ecpgp.com/

Interessant zu beobachten.

TRP kriegt die Finanzierung nicht und nicht gebacken. Irgendwie ist da ein dicker Wurm drin, auch wenn sich Herr Asher offensichtlich redlich bemüht.

21 November 2022

Tower Resources plc

("Tower" or the "Company")

Cameroon Financing Update

Tower Resources plc (AIM: TRP.L), the Africa-focused energy company, is pleased to provide an update on its financing activity in respect of its Thali Production Sharing Contract (PSC), in the Rio Del Rey sedimentary basin offshore Cameroon.

Cameroon Financing:

Tower is pleased to announce that its subsidiary, Tower Resources Cameroon S.A ("TRCSA"), has been notified by BGFI Bank Group ("BGFI"), the largest bank group in Central Africa, that the medium term loan of approximately US$7 million for which TRCSA and BGFI agreed a term sheet at the end of June 2022 (the "Loan"), has been approved by the credit committee of the Cameroon bank. Further approval is still required at the BGFI group level and discussions are now turning to the details of the structure and documentation, as well as a potential modest enlargement of the facility.

Whilst the Company aims to complete these discussions as quickly as possible, it cannot be certain of when final approval will be received, if it is successful.

As previously disclosed, the Loan should cover around 40% of the approximate US$18 million cost of the well, with a further amount of 25% already having been paid for by TRCSA. The balance of 35% of the cost of the well is also to be funded by TRCSA. This balance may be funded by further financing at the asset level, or with corporate funds.

The Company is continuing to discuss additional financing options at the asset level, including with BGFI. The Company's current plan is to complete the Loan financing documentation, if possible, before seeking to conclude any further bank discussions.

Jeremy Asher, Tower's Chairman and CEO, commented:

"We are very happy with the progress in our discussions with BGFI Bank Group, and the support that the local bank has shown towards our project in Cameroon.

"Discussions regarding the rig options with suppliers and other operators are also continuing as expected. As previously announced, long lead items for the well have already been purchased, and the environmental and social impact assessment, site survey and site debris survey are complete. Therefore, we are in a position to move quickly once a rig slot is finalised.

"We remain very confident that we will be able to drill the NJOM-3 well in good time and thank our shareholders for their patience while we seek to conclude these discussions.

TRP kriegt die Finanzierung nicht und nicht gebacken. Irgendwie ist da ein dicker Wurm drin, auch wenn sich Herr Asher offensichtlich redlich bemüht.

21 November 2022

Tower Resources plc

("Tower" or the "Company")

Cameroon Financing Update

Tower Resources plc (AIM: TRP.L), the Africa-focused energy company, is pleased to provide an update on its financing activity in respect of its Thali Production Sharing Contract (PSC), in the Rio Del Rey sedimentary basin offshore Cameroon.

Cameroon Financing:

Tower is pleased to announce that its subsidiary, Tower Resources Cameroon S.A ("TRCSA"), has been notified by BGFI Bank Group ("BGFI"), the largest bank group in Central Africa, that the medium term loan of approximately US$7 million for which TRCSA and BGFI agreed a term sheet at the end of June 2022 (the "Loan"), has been approved by the credit committee of the Cameroon bank. Further approval is still required at the BGFI group level and discussions are now turning to the details of the structure and documentation, as well as a potential modest enlargement of the facility.

Whilst the Company aims to complete these discussions as quickly as possible, it cannot be certain of when final approval will be received, if it is successful.

As previously disclosed, the Loan should cover around 40% of the approximate US$18 million cost of the well, with a further amount of 25% already having been paid for by TRCSA. The balance of 35% of the cost of the well is also to be funded by TRCSA. This balance may be funded by further financing at the asset level, or with corporate funds.

The Company is continuing to discuss additional financing options at the asset level, including with BGFI. The Company's current plan is to complete the Loan financing documentation, if possible, before seeking to conclude any further bank discussions.

Jeremy Asher, Tower's Chairman and CEO, commented:

"We are very happy with the progress in our discussions with BGFI Bank Group, and the support that the local bank has shown towards our project in Cameroon.

"Discussions regarding the rig options with suppliers and other operators are also continuing as expected. As previously announced, long lead items for the well have already been purchased, and the environmental and social impact assessment, site survey and site debris survey are complete. Therefore, we are in a position to move quickly once a rig slot is finalised.

"We remain very confident that we will be able to drill the NJOM-3 well in good time and thank our shareholders for their patience while we seek to conclude these discussions.

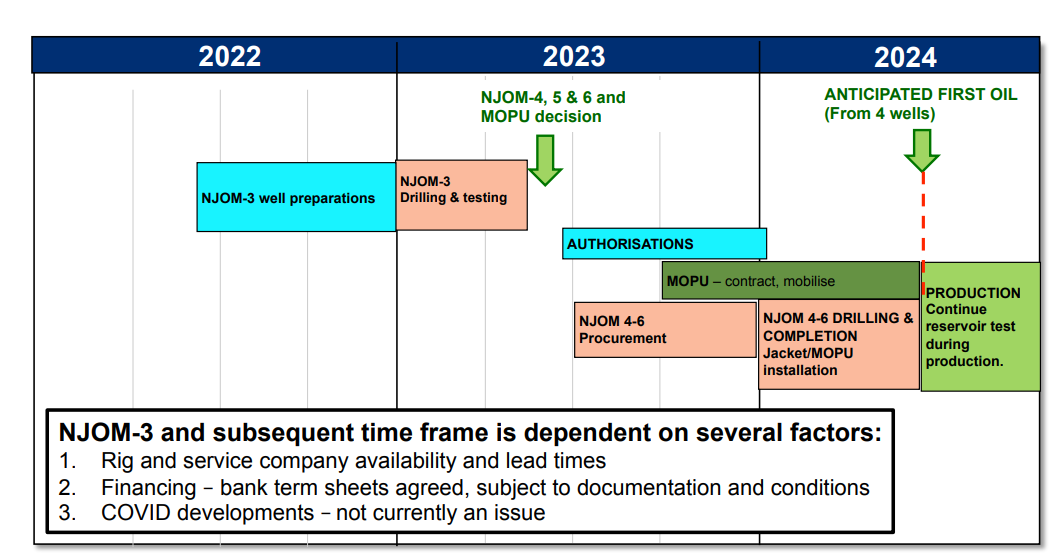

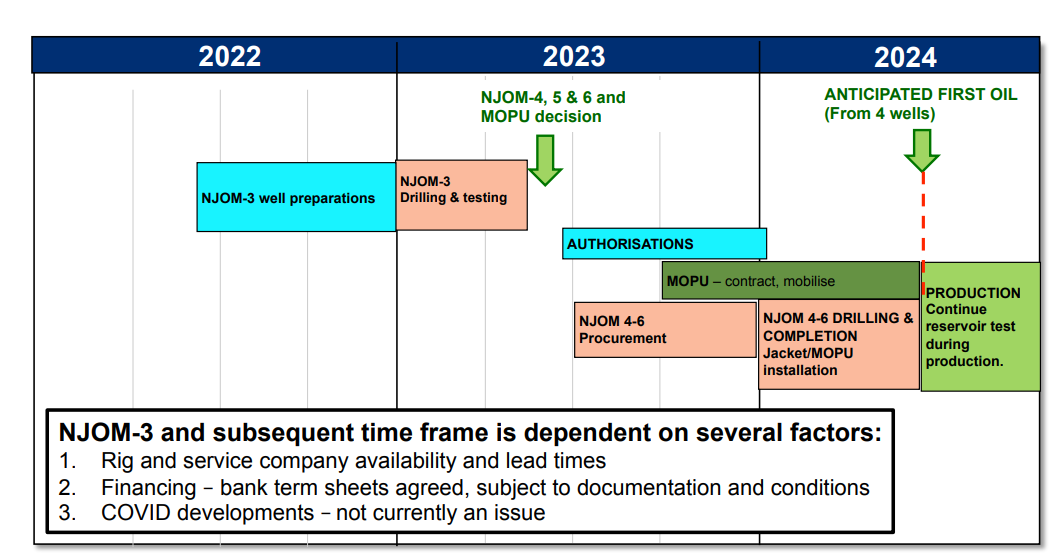

Antwort auf Beitrag Nr.: 72.515.872 von texas2 am 03.10.22 19:47:52Tower ist gleich mit 3 Präsentationen auf der Konferenz vertreten. Mir sind keine neuen weltbewegenden Infos dabei aufgefallen. Tower hat aber wieder einmal bestätigt dass sie zu den Weltmeistern beim Nachhintenverschieben gehören. Die Bohrung Njonji in Cameroon offshore soll jetzt Anfang 2023 kommen dh jetzt glaubt Herr Asher dass er das Geld bis Ende 2022 für das Projekt bekommt und auf dem Konto hat ... wahrscheinlich würde man mehr Geld machen wenn man dagegen wetten würde, sooft wie Tower dieses Projekt schon nach hinten verschoben hat. Aber zumindest hat Herr Asher ebenfalls ein wenig von seinem Taschengeld in dieser Firma)

RNS Number : 9093B

Tower Resources PLC

06 October 2022

6 October 2022

Tower Resources plc

Corporate and Technical Presentations

Tower Resources plc (AIM: TRP.L), the AIM listed oil and gas company with its focus on Africa, is pleased to announce that to coincide with the Company's participation at the Africa Oil Week Conference ("AOW") held in Cape Town, South Africa, copies of the introductory corporate presentation and the two technical presentations describing the Company's operated blocks in Cameroon and Namibia will shortly be available for download on the Company's website at www.towerresources.co.uk

https://www.towerresources.co.uk/wp-content/uploads/2022/10/…

Thali Block, Cameroon: A short cycle opportunity with upside https://www.towerresources.co.uk/wp-content/uploads/2022/10/…

PEL096 Licence, Offshore Namibia https://www.towerresources.co.uk/wp-content/uploads/2022/10/…

RNS Number : 9093B

Tower Resources PLC

06 October 2022

6 October 2022

Tower Resources plc

Corporate and Technical Presentations

Tower Resources plc (AIM: TRP.L), the AIM listed oil and gas company with its focus on Africa, is pleased to announce that to coincide with the Company's participation at the Africa Oil Week Conference ("AOW") held in Cape Town, South Africa, copies of the introductory corporate presentation and the two technical presentations describing the Company's operated blocks in Cameroon and Namibia will shortly be available for download on the Company's website at www.towerresources.co.uk

https://www.towerresources.co.uk/wp-content/uploads/2022/10/…

Thali Block, Cameroon: A short cycle opportunity with upside https://www.towerresources.co.uk/wp-content/uploads/2022/10/…

PEL096 Licence, Offshore Namibia https://www.towerresources.co.uk/wp-content/uploads/2022/10/…

Antwort auf Beitrag Nr.: 72.514.252 von texas2 am 03.10.22 15:02:37Interesting POV from Marlys blog - From Malcy today: 'After a considerable amount of time and with Chairman Jeremy Asher bearing the brunt of the funding I can now see the light at the end of the tunnel. I would have liked a few comments from him but he is reluctant to blow his own trumpet. The Thali block in Cameroon is joined by the excitement in Namibia thanks to the perceived success of the Graff-1 well which could prove up something for Tower under the nearability rule. I’m spending time with Jeremy Asher this week and I look forward to reporting back positive news.' Https://www.malcysblog.com/2022/10/oil-price-genel-coro-hurricane-reabold-tower/

Antwort auf Beitrag Nr.: 72.501.309 von texas2 am 30.09.22 12:35:34plus 50% heute in London. Ob da irgendwelche Leute Wind von der Finanzierung bekommen haben?