ARNA - Arena Pharmaceuticals - 500 Beiträge pro Seite

eröffnet am 07.10.06 21:02:16 von

neuester Beitrag 02.02.09 16:13:28 von

neuester Beitrag 02.02.09 16:13:28 von

Beiträge: 45

ID: 1.086.374

ID: 1.086.374

Aufrufe heute: 0

Gesamt: 8.134

Gesamt: 8.134

Aktive User: 0

ISIN: US0400476075 · WKN: A2DR4A

99,98

USD

+0,06 %

+0,06 USD

Letzter Kurs 11.03.22 NYSE

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,0000 | +99.999,00 | |

| 0,9998 | +122,18 | |

| 0,8970 | +75,20 | |

| 1,8200 | +34,81 | |

| 0,8680 | +31,54 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 49,24 | -9,67 | |

| 765,45 | -9,95 | |

| 2,9800 | -13,12 | |

| 4,8500 | -14,31 | |

| 0,6460 | -19,25 |

da es für meine zweite Lieblingsposition neben GPC Biotech noch keinen Thread gibt... hier ein kleiner Info-Thread...

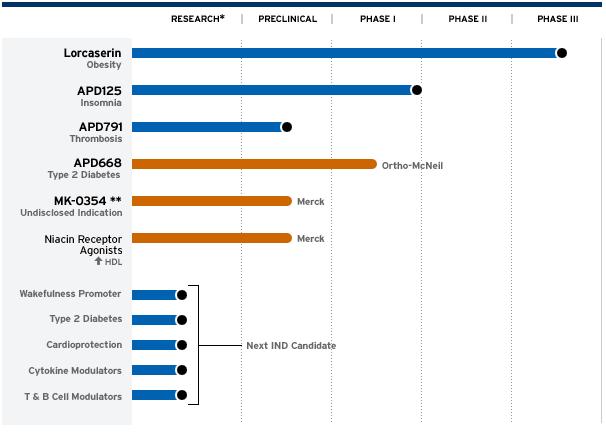

Arena Pharmaceuticals (ARNA)

http://www.arenapharm.com/

Arena Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, focuses on the research and development of small molecule drugs in the therapeutic areas of metabolic, central nervous system, cardiovascular, and inflammatory diseases. It is developing a pipeline of compounds targeting a class of drug targets called G protein- coupled receptors, or GPCRs, using its technologies, including CART (Constitutively Activated Receptor Technology) and Melanophore. The company has four internally discovered, clinical-stage drug candidates for major diseases. The most advanced candidate is lorcaserin, a selective 5-HT2C serotonin receptor agonist that is under investigation for the treatment of obesity. Arena’s lead drug candidate for the treatment of insomnia, APD125, is a selective 5-HT2A receptor inverse agonist. The company also has two clinical-stage collaborations with Merck & Co., Inc. and Ortho-McNeil, Inc. MK-0354, an Arena-discovered, orally administered drug candidate is under development by Merck for the treatment of atherosclerosis and related disorders. APD668, an Arena-discovered, orally administered drug candidate for the treatment of Type 2 diabetes, is under development by Ortho-McNeil. Arena was incorporated in 1997 and is based in San Diego, California.

von yahoo (7.10. Kurs 14.93 USD):

Market Cap (intraday): 707.01M

Enterprise Value (7-Oct-06)3: 452.09M

Revenue (ttm): 34.76M

Total Cash (mrq): 268.52M

Total Debt (mrq): 13.58M

Pipeline:

http://www.arenapharm.com/wt/page/prod_pipeline

* Lorcaserin, PIII, Fettsucht(obesity), 5-HT2C serotonin receptor, kein Partner, BLA u.U. 2009, mögliche peak sales 5+ Mrd USD

* APD125, PI (PII in Vorbereitung), Schlafstörungen(insomnia), 5-HT2A serotonin receptor, kein Partner, mögliche peak sales 2+ Mrd USD

* APD791, P0, Blutgerinnungshemmer (wie Plavix), 5-HT2A serotonin receptor, kein Partner, mögliche peak sales 6+ Mrd USD

* APD668, PI, Type 2 Diabetis, GDIR, Ortho-McNeil (J&J)

* Niacin Receptor Agonisten, P0, Atherosklerose/HDL, Merck

mfg ipollit

Arena Pharmaceuticals (ARNA)

http://www.arenapharm.com/

Arena Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, focuses on the research and development of small molecule drugs in the therapeutic areas of metabolic, central nervous system, cardiovascular, and inflammatory diseases. It is developing a pipeline of compounds targeting a class of drug targets called G protein- coupled receptors, or GPCRs, using its technologies, including CART (Constitutively Activated Receptor Technology) and Melanophore. The company has four internally discovered, clinical-stage drug candidates for major diseases. The most advanced candidate is lorcaserin, a selective 5-HT2C serotonin receptor agonist that is under investigation for the treatment of obesity. Arena’s lead drug candidate for the treatment of insomnia, APD125, is a selective 5-HT2A receptor inverse agonist. The company also has two clinical-stage collaborations with Merck & Co., Inc. and Ortho-McNeil, Inc. MK-0354, an Arena-discovered, orally administered drug candidate is under development by Merck for the treatment of atherosclerosis and related disorders. APD668, an Arena-discovered, orally administered drug candidate for the treatment of Type 2 diabetes, is under development by Ortho-McNeil. Arena was incorporated in 1997 and is based in San Diego, California.

von yahoo (7.10. Kurs 14.93 USD):

Market Cap (intraday): 707.01M

Enterprise Value (7-Oct-06)3: 452.09M

Revenue (ttm): 34.76M

Total Cash (mrq): 268.52M

Total Debt (mrq): 13.58M

Pipeline:

http://www.arenapharm.com/wt/page/prod_pipeline

* Lorcaserin, PIII, Fettsucht(obesity), 5-HT2C serotonin receptor, kein Partner, BLA u.U. 2009, mögliche peak sales 5+ Mrd USD

* APD125, PI (PII in Vorbereitung), Schlafstörungen(insomnia), 5-HT2A serotonin receptor, kein Partner, mögliche peak sales 2+ Mrd USD

* APD791, P0, Blutgerinnungshemmer (wie Plavix), 5-HT2A serotonin receptor, kein Partner, mögliche peak sales 6+ Mrd USD

* APD668, PI, Type 2 Diabetis, GDIR, Ortho-McNeil (J&J)

* Niacin Receptor Agonisten, P0, Atherosklerose/HDL, Merck

mfg ipollit

das Übergewicht heutzutage ein großes Problem darstellt dürfte bekannt sein...

For drug companies, the stakes couldn't be higher. In a world where a blockbuster drug is one with $1 billion a year in sales, analysts give $5 billion as the low estimate for sales of an important obesity drug. If a company developed a truly safe, effective weight-loss drug and sold it for $3 a day to one-quarter of the 97 million American adults estimated to be overweight, sales would exceed $26 billion a year in this country alone.

zur Zeit gibt es nur zwei zugelassene Medikamente, die z.B. die Aufnahme von Fett vermindern. In den 90er-Jahren gab es u.a. das wirkungsvolles Medikament "FenPhen", dass als Blockbuster allerdings wegen schwerer Nebenwirkungen vom Markt genommen werden musste:

24.05.2006 21:47

Wyeth erhält FDA-Genehmigung für Fen-Phen-Fonds

Der amerikanische Pharmakonzern Wyeth (ISIN US9830241009 (Nachrichten/Aktienkurs)/ WKN 850229) hat am Mittwoch von der US-Gesundheitsbehörde FDA für die Ergänzung des Diätpräparate-Vergleichs die abschließende Zulassung erhalten.

Demnach wird Wyeth im Zusammenhang mit dem Diätpräparate-Mix "Fen-Phen" 1,275 Mrd. Dollar in einen neuen Fonds zahlen. Um Schadenzahlungen begleichen zu können wird der Konzern zunächst 400 Mio. Dollar einzahlen. Der Medikamente-Mix war 1997 aufgrund von Problemen mit Herzklappen vom Markt genommen worden.

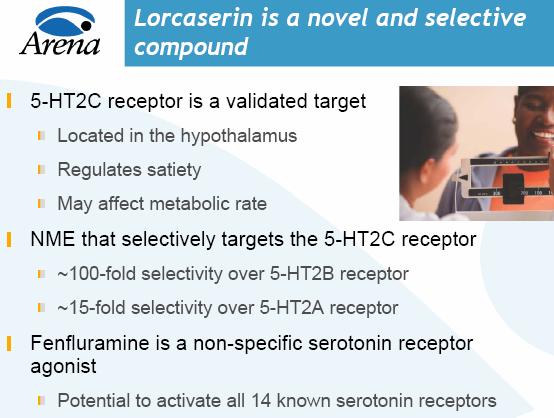

FenPhen wirkt auf Serotonin Rezeptoren im Gehirn, die das Hungergefühl unterdrücken können. Allerdings nicht selektiv genug, so dass ähnliche Rezeptoren u.a. im Herz auch aktiviert werden, was wahrscheinlich zu den schweren Nebenwirkungen führt.

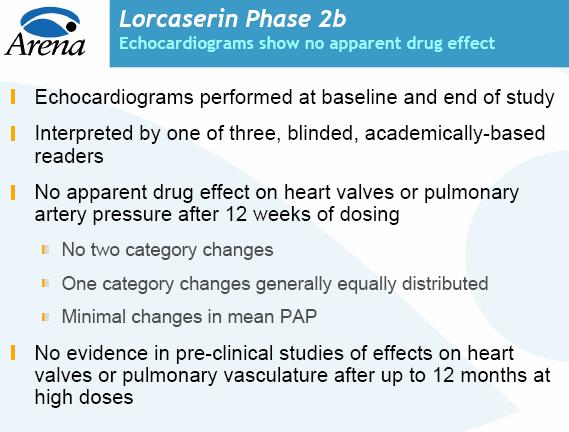

Lorcaserin (APD356) unterdrückt als praktisch selektive Variante von FenPhen über den 5-HT2C Serotonin Rezeptor das Hungergefühl. Da Lorca aber nur diese aktivieren soll, sind theoretisch die Nebenwirkungen nicht zu erwarten. Eine Wirksamkeit als Variante von FenPhen ist sehr wahrscheinlich, was in der PII bereits gezeigt werden konnte. Das Problem stellen die Nebenwirkungen dar, die bei FenPhen aufgetreten sind. Ich denke, dass dieses Risiko bis jetzt die großen Pharmas abgeschreckt hat. In der PII konnten keine Cardio-Probleme festgestellt werden, so dass die FDA die Durchführung der PIII genehmigt hat. Sollten auch hier bei 6000 Patienten die Nebenwirkungen nicht auftreten, so werden sich wohl alle um Lorca reißen. Nächstes Jahr gibt es eine erste Sicherheits-Analyse von 3000 Patienten, dann wird man vielleicht mehr wissen.

Obesity afflicts a large and increasing proportion of the population. More than 30 percent of Americans are obese, a figure that has risen sharply over the past decade, according to the Centers for Disease Control and Prevention. Substantial health risks are associated with overweight and obesity, leading to increased morbidity and mortality. Obesity is a leading cause of diabetes and accounts for more than 2.6 million deaths annually worldwide. The U.S. Surgeon General has estimated the direct and indirect economic costs of obesity at $117 billion per year. There are only two approved drugs to treat the condition. Concerns about side effects and efficacy have limited the use of these drugs, presenting an opportunity to help millions of patients with a new, safe and effective therapy.

mfg ipollit

For drug companies, the stakes couldn't be higher. In a world where a blockbuster drug is one with $1 billion a year in sales, analysts give $5 billion as the low estimate for sales of an important obesity drug. If a company developed a truly safe, effective weight-loss drug and sold it for $3 a day to one-quarter of the 97 million American adults estimated to be overweight, sales would exceed $26 billion a year in this country alone.

zur Zeit gibt es nur zwei zugelassene Medikamente, die z.B. die Aufnahme von Fett vermindern. In den 90er-Jahren gab es u.a. das wirkungsvolles Medikament "FenPhen", dass als Blockbuster allerdings wegen schwerer Nebenwirkungen vom Markt genommen werden musste:

24.05.2006 21:47

Wyeth erhält FDA-Genehmigung für Fen-Phen-Fonds

Der amerikanische Pharmakonzern Wyeth (ISIN US9830241009 (Nachrichten/Aktienkurs)/ WKN 850229) hat am Mittwoch von der US-Gesundheitsbehörde FDA für die Ergänzung des Diätpräparate-Vergleichs die abschließende Zulassung erhalten.

Demnach wird Wyeth im Zusammenhang mit dem Diätpräparate-Mix "Fen-Phen" 1,275 Mrd. Dollar in einen neuen Fonds zahlen. Um Schadenzahlungen begleichen zu können wird der Konzern zunächst 400 Mio. Dollar einzahlen. Der Medikamente-Mix war 1997 aufgrund von Problemen mit Herzklappen vom Markt genommen worden.

FenPhen wirkt auf Serotonin Rezeptoren im Gehirn, die das Hungergefühl unterdrücken können. Allerdings nicht selektiv genug, so dass ähnliche Rezeptoren u.a. im Herz auch aktiviert werden, was wahrscheinlich zu den schweren Nebenwirkungen führt.

Lorcaserin (APD356) unterdrückt als praktisch selektive Variante von FenPhen über den 5-HT2C Serotonin Rezeptor das Hungergefühl. Da Lorca aber nur diese aktivieren soll, sind theoretisch die Nebenwirkungen nicht zu erwarten. Eine Wirksamkeit als Variante von FenPhen ist sehr wahrscheinlich, was in der PII bereits gezeigt werden konnte. Das Problem stellen die Nebenwirkungen dar, die bei FenPhen aufgetreten sind. Ich denke, dass dieses Risiko bis jetzt die großen Pharmas abgeschreckt hat. In der PII konnten keine Cardio-Probleme festgestellt werden, so dass die FDA die Durchführung der PIII genehmigt hat. Sollten auch hier bei 6000 Patienten die Nebenwirkungen nicht auftreten, so werden sich wohl alle um Lorca reißen. Nächstes Jahr gibt es eine erste Sicherheits-Analyse von 3000 Patienten, dann wird man vielleicht mehr wissen.

Obesity afflicts a large and increasing proportion of the population. More than 30 percent of Americans are obese, a figure that has risen sharply over the past decade, according to the Centers for Disease Control and Prevention. Substantial health risks are associated with overweight and obesity, leading to increased morbidity and mortality. Obesity is a leading cause of diabetes and accounts for more than 2.6 million deaths annually worldwide. The U.S. Surgeon General has estimated the direct and indirect economic costs of obesity at $117 billion per year. There are only two approved drugs to treat the condition. Concerns about side effects and efficacy have limited the use of these drugs, presenting an opportunity to help millions of patients with a new, safe and effective therapy.

mfg ipollit

Antwort auf Beitrag Nr.: 24.479.657 von ipollit am 07.10.06 22:28:05ARNA :2Q Update-Details On Lorcaserin Phase III Design

2006-07-26 06:11 (New York)

Piper Jaffray & Co. Company Note

(ARNA - $10.52)

Outperform Volatility: Medium

2Q Update-Details On Lorcaserin Phase III Design

Thomas Wei, Senior Research Analyst Reason for Report:

212 284-9305, thomas.a.wei@pjc.com

Gur A. Roshwalb, M.D., Research Analyst

212-284-9314, gur.a.roshwalb@pjc.com

KEY POINTS:

Larger Phase III Trials For Lorcaserin But No Change To Timeline.

* Details On Lorcaserin Phase III Trial Design. ARNA provided an update on the

expected Phase III trial design for lorcaserin for obesity. As a reminder,

lorcaserin is a 5-HT2c agonist, similar in target but more selective than

fenfluramine, a popular diet drug which was withdrawn from the market for

causing valvular defects. ARNA disclosed that it expects the lorcaserin

Phase III program to be at the high end of its original guidance, involving

6,000 patients in three separate trials and expected to cost $125 million

over 2-3 years. Given the company's agreement with the FDA on key safety and

valvulopathy endpoints, and as such, ARNA did not see the need for a Special

Protocol Assessment (SPA). While the program size and cost is higher than

our original expectations, we are encouraged that there is no change to the

timeline for a 2009 filing, and we believe that the size is unlikely to

deter potential pharmaceutical partners for lorcaserin. We also believe that

the larger number of patients may help mitigate the potential event rate

risk stemming from the lack of data available to estimate the expected

background rate of valvulopathy in the control arm, and should provide the

appropriate statistical power to eliminate even a very small cardiac safety

risk with the drug and to convince physicians of its safety profile.

* Phase III Program To Assess Echocardiograms In 3,000 Patient Trial Over Two

Years. The initial Phase III trial will assess 10 mg of lorcaserin taken

twice daily vs. placebo in 3,000 obese patients. Echocardiograms will be

done at baseline and at 6, 12, 18, and 24 months. Echocardiograms will be

reviewed centrally and a Data Safety Monitoring Board (DSMB) will provide an

interim safety analysis of the echos at 6 and 12 months. The first DSMB

review will likely occur in mid-2007. Given the data for fenfluramine

showing separation in valvulopathy rates at month six, we believe that this

first interim analysis will be an important risk reduction event for the

drug. Assuming a positive safety outcome at the 6-month DSMB analysis, ARNA

will initiate two additional 1,500 patient trials, including one in

diabetes, testing 10 mg taken once or twice daily vs. placebo.

* Changes To Estimates. We have adjusted our model to account for updated

guidance and the size of the expected Phase III program. Our new model also

conservatively assumes that a pharma partnership for lorcaserin is signed in

2H07 following the first DSMB analysis. We are revising our EPS estimates

from ($1.91) to ($2.04) in 2006 and from ($0.02) to ($1.37) in 2007. We are

also adjusting our price target methodology for our coverage universe for

one-half fewer discount periods. Our price target remains unchanged at $20

based on a 35x 2013E EPS, discounted at 30% for 5.5 periods.

INVESTMENT RECOMMENDATION:

We are encouraged about the prospects for lorcaserin for obesity and the

company's platform technology for generating new drug candidates.

RISKS TO ACHIEVEMENT OF TARGET PRICE:

Risks include but are not limited to: (1) setbacks in lorcaserin partnership

discussions; and (2) cardiac safety concerns with lorcaserin.

COMPANY DESCRIPTION:

Arena is a leader in developing drugs to target GPCRs.

mfg ipollit

2006-07-26 06:11 (New York)

Piper Jaffray & Co. Company Note

(ARNA - $10.52)

Outperform Volatility: Medium

2Q Update-Details On Lorcaserin Phase III Design

Thomas Wei, Senior Research Analyst Reason for Report:

212 284-9305, thomas.a.wei@pjc.com

Gur A. Roshwalb, M.D., Research Analyst

212-284-9314, gur.a.roshwalb@pjc.com

KEY POINTS:

Larger Phase III Trials For Lorcaserin But No Change To Timeline.

* Details On Lorcaserin Phase III Trial Design. ARNA provided an update on the

expected Phase III trial design for lorcaserin for obesity. As a reminder,

lorcaserin is a 5-HT2c agonist, similar in target but more selective than

fenfluramine, a popular diet drug which was withdrawn from the market for

causing valvular defects. ARNA disclosed that it expects the lorcaserin

Phase III program to be at the high end of its original guidance, involving

6,000 patients in three separate trials and expected to cost $125 million

over 2-3 years. Given the company's agreement with the FDA on key safety and

valvulopathy endpoints, and as such, ARNA did not see the need for a Special

Protocol Assessment (SPA). While the program size and cost is higher than

our original expectations, we are encouraged that there is no change to the

timeline for a 2009 filing, and we believe that the size is unlikely to

deter potential pharmaceutical partners for lorcaserin. We also believe that

the larger number of patients may help mitigate the potential event rate

risk stemming from the lack of data available to estimate the expected

background rate of valvulopathy in the control arm, and should provide the

appropriate statistical power to eliminate even a very small cardiac safety

risk with the drug and to convince physicians of its safety profile.

* Phase III Program To Assess Echocardiograms In 3,000 Patient Trial Over Two

Years. The initial Phase III trial will assess 10 mg of lorcaserin taken

twice daily vs. placebo in 3,000 obese patients. Echocardiograms will be

done at baseline and at 6, 12, 18, and 24 months. Echocardiograms will be

reviewed centrally and a Data Safety Monitoring Board (DSMB) will provide an

interim safety analysis of the echos at 6 and 12 months. The first DSMB

review will likely occur in mid-2007. Given the data for fenfluramine

showing separation in valvulopathy rates at month six, we believe that this

first interim analysis will be an important risk reduction event for the

drug. Assuming a positive safety outcome at the 6-month DSMB analysis, ARNA

will initiate two additional 1,500 patient trials, including one in

diabetes, testing 10 mg taken once or twice daily vs. placebo.

* Changes To Estimates. We have adjusted our model to account for updated

guidance and the size of the expected Phase III program. Our new model also

conservatively assumes that a pharma partnership for lorcaserin is signed in

2H07 following the first DSMB analysis. We are revising our EPS estimates

from ($1.91) to ($2.04) in 2006 and from ($0.02) to ($1.37) in 2007. We are

also adjusting our price target methodology for our coverage universe for

one-half fewer discount periods. Our price target remains unchanged at $20

based on a 35x 2013E EPS, discounted at 30% for 5.5 periods.

INVESTMENT RECOMMENDATION:

We are encouraged about the prospects for lorcaserin for obesity and the

company's platform technology for generating new drug candidates.

RISKS TO ACHIEVEMENT OF TARGET PRICE:

Risks include but are not limited to: (1) setbacks in lorcaserin partnership

discussions; and (2) cardiac safety concerns with lorcaserin.

COMPANY DESCRIPTION:

Arena is a leader in developing drugs to target GPCRs.

mfg ipollit

und was macht die Konkurrenz?

z.B. die Wunderpille "Acomplia", der potentielle Multi-Mrd-Blockbuster

********

Neuartige Abspeckpille auf dem Markt

Der Arzneimittelkonzern Lilly hat gleich fünf Mittel in der Pipeline, und seit drei Wochen ist die erste biologische Abspeckpille auf dem deutschen Markt. Acomplia von Sanofi-Aventis könnte ein Blockbuster werden. Der Analyst Gbola Amusa von Sanford C Bernstein geht von einem Umsatz im Jahr 2010 von 3,9 Milliarden Euro aus – und nennt diese Prognose „konservativ“.

Die neuen Abspeckpillen wirken – anders als bisherige Produkte – dort, wo Schwarz die Regulation des Hungergefühl lokalisiert: Im Gehirn. Acomplia greift am so genannten Endocannabinoid-System. Es bedient sich Substanzen, die ähnlich wirken wie Cannabis. Sie machen Lust auf Naschereien und steigern die Geschmackssinne. Acomplia blockiert die Rezeptoren, an denen die Endocannabinoide andocken – und drosselt so den Appetit.

*******

Acomplia – Wunderpille bekämpft Fettsucht

von Prof. Oliver Reiser

Fett- und Nikotinsucht ade. Ein neues Arzneimittel, das nach einem revolutionären Mechanismus wirkt, könnte schon bald in Deutschland zugelassen werden.

Übergewicht ist eines der größten Probleme in der westlichen Welt. Etwa die Hälfte der erwachsenen Bevölkerung ab 18 Jahren in Deutschland hat Übergewicht, und trotz Diät und Sport scheint der Kampf gegen die Pfunde oftmals aussichtslos.

Immer wieder tauchen daher neue Diäten und Wunderpillen auf, die in kürzester Zeit ein dramatisches Abspecken versprechen. Doch ist der Erfolg meistens nur von kurzer Dauer, und der Jo Jo Effekt bringt oftmals mehr Pfunde wieder zurück als vor der Diät vorhanden waren.

Essen macht glücklich!

Erfolgreich sind langfristig nur zwei Maßnahmen: Eine Umstellung auf eine Kalorien bewusste Ernährung und ausreichend Bewegung. Leichter gesagt als getan: Denn die Lust gerade auf die zuckerhaltigen Kalorienbömbchen ist in der Regel nicht auf Bedarf an Nahrung zurückzuführen, sondern darauf, dass bei deren Genuss ins Gehirn Stoffe gelangen, die an Rezeptoren im so genannten „Wohlfühlzentrum“ binden und letztere so aktivieren. Das hierdurch ausgelöste Wohlbefinden wird mit Essen assoziiert, und das Gehirn verlangt durch Auslösen von Appetit in der Folge immer wieder nach der Nahrung, die dieses Wohlbefinden auslösen konnte. Es kommt zu einem Suchtverhalten, und ganz analog wird auf diesem Wege auch das Verlangen nach Nikotin oder Alkohol erzeugt.

Coca Cola light macht nicht glücklich!

Wer zur Kalorienreduktion seine Trinkgewohnheiten von zuckerhaltiger auf süßstoffhaltige Limonade umgestellt, kennt vielleicht diesen Effekt: Zunächst lässt sich das Gehirn austricksen und nimmt etwa Coca Cola light, die ja auch süß schmeckt, als Ersatz für Coca Cola an. Doch schon nach kurzer Zeit unterscheidet das Gehirn, trotz gleichen Geschmacks, zwischen Coca Cola und Coca Cola light, da das süßstoffhaltige Getränk die Wohlfühlrezeptoren im Gehirn nicht stimulieren kann.

Acomplia – ein Arzneimittel wirkt auf das Wohlfühlzentrum

Das von der Firma Sanofi-Aventis sich gegenwärtig in weit fortgeschrittener Evaluierung, in so genannter klinischer Phase III befindliche Medikament Acomplia (Wirkstoff Rimonabant) könnte in revolutionärer Weise unser Suchtverhalten – Essen, Nikotin und eventuell auch Alkohol – positiv beeinflussen. Acomplia wirkt als so genannter Antagonist am Wohlfühlzentrum im Gehirn, das heißt es blockiert die Rezeptoren, ohne sie dabei zu aktivieren und damit deren Funktion, in diesem Fall Wohlfühlen gekoppelt mit Appetit, auszulösen. Nimmt man also dieses Medikament ein, stellt sich bei anschließender Nahrungsaufnahme oder auch beim Rauchen der befriedigende Effekt, aber dadurch auch das Auslösen von Appetit nach weiterer Nahrung oder Nikotin, nicht mehr ein.

Klinische Studie in Europa, USA und Canada vielversprechend

Kürzliche Studien in Europa und Nordamerika, die je 3000 übergewichtige Probanden und einen Zeitraum von zwei Jahren umfassten, zeigen eindrucksvolle Ergebnisse: Bei fast zwei Dritteln der Testpersonen, die eine Dosis von 20 mg Acomplia pro Tag erhielten, wurde eine Gewichtsreduktion von fünf Prozent des Körpergewichts festgestellt. Nur ein Drittel der Testpersonen, die ein Placebo oder eine Dosis von nur 5 mg Acomplia erhielten, erzielten ein vergleichbares Ergebnis. Auch der Cholesterinspiegel wurde durch Acomplia positiv reguliert: Während das „gute“ HDL Cholesterin im Schnitt um 25 Prozent durch die höhere Dosis bedingt anstieg, fielen gleichermaßen die Werte für das „schlechte“ LDL Cholesterin. Alle Testpersonen erhielten zu Beginn der Studie eine Ernährungsberatung und die Empfehlung, 600 Kalorien pro Tag in ihrer Nahrung einzusparen. Keiner der Testpersonen wusste jedoch ob und welche Dosis Acomplia sie erhielt.

Keine bedenklichen Nebenwirkungen

Ein besonders wichtiges Ergebnis der Studie war die gute Verträglichkeit des neuen Medikaments. Einige Testpersonen klagten kurzzeitig über Übelkeit, doch in keinem bedenklichen Ausmaß. Depressionen und Angstzustände waren nicht stärker ausgeprägt als in den Kontrollgruppen.

Bislang mussten immer wieder gewichtsreduzierende Arzneimittel aufgrund von ernsten Nebenwirkungen für vom Markt genommen werden. Nur zwei Medikamente sind gegenwärtig zur langfristigen Behandlung von Fettsucht zugelassen, der Lipase Inhibitor Orlistat und Sibutramin, die aber beide nicht unproblematisch aufgrund ihres Nebenwirkungprofil sind.

Der neue Wirkmechanismus durch Blockierung der Suchtrezeptoren von Acomplia könnte in der Tat die Problematik herkömmlicher Medikamente auf Herz und Kreislauf umgehen. Die durch Acomplia bewirkte Umstellung der Essgewohnheiten ist darüber hinaus ein innovativer Weg, nachhaltig und langfristig Übergewicht zu bekämpfen.

Sollten die klinischen Studien weiterhin gute Ergebnisse zeigen, könnte bereits 2006/2007 Acomplia auf den deutschen Markt kommen. Eine Einführung in USA war für die erste Jahreshälfte 2006 geplant. Mit einer Entscheidung der Food and Drug Administration (FDA, Zulassungsbehörde in USA) wird Anfang März, evtl. sogar schon Ende Januar 2006 gerechnet.

******

DECEMBER 27, 2004

EUROPEAN BUSINESS

Back to Main Story

The End Of Obesity As We Know It

Sanofi-Aventis' Acomplia promises that and more. But approval isn't a slam dunk

Ever wonder why marijuana smokers get the munchies? So did a team of scientists at Sanofi Recherche lab in Montpelier, France. Fifteen years ago they began investigating marijuana's effects on the brain, including the well-known fact that cannabis makes users hungry. "We set out to try and create an anti-marijuana," a drug that could suppress appetite by blocking the same switch in the brain activated by cannabis, says Gérard Le Fur, senior executive vice-president and board member at newly merged French pharmaceutical giant Sanofi-Aventis (SNY ).

They succeeded beyond their wildest dreams, discovering a medicine that not only helps people lose weight but also shrinks abdominal fat, helps people stop smoking, improves cholesterol levels, and helps patients better regulate blood sugar.

Talk about a potential blockbuster. Initially, though, Sanofi will take it slow. It will seek approval of the drug, Acomplia, in Europe and the U.S. by the second quarter of 2005 as a treatment for just two of the conditions: obesity and tobacco addiction. Because patients in Acomplia trials regained weight after stopping treatment, the company hopes regulators will approve it for long-term use.

Researchers say side effects such as nausea and depression are relatively minor and short-lived. But as the first in an entirely new class of drugs that affect a pleasure center in the brain, even the slightest hint of psychiatric side effects may lead regulators to demand more long-term safety data, potentially delaying Acomplia's launch beyond 2006 as planned. Still, Sanofi-Aventis is confident that the drug's impressive efficacy will assuage any such worries. "It's a product that takes aim at two of the great maladies of the century," says Sanofi-Aventis CEO Jean-François Dehecq.

DEPRESSION QUESTION

Acomplia is the first in a new class of compounds under development to block receptors found in the brain and in fat tissue known as cannabinoid type 1 (CB1). These receptors control hunger and tobacco addiction. Chronic overeating and smoking sends them into overdrive. Blocking the CB1 receptors dramatically reduces such cravings. Results of a two-year clinical trial in the U.S. showed patients given Acomplia lost an average of 19 pounds, compared with five pounds for patients given a placebo. Those on Acomplia also reported higher levels of HDL, the good cholesterol, lower levels of triglycerides, and improved sensitivity to insulin. All are important in keeping heart disease at bay. "This could be a paradigm-shifting drug," says Dr. Louis J. Aronne, president of the North American Society for the Study of Obesity.

The market potential is huge. More than a third of Americans are clinically obese, or 30% above their ideal body weight. And it's not just an American phenomenon. Dr. Gbola Amusa, senior research analyst for Sanford C. Bernstein & Co. in London, estimates that as much as 10% of health-care costs in other industrialized countries are related to being overweight. The two leading obesity drugs, Xenical and Meridia, have unpleasant side effects such as diarrhea or high blood pressure, so analysts think Acomplia will quickly win market share if approved. Amusa estimates sales will reach $5.6 billion a year by the end of the decade.

Accomplia's real potential may go well beyond eating and smoking. The company hopes it will also become the first drug approved for the treatment of metabolic syndrome, a combination of abdominal fat, high blood pressure, high blood-fat levels, low levels of HDL cholesterol, and high blood-sugar levels, all of which contribute to cardiovascular disease. "This is not just a diet drug but a significant advancement in cardiovascular treatment," says Amusa.

Still, there is reason for caution. There was a noticeable rate of withdrawal in Acomplia's clinical trials due to depression. Researchers involved in the trials say that might be because people taking the drug went in with unrealistic weight-loss expectations or were more susceptible to depression to begin with.

Either way, there are no long-term studies yet of the effects of interfering with this part of the brain. And given the increased regulatory scrutiny on new drugs after the Vioxx and antidepressant controversies, the company may find it needs to submit more data than anticipated to secure approval. Is Acomplia too good to be true? "There has never been a diet drug approved that has had more benefits than risks," says Dr. Larry D. Sasich of Public Citizen's health research group in Washington. Dehecq and Le Fur are determined to prove doubters like him wrong.

************

ROCKVILLE, Md., Feb. 17 - The FDA issued an approvable letter on weight management today for Acomplia (rimonabant), spelling out the steps Sanofi-aventis needs to take to win final approval for its much-heralded diet drug.

Neither the company nor the FDA revealed the specifics of the letter.

In a press release issued in Paris, the company said "Sanofi-aventis will continue to work in close collaboration with the FDA."

Sanofi-aventis also said the FDA issued a non-approvable letter for the indication of smoking cessation for Acomplia.

*******

However, Aitken highlights the potential of several new medicines launched in the past year, including diabetes treatment Byetta, co-marketed by Eli Lilly and Amylin Pharmaceuticals, and Lunesta, an insomnia drug made by Sepracor. And there are more on the way that he says are worth watching. The two key drug launches this year are of Sutent, Pfizer's first big entry into cancer drugs, and Acomplia, the anti-obesity pill being developed by Sanofi-Aventis.

Sutent is already on the market, although sales data are not yet available. Acomplia has been delayed at the U.S. Food and Drug Administration and rejected as a stop-smoking drug. Some cardiologists, who are excited about the drug because of its potential to reduce the risk of heart disease, are also worried about side effects.

Acomplia works by blocking the same brain receptor that makes pot smokers hungry; psychiatric symptoms like anxiety are one of the most common reasons patients stopped taking Acomplia in clinical trials. "It's a pill that blocks the 'happy receptor,' " says Prediman K. Shah of Cedars Sinai Medical Center. "The main reason for concern is that it might have an adverse impact on depression or suicide." He is nonetheless very excited about the pill.

************

The Inscrutable French

Posted by Derek

Since I was asking the same musical question just the other day, I wanted to refer people to this article by Matthew Herper over at Forbes, who also wants to know: where is Acomplia/rimonabant, anyway?

It's amazed me for months now that Sanofi-Aventis can get away with saying nothing at all about the prospects for their potential biggest-selling drug ever. Back when the first FDA action came, I predicted, with miserable inaccuracy, that the company would have something to say within days. It's been months, and no one knows anything more than we did back in February.

As the Forbes piece makes clear, analysts and institutional investors seem to be losing patience. I'm not sure what it is about the Sanofi corporate culture that makes this strategy seem like a good idea, but they might want to reexamine it. What might appear like calm and steadfast behavior from their perspective is starting to look, from the outside, like the actions of a company with something to hide. This is America, guys. We talk about things over here; you can't shut us up. Join the party.

*******

praveen, The issue with rimonabant, I believe, is a mechanism-based increase in depressive symptoms. Consider that smoking marijuana containing THC (a mixed CB1, CB2 agonist) induces euphoria and hunger. The CB1 antagonist rimonabant decreases hunger but apparently also causes the opposite of euphoria, or depression. In the RIO trials of rimonabant in Europe and North America, both showed a dose-dependent increase in depressive symptoms. If rimonabant were used widely, it's not clear at this point whether the net effects; the decrease in morbidity and mortality due to weight loss, less the increase in morbiditiy and mortality due to depression, would be positive. How this will be handled by the FDA is entirely unclear at this point. The risk of depression was predictable from the mechanism and SNY should have addressed it earlier.

Of course, lorcaserin has a completely different mechanism of action and we know this isn't going to happen to ARNA. I remain upbeat about ARNA.

mfg ipollit

z.B. die Wunderpille "Acomplia", der potentielle Multi-Mrd-Blockbuster

********

Neuartige Abspeckpille auf dem Markt

Der Arzneimittelkonzern Lilly hat gleich fünf Mittel in der Pipeline, und seit drei Wochen ist die erste biologische Abspeckpille auf dem deutschen Markt. Acomplia von Sanofi-Aventis könnte ein Blockbuster werden. Der Analyst Gbola Amusa von Sanford C Bernstein geht von einem Umsatz im Jahr 2010 von 3,9 Milliarden Euro aus – und nennt diese Prognose „konservativ“.

Die neuen Abspeckpillen wirken – anders als bisherige Produkte – dort, wo Schwarz die Regulation des Hungergefühl lokalisiert: Im Gehirn. Acomplia greift am so genannten Endocannabinoid-System. Es bedient sich Substanzen, die ähnlich wirken wie Cannabis. Sie machen Lust auf Naschereien und steigern die Geschmackssinne. Acomplia blockiert die Rezeptoren, an denen die Endocannabinoide andocken – und drosselt so den Appetit.

*******

Acomplia – Wunderpille bekämpft Fettsucht

von Prof. Oliver Reiser

Fett- und Nikotinsucht ade. Ein neues Arzneimittel, das nach einem revolutionären Mechanismus wirkt, könnte schon bald in Deutschland zugelassen werden.

Übergewicht ist eines der größten Probleme in der westlichen Welt. Etwa die Hälfte der erwachsenen Bevölkerung ab 18 Jahren in Deutschland hat Übergewicht, und trotz Diät und Sport scheint der Kampf gegen die Pfunde oftmals aussichtslos.

Immer wieder tauchen daher neue Diäten und Wunderpillen auf, die in kürzester Zeit ein dramatisches Abspecken versprechen. Doch ist der Erfolg meistens nur von kurzer Dauer, und der Jo Jo Effekt bringt oftmals mehr Pfunde wieder zurück als vor der Diät vorhanden waren.

Essen macht glücklich!

Erfolgreich sind langfristig nur zwei Maßnahmen: Eine Umstellung auf eine Kalorien bewusste Ernährung und ausreichend Bewegung. Leichter gesagt als getan: Denn die Lust gerade auf die zuckerhaltigen Kalorienbömbchen ist in der Regel nicht auf Bedarf an Nahrung zurückzuführen, sondern darauf, dass bei deren Genuss ins Gehirn Stoffe gelangen, die an Rezeptoren im so genannten „Wohlfühlzentrum“ binden und letztere so aktivieren. Das hierdurch ausgelöste Wohlbefinden wird mit Essen assoziiert, und das Gehirn verlangt durch Auslösen von Appetit in der Folge immer wieder nach der Nahrung, die dieses Wohlbefinden auslösen konnte. Es kommt zu einem Suchtverhalten, und ganz analog wird auf diesem Wege auch das Verlangen nach Nikotin oder Alkohol erzeugt.

Coca Cola light macht nicht glücklich!

Wer zur Kalorienreduktion seine Trinkgewohnheiten von zuckerhaltiger auf süßstoffhaltige Limonade umgestellt, kennt vielleicht diesen Effekt: Zunächst lässt sich das Gehirn austricksen und nimmt etwa Coca Cola light, die ja auch süß schmeckt, als Ersatz für Coca Cola an. Doch schon nach kurzer Zeit unterscheidet das Gehirn, trotz gleichen Geschmacks, zwischen Coca Cola und Coca Cola light, da das süßstoffhaltige Getränk die Wohlfühlrezeptoren im Gehirn nicht stimulieren kann.

Acomplia – ein Arzneimittel wirkt auf das Wohlfühlzentrum

Das von der Firma Sanofi-Aventis sich gegenwärtig in weit fortgeschrittener Evaluierung, in so genannter klinischer Phase III befindliche Medikament Acomplia (Wirkstoff Rimonabant) könnte in revolutionärer Weise unser Suchtverhalten – Essen, Nikotin und eventuell auch Alkohol – positiv beeinflussen. Acomplia wirkt als so genannter Antagonist am Wohlfühlzentrum im Gehirn, das heißt es blockiert die Rezeptoren, ohne sie dabei zu aktivieren und damit deren Funktion, in diesem Fall Wohlfühlen gekoppelt mit Appetit, auszulösen. Nimmt man also dieses Medikament ein, stellt sich bei anschließender Nahrungsaufnahme oder auch beim Rauchen der befriedigende Effekt, aber dadurch auch das Auslösen von Appetit nach weiterer Nahrung oder Nikotin, nicht mehr ein.

Klinische Studie in Europa, USA und Canada vielversprechend

Kürzliche Studien in Europa und Nordamerika, die je 3000 übergewichtige Probanden und einen Zeitraum von zwei Jahren umfassten, zeigen eindrucksvolle Ergebnisse: Bei fast zwei Dritteln der Testpersonen, die eine Dosis von 20 mg Acomplia pro Tag erhielten, wurde eine Gewichtsreduktion von fünf Prozent des Körpergewichts festgestellt. Nur ein Drittel der Testpersonen, die ein Placebo oder eine Dosis von nur 5 mg Acomplia erhielten, erzielten ein vergleichbares Ergebnis. Auch der Cholesterinspiegel wurde durch Acomplia positiv reguliert: Während das „gute“ HDL Cholesterin im Schnitt um 25 Prozent durch die höhere Dosis bedingt anstieg, fielen gleichermaßen die Werte für das „schlechte“ LDL Cholesterin. Alle Testpersonen erhielten zu Beginn der Studie eine Ernährungsberatung und die Empfehlung, 600 Kalorien pro Tag in ihrer Nahrung einzusparen. Keiner der Testpersonen wusste jedoch ob und welche Dosis Acomplia sie erhielt.

Keine bedenklichen Nebenwirkungen

Ein besonders wichtiges Ergebnis der Studie war die gute Verträglichkeit des neuen Medikaments. Einige Testpersonen klagten kurzzeitig über Übelkeit, doch in keinem bedenklichen Ausmaß. Depressionen und Angstzustände waren nicht stärker ausgeprägt als in den Kontrollgruppen.

Bislang mussten immer wieder gewichtsreduzierende Arzneimittel aufgrund von ernsten Nebenwirkungen für vom Markt genommen werden. Nur zwei Medikamente sind gegenwärtig zur langfristigen Behandlung von Fettsucht zugelassen, der Lipase Inhibitor Orlistat und Sibutramin, die aber beide nicht unproblematisch aufgrund ihres Nebenwirkungprofil sind.

Der neue Wirkmechanismus durch Blockierung der Suchtrezeptoren von Acomplia könnte in der Tat die Problematik herkömmlicher Medikamente auf Herz und Kreislauf umgehen. Die durch Acomplia bewirkte Umstellung der Essgewohnheiten ist darüber hinaus ein innovativer Weg, nachhaltig und langfristig Übergewicht zu bekämpfen.

Sollten die klinischen Studien weiterhin gute Ergebnisse zeigen, könnte bereits 2006/2007 Acomplia auf den deutschen Markt kommen. Eine Einführung in USA war für die erste Jahreshälfte 2006 geplant. Mit einer Entscheidung der Food and Drug Administration (FDA, Zulassungsbehörde in USA) wird Anfang März, evtl. sogar schon Ende Januar 2006 gerechnet.

******

DECEMBER 27, 2004

EUROPEAN BUSINESS

Back to Main Story

The End Of Obesity As We Know It

Sanofi-Aventis' Acomplia promises that and more. But approval isn't a slam dunk

Ever wonder why marijuana smokers get the munchies? So did a team of scientists at Sanofi Recherche lab in Montpelier, France. Fifteen years ago they began investigating marijuana's effects on the brain, including the well-known fact that cannabis makes users hungry. "We set out to try and create an anti-marijuana," a drug that could suppress appetite by blocking the same switch in the brain activated by cannabis, says Gérard Le Fur, senior executive vice-president and board member at newly merged French pharmaceutical giant Sanofi-Aventis (SNY ).

They succeeded beyond their wildest dreams, discovering a medicine that not only helps people lose weight but also shrinks abdominal fat, helps people stop smoking, improves cholesterol levels, and helps patients better regulate blood sugar.

Talk about a potential blockbuster. Initially, though, Sanofi will take it slow. It will seek approval of the drug, Acomplia, in Europe and the U.S. by the second quarter of 2005 as a treatment for just two of the conditions: obesity and tobacco addiction. Because patients in Acomplia trials regained weight after stopping treatment, the company hopes regulators will approve it for long-term use.

Researchers say side effects such as nausea and depression are relatively minor and short-lived. But as the first in an entirely new class of drugs that affect a pleasure center in the brain, even the slightest hint of psychiatric side effects may lead regulators to demand more long-term safety data, potentially delaying Acomplia's launch beyond 2006 as planned. Still, Sanofi-Aventis is confident that the drug's impressive efficacy will assuage any such worries. "It's a product that takes aim at two of the great maladies of the century," says Sanofi-Aventis CEO Jean-François Dehecq.

DEPRESSION QUESTION

Acomplia is the first in a new class of compounds under development to block receptors found in the brain and in fat tissue known as cannabinoid type 1 (CB1). These receptors control hunger and tobacco addiction. Chronic overeating and smoking sends them into overdrive. Blocking the CB1 receptors dramatically reduces such cravings. Results of a two-year clinical trial in the U.S. showed patients given Acomplia lost an average of 19 pounds, compared with five pounds for patients given a placebo. Those on Acomplia also reported higher levels of HDL, the good cholesterol, lower levels of triglycerides, and improved sensitivity to insulin. All are important in keeping heart disease at bay. "This could be a paradigm-shifting drug," says Dr. Louis J. Aronne, president of the North American Society for the Study of Obesity.

The market potential is huge. More than a third of Americans are clinically obese, or 30% above their ideal body weight. And it's not just an American phenomenon. Dr. Gbola Amusa, senior research analyst for Sanford C. Bernstein & Co. in London, estimates that as much as 10% of health-care costs in other industrialized countries are related to being overweight. The two leading obesity drugs, Xenical and Meridia, have unpleasant side effects such as diarrhea or high blood pressure, so analysts think Acomplia will quickly win market share if approved. Amusa estimates sales will reach $5.6 billion a year by the end of the decade.

Accomplia's real potential may go well beyond eating and smoking. The company hopes it will also become the first drug approved for the treatment of metabolic syndrome, a combination of abdominal fat, high blood pressure, high blood-fat levels, low levels of HDL cholesterol, and high blood-sugar levels, all of which contribute to cardiovascular disease. "This is not just a diet drug but a significant advancement in cardiovascular treatment," says Amusa.

Still, there is reason for caution. There was a noticeable rate of withdrawal in Acomplia's clinical trials due to depression. Researchers involved in the trials say that might be because people taking the drug went in with unrealistic weight-loss expectations or were more susceptible to depression to begin with.

Either way, there are no long-term studies yet of the effects of interfering with this part of the brain. And given the increased regulatory scrutiny on new drugs after the Vioxx and antidepressant controversies, the company may find it needs to submit more data than anticipated to secure approval. Is Acomplia too good to be true? "There has never been a diet drug approved that has had more benefits than risks," says Dr. Larry D. Sasich of Public Citizen's health research group in Washington. Dehecq and Le Fur are determined to prove doubters like him wrong.

************

ROCKVILLE, Md., Feb. 17 - The FDA issued an approvable letter on weight management today for Acomplia (rimonabant), spelling out the steps Sanofi-aventis needs to take to win final approval for its much-heralded diet drug.

Neither the company nor the FDA revealed the specifics of the letter.

In a press release issued in Paris, the company said "Sanofi-aventis will continue to work in close collaboration with the FDA."

Sanofi-aventis also said the FDA issued a non-approvable letter for the indication of smoking cessation for Acomplia.

*******

However, Aitken highlights the potential of several new medicines launched in the past year, including diabetes treatment Byetta, co-marketed by Eli Lilly and Amylin Pharmaceuticals, and Lunesta, an insomnia drug made by Sepracor. And there are more on the way that he says are worth watching. The two key drug launches this year are of Sutent, Pfizer's first big entry into cancer drugs, and Acomplia, the anti-obesity pill being developed by Sanofi-Aventis.

Sutent is already on the market, although sales data are not yet available. Acomplia has been delayed at the U.S. Food and Drug Administration and rejected as a stop-smoking drug. Some cardiologists, who are excited about the drug because of its potential to reduce the risk of heart disease, are also worried about side effects.

Acomplia works by blocking the same brain receptor that makes pot smokers hungry; psychiatric symptoms like anxiety are one of the most common reasons patients stopped taking Acomplia in clinical trials. "It's a pill that blocks the 'happy receptor,' " says Prediman K. Shah of Cedars Sinai Medical Center. "The main reason for concern is that it might have an adverse impact on depression or suicide." He is nonetheless very excited about the pill.

************

The Inscrutable French

Posted by Derek

Since I was asking the same musical question just the other day, I wanted to refer people to this article by Matthew Herper over at Forbes, who also wants to know: where is Acomplia/rimonabant, anyway?

It's amazed me for months now that Sanofi-Aventis can get away with saying nothing at all about the prospects for their potential biggest-selling drug ever. Back when the first FDA action came, I predicted, with miserable inaccuracy, that the company would have something to say within days. It's been months, and no one knows anything more than we did back in February.

As the Forbes piece makes clear, analysts and institutional investors seem to be losing patience. I'm not sure what it is about the Sanofi corporate culture that makes this strategy seem like a good idea, but they might want to reexamine it. What might appear like calm and steadfast behavior from their perspective is starting to look, from the outside, like the actions of a company with something to hide. This is America, guys. We talk about things over here; you can't shut us up. Join the party.

*******

praveen, The issue with rimonabant, I believe, is a mechanism-based increase in depressive symptoms. Consider that smoking marijuana containing THC (a mixed CB1, CB2 agonist) induces euphoria and hunger. The CB1 antagonist rimonabant decreases hunger but apparently also causes the opposite of euphoria, or depression. In the RIO trials of rimonabant in Europe and North America, both showed a dose-dependent increase in depressive symptoms. If rimonabant were used widely, it's not clear at this point whether the net effects; the decrease in morbidity and mortality due to weight loss, less the increase in morbiditiy and mortality due to depression, would be positive. How this will be handled by the FDA is entirely unclear at this point. The risk of depression was predictable from the mechanism and SNY should have addressed it earlier.

Of course, lorcaserin has a completely different mechanism of action and we know this isn't going to happen to ARNA. I remain upbeat about ARNA.

mfg ipollit

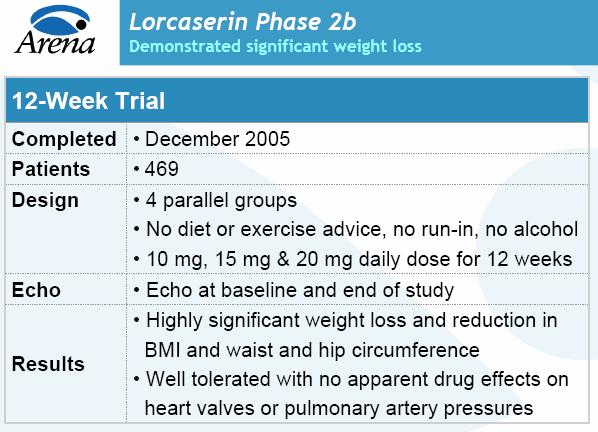

Tue Dec 13, 2005 05:29 PM ET

By Bill Berkrot

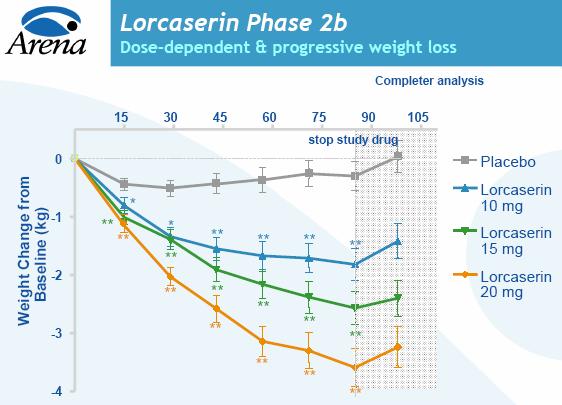

NEW YORK, Dec 13 (Reuters) - Arena Pharmaceuticals Inc. ( ARNA ) on Tuesday said its experimental obesity drug was effective in promoting weight loss after three months in a mid-stage clinical trial, pushing its shares up by 19 percent in after-hours trading.

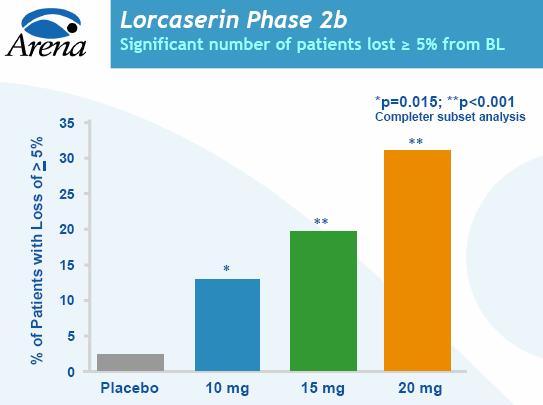

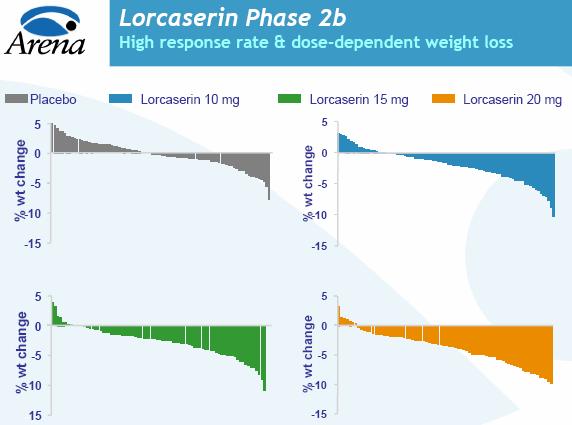

The effect of the drug, known as APD356, was highly statistically significant compared with a placebo, with patients taking the highest of three tested doses -- 20 milligrams a day -- losing almost 8 pounds (3.6 kg), or about 3.6 percent of total body weight.

Arena Chief Executive Jack Lief told Reuters the results were better than he anticipated and that the company plans to begin a series of pivotal late-stage clinical trials of the drug around the middle of 2006.

"I am one of the most bullish analysts on Arena, and their data surpassed even my expectations," said Adam Noah, an analyst with Merriman Curhan Ford, who predicted it could become a $1 billion a year drug.

The study did not include any diet or exercise programs, so presumably weight loss could have been even greater with those elements included.

"This trial demonstrated excellent weight loss, particularly considering there was no diet or exercise component in this trial, and the emerging safety and tolerability profile compares favorably with other weight loss drugs," Dr Steven Smith, the study's lead investigator, said in a statement.

It is expected that U.S. regulators will require a large 12-month efficacy study with a goal of 5 percent weight loss, and two years of safety data before considering approval.

If all goes well, Lief anticipates Arena will apply for approval with the U.S. Food and Drug Administration in 2009 with a 2010 launch, if approved for sale.

By that time, APD356 will likely be competing with Acomplia, Sanofi-Aventis's ( SNY ) highly anticipated weight loss drug, which is expected to win U.S. approval next year.

The 469-patient study tested the drug at 10 mg, 15 mg and 20 mg with the high dose group getting 10 mg twice a day. Patients weighed an average of 220 pounds (100 kg).

After 12 weeks, the 20 mg patients lost an average of 7.9 pounds, the 15 mg patients lost 5.7 pounds, or 2.6 percent of body weight, and the lowest dose group lost an average of 4 pounds, or 1.8 percent of body weight. All were considered statistically significant compared with the placebo group, which lost less than 1 pound.

Common side effects included headache, nausea and dizziness.

ADP356 works on certain serotonin receptors in the brain, which are believed to play a pivotal role in regulating food intake and metabolism. It is a similar mechanism to Wyeth's ( WYE ) notorious diet drug combination known as fen-phen, which was pulled from the market after it was found to cause serious heart valve damage.

Arena said its drug is many times more selective than was Wyeth's and appeared to have no effect on heart valves or pulmonary artery pressure.

Noah said the data and apparent safety should help Arena attract a partner to help market the medicine at very lucrative terms.

Arena shares rose to $13.60 in extended trading on the Inet electronic brokerage from their Nasdaq close at $11.41. They jumped more than 30 percent just after the data was released.

mfg ipollit

By Bill Berkrot

NEW YORK, Dec 13 (Reuters) - Arena Pharmaceuticals Inc. ( ARNA ) on Tuesday said its experimental obesity drug was effective in promoting weight loss after three months in a mid-stage clinical trial, pushing its shares up by 19 percent in after-hours trading.

The effect of the drug, known as APD356, was highly statistically significant compared with a placebo, with patients taking the highest of three tested doses -- 20 milligrams a day -- losing almost 8 pounds (3.6 kg), or about 3.6 percent of total body weight.

Arena Chief Executive Jack Lief told Reuters the results were better than he anticipated and that the company plans to begin a series of pivotal late-stage clinical trials of the drug around the middle of 2006.

"I am one of the most bullish analysts on Arena, and their data surpassed even my expectations," said Adam Noah, an analyst with Merriman Curhan Ford, who predicted it could become a $1 billion a year drug.

The study did not include any diet or exercise programs, so presumably weight loss could have been even greater with those elements included.

"This trial demonstrated excellent weight loss, particularly considering there was no diet or exercise component in this trial, and the emerging safety and tolerability profile compares favorably with other weight loss drugs," Dr Steven Smith, the study's lead investigator, said in a statement.

It is expected that U.S. regulators will require a large 12-month efficacy study with a goal of 5 percent weight loss, and two years of safety data before considering approval.

If all goes well, Lief anticipates Arena will apply for approval with the U.S. Food and Drug Administration in 2009 with a 2010 launch, if approved for sale.

By that time, APD356 will likely be competing with Acomplia, Sanofi-Aventis's ( SNY ) highly anticipated weight loss drug, which is expected to win U.S. approval next year.

The 469-patient study tested the drug at 10 mg, 15 mg and 20 mg with the high dose group getting 10 mg twice a day. Patients weighed an average of 220 pounds (100 kg).

After 12 weeks, the 20 mg patients lost an average of 7.9 pounds, the 15 mg patients lost 5.7 pounds, or 2.6 percent of body weight, and the lowest dose group lost an average of 4 pounds, or 1.8 percent of body weight. All were considered statistically significant compared with the placebo group, which lost less than 1 pound.

Common side effects included headache, nausea and dizziness.

ADP356 works on certain serotonin receptors in the brain, which are believed to play a pivotal role in regulating food intake and metabolism. It is a similar mechanism to Wyeth's ( WYE ) notorious diet drug combination known as fen-phen, which was pulled from the market after it was found to cause serious heart valve damage.

Arena said its drug is many times more selective than was Wyeth's and appeared to have no effect on heart valves or pulmonary artery pressure.

Noah said the data and apparent safety should help Arena attract a partner to help market the medicine at very lucrative terms.

Arena shares rose to $13.60 in extended trading on the Inet electronic brokerage from their Nasdaq close at $11.41. They jumped more than 30 percent just after the data was released.

mfg ipollit

A DIET PILL DEVELOPER'S market value plumped up nicely.

Shares of Arena Pharmaceuticals (ARNA: 12.22, -0.31, -2.5%) jumped 18% to $13.48 Wednesday after the drug maker's treatment for obesity showed promise in midstage trials. Participants on a higher-dose regimen lost nearly eight pounds apiece over three months.

"We believe Arena is developing a competitive anti-obesity compound, with 31% of patients losing more than 5% body weight at 12 weeks, without a diet or exercise program," wrote George Fulop, an analyst at New York investment bank Needham & Co. "Hence, we anticipate seeing additional efficacy in future trials." (Needham & Co. has an investment-banking relationship with the company.)

During the Phase II clinical trial, subjects received APD356, Arena's experimental oral obesity treatment, for 12 weeks. Patients taking a 10 milligram dose of the drug experienced an average weight loss of 4.0 pounds, compared with 0.7 pounds in the placebo group. Patients taking the 15 mg and 20 mg doses lost 5.7 pounds and 7.9 pounds, respectively. All are considered statistically significant losses, according to the company.

The trial enrolled 469 male and female patients with an average age of 41.5 years, an average weight of 220 pounds and average body mass index, or BMI, of 36.4. Eighty-seven percent of the participants were women, 53% were Caucasian, 29% were African-American and 18% were Hispanic. Patients didn't receive any diet or exercise advice, but were required to abstain from alcohol during the study.

"I'm very bullish on this, and the data surprised even me," says Adam Noah, an analyst at San Francisco investment bank Merriman Curhan Ford & Co. "We like the company — and not just because of this drug. It has a deep pipeline of drugs with very large markets. And the obesity program is the proof of principle on the entire pipeline, not just this one indication."

And the obesity program is the proof of principle on the entire pipeline, not just this one indication."

APD356 works on serotonin receptors in the hypothalamus, an area of the brain that helps control food intake and metabolism. It's a similar mechanism to that of fen-phen, Wyeth's (WYE: 50.05, -0.54, -1.1%) infamous diet drug combination. Fen-phen was withdrawn from the market in 1997 after the discovery that it caused damage to heart valves. Arena's compound was well tolerated at all doses and showed no apparent effects on heart valves or pulmonary artery pressures. Side effects included headaches, nausea and dizziness.

According to the Centers for Disease Control, approximately two-thirds of all adults in the U.S. considered obese or overweight, suggesting a huge market awaits Arena. Excessive pounds increase a person's risk of heart disease, diabetes, stroke, cancer and osteoarthritis. And even though medical treatments are limited for obese and overweight people, more than $114 billion in government funds was spent in 2000 in the U.S. on obesity-related medical costs tied to the condition, says the CDC.

Currently, there are only two obesity drugs on the market: Meridia by Abbott Laboratories (ABT: 47.90, -0.30, -0.6%) and Xenical by Switzerland's Roche. Both have serious side effects. Still, shorting Weight Watchers (WTW: 44.42, -0.17, -0.4%) shares may prove premature. Arena, which expects the APD356 program to enter Phase III trials next year, doesn't plan to submit the drug for approval until 2009. Even if everything goes perfectly, APD356 will likely compete with Acomplia, Sanofi-Aventis's (SNY: 43.95, -0.34, -0.8%) highly anticipated obesity drug, which is expected to be approved next year.

"While it's too hard to predict the market, I don't see why this can't be a blockbuster," says Merriman's Noah, who reiterated his Buy rating Wednesday. "Arena's results were just as good as Acomplia's and maybe slightly better. If you're a big pharmaceutical company that wants to get into the obesity market with a partner, then you get Arena. And it's a seller's market. Arena is in a position to negotiate this partnership very carefully and get very good numbers. We have an $18 price target and consider that conservative."

If you're a big pharmaceutical company that wants to get into the obesity market with a partner, then you get Arena. And it's a seller's market. Arena is in a position to negotiate this partnership very carefully and get very good numbers. We have an $18 price target and consider that conservative."

Jack Lief, Arena's chief executive and founder, says he's open to partnership discussions. "We are prepared to move to a new drug application by ourselves and ultimately commercialization by ourselves," says Lief. "But, we will join with a partner with the right economics."

While it has no drugs on the market, the eight-year-old company has several promising ones in its pipeline. Its insomnia treatment is scheduled to begin a Phase II trial by the end of this year. An atherosclerosis treatment developed in collaboration with Merck (MRK: 42.04, +0.09, +0.2%) is currently in a Phase I trial. Arena is also partnered with Johnson & Johnson (JNJ: 63.96, -0.27, -0.4%) on a treatment for type-2 diabetes.

For the nine months ended Sept. 30, the San Diego company posted a net loss of $48.8 million, or $1.69 a share, on revenues of $17.4 million. As of Sept. 30, Arena had $148.1 million in cash. Merriman's Noah says the company is burning through about $50 million in cash a year.

Quote:

"Arena's stock price has shown solid gains in 2005, yet we continue to believe the stock price still does not appropriately reflect Arena's pipeline potential, the positive proof of concept data announced to date, or the potential for partnership announcements," wrote Needham's Fulop, who reiterated his Buy rating and boosted his target price to $18 from $12. "In our opinion, Arena's stock remains attractive at these levels. Arena is one of our top picks for the fourth quarter of 2005, first quarter of 2006."

mfg ipollit

Shares of Arena Pharmaceuticals (ARNA: 12.22, -0.31, -2.5%) jumped 18% to $13.48 Wednesday after the drug maker's treatment for obesity showed promise in midstage trials. Participants on a higher-dose regimen lost nearly eight pounds apiece over three months.

"We believe Arena is developing a competitive anti-obesity compound, with 31% of patients losing more than 5% body weight at 12 weeks, without a diet or exercise program," wrote George Fulop, an analyst at New York investment bank Needham & Co. "Hence, we anticipate seeing additional efficacy in future trials." (Needham & Co. has an investment-banking relationship with the company.)

During the Phase II clinical trial, subjects received APD356, Arena's experimental oral obesity treatment, for 12 weeks. Patients taking a 10 milligram dose of the drug experienced an average weight loss of 4.0 pounds, compared with 0.7 pounds in the placebo group. Patients taking the 15 mg and 20 mg doses lost 5.7 pounds and 7.9 pounds, respectively. All are considered statistically significant losses, according to the company.

The trial enrolled 469 male and female patients with an average age of 41.5 years, an average weight of 220 pounds and average body mass index, or BMI, of 36.4. Eighty-seven percent of the participants were women, 53% were Caucasian, 29% were African-American and 18% were Hispanic. Patients didn't receive any diet or exercise advice, but were required to abstain from alcohol during the study.

"I'm very bullish on this, and the data surprised even me," says Adam Noah, an analyst at San Francisco investment bank Merriman Curhan Ford & Co. "We like the company — and not just because of this drug. It has a deep pipeline of drugs with very large markets.

And the obesity program is the proof of principle on the entire pipeline, not just this one indication."

And the obesity program is the proof of principle on the entire pipeline, not just this one indication." APD356 works on serotonin receptors in the hypothalamus, an area of the brain that helps control food intake and metabolism. It's a similar mechanism to that of fen-phen, Wyeth's (WYE: 50.05, -0.54, -1.1%) infamous diet drug combination. Fen-phen was withdrawn from the market in 1997 after the discovery that it caused damage to heart valves. Arena's compound was well tolerated at all doses and showed no apparent effects on heart valves or pulmonary artery pressures. Side effects included headaches, nausea and dizziness.

According to the Centers for Disease Control, approximately two-thirds of all adults in the U.S. considered obese or overweight, suggesting a huge market awaits Arena. Excessive pounds increase a person's risk of heart disease, diabetes, stroke, cancer and osteoarthritis. And even though medical treatments are limited for obese and overweight people, more than $114 billion in government funds was spent in 2000 in the U.S. on obesity-related medical costs tied to the condition, says the CDC.

Currently, there are only two obesity drugs on the market: Meridia by Abbott Laboratories (ABT: 47.90, -0.30, -0.6%) and Xenical by Switzerland's Roche. Both have serious side effects. Still, shorting Weight Watchers (WTW: 44.42, -0.17, -0.4%) shares may prove premature. Arena, which expects the APD356 program to enter Phase III trials next year, doesn't plan to submit the drug for approval until 2009. Even if everything goes perfectly, APD356 will likely compete with Acomplia, Sanofi-Aventis's (SNY: 43.95, -0.34, -0.8%) highly anticipated obesity drug, which is expected to be approved next year.

"While it's too hard to predict the market, I don't see why this can't be a blockbuster," says Merriman's Noah, who reiterated his Buy rating Wednesday. "Arena's results were just as good as Acomplia's and maybe slightly better.

If you're a big pharmaceutical company that wants to get into the obesity market with a partner, then you get Arena. And it's a seller's market. Arena is in a position to negotiate this partnership very carefully and get very good numbers. We have an $18 price target and consider that conservative."

If you're a big pharmaceutical company that wants to get into the obesity market with a partner, then you get Arena. And it's a seller's market. Arena is in a position to negotiate this partnership very carefully and get very good numbers. We have an $18 price target and consider that conservative." Jack Lief, Arena's chief executive and founder, says he's open to partnership discussions. "We are prepared to move to a new drug application by ourselves and ultimately commercialization by ourselves," says Lief. "But, we will join with a partner with the right economics."

While it has no drugs on the market, the eight-year-old company has several promising ones in its pipeline. Its insomnia treatment is scheduled to begin a Phase II trial by the end of this year. An atherosclerosis treatment developed in collaboration with Merck (MRK: 42.04, +0.09, +0.2%) is currently in a Phase I trial. Arena is also partnered with Johnson & Johnson (JNJ: 63.96, -0.27, -0.4%) on a treatment for type-2 diabetes.

For the nine months ended Sept. 30, the San Diego company posted a net loss of $48.8 million, or $1.69 a share, on revenues of $17.4 million. As of Sept. 30, Arena had $148.1 million in cash. Merriman's Noah says the company is burning through about $50 million in cash a year.

Quote:

"Arena's stock price has shown solid gains in 2005, yet we continue to believe the stock price still does not appropriately reflect Arena's pipeline potential, the positive proof of concept data announced to date, or the potential for partnership announcements," wrote Needham's Fulop, who reiterated his Buy rating and boosted his target price to $18 from $12. "In our opinion, Arena's stock remains attractive at these levels. Arena is one of our top picks for the fourth quarter of 2005, first quarter of 2006."

mfg ipollit

Antwort auf Beitrag Nr.: 24.481.237 von ipollit am 07.10.06 23:48:45Obese People Seen As Opportunity For Arena

UBS Investment Research initiated coverage on Arena Pharmaceuticals and said the specialty pharmaceutical company's anti-obesity drug lorcaserin shows promise while collaborations with big pharma validate Arena's approach.

"Obesity represents a significant market opportunity for an effective agent with a relatively clean side effect profile, and therefore we are hopeful about lorcaserin's prospects," wrote UBS analyst Maged Shenouda, in research report Thursday.

"We note that over 65% of Americans are currently overweight, with 32% being obese, a material commercial opportunity."

The analyst said the company's other main drug candidate APD125, an experimental insomnia treatment, is taking on a large but crowded market.

"Because it inhibits a CNS [central nervous system] activating system rather than acting as a CNS depressant, APD125 has the potential to avoid hangover effects seen with several marketed agents," the UBS analyst said. Arena could see a U.S. launch as early as 2011, Shenouda added.

In addition, Arena (nasdaq: ARNA - news - people ) has ongoing developmental partnerships with Merck (nyse: MRK - news - people ) and Johnson & Johnson (nyse: JNJ - news - people ) unit Ortho-McNeil to develop cardiovascular and diabetes drugs, respectively.

"Beyond their significant economic potential, we view these collaborations as external validation of Arena's discovery capabilities."

The research analyst has a price target of $20 on the stock.

mfg ipollit

UBS Investment Research initiated coverage on Arena Pharmaceuticals and said the specialty pharmaceutical company's anti-obesity drug lorcaserin shows promise while collaborations with big pharma validate Arena's approach.

"Obesity represents a significant market opportunity for an effective agent with a relatively clean side effect profile, and therefore we are hopeful about lorcaserin's prospects," wrote UBS analyst Maged Shenouda, in research report Thursday.

"We note that over 65% of Americans are currently overweight, with 32% being obese, a material commercial opportunity."

The analyst said the company's other main drug candidate APD125, an experimental insomnia treatment, is taking on a large but crowded market.

"Because it inhibits a CNS [central nervous system] activating system rather than acting as a CNS depressant, APD125 has the potential to avoid hangover effects seen with several marketed agents," the UBS analyst said. Arena could see a U.S. launch as early as 2011, Shenouda added.

In addition, Arena (nasdaq: ARNA - news - people ) has ongoing developmental partnerships with Merck (nyse: MRK - news - people ) and Johnson & Johnson (nyse: JNJ - news - people ) unit Ortho-McNeil to develop cardiovascular and diabetes drugs, respectively.

"Beyond their significant economic potential, we view these collaborations as external validation of Arena's discovery capabilities."

The research analyst has a price target of $20 on the stock.

mfg ipollit

@ipollit,

ich setze auf METABOLIC PHARM. Übergewichtspille! Hat einzigartige Vorteile, s. thrad hier auf W bzw. Firmenhomepage.

bzw. Firmenhomepage.

ich setze auf METABOLIC PHARM. Übergewichtspille! Hat einzigartige Vorteile, s. thrad hier auf W

bzw. Firmenhomepage.

bzw. Firmenhomepage.

Antwort auf Beitrag Nr.: 24.483.945 von Fruehrentner am 08.10.06 01:30:03@Frührentner

Metabolic Pharm kommt mit der MK so gerade an 100 Mio USD dran, wie hoch ist denn der Cash (dürfte nicht viel sein), kein Partner... und dann angeblich ein potentieller Blockbuster in PIII (die Lorca PIII ist für ARNA recht günstig gerechnet und benötigt trotzdem min 125 Mio USD) - das passt nicht zusammen... wenn die MK bei 500 und deutlich mehr als 100 Mio USD Cash vorhanden ist, dann könnte ich mir die nochmal ansehen. Außerdem wären Lorca und AOD9604 zwei völlig unterschiedliche Ansätze... AOD9604 ist angeblich so etwas wie Xenical, also hemmt die Aufnahme von Fett.

sorry, solche Firmen sind mir zu suspekt... es gibt zuviel faule Kandidaten da draußen...

mfg ipollit

Metabolic Pharm kommt mit der MK so gerade an 100 Mio USD dran, wie hoch ist denn der Cash (dürfte nicht viel sein), kein Partner... und dann angeblich ein potentieller Blockbuster in PIII (die Lorca PIII ist für ARNA recht günstig gerechnet und benötigt trotzdem min 125 Mio USD) - das passt nicht zusammen... wenn die MK bei 500 und deutlich mehr als 100 Mio USD Cash vorhanden ist, dann könnte ich mir die nochmal ansehen. Außerdem wären Lorca und AOD9604 zwei völlig unterschiedliche Ansätze... AOD9604 ist angeblich so etwas wie Xenical, also hemmt die Aufnahme von Fett.

sorry, solche Firmen sind mir zu suspekt... es gibt zuviel faule Kandidaten da draußen...

mfg ipollit

Antwort auf Beitrag Nr.: 24.487.309 von ipollit am 08.10.06 11:48:16Pharmaceuticals

Sanofi Remains Tight-Lipped

Matthew Herper, 10.05.06, 11:30 AM ET

Sanofi-Aventis shareholders have plenty of reason to be nervous--and the silent treatment they are getting from the world's third-largest drug company isn't likely to calm their anxious stomachs.

U.S. approval of Sanoifi's (nyse: SNY - news - people ) weight-loss pill rimonabant, which some analysts and doctors said could be one of the biggest drugs ever, has been delayed for seven months and counting. And the U.S. Food and Drug Administration outright rejected its drug Multaq, a treatment for irregular heart rhythms, on Aug. 31.

Sanofi has also had to lower its 2006 earnings-per-share forecast by 9% because of disastrous patent negotiations surrounding the blood thinner Plavix, which it sells with Bristol-Myers Squibb (nyse: BMY - news - people ). Peter Dolan lost his job as Bristol's chief executive over the botched negotiation that allowed Canadian drugmaker Apotex to launch a generic version of Plavix at almost no financial risk. Sales have been halted for now as the companies battle in court to determine if Apotex can sell its generic version.

Add to this the feeling from some that the drug giant isn't addressing investors' questions. Gbola Amusa, an analyst at Sanford C. Bernstein, has been a big booster of Rimonabant, and he predicts Sanofi shares will outperform the market. But on Tuesday, he sent a note to investors saying that Sanofi had gone silent to most investors, analysts and the media, and will remain quiet until it announces its results on Oct. 31.

Questions regarding this assertion were referred to Sanofi's Paris headquarters, where spokesman Jean-Marc Podvin said he was not aware of any new policy of silence. "I don't think company policy has changed," says Podvin. But Amusa insists that Sanofi isn't addressing important issues, such as the Plavix litigation. "It's clear there's a difference between the way they communicate, compared to other companies," he says.

Sanofi's stock has retreated from a July high of $50.05, trading on Thursday at $44.42, down 19 cents on the day.

One issue Sanofi has barely addressed is why the FDA delayed rimonabant, which underpins Amusa's growth forecasts for Sanofi stock. Rimonabant was launched in the United Kingdom and some European countries under the brand name Acomplia. Sanofi had said that it expected to bring it to the U.S. market in the second half of 2006--but the second half is half over.

Rimonabant is seen as having potential not only because it takes off pounds, but also because of its effect on cholesterol--it cuts the bad kind and increases the good. However, the drug, which works by turning off the same brain receptors that marijuana turns on to give pot smokers the munchies, also seems to cause psychiatric side effects: a subset of patients seemed to quit taking their medicine because of anxiety or depression.

Obesity represents "a desperate need," says Jaideep Bajaj of consultancy ZS Associates, which advises drug firms on marketing matters. "But you will have to convince the market that it's not hocus-pocus." Previous obesity drugs, he says, have been "riddled with side effects."

The last big weight-loss treatment was the diet combo fen-phen, which was linked to heart valve damage and led Wyeth (nyse: WYE - news - people ) to pay out $21 billion in legal damages. And the FDA is still scarred by the scandal of Merck's (nyse: MRK - news - people ) painkiller Vioxx. Neurological side effects seem the most likely reason for the long delay--and they could conceivably prevent Acomplia from joining the ranks of blockbuster drugs like Plavix and Lipitor, the Pfizer (nyse: PFE - news - people ) cholesterol pill.

Amusa, for his part, thinks the depression problem represents a "red herring," partly because the effects seem to go away when patients stop the drug and seem to occur in other obesity trials. But many investors would probably prefer to get their reassurance from Sanofi itself.

**********

Wenn Acomplia Probleme wegen Depressionen bekommt und nicht zum erwarteten Mega-Blockbuster wird... dann wäre mit Lorca schnell ein Ersatz gefunden - die Frage ist nur... ist Loca zu sehr ein FenPhen oder ein FenPhen ohne Risko von Herzschäden.

mfg ipollit

Sanofi Remains Tight-Lipped

Matthew Herper, 10.05.06, 11:30 AM ET

Sanofi-Aventis shareholders have plenty of reason to be nervous--and the silent treatment they are getting from the world's third-largest drug company isn't likely to calm their anxious stomachs.

U.S. approval of Sanoifi's (nyse: SNY - news - people ) weight-loss pill rimonabant, which some analysts and doctors said could be one of the biggest drugs ever, has been delayed for seven months and counting. And the U.S. Food and Drug Administration outright rejected its drug Multaq, a treatment for irregular heart rhythms, on Aug. 31.

Sanofi has also had to lower its 2006 earnings-per-share forecast by 9% because of disastrous patent negotiations surrounding the blood thinner Plavix, which it sells with Bristol-Myers Squibb (nyse: BMY - news - people ). Peter Dolan lost his job as Bristol's chief executive over the botched negotiation that allowed Canadian drugmaker Apotex to launch a generic version of Plavix at almost no financial risk. Sales have been halted for now as the companies battle in court to determine if Apotex can sell its generic version.