MWANA - Exploration, Mining & Produktion in Afrika - 500 Beiträge pro Seite

eröffnet am 13.11.06 21:58:18 von

neuester Beitrag 08.06.20 14:31:55 von

neuester Beitrag 08.06.20 14:31:55 von

Beiträge: 665

ID: 1.094.043

ID: 1.094.043

Aufrufe heute: 0

Gesamt: 32.220

Gesamt: 32.220

Aktive User: 0

ISIN: GB00B0GN3470 · WKN: A0HGLS

0,0090

EUR

0,00 %

0,0000 EUR

Letzter Kurs 28.07.17 Berlin

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 0,8947 | +11,85 | |

| 0,5700 | +11,76 | |

| 0,5900 | +9,26 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,500 | -6,67 | |

| 4,7500 | -7,77 | |

| 3,3200 | -9,78 | |

| 12,000 | -25,00 | |

| 46,95 | -98,00 |

Hinweis Vorab:

1. MWANA ist aus einem Reverse Takeover mit AFRICAN GOLD PLC entstanden. Die WO Bezeichnung ist nicht aktuell.

Werde versuchen, das aktualisieren zu lassen.

2. MWANA ist sehr groß, es kommen jetzt jede Menge Infos.

Geht unbedingt selbst auf die Website, werft einen Blick auf die Projekte und das Management.

Es lohnt sich, in jedes Filing reinzuschauen.

Website: http://www.mwanaafrica.com

WKN Deutschland: A0HGLS

London: MWA

Anzahl Shares zum 13.11.2006: 247 Mio Stück

Market Cap @ 13.11.2006: 92,5Mio BP, entspricht ca. 123 Mio EUR

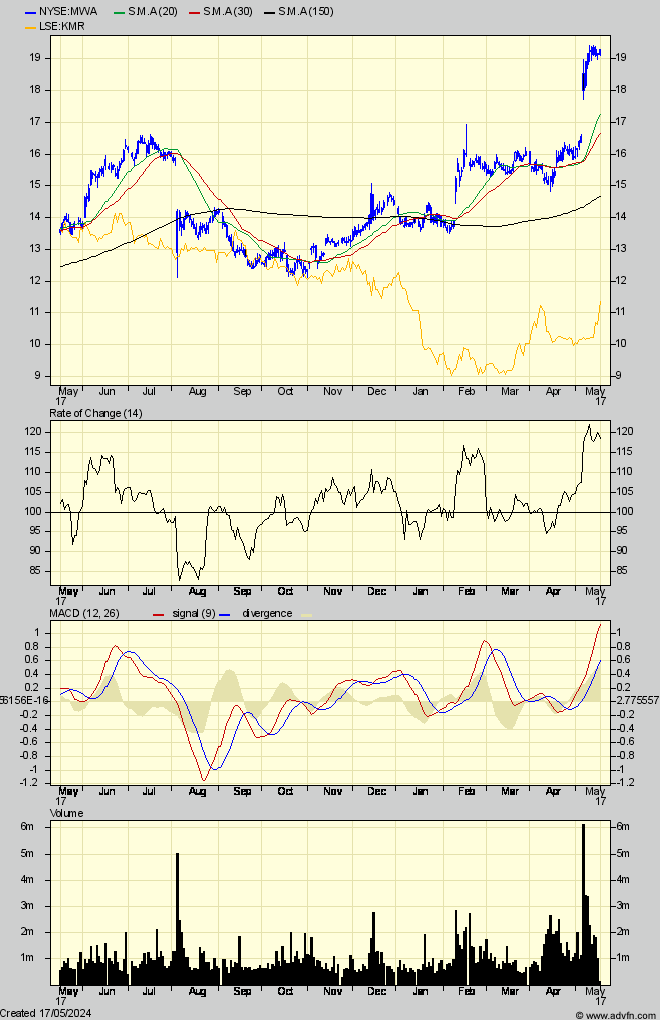

:::::::::::::::::::::::Kurs LSE::::::::::::::::::::::::::::::::::::::::::::::::::: Kurs Berlin::::::::::::::::::::::::::

Intraday LSE

lesen...staunen...(derzeit evtl in London) kaufen...(geht auch bei Consors)

Berlin ist auch gelistet

Mich hat es fast umgehaun, als ich mich näher mit diesem Wert befasst habe.

1. DRC Kilomoto Gold Projekt 3.200qkm mit Okimo

2. Anmercosa Kupferprojekt in der RC südlich vom Katanga Copper Belt, flächenmässig noch grösser als Tiger oder BHB, JV mit Anglo American, Prodiktion 2008 geplant.

Mwana ist jetzt der grösste Landholder in der Region.

3. Bindura Nickel (Exploration Mine und Sibeka Schmelze in Simbabwe.

Erzeugt schon Cash (2006 4 Mio USD seit der Übernahme in diesem Jahr)

4. Freda und Inez Golminen in Simbabwe übernommen, ebenfalls in Produktion

5. 3 Ghana Projekte

6. Marktkapitalisierung 120 Mio Euro (= z.B. ca. 1/3 von Moto Goldmines)

7. Aktienrückkaufprogramm letzte Woche angekündigt.

8. Öl Projekt JV geplant mit Energy Equity Resources

9. 15% an Gravity Diamonds (gehört zu BHP)

10. 20% an MIBA :shock: (dem kongolesischen Diamanten Staatsbetrieb)

1. MWANA ist aus einem Reverse Takeover mit AFRICAN GOLD PLC entstanden. Die WO Bezeichnung ist nicht aktuell.

Werde versuchen, das aktualisieren zu lassen.

2. MWANA ist sehr groß, es kommen jetzt jede Menge Infos.

Geht unbedingt selbst auf die Website, werft einen Blick auf die Projekte und das Management.

Es lohnt sich, in jedes Filing reinzuschauen.

Website: http://www.mwanaafrica.com

WKN Deutschland: A0HGLS

London: MWA

Anzahl Shares zum 13.11.2006: 247 Mio Stück

Market Cap @ 13.11.2006: 92,5Mio BP, entspricht ca. 123 Mio EUR

:::::::::::::::::::::::Kurs LSE::::::::::::::::::::::::::::::::::::::::::::::::::: Kurs Berlin::::::::::::::::::::::::::

Intraday LSE

lesen...staunen...(derzeit evtl in London) kaufen...(geht auch bei Consors)

Berlin ist auch gelistet

Mich hat es fast umgehaun, als ich mich näher mit diesem Wert befasst habe.

1. DRC Kilomoto Gold Projekt 3.200qkm mit Okimo

2. Anmercosa Kupferprojekt in der RC südlich vom Katanga Copper Belt, flächenmässig noch grösser als Tiger oder BHB, JV mit Anglo American, Prodiktion 2008 geplant.

Mwana ist jetzt der grösste Landholder in der Region.

3. Bindura Nickel (Exploration Mine und Sibeka Schmelze in Simbabwe.

Erzeugt schon Cash (2006 4 Mio USD seit der Übernahme in diesem Jahr)

4. Freda und Inez Golminen in Simbabwe übernommen, ebenfalls in Produktion

5. 3 Ghana Projekte

6. Marktkapitalisierung 120 Mio Euro (= z.B. ca. 1/3 von Moto Goldmines)

7. Aktienrückkaufprogramm letzte Woche angekündigt.

8. Öl Projekt JV geplant mit Energy Equity Resources

9. 15% an Gravity Diamonds (gehört zu BHP)

10. 20% an MIBA :shock: (dem kongolesischen Diamanten Staatsbetrieb)

London, 9th November 2006 - At today's Extraordinary General Meeting of Mwana Africa plc ("the Company") approval was given by shareholders to a special resolution to cancel the Share Premium Account of the Company. This will enable the deficit on the Company's profit and loss account to be eliminated and create distributable reserves to enable the Company to reduce the number of issued Ordinary Shares in the Company through a scheme to buy back Ordinary Shares. [color=red]At the Company's Annual General Meeting on the 20th October a resolution was passed authorising a buy back of Ordinary Shares.

It is anticipated that the Court Order confirming the cancellation of the Share Premium Account will be made on or about 6 December 2006. The cancellation of the Share Premium Account will only take effect when an office copy of the Court Order is duly registered by the Registrar of Companies which is expected to take place on 13 December 2006.

http://www.iii.co.uk/investment/detail?code=cotn:MWA.L&it=le

October 18, 2006

Mwana Africa Spreads Its Wings.

By Rob Davies

A junior mining company with £40million of net cash in the bank is going to be pretty popular these days as investors tighten their grip on their cheque books. Raising £42million in March was a well timed issue for Mwana Africa and puts the company in a strong position to pick up additional projects. However, that has not stopped the market pushing the shares down from the issue price of 63p to today’s level of just over 30p. Even at that it is still capitalised at £78million so it is one of the bigger fish on AIM.

However, its board is populated with people used to doing things in a big company kind of way reflecting their background in Anglo American and perhaps explains why the company spent nearly £10million on administration expenses last year. That sort of money would fund a more modest company’s exploration budget for a couple of years. Against that it is also relevant to point out that there aren’t many miners on AIM trading at three time’s historic sales. Moreover, subtract the £40million of cash and the market is only valuing those mining assets at £38million, or an EV/EBITDA ratio of less than 10. Nevertheless, that valuation reflects the fact that Mwana is doing business in some fairly racey parts of Africa like Zimbabwe and the DRC so it is perhaps understandable that costs of doing business are higher than elsewhere.

Executive chairman Oliver Baring was able to give Minesite a brief update recently and expand on some areas of the business. He is devoting all his time to the company and when combined with that of Kalaa Mpinga, the chief executive, and other heavyweights like Hank Slack, Ken Owen and David Fish makes for a powerful management team.

Mwana’s spread of activities in terms of commodities and territories is impressive for such a young company. In part that reflects its willingness to invest where others fear to tread. A case in point is its 53 per cent stake in the Bindura nickel operations in Zimbabwe, a country where even the BBC is banned. Yet Mwana has been able to extract a US$2.6million dividend payment from these two mines and has hopes of rebuilding and expanding operations there. As house broker Cannacord Adams points out in a recent note the received nickel price in its last financial year averaged US$6.25/lb. Yet for the six months to end September that will constitute the interim period nickel is likely to average something of the order of $10.50/lb. In cash terms that means an additional $5m attributable to Mwana just for the half year.

In the same country Mwana is now the owner of the Freda Rebecca mine originally developed by Cluff Resources. Production there has fallen to about 30,000 ounces from its peak of 100,000 ounces but Mwana is working on rebuilding this operation too as SRK estimates it still has a resource of over one million ounces. Mr Baring reports that doing business in Zimbabwe is not causing them any difficulty at all and in fact the company has just received its dividend cheque from Bindura so there are no problems with remitting foreign exchange.

In the DRC Mwana has a substantial gold exploration acreage but it has recently increased its exposure to the country by taking a 20 per cent stake in MIBA, the state owned diamond producer, for US$11million and a 14.99 per cent stake in Gravity Diamonds, with its interesting exploration rights, for £2.1million. Mr Baring says the MIBA mines are in a sorry state and desperately in need of fresh capital. Some developments in this regard might be forthcoming after the second round of elections in the DRC. Mwana’s strong balance sheet and cash flow from operations gives it the ability to fund a sizeable exploration programme and this year it expects to spend US$5.5million, mostly in the DRC.

Despite the cash flow attractions of Zimbabwe investors are more likely to focus on the exploration potential in the DRC and not just for the diamonds. It has a joint venture with Okimo in the north east of the DRC to explore 3,000 square kilometres of highly prospective gold territory while the Ammercosa joint venture with Anglo American gives it exploration rights to over 10,000 square kilometres in the Katanga copper belt.

The third African country Mwana is working in, Ghana, is better known to investors and here it has substantial property in the Konongo area which has been drilled. Mr Baring says that while there are no plans for a feasibility study he is very encouraged by progress at Banka. Drilling has started there and is also currently underway at Ahanta. More recently Mwana has expanded into oil and gas by entering into a joint venture agreement with Energy Equity Resources Ltd a company staffed by former Norsk Hydro people. The aim is to jointly develop African oil and gas exploration and production assets. So far it has identified five and is pursuing two of these in Angola. One is in production and the other is at an advanced stage of exploration and Mr Baring is optimistic about the potential for this new business.

At the forthcoming AGM the company will be seeking authority to buy back stock, an unusual request for a junior mining company on AIM. While the finance director may be happy to sell shares at 63p in May and buy them back at 30p six months later it is doubtful if shareholders will be so keen. But the fact that the company is prepared to do it should at least send out the right message to the market.

--

The Editor has a beneficial interest in Mwana Africa shares.

Mwana Africa Spreads Its Wings.

By Rob Davies

A junior mining company with £40million of net cash in the bank is going to be pretty popular these days as investors tighten their grip on their cheque books. Raising £42million in March was a well timed issue for Mwana Africa and puts the company in a strong position to pick up additional projects. However, that has not stopped the market pushing the shares down from the issue price of 63p to today’s level of just over 30p. Even at that it is still capitalised at £78million so it is one of the bigger fish on AIM.

However, its board is populated with people used to doing things in a big company kind of way reflecting their background in Anglo American and perhaps explains why the company spent nearly £10million on administration expenses last year. That sort of money would fund a more modest company’s exploration budget for a couple of years. Against that it is also relevant to point out that there aren’t many miners on AIM trading at three time’s historic sales. Moreover, subtract the £40million of cash and the market is only valuing those mining assets at £38million, or an EV/EBITDA ratio of less than 10. Nevertheless, that valuation reflects the fact that Mwana is doing business in some fairly racey parts of Africa like Zimbabwe and the DRC so it is perhaps understandable that costs of doing business are higher than elsewhere.

Executive chairman Oliver Baring was able to give Minesite a brief update recently and expand on some areas of the business. He is devoting all his time to the company and when combined with that of Kalaa Mpinga, the chief executive, and other heavyweights like Hank Slack, Ken Owen and David Fish makes for a powerful management team.

Mwana’s spread of activities in terms of commodities and territories is impressive for such a young company. In part that reflects its willingness to invest where others fear to tread. A case in point is its 53 per cent stake in the Bindura nickel operations in Zimbabwe, a country where even the BBC is banned. Yet Mwana has been able to extract a US$2.6million dividend payment from these two mines and has hopes of rebuilding and expanding operations there. As house broker Cannacord Adams points out in a recent note the received nickel price in its last financial year averaged US$6.25/lb. Yet for the six months to end September that will constitute the interim period nickel is likely to average something of the order of $10.50/lb. In cash terms that means an additional $5m attributable to Mwana just for the half year.

In the same country Mwana is now the owner of the Freda Rebecca mine originally developed by Cluff Resources. Production there has fallen to about 30,000 ounces from its peak of 100,000 ounces but Mwana is working on rebuilding this operation too as SRK estimates it still has a resource of over one million ounces. Mr Baring reports that doing business in Zimbabwe is not causing them any difficulty at all and in fact the company has just received its dividend cheque from Bindura so there are no problems with remitting foreign exchange.

In the DRC Mwana has a substantial gold exploration acreage but it has recently increased its exposure to the country by taking a 20 per cent stake in MIBA, the state owned diamond producer, for US$11million and a 14.99 per cent stake in Gravity Diamonds, with its interesting exploration rights, for £2.1million. Mr Baring says the MIBA mines are in a sorry state and desperately in need of fresh capital. Some developments in this regard might be forthcoming after the second round of elections in the DRC. Mwana’s strong balance sheet and cash flow from operations gives it the ability to fund a sizeable exploration programme and this year it expects to spend US$5.5million, mostly in the DRC.

Despite the cash flow attractions of Zimbabwe investors are more likely to focus on the exploration potential in the DRC and not just for the diamonds. It has a joint venture with Okimo in the north east of the DRC to explore 3,000 square kilometres of highly prospective gold territory while the Ammercosa joint venture with Anglo American gives it exploration rights to over 10,000 square kilometres in the Katanga copper belt.

The third African country Mwana is working in, Ghana, is better known to investors and here it has substantial property in the Konongo area which has been drilled. Mr Baring says that while there are no plans for a feasibility study he is very encouraged by progress at Banka. Drilling has started there and is also currently underway at Ahanta. More recently Mwana has expanded into oil and gas by entering into a joint venture agreement with Energy Equity Resources Ltd a company staffed by former Norsk Hydro people. The aim is to jointly develop African oil and gas exploration and production assets. So far it has identified five and is pursuing two of these in Angola. One is in production and the other is at an advanced stage of exploration and Mr Baring is optimistic about the potential for this new business.

At the forthcoming AGM the company will be seeking authority to buy back stock, an unusual request for a junior mining company on AIM. While the finance director may be happy to sell shares at 63p in May and buy them back at 30p six months later it is doubtful if shareholders will be so keen. But the fact that the company is prepared to do it should at least send out the right message to the market.

--

The Editor has a beneficial interest in Mwana Africa shares.

Produktionsbeginn Kupfer / Cobalt Projekt Anmercosa angestrebt 2008

In the Democratic Republic of Congo there was target generation work completed at our Zinc property at Lombe and follow up work is being planned. Work was undertaken at Kibolwe including the development of infrastructure, such as roads and site facilities, and sampling and trenching work. It is expected that resource drilling will commence in late October or early November. Once drilling has begun it is expected to rapidly result in a JORC compliant resource. Following this the next stage of development will be to initiate a feasibility study for copper production. [color=red]It is our intention to have a production facility in full operation during 2008.[/color] Several sites nearby are also highly prospective for copper and have been trenched and sampled. These will be drilled following completion of the currently planned next stage of drilling at Kibolwe.

In the Democratic Republic of Congo there was target generation work completed at our Zinc property at Lombe and follow up work is being planned. Work was undertaken at Kibolwe including the development of infrastructure, such as roads and site facilities, and sampling and trenching work. It is expected that resource drilling will commence in late October or early November. Once drilling has begun it is expected to rapidly result in a JORC compliant resource. Following this the next stage of development will be to initiate a feasibility study for copper production. [color=red]It is our intention to have a production facility in full operation during 2008.[/color] Several sites nearby are also highly prospective for copper and have been trenched and sampled. These will be drilled following completion of the currently planned next stage of drilling at Kibolwe.

Ein paar Hintergrundinfos zu den Simbabwe Aktivitäten.

Mwana ist im Mobutu Land richtig aktiv und erzielt positiven Cash Flow.

In a joint announcement made on September 10, 2004, AngloGold Ashanti confirmed its agreement to sell its entire

interest in Ashanti Goldfields Zimbabwe Limited to Mwana Africa Holdings (Proprietary) Limited for a total consideration of

$2.255 million, to be settled in two tranches, $0.75 million immediately and the balance ($1.505 million) to be settled within

six months of the satisfaction of all conditions to the sale agreement. The sale was effective on September 1, 2004 and all

conditions to the sale agreement were satisfied on April 22, 2005. Subsequently in August 2005, AngloGold Ashanti and

Mwana Africa Holdings (Proprietary) Limited agreed that the second payment of $1.505 million would be settled by an

immediate payment of $1 million and the subsequent issue to AngloGold Ashanti of 600,000 Mwana Africa plc shares,

once that company listed on the London Stock Exchange. Mwana Africa plc is a junior exploration and mining company

with assets located in Zimbabwe as well as in the Democratic Republic of Congo. AngloGold Ashanti retains its 600,000

shares in Mwana Africa plc. The sole operating asset of Ashanti Goldfields Zimbabwe Limited as sold to Mwana Africa

Holdings (Proprietary) Limited was the Freda-Rebecca Gold Mine.

http://www.anglogoldashanti.com/NR/rdonlyres/91B74CA5-8170-4…

Den Sibeka Nickel Smelter (Schmelze) hat man erst 2006 von der Firma Umicore übernommen.

http://www.umicore.de/

(übrigens nicht uninteressant, sind auch an der Börse)

Umicore stimmt Verkauf von Sibeka an Mwana Africa plc zu

http://www.umicore.de/presse/pv2006/Sibeka_220506_de.pdf

Damit verbunden war auch der Einstieg in die MIBA,

22.05.2006 09:01

Mwana Africa buys Umicore diamond unit for 11 mln usd

LONDON (AFX) - Mwana Africa PLC said it bought Sibeka, a diamond miner owned by material technology group Umicore, (Nachrichten) for 11 mln usd in cash.

Sibeka's major asset is a 20 pct interest in Societe Miniere de Bakwanga (MIBA), which produces diamonds in the Democratic Republic of Congo.

MIBA has produced an average of 6 mln carats of diamonds per year

This transaction signals Mwana's entry into the African diamond industry, Mwana said in a statement.

So war Sibeka in Umicore verbunden:

Auf die MIBA gehe ich hier nicht weiter ein, das kann sich jeder selber denken, was das bedeutet.

Das interessante ist, daß MWANA jetzt in Simbabwe eine komplett eigene Nickel Produktionsstrecke hat: Bindura:Exploration, Mine und Sibeka: Schmelze.

Die Schmelze ist so gross, daß man auch für andere mit die Verarbeitung anbieten kann.

The Bindura nickel smelter and refinery complex produces high-grade nickel cathode, copper and cobalt bi-products as copper sulphide cake and cobalt hydroxide cake. The smelter has the capacity to treat 160,000 tonnes of concentrate annually and the refinery to produce 14,500 tonnes of refined nickel.

http://www.minesite.com/CompanyDynamic.php?ID=3

Mwana ist im Mobutu Land richtig aktiv und erzielt positiven Cash Flow.

In a joint announcement made on September 10, 2004, AngloGold Ashanti confirmed its agreement to sell its entire

interest in Ashanti Goldfields Zimbabwe Limited to Mwana Africa Holdings (Proprietary) Limited for a total consideration of

$2.255 million, to be settled in two tranches, $0.75 million immediately and the balance ($1.505 million) to be settled within

six months of the satisfaction of all conditions to the sale agreement. The sale was effective on September 1, 2004 and all

conditions to the sale agreement were satisfied on April 22, 2005. Subsequently in August 2005, AngloGold Ashanti and

Mwana Africa Holdings (Proprietary) Limited agreed that the second payment of $1.505 million would be settled by an

immediate payment of $1 million and the subsequent issue to AngloGold Ashanti of 600,000 Mwana Africa plc shares,

once that company listed on the London Stock Exchange. Mwana Africa plc is a junior exploration and mining company

with assets located in Zimbabwe as well as in the Democratic Republic of Congo. AngloGold Ashanti retains its 600,000

shares in Mwana Africa plc. The sole operating asset of Ashanti Goldfields Zimbabwe Limited as sold to Mwana Africa

Holdings (Proprietary) Limited was the Freda-Rebecca Gold Mine.

http://www.anglogoldashanti.com/NR/rdonlyres/91B74CA5-8170-4…

Den Sibeka Nickel Smelter (Schmelze) hat man erst 2006 von der Firma Umicore übernommen.

http://www.umicore.de/

(übrigens nicht uninteressant, sind auch an der Börse)

Umicore stimmt Verkauf von Sibeka an Mwana Africa plc zu

http://www.umicore.de/presse/pv2006/Sibeka_220506_de.pdf

Damit verbunden war auch der Einstieg in die MIBA,

22.05.2006 09:01

Mwana Africa buys Umicore diamond unit for 11 mln usd

LONDON (AFX) - Mwana Africa PLC said it bought Sibeka, a diamond miner owned by material technology group Umicore, (Nachrichten) for 11 mln usd in cash.

Sibeka's major asset is a 20 pct interest in Societe Miniere de Bakwanga (MIBA), which produces diamonds in the Democratic Republic of Congo.

MIBA has produced an average of 6 mln carats of diamonds per year

This transaction signals Mwana's entry into the African diamond industry, Mwana said in a statement.

So war Sibeka in Umicore verbunden:

Auf die MIBA gehe ich hier nicht weiter ein, das kann sich jeder selber denken, was das bedeutet.

Das interessante ist, daß MWANA jetzt in Simbabwe eine komplett eigene Nickel Produktionsstrecke hat: Bindura:Exploration, Mine und Sibeka: Schmelze.

Die Schmelze ist so gross, daß man auch für andere mit die Verarbeitung anbieten kann.

The Bindura nickel smelter and refinery complex produces high-grade nickel cathode, copper and cobalt bi-products as copper sulphide cake and cobalt hydroxide cake. The smelter has the capacity to treat 160,000 tonnes of concentrate annually and the refinery to produce 14,500 tonnes of refined nickel.

http://www.minesite.com/CompanyDynamic.php?ID=3

Mwana Africa Holding in Company

RNS Number:0046M

Mwana Africa PLC

13 November 2006

Mwana Africa plc (the "Company")

Holdings in Company

London, 13th November 2006 - The Company was notified on 10th November 2006 that

Lehman Brothers International (Europe) has a notifiable interest of 11,683,959

shares, representing 4.74 per cent. of the issued share capital of the Company.

Enquiries:

Oliver Baring, Executive Chairman Tel: 020 7654 5588

Mwana Africa plc

Tom Randell / Maria Suleymanova Tel: 020 7653 6620

Merlin

Jaja, wer sind schon die "Lehmann Brüder"

Ich habe auch erstmal geschmunzelt, aber nun weiss ich es!

http://www.lehman.com

RNS Number:0046M

Mwana Africa PLC

13 November 2006

Mwana Africa plc (the "Company")

Holdings in Company

London, 13th November 2006 - The Company was notified on 10th November 2006 that

Lehman Brothers International (Europe) has a notifiable interest of 11,683,959

shares, representing 4.74 per cent. of the issued share capital of the Company.

Enquiries:

Oliver Baring, Executive Chairman Tel: 020 7654 5588

Mwana Africa plc

Tom Randell / Maria Suleymanova Tel: 020 7653 6620

Merlin

Jaja, wer sind schon die "Lehmann Brüder"

Ich habe auch erstmal geschmunzelt, aber nun weiss ich es!

http://www.lehman.com

Holdings in Company

Auszug aus den letzten Meldungen einiger Firmen:

3 October 2006:

Deutsche Bank AG 1,766,967

ordinary shares of the Company, representing 4.75 per cent

1st November 2006

Artemis UK Smaller Companies fund, have a notifiable interest of 19,497,500 ordinary 10p shares, representing 7.92 per cent

13th November 2006

Lehman Brothers International (Europe) has a notifiable interest of 11,683,959 shares, representing 4.74 per cent.

5th June 2006

Lansdowne Partners Limited Partnership now holds 23,157,417 shares in the Company on behalf of client funds that it manages. This holding represents 9.34 per cent.

17th May 2006

The Company was notified on 02 May 2006 that The Capital Group Companies, Inc., including Capital Research and Management Company, has a notifiable interest of 12,980,000 shares, representing 5.23 per cent.

28 April, 2006

The Company was notified on 27 April 2006 that, in accordance with Part IV of

the Companies Act 1985 (as amended), Merrill Lynch Investment Managers Group

Limited, have a notifiable interest of 6,011,671 ordinary 10p shares,

representing 3.34% per cent. of the issued share capital of the Company.

Auszug aus den letzten Meldungen einiger Firmen:

3 October 2006:

Deutsche Bank AG 1,766,967

ordinary shares of the Company, representing 4.75 per cent

1st November 2006

Artemis UK Smaller Companies fund, have a notifiable interest of 19,497,500 ordinary 10p shares, representing 7.92 per cent

13th November 2006

Lehman Brothers International (Europe) has a notifiable interest of 11,683,959 shares, representing 4.74 per cent.

5th June 2006

Lansdowne Partners Limited Partnership now holds 23,157,417 shares in the Company on behalf of client funds that it manages. This holding represents 9.34 per cent.

17th May 2006

The Company was notified on 02 May 2006 that The Capital Group Companies, Inc., including Capital Research and Management Company, has a notifiable interest of 12,980,000 shares, representing 5.23 per cent.

28 April, 2006

The Company was notified on 27 April 2006 that, in accordance with Part IV of

the Companies Act 1985 (as amended), Merrill Lynch Investment Managers Group

Limited, have a notifiable interest of 6,011,671 ordinary 10p shares,

representing 3.34% per cent. of the issued share capital of the Company.

So, das war die Erstbestückung, viel Spass, und vergesst nicht, mal auf die MK zu schauen.

moin

schon drinne?

das ja echt extrem....

allein die beteiligungen sollten doch schon mehr wert sein oder?

dazu noch in der nähe des moto gebiets

und diamanten und oil

kupfer

mein fresse das ja extrem viel unterm einem namen

jetzt weiss ich wohin mit dem moto gewinn

hmm ne mal schaun aber n übeerlegung wert

freu mich auf n debatte mit den restlichen üblichen verdächtigen

mal sehn was die von dem wert halten

Antwort auf Beitrag Nr.: 25.372.459 von tjcc281086 am 13.11.06 22:44:46kommt gleich nochwas, wir haben noch nicht fertig

http://www.eeras.com/

Mwana Africa enters oil sector via Energy Equity jv

LONDON (AFX) - Mwana Africa PLC, the pan-African mining company, has forged

an alliance with Energy Equity Resources Ltd, marking its entry in the oil and

gas sector.

Under the agreement, the pair plan to jointly develop African exploration

and production assets, Mwana said in a statement.

They are currently pursuing efforts to acquire minority interests in five

assets.

"Of these, discussions around two Angolan assets - one production and one

advanced stage exploration - have recently progressed into detailed

negotiation," added Mwana, which operates in the Democratic Republic of Congo,

Ghana and Zimbabwe.

Privately owned Energy Equity, meanwhile, has businesses in the West African

region, including Nigeria, Angola, Gabon, Mauritania, Sudan, Sao Tome and

Principe, Equatorial Guinea and Libya

.............................................................

Energy Equity Resources Builds Portfolio of Energy Assets

Thursday, June 29, 200

http://www.oilvoice.com/Energy_Equity_Resources_Builds_Portf…

Energy Equity Resources (EER), the Anglo-Norwegian energy company, has built a steady portfolio of oil and energy assets since its formation in 2003, with a current focus on the Middle East and Africa. While the company's core interests are in exploration and production worldwide, these regions have offered exceptional opportunities to date.

Significant developments have been seen in these energy markets and EER now stands poised to obtain the best returns on these assets. The company has been most active to date in Nigeria, Sao Tome and Principe, Equatorial Guinea and Angola; however, other assets are also under development, including Gabon, Mauritania, Libya, Sudan and Egypt.

EER has built strategic alliances and relationships with governments and commercial partners in these countries that maximize benefits - to the host countries and to the commercial partners. Key factors include a proven management team, ability to act quickly and to navigate effectively through host countries' bureaucracies, plus a real commitment to indigenous development in its areas of operation. At the same time, EER aims to add competitive advantage by using some of the most innovative exploration technologies currently available, allowing it to effectively identify and qualify deep-water prospects.

"There has been impressive progress to report over the last year", commented Olav Eimstad, EER's Norwegian Chairman, "and we're proud that the alliances we are building are soundly-based and will benefit all the parties involved. There will be further developments for us to announce before long," he added, "which will increase the company's influence and add to our portfolio of assets.

"We feel EER's competitive advantage can make a real difference to our partners - whether governments or commercial operators. Our strengths are appreciated, we believe, which is why we have seen steady consolidation and growth".

The most recent joint venture to be announced is with London-based mining group Mwana Africa plc, which will see a number of African assets developed jointly. Two of these have already had a memorandum of understanding signed following detailed negotiations.

Osamede Okhomina, EER's Nigerian Senior Vice-President for Business Development, is delighted at the recent alliance with Mwana, an AIM-quoted company, with operations in Ghana, the Democratic Republic of Congo and Zimbabwe. "This is an important alliance for us", he explained, "which we believe will add significant regional influence to our operations. Our joint venture with Mwana, which is one of equal partners, will complement both companies and allow solid growth in the African market, whose energy sector has seen a growing number of important opportunities recently. We have high hopes that all parties involved can benefit from this joint venture".

Mwana Africa Inks JV with Energy Equity Resources

http://www.rigzone.com/news/article.asp?a_id=33562

der kurs ist doch überhpt nicht zu erklären bei alle den deposits die hören sich an die nen milliardenschweres unternehmen

wo ist da der hacken

es kann doch nicht sein das wir den wert erst entdecken wenn db schon mit 5 & drinne ist

was ist da los wieso sind die so niedrig bewertet wo ist der fehler

wo ist da der hacken

es kann doch nicht sein das wir den wert erst entdecken wenn db schon mit 5 & drinne ist

was ist da los wieso sind die so niedrig bewertet wo ist der fehler

Antwort auf Beitrag Nr.: 25.373.181 von tjcc281086 am 13.11.06 23:06:55Es gibt keinen Haken:

MWANA hat aquiriert ohne Ende, also Ausgaben gehabt.

Nun scheint man so langsam am Ziel und hat einen regelrechten "Konzern" dastehen.

Das mit den Milliarden sehe ich übrigens persönlich auch genau so.

Allein das Anmercosa Kupferprojekt wird in die Milliarden gehen.

Aber nochmal zum Management:

Chairman Oliver Barings:

Oliver Baring has recently retired as a managing director of UBS in the Corporate Finance Division, having had responsibility for the Africa and Mining divisions. Before the merger with SG Warburg, he was a partner of Rowe & Pitman, having spent five years with the Anglo American/De Beers Group in the US, UK and South Africa. He is Chairman of Ridge Mining PLC, non-executive Chairman of First Africa Holdings Limited, a non-executive director of Merrill Lynch World Mining Trust and of the Tiedmann Trust Company, and an advisor to The Sentient Resources Fund.

http://www.thesentientgroup.com/Council.html

Die haben da ein paar hübsche Funds aufgelegt.

http://www.thesentientgroup.com/Investors.html

http://www.google.de/search?hl=de&q=Sentient+Global+Resource…

MWANA hat aquiriert ohne Ende, also Ausgaben gehabt.

Nun scheint man so langsam am Ziel und hat einen regelrechten "Konzern" dastehen.

Das mit den Milliarden sehe ich übrigens persönlich auch genau so.

Allein das Anmercosa Kupferprojekt wird in die Milliarden gehen.

Aber nochmal zum Management:

Chairman Oliver Barings:

Oliver Baring has recently retired as a managing director of UBS in the Corporate Finance Division, having had responsibility for the Africa and Mining divisions. Before the merger with SG Warburg, he was a partner of Rowe & Pitman, having spent five years with the Anglo American/De Beers Group in the US, UK and South Africa. He is Chairman of Ridge Mining PLC, non-executive Chairman of First Africa Holdings Limited, a non-executive director of Merrill Lynch World Mining Trust and of the Tiedmann Trust Company, and an advisor to The Sentient Resources Fund.

http://www.thesentientgroup.com/Council.html

Die haben da ein paar hübsche Funds aufgelegt.

http://www.thesentientgroup.com/Investors.html

http://www.google.de/search?hl=de&q=Sentient+Global+Resource…

PS: Die haben nicht ohne Grund den Rückkauf der eigenen Aktien angekündigt, die Aktienanzahl soll reduziert werden  :

:

Mwana Africa plc

Results of Extraordinary General Meeting

London, 9th November 2006 - At today's Extraordinary General Meeting of Mwana Africa plc ("the Company") approval was given by shareholders to a special resolution to cancel the Share Premium Account of the Company. This will enable the deficit on the Company's profit and loss account to be eliminated and create

distributable reserves to enable the Company to reduce the number of issued Ordinary Shares in the Company through a scheme to buy back Ordinary Shares. At the Company's Annual General Meeting on the 20th October a resolution was passed authorising a buy back of Ordinary Shares.

It is anticipated that the Court Order confirming the cancellation of the Share Premium Account will be made on or about 6 December 2006. The cancellation of the Share Premium Account will only take effect when an office copy of the Court Order is duly registered by the Registrar of Companies which is expected to take place on 13 December 2006.

:

:Mwana Africa plc

Results of Extraordinary General Meeting

London, 9th November 2006 - At today's Extraordinary General Meeting of Mwana Africa plc ("the Company") approval was given by shareholders to a special resolution to cancel the Share Premium Account of the Company. This will enable the deficit on the Company's profit and loss account to be eliminated and create

distributable reserves to enable the Company to reduce the number of issued Ordinary Shares in the Company through a scheme to buy back Ordinary Shares. At the Company's Annual General Meeting on the 20th October a resolution was passed authorising a buy back of Ordinary Shares.

It is anticipated that the Court Order confirming the cancellation of the Share Premium Account will be made on or about 6 December 2006. The cancellation of the Share Premium Account will only take effect when an office copy of the Court Order is duly registered by the Registrar of Companies which is expected to take place on 13 December 2006.

Antwort auf Beitrag Nr.: 25.373.827 von XIO am 13.11.06 23:29:30ja nun gut jetzt haben sie alle diese gebiete

aber zum größten teil noch unbewirtschaftet

das wird doch hunderte millionen kosten die alle zur produktion zur bringen

ja allein das explorieren

wie können die geld für das vorrantreiben all dieser gebiete haben und dazu noch aktien rückkauf

dachte die haben "nur" 40 mille cash

das gibt es doch garnicht entweder die sind genial und wir wissen noch nicht alles oder die sind größenwahnsinnig?

booah ich bin gespannt

aber zum größten teil noch unbewirtschaftet

das wird doch hunderte millionen kosten die alle zur produktion zur bringen

ja allein das explorieren

wie können die geld für das vorrantreiben all dieser gebiete haben und dazu noch aktien rückkauf

dachte die haben "nur" 40 mille cash

das gibt es doch garnicht entweder die sind genial und wir wissen noch nicht alles oder die sind größenwahnsinnig?

booah ich bin gespannt

Antwort auf Beitrag Nr.: 25.373.936 von tjcc281086 am 13.11.06 23:33:53immer über JV und: die generieren schon Cash mit Ihren "kleineren" Goldminen und Sibeka/Bindura Nickel.

Aussedem wird Anmercosa als JV mit Anglo American durchgezogen.

MWANA wird also gepowert wie Tenke von Phelps

Zeit ist nämlich Geld

Aussedem wird Anmercosa als JV mit Anglo American durchgezogen.

MWANA wird also gepowert wie Tenke von Phelps

Zeit ist nämlich Geld

Antwort auf Beitrag Nr.: 25.373.936 von tjcc281086 am 13.11.06 23:33:53okay das n ceo mit verbindungen der kriegt sicherlich schnell kohle zusammen wenn er beweisen kann das die gebiete schöne funde beinhalten

aber allein die kosten für die exploration ich kann das alles noch garnicht glauben

aber allein die kosten für die exploration ich kann das alles noch garnicht glauben

!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de

Antwort auf Beitrag Nr.: 25.374.022 von XIO am 13.11.06 23:38:12Überleg mal, die halten 20% an Miba (Société Minière de Bakwanga RDC)

dem kongolesichen Staatsunternehmen für Diamind Mining.

So was ähnliches wie Okimo für Moto oder Gecamines für Tiger.

2005 hat Miba 6 Mio Karat gefördert.

Da sind jetzt immer 1.2Mio Karat MWANA

Jedes Jahr, Tendenz steigend

dem kongolesichen Staatsunternehmen für Diamind Mining.

So was ähnliches wie Okimo für Moto oder Gecamines für Tiger.

2005 hat Miba 6 Mio Karat gefördert.

Da sind jetzt immer 1.2Mio Karat MWANA

Jedes Jahr, Tendenz steigend

Antwort auf Beitrag Nr.: 25.374.097 von XIO am 13.11.06 23:41:24endlich weiss ich wohin mit meim moto gewinn

http://www.gravitydiamonds.com.au/

(hässliche Website, aber nicht täuschen lassen)

Gravity Diamonds (wird von BHB gepowert)

MWANA hat 15% an denen.

Australia:

Gravity Diamonds now owns 100% of Diamond Mines Australia Limited and, for historic reasons, it conducts its diamond exploration programs and ventures through this vehicle.

* Kimberley Diamond Co Joint Venture - Ellendale Blina - FALCON® Survey completed. 2 diamondiferous lamprorite pipes discovered together with diamondiferous gravels in palaeochannels

* Striker Resources Joint Venture - King George North - FALCON® Survey completed. Loam sampling completed with follow-up work planned for 2005 field season

* Rio Tinto Exploration Pty Ltd Exploration Agreement - 5 project areas in Northern Australia - FALCON® Surveys completed. Diamondiferous kimberlite discovered at Abner Range with two microdiamonds and one macrodiamond reported and abundant indicator minerals observed. Diamonds are reported as being unresorbed, colourless octahedra with flat faces and sharp edges, which are indicative of gem quality stones (See photo on the Home Page).

Africa:

* Kasai Craton in Democratic Republic of Congo - BHP Billiton - initial kimberlitic indicator minerals sampling completed. Aeromagnetic survey of prospective areas are being planned

(hässliche Website, aber nicht täuschen lassen)

Gravity Diamonds (wird von BHB gepowert)

MWANA hat 15% an denen.

Australia:

Gravity Diamonds now owns 100% of Diamond Mines Australia Limited and, for historic reasons, it conducts its diamond exploration programs and ventures through this vehicle.

* Kimberley Diamond Co Joint Venture - Ellendale Blina - FALCON® Survey completed. 2 diamondiferous lamprorite pipes discovered together with diamondiferous gravels in palaeochannels

* Striker Resources Joint Venture - King George North - FALCON® Survey completed. Loam sampling completed with follow-up work planned for 2005 field season

* Rio Tinto Exploration Pty Ltd Exploration Agreement - 5 project areas in Northern Australia - FALCON® Surveys completed. Diamondiferous kimberlite discovered at Abner Range with two microdiamonds and one macrodiamond reported and abundant indicator minerals observed. Diamonds are reported as being unresorbed, colourless octahedra with flat faces and sharp edges, which are indicative of gem quality stones (See photo on the Home Page).

Africa:

* Kasai Craton in Democratic Republic of Congo - BHP Billiton - initial kimberlitic indicator minerals sampling completed. Aeromagnetic survey of prospective areas are being planned

Antwort auf Beitrag Nr.: 25.374.040 von tjcc281086 am 13.11.06 23:38:50Die machen jetzt Ballett

20/10/2006

Mwana Africa says nears drilling at zinc, gold, copper site in DRC

LONDON (AFX) - Mwana Africa PLC says it is near to drill stage at its zinc,copper-cobalt and gold exploration and development assets in the Democratic Republic of Congo.

In the text of a statement to its annual general meeting, the AIM-listed company said work has begun at Kibolwe that is expected to lead to a copper production facility by 2008, while drilling at the Zani Kodo gold property should be possible by early 2007.

It also said refurbishment work is underway at the Freda Rebecca Mine that aims to increase gold production to 48,000 oz per year.

At today's AGM, the resolution to reappoint Hank Slack as a director failed, although all other resolutions were passed, including one authorising the company to purchase up to 26 mln of its shares, representing 10 pct of the share capital.

newsdesk@afxnews.com

20/10/2006

Mwana Africa says nears drilling at zinc, gold, copper site in DRC

LONDON (AFX) - Mwana Africa PLC says it is near to drill stage at its zinc,copper-cobalt and gold exploration and development assets in the Democratic Republic of Congo.

In the text of a statement to its annual general meeting, the AIM-listed company said work has begun at Kibolwe that is expected to lead to a copper production facility by 2008, while drilling at the Zani Kodo gold property should be possible by early 2007.

It also said refurbishment work is underway at the Freda Rebecca Mine that aims to increase gold production to 48,000 oz per year.

At today's AGM, the resolution to reappoint Hank Slack as a director failed, although all other resolutions were passed, including one authorising the company to purchase up to 26 mln of its shares, representing 10 pct of the share capital.

newsdesk@afxnews.com

Result of AGM

http://www.advfn.com/p.php?pid=nmona&cb=1163460069&article=1…

RNS Number:8140K

Mwana Africa PLC

20 October 2006

Mwana Africa plc

RESULTS OF ANNUAL GENERAL MEETING

London, 20th October 2006 - Mwana Africa plc ("Mwana" or the "Company") held its

Annual General Meeting earlier today. All of the resolutions put to the meeting

were passed with the exception of the reappointment of Hank Slack as a director,

who has resigned as a Non Executive Director of the Company. The resolutions

include one authorising the Company to purchase up to a maximum of 26,203,565

Ordinary Shares, representing aproximately 10 per cent. of the current issued

and committed share capital.

Oliver Baring, Executive Chairman of Mwana, also provided an update to

shareholders on the latest developments with the Company.

Highlights from the update today include:

*Work has begun at Kibolwe in the DRC that is expected to rapidly lead to

a JORC compliant resource and facilitate Mwana having a copper production

facility in operation there during 2008.

*Drilling along the indicated 5 km long mineralised gold zone at the Zani

Kodo gold property in the DRC will be possible by the beginning of next

year.

*Refurbishment work at the Freda Rebecca Mine is well underway to increase

production of gold to 48,000oz per year.

*An interim dividend payment of US$2.6m was received by Mwana from Bindura

Nickel Corporation on 13th October covering the six month period ending 30th

June 2006.

The full Chairman's update is also shown below:

It was little more than a year ago that Mwana, in its current form, became a

listed company, with the current management team, and with the strategy to

develop a broadly based portfolio of natural resources assets across Africa.

Over that year we have been kept very busy indeed. We have made progress with

production, with exploration and development, and have made important strategic

acquisitions.

We have acquired two sets of promising diamond production and exploration assets

in the DRC and gold exploration properties in Zimbabwe.

We have invested in exploration and development of our existing gold assets in

Zimbabwe and Ghana and set about enhancing our nickel resources and production

in Zimbabwe.

We are near to drill stage with our highly promising zinc, copper-cobalt and

gold exploration and development assets in the DRC.

In April this year we were also able to raise #42.1 million through a public

placement on AIM, giving us flexibility about how to finance Mwana's growth.

Last but not least, over the last year we have strengthened and deepened our

senior management team with the addition of Ken Owen as Technical Director and

Charl du Plessis as Vice President Exploration.

All these moves last year laid the foundations for Mwana to continue growing

strongly and profitably across Africa and across a range of commodities.

At the operational level last year we have also had cashflow of #4 million,

incorporating only six months income from the operations of the former Mwana

Africa Holdings (Pty) Limited, including positive stand-alone cashflow from our

operations in Zimbabwe. This enabled us to implement #4.4 million in capital and

financial investment during the year.

Now to update you at the level of some of our individual sites:

In Zimbabwe:

*there was US$5million committed as investment at the Freda Rebecca Mine

to expand processing capacity, and prospective exploration licences acquired

around the existing operations, which may enable extension of the mine

beyond the current 10 year estimate. The mine refurbishment programme to

increase production of gold to 48,000oz per year is now well underway.

*there was work on the Feasibility Study for the development of the

Hunters Road nickel deposit which is progressing, as well as investment in

shaft deepening and a new concentrator at the Trojan mine.

*there was solid progress made at Bindura Nickel Corporation despite a

difficult operating environment. As a result of the strong financial

performance, as a 53% shareholder in Bindura Nickel Corporation, Mwana

received on 13th October an interim dividend payment of US$2.6m for the six

month period ending 30th June 2006.

In Ghana:

*there was further exploratory work completed at Ahanta and underway at

Banka enabling a decision on the next stage of development to be made in the

near future.

In the DRC:

*there was target generation work completed at our Zinc property at Lombe

and follow up work is being planned.

*there was work undertaken at Kibolwe including the development of

infrastructure, such as roads and site facilities, and sampling and

trenching work. It is expected that resource drilling will commence in late

October or early November. Once drilling has begun it is expected to rapidly

result in a JORC compliant resource. Following this the next stage of

development will be to initiate a feasibility study for copper production.

It is our intention to have a production facility in full operation during

2008. Several sites nearby are also highly prospective for copper and have

been trenched and sampled. These will be drilled following completion of the

currently planned next stage of drilling at Kibolwe.

*a regional study to identify new target areas of potential bulk-tonnage

Copper-cobalt (as well as other non-traditional mineralisation styles)

deposits is underway, and scheduled for completion in December.

*there was progress at Zani Kodo, in the Kilo Moto JV in North Eastern DRC

where the Kodo Mine is near drill-ready and extensive artisinal pits

indicate an approximately 5 km long mineralised gold zone. Works are now

underway to allow access to the site for drilling at the beginning of next

year. Projects that will enable rapid reconaissance of the entire licence

area are underway, and will be completed before the end of the year.

We have every intention of updating you with further news as it becomes

available.

I would like to make clear on behalf of the Board our commitment to building

long term shareholder value through the implementation of our strategy of growth

both organically and through acquisition. One of the resolutions passed today

was to allow the repurchase of up to a maximum of 26,203,565 Ordinary Shares in

Mwana, representing approximately 10 per cent. of the current share capital.

This resolution is a demonstration of the confidence of the Board in the value

of Mwana. It shows that further capital raisings to finance investment in the

business will only be made at a level substantially above the current share

price. The right to repurchase shares will of course be exercised only if it

will result in an increase in earnings per share and be in the interests of

Mwana shareholders.

At our Extraordinary General Meeting on 9 November 2006 a special resolution is

also to be proposed to cancel the Share Premium Account of the Company. The

cancellation is proposed in order to eliminate the deficit on the Company's

profit and loss account as well as create distributable reserves to enable the

Company to reduce the number of issued Ordinary Shares in the Company through a

scheme to buy back Ordinary Shares. We believe that the cancellation of the

whole of the Share Premium Account will provide the Company with greater

flexibility in respect of its balance sheet as well as bringing forward the date

upon which the Directors could consider the declaration of dividends.

http://www.advfn.com/p.php?pid=nmona&cb=1163460069&article=1…

RNS Number:8140K

Mwana Africa PLC

20 October 2006

Mwana Africa plc

RESULTS OF ANNUAL GENERAL MEETING

London, 20th October 2006 - Mwana Africa plc ("Mwana" or the "Company") held its

Annual General Meeting earlier today. All of the resolutions put to the meeting

were passed with the exception of the reappointment of Hank Slack as a director,

who has resigned as a Non Executive Director of the Company. The resolutions

include one authorising the Company to purchase up to a maximum of 26,203,565

Ordinary Shares, representing aproximately 10 per cent. of the current issued

and committed share capital.

Oliver Baring, Executive Chairman of Mwana, also provided an update to

shareholders on the latest developments with the Company.

Highlights from the update today include:

*Work has begun at Kibolwe in the DRC that is expected to rapidly lead to

a JORC compliant resource and facilitate Mwana having a copper production

facility in operation there during 2008.

*Drilling along the indicated 5 km long mineralised gold zone at the Zani

Kodo gold property in the DRC will be possible by the beginning of next

year.

*Refurbishment work at the Freda Rebecca Mine is well underway to increase

production of gold to 48,000oz per year.

*An interim dividend payment of US$2.6m was received by Mwana from Bindura

Nickel Corporation on 13th October covering the six month period ending 30th

June 2006.

The full Chairman's update is also shown below:

It was little more than a year ago that Mwana, in its current form, became a

listed company, with the current management team, and with the strategy to

develop a broadly based portfolio of natural resources assets across Africa.

Over that year we have been kept very busy indeed. We have made progress with

production, with exploration and development, and have made important strategic

acquisitions.

We have acquired two sets of promising diamond production and exploration assets

in the DRC and gold exploration properties in Zimbabwe.

We have invested in exploration and development of our existing gold assets in

Zimbabwe and Ghana and set about enhancing our nickel resources and production

in Zimbabwe.

We are near to drill stage with our highly promising zinc, copper-cobalt and

gold exploration and development assets in the DRC.

In April this year we were also able to raise #42.1 million through a public

placement on AIM, giving us flexibility about how to finance Mwana's growth.

Last but not least, over the last year we have strengthened and deepened our

senior management team with the addition of Ken Owen as Technical Director and

Charl du Plessis as Vice President Exploration.

All these moves last year laid the foundations for Mwana to continue growing

strongly and profitably across Africa and across a range of commodities.

At the operational level last year we have also had cashflow of #4 million,

incorporating only six months income from the operations of the former Mwana

Africa Holdings (Pty) Limited, including positive stand-alone cashflow from our

operations in Zimbabwe. This enabled us to implement #4.4 million in capital and

financial investment during the year.

Now to update you at the level of some of our individual sites:

In Zimbabwe:

*there was US$5million committed as investment at the Freda Rebecca Mine

to expand processing capacity, and prospective exploration licences acquired

around the existing operations, which may enable extension of the mine

beyond the current 10 year estimate. The mine refurbishment programme to

increase production of gold to 48,000oz per year is now well underway.

*there was work on the Feasibility Study for the development of the

Hunters Road nickel deposit which is progressing, as well as investment in

shaft deepening and a new concentrator at the Trojan mine.

*there was solid progress made at Bindura Nickel Corporation despite a

difficult operating environment. As a result of the strong financial

performance, as a 53% shareholder in Bindura Nickel Corporation, Mwana

received on 13th October an interim dividend payment of US$2.6m for the six

month period ending 30th June 2006.

In Ghana:

*there was further exploratory work completed at Ahanta and underway at

Banka enabling a decision on the next stage of development to be made in the

near future.

In the DRC:

*there was target generation work completed at our Zinc property at Lombe

and follow up work is being planned.

*there was work undertaken at Kibolwe including the development of

infrastructure, such as roads and site facilities, and sampling and

trenching work. It is expected that resource drilling will commence in late

October or early November. Once drilling has begun it is expected to rapidly

result in a JORC compliant resource. Following this the next stage of

development will be to initiate a feasibility study for copper production.

It is our intention to have a production facility in full operation during

2008. Several sites nearby are also highly prospective for copper and have

been trenched and sampled. These will be drilled following completion of the

currently planned next stage of drilling at Kibolwe.

*a regional study to identify new target areas of potential bulk-tonnage

Copper-cobalt (as well as other non-traditional mineralisation styles)

deposits is underway, and scheduled for completion in December.

*there was progress at Zani Kodo, in the Kilo Moto JV in North Eastern DRC

where the Kodo Mine is near drill-ready and extensive artisinal pits

indicate an approximately 5 km long mineralised gold zone. Works are now

underway to allow access to the site for drilling at the beginning of next

year. Projects that will enable rapid reconaissance of the entire licence

area are underway, and will be completed before the end of the year.

We have every intention of updating you with further news as it becomes

available.

I would like to make clear on behalf of the Board our commitment to building

long term shareholder value through the implementation of our strategy of growth

both organically and through acquisition. One of the resolutions passed today

was to allow the repurchase of up to a maximum of 26,203,565 Ordinary Shares in

Mwana, representing approximately 10 per cent. of the current share capital.

This resolution is a demonstration of the confidence of the Board in the value

of Mwana. It shows that further capital raisings to finance investment in the

business will only be made at a level substantially above the current share

price. The right to repurchase shares will of course be exercised only if it

will result in an increase in earnings per share and be in the interests of

Mwana shareholders.

At our Extraordinary General Meeting on 9 November 2006 a special resolution is

also to be proposed to cancel the Share Premium Account of the Company. The

cancellation is proposed in order to eliminate the deficit on the Company's

profit and loss account as well as create distributable reserves to enable the

Company to reduce the number of issued Ordinary Shares in the Company through a

scheme to buy back Ordinary Shares. We believe that the cancellation of the

whole of the Share Premium Account will provide the Company with greater

flexibility in respect of its balance sheet as well as bringing forward the date

upon which the Directors could consider the declaration of dividends.

Ich ahne was:

Das wird der erste Explorer, der mir Dividende zahlt

Das wird der erste Explorer, der mir Dividende zahlt

In einem UK Forum hat sich jemand die Mühe gemacht.

kein Anspruch auf Vollständigkeit.

kein Anspruch auf Vollständigkeit.

liesst sich alles wunderbar

xio das explorer zertifikat hättest dir sparen können hier hast du alles in einer firma

eine anfangs position werd ich mir auch gönnen

der gute mann ist zwar sehr optimistisch aber ich glaube das volle potential der firma wird jahren brauchen bis das ausgereizt ist

aber ich vermute das sie schon bald neues geld brauchen werden

und er sagt ja das sie erst aktienzurückkaufen und somit erst eine ka durchführen wollen wenn der kurs deutlich höher steht

da würde ich mal sagen

da bin ich dabei das ist prima

xio das explorer zertifikat hättest dir sparen können hier hast du alles in einer firma

eine anfangs position werd ich mir auch gönnen

der gute mann ist zwar sehr optimistisch aber ich glaube das volle potential der firma wird jahren brauchen bis das ausgereizt ist

aber ich vermute das sie schon bald neues geld brauchen werden

und er sagt ja das sie erst aktienzurückkaufen und somit erst eine ka durchführen wollen wenn der kurs deutlich höher steht

da würde ich mal sagen

da bin ich dabei das ist prima

Im Vorab den Nickel-Preis / Tonne:

7000x 28.000 = 196.000.000

Thema: MWANA Nickel Exploration / Erweiterung bestehender Minen:

Aufschlussreicher Artikel auf MiningMX:

http://www.miningmx.com/mining_fin/763211.htm

Mwana eyes new nickel mine

Allan Seccombe

Posted: Mon, 24 Jul 2006

miningmx.com] -- MWANA Africa will start a six-month bankable feasibility study into developing a mine at its Hunters Road deposit in the next couple of months and is looking for a partner to bring the Zimbabwean project into production, CEO Kalaa Mpinga said on Monday.

“We have completed a feasibility study and metallurgical work at Hunters Road. We are also talking with potential business partners,” Mpinga told Miningmx.

The cost of establishing the Hunters Road mine would be around $100m.

“That’s why we are looking at some joint venture partners,” he said in answer to a question of how the capital would be raised.

The President Robert Mugabe's government has sent ripples of unease through the mining industry there with its “indigenisation plan” in which it will take 51% of assets. There is no certainty what stake will end up in government hands.

Despite the political risk of investing in Zimbabwe, where the economy is in dire straights, there is still appetite for such a project, he said.

“We have a number of people who have indicated they want to get involved. There is a lot of interest,” he said.

It will be an opencast mine that will produce 7,000 tonnes/year of nickel contained in concentrate to feed into Mwana’s 53% held Bindura Nickel’s smelter and refinery, which is currently treating concentrate from two other Bindura mines as well as concentrate from South Africa and Botswana, he said.

The refinery can handle up to 15,000 tonnes of nickel but it is producing 10,000 tonnes at the moment, including the toll-treated material. Mwana would like the plant to operate at capacity.

The Shangani and Trojan mines are battling with hyperinflation and receiving currency at the official rate, which is a fraction of what the black market rate is. Zimbabwe’s inflation is running above 1,000%, the highest in the world.

Under the circumstances, the operations are running fine,” he said. “Clearly we have a lot of problems at the cost level. They are very difficult to control.”

“Thanks to the high nickel price, we are surviving.”

The two mines produce about 7,000 tonnes of nickel.

The Trojan mine is being expanded, adding another 10 years to its nine-year life. The Shangani mine has a four-year life and a study is underway to prolong it. The Hunters Road concentrate could replace that from Shangani.

7000x 28.000 = 196.000.000

Thema: MWANA Nickel Exploration / Erweiterung bestehender Minen:

Aufschlussreicher Artikel auf MiningMX:

http://www.miningmx.com/mining_fin/763211.htm

Mwana eyes new nickel mine

Allan Seccombe

Posted: Mon, 24 Jul 2006

miningmx.com] -- MWANA Africa will start a six-month bankable feasibility study into developing a mine at its Hunters Road deposit in the next couple of months and is looking for a partner to bring the Zimbabwean project into production, CEO Kalaa Mpinga said on Monday.

“We have completed a feasibility study and metallurgical work at Hunters Road. We are also talking with potential business partners,” Mpinga told Miningmx.

The cost of establishing the Hunters Road mine would be around $100m.

“That’s why we are looking at some joint venture partners,” he said in answer to a question of how the capital would be raised.

The President Robert Mugabe's government has sent ripples of unease through the mining industry there with its “indigenisation plan” in which it will take 51% of assets. There is no certainty what stake will end up in government hands.

Despite the political risk of investing in Zimbabwe, where the economy is in dire straights, there is still appetite for such a project, he said.

“We have a number of people who have indicated they want to get involved. There is a lot of interest,” he said.

It will be an opencast mine that will produce 7,000 tonnes/year of nickel contained in concentrate to feed into Mwana’s 53% held Bindura Nickel’s smelter and refinery, which is currently treating concentrate from two other Bindura mines as well as concentrate from South Africa and Botswana, he said.

The refinery can handle up to 15,000 tonnes of nickel but it is producing 10,000 tonnes at the moment, including the toll-treated material. Mwana would like the plant to operate at capacity.

The Shangani and Trojan mines are battling with hyperinflation and receiving currency at the official rate, which is a fraction of what the black market rate is. Zimbabwe’s inflation is running above 1,000%, the highest in the world.

Under the circumstances, the operations are running fine,” he said. “Clearly we have a lot of problems at the cost level. They are very difficult to control.”

“Thanks to the high nickel price, we are surviving.”

The two mines produce about 7,000 tonnes of nickel.

The Trojan mine is being expanded, adding another 10 years to its nine-year life. The Shangani mine has a four-year life and a study is underway to prolong it. The Hunters Road concentrate could replace that from Shangani.

MWANA Locations:

Bereits in Produktion:

Bindura Nickel mit Smelter

In 2004, Mwana produced 10,500 tonnes nickel at the Bindura Nickel operation, Zimbabwe.

Bindura Nickel Corporation Limited. The Group's principal activities are mining operations and smelting and refining of nickel, copper, cobalt and precious group metals. The Group currently has two mine operations, Trojan mine and Shanghai mine.

Freda-Rebecca:

In 2004, Mwana produced 30,000oz gold at Freda Rebecca mine, Zimbabwe.

in Produktion, Kapazität wird "bloß" erhöht

Bindura ist die Hauptstadt der Provinz Zentralmaschonaland in Simbabwe, 88 km nordöstlich von Harare. Sie liegt auf über 1.000 m Höhe am Great Dyke sowie an Straße und Eisenbahnstrecke Harare-Shamva. Sie ist eine Bergbaustadt mit 39.000 Einwohner (2006), in der von Firmen wie Bindura Nickel Corporation Limited Kupfer, Nickel und Kobald gefördert und geschmolzen werden. Entsprechende verarbeitende Industrie ist hier angesiedelt. AngloGoldAshanti fördert in der Mine Freda-Rebecca nahe bei Bindura 51.091 Unzen Gold im Jahr (2003, damals US-Dollar 268/Unze Weltmarktpreis, im Jahr 2006 über 450). Die Reserven dieser Mine werden auf 300.000 Unzen geschätzt.

http://de.wikipedia.org/wiki/Bindura

Bereits in Produktion:

Bindura Nickel mit Smelter

In 2004, Mwana produced 10,500 tonnes nickel at the Bindura Nickel operation, Zimbabwe.

Bindura Nickel Corporation Limited. The Group's principal activities are mining operations and smelting and refining of nickel, copper, cobalt and precious group metals. The Group currently has two mine operations, Trojan mine and Shanghai mine.

Freda-Rebecca:

In 2004, Mwana produced 30,000oz gold at Freda Rebecca mine, Zimbabwe.

in Produktion, Kapazität wird "bloß" erhöht

Bindura ist die Hauptstadt der Provinz Zentralmaschonaland in Simbabwe, 88 km nordöstlich von Harare. Sie liegt auf über 1.000 m Höhe am Great Dyke sowie an Straße und Eisenbahnstrecke Harare-Shamva. Sie ist eine Bergbaustadt mit 39.000 Einwohner (2006), in der von Firmen wie Bindura Nickel Corporation Limited Kupfer, Nickel und Kobald gefördert und geschmolzen werden. Entsprechende verarbeitende Industrie ist hier angesiedelt. AngloGoldAshanti fördert in der Mine Freda-Rebecca nahe bei Bindura 51.091 Unzen Gold im Jahr (2003, damals US-Dollar 268/Unze Weltmarktpreis, im Jahr 2006 über 450). Die Reserven dieser Mine werden auf 300.000 Unzen geschätzt.

http://de.wikipedia.org/wiki/Bindura

Antwort auf Beitrag Nr.: 25.374.962 von tjcc281086 am 14.11.06 01:08:08klingt ja alle nicht schlecht... aber sind kaum umsätze in dem wert zu finden. werde die aktie aber auf jeden fall mal beobachten. viel erfolg allen hier

Antwort auf Beitrag Nr.: 25.376.869 von zooropa am 14.11.06 08:20:43Kauf doch in London, geht doch bei den meisten Brokern, hab selber über Consors geodert, no Problem.

Aber hier wird garantiert auch noch was wachsen, was den Umsatz betrifft, da bin ich mir ziemlich sicher.

Berlin einfach mal probieren.

Kurs vorher umrechnen: www.oanda.com

Aber hier wird garantiert auch noch was wachsen, was den Umsatz betrifft, da bin ich mir ziemlich sicher.

Berlin einfach mal probieren.

Kurs vorher umrechnen: www.oanda.com

HAbt Ihr Euch mal angeschaut, was es mit Artemis auf sich hat...

http://www.mwanaafrica.com/news/11-01,%2006%20Artemis%20Hold…

Der investieren wohl auch oder???

Und wo die Investieren, geht es meistens hoch...

Kann das einer bestätigen???

http://www.mwanaafrica.com/news/11-01,%2006%20Artemis%20Hold…

Der investieren wohl auch oder???

Und wo die Investieren, geht es meistens hoch...

Kann das einer bestätigen???

Antwort auf Beitrag Nr.: 25.376.956 von Papasimon am 14.11.06 08:25:58Fertile Ground: Hedge Founds Travel to Africa

By Alistair MacDonald, The Wall Street Journal,

October 6, 2006

For 20 years, whenever Congolese businessman Kalaa Mpinga wanted to finance projects in sub-Saharan Africa, he would turn to agencies like the World Bank and the European Investment Bank. Now, rather than international development agencies, two hedge funds -- Lansdowne Partners Ltd. and Marshall Wace LLP -- are among his biggest investors. Together, they own more than 12% of the company he heads, Mwana Africa PLC.

"Today, you will get far more results by going to the market and raising your finance that way," says Mr. Mpinga, chief executive of Mwana Africa, a mining company that went public on the London Stock Exchange last year, after obtaining the listing of a rival African miner it acquired.

http://www.wdi.umich.edu/Resources/2280/

By Alistair MacDonald, The Wall Street Journal,

October 6, 2006

For 20 years, whenever Congolese businessman Kalaa Mpinga wanted to finance projects in sub-Saharan Africa, he would turn to agencies like the World Bank and the European Investment Bank. Now, rather than international development agencies, two hedge funds -- Lansdowne Partners Ltd. and Marshall Wace LLP -- are among his biggest investors. Together, they own more than 12% of the company he heads, Mwana Africa PLC.

"Today, you will get far more results by going to the market and raising your finance that way," says Mr. Mpinga, chief executive of Mwana Africa, a mining company that went public on the London Stock Exchange last year, after obtaining the listing of a rival African miner it acquired.

http://www.wdi.umich.edu/Resources/2280/

Antwort auf Beitrag Nr.: 25.377.164 von Papasimon am 14.11.06 08:36:36Ja, bei den Clienten darf einem ruhig mal die "Fresse" einschlafen

!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de

Korrektur, an zuvielen Fronten leichzeitig gepostet.

Nochmal eine kleine Zwischenzusammenfassung, damit wir das grosse Ganze nicht aus den Augen verlieren.

Meiner Auffassung nach wird das Anmercosa Projekt der Bringer, später dann das Kilo Moto Objekt.

Nochmal eine kleine Zwischenzusammenfassung, damit wir das grosse Ganze nicht aus den Augen verlieren.

Meiner Auffassung nach wird das Anmercosa Projekt der Bringer, später dann das Kilo Moto Objekt.

Ah,

die haben also einen Reverse Merger gemacht bzw. ne andere afrikanische schon gelistete Firma übernommen.

Der Chart sieht ja nicht berauschend aus...warum geht es ehgentlich immer nur runter???

Insgesamt sieht es aber sehr vielversprechend aus, dass muss ich schon zugeben...

Mal schauen, was mein Bankkontgo mir sagt!!!

die haben also einen Reverse Merger gemacht bzw. ne andere afrikanische schon gelistete Firma übernommen.

Der Chart sieht ja nicht berauschend aus...warum geht es ehgentlich immer nur runter???

Insgesamt sieht es aber sehr vielversprechend aus, dass muss ich schon zugeben...

Mal schauen, was mein Bankkontgo mir sagt!!!

Antwort auf Beitrag Nr.: 25.377.358 von Papasimon am 14.11.06 08:48:44Würde mal sagen, die haben einfach mal sehr viel Kohle ausgegeben.

Ausserdem gabs anfang 2004 einen Hype.

Da ist doch die Situation jetzt wesentlich augeklärter.

Würde behaupten: genau rechtzeitig.

Ausserdem gabs anfang 2004 einen Hype.

Da ist doch die Situation jetzt wesentlich augeklärter.

Würde behaupten: genau rechtzeitig.

HighGrade Copper über 2% als Durchschnitt ist in der Region völlig normal. In Australien oder Kanada würden sie an die Deckhe springen.

Kleiner Abstecher zur Konkurrenz Tenke / Phelps

(die haben ("nur")ein Kolwezi Projekt in der Katanga Region (oben links in der Karte), das wird eines der grössten neuen Kupferprojekt weltweit.

(Aber warten wir mal auf Anmercosa, das wird nicht weniger sein und MWANA hat eine riesen Fläche)

Congo miners must look beyond the bottom line

http://search.ft.com/searchArticle?queryText=fortin&y=0&java…

By Andrew England

FT.com site, Aug 20, 2006

Standing on a hilltop in a remote corner of the Democratic Republic of Congo, a manager with Phelps Dodge, the US mining group, stoops to pick up a piece of rock. On one side he points to a greenish colour – copper; on other side it is soot-black – cobalt.

"It's everywhere. We will carry out exploration in all conceivable directions," says Jeffrey Best, now standing and looking out across the Tenke Fungurume concession in which Phelps Dodge plans to invest hundreds of millions of dollars in the next few years. "We drive through hills worth billions of dollars."

(die haben ("nur")ein Kolwezi Projekt in der Katanga Region (oben links in der Karte), das wird eines der grössten neuen Kupferprojekt weltweit.

(Aber warten wir mal auf Anmercosa, das wird nicht weniger sein und MWANA hat eine riesen Fläche)

Congo miners must look beyond the bottom line

http://search.ft.com/searchArticle?queryText=fortin&y=0&java…

By Andrew England

FT.com site, Aug 20, 2006

Standing on a hilltop in a remote corner of the Democratic Republic of Congo, a manager with Phelps Dodge, the US mining group, stoops to pick up a piece of rock. On one side he points to a greenish colour – copper; on other side it is soot-black – cobalt.

"It's everywhere. We will carry out exploration in all conceivable directions," says Jeffrey Best, now standing and looking out across the Tenke Fungurume concession in which Phelps Dodge plans to invest hundreds of millions of dollars in the next few years. "We drive through hills worth billions of dollars."

In Deutschland gibt es ja praktisch keinen Handel.

Weitere Daten von Berlin-Bremen

Bid 0,62

Bidsize 1.000

Uhrzeit Datum 09:21 14.11.

Ask - -

Asksize - -

Uhrzeit Datum - -

Heimatbörse London.

Mal sehen ob mine Bank damit klar kommt.

Weitere Daten von Berlin-Bremen

Bid 0,62

Bidsize 1.000

Uhrzeit Datum 09:21 14.11.

Ask - -

Asksize - -

Uhrzeit Datum - -

Heimatbörse London.

Mal sehen ob mine Bank damit klar kommt.

Antwort auf Beitrag Nr.: 25.379.724 von karifel am 14.11.06 10:44:05Also London sollte jeder "normale" Broker bedienen können.

Evtl etwas höhere Ordergebühren, dafür aber sehr niedriger Spread.

In Berlin kann man ja mal alternativ versuchen, den umgerechneten ShareKurs zu bieten.