Fortune Minerals - Kobalt, Wismut, Gold + Kohle - 500 Beiträge pro Seite

eröffnet am 31.07.09 16:45:13 von

neuester Beitrag 04.03.24 12:19:35 von

neuester Beitrag 04.03.24 12:19:35 von

Beiträge: 191

ID: 1.152.098

ID: 1.152.098

Aufrufe heute: 0

Gesamt: 13.079

Gesamt: 13.079

Aktive User: 0

ISIN: CA34967D1015 · WKN: A0CAFV · Symbol: FT

0,0400

CAD

0,00 %

0,0000 CAD

Letzter Kurs 25.04.24 Toronto

Neuigkeiten

08.04.24 · Business Wire (engl.) |

01.02.24 · Business Wire (engl.) |

05.12.23 · Business Wire (engl.) |

29.09.23 · Business Wire (engl.) |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 5,1500 | +21,75 | |

| 15,590 | +19,37 | |

| 0,9000 | +16,13 | |

| 15.699,00 | +15,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,8300 | -6,81 | |

| 0,5180 | -7,09 | |

| 10,040 | -7,89 | |

| 0,5400 | -8,47 | |

| 0,5500 | -21,43 |

Projekte:

Fortune's NICO Lagerstätte.

Projektseite:

http://www.fortuneminerals.com/s/NICO.asp

Rohstoffe: Gold,Kobalt,Wismut,Kupfer

Ort:

NICO liegt 160 Kilometer nordwestlich der Stadt Yellowknife in den südlichen Teil der Northwest Territories. Das Projekt ist nur 22 Kilometer westlich von der Snare Hydro komplexe, 50 Kilometer nördlich von der Gemeinde Whatì, und 85 Kilometer nördlich von Behchoko und die Autobahn nach Edmonton, Alberta.

Status:

Nico hat mehr als $ 65 Millionen bisher für durchgeführte Arbeiten vershlungen und ist jetzt in der Umweltverträglichkeitsprüfung zur Genehmigung eines kombinierten Tagebau-und U-Minen-und Prozess-Anlage.

Eigentümer: 100% Fortune

Entdeckt: von Fortune im Jahr 1996

Vor allem, die meisten von der Vorarbeiten für die Entwicklung des unterirdische Teils der Mine ist bereits abgeschlossen im Rahmen von zwei 10 Millionen US-Dollar-Test Bergbau-Programmen, die in den Jahren 2006 und 2007 stattfanden.

Durchschnittliche jährliche Produktion von Kobalt und Wismut werden auf 4 Millionen Pfund und 4,2 Millionen Pfund, geschätzt. Vor allem, Nico wird der größte Hersteller von Wismut in der Welt. Kupfer und Nickel wird auch produziert werden,aber als Nebenprodukte.

Gold ist ein wichtiger Nebenprodukt in der NICO Mineralisierung und ist ein zyklischer Hedge, vor allem mit der aktuellen wirtschaftlichen und geopolitischen Unsicherheit, die treibt die Anleger in Gold als Reichtum.

Mineralischen Reserven und Ressourcen:

Nico enthält Nachgewiesene und wahrscheinliche Mineralreserven von 21,8 Mio. Tonnen mit 760.000 Unzen Gold, 61 Millionen Pfund Kobalt, und 77 Millionen Pfund von Wismut.

Mineralisierung:

Die NICO Reserven werden mit mindestens 15-Jahren-Mineleben bei 4000 Tonnen Erz pro Tag (1.460.000 Tonnen / Jahr) Produktion in der 2007 Micon Machbarkeitsstudie dargelegt.

Fortune's Sue Dianne-Liegenschaft, Low-Cost-Tagebau

Mineralisierung

Rohstoffe: Kupfer,Silber,Gold (oberflächennahe mineralische Rohstoffe)

Ort: Sue-Dianne liegt nur 25 Kilometer nördlich von Fortune's NICO.

Status: in der Exploration

Eigentümer: 100% Fortune

Die aktuelle Mineral-Ressource enthält 177,4 Mio. Pfund Kupfer, 977.000 Unzen Silber und 22.600 Unzen Gold und durch die Hinterlegung bleibt Potenzial für die Erweiterung nach Osten.

Kostenreduzierend wirkt auch die Nähe zum NICO Projekt und wird die dortigen Anschaffungen auch besser Auslasten und somit die Kosten auf beide Projekte aufteilen.

Damit sind die Investitionen gleich doppelt nützlich.

Bohrkern mit Kupfermineralisierung

_2-sm.jpg)

Über Fortune Minerals

Fortune Minerals ist ein diversifiziertes Unternehmen mit natürlichen Ressourcen, sieben Minerallagerstätten und eine Reihe von Explorations-Projekte, alle mit Sitz in Kanada. Dazu gehören die NICO Kobalt-Gold-Wismut-Einlagen, die Mount Klappan Anthrazit-Kohle-Vorkommen in Britisch-Kolumbien, und die Sue Dianne-Kupfer-Silber und anderen unedlen und Edelmetallen Exploration-Projekte in den Northwest Territories. Fortune Minerals konzentriert sich auf die herausragende Leistung und das Wachstum des Shareholder Value durch die Montage und die Entwicklung von hochwertigen mineralischen Ressource Projekte.

Unternehmen HP:

http://www.fortuneminerals.com/s/NewsReleases.asp

Fortune's NICO Lagerstätte.

Projektseite:

http://www.fortuneminerals.com/s/NICO.asp

Rohstoffe: Gold,Kobalt,Wismut,Kupfer

Ort:

NICO liegt 160 Kilometer nordwestlich der Stadt Yellowknife in den südlichen Teil der Northwest Territories. Das Projekt ist nur 22 Kilometer westlich von der Snare Hydro komplexe, 50 Kilometer nördlich von der Gemeinde Whatì, und 85 Kilometer nördlich von Behchoko und die Autobahn nach Edmonton, Alberta.

Status:

Nico hat mehr als $ 65 Millionen bisher für durchgeführte Arbeiten vershlungen und ist jetzt in der Umweltverträglichkeitsprüfung zur Genehmigung eines kombinierten Tagebau-und U-Minen-und Prozess-Anlage.

Eigentümer: 100% Fortune

Entdeckt: von Fortune im Jahr 1996

Vor allem, die meisten von der Vorarbeiten für die Entwicklung des unterirdische Teils der Mine ist bereits abgeschlossen im Rahmen von zwei 10 Millionen US-Dollar-Test Bergbau-Programmen, die in den Jahren 2006 und 2007 stattfanden.

Durchschnittliche jährliche Produktion von Kobalt und Wismut werden auf 4 Millionen Pfund und 4,2 Millionen Pfund, geschätzt. Vor allem, Nico wird der größte Hersteller von Wismut in der Welt. Kupfer und Nickel wird auch produziert werden,aber als Nebenprodukte.

Gold ist ein wichtiger Nebenprodukt in der NICO Mineralisierung und ist ein zyklischer Hedge, vor allem mit der aktuellen wirtschaftlichen und geopolitischen Unsicherheit, die treibt die Anleger in Gold als Reichtum.

Mineralischen Reserven und Ressourcen:

Nico enthält Nachgewiesene und wahrscheinliche Mineralreserven von 21,8 Mio. Tonnen mit 760.000 Unzen Gold, 61 Millionen Pfund Kobalt, und 77 Millionen Pfund von Wismut.

Mineralisierung:

Die NICO Reserven werden mit mindestens 15-Jahren-Mineleben bei 4000 Tonnen Erz pro Tag (1.460.000 Tonnen / Jahr) Produktion in der 2007 Micon Machbarkeitsstudie dargelegt.

Fortune's Sue Dianne-Liegenschaft, Low-Cost-Tagebau

Mineralisierung

Rohstoffe: Kupfer,Silber,Gold (oberflächennahe mineralische Rohstoffe)

Ort: Sue-Dianne liegt nur 25 Kilometer nördlich von Fortune's NICO.

Status: in der Exploration

Eigentümer: 100% Fortune

Die aktuelle Mineral-Ressource enthält 177,4 Mio. Pfund Kupfer, 977.000 Unzen Silber und 22.600 Unzen Gold und durch die Hinterlegung bleibt Potenzial für die Erweiterung nach Osten.

Kostenreduzierend wirkt auch die Nähe zum NICO Projekt und wird die dortigen Anschaffungen auch besser Auslasten und somit die Kosten auf beide Projekte aufteilen.

Damit sind die Investitionen gleich doppelt nützlich.

Bohrkern mit Kupfermineralisierung

_2-sm.jpg)

Über Fortune Minerals

Fortune Minerals ist ein diversifiziertes Unternehmen mit natürlichen Ressourcen, sieben Minerallagerstätten und eine Reihe von Explorations-Projekte, alle mit Sitz in Kanada. Dazu gehören die NICO Kobalt-Gold-Wismut-Einlagen, die Mount Klappan Anthrazit-Kohle-Vorkommen in Britisch-Kolumbien, und die Sue Dianne-Kupfer-Silber und anderen unedlen und Edelmetallen Exploration-Projekte in den Northwest Territories. Fortune Minerals konzentriert sich auf die herausragende Leistung und das Wachstum des Shareholder Value durch die Montage und die Entwicklung von hochwertigen mineralischen Ressource Projekte.

Unternehmen HP:

http://www.fortuneminerals.com/s/NewsReleases.asp

Operating Profit

2000 -0,26

2001 -0,23

2002 -0,24

2003 -0,74

2004 -1,34

2005 -0,35

2006 -0,72

2007 -0,25

2008 -1,24

2000 -0,26

2001 -0,23

2002 -0,24

2003 -0,74

2004 -1,34

2005 -0,35

2006 -0,72

2007 -0,25

2008 -1,24

Es steht doch in meiner Ausführung das zur jetzigen Zeit das Geld in die Projekte hinein fließt und nicht rauskommt.

Doch wie man oben sehen kann, werden sich beide Projekte ergenzen und so wir hier ein guter Gewinn durch die Produktion möglich sein.

Doch wie man oben sehen kann, werden sich beide Projekte ergenzen und so wir hier ein guter Gewinn durch die Produktion möglich sein.

Antwort auf Beitrag Nr.: 37.688.303 von impyer am 31.07.09 16:45:13Nico hat mehr als $ 65 Millionen bisher für durchgeführte Arbeiten vershlungen

also verballert?

Nico enthält Nachgewiesene und wahrscheinliche Mineralreserven von 21,8 Mio. Tonnen mit 760.000 Unzen Gold,

Zwischenfrage: Wieviel davon ist nachgewiesen und wieviel wahrscheinlich?

Mein Fazit: Auf gar keinen Fall kaufen, Finger weg!

also verballert?

Nico enthält Nachgewiesene und wahrscheinliche Mineralreserven von 21,8 Mio. Tonnen mit 760.000 Unzen Gold,

Zwischenfrage: Wieviel davon ist nachgewiesen und wieviel wahrscheinlich?

Mein Fazit: Auf gar keinen Fall kaufen, Finger weg!

Nico hat mehr als $ 65 Millionen bisher für durchgeführte Arbeiten vershlungen

also verballert?

Für das Geld wurden Maschienen, Erschließung und Bohrungsarbeiten durchgeführt, also nicht verballert.

Nico enthält Nachgewiesene und wahrscheinliche Mineralreserven von 21,8 Mio. Tonnen mit 760.000 Unzen Gold,

Zwischenfrage: Wieviel davon ist nachgewiesen und wieviel wahrscheinlich?

Durch die Bohrungen wurde das Gebiet sondiert und durch die Hochrechnungen, kommt es auf diese Mineralisierung

Deswegen ist die Zahl eine grobe Richtzahl, die bei den meisten Minen übertroffen wird.

Mein Fazit: Auf gar keinen Fall kaufen, Finger weg!

Wenn ich Fragen darf auch welcher Grundlage basiert deine Meinung?

So wie ich das sehe, hast du dich mit der Firma wohl nicht beschäftigt sonst wären die Fragen darüber nicht so gestellt wurden.

Das Explorationsgebiet wurde nach genormten Standards, von unhabängiger Seite untersucht.

Die Mineralisierung wurde durch die Bohrungen festgestellt und durch Berechnungen auf das Gesamtgebiet bezogen, nur so kommt man zu ordentlichen Zahlen, wie es hier der Fall war.

mfg

impyer

also verballert?

Für das Geld wurden Maschienen, Erschließung und Bohrungsarbeiten durchgeführt, also nicht verballert.

Nico enthält Nachgewiesene und wahrscheinliche Mineralreserven von 21,8 Mio. Tonnen mit 760.000 Unzen Gold,

Zwischenfrage: Wieviel davon ist nachgewiesen und wieviel wahrscheinlich?

Durch die Bohrungen wurde das Gebiet sondiert und durch die Hochrechnungen, kommt es auf diese Mineralisierung

Deswegen ist die Zahl eine grobe Richtzahl, die bei den meisten Minen übertroffen wird.

Mein Fazit: Auf gar keinen Fall kaufen, Finger weg!

Wenn ich Fragen darf auch welcher Grundlage basiert deine Meinung?

So wie ich das sehe, hast du dich mit der Firma wohl nicht beschäftigt sonst wären die Fragen darüber nicht so gestellt wurden.

Das Explorationsgebiet wurde nach genormten Standards, von unhabängiger Seite untersucht.

Die Mineralisierung wurde durch die Bohrungen festgestellt und durch Berechnungen auf das Gesamtgebiet bezogen, nur so kommt man zu ordentlichen Zahlen, wie es hier der Fall war.

mfg

impyer

Antwort auf Beitrag Nr.: 37.690.446 von Substanzfritzes am 31.07.09 21:27:08Leute, nun mal gaaaanz langsam. Es ist wie bei den meisten Explorern,

entweder es geht gut (in 1-3Jahren), oder aber die Kohle ist weg.Wer investieren will, na bitte, wer nicht, kann sicher sein, keine Kohle

verbrannt zu haben. Schönes WE an alle -@.

entweder es geht gut (in 1-3Jahren), oder aber die Kohle ist weg.Wer investieren will, na bitte, wer nicht, kann sicher sein, keine Kohle

verbrannt zu haben. Schönes WE an alle -@.

Antwort auf Beitrag Nr.: 37.691.885 von chinagerd am 01.08.09 10:14:01Ja so sehe ich es auch, wer nicht investiren will muss es nicht.

Nur für mich stellt sich hier eben Potenzial dar, da eben Gold in aussichtsteicher Menge festgestellt ist und die Abbaukosten vergleichsweise gering sein werden, da die Tiefen in denen es vorliegt, nicht sehr tief sind.

Ich wollte eigendlich eine konstruktive Disskusion drüber führen und nicht solche Anworten bekommen, wie sie bisher hier auftraten.

mfg

impyer

Nur für mich stellt sich hier eben Potenzial dar, da eben Gold in aussichtsteicher Menge festgestellt ist und die Abbaukosten vergleichsweise gering sein werden, da die Tiefen in denen es vorliegt, nicht sehr tief sind.

Ich wollte eigendlich eine konstruktive Disskusion drüber führen und nicht solche Anworten bekommen, wie sie bisher hier auftraten.

mfg

impyer

Wo finde ich denn die nachgewiesenen Reserven und Ressourcen lt. NI 43-101? Ich finde die Studie nicht. Stell mal bitte den Link ins Forum. Danke!

für Sue-Dianne Copper-Silver Deposit:

wir es vorbereitet wie die News sagt

http://www.fortuneminerals.com/s/NewsReleases.asp?reportid=2…

Für NICO

http://www.fortuneminerals.com/i/pdf/2006-12-06_NR.pdf

http://www.fortuneminerals.com/s/NewsReleases.asp?reportid=1…

hoffe hilft dir.

wir es vorbereitet wie die News sagt

http://www.fortuneminerals.com/s/NewsReleases.asp?reportid=2…

Für NICO

http://www.fortuneminerals.com/i/pdf/2006-12-06_NR.pdf

http://www.fortuneminerals.com/s/NewsReleases.asp?reportid=1…

hoffe hilft dir.

News:

http://www.fortuneminerals.com/s/NewsReleases.asp?ReportID=3…

Fortune Minerals zur Lokalisierung von Nico`s Hydrometallurgie Prozesseinrichtung im südlichen Kanada.

Diese Änderung in der NICO Projektplanung wird eine wesentliche positive Auswirkungen auf die Kapital-und Betriebskosten haben. Es wird auch dazu beitragen, Milderung künftiger Exposition gegenüber steigenden Energiekosten, den Bauplanungen, zur Senkung der Umweltbelastungen und zur Beschleunigung der Genehmigungsverfahren, die bereits im Gange sind.

-------------------------------------------------------------------

Auch wichtig:

Fortune Minerals nimmt zur Kenntnis, dass am 15. Juli 2009, China Mining Resources Group Ltd (China Mining), durch seine hundertprozentige Tochtergesellschaft, Best Tone Holdings Ltd., ein Aggregat von 9285000 Anteile am Kapital der Fortune Minerals gekauft zuhaben. Dies entspricht 14,31% der ausgegebenen und ausstehenden Aktien der Gesellschaft.

China Mining berichtet, dass diese Aktien auf der Toronto Stock Exchange gekauft wurden, für Investitionen Zwecke. China Mining ist ein in Hongkong ansässiges Unternehmen in den Bereichen Bergbau, Verarbeitung und Verkauf von verschiedenen Metallen und Metall-Produkte, sowie Investitionen und Betriebsaktivitäten.

Hier zeigt sich wieder, es steckt noch viel Potenzial die nächsten Jahre hier, meine Meinung

http://www.fortuneminerals.com/s/NewsReleases.asp?ReportID=3…

Fortune Minerals zur Lokalisierung von Nico`s Hydrometallurgie Prozesseinrichtung im südlichen Kanada.

Diese Änderung in der NICO Projektplanung wird eine wesentliche positive Auswirkungen auf die Kapital-und Betriebskosten haben. Es wird auch dazu beitragen, Milderung künftiger Exposition gegenüber steigenden Energiekosten, den Bauplanungen, zur Senkung der Umweltbelastungen und zur Beschleunigung der Genehmigungsverfahren, die bereits im Gange sind.

-------------------------------------------------------------------

Auch wichtig:

Fortune Minerals nimmt zur Kenntnis, dass am 15. Juli 2009, China Mining Resources Group Ltd (China Mining), durch seine hundertprozentige Tochtergesellschaft, Best Tone Holdings Ltd., ein Aggregat von 9285000 Anteile am Kapital der Fortune Minerals gekauft zuhaben. Dies entspricht 14,31% der ausgegebenen und ausstehenden Aktien der Gesellschaft.

China Mining berichtet, dass diese Aktien auf der Toronto Stock Exchange gekauft wurden, für Investitionen Zwecke. China Mining ist ein in Hongkong ansässiges Unternehmen in den Bereichen Bergbau, Verarbeitung und Verkauf von verschiedenen Metallen und Metall-Produkte, sowie Investitionen und Betriebsaktivitäten.

Hier zeigt sich wieder, es steckt noch viel Potenzial die nächsten Jahre hier, meine Meinung

Antwort auf Beitrag Nr.: 37.692.279 von impyer am 01.08.09 12:15:27für Sue-Dianne Copper-Silver Deposit:

wir es vorbereitet wie die News sagt

was ist das für ein krudes Zeug?

Das Ganze wirkt u n s e r i ö s

wir es vorbereitet wie die News sagt

was ist das für ein krudes Zeug?

Das Ganze wirkt u n s e r i ö s

Fortune Minerals Provides Nico Road Initiative Update - Aug 5, 2009

www.fortuneminerals.com/s/NewsReleases.asp?ReportID=358741&_…

"Fortune Minerals Limited (TSX-FT) ("Fortune Minerals" or the "Company") is pleased to provide an update about the road initiative in the Tlicho (aboriginal) region northwest of Yellowknife, Northwest Territories where the Company's NICO mine development is located. The existing winter road extending north from the town of Behchoko on Highway 3 between Yellowknife and Edmonton, Alberta to the communities of Whati and Gameti is the subject of a government plan for realignment to an overland route in order to reduce the cost of living in the Tlicho region, mitigate the impacts of climate change on community resupply, and promote economic activity. This road is also currently used to access the NICO Gold-Cobalt-Bismuth-Copper deposit, which Fortune Minerals is permitting to develop a mine, mill and process plant, which requires all-season road access for mine supply and to transport metal concentrates south for processing to high value metal products.

The initiative to upgrade the Tlicho winter road is being managed by the government of the Northwest Territories (GNWT) - Department of Transportation (DOT), working together with the Tlicho Government, and with financial support from the federal government. Preliminary engineering, route analysis, environmental scoping studies and consultation with local communities have already been undertaken to establish the feasibility of this road upgrade and its desirability from the perspective of the Tlicho people. Fortune Minerals has also contributed its own detailed engineering and environmental studies for a 50 km portion of the road as its initial contribution toward the project and is part of a working group for future planning. An approximate 136 km portion of the Tlicho road will be used for the NICO mine. Approximately 25 km of all-season road has already been built by the community of Whati and is being extended this road this summer by the community. Fortune Minerals is in discussions with the GNWT, federal and Tlicho Governments with respect to joint financing the upgrade of other segments of the route to an all-weather standard so that it can be used for mine operations.

The GNWT and the federal government have committed $18 million of additional resources toward completing the next phase of the Tlicho road initiative, which includes additional engineering and environmental work, community consultation, re-alignment of the road to an all-land route, construction of permanent bridged water crossings and the laying of road bed on portions of the route. The next phase of this road initiative received significant support from Tlicho citizens during the consultation process and the Tlicho Government has approved the engineering and environmental studies now being tendered by the DOT. The final route and other details of the road construction and operation will still require the approval of the Tlicho Government.

Fortune Minerals is very pleased to be working cooperatively with the Tlicho Government and GNWT towards completion of this important infrastructure initiative to improve the transportation and reduce the cost of living in Tlicho communities as well as provide the foundation for additional economic opportunities on Tlicho lands, including the NICO mine development for the benefit of all stakeholders.

About Fortune Minerals

Fortune Minerals is a diversified natural resource company with several mineral deposits and a number of exploration projects, all located in Canada. They include the Mount Klappan anthracite coal deposits in British Columbia, and the NICO gold-cobalt-bismuth-copper deposit, the Sue-Dianne copper-silver deposit and other base and precious metals exploration projects in the Northwest Territories. Fortune Minerals also owns the buildings and equipment from the Golden Giant Mine at Hemlo, Ontario, which have been dismantled for relocation to NICO. Fortune Minerals is focused on outstanding performance and growth of shareholder value through assembly and development of high quality mineral resource projects. (...)"

www.fortuneminerals.com/s/NewsReleases.asp?ReportID=358741&_…

"Fortune Minerals Limited (TSX-FT) ("Fortune Minerals" or the "Company") is pleased to provide an update about the road initiative in the Tlicho (aboriginal) region northwest of Yellowknife, Northwest Territories where the Company's NICO mine development is located. The existing winter road extending north from the town of Behchoko on Highway 3 between Yellowknife and Edmonton, Alberta to the communities of Whati and Gameti is the subject of a government plan for realignment to an overland route in order to reduce the cost of living in the Tlicho region, mitigate the impacts of climate change on community resupply, and promote economic activity. This road is also currently used to access the NICO Gold-Cobalt-Bismuth-Copper deposit, which Fortune Minerals is permitting to develop a mine, mill and process plant, which requires all-season road access for mine supply and to transport metal concentrates south for processing to high value metal products.

The initiative to upgrade the Tlicho winter road is being managed by the government of the Northwest Territories (GNWT) - Department of Transportation (DOT), working together with the Tlicho Government, and with financial support from the federal government. Preliminary engineering, route analysis, environmental scoping studies and consultation with local communities have already been undertaken to establish the feasibility of this road upgrade and its desirability from the perspective of the Tlicho people. Fortune Minerals has also contributed its own detailed engineering and environmental studies for a 50 km portion of the road as its initial contribution toward the project and is part of a working group for future planning. An approximate 136 km portion of the Tlicho road will be used for the NICO mine. Approximately 25 km of all-season road has already been built by the community of Whati and is being extended this road this summer by the community. Fortune Minerals is in discussions with the GNWT, federal and Tlicho Governments with respect to joint financing the upgrade of other segments of the route to an all-weather standard so that it can be used for mine operations.

The GNWT and the federal government have committed $18 million of additional resources toward completing the next phase of the Tlicho road initiative, which includes additional engineering and environmental work, community consultation, re-alignment of the road to an all-land route, construction of permanent bridged water crossings and the laying of road bed on portions of the route. The next phase of this road initiative received significant support from Tlicho citizens during the consultation process and the Tlicho Government has approved the engineering and environmental studies now being tendered by the DOT. The final route and other details of the road construction and operation will still require the approval of the Tlicho Government.

Fortune Minerals is very pleased to be working cooperatively with the Tlicho Government and GNWT towards completion of this important infrastructure initiative to improve the transportation and reduce the cost of living in Tlicho communities as well as provide the foundation for additional economic opportunities on Tlicho lands, including the NICO mine development for the benefit of all stakeholders.

About Fortune Minerals

Fortune Minerals is a diversified natural resource company with several mineral deposits and a number of exploration projects, all located in Canada. They include the Mount Klappan anthracite coal deposits in British Columbia, and the NICO gold-cobalt-bismuth-copper deposit, the Sue-Dianne copper-silver deposit and other base and precious metals exploration projects in the Northwest Territories. Fortune Minerals also owns the buildings and equipment from the Golden Giant Mine at Hemlo, Ontario, which have been dismantled for relocation to NICO. Fortune Minerals is focused on outstanding performance and growth of shareholder value through assembly and development of high quality mineral resource projects. (...)"

Antwort auf Beitrag Nr.: 37.710.481 von Substanzfritzes am 04.08.09 20:42:41was für denn bitte zu dieser Annahme wäre nett, wenn du es nicht nur so in den Raum stellst.

Das Projekt ist eben noch nicht fertig exploriert. Was soll daran unseriös sein?

Das Projekt ist eben noch nicht fertig exploriert. Was soll daran unseriös sein?

Ich habe mir Anfang Juli welche ins Depot gelegt. Da über Berlin kein Handel möglich, alle über TSX geordert.

Wenn ich meine anderen Werte anschaue (z.B.: CCE, DYL, Lyc, Mol, Ore, Pos)

könnte auch hier plötzlich ein Ausbruch erfolgen...

Wenn ich meine anderen Werte anschaue (z.B.: CCE, DYL, Lyc, Mol, Ore, Pos)

könnte auch hier plötzlich ein Ausbruch erfolgen...

http://www.newswire.ca/en/releases/archive/August2009/12/c44…

Der Abbau der aufgekauften alten Mine läuft gut und alles verwertbares wird für das NICO Projekt verwendet.

Der Abbau der aufgekauften alten Mine läuft gut und alles verwertbares wird für das NICO Projekt verwendet.

Fortune Minerals Raises $2.345 Million From Flow-Through Financing - Aug 14, 2009

www.fortuneminerals.com/s/NewsReleases.asp?ReportID=359968&_…

www.fortuneminerals.com/s/NewsReleases.asp?ReportID=359968&_…

Fortune Minerals receives draft terms of reference for NICO environmental assessment - Sep 17, 2009

www.newswire.ca/en/releases/archive/September2009/17/c6211.h…

www.newswire.ca/en/releases/archive/September2009/17/c6211.h…

Fortune Minerals Applauds Government Investment In Northwest BC Power Transmission Line; Positive impacts on Company's Mount Klappan Anthracite Coal Project - Sep 22, 2009

www.newswire.ca/en/releases/archive/September2009/22/c7418.h…

www.newswire.ca/en/releases/archive/September2009/22/c7418.h…

Hi all,

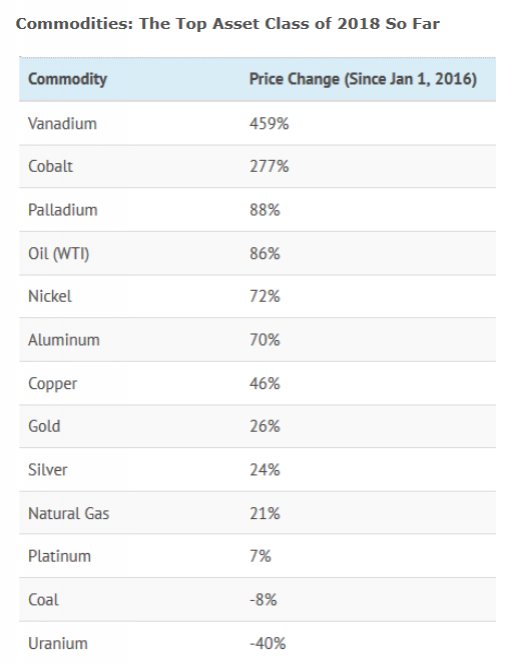

Interessant wird sein wie sich die beiden Hauptprodukte Wismuth und Kobalt preislich entwickeln werden in den nächsten Jahren, denn darauf basiert ja in erster Linie der Erlös, während Gold ja nur für die start-up-phase gut unterstützend wirkt.

Trotz der noch weiter zu erwartenden Dilution zeigt mir meine persönliche Hochrechnung ein sehr ordentliches Potential, das die noch vorhandenen Risken kompensieren hilft.

Nichts für die Zockergilde aber durchaus ein solid scheinender Titel, wenn man auf fundamentalen Daten ein Investment überlegt.

Die Vorgangsweise des Managements scheint auch kaufmännisch und zielorientiert zu sein.

Mal sehen ob sie den Zeitplan einhalten werden können.

Interessant ist Fortune allemal, da sich ja noch weitere aussichtsreiche Deposits in ihrem Besitz befinden, die entweder als eigenständige Projekte dienen können oder gute Abverkaufschancen bieten.

Picker56

Interessant wird sein wie sich die beiden Hauptprodukte Wismuth und Kobalt preislich entwickeln werden in den nächsten Jahren, denn darauf basiert ja in erster Linie der Erlös, während Gold ja nur für die start-up-phase gut unterstützend wirkt.

Trotz der noch weiter zu erwartenden Dilution zeigt mir meine persönliche Hochrechnung ein sehr ordentliches Potential, das die noch vorhandenen Risken kompensieren hilft.

Nichts für die Zockergilde aber durchaus ein solid scheinender Titel, wenn man auf fundamentalen Daten ein Investment überlegt.

Die Vorgangsweise des Managements scheint auch kaufmännisch und zielorientiert zu sein.

Mal sehen ob sie den Zeitplan einhalten werden können.

Interessant ist Fortune allemal, da sich ja noch weitere aussichtsreiche Deposits in ihrem Besitz befinden, die entweder als eigenständige Projekte dienen können oder gute Abverkaufschancen bieten.

Picker56

FT engagiert BNP für einen Kredit um NICO zur Produktion zu führen, zu organisieren:

Fortune Minerals engages BNP Paribas to arrange NICO Project debt facility - MiningTopNews - October 21, 2009

www.miningtopnews.com/fortune-minerals-engages-bnp-paribas-t…

"Fortune Minerals Limited announce that it has retained BNP Paribas to provide advice and financial services in connection with the arrangement of a US$ 200-250 million debt facility to finance the construction, start-up and operation of the Company’s NICO Gold-Cobalt-Bismuth-Copper development in the Northwest Territories. Based in Paris, France, BNP Paribas is a world class financial institution and leader in global banking and financial services. The engagement with BNP Paribas contemplates that it would act as sole and exclusive “bookrunner” and lead arranger for this debt facility. The relationship with BNP Paribas represents a significant milestone in the evolution of Fortune Minerals and the development of the NICO project as a pending significant producer of gold and high-grade cobalt and bismuth metal co-products, and by-product copper cathode and nickel carbonate.

BNP Paribas has been reviewing data from Fortune Minerals’ NICO Project for several months while it has been undergoing the first phase of environmental assessment for mine permitting. BNP Paribas has expressed its interest in working with Fortune Minerals based on the Company’s strength of management and NICO’s multi-metal profile, location and advanced stage of development. BNP Paribas will manage detailed due-diligence of: the Company, NICO front-end engineering, and the financial models, over the next few months while Fortune continues through the second half of the permitting process. The engagement does not constitute a commitment on the part of BNP Paribas to lend or commit to lend moneys, or to provide any other facilities in connection with the NICO Project. The establishment of the contemplated debt facility remains subject to additional due diligence, financial modelling, market conditions and various other factors. "

Fortune Minerals engages BNP Paribas to arrange NICO Project debt facility - MiningTopNews - October 21, 2009

www.miningtopnews.com/fortune-minerals-engages-bnp-paribas-t…

"Fortune Minerals Limited announce that it has retained BNP Paribas to provide advice and financial services in connection with the arrangement of a US$ 200-250 million debt facility to finance the construction, start-up and operation of the Company’s NICO Gold-Cobalt-Bismuth-Copper development in the Northwest Territories. Based in Paris, France, BNP Paribas is a world class financial institution and leader in global banking and financial services. The engagement with BNP Paribas contemplates that it would act as sole and exclusive “bookrunner” and lead arranger for this debt facility. The relationship with BNP Paribas represents a significant milestone in the evolution of Fortune Minerals and the development of the NICO project as a pending significant producer of gold and high-grade cobalt and bismuth metal co-products, and by-product copper cathode and nickel carbonate.

BNP Paribas has been reviewing data from Fortune Minerals’ NICO Project for several months while it has been undergoing the first phase of environmental assessment for mine permitting. BNP Paribas has expressed its interest in working with Fortune Minerals based on the Company’s strength of management and NICO’s multi-metal profile, location and advanced stage of development. BNP Paribas will manage detailed due-diligence of: the Company, NICO front-end engineering, and the financial models, over the next few months while Fortune continues through the second half of the permitting process. The engagement does not constitute a commitment on the part of BNP Paribas to lend or commit to lend moneys, or to provide any other facilities in connection with the NICO Project. The establishment of the contemplated debt facility remains subject to additional due diligence, financial modelling, market conditions and various other factors. "

Fortune Minerals announces agreement to purchase lands near Saskatoon, Saskatchewan for NICO refinery - Nov 3, 2009

www.fortuneminerals.com/News/Press-Releases/Press-Release-De…

www.fortuneminerals.com/News/Press-Releases/Press-Release-De…

Antwort auf Beitrag Nr.: 38.312.583 von Popeye82 am 03.11.09 18:47:11

"Fortune Minerals has determined that relocating its refinery to Saskatoon produces positive net impacts for the entire NICO development for the benefit of all stakeholders. It may also provide the Company with an opportunity to source materials from other projects for custom processing and also to participate in the metals recycling business. Undertaking such business activities would provide for a sustainable project extending beyond the anticipated life of the NICO mine. The Saskatoon refinery is expected to employ 85 people over a 15 to 20 year period based on the anticipated life of the NICO deposit alone. Investment in the refinery is estimated at $150 million and construction is anticipated to commence upon receipt of the NICO mine permits and project financing. NICO is in the second phase of environmental assessment for mine permitting and is under review for senior project financing by BNP Paribas, a world class bank and highly ranked market leader in global mine finance. ..."

"Fortune Minerals has determined that relocating its refinery to Saskatoon produces positive net impacts for the entire NICO development for the benefit of all stakeholders. It may also provide the Company with an opportunity to source materials from other projects for custom processing and also to participate in the metals recycling business. Undertaking such business activities would provide for a sustainable project extending beyond the anticipated life of the NICO mine. The Saskatoon refinery is expected to employ 85 people over a 15 to 20 year period based on the anticipated life of the NICO deposit alone. Investment in the refinery is estimated at $150 million and construction is anticipated to commence upon receipt of the NICO mine permits and project financing. NICO is in the second phase of environmental assessment for mine permitting and is under review for senior project financing by BNP Paribas, a world class bank and highly ranked market leader in global mine finance. ..."

Ein freundliches Hallo an Popeye82 !!

Ein recht interessanter Titel mit 2 zukunftsträchtigen Metallen.

Bin neugierig ob die BNP die Finanzierung aufstellt und ob die Raffinerie in einer weiteren Finanzierungsrunde Realität wird.

70% dept + 30% Equity ????--> und wie sich daraus die CAPEX darstellen wird.

Das würde bei heutigen Kursen in Summe rd. an die 250 Mio shares ausmachen. Mal sehen, obs so kommt.

Wenn sich Cobalt und Wismuth brav entwickeln steckt sehr viel Potential in Fortune.

Denke ich falsch bei der Annahme dass aus heutiger Sicht eine Produktionsaufnahme mit 2012 möglich ist ??

L.G.

Picker56

Ein recht interessanter Titel mit 2 zukunftsträchtigen Metallen.

Bin neugierig ob die BNP die Finanzierung aufstellt und ob die Raffinerie in einer weiteren Finanzierungsrunde Realität wird.

70% dept + 30% Equity ????--> und wie sich daraus die CAPEX darstellen wird.

Das würde bei heutigen Kursen in Summe rd. an die 250 Mio shares ausmachen. Mal sehen, obs so kommt.

Wenn sich Cobalt und Wismuth brav entwickeln steckt sehr viel Potential in Fortune.

Denke ich falsch bei der Annahme dass aus heutiger Sicht eine Produktionsaufnahme mit 2012 möglich ist ??

L.G.

Picker56

Fortune Minerals updates NICO front-end engineering - 11/04/2009

www.fortuneminerals.com/News/Press-Releases/Press-Release-De…

www.fortuneminerals.com/News/Press-Releases/Press-Release-De…

Antwort auf Beitrag Nr.: 38.321.150 von Popeye82 am 04.11.09 19:31:27Ein guter Bericht mit klar abgesteckten Zielen und Aufgaben für die nächste Zeit.

Mir erscheint das Managementteam professionell zu arbeiten.

Wichtig werden die Inhalte der neuen Feasibility sei, wo aktuelle Preise und vor allem gesenkte Kosten ein besseres Bild über die wirtschaftlichen Aussichten aufzeigen werden.

Hoffen wir dass die BNP-Paribas dies ebenfalls so positiv sieht und eine senior-dept-Finanzierung OHNE extremer zusätzlicher Dilution beschließt.

Es scheint sich tatsächlich so zu entwickeln dass gegen Ende 2011 an eine Produktion zu denken ist.

Picker56

Mir erscheint das Managementteam professionell zu arbeiten.

Wichtig werden die Inhalte der neuen Feasibility sei, wo aktuelle Preise und vor allem gesenkte Kosten ein besseres Bild über die wirtschaftlichen Aussichten aufzeigen werden.

Hoffen wir dass die BNP-Paribas dies ebenfalls so positiv sieht und eine senior-dept-Finanzierung OHNE extremer zusätzlicher Dilution beschließt.

Es scheint sich tatsächlich so zu entwickeln dass gegen Ende 2011 an eine Produktion zu denken ist.

Picker56

Fortune Minerals Limited - News Release - Nov 19, 2009

www.fortuneminerals.com/News/Press-Releases/Press-Release-De…

www.fortuneminerals.com/News/Press-Releases/Press-Release-De…

Fortune Minerals announces closing of $17.25 million public offering - Dec 3, 2009

www.newswire.ca/en/releases/archive/December2009/03/c7607.ht…

"LONDON, ON, Dec. 3 /CNW/ - Fortune Minerals Limited (TSX-FT) ("Fortune Minerals" or the "Company") is pleased to announce that it has closed its previously announced public offering (the "Offering") consisting of 26,538,550 units at an offering price of $0.65 per unit for aggregate gross proceeds of $17,250,057.50, which includes the issuance of 3,461,550 units pursuant to the full exercise of the agents' over-allotment option. Each unit consists of one common share and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one common share of Fortune Minerals at an exercise price of $0.80 per common share at any time up to 5:00 p.m. (Toronto time) on December 3, 2011. The units were offered for sale, on a "best efforts" agency basis, by a syndicate of agents led by Paradigm Capital Inc. and including CIBC World Markets Inc., Dundee Securities Corporation, Jones, Gable & Company Limited and Loewen, Ondaatje, McCutcheon Limited.

The net proceeds of the Offering will be used principally by Fortune Minerals to fund the permitting process associated with the NICO gold-cobalt-bismuth-copper project in the Northwest Territories (the "NICO Project"), the costs of the Southern Hydrometallurgical Facility, the transportation and refurbishment of the Hemlo Mill and long lead equipment for the NICO Project. The remaining net proceeds will be added to working capital and used for maintaining and joint venturing the Mount Klappan anthracite coal project in British Columbia, maintaining the Company's interests in its other projects and for administrative and general corporate purposes.

The common shares and the warrants comprising the units are listed and posted for trading on the Toronto Stock Exchange ("TSX") under the symbols "FT" and "FT.WT", respectively. The TSX has also approved for listing any common shares to be issued upon the exercise of the warrants.

The securities described herein have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States unless registered under the Act or unless an exemption from registration is available. ..."

www.newswire.ca/en/releases/archive/December2009/03/c7607.ht…

"LONDON, ON, Dec. 3 /CNW/ - Fortune Minerals Limited (TSX-FT) ("Fortune Minerals" or the "Company") is pleased to announce that it has closed its previously announced public offering (the "Offering") consisting of 26,538,550 units at an offering price of $0.65 per unit for aggregate gross proceeds of $17,250,057.50, which includes the issuance of 3,461,550 units pursuant to the full exercise of the agents' over-allotment option. Each unit consists of one common share and one-half of one common share purchase warrant. Each whole common share purchase warrant entitles the holder to acquire one common share of Fortune Minerals at an exercise price of $0.80 per common share at any time up to 5:00 p.m. (Toronto time) on December 3, 2011. The units were offered for sale, on a "best efforts" agency basis, by a syndicate of agents led by Paradigm Capital Inc. and including CIBC World Markets Inc., Dundee Securities Corporation, Jones, Gable & Company Limited and Loewen, Ondaatje, McCutcheon Limited.

The net proceeds of the Offering will be used principally by Fortune Minerals to fund the permitting process associated with the NICO gold-cobalt-bismuth-copper project in the Northwest Territories (the "NICO Project"), the costs of the Southern Hydrometallurgical Facility, the transportation and refurbishment of the Hemlo Mill and long lead equipment for the NICO Project. The remaining net proceeds will be added to working capital and used for maintaining and joint venturing the Mount Klappan anthracite coal project in British Columbia, maintaining the Company's interests in its other projects and for administrative and general corporate purposes.

The common shares and the warrants comprising the units are listed and posted for trading on the Toronto Stock Exchange ("TSX") under the symbols "FT" and "FT.WT", respectively. The TSX has also approved for listing any common shares to be issued upon the exercise of the warrants.

The securities described herein have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States unless registered under the Act or unless an exemption from registration is available. ..."

Fortune Minerals applauds Saskatchewan Government announcement - Dec 8, 2009

www.newswire.ca/en/releases/archive/December2009/08/c9265.ht…

"LONDON, ON, Dec. 8 /CNW/ - Fortune Minerals Limited (TSX-FT) ("Fortune Minerals" or the "Company") applauds the Government of Saskatchewan's December 3, 2009 announcement of several new tax incentives to attract new business to the province. Fortune Minerals anticipates one of the incentives announced, the introduction of a five-year Corporate Income Tax incentive for corporations that process minerals imported into the province, will directly benefit the Company. Fortune Minerals recently announced the decision to locate its metallurgical process plant for the NICO project in Saskatchewan and, once in production, this tax incentive, if fully enacted into law, has the potential to enhance the economics of processing metal concentrates in Saskatchewan. During the search for a suitable location for a processing facility, the Company received support from Enterprise Saskatchewan and the Saskatoon Regional Economic Development Authority in locating land in Saskatchewan. Fortune Minerals is further encouraged by the Government of Saskatchewan becoming a strong proponent of the project with support and recognition the Company's substantial investment to be made and the positive impact it will have in Saskatchewan and local communities.

The following is an excerpt from the news release issued on December 3, 2009 by Enterprise Saskatchewan:

Saskatchewan encourages value-added mineral processing

------------------------------------------------------

The Government of Saskatchewan has announced the introduction of a

five-year Corporate Income Tax incentive for corporations that process

minerals imported into the province to the prime metal stage, which has

the potential for a range of positive economic effects.

"Our Government is committed to enhancing Saskatchewan's capacity to add

value from natural resources," Enterprise Saskatchewan Minister Ken

Cheveldayoff said. "For the province at large, this incentive will mean

beneficial short-term economic activity and significant long-term gain,

while an increase in corporate presence will serve to further raise our

national and international presence and impact."

"This change will significantly enhance the attractiveness of refining

imported minerals in our province," Cheveldayoff said. "We hope to

attract quality, high-paying jobs to Saskatchewan as a result. We believe

this type of targeted tax incentive holds great potential for encouraging

economic growth in our province, and simply adds to the overall

attractiveness and competitiveness of our business climate - which is

already considerable."

Legislation to implement the five-year Corporate Income Tax incentive

will be tabled in the spring 2010 session of the Legislature."

The proposed Saskatoon area site includes access to the main line of the Canadian National Railway, which can accommodate a rail spur for delivery of concentrates from the mine, supplies from vendors and metal products sold to customers in industrial centres in North America or points of export. The property is in close proximity to the Trans-Canada Highway and other services including power, natural gas, and water supply. Saskatoon is the fastest growing city in Canada and the commercial centre for the province of Saskatchewan. "With a diversified economy, a highly skilled work force and respected post-secondary institutions, Saskatoon can accommodate everything that is required to construct and operate this process plant," said Fortune Minerals President, Robin Goad.

Fortune Minerals has determined that relocating its processing facility to Saskatoon produces positive net impacts for the entire NICO development for the benefit of all stakeholders. The Saskatoon plant is expected to employ 85 people over a 15 to 20 year period based on the anticipated life of the NICO deposit alone. It may also provide the Company with an opportunity to source materials from other projects for custom processing and also to participate in the metals recycling business. Undertaking such business activities would provide for a sustainable project extending beyond the anticipated life of the NICO mine. Investment in the plant is estimated at $150 million and construction is anticipated to commence upon receipt of the NICO mine permits and project financing.

About Fortune Minerals

Fortune Minerals is a diversified natural resource company with several mineral deposits and a number of exploration projects, all located in Canada. They include the Mount Klappan anthracite coal deposits in British Columbia, and the NICO gold-cobalt-bismuth-copper deposit, the Sue-Dianne copper-silver deposit and other base and precious metals exploration projects in the Northwest Territories. Fortune Minerals owns the buildings and equipment from the Golden Giant Mine at Hemlo, Ontario, which have been dismantled for relocation to NICO. Fortune Minerals is focused on outstanding performance and growth of shareholder value through assembly and development of high quality mineral resource projects.

For further information:

Fortune Minerals Limited, Robin Goad, President - or - Lindsay Simmons, IR Coordinator, info@fortuneminerals.com, Tel.: (519) 858-8188, Fax: (519) 858-8155, www.fortuneminerals.com; Renmark Financial Communications, Dan Symons: dsymons@renmarkfinancial.com - or - Barbara Komorowski: bkomorowski@renmarkfinancial.com; Media Contact, Valerie Lacasse: vlacasses@renmarkfinancial.com, Tel: (514) 939-3989, Fax: (514) 939-3717, www.renmarkfinancial.com "

www.newswire.ca/en/releases/archive/December2009/08/c9265.ht…

"LONDON, ON, Dec. 8 /CNW/ - Fortune Minerals Limited (TSX-FT) ("Fortune Minerals" or the "Company") applauds the Government of Saskatchewan's December 3, 2009 announcement of several new tax incentives to attract new business to the province. Fortune Minerals anticipates one of the incentives announced, the introduction of a five-year Corporate Income Tax incentive for corporations that process minerals imported into the province, will directly benefit the Company. Fortune Minerals recently announced the decision to locate its metallurgical process plant for the NICO project in Saskatchewan and, once in production, this tax incentive, if fully enacted into law, has the potential to enhance the economics of processing metal concentrates in Saskatchewan. During the search for a suitable location for a processing facility, the Company received support from Enterprise Saskatchewan and the Saskatoon Regional Economic Development Authority in locating land in Saskatchewan. Fortune Minerals is further encouraged by the Government of Saskatchewan becoming a strong proponent of the project with support and recognition the Company's substantial investment to be made and the positive impact it will have in Saskatchewan and local communities.

The following is an excerpt from the news release issued on December 3, 2009 by Enterprise Saskatchewan:

Saskatchewan encourages value-added mineral processing

------------------------------------------------------

The Government of Saskatchewan has announced the introduction of a

five-year Corporate Income Tax incentive for corporations that process

minerals imported into the province to the prime metal stage, which has

the potential for a range of positive economic effects.

"Our Government is committed to enhancing Saskatchewan's capacity to add

value from natural resources," Enterprise Saskatchewan Minister Ken

Cheveldayoff said. "For the province at large, this incentive will mean

beneficial short-term economic activity and significant long-term gain,

while an increase in corporate presence will serve to further raise our

national and international presence and impact."

"This change will significantly enhance the attractiveness of refining

imported minerals in our province," Cheveldayoff said. "We hope to

attract quality, high-paying jobs to Saskatchewan as a result. We believe

this type of targeted tax incentive holds great potential for encouraging

economic growth in our province, and simply adds to the overall

attractiveness and competitiveness of our business climate - which is

already considerable."

Legislation to implement the five-year Corporate Income Tax incentive

will be tabled in the spring 2010 session of the Legislature."

The proposed Saskatoon area site includes access to the main line of the Canadian National Railway, which can accommodate a rail spur for delivery of concentrates from the mine, supplies from vendors and metal products sold to customers in industrial centres in North America or points of export. The property is in close proximity to the Trans-Canada Highway and other services including power, natural gas, and water supply. Saskatoon is the fastest growing city in Canada and the commercial centre for the province of Saskatchewan. "With a diversified economy, a highly skilled work force and respected post-secondary institutions, Saskatoon can accommodate everything that is required to construct and operate this process plant," said Fortune Minerals President, Robin Goad.

Fortune Minerals has determined that relocating its processing facility to Saskatoon produces positive net impacts for the entire NICO development for the benefit of all stakeholders. The Saskatoon plant is expected to employ 85 people over a 15 to 20 year period based on the anticipated life of the NICO deposit alone. It may also provide the Company with an opportunity to source materials from other projects for custom processing and also to participate in the metals recycling business. Undertaking such business activities would provide for a sustainable project extending beyond the anticipated life of the NICO mine. Investment in the plant is estimated at $150 million and construction is anticipated to commence upon receipt of the NICO mine permits and project financing.

About Fortune Minerals

Fortune Minerals is a diversified natural resource company with several mineral deposits and a number of exploration projects, all located in Canada. They include the Mount Klappan anthracite coal deposits in British Columbia, and the NICO gold-cobalt-bismuth-copper deposit, the Sue-Dianne copper-silver deposit and other base and precious metals exploration projects in the Northwest Territories. Fortune Minerals owns the buildings and equipment from the Golden Giant Mine at Hemlo, Ontario, which have been dismantled for relocation to NICO. Fortune Minerals is focused on outstanding performance and growth of shareholder value through assembly and development of high quality mineral resource projects.

For further information:

Fortune Minerals Limited, Robin Goad, President - or - Lindsay Simmons, IR Coordinator, info@fortuneminerals.com, Tel.: (519) 858-8188, Fax: (519) 858-8155, www.fortuneminerals.com; Renmark Financial Communications, Dan Symons: dsymons@renmarkfinancial.com - or - Barbara Komorowski: bkomorowski@renmarkfinancial.com; Media Contact, Valerie Lacasse: vlacasses@renmarkfinancial.com, Tel: (514) 939-3989, Fax: (514) 939-3717, www.renmarkfinancial.com "

Antwort auf Beitrag Nr.: 38.531.695 von Popeye82 am 08.12.09 21:13:21

Da ging die Markierung etwas in die Hose, sollte eigentlich der Absatz unter der Regierungserklärung sein.

Gruß,

Popeye

Da ging die Markierung etwas in die Hose, sollte eigentlich der Absatz unter der Regierungserklärung sein.

Gruß,

Popeye

Fortune Minerals announces significant increase in NICO project mineral reserves - NW, LONDON - Jan 14, 2010

www.newswire.ca/en/releases/archive/January2010/14/c8478.htm…

"LONDON, ON, Jan. 14 /CNW/ - Fortune Minerals Limited (TSX-FT) ("Fortune Minerals" or the "Company") is pleased to announce a new mine plan and a 43% increase in the mineral reserves for its 100% owned NICO gold-cobalt-bismuth-copper project in the Northwest Territories, Canada. The update, prepared by P&E Mining Consultants Inc. ("P&E"), has increased the proven and probable mineral reserves for NICO to 31 million tonnes from the 21.8 million tonnes established previously in the 2007 definitive feasibility study for the project (updated in 2008) by Micon International Limited ("Micon") (see Fortune Minerals news releases, dated January 16, 2007 and May 8, 2008). The new mine plan and larger mineral reserves will extend the operating life of the NICO mine and process plant from 15 to 18 years at a higher, 4,650 tonnes per day production rate, and positively impact project economics.

Highlights of the Updated NICO Mine Plan and Mineral Reserves:

+ 43% increase in Proven and Probable Mineral Reserves to 31 million tonnes;

+ Increase in contained metals:

- Gold content increased by 147,000 ounces to 907,000 ounces;

- Cobalt content increased by 21 million pounds to 82 million pounds;

- Bismuth content increased by 32 million pounds to 109 million pounds;

- Copper now included in reserves and totals 27 million pounds;

+ Gold is now the largest projected source of revenue for the project during the first two years of operations at current metal prices;

+ Reserves contain 4.9 million ounces gold equivalent at metal price assumptions used in study;

+ Mine life increased from 15 to 18 years;

+ Identification of 6.5 million tonnes of additional marginal sub-economic mineralized material to be stockpiled for potential future processing;

+ New open pit mine plan reduces initial capital by eliminating 10 million tonnes of waste pre-stripping;

+ New underground mine plan lowers mining costs with greatly reduced backfill requirements;

+ Includes higher metal recoveries verified from pilot plant:

+ Gold recovery is 56% to 84%, averaging 72%, depending on head grade;

- Cobalt recovery of 83%;

- Bismuth recovery of 70%;

- Copper recovery of 52%;

- 16% increase in mill throughput to 4,650 tonnes per day;

- Operating costs reflect processing of concentrates to metals in Saskatchewan.

NICO is a proposed vertically integrated project to mine and concentrate ores from the Company's deposit in the Northwest Territories ("NWT"), located 160 km northwest of the City of Yellowknife and 50 km north of the Tlicho community of Whati. Bulk concentrates produced at the mine will be transported by truck and then rail for delivery to the refinery that the Company plans to construct in Saskatchewan for processing to high value metal products. Fortune Minerals has an agreement to purchase the site for this Saskatchewan Metals Processing Plant ("SMPP") located 26 km west of Saskatoon, subject to certain conditions, including appropriate re-zoning and completion of satisfactory due-diligence currently being conducted.

NICO Mineral Reserves:

The updated mineral reserves for the NICO deposit are compiled in the following tables:

Underground Mineral Reserves

----------------------------

-------------------------------------------------------------------------

Class Tonnes Au (g/t) Co (%) Bi (%) Cu (%)

-------------------------------------------------------------------------

Proven 1,403,000 2.23 0.16 0.22 0.04

-------------------------------------------------------------------------

Probable 767,000 2.92 0.17 0.19 0.03

-------------------------------------------------------------------------

Total 2,170,000 2.47 0.16 0.21 0.03

-------------------------------------------------------------------------

Open Pit Mineral Reserves

-------------------------

-------------------------------------------------------------------------

Class Tonnes Au (g/t) Co (%) Bi (%) Cu (%)

-------------------------------------------------------------------------

Proven 15,019,000 0.85 0.12 0.16 0.04

-------------------------------------------------------------------------

Probable 13,797,000 0.71 0.12 0.15 0.03

-------------------------------------------------------------------------

Total 28,816,000 0.79 0.12 0.15 0.04

-------------------------------------------------------------------------

Combined Mineral Reserves

-------------------------

-------------------------------------------------------------------------

Class Tonnes Au (g/t) Co (%) Bi (%) Cu (%)

-------------------------------------------------------------------------

Proven 16,422,000 0.97 0.12 0.16 0.04

-------------------------------------------------------------------------

Probable 14,564,000 0.83 0.12 0.15 0.03

-------------------------------------------------------------------------

Total 30,986,000 0.91 0.12 0.16 0.04

-------------------------------------------------------------------------

Contained 907,000 82 million 109 million 27 million

Metal ounces pounds pounds pounds

-------------------------------------------------------------------------

In addition to the mineral reserves, there are 6.5 million tonnes of marginal sub-economic material that will be mined and stockpiled for processing during periods of higher metal prices. This material has the potential to be processed at a profit and extend the mine life up to an additional 4 years.

The mineral reserves for the NICO deposit were updated in compliance with National Instrument ("NI") 43-101 and CIM guidelines by P&E using an updated resource model also prepared by P&E. The increase in the NICO reserves is a result of: a more efficient open pit and underground mine plan; increased mill throughput using equipment the Company already owns from its purchase of the Golden Giant Mine mill at Hemlo, Ontario; higher metal recoveries confirmed by the Company's pilot plant (see Fortune Minerals news releases, dated February 5, 2008 and February 24, 2009); and greater revenues using higher metal price assumptions and the production of some higher value metal products over those used in the Micon 2007 feasibility study and 2008 update.

The updated mineral reserves are based on operating cost net smelter return ("NSR") cut-off values that have been updated from recent front-end engineering and design studies. The C$48.07/tonne NSR open pit reserve cut-off was derived from a C$41.82/tonne processing cost and a C$6.25/tonne general and administration ("G&A") cost. The open pit unit rock mining cost for optimization, design and reserve delineation is C$2.59/tonne. The C$85.64/tonne NSR underground reserve optimization, design and reserve delineation cut-off was derived from a $37.57/tonne mining cost, a C$41.82/tonne processing cost, and C$6.25/tonne for G&A.

The metal prices and Canadian to US dollar exchange rates used in the updated mineral reserves are the 2-year trailing average adjusted downwards for certain metals to reasonable round values. They are: US$900/oz gold, US$20/lb cobalt, US$10/lb bismuth and US$2.75/lb copper at a Canadian$ to US$ exchange rate of C$1=US$0.92.

Eugene Puritch, P.Eng. and Fred H. Brown, CPG PrSciNat, both of P&E, are the Qualified Persons responsible for the updated mineral reserves as defined by NI 43-101.

Mining:

The NICO deposit will be mined primarily by open pit with the gold-rich, higher grade underground ores contributing mill feed during the initial 2 years of operations. Changes have been made to the mine plan to improve the economics during early years of production.

The underground part of the mine will be mined by retreat blast hole open stoping. The tonnage available from the underground part of the mine has been increased by 83% to 2.2 million tonnes as a result of higher projected revenues from higher metal prices and metal recoveries, and also from lower underground mining costs achieved by the significant reduction in the amount of back filling that will be required in mined out stopes. Gold-rich, higher grade ores from the underground part of the mine are now projected to contribute 60% of the mill feed at the higher 4,650 tonnes per day production rate, as compared to 30% of 4,000 tonnes per day in the Micon feasibility study. The greater amount of high-grade ores will increase the cash flow for the project during the first 2 years of the operation.

The open pit part of the mine will be a conventional truck and hydraulic shovel operation, accomplished in 4 phases at an average strip ratio of 3.4:1. The mine plan for the open pit has been re-scheduled with the identification of a low strip ratio starter pit. This, together with the greater availability of underground ores, allows the previously planned 10 million tonne waste pre-stripping program to be eliminated. This quantity of waste now becomes part of normal production stripping and can be financed from cash flow. This change also has the potential to defer the acquisition of some of the more expensive components of the mine fleet by 1 to 2 years.

Processing:

The NICO ore will be processed in 2 stages at the NICO site and SMPP, respectively. At the NICO site, 4,650 tonnes per day of ore will be processed in a crushing, grinding and flotation concentrator to produce approximately 180 tonnes of bulk concentrate per day. The high concentration ratio (low mass pull) of NICO ores is a significant economic attribute to the deposit, which allows the Company to transport a high-value concentrate to southern Canada where significant process cost savings can be achieved. Notably, a significant amount of the crushing, grinding and other equipment that will be required at NICO has already been purchased by Fortune Minerals from its acquisition and dismantling of the Golden Giant Mine mill at Hemlo, Ontario.

The NICO bulk concentrate will be transported by truck to Hay River, NWT for transfer to rail and delivery to the Company's proposed SMPP on the CN main line in Saskatchewan, located 26 km northwest of Saskatoon. At the SMPP, the bulk concentrate will undergo additional grinding and flotation to produce separate gold-bearing cobalt and bismuth concentrates, followed respectively by pressure acid leach and acid leach, hydrometallurgical processing, and then electro-winning to gold doré, 99.8% cobalt cathode, 99.5% bismuth cathode, 99.99% copper cathode and a nickel by-product.

The decision to move the downstream processing of metals to Saskatchewan was driven primarily by the availability of lower cost power and the proactive support of the Government of Saskatchewan, which has also proposed attractive tax legislation to encourage processing of raw materials that have been sourced from outside of the province. This legislation is expected to be passed in the spring of 2010 and will benefit NICO project economics.

The NICO project is in the second half of the environmental assessment process in the Northwest Territories to permit the mine and concentrator. Fortune Minerals is also working with the Tlicho and Northwest Territories Governments on making infrastructure improvements in the vicinity of the mine that will also improve the quality of life in nearby Tlicho communities.

Front-end engineering and design ("FEED") work is substantially complete for the NICO mine site and is nearing completion for the proposed SMPP in Saskatchewan. This work is being done by Aker Metals, a division of Aker Solutions Canada Inc., P&E, Golder Associates Limited, SGS Lakefield Research Limited, Faradelk Ltd., Dan Mackie and Associates, EHA Engineering Ltd. and Hydroproc. Updated economics for the NICO project will be announced upon completion of this work, targeting the second quarter of this year.

Concurrently with FEED, JDS Energy and Mining Inc., together with Tlicho Logistics, are reviewing NICO Constructability and logistics.

Fortune Minerals is very pleased to continue reporting operational improvements for the NICO project, including the new mine plan and updated mineral reserves that will extend the employment and economic opportunities for the project for the benefit of all stakeholders.

About Fortune Minerals:

Fortune Minerals is a diversified natural resource company with several mineral deposits and a number of exploration projects, all located in Canada. They include the Mount Klappan anthracite coal deposits in British Columbia, and the NICO gold-cobalt-bismuth-copper deposit, the Sue-Dianne copper-silver deposit and other base and precious metals exploration projects in the Northwest Territories. Fortune Minerals owns the buildings and equipment from the Golden Giant Mine at Hemlo, Ontario, which have been dismantled for relocation to NICO. Fortune Minerals is focused on outstanding performance and growth of shareholder value through assembly and development of high quality mineral resource projects.

The contents of this press release have been reviewed and approved by Eugene Puritch, P.Eng., President of P&E Mining Consultants Inc. and Robin Goad, P.Geo., President of Fortune Minerals Limited. "

www.newswire.ca/en/releases/archive/January2010/14/c8478.htm…

"LONDON, ON, Jan. 14 /CNW/ - Fortune Minerals Limited (TSX-FT) ("Fortune Minerals" or the "Company") is pleased to announce a new mine plan and a 43% increase in the mineral reserves for its 100% owned NICO gold-cobalt-bismuth-copper project in the Northwest Territories, Canada. The update, prepared by P&E Mining Consultants Inc. ("P&E"), has increased the proven and probable mineral reserves for NICO to 31 million tonnes from the 21.8 million tonnes established previously in the 2007 definitive feasibility study for the project (updated in 2008) by Micon International Limited ("Micon") (see Fortune Minerals news releases, dated January 16, 2007 and May 8, 2008). The new mine plan and larger mineral reserves will extend the operating life of the NICO mine and process plant from 15 to 18 years at a higher, 4,650 tonnes per day production rate, and positively impact project economics.

Highlights of the Updated NICO Mine Plan and Mineral Reserves:

+ 43% increase in Proven and Probable Mineral Reserves to 31 million tonnes;

+ Increase in contained metals:

- Gold content increased by 147,000 ounces to 907,000 ounces;

- Cobalt content increased by 21 million pounds to 82 million pounds;

- Bismuth content increased by 32 million pounds to 109 million pounds;

- Copper now included in reserves and totals 27 million pounds;

+ Gold is now the largest projected source of revenue for the project during the first two years of operations at current metal prices;

+ Reserves contain 4.9 million ounces gold equivalent at metal price assumptions used in study;

+ Mine life increased from 15 to 18 years;

+ Identification of 6.5 million tonnes of additional marginal sub-economic mineralized material to be stockpiled for potential future processing;

+ New open pit mine plan reduces initial capital by eliminating 10 million tonnes of waste pre-stripping;

+ New underground mine plan lowers mining costs with greatly reduced backfill requirements;

+ Includes higher metal recoveries verified from pilot plant:

+ Gold recovery is 56% to 84%, averaging 72%, depending on head grade;

- Cobalt recovery of 83%;

- Bismuth recovery of 70%;

- Copper recovery of 52%;

- 16% increase in mill throughput to 4,650 tonnes per day;

- Operating costs reflect processing of concentrates to metals in Saskatchewan.

NICO is a proposed vertically integrated project to mine and concentrate ores from the Company's deposit in the Northwest Territories ("NWT"), located 160 km northwest of the City of Yellowknife and 50 km north of the Tlicho community of Whati. Bulk concentrates produced at the mine will be transported by truck and then rail for delivery to the refinery that the Company plans to construct in Saskatchewan for processing to high value metal products. Fortune Minerals has an agreement to purchase the site for this Saskatchewan Metals Processing Plant ("SMPP") located 26 km west of Saskatoon, subject to certain conditions, including appropriate re-zoning and completion of satisfactory due-diligence currently being conducted.

NICO Mineral Reserves:

The updated mineral reserves for the NICO deposit are compiled in the following tables:

Underground Mineral Reserves

----------------------------

-------------------------------------------------------------------------

Class Tonnes Au (g/t) Co (%) Bi (%) Cu (%)

-------------------------------------------------------------------------

Proven 1,403,000 2.23 0.16 0.22 0.04

-------------------------------------------------------------------------

Probable 767,000 2.92 0.17 0.19 0.03

-------------------------------------------------------------------------

Total 2,170,000 2.47 0.16 0.21 0.03

-------------------------------------------------------------------------

Open Pit Mineral Reserves

-------------------------

-------------------------------------------------------------------------

Class Tonnes Au (g/t) Co (%) Bi (%) Cu (%)

-------------------------------------------------------------------------

Proven 15,019,000 0.85 0.12 0.16 0.04

-------------------------------------------------------------------------

Probable 13,797,000 0.71 0.12 0.15 0.03

-------------------------------------------------------------------------

Total 28,816,000 0.79 0.12 0.15 0.04

-------------------------------------------------------------------------

Combined Mineral Reserves

-------------------------

-------------------------------------------------------------------------

Class Tonnes Au (g/t) Co (%) Bi (%) Cu (%)

-------------------------------------------------------------------------

Proven 16,422,000 0.97 0.12 0.16 0.04

-------------------------------------------------------------------------

Probable 14,564,000 0.83 0.12 0.15 0.03

-------------------------------------------------------------------------

Total 30,986,000 0.91 0.12 0.16 0.04

-------------------------------------------------------------------------

Contained 907,000 82 million 109 million 27 million

Metal ounces pounds pounds pounds

-------------------------------------------------------------------------

In addition to the mineral reserves, there are 6.5 million tonnes of marginal sub-economic material that will be mined and stockpiled for processing during periods of higher metal prices. This material has the potential to be processed at a profit and extend the mine life up to an additional 4 years.

The mineral reserves for the NICO deposit were updated in compliance with National Instrument ("NI") 43-101 and CIM guidelines by P&E using an updated resource model also prepared by P&E. The increase in the NICO reserves is a result of: a more efficient open pit and underground mine plan; increased mill throughput using equipment the Company already owns from its purchase of the Golden Giant Mine mill at Hemlo, Ontario; higher metal recoveries confirmed by the Company's pilot plant (see Fortune Minerals news releases, dated February 5, 2008 and February 24, 2009); and greater revenues using higher metal price assumptions and the production of some higher value metal products over those used in the Micon 2007 feasibility study and 2008 update.

The updated mineral reserves are based on operating cost net smelter return ("NSR") cut-off values that have been updated from recent front-end engineering and design studies. The C$48.07/tonne NSR open pit reserve cut-off was derived from a C$41.82/tonne processing cost and a C$6.25/tonne general and administration ("G&A") cost. The open pit unit rock mining cost for optimization, design and reserve delineation is C$2.59/tonne. The C$85.64/tonne NSR underground reserve optimization, design and reserve delineation cut-off was derived from a $37.57/tonne mining cost, a C$41.82/tonne processing cost, and C$6.25/tonne for G&A.

The metal prices and Canadian to US dollar exchange rates used in the updated mineral reserves are the 2-year trailing average adjusted downwards for certain metals to reasonable round values. They are: US$900/oz gold, US$20/lb cobalt, US$10/lb bismuth and US$2.75/lb copper at a Canadian$ to US$ exchange rate of C$1=US$0.92.

Eugene Puritch, P.Eng. and Fred H. Brown, CPG PrSciNat, both of P&E, are the Qualified Persons responsible for the updated mineral reserves as defined by NI 43-101.

Mining:

The NICO deposit will be mined primarily by open pit with the gold-rich, higher grade underground ores contributing mill feed during the initial 2 years of operations. Changes have been made to the mine plan to improve the economics during early years of production.

The underground part of the mine will be mined by retreat blast hole open stoping. The tonnage available from the underground part of the mine has been increased by 83% to 2.2 million tonnes as a result of higher projected revenues from higher metal prices and metal recoveries, and also from lower underground mining costs achieved by the significant reduction in the amount of back filling that will be required in mined out stopes. Gold-rich, higher grade ores from the underground part of the mine are now projected to contribute 60% of the mill feed at the higher 4,650 tonnes per day production rate, as compared to 30% of 4,000 tonnes per day in the Micon feasibility study. The greater amount of high-grade ores will increase the cash flow for the project during the first 2 years of the operation.

The open pit part of the mine will be a conventional truck and hydraulic shovel operation, accomplished in 4 phases at an average strip ratio of 3.4:1. The mine plan for the open pit has been re-scheduled with the identification of a low strip ratio starter pit. This, together with the greater availability of underground ores, allows the previously planned 10 million tonne waste pre-stripping program to be eliminated. This quantity of waste now becomes part of normal production stripping and can be financed from cash flow. This change also has the potential to defer the acquisition of some of the more expensive components of the mine fleet by 1 to 2 years.

Processing:

The NICO ore will be processed in 2 stages at the NICO site and SMPP, respectively. At the NICO site, 4,650 tonnes per day of ore will be processed in a crushing, grinding and flotation concentrator to produce approximately 180 tonnes of bulk concentrate per day. The high concentration ratio (low mass pull) of NICO ores is a significant economic attribute to the deposit, which allows the Company to transport a high-value concentrate to southern Canada where significant process cost savings can be achieved. Notably, a significant amount of the crushing, grinding and other equipment that will be required at NICO has already been purchased by Fortune Minerals from its acquisition and dismantling of the Golden Giant Mine mill at Hemlo, Ontario.

The NICO bulk concentrate will be transported by truck to Hay River, NWT for transfer to rail and delivery to the Company's proposed SMPP on the CN main line in Saskatchewan, located 26 km northwest of Saskatoon. At the SMPP, the bulk concentrate will undergo additional grinding and flotation to produce separate gold-bearing cobalt and bismuth concentrates, followed respectively by pressure acid leach and acid leach, hydrometallurgical processing, and then electro-winning to gold doré, 99.8% cobalt cathode, 99.5% bismuth cathode, 99.99% copper cathode and a nickel by-product.

The decision to move the downstream processing of metals to Saskatchewan was driven primarily by the availability of lower cost power and the proactive support of the Government of Saskatchewan, which has also proposed attractive tax legislation to encourage processing of raw materials that have been sourced from outside of the province. This legislation is expected to be passed in the spring of 2010 and will benefit NICO project economics.