BHP Billiton - ein Basisinvestment im Rohstoffsektor (Seite 2)

eröffnet am 11.06.07 15:37:48 von

neuester Beitrag 26.04.24 14:21:22 von

neuester Beitrag 26.04.24 14:21:22 von

Beiträge: 733

ID: 1.128.624

ID: 1.128.624

Aufrufe heute: 8

Gesamt: 124.243

Gesamt: 124.243

Aktive User: 1

ISIN: AU000000BHP4 · WKN: 850524 · Symbol: BHP1

26,17

EUR

+0,62 %

+0,16 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

03.05.24 · wallstreetONLINE Redaktion |

03.05.24 · EQS Group AG |

02.05.24 · EQS Group AG |

01.05.24 · EQS Group AG |

01.05.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4000 | -7,89 | |

| 185,00 | -9,76 | |

| 0,6700 | -14,92 | |

| 12,000 | -25,00 | |

| 46,24 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Schade bin bei 26 nicht bedient worden wenn’s jetzt hochläuft auch nicht schlimm

VG

VG

Antwort auf Beitrag Nr.: 75.362.894 von morpheus83 am 28.02.24 17:33:53Sei doch froh, bekommst eine gute Dividende für einen (vermeintlich) günstigen Preis. BHP wird doch eher für buy and hold gekauft und der damit verbunden Dividende. Ich hoffe, dass BHP weiterhin in dieser Range verweilt und werde weiter aufstocken.

Antwort auf Beitrag Nr.: 75.317.344 von rokz am 21.02.24 13:11:14passiert nur nichts nach oben und das seit langem.

Langsam wieder Kauf-/Nachkaufkurse.

0,72 USD/S / 0,90 USD/S = 0,80 => Div.-Kürzung ggü. 2022 v. 20%

https://kunde.comdirect.de/inf/news/detail.html?ID_NEWS=1126…"HAMBURG (dpa-AFX) - Die Privatbank Berenberg hat die Einstufung für BHP Group nach Zahlen zum ersten Geschäftshalbjahr auf "Hold" mit einem Kursziel von 2200 Pence belassen. Die Kennziffern des Bergbaukonzerns hätten den Erwartungen entsprochen, schrieb Analyst Richard Hatch in einer am Dienstag vorliegenden ersten Reaktion./edh/mis"

Veröffentlichung der Original-Studie: 20.02.2024 / 06:46 / GMT

https://www.bhp.com/investors/financial-results-operational-…

$US0.72 per share gibt's Dividende dieses HJ

Australia's nickel producers face writedowns amid supply glut

MELBOURNE, Feb 16 (Reuters) - Australia has classified nickel as a "critical mineral" on Friday, allowing the crisis-hit industry to access billions of dollars in government support, as its prime minister prepared wider policy support for the green energy industry.A sharp slide in nickel prices over the past year, driven by a jump in Indonesian supply, has hit Australian nickel producers, leading to mine closures, production cuts and writedowns in recent months.

Australia is the world's fifth-biggest producer of mined and refined nickel, with output led by BHP Group .

Following are moves by nickel producers and developers to cope with the slump:

BHP, the world's biggest-listed miner, on Thursday flagged a $2.5 billion impairment charge for its Nickel West operations. The operations are now under review with the potential to be placed on care and maintenance.

BHP signed a deal to supply nickel to Tesla in 2021.

...

https://www.msn.com/en-au/money/markets/factbox-australia-s-…

BHP and Rio take competition out of going green

MELBOURNE, Feb 9 (Reuters Breakingviews) - Capitalism and creativity are meant to thrive on healthy competition. Throw in the challenge of climate change and business rivalries can do more harm than good. Two of the world’s biggest iron ore miners effectively acknowledged that on Friday: BHP and Rio Tinto , announced a partnership with Australian manufacturer BlueScope Steel to try to decarbonise how the alloy is produced. It’s smart on many levels.First, pooling resources could speed up finding a solution, which means the industry could cut emissions faster. That’s critical for the planet because the current steelmaking process, which involves throwing iron ore into a blast furnace powered by coal, accounts for around 8% of the carbon belched globally into the atmosphere. Working together, the companies may end up spending less than they would have individually to achieve the same results. The plan involves the three companies sharing costs equally.

Moreover, the industry in Australia risked getting left behind. That’s because virtually all the iron ore dug up Down Under is hematite which has not proved conducive to being turned into “direct reduced iron” required in the first stage of the coal-free process. Currently it only works with magnetite iron ore, which is abundant in Brazil where rival Vale operates. BHP, Rio and BlueScope reckon that’s a fixable problem.

It needs to be. Iron ore accounts for the majority of Rio and BHP’s revenue. And it’s also Australia’s top export, worth some A$130 billion in the 12 months to June. That justifies why the trio’s project may qualify for some Australian taxpayer-funded assistance.

....

https://www.reuters.com/breakingviews/bhp-rio-take-competiti…

Rivals Rio Tinto, BHP tie up in Australian 'green iron'

PORT KEMBLA, Australia, Feb 9 (Reuters) - Mining rivals Rio Tinto , and BHP Group joined with Australia's largest steelmaker on Friday to announce a pilot "green iron" project to help cut emissions for steelmakers around the globe who rely on Australian iron ore.Australia's two largest iron ore producers and BlueScope Steel , will study the feasibility of building a pilot ironmaking electric smelting furnace (ESF), the country's first, with a potential start date of 2027, according to a joint statement on Friday.

If successful, it could help slash the emissions involved in preparing iron for steelmaking. This "green iron" could help cut the carbon footprint of steelmakers around the world who rely on Australian iron ore.

The production of steel, a key material for infrastructure and the net-zero energy transition, currently contributes around 8% of global carbon emissions.

...

https://www.reuters.com/markets/commodities/rio-tinto-bhp-ti…

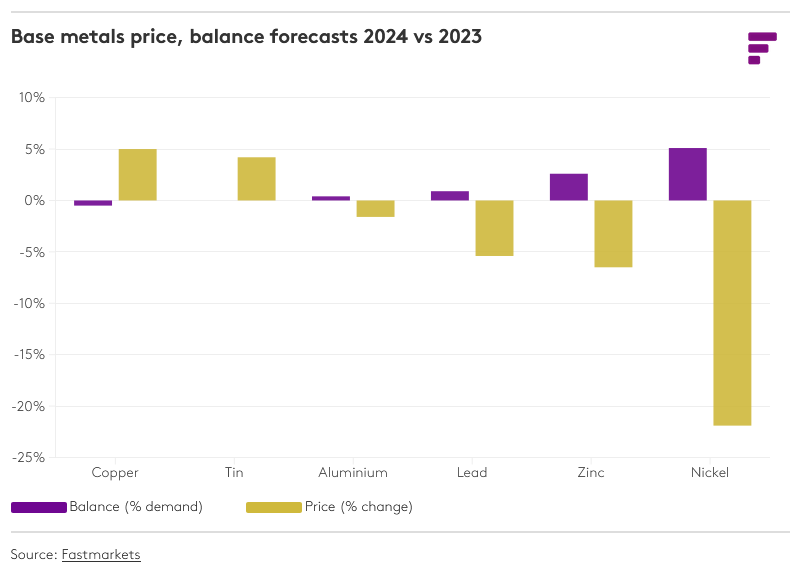

What’s ahead for the base metals market? | 2024 preview

The Fastmarkets base metals research team forecasts the dynamic trends and opportunities in the base metals market in 2024 and beyond The new year has got off to a relatively weak start for the base metals with London Metal Exchange prices generally lower in January. This reflects seasonal volatility, a rebound in the US dollar and other macroeconomic and geopolitical uncertainties that have dented risk appetite. But short-term price weakness should be viewed as a buying opportunity because there are positive macroeconomic factors ahead that should shape 2024. These factors include potential US Federal Reserve rate cuts and monetary policy injections in China, both of which could boost market liquidity and support base metal prices in the process.

The best performers of the group this year are likely to be those that have the strongest fundamental dynamics to enhance the effect of the broader macroeconomic backdrop. Here we review the outlooks for each base metal in order of their fundamentals – tightest to loosest.

https://www.fastmarkets.com/insights/whats-ahead-for-the-bas…[/quote]