Fortune Minerals - Kobalt, Wismut, Gold + Kohle - Die letzten 30 Beiträge

eröffnet am 31.07.09 16:45:13 von

neuester Beitrag 04.03.24 12:19:35 von

neuester Beitrag 04.03.24 12:19:35 von

Beiträge: 191

ID: 1.152.098

ID: 1.152.098

Aufrufe heute: 0

Gesamt: 13.084

Gesamt: 13.084

Aktive User: 0

ISIN: CA34967D1015 · WKN: A0CAFV

0,0400

EUR

+5,26 %

+0,0020 EUR

Letzter Kurs 20:03:26 Lang & Schwarz

Neuigkeiten

08.04.24 · Business Wire (engl.) |

01.02.24 · Business Wire (engl.) |

05.12.23 · Business Wire (engl.) |

29.09.23 · Business Wire (engl.) |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,0000 | +45,45 | |

| 1,6840 | +17,43 | |

| 1,0800 | +17,07 | |

| 527,60 | +15,68 | |

| 4,6900 | +15,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7300 | -8,75 | |

| 0,7000 | -10,26 | |

| 324,70 | -10,30 | |

| 0,6601 | -26,22 | |

| 47,07 | -97,97 |

Beitrag zu dieser Diskussion schreiben

"Fortune Minerals verlängert Option zum Kauf des Alberta-Raffineriegeländes für das NICO Critical Minerals Projekt"

https://de.marketscreener.com/kurs/rohstoff/LME-COPPER-CASH-…

https://de.marketscreener.com/kurs/rohstoff/LME-COPPER-CASH-…

Fortune kann die Option beibehalten, indem es JFSL 15.000 C$ pro Monat zahlt und die Einrichtungen für 5,5 Millionen C$ vor dem 31. Dezember 2023 erwerben kann.

https://www.fortuneminerals.com/news/press-releases/press-re…

https://www.fortuneminerals.com/news/press-releases/press-re…

LRC-AUN LLP ("LRC") gibt bekannt, dass es in einer privaten Transaktion 75. 500.000 Stammaktien von Fortune Minerals Limited (TSX: FT) (das "Unternehmen") zu einem Preis von etwa 0,01 $ pro Aktie (die "Transaktion") verkauft hat.

Unmittelbar vor der Transaktion besaß LRC zu einem wirtschaftlichen Vorteil 75.50.000 Stammaktien, was etwa 15,8% der ausgegebenen und ausstehenden Stammaktien entspricht. LRC besitzt jetzt null Aktien.

Der Verkauf der Stammaktien an der Transaktion durch LRC erfolgte im normalen Geschäftsverlauf. Abhängig von den Marktbedingungen, der Sicht von LRC auf die Aussichten des Unternehmens und anderen Faktoren, die von LRC als relevant erachtet werden, kann LRC von Zeit zu Zeit in der Zukunft, auf dem freien Markt oder aufgrund privat ausgehandelter Transaktionen Wertpapiere des Unternehmens erwerben oder alle oder einen Teil seiner Wertpapiere des Unternehmens verkaufen.

Diese Pressemitteilung wird im Rahmen der Frühwarn-Berichterstattungsbestimmungen der geltenden Wertpapiergesetze herausgegeben. Ein Frühwarnbericht mit zusätzlichen Informationen zu den vorstehenden Angelegenheiten wird eingereicht und unter dem SEDAR-Profil des Unternehmens unter www.sedar.com zur Verfügung gestellt.

Unmittelbar vor der Transaktion besaß LRC zu einem wirtschaftlichen Vorteil 75.50.000 Stammaktien, was etwa 15,8% der ausgegebenen und ausstehenden Stammaktien entspricht. LRC besitzt jetzt null Aktien.

Der Verkauf der Stammaktien an der Transaktion durch LRC erfolgte im normalen Geschäftsverlauf. Abhängig von den Marktbedingungen, der Sicht von LRC auf die Aussichten des Unternehmens und anderen Faktoren, die von LRC als relevant erachtet werden, kann LRC von Zeit zu Zeit in der Zukunft, auf dem freien Markt oder aufgrund privat ausgehandelter Transaktionen Wertpapiere des Unternehmens erwerben oder alle oder einen Teil seiner Wertpapiere des Unternehmens verkaufen.

Diese Pressemitteilung wird im Rahmen der Frühwarn-Berichterstattungsbestimmungen der geltenden Wertpapiergesetze herausgegeben. Ein Frühwarnbericht mit zusätzlichen Informationen zu den vorstehenden Angelegenheiten wird eingereicht und unter dem SEDAR-Profil des Unternehmens unter www.sedar.com zur Verfügung gestellt.

Cobalt News v. 28.08.2023

https://www.marketscreener.com/quote/stock/FORTUNE-MINERALS-… mögliche Verzögerung bei der Einreichung seiner Jahresabschlüsse...

https://www.businesswire.com/news/home/20230323005764/en/For… hier wird ja bis Silvester noch einiges passieren...

Q3 2022 Ergebnisveröffentlichung (geplant) - am 15.11.2022und dann noch die Erwerbung von JFSL-Anlagen.

Nachricht v. 03.11.2022

"Fortune Minerals Limited gab bekannt, dass das Unternehmen aufgrund der derzeitigen Volatilität der Wirtschaft und der Kapitalmärkte eine zusätzliche Verlängerung der Option auf den Kauf des Brachgeländes JFSL Field Services ULC (“JFSL”) in Lamont County, Alberta, erhalten hat. Fortune plant, an diesem Standort eine hydrometallurgische Raffinerie für sein vertikal integriertes NICO-Kobalt-Gold-Wismut-Kupfer-Projekt (“NICO-Projekt”) zu errichten. Bei der JFSL-Anlage handelt es sich um ein ehemaliges Stahlwerk, das sich auf einem 76,78 Acres großen Grundstück in Albertas Industrial Heartland nordöstlich von Edmonton befindet und über 42.000 Quadratfuß an gewarteten Geschäften und Gebäuden verfügt, die an die Canadian National Railway grenzen.Der Standort von JFSL befindet sich außerdem in der Nähe von Dienstleistungen, Reagenzienquellen und einem leicht erreichbaren Pool von Ingenieuren und Fachkräften für chemische Anlagen, wodurch die Kapital- und Betriebskosten für die geplante Entwicklung des NICO-Projekts erheblich reduziert werden. Gemäß der Optionsvereinbarung kann Fortune den Standort und die Anlagen von JFSL für 5,5 Millionen CAD erwerben. Die Laufzeit der Option wurde nun in monatlichen Schritten verlängert, indem Fortune an JFSL CAD 15.000 pro Monat bis zum 31. Dezember 2022 zahlt.

Während des Verlängerungszeitraums kann JFSL konkurrierende Angebote für die Anlage einholen, vorbehaltlich des Rechts von Fortune, den Kauf zu den vereinbarten Bedingungen bis zum Ende des Monats des Verlängerungszeitraums abzuschließen und/oder des Vorkaufsrechts von Fortune, ein konkurrierendes Angebot anzunehmen. Die NICO-Raffinerie würde Metallkonzentrate aus der geplanten NICO-Kobalt-Gold-Wismut-Kupfer-Mine und -Konzentrationsanlage in den Northwest Territories (“NWT”) verarbeiten und Fortune damit in die Lage versetzen, ein vertikal integrierter Hersteller von Kobaltsulfat zu werden, das für die Herstellung der Kathoden von Lithium-Ionen-Batterien benötigt wird, die in Elektrofahrzeugen, tragbarer Elektronik und stationären Speicherzellen zum Einsatz kommen. Die Raffinerie würde auch Wismutbarren und -oxid produzieren, ein Öko-Metall, das in der Automobil- und Pharmaindustrie verwendet wird und eine wachsende Nachfrage als umweltfreundlicher und ungiftiger Ersatz für Blei in Automatenstählen und Aluminium, in Messing und Lötmitteln, die in Trinkwasserquellen und in der Elektronik verwendet werden, in keramischen Glasuren, als Strahlenschutz, in Glas, Munition und Angelgewichten sowie in umweltfreundlichen Pfropfen zur Stilllegung von Öl- und Gasbohrungen hat.

Die Mineralreserven der NICO-Lagerstätte enthalten außerdem mehr als eine Million Unzen Gold und Kupfer als Nebenprodukt. Bei dem vertikal integrierten NICO-Projekt handelt es sich um ein fortgeschrittenes Erschließungsstadium für kritische Mineralien, das bereits die Genehmigung zur Umweltverträglichkeitsprüfung und die wichtigsten Bergbaugenehmigungen für die Anlagen in den NWT erhalten hat. Das Projekt wurde auch in positiven Machbarkeits- und Front-End Engineering and Design (“FEED”) Studien bewertet, die aktualisiert werden, um den neuen Raffineriestandort und die jüngsten Projektoptimierungen zu berücksichtigen."

Entdecker und Entwickler, die auf Kobaltprojekte abzielen

https://resourceworld-com.translate.goog/explorers-and-devel…

https://resourceworld-com.translate.goog/explorers-and-devel…

Endlich zeigt diese Depotmumie Lebenszeichen

News:

Fortune Minerals kündigt Entsorgungsoption für Prozessrückstände von Drittanbietern für seine NICO-Projektraffinerie an

https://www.fortuneminerals.com/news/press-releases/press-re…

Das ist ein ganz wichtiger Fortschritt für Fortune Minerals. Der Hintergrund ist Folgender: Fortune Minerals plant die vertikale Wertschöpfung seines NICO-Deposits mit Au, Co, Bi. Dazu gehört, dass eine Raffinerie in einer südlicheren Provinz gebaut werden sollte. Geplante Produktion: Kobaltsulfat, Gold Doré, Wismutbarren und Oxid. Bspw. Kobalt kann aktuell für 20$/lb verkauft werden; Kobaltsulfat für 25$/lb, also ein Premium-aufschlag von 25%.

Fortune Minerals war schon in Verhandlungen für eine Raffinerie in der kanadischen Provinz Saskatchewan. Wegen Bedenken bezüglich Umwelt war es praktisch aussichtslos eine Genehmigng dafür zu erhalten. Schon die Umzonung scheiterte im März 2019:

https://www.fortuneminerals.com/news/press-releases/press-re…

Mit dieser neuen optimierten Raffinerie-Prozess-Lösung - Entsorgung umweltschädlicher Prozessrückstände durch ein darauf spezialisiertes Entsorgungsunternehmen - ergeben sich wieder ganz neue Möglichkeiten: Tiefere Capex, kürzere Genehmigungszeiten, weniger Land und ganz wichtig: hohe Wahrscheinlichkeit für Realisierung.

Das Nico-Projekt von Fortune Minerals ist ganz speziell und einmalig in einer Tier-1 Jurisdiktion: Kobalt, Bismuth und Gold. Vor allem auch Bismuth gehört zu den kritischen Mineralien und ist in den USA und in der EU auf der entsprechenden Liste. Bismuth kann als massiv weniger giftiges Metall in gewissen Bereichen (z.B.Wasserversorgung), Blei (hochgiftig) ersetzen.

Der nächste Trigger ist die definitive Fertigstellung und Eröffnung der 97km langen All-Season-Road nach Whati, Kosten 213mCAD. Von dort braucht es dann "nur"noch eine Zugangsstrasse zur NICO-Mine von rund 50km.

urai5

Fortune Minerals kündigt Entsorgungsoption für Prozessrückstände von Drittanbietern für seine NICO-Projektraffinerie an

https://www.fortuneminerals.com/news/press-releases/press-re…

Das ist ein ganz wichtiger Fortschritt für Fortune Minerals. Der Hintergrund ist Folgender: Fortune Minerals plant die vertikale Wertschöpfung seines NICO-Deposits mit Au, Co, Bi. Dazu gehört, dass eine Raffinerie in einer südlicheren Provinz gebaut werden sollte. Geplante Produktion: Kobaltsulfat, Gold Doré, Wismutbarren und Oxid. Bspw. Kobalt kann aktuell für 20$/lb verkauft werden; Kobaltsulfat für 25$/lb, also ein Premium-aufschlag von 25%.

Fortune Minerals war schon in Verhandlungen für eine Raffinerie in der kanadischen Provinz Saskatchewan. Wegen Bedenken bezüglich Umwelt war es praktisch aussichtslos eine Genehmigng dafür zu erhalten. Schon die Umzonung scheiterte im März 2019:

https://www.fortuneminerals.com/news/press-releases/press-re…

Mit dieser neuen optimierten Raffinerie-Prozess-Lösung - Entsorgung umweltschädlicher Prozessrückstände durch ein darauf spezialisiertes Entsorgungsunternehmen - ergeben sich wieder ganz neue Möglichkeiten: Tiefere Capex, kürzere Genehmigungszeiten, weniger Land und ganz wichtig: hohe Wahrscheinlichkeit für Realisierung.

Das Nico-Projekt von Fortune Minerals ist ganz speziell und einmalig in einer Tier-1 Jurisdiktion: Kobalt, Bismuth und Gold. Vor allem auch Bismuth gehört zu den kritischen Mineralien und ist in den USA und in der EU auf der entsprechenden Liste. Bismuth kann als massiv weniger giftiges Metall in gewissen Bereichen (z.B.Wasserversorgung), Blei (hochgiftig) ersetzen.

Der nächste Trigger ist die definitive Fertigstellung und Eröffnung der 97km langen All-Season-Road nach Whati, Kosten 213mCAD. Von dort braucht es dann "nur"noch eine Zugangsstrasse zur NICO-Mine von rund 50km.

urai5

Es gibt eine lange und auch leidvolle Geschichte von Fortune Minerals. Ich beobachte den Titel schon lange. Ich hatte ihn auch beim w:o Wettbewerb 2020 ins Rennen geschickt. Natürlich war Fortune Minerals im Wettbewerb weit abgeschlagen- aber das eröffnet Chancen.

Anfang Januar hatte ich eine bescheidene Position in Fortune Minerals - zusammen mit Conic Metalls - eröffnet. Nachdem Biden-Sieg in den USA gehe ich davon aus, dass die EV Revolution auch in den USA an Fahrt gewinnt.

Das Nico-Projekt mit den Reserves (nicht Resources) in Gold, Cobalt und Wismuth mit einem In-Situ Wert von mehr als 4Mrd.$ ist einzigartig. Der wichtigste Treiber 2021 dürfte die Eröffnung der All-Season-Road nach Wahti sein. Für Fortune bleiben dann noch 50km zum Nico-Projekt.

Aus aktuellem Anlass habe ich diesen Thread hervorgehoben - letzter Eintrag 6.3.2019. Es gibt einen aktuellen Research Bericht von Arrowhead:

https://abid.co/sites/default/files/Fortune%20Minerals%20-%2…

Wenn der Cobalt-Preis weiter ansteigt und der Goldpreis mindestens auf diesem Niveau bleibt, bestehen gute Chancen, dass Nico in den kommenden Jahren gebaut und in Produktion gehen könnte. Die First Nations Tlicho stehen geschlossen hinter dem herausfordernden und spannenden Projekt.

urai5

P.S. Neuste ppt-Präsentation

https://s1.q4cdn.com/337451660/files/doc_presentations/2020/…

Anfang Januar hatte ich eine bescheidene Position in Fortune Minerals - zusammen mit Conic Metalls - eröffnet. Nachdem Biden-Sieg in den USA gehe ich davon aus, dass die EV Revolution auch in den USA an Fahrt gewinnt.

Das Nico-Projekt mit den Reserves (nicht Resources) in Gold, Cobalt und Wismuth mit einem In-Situ Wert von mehr als 4Mrd.$ ist einzigartig. Der wichtigste Treiber 2021 dürfte die Eröffnung der All-Season-Road nach Wahti sein. Für Fortune bleiben dann noch 50km zum Nico-Projekt.

Aus aktuellem Anlass habe ich diesen Thread hervorgehoben - letzter Eintrag 6.3.2019. Es gibt einen aktuellen Research Bericht von Arrowhead:

https://abid.co/sites/default/files/Fortune%20Minerals%20-%2…

Wenn der Cobalt-Preis weiter ansteigt und der Goldpreis mindestens auf diesem Niveau bleibt, bestehen gute Chancen, dass Nico in den kommenden Jahren gebaut und in Produktion gehen könnte. Die First Nations Tlicho stehen geschlossen hinter dem herausfordernden und spannenden Projekt.

urai5

P.S. Neuste ppt-Präsentation

https://s1.q4cdn.com/337451660/files/doc_presentations/2020/…

Danke Fackelmann. Unter anderem wg dem Target auf der 3. SEITE bin ich zuletzt hier rein.

Dealer Date Rating Target

Siddharth Rajeev

Fundamental Research Corp. Feb 19, 2019 Buy $0.97

MacMurray Whale

Cormark Securities Inc. Nov 6, 2018 Buy (S) $0.40

Dealer Date Rating Target

Siddharth Rajeev

Fundamental Research Corp. Feb 19, 2019 Buy $0.97

MacMurray Whale

Cormark Securities Inc. Nov 6, 2018 Buy (S) $0.40

Antwort auf Beitrag Nr.: 60.028.265 von Airwave72 am 05.03.19 21:21:23Eine aktualisiertte FS sollte demnächst vorgelegt werden.

Hat der Kobalt-Preis seinen Boden gefunden ?

https://www.metalradar.com/lme-prices/cobalt/

Hier noch die aktuelle Präsentation:

https://s1.q4cdn.com/337451660/files/doc_presentations/2019/…

Hat der Kobalt-Preis seinen Boden gefunden ?

https://www.metalradar.com/lme-prices/cobalt/

Hier noch die aktuelle Präsentation:

https://s1.q4cdn.com/337451660/files/doc_presentations/2019/…

Langsam scheint hier wieder Schwung reinzukommen.

https://www.proactiveinvestors.com/companies/stocktube/12462…

https://www.proactiveinvestors.com/companies/stocktube/12462…

Video vom Battery Metals Summit 2018 in Zurich

https://www.youtube.com/watch?v=TweRwBolOUY&t=8s Interessant!

Neues Interview mit Robin Goad: http://www.commodity-tv.net/c/mid,39130,Precious_und_Battery…

Robin Goad, CEO of Canada-based Fortune Minerals

http://www.scmp.com/business/commodities/article/2149027/chi…

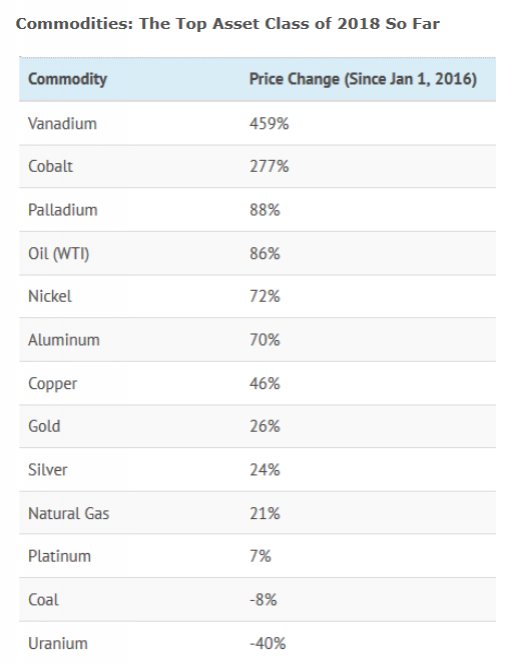

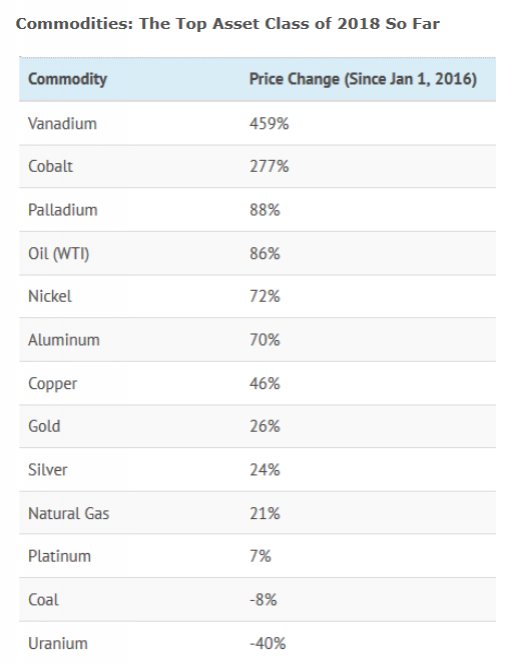

Commodities: The Top Asset Class of 2018 So Far

http://www.visualcapitalist.com/commodities-top-asset-class-…

http://www.visualcapitalist.com/commodities-top-asset-class-…

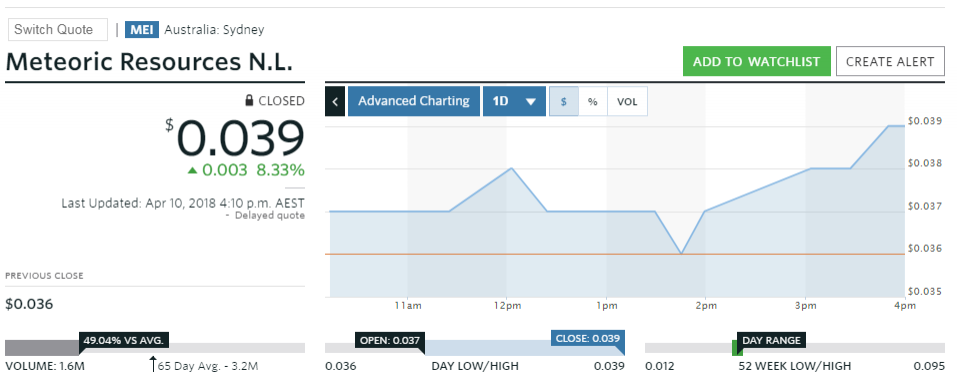

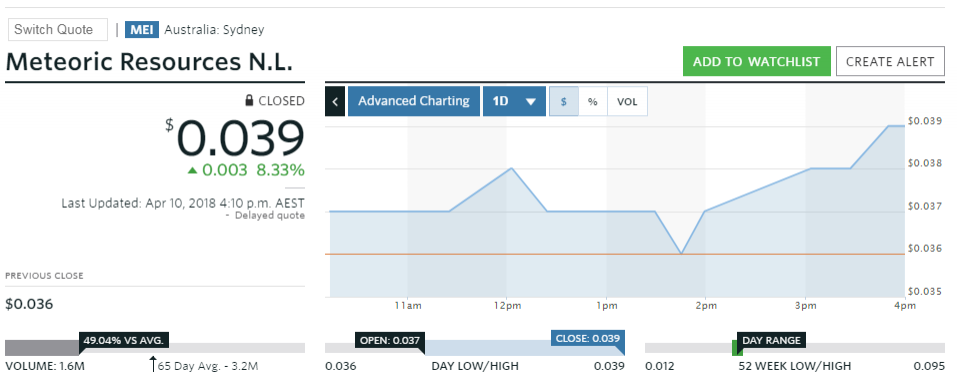

Antwort auf Beitrag Nr.: 57.507.113 von MONSIEURCB am 10.04.18 14:05:50Wer noch eine andere Kobalt-Karte spielen möchte, ...

http://www.meteoric.com.au/

http://www.meteoric.com.au/

Seit heute auch dabei ... auf guten Info- & Meinungsaustausch!

Antwort auf Beitrag Nr.: 56.573.311 von Fackelmann am 30.12.17 11:16:15

Neu:

Tlicho road gets green light from review board

http://www.cbc.ca/news/canada/north/tlicho-winter-road-green…

Rückschau

Zitat von Fackelmann: Aus 11/2017:

Fortune Minerals Limited – Raising Fair Value Estimate

https://www.baystreet.ca/articles/research_reports/fundament…

>>The average of our DCF and comparables valuation is $0.97 per share. Therefore, we are raising our fair value estimate on FT from $0.85 to $0.97 per share.

- Key potential catalysts in the next 12 months are listed below:

- Updated feasibility study results reflecting the economies of scale of expanded project

project financing and/or identify strategic partner s to advance NICO to production

- re-zoning upon receipt of permits for the SMPP site in Saskatchewan

- agreement with the Tlicho Government for the NICO access road

- road construction agreements and site preparation plans

Neu:

Tlicho road gets green light from review board

http://www.cbc.ca/news/canada/north/tlicho-winter-road-green…

Fortune Minerals provides update of NICO Project

http://www.fortuneminerals.com/news/press-releases/press-rel… "Wasserstandsmeldung" von Troy D. Nazarewicz (Fortune Min. Investor Relations Manager)

I'll be back to vacation now, but this seems of immediate interest to the board here. -------- Dear John, Thank you for your interest in Fortune Minerals. The Saskatchewan Metals Processing Plant re-zoning is underway and we will update investors when the result of the application is known. Establishing the refinery in Saskatchewan is ideal as it allows us to capture the value added from processing the unique metal assemblage of our ores (cobalt, gold & bismuth) to the final products in a lower cost jurisdiction. This also positions Fortune as a rare vertically integrated cobalt producer that is independent of Congolese mine production and Chinese refining capacity. Future business opportunities at the refinery include the opportunity to conduct toll processing for other mines and to diversify into metals recycling. As such, it potentially captures cobalt production for strategic investor that they otherwise would need to buy from China in competition with the Chinese auto/battery industry. You have a misunderstanding of the cost of the refinery. In the 2014 Feasibility Study the capital required for the entire project was C$589 million. This was split between the refinery in Saskatchewan (C$242 million) and the mine in the NWT (C$347 million). We are currently working on a new Feasibility Study that is examining a higher throughput rate to target approximately 2000 tonnes of annual cobalt production along with the by-product gold and bismuth production, and the capital requirements noted above will be changing. The new Feasibility Study is anticipated to be completed in the second quarter of this year. Sincerely, Troyhttp://www.stockhouse.com/companies/bullboard#zVYihs1Qc7SmRk…

Fortune Minerals CEO: We'll be producing battery-grade cobalt sulphate for batteries

https://www.youtube.com/watch?v=31B8RRQPIVE&feature=youtu.be

https://www.youtube.com/watch?v=31B8RRQPIVE&feature=youtu.be

und?

wird das hier was?

wird das hier was?

Japanese cobalt traders find there is none left to buy

https://asia.nikkei.com/Business/Trends/Japanese-cobalt-trad…

https://asia.nikkei.com/Business/Trends/Japanese-cobalt-trad…

Kobalt weglassen wird so schnell nicht möglich sein

https://i.pinimg.com/564x/64/6f/55/646f552103242f6a8eb1f7ca6…