Amerigas - US-MLP steueroptimiert - 500 Beiträge pro Seite

eröffnet am 04.12.09 12:52:11 von

neuester Beitrag 14.09.19 09:30:24 von

neuester Beitrag 14.09.19 09:30:24 von

Beiträge: 16

ID: 1.154.635

ID: 1.154.635

Aufrufe heute: 0

Gesamt: 2.237

Gesamt: 2.237

Aktive User: 0

ISIN: US0309751065 · WKN: 895035

29,01

EUR

+0,66 %

+0,19 EUR

Letzter Kurs 19.08.19 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 61,00 | +1.548,65 | |

| 9.341,90 | +13,74 | |

| 37,40 | +10,00 | |

| 12,000 | +8,89 | |

| 7,5000 | +8,15 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 21,600 | -10,74 | |

| 11,444 | -11,15 | |

| 1,5500 | -11,43 | |

| 1,5000 | -11,76 | |

| 490,00 | -18,33 |

11.11.2009 15:28

AmeriGas Partners Reports Fiscal 2009 Results

AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE:APU), reported net income for the Partnership for the fiscal year ended September 30, 2009 of $224.6 million, or $3.59 per limited partner unit, compared to net income of $158.0 million, or $2.70 per limited partner unit for the fiscal year ended September 30, 2008. As previously reported, net income for fiscal 2009 includes a gain of $39.5 million on the sale of the Partnership's California propane storage terminal.

The Partnership's earnings before interest expense, income taxes, depreciation and amortization (EBITDA) was $381.4 million in fiscal 2009 compared to EBITDA of $313.0 million in the prior year. EBITDA in fiscal 2009 also includes the aforementioned gain on the terminal sale.

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, ”Earnings in fiscal 2009 significantly benefited from higher unit margins resulting from a rapid decline in wholesale product costs, a benefit that was somewhat offset by the effects of the recession on volumes sold. We were pleased to increase our distribution by 5% again this year, in line with our previously stated distribution growth goal.” AmeriGas previously reported that it expects earnings in the range of $181 million to $191 million and EBITDA in the range of $335 million to $345 million in fiscal 2010, assuming normal weather.

For the twelve months ended September 30, 2009, retail propane volumes sold decreased 6.5% from the prior year to 928 million gallons as the benefits of acquisitions completed in fiscal 2009 were more than offset by the adverse effects of the significant deterioration in general economic activity which has occurred over the last year and continued customer conservation. Nationally, weather was 2.5% warmer than normal in fiscal 2009, virtually the same as the prior year, according to the National Oceanic and Atmospheric Administration. Revenues decreased to $2.26 billion in fiscal 2009 from $2.82 billion in fiscal 2008 primarily due to lower retail selling prices associated with significantly lower commodity prices and lower volumes sold.

Total margin increased $36.7 million mainly due to higher average retail propane unit margins resulting from a rapid decline in wholesale propane product costs that occurred primarily as the Partnership entered the critical winter heating season during the first quarter of fiscal 2009. Operating income was $300.5 million in fiscal 2009 compared to $234.9 million in fiscal 2008, reflecting the higher EBITDA partially offset by slightly higher depreciation and amortization expenses associated with acquisitions and capital expenditures.

For the fourth quarter of fiscal 2009, the Partnership recorded a seasonal net loss of $33.6 million, or $0.64 per limited partner unit, compared to a net loss of $20.4 million, or $0.36 per limited partner unit, for the prior-year period. Retail volumes sold in the quarter were 147.1 million gallons compared with 164.9 million gallons sold in the prior-year quarter. EBITDA for the period was $4.6 million compared to $18.5 million for same period in 2008. Revenue for the quarter totaled $337.0 million versus $525.2 million in the fiscal 2008 quarter, principally due to lower selling prices resulting from significantly lower wholesale propane product costs.

AmeriGas Partners is the nation's largest retail propane marketer, serving approximately 1.3 million customers from nearly 600 locations in 46 states. UGI Corporation (NYSE:UGI), through subsidiaries, owns 44% of the Partnership and the public owns the remaining 56%.

AmeriGas Partners will hold a live Internet Audio Webcast of its conference call to discuss fourth quarter earnings and fiscal 2010 activities at 4:00 PM ET on Wednesday, November 11, 2009. Interested parties may listen to the audio webcast both live and in replay on the Internet at http://investor.shareholder.com/ugi/apu/events.cfm or at the company website; http://www.amerigas.com and click on Investor Relations. A telephonic replay will be available from 7:00 PM ET on November 11 through midnight Friday, November 13. The replay may be accessed at 1-888-203-1112, passcode 2496390 and International access 1-719-457-0820, passcode 2496390.

AmeriGas Partners Reports Fiscal 2009 Results

AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE:APU), reported net income for the Partnership for the fiscal year ended September 30, 2009 of $224.6 million, or $3.59 per limited partner unit, compared to net income of $158.0 million, or $2.70 per limited partner unit for the fiscal year ended September 30, 2008. As previously reported, net income for fiscal 2009 includes a gain of $39.5 million on the sale of the Partnership's California propane storage terminal.

The Partnership's earnings before interest expense, income taxes, depreciation and amortization (EBITDA) was $381.4 million in fiscal 2009 compared to EBITDA of $313.0 million in the prior year. EBITDA in fiscal 2009 also includes the aforementioned gain on the terminal sale.

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, ”Earnings in fiscal 2009 significantly benefited from higher unit margins resulting from a rapid decline in wholesale product costs, a benefit that was somewhat offset by the effects of the recession on volumes sold. We were pleased to increase our distribution by 5% again this year, in line with our previously stated distribution growth goal.” AmeriGas previously reported that it expects earnings in the range of $181 million to $191 million and EBITDA in the range of $335 million to $345 million in fiscal 2010, assuming normal weather.

For the twelve months ended September 30, 2009, retail propane volumes sold decreased 6.5% from the prior year to 928 million gallons as the benefits of acquisitions completed in fiscal 2009 were more than offset by the adverse effects of the significant deterioration in general economic activity which has occurred over the last year and continued customer conservation. Nationally, weather was 2.5% warmer than normal in fiscal 2009, virtually the same as the prior year, according to the National Oceanic and Atmospheric Administration. Revenues decreased to $2.26 billion in fiscal 2009 from $2.82 billion in fiscal 2008 primarily due to lower retail selling prices associated with significantly lower commodity prices and lower volumes sold.

Total margin increased $36.7 million mainly due to higher average retail propane unit margins resulting from a rapid decline in wholesale propane product costs that occurred primarily as the Partnership entered the critical winter heating season during the first quarter of fiscal 2009. Operating income was $300.5 million in fiscal 2009 compared to $234.9 million in fiscal 2008, reflecting the higher EBITDA partially offset by slightly higher depreciation and amortization expenses associated with acquisitions and capital expenditures.

For the fourth quarter of fiscal 2009, the Partnership recorded a seasonal net loss of $33.6 million, or $0.64 per limited partner unit, compared to a net loss of $20.4 million, or $0.36 per limited partner unit, for the prior-year period. Retail volumes sold in the quarter were 147.1 million gallons compared with 164.9 million gallons sold in the prior-year quarter. EBITDA for the period was $4.6 million compared to $18.5 million for same period in 2008. Revenue for the quarter totaled $337.0 million versus $525.2 million in the fiscal 2008 quarter, principally due to lower selling prices resulting from significantly lower wholesale propane product costs.

AmeriGas Partners is the nation's largest retail propane marketer, serving approximately 1.3 million customers from nearly 600 locations in 46 states. UGI Corporation (NYSE:UGI), through subsidiaries, owns 44% of the Partnership and the public owns the remaining 56%.

AmeriGas Partners will hold a live Internet Audio Webcast of its conference call to discuss fourth quarter earnings and fiscal 2010 activities at 4:00 PM ET on Wednesday, November 11, 2009. Interested parties may listen to the audio webcast both live and in replay on the Internet at http://investor.shareholder.com/ugi/apu/events.cfm or at the company website; http://www.amerigas.com and click on Investor Relations. A telephonic replay will be available from 7:00 PM ET on November 11 through midnight Friday, November 13. The replay may be accessed at 1-888-203-1112, passcode 2496390 and International access 1-719-457-0820, passcode 2496390.

27.01.2010 13:32

AmeriGas Partners Reports First Quarter Results

AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE: APU), reported net income attributable to AmeriGas Partners, L.P. for the first fiscal quarter ended December 31, 2009 of $84.0 million compared to $124.0 million for the same period last year. The Partnership's earnings before interest expense, income taxes, depreciation and amortization (EBITDA) was $123.0 million for the first quarter of 2009 compared to $164.1 million for the same period last year. Results for the prior-year period include the impact of a $39.9 million pre-tax gain on the sale of the Partnership's California propane storage terminal.

For the three months ended December 31, 2009, retail propane volumes sold were 267.4 million gallons compared with retail propane volumes of 278.2 million gallons in the prior-year period. Weather was 1.3% colder than normal and 2.1% colder than in the prior-year period, according to the National Oceanic and Atmospheric Administration. The beneficial impact of the colder weather on volumes sold was more than offset by the effects of the economic recession on commercial and motor fuel customers and continued customer conservation.

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, "We are pleased to report that our first quarter results were right in line with our expectations, as significantly lower operating expenses offset most of the impact of lower sales volumes and slightly lower unit margins."

Revenues for the quarter decreased to $656.6 million from $727.1 million in the prior year period, reflecting lower average selling prices and lower volumes sold. Total margin decreased $14.5 million mainly due to the lower volumes sold. The decrease in total margin was largely offset by a $13.2 million decrease in operating and administrative expenses due to lower uncollectible accounts expense and lower general insurance and uninsured litigation expenses. Operating income decreased to $102.6 million from $144.8 million in the fiscal 2009 quarter, primarily reflecting the impact of the terminal sale on prior-year results.

Separately, AmeriGas announced that for the three-year period ended December 31, 2009, the compound annual total return on Partnership units exceeded that of a substantial majority of the partnerships in its peer group of publicly traded master limited partnerships. As a result, employees who received performance-contingent unit awards in early 2007 in accordance with AmeriGas's long-term compensation plan will receive a payout under the plan in Partnership units and will be deemed to have sold a portion of the units to AmeriGas Partners for cash to pay income taxes. The appropriate disclosures on Form 4 have been filed with the Securities and Exchange Commission.

AmeriGas Partners is the nation's largest retail propane marketer, serving approximately 1.3 million customers in all 50 states from approximately 1,200 locations. UGI Corporation (NYSE:UGI), through subsidiaries, owns 44% of the Partnership and the public owns the remaining 56%.

AmeriGas Partners, L.P. will host its first quarter FY 2010 earnings conference call on Wednesday, January 27, 2010, at 4:00 PM ET. Interested parties may listen to a live audio broadcast of the conference call at http://investor.shareholder.com/ugi/apu/events.cfm or at the company website: www.amerigas.com by clicking on Investor Relations. A telephonic replay will be available from 7:00 PM ET on Wednesday, January 27 through midnight Friday, January 29. The replay may be accessed at 1-888-203-1112, passcode 2705534 and International access 1-719-457-0820, passcode 2705534.

Comprehensive information about AmeriGas is available on the Internet at www.amerigas.com.

This press release contains certain forward-looking statements which management believes to be reasonable as of today's date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management's control. You should read the Partnership's Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are adverse weather conditions, price volatility and availability of propane, increased customer conservation measures, the capacity to transport propane to our market areas, the impact of pending and future legal proceedings, and political, economic and regulatory conditions in the U. S. and abroad. The Partnership undertakes no obligation to release revisions to its forward-looking statements to reflect events or circumstances occurring after today.

AMERIGAS PARTNERS, L.P. AND SUBSIDIARIES

REPORT OF EARNINGS

(Thousands, except per unit and where otherwise indicated)

(Unaudited)

Three Months Ended Twelve Months Ended

December 31, December 31,

2009 2008 2009 2008

Revenues:

Propane $ 614,358 $ 678,628 $ 2,027,620 $ 2,603,631

Other 42,237 48,436 162,006 190,454

656,595 727,064 2,189,626 2,794,085

Costs and expenses:

Cost of sales - propane 375,449 428,469 1,201,312 1,777,521

Cost of sales - other 14,120 17,069 59,223 69,983

Operating and administrative expenses 146,814 159,985 601,981 617,566

Depreciation 19,983 19,420 79,091 76,442

Amortization 1,398 1,323 5,335 4,879

Gain on sale of California storage facility - (39,887 ) - (39,887 )

Other income, net (3,783 ) (4,081 ) (15,707 ) (18,091 )

553,981 582,298 1,931,235 2,488,413

Operating income 102,614 144,766 258,391 305,672

Interest expense (16,493 ) (18,725 ) (68,108 ) (73,381 )

Income before income taxes 86,121 126,041 190,283 232,291

Income taxes (1,167 ) (637 ) (3,123 ) (1,616 )

Net income 84,954 125,404 187,160 230,675

Less: net income attributable to noncontrolling interests (995 ) (1,441 ) (2,521 ) (2,998 )

Net income attributable to AmeriGas Partners, L.P. $ 83,959 $ 123,963 $ 184,639 $ 227,677

General partner's interest in net income attributable to AmeriGas Partners, L.P. $ 1,407 $ 1,545 $ 6,599 $ 3,236

Limited partners' interest in net income attributable to AmeriGas Partners, L.P. $ 82,552 $ 122,418 $ 178,040 $ 224,441

Income per limited partner unit (a)

Basic $ 1.15 $ 1.50 $ 3.06 $ 3.63

Diluted $ 1.15 $ 1.50 $ 3.06 $ 3.63

Average limited partner units outstanding:

Basic 57,055 57,014 57,049 57,014

Diluted 57,105 57,062 57,093 57,055

SUPPLEMENTAL INFORMATION:

Retail gallons sold (millions) 267.4 278.2 917.4 992.3

EBITDA (b) $ 123,000 $ 164,068 $ 340,296 $ 383,995

Expenditures for property, plant and equipment:

Maintenance capital expenditures $ 10,429 $ 8,646 $ 39,295 $ 30,398

Growth capital expenditures $ 16,297 $ 10,493 $ 47,031 $ 33,314

(a) Income per limited partner unit is computed in accordance with accounting guidance regarding the application of the two-class method for determining earnings per share as it relates to master limited partnerships. Refer to notes 2 and 3 to the consolidated financial statements included in the AmeriGas Partners, L.P. Annual Report on Form 10-K for the fiscal year ended September 30, 2009.

(b) Earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") should not be considered as an alternative to net income attributable to AmeriGas Partners, L.P. (as an indicator of operating performance) and is not a measure of performance or financial condition under accounting principles generally accepted in the United States ("GAAP"). Management believes EBITDA is a meaningful non-GAAP financial measure used by investors to (1) compare the Partnership's operating performance with other companies within the propane industry and (2) assess its ability to meet loan covenants. The Partnership's definition of EBITDA may be different from that used by other companies.

Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes or historical cost basis. In view of the omission of interest, income taxes, depreciation and amortization from EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant years.

Management also uses EBITDA to assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's EBITDA to assess the profitability of the Partnership. UGI Corporation discloses the Partnership's EBITDA as the profitability measure to comply with the GAAP requirement to provide profitability information about its domestic propane segment. EBITDA in the three and twelve months ended December 31, 2008 includes a $39,887 pre-tax gain from the sale of the Partnership's California storage facility.

The following table includes reconciliations of net income attributable to AmeriGas Partners, L.P. to EBITDA for all periods presented:

Three Months Ended Twelve Months Ended

December 31, December 31,

2009 2008 2009 2008

Net income attributable to AmeriGas Partners, L.P. $ 83,959 $ 123,963 $ 184,639 $ 227,677

Income taxes 1,167 637 3,123 1,616

Interest expense 16,493 18,725 68,108 73,381

Depreciation 19,983 19,420 79,091 76,442

Amortization 1,398 1,323 5,335 4,879

EBITDA $ 123,000 $ 164,068 $ 340,296 $ 383,995

Contacts:

AmeriGas Partners, L.P.

Robert W. Krick, 610-337-1000 ext. 13645

Brenda A. Blake, 610-337-1000 ext. 13202

AmeriGas Partners Reports First Quarter Results

AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE: APU), reported net income attributable to AmeriGas Partners, L.P. for the first fiscal quarter ended December 31, 2009 of $84.0 million compared to $124.0 million for the same period last year. The Partnership's earnings before interest expense, income taxes, depreciation and amortization (EBITDA) was $123.0 million for the first quarter of 2009 compared to $164.1 million for the same period last year. Results for the prior-year period include the impact of a $39.9 million pre-tax gain on the sale of the Partnership's California propane storage terminal.

For the three months ended December 31, 2009, retail propane volumes sold were 267.4 million gallons compared with retail propane volumes of 278.2 million gallons in the prior-year period. Weather was 1.3% colder than normal and 2.1% colder than in the prior-year period, according to the National Oceanic and Atmospheric Administration. The beneficial impact of the colder weather on volumes sold was more than offset by the effects of the economic recession on commercial and motor fuel customers and continued customer conservation.

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, "We are pleased to report that our first quarter results were right in line with our expectations, as significantly lower operating expenses offset most of the impact of lower sales volumes and slightly lower unit margins."

Revenues for the quarter decreased to $656.6 million from $727.1 million in the prior year period, reflecting lower average selling prices and lower volumes sold. Total margin decreased $14.5 million mainly due to the lower volumes sold. The decrease in total margin was largely offset by a $13.2 million decrease in operating and administrative expenses due to lower uncollectible accounts expense and lower general insurance and uninsured litigation expenses. Operating income decreased to $102.6 million from $144.8 million in the fiscal 2009 quarter, primarily reflecting the impact of the terminal sale on prior-year results.

Separately, AmeriGas announced that for the three-year period ended December 31, 2009, the compound annual total return on Partnership units exceeded that of a substantial majority of the partnerships in its peer group of publicly traded master limited partnerships. As a result, employees who received performance-contingent unit awards in early 2007 in accordance with AmeriGas's long-term compensation plan will receive a payout under the plan in Partnership units and will be deemed to have sold a portion of the units to AmeriGas Partners for cash to pay income taxes. The appropriate disclosures on Form 4 have been filed with the Securities and Exchange Commission.

AmeriGas Partners is the nation's largest retail propane marketer, serving approximately 1.3 million customers in all 50 states from approximately 1,200 locations. UGI Corporation (NYSE:UGI), through subsidiaries, owns 44% of the Partnership and the public owns the remaining 56%.

AmeriGas Partners, L.P. will host its first quarter FY 2010 earnings conference call on Wednesday, January 27, 2010, at 4:00 PM ET. Interested parties may listen to a live audio broadcast of the conference call at http://investor.shareholder.com/ugi/apu/events.cfm or at the company website: www.amerigas.com by clicking on Investor Relations. A telephonic replay will be available from 7:00 PM ET on Wednesday, January 27 through midnight Friday, January 29. The replay may be accessed at 1-888-203-1112, passcode 2705534 and International access 1-719-457-0820, passcode 2705534.

Comprehensive information about AmeriGas is available on the Internet at www.amerigas.com.

This press release contains certain forward-looking statements which management believes to be reasonable as of today's date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management's control. You should read the Partnership's Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are adverse weather conditions, price volatility and availability of propane, increased customer conservation measures, the capacity to transport propane to our market areas, the impact of pending and future legal proceedings, and political, economic and regulatory conditions in the U. S. and abroad. The Partnership undertakes no obligation to release revisions to its forward-looking statements to reflect events or circumstances occurring after today.

AMERIGAS PARTNERS, L.P. AND SUBSIDIARIES

REPORT OF EARNINGS

(Thousands, except per unit and where otherwise indicated)

(Unaudited)

Three Months Ended Twelve Months Ended

December 31, December 31,

2009 2008 2009 2008

Revenues:

Propane $ 614,358 $ 678,628 $ 2,027,620 $ 2,603,631

Other 42,237 48,436 162,006 190,454

656,595 727,064 2,189,626 2,794,085

Costs and expenses:

Cost of sales - propane 375,449 428,469 1,201,312 1,777,521

Cost of sales - other 14,120 17,069 59,223 69,983

Operating and administrative expenses 146,814 159,985 601,981 617,566

Depreciation 19,983 19,420 79,091 76,442

Amortization 1,398 1,323 5,335 4,879

Gain on sale of California storage facility - (39,887 ) - (39,887 )

Other income, net (3,783 ) (4,081 ) (15,707 ) (18,091 )

553,981 582,298 1,931,235 2,488,413

Operating income 102,614 144,766 258,391 305,672

Interest expense (16,493 ) (18,725 ) (68,108 ) (73,381 )

Income before income taxes 86,121 126,041 190,283 232,291

Income taxes (1,167 ) (637 ) (3,123 ) (1,616 )

Net income 84,954 125,404 187,160 230,675

Less: net income attributable to noncontrolling interests (995 ) (1,441 ) (2,521 ) (2,998 )

Net income attributable to AmeriGas Partners, L.P. $ 83,959 $ 123,963 $ 184,639 $ 227,677

General partner's interest in net income attributable to AmeriGas Partners, L.P. $ 1,407 $ 1,545 $ 6,599 $ 3,236

Limited partners' interest in net income attributable to AmeriGas Partners, L.P. $ 82,552 $ 122,418 $ 178,040 $ 224,441

Income per limited partner unit (a)

Basic $ 1.15 $ 1.50 $ 3.06 $ 3.63

Diluted $ 1.15 $ 1.50 $ 3.06 $ 3.63

Average limited partner units outstanding:

Basic 57,055 57,014 57,049 57,014

Diluted 57,105 57,062 57,093 57,055

SUPPLEMENTAL INFORMATION:

Retail gallons sold (millions) 267.4 278.2 917.4 992.3

EBITDA (b) $ 123,000 $ 164,068 $ 340,296 $ 383,995

Expenditures for property, plant and equipment:

Maintenance capital expenditures $ 10,429 $ 8,646 $ 39,295 $ 30,398

Growth capital expenditures $ 16,297 $ 10,493 $ 47,031 $ 33,314

(a) Income per limited partner unit is computed in accordance with accounting guidance regarding the application of the two-class method for determining earnings per share as it relates to master limited partnerships. Refer to notes 2 and 3 to the consolidated financial statements included in the AmeriGas Partners, L.P. Annual Report on Form 10-K for the fiscal year ended September 30, 2009.

(b) Earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") should not be considered as an alternative to net income attributable to AmeriGas Partners, L.P. (as an indicator of operating performance) and is not a measure of performance or financial condition under accounting principles generally accepted in the United States ("GAAP"). Management believes EBITDA is a meaningful non-GAAP financial measure used by investors to (1) compare the Partnership's operating performance with other companies within the propane industry and (2) assess its ability to meet loan covenants. The Partnership's definition of EBITDA may be different from that used by other companies.

Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes or historical cost basis. In view of the omission of interest, income taxes, depreciation and amortization from EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant years.

Management also uses EBITDA to assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's EBITDA to assess the profitability of the Partnership. UGI Corporation discloses the Partnership's EBITDA as the profitability measure to comply with the GAAP requirement to provide profitability information about its domestic propane segment. EBITDA in the three and twelve months ended December 31, 2008 includes a $39,887 pre-tax gain from the sale of the Partnership's California storage facility.

The following table includes reconciliations of net income attributable to AmeriGas Partners, L.P. to EBITDA for all periods presented:

Three Months Ended Twelve Months Ended

December 31, December 31,

2009 2008 2009 2008

Net income attributable to AmeriGas Partners, L.P. $ 83,959 $ 123,963 $ 184,639 $ 227,677

Income taxes 1,167 637 3,123 1,616

Interest expense 16,493 18,725 68,108 73,381

Depreciation 19,983 19,420 79,091 76,442

Amortization 1,398 1,323 5,335 4,879

EBITDA $ 123,000 $ 164,068 $ 340,296 $ 383,995

Contacts:

AmeriGas Partners, L.P.

Robert W. Krick, 610-337-1000 ext. 13645

Brenda A. Blake, 610-337-1000 ext. 13202

AmeriGas Partners Reports Second Quarter Results, Updates Guidance

VALLEY FORGE, Pa., April 27 — AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE: APU),

reported net income attributable to AmeriGas Partners, L.P. for the second fiscal quarter ended March 31, 2010 of $134.5 million

compared to $147.8 million for the same period last year. Net income attributable to AmeriGas Partners, L.P. for the current year

period includes the impact of a $12.2 million loss related to the discontinuance of hedge accounting for interest rate protection

agreements related to a previously anticipated debt refinancing that is no longer needed.

The Partnership’s earnings before interest expense, income taxes, depreciation and amortization (EBITDA) decreased to

$173.6 million for the second quarter of fiscal 2010 compared to EBITDA of $187.3 million for the same period last year.

EBITDA for the current year period includes the $12.2 million loss related to the interest rate hedges and, to a lesser extent, a

decrease in total margin resulting primarily from lower volumes sold partially offset by increased retail unit margins. For the

three months ended March 31, 2010, retail volumes sold were 4% lower than the prior-year period as the impact of colder

weather was more than offset by the continuing effects of the economic recession and customer conservation. Weather was

essentially normal during the recent quarter and 4.1% colder than in the prior-year period, according to the National Oceanic and

Atmospheric Administration (NOAA).

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, “Excluding the loss on the interest rate hedges, our results were

in line with expectations for the quarter. Given the results to date and our assessment of conditions for the remainder of the year,

we expect Adjusted EBITDA (which excludes the impact of the loss related to the interest rate hedges) for the fiscal year ending

September 30, 2010, to be in the range of $335 million to $345 million.” In discussing the interest rate hedges, Bissell continued,

“We entered into interest rate protection agreements several years ago in anticipation of a $150 million debt refinancing later this

year. During the quarter we concluded that, based upon the strength of our financial performance, there is no longer a need for

such a refinancing. As a result, we discontinued hedge accounting during the quarter and settled the hedges in early April.”

-MOREContact

VALLEY FORGE, Pa., April 27 — AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE: APU),

reported net income attributable to AmeriGas Partners, L.P. for the second fiscal quarter ended March 31, 2010 of $134.5 million

compared to $147.8 million for the same period last year. Net income attributable to AmeriGas Partners, L.P. for the current year

period includes the impact of a $12.2 million loss related to the discontinuance of hedge accounting for interest rate protection

agreements related to a previously anticipated debt refinancing that is no longer needed.

The Partnership’s earnings before interest expense, income taxes, depreciation and amortization (EBITDA) decreased to

$173.6 million for the second quarter of fiscal 2010 compared to EBITDA of $187.3 million for the same period last year.

EBITDA for the current year period includes the $12.2 million loss related to the interest rate hedges and, to a lesser extent, a

decrease in total margin resulting primarily from lower volumes sold partially offset by increased retail unit margins. For the

three months ended March 31, 2010, retail volumes sold were 4% lower than the prior-year period as the impact of colder

weather was more than offset by the continuing effects of the economic recession and customer conservation. Weather was

essentially normal during the recent quarter and 4.1% colder than in the prior-year period, according to the National Oceanic and

Atmospheric Administration (NOAA).

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, “Excluding the loss on the interest rate hedges, our results were

in line with expectations for the quarter. Given the results to date and our assessment of conditions for the remainder of the year,

we expect Adjusted EBITDA (which excludes the impact of the loss related to the interest rate hedges) for the fiscal year ending

September 30, 2010, to be in the range of $335 million to $345 million.” In discussing the interest rate hedges, Bissell continued,

“We entered into interest rate protection agreements several years ago in anticipation of a $150 million debt refinancing later this

year. During the quarter we concluded that, based upon the strength of our financial performance, there is no longer a need for

such a refinancing. As a result, we discontinued hedge accounting during the quarter and settled the hedges in early April.”

-MOREContact

AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE:APU), reported a seasonal net loss attributable to AmeriGas Partners, L.P. of $12.4 million for the third fiscal quarter of 2010 compared with a seasonal net loss of $13.5 million for the third fiscal quarter of 2009.

The Partnership's earnings before interest expense, income taxes, depreciation and amortization (EBITDA) increased to $27.2 million for the third fiscal quarter of 2010 compared to EBITDA of $25.4 million for the prior-year period. For the three months ended June 30, 2010, retail volumes sold decreased to 150.1 million gallons from 160.0 million gallons in the prior-year period, primarily reflecting significantly warmer weather on heating-sensitive volumes and, to a lesser extent, continued customer conservation. Weather nationally during the quarter was 17.0% warmer than normal and 14.7% warmer than the prior-year period, according to the National Oceanic and Atmospheric Administration.

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, "Sales volume, particularly in April, was adversely impacted by very warm spring weather. I am pleased that the execution of our operating strategies and disciplined cost management more than offset the volume decline to yield an increase in EBITDA for the quarter. For the full year, we continue to forecast Adjusted EBITDA (which excludes the impact of a previously reported $12.2 million loss related to the termination of interest rate hedges) for the fiscal year ending September 30, 2010 to be in the range of $335 million to $345 million."

Revenues for the quarter increased to $396.6 million versus $372.7 million a year ago reflecting higher average selling prices associated with higher commodity prices partially offset by lower volumes sold. Total margin decreased $1.6 million from the prior-year quarter due to lower volumes sold partially offset by slightly higher average unit margins. EBITDA increased as the decline in total margin was more than offset by reduced operating and administrative expenses. The reduction in operating and administrative expenses resulted primarily from lower compensation and benefits expenses. Operating income increased $1.0 million from the prior-year period, reflecting the increase in EBITDA partially offset by higher depreciation and amortization expenses.

Estimated fiscal 2010 Adjusted EBITDA, which excludes the loss on the termination of interest rate protection agreements, is a non-GAAP financial measure. Management believes the presentation of this measure for fiscal 2010 provides useful information to investors to more effectively evaluate the year-over-year results of operations of the Partnership in fiscal 2010. This measure is not comparable to measures used by other entities and should only be considered in conjunction with income per limited partner unit.

AmeriGas Partners is the nation's largest retail propane marketer, serving approximately 1.3 million customers in all 50 states from approximately 1,200 locations. UGI Corporation (NYSE:UGI), through subsidiaries, owns 44% of the Partnership and the public owns the remaining 56%.

The Partnership's earnings before interest expense, income taxes, depreciation and amortization (EBITDA) increased to $27.2 million for the third fiscal quarter of 2010 compared to EBITDA of $25.4 million for the prior-year period. For the three months ended June 30, 2010, retail volumes sold decreased to 150.1 million gallons from 160.0 million gallons in the prior-year period, primarily reflecting significantly warmer weather on heating-sensitive volumes and, to a lesser extent, continued customer conservation. Weather nationally during the quarter was 17.0% warmer than normal and 14.7% warmer than the prior-year period, according to the National Oceanic and Atmospheric Administration.

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, "Sales volume, particularly in April, was adversely impacted by very warm spring weather. I am pleased that the execution of our operating strategies and disciplined cost management more than offset the volume decline to yield an increase in EBITDA for the quarter. For the full year, we continue to forecast Adjusted EBITDA (which excludes the impact of a previously reported $12.2 million loss related to the termination of interest rate hedges) for the fiscal year ending September 30, 2010 to be in the range of $335 million to $345 million."

Revenues for the quarter increased to $396.6 million versus $372.7 million a year ago reflecting higher average selling prices associated with higher commodity prices partially offset by lower volumes sold. Total margin decreased $1.6 million from the prior-year quarter due to lower volumes sold partially offset by slightly higher average unit margins. EBITDA increased as the decline in total margin was more than offset by reduced operating and administrative expenses. The reduction in operating and administrative expenses resulted primarily from lower compensation and benefits expenses. Operating income increased $1.0 million from the prior-year period, reflecting the increase in EBITDA partially offset by higher depreciation and amortization expenses.

Estimated fiscal 2010 Adjusted EBITDA, which excludes the loss on the termination of interest rate protection agreements, is a non-GAAP financial measure. Management believes the presentation of this measure for fiscal 2010 provides useful information to investors to more effectively evaluate the year-over-year results of operations of the Partnership in fiscal 2010. This measure is not comparable to measures used by other entities and should only be considered in conjunction with income per limited partner unit.

AmeriGas Partners is the nation's largest retail propane marketer, serving approximately 1.3 million customers in all 50 states from approximately 1,200 locations. UGI Corporation (NYSE:UGI), through subsidiaries, owns 44% of the Partnership and the public owns the remaining 56%.

AmeriGas Partners Reports First Quarter Results

VALLEY FORGE, Pa., January 26 - AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE: APU), reported net income attributable to AmeriGas Partners, L.P. for the first quarter of fiscal 2011 ended December 31, 2010 of $74.9 million compared to $84.0 million for the same period last year. The Partnership's earnings before interest expense, income taxes, depreciation and amortization (EBITDA) was $113.3 million for the first quarter of 2011 compared to $123.0 million for the same period last year.

For the three months ended December 31, 2010, retail propane volumes sold were 256.4 million gallons compared with retail propane volumes of 267.4 million gallons in the prior-year period. Weather was 2.2% warmer than normal and 3.4% warmer than in the prior-year period, according to the National Oceanic and Atmospheric Administration. The decrease in volumes sold resulted from the warmer weather during the quarter, customer conservation and lower agricultural sales volumes following a strong crop drying season in the prior-year period.

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, "The heating season got off to a slow start due to exceptionally warm early fall weather. The warmer weather and customer conservation contributed to lower sales volumes during the quarter. We also experienced more normal crop drying demand following a strong crop drying season in last year's quarter. Our team did a fine job of managing the business through these challenges, enabling us to partially offset the effects of the lower volumes sold on our quarterly results. I am also pleased with the progress we made during the quarter in pursuing our growth objectives."

Revenues for the quarter increased to $700.2 million from $656.6 million in the prior-year period, reflecting higher average selling prices partially offset by the lower volumes sold. The average wholesale cost of propane at Mont Belvieu, Texas for the current quarter was approximately 15% higher than the average cost in the same period last year. Total margin decreased $2.1 million, as lower volumes sold were partially offset by slightly higher unit margins and increased income from fees and sales of ancillary products and services. Operating expenses increased $9.6 million from the prior-year period, reflecting a number of items, including higher payroll and benefits costs and higher vehicle fuel expenses. Operating income decreased to $91.6 million from $102.6 million in the fiscal 2010 quarter, reflecting the increased expenses and lower total margin.

Separately, AmeriGas announced that for the three-year period ended December 31, 2010, the compound annual total return on Partnership units exceeded that of a substantial majority of the partnerships in its peer group of publicly traded master limited partnerships. As a result, employees who received performance-contingent unit awards in early 2008 in accordance with AmeriGas's long-term compensation plan received a payout under the plan in Partnership units and were deemed to have sold a portion of the units to AmeriGas Partners for cash to pay income taxes. The appropriate disclosures on Form 4 have been filed with the Securities and Exchange Commission.

AmeriGas Partners is the nation's largest retail propane marketer, serving approximately 1.3 million customers in all 50 states from nearly 1,200 locations. UGI Corporation (NYSE:UGI), through subsidiaries, owns 44% of the Partnership and the public owns the remaining 56%.

VALLEY FORGE, Pa., January 26 - AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE: APU), reported net income attributable to AmeriGas Partners, L.P. for the first quarter of fiscal 2011 ended December 31, 2010 of $74.9 million compared to $84.0 million for the same period last year. The Partnership's earnings before interest expense, income taxes, depreciation and amortization (EBITDA) was $113.3 million for the first quarter of 2011 compared to $123.0 million for the same period last year.

For the three months ended December 31, 2010, retail propane volumes sold were 256.4 million gallons compared with retail propane volumes of 267.4 million gallons in the prior-year period. Weather was 2.2% warmer than normal and 3.4% warmer than in the prior-year period, according to the National Oceanic and Atmospheric Administration. The decrease in volumes sold resulted from the warmer weather during the quarter, customer conservation and lower agricultural sales volumes following a strong crop drying season in the prior-year period.

Eugene V. N. Bissell, chief executive officer of AmeriGas, said, "The heating season got off to a slow start due to exceptionally warm early fall weather. The warmer weather and customer conservation contributed to lower sales volumes during the quarter. We also experienced more normal crop drying demand following a strong crop drying season in last year's quarter. Our team did a fine job of managing the business through these challenges, enabling us to partially offset the effects of the lower volumes sold on our quarterly results. I am also pleased with the progress we made during the quarter in pursuing our growth objectives."

Revenues for the quarter increased to $700.2 million from $656.6 million in the prior-year period, reflecting higher average selling prices partially offset by the lower volumes sold. The average wholesale cost of propane at Mont Belvieu, Texas for the current quarter was approximately 15% higher than the average cost in the same period last year. Total margin decreased $2.1 million, as lower volumes sold were partially offset by slightly higher unit margins and increased income from fees and sales of ancillary products and services. Operating expenses increased $9.6 million from the prior-year period, reflecting a number of items, including higher payroll and benefits costs and higher vehicle fuel expenses. Operating income decreased to $91.6 million from $102.6 million in the fiscal 2010 quarter, reflecting the increased expenses and lower total margin.

Separately, AmeriGas announced that for the three-year period ended December 31, 2010, the compound annual total return on Partnership units exceeded that of a substantial majority of the partnerships in its peer group of publicly traded master limited partnerships. As a result, employees who received performance-contingent unit awards in early 2008 in accordance with AmeriGas's long-term compensation plan received a payout under the plan in Partnership units and were deemed to have sold a portion of the units to AmeriGas Partners for cash to pay income taxes. The appropriate disclosures on Form 4 have been filed with the Securities and Exchange Commission.

AmeriGas Partners is the nation's largest retail propane marketer, serving approximately 1.3 million customers in all 50 states from nearly 1,200 locations. UGI Corporation (NYSE:UGI), through subsidiaries, owns 44% of the Partnership and the public owns the remaining 56%.

Ausschüttungen steigen stetig: http://investors.amerigas.com/investor-relations/divident-hi…

2013-Ergebnis wieder ordentlich positiv: http://amerigas.q4cdn.com/de3e1ede-dde4-46bc-a4c9-d8926cb548…

verdreifacht

AmeriGas Partners Reports Record Earnings for Fiscal 2014

11/12/2014VALLEY FORGE, Pa.--(BUSINESS WIRE)-- AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE: APU), reported net income attributable to AmeriGas Partners for the fiscal year ended September 30, 2014 of $289.9 million, compared to net income of $221.2 million for the fiscal year ended September 30, 2013. Improved results for fiscal 2014 resulted from colder than normal weather, synergies resulting from the Heritage Propane acquisition and the absence of $26.5 million of transition expenses recorded in fiscal 2013 associated with the integration of Heritage Propane.

Retail volumes sold for fiscal 2014 increased to 1.28 billion gallons from 1.25 billion gallons in the prior fiscal year. The increase in retail gallons sold in fiscal 2014 reflects temperatures that were 3.4% colder than normal and 8.8% colder than the prior year, according to the National Oceanic and Atmospheric Administration. The Partnership’s adjusted earnings before interest expense, income taxes, depreciation and amortization (Adjusted EBITDA) was $664.8 million for fiscal 2014 compared with $617.7 million in fiscal 2013, reflecting an increase in total margin partially offset by an increase in operating and administrative expenses and lower other income.

Retail volumes sold during the fourth quarter of fiscal 2014 were 211.0 million gallons, an increase of 5.6 million gallons from the fourth quarter of fiscal 2013, primarily due to increased residential volumes. Adjusted EBITDA for the quarter was $48.3 million compared with $46.5 million for the fourth quarter of fiscal 2013. The Partnership recorded a seasonal loss attributable to AmeriGas Partners for the fourth quarter of fiscal 2014 of $47.3 million compared to a seasonal loss of $54.1 million for the prior-year period.

Jerry E. Sheridan, president and chief executive officer of AmeriGas, said, “Fiscal 2014 will be remembered as a very successful, yet challenging, year for AmeriGas. Our nationwide infrastructure was a clear competitive advantage during the supply crunch this past winter and helped us deliver on our commitments to our customers and shareholders. We delivered strong financial results, generating $665 million of adjusted EBITDA, nearly doubling the earnings of AmeriGas from two years ago, while returning our distribution coverage and leverage ratios to the more conservative levels at which we have historically run the business.”

Ausschüttung inzwischen 92c/Quartal;

weiter aufgestockt

weiter aufgestockt

So ein Scheiß!

Der deutsche Fiskus läuft wieder mal Amok.

Habe anläßlich umfangreicher Nachbuchungen von comdirect erfahren, dass Monsieur le Schäuble per Schreiben vom 18.1.2016 folgendes erließ:

"Einkommensteuerrechtliche Behandlung der Erträge aus einer Limited Liability Company (LLC), Limited Partnership (LP) oder einer Master Limited Partnership (MLP)

Bestimmte Gesellschaften - beispielsweise in der Rechtsform einer LLC, LP oder einer MLP -, deren Anteile als depotfähige Wertpapiere an einer Börse gehandelt werden, können nach ausländischem Steuerrecht ein Wahlrecht zur Besteuerung als Kapital- oder Personenge- sellschaft haben. Erträge aus solchen Gesellschaften sind für das Steuerabzugsverfahren auch dann als Dividendenerträge i. S. des § 20 Absatz 1 Nummer 1 EStG zu behandeln, wenn nach ausländischem Steuerrecht zur Besteuerung als Personengesellschaft optiert wurde.

Die Anrechnung der ausländischen Quellensteuer findet allein im Veranlagungsverfahren statt. Hinsichtlich der steuerlichen Einordnung beispielsweise einer LLC, LP oder einer MLP als Personengesellschaft oder Kapitalgesellschaft gelten die Grundsätze des BMF-Schreibens vom 19. März 2004 (BStBl I S. 411) unter Berücksichtigung der Ausführungen in Textzif- fer 1.2 des BMF-Schreibens vom 26. September 2014 (BStBl I S. 1258)."

Ergebnis:

Von 100% Distribution lassen die Amis eh' schon nur 60,4% durch und davon tun sich unsere nochmal 26,375% weg. Es bleiben also 34%, die Steuerlast beträgt 76%!.

Von der Anrechnung im Veranlagungsverfahren erwarte ich mir wenig, da in den referenzierten älteren Schreiben ziemlich klar wird, dass die börsennotierten MLP nach deutschem Recht als Körperschaften einzustufen und deswegen keine US-Steuern anzurechnen sind.

Habe inzwischen alles verkauft oder ein Erinnerungsstück behalten bei:

Hi-Crush, Emerge Energy Services, Enbridge Energy Partners, Williams Partners, Energy Transfer Partners (Komplettverkauf)

Northern Tier Energy, Amerigas, Energy Transfer Equity, CONE Midstream, CNX Resources, Enterprise Products, Legacy Reserves, CSI Compressco, USA Compression, Archrock Partners, Buckeye Partners, Blueknight Partners, Boardwalk Pipeline, Alliance Resource Partners, Alliance Holdings, EV Energy Partners, Cheniere Energy Partners, Linn Energy (Erinnerungsstück(e))

Scheinbar ausgenommen vom Problem ist nur Enbridge Energy Management, weil dort nicht die US-Steuer vorabgezogen wird.

Wenigstens sollten die Verluste nun anrechenbar sein...

Werde trotz meiner Skepsis natürlich versuchen, im Anrechnungsverfahren was zu erreichen.

Wie schon gesagt: So ein Scheiß!

Der deutsche Fiskus läuft wieder mal Amok.

Habe anläßlich umfangreicher Nachbuchungen von comdirect erfahren, dass Monsieur le Schäuble per Schreiben vom 18.1.2016 folgendes erließ:

"Einkommensteuerrechtliche Behandlung der Erträge aus einer Limited Liability Company (LLC), Limited Partnership (LP) oder einer Master Limited Partnership (MLP)

Bestimmte Gesellschaften - beispielsweise in der Rechtsform einer LLC, LP oder einer MLP -, deren Anteile als depotfähige Wertpapiere an einer Börse gehandelt werden, können nach ausländischem Steuerrecht ein Wahlrecht zur Besteuerung als Kapital- oder Personenge- sellschaft haben. Erträge aus solchen Gesellschaften sind für das Steuerabzugsverfahren auch dann als Dividendenerträge i. S. des § 20 Absatz 1 Nummer 1 EStG zu behandeln, wenn nach ausländischem Steuerrecht zur Besteuerung als Personengesellschaft optiert wurde.

Die Anrechnung der ausländischen Quellensteuer findet allein im Veranlagungsverfahren statt. Hinsichtlich der steuerlichen Einordnung beispielsweise einer LLC, LP oder einer MLP als Personengesellschaft oder Kapitalgesellschaft gelten die Grundsätze des BMF-Schreibens vom 19. März 2004 (BStBl I S. 411) unter Berücksichtigung der Ausführungen in Textzif- fer 1.2 des BMF-Schreibens vom 26. September 2014 (BStBl I S. 1258)."

Ergebnis:

Von 100% Distribution lassen die Amis eh' schon nur 60,4% durch und davon tun sich unsere nochmal 26,375% weg. Es bleiben also 34%, die Steuerlast beträgt 76%!.

Von der Anrechnung im Veranlagungsverfahren erwarte ich mir wenig, da in den referenzierten älteren Schreiben ziemlich klar wird, dass die börsennotierten MLP nach deutschem Recht als Körperschaften einzustufen und deswegen keine US-Steuern anzurechnen sind.

Habe inzwischen alles verkauft oder ein Erinnerungsstück behalten bei:

Hi-Crush, Emerge Energy Services, Enbridge Energy Partners, Williams Partners, Energy Transfer Partners (Komplettverkauf)

Northern Tier Energy, Amerigas, Energy Transfer Equity, CONE Midstream, CNX Resources, Enterprise Products, Legacy Reserves, CSI Compressco, USA Compression, Archrock Partners, Buckeye Partners, Blueknight Partners, Boardwalk Pipeline, Alliance Resource Partners, Alliance Holdings, EV Energy Partners, Cheniere Energy Partners, Linn Energy (Erinnerungsstück(e))

Scheinbar ausgenommen vom Problem ist nur Enbridge Energy Management, weil dort nicht die US-Steuer vorabgezogen wird.

Wenigstens sollten die Verluste nun anrechenbar sein...

Werde trotz meiner Skepsis natürlich versuchen, im Anrechnungsverfahren was zu erreichen.

Wie schon gesagt: So ein Scheiß!

zum Halbjahr ungefähr ein Drittel Gewinnrückgang

Die ganzen letzten Quartale ordentliche Dividenden kann man nicht meckern....wie ist da die Meinung hier im Forum? leider sehr ruhig hier geworden?

09.11.17

0,95 USD

Ordentliche Dividende

Quartal

..

08.08.17

0,95 USD

Ordentliche Dividende

Quartal

..

08.05.17

0,95 USD

Ordentliche Dividende

09.11.17

0,95 USD

Ordentliche Dividende

Quartal

..

08.08.17

0,95 USD

Ordentliche Dividende

Quartal

..

08.05.17

0,95 USD

Ordentliche Dividende

inzwischen -vordergründig- gut 12% Ausschüttung;

aufgrund der bescheuerten steuerlichen Handhabung sind es leider nur 4,5% für mich

aufgrund der bescheuerten steuerlichen Handhabung sind es leider nur 4,5% für mich

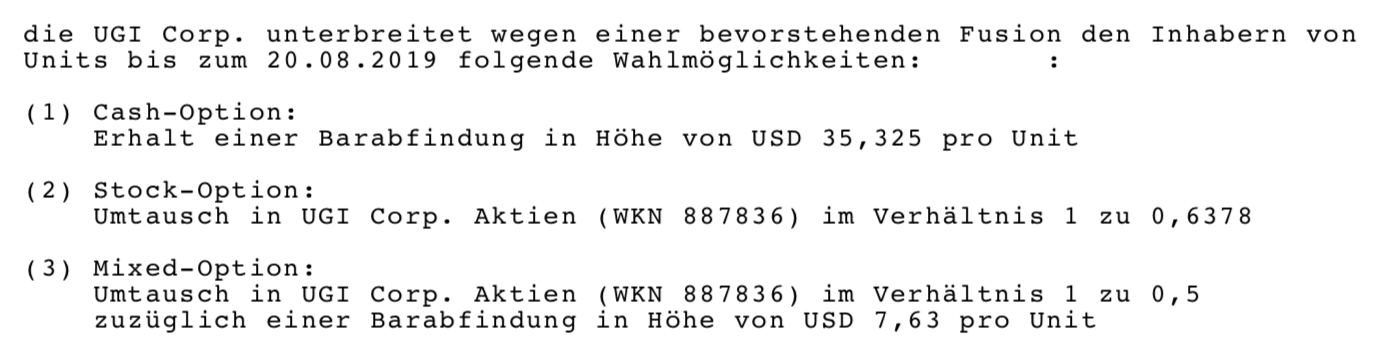

heim ins Reich...

wird von UGI wieder einkassiert:

heute Erinnerungsstück ausgebucht

over-and-out

over-and-out

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,18 | |

| -0,10 | |

| -2,29 | |

| -5,20 | |

| +0,22 | |

| +0,26 | |

| 0,00 | |

| -0,22 | |

| +0,04 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 228 | ||

| 103 | ||

| 99 | ||

| 83 | ||

| 70 | ||

| 38 | ||

| 35 | ||

| 34 | ||

| 33 | ||

| 32 |