EXXON - zahlt kontinuierlich steigende Dividenden... (Seite 6)

eröffnet am 29.03.10 13:58:52 von

neuester Beitrag 18.11.23 08:29:56 von

neuester Beitrag 18.11.23 08:29:56 von

Beiträge: 453

ID: 1.156.845

ID: 1.156.845

Aufrufe heute: 0

Gesamt: 59.908

Gesamt: 59.908

Aktive User: 0

ISIN: US30231G1022 · WKN: 852549 · Symbol: XONA

110,42

EUR

+1,01 %

+1,10 EUR

Letzter Kurs 10:30:54 Tradegate

Neuigkeiten

07.05.24 · Business Wire (engl.) |

03.05.24 · Business Wire (engl.) |

03.05.24 · wallstreetONLINE Redaktion |

02.05.24 · wallstreetONLINE Redaktion |

02.05.24 · dpa-AFX |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,1500 | +27,78 | |

| 13,300 | +27,27 | |

| 1,0400 | +18,18 | |

| 4,5500 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 82,09 | -7,39 | |

| 0,6025 | -9,40 | |

| 2,4000 | -9,43 | |

| 850,20 | -12,51 | |

| 11,790 | -12,67 |

Beitrag zu dieser Diskussion schreiben

Ja. Die Old Economy. Der Abgesang auf die fossilen Brennstoffe ist völlig verfrüht. Auch wenn westliche Politiker schon von der völligen ABkehr von Öl, Gas und Kohle reden halte ich es für gut möglich, dass selbst jüngere Forenmitglieder diesen "Ausstieg" nicht mehr erleben.

Die Physik spricht dagegen, dass der Mensch aufhört das Zeug zu nutzen.

Wahrscheinlich gehen wir hier bei Öl, Gas und Kohle in richtig starke Jahre. Die Wende weg von dem Zeug ist nämlich gar nicht absehbar. Wasserstoffwirtschaft usw. Wärmewende (woher kommt den dieser Strom dann im WInter???). Das sind alles mehr oder weniger Worthülsen. Wie das konkret im nötigen Maßstab gehen soll habe ich noch nirgends vernommen.

Die Investoren sind nicht mehr bereit in neue fossile Projekte (ob Kohlemine oder Bohrinsel) zu investieren, da dies politisch medial nicht mehr erwünscht ist. Dazu kommen immer strengere Regularien usw usw. Die Nachfrage wird viel länger bestehen als viele Denken und die Förderer von fossilen Brennstoffen sind vllt "DAS" Investment der nächsten Jahre.

Meine Meinung.

Die Physik spricht dagegen, dass der Mensch aufhört das Zeug zu nutzen.

Wahrscheinlich gehen wir hier bei Öl, Gas und Kohle in richtig starke Jahre. Die Wende weg von dem Zeug ist nämlich gar nicht absehbar. Wasserstoffwirtschaft usw. Wärmewende (woher kommt den dieser Strom dann im WInter???). Das sind alles mehr oder weniger Worthülsen. Wie das konkret im nötigen Maßstab gehen soll habe ich noch nirgends vernommen.

Die Investoren sind nicht mehr bereit in neue fossile Projekte (ob Kohlemine oder Bohrinsel) zu investieren, da dies politisch medial nicht mehr erwünscht ist. Dazu kommen immer strengere Regularien usw usw. Die Nachfrage wird viel länger bestehen als viele Denken und die Förderer von fossilen Brennstoffen sind vllt "DAS" Investment der nächsten Jahre.

Meine Meinung.

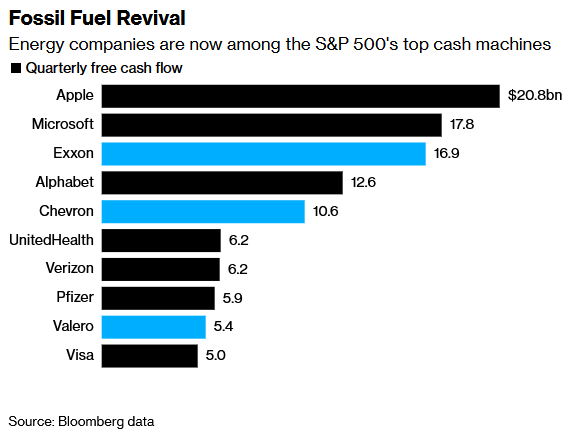

Die Rache der Old Economy

Exxon ist nun der drittgrößte Generator von freiem Cashflow im S&P 500

„Die zehn Unternehmen mit der besten Performance im S&P 500 Index sind allesamt Energieunternehmen... Zu den 10 schlechtesten gehören die ehemaligen Tech-Superstars Netflix Inc. und Meta Platforms Inc."

https://www.bloomberg.com/news/articles/2022-07-30/revenge-o…

So ist's fein,

Go Exxon go!

Big Oil offers big returns but keeps spending tight

The West's energy giants are set to return a record $30 billion to investors after reporting bumper profits in the second quarter of the year following a surge in energy prices.But the top five Western oil and gas companies have shied away from investing more of their combined record profits of nearly $60 billion in new production as they weigh the impact of recession and climate change on future fossil fuel demand.

The reluctance to spend may exacerbate an energy supply crunch that has driven inflation to multi-decade highs and ignited calls from consumers and opposition leaders for governments to increase tax on energy companies.

The spending approach contrasts with previous cycles of high oil and gas prices, such as the boom of the late 2000s that spurred rapid spending to boost production.

"Given all the uncertainty in the world, now is not the time to lose discipline," BP Chief Executive Bernard Looney told Reuters after reporting BP's highest profit in 14 years.

The combined oil and gas output of BP, Shell, TotalEnergies, Chevron and Exxon in the first half of 2022 reached 14.6 million barrels of oil equivalent per day (boed), some 10% below its pre-pandemic levels, according to Reuters calculations.

Although some of the companies modestly increased 2022 spending plans in recent days, they remain within previous target spending ranges. Most of the extra funds are focused on projects that can start producing in a short timeframe or to accelerate starting dates for projects already under way.

..........

Within the group of leading energy companies, there has been a clear divergence as Exxon, Chevron and TotalEnergies plan to expand output in the coming years, while BP and Shell aim to keep production largely flat.

Exxon expects its 2022 production to remain unchanged from a year earlier at 3.8 million boed, but plans to grow its output to 4.2 million boed by 2027, with most of the growth coming from U.S. shale and Guyana.

Chevron, which is investing heavily in the U.S. Permian basin and Kazakhstan, plans an annual growth of 3% over the next 5 years to reach over 3.5 million boed from 2.9 million boed today.

This year's surge in energy prices is in part the result of years of underinvestment, which meant that when demand recovered from pandemic lockdowns, energy markets were very tight even before the disruption caused by war in Ukraine.

Shortly after Russia began the invasion it terms a "special military operation" on Feb. 24, gas prices in Europe touched record highs and international benchmark crude reached 14 year-highs.

The record shareholder returns of $30 billion compare to quarterly pre-pandemic returns of between $16-$20 billion - and they are set to increase again in the third quarter, mainly in the form of buybacks

https://www.ibtimes.com/big-oil-offers-big-returns-keeps-spe…

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Spam, Werbung

Exxon Mobil Stock: What's The Outlook For The Rest Of 2022?

https://seekingalpha.com/article/4521996-exxon-mobil-stock-o…

https://seekingalpha.com/article/4521996-exxon-mobil-stock-o…

Qatar Energy partners with Eni for North Field East LNG project

DOHA, June 19 (Reuters) - Qatar Energy signed a deal with Eni (ENI.MI) on Sunday on the Gulf Arab state's North Field East expansion, the world's largest liquefied natural gas (LNG) project, following on from an agreement with TotalEnergies earlier this month.Qatar is partnering with international companies in the first and largest phase of the nearly $30 billion expansion that will boost Qatar's position as the world's top LNG exporter. read more

......

The North Field is part of the world’s biggest gas field that Qatar shares with Iran, which calls its share South Pars.

In all, the North Field Expansion plan includes six LNG trains that will ramp up Qatar’s liquefaction capacity from 77 million tonnes per annum (mtpa) to 126 mtpa by 2027. The fifth and sixth trains are part of a second phase, North Field South.

Exxon Mobil Corp (XOM.N), Shell (SHEL.L) and ConocoPhillips (COP.N) will also participate in the North Field expansion, sources have said.

Kaabi has said that once the investments have been completed, Asian buyers are expected to make up half the market for the project and European buyers the rest.

Total, Exxon, Shell, Italy's Eni and Chevron have offered Qatar Energy opportunities to invest in prize assets they hold overseas. Qatar Energy and Eni are partners in oil and gas projects in Oman, Mexico, Morocco, Mozambique and Kenya.

https://www.reuters.com/business/energy/qatar-energy-joins-e…

China firms in advanced talks with Qatar for gas field stakes, LNG offtake

SINGAPORE, June 17 (Reuters) - China's national oil majors are in advanced talks with Qatar to invest in the North Field East expansion of the world's largest liquefied natural gas (LNG) project and buy the fuel under long-term contracts, three people with knowledge of the matter said.It would be the first such partnership between the two nations, among the world's top LNG consumers and producers, as the Middle Eastern energy exporter shifts to expand its Asian client base at. Global energy corporations used to be the main investors in Qatar's gas industry.

The Qatari supply deal will help China create a buffer against spot price volatility and diversify its imports; relations with two major suppliers, the United States and Australia, are at a low point, and another, Russia, is in the midst of a war and faces widespread sanctions. Beijing views gas a strategic bridge fuel to replace coal on its path to carbon neutrality by 2060.

Qatar was China's largest LNG supplier after Australia in the first five months of 2022, data on Refinitiv Eikon showed.

...

QatarEnergy said on Sunday that TotalEnergies had become its first partner for the project, winning a 25% stake in one train. Asian buyers are expected to make up half the market for the project, and buyers in Europe the rest, QatarEnergy's chief executive said. read more

Exxon Mobil Corp (XOM.N), Shell (SHEL.L), ConocoPhillips (COP.N) and Eni (ENI.MI) had also submitted bids for the project. read more

...

https://www.reuters.com/business/energy/exclusive-china-firm…

Biden blasts oil refiners for record high gasoline prices, profits

WASHINGTON (Reuters) -U.S. President Joe Biden on Wednesday demanded oil refining companies explain why they are not putting more gasoline on the market, sharply escalating his rhetoric against industry as he faces pressure over rising prices.Biden wrote to executives from Marathon Petroleum Corp (NYSE:MPC) , Valero Energy Corp (NYSE:VLO) and Exxon Mobil Corp (NYSE:XOM) and complained they had cut back on oil refining to pad their profits, according to a copy of the letter https://docsend.com/view/qpg3e8a2s3fbxi3a seen by Reuters.

The letter is also being sent to Phillips 66 (NYSE:PSX), Chevron Corp (NYSE:CVX), BP (LON:BP) and Shell (LON:RDSa), a White House official, who declined to be identified, told Reuters.

> https://ca.investing.com/news/commodities-news/biden-blasts-…

Achtet auf Rücksetzer.

Prost aus Wien

..die nächsten 5 Jahre werden für uns positiv sein.... 03.05.24 · wallstreetONLINE Redaktion · Pioneer Natural Resources Company |

02.05.24 · wallstreetONLINE Redaktion · Chevron Corporation |

02.05.24 · dpa-AFX · BP |

02.05.24 · wallstreetONLINE Redaktion · BP |

01.05.24 · dpa-AFX · Pioneer Natural Resources Company |

26.04.24 · dpa-AFX · Chevron Corporation |

26.04.24 · dpa-AFX · Chevron Corporation |