Enbridge Inc. - kandischer Energietransporteur (-versorger) - Die letzten 30 Beiträge

eröffnet am 22.06.10 00:17:01 von

neuester Beitrag 20.03.24 14:39:05 von

neuester Beitrag 20.03.24 14:39:05 von

Beiträge: 91

ID: 1.158.425

ID: 1.158.425

Aufrufe heute: 1

Gesamt: 13.354

Gesamt: 13.354

Aktive User: 0

ISIN: CA29250N1050 · WKN: 885427 · Symbol: ENB

48,96

CAD

-1,13 %

-0,56 CAD

Letzter Kurs 23:00:00 Toronto

Neuigkeiten

23.04.24 · Accesswire |

22.04.24 · Accesswire |

18.04.24 · Accesswire |

16.04.24 · Accesswire |

12.04.24 · Accesswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4500 | +15,99 | |

| 7,3400 | +15,77 | |

| 9,6400 | +13,95 | |

| 7,9500 | +13,25 | |

| 1,7900 | +11,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 325,00 | -9,97 | |

| 0,6850 | -11,04 | |

| 4,3100 | -18,98 | |

| 1,3501 | -20,58 | |

| 9,3500 | -28,02 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 75.486.630 von Deflair am 20.03.24 13:50:28Enbridge zahlt die Dividende aus dem Distributable Cash Flow. Dieser lag in 2023 bei 5,48 CAD pro Aktie. Die vom Unternehmen für dieses Jahr veröffentlichte Guidance liegt bei 5,40 - 5,80 CAD pro Aktie.

Bei simplywall.st steht dass die dividende einer Ausschüttung in Höhe von 125% der Earnings per Share beträgt.

Ist das einem Einmal Effekt geschuldet oder ist die Dividende einfach nicht nachhaltig?

Ist das einem Einmal Effekt geschuldet oder ist die Dividende einfach nicht nachhaltig?

Die Enbridge Inc. ist ein kanadisches Energieunternehmen, das sich auf den Transport und die Verteilung von Erdöl und Erdgas spezialisiert hat. Laut den aktuellen Informationen von Februar 2024 beträgt die Dividendenrendite von Enbridge 7,70%.

Habe bereits seit 2020 im Depot hat sich von 0,81 CAD je Aktie auf 0,915 Cad gesteigert rund 13 % mehr in 3 Jahren plus 10% Kurssteigerung.

Enbridge zahlt vierteljährlich eine Dividende aus.

Enbridge hat die Dividende in den letzten Jahren kontinuierlich erhöht. Die durchschnittliche jährliche Steigerung in den letzten 5 Jahren betrug 5,5%1. Die erwartete Steigerung für die nächsten Jahre liegt bei 3,38%

Also dieses Jahr Steigerung auf 0,945 CAD

Habe bereits seit 2020 im Depot hat sich von 0,81 CAD je Aktie auf 0,915 Cad gesteigert rund 13 % mehr in 3 Jahren plus 10% Kurssteigerung.

Enbridge zahlt vierteljährlich eine Dividende aus.

Enbridge hat die Dividende in den letzten Jahren kontinuierlich erhöht. Die durchschnittliche jährliche Steigerung in den letzten 5 Jahren betrug 5,5%1. Die erwartete Steigerung für die nächsten Jahre liegt bei 3,38%

Also dieses Jahr Steigerung auf 0,945 CAD

13.12.

Enbridge Announces $3.1 Billion Sale of its Interests in Alliance Pipeline and Aux Sable

https://finance.yahoo.com/news/enbridge-announces-3-1-billio…

...

Enbridge Inc. ("Enbridge") (TSX: ENB) (NYSE: ENB) announced today that it has entered into a definitive agreement to sell its 50.0% interest in Alliance Pipeline ("Alliance") and its 42.7% interest in Aux Sable to Pembina Pipeline Corporation ("Pembina") (PPL: TSX) (NYSE: PBA) for a purchase price of $3.1 billion, including non-recourse debt at Alliance of approximately $0.3 billion, and subject to customary closing adjustments.

Alliance delivers liquids rich natural gas sourced in Northeast B.C., Northwest Alberta, and the Bakken region to Chicago. Aux Sable operates NGL extraction and fractionation facilities in both Canada and the U.S., with extraction rights on Alliance, offering connectivity to key U.S. NGL hubs.

The sale price represents an attractive valuation of approximately 11 times projected 2024 EBITDA for Alliance and approximately 7 times for Aux Sable, which is in line with other commodity exposed businesses.

"We are pleased to continue our strong track record of surfacing value for shareholders through an ongoing capital recycling program. With this divestiture, we will have raised ~$14 billion since 2018 at attractive valuations," said Pat Murray, EVP and Chief Financial Officer. "Today's transaction reinforces our disciplined approach to capital allocation. We remain committed to optimizing our portfolio, enhancing our industry leading cash flow profile by reducing commodity price exposure, bolstering our financial flexibility, and maintaining a strong balance sheet."

...

Enbridge Announces $3.1 Billion Sale of its Interests in Alliance Pipeline and Aux Sable

https://finance.yahoo.com/news/enbridge-announces-3-1-billio…

...

Enbridge Inc. ("Enbridge") (TSX: ENB) (NYSE: ENB) announced today that it has entered into a definitive agreement to sell its 50.0% interest in Alliance Pipeline ("Alliance") and its 42.7% interest in Aux Sable to Pembina Pipeline Corporation ("Pembina") (PPL: TSX) (NYSE: PBA) for a purchase price of $3.1 billion, including non-recourse debt at Alliance of approximately $0.3 billion, and subject to customary closing adjustments.

Alliance delivers liquids rich natural gas sourced in Northeast B.C., Northwest Alberta, and the Bakken region to Chicago. Aux Sable operates NGL extraction and fractionation facilities in both Canada and the U.S., with extraction rights on Alliance, offering connectivity to key U.S. NGL hubs.

The sale price represents an attractive valuation of approximately 11 times projected 2024 EBITDA for Alliance and approximately 7 times for Aux Sable, which is in line with other commodity exposed businesses.

"We are pleased to continue our strong track record of surfacing value for shareholders through an ongoing capital recycling program. With this divestiture, we will have raised ~$14 billion since 2018 at attractive valuations," said Pat Murray, EVP and Chief Financial Officer. "Today's transaction reinforces our disciplined approach to capital allocation. We remain committed to optimizing our portfolio, enhancing our industry leading cash flow profile by reducing commodity price exposure, bolstering our financial flexibility, and maintaining a strong balance sheet."

...

Antwort auf Beitrag Nr.: 74.772.464 von Deflair am 09.11.23 09:39:50

enbridge ist ein kanadisches unternehmen und da dürfte eine andere regelung gelten als bei amerikanischen aktien.....................

Zitat von Deflair: Ich konnte weder mit google noch mit ChatGPT rausfinden ob ich die zweiten 15% Quellensteuer auch noch direkt bei den amerikanischen Steuerbehörden zurück fordern kann oder ob das was über QI automatisch geregelt wurde schon alles ist was wir zurück fordern können.

enbridge ist ein kanadisches unternehmen und da dürfte eine andere regelung gelten als bei amerikanischen aktien.....................

Danke für die Information

Ich hab mal meinen DKB Posteingang durchsucht aber da ich die Enbridge noch kein ganzes Jahr habe hab ich so eine Abrechnung vermutlich noch nicht oder ich habs nicht gefunden.

Ich hab mal meinen DKB Posteingang durchsucht aber da ich die Enbridge noch kein ganzes Jahr habe hab ich so eine Abrechnung vermutlich noch nicht oder ich habs nicht gefunden.

Antwort auf Beitrag Nr.: 74.772.464 von Deflair am 09.11.23 09:39:50Ich halte meine Enbridge auch über die DKB. Auf meiner letzten Abrechnung wird Folgendes ausgewiesen:

Einbehaltene Quellensteuer 25 %

Anrechenbare Quellensteuer 15 %

10 % rückforderbare Quellensteuer

Einbehaltene Quellensteuer 25 %

Anrechenbare Quellensteuer 15 %

10 % rückforderbare Quellensteuer

Ich habe mir zum Test ein paar Enbridge Aktien gekauft weil ich wissen wollte wie das im Detail mit der Quellensteuer abläuft.

Die DKB hat wohl dieses QI so dass schon 15% automatisch mit der deutschen Steuer verrechnet wird.

Insgesamt zahle ich damit aber immernoch 40% Steuern auf die Dividenden.

Ich konnte weder mit google noch mit ChatGPT rausfinden ob ich die zweiten 15% Quellensteuer auch noch direkt bei den amerikanischen Steuerbehörden zurück fordern kann oder ob das was über QI automatisch geregelt wurde schon alles ist was wir zurück fordern können.

Kennt sich da jemand aus?

Die DKB hat wohl dieses QI so dass schon 15% automatisch mit der deutschen Steuer verrechnet wird.

Insgesamt zahle ich damit aber immernoch 40% Steuern auf die Dividenden.

Ich konnte weder mit google noch mit ChatGPT rausfinden ob ich die zweiten 15% Quellensteuer auch noch direkt bei den amerikanischen Steuerbehörden zurück fordern kann oder ob das was über QI automatisch geregelt wurde schon alles ist was wir zurück fordern können.

Kennt sich da jemand aus?

Heute einen ersten Fuß in das Unternehmen gesetzt. Wenn die Aktie deutlich runtergehen sollte kaufe ich gerne nach.

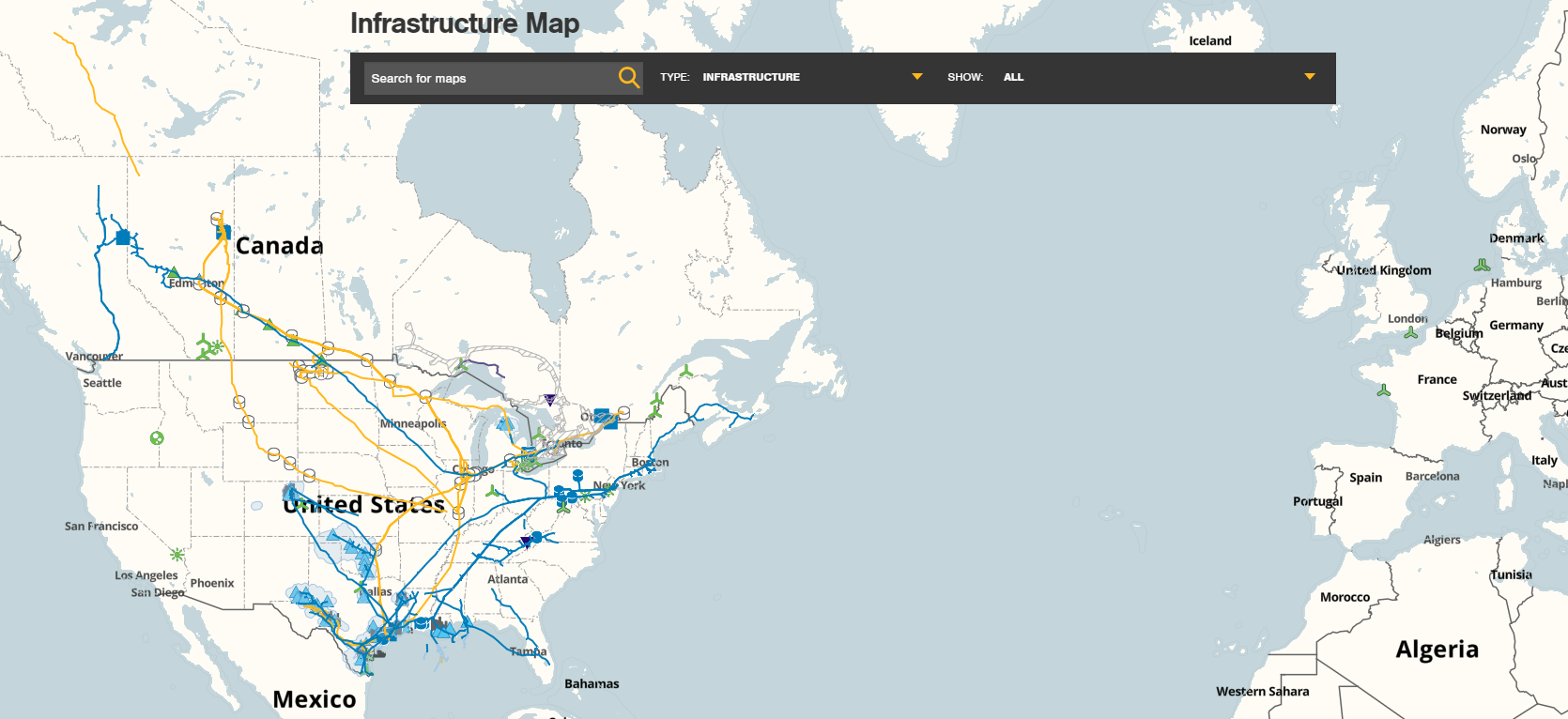

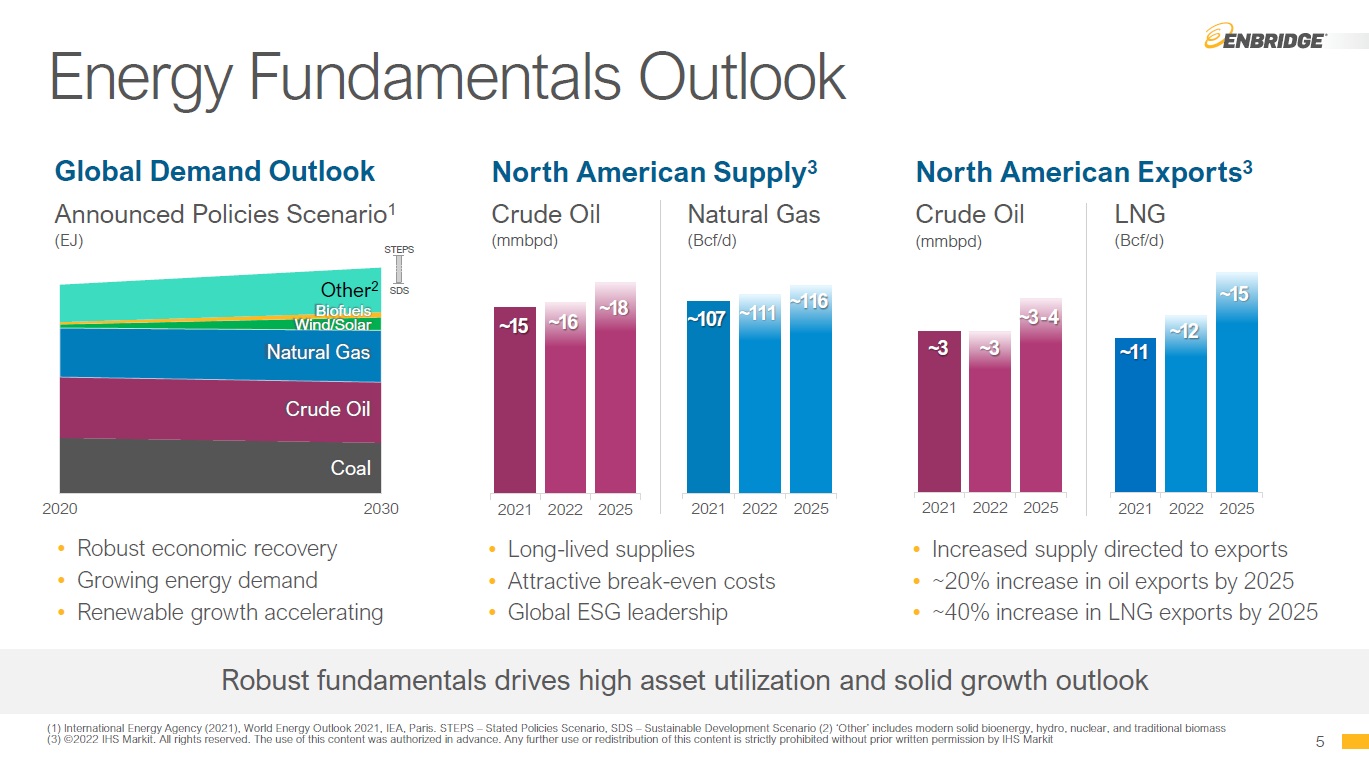

Neben Liquids+Gas-Pipelines ist Enbridge breit aufgestellt, von Geothermie bis Windkraft von Kanada bis Deutschland.

https://www.enbridge.com/map#map:infrastructure

Neben Liquids+Gas-Pipelines ist Enbridge breit aufgestellt, von Geothermie bis Windkraft von Kanada bis Deutschland.

https://www.enbridge.com/map#map:infrastructure

Antwort auf Beitrag Nr.: 74.439.183 von faultcode am 06.09.23 13:28:55Kommt nicht gut an beim Markt. Was will die Allgemeinheit denn nun, Solar und Wasserstoff laufen ja auch nicht!?

5.9.

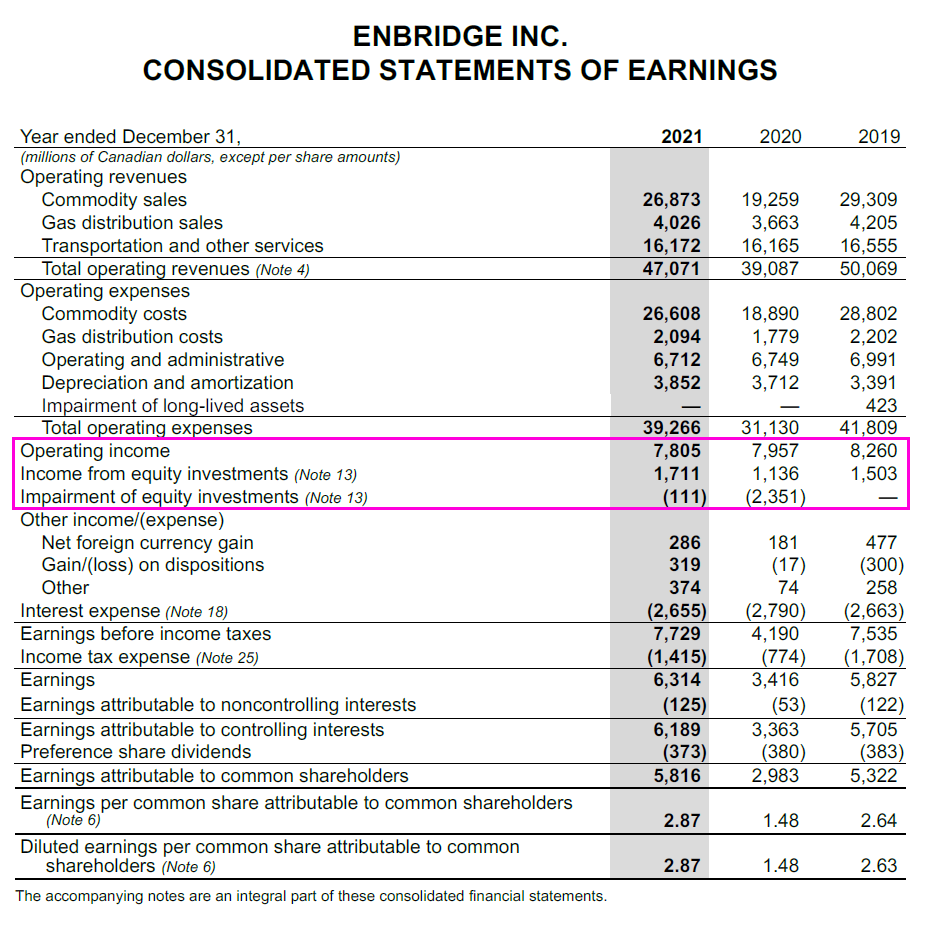

Enbridge Bets Big on US Gas With $9.4 Billion Dominion Deal

https://finance.yahoo.com/news/enbridge-buy-three-dominion-u…

...

Canadian pipeline operator Enbridge Inc. agreed to buy three utilities from Dominion Energy Inc. in a $9.4 billion deal to create North America’s largest natural gas provider.

The acquisition of the East Ohio Gas Co., Questar Gas Co. and Public Service Co. of North Carolina will double the Calgary-based company’s gas utility business, Enbridge said in a statement Tuesday.

The deal is a massive bet that gas will remain a transition fuel for the foreseeable future even as much of the world tries to phase out fossil fuels to fight climate change. While there’s a strong push to deploy more renewable energy, there’s also a growing recognition that the green transition will take time, ensuring gas will be in demand for years.

...

Enbridge Bets Big on US Gas With $9.4 Billion Dominion Deal

https://finance.yahoo.com/news/enbridge-buy-three-dominion-u…

...

Canadian pipeline operator Enbridge Inc. agreed to buy three utilities from Dominion Energy Inc. in a $9.4 billion deal to create North America’s largest natural gas provider.

The acquisition of the East Ohio Gas Co., Questar Gas Co. and Public Service Co. of North Carolina will double the Calgary-based company’s gas utility business, Enbridge said in a statement Tuesday.

The deal is a massive bet that gas will remain a transition fuel for the foreseeable future even as much of the world tries to phase out fossil fuels to fight climate change. While there’s a strong push to deploy more renewable energy, there’s also a growing recognition that the green transition will take time, ensuring gas will be in demand for years.

...

6.4.

Enbridge CEO Points to Permian to Allay Oil Unit Growth Concerns

https://finance.yahoo.com/news/enbridge-ceo-points-permian-a…

...

Enbridge CEO Points to Permian to Allay Oil Unit Growth Concerns

https://finance.yahoo.com/news/enbridge-ceo-points-permian-a…

...

23.3.

Army Corps further delays decision on Great Lakes oil tunnel

Federal officials are delaying a decision on whether to approve an oil pipeline tunnel in a Great Lakes waterway

https://abcnews.go.com/Business/wireStory/army-corps-delays-…

...

A federal review of plans for a Great Lakes oil pipeline tunnel will take more than a year longer than originally planned, officials said Thursday, likely delaying completion of the project — if approved — until 2030 or later.

The U.S. Army Corps of Engineers had intended to release a draft report later this year on how the proposed tunnel beneath Michigan's Straits of Mackinac would affect the environment. Enbridge Energy wants it to house a section of its Line 5 oil pipeline that crosses the bottom of the straits connecting Lake Huron and Lake Michigan.

But under the new timeline, the report won't be issued until spring 2025. An approval decision would be expected in early 2026.

...

The slowdown is a setback for a project that Enbridge originally planned to complete as early as next year, spending about $500 million. Mike Fernandez, a senior vice president of the Canadian company based in Calgary, Alberta, told The Associated Press the cost has risen but did not have a new estimate. The new timeline could push tunnel completion to 2030.

"It's really, really disappointing,” Fernandez said in an interview ahead of the Corps' announcement, adding that the delay “flies in the face” of the Biden administration's pledge to quicken environmental permitting for infrastructure projects.

“To borrow a phrase from the president when he was running, we want to build back better and sooner,” Fernandez said. “But right now, it appears that the federal government, or at least the U.S. Army Corps of Engineers, has not gotten that message.”

He said Enbridge remains committed to the tunnel for the underwater segment of Line 5 that Michigan Gov. Gretchen Whitmer, environmental groups and Native American tribes want shut down.

They contend the nearly 4-mile (6.4-kilometer) section is vulnerable to a rupture. Line 5 moves about 23 million gallons (87 million liters) of oil and natural gas liquids daily between Superior, Wisconsin, and Sarnia, Ontario.

Enbridge insists the nearly 70-year-old dual pipes are in good condition and monitored regularly. But the company agreed in 2018 with Whitmer's predecessor, Republican Rick Snyder, to drill a tunnel that would encase a new pipeline section in concrete.

...

Army Corps further delays decision on Great Lakes oil tunnel

Federal officials are delaying a decision on whether to approve an oil pipeline tunnel in a Great Lakes waterway

https://abcnews.go.com/Business/wireStory/army-corps-delays-…

...

A federal review of plans for a Great Lakes oil pipeline tunnel will take more than a year longer than originally planned, officials said Thursday, likely delaying completion of the project — if approved — until 2030 or later.

The U.S. Army Corps of Engineers had intended to release a draft report later this year on how the proposed tunnel beneath Michigan's Straits of Mackinac would affect the environment. Enbridge Energy wants it to house a section of its Line 5 oil pipeline that crosses the bottom of the straits connecting Lake Huron and Lake Michigan.

But under the new timeline, the report won't be issued until spring 2025. An approval decision would be expected in early 2026.

...

The slowdown is a setback for a project that Enbridge originally planned to complete as early as next year, spending about $500 million. Mike Fernandez, a senior vice president of the Canadian company based in Calgary, Alberta, told The Associated Press the cost has risen but did not have a new estimate. The new timeline could push tunnel completion to 2030.

"It's really, really disappointing,” Fernandez said in an interview ahead of the Corps' announcement, adding that the delay “flies in the face” of the Biden administration's pledge to quicken environmental permitting for infrastructure projects.

“To borrow a phrase from the president when he was running, we want to build back better and sooner,” Fernandez said. “But right now, it appears that the federal government, or at least the U.S. Army Corps of Engineers, has not gotten that message.”

He said Enbridge remains committed to the tunnel for the underwater segment of Line 5 that Michigan Gov. Gretchen Whitmer, environmental groups and Native American tribes want shut down.

They contend the nearly 4-mile (6.4-kilometer) section is vulnerable to a rupture. Line 5 moves about 23 million gallons (87 million liters) of oil and natural gas liquids daily between Superior, Wisconsin, and Sarnia, Ontario.

Enbridge insists the nearly 70-year-old dual pipes are in good condition and monitored regularly. But the company agreed in 2018 with Whitmer's predecessor, Republican Rick Snyder, to drill a tunnel that would encase a new pipeline section in concrete.

...

ENB announced a cash dividend of 0.887 with an ex-date of Feb. 14, 2023

Yahoo Finance

Yahoo Finance

Antwort auf Beitrag Nr.: 73.175.107 von bpmeister13 am 27.01.23 14:41:34Also ca. 4,8% netto Dividende

Danke für die Info

Danke für die Info

Antwort auf Beitrag Nr.: 73.174.795 von beton0815 am 27.01.23 13:59:59

bei mir waren es 0,45 €/ Stück netto

Zitat von beton0815: Kann mir jemand sagen, wie hoch die letzte Dividende netto war?

In € Cent.

Danke

bei mir waren es 0,45 €/ Stück netto

Kann mir jemand sagen, wie hoch die letzte Dividende netto war?

In € Cent.

Danke

In € Cent.

Danke

23.11.

EDF Renewables, Enbridge and CPP Investments Announce France's First Offshore Wind Project, Saint-Nazaire, is Now Fully Operational

https://www.prnewswire.com/news-releases/edf-renewables-enbr…

...

EDF Renewables and EIH S.à.r.l, a subsidiary of Enbridge Inc. (TSX: ENB) (NYSE: ENB) and CPP Investments, have achieved a significant milestone as France's first commercial-scale offshore wind project, the 480-megawatt Saint-Nazaire Offshore Wind Farm, is now fully operational. Located between 12 and 20 km from the southwest coast of France, the wind farm will help support the French State's energy transition goals, which include targets to generate 32% of its energy from renewable sources by 2030.

By providing secure, low carbon, affordable and reliable energy, Saint-Nazaire is also responding to the global energy challenge at a crucial time. The wind farm will produce the equivalent of 20% of the Loire-Atlantique's annual electricity consumption and supply the equivalent of the consumption of 700,000 people with electricity every year. To celebrate this milestone, an inauguration will take place today in Saint-Nazaire, France.

...

EDF Renewables, Enbridge and CPP Investments Announce France's First Offshore Wind Project, Saint-Nazaire, is Now Fully Operational

https://www.prnewswire.com/news-releases/edf-renewables-enbr…

...

EDF Renewables and EIH S.à.r.l, a subsidiary of Enbridge Inc. (TSX: ENB) (NYSE: ENB) and CPP Investments, have achieved a significant milestone as France's first commercial-scale offshore wind project, the 480-megawatt Saint-Nazaire Offshore Wind Farm, is now fully operational. Located between 12 and 20 km from the southwest coast of France, the wind farm will help support the French State's energy transition goals, which include targets to generate 32% of its energy from renewable sources by 2030.

By providing secure, low carbon, affordable and reliable energy, Saint-Nazaire is also responding to the global energy challenge at a crucial time. The wind farm will produce the equivalent of 20% of the Loire-Atlantique's annual electricity consumption and supply the equivalent of the consumption of 700,000 people with electricity every year. To celebrate this milestone, an inauguration will take place today in Saint-Nazaire, France.

...

8.9.

Enbridge Line 5 Can Run as Oil Pipe Is Rerouted, Judge Says

https://finance.yahoo.com/news/enbridge-line-5-run-while-161…

...

Enbridge Inc.’s controversial Line 5 oil pipeline can keep operating while the company relocates part of it to avoid an indigenous group’s land, according to a court decision.

A US District Court judge in Wisconsin ruled in favor of the Bad River Band of the Lake Superior Tribe of Chippewa Indians, who said the conduit was trespassing on their territory. Judge William Conley said the group is entitled to a monetary remedy, but stopped short of granting an injunction that would shut the line because it would have “significant public and foreign policy implications.”

“While inclined to grant alternative injunctive relief to the Band, requiring Enbridge to reroute its pipeline outside the Reservation, the court will seek input from the parties before deciding the terms of a permanent injunction,” the judge ruled.

The decision ensures “the pipeline will continue to provide energy to millions of people in the Upper Midwest while Enbridge moves forward with the relocation of Line 5 around the Bad River Reservation,” an Enbridge spokesperson said in a statement. “The court further recognized that the Line 5 relocation project needs to move forward in a timely fashion.”

Enbridge is facing multiple legal battles over Line 5, a key conduit for supplying oil to refineries in the US Midwest and Canada. Besides its dispute with the indigenous community in Wisconsin, the company is fighting an order by Michigan Governor Gretchen Whitmer to shut the pipeline due to environmental risks to the Great Lakes.

...

=> Pre-Market: 06:10AM EDT: +3%

Enbridge Line 5 Can Run as Oil Pipe Is Rerouted, Judge Says

https://finance.yahoo.com/news/enbridge-line-5-run-while-161…

...

Enbridge Inc.’s controversial Line 5 oil pipeline can keep operating while the company relocates part of it to avoid an indigenous group’s land, according to a court decision.

A US District Court judge in Wisconsin ruled in favor of the Bad River Band of the Lake Superior Tribe of Chippewa Indians, who said the conduit was trespassing on their territory. Judge William Conley said the group is entitled to a monetary remedy, but stopped short of granting an injunction that would shut the line because it would have “significant public and foreign policy implications.”

“While inclined to grant alternative injunctive relief to the Band, requiring Enbridge to reroute its pipeline outside the Reservation, the court will seek input from the parties before deciding the terms of a permanent injunction,” the judge ruled.

The decision ensures “the pipeline will continue to provide energy to millions of people in the Upper Midwest while Enbridge moves forward with the relocation of Line 5 around the Bad River Reservation,” an Enbridge spokesperson said in a statement. “The court further recognized that the Line 5 relocation project needs to move forward in a timely fashion.”

Enbridge is facing multiple legal battles over Line 5, a key conduit for supplying oil to refineries in the US Midwest and Canada. Besides its dispute with the indigenous community in Wisconsin, the company is fighting an order by Michigan Governor Gretchen Whitmer to shut the pipeline due to environmental risks to the Great Lakes.

...

=> Pre-Market: 06:10AM EDT: +3%

29.7.

Enbridge Reports Second Quarter 2022 Financial Results and Announces $3.6 Billion of Newly Secured Projects This Quarter

https://finance.yahoo.com/news/enbridge-reports-second-quart…

...

Strong operational performance is expected to be offset by challenging market conditions which continue to impact Energy Services, along with higher financing costs, due to rising interest rates, relative to 2022 financial guidance.

...

GAAP earnings attributable to common shareholders for the second quarter of 2022 decreased by $944 million or $0.47 per share compared with the same period in 2021, primarily due to the impact of the mark-to-market value of derivative financial instruments used to manage foreign exchange risk.

...

Enbridge Reports Second Quarter 2022 Financial Results and Announces $3.6 Billion of Newly Secured Projects This Quarter

https://finance.yahoo.com/news/enbridge-reports-second-quart…

...

Strong operational performance is expected to be offset by challenging market conditions which continue to impact Energy Services, along with higher financing costs, due to rising interest rates, relative to 2022 financial guidance.

...

GAAP earnings attributable to common shareholders for the second quarter of 2022 decreased by $944 million or $0.47 per share compared with the same period in 2021, primarily due to the impact of the mark-to-market value of derivative financial instruments used to manage foreign exchange risk.

...

29.7.

UPDATE 4-Canada's Enbridge to invest $1.5 bln in Pacific Energy's Woodfibre LNG project

https://finance.yahoo.com/news/2-canadas-enbridge-partners-p…

...

Canada's Enbridge Inc said on Friday it will invest $1.5 billion in the joint construction and operation of the Woodfibre liquefied natural gas (LNG) project with Pacific Energy Corp Ltd.

The move is Calgary-based Enbridge's first investment in a liquefaction facility. It comes amid a boom in North American LNG exports and high demand for the fuel as Europe seeks to replace lost Russian gas supplies following Russia's invasion of Ukraine.

Woodfibre LNG, a subsidiary of Pacific Energy Ltd, gave notice to proceed with construction to its prime contractor in April. The 2.1 million tonne per year export facility in Squamish, British Columbia, will have 250,000 cubic meters of floating storage capacity and is expected to be completed in 2027.

Under the partnership, Enbridge will invest in a 30% ownership stake in the $5.1 billion project, with Pacific Energy retaining the remaining stake in the facility.

Woodfibre is smaller and lower-cost than many other LNG projects being developed in North America, making it an attractive investment for Enbridge as the company builds experience in the sector, Jason Kearns, Enbridge's director of business development, said in an interview.

"This one's very close to existing assets in a jurisdiction that we're very familiar with, and at a scale that makes sense for us as a first foray into this space," Kearns said.

The project is underpinned by two long-term offtake agreements with BP Gas Marketing Ltd for 15 years representing 70% of the capacity, with additional commitments in development for up to 90%, Enbridge and Pacific Energy said in a statement.

...

UPDATE 4-Canada's Enbridge to invest $1.5 bln in Pacific Energy's Woodfibre LNG project

https://finance.yahoo.com/news/2-canadas-enbridge-partners-p…

...

Canada's Enbridge Inc said on Friday it will invest $1.5 billion in the joint construction and operation of the Woodfibre liquefied natural gas (LNG) project with Pacific Energy Corp Ltd.

The move is Calgary-based Enbridge's first investment in a liquefaction facility. It comes amid a boom in North American LNG exports and high demand for the fuel as Europe seeks to replace lost Russian gas supplies following Russia's invasion of Ukraine.

Woodfibre LNG, a subsidiary of Pacific Energy Ltd, gave notice to proceed with construction to its prime contractor in April. The 2.1 million tonne per year export facility in Squamish, British Columbia, will have 250,000 cubic meters of floating storage capacity and is expected to be completed in 2027.

Under the partnership, Enbridge will invest in a 30% ownership stake in the $5.1 billion project, with Pacific Energy retaining the remaining stake in the facility.

Woodfibre is smaller and lower-cost than many other LNG projects being developed in North America, making it an attractive investment for Enbridge as the company builds experience in the sector, Jason Kearns, Enbridge's director of business development, said in an interview.

"This one's very close to existing assets in a jurisdiction that we're very familiar with, and at a scale that makes sense for us as a first foray into this space," Kearns said.

The project is underpinned by two long-term offtake agreements with BP Gas Marketing Ltd for 15 years representing 70% of the capacity, with additional commitments in development for up to 90%, Enbridge and Pacific Energy said in a statement.

...

11.2.

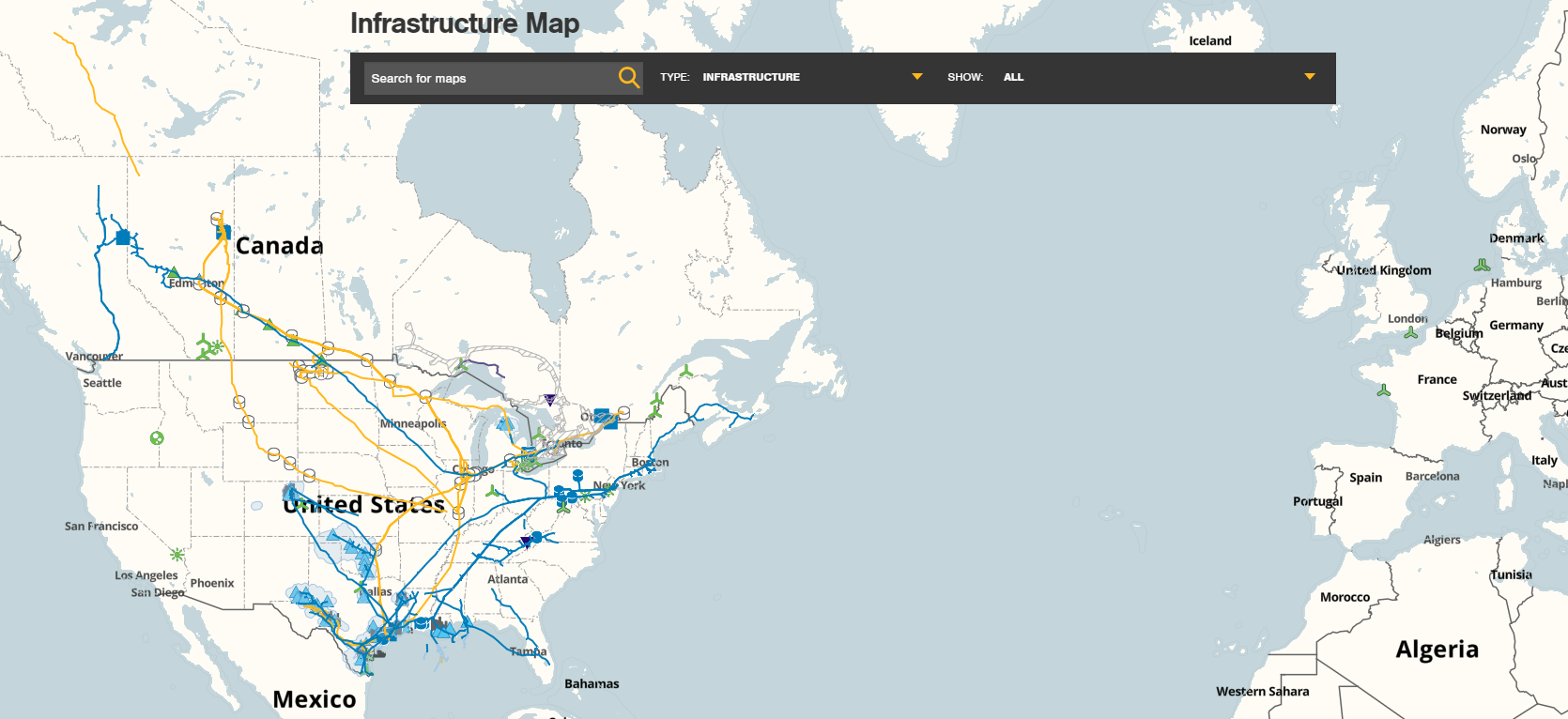

Enbridge Inc. Fourth Quarter and Year End 2021 Financial Results

https://www.enbridge.com/investment-center/events-and-presen…

...

...

...

Enbridge Inc. Fourth Quarter and Year End 2021 Financial Results

https://www.enbridge.com/investment-center/events-and-presen…

...

...

...

7.12.

Enbridge Sees Two Options for Pipelines After Contracting Failed

https://finance.yahoo.com/news/enbridge-sees-two-options-pip…

...

Enbridge Inc. is evaluating two tolling options for its vast Mainline oil pipeline network after a proposal to offer long-term contracts to keep the conduits full was rejected by Canada’s energy regulator.

North America’s largest pipeline company will either pursue a modified, incentive-based version of its current arrangement, which allows producers to decide the volumes they want to ship each month, or a system that would ensure tolls are enough to cover costs and provide a return on investments, Chief Executive Officer Al Monaco said in a presentation Tuesday.

The Mainline pipeline network ships more than 3 million barrels of crude a day from Alberta to the U.S. Midwest, where it connects to the Gulf Coast, as well as Ontario and Quebec. It includes the Line 3 and Line 5 conduits that have faced opposition in the U.S.

....

Enbridge Sees Two Options for Pipelines After Contracting Failed

https://finance.yahoo.com/news/enbridge-sees-two-options-pip…

...

Enbridge Inc. is evaluating two tolling options for its vast Mainline oil pipeline network after a proposal to offer long-term contracts to keep the conduits full was rejected by Canada’s energy regulator.

North America’s largest pipeline company will either pursue a modified, incentive-based version of its current arrangement, which allows producers to decide the volumes they want to ship each month, or a system that would ensure tolls are enough to cover costs and provide a return on investments, Chief Executive Officer Al Monaco said in a presentation Tuesday.

The Mainline pipeline network ships more than 3 million barrels of crude a day from Alberta to the U.S. Midwest, where it connects to the Gulf Coast, as well as Ontario and Quebec. It includes the Line 3 and Line 5 conduits that have faced opposition in the U.S.

....

Thanks 👍

Antwort auf Beitrag Nr.: 70.085.633 von Heardbrave am 01.12.21 13:35:19

https://de.marketscreener.com/kurs/aktie/ENBRIDGE-INC-140988…

Zitat von Heardbrave: Neu hier, ist diese Aktie einen Kauf wert...

bzw. wie hoch ist die jährliche Dividendenrendite, würde es als Anlage sehen!

https://de.marketscreener.com/kurs/aktie/ENBRIDGE-INC-140988…

Neu hier, ist diese Aktie einen Kauf wert...

bzw. wie hoch ist die jährliche Dividendenrendite, würde es als Anlage sehen!

bzw. wie hoch ist die jährliche Dividendenrendite, würde es als Anlage sehen!

26.11.

Enbridge Plan to Keep Oil Pipelines Full Rejected by Canadian Regulator

https://finance.yahoo.com/news/enbridge-plan-keep-oil-pipeli…

...

Enbridge Inc.’s proposal to keep its massive Mainline oil pipeline network full through long-term contracts was rejected by Canada’s top energy regulator in a win for some producers who want more flexibility to ship their crude.

“Mainline contracting would likely reduce the access to pipeline capacity realistically available to certain shippers,” the Canada Energy Regulator said in its ruling Friday. “The package of tolls, terms and conditions in the service offering would result in a distribution of benefits and negative impacts that is uneven and disproportionate.”

The decision deals a blow to North America’s largest pipeline company as it upgrades a vast system that ships more than 3 million barrels of crude a day from Alberta to the U.S. Midwest and Gulf Coast, as well as Ontario and Quebec. The network includes the Line 3 and Line 5 conduits that have faced opposition in the U.S.

...

Enbridge Plan to Keep Oil Pipelines Full Rejected by Canadian Regulator

https://finance.yahoo.com/news/enbridge-plan-keep-oil-pipeli…

...

Enbridge Inc.’s proposal to keep its massive Mainline oil pipeline network full through long-term contracts was rejected by Canada’s top energy regulator in a win for some producers who want more flexibility to ship their crude.

“Mainline contracting would likely reduce the access to pipeline capacity realistically available to certain shippers,” the Canada Energy Regulator said in its ruling Friday. “The package of tolls, terms and conditions in the service offering would result in a distribution of benefits and negative impacts that is uneven and disproportionate.”

The decision deals a blow to North America’s largest pipeline company as it upgrades a vast system that ships more than 3 million barrels of crude a day from Alberta to the U.S. Midwest and Gulf Coast, as well as Ontario and Quebec. The network includes the Line 3 and Line 5 conduits that have faced opposition in the U.S.

...

Antwort auf Beitrag Nr.: 69.873.179 von faultcode am 10.11.21 13:04:18die Schlacht geht weiter:

16.11.

Enbridge Defeats Michigan Governor’s Bid to Move Line 5 Pipeline Case

https://finance.yahoo.com/news/enbridge-defeats-michigan-gov…

...

Judge Janet Neff of the U.S. District Court for the Western District of Michigan Southern Division rejected Michigan’s effort to send the case over Governor Gretchen Whitmer’s order for Enbridge to shut its Line 5 pipeline to state court. The case “is properly in federal court,” according to the ruling.

Whitmer has ordered Enbridge to shut Line 5 arguing that its a threat to the Great Lakes because it presents an environmental threat where it crosses through Straits of Mackinac, where Lake Michigan and Lake Huron connect. Enbridge has refused to comply, arguing that the governor is exceeding her authority and federal jurisdiction applies.

The company says it is seeking to make the pipeline safer by building a tunnel under the waterway to house the line.

...

16.11.

Enbridge Defeats Michigan Governor’s Bid to Move Line 5 Pipeline Case

https://finance.yahoo.com/news/enbridge-defeats-michigan-gov…

...

Judge Janet Neff of the U.S. District Court for the Western District of Michigan Southern Division rejected Michigan’s effort to send the case over Governor Gretchen Whitmer’s order for Enbridge to shut its Line 5 pipeline to state court. The case “is properly in federal court,” according to the ruling.

Whitmer has ordered Enbridge to shut Line 5 arguing that its a threat to the Great Lakes because it presents an environmental threat where it crosses through Straits of Mackinac, where Lake Michigan and Lake Huron connect. Enbridge has refused to comply, arguing that the governor is exceeding her authority and federal jurisdiction applies.

The company says it is seeking to make the pipeline safer by building a tunnel under the waterway to house the line.

...

Antwort auf Beitrag Nr.: 69.850.139 von faultcode am 08.11.21 21:00:18anscheinend hat es die Biden Administration mit der Angst zu tun bekommen: alles wieder retour:

...

https://financialpost.com/commodities/energy/oil-gas/white-h…

ein Kommentar dazu:

...

https://financialpost.com/commodities/energy/oil-gas/white-h…

ein Kommentar dazu:

Antwort auf Beitrag Nr.: 68.155.144 von faultcode am 12.05.21 01:56:148.11.

Biden administration confirms it's considering shut down of part of Line 5 oil and gas pipeline

https://www.marketwatch.com/story/biden-administration-confi…

The Biden administration is looking at potentially shutting down an existing segment of the Line 5 oil and gas pipeline that serves the Midwest, White House spokeswoman Karine Jean-Pierre told reporters on Monday, confirming reports on the issue last week.

"The Army Corps of Engineers is preparing an environmental impact statement on Line 5 and the construction of that replacement line," she said.

"The EIS will help inform any additional action or position the U.S. will be taking on the replacement of Line 5." Democratic Michigan Gov. Gretchen Whitmer has sought to shut down that segment of pipeline amid concerns about the potential for a spill in the Straits of Mackinac, putting her at odds with Canadian energy pipeline company Enbridge and Canada's government.

Kanada? Ich dachte, das sind die Guten mit dem woken Justin Trudeau und so

Biden administration confirms it's considering shut down of part of Line 5 oil and gas pipeline

https://www.marketwatch.com/story/biden-administration-confi…

The Biden administration is looking at potentially shutting down an existing segment of the Line 5 oil and gas pipeline that serves the Midwest, White House spokeswoman Karine Jean-Pierre told reporters on Monday, confirming reports on the issue last week.

"The Army Corps of Engineers is preparing an environmental impact statement on Line 5 and the construction of that replacement line," she said.

"The EIS will help inform any additional action or position the U.S. will be taking on the replacement of Line 5." Democratic Michigan Gov. Gretchen Whitmer has sought to shut down that segment of pipeline amid concerns about the potential for a spill in the Straits of Mackinac, putting her at odds with Canadian energy pipeline company Enbridge and Canada's government.

Kanada? Ich dachte, das sind die Guten mit dem woken Justin Trudeau und so